Pow of Inchaffray Drainage Commission (Scotland) Bill Committee

Pow of Inchaffray Drainage Commission (Scotland) Bill - Preliminary Stage Report

Introduction

The Pow of Inchaffray Drainage Commission (Scotland) Bill1 (the Bill) was introduced in the Scottish Parliament on 17 March 2017. It is a Private Bill being promoted by the Pow of Inchaffray Commissioners (the Promoter) under procedures set out in Rule 9A of the Parliament's Standing Orders2 and the Guidance on Private Bills3.

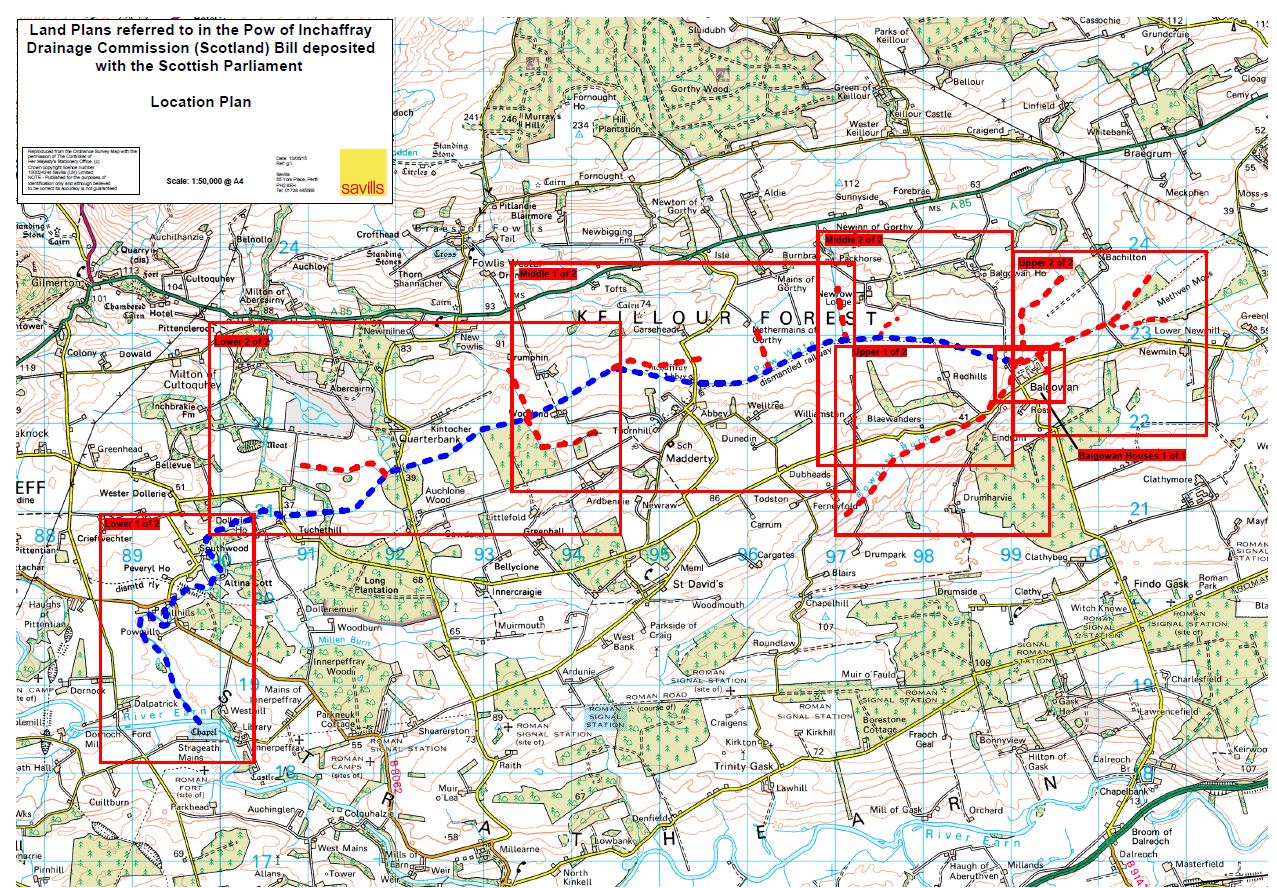

The Bill is accompanied by Explanatory Notes4, a Promoter's Memorandum5 and a Promoter's Statement6. Statements on legislative competence by the Presiding Officer and the Promoter were also published7. In addition, the Promoter made several other documents available to aid understanding and scrutiny of the Bill. These included a copy of the Pow of Inchaffray Drainage Act 18468 (which this Bill repeals in full) and copies of seven sectional land plans and one overall location plan, which show the Pow of Inchaffray, its various sections, and the land which benefits from its drainage and maintenance9.

Every Private Bill is subject to a 60-day objection period beginning immediately after introduction. In this case, the objection period ran from 18 March 2017 to 16 May 2017 and three objections were lodged.10

The Scottish Parliament's Information Centre (SPICe) published a briefing11 on the Bill which proved very useful during the Committee's preliminary consideration of the Bill.

Parliamentary procedure

The procedure for the consideration of a Private Bill is set out under Standing Orders Rule 9A1. Rule 9A.7 states that the consideration will normally consist of the following three stages—

Preliminary Stage;

Consideration Stage; and

Final Stage.

Role of the Committee at Preliminary Stage

The Pow of Inchaffray Drainage Commission (Scotland) Bill Committee was established on 19 May 2017 (under Standing Orders Rule 9A.5) to consider the Bill at Preliminary Stage and, if required, Consideration Stage. The Committee's role at Preliminary Stage is to consider and report on—

the general principles of the Bill;

whether the Bill should proceed as a Private Bill, including by satisfying itself that primary legislation is required, that the provision made is of a private rather than public nature, and that the pre-introduction requirements have been carried out correctly; and

to give preliminary consideration to all objections and reject any objection where the objector's interests are, in the Committee's opinion, not clearly adversely affected by the Bill.

If the Parliament approves the general principles of the Bill and agrees it should proceed as a Private Bill, it progresses to Consideration Stage; otherwise it falls.

Background to the Bill

The Promoter's Memorandum states that—

The Pow of Inchaffray ... is a drainage channel that provides drainage to its surrounding lands in the local authority area of Perth and Kinross. It originates at Methven Moss and meanders in a south-westerly direction for approximately nine miles until it reaches the River Earn, about two and a half miles south east of Crieff. Together with its 10 main tributaries the Pow is the equivalent of 13.7 miles long. The function of the Pow is to drain a total area of surrounding land of approximately 1,930 acres.

Pow of Inchaffray Drainage Commission (Scotland) Bill. Promoter's Memorandum (SP Bill 9-PM, Session 5). (2017, March 17). Retrieved from http://www.scottish.parliament.uk/Pow%20of%20Inchaffray%20Drainage%20Commission%20(Scotland)%20Bill/SPBill09PMS052017.pdf [accessed 31 March 2017]

The Memorandum goes on to explain that the origins of the Pow date back to around 1200, with further work carried out in 1314 at the behest of King Robert the Bruce. The Pow was first given a statutory footing in 1696 in an Act passed by the old Parliament of Scotland. This was repealed by the 1846 Act which gave the Commissioners greater powers to enable them to carry out works and improvements on the Pow and also made provision for the costs of that work to be shared amongst the owners of land that benefited from the Pow and the work of the Commissioners.

The Promoters' view is that the 1846 Act requires updating to take account of changing circumstances, including houses which have been built on land benefited by the Pow in more recent years. This was a situation not envisaged or provided for in the 1846 Act and which, the Promoter states, requires an updated mechanism for calculating the share of the Commission's annual costs payable by land owners which benefit, and provision for owners of the new houses to be represented on the Commission.

Other reasons given by the Promoter for repealing and replacing the 1846 Act include that much of the Act is no longer relevant, as it authorised works which have long been completed, and that remaining relevant sections of the Bill are archaic and difficult to follow. For all of the these reasons the Promoter wishes to update and modernise the whole statutory basis for managing the Pow.

The Memorandum sets out the alternate approaches considered by the Promoters, which included approaching Scottish Water, Perth and Kinross Council, and the Scottish Environment Protection Agency (SEPA) to ask them whether they would be willing to take over responsibility for the administration and maintenance of the Pow. None of these organisation expressed an interest in taking over such responsibilities and the Promoters therefore concluded that the only way to ensure the proper administration and maintenance of the Pow was by bringing forward the Bill.

The Memorandum also details the consultation which was carried out in advance of the Bill being introduced, which included three public meetings (two in 2015 and one in 2016); the circulation of notice and information sheets to those that would be affected by the Bill; and the issuing of a consultation paper between 18 May and 12 July 2016, to which seven responses were received, considered and responded to.

The Memorandum concludes that in light of—

the requirement for the 1846 Act to be updated to take account of changing circumstances;

the bulk of the 1846 Act no longer being relevant;

the language of the remaining relevant provisions of the 1846 Act being archaic and hard to follow; and

there being no public body prepared to take on responsibility of the Pow;

that only a new Act to replace the 1846 Act will ensure the proper future administration and maintenance of the Pow in a fair and transparent manner.

Giving evidence to the Committee on 24 May 2017, Commissioner Jonathan Guest stated—

The 1696 Act operated for 150 years and the 1846 Act has operated for 170 years. It is hoped that, by having simple, future-proofed procedures, the pow can continue to be run economically and that the Bill, if enacted, will provide to be as durable as its two predecessors.

Pow of Inchaffray Drainage Commission (Scotland) Bill Committee 24 May 2017 [Draft], Jonathan Guest (Pow of Inchaffray Commission), contrib. 4, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=10979&c=2004335

Contents of the Bill

The Bill has four Parts, containing 29 sections in total and has six schedules. The Policy Memorandum sets out the provisions of the Bill as follows—

(a) incorporation of the Commission as a body corporate;

(b) the Commission's functions and powers;

(c) the procedures for appointment of Commissioners and their terms of office;

(d) the extent of the Pow and the benefited land;

(e) heritors' meetings ["heritor" is the term used in the Bill to mean "owner of benefited land"] and Commissioners' meetings;

(f) calculation of the annual assessments payable by each heritor;

(g) access by the Commissioners over benefited land and land adjacent to the Pow for necessary purposes (subject to reinstating any damage);

(h) the Commission to be treated as an owner of the Pow for the purposes of notification under planning legislation;

(i) a requirement that any person must obtain consent from the Commission to—

obstruct the Pow,

restrict access to the Pow,

discharge into, or abstract water from, the Pow;

(j) recovery of unpaid sums due to the Commission by way of court proceedings; and

(k) repeal of the 1846 Act.

Consideration by the Committee

The Committee first met on 10 May 2017, at which members made the relevant declarations; chose a Convener (Tom Arthur MSP); and agreed its work programme and approach to its scrutiny of the Bill.

The Committee took oral evidence from the Promoters on two occasions and wrote to three organisations (Perth and Kinross Council, Scottish Water, and SEPA) to ask them to set out their positions on the Bill. The Committee also contacted the Law Society of Scotland, the Registers of Scotland, and a variety of relevant academics and experts to give them the opportunity to comment if they wished to do so. The Committee made a fact-finding visit to the site of the Pow on 8 September 2017 and a note1 of the visit is available on the Committee's webpage. The Committee concluded its considerations by giving preliminary consideration to the three objections.

The Committee received 14 written submissions on the Bill which were published on its webpage.2 These include submissions from—

the three bodies which the Committee requested views from;

some of the organisations and individuals the Committee wrote to to give the opportunity to submit views;

responses from other interested parties, which included—

- Scottish Natural Heritage (SNH) (specifically on the issue of beaver management);

- one of the objectors (Tom Davies); and

- the Scottish Government (which had annexed to it the Statement of Account of the Commission which had been obtained from the Perth Sheriff Court); and

several supplementary written submissions from the Promoters of the Bill.

The Committee also published several pieces of correspondence relating to the Bill.3

General Principles of the Bill

The Committee comments on all Parts of the Bill below, sets out the main issues which emerged during its Preliminary Stage considerations, and makes conclusions and recommendations where appropriate. This report should be read in the context of these being the preliminary findings of the Committee, and that several issues will require further consideration and debate at Consideration Stage, should the Bill proceed.

Part 1 - The Commission

Part 1 of the Bill (sections 1-9) focuses on the Commission. It states that the Commission should take the legal form of a body corporate, sets out the number of Commissioners, makes provisions about the appointment of Commissioners, and defines the Pow.

Schedule 1 (introduced by section 1(2)) relates to the administration and functions of the Commission and sets out provisions relating to: functions; general powers; appointment of the Clerk; committees; advisers and other services; proceedings; finances, accounts and audit; and execution of documents.

Schedule 2 (introduced by section 4) relates to the Commissioners and makes provisions relating to appointment and early termination of an appointment.

Schedule 3 (introduced by section 6) deals with meetings of the Commission and makes provisions relating to: meetings; conflicts of interest; and records of resolutions (formal decisions).

Need for a Commission and Commissioners

The Committee first considered whether there was a requirement for any body to continue to manage and maintain the Pow, and, if so, whether there were any alternatives to that body being the Commission.

Noting that the Policy Memorandum stated that Perth and Kinross Council and SEPA had confirmed to the Commission that they would not, or could not, take on responsibility of the Pow, and Scottish Water did not respond, the Committee wrote to all three of these organisations to ask them to set out their positions on the Bill for the benefit of the record. All three responded and confirmed they had no comments to make on the Bill or had no interest and/or locus to take on responsibility for the Pow.

The Committee notes the historical background of the Pow and accepts the requirement for it to be managed and maintained for the benefit of the surrounding land and property. The Committee notes that there is no other body willing or able to take on the management and maintenance of the Pow of Inchaffray. The Committee therefore accepts the need for the Commission established by statute to remain in place and continue its work.

The Bill states that the Commission will consist of seven Commissioners, two each for the lower, middle, and upper sections of the Pow, and one for the Balgowan section (where the majority of the residential property is located). This changes the current situation where there are six Commissioners, with no Balgowan Commissioner, so will give the Balgowan area residents a Commission representative for the first time.

Several written submissions (including from one of the objectors, Tom Davies) questioned the appropriateness of the Balgowan area having only one Commissioner out of seven, which would not proportionately represent the financial contribution made by those heritors to the annual budget.

The Committee questioned the Commissioners on this issue on 27 September 2017. It noted that all other sections of the Pow are represented by two Commissioners and that approximately 77 heritors (73% of the total number) live in the Balgowan section which it is proposed will be represented by just one Commissioner. In response, the Promoters confirmed that they would be prepared to suggest an amendment to the Bill, should the Bill proceed, to allow two Commissioners for the Balgowan section, meaning there would be eight Commissioners in total. The Promoters added that, if this change was made, the quorum for meetings of the Commission should be changed from three, as it is in the Bill, to four, to reflect the higher number of Commissioners and require at least 50% attendance.

The Committee is pleased that the Commissioners responded to feedback during its consultation period and included provision for a Commissioner to represent the Balgowan section. However, given that a majority of heritors live within the Balgowan section, and that every other section, where are there are far fewer heritors, is represented by two Commissioners, the Committee is also pleased to note that the Promoters have responded to scrutiny on this issue and would support extending the number of Commissioners for the Balgowan section further, to allow two, and eight Commissioners overall. The Committee will explore this further at Consideration Stage with the objectors and Promoters with a view to an amendment being brought forward if appropriate.

Definition of benefited land

The Bill refers to land which benefits from the drainage of the Pow as "benefited land" and defines that as the land shown as benefited on the land plans. The land plans are based on the 1846 Act, and a survey which informed that Act that defined land where economic value was increased by the drainage of the Pow.

This issue was raised in some of the objections and written submissions the Committee received and questions were raised about the evidence base and information which informed the land plans and the determination of the benefited land. The written submission from one individual, Peter Symon, noted differences between the land plans and the SEPA online flood risk mapping, including that SEPA's mapping does not show the Balgowan housing estate area as being at risk from flooding.

The Commissioners told the Committee that such discrepancies resulted from SEPA's mapping not being as detailed and robust as the combination of the 1846 survey and map and the subsequent knowledge and experience of the Commissioners, all of which which informed the current land plans.

In its written response to the Committee, SEPA stated that its national scale flood hazard maps are produced using a range of assumptions which may not hold true for the Pow. It added that—

... there is a high level of uncertainty in our assessment of how frequently land may be expected to flood from the Pow, and SEPA’s flood maps cannot be used to assess the areas benefiting from the Pow.1

The Commission also explained that the benefited land is not only determined by whether land is likely to flood but is also determined by the drainage the Pow provides to the land. With regard to the Balgowan estate in particular, Alastair McKie, a Partner at the Commissioner's agents Anderson Strathern, stated—

The pow fulfils a flood alleviation function and it also enables properties to have surface water and foul drainage. Our position is that the residential properties could not have been consented without the opportunity for surface water and foul drainage, which ultimately goes into the pow.

Pow of Inchaffray Drainage Commission (Scotland) Bill Committee 24 May 2017 [Draft], Alastair McKie, contrib. 18, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=10979&c=2004349

The Committee notes the concerns raised in evidence regarding the definition and extent of the Pow. The Committee also notes the comments from the Scottish Environment Protection Agency which indicate that its flood risk mapping should not be used to assess the land which benefits from the Pow.

The primary concern of some is whether the Balgowan estate area is, or is not, land which benefits from the Pow. Having visited the area in question, the Committee is satisfied that the drainage the Pow provides is essential for the drainage of surface water and waste for the houses in the Balgowan area. The Committee is therefore currently satisfied with how the extent and definition of the benefited land has been determined.

Commission powers and decision-making

The Committee considered the appropriateness of the powers the Bill gives to the Commission and its Commissioners, and how decisions will be taken.

One issue raised was whether the Bill gives disproportionate power to land (agricultural) heritors over residential heritors. The Bill proposes that a resolution to change the number of Commissioners or to alter the boundaries and extent of the Pow and its ditches can be passed by heritors representing 75% of chargeable values of all land, rather than by a one-vote-per-heritor system. The Commissioners explained that the Bill was drafted this way to reflect the larger amount of land, and higher payments made, by larger agricultural heritors. They also noted that the threshold only applied to two specific situations rather than other resolutions/decisions of the Commission.

The additional information given to the Committee by the Promoters1 explained that the 75% figure was a) intentionally linked to chargeable values rather than land area, and b) given that agricultural land only makes up 62.4% of the chargeable value, is deliberately difficult to meet and designed to prevent one interest becoming dominant. The Promoter added that a one-heritor-one-vote system could potentially be manipulated by heritors subdividing their land to create new heritors thus affect the voting power.

The Committee is satisfied that resolutions to change the number of Commissioners and boundaries of the sections of the Pow must be passed by heritors representing 75% of chargeable values of all land as, for the 75% threshold to be reached, there must be support from both agricultural and residential heritors.

The Bill allows heritors to appoint Commissioners but not dismiss them. The Bill provides that only the Commission can dismiss a Commissioner on the various grounds set out in the Bill. The Promoters explained that this was a carry-over from the 1846 Act which had actually been expanded on in the Bill, where there are a wider range of reasons for the removal/dismissal of a Commissioner. It was confirmed that heritors would be able to pass a motion to dismiss a Commissioner but that this would not be binding on the Commission.

In additional written information provided to the Committee the Promoters confirmed that their preference was not to include a mechanism for heritors to be able to dismiss a Commissioner. Reasons given included that—

as the Commission acts as one body dismissing an individual Commissioner is unlikely to benefit heritors;

the Commission, which is chosen by heritors, can dismiss Commissioners in certain circumstances; and that

consideration would need to be given as to whether heritors could only dismiss Commissioners for their own section, or for any section. If only for their own section, the Promoters argue that it would limit the effectiveness of the procedure as a majority of all heritors could not dismiss specific section Commissioners (and a minority of all heritors could dismiss a specific section Commissioner). If for any section, then the Promoters noted that heritors of a specific section could reappoint the same Commissioner under the terms of the Bill.

However, when this issue was discussed again with the Promoters on 27 September 2017 they confirmed that the Commissioners have reflected further and were prepared to suggest an amendment to the Bill which would allow a majority of heritors in a section to dismiss a Commissioner for that section.

The Committee also noted that there may be an unintended loophole in the Bill which provides that a person appointed as a Commissioner must be a heritor (or a heritor's representative) but that ceasing to be a heritor is one of several reasons given as to why a Commissioner's appointment may be terminated.

In the subsequent additional written information provided, the Promoters confirmed that the Bill did allow for the possibility of someone ceasing to be a heritor but continuing to be a Commissioner. The Promoters argued that it was difficult to imagine why the Commission would not dismiss a Commissioner in these circumstances. However, they noted that there was no reason why the Bill should not be amended to require dismissal in such circumstances.

Having considered all views submitted to it, the Committee welcomes the Promoters' willingness to consider changing the Bill to both make it possible for heritors to dismiss Commissioners in their section, and for Commissioners to have to be dismissed once they are no longer heritors. The Committee will consider this matter further with the Promoters and objectors at Consideration Stage, should the Bill proceed, with a view to appropriate amendments being brought forward.

Part 2 - Annual Assessments

Part 2 of the Bill (sections 10-16) concerns the annual assessments payable to the Commission by heritors and how they are calculated. Schedule 4 (introduced by section 10(6)) deals with the calculation of chargeable values and sets out the different land categories, assumed value per acres and valuation assumptions.

The Bill proposes a charging scheme which relates the costs to the level of benefit each heritor is thought to gain. However, rather than calculate this for each individual heritor, the proposed approach is to make a calculation for specified categories of land use (residential, commercial, agricultural etc.).

The first stage in the process is for the Commission to estimate the total budget needed for the forthcoming financial year. The contribution each heritor is required to make to the budget is then based on the chargeable value of the land in question.

The chargeable value of a heritor’s land is an estimate of the difference between the current market value of that land use type (the assumed value) and the value of that land type had no drainage works been carried out (known as the base value and fixed at £500 an acre). The assumed values for different types of land are initially fixed in schedule 4 of the Bill, based on a fixed rate per acre of each land use type.

Accordingly, for a residential property it is the size of the plot which is significant, not the size of the house. Indeed, the assumed value excludes works carried out by the heritor or predecessors, for example, building a house. The assumed value for land with planning consent for residential use, for example, is £300,000 per acre (compared to £50,000 for commercial use and a range of £2,500 - £6,000 for agricultural use).

A significant part of the evidence and information the Committee received on the Bill (including in the three objections lodged) focussed on the likely amount of the annual budget and the consequential amounts heritors would be charged in their annual assessments, including issues of fairness, affordability and proportionality.

Number of heritors

The Committee clarified with the Promoters that, should the Bill be passed, the number of agricultural heritors would remain as it is currently (29) but the number of residential and commercial heritors will increase by 20, from 57 to 77, giving a total of 106 heritors should the Bill be passed, increased from 86 at present under the 1846 Act.

The Promoters explained to the Committee why there would be 20 new heritors as a result of the Bill and the background of the newly charged properties. Commissioner Hugh Grierson said—

To start with, they were wooden shacks that people used on a temporary basis and the landowner continued to pay the bill for that area of land. At some stage, they were sold off; for a while, they were used by members of the Traveller community. The commission lost the information on who owned the plots of land, although the area of land was always in the benefited land. The landowners should always have been heritors, but their names were lost so they were not sent invoices.

The bill should make it fair and get everyone who is on benefited land back on the register. We are going to form an official register of names to make sure that it does not happen again. If the area of land that a house is built on was defined as benefited land under the 1846 act, the landowner should be a heritor. We lost track of the heritors’ names, which meant that they did not get invoices, so it is a surprise to them that they are on the new register.

Pow of Inchaffray Drainage Commission (Scotland) Bill Committee 24 May 2017 [Draft], Hugh Grierson, contrib. 26, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=10979&c=2004357

It is unfortunate that the details of owners of some land and properties were lost for a time which has resulted in owners not being appropriately charged for their share of the Commission's budget. However, the Committee agrees, having seen the area in question, that it is fair and reasonable that all owners of land and property in the benefited areas should pay towards the upkeep of the Pow.

The Committee is satisfied that the Bill ensures that all those who should pay will receive an annual assessment. The Committee hopes that the Bill will prevent any future owners of land and property in the benefited areas not being known and not receiving an assessment.

The Commission's budget: recent and future spending

As the heritors annual assessments are determined by the Commission's overall annual budget the Committee sought to clarify the Commission's recent and likely future spending. It is important to note that the Commission is a non-profit making body which is fully funded by contributions from the heritors (which includes all of the Commissioners). Therefore any expense incurred is part funded by every heritor.

Recent spending

The Scottish Government's submission stated that there was not much information in the Bill about the annual expenditure of the Commission and therefore what amounts landowners and homeowners would be likely to pay each year. On request, the Promoters gave the Committee publishable details of the budget from 2004-2016, and the breakdown of the main areas of expense during those years.1 This shows that the budget has varied between £2,582 and £30,337 between 2004 and 2016, with an average annual budget of £14,609 in that 13 year period. The categories of expense each year are shown as—

cleaning and repairs;

accounting and auditing;

surveyor; clerk and treasurer (solicitor); and

miscellaneous (including Private Bill).

By far the biggest expense (around 70-90% of the total) is the cleaning and repair of the Pow, apart from in 2005 and 2011, when no cleaning and repair work was carried out, and in the last two years (2015 and 2016) when there has been no cleaning and repair work undertaken due to the funding of the Bill.

The Committee's scrutiny of the Bill would have been helped by the inclusion of more detailed information on the Commission's current spending in the Bill's accompanying documents. As it is, the Committee received this information from the Promoters on request and has now placed this in the public domain. This shows that the annual budget has never exceeded £30,337 and averaged £14,609 over the last 13 years.

Future spending

Having established the details of the Commission's spending over the past 13 years, the Committee's scrutiny focussed on identifying the level of risk that the annual budget could, on occasion, increase substantially. Three main areas were identified as potentially having a significant impact on upcoming budgets: the backlog of cleaning and repair work required on the Pow; the costs of promoting the Bill; and the preparation and erection of gates to protect the Pow from damage by beavers.

Cap on spending

Given these identified areas will lead to certain, or likely, increase in the Commission's budget (and therefore the heritors' assessments) the Committee explored whether it would be desirable for a cap to be placed on the annual budget to ensure it remained affordable for heritors. Several written submissions, and two of the three objections, raised this issue.

The Promoters told the Committee that it would not be practical to cap the annual budget as the budget will always be set to cover necessary expenditure only and the Commissioners cannot control what might be necessary. If they were not able to fund urgently required works then it could have serious effects on landowners and homeowners. They also stated that they wanted to ensure that the resulting Act would be in place for generations, without the need to return to the Parliament for further amendment (such as changing the level of any cap), which is a costly process. They concluded that it was not in the Commission's interests, as a non-profit making body made up of heritors, to set the annual budget at a greater amount than was strictly necessary.

The Committee notes the calls by some for the Commission's budget to be capped to ensure it remains affordable in future years. However, the Committee understands and accepts why imposing a cap on the Commission's spending could lead to difficulties which could have serious consequences for heritors. However, given the established possibilities for the budget to rise substantially in future years, and in order to future-proof the Bill, the Committee believes that some added safeguards are required to protect heritors from the budget being set at unnecessary levels, and comments on this in more detail below.

Calculation and amount of individual assessments

Section 10 of the Bill relates to the calculation of annual assessments. Whilst the section confirms that heritors must be notified of the annual budget and individual assessment amounts, there is no right for heritors to challenge the budget. The Bill does not contain any right of appeal for heritors in any circumstances, and this is considered in more detail below.

The Committee examined the valuation process outlined in the Bill which determines how individual heritors' contributions are assessed, and also sought more detail on the effect this would have on future heritors' charges as compared to historic assessments. Commissioner Jonathan Guest confirmed that the current residential assessments were calculated by him when the first property appeared, and were linked to Council Tax water charges. The charge was set at £150 (excluding VAT) and was not subject to any independent assessment. The same charge was then applied to all subsequent new properties when they appeared.

The Committee sought further information about how the assumed values per acre of the land categories in schedule 4 were arrived at, such as the assumed value per acre of £300,000 for residential land. The Promoters confirmed that this assumed value was based on 2016 values determined by chartered surveyors through a robust analysis of sale prices of comparable land in the area.

On request, the Promoters gave the Committee sample calculations of assessment charges for both agricultural and residential heritors and a schedule of the annual assessments for all current and future heritors, both under the 1846 Act and under the Bill for comparison.

The projected charges under the Bill, based on a Commission budget of £20,000, shows that 12 of the 29 agricultural heritors will see a decrease in payments, with the remaining 17 seeing an increase in payments. Of those, nine see a more significant proportionate increase in the payments. Four of the charges are over £1,000, with the largest payment being £3,571.96, and eleven of the charges are less than £200, with the lowest being £1.30.

In terms of the residential and commercial heritors, the standard charge (before VAT) for the Manor Kingdom Balgowan estate was £150, as explained above. Under the Bill these charges will be more varied and all but three of the 57 current heritors shown will see a decrease in the annual assessment (based on the budget remaining as it was in 2016), some showing a significant decrease. Two of the three heritors facing an increase in payments show a significant increase of close to, or more than, 50%. The information shows significant variation in the assessments for the 20 new heritors, from £8.38 to £338.02. Eight of the charges are over £100, of which five are over £200, and three over £300. This is due to the size of the plots concerned.

The Committee explored why the values are based on land size rather than the value of buildings, an issue raised in the objection by Mr and Mrs Bijum. The Committee questioned the Promoters on this issue and whether it was right that an owner of a small house with a large garden could be charged the same or more than the owner of a large house with a small garden, and explored the issue of whether the valuations took sufficient account of situations where a home or land owner was asset rich but income poor.

Commissioner Jonathan Guest confirmed that the valuation is seeking to take account of the scope for new houses to be built on benefited land plots. He noted that the situation of smaller houses on bigger plots was complex and was only relevant in a very small number of situations. He suggested a modification which could be made to the Bill to address this issue, stating—

One thought occurred to me about a possible refinement, which might be a way of making the approach a bit more sophisticated. You will see that there is a category for amenity land, which has a nil value. The reason why we put that in was because, at the Balgowan development, the houses all sit on individual plots and, in the middle, there is common land, which is a sort of green. Obviously, that is benefited land, because it is within the benefited area, but it has no value. That is why we put a nil value on it—although actually, the value is £500, based on the fact that the value of the land before the 1846 agreement was £500, and £500 minus £500 is nothing. To refine the system, we could say—just for the sake of argument—that the ground that goes with a house can be three times the footprint of a house and that anything over that is amenity land. Therefore, for a small house on a large plot, only part of the plot would be treated as development ground and the rest would be treated as amenity land. We could make that refinement.

Pow of Inchaffray Drainage Commission (Scotland) Bill Committee 24 May 2017 [Draft], Jonathan Guest, contrib. 185, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=10979&c=2004516

This issue was revisited on 27 September, when the Promoters confirmed that they were considering whether the Bill could be amended along the lines suggested by Jonathan Guest in the quote above. On 11 October 2017 the Promoters wrote to the Committee2 and set out a proposed change to the Bill in detail which could deal with houses with a relatively large garden to house size. The proposal is based on revaluing residential properties on the basis of the area of the footprint of the house and any outbuildings multiplied by five (chosen because it led to minimal movement of total residential rateable values), with any remaining land treated as amenity land which has a zero rateable value. To aid the Committee the Promoters included two lists of residential charges by address, one as it would be under the Bill3, and the other, to compare, as it would be if the proposed amendment were made to the Bill4. The latter shows that, if the changes proposed were to be made, 52 of the 77 residential and commercial heritors would have their charges increased and 25 reduced. Of those who would have charges reduced, 13 are amongst the 20 new heritors.

The Committee welcomes the provision of detailed current and possible future assessments for all heritors by the Promoters and notes that it would have been helpful if this had been provided as part of the accompanying documents.

The Committee notes that the Bill would enable assessment charges to be varied based on the amount and value of land owned by each heritor. This means that, providing that the budget remained at the 2016 level, many heritors will see decreases in payments, some of which are significant. The Committee believes that the Bill provides for a broadly fairer system of calculating the annual assessments than is currently the case, with one exception, which is that heritors who may be asset rich but income poor, such as a residential heritor who owns a modest property which sits on a large plot for historical reasons, will end up paying more than some heritors owning larger houses on smaller plots. The Committee notes that a possible way to address this has been proposed by the Promoters, albeit one which would see a majority of heritors paying more.

Should the Bill proceed, the Committee recommends that this issue be considered in detail at Consideration Stage, with a view to a suitable resolution being agreed between the Promoters and objectors and the Bill being amended if necessary.

Collection of charges

The Committee asked the Promoters if consideration had been given to allowing heritors to pay assessments by instalment. In response, the Commissioners confirmed that this had not been considered due to a desire to keep administration simple and affordable.

The Law Society of Scotland questioned whether responsibility for paying the charge needed clarification in situations where a property is sold or where an owner dies and the property is handled by an executor. Its submission questioned whether a charge incurred on or before the conclusion of the missives stay with the seller, and whether an executor is a heritor under the Bill.

The Bill includes provision (in section 16) that means that a heritor remains responsible for the assessment charge until they notify the Commission about a change of name or address, or that they have ceased to be a heritor. It is not clear about situations where the ownership of a property reverted to an executor (for example, in situations where a heritor died ) or to a bank/building society (for example, in situations of repossession). The Committee recommends that the Promoters give further consideration to whether such situations should be directly addressed in the Bill.

Debt recovery

The accounts of the Commission obtained by the Scottish Government show that there are a significant number of historic unpaid assessments. This was confirmed by the Promoters who sent the Committee details of outstanding debts dating back to 2012, totalling £21,480. The Commissioners confirmed that these have not been pursued due to the likely costs of doing so being more than the outstanding amounts in question. It was confirmed however that the ability to pursue historic debts was retained by section 1(3) of the Bill which transfers previous "property, rights, liabilities and obligations" of the Commission from the 1846 Act to the new Commission. The Commissioners agreed to write to the Committee to clarify its position on historic debts.

In the subsequent written statement the Promoters confirmed that the Bill does allow for historic debts under the 1846 Act to be pursued, but stated that—

Such legal action would only be taken following legal advice and a policy decision of the Commissioners in relation to the cost effectiveness of such legal action. In the event that the Pow Bill is passed, then the Promoter considers it unlikely that legal proceedings would be taken in relation to old debts and in making such a decision the prospect of recovering the debt and costs associated with that recovery would be important considerations in deciding whether to proceed. It is also important to note that the Commission's legal expenses in any proceedings which were not recovered would be shared amongst all heritors.

Pow of Inchaffray Commissioners. (2017). Written submission. [accessed 30 August 2017]

Giving evidence to the Committee on 27 September, the Promoters confirmed that the Commission met formally on 15 August 2017 and agreed and minuted that all historic debt will be written off and not pursued. The Promoters also confirmed that court action would be taken to recover any future debts incurred under the Bill.

It should be noted that one of the objections, by Mr and Mrs Bijum, stated that it is unfair that some current heritors pay the assessment while others do not. They were of the view that the new heritors were only being charged to make up for the shortfall in funds.

The Committee welcomes the additional information provided by the Promoters which helped it understand the position on collection and debt recovery of annual assessments. The Committee notes that the Bill does enable historic debts to be pursued, and that these debts currently date back to 2012 and total £21,480. The Committee notes that the Commission has agreed formally not to pursue these debts. The Committee also notes that any future debts will be pursued by the Commission. It does appear therefore that all heritors under the Bill, including the 20 new heritors, could face increased charges as a result of some previous heritors not having paid historic assessments. Should the Bill proceed, the Committee will consider this further with the objectors and Promoters.

Revaluation process and amending land categories

The Bill states, in section 11, that a revaluation of the base value and assumed values (see earlier explanations of these terms) contained in schedule 4 is to happen in the first year then every ten years after that. This revaluation is to be carried out by a Commission-appointed surveyor and notified to heritors. The Bill includes (in section 11(4)) a right for heritors to make representations to the Commission-appointed surveyor on receipt of a revaluation proposal. The Bill states that the surveyor must have regard to any such representations, however, there is no confirmation of what this means in practice.

The Bill also contains a right for the Commission to appoint a surveyor at any time to amend a land category in schedule 4 to meet changed circumstances and to make any consequential changes to the assumed value per acre of that category. As with the revaluation process, any such proposed changes must be notified to heritors and, again, heritors have 28 days to make representations, which the surveyor must have regard to.

However, the Bill does not explain what "have regard" to heritors' views means in practice and there is no formal right of appeal in either of these circumstances.

The Committee notes the Bill's processes for revaluation of the base and assumed values and for amending the land categories, and that there is a process which allows heritors to make representations to a surveyor on these issues. However, this right does not seem to be a formal right of appeal, and also only applies to two specific situations and not to the annual setting of the budget and determination of heritors' individual assessments. This is discussed further below.

Right of appeal

The 1846 Act gave heritors a right to appeal to the Commission and then to the Sheriff Court if they were not satisfied with their assessment. However, this was not carried forward in the Bill and no other right of appeal was included. This issue was raised in several of the responses to the Committee, both in objections and written submissions. For example, the Scottish Government's letter states—

The Scottish Government considers it important to be clear whether appeal mechanisms are needed in relation to Commission decisions and if appeal mechanisms are not needed, why they are not needed. It would seem preferable to replicate existing appeal rights in the new Bill. The Committee may wish to seek the Promoters’ views on removal of the existing statutory appeal mechanism.

Scottish Government. (2017). Written submission. Retrieved from http://www.scottish.parliament.uk/S5PrivateBillsProposals/Scottish_Government_Written_Submission.pdf [accessed 31 August 2017]

In the additional information provided to the Committee the Promoters confirmed that consideration was given to continuing the right to appeal provisions in the 1846 Act but that it was decided, on balance, not to do so for the following reasons—

the values which underpin the calculation of the annual assessments are set out in the Bill (which was not the case in the 1846 Act);

the only variable factor is the amount of the Commission's budget;

there is therefore much less scope for challenge compared to the 1846 Act and challenges are only likely to be made because of—

- an error in an assessment (in which case a heritor would not be obliged to pay and the matter would be resolved directly with the Commission);

- the budget being too high (which, as previously discussed, would not be the case as Commissioners are heritors and can and will only set the budget to cover what is necessary);

- or as a result of revaluation of the assumed and base values, or amendment to a land category (the Bill provides many safeguards against this and, in any case, any appeal would likely be referred to a surveyor, who would have made the determination in the first place);

the Bill provides for a cost-effective proportionate system for all involved, and the costs of any appeals would have to be shared amongst all heritors; and that

judicial review remains an option of last resort.

The Committee continued to press the Promoters on this and on 27 September the Promoters told the Committee that further consideration had been given to the concerns expressed in evidence to the Committee. They suggested one way forward may be to amend the Bill to ensure that, when heritors are issued with annual details of the Commission's budget and individual annual assessments, they are then given 21 days to make representations to the Commissioners (a similar process, albeit with a shorter timescale, to the Bill's process for heritors commenting on the ten year revaluation process and alteration to land categories). The Commissioners would then have to "have regard" to those comments when finalising the budget. The Promoters believed this to be a straight-forward and proportionate compromise position and restated their reluctance to include a right of appeal as they do not consider it to be necessary or proportionate.

The Committee asked the Promoters to consider additional measures, such as a referral to a third party, such as an arbitrator or surveyor. The Promoters agreed to consider this and then write to the Committee with its views. On 11 October 2017 the Promoters wrote to the Committee2 to outline a further suggested change to the Bill (in addition to the right of consultation and comment detailed above) which would provide a right of appeal to an independent expert in circumstances where ten or more heritors wish to appeal. The letter states—

The Promoter considers that having a minimum of ten heritors seeking to lodge an appeal is a proportionate mechanism, taking into account the previously expressed concerns that any appeal process should balance the interests of individual heritors with the wider group of all heritors, as all heritors would have to bear the cost of any such appeal.

The letter sets out a draft amendment that could be made to the Bill to give effect to this proposal, but stresses that this is not the preference of the Commission but is being made in response to concerns expressed by the Committee. The letter also contains detailed comment on behalf of the Promoters relating to what issues could be appealed and sets out concerns relating to the delays such a process could cause to the setting of the annual budget, stating that, as a result, the budget may be less accurately assessed, requiring a contingency figure which it states "may result in less accurate, and higher, budgets than would be the case if there were no appeal process on top of the proposed consultation process."

The letter also includes a practical illustrative example which looks at two years' payments and concludes that all heritors would pay more should an appeal be unsuccessful and that, in some circumstances, due to the costs of the appeal, all heritors may end up paying more even if an appeal was successful.

The Committee notes the evidence provided to it expressing concern that the Bill contains no right of appeal for heritors to challenge the setting of the annual budget. The Committee also notes the Promoters reasons for not including any such right, and its proposed responses of a) its preferred option of a right to make representations which the Commission must "have regard" to (similar to that which exists in other parts of the Bill), and b) (in addition to option a) a right of appeal to an independent expert in circumstances where ten or more heritors' wish to appeal.

The Committee is concerned about the lack of a right of appeal in the Bill, especially given the issues identified regarding the potential for the annual budget to increase substantially and unchecked, and that the 1846 Act contains an appeals process for assessments to be appealed to the sheriff. If the Bill is to stand the test of time then it seems prudent for it to contain proportionate appeals and dispute resolution procedures for those it affects. The Committee also does not believe judicial review, which is a potentially expensive form of court action that has to be heard in the Court of Session in Edinburgh, will be a realistic option for most heritors.

Should the Bill proceed to Consideration Stage, the Committee will discuss this issue with the Promoters and objectors. It is the Committee's preliminary view that the Bill may need to be amended to ensure appropriate and proportionate appeal and dispute resolution mechanisms are put in place.

Land plans

The Committee received a written submission from Professor George Gretton concerning the land plans provisions in section 15. Professor Gretton noted two concerns with this section of the Bill: firstly that no cartographic standard is specified, which he describes as "unsatisfactory"; and secondly that only the heritors have a right to view the plans. On the issue of cartographic standard he notes that the Land Register is Ordnance Survey based and that, if the same is not the case with the land plans, it could lead to discrepancies between properties shown on each. On the issue of who has the right to see the plans, he noted that the usual policy is that such plans are available to everyone, albeit that a fee may be charged.1

When questioned on this, the Promoters confirmed to the Committee that the plans are all based on Ordnance Survey material and that the Bill could be amended to ensure that the land plans are publicly accessible.

The Committee welcomes the provision of land plans which show the overall area as well as breakdowns of the lower, middle, upper and Balgowan sections of the Pow and is satisfied with their cartographic standard. However, the Committee believes it would help with transparency and accessibility for the plans to be publicly available and notes the Promoter's support for this. The Committee therefore believes it would be in everyone's interests for the Bill to be amended to ensure this is the case.

Register of heritors and prospective purchasers

The written submission from Professor Gretton notes that the Register of Heritors is only to be available to viewing by heritors, which he believed was a departure from usual legislative practice. When asked if they would support the publishing of the Register, or making it publicly available for inspection, the Promoters told the Committee that they would consider this, and the data protection implications of doing so.

In the subsequent written information provided, the Promoters repeated concerns regarding publishing a register with personal data of heritors and how that would be compatible with data protection legislation. They also noted concerns regarding associated administration costs. However, on 27 September, the Promoters confirmed that, after further consideration, they would support an amendment being made to the Bill to require publication of a searchable register.

The Committee believes that it would be beneficial for transparency and accessibility reasons to ensure that the Register was published and therefore publicly available for inspection. The Committee agrees that the Commission should ensure that this is data protection compliant.

Concerns were raised in written submissions about how prospective purchasers or their solicitors would become aware of the Pow and the annual assessment requirements. In a written submission, Professor Robert Rennie noted that he did not think current property questionnaires (forming part of the Home Reporti required for the marketing of most residential properties in Scotland) and Property Enquiry Certificates (usually ordered by the seller's solicitor and made available to the purchaser's solicitor) would necessarily disclose the existence of the annual assessments and gave this example—

I asked some of the partners in our private client department if they had ever come across/ever had to deal with the Pow of Inchaffray. Only one partner had. She advised that it had come up because the seller had mentioned it casually to the purchasers. The purchasers mentioned it to their solicitor who in turn raised it with the seller's solicitor. The seller's solicitor did not seem to know anything about it and simply tried to get the purchasers' solicitor to "accept the position" with little or no further information. At this time of course the 1846 board had ceased to exist so there was no one to check with. The purchasers did not go ahead.

Rennie, R. (2017). Written submission. [accessed 30 August 2017]

This was supported in the written submission by Peter Symon—

I phoned two estate agents currently selling houses in Manor Kingdom estate and both confirmed that they were aware of no property details mentioning any obligations in respect of the Pow Commission, which they had not heard of.

Symon, P. (2017). Written submission. [accessed 30 August 2017]

This issue was also highlighted by the Law Society. It noted that the obligation to pay would not be noted in the Land Register and suggested possible solutions—

that the Bill specifically stipulate that the obligations be registered, bringing it within the scope of an “encumbrance” under section 9(1)(f) of the Land Registration (Scotland) Act 2012 and in turn ensuring disclosure to purchasers or prospective purchasers; and

to impose a specific obligation to include details of the Commission and attached charges in Home Reports.

The submission from the Scottish Government also raised this issue, stating—

It appears to the Scottish Government, and to Registers of Scotland, that the Bill seems to propose a form of obligation that is intended to “run with the land”. However, it is not clear from the terms of the Bill that it would be publicised by registration in the Land Register.

Scottish Parliament Pow of Inchaffray Drainage Commission (Scotland) Bill Committee. (2017, May). Written submission from the Scottish Government. Retrieved from http://www.parliament.scot/S5PrivateBillsProposals/Scottish_Government_Written_Submission.pdf [accessed 23 May 2017]

The Government's letter gave examples of alternatives to registration, such as notification through ScotLIS (an online land and information system still in development) or via Home Reports, although it was noted that there are limitations to Home Reports which would not guarantee that the Pow burdens would always be captured.

When asked how the Commission planned to address this problem, Shirley Davidson, a solicitor with McCash and Hunter (which acts as clerks to the Commission), noted that companies that provide property enquiry certificates will be contacted with a view to their making specific reference to the Pow of Inchaffray. She added that the Bill contains a provision which means heritors retain the responsibility for assessments until they notify the Commission about a change of ownership, and that any website the Commission may adopt in the future could contain a system for easily notifying change of property ownership. She added—

Moreover, I believe that a new digital and land property information service—the Scottish land and information system, or ScotLIS—is being developed by Registers of Scotland, and that would definitely seem to be the place where the pow’s arrangements could be flagged up in future.

Pow of Inchaffray Drainage Commission (Scotland) Bill Committee 24 May 2017 [Draft], Shirley Davidson, contrib. 289, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=10979&c=2004620

This issue was discussed further on 27 September. Shirley Davidson updated the Committee on the Commission's position—

In the commission’s view, there are satisfactory methods by which future purchasers will have the matter flagged up to them. In rural and semi-rural areas, it is recognised that it is not unusual for properties not to be connected to the public sewage system. In the case of the benefited properties here, the question of whether the property is connected to—or lies ex adverso to—the public drainage system is covered in the home report, the survey report, the standard missive and the property enquiry certificate. That question will—or certainly should—always produce the answer no. That alone, I would submit, puts the solicitor acting for the purchaser on notice that that solicitor should make the appropriate inquiries and advise their client accordingly.

The land certificates for all the houses in the Balgowan housing development set out in full the deed of conditions, which makes reference to a requirement to pay a share of the annual drainage levy to the Pow of Inchaffray Drainage Commission.

Property enquiry certificates are produced in the general course of a sale and purchase transaction. I have spoken to the local private searcher, which most solicitors in Perthshire use, and to Millar & Bryce, which I think is the largest searcher covering Scotland. They have confirmed that in principle they would be more than happy to make specific reference to what will be the pow act if we provide the land plan, the addresses and the postcode or whatever of the properties and the land in question. That would assist.

It is absolutely the normal practice for solicitors to ascertain what the drainage position is. If they fail to do so or fail to adequately advise their clients of the position, clients can use a complaints procedure that is free to them, the availability of which must be brought to clients’ attention according to Law Society rules.

Pow of Inchaffray Drainage Commission (Scotland) Bill Committee 27 September 2017 [Draft], Shirley Davidson, contrib. 100, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11126&c=2027930

The Committee asked the Promoters to consider this further and write to it outlining suggestions for other ways to ensure that new heritors are informed/aware of their obligations. In its letter to the Committee, dated 11 October 2017, the Promoters confirmed that the Home Report, the survey report, the standard missives, the property enquiry certificate and the prospective ScotLIS "should be more than adequate to alert a purchaser's solicitor to the fact that the property is not connected to the public drainage system and to put him or her on notice that some other arrangement is in place." The letter also confirms the intention to create a user-friendly website which incorporates a link to enable easy communication of changes of ownership, and suggests a further proposal to include a standard sentence in communications with heritors asking them to advise the Commission of any changes of ownership.

The written submissions made to the Committee demonstrate that it is possible that prospective purchasers may not be made aware of the Pow and the obligations to make payments to the Commission. The Committee notes the comments made by Shirley Davidson of McCash and Hunter solicitors (Clerks to the Commission) and, in the letter to the Committee of 11 October 2017, stating that the Commission considers there to be adequate measures in place to alert prospective purchasers.

However, the Committee believes more may need to be done, should the Bill be passed, to alert prospective purchasers to the Pow's existence and purpose and the obligations to make payments to the Commission. Whilst amending the Bill to ensure that the land plans and Register of Heritors are both publicly available and able to be inspected, as previously discussed, should help make it easier for information to be obtained by solicitors acting on behalf of prospective purchasers, or purchasers themselves, additional steps should be considered.

The Committee notes that the Promoter believes private providers of property enquiry certificates operating in the local area are prepared to include reference to Pow charges in their certificates. The Committee asks the Promoter to provide the Committee with written confirmation of these commitments.

Some property enquiry certificates are obtained from councils directly (rather than from private search companies). The Committee notes Perth and Kinross Council's public information about its certificates makes no reference to drainage arrangements for a property being included. The Committee is also unsure whether the Council is committed to making specific reference to the charges associated with the Pow. The Committee recommends that the Promoter explores with the Council how it would approach the Pow charges in itscertificates.

The Committee agrees that ScotLIS could offer a potential way for the Pow charges to be highlighted to a prospective purchaser. The Committee recommends that the Promoter obtains further information on whether the Commission is likely to be treated as an organisation which would be able to add information to ScotLIS and when it would likely to be able to add such information.

Property Factors (Scotland) Act 2011

The Law Society of Scotland suggested that consideration be given to whether the Commission should, or would, be required to be registered as a property factor under the terms of the Property Factors (Scotland) Act 2011 adding that, as this is a public register, it would also alert prospective purchasers to the existence of the Pow and the obligations involved.

The Promoters told the Committee, in oral evidence on the 27 September 2017, that they do not consider that the Commission falls within the definition of the 2011 Act.

The Committee notes the comments made on this by the Law Society of Scotland and the response of the Promoters. It seems that the Commission does not fall within the definition of the 2011 Act. Given that the management requirements of the Pow are unique and specific, and the 2011 Act is intended for councils and private businesses as property factors, the Committee does not see sufficient merit in the Commission seeking to amend the 2011 Act to bring the Commission within its scope.

Part 3 - Miscellaneous and General

Part 3 of the Bill (sections 17-24) sets out general and miscellaneous provisions, including: access arrangements; notice of planning applications; consent for activities affecting the Pow; liability; court proceedings; interest on sums due; certification of land plans; and service of notices.

Schedule 5 (introduced by section 19(2)) sets out the consents procedure and Schedule 6 (introduced by section 24) is concerned with the serving of notices.

In its written submission, the Scottish Government pointed out that sections 17-19 of the Bill, relating to the powers of the Commission with regards to access, planning application notification, and consents, would be without prejudice to the regulatory functions of statutory bodies, controls or protections. An example is given, relating to the Commission's function to control fauna and flora within the Pow and affected land, of the fact that beavers will become a protected species within the course of 2017.

The written submission from Perth and Kinross Council confirmed it was content with the access and consent provisions in the Bill—

I can confirm the Council is satisfied with the proposal that it will not be required to seek consent from the Commission for any work within 6m of the Pow in order to carry out any of its statutory powers and duties. It is also recognised that the Council will give the Commission seven days’ notice prior to any proposed works starting, unless an emergency situation arises where notice shall be given as soon as reasonably practicable.

Perth and Kinross Council. (2017). Written submission. [accessed 30 August 2017]

The Committee notes the access and consent provisions in the Bill and that Perth and Kinross Council is content with these provisions. The Committee also notes the comments from the Scottish Government which states that the Bill cannot take precedence over general law in these matters. The Commissioners would still have the same duty as anyone else not to, for example, kill or disturb beavers, and couldn't rely on their statutory right to "control" fauna as giving them any special immunity.

Part 4 - Final Provisions

Part 4 covers final provisions including: transitional arrangements; repeal of the 1846 Act; interpretation; and commencement.

The Committee is content with these sections of the Bill, which includes that the Bill shall come into force on the day of Royal Assent, apart from section 2 (which establishes the new number of Commissioners) which comes into force three months after Royal Assent.

Should the Bill proceed as a Private Bill?

To determine if the Bill should proceed as a Private Bill the Committee considered whether the Bill conforms to the definition of a Private Bill as set out in Rule 9A.1.1 of Standing Orders, and whether the Bill's accompanying documents conform to Rule 9A.2.3 of Standing Orders and are adequate to allow proper scrutiny of the Bill.

Conforming with the definition of a Private Bill

The definition of a Private Bill in Standing Orders Rule 9A.1.1 is—

A Private Bill is a Bill introduced for the purpose of obtaining for an individual person, body corporate or unincorporated association of persons ("the promoter") particular powers or benefits in excess of or in conflict with the general law, and includes a bill relating to the estate, property, status or style, or otherwise relating to the personal affairs, of the promoter.

Scottish Parliament. (2017, March). Standing Orders of the Scottish Parliament. Retrieved from http://www.parliament.scot/parliamentarybusiness/17797.aspx [accessed 25 April 2017]

The Committee is satisfied that the Bill confirms with the definition of a Private Bill.

Form and adequacy of accompanying documents

Rule 9A.2.3 of Standing Orders states that the Promoter is required to provide the following accompanying documents—

a statement on legislative competence;

Explanatory Notes ;

Promoter's Memorandum; and

Promoter's Statement.

Form

The Committee is satisfied that the Bill is accompanied by the required documents and that those documents conform to Standing Orders requirements.

Adequacy

In terms of the adequacy of the documents to allow proper scrutiny of the Bill the Committee had to ask for a significant amount of additional information from the Promoters to enable it to properly scrutinise the provisions in the Bill.

In particular, there was a lack of information in the accompanying documents regarding the historic budget and spending, annual assessments and how much heritors were likely to have to pay, and how the Bill would affect these charges. There was also an absence of information about how and why the Bill would result in a number of additional heritors, or why those heritors have not previously been included.

The Committee also requested further information on the consultation process carried out by the Commissioners and a copy of the consultation document, which were subsequently provided by the Promoters. The consultation document, which had not been previously made available, contained a great deal of information including worked examples of annual payment assessments.

Other further information provided by the Promoters on request included: copies of the note prepared for the heritors meeting on 2 March 2015; the agenda and minutes of the heritors meeting on 11 May 2015; cover letters regarding the consultation sent to current and future heritors in May 2016; a note of a consultation meeting held on 17 June 2016; and copies of the seven consultation responses and replies to those made by the Clerk to the Commission. The Promoters confirmed that the note of the consultation meeting of 17 June 2016 was not circulated to current or future heritors.

On the two occasions that the Promoters appeared before the Committee they circulated various documents, such as an old map of the Pow and detailed plans showing each commercial and residential heritor on the sections of the Pow together with thier current and potential future assessments. Again, this information would have been more helpfully provided in, or alongside, the accompanying documents.

The Committee considers that it would have been helpful for the Committee, heritors and all those with an interest in the Bill, if the accompanying documents had included, or been able to link to, much of the information subsequently provided to the Committee on request. This includes details of the historic budget and spending, annual payment assessments, together with worked examples showing the difference between the current assessment and an assessment made under the Bill, and information explaining why new heritors would be created by the Bill. The Committee is also disappointed that a note of a consultation meeting was not circulated to current and future heritors, many of whom attended the meeting, and all of whom had an interest in the proceedings.

From the information provided, the Committee is satisfied that adequate consultation was carried out by the Commission in advance of the Bill being introduced. However, the Committee hopes that the Commission can learn from this process, and the views of some heritors and others with an interest, and improve its communication with all heritors, and potential heritors, and the accessibility and transparency of its operations. The Committee notes the Commission's intention to establish a website and believes that would be a positive step it helping to improve accessibility, transparency and communication in general.

Preliminary consideration of objections

The objection period for the Bill ran from 18 March 2017 to 16 May 2017. During this period three admissible objections were received.1

Under the terms of Rule 9A.8.2 of Standing Orders, the Committee is required to—

... give preliminary consideration to the objections, if any, and shall reject any objection where the objector’s interests are, in the opinion of the Committee, not clearly adversely affected by the Private Bill.

The test that the Committee must therefore apply at Preliminary Stage is whether the objector's interests would be clearly adversely affected by the Bill. In terms of this Bill, an objection does not pass this test just because an objector's interests are clearly adversely affected by the 1846 Act and/or by the current system of management of the Pow by the Commission.

Objection 1 - Gareth G.J. Bruce

The first objection was made by Gareth G.J.Bruce. Mr Bruce's objections lists 11 grounds for his objection and states that his objection is to the whole Bill.

The Committee considered the following grounds for objection given by Mr Bruce—

his property does not drain into the Pow as it is too far away;

the values given in the Bill for land with and without the benefit of the Pow have been estimated as his property has never flooded;

the Bill should include compensation for homeowners for any drop in property value because of the Pow;

properties close to the Pow and at greater risk of flooding should pay more than properties further away;

maintenance should be paid for out of council tax payments;

the Bill should include a cap on charges;

the Bill requires a mechanism to prevent incorrect classification of benefiters;

previous owners of his property have not been liable to pay the charge;

the Bill should compensate homeowners if flooding and damage does occur; and that

the Bill will lead to a return of a feudal system of land ownership which benefits wealthy landowners at the detriment of others.

Mr Bruce's property is within the benefited area, but is one of the properties that, for historical reasons, is not chargeable under the 1846 Act and Mr Bruce is therefore one of the 20 new heritors who would be charged following the enactment of the Bill.

Given that Mr Bruce lives in a property that is within the benefited area, making him liable for charges, and that the Bill contains provision which allows his land to be revalued, registered and charged (whereas previous owners of his property were not charged), the Committee is satisfied that Mr Bruce's objection demonstrates that his interests are clearly adversely affected by the Bill. The Committee did not reject the objection and will therefore give full consideration to Mr Bruce's objection at Consideration Stage, should the Bill proceed to that Stage.

Objection 2 - Mr and Mrs Bijum

The second objection was lodged by Russell and Susan Bijum and was also an objection to the whole Bill. The main grounds of their objection are that—

the deeds to their property do not contain any liability to pay towards the upkeep etc of the Pow;

their property is far from the Pow and at no risk from flooding;

they are only now being expected to pay to make up for a shortfall in funds from liable properties that are not paying the charges; and

the Bill's charges are based on the size of each relevant plot of land and as their property is small, but with a large garden, they will likely pay as much as, or more than, much larger properties.

As with the objection from Mr Bruce, it is clear to the Committee that Mr and Mrs Bijum's property is within the benefited area and is one of the 20 new properties that would be charged following the enactment of the Bill.

Given that Mr and Mrs Bijum live in a property that is within the benefited area, making them liable for charges, and that the Bill contains provision which allows their land to be revalued, registered and charged (whereas previous owners of their property were not charged), the Committee is satisfied that Mr and Mrs Bijum's objection demonstrates that their interests are clearly adversely affected by the Bill. The Committee did not reject the objection and will therefore give full consideration to Mr and Mrs Bijum's objection at Consideration Stage, should the Bill proceed to that Stage.

Objection 3 - Tom Davies

The third and final objection was lodged by Tom Davies and is an objection to two specific parts of the Bill as follows—

Part 1, section 3 (Extent of the Pow and benefited land); and

Part 2, section 10 (Calculation of annual assessments).

Within his overall objection to section 10 of the Bill, Mr Davies notes a specific objection to sections 10(10) and 10(11) which deal with the recovery of promotion costs of the Bill under the 1846 Act.

Mr Davies' objection to section 3 of the Bill states that he has not seen any justification or evidence for the definition and extent of benefited land in the Bill and therefore he wishes a re-assessment of the land to clearly establish the land which benefits from the maintenance of the Pow.

Mr Davies' objection to section 10 of the Bill is on the basis that the Bill allows the Commissioners to determine the annual budget, and therefore the amount of individual payments, without any mechanism to allow heritors to veto increases or any cap to be placed on the annual budget.

Mr Davies' specific objection to sections 10(10) and 10(11) relate to the recovery of unpaid promotion costs under the 1846 Act. Mr Davies questions the recovery of costs under an Act which is being repealed by this Bill because it is unfit for purpose. He questions why, if the way the annual charge is calculated is being changed by the Bill, provision in the 1846 Act should still be enforced.

The Committee notes that Mr Davies lives in a property that is within the benefited area, and is currently already liable for charges, as recorded in the deeds of his property, under the 1846 Act.