Scotland's exports 2018

This briefing provides analysis of the Export Statistics Scotland 2018 release from the Scottish Government, providing a breakdown of exports by sector and location.

Executive Summary

This briefing analyses the Export Statistics Scotland 2018 1release from the Scottish Government, providing a breakdown of exports by sector and location.

The key points from this year's statistics:

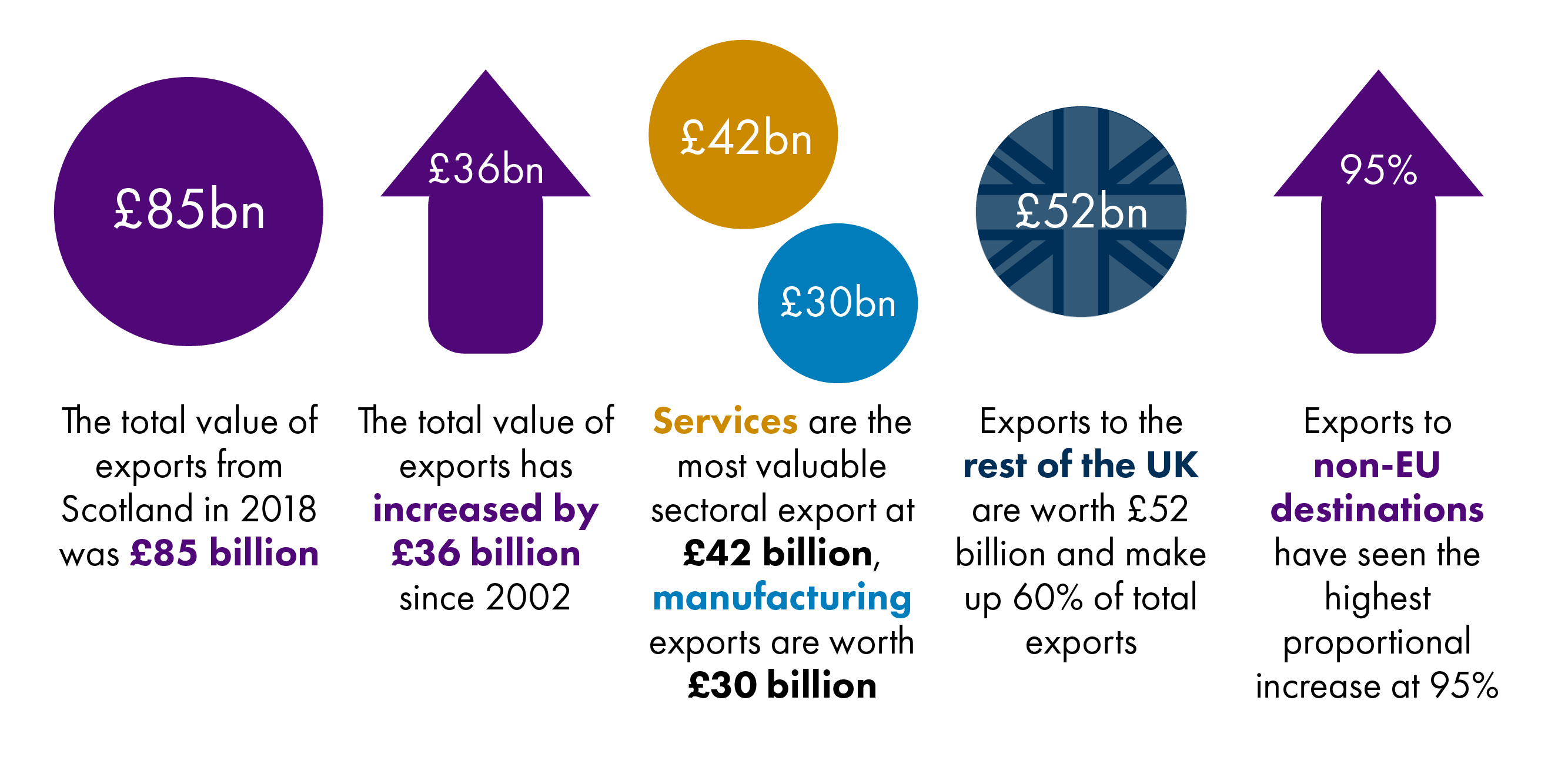

The total value of exports from Scotland were worth £85 billion in 2018.

This is an increase of £36 billion, or 73%, since 2002.

Services are the most valuable sectoral export, at £42 billion, with manufacturing worth £30 billion.

Exports to the rest of the UK are worth £52 billion, and make up 60% of total exports.

Exports to non-EU destinations have seen the highest proportional increase, at +95%.

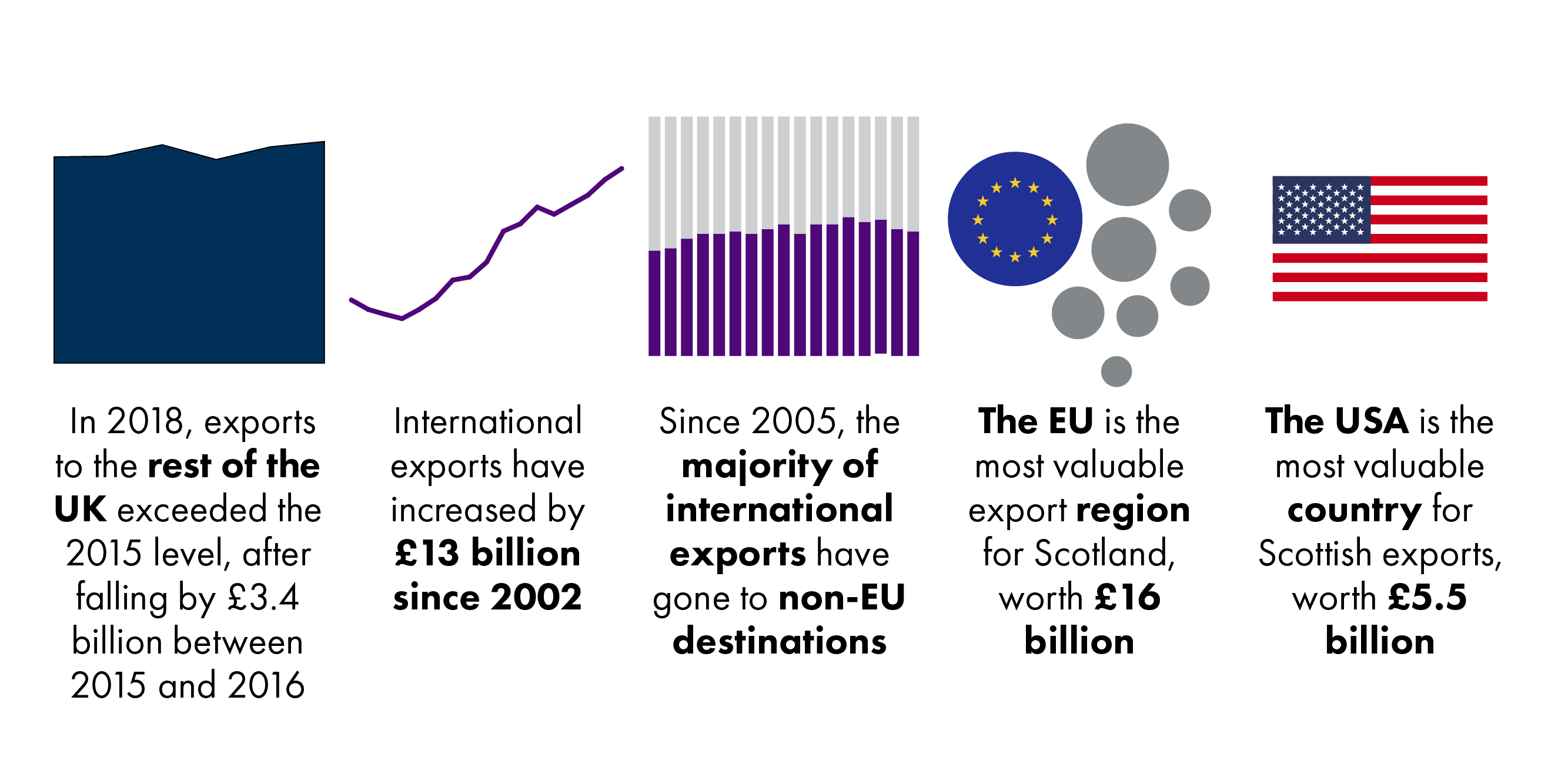

In 2018, exports to the rest of the UK exceeded the 2015 levels, after falling by £3.4 billion between 2015 and 2016.

International exports have increased by £13 billion since 2002.

Since 2005, the majority of international exports have gone to non-EU destinations.

The EU is the most valuable export region for Scottish, at £16 billion.

The USA is the most valuable country for Scottish exports, at £5.5 billion.

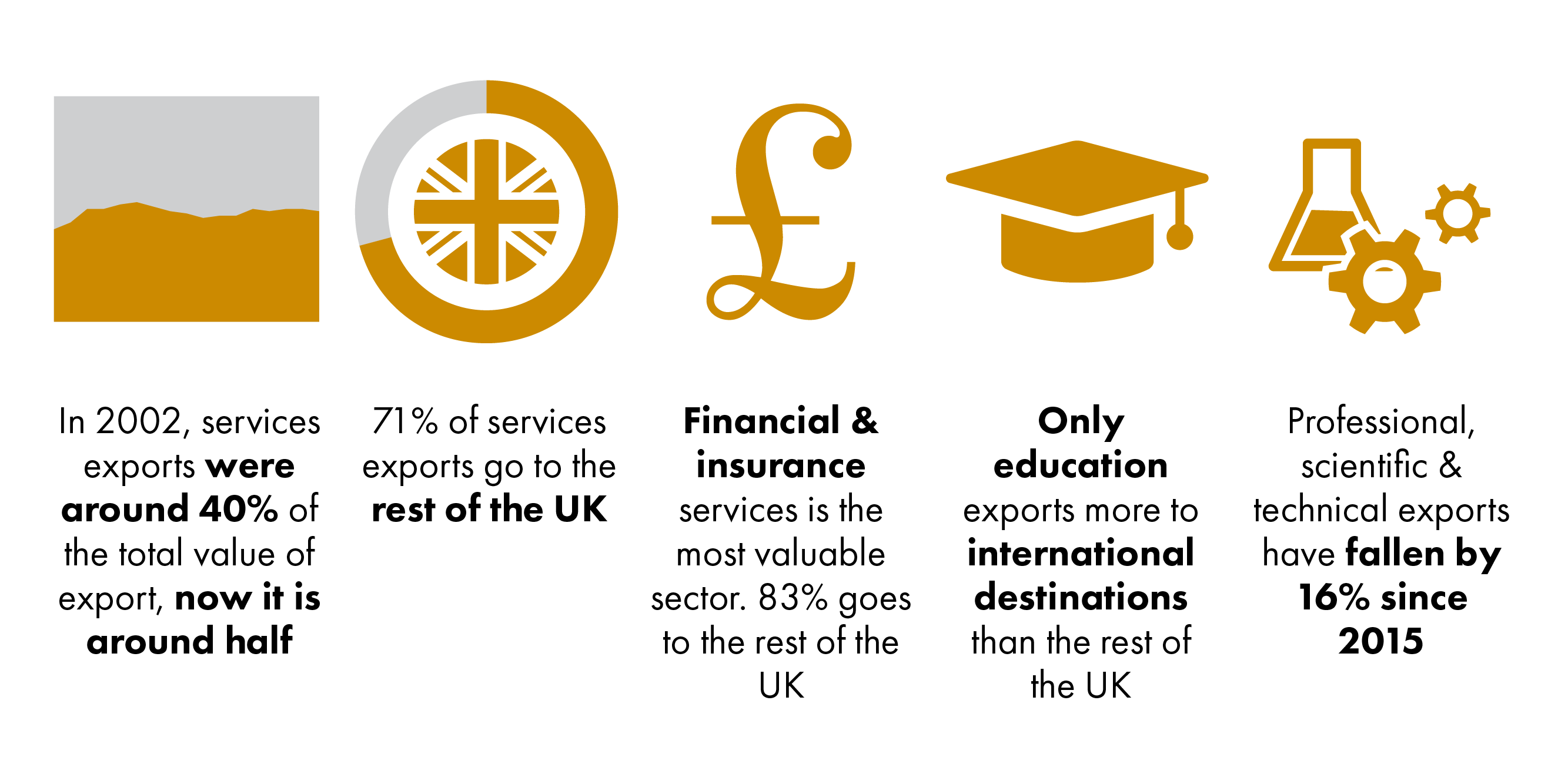

In 2002, services were around 40% of the total value of exports, it is now around half of the total value.

Seventy one percent of services exports go to the rest of the UK.

Financial and insurance services is the most valuable sector, with 83% going to the rest of the UK. The value of exports from the sector has grown by £4 billion since 2011, having fallen by £3 billion from 2007 to 2011.

Only education exports more to international destinations than the rest of the UK.

Professional, scientific and technical exports have fallen by 16% since 2015. This is linked to a fall in engineering services to the rest of the UK.

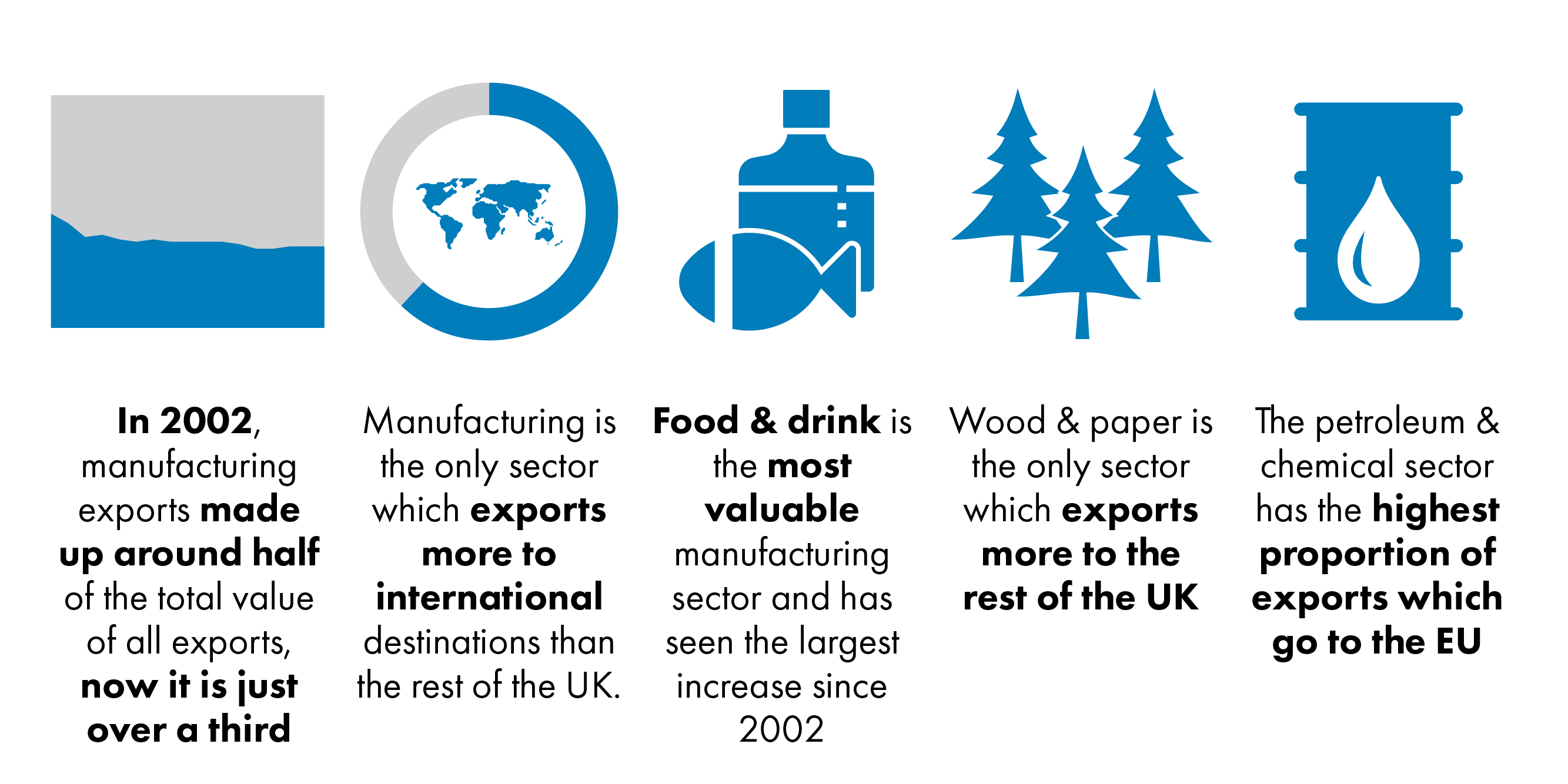

In 2002, manufacturing accounted for around half of the value of all exports, now it is just over a third.

Manufacturing is the only sector which exports more to international destinations than the rest of the UK.

Food and drink is the most valuable manufacturing sector, and has seen the largest increase since 2002.

Wood and paper is the only sector which exports more to the rest of the UK.

The Petroleum and chemical sector has the highest value of exports which go to the EU.

What is the Exports Statistics Scotland publication?

Exports Statistics Scotland1 is the Scottish Government's annual publication that provides estimates for the the value of exports from Scotland. It provides data on the value of exports by sector and destination, which includes exports to the rest of the UK.

The main source of data comes from the Global Connections Survey (GCS) which is sent to 6,000 businesses across Scotland each year. Other data are then used to enhance the GCS, including surveys such as the Office for National Statistics (ONS) Monthly Business Survey 2,the International Trade in Services Survey3 (ITIS) and various administrative data sources, including the HM Revenue & Customs (HMRC) produced Overseas Trade Statistics.4

More information about Exports Statistics Scotland can be found in the About Export Statistics Scotland publication.5

Please note that:

Unless otherwise stated, figures in this briefing are in cash terms.

The latest data is for 2018, published in January 2020.

How important are exports to the Scottish economy?

One way of looking at how important exports are is by comparing their value to GDP. This shows the relative importance of exports over time, and gives an indication of trends regardless of changes to prices. What it does not do is show the contribution that exports make to Scottish output/GDP.

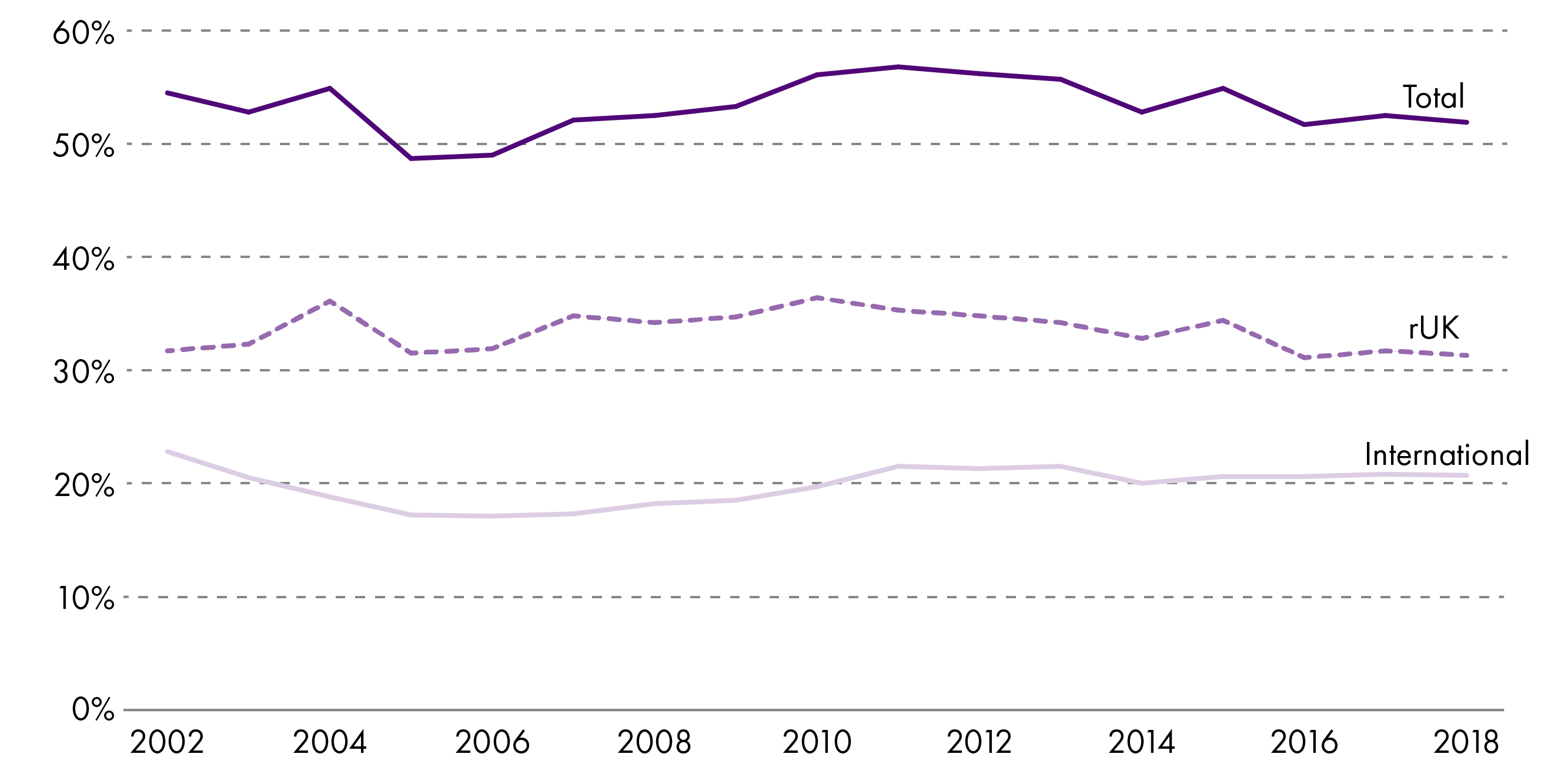

Since 2002, total exports have been equivalent to around 53% of onshore GDP in Scotland, peaking at 56.3% in 2011 and hitting a low of 48.9% in 2006. Looking at a breakdown by destination shows that:

Between 2002 and 2006, exports to the rest of the UK were around 33% of onshore GDP, then from 2007 to 2015 they were around 35% of GDP. In 2016 and 2018 they were around 31%.

Between 2002 and 2006, international exports fell from 23% to 17%, then from 2007 to 2012 they increased to 21%. Since then they have remained around 21%.

Scottish Government analysis of exports as a proportion of GDP found that1:

International exports have increased in value terms over the last two decades, however they have remained broadly static as a proportion of GDP, whilst those of many similar sized nations have increased. Some of this decline can be attributed to specific events, particularly the decline in Scotland’s electronics manufacturing (the so called ‘Silicon Glen’). However, the general static trend shows that Scotland has not been internationalising at the same pace as its competitors.

Including ‘exports’ from Scotland to the rest of the UK shows a similar picture, with rest of UK plus international exports as a proportion of GDP remaining at around 53% for the last twenty years.

The share of Scotland’s economy that receives the benefits that international exporting can deliver is low when compared to other small advanced economies.

How much are exports worth?

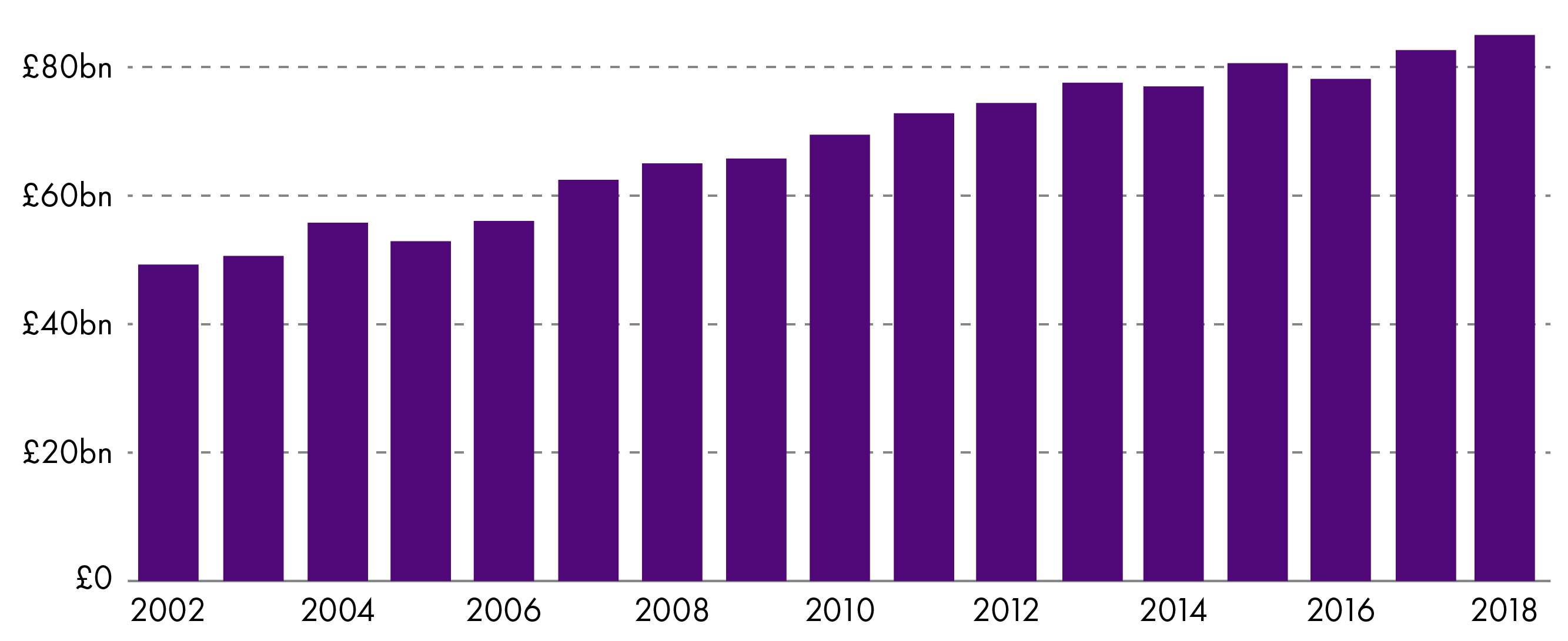

Total exports from Scotland were estimated to be worth £85.0 billion in 2018. This figure consists of exports to the rest of the UK plus international exports, but does not include oil and gas exports from the Scottish section of the UK Continental Shelf1.

Between 2017 and 2018 the total value of exports increased by 2.9%, or £2.4 billion.

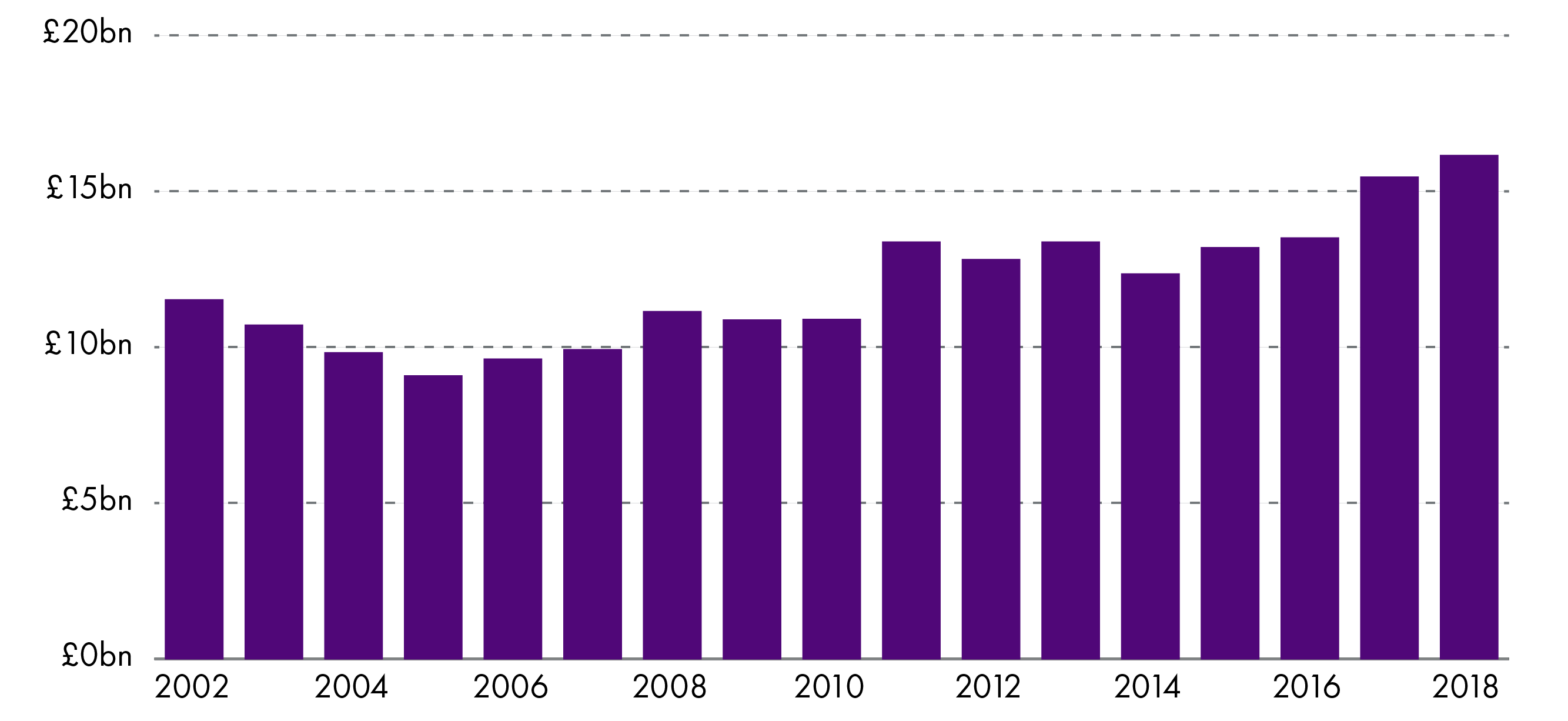

The data from 2002 to 2018 shows that:

Between 2002 and 2018 the total value of exports grew by £35.8 billion, or 72.6%.

The average yearly increase between 2002 and 2009 is 4.4%, while between 2010 and 2018 it was 2.9%.

What does Scotland export?

What do Scotland's overall exports look like?

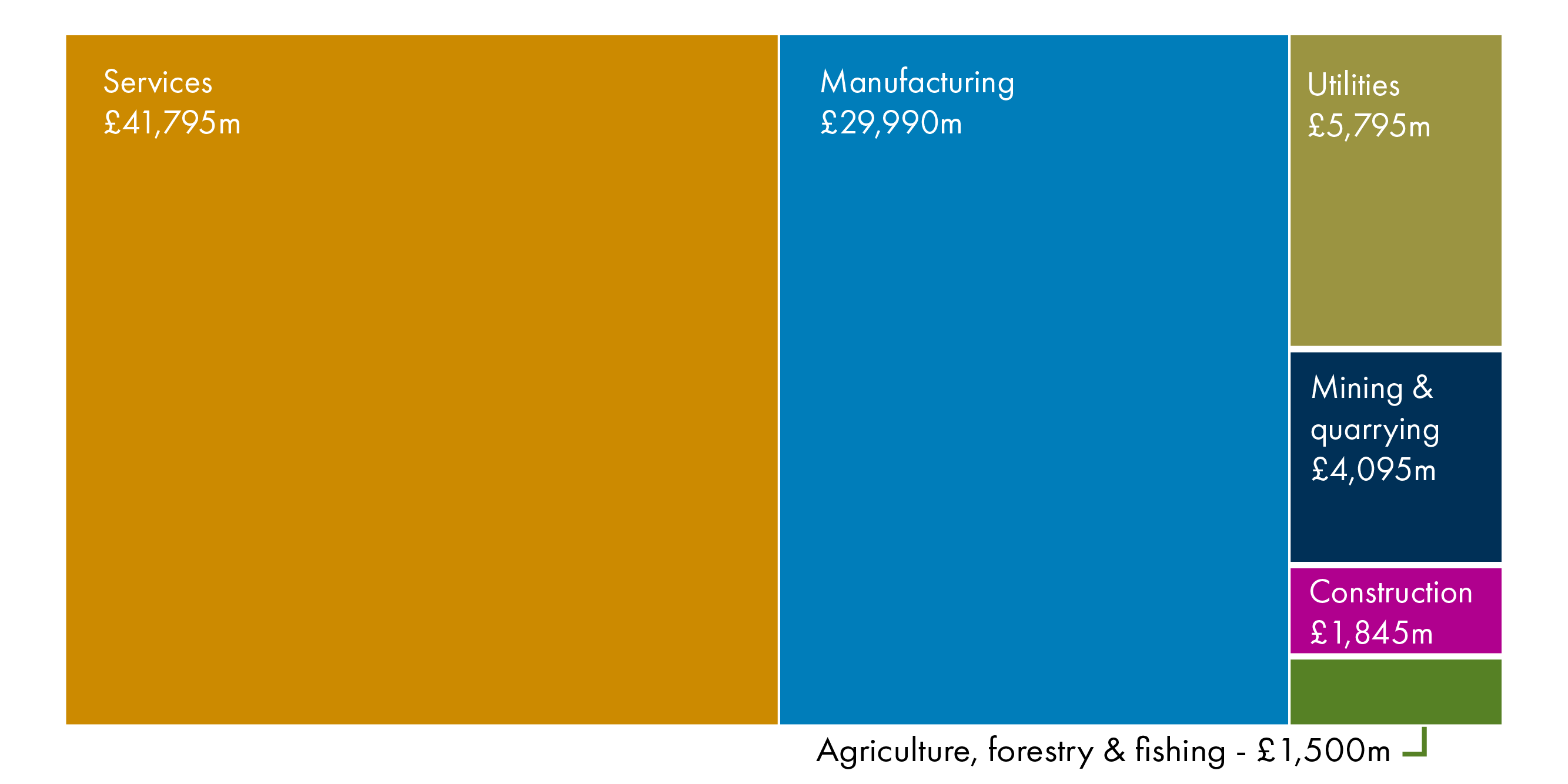

Figure 3 shows total Scottish exports broken down by sector. Between them, services (49.2%) and manufacturing (35.3%) comprise £71.8 billion, or 84.5%, of total Scottish exports. The rest is made up of:

Utilities (6.8%) - providing electric power or natural gas through permanent infrastructure network such as lines, mains and pipes.

Mining and Quarrying (4.8%) - the statistics exclude extraction of oil and gas but include activities related to the preparation of oil and gas. This includes the concentrating of ores, liquefaction of natural gas and collection of solid fuels. However, this does not include the processing of material which is included in manufacturing.

Construction (2.2%) - general and specialised construction activities for buildings and civil engineering works.

Agriculture, Forestry and Fishing (1.8%) - growing crops, raising and breeding animals, harvesting timber and other plants, animals or animal products from a farm or their natural habitats. Food and drink products are included in manufacturing.

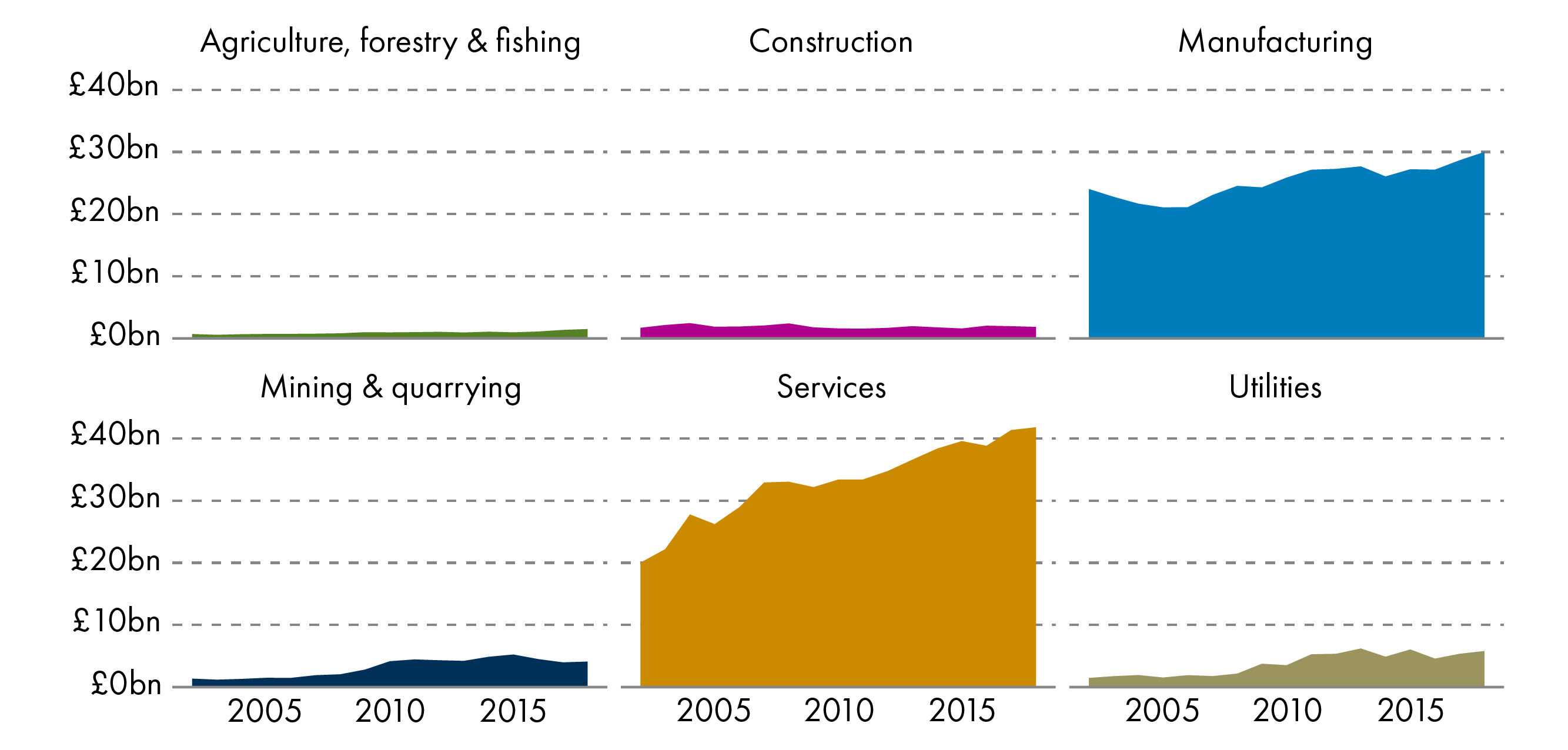

Looking at the value of exports by sector between 2002 and 2015:

Utilities saw the largest proportional increase between 2002 and 2018, increasing by 296% or £4.3 billion.

Services exports increased by £21.8 billion between 2002 and 2018.

Construction saw the smallest proportional increase at 9%.

Manufacturing saw the largest increase in value between 2017 and 2018, increasing by £1.3 billion. Over the most recent year, proportionally "Agriculture, Forestry & Fishing" saw the largest increase at 10.5%, while "Construction" saw a decrease of 5.6%.

What services does Scotland export?

Services products are when a business provides a service, such as retail, transport, distribution, or accommodation and food. Total services exports in 2018 were worth £40.3 billion, and accounted for 49.5% of all exports.

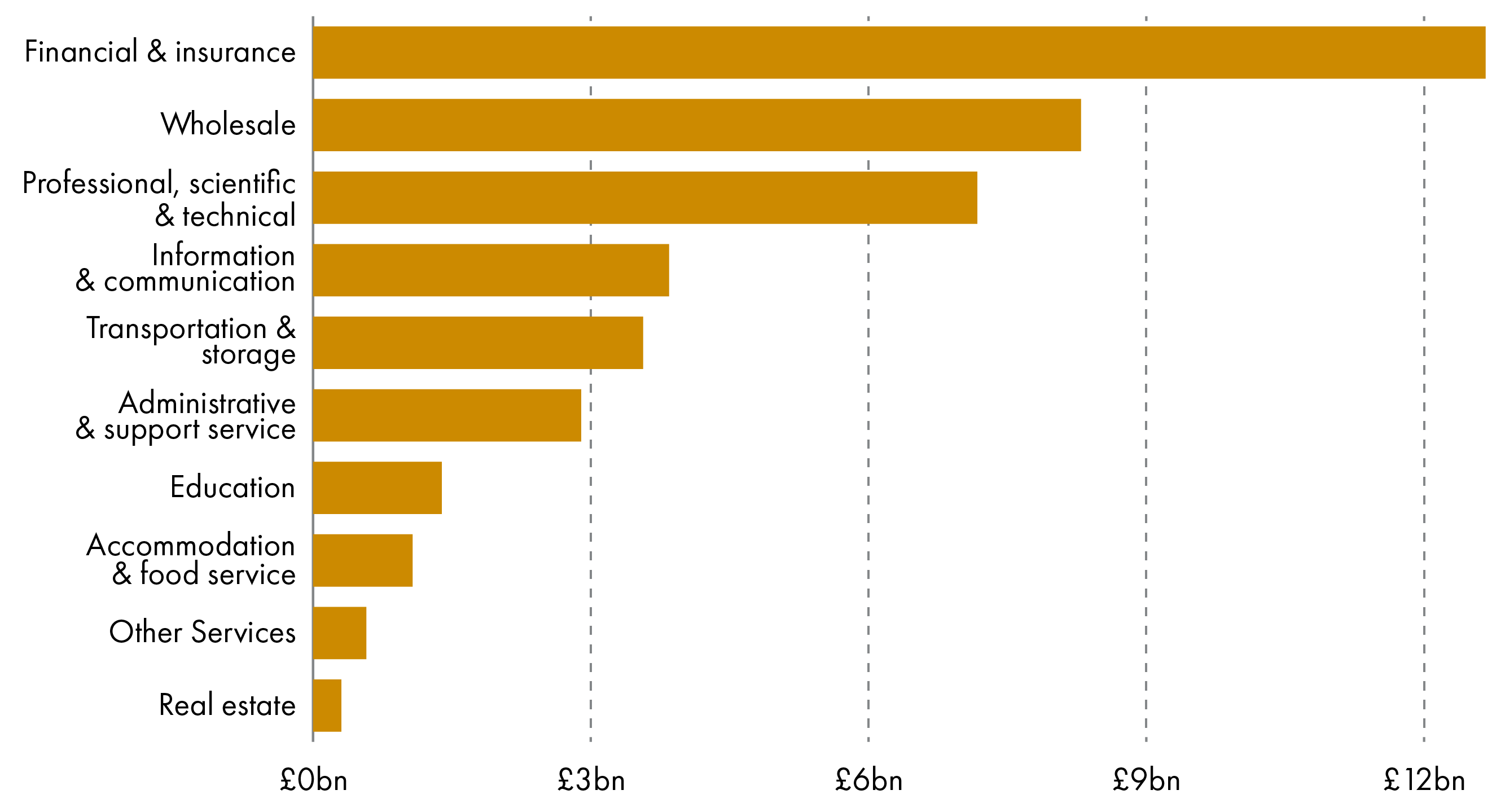

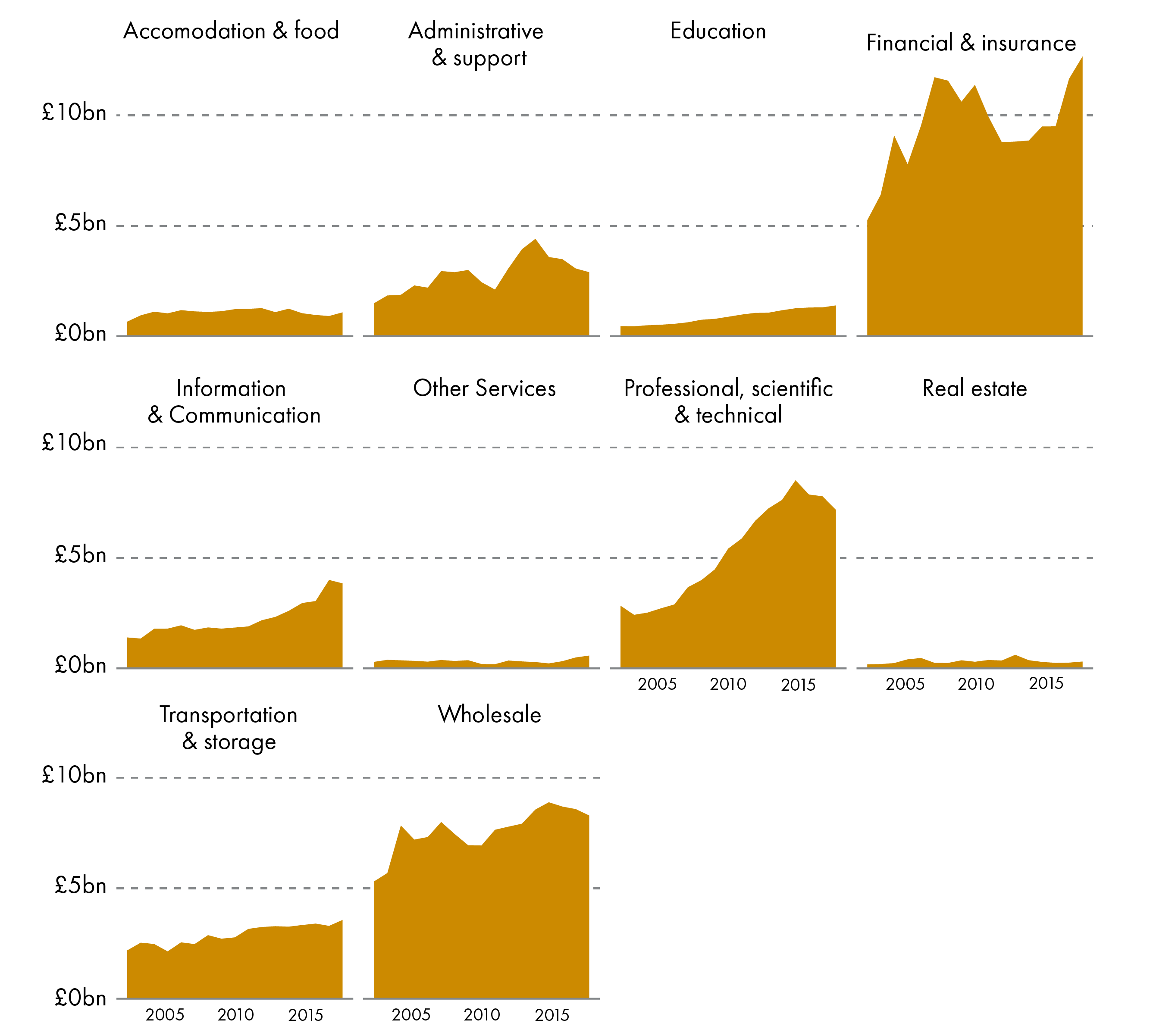

In 2018 Financial and insurance exports were the most valuable services exports at £12.7 billion. This is also the most valuable exporting sector in Scotland. It was one of only six service sectors which saw an increase in exports between 2017 and 2018:

Real estate +20.3% or £50m.

Accommodation and food +18.1% 0r £165m.

Other services +17.2% or £85m.

Financial and insurance +8.7% or £1,010m.

Transport and storage +8.2% 0r £270m.

Education +6.7% 0r £85m.

Professional, scientific and technical activities saw the largest decrease in both value and percent, falling by £615m or 7.9%.

Figure 6 shows the value of service sector exports between 2002 and 2018. Exports from the Education service sector saw the largest proportional increase in the value of exports at 209%. Exports from the Financial and insurance sector saw the highest increase in value at £7.4 billion.

Professional, scientific and technical activities have fallen for a third consecutive year and are now 15.7% lower than in 2015. Scotland's Exports Performance Monitor 1 allows us to look at the data in more detail. It shows that there has been a fall of £1 billion in Engineering Service exports to the rest of the UK between 2015 and 2018.

What manufactured goods does Scotland export?

The export of manufactured goods includes products like whisky, clothes or petroleum products. In 2018, manufacturing exports were worth £30.0 billion and accounted for 35.3% of all exports.

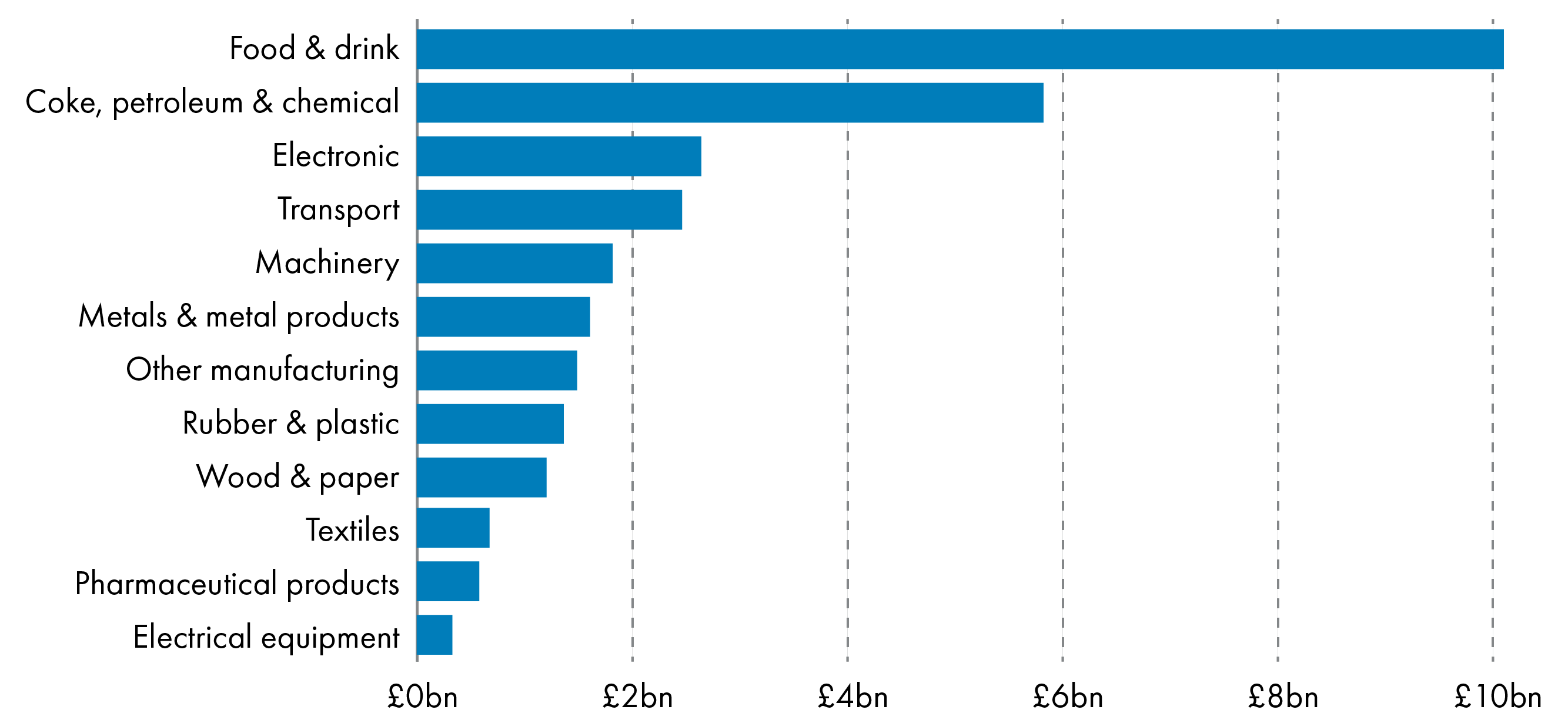

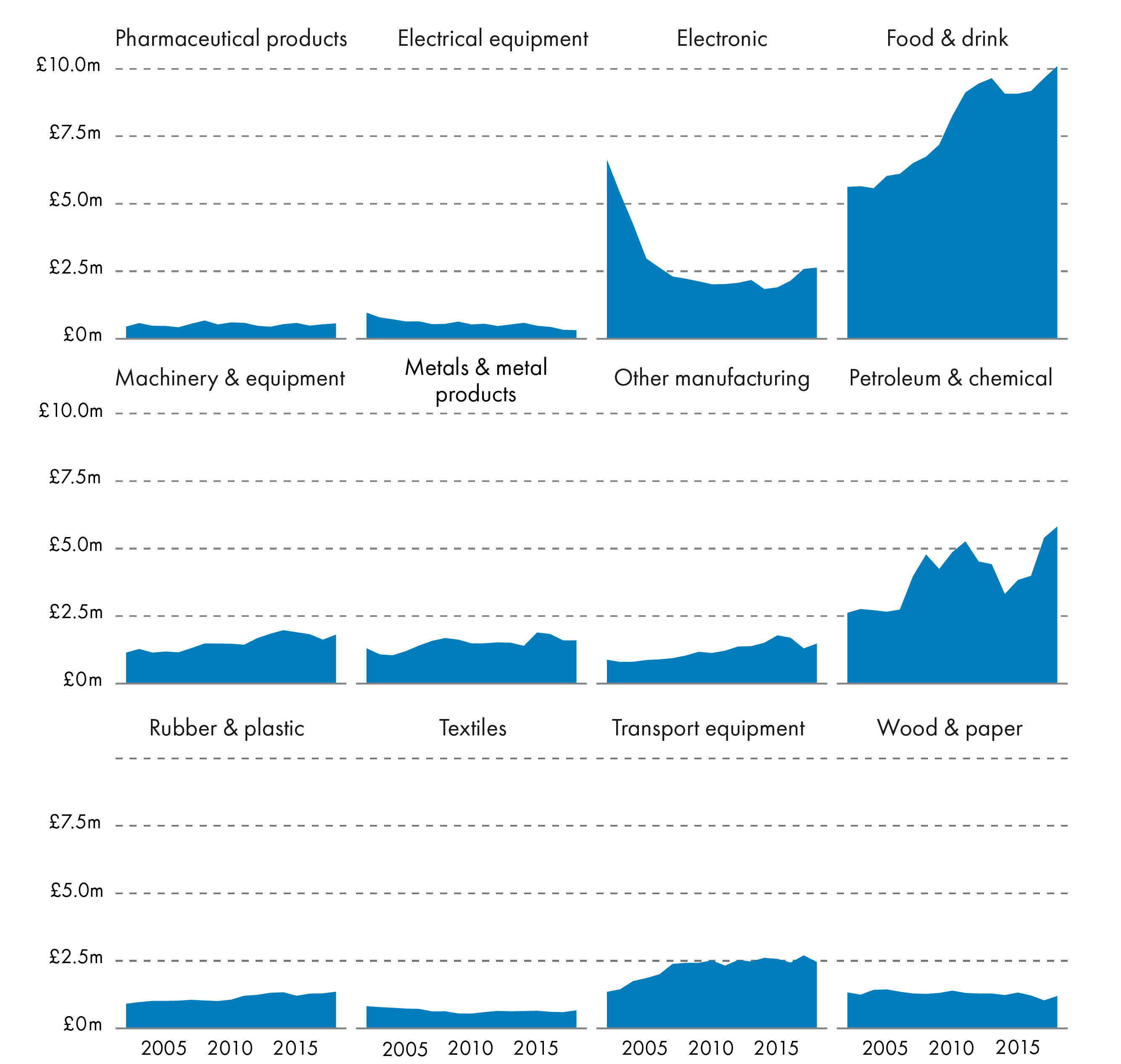

Figure 7 shows the value of manufacturing sector exports in 2018. Food and Drink exports were the most valuable manufacturing export from Scotland in 2018 at £10.1 billion.

Computer, electronic and optical products exports fell by £4.0 billion, or 60%, between 2002 and 2018. However, this sector saw a resurgence over the last few years with exports increasing by £795 million (43%), since 2014. Food and drink saw the largest increase in total exports between 2002 and 2018 at £4.5 billion, or 79%. Petroleum and chemicals saw the largest proportional increase at 122%.

Between 2017 and 2018 food and drink exports increased by £440 million, this was the highest increase by value of manufactured goods. Wood and paper saw the largest proportional increase over the year, increasing by 15%

Transport equipment saw the largest proportional decrease at 9.1%, and also saw the highest decrease by value, falling by £245 million.

Where does Scotland export to?

Overall where does Scotland Export to?

Exports Statistics Scotland provides data on exports to the rest of the UK as well as international destinations.This section looks at where Scotland exports to. Looking at the broad exports destinations, it also looks at international exports and exports to the EU.

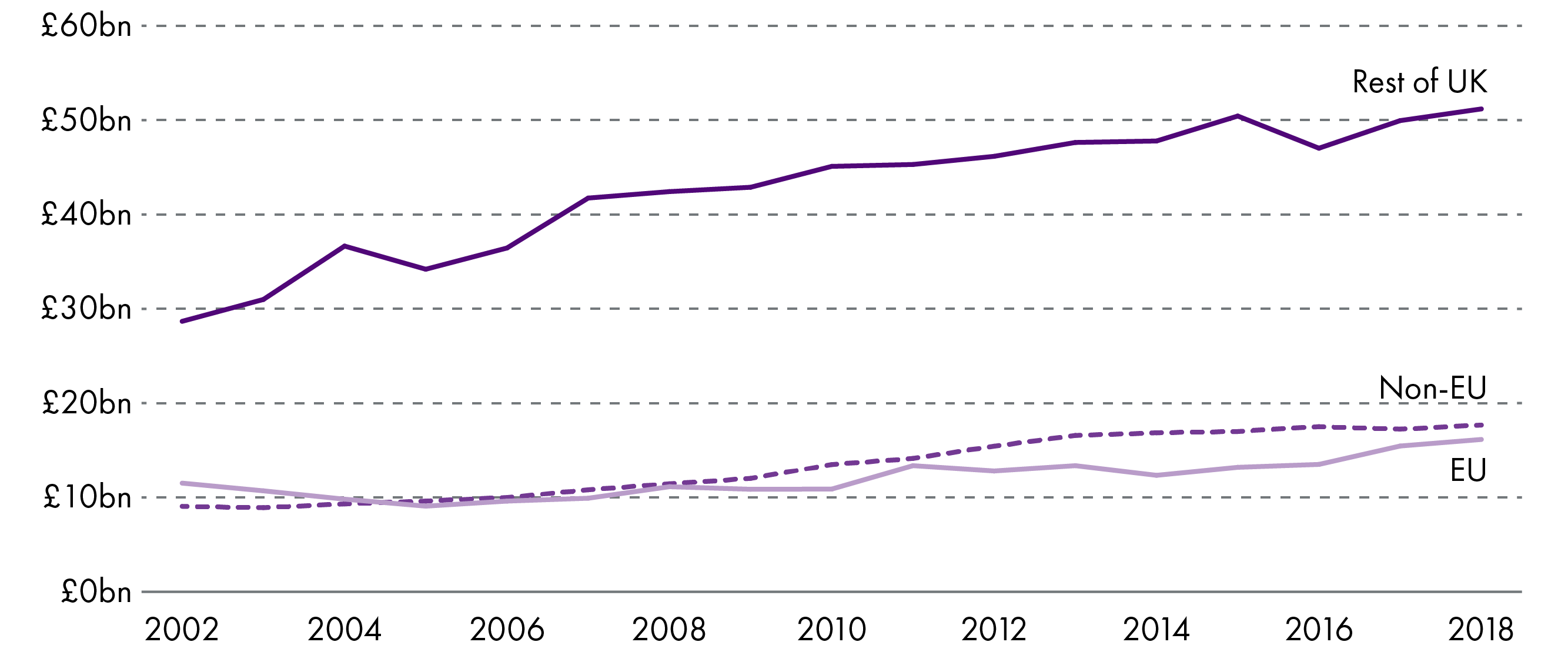

Figure 9 shows the change in exports by broad destination between 2002 and 2018:

In 2018, exports to the rest of the UK were worth £51.2 billion, increasing by £1.2 billion between 2017 and 2018.

Between 2002 and 2018, exports to the rest of the UK increased by £22.5 billion, or 78.5%.

International exports were worth £33.8 billion in 2018, an increase of £13.2 billion, or 64.3%, from 2002:

Non-EU exports increased by £8.6 billion, or 95%, between 2002 and 2018.

Exports to the EU increased by £4.6 billion, or 40%, between 2002 and 2018.

Exports to the rest of the UK accounted for 60% of the total value of exports from Scotland, falling from 67% in 2007 but still above the 2002 figure of 58%.

In terms of exports to the rest of the UK, a proportion may be re-exported internationally. While it is not possible to quantify this exactly, it is likely to be a small proportion of the total. This is because exports from services, utilities and construction, which make up 72% of exports to the rest of the UK, are highly unlikely to be re-exported. The Scottish Government has also suggested that many of the manufactured goods exported to the rest of the UK are in sectors where re-exporting is unlikely1.

On the other hand, some products exported to the rest of the UK are incorporated into other products, and then re-exported. These will be counted as exports to the rest of the UK as only the original product comes from Scotland.

Scotland's international exports

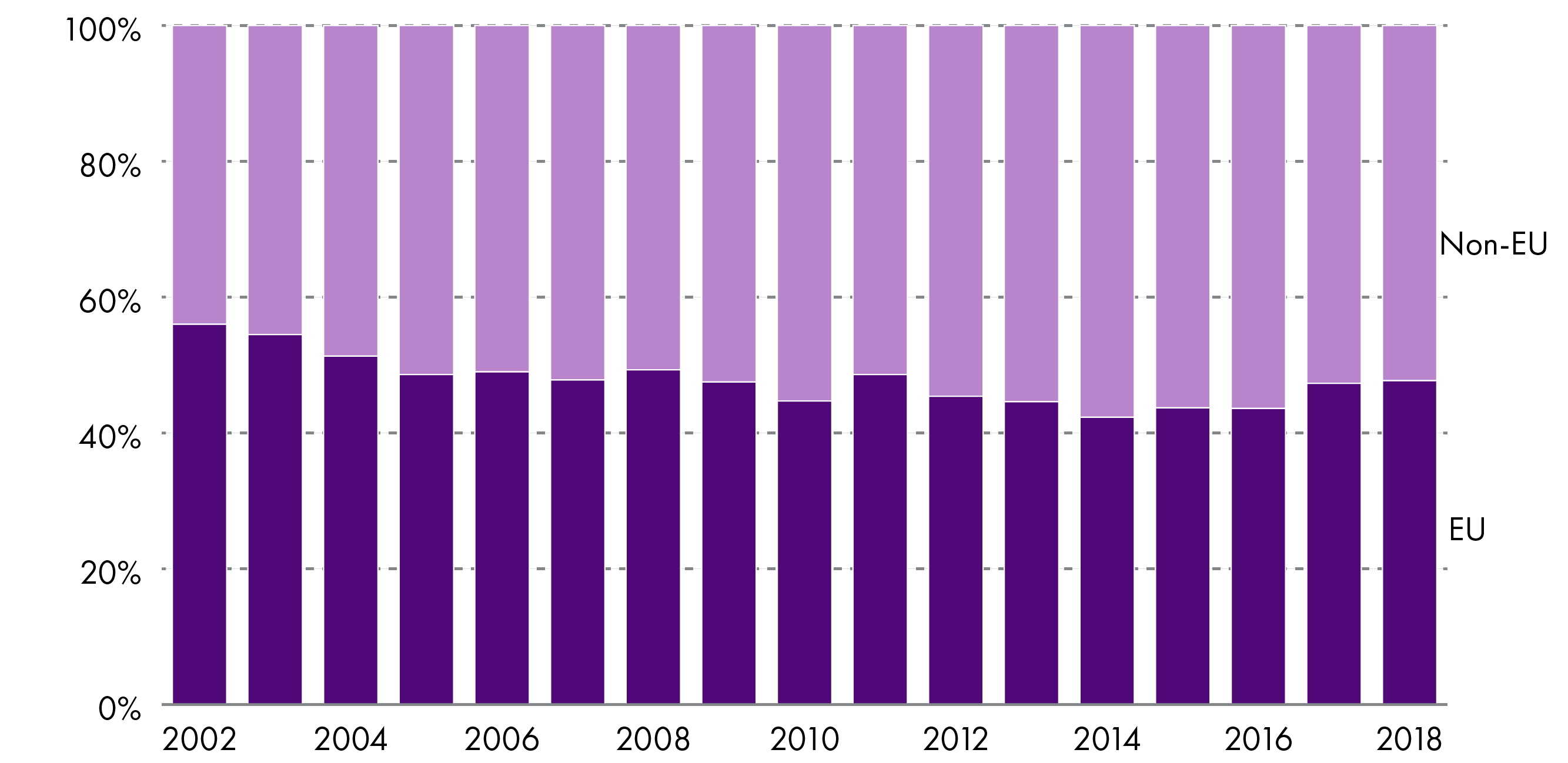

Figure 10 shows the proportion of international Scottish exports which go to EU and non-EU countries. Since 2005 the majority of international exports have gone to non-EU countries. In 2018, 52% of international exports went to non-EU countries. Since 2002, the value of exports to the EU increased by £4.6 billion (+40%), while exports to the rest of the world increased by £8.6 billion (+95%).

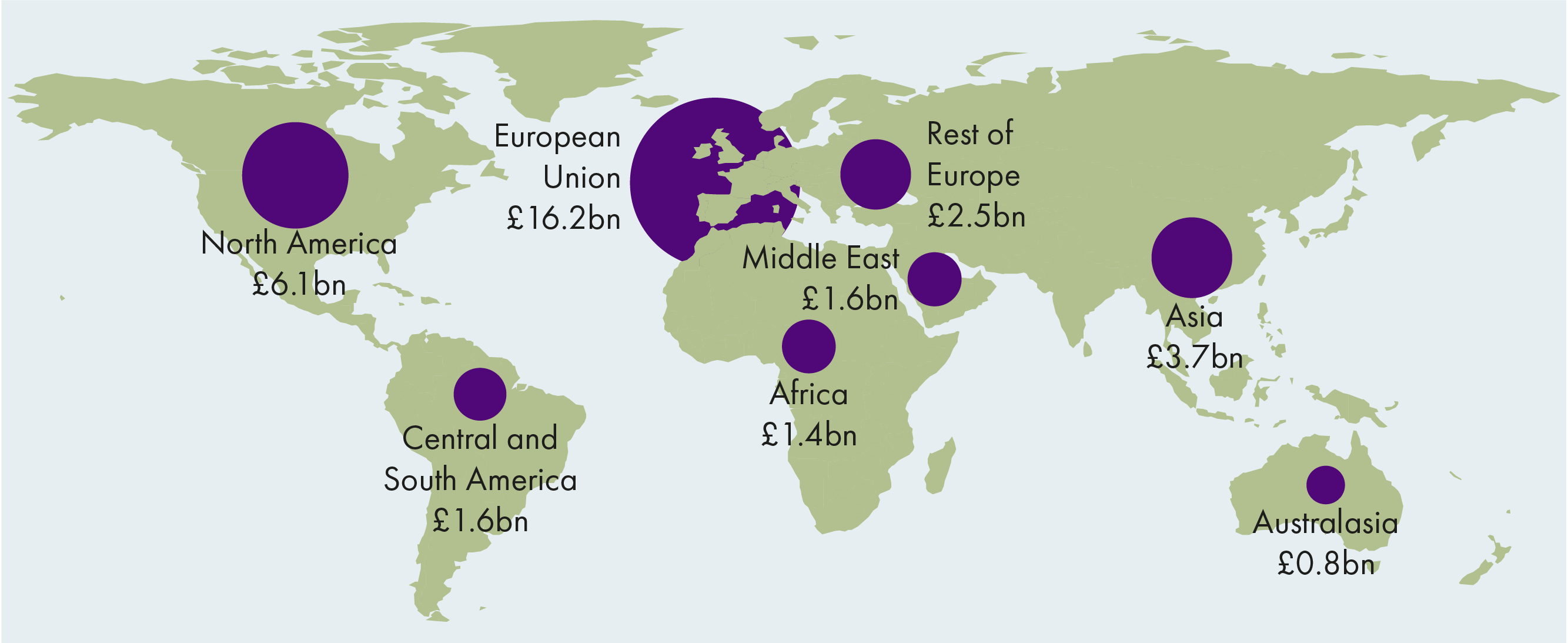

In 2018 the EU was Scotland's largest international export region, worth £16.2 billion (48%). North America had the second highest value of exports at £6.1 billion (18%). The majority of these exports go to the US, which is the single largest country destination for Scotland's international exports (at £5.5 billion in 2018).

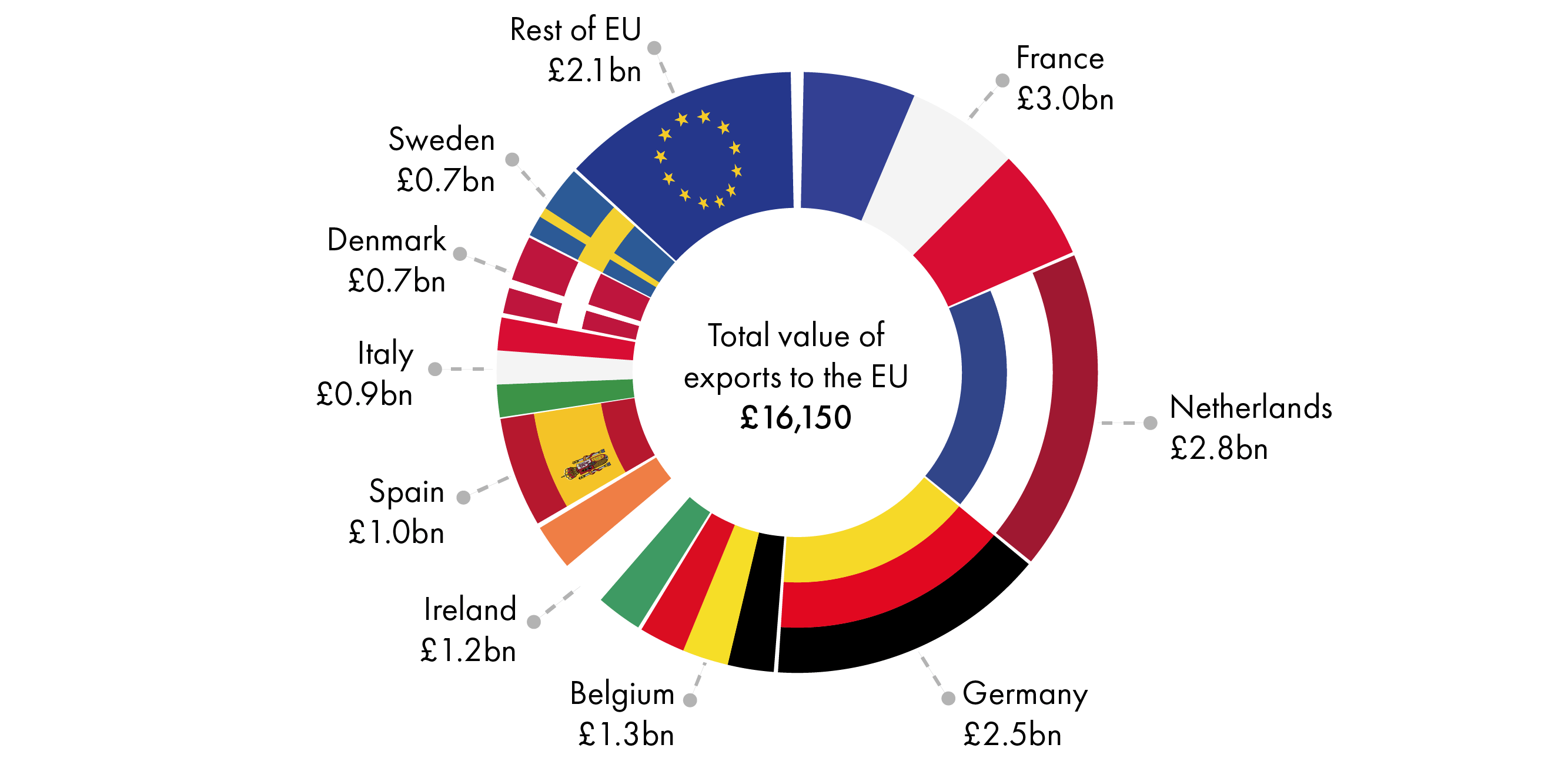

Scotland's exports to the EU

Figure 12 shows the value of exports to countries in the EU with a value over £500 million in 2018. Within the EU, France is Scotland's largest export destination with exports valued at £3.0 billion in 2018, having increased by £315 million since 2017. This is partly explained by France being the second largest international market for Scotch whisky behind the USA.1

The Netherlands is the second highest at £2.8 billion. This is because Rotterdam is one of the largest ports in the world and while goods arrive there, the Netherlands may not be the final destination. Over the year exports to the Netherlands increased by £280m or 11%.

Over the year exports to Ireland saw the largest decrease falling by £240 million (16%).

Since 2002 exports to the EU increased by £4.6 billion, or 40%. However between 2002 and 2005 exports fell, by £2.4 billion (-21%). From 2005 to 2011 they increased by £4.3 billion or 47%. By 2018, exports to the EU had increased by 80% from the 2005 low.

Which exports go where?

Overall which exports go where?

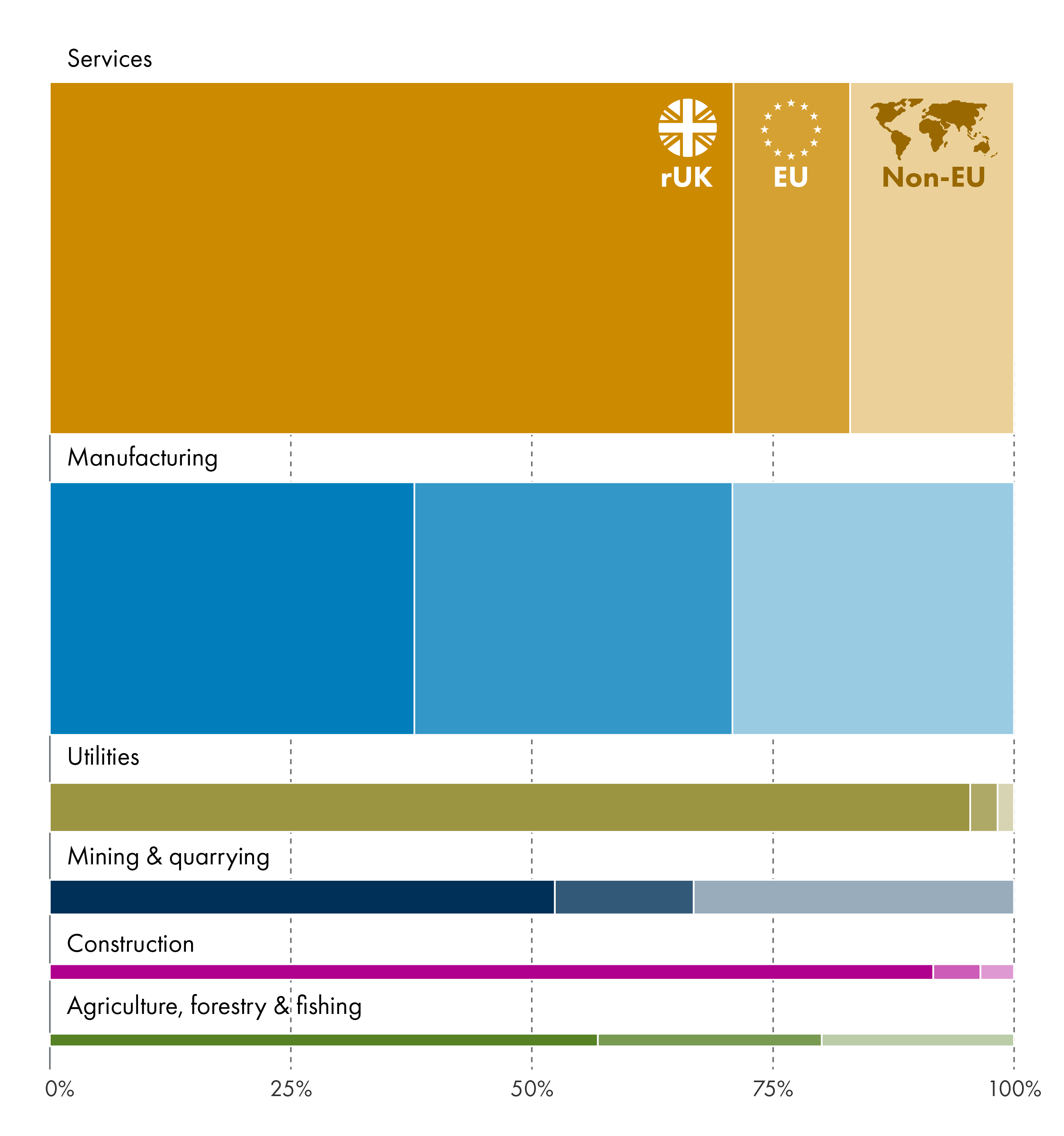

Figure 14 shows the proportion of exports for each sector that go to either the rest of the UK or to international markets. The sectors are ordered by the value size of the sector.

Manufacturing is the only sector with a higher proportion of exports which go to international destinations at 62%. Utilities has the highest proportion of exports to the rest of the UK at 96%. As Utilities exports consist of services, such as transmission of electricity, through the national grid, this is not surprising.

Table 1 shows the top five exporting sectors to the three broad destination regions: Rest of the UK, EU and non-EU destinations in 2018.

| rUK | EU | Non-EU | |||

|---|---|---|---|---|---|

| Sector | Value | Sector | Value | Sector | Value |

| Financial & insurance (Services) | £10,500m | Refined petroleum & chemical (Manufacturing) | £3,445m | Food & drink (Manufacturing) | £4,020m |

| Wholesale (Services) | £6,440m | Food & drink (Manufacturing) | £2,325m | Professional, scientific & technical (Services) | £2,240m |

| Utilities | £5,540m | Wholesale (Services) | £1,160m | Mining & Quarrying | £1,355m |

| Professional, scientific & technical (Services) | £3,785m | Computer, electronic and optical products) | £1,155m | Financial & insurance (Services) | £1,335m |

| Food and drink (Manufacturing) | £3,750m | Professional, scientific & technical (Services) | £1,155m | Transport (Manufacturing) | £1,115m |

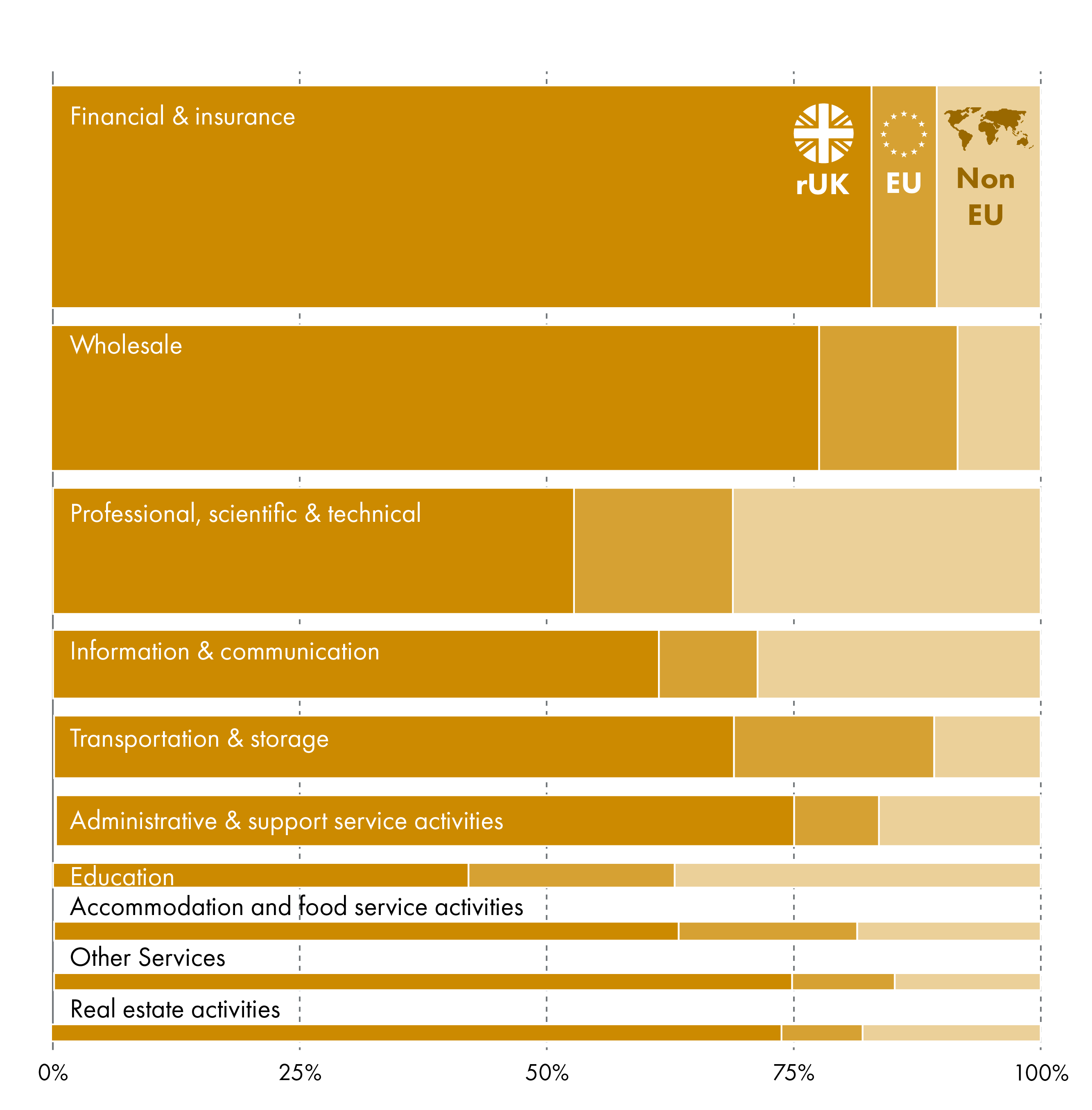

Where do Scotland's services exports go?

Services exports, worth £42 billion, make up 49% of all exports from Scotland. £30 billion, or 71%, of these are classed as exports to the rest of the UK. International services exports are worth £12 billion, with the majority (£7 billion) going to non-EU destinations.

Looking at the services export sector breakdown in more detail, only Education has a higher proportion of exports going to international destinations, with 37% going to Non-EU destinations and 21% going to the EU.

Financial and insurance exports were worth £12.7 billion in 2018, with 83%, or £10.5 billion going to the rest of the UK. Of the £2.1 billion international exports from the sector, only £0.8 billion went to the EU.

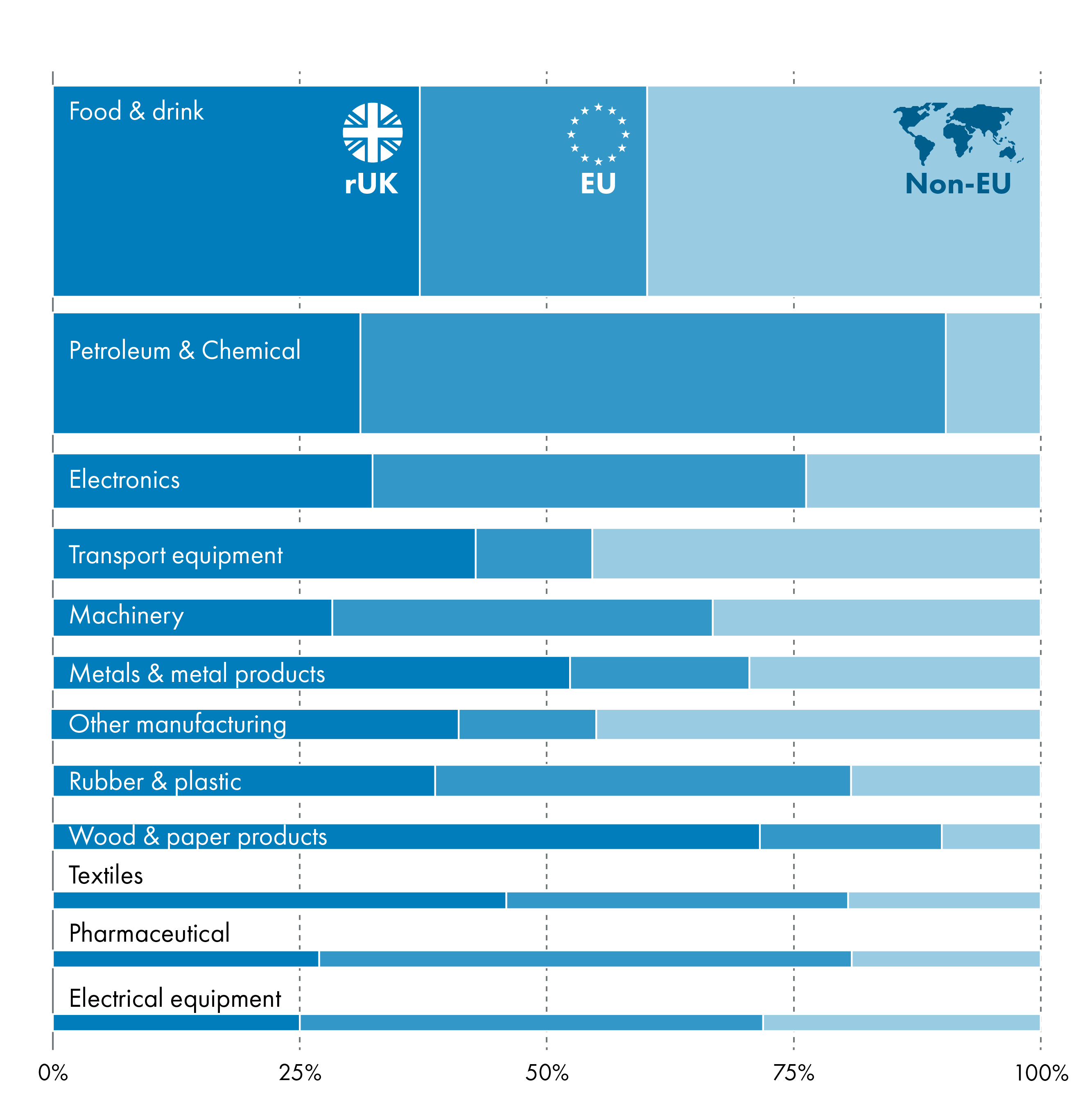

Where do Scotland's manufacturing exports go?

Manufacturing makes up 35% of the value of exports from Scotland. Almost two thirds approximately £18.7 billion (62%), are classed as international exports. In 2018, manufacturing exports to non-EU destinations were £1.1 billion higher than to the EU.

In 2018 Wood and paper was the only sector which had a higher export value to the rest of the UK, with 72% of exports going to the rest of the UK. Food & drink products are worth £10.1 billion, which is around a third of all manufactured goods exported from Scotland.

Petroleum and chemical products is the second largest manufacturing sector in terms of value of exports, at £5.8 billion. It has the highest proportion of exports which go to the EU, at 59%, or £3.4 billion.

Food and drink has the highest proportion of exports that go to non-EU destination at 40% or £3.8 billion. This is linked to whisky exports, as six of the top ten destinations for whisky exports are outside of the EU, with the USA the top destination, valued at £1.1 billion in 2018.1

Scottish Government exports strategy

Scotland: A Trading Nation1 is the Scottish Government's latest exports strategy. The headline target for the strategy is to increase international exports (excluding rest of UK) to equal 25% of GDP by 2029. You can read more about this in How important are exports to the Scottish economy? section. There are other targets which look to:

add £3.5 billion to GDP

create 17,500 jobs

almost double the value of exports.

Further analysis of the policy from SPICe can be found in Scotland – A Trading Nation?

In order to achieve these targets the strategy identifies countries where Scotland has an export gap. These are destinations that Scotland is trading less with than competitor countries.

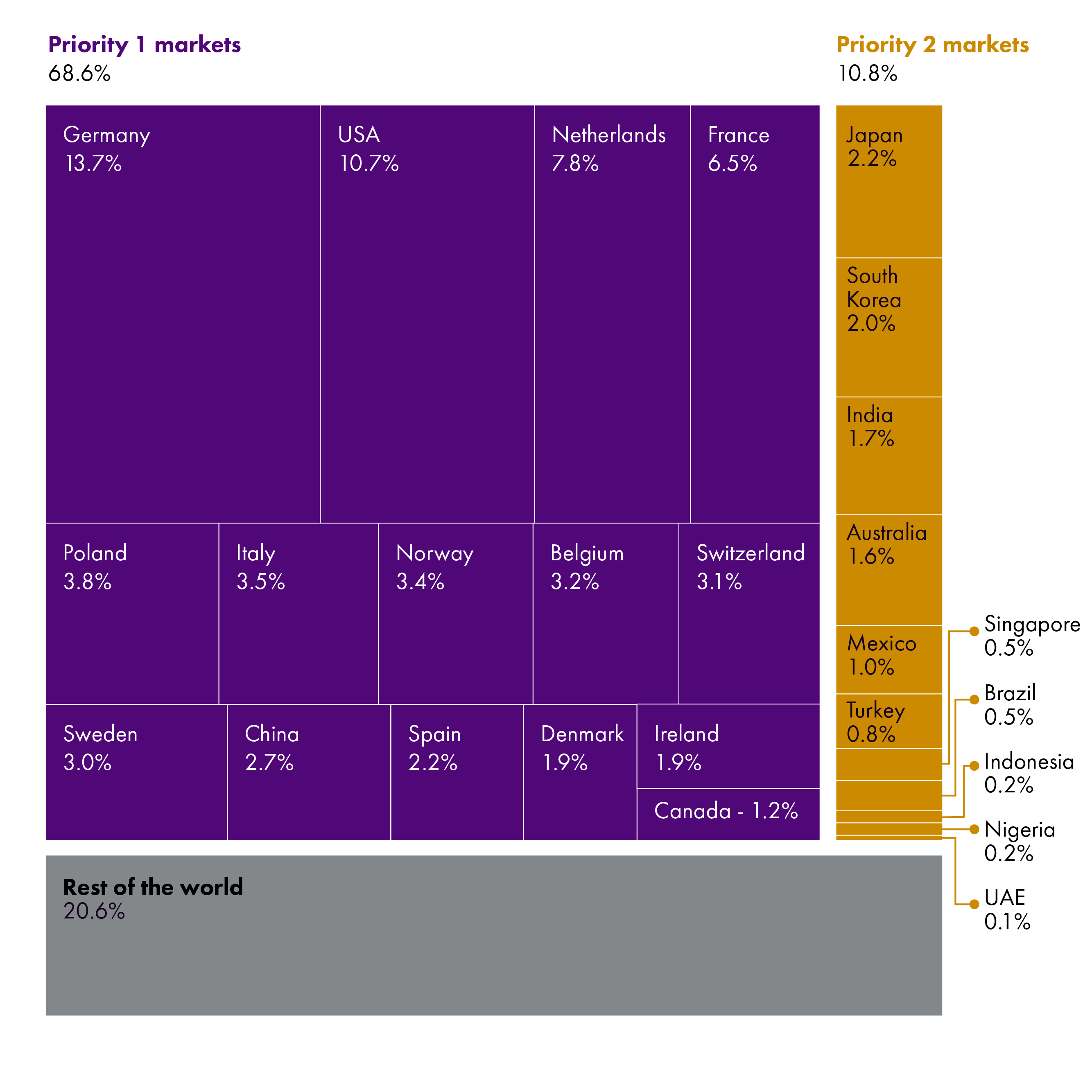

Priority 1 countries are the countries where the Scottish Government expect the majority of exports growth to come from. These are mainly mature markets and those that are close to Scotland.

Priority 2 markets are key emerging markets, distant but mature markets and markets which have potential for strong sector specific growth.

In 2018, Priority 1 markets accounted for 68.6% of the total value of international exports while Priority two markets accounted for 10.8%.

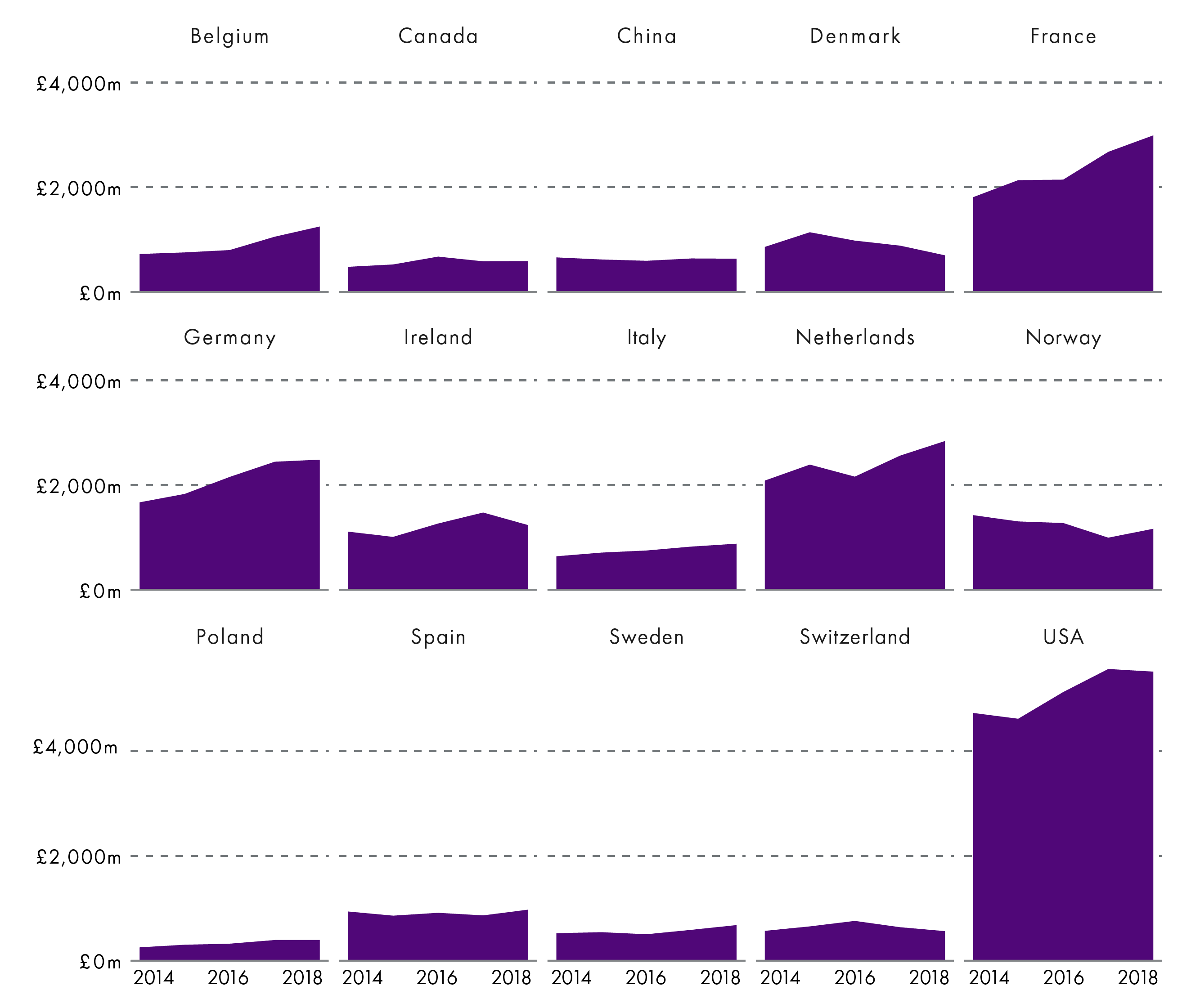

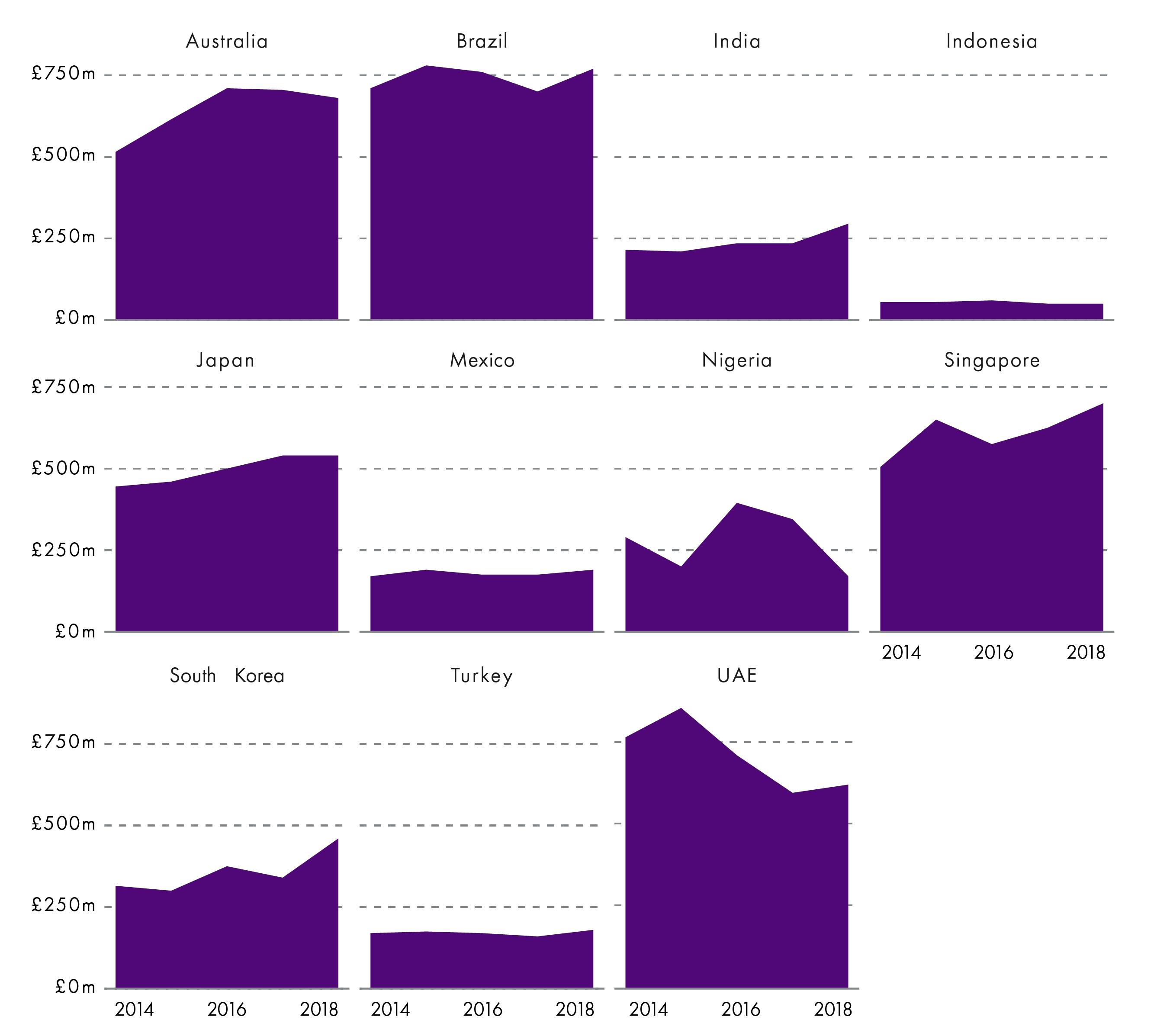

The data in Exports Statistics Scotland allows us to see have the value of exports to individual counties have changed since 2014. This allows us to see how exports to the priority counties have changed.

Exports to most Priority 1 countries have increase between 2014 and 2018. However, there are some notable exceptions:

exports to China have remained around £630m

exports to Ireland have remained around £1,230m, despite two years of double figure percentage growth

exports to Norway have fallen by £260m between 2014 and 2018, despite an increase of £170m between 2017 and 2018.

Exports to most Priority 2 countries have increase between 2014 and 2018. However, there are some notable exception:

exports to the UAE have fallen by around a fifth between 2014 and 2018

exports to Nigeria have more than halved between 2016 and 2018.

Annex

The following tables provide the full classifications of the Manufacturing and Services sectors as they appear in the Scottish Government publication.

| Abbreviated version | As appears in the official publication |

|---|---|

| Food & Drink | Food products, beverages and tobacco products |

| Textiles | Textiles, wearing apparel, leather and related products |

| Wood & paper | Wood and paper products; and printing |

| Petroleum & chemical | Coke, refined petroleum and chemical products |

| Pharmaceuticals | Basic pharmaceutical products and their products |

| Rubber, plastic & other products | Rubber, plastic and other non-metallic mineral products |

| Metals and metal products | Basic metals and fabricated metal products, except machinery |

| Electronic | Computer, electronic and optical products |

| Electrical equipment | Electrical equipment |

| Machinery | Machinery and equipment n.e.c |

| Transport | Transport equipment |

| Other manufacturing | Furniture, other manufacturing; repair and installation of machinery and equipment |

| Abbreviated version | As appears in the official publication |

|---|---|

| Wholesale | Wholesale, retail trade; repair of motor vehicles and motorcycles |

| Transportation & storage | Transportation and storage |

| Accommodation & food | Accommodation and food service activities |

| Information & communication | Information and communication |

| Financial & insurance | Financial and insurance activities |

| Real estate | Real estate activities |

| Professional, scientific & technical | Professional, scientific and technical activities |

| Administrative | Administrative and support service activities |

| Education | Education |

| Other Services | Other Services |