Report on the Scottish Government's Draft Budget 2018/19

Introduction

On 14 December the Scottish Government's Draft Budget for 2018/19 was published. This meant that for the second year running the Local Government and Communities Committee budget scrutiny process has, of necessity, required evidence gathering from stakeholders to be undertaken prior to the budget being published. Full details of those who provided us with their views (written and/or oral) can be found on our Committee webpage. We thank them all for taking the time to share their views with us.

A new budget scrutiny process will begin next year for the 2019/20 fiscal year. This will involve the Committee and stakeholders considering the future financial implications of Scottish Government policy throughout the year, and gives committees the chance to influence the budget before publication. This new process will bring advantages with more direct scrutiny of the budget consequences of policy decisions throughout the year rather than focussing on the months immediately prior to the budget being published. We recognise, however, that after 18 years of the existing process those wanting to take part in future budget scrutiny will have to change the way they contribute their views.

We therefore seek confirmation from the Finance and Constitution Committee as to whether it intends to brief Committees and their external stakeholders on how the new budget process will impact on them so that stakeholders can proactively plan their budget scrutiny for 2019/20 onwards.

Draft Local Government Budget 2018/19

The Draft Budget 2018/19 document sets out the overall budget for Local Government and should be considered alongside the Local Government Finance Circular No 5/2017 (referred to as the Finance Circular) which is published on the same day. The Finance Circular sets out the provisional total revenue and capital allocations for each local authority for 2018/19. The totals in the Finance Circular are different to those in the Draft Budget – these are explained below. In 2016/17 the Accounts Commission again reported that all local authorities accounts were unqualified “an indication of the good stewardship of public funds that we continue to see in local government.”1

The total allocation to local government in the 2018-19 Draft Budget is £10,384.1m a fall of 0.6% (-£58.1m) in real terms since 2017-18.

Table 1 - Local Government budget - compared to 2017-18 Draft Budget, as amended

| Local Government | 2017-18 | 2018-19 (cash) | Cash change | Cash change % | 2018-19 (real) | Real change | Real change % |

|---|---|---|---|---|---|---|---|

| General Revenue Grant | 6,627.8 | 6,608.5 | -19.3 | -0.3% | 6,512.3 | -115.5 | -1.7% |

| Non-Domestic Rates | 2,665.8 | 2,636.0 | -29.8 | -1.1% | 2,597.6 | -68.2 | -2.6% |

| Support for Capital | 653.1 | 598.4 | -54.7 | -8.4% | 589.7 | -63.4 | -9.7% |

| Specific Resource Grants | 210.9 | 263.2 | 52.3 | 24.8% | 259.4 | 48.5 | 23.0% |

| Specific Capital Grants | 133.4 | 278.0 | 144.6 | 108.4% | 274.0 | 140.6 | 105.4% |

| Total Level 2 | 10,291.0 | 10,384.1 | 93.1 | 0.9% | 10,232.9 | -58.1 | -0.6% |

| GRG+NDRI | 9,293.6 | 9,244.5 | -49.1 | -0.5% | 9,109.9 | -183.7 | -2.0% |

| GRG, NDRI and SRG | 9,504.5 | 9,507.7 | 3.2 | 0.0% | 9,369.3 | -135.2 | -1.4% |

| Total Capital | 786.5 | 876.4 | 89.9 | 11.4% | 863.6 | 77.1 | 9.8% |

Source: SPICe. (2017, December 18). Local Government Finance: Draft Budget 2018-19 and provisional allocations to local authorities. 2

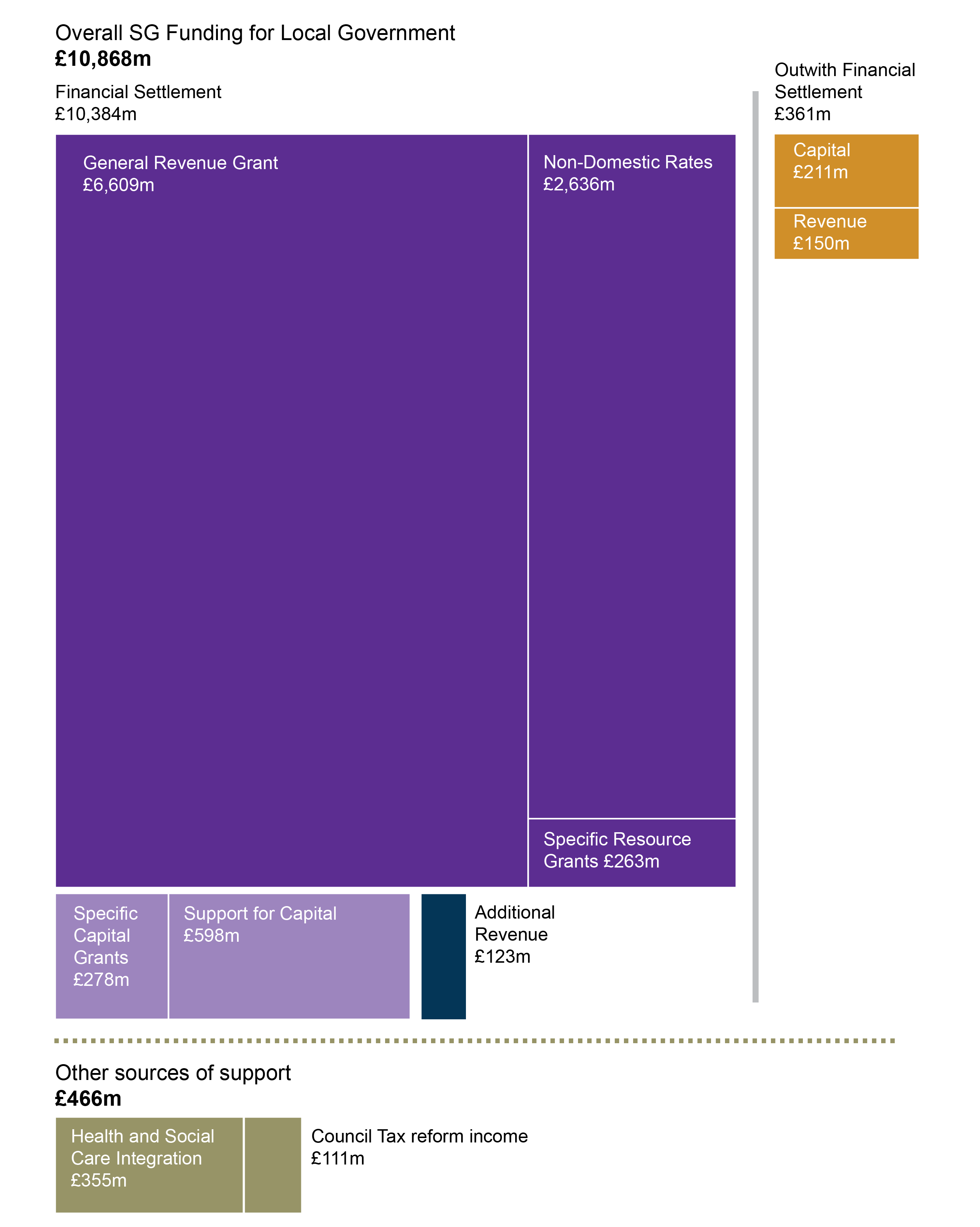

This is mostly made up of General Revenue Grant (GRG) and Non-Domestic Rates Income (NDRI), with smaller amounts for General Capital Grant and Specific (or ring-fenced) Revenue and Capital grants. Broken down, this is as follows

General Revenue Grant plus Non Domestic Rates Income falls by 0.5% ( -£49.1m) in cash terms, or 2% (-£183.7m) in real terms between 2017-18 and 2018-19.

When Specific Revenue Grants are taken into account, there is a small cash increase in Total Revenue funding for 2018-19 (+£3.2m). In real terms, this results in a reduction of 1.4% (-£135.2m).

Total Capital funding, by comparison, increases by 11.4% (£89.9m) in cash terms, or 9.8% (£77.1m) in real terms. However, this increase is due to an increase in specific capital grants. General support for capital has reduced in cash and real terms.

Once Revenue funding in other portfolios is included (as set out in the Finance Circular), the "Total Core Local Government Settlement" is £10,507.1m. If all funding outwith the local government finance settlement (but still from the Scottish Government to local authorities) is included, the total is £10,868.1m. Finally, if "other sources of support" are included the total rises to £11,334.1m (see Figure 1).

"Other sources of support" includes funding for health and social care integration, which is in the Health budget, and additional income from Council Tax reform changes. The numbers for "other sources of support" in the budget tables do not include amounts Councils could raise by increasing Council Tax by 3%.

The Cabinet Secretary for Finance and the Constitution (hereafter referred to as the Cabinet Secretary) explained that, bearing in mind the Scottish Government has “had a real terms reduction in our resource funding”, the £10.5 billion total settlement means that -

I have been able to protect the resource budget in cash terms and increase the capital budget in real terms, which will result in a total increase in local authority core funding of £94 million.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, The Cabinet Secretary for Finance and the Constitution (Derek Mackay), contrib. 3, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051740

Adequacy of the Local Government budget

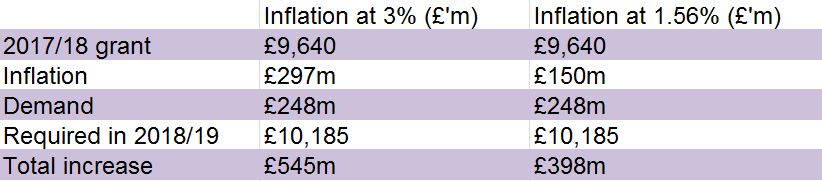

In its pre-budget written evidence the Convention of Scottish Local Authorities (COSLA) forecasted that just to stand still in 2018/19 it would require a revenue increase of £545 million (or 5.7%) to address the impact of 3% inflation (based in the Consumer Price Index) and 2.6% increase in demand. In supplementary written evidence, COSLA elaborated further that it in arriving at £545m-

The 3% inflation figure used was the CPI 12-month rate, which was for September and October (not including housing costs). We felt that this was an appropriate measure of inflation that local authorities will endure however recognising that Scottish Government use the GDP deflator at 1.56% for 2018/19 the calculation below [Table 2] reflects this.

The demand figure is based on a model we developed with the Improvement Service to forecast expenditure. It’s essentially made looking at what population groups use each service area and then used the population projections to see how demand will increase.1

SPICe calculate that in the Finance Circular and provisional allocations for local authorities “the total revenue budget is shown as falling by 0.2% in cash terms (£17.1m) and by 1.6% in real terms (-£137.3m).” This is calculated by using the GDP deflator, as per all SPICe calculations of real terms values for public spending. 2

In calculating its "cut of £153m for essential local government services", COSLA takes the resource commitments for Early Learning and Childcare expansion (£52.2m and £11m), Health and Social Care (£66m) and teachers' pay (£24m), which together total £153m. COSLA's rationale is that, as local government is required to fund these commitments, in their view, in reality "this is not a flat cash revenue settlement for local government." 3

COSLA explain that as these are new or additional services over and above those delivered by local authorities in previous years, they represent an additional burden on the core revenue grant. That is local authorities are being expected to do more without the corresponding additional £153 million in funding.

UNISON called for greater clarity regarding funding announcements as to whether the funding announced was to provide new investment in existing day to day services or is new funding for new priorities.4

The Cabinet Secretary confirmed that in its General Revenue Grant it had included funding for services such as health and social care integration, support for teachers’ pay and childcare as they are 'partnership priorities'. In identifying these figures “The sum has been allocated to that within the settlement reflects local authorities ask of the Scottish Government, as do the sums for support for teachers pay and expansion of early learning and childcare.” He stated that the difference between the Scottish Government revenue grant figures and COSLA’s view of revenue funding was down to interpretation but that -

that is real money—real cash—and it will sustain what local government has. I know that these are challenging times for public services and that local authorities are feeling pressures, but those are areas of negotiation, where the Scottish Government was asked to recognise the partnership approach and put that sum in.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Derek Mackay, contrib. 18, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051755

We welcome the steps taken by the Scottish Government to improve the transparency of the draft Budget figures for local government and its read across to the Finance Circular (see the later section on transparency). This has assisted the Committee to better understand the differing views of the Scottish Government and COSLA on the adequacy of the budget settlement for local government in 2018/19.

That said, much of debate during this year’s budget scrutiny stemmed largely from different approaches to funding commitments being taken by the Scottish Government and local government. Where the Scottish Government requires local government to deliver new services or an additional level of an existing service then we consider those requirements should be identified and fully funded.

We consider however that greater transparency would be delivered if in future the total General Revenue Grant budget line specifically identified funding commitments entered into by the Scottish Government and local government from those resources which councils can spend at their discretion. The Committee would welcome greater clarity on what is a partnership commitment and how that impacts on funding.

The Committee acknowledges the work undertaken by the Improvement Service, economists and statisticians to look at local government trend data to provide an estimate of future demand for their services. We seek clarification from the Scottish Government of the extent to which it utilises future demand forecasts to inform its calculation of the local government settlement.

Inflation

The Committee explored the differing approaches to calculating the impact of inflation adopted by COSLA (which used CPI) and by the Scottish Government (which used the GDP deflator). In its Factsheet on Inflation, SPICe explain that the Consumer Price Index (CPI) is the UK Government's preferred measure of household inflation and is used for the Bank of England’s target of 2% annual inflation. CPI is the UK’s version of the Harmonised Index of Consumer Prices (HICP), which is the EU’s standard measure of household inflation. CPI is to be used by the UK Government for the indexation of benefits, tax credits and public sector pensions.

The GDP (Gross Domestic Product) deflator is used to show inflation for all goods and services produced in the UK, including government services, investment goods and exports. It excludes the price of imports. The GDP deflator is used as a tool to show GDP in constant prices and due to its wide scope, it is suitable to deflate public expenditure. The GDP deflator is used to calculate real terms figures for both the UK and Scottish Governments' budgets.

In its supplementary written evidence dated 10 January 2018, the Scottish Government explained that "the Gross Domestic Product or GDP deflator is an implicit price deflator and is a measure of the level of prices of all new, domestically produced, final goods and services in an economy. Unlike the Consumer Price Index (CPI) or the Retail Price Index (RPI) it is not based on a fixed basket of goods and services, so therefore provides a more appropriate, broader, responsive measure of inflation for Government.The Government is in itself a producer and therefore it would not be appropriate to use either the consumer or retail indices." 1

In commenting on COSLA’s use of CPI the Scottish Government confirmed that it used the GDP deflator approved by HM Treasury as it more clearly reflects what is happening in Government rather than the outside world. In that regard the Scottish Government commented that -

it seems strange for local government to use a different number. As part of the process of clarification, we use the same number so that everything can be looked at in the same light.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Bill Stitt, contrib. 105, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051842

The Cabinet Secretary highlighted that the Scottish Fiscal Commission may, in the fullness of time, -

be able to provide more analysis on such matters. It builds up the forecast from Scottish economic circumstances, rather than using a top-down perspective of what might be coming from the UK level.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Derek Mackay, contrib. 108, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051845

We are not convinced that CPI is an appropriate measure of the inflationary pressures on local government especially given the widespread and longstanding use of the GDP deflator by the Scottish and UK Governments.

That said we seek clarification from the Scottish Government of how it assures itself that use of the GDP deflator to deflate budgets represents a robust measure of the inflationary pressures on local authorities given the diversity of services they deliver.

Local Government Pay

Alongside the Draft Budget 2018/19 the Scottish Government published its 2018/19 Public Sector Pay Policy. This includes a 3% pay rise for all earning less than £30,000; caps the pay bill at 2% for all those earning more than £30,000; and limits the maximum pay uplift for those earning over £80,000 to £1,600.

COSLA highlighted that it did not consider that the local government settlement included funding for any local government pay award. They contend that the Scottish Government pay policy sets an expectation for local government workers and that: “Local Government has a significant portion of working earning under £30k so a 3% increase will be a significant pressure.1

SPICe also highlight the challenges local authorities face in setting their pay policy estimating that, if local authorities were to match the Scottish Government's pay policy, this would cost around £150m in 2018-19. SPICe also observe that-

These are total costs and do not reflect the costs that would have been incurred in awarding a 1% increase. When compared with the costs of implementing a 1% pay award, the additional costs are around £90m i.e. the new pay policy would cost £90m over and above the costs of a 1% pay settlement. These estimates relate only to the costs of the pay policy and take no account of any additional costs relating to pay progression (whereby staff progress through set pay bands on an annual basis, regardless of the basic pay settlement). They also assume no change in the mix of staff and take no account of adjustments that employers might make in order to maintain pay differentials between staff.2

UNISON also highlighted to the Committee its concerns that the pay of local government workers had fallen by about 15% below inflation over the past eight years.

In setting public pay policy the Cabinet Secretary explained that he had recognised the cost of inflation on household budgets, and been mindful of its impact on local government. The Cabinet Secretary highlighted the pay policy as progressive including support for people on lower pay along with a no compulsory redundancies approach.

The Cabinet Secretary explained that there is a tripartite arrangement between the Scottish Government, local government and teachers. In relation to this year’s settlement “To be able to secure a satisfactory deal with the workforce, local government asked for more money and it got that.” This arrangement is different from the pay settlements for other council staff in which the Government does not have a direct say.

The Cabinet Secretary acknowledged that the Scottish Government's lifting of the pay cap creates a culture of expectation about what local authorities may be able to do, but they -

knew that there would be a degree of pressure on them to move on pay. What they do in negotiations with trade unions is a matter for them but, putting it in the context of councils making efficiency savings and having a better settlement than they expected, I think that they will be able to arrive at a fair settlement for their workforce. However, I do not set that.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Derek Mackay, contrib. 104, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051841

Local government pay policy is a matter for local authorities to decide. However, the outcome of the Scottish Government's Public Sector Pay Policy creates an expectation as to what local government workers might receive. The Scottish Government's pay policy states that it is to act as “a benchmark for all major public sector workforce groups across Scotland" albeit it recognises that it is not responsible the local government pay agreement.

Whilst we recognise the different responsibilities for the Scottish Government and local government in setting pay policy, we seek information from the Scottish Government about how its public sector pay policy aspirations are taken into account in its decision on the local government revenue budget.

The impact of protected funding commitments

In its report the Accounts Commission highlights that “the proportion of council funding directed towards national policies is increasing, a trend that will continue with Scotland's proposals for fairer funding for equity and excellence in education.”1

The Accounts Commission highlights that “this pattern of larger reductions to relatively smaller service areas has been recurrent in recent years and is something that has continued into 2017-18.2

COSLA set out in its submission its view that “58% of local authorities spending now being controlled through sanctions or stipulations” as a result of “over and above” Scottish Government policy initiatives. As a consequence, if COSLA's view is borne out, only 42% of local authorities’ core budget (such as economic development, employability, public protection and early interventions for tackling inequalities) has to absorb any funding shortfalls.3

For clarity, this 58% figure is far larger than the current amounts for specific revenue and capital grants provided to local authorities, as can be seen in Figure 1. What COSLA is referring to here includes much of the core revenue grant to local authorities, in addition to the small amounts ring-fenced for specific purposes.

This, COSLA argues, results in an even bigger cut on those services e.g. an 8% cut in overall local government resources results in a 20% cut in those services not protected by Scottish Government policy. As such COSLA called for greater trust between local government and the Scottish Government such that local authorities have greater flexibility to make local decisions about which services should be subject to efficiency savings.

Comhairle nan Eilean Siar echoed this view explaining that it was looking to make savings of 8% out of about 40% of the budget with unprotected areas such as leisure services, roads, non-teaching aspects of education and transport more likely to suffer.4

The Association of Local Authority Housing Officers (ALACHO) highlighted that one impact of protecting front line services was the reduction in senior and strategic management within the organisations leading to a “reduction in the ability to plan, and a spreading of the focus of many senior staff”.5

UNISON explained that because the local government revenue budget is not protected, a reduction in that budget-

can only impact on the services that are provided in local authorities, and the day-to-day services and the jobs and pay of our members are funded out of that revenue budget.

Local Government and Communities Committee 06 December 2017, Douglas Black (Unison), contrib. 118, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047204

The Accounts Commission highlighted the differential impact of the savings that have had to be made. It explained that whilst it was for local government and national government to decide their approach to protecting services, when it comes to delivering savings -

the consequences of that for other services have to be noted, and we think that it is part of councils’ best-value duty to make sure that they do that. We are pushing very hard to ensure that the impact of savings on other services is understood by councils, and we will say more on that in the report that we publish in the new year.

Local Government and Communities Committee 29 November 2017, Ronnie Hinds, contrib. 152, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11240&c=2045388

In considering the funding provided for protected policies the Cabinet Secretary explained that “it is not unreasonable for the Government to earmark and ring fence resources for something that is a priority”. One such example was the pupil equity fund of £120 million which the Cabinet Secretary highlighted as being spent directly on measures to tackle the attainment gap which has ensured hundreds more teachers are employed.8

Cabinet Secretary said that he had no plans to review previously ring-fenced money which had been subsumed into general revenue grant funding -

That said, local authorities, through COSLA, negotiate with me every year and raise areas in relation to which they want more flexibility or have different asks. We still have that engagement every year. However, I have no immediate plans to review historical elements of the settlement.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Derek Mackay, contrib. 77, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051814

As we heard, local authorities welcome additional funding directed at addressing national priorities. Protecting funding to a specific policy can however have a knock on effect on the ability of local authorities to deliver savings which must then come from the remaining unprotected budget, if not fully funded.

The Committee agrees that, as the Cabinet Secretary states “it is not unreasonable for the Government to earmark and ring fence resources for something that is a priority”. But the Committee also notes that when COSLA asserted that about “58% of local authorities spending now being controlled through sanctions or stipulations”, it is referring to large amounts of the core budget for local authorities being controlled in this way, and not just the small amounts that are ring-fenced as specific grants.

We therefore seek the Scottish Government’s response to COSLA’s assertion at paragraph 49 and to what extent it considers that this approach effectively ring-fences large amounts of the local government budget.

Transparency

In last year’s budget report we called for greater transparency in the draft budget and the allocations to local authorities in order to support scrutiny of exactly which funding local authorities can be expected to receive, from what sources and with what conditions. In response to the issues raised during the 2017-18 budget process, and by the Budget Process Review Group, the Scottish Government has made a number of changes to the way in which the local government information is presented in the Draft Budget 2018/19 document and the Local Government Finance Circular.

In addition to setting out the level 3 breakdown of the local government budget, the Draft Budget 2018/19 now contains additional tables which enable readers to track funding from the Budget to the Local Government Finance Circular and to see the full picture of funding outside the local government finance settlement.

We welcome this greater transparency in the local government budget figures in this year’s Draft Budget 2018/19 which has assisted our scrutiny of the draft budget and the accompanying Finance Circular.

Despite these improvements we heard of other areas where greater transparency would be welcomed. Local Authorities suggested a number of ways including:

providing more detailed information in finance circulars on the structure of Grant Aided Expenditure(Aberdeenshire Council)

using an agreed set of figures for year-on-year comparisons, for instance using Total Estimated Expenditure instead of combined revenue and general grant funding (North Ayrshire Council)

more clarity on the impact of policies on existing services (Comhairle nan Eilean Siar), and the Scottish Government explicitly setting out the funding for core services which is not ring fenced for specific services (Glasgow City Council).

The Accounts Commission confirmed it is planning a second report on Integrated Joint Boards (IJBs) in 2018, highlighting to us in oral evidence that the differing timings of budget cycles between Councils and Health Boards adds to the complexity. They explained that one of the things they will be interested in is clarity about whether all of that money than finds its way into the budgets of IJBs.1

The Accounts Commission highlighted that the funding formula for the 32 local authorities is based on a needs based formula which hasn't been looked at fundamentally for 10 years or so. They recommended that "The Scottish Government and COSLA should assure themselves that the funding formula remains fit for purpose in a changing landscape for local government. It is important that it is suited to improving outcomes for local communities and sensitive to priorities such as reducing inequality within and across council areas."2

The Improvement Service highlighted that individual Councils are also trying to improve the transparency of their budgets, in terms of presentation and what is in the budget as well as how consultation has informed those budgets. The Improvement Service is also collaborating and sharing at a national level work around the common sets of assumptions that are used across local government partners.3

The Cabinet Secretary confirmed that there were no plans to revisit or change the overall funding formula for local authorities. He explained that distribution of new funds or changed funds was done through partnership with local authorities through the distribution assessment group but that-

Sometimes, it is appropriate for funds to be specifically needs based; at other times, it might be proportionate and appropriate to determine shares through other mechanisms, such as population size.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, The Convener, contrib. 94, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051831

We note the calls for further transparency in the Draft Budget figures from local authorities and others, and would encourage the Scottish Government to consider these.

We also note comments from the Accounts Commission on the funding formula for local authorities. We recognise however that any reform to the formula will be a very difficult task.

Recently the Cabinet Secretary for Communities, Social Security and Equalities, together with the President of COSLA, launched the Local Governance Review on the future of local democracy in Scotland. We consider that the outcome of this work should provide an opportunity to revisit the extent to which the funding formula for local authorities adequately reflects their services, needs, and pressures.

We recognise that the creation of Integrated Joint Boards (IJBs) has complicated the picture of local authority funding and spending. We look forward to the Accounts Commission report on IJBs and in particular any clarification it may provide on how any specific IJB spending supports local government priorities (as compared with health service priorities).

Non Domestic Rates

Non-domestic rates (NDR) are collected by individual councils and pooled by the Scottish Government who then redistribute it to councils as part of the overall annual local government funding settlement. The Government guarantees the level of NDR and General Revenue Grant (GRG) to each local authority.

The Scottish Government sets out each year in the Draft Budget the amount to be redistributed to councils (the "distributable amount"). This is a policy decision. This amount is then redistributed to councils in proportion to their prior-year estimates of what they will raise. For example, Aberdeen City Council's estimate of their 2016-17 NDR income accounted for 7.7% of all councils' estimated contributions and they were allocated 7.7% of the 2017-18 distributable amount determined by the Scottish Government.1

This system is managed in the NDR account. Because of timing differences in terms of collection and redistribution, the NDR account is either in surplus i.e. more money was paid in by councils, than paid to councils; or in deficit i.e. more money was paid to councils than was paid in by councils.

The pool has been in deficit since 2013-14, and it has had a cumulative deficit since 2014-15. In February 2017 the Government stated its intention to bring the account into balance over time. The Draft Budget 2018/19 included, at Table 10.17, the Scottish Fiscal Commission estimates of Non Domestic Rates for 2018-22 and the Scottish Governments income forecasts for 2017-18.

In December 2017 The Auditor General for Scotland published a report entitled The 2016/17 audit of the Scottish Government's Non-Domestic Rating Account under section 22 of the Public Finance and Accountability (Scotland) Act 2000. It recommended that the Scottish Government:

Develop a strategic plan of how it plans to manage the NDR account balance in the future

Improve the information it publishes to make it easier to see how NDR are budgeted for and reflected in annual accounts

Publish details of how the distributable amount is calculated and set

Publish details of future distributions and how it expects the NDR account balance to change over time.1

In August 2017 the external review of Non Domestic Rates by Ken Barclay reported its recommendations, the majority of which were accepted by the Scottish Government including ending charity relief for independent schools. The Draft Budget 2018/19 includes confirmation that the Scottish Government will use the Consumer Price Index as the inflationary measure to uplift the annual non-domestic rates poundage and will set a poundage rate of 48.0 p for 2018/19. In addition the Small Business Bonus Scheme will continue and a growth accelerator will be created to provide for 12 months rates relief for certain properties such as new builds or improved or expanded properties.

The Cabinet Secretary explained that in relation to the growth accelerator he wasn't able to say that the business growth accelerator will result in a specific amount of economic growth but that “the evidence from business organisations was that it is difficult for businesses to invest in their property or premises without having a chance to raise some revenue” This approach, according to businesses, will act as a stimulant to the economy.

He also highlighted that the Small Business Bonus Scheme had been a lifeline to many small businesses and it ensures that “we have a competitive package of business rates relief”. The Scottish Government confirmed that it will be undertaking a review of this scheme “to ensure that we maximise the economic and social benefits of the scheme” with any findings addressed in time for the 2022 revaluation. 3

We endorse the Auditor General for Scotland recommendations for greater transparency of how the distributable amount of non-domestic rates is calculated by the Scottish Government and recommend that the Scottish Government implements those recommendations as set out above.

In relation to the Small Business Bonus Scheme and the new growth accelerator, we seek clarification from the Scottish Government of whether it will evaluate the effectiveness, economic impact, and value for money of these schemes and if so, what measures it will use to determine this.

Council Tax

Council Tax remains a significant source of income for local authorities. In 2017/18, it is expected to raise £2,539m (22%) of Total Estimated Expenditure.

In 2016/17 there were two kinds of change to Council Tax – firstly the Scottish Government increased the multiplier rates for Band E-H which was designed to make the tax more progressive (non-discretionary changes). This change is expected to provide £110m extra income to Local Authorities in 2017/18.

Secondly the Scottish Government lifted the Council Tax freeze enabling councils to raise their Council Tax charges by up to 3% should they decide they so wish (referred to as discretionary changes). Twenty-four councils chose to increase Council Tax, with 21 approving the maximum 3% permitted. This was estimated by the Scottish Government to provide £70m income in 2017/18, however only 21 councils chose to implement the full 3% raise, so SPICe estimates of income fall at slightly below £53m.

The Accounts Commission explained that the removal of the Council Tax freeze restores a degree of local flexibility but that it remains a relatively small part of councils overall budget “we compare it to the cost of a 1% pay award for staff”.

In its report “The social impact of the 2017-18 local government budget”, SPICe highlight the overall impact on budgets of these changes:

Increases in non-discretionary multiplier ratios for properties in Bands E-H were more important for raising revenue from Council Tax than the relaxation of the Council Tax freeze;

While Council Tax Revenue makes up only a small part of councils’ total revenue, it makes up a bigger proportion of the income of less deprived authorities. This means that the least deprived authorities saw greater increases in income from Council Tax than more deprived authorities as a result of these changes – mainly because they benefited much more from the non-discretionary changes;

This would suggest that the reforms to Council Tax to date have benefited better off councils more than more deprived councils.1

The reasons for councils choosing to raise Council tax (or not) up to the discretionary 3% level are, as the Accounts Commission explained, “many and varied” including service pressures, and political considerations but that-

I would not expect the councils that were in most difficulty to have been the ones that chose not to raise their council tax, but we have not tried to make that correlation to find out whether it was the case.

Local Government and Communities Committee 29 November 2017, Ronnie Hinds, contrib. 128, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11240&c=2045364

Renfrewshire Council explained that it chosen not to raise Council Tax for Band D households as those residents were already “hard pressed due to other financial demands” thus the Council had foregone £2 million in income. Comhairle nan Eilean Siar explained that in discussing with its communities how the budget should be spent, there had been questions about why Council Tax wasn’t being raised. It was therefore an easier decision for the council to raise it by 3% albeit its contribution to the overall budget total was relatively minor (anticipated to be £500,000 from both elements of changes to Council Tax in 2016/17).3

We heard however that there are huge disparities in Council Tax across Scotland. Some councils, prior to the freeze had kept Council Tax level low, meaning they were at a huge disadvantage now given the 3% cap on discretionary Council Tax. The Improvement Service, COSLA and a number of local authorities called for this cap to be lifted to provide greater flexibility to local authorities. COSLA argued that providing local authorities with greater taxation powers or working outwith the 3% cap would mean that local authorities would make fewer demands on the Scottish Government for funding.

The Draft Budget 2018/19 confirms that future increases in Council Tax will be capped at 3% which “will preserve the financial accountability of local government, whilst potentially generating around £77 million in 2018/19”. The Cabinet Secretary confirmed that the funding that is raised by the uplift in Council Tax for the top four bands would be retained by local authorities. That said the Scottish Government confirmed that the distribution formula would revert to the previous equalisation process in 2018/19 (compared with the approach in 2017/18 when Council Tax income was retained by the Council within which it was raised). 4

We recognise that Council Tax income makes a significant and important contribution towards funding services. In that regard reverting the distribution mechanism in 2018/19 to equalisation for the income raised through the uplift will better support those councils with higher levels of deprivation which benefited less under the previous distribution mechanism. The Committee seeks further information on the extent to which this will benefit councils with higher levels of deprivation. We will return to this in future to scrutinise the extent of equalisation that has taken place.

Balancing the Books

In its pre-budget evidence the Committee heard of the challenges facing local authorities as they seek to balance their books. Those challenges include inflation, ever-increasing demand for services and restrictions on local taxation which are exacerbated by one year budgeting.

The exact impact of changes to income, expenditure, inflation, pay rises and other pressures will only become clear as the year progresses. This uncertainty means that local authorities have to plan their budgets to meet a range of different scenarios. The Committee therefore explored how councils are planning to meet these challenges in 2018/19.

Fees and Charges

Increasing fees and charges for accessing local authority services is one way that local authorities can offset budgetary pressures. In its report entitled Local Government Finance: Fees and Charges 2011-12 to 2015-16, SPICe analysed the high-level trends during those years and found that:

Between 2010-11 and 2015-16, income for Scottish local government as a whole from fees and charges for services had increased by almost 13%, with the most significant increases in charging being in Central Services, Planning and Development Services, Education and Roads and Transport;

Excluding Housing Revenue Account income, local authorities received customer and client receipts of £1.26bn - around 8% of councils’ total income in 2015-16. Fees and charges for General Fund services made up around 40% of these customer and client receipts in 2015-16 (£544.2m) i.e. around 3.5% of councils' total income.

Since 2011-12 the income that councils have raised from fees and charges to service users has reduced from £569.7m to £544.2m (4.5%, real terms).

The largest area of income from fees and charges for General Fund services comes from Social Work (44%), with Roads (12%) and Education (11%) representing the next largest areas of income. Combined, these represented around two thirds of fees and charges income in 2015-16.

SPICe note that it is challenging to identify the income generated from fees and charges due to the format of councils' accounts, variations in how income is accounted for and changes to accounting practices in 2016/17.

The Accounts Commission also commented on these data quality challenges suggesting that “the Scottish Government is looking to address that issue and to clean the data up for 2016-17.”1 The SPICe briefing and the Accounts Commission highlight the inconsistencies in fee and charging approaches adopted by local authorities. For example North Ayrshire Council, Aberdeen City Council and Angus Council raise more than 80% of the arts and culture budget through charging and fees whilst in East Renfrewshire Council it is none (which may indicate services have been transferred to an Arms-Length External Organisation (ALEO)). The Health and Social Care Alliance suggested that the increased use of fees and charges is a “tax on disabled people” and suggest that, in relation to the inconsistencies in charging across the country, guidance on fees and charges should be placed on a statutory footing.2

The Accounts Commission noted that although there has been a downward trend since 2011-12 “what we are beginning to see, given other budget pressures in other areas, is councils looking to reverse that downward trend”.3

Renfrewshire Council and Comhairle nan Eilean Siar explained the conundrum of increasing fees and charges which may then actually deter use and consequently reduce income. They, along with others such as UNISON, did not see increasing fees and charges as the way to address funding shortfalls in any significant way.

Comhairle nan Eilean Siar explained that as a low wage economy increasing leisure facility membership scheme fees could not only lose people from it but also then lose the wider health benefits. Taking a different approach 5 years ago they introduced a standard membership scheme which was very successful in relation both take-up and participation. Comhairle nan Eilean Siar had however increased charges in relation to the business sector by increasing pier and harbour charges but they recognised that business had limited capacity to absorb increases.4

The majority of local authority submissions detailed use of the Equality Impact Assessment (EQIA) approach to assess the impact of changes to fees and charges on different social demographics. Some councils provide these to Councillors to inform their budget decisions. Both Renfrewshire Council and Comhairle nan Eilean Siar explained that by using Equality Impact Assessments on budget choices and decisions, they had not had to subsequently adjust their proposals as a result of an unexpected negative impact on a specific group.

A number of councils told us how they planned increases to fees and charges acknowledging the impact on vulnerable and low income groups. Approaches adopted include concessionary and rebate schemes (Aberdeenshire Council), retaining income in the services affected and considering affordability (South Lanarkshire) and consulting upon any increases above inflation (East Ayrshire Council).

The Cabinet Secretary confirmed that individual charging regimes are a matter for local authorities whilst recognising that -

it is another fiscal lever that local authorities have, although it is not particularly substantial. Local authorities have council tax, but their main funding source is the revenue support grant. We would not normally express a view on individual charges made by individual local authorities; it is entirely up to them.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Derek Mackay, contrib. 53, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051790

We agree with witnesses that there is a difficult balance to be struck in relation to increasing fees and charges – between raising income to address budget challenges without deterring usage and consequently losing income. The impact on other policies such as reducing inequalities also has to be considered.

We seek confirmation from the Scottish Government on its work to address the data quality issues highlighted by the Accounts Commission and others.

We also welcome further information from the Improvement Service on how it is supporting local authorities to better understand the variations in charging and fee policies between local authorities.

Service Redesign

The Accounts Commission reported that some of the demand pressures such as those associated with an ageing population and placements for looked after children are often not easy to forecast and budget for. They highlight that councils revenue funding from the Scottish Government has fallen in real terms by 7.6% since 2010/11 which presents councils with a challenge in delivering services and most required to identify savings.1

The Improvement Service explained that the work being done on the local government benchmarking framework was helping to understand the difference between services across family groups of similar councils. This included thematic workshops around looked after children and economic development as well a digital and internal transformation work.

The Improvement Service however highlighted that “There is an upfront cost to managing services as efficiently as we can today while thinking about new approaches”. They explained that leadership, capacity, people, time and investment are all required in order to identify investments in service redesign that will provide a return as well as how to pay back those investments. They and others highlighted the impact of the significant flattening of council structures which has caused issues with sustainability and resilience particularly in protected and corporate services.2

A number of councils and COSLA also suggested that service redesign is now becoming increasingly challenging. Comhairle nan Eilean Siar explained that, of the £35m it had to save in 2016/17 to balance the budget, approximately £19m had been saved through doing things more efficiently without impacting on the outcomes they were trying to achieve. However, as with very remote and rural islands, reducing services becomes more and more difficult -

When we provide a minimum service at an optimum level, the only changes that we can make are to withdraw it or to shrink it.

Local Government and Communities Committee 06 December 2017, Robert Emmott, contrib. 175, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047261

The Scottish Council on Deafness argued that service redesign was not going “far enough or at any reasonable pace to effectively improve access, inclusion and integration of over a million deaf people”.4

Comhairle nan Eilean Siar highlighted that there are opportunities for island communities to look at the single island authority given shared collaboration across councils is not an option-

The way to have the best public sector economy is through an area or place-based collaboration around the islands. That is a potential opportunity not only to make efficiencies, but to ensure that the services are best designed for the citizens.

Local Government and Communities Committee 06 December 2017, Robert Emmott, contrib. 245, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047331

Renfrewshire Council suggested a similar place based approach whereby community planning partners arrive at a consolidated view on what the total resources are for an area and how they can be used to best address the issues local communities have.

It is about having a wider, much more community planning-based approach, rather than having individual public sector organisations doing their own thing and planning in isolation, which is what we are trying to overcome.

Local Government and Communities Committee 06 December 2017, Alastair MacArthur, contrib. 250, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047336

The Improvement Service also advocated a place based discussion through community planning but recognised that it would not be the whole answer to service redesign. COSLA are looking for a more permissive environment to allow public services to work together to unlock those opportunities.

The Cabinet Secretary highlighted the role of single outcome agreements in providing for partnership working with local authorities in relation to the outcomes that should be achieved by local authority services. In addition he explained that -

Broadly speaking, there is a single outcome agreement between the Government and all community planning partners, but the audit agencies look at how local authorities are performing and how they are meeting their statutory indicators. At national level, we have Scotland performs, which looks at overall national performance, so there is a range of ways that the performance and delivery of councils is monitored.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Derek Mackay, contrib. 55, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051792

A number of witnesses also told us that service redesign is becoming increasingly difficult but that opportunities may arise through a range of public services working together through a place based approach or in the extreme, a single island authority.

We note that the Scottish Government and COSLA are undertaking a review of Local Governance, and seek confirmation of whether options such as supporting greater collaboration between public sector bodies and single island authorities will be considered.

General Fund Reserve Use

General Fund Reserves are one mechanism that councils can use to support service redesign by meeting the up-front costs of managing services whilst implementing new approaches. However the Accounts Commission concluded in its report that councils are showing signs of increasing financial stress with 20 councils drawing on their useable revenue and capital reserves in 2016/17 (up from 8 in 2015/16) with the vast majority not using their reserves as planned.1 They highlight the range of reasons why this may occur, some of which are planned, whilst some may be unplanned such as poor budget setting and/or budgetary control e.g. failing to deliver savings due to underestimating the time require for change programmes to deliver benefits. Management commentaries that councils are obliged to produce should explain such variation from the original plans but as the Accounts Commission found there were deficiencies in some of those reports.2

Whilst it was recognised in the submissions that we received that reserves should be used for longer term initiatives such as transformation strategies, there were examples of reserve funds being used to alleviate short term pressures, including countering the reduction in funding settlement from the Scottish Government. COSLA explained that -

Councils have used reserves to smooth budgets and invest in transformation programmes in recognition of where public finances have been going. We try to highlight that in our submission. Local government has done a lot and managed with the finances as they are, but the sustainability of that approach is very much diminished.

Local Government and Communities Committee 22 November 2017, Vicki Bibby, contrib. 177, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11222&c=2042447

The Accounts Commission reported using General Fund Reserves at the current rate is not an option for some councils - Clackmannanshire, Moray and North Ayrshire councils would run out of such reserves within 2-3 years if they continued to use them at the level planned for 2017/18.1

We are concerned at the increase in unplanned use of General Fund Reserves by councils and the evidence we received that reserves are being used to address short term funding pressures. Using reserves in this way means those funds cannot then be used to transform services to deliver longer term sustainable savings alongside better outcomes.

Draft Housing Budget 2018/19

The total housing budget for 2018-19 is £891.6m, an increase (in cash terms) of 21%. There are also resources for Glasgow and Edinburgh councils to fund housing supply through the Transfer of Management of Development Funding (TMDF) arrangements. This funding, of £92.6m in 2018-19, gives a total budget of £984.2m.

More Homes Scotland is the Scottish Government's overarching approach to support the increase in the supply of homes across all tenures. As part of the More Homes Scotland approach, the Scottish Government plans to spend at least £3bn to deliver at least 50,000 affordable homes, by March 2021. The More Homes budget accounts for the majority (80%) of the housing budget. In 2018-19, the More Homes budget is £722.5m, an increase of 24% from 2017-18.

The Scottish Government has already announced that the Resource Planning Assumptions for 2018-19 will be £532.7m. This implies that around £282m will be available for centrally managed programmes. The centrally managed programmes include the Help to Buy (Scotland)(Affordable) Homes scheme, the open market shared equity scheme and the Rural and Islands Housing Fund.

For the More Homes budget line, capital funding for the delivery of the 50,000 affordable housing commitment has increased substantially (by 40%). The budget for bringing empty homes back into use has also doubled.

There has been a slight decline, of 1.4% to £221.3m in the budget for financial transactions. Financial transactions are funding for equity and loans programmes e.g. Help to Buy, Open Market Shared Equity Scheme and infrastructure. The Minister confirmed that more information on how this will be spent will be available at the start of 2018 although the Cabinet Secretary confirmed that -

Financial transactions may assist where there have been help-to-buy schemes and, potentially, I am proposing to use some of the money to capitalise the Scottish national investment bank and the building Scotland fund. There may be other ways in which we can support housing growth by using financial transactions.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Derek Mackay, contrib. 121, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051858

The Scottish Government gives each local authority a Resource Planning Assumption (RPA) which they use to plan for the provision of affordable housing in their areas. That affordable housing is mainly provided by local authorities and Registered Social landlords (RSLs).

| YEAR | £M |

|---|---|

| 2017-18 | 422.60 |

| 2018-19 | 532.7 |

| 2019-20 | 591.6 |

| 2020-21 | 630.2 |

Source: Scottish Government news release 13 June 2017 £1.75bn boost for investment in affordable housing

2017-18: Scottish Government https://beta.gov.scot/publications/resource-planning-assumptions-to-councils-2017-2018/

Local authorities develop Strategic Housing Investment Plans (SHIPs) which set out their strategic investment priorities for affordable housing over a 5 year period and which will achieve the outcomes set for the local housing strategy. SHIPs are key documents for identifying strategic housing projects to assist with the achievement of the Scottish Government’ 50,000 affordable home target.

The Accounts Commission highlighted that changes in population and demographics have implications for housing demand. The population of Scotland is projected to rise from 5.40 million in 2016 to 5.70 million by 2039, with the number of people over 65 increasing by 53%. The number of households is also increasing with a significant growth in one person households.3

The Affordable Housing Supply Programme (AHSP)

On 20 December the Scottish Government confirmed that in 2018/19, more than £756m will be made available through the Affordable Housing Supply Programme – 28% higher than the previous year. 1The majority of this funding (£532.7m) is for locally developed programmes through local authority Resource Planning Assumptions (RPAs). The remainder is made up of a central programme element.

We heard from a range of stakeholders that the three year RPAs are very much welcomed, with the 50,000 affordable homes target having been based on solid evidence from a range of organisations. In addition by providing three years of figures, local authorities and housing associations can plan for the long term and commit to the programme. That said, ALACHO observed that-

although we have three years’ worth of resource planning assumptions, councils have just submitted a five-year strategic housing investment plan. The last two years of the submitted plan are speculative in terms of the resources available. We have resources for only three years.

We are already planning for years 4, 5 and 6, but we do not know what those resources will be. In our submission, we said that we need to move to a much longer timeframe for planning new affordable housing and housing supply.

Local Government and Communities Committee 06 December 2017, Tony Cain, contrib. 11, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047097

ALACHO explained that whilst the commitment of £3 billion over five years is “huge and very welcome” there now needs to be greater clarity about “what the overall objective intervention in the housing market is intended to achieve or what a properly effective housing system should be.” 3 In oral evidence ALACHO elaborated further that whilst SHIPs will help identify the housing needs for each area that are priorities for the 50,000 homes target, an understanding was needed of wider issues. Such issues include the impact of the unsustainability of current levels of owner occupation on affordable alternatives in communities or the currently relatively narrow range of locations of social housing and what that means for areas without social housing. In that regard ALACHO said -

A national conversation about what a properly functioning housing system looks like is needed.

Local Government and Communities Committee 06 December 2017, Tony Cain, contrib. 17, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047103

The Minister for Local Government and Housing (the Minister) explained that the Scottish Government cannot make commitments beyond the end of this session of Parliament, “Nevertheless I am willing to talk to all parties about all issues, as members will know.”5

We welcome the overall increased funding for housing supply in the Draft Budget 2018/19. As we did in our budget report 2017/18 we also welcome the three year RPAs for the affordable housing supply programme as providing investors with confidence and supporting longer term planning by Councils and RSLs.

We seek confirmation from the Scottish Government of how it will monitor and, if necessary, address any negative impacts on affordable housing supply as the final year of RPAs approaches. In addition, given councils have provided SHIPs which cover the next five years, what steps will the Scottish Government take to ensure that momentum in housing investment is maintained beyond the end of the current RPAs in 2020/2021.

As we understand it the More Homes Budget for 2018/19 will be £814.70m (which includes £92.2m for Transfer of Management of Development Funding (TMDF)). The Scottish Government has confirmed that the AHSP is £756m. We therefore seek clarification of which housing programmes the remaining £58.7m will be used to support (broken down by programme and funding level). We also look forward to receiving further information from the Cabinet Secretary on how the Building Scotland Fund will promote housing supply.

Housing for particular groups or areas

SHIPs are a key mechanism to identify strategic housing projects to assist in delivering the 50,000 affordable homes target. Equality Impact Assessments of SHIPs, along with housing needs and demands analysis, and a range of other information is used to help determine the local housing strategy. The Committee explored how SHIPs help support the delivery of housing for particular groups of more vulnerable people such as survivors of domestic violence, young people or older people. In our work on SHIPs, we learned that some councils have undertaken more local housing needs studies or commissioned specific pieces of research which then inform their SHIP e.g. Scottish Borders Council commissioned research which led to plans to work with two RSL delivery partners to develop new build extra care housing developments for older people in key settlements. 1

We heard about the different groups of people for whom accessing social housing remains a particular challenge including young people who are not going to university or college but who cannot or don't want to live at home. In relation to survivors of domestic abuse ALACHO observed that the housing sector is alive to their needs and-

the extent to which our response to domestic abuse is adequate, sufficient and as sophisticated as it should be and on whether we need to move to a different approach on a range of issues. That conversation is starting.

Local Government and Communities Committee 06 December 2017, Tony Cain, contrib. 36, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047122

SFHA raised the issue of the provision of homes for older people and for people with particular needs. SFHA referenced the work of the Housing Subsidy Review Group which had recommended a ring-fenced fund to support the supply of new build housing for those groups. 3SFHA explained that the Scottish Government took the approach, however, that flexibility would be given when housing associations or local authorities applied for funding.

SFHA questioned whether sufficient housing is being developed in remote areas highlighting “Recent research by the Rural Housing Scotland found that rural Scotland was not getting its fair share of affordable housing investment and that the problem was particularly acute in remote areas – although particular funds have been set up for rural and island communities to help address this.”4

ALACHO questioned the extent to which new social housing supply (and other investment to support increased economic activity) in rural and island communities is properly balanced and sufficient to meet the Scottish Government's ambition of “Repopulating and empowering Scotland’s rural, coastal and island communities.” This was particularly given that, to qualify for investment, a housing need required to be demonstrated. ALACHO argued that this is challenging if that 'need' is the ambition to grow the population in a remote and rural location.5

Comhairle nan Eilean Siar very much welcomed the allocation of resources for housing. They considered it is “essential that housing funding is permitted to be used flexibly to prevent the significantly higher cost of building houses in island locations acting as a barrier to development, and consequently population retention.” In oral evidence they explained that it can take longer to deliver a smaller number of houses in remote and rural locations and other mechanisms such as bringing empty homes into use again become important. Comhairle nan Eilean Siar doubled the council tax on empty homes to try and bring more empty homes into use but recognised that this approach remains a challenge for those properties where the person is in care. 6

We heard that SFHA and Shelter Scotland have funded research that looks at what is being proposed in the SHIPs that is then being delivered across Scotland. In addition to progress towards the 50,000 affordable homes target this research will explore specific provisions such as for rural areas or particular needs.

The Minister highlighted the £25m rural housing fund and the £5m island housing fund as recognising the challenges faced by rural housing. That said, in relation to the affordable housing programme “we recognise that there need to be flexibilities”. Similarly in relation to its housing for disabled people “A fairer Scotland for Disabled People – Our Delivery Plan to 2021” the Minister confirmed that “we will be flexible in our approach to housing delivery”.

In relation to the affordable housing programme the Minister confirmed that 94% of the houses that are being delivered are classed as housing for varying needs – that is housing that can be readily adapted. In addition building standards staff will be looking at their role in “dealing with housing for varying needs in the private sector” 7

We welcome the Minister’s reassurance that a flexible approach will be taken to funding for affordable housing for those people with particular needs. We seek clarification of how the Minister seeks to reassure himself that this approach being delivered consistently and fairly across Scotland. The work being undertaken by SFHA and Shelter Scotland on SHIPs may assist in assessing this.

We note the comments of witnesses that rural housing may face particular challenges especially in demonstrating a need when the objective is to more generally ‘grow the population’. Whilst we welcome the rural housing and island housing fund, we request further information on how the More Homes approach recognises this aspect of housing need.

Adaptations

The Accounts Commission reported that an ageing population means there are increasing number of pensioners living alone. This places requirements for adaptations to allow people to stay independently at home. A large numbers of dwellings have already been adapted; however, there is a constant need with differing requirements. Councils completed a total of 15,316 medical adaptations in 2016/17. 1

ALACHO explained that there are three main funding streams for adaptations, two (the Housing Revenue Account and General Fund Money) were held by local government which the Scottish Government then decided to transfer to the Integrated Joint Boardsi. The third funding stream (for housing association tenants) is retained by the Scottish Government. ALACHO raised a concern that with the transfer of council adaptations budgets to the Integrated Joint Boards -

That leaves us with an inconsistent approach to directing and managing funds and a lack of clarity in terms of not only leadership but the Scottish Government’s purpose.

Local Government and Communities Committee 06 December 2017, Tony Cain, contrib. 82, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11251&c=2047168

The evidence the Committee received from SFHA and ALACHO expressed some concerns about the funding of adaptations, particularly for housing associations. Housing associations use the Scottish Government grant for adaptations. The amount dedicated to this has stayed static for a number of years (around £10m) and the draft Budget 2018/19 confirms that this fund has remained at £10m.

The SFHA explained that housing associations fund more expensive adaptations through an annual grant "but that sometimes means that there is not enough funding to do all the adaptions that might be required.”3

Both witnesses also noted that some of the recommendations of the Adaptations Working Group, which reported in November 2012, had been taken forward as pilots but progress had been slow. ALACHO highlighted that over the past 5 years the way adaptations are delivered has not moved on and is “now pretty much the only area of housing association performance where local authorities are performing better.” 2 They recognised that some discussions have begun about how to improve delivery of adaptations with the Improvement Service and the i-hub, but given the demands of an ageing population, they questioned why this budget hadn’t increased in over 5 years.

The Minister confirmed that he is considering the recommendations of the Adaptations Working Group and that he will be meeting with officials in the new year to-

see how we can ensure that they are acted on. That will include working with senior staff in health and social care partnerships on the preventative benefits of investing in a well-functioning and well-resourced adaptations service. Integration joint boards must recognise their responsibilities. Many are doing well in that regard, but others are not doing so well. Nevertheless, we are committed to implementing the recommendations of the adaptations working group ...

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Kevin Stewart, contrib. 128, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051865

People should have access to a safe and secure home which meets their needs. A properly funded, streamlined and effective adaptations programme is an important part of enabling people to remain in their homes for longer as well as enabling people to more quickly return home from hospital thus reducing delayed discharge.

We note that a key recommendation of the Report of the Adaptations Working Group is that there should be a strategy for housing adaptations, which is ‘tenure neutral’ with a single funding source. We seek confirmation from the Minister of when and how he proposes to deliver this recommendation. More generally we would seek an update from the Minister on the timescales and approach to implementing the recommendations in this report.

We also request clarification of the evidence base upon which the Scottish Government's decided to maintain its own funding programme at £10 million per annum over the past few years, particularly as we heard of increasing levels of demand for this funding. We look forward to the Minister’s response on the level of additional funding provided by IJBs for adaptations.

Grant Subsidy Benchmarks

The Scottish Government sets grant subsidy benchmarks with which social landlords are expected to develop new housing. There are lower subsidy benchmarks for councils compared to those for Registered Social Landlords (RSLs).

Three local authority respondents (Aberdeenshire, North Ayrshire and Renfrewshire) made specific reference to the subsidy benchmarks. North Ayrshire Council urged the Scottish Government to increase local authority subsidy rates, at least by interim construction output price index (OPI) rates. They said: “This would allow subsidy rates keep pace with construction costs, and would help avoid the widening funding gap that local authorities and tenants require to fill in order to fully realise our collective development ambitions.” 1

Renfrewshire Council also indicated that an increase of local authority subsidy rates to match that of RSLs, “could have a significant impact on the level of new build housing councils can deliver.”2

Aberdeenshire Council said that the national grant benchmark levels are often insufficient to allow the scale of affordable housing development to come forward that is required to contribute towards the national target, particularly on small brownfield sites. They said that a, “grant benchmark level which reflects the costs of the local housing market would help to increase levels of new affordable supply.”3

ALACHO commented that whilst it had concerns about grant levels in relation to particular needs housing the subsidy levels were not a big concern for it this year. It would likely be an issue of greater focus when the general issue of grant rates is reopened in the run-up to the next programme.4

COSLA explained that “The complex argument used to justify the £13k differential [between Council and RSLs subsidy levels] includes the different borrowing mechanisms available to RSLs, council land-ownership and councils’ increased ability to provide associated utilities and infrastructure. COSLA disputes this and has continued concerns around the difference…”5

The Minister confirmed that he did not intend to review the subsidy levels for new build social housing and renegotiating them again would divert focus away from delivering housing. That said, he explained that his approach is to be flexible -

We have already gone over such flexibilities, but they include some higher rates for island and very rural communities for wheelchair-accessible housing and housing with many more bedrooms than the average where need shows that that is necessary. Instead of opening up a can of worms and having a rammy about what the new rates should be, I would rather be flexible and have the constant discussion.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Kevin Stewart, contrib. 148, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051885

We welcome the flexible approach the Minister has committed to in relation to subsidy levels for councils which may face challenges delivering new build houses such as in rural areas or for people with additional needs.

We note the factors which underpin the decision to provide differing subsidy levels for councils as compared with RSLs however we would welcome clarification of how the Minister reassures himself that these differing levels are not unduly limiting councils ability to provide new build social housing.

Energy efficiency

The Fuel poverty/Energy efficiency budget for 2018-19 is £114.3m. This represents no substantial change from 2017-18. This budget funds the Home Energy Efficiency Programmes for Scotland (HEEPs) including grants to local authorities to deliver Area-Based Schemes and support to eligible households through the Warmer Homes Scotland scheme. The Scottish Government is currently in the process of preparing for the launch of Scotland’s Energy Efficiency Programme in 2018.

Responding to questions about whether the Scottish Government’s £0.5 billion pounds investment in energy efficiency over four years will be delivered, the Minster confirmed that the Scottish Government remained committed to that spend-

we will lay out more detail on all of this when we produce Scotland’s energy efficiency programme route map and as we move forward with the warm homes bill, which will be introduced this year.

We are on track to spend that £0.5 billion pounds, and, by the end of this parliamentary session, we will have spent £1 billion on energy efficiency since 2009.

Local Government and Communities Committee 20 December 2017 [Draft] Business until 11:20, Kevin Stewart, contrib. 143, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11279&c=2051880

We note the work ongoing on energy efficiency but request clarification from the Minister of the profile of budgets for each of the four years that the £0.5bn announced for energy efficiency and fuel poverty is due to run over (from 2017/18 to 2020/2021).

Future Challenges

In our budget report last year we commented on long term planning and the desire for local authorities to receive multiyear funding in order to undertake effective financial planning. A number of local authorities such as South Lanarkshire Council called for multi-year funding again this year.

The Accounts Commission recognised the difficulties for councils in three-year forward planning especially when there is a one-year financial settlement for the largest part of their funding. In their report they note that “currently only about half of councils routinely update their three-year forecasts as part of their budget-setting process".1

COSLA also highlighted the importance of multiyear budgeting, in the context of the 10-20 year funding commitments given for City Region Deals, explaining that longer term planning would be ideal for supporting a longer term vision for services such as social care and the delivery of childcare. Longer term funding such as the pupil equity funding are good examples of multi-year funding -

but our local government settlements go from year to year, and if we are looking at longer-term outcomes and targeting funding, which is absolutely essential in relation to the most vulnerable people in our communities, we have to look at a longer-term approach.

Local Government and Communities Committee 22 November 2017, Councillor Macgregor, contrib. 166, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11222&c=2042436

In that regard they and others such as Renfrewshire Council argued that longer term financial forecasting, which local authorities accept needs to be better, is more difficult to do with one-year budgeting.

COSLA supported the suggestion of a fiscal framework with rules about the impact of spending -

obviously, we believe that we are the best people to determine how to do what we do at the local level, but that has to be done within a larger framework. I completely understand that, which is why I am saying that we have to work with the Scottish Government and the UK Government. Autonomy is great, but it has to be under something wider. I am not entirely sure that local government has been given the credence that it deserves at times, either. We feel like the poor cousin, and perhaps we need to bolster our structures. As you say, a fiscal framework would certainly assist with that.

Local Government and Communities Committee 22 November 2017, Councillor Macgregor, contrib. 160, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11222&c=2042430

The Accounts Commission highlighted the impact of levels of net debt on future financial planning with levels increasing by £836 million in 2016/17. They explained that on average councils are spending almost 10% of their revenue budgets servicing this debt. This represents a reduction on the figure for the previous year. The Accounts Commission explained that whilst a not insubstantial figure, councils have pretty good treasury management strategies including the amount they borrow. 1

UNISON also highlighted the potential of longer–term proposals such as reform of local taxation -

We firmly believe that new local taxation that introduced a local property charge with proper re-evaluation of bandings and so on would place local authorities in a much more stable position.