Scottish Budget 2024-25: Taxes Infographic

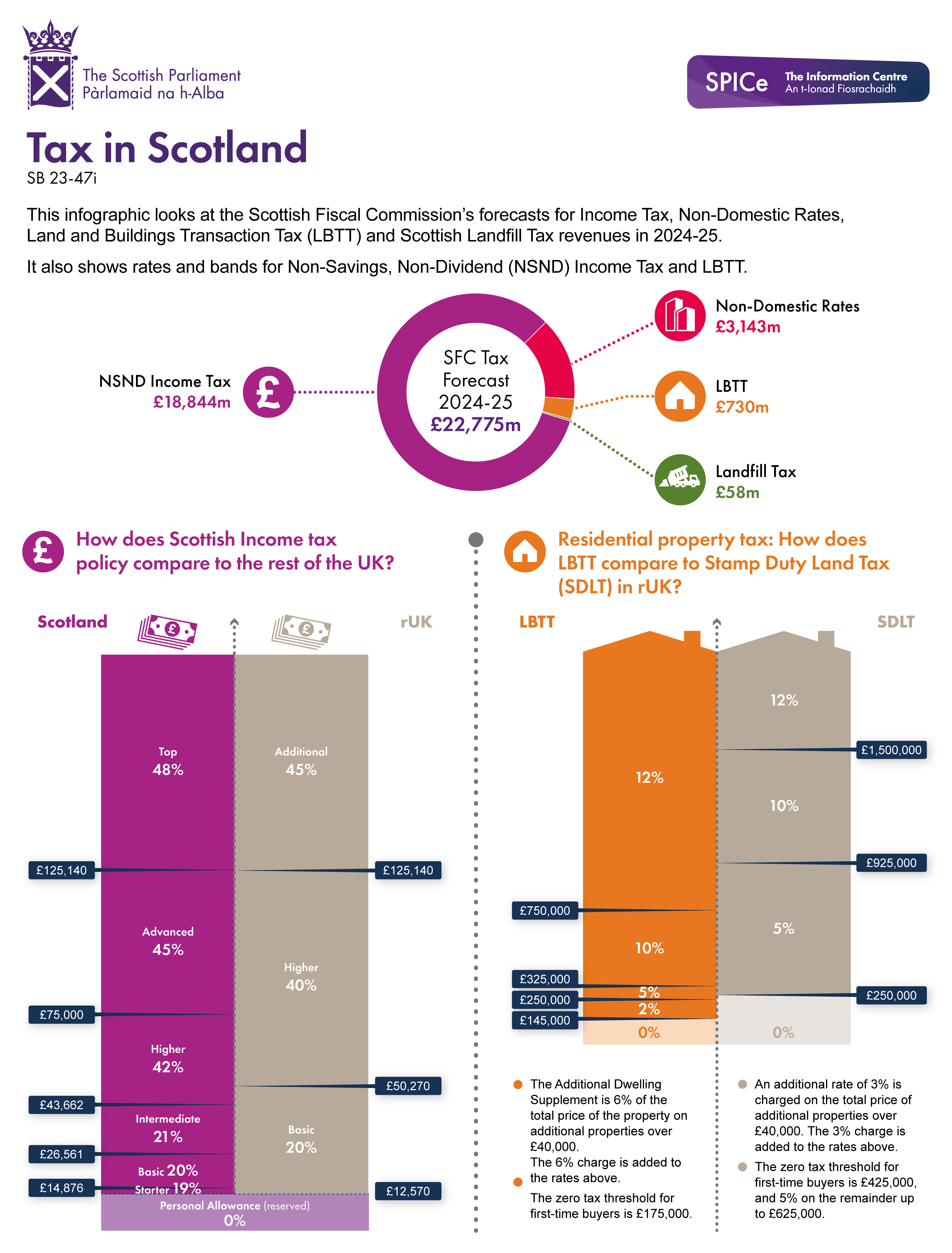

This infographic looks at the Scottish Fiscal Commission's forecasts for Income Tax, Non-Domestic Rates, Land and Buildings Transaction Tax and Scottish Landfill Tax.

Scottish Budget 2024-25: Taxes Infographic

Data

| Tax | Amount |

|---|---|

| NSND Income Tax | £18,844m |

| Non-Domestic Rates | £3,143m |

| Lands and Buildings Transaction Tax (LBTT) | £730m |

| Scottish Landfill Tax | £58m |

| SFC Tax Forecast 2024-25 | £22,775m |

| Taxable income | Band | Tax rate |

|---|---|---|

| Up to £12,570 | Personal Allowance (reserved) | 0% |

| £12,571 to £14,876 | Starter | 19% |

| £14,877 to £26,561 | Basic | 20% |

| £26,562 to £43,662 | Intermediate | 21% |

| £43,663 to £75,000 | Higher | 42% |

| £75,001 to £125,140 | Advanced | 45% |

| Above £125,140 | Top | 48% |

| Taxable income | Band | Tax rate |

|---|---|---|

| Up to £12,570 | Personal Allowance | 0% |

| £12,571 to £50,270 | Basic | 20% |

| £50,271 to £125,140 | Higher | 40% |

| Over £125,140 | Additional | 45% |

Source: UK Government Income Tax Rates

| Purchase price | LBTT rate |

|---|---|

| Up to £145,000 | 0% |

| £145,001 to £250,000 | 2% |

| £250,001 to £325,000 | 5% |

| £325,001 to £750,000 | 10% |

| Over £750,000 | 12% |

| Purchase price | SDLT rate |

|---|---|

| Up to £250,000 | 0% |

| £250,001 to £925,000 | 5% |

| £925,001 to £1,500,000 | 10% |

| Over £1,500,000 | 12% |