Economy, Energy and Fair Work Committee

Pre-budget scrutiny 2020-21

Background

This report sets out the Economy, Energy and Fair Work Committee’s pre-budget 2020/21 scrutiny.

Following a review of the budget process, Scottish Parliament Committees now carry out scrutiny before the publication of the budget. The aim of this is to have greater influence on the Scottish Government’s budget proposals. Under the new process, there is more emphasis on what spending is achieving and an increased focus on outcomes. This involves committees building up an evidence base over time on the impact of spending.i

With this in mind, the Committee agreed to focus this year’s budget scrutiny on regional selective assistance (RSA) and other financial assistance offered to businesses by Scotland’s enterprise agencies. The Committee has sought to examine the impact of this funding in delivering the Scottish Government’s economic goals. The Committee also considered whether RSA impacts employment levels and fair work practices.

This inquiry follows on from the Committee’s scrutiny of Scottish Enterprise (SE) following the closure of Kaiam, a Livingston based technology company in receipt of RSA which went into administration in January 2019.

The Committee has scrutinised the overall budgets and outcomes of the enterprise agencies every year since 2016. This has allowed the Committee to build up evidence over time.

The Committee thanks all those who contributed to the inquiry.

2020/21 budget - context

The Cabinet Secretary for Finance, Economy and Fair Work (Cabinet Secretary) set out the context for this year’s budget. The UK Government announced a one-year spending round on 4 September; however, without the tax announcements and the economic forecasts of a full UK budget, he said that the spending round does not give the Scottish Government enough clarity on the funding available for Scotland in 2020-21.i

The Cabinet Secretary spoke of the need to prioritise in the face of ‘a disorderly Brexit’ which he described as ‘the biggest and most economically disruptive challenge that the Scottish Government has had to face.’ The Scottish Government is planning a spending review which will focus on the outcomes and wellbeing in line with the national performance framework (NPF). The economic action plan will also be refreshed in the autumn.ii

The Scottish Government plans to review all of its financial products. The Cabinet Secretary said that this is necessary ‘because of the economic turbulence that we face.’ The review would also aim to simplify the range of products available and to ensure that the products are appropriate in the current economic context.iii

This review is relevant to the forthcoming introduction of a single portal which will be a single point of entry for businesses trying to access support services. The Cabinet Secretary said:

I want to simplify the range of assistance that we have for businesses, which is why I am supportive of the single portal. Businesses come in once, and it is up to the enterprise agencies to organise the appropriate response and package of support for an individual applicant or company. That is why the diagnostics behind front-facing business support will be so important.iv

Regional Selective Assistance background

In Scotland, RSA is the main national scheme of financial assistance to industry. It is administered by SE across the whole of Scotland. It provides discretionary grants to investment projects that will create and safeguard employment in Assisted Areas (areas designated for regional aid under European Community law).

The nature of RSA grants means that they can support a range of projects, as long as they will create or protect jobs in Scotland. They should also involve some kind of capital investment and service markets wider than Scotland only or compete with companies outside Scotland.i

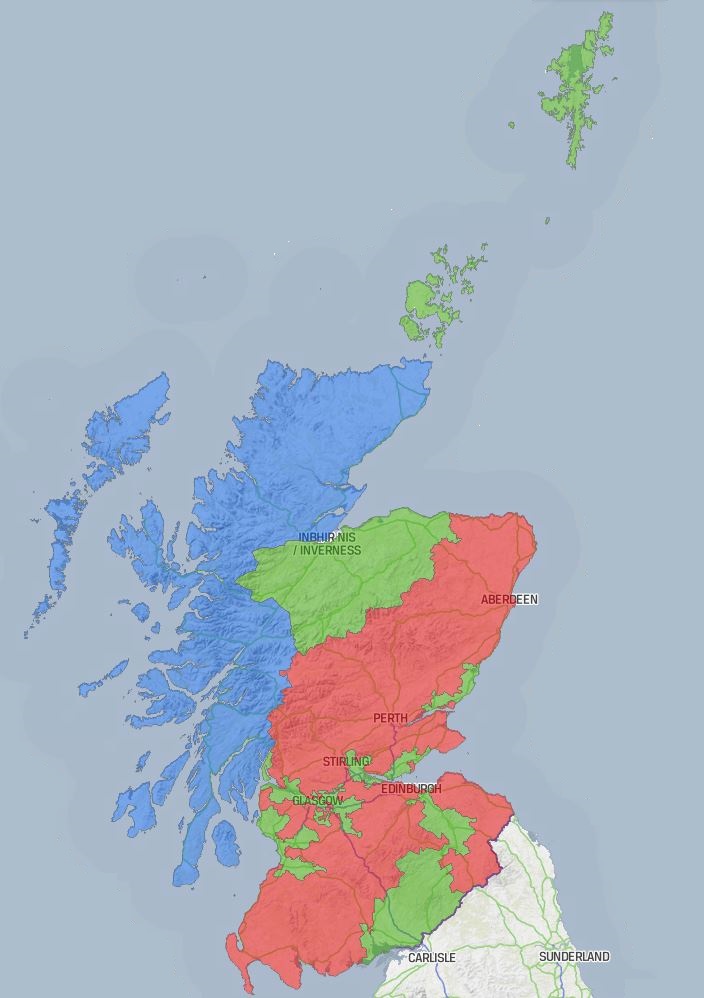

The amount a business is eligible for depends on its size and location, as illustrated by the table and map below. Over 90% of grant offers are made to SMEs and most offers are between £100k and £250k, but smaller or larger grants can be offered.

Maximum aid available by location RSA

| Map colour | Tier | Small enterprise | Medium enterprise | Large enterprise |

| Green | Tier 2 | 30% | 20% | 10% |

| Blue | Tier 2 sparsely populated areas | 35% | 25% | 15% |

| Red | Tier 3 | 20% | 10% | 0% |

Map of RSA Tiers [green = Tier 2, blue = Tier 2 sparsely populated, red = Tier 3]

The subsidy rate for assisted areas depends on a number of factors, these can include an area’s GDP per capita compared to the EU average, population density and unemployment rate.

From 1 July 2014, large businesses which are not SMEs will only be eligible if the project involves 'new activity'. Examples are projects which are at a new assisted area location or projects which involve diversification at an existing location.

Businesses must be able to demonstrate that their project needs RSA to proceed as planned. RSA will not be offered if a business is already committed to undertaking the project or if SE believes that the project would proceed anyway. The project and the underlying business must be financially viable. It must make commercial sense and contribute towards national economic performance.

Projects must have an impact on employment in Scotland and specifically create or safeguard jobs within a business. These jobs must be permanent posts. Only jobs directly employed by the supported business are eligible. A business must be able to demonstrate that the project's employment impact within the business will not be offset by job losses elsewhere in Scotland. For safeguarded jobs, there must be a real threat to these posts if the business did not carry out the project.

Through RSA, the aim is for overall gains in net employment in Scotland and therefore assistance is more likely to be approved for projects that service markets wider than Scotland only, or where competitors are largely based outside Scotland. According to the enterprise agencies, this requirement should reduce displacement effects on to other non-subsidised firms serving the same local market. HIE states that sectors that tend to be more local market focused are unlikely to qualify for funding.i

Payment of RSA is made in instalments, typically over several years as job and capital expenditure targets are met. Not all projects will proceed, nor do all accepted offers result in full payment, as projects are sometimes scaled down or abandoned before payments are made.

Recent strategic changes have seen SE’s approach to grant funding evolve. In the 2019/20 operating plan:

Job-related grants have become contingent on fair work practices and SE tell us that they are considering how to apply this more widely across all grants and services.

SE is working on delivery of a new model for business grants, offering transparency, consistency and speed in eligibility and decision-making.

SE is establishing a national centre of excellence for grant management during the lifetime of its 3-year plan, according to SE this will tap into artificial intelligence and technology development to transform customer experience.

From April 2019, fair work conditions applied to RSA, and other large job-related grants, ensuring that:

Only jobs paying the Real Living Wage will be eligible for grant support.

Jobs with zero-hour contracts will be ineligible for grant support and any wider use of zero hours contracts by the company will be reviewed as part of the appraisal process.

Applicants with over 250 employees meet the legal requirement to report on their gender pay gap. SE will also support smaller applicants to calculate their gender pay gap; and encourage all applicants to take steps to narrow the gap.ii

These changes are discussed later in this report.

Regional Selective Assistance

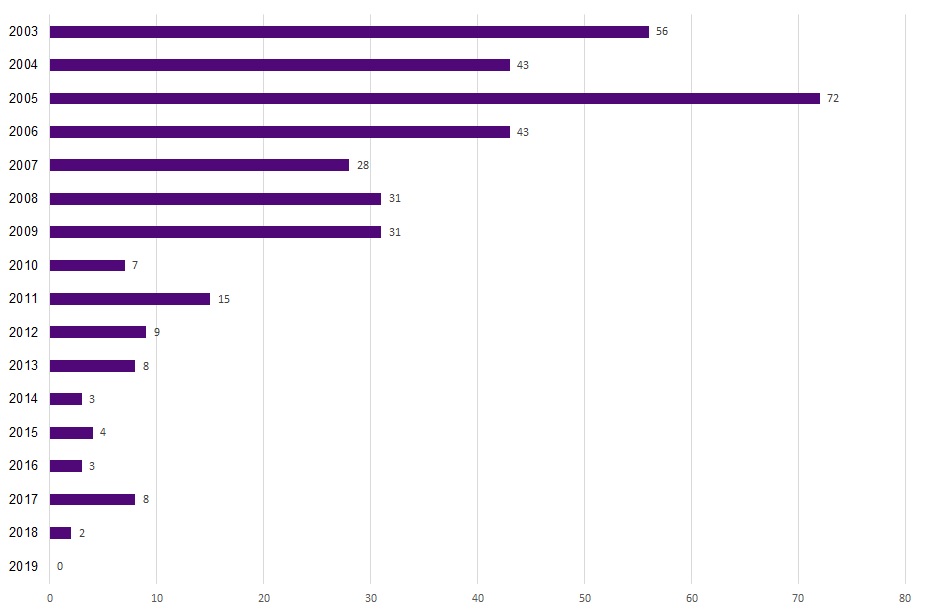

In total, over the period April 2009 to May 2019, over £337 million of RSA was offered to firms. According to SE, since 2010, RSA grants have helped to either maintain or generate more than 20,000 jobs across Scotland. The table below shows the total number and value of RSA offers from 2009/10 to May 2019.

Since 2015-16 the number of offers has declined significantly. This is related to state aid rules changes in 2014. The average grant value also declined between 2015-16 and 2017-18. 2018-19 saw a reversal in this trend, although it remains to be seen if this will continue.i

| RSA offers accepted | £ Total value of grants offered | £ Average grant value | |

| 2009-2010 | 110 | 50,673,175 | 460,665 |

| 2010-2011 | 112 | 40,422,000 | 360,911 |

| 2011-2012 | 86 | 32,810,350 | 381,516 |

| 2012-2013 | 118 | 34,667,500 | 293,792 |

| 2013-2014 | 118 | 51,380,750 | 435,430 |

| 2014-2015 | 120 | 48,600,050 | 405,000 |

| 2015-2016 | 66 | 17,581,704 | 266,389 |

| 2016-2017 | 64 | 15,416,858 | 240,888 |

| 2017-2018 | 75 | 13,959,829 | 186,131 |

| 2018-2019 | 69 | 24,468,000 | 354,609 |

| 2019-2020 (as of May 19) | 24 | 7,210,000 | 300,417 |

| Total | 962 | 337,190,216 |

Overall view of Regional Selective Assistance

The Committee received evidence of the positive impact of RSA on the Scottish economy.

Matt Lancashire of the Scottish Council for Development and Industry (SCDI) said that this positive impact is due to RSA generating additional jobs in economic downturns.i Similarly, Alliance Scotland (part of the Industrial Communities Alliance, an all-party association of local authorities in the industrial areas of England, Scotland and Wales) said that RSA supported investments have ‘been instrumental in contributing to the modernisation and expansion of our local work places and economies.’ii

Scottish Local Authorities Economic Development Group (SLAED) highlighted that there is a high level of interaction between RSA, financial readiness and innovation. They believe that this is very positive when compared with the system in England and Wales; RSA is the only public sector award aimed at capital expenditure, which they believe is of great strategic benefit to businesses.ii

West of Scotland European Forum (WOSEF) felt that having an established scheme with a distinct budget line gives relevant Scottish areas a distinct advantage compared to their English counterparts in terms of attracting inward investment. They believe that RSA supported activity makes a significant contribution to the economic strategy’s aim 'to reduce disparities in economic performance between regions and local areas within Scotland.'ii

COSLA claimed that RSA and other grants play a valuable role as part of a wider, aligned and integrated programme of support that helps to enhance the viability of a project and a business.ii

Continued relevance of RSA and suggested changes

The Committee heard that the continued relevance of RSA should be considered and a number of changes were suggested.

SLAED highlighted the increasing move towards automation in manufacturing and engineering businesses that could ultimately reduce the requirement for staff and queried how RSA is accounting for these changing trends. Matt Lancashire of SCDI also highlighted the importance of artificial intelligence and digital sectors as well as the clean growth sector.i

On a visit to Musselburgh based fish processing business JK Thomson, Members heard that given the level of bespoke equipment required, investment in automation will be heavily capital intensive. Thus, they are hoping to work with Scotland’s enterprise agencies to explore feasibility options for automation.ii

SLAED suggested that RSA could be packaged up with other loan programmes offered through the public sector that can be properly monitored and work to the same timescales and objectives, such as Business Loans Scotland, DSL or Digital Loan Scotland.iii

Women’s Enterprise Scotland’s (WES) survey of women-owned businesses found that only 24% of respondents had used any form of grant funding to finance their business; yet research evidence shows that access to funding is a key resource for women-owned businesses seeking to grow. The RSA grant is focused on capital outlays and many women-owned businesses do not operate in sectors requiring capital expenditure or seek out significant capital funding. A total of 67% of survey respondents said that they felt more micro finance schemes were needed for small businesses.iii

The Committee notes the comments made in evidence regarding diversifying the purpose of RSA. Its current focus and evaluation of its outcomes are explored further below.

Jobs

As noted above, the primary focus of RSA in the creation and safeguarding of jobs in Scotland. The average cost per full-time equivalent job created by RSA is £7,730.i

SE told us that 99% of RSA now supports SMEs (following changes to state aid which eliminated larger companies from the scheme) and that SMEs tend to have lower job counts.ii

There were suggestions that the objectives for RSA could be widened, particularly given the current high employment rates in Scotland. Matt Lancashire of SCDI suggested that rather than a pure focus on job creation/protection, RSA could promote increasing profit, productivity, exporting and efficiency which would, in turn, lead to better jobs.iii

Data on job outcomes

Data is available about RSA offers made and the planned number of jobs. Similarly, HIE’s annual report sets out projects approved and job forecasts for their financial support rather than actual outcomes. In relation to RSA, as projects are delivered over three to five years, the data is not publicly available to demonstrate the actual number of jobs created and retained. SE explained that the actual impact of spend can only be measured upon completion. SE told the Committee that this information is gathered but not published.i

4-Consulting economist Richard Marsh believes that the method of accounting for RSA related jobs should be improved:

We need to measure what RSA is doing far better than we do currently. We highlight where RSA is being used to help companies invest and we report the jobs that are going to be safeguarded and created, but we do not measure consistently over time the number of jobs that are sustained over the life of a company in different parts of Scotland.’ii

Following its evidence session with the Committee, SE provided the following table which summarises desk research on RSA for completed projects (i.e. projects at the end of their contractual period – usually three or five years after the last payment associated with the grant). It suggests that SE delivered more jobs than were forecast at the commitment stage. This includes both jobs created and safeguarded.

It should be caveated that these are portfolio figures. There will be companies included in the data who will have breached conditions and had money clawed back or written off, likely due to loss of jobs and that will have been taken into account in the totals.iii

JOBS DELIVERED FROM COMPLETED RSA PROJECTS 2014-15 to 2018-19

| FY | No. of Projects | Grant Offered (£m) | Grant Paid (£m) | Total Jobs at Offer Stage | Total Actual Jobs | Capex at Offer (£m) | Actual Capex(£m) |

| 14-15 | 84 | 42.5 | 42.5 | 5303.0 | 5633.5 | 448.6 | 547.8 |

| 15-16 | 81 | 32.4 | 31.9 | 3948.5 | 4386.5 | 173.1 | 197.2 |

| 16-17 | 74 | 21.8 | 21.7 | 1858.0 | 1964.0 | 198.7 | 202.1 |

| 17-18 | 86 | 30.2 | 30.1 | 3741.5 | 4124.0 | 177.6 | 187.6 |

| 18-19 | 63 | 12.3 | 11.6 | 1582.5 | 1722.0 | 40.5 | 40.6 |

| Total | 388 | 139.2 | 137.8 | 16433.5 | 17830.0 | 1038.5 | 1175.3 |

The Committee welcomes the provision of data on actual jobs delivered by RSA projects. It is encouraging that in every case more jobs were delivered than projected. The Committee would have expected this data to be published as part of SE’s annual reporting information.

The Committee recommends that information on jobs delivered from completed RSA and other job-related grant funded projects is published on an annual basis as part of enterprise agencies’ annual reports. It is important to be able to scrutinise the outcomes of spend in this way.

The Committee considered whether longer term jobs data should be tracked to demonstrate the sustainability of the jobs beyond the length of the RSA project.

SE outlined the challenges associated with tracking this data:

With regards to the longer-term aspects of job sustainability, companies are only contractually obliged to provide SE with information for the period of their project and associated conditions period, so there is no data available beyond this period. In addition, tracking information beyond the 5 to 7-year period would present challenges given the volume of data this would involve and the administrative burden it would place on companies.

The systems are not capable of providing systematic reports of overall combined final actual jobs at the end of projects and project conditions periods. This would require a significant amount of time and resource, which would be further amplified should we be required to track job numbers in a company beyond the conditions period.

Additionally, over the longer-term, the ability to specifically link jobs back to a single grant supported project becomes increasingly challenging, if not almost impossible, due to the changeable nature of market and economic conditions that most companies are operating in and responding to.’iv

The Committee acknowledges the difficulties in longer term tracking of jobs delivered by RSA. However, the Committee believes that the sustainability of jobs should be an objective of RSA. Whilst we acknowledge that the enterprise agencies seek to achieve sustainable outcomes, it would be helpful to be able to measure longer term outcomes of RSA and other job related financial assistance.

The Committee recommends that the analytical unit works with the enterprise agencies to determine whether the obstacles to tracking longer term jobs data can be overcome to allow this data to be produced. This would aid scrutiny of enterprise agency spend and assessment of the long-term effectiveness of different interventions.

RSA- regional spend

The Committee has received data on the distribution of RSA by local authority for a five-year period (2016-17 to 2018-19).

This data was provided to the Committee after the oral evidence session with Scottish Enterprise, despite it being requested in advance. The Committee is disappointed that the information was not provided on time. The Committee believes that regional data should be produced routinely to allow for scrutiny of the regional spread and recommends that it is produced as part of future annual reports of SE.

Regional data

The chart below summarises regional RSA data aggregated over the five-year period. The full annual regional tables are available in Annexe B.

When analysing regional trends, the following factors should be taken into account:

Commuting patterns will create varying inflows and outflows of residents between local authorities. Thus, areas like Glasgow City have greater workplace populations relative to their resident populations.

SE does not have a regional remit and its objective is to grow additional economic activity at a Scotland level.

Reducing regional labour market inequalities is the key aim of RSA and reducing regional imbalances is a key strand of inclusive growth.

There were 395 RSA grant offers accepted across Scotland between 2014-15 to 2018-19. Despite much of the HIE region offering the highest level of RSA grant (Tier 2 sparsely populated areas), there have been no RSA offers accepted in this region over the last three years and only four offers over the last five years. East Renfrewshire, Clackmannanshire, East Dunbartonshire, and Inverclyde have also had very limited RSA investment over this period.

Approximately one in five (21%) RSA investments were in Glasgow City over the last five years. Fife (10% of 5-year total) and North and South Lanarkshire (both 8% of 5-year total) were the other areas with clusters of investment.

In total, for the period 2014-15 to 2018-19, over £119m in RSA grants were offered across Scotland. From this £44m (37% of total) went to the Glasgow City local authority area. Approximately 56% of all RSA investment over the last five years has gone to the wider Glasgow City Deal Region.

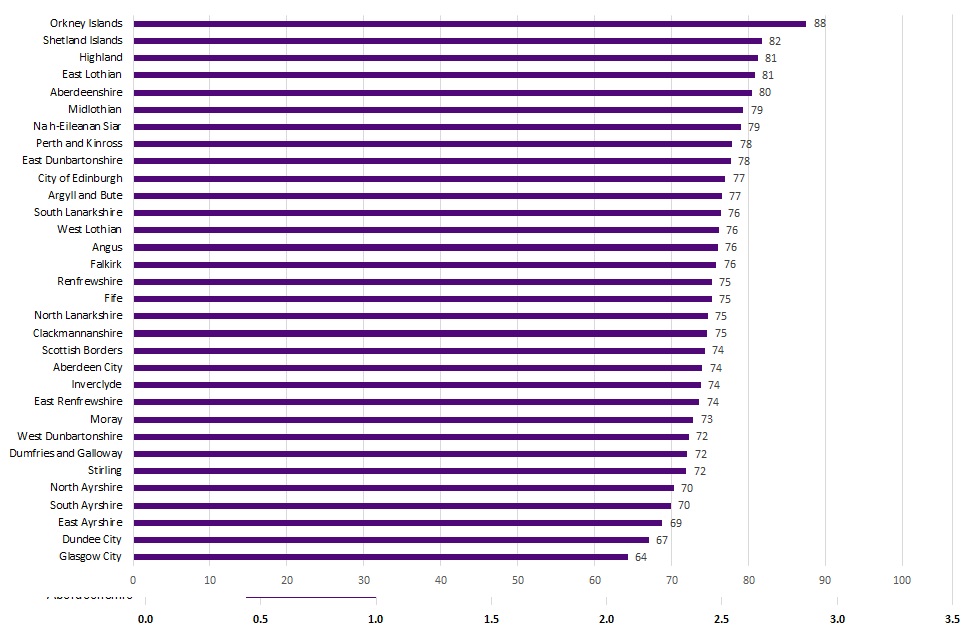

The chart below shows each local authority’s proportionate share of total RSA over the five-year period related to the area’s national population share.

A score of one in the below indicates that RSA allocation is in line with population share. Inverclyde, South Lanarkshire, and Stirling all have scores of approximately one and thus have no data markers crossing the vertical axis.

A score over one suggests a higher allocation of RSA relative to population, and vice versa for scores under one.

The chart above shows that Glasgow City’s share of RSA is 3.2 times greater than the area’s national population share. However, when considering this high score, commuter flow patterns need to be considered. Glasgow City is a significant commuter hub for the residents of other surrounding local authority areas. Other areas with an over-representative share of RSA relative to population were Dundee, Fife, North Ayrshire, Renfrewshire, and South Ayrshire.

Similarly, when considering the regional distribution of RSA, employment levels should be considered, as low employment levels are a factor in the designation of assisted areas. The chart below shows average employment across local authority areas in 2018. Glasgow City had the lowest employment rates at 64.3% and Orkney Islands the highest at 87.5% (the figures have been rounded in the chart).

Looking back at 2013 unemployment levels (this is the data that would have been used in the designation of assisted areas), the area with the greatest unemployment challenges were: North Ayrshire (60% employment rate), Dundee City (61%), Glasgow City (63%), West Dunbartonshire (65%), Clackmannanshire (66%), East Ayrshire (68%), Inverclyde (69%), Fife (70%), North Lanarkshire (70%), and Dumfries and Galloway (70%). Some of these areas with employment challenges have benefited most from RSA over recent years.

In total, there are 13,784 planned jobs associated with RSA grant offers accepted over the period 2014-15 to 2018-19. The largest proportion (35%) of the planned jobs are in Glasgow City, as demonstrated in the chart below.

RSA - addressing labour inequalities?

As noted above, the objective of RSA is to reduce regional labour inequalities In evidence, SE told the Committee:

Scotland’s economy still has inequalities and we still need to stimulate the market to invest in the cooler areas of the economy. In the past five years, despite lots of changes to RSA, something like 80 per cent of the jobs that have been created through that investment and more than 90 per cent of the capital investment that has been stimulated have been in those areas.i

The Committee had not received the regional data when this evidence was given. However, SE did suggest that consideration should be given to a more proactive approach across the regions:

‘Our organisation is considering how to use incentivisation across Scotland’s regions—we do not have the answer yet, and it will be interesting to see the committee’s findings, which may be helpful to us. On the question whether we could and should go further in Scotland’s regions to stimulate investment where it is badly needed…’i

Richard Marsh told the Committee that Scotland still has ‘significant regional inequalities.’iii Matt Lancashire of SCDI also highlighted the lack of spread across the country:

The evidence that we found is that the central belt dominates the funding, which continues to be focused there. There are fewer funding applications to the grant fund from businesses from regions in the south of Scotland and further afield. The evidence from our members also shows that there is a regional disparity in how the fund has been awarded in the past.iii

The local context is important when considering the impact of delivering jobs. As Richard Marsh highlighted:

The creation of a small number of jobs in a deprived area that is in desperate need of jobs is probably worth a lot more than an intervention that creates jobs in the centre of Glasgow or Edinburgh.v

Tony Mackay agreed:

I think that the principle of rural areas requiring more assistance than Glasgow and Edinburgh is still very valid.vi

The Scottish Government’s economic strategy lists place and regional cohesion as one of its inclusive growth priorities (along with fair work, the business pledge and promoting equality and tackling inequality). The strategy sets out to ensure that ‘all parts of Scotland benefit from sustainable economic growth.’vii

The Committee notes that SE’s new strategic framework has a greater emphasis on places and highlights regional economic partnerships. The first ‘ambition’ set out in SE’s new strategic framework is to ‘build vibrant economic communities across Scotland, spreading increased wealth and wellbeing.’ The strategy states:

35% of the working-age population live in local authority areas with below Scottish average employment rates. If employment rates in these areas matched the Scottish average, over 50,000 more people would be in work.viii

Although HIE is not responsible for awarding RSA, they confirmed that they are considering how to measure impact according to location:

We are currently looking at how we can assess the impacts of developments in more fragile areas and weighting them to see how they compare to developments in more urban or central areas. For our purposes, two jobs that are created in Coll are worth an awful lot more to the community than two jobs that are created in Inverness or Elgin.ix

The Cabinet Secretary also highlighted the importance of scale in deploying economic development activities:

Twenty jobs in a more rural or peripheral community could be massive compared with 20 jobs created in the cities of Edinburgh, Aberdeen or Glasgow. That is why we are trying to target efforts towards towns and rural communities as well as the cities.x

SE emphasised that RSA is, like all SE grants, a demand-led scheme. There are no targets based on area. They also said:

It should [also] be noted that support via a particular grant product for companies in a particular constituency is not necessarily a good measure of economic impact for most constituencies in Scotland. Given commuter flows, investment in one area could result in jobs that are filled by people from a different area or constituency.xi

The demand-led nature of RSA and other grants is discussed in the next section of the report. Although the Committee has only seen five years’ worth of data, it is concerning that certain areas in Scotland are barely benefiting from this funding and that there appears to be a concentration in the central belt. Commuter flows will play their part in spreading the benefit of the funding; however, this is not the case for areas such as the Highlands and Islands. This calls into question the demand-led nature of the funding and whether more could be done to increase demand across the regions.

In supplementary evidence, SE outlined the number of applications for RSA which have been rejected over the last five years (the table is attached at annexe B). Out of a total of 32 rejected applications, 13 did not have a specific location at the time of appraisal. This describes projects where the application has been made but the applicant has still to finalise the location of the project as part of their internal planning processes and decision making. None with a known location had been rejected from the Highlands and Islands and one had been withdrawn.

Another factor impacting on demand is the dominance of certain sectors in different regions across Scotland. The Committee notes that HIE highlighted that companies operating solely in the local market (such as retail or catering) are less likely to be eligible for RSA.

The Cabinet Secretary said that RSA is just one part of the financial support available to companies and that it should be seen within the global context. Although he would like to see further distribution of RSA across the country, he is satisfied that the enterprise agencies are being proactive in promoting RSA across the country. In his view, the regional disparities are not down to any systemic failure but could be explained by demand and the issue of projects meeting the criteria (around scale and the location of the manufacturing base in Scotland).xii

The Committee notes the striking regional disparities in the award of RSA over the last five years. We acknowledge that RSA is part of a wider package of support for businesses across the regions and is demand led. However, the Committee welcomes evidence from SE that they are considering how to use incentivisation across the regions and recommends that this work is carried out as a matter of urgency to maximise demand stimulation. The Committee asks to be kept updated on progress with this work.

The Committee invites the analytical unit to consider whether SE should set regional targets to track progress in supporting businesses in regions across Scotland. These targets could take regional factors such as unemployment levels and regional spread of different sectors into account.

Assisted areas: limiting or beneficial?

WOSEF highlighted that historically the bulk of RSA activity in Scotland has been concentrated in the West of Scotland. They said that this reflects the more extensive Assisted Area coverage in the region compared to other parts of Scotland – with the exception of the Highlands and Islands; this designation has been due to the contraction and disappearance of previously dominant industries such as steel and coal.i

Aberdeenshire Council stated that the criteria for securing Assisted Area status and RSA schemes are such that areas that are relatively affluent, and where macro indicators mask smaller areas of higher economic inequality, are usually deemed ineligible. They believe that this, coupled with the long duration of RSA and Assisted Area legislation (7 years in line with EU funding periods), means that RSA is inflexible and cannot be utilised to respond to economic shocks or opportunities.i

In the 2014-2020 reassessment of Assisted Areas, the whole of the Aberdeenshire Council area was classed as a Tier 3 area, meaning that only the lowest levels of intervention to support businesses are possible. According to Aberdeenshire Council, this is in spite of the statistically proven similarities (economically and socially) between places such as Buckie (Moray), which has Tier 2 status and the Banff and Buchan area of Aberdeenshire. i

SLAED believes that some of the qualifying conditions are limiting, especially as it is not within the gift of SE or the Scottish Government to alter Assisted Area coverage or the maximum aid intensities. There are also some ineligible sectors due to the minimum project size and value, which is often out of scope for many of the clients that Business Gateway and local authorities engage with. They note that a blanket approach in not supporting certain sectors is also at odds with businesses that are innovating and disrupting markets.i

WES stated that women-owned businesses which had applied for RSA commented that it was a “post-code lottery” and they were unable to benefit due to the location of their business.i

Regional aid guidelines

WOSEF is concerned that the impact of the 2014-20 Regional Aid guidelines has been to diminish the contribution that assistance uniquely available through the Guidelines has made to regional development within the West of Scotland. They asserted that the impact of the current guidelines has been to reduce the value of RSA awards in Scotland by around two thirds compared to the previous period.i

Alliance Scotland highlighted that while the proportion of Scotland’s population covered by Assisted Areas (and hence eligible for the full RSA offer) increased slightly compared to the previous period, this was more than offset by the reduction in permissible aid intensities and in particular by the prohibition on support for ‘expansion’ investments undertaken by larger firms already located within an Assisted Area. They noted that there is no convincing evidence that economic disparities – as measured for example by indicators such as Gross Value added (GVA) and labour market participation – have narrowed within Scotland to the extent that the need for a geographically targeted instrument such as RSA has become redundant.i

Many of the submissions highlighted that there may be opportunities to change the legal framework for regional aid in the UK as a consequence of Brexit. The scope, however, to do this would be dependent on the nature of the UK’s withdrawal from the EU and would ultimately be constrained by World Trade Organisation obligations.

RSA - demand led

As noted above, RSA is a demand-led grant, responding to opportunities presented by businesses.

The state aid rule changes in 2014 (e.g. aid could no longer be granted to expansion projects, only new activity) meant that larger companies found it more difficult to apply RSA to their projects. As larger companies tended to undertake projects of a greater scale than SMEs, there was an overall decline in commitments. Following the changes, SE launched a targeted customer engagement programme aiming to increase the number of applications. They indicated that after an initial dip, commitments have risen again as of 2018/19.i

SE told the Committee that since the change to state aid rules:

we have worked extremely hard with our SME community to remind everybody that the scheme is still open for business.ii

Steve Dunlop, Chief Executive of SE, described demand stimulation as a ‘growth area’:

We see ourselves as being one of the family that is responsible for creating a large queue of businesses that are ready to be invested in. Demand stimulation is something that we do now and will continue to do. In our new strategic framework, it will have to be a growth area for Scottish Enterprise, and we will therefore be looking for talent to help us with that.iii

Similarly, HIE confirmed that they have recruited an additional staff member deal with funding opportunities and to work with the new Scottish National Investment Bank (SNIB).iv

The need for demand stimulation activity by the enterprise agencies suggests that there might be a mismatch between the market demand for grants and what the public sector is offering. The Committee explored similar themes around demand stimulation in its Stage 1 scrutiny of the SNIB Bill.

Matt Lancashire of SCDI believes that businesses have to take responsibility for informing themselves of funding options such as RSA but that:

Awareness is sporadic depending on the type of business and where it is located. Raising awareness of any type of grant programme, but RSA in particular, would be beneficial, because it would give business leaders the option to suggest whether it is a useful fund to support their future capital expenditure.v

The Cabinet Secretary, responding to the assertion that there may be a mismatch between products and demand, said:

A wide range of financial products are able to support businesses. However, I am reassured that we can create bespoke packages and engage with companies to design the financial support that is right for them. It can be bespoke; it can be tailored to the needs of a business.vi

In supplementary evidence, the Cabinet Secretary highlighted that HIE had delivered £123.6m and SE £471.3m (excluding RSA and Scottish Investment Bank funding) to companies over the period 1 April 2015 to 31 March 2019, representing five times the total amount of RSA awarded over the same period.vii

In last year’s budget scrutiny, the Committee explored the lack of progress in committing the money for the Scottish-European Growth Co-investment Programme (SEGCP). This issue was also followed-up on in the Committee’s scrutiny of the SNIB Bill and the related need for demand stimulation.

The Scottish Enterprise/Scottish Investment Bank submission to the Committee on the SNIB Bill suggested that a ‘significant impact’ has been made in ‘addressing the demand and supply challenges of the Scottish market for risk capital and more recently debt finance’. It accepted, though, ‘that even more needs to be done in an increasingly uncertain economic environment’. SIB’s integration into SNIB and alignment between SE and SNIB were ‘essential to make a step change in the market’. SE/SIB said that substantial demand stimulation activities were necessary alongside the additional ‘investment capability’ of SNIB.viii

SE did not meet its growth funding target in 2018/19. SE explained the reasons for this:

A number of programmes contribute to this Measure, including anticipated funding raised via the Scottish European Growth Co-Investment Programme (SEGCP), announced by Scottish Government in June 2017. The programme focuses on companies looking for equity investment above £2 million. Take up from companies was slower than expected for most of 2018/19, despite promotional activity. Dedicated Scottish Investment Bank resources were put in place to focus on more demand stimulation activity across Scottish Enterprise to raise awareness of the funding opportunity and identify pipeline projects. Interaction and engagement with investors was positive throughout the year and this together with the additional work to raise awareness resulted in projects coming forward, but not early enough in the year to contribute to the Growth Funding measure at the anticipated scale. For information, SEGCP delivered £6.12m of equity investment to the first cohort of companies to come through the process towards the end of the 2018/19 financial year, facilitating investment rounds totalling £16.26m.ix

When asked about this in evidence, the Cabinet Secretary said that of the overall £500 million from the Scottish growth scheme, to date, 233 companies have received £149.5 million of investment.x He stressed that the fund is demand led and has been adapted over time to seek to suit the needs of businesses:

there has been some leverage through the scheme, but not as much as we would have hoped. Still, there is plenty of support elsewhere through the different financial products that we have.xi

The Scottish Government announced its intention to create the Scottish Growth Scheme in the 2016 Programme for Government. The Scheme was intended to deliver up to £500 million of investment through a combination of equity, loans and guarantees over 3 years. The Cabinet Secretary described it as ‘funding a range of financial interventions aimed at helping SMEs realise their growth and export ambitions.'xii

In supplementary evidence, the Cabinet Secretary confirmed that as of 31 August 2019, the total of £149.5m public and private investment made in 233 companies under the Scheme is made up of £39.8m investment from the public sector and £109.7m from the private sector. The public sector investment consists of £24.1m through Scottish Enterprise, £12.2m in European funding and £3.5m direct from the Scottish Government.vii

The Cabinet Secretary confirmed that the public/private investment breakdown of each component of the Scottish Growth Scheme is as follows:

Scottish European Growth Co-investment Programme as at 31 August 2019: Scottish Enterprise and European Investment Fund investment of £2.8m each unlocked private sector investment of £9.4m bringing the total investment to £15m invested in five companies;

Equity investment below £2m – fund closed in October 2018: Scottish Enterprise investment of £18.3m unlocked £10m ERDF and £75.3m from the private sector bringing the total investment to £103.6m invested in 81 companies;

Fund Managers as at 31 August 2019: Scottish Government investment of £3.4m unlocked £2.2m ERDF and £11.1 private sector investment totalling £16.7m. This funding supported the Scottish Growth Scheme overall by funding five fund managers providing microfinance up to £25k; debt of £25-100k; and equity up to £2m. This funding has supported 127 companies;

Scottish Loan Scheme as at 31 August 2019: Scottish Enterprise investment of £3m, which has supported 8 companies. The loan scheme’s purpose is to provide direct loans therefore there is no match funding from the private sector included in this scheme.xiv

The Cabinet Secretary said:

current uncertainty in the economy has had a major impact on demand for the available funds under the Scottish Growth Scheme from Scottish SMEs.

He went on to say that the Scottish Growth Scheme aims to unlock investment for growth and exporting businesses, especially young technology based that would not readily access the capital they need from traditional sources, like banks.xiv

The Scottish Government has proposed that the Scottish Investment Bank, currently administered by Scottish Enterprise, be transferred to SNIB; it is also proposed to align the Scottish Growth Scheme and the SME Holding Fund within SNIB.

In last year’s budget report, the Committee said:

The Committee is concerned about the lack of progress in committing the money for the Scottish-European Growth Co-investment Programme. With only £0.5 million invested by Scottish Enterprise out of a pot of £10 million, the programme has not been a success to date.

Given the underspend in financial transaction money over the last year, the Committee does not have confidence that Scottish Enterprise will commit the increased funds, consisting of financial transaction money, which largely accounts for its increased budget for the forthcoming year.

The Committee recommends that Scottish Enterprise take urgent action to ensure that this money is spent to benefit the Scottish economy.xvi

In its consideration of the regional spread of RSA, the Committee noted that consideration is being given to incentivisation for uptake of interventions across the regions. The Committee notes the enterprise agencies’ plans to increase their demand stimulation activity, particularly with SNIB offering new opportunities to businesses in the next year. The Committee believes that this is vital work and recommends that sufficient resources are allocated to this activity in the forthcoming budget.

The Committee notes that limited progress has been made in allocating the £500 million funding for the Scottish Growth Scheme. Only £39.8 million (and £109.7 million from the private sector) has been invested through the public sector since the fund was announced in 2016. This calls into question whether the Scottish Growth Scheme has the right range of products to meet business demand.

The Committee notes that the Scottish Government plans to review all of its financial products.xvii The Committee recommends that the Scottish Government reviews the range of products within the Scottish Growth Scheme and sets out changes required for increasing its uptake. The Committee asks to be kept updated on progress with this work. The Committee also asks the Scottish Government to clarify how it will meet the original £500 million Scottish Growth Fund target over the next two years.

Role of local authorities in stimulating demand

COSLA said that nearly 50% of RSA grants are accessed through the connections made by Business Gateway advisers into the wider support system. They highlighted the importance of sufficient resources for local authorities (including their role in promoting inclusive growth):

This is why it is vitally important to see enterprise agency financial support in the context of overall Local Government budgets, particularly in light of reduced spend on employability and business support.i

COSLA urged the Committee to consider the overall local government settlement ‘as fundamental to specific consideration about enterprise agency financial support.’i

In its report on its Business Support inquiry, the Committee noted the variance in spend on Business Gateway services in different areas across the country and that the spend has not increased in the last decade.iii In response, COLSA said that this service, along with all council services, has been impacted by the financial crisis of 2008 and subsequent years of austerity and budget cuts.iv The Scottish Government responded that:

In the context of respecting local accountability and discretion, we will work with local authorities and Business Gateway to ensure there is adequate transparency and consistency regarding budgets and what is being prioritised in any spending.’v

The Cabinet Secretary spoke of the importance of the forthcoming single portal in assisting with signposting businesses to the appropriate support. He also confirmed that he is discussing the Committee’s recommendations with COSLA:

The engagement with Business Gateway has been positive so far but, because of the nature of that local government function, I am trying to do things in partnership with it…vi

The Committee invites the Scottish Government to consider the evidence from COSLA on the role of local authorities in stimulating demand for enterprise agency products, not least through Business Gateway. The Committee welcomes the update from the Cabinet Secretary and will await a further response from the Scottish Government on how to address the role of Business Gateway as part of the wider economic development system.

Risk

In some of Committee’s previous work, questions have arisen about value for money with RSA, especially where RSA funding has gone to businesses that have subsequently collapsed.i

Kaiam was in receipt of a £850,000 RSA grant award and SMASii project support with an SE contribution of £9,600, matched with £9,600 from the company.i At a one-off evidence session with SE the Committee explored the circumstances of the demise of Kaiam whilst it was in receipt of RSA. Issues raised included:

system of early warning signals or flags that might show early signs that a company is in distress;

due diligence carried out prior to award of RSA (particularly in relation to a parent company offering guarantees);

breach of conditions of RSA awards and

granting awards and conditions attached to fair work (Kaiam did not sign up to the Scottish Business Pledge).ii

SE’s new strategy states ‘we will embrace change and not be afraid to take calculated risks. And we will celebrate success and learn from our mistakes.’iii In evidence, Steve Dunlop confirmed SE’s ambitions to take risk where necessary; he has invited the Cabinet Secretary to ‘reinforce what our risk appetite should be.’iv

The Cabinet Secretary confirmed that he does not think that there is an issue with the appraisal mechanism for RSA. Whilst not every company will be a success, he believes that due diligence is carried out at the time of award.v

SE highlighted the fact that ‘grants are provided in response to a defined market failure’ which requires ‘an inherent level of risk.’ Funds are clawed back where the conditions of a grant are breached; however SE said:

It is not usually in the best interests of the Scottish economy for SE to force a company into administration to recover grant funding.vi

STUC acknowledged the role of RSA and other grants in securing strategic assets in Scotland’s economy. However, they went on to say that such interventions should be considered in a systematic way:

rather than considering simply what we can give people access to and what sticking plaster we can put on today. That approach could play a large role in an industrial strategy within Scotland.vii

Richard Marsh also believes that it is worth exploring the strategic direction of RSA grants. He acknowledged that by investing in Kaiam SE was seeking to save a large employer ‘in an area that desperately needed jobs’; however he questioned whether RSA was the right tool, given its focus on capital investment and workforce expansion. He went on to say that direct funding for these purposes ‘seems to be a very brave decision if a company is possibly facing cash-flow problems.’viii

In terms of strategic direction, Tony Mackay cited the fabrication industry (in relation to renewables) as one sector that could be proactively supported by the enterprise agencies.ix Matt Lancashire of SCDI said that consideration must be given to how businesses create wealth which is linked to leadership and management.x

Audit Scotland’s 2018/19 audit of the Scottish Government Consolidated Accounts recommended that the Scottish Government develop a framework outlining its approach to financial interventions in private companies.xi The Cabinet Secretary pointed to the economic strategy and NPF which guide the Scottish Government’s activities but argued that when some companies require Government support, ‘an ad hoc financial intervention has been the right thing to do.’xii

The Committee accepts that enterprise agencies must take risks in supporting businesses. The conditions attached to RSA mean that it will not be awarded to a failing company, although the company may face challenges whilst in receipt of the funding. In relation to Kaiam, the Committee queried whether warning signs of failure could have been detected earlier. The Committee highlights the need to be vigilant and take action at the earliest opportunity to protect staff.

Application process

The Committee heard in evidence that the RSA application process can be onerous for businesses. However, it was acknowledged that in awarding substantial sums of public money due diligence must be carried out.

SLAED noted that RSA funding applications require a high volume of information and evidence, and some clients have expressed concern around the time required to complete this before funding is released. In this sense, evaluation is more stringent than most SE grants. They said that the process can be ‘daunting’ for SMEs who often require significant support from advisers.i

Three respondents to the Committee’s online survey successfully applied for RSA and two of these highlighted the challenging application process:

We found this a very difficult process. The form for the financials was a spread sheet which we had to get our chartered accountant to fill in, and he found it very difficult and time consuming to fill in as it used an arcane accounting system. It took a lot of time and expense to fill these forms in. These forms are designed for large companies which have the resources to fill them in, but you do not find in these business areas which qualify for RSA. So, it is a Catch 22 situation which (by accident or design) would mean a low uptake of this scheme.

Similarly, Ceramco Ltd, a ceramics company based in Dumbarton, told us of the need for companies to have or hire somebody with RSA experience (otherwise the process is too difficult to navigate), on which basis many SMEs may miss out.ii

SE said that the application and approval process varies depending on the level of funds requested. The larger the investment from SE, the more detailed the diligence process. Work is underway, as part of SE’s digital transformation, to simplify and streamline the grant application process using online channels.iii

The Committee notes the evidence that the RSA application process may deter SMEs from applying, or require them to invest in consultancy services to complete the process. We welcome evidence from SE that work is underway to simplify the process and ask SE to provide a timescale for completing this work.

Overall enterprise agency direction

In June 2019 at an event entitled ‘Building Scotland’s Future Today’ both Scotland's enterprise agencies launched a new vision aimed at helping build a more economically vibrant country. They are planning to enhance collaboration and their strategic plans were devised with the Enterprise and Skills Strategic Board (Strategic Board) and the Scottish Government, with the aim of delivering a shared vision of a more sustainable and inclusive economy.

SE’s new strategy comes after a year-long review of the agency, led by new Chief Executive Steve Dunlop, who took the helm in 2018. It marks a significant change in direction for the agency. Until now SE’s efforts were on supporting a segmented group of businesses and favoured sectors. However, SE now plan on delivering support to all businesses, particularly with a focus on creating more quality jobs and tackling inequalities.

HIE's three-year strategy sets out the agency's plans to help improve productivity, equality, wellbeing and sustainability, aiming to build an inclusive rural economy through a place-based approach across all parts of the Highlands and Islands. Included in it is a commitment to grow the working age population by attracting and retaining more young people, as well as aiming to increase incomes and embracing the ‘Fair Work First’ approach.i

In evidence, SE explained:

Scottish Enterprise, in focusing on key sectors and key businesses of a certain scale, had disconnected from the rest of the economic community. People were very clear about that. They wanted us back in those places and wanted us to play a full part, whether through a regional economic partnership or through collaborative work.ii

STUC welcomed the change in strategic direction from SE, particularly the shift away from a high growth sector strategy to one focused on supporting the creation of ‘quality jobs’. STUC believes that the challenge will be to ‘turn positive principles into meaningful change for workers.’iii

SE Annual Report performance metrics

Scottish Government grant-in-aid to Scottish Enterprise reduced by 20% in real terms between 2008/09 and 2018/19 (this equates to £60.4m using the SPICe deflator). Figures for the most recent financial year, 2018/19, show an underspend of £1.9m. The majority of this (£1.6m) relates to income attributable to the sale of investments made from financial transactions funding and which was subsequently returned to the Scottish Government.i

During 2018/19 there were 46 ‘claims wavered or abandoned’, loans to companies or equity arrangements that were written-off during the year. These totalled £12.4m (up £4m on the previous year).i

SE’s 2018-19 Annual Report states that:

Reflecting on the recommendations from the Enterprise and Skills Review we have been working with partners during 2018/19 to establish a new comprehensive measurement framework that will capture data and evidence across the wider economic development arena in future years. This includes working proactively with our partner Highlands and Islands Enterprise to identify how we best align our measurement and reporting.

SE further states that as an interim measure for 2018/19, they have applied a simplified measurement framework, aligned to Scotland’s National Performance Framework (as explored below), and reflecting the drivers of productivity and inclusive, sustainable economy factors set out in the Enterprise and Skills Review. This interim framework is illustrated in the chart below.

| Measure Description 2018/19 | Result | 2018/19 |

| £350m - £400m planned R&D investment | ◄► | £384m |

| £300m - £350m planned turnover from innovation | ▲ | £479m |

| £275m - £325m growth funding raised by supported companies | ▼ | £225m |

| £150m - £200m planned business and sector capital asset investment | ▲ | £570m |

| 6,500 - 8,000 inward investment jobs paying at least the real living wage | ▲ | 9,489 |

| £1.25bn - £1.5bn planned international exports | ▲ | £1.56bn |

Key: ▲Exceeded; ◄►Achieved; ▼ Not Achieved

SE delivered five of the six published targets for 2018/19, with four of those exceeding the target range. The growth funding was the only target not met (discussed above).

HIE Annual Report performance metrics

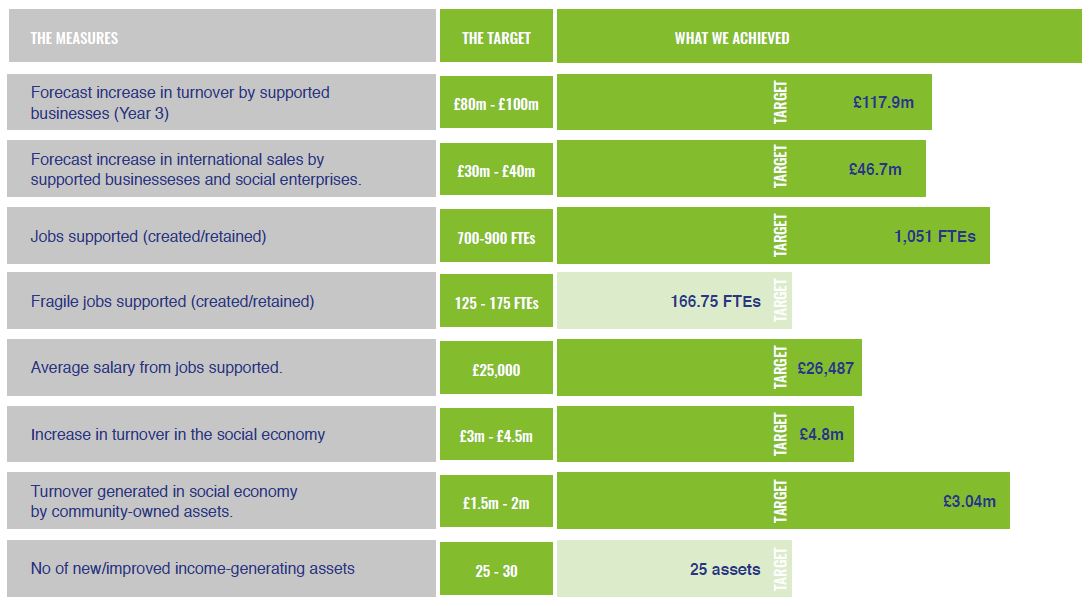

HIE’s 2018-19 Annual Report states that in 2018-19:

We approved £54.6m to support 564 new projects representing a total combined investment of £185m. This will deliver well over 1,000 jobs, raise turnover among supported enterprises by nearly £118m, and boost international trade by £46m a year.

The chart below shows their key performance measures.i

When asked about meeting all their targets, HIE said:

With hindsight and in retrospect, we could have set more challenging targets. For future years, we are considering reviewing that as we go through the year. If it looks as if certain targets were not as challenging as they should have been, we would look to enhance them as the year goes on.ii

Cairngorm Funicular Railway and HIE budget issues

The table below summarises the key financial data for 2018-19 relating to HIE’s involvement in the Cairngorm Funicular Railway.i

Audit Scotland has prepared the section 22 report to draw to the attention of the Scottish Parliament—

…the circumstances related to HIE’s establishment of a subsidiary company, Cairngorm Mountain (Scotland) Ltd (CMSL), to take over the operation of the Cairngorm Mountain ski resort, including the funicular railway. This was in response to the previous operator Cairngorm Mountain Ltd (CML), entering administration in November 2018.ii

The figures in Audit Scotland’s report focus mainly on HIE’s balance sheet as at 31 March 2019. This provides a snapshot of HIE’s financial position, including the impact of its involvement in CMSL, with a focus on the implications for its finances in future.

Expenditure incurred by HIE during 2018-19 in relation to CMSL

| Item | Value | Notes |

| HIE revenue expenditure | ||

| HIE expenditure on professional legal and accountancy advice associated with establishing CMSL and considering options for the future financial sustainability of the ski resort | £244,000 | |

| HIE estimate of cost of staff time involved in dealing with Cairngorm situation | £262,000 | Not an additional cost as staff were already employed by HIE, but an indication of resources devoted to dealing with the Cairngorm situation that could otherwise have been deployed elsewhere |

| HIE capital expenditure | ||

| HIE purchase of shares in CMSL | £461,000 | Impaired to £46,000 in HIE accounts to reflect the lower valuation of CMSL at 31 March 2019 – this impairment has the effect of reducing the value of the shares in HIE’s balance sheet |

| Purchase of snowmaking and snow-spreading equipment | £1,000,000 | Approved October 2018 |

| CMSL net expenditure | ||

| Expenditure of CMSL less income generated by CMSL | £561,000 | From establishment of CMSL in Dec 2018-end March 2019 (total expenditure of £804,000 less income of £243,000) |

An overspend of £2.3 million was authorised by Scottish Government during 2018-19 to cover costs relating to Cairngorm Mountain operations (the actual overspend across all HIE’s activities was £1.8 million). A similar arrangement is in place for 2019-20.ii

Other accounting impacts of CMSL

| Item | Value | Notes |

| Provision for costs of repairing funicular railway | £9.6 million | The amount that has been included in the accounts to recognise HIE’s obligation to repair the funicular railway. Costs have not yet been incurred but are likely to be incurred in 2020-21[i] |

| Valuation of Cairngorm ski resort including snow making equipment | £0.7 million | |

| Loan from HIE to CMSL to provide working capital | £0.7 million | Impaired by 90% to reflect uncertainty around repayment of loan – this impairment has the effect of reducing the value of the asset in HIE’s balance sheet.i |

HIE highlighted a number of financial risks going forward for the organisation:

Finalisation of the potential backdated VAT liability with HMRC. This figure is not quantified with any certainty;

Operating losses at CMSL;

The loss of rental income arising from the sale of the Centre for Health Science (CfHS) was mitigated by profit on disposal in 2019/20 but there will be an ongoing impact;

Risk regarding the Space Hub Sutherland project due to its novelty and complexity. This risk would essentially encompass delay, costs overrun or ‘scope creep’;

The funicular railway at Cairngorm is another risk that is certain to require significant investment. Most of the cost is likely to crystallise in 2020-21. Discussions are ongoing with the Scottish Government regarding funding for this. One potential source of funding is the sale proceeds from the sale of CfHS and

Uncertainties associated with Brexit represent a further risk both directly to HIE (in view of HIE’s ability to access EU funding in the past) and indirectly given the potential impact on the local economy.i

In evidence, HIE confirmed that it has access to external expert resources that would supplement its own customer knowledge.iii HIE quantified this for 2019-20 as follows:

Cairngorm: HIE has assessed the cost of staffing and external support as £1,629,000 for Cairngorm;

Centre for Health Science: HIE has paid professional fees of £32,300 to property consultants for the sale of the Centre for Health Science;

Space Hub Sutherland: HIE spend to date is £610k, with a forecast of £1,513,000 for the remainder of the year giving a full year forecast of £2,123,000;

VAT: HIE estimated costs of VAT advice and staff costs is c£250k for 2019-20.iv

The proposed Space Hub Sutherland project, which HIE is expected to support with a contribution of £9.8m, was mentioned in the Audit Scotland 2018-19 Annual Audit Report. It stated:

Recent indications are that the costs of the project are increasing, and it is not yet clear how these will be funded. HIE recognises this project is high risk and is in active discussion with key stake holders, including the Scottish Government and the United Kingdom Space Agency.

HIE stated that the 2019-20 budget-setting process within HIE was ‘quite challenging in view of the very tight financial settlement.’v

In supplementary evidence, the Cabinet Secretary for the Rural Economy provided further information on VAT expenditure. In 2017, HMRC reviewed HIE’s VAT arrangements and concluded that they should be reviewed and updated. HIE commenced a review and engaged Ernst and Young to provide expert advice in this technically complex area on both the reviewing of their VAT arrangements and in terms of agreeing a settlement with HMRC on any backdated liability which could date back to 1 April 2014. HIE have therefore made a provision for this totalling £4.534m in their accounts.vi

Members were concerned that funds are being diverted from other investments to fund the management of the Cairngorm project. HIE told the Committee that it has retained significant income from the sale of a significant asset (Centre for Health Science), and they are positive about potentially using that money in addition to theircore budget.vii

HIE said that there is a section 50 agreement which means that the funicular, if it is out of operation or ceases to operate for a period and there are no plans to repair it, has to be removed from the hill which has to be reinstated to how it was before the funicular was built. HIE said that currently, the estimated cost of doing that is significantly greater than the cost of repairing the funicular. A final decision on next steps is expected by the end of the year.viii

The Committee wrote to the Cabinet Secretary for the Rural Economy highlighting the risks currently faced by HIE; he responded as follows:

HIE continue to provide economic development support to the Highlands and Islands region and as outlined in their annual report, they successfully delivered all of their key measures for 2018-19, with six out of eight measures exceeding the target range and successfully supported 1051 FTE jobs to be created or safeguarded in addition to 166.75 FTE jobs in fragile areas. This is in tandem with managing the Spacehub and Cairngorm complex areas of work.

As outlined above HIE recognises the need to devote considerable staffing resource and procure external expertise to ensure that major projects and challenges are managed effectively, and I have assurances from senior management at HIE that they are alert to the risks that this presents.ix

The Committee notes that HIE is managing a number of additional risks this year, not least the Cairngorm project. The Committee also notes the additional expenditure associated with managing these risks. The Committee seeks confirmation from the Scottish Government that the costs associated with ongoing management of the Cairngorm project will not impact on HIE’s other economic development activities and support for other businesses in the region.

Enterprise agency targets

In previous budget reports, the Committee has commented that the enterprise agencies created their own targets and assessed their own performance. In last year’s budget report, the Committee said that the Strategic Board must ensure that the enterprise agencies set ambitious and stretching targets.i

SE told the Committee that the enterprise agencies are now working with the strategic board to seek to work to consistent measures.i They described this as a work in progress with the Scottish Government’s analytical unit now supporting that work, and the enterprise agencies working towards the NPF targets:iii

‘In year 1, we did not even have the same definitions for targets as HIE—we measured things in slightly different ways. We decided that we needed to sort that out, getting the basics done first in order to ensure that we were much more consistent in our definitions. The strategic board looked at the targets across the enterprise and skills agencies and challenged us to think very differently.’iv

Similarly, HIE said:

As a result of the Enterprise and Skills Strategic Board work, we are getting closer alignment between the agencies…… It is not a huge impact. In relation to the social community impact and the inclusive growth model that we want to pursue, some of the things that we would like to do as an agency require system changes… That requires adjustment both to information technology and to data collection. It will take a number of years to come through, but that alignment is there.v

The Committee welcomes the role of the Strategic Board in aligning the targets of the enterprise agencies. As set out below, this is a work in progress.

Linkages to NPF

Measuring the activities of the enterprise agencies against the Scottish Government’s budget and intended outcomes has been an ongoing challenge for the Committee.

The NPF was developed by the Scottish Government in 2007 and last updated in 2016. It is a tool to support the delivery of the Scottish Government’s purpose and priorities and is based on delivering outcomes that improve the quality of life for people in Scotland.

In a recent SPICE blog entitled Linking budget to outcomes: the impossible dream?, it was argued that linking spend to NPF outcomes is still a challenge:

it is not immediately clear how the [NPF] baseline report, or indeed the new website, supports efforts to identify linkages between budget decisions and outcomes as recommended by the Budget Process Review Group.

Linking budgets to outcomes is notoriously difficult, for who can say that complex social and economic outcomes are ever neatly attributable to any one budget line? However, it should still be possible for parliamentarians to gain an understanding of the extent to which a budget line has made a positive contribution to an outcome. After all, budgets buy inputs which should lead to measurable outputs. The effectiveness of these outputs can then be assessed against desired outcomes.i

Looking at the National Indicators Performance Overview, it is striking that none of the eight indicators relating to the business and fair work show any improvement over the most recent reporting period. Three indicators - the percentage of high growth businesses, the total number of businesses and the percentage of innovation-active businesses - have seen performance worsening, and the living wage and employee voice indicators have both seen little change over recent years despite being the subject of considerable policy focus.

STUC noted this lack of improvement and stated that ‘significant focus will need to be placed on these issues in order to move forward with Scotland’s Fair Work and economic development ambitions.’ They said that there should be a focus on fair work in a range of business subsidies to start to address this.ii

As part of our outcome focused budget scrutiny process, it should be possible for the Committee to take a view on the extent to which RSA and other enterprise agency expenditure has contributed to the Scottish Government's indicators, and the following related National Outcomes:

We have thriving and innovative businesses, with quality jobs and fair work for everyone.

We have a globally competitive, entrepreneurial, inclusive and sustainable economy.

In response to the Committee’s budget report last year, the Cabinet Secretary said:

The Strategic Board’s Analytical Unit is developing a measurement framework which will allow the Board to track progress against outcomes and impacts using relevant indicators from the newly refreshed National Performance Framework, and to use the agencies’ management information and existing performance frameworks to shed light on the agencies’ contribution to outcomes and impacts. Importantly, agency level information about inputs, activities and outputs will be aligned with the NPF to ensure that there is a clear understanding of which agency activities contribute to which outcome and consistency in terms of the outcomes which are measured. The Board will then use this information to inform its recommendations on agency targets and priorities.iii

SE told the Committee that they now relate their activity with the NPF. For example, they have headline target measures around jobs, R and D and exports, all of which link to the framework.iv They said:

economic development is really complex. There is not a magic bullet or a single number; there have to be a plethora of things. What does the dashboard look like over the piece? The national performance framework is probably the right route to follow to see whether shifts are happening in the economy.v

The Committee welcomes the move by the enterprise agencies towards tracking targets of relevance to the NPF. However, it remains challenging for the Committee to assess enterprise agency spend against Scottish Government outcomes. The Committee also notes the lack of progress in relation to NPF fair work and business indicators.vi

The Committee invites the Strategic Board and enterprise agencies to set out how their work on targets will progress to enable meaningful scrutiny of outcomes related to spend.

Inclusive growth

Definition and measurement

Inclusive growth is a central plank of the Scottish Government’s economic policy; its inclusive growth priorities are: place and regional cohesion, fair work, the business pledge and promoting equality and tackling inequality. However, the Committee has heard repeatedly that there is no commonly adopted definition of the term.

HIE said that the diverse nature of place in Scotland leads to challenges in creating a single definition of inclusive growth:

What inclusive growth feels and looks like in the centre of Glasgow will be different from what it feels and looks like in the Highlands and Islands, where businesses and communities will have different priorities and face different challenges. Similarly, the opportunities that land at their doors will look and feel different.

In Scotland, we share the same concept and we understand what that is, but we need to look at the issue from a particular organisational or regional perspective. It is very important that HIE does that, given our social and community remit.i

HIE said that inclusive growth evaluation is ‘challenging’ but that they will work with SE:

We have particular targets for fragile areas. We will work with Scottish Enterprise and the emerging south of Scotland enterprise agency on developing the pilot more accurately to measure inclusive growth.ii

SE acknowledged that there is no single measure of inclusive growth. In its new strategic plan document, they said:

we will continue to work closely with our partner agencies, and Highlands & Islands Enterprise in particular, to further align our measurement approaches. For example developing common measures on how to more effectively monitor and evaluate inclusive growth.iii

HIE explained that the enterprise agencies have a range of target measures that relate to matters such as community investments, generating income from assets in communities and average wages. They track the quality of jobs and their salaries. They also look at where the investment is being made. HIE spoke of ‘a strong place-based approach.':

We are looking not just at the numbers but at where the impact is felt across our region.iv

HIE highlighted that measures alone do not convey the relative impact of interventions in different geographic areas or among groups that are under-represented or facing disadvantage in social or economic terms and therefore do not represent the extent to which investments contribute to inclusive growth. To address this gap, HIE is developing a model through which individual investment options can be compared not only in terms of their economic benefit but also in terms of their contribution to inclusive growth.v

In last year’s budget report the Committee recommended that the enterprise agencies produce more explicit, measurable inclusive growth targets in future business plans. The Committee made a similar recommendation in its report on Scotland’s Economic Performance.vi

In September 2018, the Scottish Government set out its definition of inclusive growth in its response the economic performance report:

The Scottish Government defines inclusive growth as growth that combines increased prosperity with greater equality, creates opportunities for all, and distributes the dividends of increased prosperity fairly. The Government is committed to creating a shared understanding of both what inclusive growth is, and how it can be achieved.vii

The Cabinet Secretary believes that the definition is clear and that the way in which it is expressed in actions, through the economic action plan, is helpful.viii However, this definition has not been used by the enterprise agencies in evidence to the Committee.

In December 2018, the Scottish Government’s response to the Committee’s budget report stated:

The delivery of sustainable and inclusive growth underpins the business plans of both Scottish Enterprise’s and Highlands and Islands Enterprise. ……The recording of the average salary of jobs supported was introduced in 2016/17 and, in the absence of comprehensive regional statistics, this target provides a useful inclusive growth indicator as it allows Highlands and Islands Enterprise to track the contribution its interventions make to raising average wage earnings across the region.

The Committee heard that there was still room for improvement around promoting and measuring inclusive growth. Economist Richard Marsh believed that RSA had the potential to make more of an impact; however he thought that inclusive growth was ‘ill-defined and currently not fit to shape policy interventions.’ STUC believed that the relationship between inclusive growth and fair work has not sufficiently filtered down to all the agencies. They pointed to the target for Scotland to be a fair work society by 2025 and said that there has been a change in ‘policy speak’ but there has not been any visible change.ix

Inclusive growth is a key plank of the Scottish Government’s economic policy. The Committee has previously recommended that a commonly understood definition of inclusive growth is needed so that progress can be properly measured. We welcome the planned work across the enterprise agencies in this area. However, it appears from evidence that there is still no commonly adopted definition being applied across their activities.

The Committee recommends that the Strategic Board monitors progress in aligning inclusive growth across the enterprise agencies. The Committee will take evidence from the Board in early 2020 and asks for an update to be provided at that meeting.

Jobs and conditionality

The Scottish Government’s Fair Work initiative asks employers to commit to:

investment in skills and training;

no inappropriate use of zero hours contracts (for example using zero hours contracts when people are working regular hours; exclusive contracts that stop flexible workers working for other people);

action to tackle the gender pay gap;

genuine workforce engagement such as trade union or employee association recognition, and

payment of the real living wage.

The Scottish Government stated that, in 2019/20, it will test this new approach by attaching fair work criteria to RSA and other large Scottish Enterprise job-related grants. This will focus on grant recipients paying the real living wage, no inappropriate use of zero hours contracts and meeting the legislative requirements to publish information on the gender pay gap.i

Both agencies said that jobs are key to their work on promoting inclusive growth. SE now aims to secure jobs that pay at least the real living wage but they also monitor high-value jobs:

A quality job is one that pays the real living wage in a company that adopts fair work practices. It is about the sense of being a valued employee. We also use a definition of value-added jobs, such as our research and development jobs. That is a Scottish Government definition, which means salaries of more than £40,000. A quality job is one in which the employee feels valued, and they are earning enough money to live. You can see that right through our strategic framework.ii

The STUC believed that collective bargaining coverage is important as companies might pay the living wage but deny employees other benefits such as subsidies: