Bankruptcy and Diligence (Scotland) Bill

The Bankruptcy and Diligence (Scotland) Bill would give Scottish Ministers power to create a scheme to pause debt enforcement action against people with serious mental health problems. It would also make some changes to the laws covering bankruptcy and debt enforcement.

Summary

The Scottish Government has convened several working groups looking at improvements to statutory debt solutions and formal debt enforcement options. The Bill would implement those recommendations which are being taken forward immediately and which require primary legislation.

The working groups made a number of other recommendations which do not feature in the Bill. These either require more development or can be taken forward via secondary legislation or changes to guidance.

The Bill would:

This would be a legally enforceable pause on debt enforcement action for debtors with serious mental health issues. Note that there is no detail on the face of the Bill in relation to how the mental health moratorium would operate.

The reforms are considered to be uncontroversial and are not discussed in any detail in this briefing.

Creditors with the authority of the court can use a range of special measures to seize or freeze assets belonging to a debtor. Some of the changes proposed in the Bill would be to the advantage of creditors and some would benefit debtors.

In summary, the debt enforcement changes would

require bodies like banks and employers to tell creditors why attempts to arrest a debtor's assets have been unsuccessful

require debtors to be provided with a Debt Advice and Information Package in advance of the relevant hearing for "diligence on the dependence" (diligence which takes place before court action has concluded)

extend the time frame a debtor has to reclaim assets seized at their home

increase flexibility around when a money attachment can be carried out on business premises.

Cover photograph by Howard Lake, licensed under Creative Commons Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0).

Terminology

The Bill deals with technical money advice and legal issues. Some of the terminology used is explained below.

Use of the word "debtor"

There is an argument that the term debtor is pejorative. Certainly many people who have been through legal processes relating to debt will have experienced it in a negative way. However, to increase the simplicity and clarity of the explanations of the law in this briefing, we have chosen to continue to use it.

It is used specifically to describe someone who is the subject of legal processes relating to debt - for example, they have entered a statutory debt solution or are the subject of debt enforcement action.

Accountant in Bankruptcy - both the Scottish Government agency which supervises statutory debt solutions and the individual office holder who heads up that agency. Among other functions, the Accountant in Bankruptcy can take the role of trustee in a bankruptcy where no one else has been nominated to act. This happens in the majority of cases.

Arrestment - a type of formal debt enforcement in which assets belonging to a debtor in the hands of a third party can be seized by creditors. The most common types are arresting money in a bank account and wages in the hands of an employer (an "earnings arrestment").

Attachment - a type of formal debt enforcement in which assets belonging to a debtor and in their possession can be seized by creditors - for example, stock in a shop. Seized assets can be sold to raise money to pay the debt. There are additional requirements to be met before a creditor can seize items in a debtor's home.

Bankruptcy - a statutory debt solution which includes debt write off for debts which cannot be paid during the duration of the bankruptcy. Debtors can apply for their own bankruptcy, and creditors can petition to make a debtor bankrupt.

Common Financial Tool - an income and expenditure assessment tool which is used across all statutory debt solutions to work out how much a debtor should contribute from income to repay their debts. In many bankruptcy cases, a debtor will have no surplus income to contribute.

Debt Arrangement Scheme - a statutory debt solution which enables people to pay their debts in full over an extended time period.

Debt Advice and Information Package - a leaflet about debt and debt enforcement which must be given to people before creditors use most types of formal debt enforcement action against them.

Diligence - the legal term for formal debt enforcement action.

Formal debt enforcement action - options available to creditors who have court authority to pursue a debt. Creditors in this situation can access a legal framework of debt enforcement options which are not available to those who do not have court authority - such as arrestment and attachment.

Full administration bankruptcy - standard bankruptcy, covering anyone who does not apply for Minimal Asset Process Bankruptcy. Full administration bankruptcy affects all a debtor's non-essential assets, including a family home, and any surplus income. It generally lasts for four years.

Inhibition -a form of formal debt enforcement which stops a debtor being able to deal with (for example, sell) land and buildings until the debt is paid.

Insolvency practitioner - a qualified professional specialising in insolvency issues. Insolvency practitioners manage Protected Trust Deeds on behalf of creditors. They may also act as trustees in bankruptcy. Insolvency practitioners are regulated by their professional bodies.

Minimal Asset Process bankruptcy - a form of bankruptcy available to people with low income and few assets. There are specific entry criteria, including a cap on the value of assets owned, a maximum debt threshold and a requirement not to own land or buildings. Minimal Asset Process bankruptcy is quicker and lighter touch than full administration bankruptcy.

Moratorium on diligence - a legally enforceable pause on formal debt enforcement action by creditors. Someone who is considering entering a statutory debt solution can apply for a moratorium on diligence to protect them from their creditors while they take advice on the best option to deal with their debts.

Free sector money adviser - money advisers provide advice on income maximisation, budgeting and dealing with debt. They can help a client decide which is the best option for dealing with their debt problem. Free sector money advisers do not charge a fee for their services. They are mainly available through local authorities and charities, such as Citizens Advice Bureaux.

Private sector money adviser - private sector money advisers charge a fee for their services. Some work for insolvency practitioners and will advise on entering statutory debt solutions. Others work for businesses which negotiate reduced payments with creditors. This arrangement usually is called a debt payment plan.

Protected Trust Deed - a statutory debt solution with the same general legal framework as bankruptcy but with more flexibility. Only insolvency practitioners can offer Protected Trust Deeds. They charge a fee for their services.

Statutory debt solutions - the three options available in legislation to deal with debts in Scotland - bankruptcy, a Protected Trust Deed or a Debt Payment Programme under the Debt Arrangement Scheme.

Summary warrant - an expedited court process which some public sector bodies can use to enforce debts. There is no court hearing. Instead, the creditor presents a list of names and certifies that the legislative requirements necessary to use the process have been met. Currently, creditors using summary warrant can only enforce debts using arrestment, earnings arrestment or attachment.

Trustee - the person who administers a bankruptcy or Protected Trust Deed. They act on behalf of creditors. In Protected Trust Deeds, the trustee will be an insolvency practitioner in private practice. In bankruptcy, it can be either the Accountant in Bankruptcy or an insolvency practitioner in private practice.

The Bill - important dates and documents

The Bankruptcy and Diligence (Scotland) Bill was introduced in the Scottish Parliament on 27 April 2023 by Shona Robison MSP, Deputy First Minister. It is a Scottish Government Bill.

The Economy and Fair Work Committee is the lead committee for Stage 1 scrutiny of the Bill. Stage 1 scrutiny looks at the general principles of the Bill.

The Economy Committee issued a call for views on the Bill. This closed on 21 July 2023.

Documents relating to the Bill are available on the Bankruptcy and Diligence (Scotland) Bill webpages on the Scottish Parliament website. They include:

the Bankruptcy and Diligence (Scotland) Bill [as introduced]1

the Explanatory Notes2- these explain the effect of each section of the Bill

the Policy Memorandum3 - which explains the reasons why the Scottish Government is bringing forward the Bill and what it is expected to achieve.

Options for people in debt

People who have debt problems can access a range of options set out in legislation to deal with debt. These are called statutory debt solutions. They may also enter into informal arrangements with their creditors - for example, paying a reduced amount each month.

The best option for someone in debt will depend on their personal circumstances. There are various legal requirements to be met for each statutory debt solution. It will also depend on their prospects for the next few years - for example, if their financial situation might improve.

Finally, it will depend on their personal preference. For example, some people are reluctant to enter bankruptcy even when this is the most suitable option in their circumstances. Others just want to get the process over and done with as quickly as possible so they can move on with their lives.

Entering a statutory debt solution

The criteria for entering a statutory debt solution are regulated by legislation. These solutions can have significant advantages:

once someone in debt enters a statutory debt solution, their creditors can no longer contact them about payments; take them to court; or carry out formal debt enforcement action

once a solution is formally in place (and there is usually an objections process for creditors in advance of this), all creditors must comply with it, even those who objected

the person in debt makes regular, stable, consolidated payments to the person or body administering their solution, rather than having to make a range of payments to individual creditors.

Anyone voluntarily entering a statutory debt solution must receive advice

This advice can come from a money adviser in the free sector, or from a private provider. It can also come from an insolvency practitioner (in particular, for Protected Trust Deeds).

People can be forced into bankruptcy by their creditors. In this situation, there is no requirement to receive advice.

There are three statutory debt solutions in Scotland

These are:

Informal debt options

Lots of people in debt don't access a statutory debt solution. This may be because they aren't aware of the options available or that none meet their personal circumstances. Even those who have received advice from a money adviser may be in this situation.

Usually, people (with or without the assistance of a money adviser) negotiate lower payments with their creditors. This has the advantage of significant flexibility. It is also a good interim option if people expect their financial position to improve.

However, informal debt options usually still involve making lots of different payments and regular contact with creditors. Creditors may also review payments and ask for more money, or threaten to take action to enforce the debt.

Both free and for-profit money advice organisations can negotiate with creditors and arrange payments on behalf of people in debt. This is usually called a debt payment plan.

Bankruptcy

In bankruptcy, all of a debtor's non-essential assets are managed by a trustee for the benefit of creditors, generally for a four year period. This usually means that any assets will be sold. Where a debtor is assessed as having surplus income, they will also have to make regular payments from this.

People can apply for their own bankruptcy. Creditors can also force someone into bankruptcy if they owe at least £5,000.

There are two different types of bankruptcy. Minimal Asset Process bankruptcy can be used by people with low income and few assets. Full administration bankruptcy covers all other situations.

Main advantage: almost all debts are written off at the end

Main disadvantages: a debtor's assets, including a family home, will usually be sold; creditors usually receive only a small proportion of what they are owed.

Protected Trust Deeds

As with bankruptcy, a debtor's assets are managed by a trustee for the benefit of creditors for a minimum of four years. This period can be extended, depending on the circumstances of the debtor. The debtor will also usually make contributions from their income. The money available has to be sufficient to pay the trustee's fees and provide a return to creditors.

Main advantages: more flexible than bankruptcy - for example, it is usually possible to avoid selling the family home; almost all debts are written off at the end of the process

Main disadvantages: trustee fees eat into returns to creditors, so that they may receive very little; debtors need sufficient income to make the required contributions.

Debt Payment Programmes under the Debt Arrangement Scheme

The Debt Arrangement Scheme enables debtors to pay their debts over an extended period of time. It can last for any "reasonable" time period, but the average is around six years1.

Main advantages: there is no requirement to sell assets; creditors receive most of the money which is repaid

Main disadvantages: there are only limited opportunities to write off debt. This means it is only available to people who can repay their debts in full over a reasonable period, which is a small proportion of people with debt problems.

Use of statutory debt solutions over the past 10 years

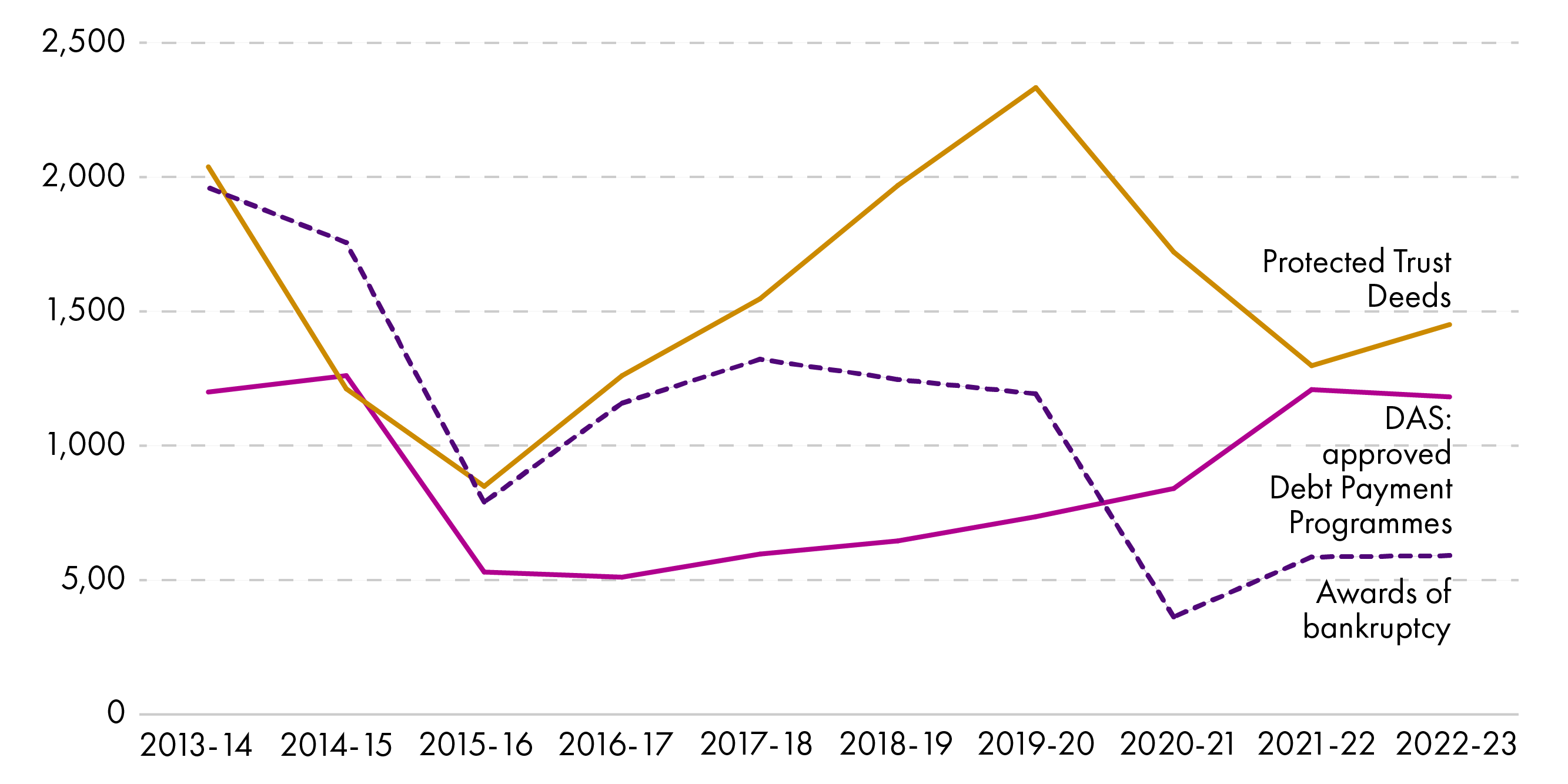

The figure below shows how the three statutory debt solutions have been used over the past 10 years.

At the beginning of the time series, take up rates of all statutory debt solutions were declining from historical highs, created by various policy interventions. For the Debt Arrangement Scheme, it had become easier for money advisers to offer Debt Payment Programmes. For bankruptcy, new routes into bankruptcy had increased demand.

Over the past 10 years, the main trend has been the increasing popularity of the Debt Arrangement Scheme as an option for dealing with debt. Numbers of Debt Payment Programmes under the Debt Arrangement Scheme overtook awards of bankruptcy at the end of 2019-20. This followed legislative changes which made it viable for private sector providers to offer Debt Payment Programmes without charging a fee to clients.

The dip in bankruptcy applications in the first quarter of 2015/16 reflects the introduction of Minimal Asset Process bankruptcy to replace the Low Income Low Assets route. Applications dropped as people got to grips with the new process.

The dips in both bankruptcy and Protected Trust Deed numbers at the beginning of 2020 reflect the impact of the COVID-19 pandemic and, in particular, the first lockdown, on access to advice.

The Review of Scotland's Statutory Debt Solutions

The Bill takes forward a recommendation from stage 2 of the Review to introduce a specific moratorium process for people with serious mental health issues.

Following a recommendation from Session 5's Economy, Energy and Fair Work Committee, the Scottish Government committed to carrying out a review of Scotland's statutory debt solutions. This was taken forward by the Accountant in Bankruptcy.

The review is taking place in three stages:

Stage 1 looked at immediate priorities for changes which could be taken forward quickly and in the context of the COVID-19 pandemic

The Accountant in Bankruptcy website has more information about stage 1. It resulted in a number of changes to bankruptcy legislation, some of which built on temporary measures in COVID-19 legislation. These included:

reducing the application fees for bankruptcy, including removing the fee for people claiming certain social security benefits

making it easier to access a Minimal Asset Process bankruptcy by increasing the maximum amount of debt an applicant can have and removing student loans from the total.

Stage 2 involved stakeholder working groups considering medium-term changes to the current framework for statutory debt solutions

The Accountant in Bankruptcy website has more information about stage 2.

Three working groups looked at: moratoriums and the Common Financial Tool; Protected Trust Deeds; and bankruptcy and cross-cutting issues respectively. The working groups made a number of recommendations. However, they struggled to reach consensus on some of the issues.

The Bill will take forward the stage 2 recommendation to create a moratorium process for people with serious mental health issues. The Scottish Government states (Policy Memorandum paragraph 11) that the other recommendations it intends to take forward can be implemented via secondary legislation or guidance.

Annexe 1 looks at the stage 2 working group recommendations in more detail.

Stage 3 will take a longer term, strategic look at the suitability of Scotland's statutory debt solutions to meet the needs of a modern economy

For example, it will consider issues like the treatment of a family home across statutory debt solutions and debt enforcement. The Accountant in Bankruptcy website has more information about stage 3.

This work will be taken forward independently of the Scottish Government. SPICe understands that the Scottish Government expects to announce the appointment of an independent chair soon1.

Diligence Review

The Bill will also take forward some recommendations from a review of formal debt enforcement options - known as "diligence" - undertaken by the Accountant in Bankruptcy.

The Accountant in Bankruptcy consulted on the effectiveness of a wide range of diligences in 2016

Copies of the consultation1 and the summary of responses2 are available on the Accountant in Bankruptcy's website. Respondents came up with a range of suggested improvements which the Accountant in Bankruptcy committed to exploring further.

The Accountant in Bankruptcy convened a Diligence Working Group in 2018 to consider options for reform

The Diligence Working Group was made up of representatives from the legal, creditor and advice sectors. It issued a final report3 in 2021.

The report made a number of recommendations. These include significant additions to the options available to creditors. However, options for bigger changes to the current legal framework are likely to be considered alongside stage 3 of the Review of Scotland's Statutory Debt Solutions.

The Diligence Working Group recommendations are summarised at Annexe 2.

The Scottish Government states that the Bill takes forward the recommendations of the Diligence Working Group which require primary legislation (Policy Memorandum, paragraph 11). However, there are a number of longer term proposals from the group which would appear to still be under consideration.

Scottish Government consultation

The Scottish Government published a consultation in 20221, outlining its proposals for taking forward the recommendations of both the statutory debt solutions and diligence working groups.

Key areas where the Scottish Government intends to depart from the recommendations of the working groups include:

not freezing interest and charges in the standard moratorium on diligence - it argues that this would be administratively complex, requiring new processes and IT systems

not reducing the period when a debtor (who is assessed as being able to) must make a contribution from income towards their bankruptcy to three years - it argues the current four year period better balances the interests of creditors and debtors

not increasing the potential for composition (where a debtor makes a reduced repayment offer to creditors to settle their debts) in the Debt Arrangement Scheme - it argues that the current rules provide a better balance between the interests of creditors and debtors.

A summary of the responses to the consultation2 has also been published. Individual responses can be viewed on the Scottish Government's website.

Broadly, there was support for all the policy proposals put forward by the Scottish Government. However, some proposals were less popular, including:

not increasing the minimum debt threshold to enter a Protected Trust Deed from £5,000 (59% agreed; 27% disagreed; 14% neutral)

replacing the current system for setting thresholds for income and expenditure in statutory debt solutions with a new framework - called the Standard Financial Statement and used in the rest of the UK to negotiate with creditors (42% agreed; 18% disagreed; 40% neutral)

not introducing more flexibility for a debtor to keep some income in bankruptcy and Protected Trust Deeds (49% agreed; 33% disagreed; 18% neutral)

not introducing more flexibility to make a reduced offer of repayment (composition) in the Debt Arrangement Scheme (59% agreed; 27% disagreed; 14% neutral)

introducing Information Disclosure Orders, which would allow creditors to get information about a debtor's assets from third parties (59% agreed; 22% disagreed; 19% neutral).

Low income and debt - the work of the Social Justice and Social Security Committee

After an inquiry last year, the Scottish Parliament's Social Justice and Social Security Committee made recommendations relevant to statutory debt solutions and debt enforcement.

The inquiry looked specifically at the challenges faced by people with debt issues and low income

The Committee heard from stakeholders as well as an "Experts by Experience" panel, made up of people with low income and debt issues. The inquiry's focus included the types of debt commonly experienced by this group, as well as what improvements could be made to debt processes and the legislative framework. It also took evidence on the links between problem debt and mental health issues.

The evidence highlighted that people on low incomes are not well served by existing processes

The Committee heard about people with "deficit budgets" - whose essential outgoings were more than their income. Even small amounts of debt could create unsustainable pressure for this group. And traditional options for dealing with debt - such as entering a statutory debt solution - were often not available.

The inquiry report - Robbing Peter to pay Paul: low income and the debt trap (2022)1 - made a range of recommendations relevant to statutory debt solutions and debt enforcement. The Scottish Government has already implemented a key call - to remove the minimum debt threshold for Minimal Asset Process bankruptcy (previously £1,500).

Other relevant recommendations include:

that the Scottish Government considers removing the minimum debt threshold for full administration bankruptcy (currently £3,000)

that the Scottish Government considers reducing the time period someone must wait before reapplying for a Minimal Asset Process bankruptcy (currently 10 years)

that the Diligence Review considers whether household composition (e.g. number of children) could be factored into setting the level of contribution in bank and earnings arrestments

that creditors should be given greater flexibility to reduce the amount of money taken in an earnings arrestment (as a solution to the situation where someone cannot pay their current Council Tax bill because too much money is being seized to pay arrears)

that stakeholders develop national Council Tax collection standards - including setting parameters for proportionate enforcement action, allowing for individual debt write-off and providing access to an independent dispute resolution process.

The Committee also made recommendations in relation to mental health and debt, including the introduction of a specific mental health moratorium

The evidence presented to the Committee on this subject is discussed in the section dealing with the mental health moratorium.

What the Bill does

The Bill would do three things:

give the Scottish Government powers to introduce a mental health moratorium(a pause on debt enforcement for people with serious mental health issues)

make changes to the law on formal debt enforcement (options for a creditor with authority from the courts to get payment from a debtor - known as "diligence").

Mental health moratorium

Section 1 of the Bill would give Scottish Ministers power to make regulations to introduce a mental health moratorium. However, nothing is said on the face of the Bill about how the moratorium would work.

This would implement a recommendation made by one of the stage 2 working groups from the Review of Scotland's Statutory Debt Solutions that such a moratorium should be introduced. There is also wider support from stakeholders - including the Social Justice and Social Security Committee - for a mental health moratorium.

The Accountant in Bankruptcy has established a Mental Health Moratorium Working Group, with representation from mental health professionals, money advice organisations and creditors. This group has been developing recommendations for the operation of the mental health moratorium.

It is hoped that the group's report will be available by September 2023. It is expected that this will be followed by further consultation on the proposals1.

This part of the briefing looks at:

The existing "moratorium against diligence"

The current legal framework for statutory debt solutions allows people in debt - including those with mental health issues - to apply for a moratorium against diligence while they consider how best to deal with their debt problem.

Individuals can apply for the moratorium themselves. However, it is often done by money advisers as an initial part of the money advice process.

The effect of the moratorium is to prevent creditors being able to take formal action to enforce payment of debts - known as diligence - against the applicant

This is intended to give someone with debt problems time to work out what the most appropriate solution to their debt situation is. It also prevents their financial situation from being made even worse by enforcement action by creditors (e.g. seizing money in a bank account).

Statutory debt solutions also protect debtors from debt enforcement action by their creditors. Therefore, if someone enters a statutory debt solution before the end of the moratorium, the protection will continue.

However, a moratorium does not affect the legal obligation to pay a debt. Where they can, someone in debt should still make payments to their creditors. A creditor can add interest and charges to the debt in line with their contractual rights.

The moratorium lasts for six months

When it was introduced, the moratorium period lasted for six weeks. This was extended to six months during the COVID-19 pandemic, and the extension has since been made permanent.

There are arguments - from both creditors and some in the money advice sector - that six months is too long, in particular that people seeking money advice may disengage with the process as a result. However, with many money advice providers over-stretched, it can take time to access advice and for an adviser to collect the information needed to identify the best options for dealing with a debt problem.

When discussing the amendment to the Coronavirus (Recovery and Reform) (Scotland) Bill which made the six month period permanent, John Swinney MSP, Deputy First Minister and Cabinet Secretary for Covid Recovery, stated (col 71)1:

It is very likely that many households that have previously been able to manage their budgets will come under increased pressure, resulting in their debt potentially becoming unsustainable. That is why we have retained the existing enhanced protection, but it comes with a commitment to review and introduce an amended timeframe when the current risks subside, as we hope they will. The regulation-making powers will enable flexible and rapid responses to changing economic circumstances.

Breathing Space in England and Wales

Breathing Space is a similar initiative to the moratorium on diligence. It became operational in England and Wales in 2021.

There are two types of Breathing Space - standard Breathing Space and mental health Breathing Space. Mental health Breathing Space can be used by people receiving "mental health crisis treatment"1.

Standard Breathing Space lasts for up to 60 days, while mental health Breathing Space lasts for the length of the crisis treatment plus 30 days.

Breathing Space has a wider effect than a moratorium, but can be argued to be more administratively burdensome

The key differences between the moratorium on diligence and Breathing Space are:

Breathing Space must be applied for by a money adviser on behalf of the person in debt, while a moratorium can be applied for by the individual affected. The money adviser has an ongoing role in monitoring the scheme.

In Breathing Space, a creditor cannot contact the debtor and any interest and charges on the debts affected are frozen, in addition to acting as a pause on formal debt enforcement action.

One of the recommendations from stage 2 of the Review of Scotland's Statutory Debt Solutions was that the moratorium on diligence should be extended to end creditor contact and freeze interest and charges.

However, the Scottish Government has rejected this proposal. It argues that the current scheme benefits from simplicity. Extending the scheme in the way proposed would require notification to creditors affected, increasing the burden on money advisers and requiring the development of new IT systems2.

There are additional requirements to access mental health Breathing Space

An Approved Mental Health Professional must certify that someone is undergoing mental health crisis treatment before they can access mental health Breathing Space.

The term Approved Mental Health Professional applies to people working for local authorities in England and Wales who have the authority to decide whether someone should be detained under mental health legislation. They have undergone specific training in mental health issues. They are often social workers, nurses or others with expertise in mental health issues.

Doctors, including GPs, do not have a role in certification in mental health Breathing Space.

Mental health crisis treatment covers detention at a hospital or by a police officer. It can also cover other treatment in hospital or in the community involving specialist mental health services where the mental health issue is comparable in severity to one requiring detention.

The evidence presented to the Social Justice and Social Security Committee

The Social Justice Committee supported implementation of a mental health moratorium. Evidence from stakeholders pointed to some of the issues it could cover.

Debt as a cause and a symptom of mental health issues

The links between debt and mental health were noted by those who engaged with the Committee. People with mental health issues might be more likely to get into debt - e.g. because they struggled to keep track of their finances or because they couldn't get motivated to deal with problems. At the same time, the pressure of being in debt could create or exacerbate mental health issues.

Accessing a mental health moratorium

The Money and Mental Health Policy Institute gave evidence to the Social Justice Committee. It had been a key campaigner for the creation of mental health Breathing Space in England and Wales.

It noted the importance of someone other than the person in mental health crisis being able to apply for the scheme. It would be unrealistic to expect someone with severe mental health issues to be able to make the application themselves (col 36)1.

In England, applications are made via a money adviser. However, other people - such as advocates, social workers, carers or family members - can contact the money adviser on behalf of the person in mental health crisis.

The Scottish Association for Mental Health questioned whether someone's mental health should have to have reached crisis stage before accessing support was possible. They also asked whether a 30 day buffer after someone had finished crisis treatment was long enough (col 35)1.

What a mental health moratorium should do

The Money and Mental Health Policy Institute noted the pressure ongoing contact from creditors could put on people in mental health crisis (paragraph 308)3. This suggests that a mental health moratorium which limits creditor contact would be helpful.

The Social Justice Committee also commented that it was unfair that people in mental health crisis continued to be charged interest on their debts (paragraph 313)3.

Implementing a mental health moratorium

The Social Justice Committee heard that there could be a disconnect between money advice and mental health services. Those providing mental health support may not realise the impact that debt problems can have. Even where they do, they may not know enough about money advice or available services to be able to refer people to appropriate support.

The Money and Mental Health Policy Institute noted the importance of any Scottish scheme being developed in conjunction with healthcare professionals (col 37)1. This would raise awareness of the scheme and the potential impact of debt problems. It would also allow health professionals to have input on who would be best placed to provide any certification necessary to access the scheme.

The issue of who should be able to sign off on access to the scheme was also discussed by one of the working groups in stage 2 of the Review of Scotland's Statutory Debt Solutions. Some members argued that the pool of professionals who could do this in England and Wales was too limited. The group's final report stated6:

One of the main issues is the restricted list of mental health professionals required to support the application. Some members of the group believe this list should be more open if a mental health crisis moratorium is to be introduced in Scotland. However, other members of the group did not favour that list being too open. They believe the criteria set out in England and Wales aims to ensure the appropriate people are accessing this protection.

Changes to bankruptcy legislation

Sections two to five of the Bill would make minor, technical changes to the Bankruptcy (Scotland) Act 2016.

They deal with recall of an award of bankruptcy, applying for Minimal Asset Process bankruptcy, gratuitous alienation (where a debtor deliberately disposes of assets to defeat the purposes of bankruptcy) and appeals against decisions made by the Accountant in Bankruptcy.

The Scottish Government states (Policy Memorandum, paragraph 31):

These proposals were not part of the public consultation. The changes should be largely uncontroversial. They are intended to clarify existing requirements, remove potential ambiguity in the interpretation of processes, and correct errors in the 2016 Act.

The changes are therefore not discussed further in this briefing.

Changes to the law on debt enforcement

Sections six to ten of the Bill would make reforms to the current law on formal debt enforcement. These implement changes recommended by the Diligence Working Group.

Some of the changes give an advantage to creditors, while some benefit debtors.

This part of the briefing looks at:

Changes to arrestment and diligence against earnings

The Bill would require an arrestee - the person or body who may be in possession of the assets belonging to the debtor - to tell the creditor where diligence has been unsuccessful. Currently, the law only requires information to be sent to the creditor where diligence is successful.

There would be a financial penalty on the arrestee for failing to supply the information.

Both standard arrestment and diligence against earnings involve seizing assets belonging to a debtor in the hands of a third party. Arrestment commonly covers money in a bank account, although a range of other assets can be arrested.

There is a specific legal regime covering arrestment of wages - known as diligence against earnings. There are three types of arrestment:

earnings arrestment

current maintenance arrestment (for debts relating to maintenance, usually of children)

conjoined arrestment (involving more than one creditor).

The Scottish Government argues that providing information about unsuccessful arrestments increases transparency

Reform would allow the creditor to better target their approach, saving money on unsuccessful attempts at debt enforcement. For example, if a creditor knows a bank arrestment has been unsuccessful because the debtor does not have an account with the bank in question, they can decide to try a different bank. If it is because there was insufficient money in an account, this may indicate that there is no point pursuing further action.

The effect of the amendments is slightly different for the different types of diligence. There is more detail in following sections:

Effects of amendments on arrestment

The arrestee would have to tell a creditor whether an arrestment had been unsuccessful and why, within 21 days. The Bill adds to the current duties on arrestees.

Arrestments in this context may be unsuccessful because - for example - the debtor does not have a bank account with the arrestee, or because the funds in the account are below the legally protected minimum balance (currently £1,000).

Arrestees already have to inform the creditor where an arrestment has been successful. They must tell the creditor what has been arrested and its value, if known. What is proposed in the Bill follows the same general process.

However, there will be an additional cost to creditors to respond to all arrestments, rather than just those which were successful. This is not likely to be significant in individual cases. But, for bodies such as high street banks - which may receive thousands of arrestment requests - there will be a cumulative effect.

There would be a financial penalty - the lesser of £500 or the amount owed by the debtor - where an arrestee fails to notify the creditor as required

This also builds on the existing law. Currently an arrestee can be required to pay the lesser of the minimum protected balance in a bank account or the amount owed by the debtor.

Note though that the process is not automatic. A creditor must go to court to ask the sheriff to order the arrestee to pay this sum.

The minimum protected balance has recently been significantly increased to £1,000 to provide additional protection to debtors. This is in recognition of the fact that the previous sum - which would have been £655.83 - didn't offer sufficient protection where a debtor's entire wage or social security benefit entitlement was paid into their bank account.

However, the Scottish Government argues that it is no longer proportionate to keep the link to the minimum protected balance. The figure of £500 is argued to be more appropriate (Policy Memorandum paragraph 67).

Effects of amendments on diligence against earnings

As with standard arrestment, the employer would have to tell a creditor whether an arrestment had been unsuccessful and why, within 21 days. The Bill adds to the existing duties on arrestees.

Diligence against earnings seizes a proportion of what the debtor earns above the minimum threshold. This varies depending on how much the debtor earns.

Where an arrestment has been unsuccessful, the employer would have to confirm which of two reasons provided for in the Bill applies. This would be either because:

no money would be caught by the arrestment (usually because the debtor earns below the minimum threshold - currently £655.83)

the debtor is not employed by the arrestee.

Currently, where diligence against earnings is successful, the employer must tell a creditor how often the debtor is paid, when their next pay day is, how much they will be paid and how much will be caught by the diligence. They must do so "as soon as is reasonably practicable".

There will be increased costs to employers in responding to all arrestment requests, rather than just successful ones. However, in most cases, this can be expected to be minimal.

There would be a financial penalty - the lesser of £500 or the amount owed by the debtor - where an employer fails to notify the creditor as required

Currently, an employer is required to notify the creditor if a debtor ceases to be employed by them. The employer can be required to pay up to twice the sum that would have been caught by the diligence against earnings if they fail to do so. As with arrestment, the creditor must go to court to ask the sheriff to order an employer to pay.

The Bill would set the financial penalty at £500 to match the penalty which applies in arrestment. It would apply where any of the requirements to provide information are not complied with.

Changes to diligence on the dependence

The Bill would require that a debtor who is an individual is provided with a copy of the Debt Advice and Information Package before a court hearing relating to diligence on the dependence.

Diligence on the dependence refers to diligence used before a court action has concluded

It is short for diligence on the dependence of the action. In this type of diligence, the purpose is to prevent one of the parties to the action from disposing of assets which may later be needed to comply with a court order.

For example, diligence on the dependence may be used to arrest a major asset belonging to one of the parties. If they were able to dispose of the asset, they may not be able to pay any award of compensation ordered by the court.

There are two types of diligence on the dependence:

arrestment on the dependence - seizing assets in the hands of a third party

inhibition on the dependence - pausing the debtor's ability to sell or re-mortgage land or buildings they own.

It may be important that the person affected does not get advance warning of diligence on the dependence

There will generally be a court hearing before authority to use diligence on the dependence is given. However, it is possible for authority for diligence on the dependence to be granted without a hearing. This can happen where there is a risk that the party who is the subject of the diligence is on the verge of insolvency or will deliberately dispose of assets to defeat the purpose of the court action.

Where no hearing is held in advance, a judge must hold a hearing after authority to use diligence on the dependence has been granted.

The Bill's proposals on service of the Debt Advice and Information Package take account of the element of surprise. Where a hearing is held in advance, the Debt Advice and Information Package would be sent to the affected party before the hearing.

Alternatively, in cases where there is no advance hearing, the Debt Advice and Information Package would be sent to the party before the follow up hearing. Thus, the service of the package in itself would not give the affected party notice of likely diligence against them.

The Debt Advice and Information Package is only a requirement for debtors who are individuals

It is not necessary to send a copy of the package to entities such as companies.

Copies of the Debt Advice and Information Package1 are available from the Accountant in Bankruptcy's website.

Changes to exceptional attachment

Exceptional attachment can be used to seize non-essential assets situated in a debtor's home. The Bill would extend the time period debtors have to reclaim seized assets.

Exceptional attachment is seen as a particularly intrusive form of debt enforcement

Exceptional attachment replaced poindings and warrant sales as the diligence which catches assets in a debtor's home. Sheriff officers will visit the home in order to take control of the assets. Ultimately, the assets can be auctioned to raise money to repay the debt.

Reflecting the sensitivity of the procedure, there are a range of protections for debtors in legislation. Creditors must seek an additional court hearing before they can proceed. Among the things a sheriff must consider in relation to granting an order are:

whether the creditor has taken reasonable steps to negotiate settlement of the debt

whether the creditor has attempted the less intrusive debt enforcement options of arrestment and earnings arrestment

whether it is likely that the sum recoverable by using exceptional attachment would at least cover the costs of the action plus £100.

Before deciding whether to grant the order, the sheriff can require the debtor to receive money advice.

Debtors can buy back seized assets - and they can also go to court to challenge the validity of the attachment

The grounds for challenging an attachment are:

that rules for attachment were not properly followed

that auctioning an asset would be unduly harsh

that the assets are of sentimental value (and likely to be auctioned for not more than £150).

The Bill would extend the timescales a debtor has to reclaim assets left in their home to 14 days

Currently, a debtor has seven days from the point sheriff officers remove assets to reclaim them. However, assets seized by sheriff officers may be left in the debtor's home or taken into storage. Where they are left in a debtor's home, sheriff officers must given them at least seven days' notice of the intention to remove them.

So, in practice, where assets are left in a debtor's home, a minimum of 14 days must pass before they can be sold. The Bill would therefore extend the period assets can be reclaimed in this scenario to 14 days.

The period to reclaim assets where sheriff officers have taken them into storage would remain at seven days. The Diligence Working Group was concerned that extending this period would increase a debtor's liability for storage costs.

Changes to money attachment

Money attachment can be used to seize money kept in business premises. The Bill would give greater flexibility around the times when this can happen.

Money attachment can't be used to attach money kept at home.

Currently, money attachment can only be carried out Monday to Saturday (excluding bank holidays), between 8am and 8pm. A creditor who wishes to instruct a money attachment outside these hours must get further permission from the court.

Money attachment is particularly useful when enforcing against businesses which take a lot of cash from customers - such as bars and nightclubs. The current restrictions can make this enforcement option less effective.

The Bill would allow money attachment to take place at any point when the premises in question was open for business. This need not mean that the premises is open to the general public.

Annexe 1 - Review of Scotland's Statutory Debt Solutions: recommendations from the stage 2 working groups

The stage 2 working groups from the Review of Scotland's Statutory Debt Solutions made a range of medium term recommendations for changes to debt solutions.

The recommendations are summarised in the sections dealing with the relevant working group below. Note that the tables do not attempt to capture all the detail of the working groups' discussions. Where it is known that the Scottish Government does not intend to implement a recommendation as expected by the working group, this is noted as an outcome.

The three working groups were:

Working group on moratoriums and the Common Financial Tool

Definitions of the moratorium on diligence and the Common Financial Tool can be found in the Terminology section.

The recommendations of this group which the Scottish Government intends to implement - other than the creation of a mental health moratorium - can be taken forward using secondary legislation or by changing guidance. A timescale for this work is not yet available.

| Issue | Recommendation |

|---|---|

| Scope of current moratorium | Agreed that interest and charges should be frozen during moratorium period, and that this would require new processes to support it, including application via a money adviserOutcome: The Scottish Government is not taking this forward due to the administrative complexity. |

| Agreed that stage 3 should consider additional protections for those in a moratorium. | |

| Length of the current moratorium | No consensus reached; a majority favoured a 60 day period with the potential for a 30 day extension in extenuating circumstancesOutcome: The Scottish Government intends to keep the current six month period as an immediate solution. |

| Introduction of a mental health moratorium | Agreed - but it should not exactly mirror the English version, further consultation needed. |

| Whether an income assessment model based on assessing actual outgoings or taking a proportion of income should be used | No consensus reached; however, it was acknowledged that the administrative burdens of the current tool needed to be addressedOutcome: The Scottish Government intends to keep an income and expenditure model but move to UK-wide expenditure thresholds. |

| Agreed that, where there is surplus income, a debtor should be able to keep a proportion of this to improve financial resilienceOutcome: The Scottish Government argues the new income and expenditure thresholds include a bigger savings element. The Scottish Government will use secondary legislation to protect special purpose payments such as cost-of-living payments for benefits claimants. |

Working group on Protected Trust Deeds

Note that a number of the suggestions considered by this working group came from the Session 5 Economy, Energy and Fair Work Committee's report on Protected Trust Deeds1.

The working group has recommended various changes to the legislative framework for Protected Trust Deeds. Scottish Ministers have regulation-making powers in this area under the Bankruptcy (Scotland) Act 2016 so do not need to use primary legislation to do so. A timescale for this work is not yet available.

| Issue | Recommendation |

|---|---|

| Role of the Protected Trust Deed protocol (voluntary protocol set up by the Accountant in Bankruptcy, covering the vast majority of PTDs) | The protocol was introduced to address some of the concerns about the use of PTDs - agreed that it should be allowed to run for a reasonable period to measure its impactOutcome: The Scottish Government intends to put some aspects of the protocol into legislation. |

| Appropriate restrictions on entering a PTD - e.g. increased minimum debt level | No consensus reached. |

| Introduction of an additional statutory debt solution | Agreed that this was for consideration at stage 3 of the review. |

| Creation of an information leaflet about the benefits and risks of entering a PTD | Agreed that an easy to understand leaflet would be helpful; draft text provided. |

| Requirement for advice from a free sector money adviser before entering a PTD | Agreed that provision of good advice before entering a PTD was important, but it was unlikely to be feasible for this to be provided by the free sector. |

| Create a cooling-off period before a PTD comes into effect | Agreed this would be too difficult to achieve in the current legal frameworkOutcome: this issue will be considered at stage 3. |

| Options for ending a PTD early - e.g. where a debtor's circumstances have changed so they can no longer make payments | Agreed that the law should be changed to create several new ways to discharge a debtor, with a role for the Accountant in Bankruptcy where creditors disagreeOutcome: Scottish Government is still considering this issue. |

Working group on bankruptcy and cross-cutting issues

A number of the recommendations made by this group, and which the Scottish Government intends to implement, can be taken forward using secondary legislation or by changing guidance. Options in relation to some of the recommendations are still being considered. A timescale for this work is not yet available.

| Issue | Recommendation |

|---|---|

| Entry requirements for various routes into bankruptcy | Various changes agreed, including:

|

| Repayment periods in bankruptcy and the Debt Arrangement Scheme | Agreed that there should continue to be no fixed period in DAS; the period in full administration bankruptcy should be reduced to three yearsOutcome: the Scottish Government does not intend to reduce the bankruptcy payment period. |

| Period when trustee can recover debtor's assets in bankruptcy | No consensus reached. |

| Options for exiting bankruptcy and the Debt Arrangement Scheme | Agreed that it should be easier for a debtor to exit DAS by making a reduced offer of repayment to creditors (called "composition"); this option should also be re-introduced for bankruptcyOutcome: the Scottish Government does not intend to increase composition options in DAS, but will give further consideration to re-introducing this for bankruptcy and PTDs. |

| Agreed that, where a DAS Debt Payment Programme is revoked because a debtor has died, interest and charges should not be added to the debtsOutcome: the Scottish Government is still considering this issue. | |

| Agreed that it is not appropriate for discharge to be deferred indefinitely because of debtor non-cooperation in bankruptcyOutcome: the Scottish Government does not intend to re-introduce automatic discharge. It will investigate options for transferring responsibility to the Accountant in Bankruptcy. | |

| Agreed that there should be a time limit on how long a bankruptcy remains open when a debtor cannot be foundOutcome: as above. | |

| Changes to the prescribed rate of interest (charged on some debts where they can be paid in full), which is currently 8% | Agreed that the rate should be reduced to better reflect the actual loss to the creditor; consultation on the precise mechanismOutcome: the Scottish Government favours the Bank of England base rate plus 2%. |

| Treatment of creditors who have a contractual rate of interest higher than the prescribed rate | Agreed that the law should change so that creditors would not be able to recover more than the prescribed rate (with the potential for exceptions where a creditor could justify this). |

| Time period for a trustee to submit a proposal for a Debtor Contribution Order (setting the contribution a debtor should make from their income), currently 12 weeks | Agreed that legislation should require proposal as soon as reasonably practicable rather than having a fixed time scale. This would avoid additional costs when the deadline was missed.Outcome: the Scottish Government will monitor current 12 week period. |

| Process for varying contributions via a Debtor Contribution Order (e.g. where a debtor's income has reduced) | Agreed the law should be changed so that a variation could be backdated. |

| No consensus reached on the role of creditors in the process. |

Annexe 2 - Diligence Review recommendations

The Diligence Review made recommendations across the different types of formal debt enforcement options and related procedures. Some of the longer term proposals appear to need further development.

This section summarises the recommendations of the Diligence Working Group. It does not capture all the recommendations, or the discussions surrounding them.

Exceptional attachment

This diligence can be used to attach non-essential goods in a debtor's home. There are specific criteria in legislation which require additional court hearings. This can make it difficult to use in practice.

Recommendations:

the process should not be streamlined as this would reduce debtor protections

the value of goods of sentimental value which cannot be attached should increase to £500

timescales for disposal of attached goods should be clarified (a debtor can reclaim goods before this deadline) - to seven days where items are removed and stored by court officers and 14 days where they are left in the debtor's home.

Inhibition

This diligence can be used to stop a debtor selling or re-mortgaging land or buildings they own until a debt is repaid. An inhibition lasts for five years but can be renewed.

Recommendations:

the option of using inhibition should be available under summary warrant

it should be possible to renew an inhibition online.

Diligence on the dependence

This refers to diligence used before a court action has concluded. Its purpose is to prevent one of the parties to the action from disposing of assets which may be needed to comply with an order made by the court.

Recommendation:

the Debt Advice and Information Package should be supplied in advance of carrying out diligence on the dependence.

Money attachment

This diligence can be used to attach money and physical equivalents in business premises.

Recommendations:

time restrictions (Monday to Saturday, 8am to 8pm) should be removed

further work should look at how to make this diligence more effective as society moves away from using cash.

Diligence against earnings

This covers several types of diligence which can be used to require an employer to make deductions from a debtor's wages.

Recommendations:

employers should be required to tell court officers if an earnings arrestment has been unsuccessful within 21 days

the Accountant in Bankruptcy, rather than the courts, should be responsible for distributing funds to creditors in conjoined (joint) arrestments

options for making quarterly payments to creditors should be investigated.

Separately, the Scottish Government committed to investigate options for creditors to vary the amount taken in an earnings arrestment.

Arrestment

This type of diligence allows a creditor to seize a debtor's assets in the hands of a third party - typically money in a bank account. There is a minimum protected balance (below which money cannot be arrested) for bank accounts. This is currently £1,000.

Recommendations:

explore options for making the process more efficient, including electronic notification of bulk arrestments

arrestees (those who may be in possession of arrested assets) should be required to notify court officers where the diligence has been unsuccessful within 21 days

explore options for enabling bank arrestments for bank accounts held outwith Scotland

further consideration of how to protect social security benefits in bank accounts which were the subject of an arrestment.

Summary warrant

This is a court procedure used by some public sector bodies to enforce debts. The biggest users are local authorities collecting Council Tax debts.

Recommendations:

the Debt Advice and Information Package should be supplied to debtors before an organisation applies for a summary warrant

private sector creditors should not have the option of using summary warrant procedures.

Adjudication for debt

This diligence allows a creditor to get security over land and buildings belonging to the debtor in relation to the debt. After 10 years, the creditor can force the sale of the property. However, old-fashioned, unclear processes mean it is rarely used.

Recommendation:

adjudication for debt should be abolished. However, there should be a viable form of diligence to deal with interests in land and buildings.

Stage 3 of the Review of Scotland's Statutory Debt Solutions will consider the treatment of land and buildings in various debt-related scenarios.

Land attachment

Land attachment is a more modern form of diligence designed to allow a creditor to access equity in land and buildings. It was legislated for in the Bankruptcy and Diligence etc. (Scotland) Act 2007. However, it has not been brought into force due to concerns about the impact on a family home.

Recommendations:

work should be undertaken to develop an effective diligence over land and buildings

the treatment of land and buildings in diligence should be considered by an independent group.

This will be taken forward as part of stage 3 of the Review of Scotland's Statutory Debt Solutions.

Residual attachment

This diligence was legislated for in the Bankruptcy and Diligence etc. (Scotland) Act 2007. It is intended to cover assets not dealt with by other diligences. However, it is not effectively in force.

Recommendations:

when issues around diligence in relation to land and buildings were resolved, residual attachment should be brought into force

it should cover a wide range of assets, but existing debtor protections should be maintained.

Information Disclosure Orders

The power to create Information Disclosure Orders was also legislated for in the Bankruptcy and Diligence etc. (Scotland) Act 2007. However, they have not been further developed. The intention is to provide a mechanism by which creditors can get information about the assets owned by a debtor from third parties.

Recommendations:

Information Disclosure Orders, with appropriate safeguards, would be a useful addition to the diligence framework

Agreed a proposal for how they should operate in practice - key features include: a requirement that the creditor already has court authority to enforce a debt; the need to apply via a professional adviser (e.g. a court officer or solicitor); and that debtors would not be notified that the creditor was seeking an order. It was expected that government bodies would not initially be covered by the requirements, but that ways of including them should be explored.