Non-Domestic Rates (Scotland) Bill

The Non-Domestic Rates (Scotland) Bill was introduced in the Scottish Parliament on 25 March 2019. This briefing sets out the background to the legislation, an overview of Non-Domestic Rates in Scotland in the context of Scottish taxes and local government funding, and an introduction to the Bill.

Executive Summary

Non-domestic rates (NDR) (also known as business rates) is one of two local taxes that part-fund local authorities. NDR are charged on non-exempt, non-domestic premises.

Background and key elements of NDR

The Lands Valuation (Scotland) Act 18541 established the basis of the current NDR system. The key elements of NDR are:

Rateable values (RV) are set by independent Assessors on the basis of market value every five years, except the 2017 revaluation, which was seven years after the last one. Scotland will move to a three year revaluation cycle from 2022.

The rate, or poundage, which is set by the Scottish Government and is based on the rateable values of the premises. The Non-Domestic Rate (Scotland) Order 2019 (SSI 2019/35) sets the poundage at 49p in 2019-20. There is also a Large Business Supplement for premises with a RV over £51,000 of 2.6p.

Non-exempt non-domestic premises are listed alongside their RV on the Valuation Roll, which is maintained by the Scottish Assessors Association (SAA) and can be searched online.

Revaluations have historically incurred a decrease in poundage so as to be broadly revenue-neutral. This is a policy commitment, whereas in England it is a legal requirement.

Rates liability can be reduced or removed in three ways: exemption from the Roll (e.g. agricultural land), exemption from rates (derating) (e.g. livestock or fishing), or receipt of relief (e.g. the Small Business Bonus Scheme).

Councils collect NDR directly and now retain all the Non-Domestic Rates Income (NDRI) collected within their council areas. It is however accounted for at the end of each year when balances between what local authorities have collected and the Scottish Government are notionally distributed are settled.

Wider context of NDR

In the context of wider funding, Non-Domestic Rates are forecast to represent 15% of devolved tax income in 2019-20, and the income from Non-Domestic Rates is roughly equivalent to 10% of the Scottish Government's Fiscal Resource Budget Limit.

In a more specific local government context, Non-Domestic rates represent 22% of local government revenue funding in 2019-20, which is roughly the same amount as Council Tax. The remaining 56% of local government Revenue funding comes from the Revenue grant provided by the Scottish Government (N.B. this calculation does not take in to account funds directly raised by local authorities through revenue streams such as fees and charges to service users).

Barclay Review of Non-Domestic Rates

In December 2015 the Scottish Government announced it would review business rates with recommendations expected to be submitted to Ministers by summer 2017. It set up the Barclay group in March 2016, led by former chair of RBS Scotland, Ken Barclay, to undertake the review, with the following remit:

To explore ideas and options to improve the business rates system in Scotland to better support business growth that:

consider how the system can respond to wider economic conditions and changing marketplaces;

support long-term growth and investment;

are based on overall revenue neutrality and on maintaining the overall level of funding for local government.

The Barclay review's final report1 was published on 22 August 2017, and the Scottish Government published its Implementation plan in response to the Barclay review on 14 December 20172.

The Non-Domestic Rates (Scotland) Bill

The Non-Domestic Rates (Scotland) Bill1 ("the Bill") was introduced in the Scottish Parliament on 25 March 2019, and the Local Government and Communities Committee was assigned as the lead committee.

The policy memorandum for the Bill sets out that the policy objectives of the Bill are to:

deliver a Non-Domestic Rates system designed to better support business growth and long-term investment and reflect changing marketplaces

improve ratepayers' experience of the rating system and administration of the system

increase fairness and ensure a level playing field amongst ratepayers by reforming rate reliefs and tackling known avoidance measures.

The Financial Memorandum (FM)2 published alongside the Bill sets out the estimated costs of introducing the legislation and the additional receipts that are expected to be generated as a result of the changes proposed.

Over a six year period, costs are expected to total £100 million. Around two-thirds of these costs are expected to fall to ratepayers through higher Non-Domestic Rates bills and through the payment of newly-introduced penalties. These additional costs to ratepayers will represent additional revenues to the public sector and, if realised, will fully offset the estimated costs of the legislation.

Introduction

The aim of this briefing is to summarise background detail on Non-Domestic Rates to help provide some context to the legislation. This will explain the key aspects of rate-setting, forecasting and reliefs, with signposting to further sources of information. A summary of the Barclay Review is included, as is detail on the role of NDR income both in terms of local government revenue funding, and as one of Scotland's devolved taxes.

Detail on the Bill itself has been kept to setting out the structure and key points to avoid duplicating the level of detail set out in the Policy Memorandum1 and Explanatory Notes2 accompanying the Bill.

Non-Domestic Rates

Non-Domestic Rates, sometimes known as Business Rates, are a property-based tax charged to businesses and the public and third sectors. A non-domestic property is an individual property used for non-domestic purposes, for instance business premises and third and public sector properties. Non-Domestic Rates Income is collected by local authorities, pooled at a Scottish level and then redistributed back to local authorities. The amount distributed back is known as the Distributable Amount.

The key elements of NDR are:

Rateable values are set by independent Assessors on the basis of market value every five years, except the 2017 revaluation, which was seven years after the last one. The methodology for doing so is set out in Scottish Assessors Association Practice Notes. Scotland will move to a three year revaluation cycle from 2022.

The rate, or poundage, which is set by the Scottish Government and is based on the rateable values of the premises. In 2018-19, the Scottish Government increased it by the Consumer Price Index (CPI), however in 2019-20 the increase was below the rate of inflation. There is also a Large Business Supplement for premises with a RV over £51,000 of 2.6p.

Non-exempt non-domestic premises are listed alongside their RV on the Valuation Roll, which is maintained by the SAA and can be searched online.

Revaluations have historically incurred a decrease in poundage so as to be broadly revenue-neutral. This is a policy commitment, whereas in England it is a legal requirement.

Rates liability can be reduced or removed in three ways: exemption from the Roll (e.g. agricultural land), exemption from rates (de-rating) (e.g. livestock or fishing), or receipt of relief (e.g. the Small Business Bonus Scheme).

There are three main bodies involved in the rating system: the Scottish Government, the Scottish Assessors and local authorities. The Scottish Government sets the non-domestic rates policy (including rates, reliefs and exemptions) and the legislative framework for the tax (such as this Bill).

Legislation

The Lands Valuation (Scotland) Act 18541 established the basis of the current NDR system, and required that each county or burgh keep a "roll" (updated annually) with the details of the yearly rental or value of all land and heritages. The Act also provided for a new type of officer, the Assessor, whose role it was to calculate "rental", according to the notion of market value.

Detail on legislation related to NDR is available on the Scottish Government's website.

The Local Government and Communities Committee frequently considers subordinate legislation relating to Non-Domestic Rates. Typically, this takes the form of negative instruments used to update the poundage, levying arrangements, and reliefs, among other things. To give an indication of the number of these instruments, at the point of publication of this briefing, ten negative instruments relating to NDR had been laid in 2019, and the Committee considered these at meetings on 20 March 2019 and 1 May 2019. In 2018, eight negative instruments relating to NDR were laid and considered in total.

Assessors

The Scottish Assessors are responsible for determining the classification and valuation of non-domestic and domestic properties (see below for more information on the valuation process). They are independent of both the Scottish Government and local authorities. All non-domestic properties and their corresponding rateable values are listed on the Valuation Roll, which is maintained by the Scottish Assessors.

The Scottish Assessors’ Association is a voluntary organisation that acts as a forum for Scottish Assessors to share practices and experiences, and facilitate a consistency of approach in the administration of the valuation, Council Tax and electoral registration services. There are 14 Assessors in Scotland, and Assessors and their senior staff are members of the Association. The SAA Portal provides all Scotland Valuation Rolls. Valuation Roll search results can be ordered by description (this provides a standardised and consistent way of searching for similar properties across Scotland), rateable value, reference number or address

Rateable values and revaluation

NDR are based on a property's rateable value (RV) which is a legally defined valuation provided by the Assessor. A poundage is applied to the RV, this is the rate taxed for each pound of RV. This is generally charged annually on a ten-month basis. The RV of a property is generally based upon its estimated open market value on the "tone date" were it to be vacant and to let. The tone date is currently 1 April two years before the date of revaluation.

Rateable values are revalued on a regular basis. Following the 2010 revaluation, a revaluation was initially planned for 2015. In 2012 the Scottish Government announced it would delay revaluation to 1 April 2017 to match the UK Government's decision to delay the revaluation in England to 2017, as this would maintain a competitive business environment in Scotland. The tone date for this revaluation was 1 April 2015. The Scottish Government states in the Policy Memorandum to the Non-Domestic Rates (Scotland) Bill1 that:

revaluations are intended to redistribute the tax base to reflect shifts in market values that have taken place since the last valuation. They are not intended to increase the overall tax burden and are generally revenue-neutral as any increase in total rateable value is accompanied by a fall in the tax rate, known as the poundage.

Poundage

The poundage is the rate applied to a business's rateable value to calculate its annual NDR liability, not including any reliefs or exemptions. The Local Government (Scotland) Act 19751 allows Scottish Ministers to set the poundage by Scottish statutory instrument (SSI). The Non-Domestic Rate (Scotland) Order 2019 (SSI 2019/35) sets the poundage at 49p in 2019-20.

The Large Business Supplement (LBS) introduces a higher poundage for businesses over the LBS threshold. This means the poundage for large businesses is applied to the whole RV. The Non-Domestic Rates (Levying) (Scotland) Regulations 2019 (SSI 2019/39) sets the LBS threshold and rate for 2019-20 (2.6 pence on properties with a rateable value in excess of £51,000), and for reductions in Non-Domestic Rates as a result of the Small Business Bonus Scheme (SBBS) for 2019-20. There is no change compared to 2018-19.

As a guide (rather than an exhaustive list), those properties which are likely to sit above the LBS threshold might be supermarkets, schools and colleges, superpubs or nightclubs, health centres, police and fire stations, or large retail units. Businesses which fall below this threshold are typically small shops, banks, post offices, betting offices, sports centres and hair salons.

Reliefs

Local authorities determine relief eligibility, issue Non-Domestic Rate bills and collect payments. There are three ways of providing exemptions or relief from NDR:

Exempting premises from entry in the Valuation Roll (e.g. public parks, ATMs in rural areas).

De-rating their rateable value shown in the Valuation Roll. This is uncommon but one example is minerals.

Maintaining the entry in the Valuation Roll but granting relief from the amount of rates payable (e.g. qualifying general stores, food stores or post offices in rural settlements).

Annual changes to NDR rate relief and related Scottish Statutory Instruments are set out annually in the Local Government Finance Circular accompanying the Local Government Finance Order. For 2019-20, the relevant circular is the Local Government Finance Circular 2/2019.

There are a number of rate reliefs available, some mandatory and some discretionary, and some which combine a mixture of mandatory and discretionary elements.

Current reliefs are set out in detail on the Scottish Government's website. These are:

Reliefs for empty or newly re-occupied properties.

As stated in the Draft Budget 2019-201, certain reliefs are awarded under the EU State Aid de minimis regulation. It is unclear at this point what impact the UK's planned departure from the European Union will have on these arrangements. More information on State Aid can be found on the Scottish Government's website.

Distribution

Councils collect NDR directly, and now retain all the NDRI collected within their council areas. It is however accounted for at the end of each year when balances between what local authorities have collected and the Scottish Government have notionally distributed are settled. The Scottish Government sets an annual "distributable amount" (DA), based on forecast collected revenue and on policy choice. Since 2018-19 the collectable amounts have been set by the Scottish Fiscal Commission. The amount is distributed to councils on the basis of their share of the previous year's mid-year estimated income.

The NDR system is managed in the NDR account. Because of timing differences in terms of collection and redistribution, the NDR account is either in surplus i.e. more money was paid in by councils, than paid to councils; or in deficit i.e. more money was paid to councils than was paid in by councils.

In the 2018-19 Draft Budget1 the Scottish Government set a DA that would have brought the NDR Account back into balance had the collected amount equalled the forecast. It's important to note that if NDR receipts within a local authority are higher than forecast, the General Resource Grant for that authority will be adjusted accordingly. The section on Forecasting sets out detail on NDR forecasts for coming years.

In the 2019-20 Budget2, the Scottish Government added £100 million of forecast NDR funds from future years to the 2019-20 Budget. The Statutory Background to the Non Domestic Rating Account is set out in the annual account3. The legislation makes it clear that all Non-Domestic Rates collected must be redistributed but it does not give any timescale for doing so. The account states that, if there is a surplus, it is carried forward by debiting the account for the year and crediting the next year's account, so increasing the amount available for redistribution the following year. A deficit is carried forward by crediting the account for the year and debiting the next year's account (Schedule 12, Paragraph 8). This account demonstrates that, looking at the Non-Domestic Rates account over a number of years, all Non-Domestic Rates paid to Scottish Ministers are redistributed to authorities.

Business Rates Incentivisation Scheme

The Business Rates Incentivisation Scheme (BRIS) sets buoyancy targets for each local authority, that is to say the expected growth in the tax base (total rateable value). Buoyancy targets are calculated using historical average growth figures at an individual local authority level rather than for a single year. Local targets are issued on a regular basis (most recently in 2016-19).

Under the BRIS any local authority that gains from increased buoyancy retains 50% of the extra income until the next revaluation. The other 50% is retained by the Scottish Government. For local authorities who demonstrate an increase in the tax base (total RV) without any evidence of a corresponding increase in NDRI, this does not trigger rates retention under the buoyancy focussed targets (therefore excluding properties which pay no rates because of an exemption or relief).

At the time of writing, the Scottish Government set out (in Local Government Finance Circular 2/20191) that:

Business Rates Incentivisation Scheme outcome of the amounts to be retained by local authorities for 2017-18, revised targets for 2018-19 and provisional targets for 2019-20 will be confirmed shortly

Forecasting

From April 2017 the Scottish Fiscal Commission (SFC) became responsible for producing independent economic and fiscal forecasts for the Scottish Budget.

On the same day as the Draft Budget 2018-191, the SFC published its first five-year forecast of:

Revenue from fully devolved taxes (LBTT and SLfT) and Non-Domestic Rates

NSND income tax receipts

Onshore Gross Domestic Product (GDP) in Scotland

Devolved demand-led social security expenditure

The SFC set out the approach taken to forecast NDR in its September 2017 paper2 and December 2017 forecast3 publication. In summary, the process is as follows:

Data from the Scottish Assessors Association on the tax base are used to estimate the amount of gross NDR income to be collected, taking account of growth in the tax base and losses from revaluation appeals.

Various deductions to this forecast of gross income are then made to account for the factors that reduce the amount of NDR income collected by local authorities. This includes factors such as expenditure on mandatory reliefs, write-offs and refunds resulting from overpayments in previous years.

The final step in the model accounts for the effect of a revaluation on NDR income. To do this, it is assumed that the Scottish Government will set the poundage following a revaluation in order to maintain revenue neutrality. With a revenue-neutral poundage, the only effect of a revaluation on NDR income is through the resolution of appeals, which cause revenues to be high early in the cycle before declining as increasing numbers of appeals are resolved.

Scottish Fiscal Commission. (2018, December 12). Scotland's Economic and Fiscal Forecasts December 2018. Retrieved from http://www.fiscalcommission.scot/publications/scotlands-economic-and-fiscal-forecasts/scotlands-economic-and-fiscal-forecasts-december-2018/ [accessed 30 April 2019]

The following table sets out the SFC's NDR forecast as published in Scotland's Economic and Fiscal Forecasts December 20184.

| £ million | 2017-18 Outturn | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 |

|---|---|---|---|---|---|---|---|

| 2,762 | 2,827 | 2,785 | 2,887 | 3,087 | 3,295 | 3,332 |

In relation to the Bill, the SFC stated in its December 2018 forecast that once the detail and timing of any further changes to the rates system is available, they will be included in forecasts.

The wider context of Non-Domestic Rates

Tax revenues raised in Scotland fund around 40% of Scottish Government expenditure. The Scottish Government currently has power over:

Rates and bands for Non-savings non-dividend income tax.

Land and buildings transaction tax.

Scottish landfill tax.

Local taxes (Council Tax and Non-Domestic Rates).

These taxes are taken into account in the delivery of the Scottish Government's block grant from the UK Government via the operation of the Barnett Formula. The details of the block grant adjustments (BGA) are set out in The agreement between the Scottish government and the United Kingdom government on the Scottish Government's fiscal framework1.

For each tax, the calculation consists of:

An initial baseline adjustment equal to the tax revenue in Scotland the year before devolution of the tax

An annual indexation is applied to the BGA for future years. For the first BGA (the year a tax is devolved, "Year 1"), the indexation is to the initial baseline adjustment representing tax revenue the year before devolution ("Year 0"). For the following years ("Year 2" onwards), the indexation is to the previous year's BGA.

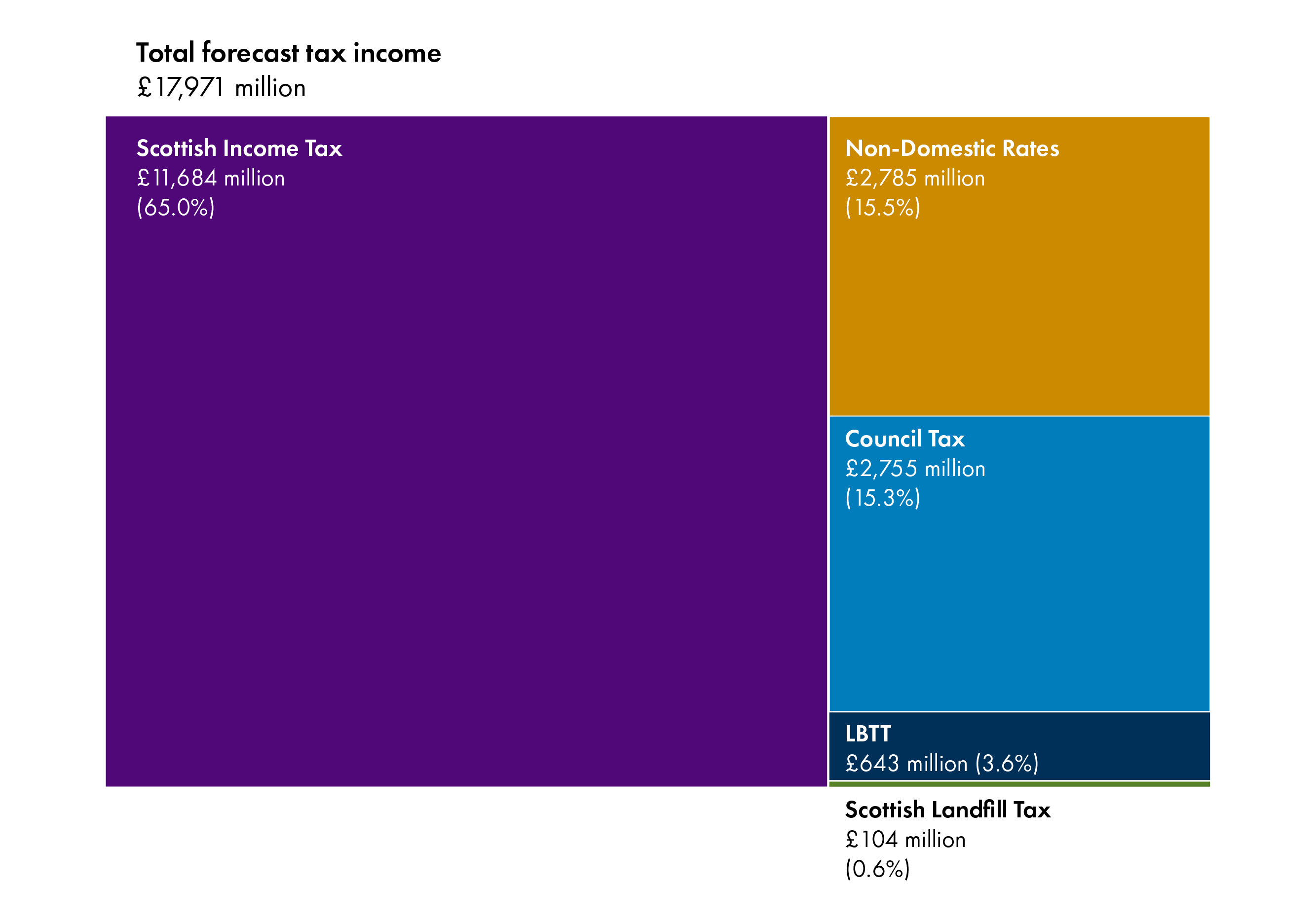

Figure 1 sets out the balance of tax revenues raised in Scotland in the context of the block grant.

Only income tax represents a higher proportion of taxation income than Non-Domestic Rates in Scotland, at 65% to NDR's 15.5%. Council Tax represents a slightly lower 15.3% of Scottish Tax income. NDRI is equivalent to approximately 10% of the Fiscal Resource Budget Limit provided to the Scottish Government through the Block Grant from HM Treasury.

The devolution of air passenger duty (APD) had been planned for April 2019, but was deferred pending the resolution of issues in relation to the exemption of flights departing from the Highlands and Islands. The Cabinet Secretary for Finance and the Constitution announced on 7 May 2019 that cuts to APD would no longer take place as such action would be incompatible with the Scottish Government's climate targets.

Devolution of the Aggregates Levy and the assignment of VAT raised in Scotland is also planned, however the Cabinet Secretary stated, in evidence to the Finance and Constitution Committee on 7 May 2019, that changes to VAT would not be applied until 2021 at the earliest.

Local government funding

Non-Domestic Rates income plays a key role in the funding of local authorities.

The Scottish Government estimates how much local government needs to fund the services it provides. It then applies a needs-based formula to allocate the total available funding. Once these initial allocations are calculated, the Scottish Government adjusts these initial figures using the Main Funding Floor, to ensure that no local authority experiences particularly large swings in support from one year to the next. From this total, Council Tax income, Distributable Non-Domestic Rates income, and specific revenue grants are deducted to obtain the General Resource Grant (GRG), which together with the Distributable Non-Domestic Rates income makes up the guaranteed non-ring-fenced funding the Scottish Government provides to local government. A further funding floor is applied to ensure that no local authority receives less than 85% of the Scottish average of per head Revenue funding, and finally, a figure for Distributable revenue funding is reached.

The funding formula is set out in detail in the Scottish Government's Green Book for Grant-Aided Expenditure1, and is explained in the SPICe briefing 18/60 Local Government Finance: the funding formula and local taxation income2.

The role of local taxation in local government income

The Scottish Government guarantees the combined General Resource Grant and distributable NDRI figure, approved by Parliament, to each local authority. If NDRI is lower than forecast, this is compensated for by an increase in GRG and vice versa. Therefore, to calculate Local Government's Revenue settlement, the combined GRG + NDRI figure is used.

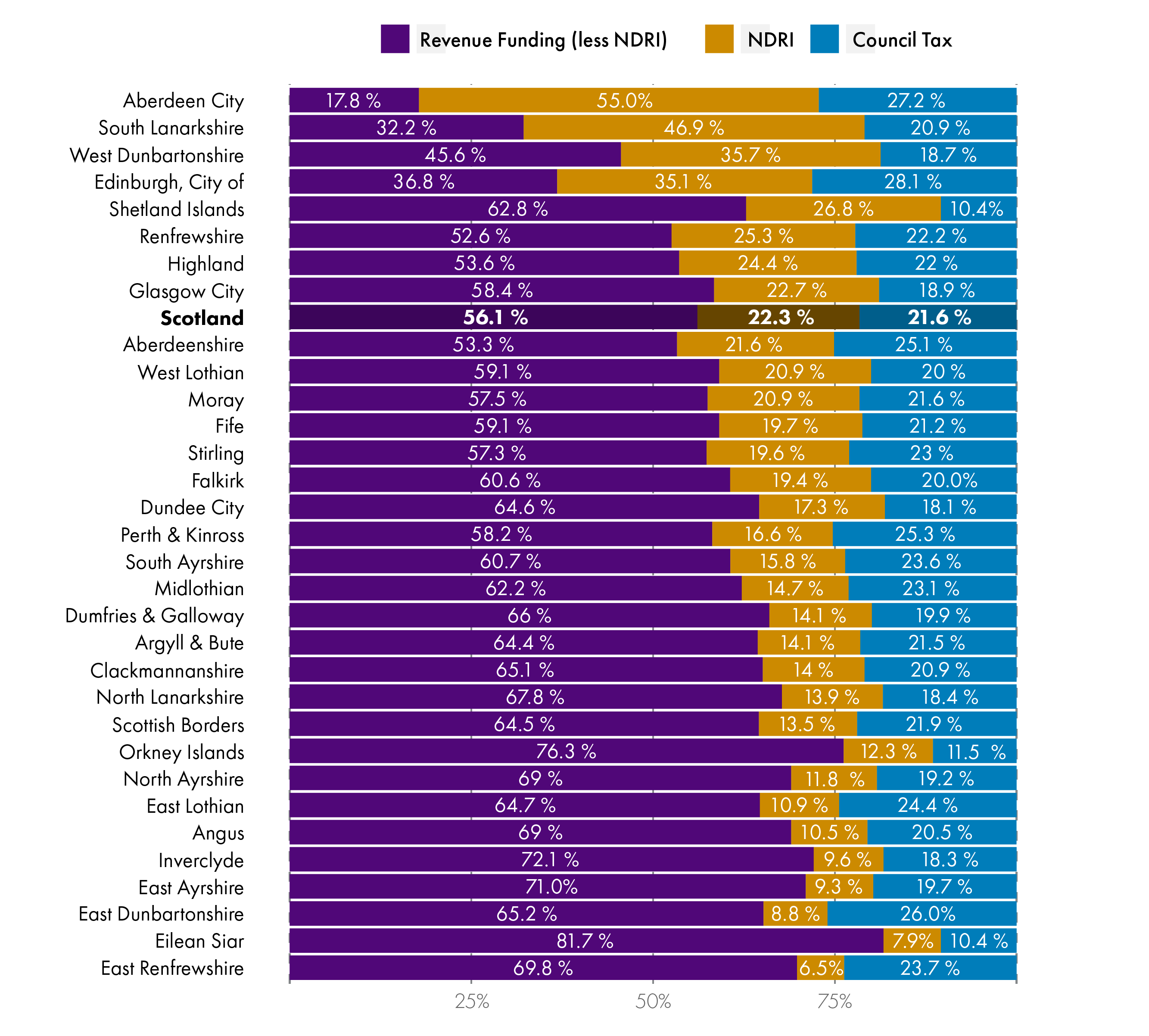

Figure 2 looks at the relative proportion of total funding that Revenue grants provided by the Scottish Government, Non-Domestic Rates income and Council Tax income represent - in this case NDRI and GRG have been separated out to give an indication of expected proportions. Figures can be found in the Annex. It's important to note that this does not represent the total amount of funding available for local authorities - it does not include, for instance, income collected directly by councils through fees and charges for services, any funding delivered to councils which is not set out in the Local Government Finance Circulars (for instance funding for Health and Social Care Integration), or Capital funding.

In 2019-20, Non-Domestic Rates Income will make up 22.3% of the funding for local authorities across Scotland. Council Tax will also make up an estimated 21.6% of the funding available. It's important to note, however, that the figures for individual councils vary widely:

Aberdeen City and South Lanarkshire see a higher proportion of income coming from NDRI than the Scottish Government's Revenue Grant. This is due to the area having both a high number of businesses in the local authority and a high average rateable value for those business properties.

On Council Tax, those councils with a high proportion of Band E-H properties (Edinburgh, Aberdeen City and East Dunbartonshire) receive a much greater proportion of total income from Council Tax than areas which typically have few higher band properties, particularly the island authorities.

When Council Tax and Non-Domestic Rates income is combined, four councils (Aberdeen City, Edinburgh, South Lanarkshire and West Dunbartonshire) receive more money through local taxation than through the Scottish Government's revenue grant.

N.B. Revenue figures represent the Revenue settlement set out in the Local Government Finance Circular 2/20191. These figures differ from outturn figures, which will not be available until late-2019 at the earliest, and will take into account any additional allocations made in-year. NDRI figures represent the distributable amount, as opposed to the forecast used in the section on the wider context of funding.

The Barclay Review

In December 2015 the Scottish Government announced it would review business rates with recommendations expected to be submitted to Ministers by summer 2017. It set up the Barclay group in March 2016, led by former chair of RBS Scotland, Ken Barclay, to undertake the review, with the following remit:

To explore ideas and options to improve the business rates system in Scotland to better support business growth that:

consider how the system can respond to wider economic conditions and changing marketplaces;

support long-term growth and investment;

are based on overall revenue neutrality and on maintaining the overall level of funding for local government.

The Group ran a call for submissions from 13 July 2016 to 7 October 2016 .

The Local Government and Communities Committee heard evidence on the Barclay Review from witnesses, including Ken Barclay, on 26 April 20171, and from Derek MacKay, Cabinet Secretary for Finance and the Constitution, on 17 January 20182.

Background

In 2012 the Scottish Government committed to conducting a "thorough and comprehensive review of the whole business rates system" between 2012 and the 2017 revaluation. This process began with a consultation paper on NDR Supporting Business - Promoting Growth which ran from 2012 to 2013. In particular, the Government stated: "Our approach will ensure all reforms are in place by the next revaluation in 2017, delivering a fairer, simpler and more efficient business rates system". A separate Consultation on the non-domestic rating valuation appeals system was launched on 11 December 2014 and closed on 6 March 2015.

First Minister Nicola Sturgeon announced in March 2016 that the Scottish Government would retain the Small Business Bonus Scheme until at least 2021.

Findings

The Barclay review's final report1 was published on 22 August 2017.

The report discussed the suggestion made by some ratepayers that the current NDR system be replaced by a local tax based on land value or a local turnover or sales tax, or a combination of these. The Review noted the following arguments in favour of these options:

They may create a better link between tax liability and the ability to pay.

They may alleviate ratepayer concerns that a revaluation would result in unaffordable bill increases.

They could better reflect changing economic circumstances, such as the fast expanding digital economy.

The Review also highlighted however:

While appropriate for some sectors, these types of changes would not be appropriate for the whole tax base, e.g. many third and public sector organisations do not deliver profit and turnover.

There is no consensus amongst those arguing for closer alignment with "ability to pay" on which system would best deliver that (a tax on profit, on turnover? A combination of a tax on land value and on profits/turnover?).

Such a change would also require an assessment of the overall tax mix in Scotland including consideration of the interactions with other taxes such as Corporation Tax and VAT and to what extent the overall package of taxes was “fair”.

Recommendations

The Barclay Review report made thirty individual recommendations on how the business rates system in Scotland could be reformed. These recommendations are set out below.

A Business Growth Accelerator – to boost business growth, a 12 month delay should be introduced before rates are increased when an existing property is expanded or improved and also before rates apply to a new build property.

There should be three yearly revaluations from 2022 with valuations based on market conditions on a date one year prior (the ‘Tone date’).

The large business supplement should be reduced.

A new relief for day nurseries should be introduced to support childcare provision.

Town Centres should be supported by expanding Fresh Start relief.

There should be a separate review of Plant and Machinery valuations with particular focus on renewable energy sector valuations and statutory improvements to property including sprinkler systems.

The effectiveness of the Small Business Bonus Scheme should be evaluated.

The Scottish Government should provide a ‘road map’ to explain changes to the rating system and should consult whenever possible on those changes, prior to implementation.

There should be better information on rates made available to ratepayers – co-ordinated by Scottish Government.

A full list of recipients of rates relief should be published to improve transparency.

A “rateable value finder” product should be used – to identify properties that are not currently on the valuation roll, so as to share the burden of rates more fairly.

Assessors should provide more transparency and consistency of approach. If this is not achieved voluntarily, a new Scotland wide Statutory Body should be created which would be accountable to Ministers.

The current criminal penalty for non-provision of information to Assessors should become a civil penalty and Assessors should be able to collect information from a wider range of bodies.

Standardised rates bills should be introduced across Scotland.

Ratepayers should be incentivised to sign up for online billing where available except in exceptional circumstances.

A new civil penalty for non-provision of information to councils by ratepayers should be created.

Councils should refund overpayments to ratepayers more quickly.

Councils should be able to initiate debt recovery at an earlier stage.

Reform of the appeals system is needed to modernise the approach, reduce appeal volume and ensure greater transparency and fairness.

A General Anti-Avoidance Rule should be created to reduce avoidance and make it harder for loopholes to be exploited in future.

To counter a known avoidance tactic, the current 42 days reset period for empty property should be increased to 6 months in any financial year.

To counter a known avoidance tactic for second homes, owners or occupiers of self-catering properties must prove an intention let for 140 days in the year and evidence of actual letting for 70 days.

The Scottish Government should be responsible for checking rates relief awarded, to ensure compliance with legislation.

Charity relief should be reformed/restricted for a small number of recipients.

To focus relief on economically active properties, only properties in active occupation should be entitled.

To encourage bringing empty property back into economic use, relief should be reformed to restrict relief for listed buildings to a maximum of 2 years and the rates liability for property that has been empty for significant periods should be increased.

Sports club relief should be reviewed to ensure it supports affordable community-based facilities, rather than members clubs with significant assets which do not require relief.

All property should be entered on the valuation roll (except public infrastructure such as roads, bridges, sewers or domestic use) and current exemptions should be replaced by a 100% relief to improve transparency.

Large scale commercial processing on agricultural land should pay the same level of rates as similar activity elsewhere so as to ensure fairness.

Commercial activity on current exempt parks and Local Authority (council) land vested in recreation should pay the same level of rates as similar activity elsewhere so as to ensure fairness.

Scottish Government response

In the Programme for Scotland 2017-181, before publishing its full response, the Scottish Government announced that it would be urgently take forward four of the recommendations made in the Barclay Review report. These were to hold more regular revaluations (2); introduce a new relief for day nurseries (4); expand fresh start relief to create a greater incentive to bring empty properties back into economic use (26); and, to review plant and machinery valuations (6).

On 12 September 2017 the Cabinet Secretary for Finance and the Constitution gave a statement to Parliament setting out his response to the Barclay Review report2 which confirmed that the majority of recommendations would be carried forward, but suggested that certain recommendations would merit further consultation:

Recommendations that require further consideration and engagement are those that remove charity relief for certain recipients including ALEOs, independent schools and accommodation by universities, reform of relief for sports clubs, empty properties and properties in active occupation and the levying of rates on parks.

The Cabinet Secretary confirmed that the Scottish Government would not progress two recommendations - the recommendation that all property should be entered on the valuation roll (except public infrastructure such as roads, bridges, sewers or domestic use) and current exemptions should be replaced by a 100% relief to improve transparency (28), and the recommendation that Large scale commercial processing on agricultural land should pay the same level of rates as similar activity elsewhere so as to ensure fairness (29).

The Scottish Government published its Implementation plan in response to the Barclay review on 14 December 20173. In January 2018, the Barclay Implementation Advisory Group was set up to offer advice to the Scottish Government on how to best implement the recommendations of the Barclay review, and it published its report on 22 February 20194.

A number of measures have been implemented to date (see next section), and the Bill addresses more fundamental changes.

As part of its 2019-20 finance settlement for Local Government, the Scottish Government included an allocation of £3.3 million for Barclay Review implementation costs5.

Implementation to date

A number of Barclay Review recommendations, which do not require fundamental legislative change, have been implemented in advance of the introduction of the Bill.

These are:

A commitment by the Scottish Government for revaluations to take place every three years after 2022, and to bring the tone date forward to one year prior to revaluation (rather than two). This commitment forms part of the Bill.

The large business supplement continues to be set annually under secondary legislation in line with affordability, however the annual rates poundage for 2018-19 was be uplifted in line with CPI inflation, rather than the higher RPI.

A new time limited 100% rate relief for qualifying day nurseries, which came in to force on 1 April 2018.

Fresh Start relief, aimed at bringing empty properties in to use, was extended on 1 April 2018. The relief increased from 50% to 100% for the first year of new occupation and was made to apply after a property had been empty for six months rather than the previous 12. This was also extended to apply to all types of property, including industrial property.

The Business Growth Accelerator was introduced as part of the Budget 2018-19, and from 1 April 2018 new properties have been exempt from business rates until 12 months after occupation.

Changes were made to the information available for ratepayers on the Scottish Government's website, including the addition of the 'roadmap' suggested in the review recommendations.

A Billing sub-group of the Barclay Implementation Advisory Group consulted on and introduced a new billing template, encouraging as many councils as possible to move to this in the 2019-20 financial year.

Data on properties in receipt of relief has been published since 1 April 2019.

A consultation of the review of SBBS will be independently commissioned in 2019, with findings addressed in time for the 2022 revaluation.

Assessors produced an implementation action plan on 29 September 2017, with the most recent updates to this dating from August 2018.

The Non-Domestic Rates (Scotland) Bill

Consultation

The Scottish Government ran a three-month consultation between 25 June - 17 September 2018 to seek views on the specific details of how the legislation underpinning several of the Barclay Review recommendations will work in a number of areas. The outcome of the consultation was announced as part of a Government Inspired Parliamentary Question on 22 February 2019 (S5W-21757), which detailed provisions to be included in the Bill.

The aim of this briefing is to give an overview of the Bill; it does not replicate the detailed discussion on consultation responses and the Scottish Government's response set out in the Policy Memorandum1, not does it provide the level of detail on provisions set out in the Explanatory Notes.

Introduction

The Non-Domestic Rates (Scotland) Bill1 ("the Bill") was introduced in the Scottish Parliament on 25 March 2019, and the Local Government and Communities Committee was assigned as the lead committee.

The policy memorandum for the Bill sets out that the policy objectives of the Bill are to:

deliver a Non-Domestic Rates system designed to better support business growth and long-term investment and reflect changing marketplaces

improve ratepayers experience of the rating system and administration of the system

increase fairness and ensure a level playing field amongst ratepayers by reforming rate reliefs and tackling known avoidance measures.

General provisions

Part 1 of the Bill sets out how the Parts are arranged and summarises what each Part does, and Part , and Part 5 of the Bill contains general and final provisions and definitions. The following sections do not set out provisions in full; rather provisions making key policy changes are summarised.

Current legislation allows local authorities to grant relief in respect of certain lands and heritages, which may include a club, society or other organisation not established or conducted for profit and used wholly or mainly for the purposes of recreation (i.e. sports clubs). Section 11 of the Bill makes provision for the Scottish Ministers to issue guidance on how local authorities exercise their discretion to grant relief.

Administration and enforcement of Non-Domestic Rates

Revaluation years

Section 2 amends the definition of “year of revaluation” in section 37(1) of the 1975 Act so that revaluations will be carried out every three years, rather than every five years. The next year of revaluation is due to be the year 2022-23, which the Bill does not change, but the Bill makes provisions meaning that the following year of revaluation will be three years later (that is, 2025-26).

Valuation roll and notices

Section 3 will help with the identification of properties which are new or have been altered. Assessors will be required to make a mark in the valuation roll against these properties, and entries in the valuation roll will be shared with the local authority when they are made or altered. This means that the local authority will be able to use this mark to identify properties which may be eligible for relief.

Section 6 adjusts existing legislation in relation to the information that assessors must give ratepayers in a valuation notice, and also in how those notices may be provided. Under new provisions, valuation notices will need to include additional detail, such as how the rateable value was calculated and any other information that the assessor deems appropriate. Provisions are also included to allow assessors to send notices electronically where previously they were all sent via post.

Section 7 introduces a new mechanism for ratepayers to challenge entries in the valuation roll before making an appeal to the valuation appeal committee. Previously, appeals could be made within 6 months following revaluation, or after a material change in circumstances. Within this updated approach, ratepayers would be required to lodge a proposal with the assessor in order to subsequently lodge an appeal if there is a failure to reach agreement at the proposal stage.

Only once a decision has been taken by an assessor not to alter a valuation, or a certain period has elapsed with no decision being made, can an appeal be lodged. The Bill as drafted would give Scottish Ministers power to make provisions (through regulations) on how the new proposal system would work.

Entering of parks in the valuation roll

Section 19(1) of the Local Government (Financial Provisions) (Scotland) Act 1963 provides that lands and heritages which consist of certain types of park (including buildings in the park used for purposes ancillary to those of the park) are not to be entered in the valuation roll. Non-domestic rates are not payable in respect of lands and heritages which are not entered in the roll. Currently, there are two reasons why a park may be entered on the valuation roll. There are:

local authority owned parks which generate a net profit for the local authority,or

parks under the control (through Ministers or Government departments) of the Crown where the park is not available for free and unrestricted use by members of the public.

In Section 4 provisions are made to update existing legislation setting out the basic rule that parks of these types are not to be entered into the valuation roll except in certain cases. These cases are where there is not free and unrestricted access to the park, or where a local authority park consists solely of facilities that are charged for.

A new provision specifies that any part of these two types of park occupied by another person (i.e. a food outlet) must be entered in to the roll.

Rates relief

Section 9 of the Bill allows Ministers to, by regulations, make provision for the relief from the payment of Non-Domestic Rates for new and improved properties. This relief is currently available through the Non-Domestic Rates (Relief for New and Improved Properties) (Scotland) Regulations 2019, and the Bill sets out provision for what future iterations of similar regulations might cover.

Section 10 makes changes to the charitable relief options available to independent schools. Under current legislation:

a relief of 80% is automatically granted to independent schools which are registered as a charity

local authorities have discretion to grant further relief to these schools, which means that it could grant relief from the remaining 20% of the rates payable leaving such organisations with no Non-Domestic Rates liability.

This applies to both mainstream and specialist independent schools registered as charities. By contrast, mainstream schools provided through local authorities do not have charitable status, and will generally pay rates.

The Bill makes provisions to remove the mandatory 80% charitable relief from mainstream independent schools registered as charities. These schools will still maintain their charitable status, but will be liable to pay NDR. Independent special schools, including St Mary's Music School, the only independent specialist music school in Scotland, will retain the mandatory 80% relief.

Payment

Section 13 makes changes to the way in which local authorities can recover unpaid Non-Domestic Rates, by enabling them to take debt recovery action sooner. Under new provisions, if a ratepayer has already been served with two reminder notices for payment then the total amount of unpaid rates for the year becomes payable on the day following the day on which the missed instalment was due to be paid. Changes are also set out the the summary warrant procedure, including a 14 day window between the unpaid rates balance being due and a summary warrant being issued.

Information notices and notifications of changes to circumstances

Assessor and local authority information notices

Part 3 of the Bill makes provisions about information-gathering powers for assessors and local authorities. It also contains a duty on certain persons to notify a local authority of changes in circumstances that might affect their Non-Domestic Rates liability. There are associated offences and civil penalties for failure to comply with the requirements.

Section 14 gives power to assessors to give written notices to a range of persons requiring those persons to provide such information as the assessor may need for the purpose of valuing the lands and heritages. Notices could be given to both the person who the assessor thinks is the proprietor, tenant or occupier of a property, or anyone else whom the assessor thinks could provide information which would be required in the valuation of the property.

Section 15 has similar aims, but related to information to be provided to local authorities to ensure for example rates bills are correctly calculated and the correct amount of relief is applied.

Section 16 requires a ratepayer to tell the local authority, within 21 days, about certain types of changes in circumstances, both in terms of their personal circumstances and changes to the property concerned.

Section 17 creates a number of criminal offences to enforce the duties in sections 14-16.

Failure to comply, appeals, and enforcement

Section 18 gives an assessor power to give a person who fails to comply with an assessor information notice a penalty notice imposing a civil penalty of £100, and sets out the requirements and operation of the penalty notice.

Section 19 sets out the appeals process where notices have been served under the provisions outlined in Section 18.

Section 20 gives a local authority power to give persons who fail to comply with a local authority information notice a penalty notice imposing a civil penalty of £95, and and sets out the requirements and operation of the penalty notice.

Section 21 sets out the appeals process where notices have been served under the provisions outlined in Section 20.

Anti-avoidance regulations

Section 5 of the Bill essentially aims to tackle tax avoidance in situations where a domestic property is moved from the Council Tax valuation list to the NDR valuation roll by giving local authorities the discretion to define whether a property is a "dwelling" (and thus liable for Council Tax) or not.

Section 12 of the Bill is another attempt to minimise tax avoidance, in this case where a ratepayer may be using a relief option (such as charitable rate relief or SBBS) on an empty or underused property where unoccupied property relief would be more appropriate, but would result in a lower rate of relief. The provisions in the Bill would allow local authorities to serve notice on a property which it considers is being used minimally or not at all, with the expectation that ratepayers would then need to respond within a 28 day period. The local authority would then decide whether the relief applied might need to be changed to unoccupied property relief.

Part 4 of the Bill makes provision about power for the Scottish Ministers to make regulations to tackle avoidance of Non-Domestic Rates

Sections 23-27 of the Bill enables the Scottish Minsters to make "anti-avoidance regulations". These are regulations making provision with a view to preventing or minimising advantages arising from Non-Domestic Rates avoidance arrangements that are artificial. Sections 24, 25 and 26 explain what is meant by an “advantage”, “Non-Domestic Rates avoidance arrangements” and “artificial” respectively, and Section 27 sets out the procedure for anti-avoidance regulations, including the consultation process.

Financial Memorandum

The Financial Memorandum (FM)1 published alongside the Bill sets out the estimated costs of introducing the legislation and the additional receipts that are expected to be generated as a result of the changes proposed. Costs are analysed according to four broad groups that will be affected:

Scottish Administration

local authorities

Scottish assessors

other bodies, individuals and businesses.

The FM sets out anticipated costs and receipts over a six year period. These are summarised in Table 2 below.

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | Total | |

|---|---|---|---|---|---|---|---|

| Scottish Government | 0.2 | 0.2 | |||||

| Local authorities | 0.5 | 0.6 | 0.4 | 0.4 | 0.6 | 2.6 | |

| Scottish assessors | 2.5 | 4.6 | 5.2 | 5.3 | 5.5 | 6.0 | 29.1 |

| Ratepayers | 16.0 | 11.1 | 9.0 | 18.2 | 13.4 | 67.7 | |

| Total | 2.7 | 21.1 | 16.9 | 14.8 | 24.2 | 20.0 | 99.6 |

Over a six year period, costs are expected to total £100 million. Around two-thirds of these costs are expected to fall to ratepayers through higher Non-Domestic Rates bills and through the payment of newly-introduced penalties. These additional costs to ratepayers will represent additional revenues to the public sector and, if realised, will more than fully offset the estimated costs of the legislation.

Costs to Scottish Administration

The Scottish Government is expected to face costs of £0.2 million in 2019-20 when the changes are introduced. According to the FM, these costs reflect the administrative costs associated with preparing regulations and guidance and sending publicity materials relating to the Bill to each ratepayer. The Scottish Government estimates that this will involve three days of work for a Scottish Government employee, plus the postal costs for the publicity materials.

The Scottish Government does not anticipate that rates bills for the wider Scottish Administration will increase as a result of the Bill's proposals.

Cost to local authorities

As a result of the Bill's proposals, local authorities are expected to face additional costs totalling £2.6 million over six years. These costs result from the administrative costs for local authorities associated with implementing in relation to the following aspects of the Bill:

three-yearly revaluations (costs of £340,000 over six years, mainly in the years prior to revaluation)

penalties for non-provision of information to local authorities (£446,000 over six years)

quicker debt recovery by local authorities (£818,000 over six years)

removal of charity relief for most independent schools (£10,000 in 2020-21 when the change is introduced)

removal of relief for properties in active occupation (£936,000 over six years)

charging of rates on commercial activity in parks (£4,000 in 2022-23 when the change is introduced).

The FM states that the estimates of costs for local authorities are based on information for 21 local authorities which was collated by COSLA and then extrapolated to provide estimates for all 32 local authorities. Costs do not take account of inflation over the period. The FM notes that no sensitivity analysis is available in respect of these estimates, although a number of factors suggest that there is potential for the overall costs to local authorities to vary from those set out in the FM:

A footnote to Table 3 of the FM (p16) highlights that, in respect of the costs of moving to three-yearly revaluations, one local authority estimated that it would face additional annual costs of £800. By comparison, the FM estimates total costs for the whole of Scotland of £1,000 in all years other than those preceding a revaluation.

The FM also notes that a number of local authorities highlighted the difficulties of estimating costs in the absence of detailed provisions.

Beyond stating that they are based on estimates from 21 local authorities, the FM does not provide detail on the basis for the estimates. The FM states that the Scottish Government will continue to review costs in conjunction with COSLA.

The FM also notes that local authorities may face additional costs as a result of the Bill's provisions as they themselves are ratepayers and so may face additional rates bills (either directly or indirectly via ALEOs) as a result of the inclusion of commercial activity in parks on the Roll. Local authorities may also potentially incur penalties as a result of the new provisions. These costs are not separately identified, but are included in the estimate of additional costs to ratepayers.

Costs to assessors

Assessors are expected to face the most significant additional costs as a result of the legislative proposals, amounting to £29.1 million over six years. The majority of these additional costs (£26 million) result from additional staffing costs, although the FM states that no account has been taken for inflation or wage growth over the period.

The FM does not provide a breakdown of the additional costs in relation to individual provisions, but states that the majority of additional costs for assessors will result from the move to a three-yearly revaluation cycle. Estimates are based on the assumption that the number of appeals will reduce by 25% as a result of the Bill's provisions.

The estimated costs were provided to the Scottish Government by the Scottish Assessors Association. As with the estimated costs to local authorities, no sensitivity analysis is available. In respect of the estimated costs to assessors, the FM also notes that estimates do not reflect:

additional pressures on 'designated assessors' who assess public utility infrastructure-related subjects on a national basis, the costs of which will increase as a result of three-yearly revaluations, and are described as "considerable", but "extremely difficult to quantify"

additional costs resulting from Scotland's revaluation cycle moving out of sync with England and Wales and the consequent loss of ability to share expertise and resources across jurisdictions both during the revaluation phase and the appeals phase.

The FM notes that, in 2019-20, £2.5 million was provided to local authorities to ensure that the assessors had sufficient additional resources to implement any reforms arising from the legislation. This is in line with the FM's estimates of additional assessors costs for 2019-20.

Costs to ratepayers

Ratepayers will face additional costs as a result of:

removal of charity relief from mainstream independent schools

inclusion of commercial activity in public parks

imposition of penalties

These additional costs (which will represent additional public sector revenues) are set out in Table 3.

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | Total | |

|---|---|---|---|---|---|---|

| Removing charity relief from mainstream independent schools | 7.0 | 7.2 | 7.4 | 7.5 | 7.7 | 36.9 |

| inclusion of commercial activity in public parks | 1.6 | 1.7 | 1.7 | 5.1 | ||

| Imposition of new penalties | 9.0 | 3.9 | 9.0 | 3.9 | 25.8 | |

| Total | 16.0 | 11.1 | 9.0 | 18.2 | 13.4 | 67.7 |

The removal of charity relief from mainstream independent schools is expected to raise £36.9 million in additional rates income over the period 2020-21 to 2024-25. These estimates are based on an uprating of the charity relief currently provided to 53 mainstream independent schools in Scotland.

The charging of rates on commercial activities in parks is expected to raise £5.1 million over the period 2022-23 to 2024-25, although the FM notes that "the evidence base is very limited!. The estimates are based on the estimate provided in the Barclay Review Report uprated in line with inflation.

The imposition of penalties for failure to provide information or to notify the local authority of a change in circumstance are expected to generate income of £25.8 million over the period 2020-21 to 2024-25. The FM notes that the primary intention of the penalties is to incentivise ratepayers to provide the relevant information rather than to generate income, but acknowledges that there will nevertheless be a net positive impact on public sector revenues after administration costs are taken into account.

Penalties for non-provision of information to assessors are estimated to generate £9 million in tone date years as this is when information is likely to be requested by assessors. The FM notes that there is a significant error margin attached to this estimate as it is based on a number of assumptions about numbers not providing information, the promptness of response to penalties and the maximum penalties imposed. The £9 million estimate presents a mid-point estimate.

Similarly, the estimate for penalties payable as a result of non-provision of information to local authorities is based on a number of assumptions about how many ratepayers are currently failing to provide information and how promptly they might respond to penalty notices. The FM assumes a mid-point figure of £3.9 million in each revaluation period, thereby totalling £7.8 million over the period covered by the FM.

For local authorities, the estimated revenues from penalties of £7.8 million over the period are well in excess of the anticipated administrative costs associated with the penalties (£0.4 million over the period). The same comparison cannot be made for assessors as the administrative costs associated with penalties are not shown separately for assessors.

The FM also notes a number of other potential costs to ratepayers, but these are not included in the FM as they involve enabling powers, so any resulting costs are not the result of primary legislation. These costs result from the proposed:

powers to restrict relief to properties in active use

powers to issue statutory guidance on discretionary sports club relief

increase in the empty property reset period from 42 days to 6 months

enabling powers for anti-avoidance regulations and local authority discretion over criteria for non-domestic classification of dwellings.

For illustrative purposes, the FM provides analysis of the potential impact of these changes on ratepayers. In total, the first three proposals set out above are expected to lead to a potential increase in ratepayers bills of £22 million in 2020-21. The proposals for anti-avoidance regulations could result in increased revenues of around £21 million in 2018-19 (although a wide range is attached to this estimate). This would indicate that the impact on ratepayers is potentially significantly higher than indicated by the measures that are included in the primary legislation.

Finally, the FM states that any additional administrative costs to ratepayers as a result of the Bill's provisions are expected to be small, so are not included.

Annex

| £m, Cash | 2019-20 Revenue Funding less NDRI | 2019-20 NDRI* | 2019-20 Est Gross CT Revenue** | Total |

|---|---|---|---|---|

| Aberdeen City | 83.74 | 258.56 | 127.79 | 470.09 |

| Aberdeenshire | 305.57 | 123.81 | 144.08 | 573.47 |

| Angus | 180.73 | 27.47 | 53.78 | 261.98 |

| Argyll & Bute | 163.10 | 35.63 | 54.47 | 253.20 |

| Clackmannanshire | 80.22 | 17.32 | 25.73 | 123.27 |

| Dumfries & Galloway | 239.41 | 51.15 | 72.38 | 362.94 |

| Dundee City | 240.11 | 64.31 | 67.10 | 371.51 |

| East Ayrshire | 208.57 | 27.36 | 57.89 | 293.82 |

| East Dunbartonshire | 167.06 | 22.67 | 66.59 | 256.31 |

| East Lothian | 152.21 | 25.55 | 57.50 | 235.26 |

| East Renfrewshire | 165.16 | 15.38 | 56.16 | 236.69 |

| Edinburgh, City of | 382.44 | 365.25 | 291.98 | 1039.67 |

| Eilean Siar | 87.92 | 8.48 | 11.22 | 107.62 |

| Falkirk | 218.41 | 69.74 | 72.23 | 360.38 |

| Fife | 496.15 | 165.72 | 178.05 | 839.91 |

| Glasgow City | 918.03 | 356.23 | 297.16 | 1571.42 |

| Highland | 314.87 | 143.24 | 129.44 | 587.55 |

| Inverclyde | 149.08 | 19.83 | 37.81 | 206.72 |

| Midlothian | 134.09 | 31.62 | 49.86 | 215.57 |

| Moray | 119.99 | 43.56 | 44.97 | 208.53 |

| North Ayrshire | 240.49 | 41.12 | 67.06 | 348.67 |

| North Lanarkshire | 524.58 | 107.25 | 142.11 | 773.94 |

| Orkney Islands | 65.04 | 10.46 | 9.77 | 85.27 |

| Perth & Kinross | 198.35 | 56.59 | 86.16 | 341.10 |

| Renfrewshire | 217.12 | 104.42 | 91.53 | 413.07 |

| Scottish Borders | 174.83 | 36.62 | 59.42 | 270.88 |

| Shetland Islands | 60.82 | 25.93 | 10.10 | 96.85 |

| South Ayrshire | 163.33 | 42.46 | 63.46 | 269.25 |

| South Lanarkshire | 234.03 | 341.17 | 152.25 | 727.45 |

| Stirling | 128.61 | 44.04 | 51.60 | 224.26 |

| West Dunbartonshire | 108.15 | 84.74 | 44.28 | 237.16 |

| West Lothian | 240.63 | 85.33 | 81.49 | 407.45 |

| Scotland | 7,162.82 | 2,853.00 | 2,755.43 | 12,771.25 |

*Distribution figures as set out in Local Government Finance Circular

** Based on Est. 2018-19 Gross Revenue (provided by Scottish Government from CTAXBASE) with individual % increased made by local authorities in 2019-20 applied.

Abbreviations

ALEO - Arms Length External Organisation

APD - Air Passenger Duty

ATM - Auto-Telling Machine

BGA - Block grant adjustments

BRIS - Business Rates Incentivisation Scheme

COSLA - Convention of Scottish Local Authorities

CPI - Consumer Price Index

DA - Distributable Amount

FM - Financial Memorandum

GDP - Gross Domestic Product

GRG - General Revenue Grant

LBS - Large Business Supplement

LBTT - Land and Buildings Transaction Tax

NDR - Non-Domestic Rates

NDRI - Non-Domestic Rates Income

NSND - Non-savings n0n-dividend

RV - Rateable Values

SAA - Scottish Assessors Association

SBBS - Small Business Bonus Scheme

SFC - Scottish Fiscal Commission

SLfT - Scottish Landfill Tax

SSI - Scottish Statutory Instrument

Related Briefings

SB 15/32 - Non-domestic Rates

SB 17/88 - Local Government Finance: Draft Budget 2018-19 and provisional allocations to local authorities

SB 17/89 - Draft Budget 2018-19

SB 17/90 - Draft Budget 2018-19: Taxes

SB 18/34 - Local Government Finance: Facts and Figures 2013-14 to 2018-19

SB 18/60 - Local Government Finance: The Funding Formula and local taxation income

SB 18/84 - Budget 2019-20