Building Safety Levy (Scotland) Bill

The Building Safety Levy (Scotland) Bill was introduced to the Scottish Parliament on 5 June 2025. The Bill introduces a new tax, called the Scottish Building Safety Levy, to be charged on the construction or conversion of residential property developments. The proceeds of the levy are intended to contribute to the costs of cladding remediation in Scotland. This briefing provides background to the Bill and summarises some of the key proposals within it.

Summary and key Bill documents

The Building Safety Levy (Scotland) Bill was introduced on 5 June 2025. The Bill as introduced can be found on the Scottish Parliament website alongside its supporting documents which include:

Alongside the Bill documents, the Scottish Government has also published:

Overview of the Bill

The Bill introduces a new tax, called the Scottish Building Safety Levy (SBSL), to be charged on the construction or conversion of residential property developments, with some exceptions. This follows an amendment to the Scotland Act 1998 to include powers for a devolved tax to be charged in relation to certain steps in the building control process.

Money raised through this levy will be used to fund building safety expenditure. An equivalent tax is also being developed in England.

The Bill defines:

which types of developments will be liable to pay the SBSL and those which are exempt,

when in the construction process the tax will be due,

how the SBSL will be calculated,

penalties for non-compliance and how appeals will be handled,

reporting requirements on the operation of SBSL.

Policy Background

The Grenfell Tower Fire which broke out on 14 June 2017 has highlighted concerns around the safety of medium and high-rise buildings with external wall cladding (an outer layer of another material applied to the structure of a building, usually for a purpose such as weather proofing or insulation).

As building construction and safety are devolved policy issues, the Scottish Government established the Cladding Remediation Programme in response to these concerns. The Programme scope is limited to flatted, residential buildings (which may include commercial premises), constructed or developed between 1 June 1992 and 1 June 2022, 11 metres or more in height and which incorporate a form of external wall cladding system. The Programme scope includes 'single owner buildings', including social housing which is wholly owned by a local authority or registered social landlord. A £10 million 'Single Open Call' will support assessment of affected buildings; the scheme is currently open for expressions of interest until 30 September 2025, or until funding is fully committed. As of the 30 April, there were 32 expressions of interest, of which more than half came from registered social landlords.

The Scottish Government state that they expect the developer responsible for in scope buildings to meet the costs of the assessment and any remediation:

[We] expect that responsible developers will agree to take forward and pay for the assessment and potential remediation of buildings that are within the scope of the Act. However, the Government will take this work forward in cases where a building is not linked to a developer.

The Scottish Government is working with large developers to secure agreement on a developer remediation contract. However it is expected that there will also be a role for public funding where a building cannot be linked to a developer.

The UK Government levied the Residential Property Developer Tax from April 2022. This is a supplement to Corporation Tax paid by the largest residential property developers. This tax applies UK wide, but the proceeds are spent on cladding remediation in England. The Scottish Government state in the policy memorandum1 that:

the Scottish Government expects to receive Barnett consequentials of around £194 million over the expected ten-year period.

UK Government levy for England and devolution of powers to the Scottish Parliament

The UK Government is also developing a Building Safety Levy on the development of new residential buildings. Unlike the Residential Property Developer Tax, this will apply in England only and so will not result in any funding for the Scottish Government. The England-only levy is expected to come into effect in Autumn 2026.

The UK and Scottish Governments jointly held a consultation seeking views on the proposal to devolve powers to the Scottish Parliament to create a Scottish equivalent of the UK Building Safety Levy. The Scotland Act 1998 (Specification of Devolved Tax) (Building Safety) Order 20241 was passed in December 2024 to devolve the necessary powers. The Finance and Public Administration Committee considered this order at its meeting on 29 October 2024. At this meeting, the Cabinet Secretary for Finance and Local Government stated that:

As both Governments agreed that the consultation had surfaced no evidence to prevent the transfer of powers from proceeding, the UK Government confirmed that it would proceed to legislate for the transfer of powers, but that process was interrupted by the general election. However, we have since renewed the agreement to legislate with the new UK Government Administration, and the order will be considered by the UK Parliament this week.

The draft order before us today sets out high-level criteria for the new devolved tax. It provides that a Scottish building safety levy must be charged at a point in the building standards process and that revenue that is raised through any levy must be spent on building safety expenditure. In doing so, the order, in effect, matches the powers that were taken by the UK Government in the Building Safety Act 2022, which was the UK Government’s intention in drafting the order.

Scottish Government consultation

The Scottish Government carried out a consultation seeking views on the proposed SBSL and how it should operate between September and November 2024. The consultation received a total of 78 responses, nine from individuals and 69 from organisations. In June 2025, the Scottish Government published a report with analysis of the consultation responses received1. Key points highlighted in this analysis include:

The view that property developers are already contributing to the cost of cladding remediation, and that the SBSL would constitute a disproportionate burden relative to level of responsibility for the problem.

Emphasis on the importance of considering the impact of the SBSL within a wider context of cumulative impacts and regulations on the housebuilding industry.

Strong support to exempt affordable housing from the SBSL.

Strong support to exempt smaller developers from the SBSL.

The view that there should be consideration of differing regional impacts of the SBSL, particularly on island and rural communities.

Emphasis on the importance of certainty and clarity for property developers in understanding their liability for the tax and factoring these costs into their financial planning for development projects.

The report also summarises other engagement work that has taken place. In May 2024, the Scottish Government convened the Building Safety Levy Expert Advisory Group. This group has published minutes for four meetings so far, the most recent for the meeting on January 2025. The minutes note that members of the group expressed a number of concerns about the proposed legislation (which had not been introduced at the time of this meeting). These concerns include that:

The use of secondary legislation, while providing flexibility, created uncertainty for businesses who might be liable to pay the SBSL. Some participants expressed a view that there should be limits on how frequently the powers to introduce secondary legislation could be used.

Concerns were expressed about the complexities involved in affordable housing transactions, which might mean that some transactions which are intended to be exempt from the SBSL are not.

There were questions about whether Small and Medium Enterprises (SMEs) would be liable to pay the SBSL.

In addition to the consultation and the advisory group, the Scottish Government carried out further engagement including with SMEs. In the Business and Regulatory Impact Assessment2, the Scottish Government provides further detail on the engagement undertaken, which included:

Round-table events focussed on different key stakeholder groups, including: developers and representative bodies in the Scottish housebuilding sector, tax and legal professional bodies, as well as Local Government representative bodies.

Follow-up engagement sessions with Local Authorities and Enterprise Agencies.

An impact questionnaire was shared to collect views on the impact of the SBSL on stakeholders through three channels: administrative and financial, cumulative regulatory, and wider impacts on land and housing.

Engagement with HM Revenue and Customs, HM Treasury, the UK Ministry of Housing, Communities and Local Government, the Office of the Secretary of State for Scotland, and the Welsh Government.

Internal engagement including with Revenue Scotland.

Contents of the Bill

The Bill1 contains 7 parts:

Part 1 defines the levy as a tax charged on certain ‘building control events’ and gives responsibility to administer and collect the tax to Revenue Scotland.

Part 2 defines key concepts such as the building control events and who is liable to pay.

Part 3 sets out that the rate of levy will be calculated on the basis of the square footage of the building. Scottish Ministers will define the precise rate in regulations. Sets out that the proceeds of the levy are to be used for the purposes of improving the safety of persons in or about buildings in Scotland.

Part 4 concerns the administration of the levy, and sets out how registration and accounting of the levy will be handled. This part also sets out exemptions to the buildings in scope of the levy.

Part 5 sets out the penalties associated with non-payment of the levy.

Part 6 makes provisions for appealing against decisions of Revenue Scotland with respect to the levy.

Part 7 contains final provisions, including requirements to produce reports on the operation of the Act should it be passed.

Scottish Building Safety Levy

The Scottish buildings safety levy (SBSL) is defined as a tax that is to be charged on certain 'building control events', which are specified in Part 2 of the Bill. Revenue Scotland will be responsible for the collection and management of the levy.

Key concepts

A 'building control event' occurs on the building completion date related to the construction or conversion work which creates a new residential unit. The building completion date is either:

The acceptance of a completion certificate in accordance with section 18 of the Building (Scotland) Act 2003 (the 2003 Act)1, or

the grant of permission for the temporary occupation of that building under section 21(3) of the 2003 Act.

The policy memorandum2 notes that this is later in the process than the England only levy. This decision has been made to reflect concerns expressed in the UK consultation about requiring payment of the levy too early in the process, which may cause cash-flow problems for developers. The policy memorandum states that:

Placing the tax point towards the end of the building standards process and closer to the point of sale will also assist in mitigating cash flow issues for developers, a key concern they cited in relation to the UK Government Levy. In addition, the majority of the tax base for the SBSL will comprise properties build for onward sale. Where this happens, the Scottish Government understands that the issuance of a completion certificate and the sale of the property generally take place in short order. This means that, in many cases, the developer will be in receipt of funds from the sale of the property by the time that the liability to the SBSL is due for payment.

Construction is defined as meaning any construction (including alteration, erection and extension) of a building where a building warrant is required in accordance with section 8 of the 2003 Act, while conversion works is defined as building work changing the occupation or use of a building for which a building warrant is required in accordance with section 8 of the 2003 Act.

A 'new residential unit' means a unit consisting of either a whole or part of a whole constructed or converted building which is intended to be used as a dwelling or other accommodation, other than those units which are defined as exempt. Section 4 (3) of the bill defines the types of buildings which are not captured by this definition, this includes:

temporary residential accommodation, such as a hotel

a residential institution which provides residential accommodation for children, with care for persons in need of person care due to age, disability, dependence on alcohol or drugs, or mental disorder

a hospital or a hospice

military barracks or other residential accommodation for use by the arms forces or their families

a prison

residential accommodation for school pupils

accommodation provided to a person employed full time to perform the work of a minister, or within a monastery or nunnery, or a similar establishment.

An 'exempt new residential unit' is defined as a pre-existing residence that is a building or part of one which was being used as or was suitable to be used as a dwelling before construction, or on completion contains the same number of parts which are intended to be used as a dwelling.

Exempt new residential units also include:

Social housing as defined in section 11 of the Housing (Scotland) Act 20013.

Affordable housing, which is defined as a development for which funding has been provided under either section 1 or 2 of the Housing (Scotland) Act 19884, or section 92 of the Housing (Scotland) Act 2001.

Is situated on an Island as defined by section 1 of the Islands (Scotland) Act 20185.

Scottish Ministers are given powers to alter the list of exempt buildings through secondary legislation.

The person liable to pay the SBSL is the owner of the new residential unit on the date of either the submission of an application for a completion certificate, or the application for a grant of permission for temporary occupation if earlier.

Calculation and use of the levy

As with other devolved taxes, the Bill does not specify the rate of the SBSL but grants Scottish Ministers the power to set the rate or rates through regulations. The Bill does require that the SBSL rate is set with reference to the area in square metres of the floorspace of the new residential unit.

The Bill notes that different rates may be set for different purposes, including for different geographic areas, for different types of land, or with reference to any other factor which the Scottish Ministers consider appropriate.

Scottish Ministers may also make regulations to specify the methodology for calculating the areas in square metres to be used in the calculation of SBSL liabilities.

The Bill sets out a 6 step process for calculating an individuals SBSL liability:

Identify the total number of building control events in relation to new residential units owned by the taxpayer in the accounting period.

Remove any building control events where the taxpayer is entitled to relief.

Deduct any levy free allowance remaining for the relevant accounting period.

If after making these deductions the total number of remaining building control events is 1 or greater, these are then considered 'taxable building control events'.

Calculate the SBSL liability for each 'taxable building control event'

The sum of all 'taxable building control events' is the taxpayers liability.

A financial year is defined as 12 months beginning on 1 April, ending on 31 March. The Bill includes powers for Scottish Ministers to alter this to a different 12 month period.

Scottish Ministers are given powers to make provisions for reliefs and a levy-free allowance.

The Bill states that:

The proceeds of the levy must be used by the Scottish Ministers for the purposes of improving the safety of persons in or about buildings in Scotland.

Administration of the levy

Revenue Scotland must keep a register, to be known as the Scottish building safety levy register, with Revenue Scotland to determine what information will be contained on the register.

Revenue Scotland may publish information related to the register, provided it falls within the description set out in subsection 5. This includes:

Names, trading names, registered addressed and registration numbers of persons on the register.

Whether those registered persons constitute a body corporate which is treated as a member of a group.

The names of tax representatives against the names of the non-resident taxpayers of whom they are representatives.

And any other information that Revenue Scotland considers appropriate.

The Bill states that responsibility for registering for the SBSL lies with the person who is the owner of a new residential unit when a registrable event occurs. A registrable event is defined as the submission of a completion certificate, or an application for the grant of permission for the temporary occupation - the same conditions defined as the building completion date in the Bill.

A person responsible for registering must notify Revenue Scotland. A registered person who ceases to carry out activities that result in a registrable event must also notify Revenue Scotland. Revenue Scotland must cancel a persons registration once it has received such a notification, and is satisfied that the relevant activities will not be carried out, and that no levy that the person is liable for is unpaid.

The Bill gives Scottish Ministers the power to, through regulations, secure that every non-resident taxpayer appoints a person within the United Kingdom to act as the taxpayers tax representative. These regulations may include a requirement to notify Revenue Scotland when a person becomes a non-resident taxpayer, require that non-resident taxpayers appoint tax representatives, and require that the non-resident taxpayer seeks approval from Revenue Scotland for any appointment.

Where bodies corporate are treated as members of a group for the purposes of the SBSL Act, the liability for any group members to pay the levy is taken as a liability of the representative member to pay. A body corporate either forming a group or ceasing to be in a group must inform Revenue Scotland.

Revenue Scotland is given powers to require that a person liable to pay the levy provide any security that Revenue Scotland consider necessary to protect revenue.

Penalties

This part of the Bill proposes modifications to the Revenue Scotland and Tax Powers Act 20141 to specify existing penalties for devolved taxes which will also apply the SBSL. These include:

Failure to make a return.

Failure to pay the SBSL.

Inaccuracies in taxpayer documents.

Failure to register for the SBSL.

Failure to request approval of a tax representative appointment.

The Bill also makes provisions relating to penalties which relate only to the SBSL. These include specifying that:

Failure to request approval of tax representative appointment carries a penalty of £10,000.

Failure to notify cessation of eligibility for group treatment or of having place of business in UK carries a penalty of £500.

Failure to notify change to group treatment application or notification carries a penalty of £250.

Failure to provide security carries a penalty of £20,000.

Penalties must be paid within 30 days from when the penalty is issued. Scottish Ministers can, through secondary legislation, alter the circumstances in which a penalty is payable, the amounts of the penalties, the procedure for issuing penalties, enforcement of penalties and appeals against penalties.

Reviews

This part of the Bill proposes modifications to the Revenue Scotland and Tax Powers Act 20141 to increase the list of appealable decisions to include SBSL decisions:

in relation to whether or not any person is required to have a tax representative

in relation to the giving, withdrawal or variation, of any approval or direction with respect to the person who is to act as another’s tax representative

In relation to whether a body corporate is to be treated, or ceases to be treated as a member of a group, the times at which a body corporate is to be treated as such, and which body corporate is to be the representative member for a group

in relation to the requirement of security for the payment of Scottish building safety levy

Final provisions

Scottish Ministers must report on the operation of the Act. This report must include an assessment of how proceeds of the SBSL are being used, as well as any other matters Scottish Ministers consider appropriate. It is left to Scottish Ministers to define the intervals of any such reports, and the manner of publication.

Summary of proposed subordinate legislation in the Bill

The Delegated Powers Memorandum1 sets out the proposed secondary legislation which is contained in the Bill. This is summarised below:

| Power | Description |

|---|---|

| Section 6(1): Power to modify the types of buildings which may be taxable | Sections 4 and 5 of the Bill provide definitions of 'new residential units' and 'exempt new residential units'. This power would allow Scottish Ministers to modify these definitions. |

| Section 7: Amendment of the Building (Scotland) Act 2003 | Amendment of a power conferred on Scottish Ministers under the Building (Scotland) Act 2003. This amends the existing regulation making power to allow Scottish Minister to make changes to the form and content for applications, warrants, certificate, notice or documents to include information considered appropriate to determine any liability to pay SBSL. |

| Section 9(2): Charging and rate of levy - rate | This allows Scottish Ministers the power to specify the rate or rates of the levy, but these rates must be set with reference to the area in square metres of the floorspace. Ministers can set different rates, for example for different land types, in different geographic areas, or with reference to other appropriate factors. |

| Section 9(5): Charging and rate of the levy - methodology | This grants Scottish Ministers the power to set the methodology used to determine the square metres floorspace of a new residential unit. |

| Section 10(3)(b): Definition of financial year | The Bill defines a financial year as beginning on 1 April and ending on 31 March, but this power is granted in case there is an alternative definition which might better align with industry practice. |

| Section 11(1): Reliefs | This grants Scottish Ministers powers to make provision for and in connection with reliefs from the levy in relation to certain building control events. |

| Section 12(1): Levy-free allowance | This grants Scottish Ministers powers to specify a quantity of building control events within a financial year which may be exempt from the SBSL. |

| Section 15(6): Duty to register for the levy | This provides Scottish Ministers with a power to exempt some owners of relevant residential property from the requirement to register for SBSL. |

| Section 18: Registration, notification and compliance | This provides Scottish Ministers with the power to make regulations for and in connection with specifying the period within which a notification under sections 15 or 16 must be made; the form and content of the notification; requiring a person who has made a notification to inform Revenue Scotland of any information provided in connection with the notification which has become inaccurate; and the correction of entries in the register. |

| Section 19: Accounting for levy and time for payment | This provides Scottish Ministers with powers to specify the accounting periods for completing returns. |

| Section 22(1): Appointment of tax representatives | This provides Scottish Ministers with the power to make regulations requiring that every non-resident taxpayer has a person resident in the United Kingdom to act as their tax representative. |

| Section 23(2): Effect of appointment of tax representatives | This provides Scottish Ministers with the power to make regulations regarding the extent to which the tax representative of a non-resident taxpayer is required to secure the non-resident taxpayer’s compliance with any requirements of this Bill. |

| Section 29(1): Partnerships | This allows for Scottish Ministers to, by regulations, make provision applying the requirements of the Bill to cases where a business is carried on in partnership, or by an unincorporated body. |

| Section 30(1): Bankruptcy etc | This provides a power to Scottish Ministers to make regulations in relation to a person who is carrying on a business of a registerable person who has died, become bankrupt or become incapacitated. |

| Section 31(1): Transfer of business as a going concern | This provides Scottish Ministers with the power to make regulations regarding the transfer of a business as a going concern - this is equivalent to a power in the Scottish Aggregates Tax. |

| Section 34: Delegation of functions by Revenue Scotland | The Revenue Scotland and Tax Powers Act 20142 already allows Revenue Scotland to delegate its functions relating to Land and Building Transaction Tax, Scottish Landfill Tax and Scottish Aggregates Tax - powers are granted to Scottish Ministers to extend this to also cover SBSL. |

| Section 43: General provisions for penalties relating to the Scottish building safety levy | This grants Scottish Ministers a power to make provision about the new penalties relating to SBSL. |

| Section 49: Power to make ancillary provisions | This provision enables Scottish Ministers to make such incidental, supplementary, consequential, transitory, transitional or saving provision as they consider appropriate for the purposes of, in consequence of, or for giving full effect to, any provision of the Bill or made under the Bill. |

| Section 51: Commencement | This provides that the Scottish Ministers may, by regulations, appoint days on which the provisions in the Bill come into force, except for those provisions that come into force on the day after Royal Assent. |

Costs associated with the Bill

In terms of consideration of the financial implications of the Bill, there are two relevant aspects that parliamentarians may wish to consider. Firstly there are the anticipated overall costs of cladding remediation in Scotland. This Bill as drafted requires that proceeds from the SBSL are used for the purpose of “meeting building safety expenditure”. However, the Scottish Government states in the Policy Memorandum that:

The overarching policy aim is to seek a contribution from the housebuilding sector to support the funding of the Scottish Government’s Cladding Remediation Programme. The SBSL will complement the existing funding streams available and ensure that the associated costs of cladding remediation do not fall directly onto affected homeowners or disproportionately onto the general taxpayer.

The second aspect is the direct costs that the Scottish Government and other public bodies will bear in relation to the establishment and administration of the SBSL.

Estimated costs of cladding remediation in Scotland

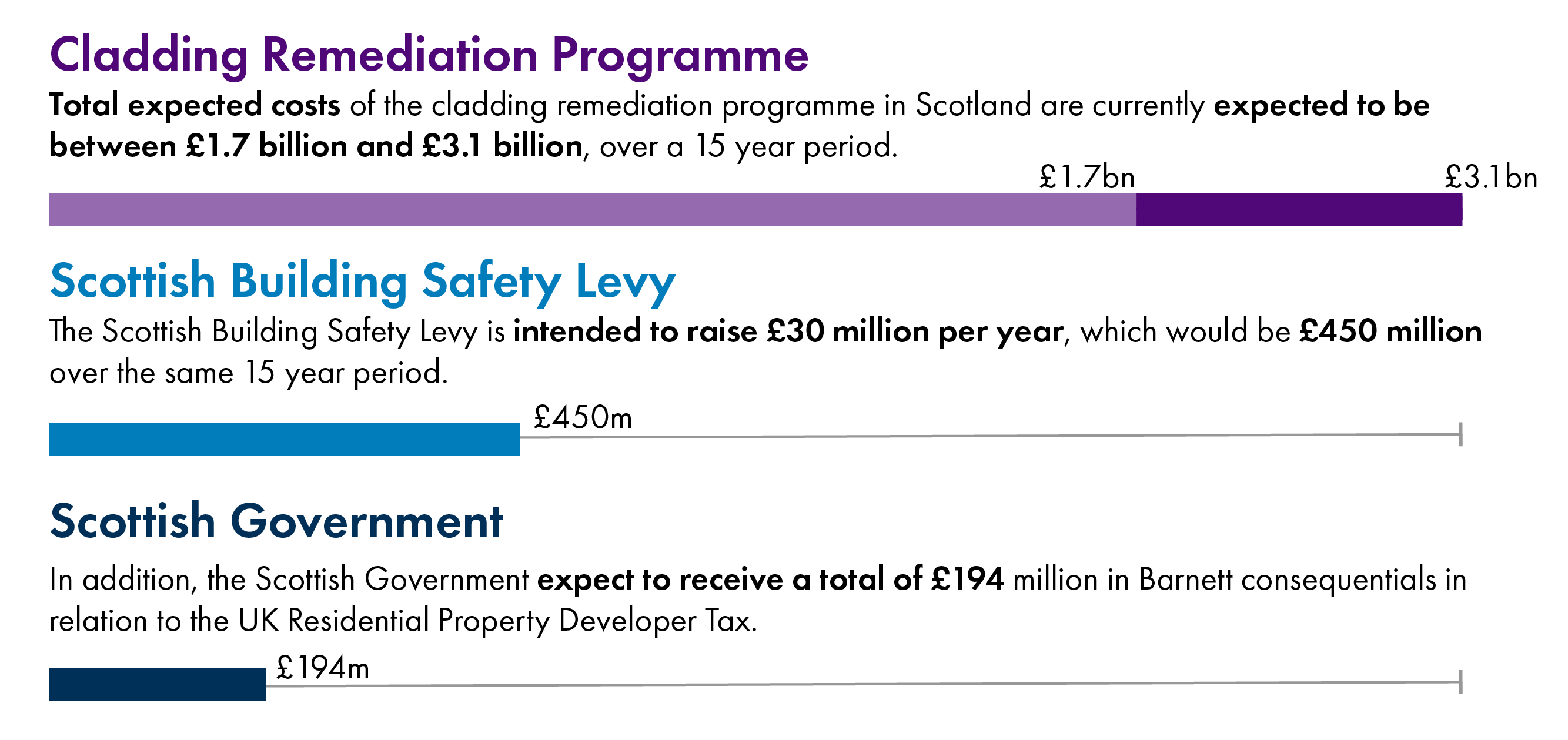

The Financial Memorandum1 (FM) suggests that the public costs of the cladding remediation programme could be in the range of £1.7 billion to £3.1 billion over a potential 15 year programme of works. This is based on analytical work to estimate the number of residential buildings above 11 metres in height in Scotland2. To estimate costs it then uses unit cost information from the rest of the UK, taking into account building height, the percentage of buildings likely to need remedial work, the degree of remedial works required and the subset to be developer led. If there are material differences in these factors, for example if a higher or lower percentage of buildings in Scotland require remediation than in England, then the total cost may be different to that currently anticipated.

The nominal costs of the work are expected to lie in the range of £0.9 billion to £1.7 billion. The modelling also outlines a projection of construction sector inflation of between £0.6 billion and £1 billion over the 15 year period – this assumes an average annual rate of inflation of approximately 3.4%. The Scottish Government also make an allowance for 'optimism bias' of between £200 million and £400 million - this represents a tendency to under estimate capital costs at the outset of a project. Together, these three elements give the total range of costs of £1.7 billion to £3.1 billion over 15 years.

The Scottish Government is currently undergoing analytical work to refine these total estimated costs of cladding remediation. The ongoing identification of specific buildings affected by cladding will also inform the potential total costs of remediation activity.

Revenues from the building safety levy are expected to make a contribution to these public costs. The overall costs of cladding remediation will be supported by two additional sources of funding:

Developer led remediation. The Scottish Government is working with large developers to agree a contract for further assessment and remediation in 2025. The estimated overall programme costs above adjust for an assumed share of developer led buildings.

Residential Property Developer Tax is a UK wide corporation tax supplement which has operated since 1 April 2022. The UK Government intends for this to raise £3 billion over a 10 year period. The Scottish Government expects Scotland’s share of these receipts through the Barnett formula will be £194 million and has stated that these Barnett consequentials will be spent on cladding remediation.

The Scottish Building Safety Levy is intended to raise £30 million per year, with rates set in line with this intent. The Scottish Government states that this is in line with the Barnett consequentials that the Scottish Government might have received had the proposed new UK levy operated outside of England. Aligning this to the 15 year operation period assumption within the FM would mean that the SBSL will raise around £450 million. This would cover somewhere between 15% to 25% of the total anticipated public costs.

Direct costs associated with the Bill

The FM1 anticipates that annual costs will largely occur in 2025-26, 2026-27 and 2027-28. After this point, the set up costs will have been accounted for and running costs are expected to be in a ‘steady state’. Total costs are expected to be £3.7 million to set up and administer the first year of the tax.

The costs for the Scottish Administration are expected to be through five channels:

Impact of the SBSL on the Scottish Budget

Scottish Government staff resourcing costs

Costs of data sharing

Revenue Scotland costs for administration and compliance

Costs for the Scottish Fiscal Commission to prepare official forecasts.

Impact on the Scottish Budget

SBSL is intended to raise £30 million per year, which will be a positive contribution to the funding available each year for cladding remediation. The FM notes that unlike other devolved taxes there will be no block grant adjustments as a Building Safety Levy has never been collected by the UK Government in Scotland, which means there are no anticipated transition costs in moving to a devolved tax.

Scottish Government staffing costs

Existing Scottish Government budgets will cover the costs associated with the development of the primary legislation in 2025-26. Secondary legislation is expected to cost between £89,000 and £99,000 during the 2026-27 financial year (this cost will cover 1.6 to 1.75 FTE policy and legal support). Thereafter, ongoing costs are expected in relation to producing a report on the SBSL. These costs are expected to be £62,000 per year from 2027-28 onwards.

Costs of data sharing

The FM states that there may be a need for a legal data sharing gateway between local authorities, Revenue Scotland, and other public bodies. Initial scoping work suggests this could cost between £50,000 and £100,000 to set up, with running costs being “fairly minimal” and accommodated within annual budgets of the public bodies involved. The Scottish Government plans to revise the Financial Memorandum should it be necessary to establish a data sharing agreement.

Costs on Revenue Scotland for administration and compliance

The overall costs to Revenue Scotland are expected to be in line with those expected to be incurred in establishing the Scottish Aggregates Tax. Staff costs for Revenue Scotland are expected to be £555,425 in 2025-26 and £755,935 in 2026-27 – a total cost of £1.3 million. OF these costs, £680,000 relate to a programme team, which has been set out based on the experience of previous devolved taxes, while £630,000 represents staff costs to business as usual functions across Revenue Scotland.

The FM also anticipated non-staff costs of £1.6 million over 2025-26 and 2026-27, of which £1.5 million relate to the cost of developing the IT system to administer the tax.

From 2027-28, Revenue Scotland’s ongoing costs to administer the SBSL are expected to be £545,309 per year.

Costs on the Scottish Fiscal Commission (SFC)

Costs to the SFC are expected to be far lower than forRevenue Scotland; £30,000 in set up costs during 2026-27, and £20,000 ongoing costs from 2027-28 onwards.

As the administration of the tax will be centralised through Revenue Scotland (unlike in England where Local Authorities have a role), the FM does not envisage any significant costs for local authorities.

Other public bodies likely to be impacted by the SBSL

The Scottish Courts and Tribunal Service provides administrative support to the First Tier Tribunal and the Upper Tribunal, to which decisions by Revenue Scotland can be appealed. In preparing for the administration of SBSL, there will be costs associated with IT changes to case management systems and training for tribunal members to deal with new appeal types. These are expected to cost a total of £20,000 in 2026-27.

Ongoing costs are expected to be minimal, as it is anticipated that there will be fewer than 1 appeal per year given the relatively small number of people liable for SBSL. The total cost of each case is expected to be £2,433, so the FM allows for ongoing costs of £3,000 per annum from 2027-28 which it statescan be absorbed by existing budgets.

Areas for parliamentary scrutiny

The aim of the Bill is to introduce a tax on the construction of new residential buildings to make a contribution to the public costs of remediation of existing building stock affected by unsafe cladding. Parliamentarians may wish to consider:

Whether taxing certain new developments to make a financial contribution to remediation of cladding on existing building stock is the correct approach.

How the remaining anticipated public costs of cladding remediation will be funded, and whether the Bill is aiming for the correct level of contribution from the sector.

The Financial Memorandum assumes that there will be no direct costs to individuals as a result of the Bill. PArliamentarians may wish to consider whether the tax will ultimately be passed on to individual house buyers through increased purchase prices.

Whether this tax is likely to have any impact on the wider house building sector in Scotland.

As the receipts from the tax are intended to be used as a contribution to the time limited cladding remediation, whether there should be a time limit attached to the operation of this tax, via a sunset clause attached to the Bill.

The Bill includes an exemption for island communities "in recognition of the particular challenges faced by housebuilders on islands". Parliamentarians may wish to consider whether there are other areas of Scotland where the house building sector faces similar issues.

How the Scottish Government's New Deal for Business has influenced the development of this legislation, and whether impacted businesses feel engaged in the development of the Bill.