Finance and Public Administration Committee

Report on the Scottish Budget 2026-27

Introduction

Published much later than usual, on 13 January 2026, the Scottish Budget 2026-27 sets out the Scottish Government’s proposed tax and spending plans for the next financial year. This timeframe, the consequence of a late UK Budget, provided an unacceptably short time for parliamentary scrutiny. The Committee therefore calls on the UK Government to give much greater regard to devolved budgets when setting the timing of future fiscal events.

The Scottish Budget 2026-271 was accompanied by the Scottish Fiscal Commission’s (SFC’s) latest set of forecasts2 for the economy, tax revenues, and social security spending which, alongside forecasts from the Office for Budget Responsibility (OBR), inform the overall size of the Scottish Budget. The SFC noted that economic conditions remain largely unchanged compared with its expectations in December 2024, with global instability and uncertainty “weighing on household and business confidence”2, while the OBR warned that the UK public finances remain vulnerable to future shocks4.

Total funding available to the Scottish Government is forecast to be £61,677 million in 2026-27, an increase of 1.3% in real terms from 2025-26. The funding outlook is forecast to grow on average by 0.8% in real terms in each year of the forecast period (up to 2030-31)2.

The Scottish Government has said “this is a Budget that delivers opportunity for Scotland by investing in families, public services and the economy while continuing to build a fairer, greener and more prosperous future”. It also notes that “delivering these ambitions within tight funding constraints demands reform and innovation”.1 The Scottish Budget 2026 is accompanied by a three-year Scottish Spending Review (SSR), which the Scottish Government states, sets “a clear financial trajectory for public spending, underpinned by £1.5 billion in planned efficiencies and reforms that will protect investment in frontline services”7. As in previous years, the need for greater transparency in relation to all budgetary documents is a key theme in this report.

Longer-term, the SFC has warned that “the Scottish Government will face significant challenges funding devolved public services in the future, particularly over the next twenty-five years … because the population in Scotland will age earlier than in the rest of the UK”. In its baseline scenario the SFC “project that, on average, Scottish devolved public spending would have to be reduced by 4.1% on average each year compared to projected spending to balance the budget. This is equivalent to £4.6 billion in 2024-25 prices.8 In our pre-budget 2026-27 report, we therefore called on the Scottish Government to place much greater emphasis on longer-term financial planning in order to start mitigating the potential significant impact of future trends.9

It is against this background that the Committee publishes the findings of our scrutiny of the Scottish Budget 2026-27. While our report also includes evidence and some recommendations relating to the SSR and the long-awaited Infrastructure Delivery Plan (IDP), separate scrutiny of these documents will take place in February and March 2026.

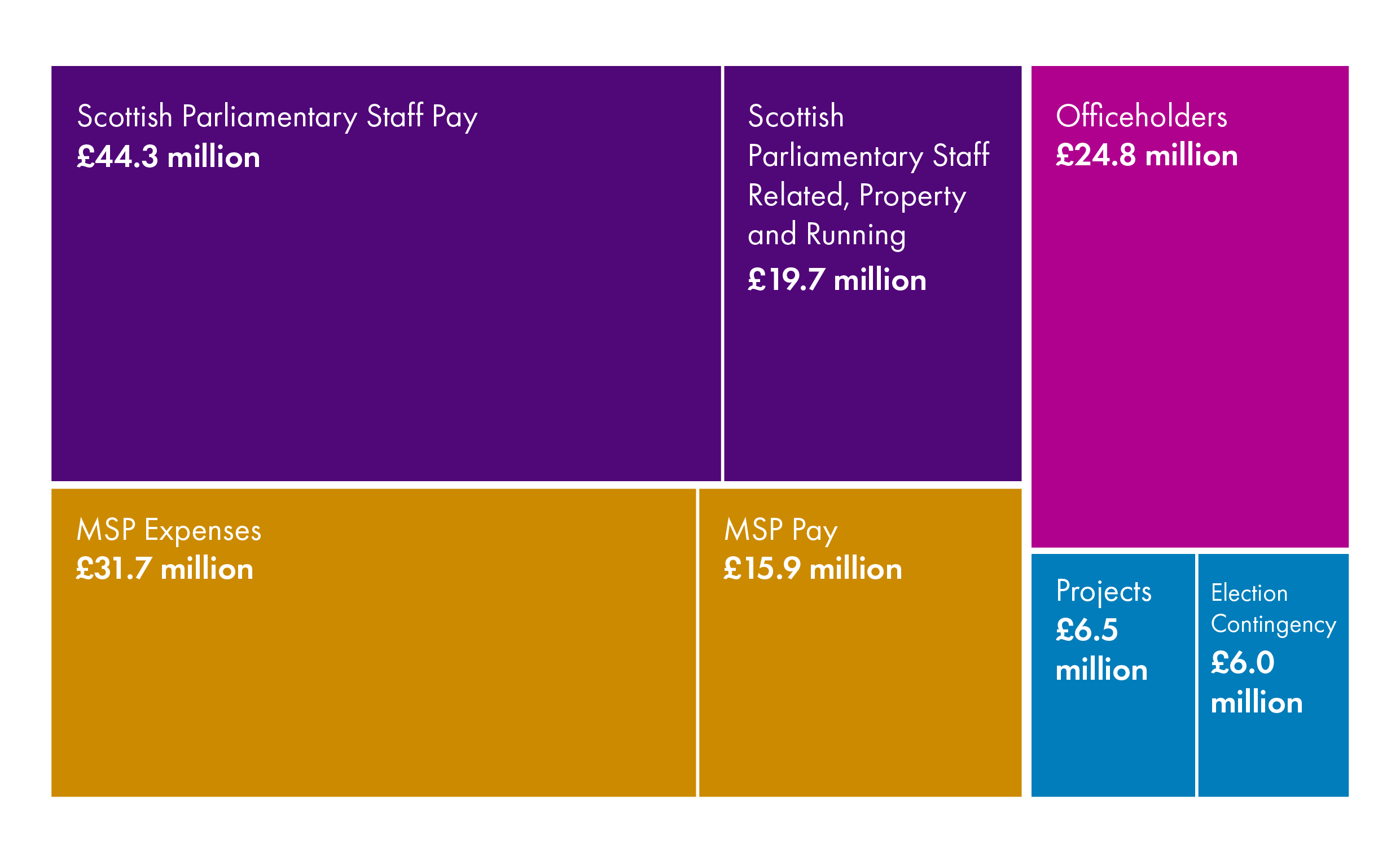

In addition, this report reflects our consideration of the Scottish Parliamentary Corporate Body’s (SPCB’s) budget proposal for 2026-27, as required under the Session 6 Agreement between the Committee and the SPCB.

The Committee thanks our witnesses for their valuable evidence, which has helped shape our findings and recommendations.

UK context

The OBR, in its November 2025 outlook, forecasts real GDP growth of 1.5% in 2025, an increase on its March figure of 0.5% “because output growth was revised up in the second half of 2024 and growth was stronger than expected in the first quarter of 2025, at 0.7%”. The OBR also reduced its central forecast for productivity growth in the medium term to 1%, 0.3 percentage points slower than in its March forecasts. This, it explains, is because “the UK’s productivity performance has undershot our forecasts, despite several substantial downgrades since 2010, as a significant rebound from recent negative shocks has not materialised”.1

The UK Government said its 2025 Budget “takes the fair and necessary choices to deliver on the government’s promise of change”, by cutting the cost of living, reducing the NHS waiting list in England and decreasing debt and borrowing. It further highlights that “the [UK] Government’s plans are underpinned by its non-negotiable fiscal rules which provide credibility by ensuring day-to-day spending is met with revenues, while allowing the step change needed in investment to grow the economy”.2

Key spending announcements in the UK Budget 2025 include removing the two-child limit in universal credit from April 2026 and cancelling the reforms to eligibility for personal independence payments (PIP) which had been announced at the Spring Statement. The UK Budget also sees increases to the national living wage, an extension to the freeze on fuel duty, and the introduction of a cash limit of £12,000 within the overall annual limit of £20,000 for individual savings accounts (ISAs).i

According to the OBR, policies in the UK’s 2025 Budget “increase spending in every year and by £11 billion in 2029-30, primarily to pay for the summer reversals to welfare cuts and lift the two-child limit in universal credit”.1

The UK Government froze personal tax thresholds for both income tax and national insurance contributions (NICs) for employees and the self-employed for a further three years (from 2028 to April 2031), and capped NICs relief on salary sacrifice into pension schemes to the first £2,000 of pension contributions per person from 2029.

It also increased tax on property income and savings income by two percentage points at the basic, higher and additional rates from April 2027. At the time of writing, the Scottish Parliament is considering a legislative consent memorandum to devolve similar powers to Scotland through the UK Finance (No.2) Bill. A new council tax surcharge was also announced for England from April 2028 on residential properties valued at or over £2 million (a so-called ‘mansions tax’).

Other tax measures include introducing electric vehicle excise duty, a new mileage-based charge for electric vehicles and plug-in hybrid cars from April 2028, increasing gambling levies to 40% from April 2026, and implementing permanent lower business rates for retail, hospitality and leisure properties.

The OBR notes that the UK Budget raises taxes “by amounts rising to £26 billion in 2029-30 [, … bringing] the tax take to an all-time high of 38% of GDP in 2030-31”.[1] The OBR also highlights that debt rises as a share of GDP from 95% this year to 96% of GDP by 2030, “twice the debt level of the average advanced economy”.1

The Chancellor’s fiscal rule that the UK Budget is to be in surplus in 2029-30 is forecast to be met by a margin of 0.6% of GDP (£22 billion), compared to a margin of 0.3% of GDP (£10 billion) in March 2025. The OBR suggests that the probability of meeting this rule has therefore risen from 54% in March to 59%. In line with a proposal from the International Monetary Fund5, the Chancellor has announced that while the OBR will continue to produce two forecasts a year, the Autumn outlook only will assess the Government against its fiscal targets. The OBR told us that this approach is common in other countries6, while the Fraser of Allander Institute (FAI) said it “is unlikely to have any practical consequences”, adding “the OBR will still publish the relevant figures, and the headroom will be very easy to calculate by everyone”7.

Decisions in the UK Autumn Budget have led to additional consequential funding for the Scottish Government of £510 million in resource funding over the next four years and an extra £310 million in capital funding over five years (£820 million in total).2 The FAI has suggested that this funding for the Scottish Government “is quite lumpy: there is a boost in the short-term, eroding away quickly and a small cut in day-to-day spending in 2028-29”7.

Scottish context

Economic and fiscal outlook

In its January 2026 forecasts, the SFC highlights that economic conditions remain largely unchanged compared with its expectations in December 2024. It has therefore only made small adjustments to its five-year economic outlook in line with recent outturn data and updated UK economy assumptions based on the OBR’s November 2025 forecast—

It has revised down its GDP forecast slightly, in line with outturn data since the end of 2024. It explains that factors such as global instability and higher consumer and business costs had a greater impact on outturn data towards the end of 2024 than the SFC had anticipated.

It has also revised down its forecast of trend productivity growth from between 1% and 1.2% in its December 2024 forecasts to 0.9%, “with the reduction in 2029-30 mirroring the OBR’s downgrade”.

It has revised up Scottish earnings growth to 2.9% for 2026-27, a small increase from its December 2024 forecast of 2.8%. The OBR revised up its UK earnings growth prediction for 2026-27 in its November 2025 forecasts to 3.2% (from 2.1% in the OBR’s October 2024 forecast). The SFC explains that real time information data up to October 2025 shows that annual mean pay growth in Scotland is slightly below the UK, partly due to slower earnings growth in the North East of Scotland relative to the Scottish average.

Economic inactivity is now back close to its pre-COVID-19 pandemic rate in both Scotland and the UK.1

As noted earlier in this report, the SFC forecasts total funding available to the Scottish Government of £61,677 million in 2026-27, an increase of 1.3% relative to 2025-26 in real terms. Total funding is forecast to grow on average by 0.8% in real terms in each year of the forecast period (2025-26 to 2030-31).

Resource funding increases in each year of the forecast by an average of 1.1% in real terms. Capital funding increases by nearly 2.9% in real terms in 2026-27, followed by real-terms cuts to funding in subsequent years. However, the SFC explains that the Scottish Government has reduced capital funding in 2025-26 by £226 million, which means the growth rate in funding between 2025-26 and 2026-27 is higher than would otherwise have been the case. The SFC also notes that the Scottish Government has taken the decision to reduce capital funding in-year in 2025-26 “to minimise any underspend”.1

The projected income tax net position for 2026-27, on which the Scottish Budget 2026-27 is set, is £969 million. This compares to £838 million in the 2025-26 Budget (based on the latest available forecasts in December 2024). The SFC explains that this is largely due to lower-than-expected UK Income Tax data reducing the BGA forecast.

The outturn data for 2023-24 also resulted in the reconciliation being applied to the Scottish Budget in 2026-27 increasing by £126 million from £279 million to £406 million. The reconciliation to be applied to the 2027-28 Budget is now projected to be a negative £310 million, compared to June 2025 projections of negative £851 million. The SFC notes that “the [previous] projection would have been larger than the Scottish Government’s resource borrowing limit in that year, but the Scottish Government can now borrow in full to cover it and intends to do so”.1

Scottish Budget 2026-27

Taxation plans

The Scottish Government states that “this Budget builds on the foundations laid over recent years, during which changes to Scotland’s taxes have delivered a fair and progressive system while generating significant additional revenues”. The Budget document goes on to say that the Scottish Government has prioritised “stability for taxpayers, delivering a predictable and transparent framework that supports economic confidence while safeguarding the public finances”.1

Key elements of the Scottish Government’s taxation plans announced at the Scottish Budget 2026-27 are explored in more detail below.

Income tax

The Scottish Government has increased the basic and intermediate rate thresholds of income tax by 7.4% in 2026-27, which the SFC forecasts reduces revenues by £50 million. Previously announced freezes to the higher rate, advanced rate, and top rate thresholds in 2026-27 also come into effect, already baselined into the SFC’s forecasts. The Government’s plans to extend these freezes to 2027-28 and 2028-29 would, the SFC forecasts, increase revenues by £72 million in 2027-28 and around £200 million from 2028-29 onwards.

The Committee heard a number of concerns relating to the Scottish Government’s plans in relation to income tax. Professor David Heald from the University of Glasgow suggested, “if you are going to have six tax bands, they should go up more gradually”, given anomalies arising from how the Scottish income tax rates interact with UK national insurance and personal allowance policies. It was noted this “is not a fair income tax schedule and it does have implications for decisions people are making”, which “isn’t good for the economy; it isn’t good for tax receipts”.1

Witnesses noted that with all higher thresholds remaining frozen for 2026-27 and the following two years, significant revenue will be raised through fiscal drag, which we heard is “perceived to be less politically costly” than raising rates. Professor Heald suggested that this is now the main tax policy instrument of both the UK and Scottish Governments, “seeking to exploit the lack of taxpayer understanding of the interaction between tax bands and rates”. However, he went on to suggest that the Scottish Government must have considered when making this decision that “the block grant adjustment would have got bigger if Scotland had not done that”, due to the UK Government’s decisions on income tax.2

Professor Mairi Spowage, Director of the Fraser of Allander Institute (FAI), highlighted that because Scotland’s higher rate threshold has been frozen for many years, the number of taxpayers paying the higher rate of tax or above has risen from around 12% in 2016-17 to about 30% by the end of the forecast period (2030-31). That, she suggested, is “a fundamental change in our understanding of who counts as a higher rate taxpayer and what proportion of the income distribution should be paying higher rates of tax”.1

Witnesses discussed the level of public understanding in relation to the tax system in Scotland and the UK and suggested that, while the Scottish income tax system is layered onto an already complex UK system, a simpler more understandable Scottish income tax model is possible.1 Professor David Bell, University of Stirling, also argued that there needs to be a broader discussion about how progressive other taxes are, rather than focusing mainly on income tax, with council tax highlighted as the least progressive tax in Scotland.1

The Committee repeats its calls for the Scottish Government to work with the UK Government to address the anomalies arising from how Scottish income tax rates interact with UK national insurance and personal allowance policies. This work should include understanding and resolving potential behavioural impacts.

While we recognise the fiscal pressures in the Scottish Budget, we ask the Scottish Government in place after the election to consider the most effective way to ensure a fairer, more gradual and transparent approach to raising income tax revenues than continuing to use ‘fiscal drag’.

Council tax

While there is no cap or limit on increases to council tax in 2026, the Cabinet Secretary said in her Budget statement that the 2% real terms increase in the local government budget “[…] is a reasonable deal and, given the cost-of-living pressures that we all recognise, I urge local authorities to translate that settlement into reasonable decisions on council tax”.1 The significant pressures in the local government budget and potential for council tax increases are discussed separately in the spending section of this report

New council tax bands for properties with a 2026 market value above £1 million will be introduced in 2028. The SFC states that “we have assessed the potential behavioural effect of this policy on LBTT revenue and consider that it will fall below our materiality threshold, and so we have not made any adjustments to our LBTT forecast”.2

Witnesses highlighted a lack of clarity regarding how the revenues from the new council tax bands for high-value properties will be distributed across local authorities and whether there could be any impact on the local authority settlement. In its reaction blog, the FAI suggested that “clarity on whether how/if additional income will be equalised across local authorities needs to be clarified – obviously most £1 million+ properties will be clustered geographically, but this doesn’t mean that those geographical areas will retain all that income”.3

Subsequently, Professor Spowage said “my understanding […after reading the Official Report] is that that funding will accrue to local government […,] however, it will only accrue to certain bits of the country, one would think, which will mean that how it will be pooled and how it will impact on the general revenue grant is to be negotiated”. She went on to highlight “we do not know yet how much the tax will raise”, although she reported comments from the Minister for Public Finance that it could raise around £14 million.4

In evidence to the Committee, the Cabinet Secretary advised that the Scottish Government has agreed the funds raised should be retained in local government and it will be for COSLA to decide how revenues should be used. This could involve a distribution formula across all local authorities or revenues staying within the local authorities that accrue them. The Cabinet Secretary further highlighted the UK Government’s decision that revenues from a similar tax being implemented in England will be returned to central government. She further noted that the Scottish tax will not take effect until 1 April 2028, so there is “scope and time” for local government to discuss and agree how it will work.

There was consensus amongst witnesses that a much wider review of council tax is urgently needed and disappointment that the revaluation is limited to the new higher bands. For example, the FAI said that “such a move by the Scottish Government to tweak around the edges is not surprising based on past experience but is hugely disappointing”.3

The Committee welcomes the Scottish Government’s decision that revenues gathered through the new higher-rate council tax bands will remain within local government.

We, however, seek assurances that the local government core funding settlement will not be adjusted downward to reflect these additional funds and look forward to receiving further details on how the revenues will be distributed, as and when this becomes available.

While the Committee wanted to see much greater progress towards reform of local government taxation in recent years, we urge the next Parliament at the start of the session to consider this.

Other taxes

The Budget includes 15% non-domestic rates relief in 2026-27 for retail, hospitality and leisure (RHL) premises. The SFC states that its non-domestic rates forecast is based on the new valuation roll which comes into effect on 1 April 2026, leading to an increase in forecast revenue from £3,097 million in 2025-26 to £3,387 million in 2026-27. It estimates that the RHL premises reliefs announced along with transitional reliefs relating to the new valuation roll are estimated to reduce revenue by £153 million in 2026-27. Concerns have been raised by the sector that the reliefs fall short of the permanent business rate discounts on offer to retailers in Englandi.

The UK Government recently announced additional NDR reliefs for pubs in England, to be in place from April 2026. This will result in some additional funding for the Scottish Government.

The small business bonus scheme will be maintained at the existing rates and thresholds for the next three years of the revaluation cycle “in order to ensure certainty for businesses”.

All LBTT rates are maintained in 2026-27, while Scottish Landfill Tax (SLfT) rates will continue to be aligned with equivalent UK rates in 2026-27, “ensuring consistency and simplicity for taxpayers”. The Scottish Aggregates Tax (SAT) comes into effect from 1 April 2026 and will be aligned to the equivalent UK tax rate in 2026-27. SAT is forecast to raise £42 million in 2026-27, increasing to £48m in 2030-31.

The Budget states that Air Departure Tax (ADT) will come into force in April 2027. The Scottish Government is launching a consultation by the end of January 2026 on a new Highlands and Islands Exemption for domestic flights. It also plans “to bring forward a Private Jet Supplement within ADT in 2028-29 and engage with the UK Government to seek further devolution to allow private jet ‘ghost flightsii’ to be addressed”.1

The Committee seeks clarity on how the additional funding arising from recently announced NDR reliefs for pubs in England will be used for a similar purpose.

Spending plans

Overview

The Cabinet Secretary for Finance and Local Government made the following spending announcements in the Scottish Budget 2026-27—

“A record £22.5 billion for health and social care”, with £36 million being provided to start the rollout of new High Street walk-in GP clinics, “making it easier to access same-day appointments”.

Additional funding of £15 million “to build on existing delivery” for breakfast clubs to be rolled out for every Scottish primary and special school pupil from August 2027.

A combined increase of £70 million in resource and capital funding for the college sector, “equivalent to a 10% uplift on last year’s budget”. Concerns have been expressed regarding the accuracy of this figure, which is considered in more detail under the Transparency section of this report.

A total of £5 billion for “measures that will reduce Scotland’s carbon emissions, increase our resilience in the face of climate change, and in many cases, save families hard-earned cash” in 2026-27. Targeted support will be provided “to ensure critical skills shortages in our offshore renewables sector are met, and to help retrain workers in the oil and gas sector”.

Funding of £926 million in 2026-27 for the Scottish Government’s Affordable Housing Supply programme, “ensuring new, affordable homes are energy efficient and meet environmental standards”.

Investment in Enterprise Agencies of £326 million and a commitment to a further £200 million for the Scottish National Investment Bank.

Increased funding for Scotland’s International Development Fund and Humanitarian Emergency Fund to £16 million in 2026-27.

Investment of £29.9 million through the next round of Invest to Save for projects that “will deliver ongoing savings and support the delivery of the PSR [Public Service Reform] strategy – a key part of the Government’s overarching approach to fiscal sustainability”.1

On spending, the IFS suggested that “the overall outlook for Scottish public finances and services is far less rosy than [… the topline announcements] would suggest”, with many public services in Scotland set to see a reduction in their budgets.2 Overall day-to-day spending on public services will see very small increases over the next three years (0.6% above inflation in 2026-27, and 0.2% above inflation a year on average over the following two years).

The IFS goes on to highlight an 0.7% increase in health and social care spending in 2026-27, which “allows [… the Scottish Government] to avoid cuts to other services, but without heroic improvements in productivity will almost certainly not be enough to maintain let alone improve services”.2 Concerns have also been raised by the IFS and other commentators that emergency budget changes may be required in year, should the Scottish Government not meet its efficiency targets or if public sector pay deals are higher than planned.

Committee Members discussed with the Cabinet Secretary details of the increased housing budget. She explained that “there is a significant uplift in the funding for the affordable housing supply programme [… as] part of the overall £4.9 billion of investment over the next four years”, involving £4.1 billion of public money and £800 million of private investment “levered in to grow the pot for delivering the target of 110,000 affordable homes by 2032”. The Scottish Government’s Director of Public Spending told the Committee that “there is a greater degree of investment of financial transactions in 2026-27 compared with the 2025-26 figures, but we will come back to you on that for full transparency, convener”.

Two of the largest areas of spending in the Scottish Budget – local government and social security - are explored in more detail below, given concerns raised in evidence.

Local authority funding

The Scottish Budget includes an overall increase in local authority funding of 2% in real terms, although there are questions around the accuracy of this figure (see the Transparency section of this report). Regardless of the figures used, witnesses expressed concern regarding the funding available for local government in the upcoming budget and over the Scottish Spending Review period.

Professor Spowage told the Committee that “council budgets have been under significant pressure for years [and …] in that time, overall funding for councils has formed a smaller proportion of the Scottish Government’s budget”. She highlighted that the small real-terms increase (of 0.4% according to the SFC), “is unlikely to be sufficient to avoid what will probably be fairly large—at least high single-digit increases in council tax”.1

Professor Spowage also highlighted “a potential danger that local authorities will not manage to meet their statutory obligations”, and “to some extent, we can already see that in relation to housing and homelessness, given the pressure that local government is under in that regard”.1 Professor Bell further noted the demands on social care will increase substantially and “a lot of additional spending is needed in health because local government does not have the capacity to deal with people looking for a place when they come out of hospital”. He went on to say: “the overall position is severe, and it will become critical”, with “continuing pressure on local government spending, which is the front line when it comes to this issue”.1

COSLA has also criticised the budget as “a very poor settlement which fails to address the dire financial situation of local government”, highlighting specific concerns regarding the level of social care funding. In advance of the Budget, it had “made a clear and urgent ask for significant additional investment of £750 million to protect and strengthen social care [… however,] the Scottish Budget as it currently stands, fails to deliver on this”.4

The SPICe briefing on the Scottish Budget 2026-275 quotes a recent Local Government Information Unit survey of council leaders, chief executives and senior finance officers which found that every respondent intends to reduce spending on services and increase council tax in 2026-27. The report concludes that “the scale of council tax increases continues to be significant”, with every council planning to raise council tax by at least 5% and over a fifth planning increases of over 10%.6

Asked to respond to concerns regarding the financial pressures on local government, the Cabinet Secretary said, “there’s a debate among commentators about what the level of real terms increase is, but everybody has accepted there is a real terms increase”. She went on to say that the “planning assumptions that I’ve set out to local government are based on what we have available to us […,] but I expect those figures to change—and to change considerably”. She added “no Spending Review stays the same, it always shifts in a positive direction”.

The Cabinet Secretary was also asked whether she expects local authorities to struggle to meet their statutory obligations. The Scottish Government’s Director for Local Government told the Committee “there have been conversations throughout [her four years working on local government] about the challenges in delivering statutory services, as well as preventative or more discretionary services”, adding “that has been consistent […] and has fed into the conversations about reform and about looking at how some services are delivered”. She went on to say that some of the extreme pressures such as homelessness and social care require to be addressed.

The Cabinet Secretary also confirmed that while all funding has been allocated in the draft budget, she has been discussing with COSLA where joint funding might be provided to deliver complex social care in a different way, leading to better outcomes.

The Committee has significant concerns that the pressures on local government finance may lead to large council tax rises and some local authorities struggling to meet their statutory obligations. We therefore ask the Scottish Government to discuss with local government how and where further support might be provided to ease such pressures, including if additional funds become available through revenues or the block grant. An update on the Scottish Government's discussions with local government should be provided ahead of the Stage 1 debate.

While it is encouraging that the Scottish Government is exploring different ways to fund the delivery of complex social care, we do not consider the current model of funding to be sustainable given current and future demand. The Committee therefore urges the Scottish Government to explore with local government how a more sustainable model can be put in place that can meet the significant demographic challenges ahead.

Social security spending

As part of the Scottish Budget 2026-27, the Cabinet Secretary announced an inflationary increase in the Scottish Child Payment (SCP) to £28.20 per week from 2026-27 and introduction of a “premium payment of £40 per week for eligible children under 12 months”, from 2027-28.1 The SFC expects around 12,000 children to receive the £40 SCP at a cost of around £7 million per year from 2028-29 (£3 million in 2027-28 due to mid-year introduction).

More broadly, the SFC forecasts spending on social security to rise from £7.4 billion in 2026-27 to £9.2 billion in 2030-31, which it states, “is driven by annual increases in payment rates with inflation and an ongoing rise in the number of people receiving disability and carer payments”.2

The gap between social security spending in Scotland and the social security element of the BGA is expected to widen from £954 million in 2024-25 to £1,202 million in 2030-31. However, changes at a UK and Scottish level have led to this gap narrowing compared to the SFC’s December 2024 forecasts. The SFC considers “there is still a risk to the Scottish Budget from social security spending, but the current scale of the risk is lower now than for previous forecasts”.2

The SFC has reduced its spending forecast for adult disability payment (ADP) “because there have been fewer approved applications and more people exiting the payment than we expected in December 2024”. While spending on ADP is expected to exceed what would have occurred if PIP remained in Scotland, “the latest data suggests the difference between ADP and the counterfactual of the continuation of PiP is narrower than our previous forecasts suggested”2. During evidence, Professor Graeme Roy, Chair of the SFC, told the Committee that “if that trend continues, […] it raises interesting questions about whether that is what the Government is expecting to happen with ADP—that two thirds of people who apply will not be successful and only one third will be—and about the long-term trend”.5

In our pre-budget 2026-27 report, the Committee said we are not convinced that the Scottish Government has set out sufficient evidence to support its argument that the future social security budget is sustainable. We therefore requested that the Scottish Government should carry out reviews to assess (1) the fiscal sustainability of social security spending, (2) the extent to which the level of social security assistance provided supports economic activity, and (3) the spending and outcomes arising from universal payments and services.6

While the Scottish Government’s response highlights other strands of work relating to some of these issues, it does not commit to carrying out the specific reviews as requested. It did however highlight, in response to the request for a review of the spending and outcomes arising from universal payments and services, that “the Scottish Government is developing its approach to public value”. Following publication of the Scottish Spending Review, “this approach will embed a framework for understanding spending proposals through a lens which considers the delivery of government outcomes, delivery risk, impact assessments, the financial implications and other key factors and drawing upon this information to make decisions about government spending plans”.7

The SFC said during evidence that it is not aware of the Scottish Government’s work on public value, though it also suggested it would not necessarily need to see this unless it has a material impact on its forecasts.5

Asked if there should be more emphasis on those policies that deliver the best outcomes, the Cabinet Secretary said, in principle, “it is hard to disagree with that, […] it is a case of then considering the evidence on outcomes of policies”. She explained, “when we are setting budgets and through our work on the spending review, policies are pretty robustly scrutinised and tested [and] every Cabinet Secretary in every portfolio is challenged to set out the degree to which their spending is having an impact on the First Minister’s four key priorities”.

The Committee remains of the view that the Scottish Government has not provided sufficient evidence of the sustainability of the social security budget. It is disappointing that the Scottish Government has not carried out the work we asked for, which would have provided much more data on this issue. We therefore urge the new Scottish Government to carry out these reviews as a matter of urgency when coming into office after the election.

The Committee also has continuing concerns regarding the impact of spending on social security on other areas of the Scottish Budget which are being squeezed. We therefore seek further information on the Scottish Government’s ‘public value’ work and how it will assess which social security programmes deliver the best outcomes, including in relation to universal payments. We would also like to see a clear timetable for when this approach will be fully in place.

Professor Heald noted that “overspends on devolved social security benefits have to be accommodated within the Scottish Budget, creating another source of destabilising fiscal pressure on public services”. He suggested there is therefore an argument for demand-led social security payments to be categorised under AME (annual managed expenditure) rather than DEL (departmental expenditure limits) as is the case in the rest of the UK. He explained “my concern was that there would be an erosion of the rest of the Scottish budget because of higher claims from social security, which are often unpredictable and create pressures for short-run changes”.5 Professor Bell said he made similar points on the DEL-AME split in relation to social security spend as part of a submission on the fiscal framework review.5

The Cabinet Secretary said there may be merit in considering a similar approach for social security, highlighting that agreement has now been reached on moving police and fire pensions funding into AME, which “gives no fiscal benefit apart from future proofing against risk, but it’s a good thing”.

The Committee asks the Scottish Government to discuss with the UK Government the merits of Scotland’s social security budget being reclassified as AME to provide more flexibility to meet unexpected increases in demand.

We also heard that a lack of data makes it difficult to identify which social security policies are making the most difference in Scotland. Professor Bell told the Committee, “I would not say that this is a data-free zone, but there could be a lot of improvement”, adding “there are general population-level statistics, but there is a need to understand what is happening at the individual level, which you can do only through survey work”. 5Professor Spowage added “in order for researchers to understand the interaction between labour market incentives and payments—in particular, the Scottish child payment and other social security benefits—the interactions that somebody receiving ADP might have with the health service, the conditions that those people have and the policies that might help people who are on a particular set of benefits, we need linked administrative data”.5

She went on to highlight work on developing the UK RAPID[1] project which will provide a population-based dataset created from administrative records held by the Department for Work and Pensions (DWP) and His Majesty’s Revenue and Customs (HMRC). However, witnesses noted that data on devolved social security payments is not included in this project, which Professor Spowage described “will increasingly become a blocker for us in understanding what is going on for Scotland specifically”.5

The Committee urges the Scottish Government to work with Social Security Scotland, the DWP and HMRC with a view to enabling data on devolved benefits to be included in the UK RAPID project in the future. This is important in enabling policymaking on social security to be based on the most reliable and up-to-date information.

Should there be a time lag on Scottish data being included in the UK RAPID project, options should be explored to release as much administrative data on devolved social security payments as possible, to allow more analysis to be undertaken.

Scottish Government’s approach to financial planning

Prioritisation

The Committee in our pre-budget 2026-27 scrutiny report sought clarity in future documents on which areas of spending within the Scottish Budget are being prioritised and deprioritised.1 The Scottish Government responded that “progress is being made to further improve this in our 2026-27 Scottish Budget, including clear references to how prioritised funding delivers the Scottish Government’s four priorities”.2 These priorities are eradicating child poverty, growing the economy, tackling the climate emergency, and ensuring high-quality, sustainable public services.

The SFC explained that “for the first time, we have presented tables of portfolios as a share of the Scottish Government’s budget, which show, arithmetically, areas that are being prioritised versus areas that are being deprioritised”. Within an “overall budget [that] is going up very slightly, […] areas such as health and social care and social justice are taking up a bigger share, which shows their priority” and “you then see the figures for local government and education and skills going down”.

The Cabinet Secretary was asked how certain spending decisions in the Scottish Budget 2026-27 align with the Government’s priority of growing the economy, including reductions in the budgets for SNIB, Scottish Enterprise (SE) and Highlands and Islands Enterprise (HIE), and continuing flat cash for Scotland’s five National Performing Companies (NPCs).

She explained that SNIB will receive £200 million for “mission-assigned investments” and flexibility to access to up to £25 million of the Scotland Reserve “to deposit funding that can be carried forward into the next financial year, which will help with its cash flow”. She also highlighted limited financial transactions in the UK Government's Budget which would usually be spent by the Scottish Government on SNIB and on the housing budget. The Cabinet Secretary further highlighted that SNIB has reached its “five-year anniversary and has already managed to crowd in £1.4 billion of third-party co-investments, so it is doing well”.

On enterprise agency funding, she argued “it is a reasonable budget in the light our constraints”, adding that at SE’s request, it has also given SE more flexibility to be able to deliver an ambitious programme of reform and transformation.

Funding for Creative Scotland increases by £20 million in the 2026-27 Scottish Budget, while the budgets of the five NPCs will be “protected”, with a view “to providing additional support in future years as part of the cultural funding uplift to the additional £100 million by 2028-29”. The NPCs told the Committee during evidence on 13 January 2026 they are “operating on pretty much the same money they had in 2009” but are estimated to have generated an economic impact worth £60.6 million Gross Value Added (GVA) for the Scottish economy in 2024-25, along with significant wellbeing impacts.

The Cabinet Secretary was therefore asked why, in the context of the increasing culture budget, Scotland’s five NPCs had not been prioritised for an uplift in funding, given their demonstrable contribution to economic growth. She explained that “a lot of funding has gone directly to smaller arts and culture organisations that were struggling, which has brought stability to those organisations, in constituencies across Scotland”.

Pressed on this issue, the Cabinet Secretary said she would discuss with the Cabinet Secretary for Constitution, External Affairs and Culture what level of clarity can be provided on the trajectory of funding the NPCs can expect over the period of the Scottish Spending Review.

The Committee welcomes the SFC's decision to present tables showing arithmetically which portfolios are being prioritised and deprioritised for funding. We request that in future Scottish budgets, an explanation should be included on why these decisions have been taken in the context of the Government’s key priorities.

Given our ongoing concerns regarding the significant financial pressures on Scotland’s colleges and the vital role they play in driving economic growth, we welcome the increased funding for this sector.

The Committee however remains unclear why some spending decisions, such as reductions to funding for SNIB and the enterprise agencies, do not appear to align with the Scottish Government priority of growing the economy.

We also seek further clarification regarding its decision not to provide an uplift in funding, as part of the significant increase in culture spending, to Scotland’s National Performing Companies, which are clearly providing demonstrable economic, wellbeing and social impacts.

The Committee welcomes the Cabinet Secretary’s commitment to discuss with the Cabinet Secretary for Constitution, External Affairs and Culture what level of clarity and certainty can be provided on the trajectory of funding the NPCs can expect over the Scottish Spending Review period. We look forward to receiving an update on the outcome of these discussions at the earliest opportunity.

Transparency

Baselining in-year transfers

A consistent theme in the Committee’s financial scrutiny this parliamentary session has been the need for greater transparency and more data in relation to budgetary information. The Committee, as well as the SFC, FAI, IFS and SPICe have each recognised that the Scottish Government has made improvements in this area. This includes providing data by Classification of the Functions of Government (COFOG) and enabling more accurate comparison between the following year’s draft Budget against the latest spending position in the current year’s Autumn Budget Revision (ABR).

The Committee has in recent years also called for all routine in-year transfers to be baselined in the Scottish Budget, most recently in our pre-budget 2026-27 report. However, in its response, the Scottish Government states that “some progress has been made, […] with £786 million of baseline transfers actioned”, however “[…] these transfers can reflect the complexity of the delivery landscape, and not all the regular transfers will be baselined”.1

In its forecasts, the SFC highlights a remaining £606 million of resource internal transfers between portfolios contained in the 2025-26 ABR which have not been reflected in the 2026-27 Budget. This, it argues, has implications for comparing Budget changes between 2025-26 and 2026-27 for key portfolios, in particular Local Government, Education and Skills, and Health and Social Care. The SFC has therefore chosen to present resource spending in 2025-26 based on the 2025-26 ABR position adjusted for the routine in-year transfers which have not been baselined, therefore providing “a more accurate picture”.2

Professor Roy told the Committee: “we continue to recommend that all routine budget transfers should, from the outset, be contained in the spending portfolio to which they will ultimately move”, adding “from our perspective, it would seem that it is a work in progress”. For example, while the Scottish Government has said local government funding increases in real-terms by 2%, the SFC highlights that this figure is actually 0.4% once all regular in-year transfers are baselined.3 SPICe notes that funding for the Education and Skills portfolio increases in real-terms by 23.1% when using the ABR baseline, but when compared to the 2025-26 Budget, the increase is 12.7% in real terms.4

There was a high level of frustration amongst witnesses and commentators regarding the Government’s approach. The IFS said, “the Budget document continues to bury the most appropriate spending figures in an annex, with the main body including figures for this year and next that just cannot be meaningfully compared – a recipe for confusion”. This, it argues, “isn’t good enough – especially in an election year, when the electorate deserve a clear picture of how tax and spending are changing”.5 SPICe also noted that this approach can “distort comparisons”4, while Professor Spowage said, “let us stop this immature nonsense of not baselining those transfers so that, on budget day, we can all see what the Government is actually spending and whether it has gone up or down”.3

During evidence to the Committee, the Cabinet Secretary was repeatedly asked why the Scottish Government had fallen short of baselining all regular in-year transfers in the Scottish Budget 2026-27. She responded that “the direction of travel has certainly been towards baselining more and more funding”, however, Ministers with portfolio responsibility need to be able to make changes to policy, which they could not do if they “do not hold the money”. She went on to say the Scottish Government is “not trying to create any confusion, which is why table 4.15 [in the budget document] sets everything out”.

The Cabinet Secretary also explained that the Scottish Government did not baseline all local government transfers as the ABR position was inflated due to eNICs funding of £144 million and pay of £109 million. Despite the Cabinet Secretary’s comments during evidence, the SPICe briefing makes no reference to welcoming or recommending the Government’s approach.

Asked whether the Scottish Government would agree a position on the presentation of transfers in next year’s budget with the SFC, the Cabinet Secretary responded, “if it recommends setting out the in-year transfers in a different way, we will respond to that”. Commenting on the suggestion, the SFC said “this is welcome [… and] the obvious way to do that would be through the Protocol between the SFC and Scottish Government as part of the formal process”, which allows transparency and clarity. The SFC added it would “also like to see the promise of COFOG data sufficiently in advance” to feed into its forecasts. (COFOG data published alongside the 2026-27 Budget was not available in sufficient time for the SFC to analyse and incorporate it into the January 2026 forecasts.)2

The Committee recognises the improvements made by the Scottish Government throughout this parliamentary session on presenting budgetary information. However, like our witnesses and other experts, we are frustrated and disappointed that despite repeated requests, the Scottish Government has fallen short of baselining all routine in-year transfers.

We cannot understand the Scottish Government’s continued resistance to carrying out this request, when it would bring much-needed transparency, clarity and understanding to its spending plans.

The Committee therefore recommends that the Protocol currently under negotiation between the Scottish Government and SFC is updated to include agreement on how regular in-year transfers should be presented, in time to be implemented in the Scottish Budget 2027-28. Agreement should also be reached in the Protocol on a suitable timetable for the Scottish Government to provide COFOG data to the SFC for inclusion in its Budget forecasts.

Public Private Partnership funding

In recent years, the Committee has also called for consistency in the presentation of Public Private Partnership (PPP) funding in the Scottish Budget. The Committee therefore sought clarification from the Cabinet Secretary on why PPP funding appears in the Scottish Budget 2026-27 in relation to the transport portfolio but not in other areas such as health or education.

The Scottish Government’s Director of Public Spending explained that for health, PPP repayments are part of the health board’s core funding so they will not appear as a separate budget line, whereas repayments in relation to roads come directly under the transport portfolio. The Cabinet Secretary offered to provide additional information in writing on the profile of PPP repayments.

The Committee would welcome further clarification on why some PPP repayments are clearly shown within portfolios while others do not appear in the Scottish Budget at all. We also ask the Scottish Government to consider how it can present information on the profile of PPP repayments more transparently in future years.

New money?

As noted above, concerns were raised by witnesses regarding a lack of clarity and transparency about where some of the figures in the Scottish Budget have been arrived at and if the funding announced is all ‘new money’. This includes funding for the college sector and how money previously allocated to mitigate the two-child cap would be spent.

SPICe explained in its Briefing on the Scottish Budget 2026-27] that the Scottish Government’s announcement of a £70 million increase in college funding does not include the £30 million spent on the Dunfermline Learning Campus in 2025-26 – including this spending reduces the year-on-year increase to around £40 million.1

The Cabinet Secretary told the Committee that “we have accepted […] that the way the figures have been set out is perhaps not the most helpful [and] Jenny Gilruth is writing to the Education, Children and Young People Committee this week to set out the figures in a way that is absolutely clear”. She went on to say that there is £70 million of new money for colleges, £62 million resource and £8 million capital, and “on top of that, there is a further £8 million for colleges to deliver employability programmes” through the child poverty funds.

Professor Spowage told the Committee that, while the Cabinet Secretary had framed the UK Government’s removal of the two-child limit as an opportunity to reinvest that money to prioritise tackling child poverty, little detail was provided on exactly how the money would be allocated. From a transparency perspective, she also said, “it is not particularly helpful to present [… the statutory uprating of the Scottish child payment] as new money to be used to deal with child poverty, when […] that would have happened anyway”.

The Committee requests that the Scottish Government makes absolutely clear in future budgets what elements of funding is ‘new money’, to provide certainty for public bodies and local government and avoid the unhelpful and unnecessary confusion that has occurred this year.

Use of flexibilities

ScotWind funds

The Committee heard during evidence that the Scottish Government is using all the flexibilities it has at its disposal to deal with fiscal pressures, particularly “to shore up finances in 2027-28” when the budget is especially tight.

The SFC highlights in its forecasts that the Scottish Government has considered other funding sources “to manage its budget and balance resource and capital funding across the next four years”, including borrowing, using the Scotland Reserve, and using Crown Estate revenues (mostly from the ScotWind leasing programme) to support capital and resource spending.1

Over the Scottish Spending Review period, the Scottish Government is allocating a total of £476 million of Crown Estate revenues, leaving a balance of £61 million unallocated. As in previous years, it hopes not to draw down all the allocated ScotWind funds if other funding becomes available. The Scottish Government also plans to move £132 million of resource funding to capital in 2028-29.

The SFC told the Committee that “it is not great to use one-off resources to pay for day-to-day expenditure because, by definition, once you have used that, you cannot use it again”. The Scottish Government “has, over the past few years, used ScotWind essentially as a fund—almost like an additional reserve—that it can earmark to spend”. However, “when it comes to the crunch, if it gets more money in, it does not actually use ScotWind money”. According to the SFC, more funding can emerge than is allocated in the UK Spending Review.1

The FAI commented that the Budget is “another example of the Scottish Government plugging an underlying deficit of over half a billion pounds with one-off funding pots – and even then having to make significant cuts to its planned expenditure”.3 Explaining this position further in evidence, Professor Spowage said this appears to be a trend in recent years and, although it may be understandable given the fiscal constraints, “it does not really fit with ScotWind’s policy goals and what it is about”.4

The Cabinet Secretary explained to the Committee that the ScotWind fund is “one of the few flexible pots of funding that we have, given the constraints on borrowing, the reserve and all the rest of it”, adding that otherwise the Scottish Government would have had to make “some major reductions in funding lines”. She also pointed to the Scottish Government’s “track record” in “reversing out ScotWind allocations [… because] we do not want to utilise that money for resource spending” and reiterated that is its intention for 2027-28.

The Cabinet Secretary went on to say, “I do not believe [the UK Government spending review outlook] will hold in its current form given that we are heading to a general election in 2029, so the figures for 2027-28 and 2028-29 will change, for sure, in terms of the funding available”.

The Committee recognises that the Scottish Government faces significant financial pressures and has limited flexibilities to manage cash flow across years. However, we continue to be concerned that one-off ScotWind funds are being used to plug funding gaps rather than allocated to net zero projects as intended.

The Committee notes that the Cabinet Secretary appears to be relying on additional funds becoming available through the block grant ahead of the UK general election to avoid drawing down the allocated ScotWind funds. We are not convinced this is the most effective and efficient way of managing Scotland’s finances and we therefore urge the Scottish Government to develop plans that ensure ScotWind funds are in future protected for their intended purpose.

Bonds

The Scottish Budget 2026-27 states that the Scottish Government “will issue the first Scottish Government Bond, as part of a multi-year £1.5 billion issuance programme, to support capital investment”. This follows a recommendation of the Scottish Government’s Investor Panel in 2023 to make bonds available to market as a means of raising Scotland’s profile and attracting investment. Proceeds raised would be used for capital investment in line with the capital borrowing powers in the fiscal framework.1 During evidence to the Committee, it was also noted that Bonds have an important role in developing capital markets.

To begin this process, the Scottish Bonds Programme has been allocated £2.1 million in the 2026-27 Budget. Speaking at an event on 26 January 2026, the First Minister stated, “our intention is to make Scotland the most attractive destination for investment in the UK and our bonds programme is one of the ways we will do that”. He went on to say, “we also want to diversify our sources of borrowing so as to maximise value for money for Scotland’s taxpayers”, adding “a Scottish Government bond issuance will enable us to structure our debt more effectively – using the powers we have to borrow better, not more”.2

The Committee seeks further information on the Scottish Government’s approach to delivering a Scottish Bonds Programme, how it will ensure due diligence, cost comparisons with other borrowing options, and value for money are at the heart of this Programme, and on what areas it plans to spend the £2.1 million fund allocated for 2026-27.

Fiscal framework

Throughout this parliamentary session, the Committee has continued to hear evidence that the fiscal flexibilities in the fiscal framework between the Scottish and UK governments should be revisited to ensure they adequately correspond to the increasing level of risk relating to the Scottish Budget.

Following a narrow review in August 2023 which made limited changes to the framework, the Scottish Government and HM Treasury are now in discussions regarding the scope of a future fiscal framework review. As requested, the Committee submitted views on what should be included within scope of the review on 19 December 20251, including borrowing and the Scotland Reserve, the timing of fiscal events and forecasts, and block grant adjustments and forecasting.

During evidence on 20 January 2026, witnesses said they shared the Committee’s concern regarding timing of UK fiscal events and suggested that this issue should be considered as part of next fiscal framework review. Professor Heald said the “paradox of more tax devolution is that Scotland’s public finances are now more vulnerable to UK fiscal events, in terms of both timing and substance”, adding “I do not think that the UK Government takes seriously enough the fact that the constitutional structure of the UK has changed and the devolved legislatures need time to set their own budgets”.2

Professor Bell, University of Stirling, noted that “the framework was established with an understanding there would be goodwill” between the two governments. However, “given the date selection by the UK Government, the Scottish budget has been so truncated that it has been difficult to put in place all those budgets for health boards, local governments and so on”. He went on to say that “timetabling has to be raised as a significant issue in terms of the fiscal framework review”.2

We were told by Professor Spowage that there was no reason why the UK Budget could not have been published much earlier than November 2025. She said, “I would hope for an earlier budget this year—not only because of the impact on devolved Governments but because of the general economic commentary and uncertainty caused by the way in which the budget was carried out, including the endless leaking of potential policies, which were then backtracked on, and so on”.2

Asked if the UK Budget should be set a date in the last week of October for the UK Budget, Professor Spowage said “it would be much better if that was broadly the expectation […,] we would then know that the Scottish budget could always be before Christmas, which would at least give us a bit more time for parliamentary scrutiny”. She also agreed it would be helpful to see more engagement with the Committee from Treasury Ministers, noting “the irony is that the devolution of significant powers means that budgets and what is happening at the UK level are even more interconnected than before those powers were devolved, given the fiscal framework and the BGAs”.2

Professor Heald provided an example of “how vulnerable the finances of devolved Scotland are to changes … made at the UK level”. If, as was briefed before the UK Budget 2025, the UK Government had reduced NICs by 2% and added 2% on to the basic rate of income tax, this would have cost the Scottish Budget £1 billion in relation to the BGA. Professor Heald explained that in this type of scenario, borrowing powers would be “extremely valuable”.2

Professor Spowage described the limit on the Scotland Reserve as “a fiscal restriction that could be relaxed without much risk to anybody” as it “would mean that there would be a larger bank account that the Government could put money into that it could then draw down”. She went on to explain that “if there were big unexpected consequentials in the middle of a financial year, the more space the Government had in the reserve, the more incentive [the Scottish Government …] would have to pop that money into the reserve and keep it for the next year, if there was something coming down the line such as a big reconciliation”.2

Professor Spowage also said there are “legitimate questions […] about why there is a cap on [resource borrowing for forecast error] at all and why the cap has been set at the level that it has been set at, when it is eminently possible that the Government could have to deal with a reconciliation of more than £600-odd million”.2

Responding to points made by witnesses in relation to fiscal flexibilities, the Cabinet Secretary told the Committee, the “time is absolutely right for a more ambitious review” of the fiscal framework. The Scottish Government’s Director of Tax explained that it was the intention of both Governments to agree the broad scope of the review before the Scottish Parliamentary elections in May 2026, and to conclude the review in 2028. Key issues for the Scottish Government are the size of the Scotland Reserve and annual cap on borrowing. The Scottish Government’s understanding is that there is no willingness in HM Treasury to discuss fiscal flexibilities outside the formal fiscal framework review.

The Committee believes that a comprehensive review of the fiscal framework is now urgent. We urge the UK Government to work with the Scottish Government to develop a consultative approach for the review while balancing the need for early resolution.

We also ask that the views of witnesses on the need for greater fiscal flexibilities heard during our Scottish Budget 2026-27 scrutiny are reflected in the scope of the review, along with the recommendations in our letter of 19 December 2025.

Long-term financial planning

The Committee’s pre-budget 2026-27 scrutiny focused on responding to long-term fiscal pressures, drawing on the SFC’s Fiscal Sustainability Report – April 20251. The SFC identified an ‘annual budget gap’, which it described as “the Scottish specific fiscal sustainability challenge”, averaging - 1.5% between 2030-31 and 2049-50 and -0.9% between 2050-51 and 2074-75 “… because demographic pressures in Scotland are greater than in the rest of the UK over the next twenty-five years”.1

In our pre-budget 2026-27 report, the Committee concluded that “we […] remain in the dark on the Scottish Government’s longer-term financial plans”. We therefore urged the Scottish Government to place much greater emphasis on longer-term financial planning in order to start mitigating the potential significant impact of future trends. In the first instance, the Committee called on the Scottish Government to provide a full response to the SFC’s 2025 Fiscal Sustainability Report.3

The Scottish Government has not committed to providing a full response to the SFC’s report. Instead, the response says it recognises and is responding to the anticipated impact of future trends, through delivery of its Population Strategy, Scotland’s Migration Service, and the Health and Social Care Service Renewal Framework. Its Future Trends for Scotland report published in June 2025 “set out the best available Scotland-specific evidence on trends likely to be important to Scotland’s future [and] is helping to inform and improve long-term decision-making”.4

Professor Heald however highlighted during evidence that, with the exception of “repeated messages from the SFC […,] there is no recognition in public debate that the finances of the Scottish Government are fiscally unsustainable”.5

Asked why the Scottish Government has not committed to providing a formal response to the SFC’s report, the Cabinet Secretary said, “we have responded through the immediate spending review outlook [which] is why the Fiscal Sustainability Delivery Plan sets out efficiency savings that go quite far and quite deep […]”. Beyond that, she pointed to the need (a) for a fundamental review of the fiscal framework, and (b) to move “further and faster with the transformation of services” to be able to respond to the demographic challenge.

The Committee’s report also requested a response by the end of January 2026 on the Cabinet Secretary’s reflections on the Lithuanian approach to collectively developing and implementing Lithuania 2050, Lithuania’s vision for the future, with a parliamentary committee monitoring progress towards achieving the vision.3

A key theme of the Committee’s budget scrutiny this parliamentary session has been to urge the Scottish Government to recognise and respond to the significant fiscal sustainability challenges that lie ahead in the long-term, including demographic trends. As part of this work, we have repeated our calls for the Scottish Government to respond in full to the SFC’s two fiscal sustainability reports published in 2023 and then in 2025. It is deeply disappointing and disrespectful that on both occasions no response has been forthcoming.

We look forward to receiving the Cabinet Secretary’s reflections on the Lithuanian approach to collectively developing and implementing Lithuania 2050, that nation’s vision for the future, with a parliamentary committee monitoring progress towards achieving the vision.

Scottish Spending Review

In our report on the Scottish Budget process in practice published in June 2025, the Committee said we are “supportive of the Scottish Government carrying out a Scottish Spending Review (SSR) at this time and of publishing the outcomes in December 2025 alongside the Scottish Budget 2026-27”.1

The Scottish Spending Review 2026 (SSR) published alongside the Scottish Budget 2026-27 sets out the Scottish Government’s indicative spending plans up to 2028-29 for resource, and up to 2029-30 for capital. In her foreword to the SSR, the Cabinet Secretary states that—

“With continued focus on our key priorities and the commitments set out in the Programme for Government, the SSR delivers cumulative real terms resource spending growth of 2.8% up to 2028-29. While Scotland’s capital funding will reduce in real terms by 0.3% by 2029-30, as a result of UK Government decisions, we are nevertheless using all funding levers at our disposal to sustain an impactful capital programme.”2

Annex A of the SSR includes a Summary of Portfolio Spending Plans. The document notes that these plans “are focused on delivering our priority outcomes for the people of Scotland [… and] it represents an important step forward in progressing our work on fiscal sustainability and providing a funding framework for our partner organisations to plan effectively and strategically”.2 Many of the funding assumptions across the SSR period were referred to in the Scottish Budget and are therefore highlighted earlier in this paper.

The SSR further states that while the review is based on robust funding assumptions, “plans should be viewed as indicative and subject to substantial change”, given the wider risks and uncertainties set out in the MTFS.2

The Scottish Government intends to take forward monitoring and reporting through established governance structures, supplemented through focused reviews of areas of significant spend over the course of the SSR. Progress towards delivery of the targets and measures “will be regularly monitored and updates on progress of the FSDP will be provided publicly as part of the update of the MTFS”.2

All witnesses welcomed publication of the SSR. The SFC told us: “the fact that the Government has done a spending review is a step forward, and the fact that spending allocations have been made for the next three years is an improvement on what we have had in previous years”.6 Professor Heald also said “the Scottish Government deserves credit for getting a three-year spending review”, particularly given the recent UK Spending Review came at the end of the parliamentary session in Scotland rather than at the start, as is the usual position. He explained the lack of UK multi-year spending reviews in recent years “has destabilised spending” and caused inefficiencies for public bodies in having one-year funding.6

Concerns were however raised regarding a lack of detail in the SSR. The SFC commented that the SSR is less detailed than the 2011 spending review, which provided level 3 figures for all portfolios. It goes on to say, “given that many public policy budgets are at level 3, it is not possible to look at the document and see the funding outlook for key public bodies like Skills Development Scotland and SEPA, or to see how level 2 budgets are split between resource and capital”.6

Professor Spowage suggested “we do not have the level of detail that we would want to have in order to know what is happening to, say, individual enterprise agencies or the overall higher or further education budgets”. She went on to say that it is not possible to see what progress is being made towards achieving the Scottish Government’s priorities if the spending allocations are not set out.6

Asked if the Committee should be pressing for more detail, Professor Roy said, “as you would expect, our answer to that will always be yes [,…] the more detail, the better”.6 Professor Spowage argued that the incoming Scottish Government after the election should produce a more detailed version of the SSR and capital plans, “perhaps even before the next Scottish Budget”6, while Professor Heald also recognised “whatever the political composition of the next Scottish Government, it will want to have a relook at certain things”.6

The Committee welcomes the Scottish Spending Review which should provide a greater level of certainty to portfolios, public bodies and local government on the trajectory of spending they can expect over the next three years. We however agree with witnesses that more detail could have been included, such as level 3 figures split by capital and resource funding throughout.

The Committee therefore recommends that the incoming Scottish Government after the election prioritises updating the SSR as early as possible into the new parliamentary session.

Following the Committee’s visit to Estonia in September 2024, the Committee recommended that the Scottish Government considers adopting a zero-based budgeting approach for the next SSR.13 The Committee thereafter concluded in our pre-budget 2026-27 report in October 2025 that we remain of the view that a zero-based budgeting approach should be taken in the SSR and requested in-depth information on the process for preparing, scrutinising and delivering the Review.14

The Scottish Government’s response advises that it already adopts the principles of zero-based budgeting and spending is reviewed in detail throughout the Scottish Budget process. The in-depth information requested on process undertaken for the SSR has not been provided in the Scottish Government response.15

During evidence, the SFC said it is unaware of the methodology used for producing the SSR. It explained, “obviously, we had a conversation with the Government, [and] it walked us through the various decisions and how it came up with the overall numbers, but there was no detail on how those things were arrived at”. The SFC also reiterated comments the SFC “repeatedly” made prior to the SSR that “the Government needs to set out the process it goes through, including how it comes up with the numbers, how its efficiency savings link into all that, and how it will monitor, evaluate and track things”. That information, he concludes, is not published anywhere in any detail and “it would be really interesting to get more detail on that”.6

Asked whether the Scottish Government could have started working on its methodology and zero-based budgeting approach before the UK Government began its Spending Review, Professor Spowage said, given the overall envelopes were set in the previous UK budget, “it was really about where departmental budgets would fall, so it is difficult to know the extent to which that allocation was going to move hugely, but I am sympathetic to the idea that it could have been doing that in parallel”. She explained that “the UK Government went through a process of asking departments to make pretty tough choices about the 20% of activity that they would drop if they must drop something because of their budget allocation”.6

The Cabinet Secretary offered to provide the framework, proformas, format and areas of discussion with individual Cabinet Secretaries on spending in their portfolios, which was used as part of the Scottish Government’s approach to the SSR.

The Committee is disappointed that the Scottish Government does not appear to have taken a zero-based budgeting approach to the SSR, despite our recommendations that it do so in autumn 2024 and 2025. Furthermore, there is very little detail in the document about the exact approach the Scottish Government did take. It is therefore not possible for the Committee to have any certainty that the Government took a comprehensive and credible approach.

The Cabinet Secretary during evidence to the Committee also made a number of references to the figures in the UK Spending Review changing in the run-up to the UK Government election. As we mention earlier in this report, the Scottish Government should be planning on the basis of the funding it knows it will have rather than what may or may not materialise.

The Committee looks forward to considering the SSR in more detail in evidence sessions with a wider range of witnesses during February and March 2026.

Public service reform

Overview

This parliamentary session, the Committee has undertaken regular scrutiny of the Scottish Government’s progress in relation to public service reform (PSR). The Scottish Government published Scotland’s Public Service Reform Strategy: Delivering for Scotland on 19 June 2025, which “sets out commitments to change the system of public services - to be preventative, to better join up and to be efficient - in order to better deliver for people”. 1

In our pre-budget 2026-27 report, the Committee made a number of recommendations in relation to preventative spend and the Invest to Save Fund for reform.2

On prevention, the Committee sought an update on progress with work in considering and reporting back on the potential benefits, risks and costs of introducing a new category of expenditure on preventative spend.2 The Government response highlights that as part of this work, “we are testing a budget tagging method for tracking preventative spend across the Scottish Budget” along with developing pilots to test this approach across portfolio areas of the budget. A first set of results is planned for publication in summer 2026.4

The SFC told the Committee that “if you tag the spend, it is really important to follow that up and, later on, to evaluate what was achieved […,] in three years, five years, 10 years or whatever the time horizon is, you need to ask, “What did it deliver? Did it work? What is the learning from that? How do we continue to drive the behaviours that we want?” It also said while there are different definitions of preventative spend that could be used, “it is less about which definition you choose and more about everyone being clear about the definition that you are using”.5

The Scottish Government’s Director of Public Spending explained that the Scottish Government is in a process of ‘budget-tagging’ “across all level 4s”, while also engaging some NHS Boards and local government in this work. It would like to be in a position to roll out budget-tagging in time for the 2027-28 Scottish Budget.

The Committee welcomes the Scottish Government’s progress towards tracking and measuring the outcomes of preventative spend through a budget-tagging approach. We seek further information on how this method will work in practice, including evaluating what has been achieved, even for very long-term programmes.

Our pre-budget 2026-27 report also sought details of how the projects receiving funding under the PSR Invest to Save Fund are being monitored for outcomes and whether success is being shared more widely across the public sector.2 The response explains that successful projects are required to provide six-monthly progress reports, which are then collated to provide an overview of programme. It goes on to say that some projects with similar themes are working together to share resources, including sharing learning and opportunities to implement similar efficiencies with bodies not directly funded by the programme.4

As noted earlier in this report, the SSR confirms that funding will be provided in 2026-27 to continue the Invest to Save Fund.8 Asked whether the funding provided (£29.9 million in 2026-27) is sufficient to make the level of transformation neededi, the Cabinet Secretary said she expects the savings made through the Fund to be reinvested with a view to making further savings.

The Committee notes the information provided in the Scottish Government’s response to our pre-budget report on the measures in place to monitor progress and learn lessons from successful projects funded through the Invest to Save Fund.

We also welcome the extension of funding through the Invest to Save Fund for reform projects, although we question whether the level of funding will provide the transformational results as quickly as is required.

Portfolio Efficiency and Reform Plans