Scottish social security benefits

This briefing describes the first five devolved social security benefits to be delivered by Social Security Scotland: carer's allowance supplement, best start grant, best start foods, funeral support payment and the young carer grant. Together these comprise the first phase or 'wave one' of delivering devolved social security. In addition, it describes eligibility for universal credit Scottish choices.

Executive Summary

The Scotland Act 2016 devolves various areas of social security to Scotland. These relate mainly to carer and disability benefits and the process is expected to be complete by 2025. This briefing describes the benefits that are currently being delivered by Social Security Scotland (autumn 2019).

Scottish social security currently (October 2019) comprises:

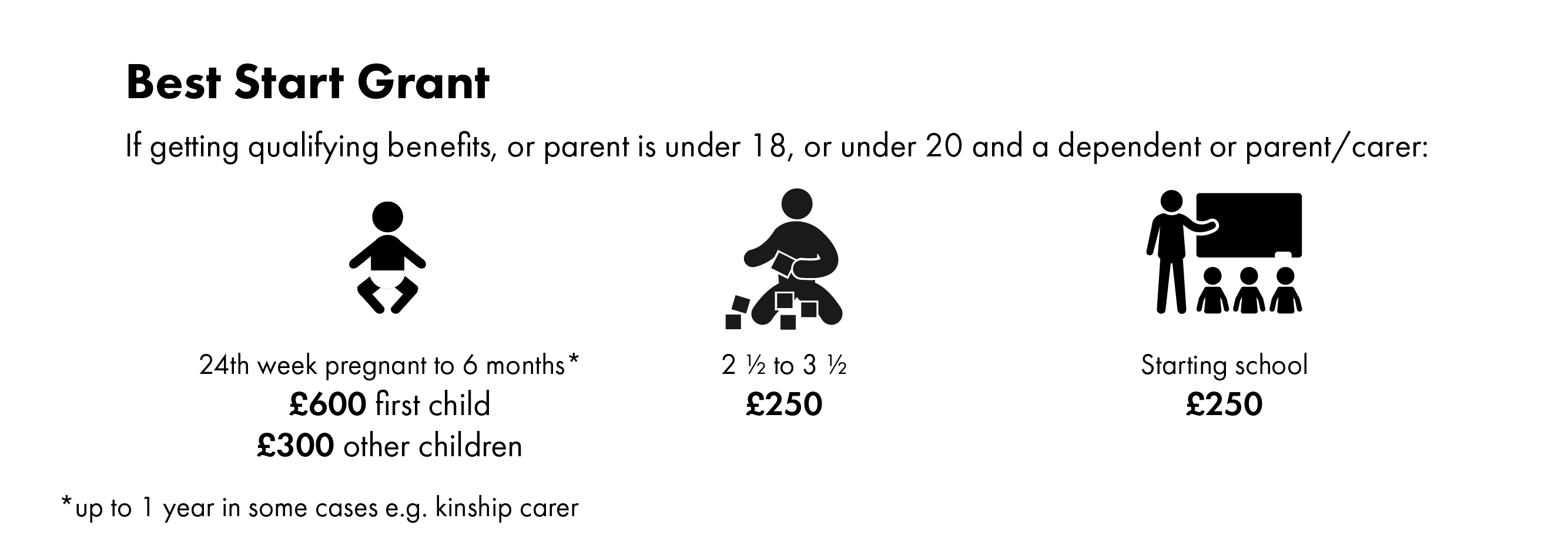

The best start grant - a grant of £600 for the first child and £300 for later children paid around the time of a child's birth, followed by payments of £250 between the age of two and three and a half, and a further £250 around the time a child starts school.

Carer's allowance supplement - £226.20 every six months to those who get carer's allowance.

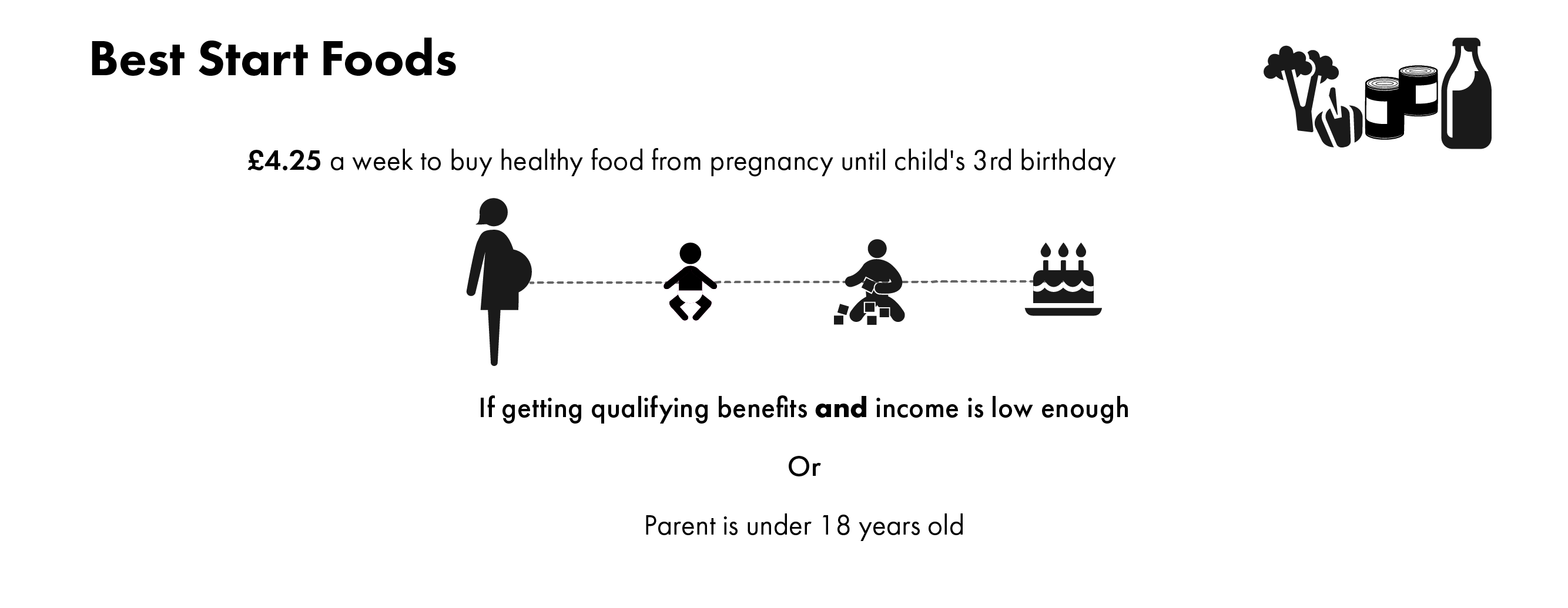

Best start foods - pre-paid card credited with £17 every four weeks for certain foods for pregnant mothers and parents of young children.

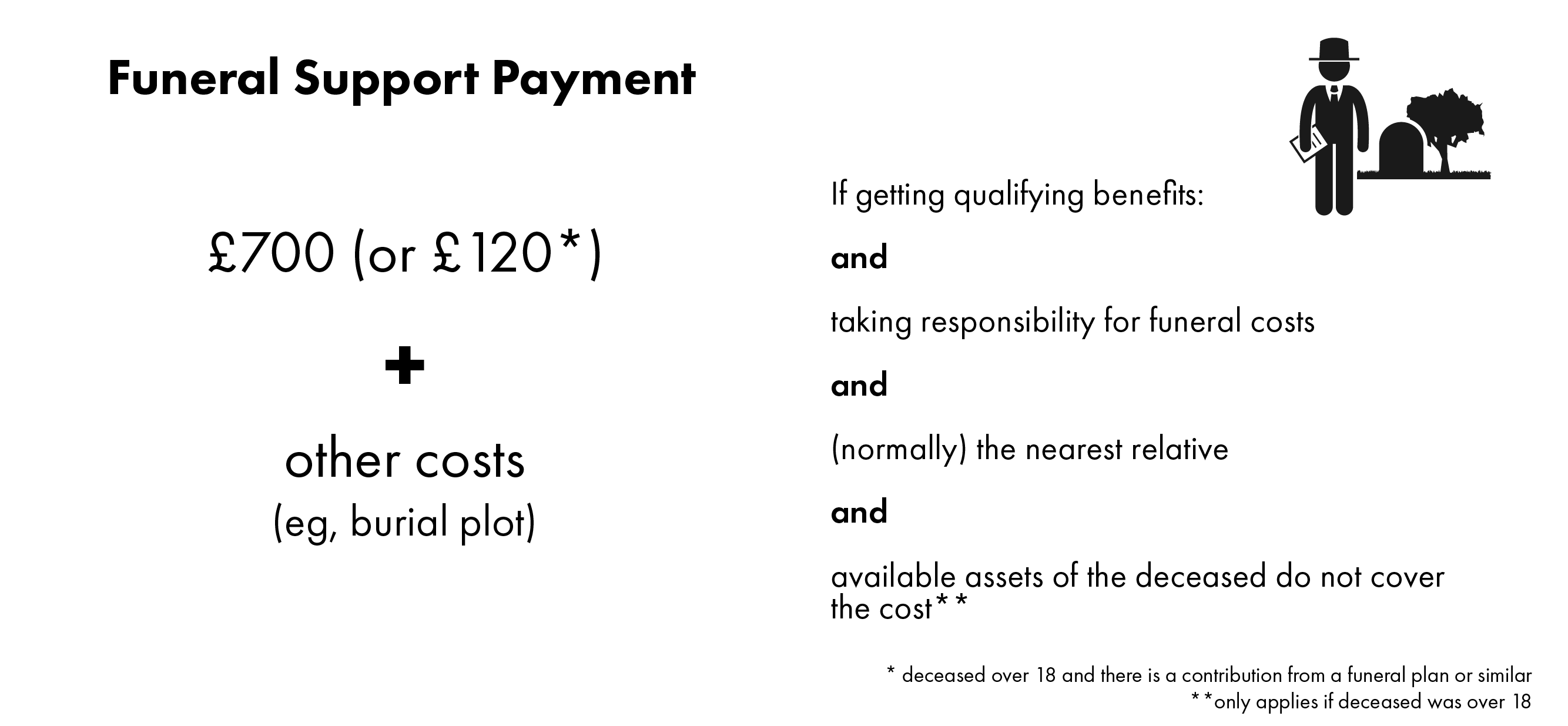

The funeral support payment - £700, plus payment of certain other expenses to assist with the costs of organising a funeral.

The young carer grant - an annual grant of £300 for young carers.

In addition, people in Scotland getting universal credit can choose to have their housing costs paid directly to the landlord and/or to split their award into a twice monthly payment.

This completes 'wave one' of social security delivery, which comprises 2% of the total value of benefits being devolved. 'Wave two' will start in summer 2020 with the introduction of disability assistance for children and young people. Table 1 below summarises the forecast spend and caseload for the 'wave one' benefits.

| Amount provided (2019/20) | Eligibility | Forecast Spend in 2020/21 | Forecast Caseload in 2020/21 | |

|---|---|---|---|---|

| Carer's allowance supplement | £226 twice a year | For people who get carer's allowance | £40m | 87,000 |

| Best start grant | 3 one off payments in early childhood. At birth, £600 (1st child), £300 (other children), £250 at nursery and school age | For people on certain social security benefits | £16m | 55,000 |

| Best start foods | £4.25 per week to spend on certain foods | £6m | 21,000 | |

| Funeral support payment | £700 plus certain expenses | £7m | 5,000 | |

| Young carer grant | £300 per year | For people aged 16 to 18 caring for someone on disability benefits | £0.7m | 2,400 |

| Total | £70m | 170,400 |

Scottish social security: 2017 to 2025

Between 2017 and 2025, the Scottish Government will gradually introduce 'Scottish versions' of the benefits devolved under the Scotland Act 2016. The DWP will continue to deliver reserved benefits (such as universal credit) in Scotland. To start with, some of the devolved benefits will continue to be delivered by the DWP by agreement with the Scottish Government. However, this briefing focuses on benefits for which a specific Scottish scheme has been developed and which are being delivered by Social Security Scotland.

Social Security Scotland is an executive agency established in 2018. By the end of this year (2019) the agency will be delivering five benefits: the carer's allowance supplement, the best start grant, best start foods, funeral support payment and the young carer grant. By the end of 2022 the agency will be delivering fourteen benefitsi - including disability benefits. Transfer of the existing caseload from the DWP will tadke a little longer - this is due to be completed in mid-2025.12 The timetable is set out in tables 2 to 5 below.

In total, 'wave one' has an annual caseload of around 170,000ii and expenditure of around £70m (Table 1 above). This is only around 2% of the expenditure on all the benefits that will be devolved by April 2020. At the start of 2020/21, the remaining 98% will be administered by the DWP under agency agreements.

For an overview of how the newly devolved powers fit into the wider context of reserved social security see: Social Security for Scotland.

| Start date | Name | UK equivalent |

|---|---|---|

| October 2017 | Universal credit Scottish choices | n/a |

| September 2018 | Carer's allowance supplement | n/a |

| December 2018 | Best start grant: pregnancy and baby payment | Sure start maternity grant |

| April 2019 | Best start grant: early years payment | n/a |

| June 2019 | Best start grant: school age payment | n/a |

| August 2019 | Best start foods | Healthy start vouchers and vitamins |

| September 2019 | Funeral support payment | Funeral expenses payment |

| October 2019 | Young carer grant | n/a |

| start date | name | UK equivalent |

|---|---|---|

| spring | Job start paymentiii | |

| summer | Disability assistance for children and young people (DACYP) | Disability living allowance |

| summer | Short term assistanceiv | n/a |

| August | Scottish nursery milk schemev | Welfare foods (nursery milk) |

| Christmasvi | Scottish child payment | n/a |

| winter | winter heating assistance where a child has highest rate care component of the new DACYP | n/a |

| start date | name | UK equivalent |

|---|---|---|

| 'early' | Disability assistance for working age people | Personal independence payment |

| 2021 | Disability assistance for older people | Attendance allowance |

| 2021 | Carer's allowance supplement for those with more than one disabled child | n/a |

| winter | Winter heating assistance for older people (initially for those on another Scottish benefit) | Social fund winter fuel payment |

| winter | Cold spell heating assistance | Social fund cold weather payment |

| date | name | UK equivalent |

|---|---|---|

| spring | Carer's assistance | Carer's allowance |

| autumn | Employment injury assistance4 | Industrial injuries disablement benefits |

| end | Scottish child payment extended to those under 16 | n/a |

Delivery of the last of the Scottish benefits by Social Security Scotland is expected to start by the end of 2022. Existing DWP clients will be transferred to Social Security Scotland by mid-20252 with the exception of those claiming severe disablement allowance which, although devolved, will continue to be administered by the DWP.

Universal credit Scottish Choices

Scottish Choices, introduced in October 2017,12 offer recipients two options for payment of universal credit. If they are renting, they can choose to have the housing costs element of their universal credit award paid directly to the landlord. In addition they can choose to have their universal credit award divided into two payments each month.

Scottish Choices and APAs

The DWP's 'alternative payment arrangements' (APAs) also allow different ways of paying universal credit. Like Scottish Choices, these allow rent to be paid directly to the landlord and enable the benefit award to be split into two payments a month instead of one. They also allow payments to be split between a couple.

The main difference between Scottish Choices and APAs is that APAs are not set up whenever a claimant chooses but must be requested by work coaches, case managers or landlords if a claimant experiences difficulty in managing their single monthly payment or gets into difficulty paying their rent.1 In contrast, a claimant can make a 'Scottish Choice' or change their mind at any time (after the first month) by putting a note in their online journal.

APAs can be put in place from the start of a claim.1 Scottish Choices are offered from the second assessment period (i.e second month of a claim).

In practice, the same administrative processes are used by the DWP for Scottish Choices and APAs.

Take-up of Scottish Choices

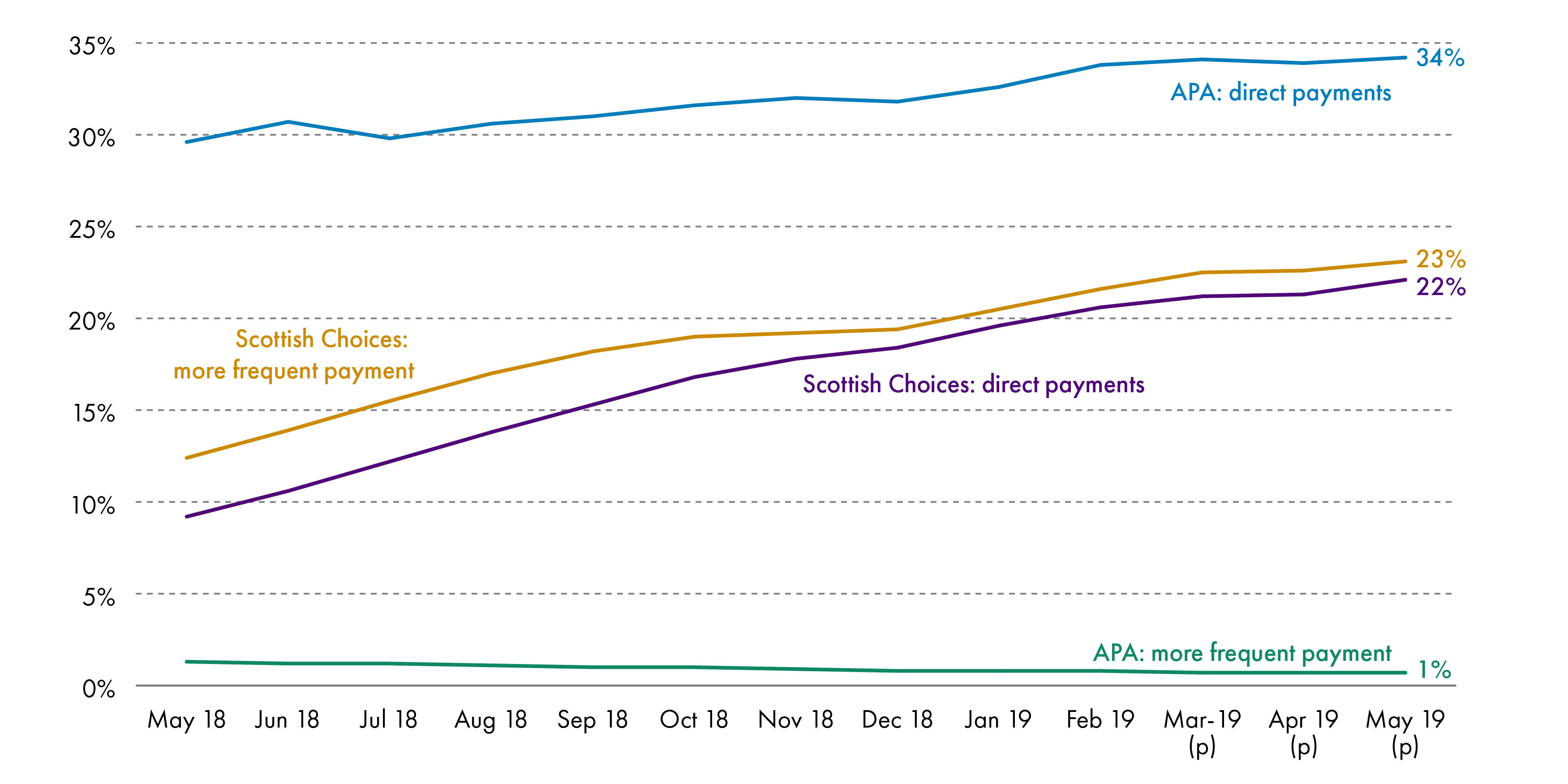

Take-up of 'Scottish Choices' has increased steadily over the last year. Chart 1 below shows that in May 2019 around a quarter (23%) of Scottish universal credit claimants were getting their payments twice a month - up from 12% the previous May. Similarly, 22% of those getting help with their rent through universal credit in Scotland were getting their rent paid directly to their landlord under 'Scottish Choices.' This has increased from 9% the previous May.

People can also get direct payments and more frequent payments through APAs (see above). In May 2019, over half (57%) of the 108,929 Scottish universal credit clamaints, whose award included housing costs, had their rent paid directly to their landlord.1 Most of these (30,518) did so under an APA rather than as a 'Scottish Choice' (19,750). This may reflect the fact that APAs can be arranged before someone can make a 'Scottish Choice'.

It is much more common for those in social rented housing to have their rent paid direct to their landlord. Over half (59%) of households on universal credit in social rented housing get their rent paid direct to the landlord (37% through an APA and 22% through a Scottish Choice). This compares to only 12% of those in private rented housing (5% through an APA and 7% through a Scottish choice).

In May 2019 a quarter of universal credit households in Scotland were receiving more frequent payments. In contrast to direct payments to landlords, almost all of these were through Scottish Choices. Only 1% of all universal credit households in Scotland had an APA providing twice monthly payments compared to 23% under Scottish Choices.

Cost of Scottish Choices

Scottish Choices are implemented through the universal credit system by the DWP. The Scottish Government paid one off administrative costs of c. £0.5m to the DWP to establish the scheme. This included changes to the universal credit information technology system and updates to DWP staff guidance and training.1 Ongoing operational costs have been estimated at £1.6m for 2018/19.2 The Scottish Government also pays the DWP around £2.50 per ‘Scottish Choice.’3

Review of Scottish Choices

The Scottish Government has said that, in late 2019, it will review how Scottish Choices is working. This will include considering: the way the choice is offered, the timing of the offer, general awareness of the choices and value for money of the payments made to the DWP for administering the system.1

One of the issues often raised in relation to universal credit is the degree to which paying the claimant rather than the landlord contributes to rent arrears.i Partly for this reason the Social Security Committee has recommended that rent payments should, by default, be made directly to the landlord, with tenants having the choice to opt to receive the payment themselves.2 In response, the Scottish Government said that:

those with lived experience told us that they wished to have a choice about whether or not to have the housing costs in their UC award paid directly to their landlord.

Somerville, S.A., & Stewart, K. (2019, August 8). Letter from Shirley-Anne Somerville MPS, Cabinet Secretary for Social Security and Older People and Kevin Stewart MSP, Minister for Local Government, Housing and Planning to Bob Doris MSP, Convener, Social Security Committee. Retrieved from https://www.parliament.scot/S5_Social_Security/Inquiries/20190808_CabSecSSOP_MinisterLGPH_to_Convener_response_SSSHreport.pdf [accessed 25 September 2019]

Further universal credit flexibilities

The Scotland Act 2016 (the 2016 Act) devolved three powers to Scottish Ministersi to vary the administration of universal credit payments. These were the power to:

vary the housing costs element (i.e the amount to help pay rent) (s.29, 2016 Act)

alter the timing of payments from the default monthly payment (s.30, 2016 Act)

split payments between members of a couple, instead of making one payment per household (s.30, 2016 Act)

The first two have been used to create Scottish Choices, described above. Scottish Government policy is to make further use of these flexibilities to enable:

splitting payments between a couple, and

mitigation of the 'bedroom tax' (currently being achieved by using discretionary housing payments (DHPs)).

The policy detail and administrative arrangements for these are still being developed.2

Carer's allowance supplement

The carer's allowance supplement (CAS), introduced in September 2018, is an automated additional payment made twice a year to people who receive carer's allowance. It is provided under s.81 of the Social Security (Scotland) Act 2018. It is a temporary benefit 1which will no longer be needed once the transition to Scottish carer's assistance is completed in 2025.

Amount of carer's allowance supplement provided

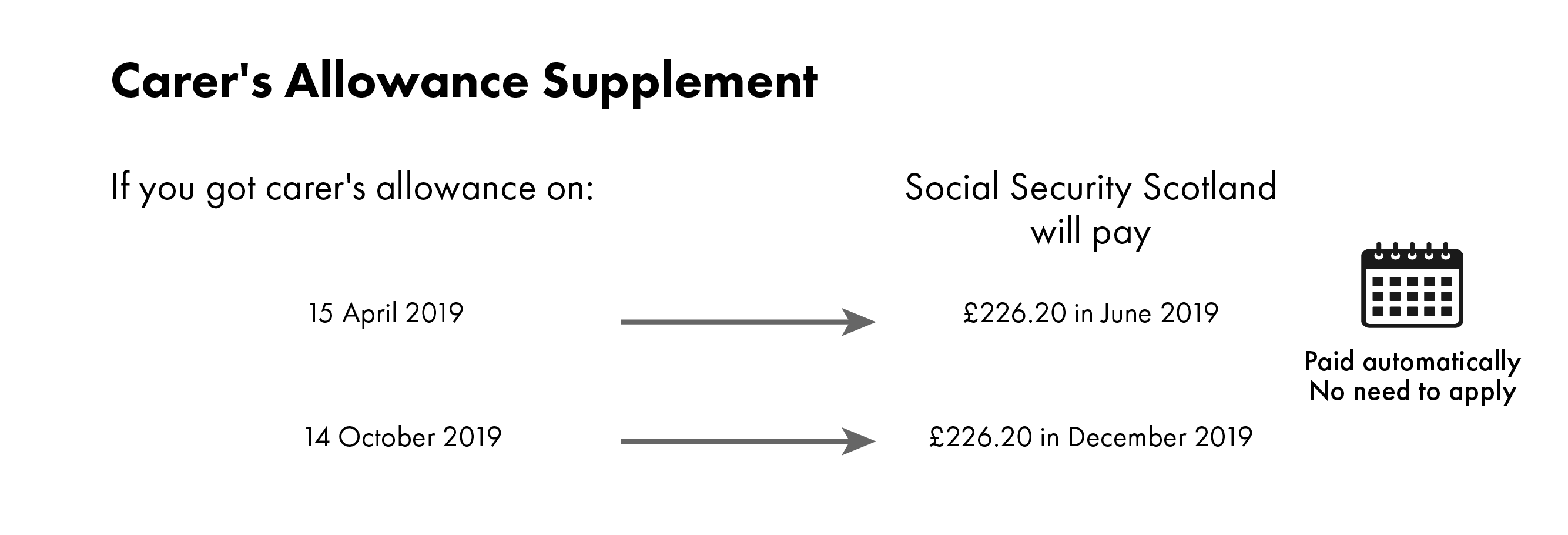

For 2019/20 the CAS was set at £226.20, with this amount paid in June and December 2019. This is an increase of 2.4% on the 2018/19 payment of £221.

Section 81 of the 2018 Act requires Scottish Ministers to uprate CAS to take account of inflation and, before the start of the new tax year, 'publish a statement explaining how they have calculated inflation for this purpose.'i There was debate in Parliament about the appropriate approach to take for 2019/20. As a result, in September 2019, the Scottish Government issued a report on uprating measures and asked the Scottish Commission on Social Security (SCOSS) and the Scottish Parliament's Social Security Committee for their views. The Scottish Government proposes to uprate Scottish social security benefits by CPI "for the foreseeable future."2 SCOSS agreed with the proposal to use CPI in the short term, but recommended this was reviewed in the longer term.3 The Social Security Committee noted the proposals.4

Unlike carer’s allowance, CAS is not counted as income for other social security benefits.5 Like carer’s allowance, CAS is taxable.6

Eligibility for carer's allowance supplement

CAS is paid to people living in Scotland who receive carer’s allowance on certain qualifying dates. This year (2019/20), those dates are 15 April and 14 October. The payments are made in June and December.1

CAS is only paid to people who are actually in receipt of carer's allowance. Some people have an 'underlying entitlement' which means they have claimed it but do not receive it because they get another 'overlapping' benefit. For example, it is not possible to get the full amount of the state pension and carer's allowance at the same time. In November 2018, there were 46,129 people in Scotland who had 'underlying entitlement.i' These people meet the eligibility conditions for carer's allowance but get neither this nor CAS because they get another income replacement benefit.

Because carer's allowance counts as income in a universal credit award, a person would receive no financial gain by claiming carer's allowance and universal credit. However, in Scotland, if they claimed carer's allowance and universal credit they would also get the CAS payment of £226.20 twice a year.

No application is necessary

There is no need to apply for the CAS. Eligible people are identified by Social Security Scotland using DWP lists of those receiving carer’s allowance at a Scottish address on the qualifying dates.

Challenging a decision on carer's allowance supplement

There is no redetermination or appeal for CAS. However, if a claimant is unhappy with a decision or with the service they’ve received they can complain to Social Security Scotland. Between September 2018 to June 2019 there were 60 complaints, of which 20 were upheld.1

Carer's allowance supplement spend and caseload

In total, the agency made 153,380 payments in 2018/19 (77,620 in September and 75,760 in December) to the 83,000 carers who were eligible on at least one of the required dates.1

The agency paid out £35m in 2018/19 which is £1m over budget. This is because, even though it was known who was in receipt of carer's allowance on the relevant dates, some claims were backdated following reconsideration or appeal so creating a requirement to pay the CAS.2

The budget for carer's allowance supplement is expected to increase to £51m by 2024/25. This increase is based on uprating for inflation and a forecast increase in caseload to 103,000 over the period. This is set out in table 6 below.

| 2018-19[actual] | 2019-20[forecast] | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

|---|---|---|---|---|---|---|---|

| Spend (£m) | £35m | £37m | £40m | £42m | £45m | £48m | £51m |

| Caseload | 83,000 | 83,000 | 87,000 | 91,000 | 96,000 | 100,000 | 103,000 |

| value (twice yearly) | £221 | £226.20 | £230.10 | £234.00 | £237.90 | £243.10 | £247.00 |

Young carer grant

The young carer grant (YCG) started on 21 October 2019.1 It will provide £300 per year to around 2,400 young carers.i The Scottish Government say that the purpose of the grant is:

to provide support during a key transition period in young carers’ lives to help improve their health and education outcomes as they move into the adult world

Scottish Government. (2018, September). Young Carer Grant regulations: consultation. Retrieved from https://www.gov.scot/publications/consultation-young-carer-grant-regulations/pages/4/ [accessed 10 April 2019]

It is a form of carer's assistance under the Social Security (Scotland) Act 2018. The Carer's Assistance (Young Carer Grants)(Scotland) Regulations no. 2019 3 were approved by the Parliament on 19 September.4

Young carers who get YCG will also get free bus travel from 2020/21 (subject to successful piloting). In addition, a young carer element to the Young Scot National Entitlement Card was launched in June 2019 providing various non-cash benefits such as discounted cinema tickets.5

In addition to public consultation and scrutiny by the Scottish Commission on Social Security,6 the YCG policy has been informed by the Young Carer Grant Working Group (established October 2017 and made up of young carer representatives and other relevant organisations), the Young Carer Panel7 (established early 2018 and made up of young carers aged 16 to 25) and the Disability and Carers Benefits Expert Advisory Group.

The Scottish Government has committed to monitoring how various aspects of the YCG policy are working, including the definition of care and only allowing one grant for each person cared for. The operation of the YCG will be reviewed after a year.

The following describes the main rules.

Amount of young carer grant provided

The YCG is worth £300 per year, so each eligible young carer will receive a maximum of £900 over the three years they could be eligible for the grant.

The Scottish Government intends that the YCG will not count as income for reserved social security benefits or council tax reduction.1

As it is a form of carer's assistance, the Scottish Government is required to uprate it by inflation each year.i

Eligibility for the young carer grant

The YCG is available to 16, 17 and 18 year olds who do not get carer's allowance but who care for a person in receipt of certain disability benefits.

Type of care provided

The care provided must: "involve activity that promotes the physical, mental or emotional well-being of the person being cared for."i This contrasts with carer's allowance which does not define 'care.' The Scottish Government considers that a definition is required because young carers do not always identify themselves as such, but will monitor the policy for any unintended consequences.1

The young carer must have provided at least 16 hours of care per week on average over a 13 week period before they can apply for the grant (at least 208 hours of care in total). They must have provided care in at least 10 of those 13 weeks.

Social Security Scotland will not check that the care is being provided, except in exceptional cases. It is enough for the young person to declare on the form that they provide the care. Social Security Scotland will, however, check that the person being cared for has been getting a qualifying benefit for the required period of time.2 The Cabinet Secretary explained to the Committee:

The benefit is administered on a first come, first served basis, so if you apply and get the young carer grant, you are the young carer for that cared-for person. To ensure that the benefit is as simple as possible, the only verification that is done is that the young carer must give the details of the cared-for person, and that cared-for person is sent a letter that says that the young person has said that they are the carer. The cared-for person does not have to reply to that, so that there is no delay in getting the benefit, but it gives the named person the ability to say whether the care does happen and to feed that back.

Social Security Committee 19 September 2019 [Draft], Shirley-Anne Somerville, contrib. 58, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=12268&c=2200713

If someone cares for more than one person, they can combine their hours of caring for up to three people to make up the 208 hour total.

However, if two people care for the same person, only one of them can get the grant.ii This, the Cabinet Secretary explained to the Social Security Committee, is to make applying for the benefit as simple as possible. However, as with the definition of care, the impact of this rule will be monitored.1

Qualifying benefits for the young carer grant

The young carer does not need to receive any social security benefits to qualify for the young carer grant. However, if they get carer's allowance then they cannot also get the young carer grant.

The person they are caring for must be getting one of the following disability benefits. These are the same as the qualifying benefits for carer's allowancei and are:

highest or middle rate of disability living allowance care component (adults or children)

personal independent payment daily living component

constant attendance allowance in respect of an industrial or war disablement

The benefits that qualify a person for Scottish replacement for carer's allowance will also qualify them to receive the young carer grant. This form of Scottish carer's assistance is currently expected to be introduced in early 2022.1

Residence requirements for the young carer grant

To get the YCG someone must normally be both;

ordinarily resident in Scotland and,

habitually resident in the UK, Channel Islands, Isle of Man, EEA or Switzerland.

However, someone living in another UK country, Channel Islands, Isle of Man, the EEA or Switzerland can get the grant if they were previously in Scotland and received the grant here.

Someone living in Scotland, but who is not habitually resident in the UK, Channel Islands, Isle of Man, EEA or Switzerland, can still get the grant if they have certain kinds of immigration status such as being refugee or having discretionary leave to remain for humanitarian reasons.

The person being cared for must be getting certain disability benefits (see above) and so will have had to have met the separate residence requirements for those benefits.

When an application for the young carer grant can be made

A young carer can apply once they have been providing care for 13 weeks. They will need to re-apply each year.

The person they care for will need to be getting a qualifying disability benefit for the whole 13 weeks before an application can be made.

If an applicant is initially turned down for the YCG they can still get the payment if the person they care for subsequently gets an award of a qualifying benefit that is backdated to cover the required 13 weeks.

How to apply for the young carer grant

Applications can be made by filling out a form (24 pages) by phone (0800 182 2222) or online at https://www.mygov.scot/young-carer-grant/how-to-apply/

Challenging a decision on the young carer grant

An applicant who disagrees with the decision not to award YCG has 31 calendar days to ask for a redetermination. The redetermination must be completed by Scottish Ministers within 16 working days. The applicant then has 31 calendar days to appeal, or up to a year if the First-tier Tribunal is satisfied they had 'good reason' for not applying sooner.

Young carer grant spend and caseload

While there are an estimated 11,000 young carers in Scotland aged 16 to 18,1 only a minority of these will qualify for the young carer grant. This is because not all young carers will be caring for the required number of hours or caring for someone on a qualifying disability benefit.

The Scottish Government estimate that 1,900 young carers will be eligible in 2019/20, increasing to around 2,400 young carers its first full year of operation in 2020/21.i At £300 each, this suggests an annual cost in 2020/21 of around £720,000.

The Scottish Fiscal Commission has not forecast spend for this benefit because it is below £2m.ii

Best start grant

The best start grant (BSG) provides three payments to help with the costs of babies and young children. One payment is made around birth, a second around nursery age and the third around the time of starting school. The pregnancy and baby payment replaces the UK sure start maternity grant and the other two payments are new benefits.

BSG is provided under the Early Years Assistance (Best Start Grants) (Scotland) Regulations 2018 (as amended).123 Guidance for the staff who process applications has been published under freedom of information requests.4 5

The pregnancy and baby payment started in December 2018, the early years payment on 29 April 2019 and the school age payment on 3 June 2019.

The best start reference group advises ministers on policy.

The following describes the main rules.

Amount of best start grant provided

For qualifying parents, the BSG provides payments of:

£600 for the first child and £300 for subsequent children. There is an additional £300 payment for multiple births. (So if someone's first children are twins, they will get £1200)

£250 for each child around nursery age

£250 for each child around school age

The BSG does not count as income for reserved social security benefits1 2nor council tax reduction.3

Each year, the Scottish Government must consider whether to uprate the best start grant and must report to Parliament.i The Scottish Government propose to uprate Scottish social security benefits by the consumer price index (CPI) 'for the foreseeable future.'4

Eligibility for the best start grant

In most cases, the person applying for the BSG will be the mother or her partner. However, the rules allow for more complex circumstances. These are summarised below.

Relationship to the child

The applicant must be either:

responsible for the child. (This covers most parents, and also adoption, guardianship and most forms of kinship care),i or

the grandparent or the parent's kinship carer who, in some circumstances , can apply for the BSG. This is possible if the parent is under 20 and her own parents (or kinship carer) get benefits for her.ii (For example a 19 year old mother whose own parents still get child benefit for her).

Foster parents cannot get the payment for the children they foster.

For kinship carers to be eligible they must either:

be receiving benefits for the child,iii

have an order from a court or children's hearing, or

have an arrangement with the social work department.

These rules mean that its possible for more than one person to be eligible for the BSG for the same child. Generally, if a payment has been made, then no-one else can get a paymentiveven if they would have been eligible had that other application not been made.

If two eligible people apply for a BSG for the same child at the same time, then the application received first will be processed first.1

If an applicant has received the UK sure start maternity grant, they cannot get a BSG pregnancy and baby payment for the same child.v They will, however, be able to get the early years and school payment for that child.

Qualifying benefits for best start grant

With some exceptions (see below), a parent or carer must be receiving the following ‘low income’ benefits.

universal credit (or the benefits it is replacingi)

However, a person does not have to be getting one of these benefits if:

they are under 18

they are 18 or 19 and their parent or carer receives a benefit such as child benefit for them or their carer is their approved kinship carer ii

In the first seven months of the BSG, 1% of applications were from people aged under 18.1

Residence requirements for the best start grant

To get the BSG, a person must be ordinarily resident in Scotland. Most applicants will need to be on a qualifying benefit, and so also meet the residency requirements for those benefits. However, young parents under 18 (or under 20 and dependent on someone else) do not need a qualifying benefit and the regulations set out further residency criteria for them which include, for example being habitually resident in the EEA, Switzerland or common travel areai or having refugee status.

In general, people with 'no recourse to public funds,' such as asylum seekers, cannot claim social security benefits.ii However, the Scottish Government has an agreement with the Home Office that the pregnancy and baby payment will be accessible to those under 181 with ‘no recourse to public funds.’ The announcement only refers to the baby payment - not the early years or school age payment.2

The Cabinet Secretary has made clear that this is particular to the BSG and that this approach will not be extended to other Scottish social security benefits.

We have to understand that the Home Office’s recognition of those groups for the best start grant payment was exceptionally unusual and related to compelling arguments in that particular case. The arguments are not the same for the funeral expense assistance, so the Home Office would not grant the same eligibility for that benefit.

Social Security Committee 21 February 2019, Shirley-Anne Somerville, contrib. 46, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11955&c=2153990

When an application for best start grant can be made

Generally, the eligibility criteria for BSG must be met within 10 days of the application being received by Social Security Scotland.i

A person must apply for BSG within the ‘application window’ linked to the age of the child. This is set out in table 7 below.

| Time of year | Age of child | Application window | |

|---|---|---|---|

| Pregnancy and baby | no restriction | 24th week pregnancy to 6 months | 9 1/2 months |

| Pregnancy and baby (kinship care or similar) | no restriction | up to 1 year | 12 months |

| Early learning | no restriction | aged 2 to 3 1/2 | 18 months |

| School age (March to December birthdays) | between June and February | year in which child turns 5 | 9 months |

| School age (January and February birthdays) | between June and February | year in which child turns 4 | 9 months |

A child does not have to be in nursery to get the early learning payment and does not have to be in school to get the school age payment.

If a person applies but isn’t eligible, but then later becomes eligible, a second application can be made so long as it falls within the deadline. Shirley-Anne Somerville told the Social Security Committee that:

we will ensure that that is made clear in the letters that go out to clients.ii

Social Security Committee 21 February 2019, Shirley-Anne Somerville, contrib. 38, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11955&c=2153982

In some limited situations, an applicant can get a BSG if they get a backdated award of a qualifying benefit after the deadline for BSG applications has passed. This can happen:

up to 20 days after the ‘application window’ closes, provided no previous application had been made for the BSG

at any time, if the person was refused the BSG but then a qualifying benefit was awarded following an appealiii

If someone is wrongly turned down for a BSG due to official error then the agency can correct this and make an award without requiring the claimant to make another application.

How to apply for the best start grant

Applications can be made by filling out a form (24 pages) by phone (0800 182 2222) or online at: https://www.mygov.scot/best-start-grant-best-start-foods/

In the first seven months of the BSG 93% of applications were made online.1

The same form is used for best start foods, but if someone applies for both, they will get separate decision letters.

A decision on eligibility is normally made within 14 days and the grant provided within seven days of the decision letter.2

Challenging a decision on best start grant

An applicant who disagrees with the decision not to award BSG has 31 days to ask for a redetermination. The form is not available online, but is provided with the decision letter. An applicant can also phone 0800 182 2222. Further details are available at: http://www.mygov.scot/if-you-do-not-agree-with-a-benefit-decision/

The redetermination must be completed by Scottish Ministers within 16 working days. The applicant then has 31 days to appeal, or up to a year if the First-tier Tribunal is satisfied they had 'good reason' for not applying sooner. The appeal form is not available online, but is sent with the redetermination letter. An applicant can also phone 0800 182 2222. Further details are available at: https://www.mygov.scot/appeal-to-a-tribunal-about-a-benefit-decision/

In total, from its launch to end of June 2019 there were 835 requests for redetermination. Of the 715 processed (by the time statistics were published), 240 were allowed. There had been 25 applications for appeal, of which 10 had been heard, none of which were upheld.1

Spend and caseload on best start grant

Each of the three BSG payments has had many more applicants, and many more valid applications, than had been expected. The table below shows the numbers of applications and authorised payments up to June 2019.

| BSG | Applications received | Payments authorised | % applications authorised |

|---|---|---|---|

| Pregnancy and baby | 27,815 | 15,840 | 57% |

| Early learning | 23,800 | 17,235 | 72% |

| School | 14,310 | 10,185 | 71% |

In total, from December 2018 to the end of June 2019 nearly £13m was paid out in best start grants.

In 2018/19, only the pregnancy and baby BSG payment was available. The Scottish Fiscal Commission (SFC) initially forecast that around £1.7m would be spent on this in 2018/19. However, from its launch in December 2018 to March 2019, £4.27m was paid out on the baby grant,2 which was £2.8m over budget2 and more than double what had been expected. This was partly due to the way the 'application window' worked. People who had babies up to six months prior to the launch of the BSG appear to have applied for the BSG rather than for the DWP sure start maternity grant which it replaced. The SFC considered that the higher take-up was also due to the publicity surrounding the launch of the benefit.

The table below compares the forecasts made in December 2018 and May 2019 for 2019/20 (full year) with the outturn in the first quarter of that year. It is noticeable that the payments made for the first quarter are more than 25% of the forecast spend for the whole year. However, it may be that the length of time covered by the 'application window' results in applications being unevenly spread across the year, particular in the first year.

| 2019/20 forecast in December 2018 | 2019/20 forecast in May 2019 | Actual (Q1 only)April to June 2019 | Q1 as % of forecast for year | |

|---|---|---|---|---|

| Pregnancy and baby | £5m | £6m | £1.95m | 33% |

| Early learning | £4m | £10m | £4.32m | 43% |

| School age | £3m | £5m | £2.4m | 48% |

| Total | £12m | £21m | £8.67m | 41% |

The May 2019 forecast spend for the best start grant up until 2024/25 is set out below together with the outturn for 2018/19. The outturn for the first quarter of 2019/20 is given above.

| £m | 2018-19[outturn] | 2019-20[forecast] | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 |

|---|---|---|---|---|---|---|---|

| Pregnancy and baby | £4m | £6m | £6m | £6m | £7m | £7m | £7m |

| Early learning | n/a | £10m | £5m | £5m | £5m | £5m | £5m |

| School age | n/a | £5m | £5m | £5m | £5m | £5m | £5m |

| Total | £4m | £21m | £16m | £16m | £17m | £17m | £18m |

Best start foods

Best start foods (BSF) provides a pre-paid card to spend on healthy food. This benefit started on 12 August 2019 and is available to:

people under 18 who are either pregnant or who have a child under one, and

people of any age on certain social security benefits who are either pregnant or have a child under three.1

BSF is devolved social security legislated for by The Welfare Foods (Best Start Foods) (Scotland) Regulations SSI 2019/193. These are made under s.13 of the Social Security Act 1988 (the 1988 Act)2 rather than as a form of ‘early years assistance’ under the Social Security (Scotland) Act 2018 (the 2018 Act). As a result, best start foods:

need not be covered by the take-up strategy on Scottish social security benefitsi

need not be covered by the Charter on Scottish social security

need not be covered by the annual report on social security

need not be scrutinised by the Scottish Commission on Social Security

cannot be appealed to the First-tier Tribunalii

The Social Security Committee queried the legislative route used to provide the BSF and, in reply, the Scottish Government said that Ministers' powers under s.13 of the 1988 Act "were considered sufficient to enable the new BSF scheme to be established for Scotland."3

The following describes the main rules.

Amount provided for best start foods

Best start foods (BSF) provides:

£4.25 per week for pregnant women

£8.50 per week from birth until the child's first birthday

£4.25 per week for those with children aged one and two, until the child's third birthday

BSF can be used to buy the following foods:

cow's milk and infant formula

fresh, tinnedi pulses, fruit and vegetables

frozen fruit and vegetables

eggs

BSF payments are made every four weeks using a pre-paid card which is managed by allpay.Cards can be used at any shop displaying the 'mastercard' logo and its possible to check the balance on the card online, over the phone or at a cash machine.

In response to the consultation there was some comment that £4.25 per week was too low.1 However, this figure was proposed as it was sufficient to buy five portions of fruit and vegetables and half a pint of milk per day.2

Unlike other benefits delivered by Social Security Scotland, there is no statutory requirement on the Scottish Government to consider uprating best start foods each year. When this was questioned by the Social Security Committee, Joe Fitzpatrick, MSP, Minister for Public Health, Sport and Well-being noted in a letter that: "additional funds to support BSF will need to be considered as part of the Scottish budget process."3

Eligibility for best start foods

BSF is available to pregnant women and those responsible for children under three if they get certain qualifying benefits. However, as with the best start grant, the rules allow for more complex situations and provide additional eligibility for parents under 18.

BSF is available until a child's third birthday, whereas healthy start vouchers, the scheme it replaces, was available until a child's fourth birthday. There is transitional protection for people with a child aged two or over who already get healthy start vouchers and who apply for BSF before 31 March 2020. These people will continue to get support until their child's fourth birthday.

Explaining the reduction in age limit, the Scottish Government referred to the planned availability of 1,140 hours of free early learning and childcare from the term following the child's third birthday which starts in August 2020.1 Children in early learning and childcare will be entitled to a free meal.i

Relationship to the child

The applicant must be pregnant or responsible for a child under three (or under four if they get transitional protection - see above). 'Responsible for a child' means:

receiving certain benefits for the childi,

being the child's grandparent. This applies if the parent is under 20, and her parent gets benefits for her,

being the parent's kinship carer. Again, this only applies if the parent is under 20.

being the child's guardian or adopted parent

certain forms of kinship careii (either as a 'looked after'iii child or under a 'kinship care order'iv).

Once the child is born, the natural parent needs to be getting a benefit, such as child benefit, in order to be considered responsible for the child. However, if the parent is under 20, they can still get BSF if they are included in their own parent's or carer's benefits or are in kinship care. (For example a 19 year old mother whose own mother still gets child benefit for her or a 16 year old mother in a kinship care placement.)

Foster parents cannot get BSF for the children they foster.

Qualifying benefits for best start foods

People under 18 who are either pregnant or have a child under one year of age do not need to be on qualifying benefits to get BSF.

An applicant on the following benefits qualifies for BSF regardless of their income:

income support

pension credit

income based job seeker's allowance

income related employment and support allowance

Other benefits also create entitlement, but only if their income is less than a certain amount. This amount is different for different benefits as set out in table 11 below.

| Benefit | Income threshold |

|---|---|

| Universal credit in current or previous two months | £610 net per monthi (£7,320 per year) |

| Child tax credit but not working tax credit | £16,190 gross per year |

| Child tax credit and working tax credit | £7,320 gross per year |

| Housing benefit | £311 net per week (£16,172 per year) |

Entitlement is narrower than for the best start grant. For example, the BSG is available to those on universal credit regardless of income but the BSF is limited to those with an income of under £7,320 per year. Nor is it the same as free school meals low income eligibility which includes as a qualifying benefit support payments provided under immigration legislation.

Residence requirements for best start foods

Someone must be ordinarily resident in Scotland in order to qualify for BSF.

Almost all applicants will need to be on qualifying benefits and so will need to meet the residency criteria for these benefits.

However, people under 18 who are either pregnant or have a child under one year of age do not need to be on qualifying benefits and so there are additional residence criteria that apply to them. These are the same as for the best start grant (see above).

People's access to benefits can be restricted because of their immigration status, particularly if they have 'no recourse to public funds.' Healthy start vouchers are not specifically listed as public funds under the s.115 Immigration and Asylum Act 1999, which might suggest that BSF would not be expected to be added. However, access to BSF is still be restricted. This is because, in most cases, once the child is born, someone will need to be getting certain benefits in order to show that they are responsible for the child. All the benefits listed (child benefit, pension credit, child tax credit and universal credit) are 'public funds' under immigration law.i

When an application for best start foods can be made

Applications can be made at any time, but the person must be on a qualifying benefit on the date that the application is received by Scottish Ministers.

Applications for transitional protection must be received before 31 March 2020.

If someone loses entitlement because a qualifying benefit stops but it starts again within twelve weeks then their BSF claim can start again without having to make a new application. They will however have to show that they have regained entitlement to a qualifying benefit.

Transitional protection will continue until the child's fourth birthday so long as the applicant remains on a qualifying benefit.1 Therefore if there is a gap in benefit entitlement of more than 12 weeks (i.e the linking period referred to above), transitional protection will be lost.

How to apply for best start foods

Applications can be made by filling out a form (24 pages), by phone (0800 182 2222) or online at: https://www.mygov.scot/best-start-grant-best-start-foods/

A person currently getting healthy start vouchers will not be automatically transferred to best start foods. They will need to apply. By December 2019 the Scottish Government plans to have written to all those in receipt of healthy start vouchers. This will be followed by a further exercise publicising the new benefit between January and March 2020.1

Best start grants and best start foods use the same application form, but separate decision letters are issued.

A decision on eligibility is normally made within 14 days, although it may be up to six weeks after this that someone receives their payment card.2

Challenging a decision on best start foods

There is no appeal against a decision on BSF. Instead the person affected can ask Social Security Scotland to reviewitheir decision by phoning them on 0800 182 2222.2

The review will re-run the eligibility check. Late requests (31 days after the decision letter) will not be accepted. This is different from the redetermination process which applies to other Scottish social security benefits where, with good reason shown, late requests can be accepted for up to a year. Another important difference is that a redetermination can be appealed to the First-tier Tribunal but a review of a BSF decision cannot.

If a claimant or applicant is unhappy with the service they’ve received they can complain to Social Security Scotland.

Offences relating to best start foods claims

It is an offence to:

fail to notify a change in circumstances

make dishonest representations to obtain BSF

not produce the payment card to Scottish Ministers on request

The policy on fraud and overpayments will be set out in operational guidance.1 For other benefits delivered by Social Security Scotland, the offences are set out in sections 71 to 74 of the Social Security (Scotland) Act 2018.

Spend and caseload on best start foods

The Scottish Fiscal Commission forecast spend of £3m on BSF in 2019/20, increasing to £6m the following year due to transitional protection before falling to £4m. Table 12 below shows the May 2019 forecasts of spend and caseload for BSF.

| 2019/20 | 2020/21 | 2021/22 | 2022/23 | 2023/24 | 2024/25 | |

|---|---|---|---|---|---|---|

| Caseload | 11,000 | 21,000 | 15,000 | 15,000 | 14,000 | 13,000 |

| Spend | £3m | £6m | £4m | £4m | £4m | £4m |

Once transitional protection has ended, BSF will support around 15,000 people a week at a cost of £4m per year.1 In comparison, healthy start vouchers, which it replaces, provided support to around 20,000 people per week at a similar cost.i

The Scottish Fiscal Commission has estimated that transitional protection (continuing to pay healthy start voucher recipients until their child's fourth birthday) will cost around £2m in total between 2019 and 2021.1

The above figures are based on a take-up rate of 68%. BSF was included in the Scottish Government's benefit take-up strategy (although under the 2018 Act it does not have to be). The strategy does not include targets but does set out how social security is being designed in an accessible way. BSF has the same application form as the best start grant so increased take-up for one may impact on the other. The Scottish Government has also said that from 2020/21 it will contact eligible families to invite them to apply. (The Department of Health and Social Care does this for healthy start vouchers).1

Comparison with healthy start scheme

BSF is very similar to the healthy start scheme. Differences include:

BSF provides a higher weekly payment, but is only available until the child turns three.

Additional foods can be bought under BSF, and it is provided as a smart card rather than paper vouchers

The eligibility criteria are slightly wider for BSF. It sets a higher income threshold for universal credit (that corresponds to the income threshold for free school meals), and also includes those on maximum working tax credit, pension credit and low income families on housing benefit.

BSF does not include provision of vitamins. In England and Wales 'healthy start vitamins' are provided on the same basis as 'healthy start vouchers' up to the age of four. In Scotland, all pregnant women, breastfeeding mothers and babies under one can get vitamin D and the policy intention is to extend this to all children under three.

The table below compares healthy start vouchers and BSF.

| healthy start vouchers | best start foods |

|---|---|

| All those under 18 who are pregnant | All those under 18 who are pregnant or have a child under 1 |

| pregnant mothers and those with a child under 4 in receipt of qualifying benefits | pregnant mothers and those with a child under 3 in receipt of qualifying benefits |

Qualifying benefits:

| Qualifying benefits. As England and Wales plus:

|

| Vouchers | Smart Card |

| £3.10 pwk (£6.20 in child's first year) | £4.25 pwk (£8.50 in child's first year) |

| Foods available: cow's milk, infant formula, fresh or frozen fruit and vegetables | Foods available: as England and Wales plus: fresh or tinned pulses, eggs |

| Form must be signed by health professional and retailers must be registered | no need for form to be signed and no need for retailers to register |

| Vitamins: part of healthy startFolic acid and vitamins C and D for pregnant women and breastfeeding mothers.Vitamins A, C and D for children from birth to 4th birthday. | Vitamins: universal schemefolic acid and vitamins C and D for all pregnant women. vitamin D for breastfeeding mothers and babies under one.policy intention to provide vitamin D to all children under age 3. Until April 2020 health boards have been instructed to continue to provide vitamins as per healthy start scheme.i |

Funeral support payment

The funeral support payment (FSP) started on 11 October 20191 replacing the UK funeral expenses payment paid from the social fund. It is available to those on qualifying benefits and pays the necessary costs of burial and £700 for other costs (£120 if the deceased had a funeral plan or similar). It is provided under the Funeral Expense Assistance (Scotland) Regulations SSI 2019/292. The following gives a brief description of the main rules.

Amount of funeral support payment provided

The FSP provides a contribution towards the costs of a funeral. Social Security Scotland expects the average award will be £1,300.1 However the actual amount will vary between individual applicants. The payment includes:

a flat rate of £700 (or £120 if the deceased was over 18 and there is a contribution from a funeral plan or similar),

reasonable costs fir the burial plot, local authority fees, grave-digging and (for cremation) removal of medical devices, and

certain transport costs.

The amount provided for burial or cremation depends on the fees charged by the local authority. These vary considerably for adults from £799 for a plot and burial in the Western Isles up to £2,575 in Edinburgh.2 Local authorities do not charge fees for child burials.i

The amount provided can be reduced if the deceased had assets that could be used to pay for the funeral such as cash, an insurance policy or burial club.

Social Security Scotland can recover some or all of the payment if money becomes available from the person's estate.

The flat fee element must be uprated every year in line with inflation.ii The Scottish Government has proposed using CPI inflation for the foreseeable future.4

Eligibility for funeral support payment

Responsibility for the funeral costs

The applicant must have accepted responsibility and Scottish Ministers must consider its reasonable for them to take responsibility for the funeral. Normally this will be the nearest relative but there is also an element of discretion in order to consider complex circumstances.

Qualifying benefits for funeral support payment

An applicant qualifies for the FSP if they get one of the following benefits:

universal credit

disability or severe disability element in working tax credit

child tax credit

housing benefit

pension credit

income based job seeker's allowance

income related employment and support allowance

income support

Residence requirements for funeral support payment

In order to receive the FSP, the applicant must be ordinarily resident in Scotland and the deceased person must have been ordinarily resident in the UK. In addition, because the applicant must also be on a qualifying benefit, they will also have to meet the UK residency requirements for those benefits. The funeral can take place in the UK, EU, Iceland, Norway, Switzerland or Liechtenstein.

When an application for funeral support payment can be made

Applications for FSP can be made up to six months after the funeral. Late applications can be made up to 20 days after the six month deadline has passed if the applicant gets a backdated award of a qualifying benefit.

How to apply for the funeral support payment

Applications can be made by filling out a form, (separate forms for adults (28 pages) and children (24 pages)) by phone ( 0800 182 2222) or online at: https://www.mygov.scot/funeral-support-payment/how-to-apply/

Although not set out in the regulations, the policy is that applications will be processed within ten days of receipt of a completed application.1 Social Security Scotland expect that payments will be made within 4 or 5 days of the decision letter.2

Challenging a decision on funeral support payment

The rules are the same as for the best start grant and young carer grant.

An applicant who disagrees with the decision not to award the FSP has 31 days to ask for a redetermination. The form is not available online, but is provided with the decision letter. An applicant can also phone 0800 182 2222. Further details are available at: http://www.mygov.scot/if-you-do-not-agree-with-a-benefit-decision/

The redetermination must be completed by Scottish Ministers within 16 working days. The applicant then has 31 days to appeal, or up to a year if the First-tier Tribunal is satisfied they had 'good reason' for not applying sooner. The appeal form is not available online, but is sent with the redetermination letter. An applicant can also phone 0800 182 2222. Further details are available at: https://www.mygov.scot/appeal-to-a-tribunal-about-a-benefit-decision/

Funeral support payment spend and caseload

Table 14 below is the Scottish Fiscal Commission's latest forecast of spend and caseload up to 2024/25. Their earlier (December 2019) forecast also showed around £2m per year additional projected spend for the Scottish benefit compared to the DWP equivalent.1 This is largely because in Scotland help is provided even if there is someone else, equally closely related to the deceased, who could be expected to take responsibility for the cost.

The first statistics on claimants and spend are expected in December 2019.2

| 2019/20 | 2020/21 | 2021/22 | 2022/23 | 2023/24 | 2024/25 | |

|---|---|---|---|---|---|---|

| spend | £6m | £7m | £7m | £7m | £8m | £8m |

| take-up rate | 55% | 57% | 59% | 61% | 63% | 65% |

| caseload | 4,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 |

Figures assume a 1st June start date, as the scheme was expected in summer 2019, whereas the scheme actually started in October. Figures for 19/20 are likely therefore to be over-estimated.

Comparison with DWP scheme

In the DWP scheme, help is only provided if there is no-one else equally closely related who could reasonably be expected to meet funeral costs.

In the Scottish scheme, help is provided even if there is someone equally closely related who could pay. This difference increases estimated eligibility in Scotland by around 40% according to the Scottish Fiscal Commission.

The Scottish scheme offers a flat rate of £700 or £120 and uprates these annually. The DWP scheme offers 'up to' these amounts which have not been uprated since 2003.1

The Scottish scheme ignores the deceased's assets where they are under 18 and local authorities do not charge fees for the burial or cremation of a child.2

In England there is a separate 'Children's Funeral Fund' which is not means tested and pays burial or cremation fees and provides £300 towards the cost of a coffin, shroud or casket. This can be paid in addition to the means tested funeral expenses payment.