Net Zero, Energy and Transport Committee

Scotland’s electricity infrastructure: inhibitor or enabler of our energy ambitions?

Conclusions and recommendations

Modernising the grid

An expanded National Grid is a direct and inevitable consequence of decarbonising our energy supply to achieve net zero: it is a public good. The approach of seeking to match Grid capacity to current usage is now outdated as policy, and should be replaced by the principle of prudential investment in Grid capacity in anticipation of future need, and in order to meet the 2045 net zero target. The Committee calls for this changed approach to be signalled clearly and strongly by governments and Ofgem. Amongst other things, this would also increase long-term public and investor confidence in our renewables industry.

For the same reasons, a clear statement of intent about, and plan of action for, speeding up Grid connection is also needed from governments. It is unacceptable that developers are being asked to wait upwards of a decade for a connection. It is also completely at odds with ambitions to grow a world-leading renewables sector.

We call on the Scottish Government to work with the UK and Welsh Governments, Ofgem and National Grid ESO to:

enshrine and publicly promote Grid expansion in anticipation of need as a joint long-term, strategic goal of GB energy policy, setting out how this is to be achieved, and

promote a plan of action (including investment and legal change where needed) to bring down average waiting times for Grid connection.

The Committee is also specifically concerned by evidence of a "first come first served" approach to Grid connections that can mean delayed or speculative projects in the line for a connection act as a a block on others, and that it is smaller or less established players in the renewables sector that disproportionately suffer because of this. We agree with views that a more proactive regulatory approach to queue management is needed. We ask the Scottish Government whether it accepts this evidence and, if so, what action it can take, including by way of making representations to the UK Government or Ofgem, to address this.

We direct the above conclusions and recommendations to the UK Government and to Ofgem for comment.

The Committee welcomes the UK Government's amendment of the Energy Bill to impose an express mandate on Ofgem to support the achievement of net zero, for which there was much support throughout this inquiry. We hope this helps clarify the central role that reaching net zero must play in Ofgem's strategic planning, decision-making and overall regulatory approach.

Creating the infrastructure

The Committee continues to be concerned by evidence consistently pinpointing Scotland's planning system as a major block on our net zero ambitions, given the momentum that will be required to build the new generating and transmitting infrastructure needed to ensure that our energy supply is decarbonised by 2045. We accept that development of this sort can be controversial, particularly at community level, and support a planning system that permits robust interrogation of any major proposal and gives local people a say.

We note and welcome evidence that the Fourth National Planning Framework introduced earlier this year will make a positive change. But NPF4 cannot, on its own, address concerns over:

Depleted human resources at planning authorities, including the loss of many experienced planning professionals from the public sector in the last decade;

Complexities within planning legislation and policy that mean that many find the process painstaking, costly and confusing;

Different working practices across Scotland's 34 planning authorities, and differences across authorities in levels of experience and knowledge in handling major renewable developments.

We ask the Scottish Government for a progress report on three recommendations from an earlier inquiry that the Scottish Government has accepted, or accepted in principle:

on the "Climate Intelligence Service" that the Scottish Government has this year committed to setting up jointly with the local government sector. As well as seeking a general update on progress in establishing the Service, we also ask how the Service can promote a consistent approach, and a sharing of knowledge, on the effective handling of applications for renewable energy or electricity transmission projects by planning authorities;

on creating a new route into the planning professional for school leavers via an apprenticeship system; and

on defining planning as a STEM (science, technology, engineering, mathematics) subject within the tertiary education system.

We also ask the Scottish Government to set out what changes it could make to the planning system in relation to applications for renewable generation or electricity transmission that would streamline and simplify the process for all (applicants and other affected parties), and which do not require primary legislation. In particular, we ask the Scottish Government to respond to views that the system would benefit from setting defined temporal "milestones" for planning authorities to meet when handling such applications.

We also ask the Scottish Government to respond to industry views that there is a currently a skills gap in Scotland, with not enough people with the right skills to work on the pipeline of renewable and transmission projects that will be needed to decarbonise the energy sector by 2045. We endorse the Economy and Fair Work Committee's recommendation (from their inquiry into the Just Transition in Grangemouth) that the Scottish Government must set out clearly how it will deliver a skills agenda to meet the challenge of transitioning to a net zero energy supply.

The Committee welcomes the ambition of setting a 5 GW target for green hydrogen in the draft Strategy but asks the Scottish Government to note and respond to evidence that it must more clearly map out a plan for how this is to be achieved for this ambition to have more credibility with industry and potential investors. This should include mapping out what role green hydrogen could play in helping decarbonise Scotland's main industrial emitters of greenhouse gases, whether in the short or longer-term.

The Committee asks the Scottish Government to respond to views from industry that, in not proposing targets for increased solar, tidal and wave energy, or for battery production, the draft Strategy has missed an opportunity to send a signal to the markets that these sectors have governmental backing, and that this should be rectified when the Strategy is finalised.

Intergovernmental co-operation and differences

A successful Scottish energy policy requires the Scottish and UK Government to be broadly agreed on common goals and to work together. We note that the UK Government has welcomed the Scottish Government's draft Energy Strategy.

The Committee recognises that reform of transmission charging raises complex issues and must fit into a whole-system consideration of how Grid maintenance and expansion is financed. However, a long-term strategic switch to offshore and onshore wind, green hydrogen and other forms of renewable energy changes Great Britain's energy generation map and raises questions as to whether charging for transmission based on relative remoteness is consistent with net zero goals. We note that Ofgem appear to have an open mind on revisiting the principles currently underlying the charging regime. It is now past time for this issue to be resolved, and for a clear view on the overall direction of travel on transmission charging to be set out. We request an update on proposed reforms from Ofgem and from the UK Government.

The Committee is disappointed that the Scottish and UK Governments appear not to have resolved their differences over order-making provisions inserted into the UK Energy Bill that may affect the consenting regime for offshore energy projects in Scottish waters. We repeat our concerns about the potential "chilling effect" on investment if the regulatory regime for this type of development is perceived to have become complex and overlapping, and call on both governments to continue to work towards a common understanding in this area, before these new powers under the Energy Bill, as enacted, are used.

The Committee notes views that pumped storage hydro should become a more significant component of Scotland's, and Great Britain's, future energy mix, as a means of increasing baseload and storage capacity within a decarbonised system. The Committee is not satisfied that the UK Government has made clear during this inquiry whether it is minded to intervene to provide assurance to potential private investors looking to invest in pumped hydro projects, such as at Coire Glas. We invite it to provide this clarity in its response to this report.

We also ask the Scottish Government to set out what ongoing action it is undertaking to support the viability of the Coire Glas scheme, and what further action it could take.

Engaging the public and communities

As this report has made clear, an expanded National Grid is a public good, and a necessary one, in response to the climate crisis. There is an urgent need for a national conversation, led by the Scottish Government, on what this change will mean: for Scotland as a whole and for different regions of Scotland. This should also include an informed discussion of the benefits and costs (including whole-life carbon costs) of different possible courses of action. All of this would be putting into practice the strategic "whole system approach" to energy decarbonisation that stakeholders have agreed is necessary.

The Committee believes that this should be backed up by a long-term spatial plan, produced in collaboration with network operators, Ofgem and the National Grid providing a best estimate of the scale and type of new infrastructure that will be needed and where it is likely to go, so that the public can see upfront what changes are likely and the reasons for them. Identifying opportunities for self-sufficiency in energy in remote or off-grid communities could be another goal of the plan, and it should identify remaining gaps in the distribution network where there is capacity to re-power or expand smaller sites through community energy projects.

The Committee is supportive of the principle of mitigatory measures for community benefit for any locality directly and significantly impacted by Grid development, recognising that it is important to get right the detail of any scheme that would put this into practice. This too must be part of this national conversation.

The Committee asks the Scottish Government for an update on its work to simplify and streamline the net zero funding landscape, in order to make it more accessible at the volunteer and community level, particularly in respect of community energy projects.

We reiterate our call for a planning process for energy transmission and generation projects that is more streamlined and reaches an endpoint more quickly, without diluting an individual or community's right to interrogate or challenge a proposal that directly affects them. No one's interest is served by lengthy delay, uncertainty and planning blight.

Introduction

Scotland is on a journey to net zero that requires an energy revolution. Replacing fossil fuels will require a radically different energy mix. Amongst other things, this means more electricity - sourced cleanly from renewables or other low or no-carbon sources - to help power industry, transport and appliances, and heat homes and offices. This change must happen at pace if Scotland is to meet its target of being net zero in greenhouse gas emissions by 2045.i

In this short, snapshot inquiry, the Net Zero, Energy and Transport Committee has examined Scotland's preparedness for this change, what progress has been made so far, and what more needs to be done in the run-up to the 2045 deadline. Our specific focus is on Scotland's electricity infrastructure: the "hardware" needed to make, store and move electricity, and on whether it is currently geared to enable this revolution or could impede it. The inquiry builds on prior NZET Committee scrutiny in this 2021-26 Parliamentary session, where stakeholders from different walks of life: local government, planning, transport, business and others, identified the expansion of electricity infrastructure as both a priority and a challenge:

Our work on Outcomes of the Conference of the Parties ("COP26") in Glasgow in 2021;ii

Our work on the fourth National Planning Framework for Scotland ("NPF4"); and

Our work on the role of local government and its cross-sectoral partners in financing and delivering a net-zero Scotland.

Remit

We agreed this remit for the inquiry:

This inquiry will scrutinise what electricity infrastructure will be needed to realise the ambitions set out in the Scottish Government's recently released Draft Energy Strategy and Just Transition Plan, and what will be needed to deliver that infrastructure. The Draft Strategy aims to deliver the Scottish Government's vision for a net zero energy system. This will be a short "snapshot" inquiry leading to a report to the Scottish Government as it finalises its new Strategy. It will also help inform future Net Zero, Energy and Transport Committee scrutiny of specific aspects of energy and climate policy and practice.

Areas of interest to the Committee in this inquiry include:

the suitability of the different electricity technologies that the Scottish Government wants to play a role in future energy supply (onshore/offshore wind, marine, solar, hydro)

the relationship between technologies (e.g. intermittent renewables, pumped hydro, battery technologies, hydrogen etc.)

these technologies’ compatibility with the current and planned electricity network

the regulatory regime within which they operate

whether the current planning system is geared to support and enable development of the infrastructure we will need within the right timeframes to reach net zero

This inquiry relates to electricity infrastructure in a broad sense, incorporating supply, transmission, distribution and storage. Substantial investment and changes in all these asset types will be needed for Scotland to meet its ambition to achieve net zero greenhouse gas emissions by 2045.

Planning for future electricity infrastructure in Scotland requires simultaneous consideration of the forms of supply, the relationships between supply and storage assets and the readiness of the electricity transmission and distribution networks for change. While the Scottish Government has significant control over the supply sources sited in Scotland, largely through devolved planning powers, the governance of electricity networks is a reserved matter.

The Draft Energy Strategy and Just Transition Plan was published in January. The overall aim of the Strategy and Plan are to set out how the Scottish Government aims to ensure Scotland has clean, secure and affordable energy in future and meets the 2045 target, by way of a just transition.

A "just transition" means achieving net zero by 2045 in a way that does not leave anyone behind and creates new economic and social opportunities, especially in those areas most impacted by a transition away from fossil fuels or other high carbon industries. It also means affordable energy for all. The main scrutiny work in this area is being taken forward at Parliamentary level by another Committee - the Economy and Fair Work Committee - which has a rolling programme of scrutiny on the just transition.

The Scottish Government have presented the Strategy and the Plan as a single text, rightly underlining that considerations on future energy supply are indivisible from considerations of fairness and social justice. In this report, we use "the draft Strategy" as a shorthand for the document, reflecting that our main focus has been on the energy part of it. However, the just transition has been raised during this inquiry, and is addressed at points in this report.

Formal consultation on the draft Strategy closed on 9 May. According to Parliamentary convention, the Scottish Government must respond directly to this report, but over and above this, we also want it to take our report into account as it continues its work on the Strategy. We are pleased to note that the Cabinet Secretary for Wellbeing Economy, Fair Work and Energy has indicated that this is something the Scottish Government will do.

The Committee's scrutiny

We issued a call for written views at the launch of the inquiry. It posed 13 specific questions, structured around the main strands of the remit. In view of the time-limited nature of the inquiry, this was a targeted rather than a general call for views, directed at key energy sector stakeholders with a particular interest in electricity infrastructure. However, as ever, we were happy to accept as evidence responses received from anyone during the period of the consultation that were relevant to the remit. We received 19 responses and links to these, along with relevant Ministerial correspondence, are available at via the "correspondence" tab on the inquiry homepage.

Committee Members also received some correspondence from individual members of the public as the inquiry was drawing to a close. These were of a similar nature, objecting to the perceived negative impact of a proposed major development of electricity infrastructure on a particular mainly rural area of Scotland. This correspondence did not arrive in time to be treated as formal evidence, and it is not the Committee's role to look into specific cases, but the general point had been raised in other written and oral evidence, and is noted in this report.

On the evening of 18 April, some Committee Members had an informal online discussion with 11 representatives of Small or Medium Enterprises (or bodies working with SMEs) in the renewable energy field in Scotland. The group was geographically diverse, with an equally diverse set of skills and specialisms; for instance, in batteries and storage, wind or tidal energy, geothermal heat or electric vehicles. We asked about the obstacles they face as businesses, and about what interventions could be made to help our domestic renewables sector flourish. Hearing from those seeking to run a viable, thriving business at the cutting edge of new or developing technology helped the inquiry remain focused, with an emphasis on finding solutions and identifying deliverable, positive change. A note of this discussion is available from a link on the inquiry homepage.

We also made an inquiry-related visit on 24 April, when some Committee Members were guests of Scottish Power, which, along with SSEN, is one of Scotland's two electricity network owners and operators. We visited Scottish Power's control room in Glasgow, watching how the network they cover - encompassing millions of homes and businesses - is managed in real time. Scottish Power then took us on a tour of the UK's largest onshore windfarm at Whitelee, south of Glasgow. We discussed the challenges of getting the windfarm started, of maintaining it, and maximising its energy potential. We discussed how environmental impacts of the site are managed and mitigated and how it is used as a green energy learning space. We also heard about Scottish Power's future plans for Whitelee, including their plans to repower, by replacing existing turbines with a smaller amount of the next generation of turbines, which are larger, and more efficient.

We held four evidence sessions:

On 21 March, we took evidence from two panels of key energy industry stakeholders and experts;

On 28 March, we heard from the Office of Gas and Electricity Markets (Ofgem);

On 27 April, we heard from Andrew Bowie MP, Minister for Nuclear and Networks and supporting officials from the Department for Energy Security and Net Zero (DESNZ), UK Government; and

On 9 May, we had our concluding evidence session with Neil Gray MSP, Cabinet Secretary for Wellbeing Economy, Fair Work and Energy, and supporting officials.

We are grateful as ever to everyone who, in different ways, has contributed their time and expertise to our scrutiny.

There were two changes in the Committee's membership between the start of the inquiry and our report being published:

Fiona Hyslop MSP ceased to be a member of the Committee on 14 June, and was replaced by Ben Macpherson MSP on 28 June, who also replaced her as Deputy Convener; and

Liam Kerr MSP ceased to be a Member of the Committee on 29 June, and was replaced by Douglas Lumsden MSP on 29 June.

Following this introduction, the report is in two parts:

The first sets the scene, putting in context the matters the Committee has considered during this inquiry;

The second sets out key themes and findings of the inquiry. This contains our main conclusions and recommendations.

Setting the scene

Reserved and devolved energy policy

The remit for this inquiry alludes to the significantly reserved nature of energy policy. A single integrated electricity grid operates on the island of Great Britain, with responsibility for most energy policy resting with the UK Government and UK Parliament. This includes the regulation of the energy sector which is delegated by statute to an independent regulator; the Office of Gas and Electricity Markets (Ofgem).

As this inquiry was running, major reforms to energy policy were being proposed in the UK Parliament in the Energy Bill, which was at its final amending stages as the Committee was agreeing this report. Overall, these are intended to deliver increased energy security at a time of change for the sector and to meet ambitious net zero-linked goals. There have been other relatively recent changes, or proposed, changes to reserved elements of energy policy and, where relevant, these are discussed further in the report.

The Scottish Government has responsibility for the promotion of renewable energy generation, energy efficiency, and the consenting of electricity generation and transmission development. It has general responsibility for planning law, through which any developments must be approved and through which the environmental impacts of developments can be addressed. Skills development and enterprise bodies are devolved.i Policies adopted in Scotland in areas that are largely devolved such as home heating , and even in areas like public sector procurement, can also have a huge impact on energy policy.ii

Another distinct element of energy policy in Great Britain is the existence of private companies effectively exercising monopoly roles, under regulation, in relation to the provision of a key public service: reliable and affordable electricity for all.iii They have statutory powers to secure their ability to perform this role, the exercise of which may interfere in some cases with the private rights of individuals or legal persons. Examples include the right of electricity network operators (in Scotland, SSEN and SPEN) to obtain "necessary wayleaves" to place or maintain electric lines on land.

In line with the Committee's constitutional role, our recommendations in this report are primarily directed at the Scottish Government, with a focus on matters where it has power or the capacity to exert influence, but this report will also be shared with the UK Government and with Ofgem, and some recommendations are also directed to them.

Draft energy strategy and just transition plan

Scotland has made progress in reducing its carbon footprint but it is widely agreed that progress in future years will be harder, requiring radical changes in some areas. The most recent annual report on Scotland's progress to net zero from the Climate Change Committee - the statutory advisor to all UK administrations - warned of a loss of momentum. It said that the Scottish Government must place an increased focus on effective net zero planning and delivery in order to get back on track to meeting its own 2045 target

Areas where the CCC and others agree that change is most needed include:

Industry; for instance, finding ways to create the intense heat required in sectors such as construction without burning fossil fuels;

Transport: powering public transport systems through cleaner energy and continuing to encourage and enable a societal shift to electric car use;

Built environment; ending reliance on fossil gas or oil as the usual heating fuel in homes and offices. The Scottish and UK Governments and the Climate Change Committee all envisage heat pumps (which use electricity) as playing a major role in delivering this change at scale, although it is recognised that current heat pump technology may not be optimal in all cases (e.g. for older and less well-insulated properties);

Agriculture: for instance finding cost-effective ways to make fertilisers from low or no carbon.

Making progress in these areas means:

Generating much more electricity than we do at present, from clean or very low carbon sources, as a replacement for fossil fuels;

Increasing network capacity so that the grid can handle this greater flow;

Increasing our capacity for storing electricity in batteries, for instance when wind turbines generate more energy than is needed at that time or can be safely put on the grid. Batteries are also expected to play an increased role at household level, linked to other technologies like solar panelling;

Having increased capacity to convert electricity into other forms of energy, for specific purposes for which electricity is not well suited or to maintain a baseload.i (This is also, in a broad sense, a type of storage.) Hydrogen and pumped storage hydro power are two examples mentioned in the inquiry remit and they are discussed further below.

This need for more electricity might be met by importing more. However, this would be to disregard the enormous renewable energy potential of Scotland's landmass and offshore waters. This is reflected in the growth so far of Scotland's renewable energy output: from 2.7 Gigawatts (GW) of installed energy capacity of in 2010 to 14.2 GW in 2023. Thus far, this growth has mainly been in onshore wind, but the 2022 "Scotwind" leasing round, when bids for 20 major offshore wind projects were accepted, adding up to almost 28GW of new capacity (if fully realised), is a recent example of the potential for growth in other areas. Generating more energy domestically, and from a greater variety of sources and technologies, also increases our national energy security.iii Finally, creating new jobs from green energy is the just transition in action,iv with the potential to create many thousands of new jobs, including in more remote or less economically active parts of the country, and to harness the transferable skills of oil and gas workers.

This ambition is reflected in the opening message of the Scottish Government's draft Strategy. It states:

To realise our climate change ambitions, we need to transform the way Scotland generates, transports and uses energy. We must seize the huge opportunity this presents and deliver maximum benefits to Scotland's people, workers, communities and economy from our vast renewable energy resource.

Targets, aims and policy positions set out in the Strategy that are relevant to this inquiry include:

Renewables: "20 GW [gigawtts] of additional low-cost renewable electricity generation capacity by 2030, including 12 GW of onshore wind, and we are consulting on setting a further offshore deployment ambition". The draft Strategy states that adding 20 GW capacity would be the equivalent of 48% of Scotland's current total energy demand. On offshore wind, the draft seeks views on whether the Scottish Government's 2020 target of 8-11 GW of offshore wind in Scottish waters by 2030 should be increased, and what the ambition should be for 2045.

Hydrogen: "a renewable and low-carbon hydrogen production ambition of 5 GW by 2030 - equivalent to a sixth of Scotland's energy needs by 2030 - and an ambition for 25 GW by 2045. Hydrogen is an emerging sector perfectly placed to support a just transition for existing oil and gas workforces and we have set out plans to rapidly grow Scotland's hydrogen economy."

Hydro power: "Hydro power has the potential to play a significantly greater role in the energy transition and we are urging the UK Government to act now to ensure the clean energy and storage capability of Scotland's hydro resource can be realised by instituting appropriate market mechanisms."

Heat in buildings: "This draft reaffirms our ambitions to decarbonise 1 million homes by 2030, and to reduce emissions from our non-domestic buildings and invest over £1.8 billion in decarbonising homes and buildings, through Heat and Energy Efficiency Scotland - our national energy agency."

Off-grid homes: "We are taking action so that by 2030 the vast majority of the 170,000 off-gas homes that currently use high emissions oil, LPG and solid fuels, as well as at least 1 million homes currently using mains gas, convert to zero emissions heating."

Nuclear: "The draft reiterates our firm position on traditional nuclear energy, that we do not support the building of new nuclear power plants under current technologies."

Community-owned energy: The Scottish Government has an ambition of 2 GW of community and locally owned renewable energy by 2030.

Climate Change Committee report

The Climate Change Committee's published their report, Delivering a Reliable Decarbonised Power System, in early March, at around the same time as our inquiry launch. It was addressed primarily to the UK Government but contains relevant messages for this inquiry. These include:

A resilient decarbonised electricity system is deliverable by 2035 but only with "urgent" changes. These include enabling planning, consenting and connecting processes to move at far greater speed;

The same urgent approach is needed to enable the development of the "portfolio of low-carbon flexibility and back-up capacity". The CCC estimates that around £300-430 billion will be required to assemble this portfolio, meaning new regulations, incentives and business models are needed;

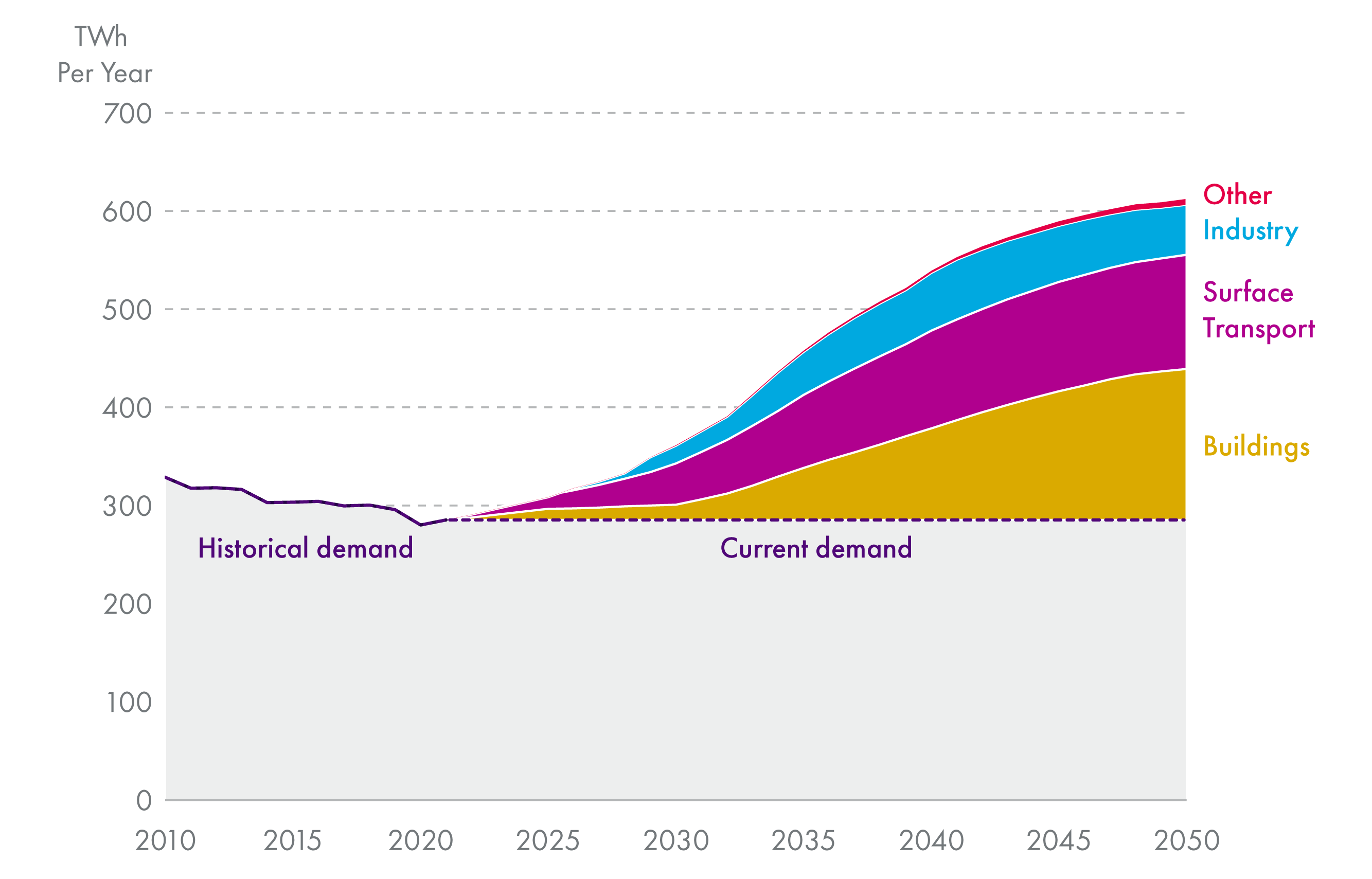

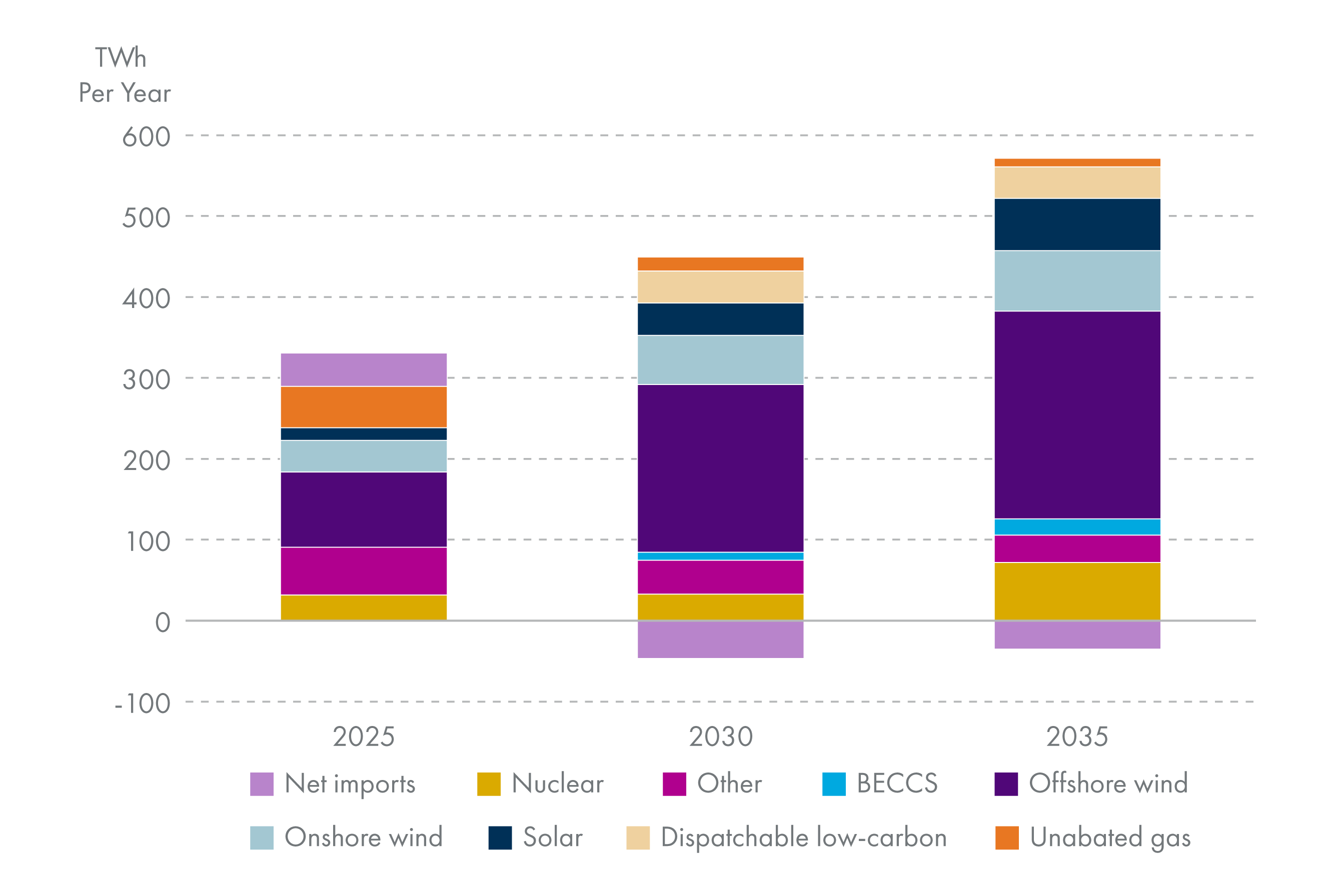

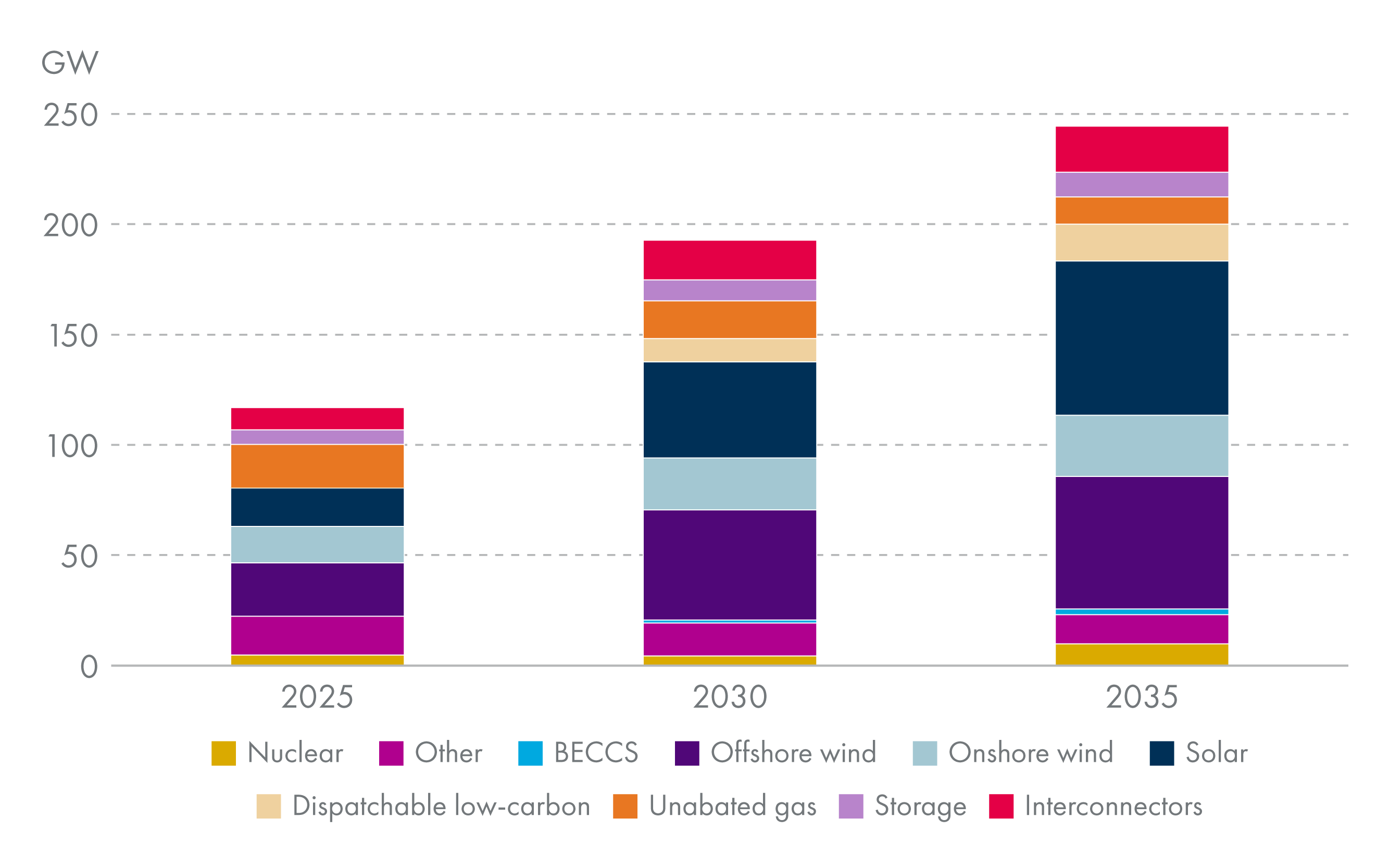

Decarbonisation of the energy system means more electricity is needed. The CCC's "balanced pathway" estimate is that there will be a 50% increase in electricity demand by 2035 and a doubling by 2050. Alternative modelling indicates need could even be trebled by 2050;

A decarbonised electricity system will add to the UK's energy security by massively reducing dependence on fossil fuel imports. It also provides opportunities for economic growth, especially in established or emerging renewable energy technologies;

Government must set strategic direction for future hydrogen use, identifying a set of "low-regret" investments that can proceed now. Decisions on hydrogen transmission, transportation and storage should be fast-tracked;

Winser report

Another contribution to the current debate comes from the report on Accelerating electricity transmission network deployment by Nick Winser, the UK Government's first independent Energy Networks Commissioner ("the Winser report"). This was published on 4 August, after we had concluded taking evidence. It echoes the CCC's March report in calling for "dramatic" and "bold" changes, both to increase the Grid's overall capacity and to speed up the rate of Grid connection.

Our future energy mix

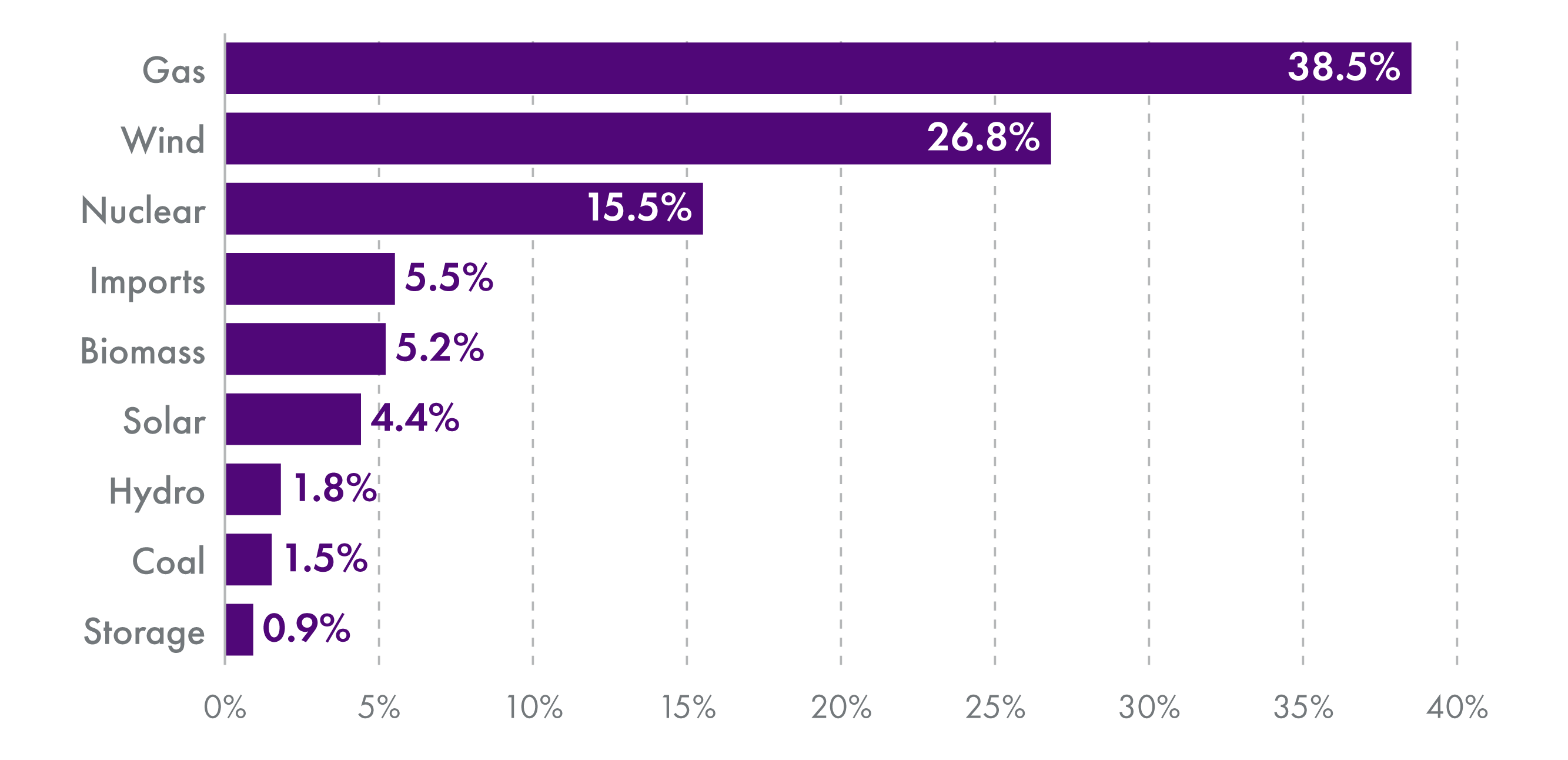

The CCC's March report sets out scenarios for a future energy generation mix on the British grid up to 2050. These envisage renewables (primarily onshore and offshore wind and solar energy) comprising around 70% of annual generation, with the balance including low-carbon back-up generation (such as hydrogen-fired turbines) and nuclear power. The report envisages a continuing but much reduced role for unabated fossil gas to provide flexibility and additional security.

The energy sector is the classic complex system, and ascertaining future energy need at a time of great change - in response both to the climate emergency and geopolitical shocks such as the Ukraine war - will be iterative and dynamic, especially in relation to some relatively untested or currently underdeveloped technologies. However, stakeholders have offered their views on probable trends or outcomes, and where relevant we comment on what this should mean in terms of future electricity infrastructure needs. The premise that we will need significantly more electricity than at present to reach net zero, with most of this coming from domestic renewables, was not challenged during the inquiry. Stakeholders who referred to the CCC report, among them Ofgem, saw it as setting credible parameters in relation to both future energy need and future energy supply.i

Green hydrogen

There was also widespread agreement that reaching net zero will mean hydrogen playing an increased role in the energy mix.i Hydrogen can be burned as fuel like oil or gas, but creates only water vapour, not greenhouse gases. It is abundant but rarely in a pure form, and is highly reactive. A process is needed to separate it, capture it and store it securely, and there is a cost to this.

Part of the overall discussion on hydrogen's place in the energy mix is a discussion on the various ways of processing hydrogen and which of these processes will realistically have a role in the net zero journey. As a shorthand, these methods are referred to by colours: "grey" hydrogen, "blue" hydrogen, etc.

Our interest in this inquiry has been in "green" hydrogen: hydrogen obtained by running an electric current through water. The infrastructure needed for this -electrolysers, storage and means of transportation - is therefore within the inquiry remit. Green hydrogen is the way of making hydrogen with the lowest carbon footprint, provided the electricity used to make it is itself "green". The production of green hydrogen for everyday use is already happening in Scotland, albeit on a relatively small scale. We saw this for ourselves in 2022 on visits in relation to our local government and net zero inquiry. For instance, in Orkney, we heard how an island community were able to convert excess electricity from a small renewables project into hydrogen for local use.

In that example, electricity was "excess" in that more was at times being produced than the local network had the capacity to handle. Converting the electricity into hydrogen meant that the energy could be used, not wasted.iii However, energy is lost during electrolysis.iv To that extent, creating green hydrogen from renewable electricity is less energy efficient than making direct use of the electricity.i

On the other hand, there are harder to decarbonise areas where hydrogen will be a more viable replacement for fossil fuels than electricity. These may include aviation, large ground vehicles (as we saw councils pioneering during visits in our local government inquiry), any industrial process requiring intense heat, and the manufacture of ammonia. A more controversial issue is as to whether hydrogen will play any substantial role in heating buildings. Hydrogen and electricity are also transported differently, creating different constraints and potential advantages. The prospect of a global market in hydrogen is being increasingly discussed, and the draft Energy Strategy envisages Scotland "exporting renewable hydrogen and electricity to support decarbonisation in Europe".

One of the key challenges of current energy policy is the development of a future system which efficiently produces the right amount of energy sources (such as electricity and hydrogen) to match demand.v This can be expected to vary in line with local or global circumstances. Preparedness and flexibility in relation to future green hydrogen infrastructure were therefore relevant considerations for this inquiry. Maximising green hydrogen also reduces the need for blue hydrogen: hydrogen produced from hydrocarbons. Whilst the UK and Scottish Governments both envisage, and are planning for, blue hydrogen being part of our future energy mix, not everyone agrees that it has a viable role in the journey to net zero, and this was touched on at times during this inquiry.vi

Storage of electrical energy and future baseload

Green hydrogen "stores" electrical power, albeit it has discrete uses in that form. There is consensus that much more storage capacity will be needed overall in the system as fossil fuels are replaced by renewables, and in different forms, to increase flexibility and to spread the risk.i This is because intermittency (peaks and troughs of generation) is a natural feature of most renewable energy and because phasing out fossil fuels, as well as closing Scotland's last remaining nuclear power at Torness by 2028, means finding new ways of achieving a reliable baseload. (It is important to caveat this in the context of an integrated GB grid which also draws power from continental sources - including nuclear power - to secure a continuing baseload.)

The draft Strategy endorses an overall vision of increasing storage capacity, including developing Grid-scale batteries as an established asset class, but does not set targets for increasing battery storage. It says:

Scotland has approximately 864 MW of electricity storage capacity, and 2.2 GW of battery storage that has been approved planning permission. We need to significantly increase this capacity.

Pumped hydro storage involves using electric power to pump water to a higher elevation. (This is as opposed to conventional, i.e. river-run, hydro-power, which is a means of generating power but not storing it.) Running the water downhill through turbines generates electricity. As well as being a general source of stored energy, pumped hydro can, at sufficient scale, deliver a "black start" of a transmission system that has suffered a blackout, an essential element of national energy security. Whilst once again not setting a specific target for pump hydro storage, the draft Strategy calls for more action to enable expansion:

There are currently 1.5 GW of pumped hydro storage projects awaiting construction in Scotland that could deliver vital flexibility for the grid and balance out the intermittent nature of renewables. However, the lack of a dedicated support mechanism means these projects do not have sufficient certainty to proceed. We have repeatedly called on the UK Government to support the development of pumped hydro storage. Recent events have fully demonstrated that reliance on gas balancing is no longer tenable from a price or environmental perspective. Given this, it is now imperative that the UK Government provides the right framework for investment to enable pumped hydro storage projects and similar technologies to proceed.

Key themes and findings of the inquiry

In an inquiry focused on potential enablers and inhibitors of energy ambitions, the following emerged as key themes:

The grid: capacity and connection;

Creating the infrastructure;

Complexity and cooperation;

Engaging the public and communities.

There was also one underlying and linking theme. This was urgency. In this time of a climate emergency, stakeholders agreed we will not meet key targets, including the 2030 interim targeti and the 2045 target, unless governments, regulators and operators move at pace to address barriers to a decarbonised energy network.i

Modernising the Grid

Regulation of the electricity Grid is reserved but it was one of the main issues brought up during the inquiry, including in our informal session with SMEs. The overwhelming view from industry stakeholders was that, in its current state, it is an inhibitor of our net zero ambitions and of a truly entrepreneurial culture in the energy sector.i Two main concerns were raised:

The Grid's overall capacity to handle an increased electricity load;

Delays in connecting new generation sources to the Grid.

These concerns are related, in that it is the lack of Grid capacity that tends to hold up new connections.

In its draft Energy Strategy the Scottish Government states:

Significant infrastructure investment in Scotland’s transmission system is needed to ameliorate constraints and enable more renewable power to flow to centres of demand. National Grid ESO has identified the requirement for over £21 billion of investment in GB electricity transmission infrastructure to meet 2030 targets. Over half of this investment will involve Scottish Transmission owners SPEN and SSEN. The most recent Network Options Assessment from the ESO also includes two major subsea links to England from Peterhead..

The draft states that the Scottish Government are “engaging with Ofgem and the network operators to provide clear and transparent information on the impact of SG policies and targets on network infrastructure”. At a UK level, the Scottish Government is working in partnership with relevant stakeholders through the Offshore Transmission Network Review.

In its March report, the CCC noted National Grid's own estimate that in order to support the UK Government target of up to 50 GW wind by 2030, more than five times the amount of transmission infrastructure will have to be installed in England and Wales than has been built in the last 30 years and that "the requirements in Scotland will add to this further."

Grid capacity

A private company- National Grid ESO - runs the Grid, but is subject to regulation by Ofgem. The grid has been run "tightly" and with "little headroom" in the words of a Scottish Government witness, i.e. seeking to match capacity closely to usage.i The main reason for this is cost, as expanding the grid is expensive, and costs will be passed on to the consumer in their energy bills.

It was a widespread view in evidence that this approach was becoming increasingly outdated.ii Moving away from fossil fuels will require more electricity loaded onto the Grid to substitute for them. As the bulk of this electricity will come from renewables, it will also mean more intermittency and a wider geographical spread of electrical generation; a large proportion of this from Scotland or Scottish waters. These combined factors will leave Grid capacity increasingly overstretched. Grid capacity was designed to accommodate centralised, large-scale generation and is now inadequate. A number of stakeholders said that oversupply of renewables was a growing risk,iii with one submission claiming that "we already curtail one third of wind generation in Great Britain"iv. The different approach that most stakeholders thought was now needed is often described as investment ahead, or in anticipation, of need. The Energy Saving Trust called for:

More anticipatory grid investment ahead of firm demand, as otherwise there is a risk that capacity will not be in place when it is needed. This risk is arguably much greater now than the risk of building too much grid capacity.v

Stakeholders made clear that the need for anticipatory investment applied to the distribution network just as much as it did to the transmission network, in response to the need to decarbonise transport and domestic heating, for example.vi

The Winser report also calls for a major shift. It says it is no longer tenable to "wait and see what energy sources and demands arise, then hope to build the necessary networks in time. This would guarantee that network capacity upgrades will be late and insufficient."

Grid connection

In our call for written views and in our evidence sessions, we also sought views on:

Whether current business plans from Scottish and Southern Energy Networks (SSEN) and Scottish Power Energy Networks (SPEN) allow for sufficient investment in networks to realise the Energy Strategy's ambitions;

Whether SPEN and SSEN are able to alter investment plans sufficiently in response to a fast-moving policy environment.

Connection to the Grid is a matter for the electricity network operators, under regulation by Ofgem. Ofgem sets price controls for operators, which regulates how much can be spent on investment and innovation. In doing so, they seek to balance interests, including the interests of consumers, to whom costs arising from investment could be passed on. SSEN is the monopoly operator for approximately the northern half of Scotland and SPEN for the southern half. They have an operating role in relation both to the transmission network; electricity's high-speed, high-volume "motorway", and the distribution network, which conveys electricity to local areas and therefore has more overall reach.

We heard widespread agreement that the time taken to gain a Grid connection is one of the most substantial barriers to accelerating the pace of renewables deployment and therefore to achieving net zero goals.i Whilst the time taken to obtain a connection will vary depending on location, we heard that connection dates now stretch well into the 2030s,ii that operators are currently "overwhelmed" by the volume of applicationsiii and that this risked having a chilling effect on the expansion of the renewables base, and the associated economic benefits. The submission from the West of Orkney Windfarm said:

Any delays, predominantly linked to planning and supply chain constraints, will jeopardise investor confidence, Scottish supply chain development and the scope for Scotland and the wider UK to meet their respective 2030 targets.

Lack of a grid connection was also one of the main barriers identified in our informal session with renewable SMEs.

The regulated period for the transmission network (known as RIIO-T2) runs from 2021 – 2028, and for the distribution network (known as RIIO-ED2) from 2023 – 2028. SSEN’s RIIO-T2 Business Plan gives an expenditure forecast of £2.36bn, and their RIIO-ED2 Business Plan assumes a total base expenditure of £3.99bn. SPEN’s RIIO-T2 Business Plan sets out expenditure of £1.38bn, and their RIIO-ED2 Business Plan assumes total expenditure of £3.3bn. We sought views on whether the existence of multi-year investment plans risked leaving operators boxed in, with insufficient flex to adapt to new developments or revised priorities. Most respondents to express a viewiv considered that this was a risk but that it was, to an extent, mitigated by measures such as:

uncertainty mechanisms which, if certain conditions are met, allow for a degree of financial reallocation, in response to a change in circumstances,

the Accelerated Strategic Transmission Investment (ASTI) framework, introduced by Ofgem at the end of 2022. The ASTI framework aims to accelerate major electric transmission projects by streamlining the regulatory approval process.

Among those to express a view along these lines was SSEN, one of Scotland's two network operators. They said that uncertainty measures were "largely delivering as intended".v However, stakeholders agreed that it would be important to keep these measures under review, and to check whether they were continuing to deliver the real-time flexibility needed throughout the regulated period.vi

A related issue raising concerns particularly from smaller players in the energy industry was what was seen as the operators' "first come first served" approach to allowing new grid connections. In evidence in our informal session with SMEs, we heard of concerns that larger firms dominated the list, closing out opportunities for smaller rivals. We also heard that there appeared to be no clear mechanism to remove bids from the list when there has been a lack of progress.

In the cover letter to his August report, Nick Winser commented:

Currently, the expectation is that strategic transmission may take twelve to fourteen years from identification of the need to commissioning. Very few new transmission circuits have been built in the last 30 years and a dramatic increase will be required through to 2050 [the year set by the UK Government for net zero], so even these long timescales may be challenging to meet if we fail to streamline the process. Substantial wind generation can be built in half this time. So, the challenge to me, set by the Secretary of State at the time, to reduce the timescale for building strategic transmission by three years, and ultimately by a half is the right one. I believe that we must hit the more ambitious end of this and reduce the overall timescale to seven years. I am confident that this is achievable.

Views of government and regulators

Ofgem told us that nothing in their regulatory approach ruled out investment ahead of need. They said the introduction of ASTI indicated a strategic switch to "system planning with anticipatory investment".i They told us it was for companies making an approach to them for grid expansion to demonstrate the robustness of their business case for the whole lifespan of the asset. They told us they would "probably not apologise" for their stress on cost efficiency but said they were adjusting their approach in response to the changed energy landscape. They cited the recent introduction of the ASTI framework as an example of this changed approach.ii

Ofgem also told us they were minded to introduce "milestones for parties that are progressing their projects, so that, if they do not hit those milestones, they will be removed from the queue."iii

The Cabinet Secretary told us that the Scottish Government had been calling for a more agile approach to network regulation for many years. He said that Ofgem's recent approval of local network business plans for the next five years and the decision to accelerate the delivery of strategic transmission investment were "positive steps in that direction".iv

However, he added that:

... the UK Government’s plans to redesign our electricity market through its review of electricity market arrangements—or REMA—must be conducted with sufficient lead time to protect investor confidence and ensure that the critical infrastructure and investment needed today to protect consumers and keep us on the pathway to net zero are not delayed. That is why we are continuing to call for urgent reform to the grid connection, queue management and transmission charging regimes, all of which could lead to transformational change in much quicker time. We agree that the time taken to consent Grid infrastructure projects needs to be accelerated, while still ensuring robust and balanced decision making.iv

The UK Minister told us that the UK Government was working closely with Ofgem on network capacity. He said that:

As part of the electricity distribution network framework, which sets the allowances for networks for the lower voltage network which comes to consumers’ homes, Ofgem has allocated £22.2bn of investment, which includes £3.1bn for network upgrades. These upgrades will ensure the network has adequate capacity for consumers’ demand as more low-carbon technologies, like heat pumps and electric vehicles connect to the grid, as well as accommodating smaller-scale, local renewable generation on the distribution network.vi

Ofgem's net zero role

Ofgem's statutory obligations have not included an explicit requirement to support or enable net zero. Their principal statutory objective is "to protect the interests of existing and future gas and electricity consumers." In addition, they have a duty to protect existing and future consumers’ interests by the reduction of greenhouse gases emissions in electricity and gas.

In evidence, and in our informal session with SMEs, there was widespread support for imposing a more specific net zero duty. We even heard views that the absence of such a requirement made Ofgem a barrier to reaching net zero, giving too much weight to short-term costs and benefits to the consumer rather than the bigger picture.i

This was not a view shared, at the time, by either the UK Government or by Ofgem themselves. Ofgem told us that they felt a change along these lines would make no practical difference, as they "already doing the things that we think we need to do to deliver net zero".ii When he gave evidence on 27 April, the UK Minister said the Government was still reflecting on proposals to add achieving net zero to Ofgem's statutory role by way of amendment to the Energy Bill, but was not at that point persuaded.iii

There has been a change since then with the UK Government in early June laying an amendment to its own Bill to create a more express duty to support the achievement of statutory net zero targets. Ofgem has made a public statement that it welcomes this proposed new mandate.

An expanded National Grid is a direct and inevitable consequence of decarbonising our energy supply to achieve net zero: it is a public good. The approach of seeking to match Grid capacity to current usage is now outdated as policy, and should be replaced by the principle of prudential investment in Grid capacity in anticipation of future need, and in order to meet the 2045 net zero target. The Committee calls for this changed approach to be signalled clearly and strongly by governments and Ofgem. Amongst other things, this would also increase long-term public and investor confidence in our renewables industry.

For the same reasons, a clear statement of intent about, and plan of action for, speeding up Grid connection is also needed from governments. It is unacceptable that developers are being asked to wait upwards of a decade for a connection. It is also completely at odds with ambitions to grow a world-leading renewables sector.

We call on the Scottish Government to work with the UK and Welsh Governments, Ofgem and National Grid ESO to:

enshrine and publicly promote Grid expansion in anticipation of need as a joint long-term, strategic goal of GB energy policy, setting out how this is to be achieved, and

promote a plan of action (including investment and legal change where needed) to bring down average waiting times for Grid connection.

The Committee is also specifically concerned by evidence of a "first come first served" approach to Grid connections that can mean delayed or speculative projects in the line for a connection act as a a block on others, and that it is smaller or less established players in the renewables sector that disproportionately suffer because of this. We agree with views that a more proactive regulatory approach to queue management is needed. We ask the Scottish Government whether it accepts this evidence and, if so, what action it can take, including by way of making representations to the UK Government or Ofgem, to address this.

We direct the above conclusions and recommendations to the UK Government and to Ofgem for comment.

The Committee welcomes the UK Government's amendment of the Energy Bill to impose an express mandate on Ofgem to support the achievement of net zero, for which there was much support throughout this inquiry. We hope this helps clarify the central role that reaching net zero must play in Ofgem's strategic planning, decision-making and overall regulatory approach.

Creating the infrastructure

Meeting the scale of ambitions for renewables set out in the draft Strategy means investment at scale in a wide variety of physical assets. For some of these, such as domestic-scale batteries, there is a developing international market and demand might be met through importation. However, the draft Strategy states that:

Maximising opportunities for growing net zero energy sectors and businesses, driving investment and increasing trade opportunities will be critical to delivering a just transition. Through government investment in the net zero energy economy and by providing a stable policy environment and clear market signals, our aim is to attract increased levels of private and inward investment into Scotland's energy sector. Boosting our skills base and domestic supply chain will support the creation of vital jobs across the economy.

Developing this asset base also means vastly increasing storage capacity, much of this in new ways. For instance, we have no prior experience in Scotland or the wider UK of storing hydrogen at scale, and we heard from Professor Stuart Haszeldine of the University of Edinburgh that this presents logistical challenges in Scotland, which does not appear to have the right geology for mass underground storage. He cited recent studies indicating that in future, we will have to store some 15 to 25 percent of our annual energy: a "huge amount". He told us that "Work on that is in progress, but it will be needed much sooner than the progress suggests it will happen at the moment."i

Stakeholders told us that growing the asset base raised a number of practical challenges. Concerns related to:

The planning system

skills and workforce

Targets and governmental signalling.

These concerns were interconnected. Together, they all related to having confidence in Scotland as a reliable, business-friendly place for the renewable energy sector.

The planning system

The Committee is by now familiar with concerns about the planning system's chilling effect on investment in the Scottish renewables industry, and the risk of investors looking elsewhere because of concerns that the consenting period here will be too slow. We heard this during our scrutiny of NPF4 and our inquiry into local government's role in contributing to net zero. These concerns were repeated in this inquiry. They include:

that the planning regime has, over the years, become too complex. Stakeholders said that complexities of the system burdened projects with unnecessary delay or slowed decision-making;i

a loss of resources - especially human resources - within council planning departments and the additional burden this placed on an already strained system.ii During our local government inquiry, we heard that nearly a third of planning staff had been cut since 2009, and that the number of planners working for planning authorities had decreased by around 20% between 2011 and 2020. We heard that further strain arose from it being disproportionately the most experienced cadre who had left the local government planning system;

A lack of consistency in the application of the rules across planning authorities and in the depth of technical knowledge in different planning departments, creating unpredictability.iii

We were interested to hear views that local authority planning departments can "be overwhelmed with detailed technical asks" and that the solution might be "a central facility in Scotland to dispense and disperse information".iv This mirrors the recommendation in our local government report for there to be a "central intelligence unit" to assist local government with more technical and difficult net zero-related challenges. This was largely accepted by the Scottish Government and we understanding that implementation is now being carried forward jointly with COSLA.

NPF4, which identifies climate change as the key objective of national planning policy, was generally welcomed as a step forward.vi Scottish Renewables described it as enabling "probably the best planning regime for renewables in the whole of Europe".vii But we also heard that it cannot, on its own, rectify those many aspects of the the planning system that cause delay and uncertainty. We heard calls for "a more structured process with clear timelines, clear roles and a voice for everyone involved".viii Scott Mathieson of Scottish Power Energy Networks said of NPF4 that:

It takes us forward, but it does not go far enough. We need a planning process that has defined timescales. One of our projects is from Beauly to Denny, and our Kendoon to Tongland reinforcement project in south-west Scotland has been eight years in the making. It has been frustrated through a planning process for four or five years, and there were also three years of redesign and changes to accommodate what stakeholders in the area wanted. That cannot happen if we are to build the DC [Direct current] links.ix

This call for defined timescales within the planning process was repeated in other evidence. x

The Winser report recommended that in Scotland:

the trigger for mandatory public local inquiry is removed from the planning authority so that only a Scottish minister can trigger one based on all responses from statutory consultees. This amendment to The Electricity Act of 1989 should be progressed as a matter of urgency, possibly through the current Energy Bill passing through Parliament. This is required to support 2030 projects required to meet energy targets.’

As we discuss later, views such as these exist alongside views that more and better consultation at community level is needed in advance of any major work to create new network infrastructure.

Skills and workforce

A number of stakeholders also identified workforce capacity as a potential barrier.i They questioned whether Scotland had enough people with the right skills in the right places to accelerate the development of renewables at the pace set out in the draft Strategy or in the Scottish Government's Onshore Wind Policy Statement (2022). Whilst redeployment of oil or gas workers to the low or no-carbon energy sector is often cited as a key aim of the just transition, and there are felt to be useful skills synergies in some developing areas (such as floating offshore windii), we heard that this read-across of skills is often not exact. iii Views in this inquiry that local authorities need support to invest in skills training for future energy needs echo views we heard repeatedly during our local government inquiry.iv

In our informal session with SMEs, we heard views that the draft Strategy does not set out how the Scottish Government proposes to address the skills deficit.

Aileen McLeod of SSEN identified skills training as one of the three main issues (alongside planning reform and clearer market signalling) that the Scottish Government must prioritise:

We want to transition, in effect, from a high-carbon economy to a low carbon economy. Doing that in a managed way will require planning for skills development across our whole country so that our young people can see a future and a high-value job through which they can contribute to the social good and social fabric of our country.v

Our scrutiny in this area links to recent work by the Economy and Fair Work Committee. During their inquiry into the Just Transition in the Grangemouth area, they heard from witnesses about the importance of skills development to enable the transition to net zero, and to ensure that opportunities were accessible to everyone. This will require clear sight of the pipeline for opportunities so businesses have confidence to invest in their workforce, and so that people can make informed decisions about the education and training they undertake. The report called for the Scottish Government to:

Set out clearly how it will deliver a skills agenda that meets these challenges.

Targets and governmental signalling

The draft Strategy's aim is to mark Scotland out as a global leader both in renewables (especially wind, tidal and wave energy) and green hydrogen. However, stakeholders made clear during this inquiry that Scotland is increasingly in a global race for investment, people and materials,i and risks losing out unless the right choices are made, and quickly, and the right market signals are sent by government, including national strategic and spatial planning at governmental level. ii Constraints on the global supply chain in materials for renewables were repeatedly cited as a threat to the Scottish Government's energy ambitions.iii Written evidence from the Scottish National Investment Bank suggested it could play a role in helping develop a supply chain for the nascent floating offshore wind sector. In relation to opportunities in offshore wind, the Bank commented that it:

has a crucial role in investing its commercial public capital in flexible forms, response to the particular needs of asset classes within the supply chain, to entice the required private capital.

Some evidence iv referred to the importance of taking a "whole system approach" to future energy transmission and generation (of all types); mapping out sequentially and spatially what new infrastructure will be needed and maximising opportunities for synergies and efficiencies, as the network is transformed - synergies, for instance in relation to offshore wind and green hydrogen.v

The draft Strategy sets a 5 GW by 2030 target for hydrogen, and this was generally welcomed, with most stakeholders to express a views supportive of the push to make Scotland a major player in green hydrogen. However, there were views that the Strategy must do more to map out how, and where, this ambition would be achieved.vi For instance, the energy company EDF said that more detail was needed on matters such as:

Where in Scotland green hydrogen would be produced;

What barriers there are to expansion;

What the "demand case" is for green hydrogen produced in Scotland;

What infrastructure for green hydrogen is currently available in Scotland, and what more is needed.vii

We heard there is not yet a large enough market in electrolysers to allow us to develop hydrogen at scale as a strategic energy asset.viii However, the Scottish National Investment Bank considers that this problem is reducing, as green hydrogen comes to be seen as increasingly viable, with the cost of electrolysers in decline.viiThe Cabinet Secretary told us that the Scottish Government had carried out a strategic review of the electrolysers market in 2022, and was engaging with potential electrolyser manufacturers. He said that the Scottish Government had also committed £100 million to support renewable hydrogen production through the Emerging Energy Technologies Fund (EETF) to "kick start the hydrogen economy in Scotland". The first £10 million of this had been committed and "several of the projects supported will explore electrolysis technologies."

The draft Strategy sets specific targets for the growth of some renewables (most notably offshore and onshore wind) but not others; for instance, solar, wave or tidal. Nor does it set targets for battery storage, either in general or for particular battery classes. We heard views both in evidence and in our informal session with SMEs that this constituted a missed opportunity and should be addressed when the Strategy is finalised.xi

Solar UK have proposed a national target in the strategy of 6 GW. Emily Rice of Solar UK told us that the lack of a national target for solar energy currently made solar a "footnote" in distribution network operators' strategies:

Essentially, DNOs have to go to Ofgem with spending plans and say, “This is how we will invest our money and this is why.” If there is no national ambition for solar, there is no evidence for them to say, “The industry is telling us that it will put in 4GW of solar by 2030.” There is not really a strong enough reason for Ofgem to say, “Yes, then you should invest to plan for that."xii

She said that setting a national target for for solar, even a modest one, would give the solar industry in Scotland greater credibility in international markets. In our informal session with SMEs, we heard similar views in relation to other currently more niche sectors like tidal and wave energy, as well as battery storage. There was a view that without targets, these developing technologies would struggle unless they focussed on exports.

The Scottish Government pointed to the creation of an onshore wind strategic leadership group as an example of its engagement with industry to find practical solutions to issues like supply chain blockage.xiii The Cabinet Secretary told us that "clearly, targets drive investment and progress." He indicated that he had an open mind on whether the final Strategy should set targets for solar and tidal energy.xiv

The Committee continues to be concerned by evidence consistently pinpointing Scotland's planning system as a major block on our net zero ambitions, given the momentum that will be required to build the new generating and transmitting infrastructure needed to ensure that our energy supply is decarbonised by 2045. We accept that development of this sort can be controversial, particularly at community level, and support a planning system that permits robust interrogation of any major proposal and gives local people a say.

We note and welcome evidence that the Fourth National Planning Framework introduced earlier this year will make a positive change. But NPF4 cannot, on its own, address concerns over:

Depleted human resources at planning authorities, including the loss of many experienced planning professionals from the public sector in the last decade;

Complexities within planning legislation and policy that mean that many find the process painstaking, costly and confusing;

Different working practices across Scotland's 34 planning authorities, and differences across authorities in levels of experience and knowledge in handling major renewable developments.

We ask the Scottish Government for a progress report on three recommendations from an earlier inquiry that the Scottish Government has accepted, or accepted in principle:

on the "Climate Intelligence Service" that the Scottish Government has this year committed to setting up jointly with the local government sector. As well as seeking a general update on progress in establishing the Service, we also ask how the Service can promote a consistent approach, and a sharing of knowledge, on the effective handling of applications for renewable energy or electricity transmission projects by planning authorities;

on creating a new route into the planning professional for school leavers via an apprenticeship system;

on defining planning as a STEM (science, technology, engineering, mathematics) subject within the tertiary education system.

We also ask the Scottish Government to set out what changes it could make to the planning system in relation to applications for renewable generation or electricity transmission that would streamline and simplify the process for all (applicants and other affected parties), and which do not require primary legislation. In particular, we ask the Scottish Government to respond to views that the system would benefit from setting defined temporal "milestones" for planning authorities to meet when handling such applications.

We also ask the Scottish Government to respond to industry views that there is a currently a skills gap in Scotland, with not enough people with the right skills to work on the pipeline of renewable and transmission projects that will be needed to decarbonise the energy sector by 2045. We endorse the Economy and Fair Work Committee's recommendation (from their inquiry into the Just Transition in Grangemouth) that the Scottish Government must set out clearly how it will deliver a skills agenda to meet the challenge of transitioning to a net zero energy supply.

The Committee welcomes the ambition of setting a 5 GW target for green hydrogen in the draft Strategy but asks the Scottish Government to note and respond to evidence that it must more clearly map out a plan for how this is to be achieved for this ambition to have more credibility with industry and potential investors. This should include mapping out what role green hydrogen could play in helping decarbonise Scotland's main industrial emitters of greenhouse gases, whether in the short or longer-term.

The Committee asks the Scottish Government to respond to views from industry that, in not proposing targets for increased solar, tidal and wave energy, or for battery production, the draft Strategy has missed an opportunity to send a signal to the markets that these sectors have governmental backing, and that this should be rectified when the Strategy is finalised.

Complexity and cooperation

Evidence taken during the short lifespan of this inquiry has underlined the complicated nature of energy policy. Over and above the innate complexities of a technical area of policy - where resources fluctuate in price and availability and advances in technology or scientific understanding can redefine what is possible - is the requirement to hold in balance the goals of net zero, security of supply, and affordable prices for all. This involves difficult policy choices.

A further layer of complexity is added by the cluttered policy and regulatory landscape in which energy policy operates. Elements of this include:

That private companies in a monopoly position are responsible for grid expansion and grid connections but are subject to regulation in how they do this;

That the main regulator; Ofgem, is arms-length from government; operationally independent but exercising powers within a framework set by government, including legislative reforms like the current UK Energy Bill;

That Ofgem is also subject to governance by another body; the Gas and Electricity Markets Authority, with powers are set out in a number of different Acts;

That there are a number of other players in important regulatory or policy-shaping roles, for instance the relatively new role (2022) of Electricity Networks Commissioner.

The current Energy Bill makes provision for another role: that of "Future Systems Operator". This appears to be a response to views (including views put forward during this inquiry) that there is a pressing need for a centrally co-ordinated, whole system approach to decarbonising the energy system. The UK Government has explained that this body:

... will bring together the planning for the electricity and gas systems, and potentially systems for new technologies like hydrogen and carbon capture and storage, into a single institution to enhance our ability to transition to a zero-carbon energy system and reduce the costs involved. The FSO will build on the existing capabilities and functions of the Electricity System Operator, managing the electricity system in real time, as well as supporting its future development. It will also be responsible for gas strategic network planning, long-term forecasting and market strategy functions. As a new public body, the FSO will be a trusted and expert institution providing independent advice to government and Ofgem.i

Charging for electricity is another complicated aspect of energy policy, both for consumers and for users of the grid. It is highly unlikely that most consumers understand the combination of factors that determine the cost of their bills. As discussed below, there are views that some of the factors helping determine electricity may cut against other policy goals.

It is in this context that a quite radical and accelerated switch - from centralised and dispatchable power, to distributed and intermittent power - is currently being managed.

Intergovernmental co-operation and differences

Another layer of complexity is added by the reserved and devolved split of responsibilities over energy policy, meaning different statutory or policy targets north and south of the border (including on net zeroi), and the potential for disagreement between administrations. As noted earlier in the report, a theme in evidence is that industry is to some extent looking to be led; by way of a coordinated and strategic "whole system approach" to decarbonising the energy system that must be initiated by government. For this to work, energy policies and end goals set in Edinburgh and Whitehall must be broadly aligned.

We invited the UK Government, as well as the Scottish Government to give evidence to this inquiry, in recognition of the importance of the two administrations having good communication and coordination on energy across the devolved-reserved divide. We also wanted a candid view of whether there were areas of disagreement that made cooperation in relation to future electricity infrastructure difficult.

The UK Minister, in his opening statement during our evidence session with him, expressly welcomed the Scottish Government's draft Strategy, commenting that "it is clear that we are on the same page on many of the issues."i Nonetheless, there are important points of difference. The draft Strategy lists various reserved areas where it says the UK Government must take action to secure the full benefits of the energy transition. These include:

electricity market reform;

reforms to consenting of offshore wind and regulation of the offshore marine environment; and

the development of new market mechanisms to support clean energy technology deployment.

Several issues, as set out below, arose in evidence as areas where the UK and Scottish Governments currently take different approaches or disagree on policy.

Transmission charging

Current Transmission Network Use of System (TNUoS) charges are not popular with the renewables industry in Scotland.i In broad terms, charges are higher the further away electricity generation is from Great Britain's centre of population.ii The sector argues that the principle that more must be paid for transmission of electricity generated in relatively more remote parts of Great Britain (such as northern Scotland) is not consistent with the drive to generate much more power from renewables. The system is also criticised for its unpredictability, with price forecasts under TNUoS not seen as reliable.iii These views are shared by the Scottish Government, with the Cabinet Secretary telling us that "urgent reform" was needed.iv

During 2022, the UK Government carried out a public consultation on a Review of Electricity Market Arrangements, the final outcome of which is awaited. Some evidence to this inquiry stressed the importance of the Review delivering proper incentives to providers for decarbonised energy, to provide a boost to the renewables industry, and for consumers to see a difference in lower costs for decarbonised electricity. v There were also views that any proposed changes to market arrangements should be "incremental" and that large-scale reforms could be "disruptive" to the energy sector in Scotland.vi The Review did not cover transmission charging but stated: