Economy, Energy and Fair Work Committee

Scottish National Investment Bank Stage 1 Report

Introduction

Timeline

The Scottish National Investment Bank Bill was introduced in the Parliament on 27 February 2019 by the Cabinet Secretary for Finance, Economy and Fair Work.

On 12 March 2019 the parliamentary Bureau designated the Economy, Energy and Fair Work Committee as lead committee to consider the Bill.

The Scottish Government intends, parliamentary approval permitting, that the Scottish National Investment Bank (the Bank or SNIB) be operational in 2020.i

What the Bill does

According to the Explanatory Notes—

The Bill places a duty on the Scottish Ministers to establish the Scottish National Investment Bank as a public limited company and gives the Scottish Ministers the necessary powers to capitalise the Bank. Scottish Ministers will also be given the power to set the strategic direction of the Bank by the setting of Missions.

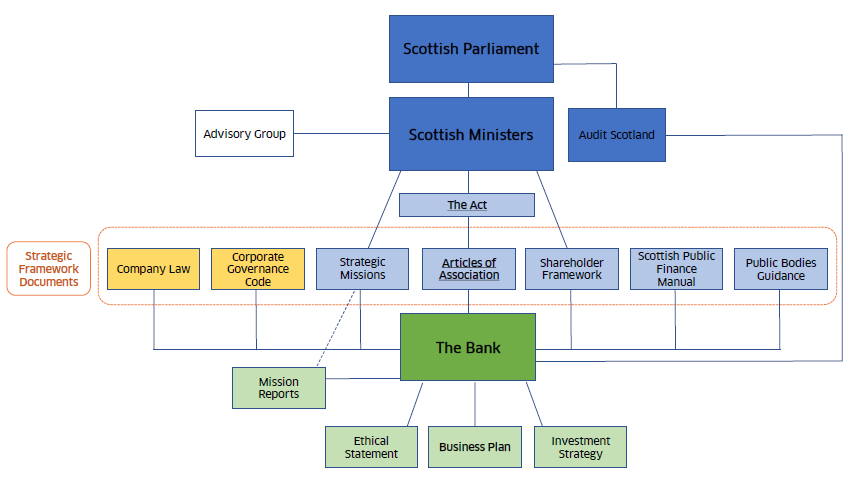

The Bill describes the relevant powers of the Bank in broad terms, leaving much of the detail to other documents, most notably the Articles of Associationi (currently in draft form).

The aim of the Bank as set out in the Policy Memorandum is “of boosting Scotland’s economic performance and realising the Scottish Government’s ambition for the economy by providing patient capital to finance growth”.i

Background to the Bill

The Scottish Parliament Information Centre (SPICe) has published an extensive briefing on the characteristics of – along with the rationale for – a national investment bank, the detail of what the Bill does, and financial implications. It also has a glossary explaining key terminology such as Financial Transactions, Multi-criteria Analysis and Patient Capital.

Announcements, consultation and parliamentary debate

The idea for a ‘Scottish Business Development Bank’ dates back to at least 2013 when the Scottish Government published a Sustainable, Responsible Banking Strategy for Scotland. In its Programme for Government 2017 to 2018, the Scottish Government announced plans to establish a SNIB. It set out terms of reference and commissioned Benny Higgins, former Chief Executive of Tesco Bank, to provide recommendations on the role, remit, governance and capitalisation of the Bank.

Alongside that work, a consultation was issued on 20 October 2017 and a consultation report published in February 2018.

An implementation plan, developed by Mr Higgins and an Advisory Group on the Implementation Plan for a Scottish National Investment Bank, was launched on 28 February 2018. This set out a blueprint for SNIB as a unique new public institution and the Scottish Government accepted all 21 of the recommendations.

A debate took place in the Parliament on 8 May 2018, from which the following motion (as amended) was agreed—

That the Parliament notes the publication of the Scottish National Investment Bank Implementation Plan, which sets out proposals and recommendations for the establishment of the bank; further notes the emphasis that these proposals place on the bank being bold and ambitious by providing patient mission-based finance, which will help create and shape future markets and help Scotland achieve its full economic potential; acknowledges concerns expressed by stakeholders that a cluttered policy landscape can lead to confusion, a lack of alignment, duplication and weakened accountability, and calls on the Scottish Government for clarity of focus and delivery with respect to the role and objectives of the bank.

In the Programme for Government 2018-2019, the First Minister announced plans to legislate to underpin the Bank. A further consultation was issued during September and October 2018 and the Scottish Government additionally held 21 engagement events. An independent analysis of the responses was published in February 2019 and the Bill introduced toward the end of that month.

Overview of the Bill

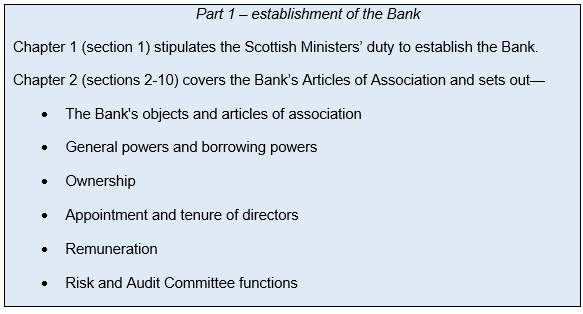

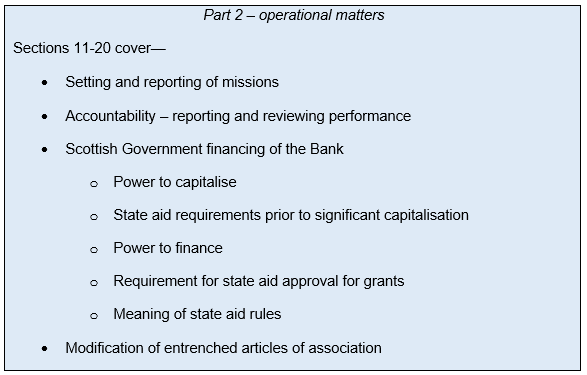

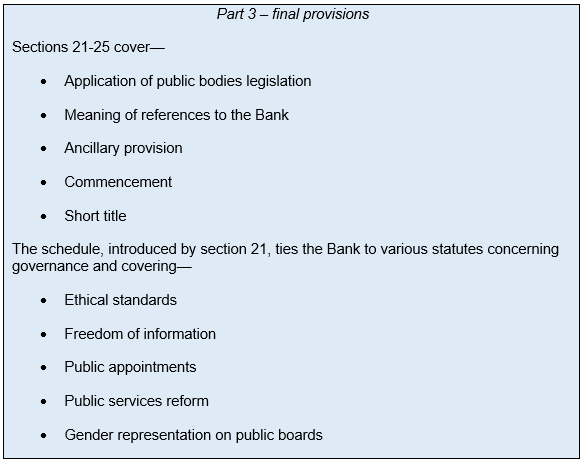

The Bill is comprised of three parts and 25 sections plus a schedule.

EEFW Committee's considerations

The Committee issued a call for views that closed on 3 May 2019, receiving 27 written responses plus one piece of supplementary evidence.

A letter from the Cabinet Secretary was received on 25 April and the Committee replied on 2 May. The Cabinet Secretary wrote again on 16 May and once more on 26 May along with a copy of the draft Strategic Framework for the SNIB (focused on the Shareholder Framework Document).

The Scottish Government provided a briefing note on the draft Articles of Association on 21 May. The Committee sought external views on the Articles and asked the Scottish Government to respond. The points raised and responses can be found in Annexe A.

The Committee held evidence sessions on 7 May, 14 May, 21 May, 28 May, 4 June and 11 June, hearing from members of the advisory group (whose implementation plan informed the Bill), business organisations, STUC, the third sector, Scottish Enterprise, think tanks, investors, the Clydesdale Bank, economists Mariana Mazzucato and Laurie Macfarlane (authors of A mission-oriented framework for the Scottish National Investment Bank), other investment banks, and the Scottish Government.

Consideration by other committees

The Finance and Constitution Committee considered the Financial Memorandum and received three written submissions to its own call for views, deciding to undertake no further work on the financial implications of the Bill.

Scrutiny

It should be noted that the Bill itself does not establish the Bank as a statutory body and does not confer any powers in itself. Rather, it places the Scottish Government under a duty to establish it as a public limited company, which will be done according to the rules of the Companies Act 2006.

This is very much an enabling or framework Bill, one which describes the set-up and operational activity of the Bank with broad strokes, while a lot of the detail is left to the Articles of Association. Many of the intentions and aspirations expressed in the Implementation Plan are not explicit in the Bill. As described by Bennie Higgins, Strategic Adviser to the First Minister on SNIB, the approach taken with the Bill is “relatively light”.i

Were the Bank subject to legal challenge, it would be its Articles of Association that the courts would look to rather than this enabling Bill. Given the technical nature of such a document, and that it is still in draft form, we have sought views from the Scottish Law Society and a legal academic on the content of the Articles as currently drafted. The points raised have been put to the Scottish Government and can be found along with the response in Annexe A.

There are various reports, strategies and plans mentioned in the Bill or wider suite of supporting materials – some in draft form and still evolving, some for the future and the Bank to devise.

Documents that come under the catch-all heading of “Strategic Framework for the Scottish National Investment Bank” (focused on its operation and relationship with the Scottish Government) include—

The medium-term strategic missions for the Bank that will be set by Scottish Ministers

The Ethical Statement that the Bank will publish

The Shareholder Framework Document

Documents that will be required from SNIB when established (as listed in Appendix A of the SPICe briefing) include—

The Annual Performance Report

The External Performance Review

The Investment Strategy

The Mission Report

The vision is of a new institution at the heart of the Scottish economy, a body that can take the long view but adapt its approach as necessary. As Alan McFarlane, a member of the Advisory Group, put it—

We are talking about forming an entity that is here for the long-term and which is demonstrably patient, evergreen and continuing.ii

The draft strategic framework states—

As an institution to be underpinned by statute, which will be both a public limited company and a Scottish public body, the Scottish National Investment Bank will be an unusual body.

All of which presents something of a challenge to the parliamentary scrutiny of a Bill that – though an integral part in the establishment of SNIB – is not the only piece in the jigsaw. Therefore, in the interests of rigour and completion of the puzzle, so to speak, this report takes a wider and thematic approach rather than limit consideration to the nine pages of the Bill alone.

Accordingly, the following sections will consider—

Role and status

Capitalisation and costs

Governance and accountability

Markets and demand

Ethics and equalities

Vision and mission

Role and status

This section addresses the characteristics, role and status of an investment bank, the private sector focus, what is meant by commercial activities, and expectations for what can be achieved by SNIB.

What is it?

In simplest terms, a national investment bank is an institution created by a government to finance economic development. Such bodies have become popular again in Europe post-2007-08. The British Business Bank (BBB) and Banking Corporation of Ireland, for example, were set up in 2014, the Development Bank of Wales (DBW) in 2017.

Par Equity’s Andrew Castell told the Committee—

Essentially, SNIB is an example of that great Scottish invention, the investment trust – it is not really a bank.i

Why do we need one?

The key issues for SNIB, identified by the Advisory Group, were—

A need for greater long-term investment (or patient capital) in small to medium size enterprises (SMEs)

Scotland’s relative innovative performance lagging behind comparator countries

Furthermore, the Bank will have a national mandate while also being expected to maintain regional reach in order to help businesses across Scotland to achieve their economic potential; something considered particularly important since Scotland’s productivity varies significantly across regions.

How will it work?

The Bank will act commercially (see paragraph 62 for elaboration of acting commercially), meaning it should target a positive financial return at both an individual investment and portfolio levels – the portfolio return target set over the long-term. The financial target rate of return will be finalised prior to vesting of the company.

Benny Higgins said—

We have not yet set out the precise numbers associated with that and we have to take into account also the comments made about societal benefit, but the intention is that the bank will make a return on capital.i

SCDI’s Matt Lancashire told us—

We need to crowd in funding. Germany’s KFW and the Japan Finance Corporation have similar mechanisms and institutions. There are global examples of national investment banks or similar being used as cornerstones to pull not only public finance but private sector investment together as long-term patient capita.ii

Public limited company model

The Policy Memorandum considers the public limited model “the most appropriate model for the Bank”. It suggests this will allow it to raise capital from a range of sources, provide “additional protections” – e.g. ensuring ownership remains with the Scottish Ministers, and not restrict the potential issue of dividends.i

STUC welcomed the Bank being established as a public limited company “wholly owned by Ministers” as it ensured privatisation would need primary legislation.Women’s Enterprise Scotland’s Lynne Cadenhead suggested it was important to learn from what had worked in other countries and that “on balance” the approach was “the right one”.iii Mydex CIC argued for the Community Investment Company model, contending that such an approach was “asset and mission locked” and offered future protection against being “driven down a market forces route”.iv

Benny Higgins said the Advisory Group had discussed different models and concluded—

…the best way to serve the Scottish economy in the long run is to have clear and unequivocal ownership by the Scottish Government.v

Classification

It is proposed the Bank should be classified as a public body, or more specifically a non-statutory non-departmental public body (NDPB), classified by the Office for National Statistics under the heading General Government. How the Bank is classified relates to its capitalisation and also the degree and form of Ministerial control.i Such an approach is intended to ensure better alignment between the activities of the Bank and the broader economic policy of the Scottish Government and its enterprise agencies.

Economic, social and environmental returns

According to the Implementation Plan, the Bank should take into account economic, social and environmental returns, and with reference to the National Performance Framework, when making investment decisions. A balanced scorecard will be developed between the Bank and Scottish Government to establish the requirement and measurement of non-financial returns. Investment should also be undertaken on an ethical basis, with the Bank expected to develop a code of ethics. The balanced scorecard, it should be noted, is not referenced in the Bill or any of its accompanying documents.

Additionality

It will be for the Bank itself to develop its own products, the expectation of the Implementation Plan being that it will invest through a variety of instruments – including debt, equity and mezzanine finance (a hybrid of debt and equity). But the Bank should aim to maximise additionality i.e. giving priority to areas of investment that are additional to the finance already provided by the market and other providers. Through doing so, it can complement rather than crowd-outi existing or potential investment.

In a blog by Laurie Macfarlane and Mariana Mazzucato from February 2018, they framed additionality with the words of John Maynard Keynes—

The important thing for Government is not to do things which individuals are doing already, and to do them a little better or a little worse; but to do those things which at present are not done at all.

Funding the funders

It is intended that much of the Bank’s investment and lending activities, similar to the British Business Bank, will be through others, requiring a fund management role and structures.

Co-investment will also be key. David Ovens of Archangel Investors praised Scottish Enterprise’s Scottish Co-investment Fund model, describing it as “demonstrably successful”. He urged SNIB to build on what worked and told the Committee—

It has been copied around the world, most recently by the British Business Bank.i

Mariana Mazzucato invoked Keynes’ animal spiritsi, suggesting the central role of SNIB was to provide direct finance “in mission-orientated areas in order to create a new landscape in which there is increased business investment afterwards”.

CBI’s Flora Hamilton spoke of “three distinct buckets of activity” which she described as—

…funding for entrepreneurial businesses at start-up stage, funding for scale-up for the mid-tier businesses, where real economic growth lies, and long-term patient capital to go into projects that sit within the specific missions…ii

What it will not do

The Bank will not undertake funding activities such as the awarding of capital and revenue grants, which will remain with the Scottish Government and its agencies. It will not function as a traditional retail bank i.e. it will not take deposits.

As stipulated in section 4 of the Bill, the Bank can only borrow from the Scottish Ministers. It will not issue bonds or public shares.

Furthermore, as stated in the Policy Memorandum—

The Bank will lend solely to the private sector. It will not lend to public institutions including local authorities, government agencies or arms-length bodies.i (See also paragraph 62 for elaboration of what constitutes the private sector.)

Commercial focus

STUC’s Helen Martin spoke of the “tension at the heart of the bill” between using patient capital to aim at “innovation in society” with that of “short-term requirements for supporting growth companies”. She wondered if the commercial focus might “act as a brake” to “long-term and slow-growth projects”, suggesting aspects of the Bill had “not been…bottomed out”.i

Commercial can mean different things to different people suggested Mydex CIC’s David Alexander—

I ask people to consider that the word commercial is about the mission of making things better, faster, cheaper, more efficient and fairer.ii

Citing the different elements of SNIB’s stated remit, the socioeconomic focus and commercial approach, Clydesdale Bank’s Graeme Sands thought it would be “incredibly hard” to cover everything “if, as we would suggest, its remit keeps it clearly away from existing commercial opportunities.”iii

LINC Scotland’s David Grahame sought a “fuller understanding” of what was meant by commercial and did not consider it restricted activity to the private sector. He added the proviso that what was being invested should be capable of offering a return, “otherwise, it is just a grant”.iv

Referring to A mission-oriented framework for the Scottish National Investment Bank, Mariana Mazzucato said—

…the bank should provide patient finance to organisations in the public, private and third sectors and in civil society that are willing to engage with the government missions.vi

She spoke of “commercial dynamics” by which investment in one area might suggest possibilities in another, citing Viagra as a “classic example”, it being a product originally intended to treat heart problems.vi

Her UCL colleague Laurie Macfarlane said it was his “understanding” that “‘private sector’ meant everything – social enterprises, charities and so on – apart from the public sector”.viii

Professor Mazzucato said efforts to deal with “global problems” – such as the energy and health challenges – were being funded by institutions from various sectors, and “multiple solutions” were necessary—

We call it a cross-sectoral, cross-disciplinary, cross-actor investment process. I encourage the committee to keep provoking on that point.ix

Support for the Bill

Describing the Bill as “close to our hearts”, Robin McAlpine of Common Weal said he would have preferred to see more emphasis on “working with local authorities housing associations and others” and that in some places—

…the bill implies slightly more than I would have liked that the bank will be just an SME bank...i

Identifying where the emphasis lay in its developmental work, Bennie Higgins said—

The bank will work on the origination in relation to the mission-related projects, while SMEs will be covered by the existing agencies…ii

He had been “delighted” by the “very broad support” for the Bank “across the political spectrum and the Scottish economy’s ecosystem”. From consultation as well as informal conversations, people had expressed their views and raised issues—

There were questions about whether the bank will be big enough, and how we will operate pay policy…whether there would be an ethical code and what the approach to missions would be…all legitimate questions that were asked within almost universally strong support for the bank.iii

Clarification on 'private' and 'commercial activities'

SPICe sought further clarification from the Scottish Government on the reference in the Policy Memorandum to lending solely to the private sector (see paragraph 50) and the focus on commercial activities (see paragraph 34). It received the following response—

Our understanding from the questions that have been asked in the Committee and the recent PQs submitted is that Members would welcome clarity as to the range of types of body in which the Bank could invest and particularly whether third sector bodies, CICs, social enterprises and cooperatives may be eligible to seek financing from the Bank.

We can confirm that this will be case. The reference to “private sector” in the Policy Memorandum was intended to mean non-public and we’re happy to clarify that. We have engaged on this subject with a number of interested groups and will be continuing to do so.

The reference to “commercial activities” in section 2 of the Bill and elsewhere does not inhibit these types of entity’s access to finance from the Bank either. Commercial activities in this context refers to business activities that are profit-making or aim to be profit-making, carried out by business associations of various types, that the Bank may be interested in providing financial assistance to. This would clearly include a social enterprise or CIC [Community Interest Company] for example.

Expectations

Hopes for what the Bank can achieve are high and a number of witnesses counselled against unrealistic expectations. Benny Higgins described it as a “critically important additional piece of apparatus” but “we cannot imagine that the bank will solve every problem”.i

Common Weal’s Robin McAlpine said “it cannot do everything”ii and was worried people might conclude “that’s Scotland decarbonised and gender equal”—

No – we have a source of finance that is more conducive to making those things happen, but we cannot take our foot off the pedal...iii

Although in principle “strongly in favour” of a SNIB, Clydesdale Bank’s Graeme Sands highlighted the use of “bold” and “ambitious” in the consultation and the wish to address socio-economic concerns while also being “commercial” and “achieving an ambitious rate of return”. He said—

It will be incredibly hard for the bank to achieve all those aims in combination...iv

Many witnesses recognised the ambition of the undertaking but urged patience. David Alexander of Mydex CIC told us—

We are constantly faced with people trying to rewire the building with the power still switched on. That is the transformation that is under way and it is not going to be done in three years.v

David Grahame of LINC Scotland pointed out it was 15 years since the co-investment fund was founded and only now was its work coming to fruition. Patience was again the word and he saw a “real challenge” for those designing SNIB to enable it to endure and withstand criticism—

Most of the bad news comes earlier, which is sometimes difficult politically…The lemons ripen before the plums.vi

Scottish Government

The Cabinet Secretary said consultation had been “crucial” to SNIB’s progress to date, but “certain key decisions” – such as the products it will offer, its structure and the scope of the missions – were still to be taken.i He said—

We will continue to consult widely, including with this committee, as we finalise our proposals to ensure that the bank can truly transform Scotland’s economy.i

Addressing the question of commercial activities and its meaning, he told us—

The commercial element concerns the financial instruments that it can use, and the bank will not invest in the public sector in the way government would do through resource or capital grants.iii

Reporting that discussions with HM Treasury over dispensation for SNIB to carry over funds were “still under discussion”, he suggested “we would manage without it, but that would be far from desirable”. Regarding permissions required from the European Commission, the Scottish Government were “building up that case” and work would be passed to the UK Department for Business, Energy and Industrial Strategy to “carry out the notification process”.iv

Asked why a Bill was necessary to underpin the establishment of the Bank, David Wilson told the Committee—

…the decision that has been made, and the advice that we received, was that, in order to capitalise such a company on the scale that ministers intend, legislation would be needed.v

The Cabinet Secretary said—

It is about the scale of the bank. If we get the dispensations, the bank will have further financial flexibility, which the agencies that we currently have do not enjoy. There are benefits from establishing the bank in legislation.vi

On the question of whether the Bank required a banking licence, the Cabinet Secretary told us there was no need for one “given the nature of the activities that the bank will be engaged in”. Asked about regulation by the Financial Conduct Authority, David Wilson said the FCA’s “approval will be required for the use of the term, “bank” but the Scottish Government were “not anticipating any particular challenge around that”.vii

As to its intended longevity, and the Bank being allowed to get on with its work beyond the short-term political cycle and without any undue interference, Mr Mackay felt the approach to engagement, operation, accountability, transparency and governance “gets the balance right”.viii

The sense was “the bank will achieve more if it is as independent as possible” but the checks and balances envisaged “will give us assurances about its operation”. He said—

…I think that we have struck the right balance to ensure that the bank endures beyond any parliamentary term…viii

Conclusions

The Committee acknowledges that the Bill is part of a wider process that the Scottish Government is undertaking to establish the Scottish National Investment Bank. There are numerous other documents related to the Bill – Articles of Association, Shareholder Framework etc. – and we ask that the Scottish Government provide further drafts or ideally final versions of all relevant materials as soon as possible and certainly in advance of the Stage 1 debate.

We note that the proposal for the Bank has been consulted on twice by the Scottish Government – before our own call for views – and that there has been a strong level of engagement with the business community, investment organisations, economists, the third sector, think tanks and others. There was also a debate in the Parliament on 8 May 2018, with the motion (as amended) agreed to – see paragraph 11.

The Committee recognises, given the level of capitalisation being sought, the need and rationale for the Bank to have a statutory underpinning.

We note the public limited company model being proposed and – having heard various views, some questioning, many positive – are content with the approach.

The Committee welcomes the Scottish Government’s clarification on the meaning and emphasis on commercial activity and the private sector – see paragraph 60. However, the Implementation Plan stated that the Bank should take into account economic, social and environmental returns when making investment decisions, and that a balanced scorecard would be developed to establish the requirement and measurement of non-financial returns. The balanced scorecard, which is to be devised between the Bank and the Scottish Government, is not referenced in the Bill or anywhere else outside of the Implementation Plan. Some witnesses perceived a tension at the heart of the Bill between the commercial aspect and the long-term slow-growth focus. We believe non-financial returns must be anchored in the Bill and invite the Scottish Government to consider how best that can be achieved.

The Committee is aware of the constraints around Financial Transactionsi and the rationale for the Bank not to provide input where the Scottish Government itself can deploy resources. However, as Mariana Mazzucato told us, the Bank “should provide patient finance to organisations in the public, private and third sectors and in civil society that are willing to engage with the government missions”. We ask therefore that the Scottish Government think beyond SNIB’s work in its initial phase, look to future-proof the mission-orientated focus, and – given that potential missions such as the climate emergency, social care and fuel poverty will inevitably require public sector/local government input – keep the door open to who the Bank will be able to work with in the longer-term. We invite the Scottish Government to set out how it would intend to achieve this.

Dispensations/permissions are still required from HM Treasury, the European Commission and the Financial Conduct Authority. We were told these matters are all in-hand but the Committee urges the Scottish Government to follow-up on all fronts as soon as possible – accepting the need to work through the UK Department for Business, Energy and Industrial Strategy for the case to be put to the EC to secure permission in order to comply with State Aid rules – and to keep us informed of progress, providing copies of correspondence.

People have such high expectations for the Bank that it is unlikely it can deliver on everything to which its name has been speculatively attached before even a single mission is framed or its first investment made. The vision is that of a new and unique institution, one that will become a cornerstone of the Scottish economy via its investments and missions; an entity which the Committee agrees should be independent but accountable and permanent but adaptable, taking a long-term, patient view.

Capitalisation and costs

This section deals with the level of capitalisation, the proposed costs of establishing and running SNIB, and remuneration.

Scale of capitalisation

The Implementation Plan suggests the capitalisation proposed is consistent with levels for other national investment banks and—

In a Scottish context, £2bn broadly equates to 1.3% of GDP.

It is noted, however, that such a statement will be correct only when full capitalisation is achieved after a 10-year period.

The impact of that sum was “difficult to speculate on” according to Bennie Higgins but he described it as a “catalyst” and “wonderful opportunity to make a big difference” and “feed ambition”.ii He said—

…£2 billion strikes a decent balance between aspiration and impact.iii

The amount compared “pretty reasonably” with similar institutions in the UK and internationally, according to Laurie Macfarlane. The difference was that SNIB would not be able to leverage that capital by borrowing or issuing bonds, which was “where the difference might lie, at least in the initial phase”.iv

SCDI welcomed the sum but contrasted that level of capitalisation with the scale of ambition set out in the vision to transform Scotland’s economy. It contended that it could be challenging – with the investment spread across a decade – “to deliver a truly transformative macroeconomic impact” and—

Our concern is that we will not reach that proportion of GDP until 2030...Scale and speed are required quickly.

Advisory Group member Alan McFarlane said it could be argued “the denominator is not the £170 billion that is Scotland’s gross national product but 10 times that number”. He thought the approach “could be significant if it is targeted but it cannot be a blunderbuss”; and explained that because leverage in terms of “borrowing money from your own balance sheet” was not permitted for SNIB, it would have to mean “influencing others to behave differently”. He suggested there was “clear evidence” the Scottish Investment Bank (SIB) had been “quite good” at doing this.vi

UNITE Scotland was not convinced £2 billion represented a sufficient level of capital investment to deliver real economic change. It cited several examples of projects that would have made a significant albeit hypothetical dent in the figures – e.g. the Beatrice offshore wind farm being a £2.6 billion project and if the owners had sought just 10% of the cost, that would have come to £260 million, “wiping out the whole budget in one year, on one project”.

Similarly, RSE had concerns over the level of capitalisation restricting the number of potential missions the Bank could have. It suggested £200 million a year over the first decade was “not enough to provide investment across three or four missions - such as demographic issues and/ or transition to low carbon economy - which are significant in scale”.

DBW’s Rob Hunter told the Committee—

I know that in Scotland the challenge is to invest £200 million a year and from our experience in Wales, I think that is a probably the right level to aim at.ix

Robin McAlpine of Common Weal said—

Everything has to start somewhere and £2 billion is a good starting point, but we are much more ambitious of the bank’s future than that.x

Costs

The Financial Memorandum states—

The indicative financial modelling projects that the Bank will cover its operational costs from 2023/24. The indicative financial modelling is subject to further review and change.

The document is heavily caveated and the figures for SIB are not reflected in the costings set out. More information is due to be published by the Scottish Government on the operating costs and indicative financial modelling.

Alan McFarlane told the Committee—

There will be red ink spilled in its annual reports and accounts every year until 2023. That is why I said at the beginning that, if you want long-term patient capital, you have to have long-term patient investors.ii

Also asked about the Bank’s break-even point of 2023/24, Andrew Castell from Par Equity stated bluntly “in government cash-accounting terms, I would say that there is not a hope”. Looking at a company level, however, and as to whether SNIB could turn “an accounting profit”, he believed “it probably would” but much would depend on whether Scottish Enterprise’s existing portfolio was transferred over.iii David Ovens of Archangel Investors suggested “it is difficult to see how the bank will be washing its own face within five years”.iv

Mydex CIC’s David Alexander also had concerns, describing the 2023/24 aim as “completely unrealistic” and contending that becoming self-funding “will not happen overnight”. He said—

I think that you would be happy if the bank broke even in 15 years. That might be blasphemous.v

Asked about operating costs, Ray Perman of the Royal Society of Edinburgh (RSE) suggested the £25 million figure represented a “very high expectation of costs” when compared with the British Business Bank. In particular he questioned the need for the 40 civil servants and £4 million a year identified by the Implementation Plan to staff the sponsorship unit within the Scottish Government—

“That seemed rather excessive for monitoring a bank that will have only 100 people.”vi

Benny Higgins, asked whether the proposed levels of operating costs in the Bank’s first few years were realistic, told us—

We have modelled that on the basis of the nature of the activity and the number of people involved. It is our best guess. We have taken as many readings against similar organisations as we can, so we think that it is realistic.vii

Remuneration

The Bill provides that the Articles of Association must include that the remuneration of the Bank’s directors and staff be determined by the directors, subject to any direction from the Scottish Ministers. Work is ongoing to determine the eventual position.

The Bank will be operating in the financial sector and the Scottish Government believes it will need to reflect that in its terms and conditions of employment. However, it will also be a public body and required to deliver value for money. It is expected that the majority of staff will fall within public sector pay policy, but alternative approaches may be required for some roles.

Respondents to the Scottish Government’s consultation believed that any attempts at performance-related remuneration should be approached with great caution as such schemes almost inevitably lead to distortion of behaviour. The simpler and more transparent the process the better.

SCDI thought investing in people was vital to organisational success and supported a “judicious approach to remuneration which ultimately reflects labour market realities”. It also suggested that remuneration, particularly for staff at the leadership level, “be closely linked to the performance of the Bank, macroeconomic impact delivered, and rates of financial return achieved”.

It was crucial to the STUC that the Bank’s remuneration policy retained public support—

Given the Scottish financial sector's track record of failure, it is simply not credible to pay senior staff as private sector bankers instead of public servants...

The Law Society of Scotland said in relation to section 8 of the Bill that any direction from the Scottish Ministers about remuneration of staff should be “in line with levels of transparency and accountability in terms of civil service remuneration”.

It was the view of Friends of the Earth Scotland that there could be “no credible case for the Bank paying senior staff as private bankers instead of public servants”. It welcomed the proposal to pay all Bank staff the Scottish Living Wage or more and proposed this was “extended to sub-contracted services such as cleaning and IT”. Furthermore—

Pay within the Bank should not exceed the First Minister’s salary, which currently stands at £151,721.

Placing the issue in a wider context, Mariana Mazzucato argued the case for reframing the public sector “to attract the top talents” in the investment and scientific sectors in order to “take a risk and be a creative actor”. She said such an approach had been shown to work in “bringing in high level expertise” to government bodies—

You do not have to match bankers’ salaries but you have to ensure that the bank’s remit is ambitious and that it will be an honour to work there.v

Graeme Sands of Clydesdale Bank felt the right people would be attracted to “execute that purpose”.vi David Ovens of Archangel Investors cautioned “against a bonus culture”, suggesting that any incentives be long-term in outlook, like the Bank itself.vii Mydex’s David Alexander argued the “masters of the universe” model was “an illusion” and recruits from the financial sector did not have to be “treated like gods.”. What was needed, in his view, was clarity about the mission and the role and that the Bank was an opportunity to “do something different”—

You should insist on talent but make it plain that you are not paying eye-watering salaries.viii

DBW’s Rob Hunter explained that their salaries were independently market- tested every three years, with “pinch points for the higher salaries” relating to fund managers—

We have adjusted our salaries for the people who deal with equity, but we recognise that we cannot offer the stellar bonuses that people who work in the private sector can get.ix

Scottish Government

Regarding the level of capitalisation, the Cabinet Secretary said—

We have set out the £2 billion capitalisation over the 10-year period, but exactly how we profile that will be determined by the resources that we have available from budget to budget, within that aspiration.i

On the likelihood of the Bank meeting its break-even deadline of 2023-24—

It might. It is possible, and even likely, but it will depend on what the bank invests in; when there is a financial return; the state of the economy at the time; where there is success, whether that is around the bank’s missions or around its investment profiles; and what we choose to do around the economic cycle.ii

He wished the Bank to be self-financing and “able to reinvest its returns as soon as possible” but did not view the Bank “as a cash cow that will be able to contribute to the fiscal coffers”. Success would be “allowing investments to happen that would not otherwise have happened”, which was of “much greater importance than ministers having the ability to take a dividend from it”. That was not the motivation—

“It is about transforming the economy to direct more efforts towards demographic and environmental challenges, including the transition to a low-carbon economy and the scale-ups.”ii

Remuneration was an issue “we will wrestle with” he said. As a PLC and a public body, the challenge was of “attracting the right people to operate the bank while working within the public sector pay policy, as far as possible”. The Bank “will work within the fair work principles and…be a living wage employer”. However, “higher remuneration levels will be required for some posts” and close attention would be given to the BBB’s pay policy so as to “be commercially minded but publicly accountable”. He told us—

“We will give the matter a great deal of thought and we will balance the need for people who have the right skills and experience with respect for the public sector pay policy, which the vast majority of the staff will be under.”iv

Mr Mackay explained the Bank itself would “lead on its remuneration policy and the recruitment of staff, but ministers will set out a view and a direction” and said—

I do not want to encourage a bonus culture in the bank, which would be an inappropriate driver. I want the bank to be inspired and energised by its missions.v

Conclusions

The Committee considers the level of capitalisation a good starting point but – given the duration of 10 years during which the annual sum will be subject to each year’s budget process – our welcome is a qualified and cautious one.

We draw attention to the fact that the Financial Memorandum is heavily caveated and the figures for the Scottish Investment Bank are not reflected in the costings. We note that more information is due to be published by the Scottish Government on the operating costs and indicative financial modelling. In the interests of transparency, we seek an updated set of figures at the earliest opportunity and certainly well in advance of the Stage 1 debate.

The Committee notes the concerns of at least one submission to our call for views at the size and cost of the sponsorship unit within the Scottish Government. We would welcome a more detailed breakdown of the projected figures and thorough explanation for the number of staff thought to be required.

Remuneration is a difficult and potentially contentious issue in the case of an investment Bank that is a plc but also a public body. We were encouraged, however, to hear a number of witnesses say that making the Bank a great place to work – innovative in its approach and pursuing missions of wider social significance – would attract those with talent and expertise. The Committee agrees that the broader purpose of the Bank will help to attract people with the right ethos as well as the right skills and welcomes the Cabinet Secretary’s statement of not encouraging a bonus culture, notes that the majority of employees will come under public sector pay policy, and recommends that the Scottish Government look to the examples of the Development Bank of Wales and the British Business Bank – other relevant and commercially minded but publicly accountable bodies.

Governance and accountability

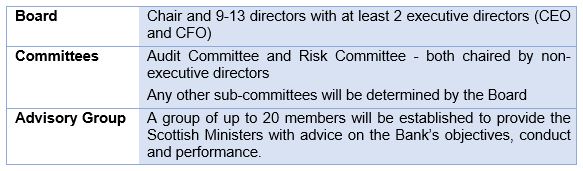

This section covers SNIB’s governance arrangements, including the Board of directors, the proposed Advisory Groupi, accountability and the role of the Parliament.

Governance

The Policy Memorandum makes clear that “Ministers will not have a role in the Bank’s internal governance or the operational decisions made by the Board”.i Bennie Higgins drew attention to another document key to the relationship between the Bank and the Scottish Government—

There will be a strategic framework, which I see as being an envelope within which the bank will operate; we seek to create an envelope that will allow the bank to be operationally independent.ii

Alan McFarlane observed that the board of directors would take on the same responsibilities as directors of any company under the Companies Act 2006. What would be key was the interaction with the Scottish Government—

The bank will make losses for the first three or four years, so it will be imperative that there is an extremely close and confident relationship between the board of directors and the shareholders, who will be the Scottish ministers.iii

Furthermore—

To have an audience of fans baying for the manager to be sacked three games in would be the worst possible outcome.iii

Advisory Group

The Financial Memorandum states—

An Advisory Group of up to 20 members will be established to provide the Scottish Ministers with advice on the Bank’s objectives, conduct and performance. It will be resourced by the Scottish Government and is anticipated to meet 1-2 times a year. The establishment of an Advisory Group is not provided for in the Bill but will take place following the coming into force of the Bill.i

The annual costs of the Group are estimated between £20,000 and £50,000 but the Financial Memorandum only captures these until 2022-23.ii

Mariana Mazzucato stressed the importance of having a representative Advisory Group. She said it was not practical to involve “hundreds of people” but “you can ensure that the people who are around the table genuinely represent different voices”. How that was decided was for the “political process” but—

Ideally, different types of voice will be represented. For example, if there is a care mission, it is obvious to me that social care workers and nurses should be at the table.iii

Linda Hanna from Scottish Enterprise was positive about the role of the Advisory Group, suggesting that it has a “real opportunity to bring diversity of thinking to the matter” and “to provide some independent thought”. She distinguished its role from the issue of the Bank’s governance.iv

An “advisory board that focused on customers” was the description of Common Weal’s Robin McAlpine. He added “the customers being Scotland”. He recognised that the board could heed the advice or not but—

We suggested taking that approach to address the fear that banks can sometimes be a little tin-eared when it comes to fiduciary duties.v

RSE expressed concern at the lack of clarity and potential influence of the proposed Advisory Group, warning of the risk of a clash with the Board and how this might “increase the risk of inappropriate political interference from Ministers”. It recommended that the Chair of any Advisory Group should not sit on the Board.

The CBI described the Advisory Group’s role as “crucial” and suggested it draw its membership from business, finance, higher education, think tanks, and enterprise agencies. Flora Hamilton said—

The advisory group’s membership must cover a broad spectrum, and it must be independent, clear and transparent in its monitoring of the bank’s performance and how it delivers against a set of tangible and measurable KPIs.vii

In Laurie Macfarlane’s opinion—

It must not be seen as being there just to provide cover, with no meaningful agency to shape things.viii

Benny Higgins was keen to “respond to the desire of a broad church of people who would like to have a voice that ministers hear as they go through the strategic cycle”.ix However, he emphasised that the Group’s role was to advise ministers and not the bank itselfix—

An advisory board will have a voice to inform ministers, as the owners of the bank, but it will not inhibit the bank’s day-to-day operation.xi

Accountability and the role of Parliament

The Policy Memorandum states that—

While the Bank will be operationally and administratively independent, the Scottish Ministers, as the Bank’s sole shareholder and sponsor, will set the parameters within which the Bank should work. Scottish Ministers will also set the direction for the Bank’s investment through setting it strategic missions.i

Section 11 of the Bill gives the Scottish Ministers that power of setting the missions and after sending the Bank a document doing so, the Scottish Ministers must “lay a copy of it before the Scottish Parliament”. Section 14 (Review of performance) stipulates that the Scottish Ministers do the same with a copy of a review of the Bank’s performance (to be carried out at least every five years).

The Law Society of Scotland observed that the Bill made “provision for transparency and accountability” for SNIB’s reporting to the Scottish Ministers on missions. However, there was “”no corresponding duty” on the Scottish Ministers to allow parliamentary and public scrutiny of the Bank’s performance. It suggested the Bill require that a copy of the report be sent to the Scottish Parliament and made publicly available.

There was support from STUC for the key role of Scottish Ministers in determining the strategic framework, setting missions, and defining performance objectives—

However, ultimately, we believe that Parliament should also input and authorise final approval. They should therefore be subject to affirmative procedure.

Helen Martin of STUC said the Parliament’s role was “crucial” and it “should have the right to consider, amend and vote on the bank’s missions.”iv

There were concerns from Friends of the Earth Scotland that the “lack of Parliamentary oversight over the setting and delivery of missions” could downplay their importance. It argued there was a “real risk” that the missions could be seen as a minor part of the Bank’s work.

Asked whether the Parliament should have a role in agreeing the mission(s), Ray Perman of RSE and Common Weal’s Robin McAlpine thought it should.vi LINC Scotland’s David Grahame suggested “scrutiny and comment rather than full approval”.vii

Bennie Higgins told us—

I think that we could over-intellectualise it by having to go through a parliamentary process to address the missions. There are big obvious missions that we need to pursue in this country.viii

Scottish Government

Asked if the chair or another member of the Advisory Group should sit on the Board of the Bank, the Cabinet Secretary said he “could give that further thought”. He was not suggesting the advisory group “should never meet representatives of the bank” or wishing to “be overly restrictive” but he pointed out that the advisory group’s role was “ultimately to advise ministers”. Given that advisory function, he was “not proposing to put it in the act”.i

Rachel van Kempen said the consultation had proposed that a non-executive director of the Board would chair the Advisory Group, the thought being of “creating a connection between the advisory group’s thinking and the board and its thinking”. The Cabinet Secretary said that would “give you the link that you were asking about—not from the advisory group into the board, but from the board to the advisory group”.i

He told us—

The important point about the advisory group is that we want it to be reflective of Scotland and its key economic interests. It cannot be totally comprehensive and cover every sector, but we want the group to be informed, and for it then to inform ministers.i

In terms of accountability, the Cabinet Secretary did not believe the missions should be subject to formal parliamentary scrutiny or approval—

I think that it is right for the Government to be able to get on with its job as an executive and have a relationship with the bank, whereby the bank will have a degree of independence, but the missions will set out the parameters within which it should operate.iv

However, he was “keen for a cross-party approach to be taken to refining the missions”, likening it to his work on the national performance framework—

That did not require an affirmative vote by Parliament; it was a mission for the whole country.iv

The NPF was developed “in an inclusive way”, Mr Mackay said, suggesting a similar approach with the missions – and committing “to taking a round-table approach”. He proposed—

Rather than have a parliamentary vote and unnecessary division on the missions, I would like to engage with Parliament on them, in the same way that I did for the national performance framework.iv

Conclusions

The Advisory Group, as we understand it, will have a crucial role in advising the Scottish Ministers on the Bank’s objectives, conduct and performance. It has the potential to help shape the thinking and decision making that sets the parameters within which the Bank operates, most notably via its missions.We agree that membership should cover a broad spectrum of business and society, that it should be independent, rigorous and transparent in its monitoring of the bank’s performance against a set of tangible and measurable KPIs, and that its membership should be changeable and refreshed over time, reflecting the challenges of different missions e.g. for a social care mission, care workers and nurses should be around the table. This is no small undertaking for a group that it is intended to meet once or twice a year and number no more than 20 members.

The Committee is concerned at the potential for confusion over the nature of the Advisory Group’s role, the make-up of its membership, and how much agency it will have in shaping the Bank’s missions. Doubtless the Scottish Government is working on various models, scenarios and permutations and we invite them to share these in advance of the Stage 1 debate.

The Committee would expect to see the STUC and COSLA among those represented, and we also recommend that the Scottish Government consider how the Advisory Group could be reflected in the Bill. The Scottish Government must clarify that the Advisory Group is there to advise Scottish Ministers as the sole shareholder of the Bank.

The Scottish Government’s consultation included the suggestion of a member of the Bank’s Board of Directors sitting on (and chairing) the Advisory Group. The Cabinet Secretary said he would give further thought to the idea of a reciprocal arrangement whereby the chair (if not a member of the Board) or another member of the Group might have a seat on the Board. We recommend that a member of the Board does not chair the Advisory Group, our concern being a potential conflict of interests.

The Committee welcomes the Cabinet Secretary’s suggestion of a roundtable approach to refining the missions, similar – as he saw it – to the approach taken with the National Performance Framework. Our view, however, is that the Parliament should be formally consulted on those areas that will set the long-term focus of the Bank’s work – likely to be fundamental policy matters such as climate crisis, social housing or the care system. Examples of formal parliamentary consultative mechanisms that already exist can be found in the Community Empowerment (Scotland) Act 2015 (regarding the National Performance Framework), the Climate Change Scotland Act 2009 (regarding the Climate Change Plans) and the Town and Country Planning (Scotland) Act 1997 as amended (most recently by the Planning (Scotland) Bill of 2019) (regarding the National Planning Framework). We recommend the Scottish Government consider these examples in order to devise a means for the Parliament to be consulted on and meaningfully inform the process by which the Bank’s missions are formulated and refined.

Markets and demand

The pertinent question in the Committee’s call for views was: How can we ensure the market is ready for the investment opportunities the Bank can offer? The following section examines demand concerns and stimulation, alignment, expectation of return, and performance metrics.

Demand

What the Committee heard about business demand for finance was mixed.

The supply of capital was growing – according to RSE – via the private sector and also the BBB, but investment remained low, which suggested the “critical importance of a lack of demand in the market”. If SNIB did not help to stimulate demand, directly or otherwise, “then it will be particularly difficult for it to achieve its main objective of stimulating investment and enhancing productivity”.

Alan McFarlane said there were “no guarantees” but he did not believe that the low uptake of initiatives such as the Scottish Growth Scheme “damns anything”—

…having an enduring and continuing entity, which makes it its business to let everybody know that it is available, is a big step forward.ii

SIB’s Kerry Sharp said that uptake of the Scottish-European Growth Co-investment Programme had been “slower than we would have liked” but there had been 120 inquiries and they were “actively working on 30 or so”. Brexit, she though, had “played a negative role” on both the investor and company sides. However—

SEGCP was always a niche fund – the objective was to support only five, six of seven companies a year.iii

She had also said—

Another issue is the nature of the programme, which is different, new, first in class and has never been done before—we are the first in Europe to do it. It has taken time to educate the companies and speak to investors.iv

The issue of awareness was also raised by David Grahame from LINC Scotland. He suggested demand could be “inhibited by a number of factors”, of which lack of awareness of what was there and how to get it was the most basic. Confidence was another factor, depending on the certainty or otherwise of the times, as was the cyclical nature of markets when “at any point in the cycle the nature of demand can be out of step with available supply”. He said—

An important requirement of SNIB is that it be well informed and agile in order to enable it to respond. It will also need to be extremely well integrated with all sorts of other agencies in order to manage the demand flow properly.v

He sought to distinguish between “need” and “demand”—

Need is huge, but the ability to convert that need to fundable demand is a big issue.v

The Scottish Enterprise/Scottish Investment Bank [add link] (SIB) submission suggested a “significant impact” has been made in “addressing the demand and supply challenges of the Scottish market for risk capital and more recently debt finance”. It accepted, though, “that even more needs to be done in an increasingly uncertain economic environment”.vii

SIB’s integration into SNIB and alignment between Scottish Enterprise and SNIB were “essential to make a step change in the market”. Substantial demand stimulation activities” were also necessary alongside the additional “investment capability” of SNIB.vii

The BBB highlighted its new Demand Development Unit (DDU), “created specifically to develop the Bank’s positioning and relationship with smaller businesses across the UK” and help it deliver against the following objectives—

Encouraging and enabling SMEs to seek the finance best suited to their needs

Promoting the Bank as the Government’s Centre of Expertise for smaller business finance in the UK

Identifying and helping to reduce imbalances in access to finance for smaller businesses across the UK

Mariana Mazzucato said there were two issues behind a “lot of status quo behaviour”: a lack of “quality finance” i.e. the patient kind, and not enough demand for finance in the SME space. She suggested that instruments such as tax incentives, guarantees and subsidies work on the assumption that the private sector wants to invest already. If that proves not the case, these “indirect incentives” simply boost profits—

However, there is no profits problem – there is an investment problem.x

She thought SNIB could draw in investment by “increasing the imagination of the business community” and showing it an “exciting new future” in the realm of “mobility, clean growth and an aging society”, one in which there were “long-term profits to be made”.x

Alignment

Bennie Higgins said he was “working hand in glove” with Scottish Enterprise and Highlands and Islands Enterprise on “origination” in order to reach the “right place”.i

His colleague Paul Brewer said whether it was low carbon or digital and data—

…the bank will need to work with academia, existing businesses and other investors to bring in considerable expertise, so that Scotland is seen as a place with a fertile investment environment.ii

Scottish Enterprise’s Linda Hanna referred to the Enterprise and Skills Strategic Board and the agenda to “rationalise and simplify”. It was “about the whole system working” and delivering “business services that business needs” and connecting “into new instruments such as SNIB”.iii

Kerry Sharp of SIB saw the need that “everything in the ecosystem is as joined up as possible”, including Business Gateway. SIB’s financial readiness team, which is staying within Scottish Enterprise rather than moving over to SNIB, “works well with Business Gateway” and colleagues “are often based in Business Gateway offices”.iv She said—

That area of specialism is very much the lynchpin between the wider enterprise support of the type that is delivered by Business Gateway and the funding support that SNIB will provide.v

However, warning of “over-lapping initiatives” and encouraging “targeted advice” to be “consistently delivered”, Mydex’s David Alexander told us—

There have to be contact points that join the dots. Otherwise we will have a Venn diagram on steroids, with everybody trying to provide advice…vi

The experience of Wales was that there had been a “lot of discussion” around integration between DBW and Business Wales. Board representation was “the first step”, followed by “automatic routing” of phone inquiries (so callers were not “batted around various departments”), and a “full joint strategy session” between the Business, Economy and Innovation Department and “all the other elements”. Rob Hunter told us—

…we wanted to hide the wiring as far as businesses were concerned.vii

Returns

The Implementation Plan states that in some cases SNIB will invest on the same commercial terms as the private sector. In other areas, e.g. in response to specific market failures where State Aid allows, it may take different risks or different returns, but always in expectation of a return. This will be assessed alongside the wider economic, social and environmental impacts.

The concept of the level of return is referenced in the Policy Memorandum but not the Bill. The Scottish Government has confirmed that the financial target rate of return for the Bank will be finalised prior to the company being established.

It can be noted that the BBB’s target rate of return is 2.5% though it achieved 4.7% in its most recent full-year report. Also, neither DBW nor SIB has a target rate of return, albeit DBW’s Rob Hunter indicated “our target return of investment is currently forecast to be positive by about 0.7%”.ii

Equity Gap’s Jock Millican told us—

…it would hamstring the bank very badly to set out an ambitious rate of return at an early stage.iii

In a similar vein, Graeme Sands of Clydesdale Bank warned against “trying to make the organisation too commercial too quickly” and argued that placing an emphasis on “aggressive rates of return” early on “could be hard to sustain”.iv

Bennie Higgins told us work on rates of returns was a “work in progress” and that in some scenarios, e.g. where a market does not yet exist, no comparators were available. However—

For the avoidance of doubt, the bank is being set up to make a return on capital.v

Performance

Some respondents to our call for views expressed concerns about how SNIB’s performance would be assessed.

Engender stated—

We do not feel there is sufficient clarity about the metrics that will be employed to measure success, particularly non-commercial, economic returns.

Similarly SCVO highlighted that the Bill provides scant indication of the importance of measuring the Bank’s investments “beyond generating financial profit and surplus for reinvestment”.

Close the Gap agreed that the success ought not to be measured by financial indicators alone, proposing “wellbeing indicators” to judge the public benefits of patient capital.

Warning against the Bank starting out in search of “some quick wins”, Laurie Macfarlane said such an approach “will not generate the kind of additionality that is the point of the bank”. It was “not the volume…but the direction of investment”. He told us—

Making sure that it is doing things that would not otherwise happen will be key to the success of the bank.iv

According to Businesses for Scotland, drawing on the National Performance Framework was “fundamental” and the Scottish Government should avoid the "absence of clarity in the criteria through which the Green Investment Bank was going to be evaluated".

Benny Higgins said work on the key performance indicators was in progress and—

One has to remember that we have to get back to the national performance framework…The bank should play its part in delivering that.vi

Quizzed about HM Treasury Green Book, he said it had been “part of the conversation” and was “not being ignored”.vii

Mariana Mazzucato suggested the Green Book was “determined very much by cost benefit-type calculations” and they were working with the Treasury on “more dynamic efficiency versus allocative efficiency metrics”.viii

She also called for flexibility, adaptability and “knowing when to turn the tap off”—

…you should know how to pivot and how to question your behaviour and why things are not succeeding.ix

Scottish Government

Emphasising the importance of engaging with the enterprise agencies, the Scottish Futures Trust and the banks to stimulate interest and raise awareness, the Cabinet Secretary said—

We want to ensure that there is demand—folk queueing up at the door, if you like—so that people take advantage of the financial products that will be available.i

We could learn “from Wales and from the British Business Bank and the Green Investment Bank” but SNIB was also “different from all of them…unique to Scotland’s economic circumstances and landscape”. But the intention was not “to crowd out the BBB, either—we want it to keep investing in Scotland”. Additionality was the word.i

Decisions remained on “who and what transfers, and what resource is where” and he would “look closely at those issues to avoid duplication”. What was wanted was a “potent, targeted, national investment bank”, the enterprise agencies and SFT left with their functions—

We will look closely at how we align our efforts, organisations and staff. We are also working right now on a single point of entry for business support. It is about decluttering.iii

The question was “what fits best where and how we can address duplication to ensure that we get maximum output from public finance”.iv

Asked about the relationship to the strategic board, the Cabinet Secretary said it would “be wrong to assume that the strategic board will take no interest in the bank”. The board “might be able to give advice on the landscape of the agencies” and he would “give that further thought”. However, he did not wish for “too many sources of leadership, when the purpose was to declutter and to bring things together”.iv

Questioned on the take-up of the Scottish Growth Fund, perhaps a signal of demand in the current market, he committed to write to the Committee with a detailed update broken down by portfolio, but—

Am I still confident that the half a billion pounds to which we committed in the programme for government will be allocated over the period? Yes, I am.vi

Discussing demand in the context of the Scottish-European Growth Co-Investment Programme, Mr Mackay said—

If we have financial products for which there is not enough demand, we can create bespoke products and look at how we can support companies if they want a different kind of financial product.vii

Furthermore—

Companies will, naturally, always take free money before loans or equity—anyone would take a grant first—but we will provide loans and equity. Because of the nature of the economy and risk or financial uncertainty, companies may not be willing to take up specific projects.vii

The target rate of return was raised with the Cabinet Secretary and he said it was “important” to have one and he would “engage with the bank” on the matter, but he did not see it as “a matter of primacy” when this was “about transforming our economy and adding to it”.ix He told us—

It should be there, and we should be mindful of it, but it must not be our north star—the only thing that we follow.x

Success was described by the Cabinet Secretary as “the bank allowing investments to happen that would not otherwise have happened”.xi Asked about the balanced scorecard, referenced in the Implementation Plan, he said they were “still working on it” but would appear in the stakeholder framework document, along with financial targets, and also the business plan and the investment strategy. The missions would “cover key socioeconomic challenges…both the financial and non-financial returns will be part of that”. He told us—

It will build on the Treasury’s green book guidance and develop a specific approach suited to a mission-orientated development bank.xii

He said—

The bank will be held to a very high standard, and that is admirable.xiii

Conclusions

The Committee believes the issue of demand for the investment opportunities that the Bank will offer is paramount. Close working with the enterprise agencies, the Scottish Futures Trust and Business Gateway – all those bodies directly involved with companies and closest to the markets – will be key. What nobody wants is an even more confusing and cluttered landscape of business support, or – as one witness put it – a Venn diagram on steroids. Given the Cabinet Secretary’s indication that he would think further about the role of the Enterprise and Skills Board, and while recognising its and the Bank’s very distinct roles but not losing sight of the need for alignment, we ask for clarification as to how these two bodies will interact.

The need to stimulate demand was a message the Committee heard loud and clear and that role would seem to sit primarily with the enterprise agencies. Lessons can also be learnt from the Development Bank for Wales, the British Business Bank and the Green Investment Bank in terms of boosting awareness and profile and – to paraphrase one of our contributors – identifying the best way to convert investment need into fundable demand. The issue is one of resources and where to direct them. The enterprise agencies could fulfil this role and/or consideration given to establishing a Demand Development Unit within SNIB itself. We ask the Scottish Government to specify its intentions with regard to stimulating demand and how this will be resourced.

The Committee was told by Bennie Higgins and others that the Bank is being set up to make a return on capital. The rate of return is to be determined closer to it being operational. The Committee understands the concept of additionality in terms of how, where and to whom the Bank directs its funding and the wider long-term socio-economic and sustainable benefits at which the missions will be aimed – and members recognise that a not-yet-determined percentage figure will not be the Bank’s guiding star – but we heard little in the evidence to suggest the rate is likely to be much more than notional.

Our concern is that from being a notional rate, it may preoccupy the Bank and become the measure by which the institution is judged, perhaps harshly, in the early years. The Committee therefore recommends that a rate of return is not set or applied for the short term, say the first 2-3 years of the Bank being in operation. Beyond that, and looking at the experience of other investment banks, we believe a rate of return would have a useful part to play in the Bank’s investment activities.

Evaluation of the Bank, not just the rate of return of its investments but the wider benefits desired from the mission-orientated approach, will be a challenge. The National Performance Framework and UK Treasury Green Book were discussed but the question remains of how best to measure the Bank’s performance, particularly regarding what you might call the non-commercial, economic returns. The Scottish Government says work is ongoing. The Implementation Plan mentions the balanced scorecard yet, as said, this is not referenced in other documents. As previously set out (in paragraph 80), the Committee believes that non-financial returns must be firmly anchored in the Bill and we ask the Scottish Government to consider how best to do that.

We note also the initiative being undertaken Mariana Mazzucato in collaboration with the Treasury to move away from cost benefit-type calculations and toward what she called more dynamic efficiency-versus-allocative-efficiency metrics. Whatever is devised must – as the Cabinet Secretary encouraged – allow us to hold the Bank to a high standard. The Committee seeks more clarity on how this is to be achieved.

Ethics and equalities

This section outlines issues concerning the ethical framework of the Bank and questions raised over equalities – including criticism of the Equality Impact Assessment (EQIA).

Ethical framework

The Bank’s investment, according to the Implementation Plan, should be on an ethical basis; to which end it should develop a code of ethics that goes beyond regulatory requirements and adopts a best practice approach.

SCDI wanted further clarity on whether ethical framework would prevent the Bank investing in certain sectors – as the Scottish Government’s consultation had suggested – and, if so, which sectors.

Social Enterprise Scotland thought those receiving investment should be obliged to adopt a social enterprise business model or sign up to the Scottish Business Pledge or Scotland Can B.

Scottish Environment LINK pointed to the Green Purposes of the original state-owned Green Investment Bank and suggested a “minimum standards assessment” be included in the Articles of Association. It said many banks and pension funds apply ethical lending exclusions, including RBS, the Norwegian Sovereign Wealth Fund, Green Investment Group and Triodos.

According to Equity Gap’s Jock Millican, ministers should provide guidelines because—

…what was ethical 20 years ago may not be ethical now.v

Alan McFarlane suggested that some ethical investment questions “answer themselves” but there were “more ticklish issues”, oil supply for example. His experience of ethical investment suggested such issues were “generally problematic but individually usually much easier to deal with.”vi

Mydex’s David Alexander knew of “no investment bank or venture capitalist that does not have some sort of portfolio rulebook that says that they invest only in certain things.” Given the aim of SNIB was “to improve society”, he asked—

…why would anyone back something that made things worse?vii

Engender observed that the EQIA was intended to inform the drafting an Ethical Investment Statement. However, based on the “current form” of that document, the organisation felt it could have “no confidence” in such a statement—

We do not know how the incomplete evidence-base included could sufficiently inform the Bank’s equalities considerations in its lending, operation and governance.

Equalities

Close the GAP stated—

“We are concerned that the equality impact assessment of the Bill is significantly flawed, in terms its process and structure, the scope of its content, its analysis, and conclusions.”

The organisation saw this as “part of a wider challenge across Scotland’s public sector” where EQIAs were “often not done, and where they are, they are done poorly”.

According to Engender—

“…as an EQIA it is insufficient, lacking anything more substantive than a cursory analysis and omitting all but two of the protected characteristics...”

Those that were addressed, race and gender, it found “limited”, looking at particular aspects such as access to finance for women-led businesses, but not examining the “different economic and social contexts of men and women”.

Eilidh Dickson elaborated on Engender’s concerns, She told us an EQIA was “not just a bureaucratic, tick-box exercise”, and from the information gathered that policy should be articulated, research carried out and changes seen—

There is very little evidence that the equality impact assessment has informed any aspects of the Bill.v

Ms Dickson was “pretty convinced” the EQIA would need to be “redeveloped” with “missing sections” added and the “whole process of analysis will have to be redone”. Furthermore, she told us—

Equality and non-discrimination are not included in the bill, and that does not translate through to meaningful action.vi

Scottish Government

Asked about the ethical dimension expected of the Bank, the Cabinet Secretary said that he did “not intend to legislate specifically on defining things as ethical”. However, there would be an ethical statement and that could be reviewed. He would “not just leave it to the bank to compose the statement—I propose to engage beforehand”.i

One scenario from an earlier evidence session was that of investment in the oil and gas sector. Mr Mackay suggested it took us “to a wider debate about the bank’s ethical statement and the restricted nature of what the bank may or may not invest in, on which we may have a view”. However, he did “not want to speculate too much about what the bank may or may not invest in”, suggesting such matters will be covered either by the investment strategy or ethical policy.ii

Addressing criticism of the EQIA, he had “seen the evidence from Close the Gap and Engender” and said officials were meeting with the organisations so that “what they have to say shapes and informs future work”.iii

He also told us “further work on socioeconomic deprivation will be carried out under the Fairer Scotland duty assessment”, the findings expected to be published “at the end of the summer”.iv

His aim was to “ensure that we cover issues such as having an inclusive approach, ensuring inclusive economic growth, sustainability and equality and tackling inequality”. They should also “feature in the missions and the shareholder framework document, and I also expect them to be set out in the remuneration policy, the investment strategy, the business plan and the ethical statement”.iv

The Cabinet Secretary said of the EQIA—

If it was felt—as was clearly the case in the evidence that you received—that there were gaps in the assessment, I would want to work on that, including in what we could do with those with protected characteristics.iv

Also—

We will meet the individual organisations to see what progress can be made during the passage of the bill, but I point out that what are perhaps even more important than the bill itself, which allows us just to build the bank, are the strategic documents and directions, which are where equalities should feature.iv

And—