Late Payment (commercial transactions) Framework

This briefing discusses the Common Framework on Late Payment (commercial transactions). The Late Payment Framework covers the Late Payment Directive (2011/7/EU) which was designed to protect European businesses against late payment of monies owed in commercial transactions. It also provides background information on the common frameworks programme.

Summary

This briefing provides detailed information on the Late Payment (commercial transactions) framework. The Economy and Fair Work Committee will lead on scrutiny of this framework.1

Background information on, for example, what common frameworks are and how they have been developed is also provided in this paper. The policy context of the framework is also briefly covered in this briefing.

The SPICe common frameworks hub collates all publicly available information on frameworks considered by committees of the Scottish Parliament.

In session five the Finance and Constitution Committee reported on common frameworks and recommended that frameworks should include the following:

their scope and the reasons for the framework approach (legislative or non-legislativei) and the extent of policy divergence provided for;

decision making processes and the potential use of third parties;

mechanisms for monitoring, reviewing and amending frameworks including an opportunity for Parliamentary scrutiny and agreement;

the roles and responsibilities of each administration; and

the detail of future governance structures, including arrangements for resolving disputes and information sharing

The Scottish Government’s response highlighted that there may be a "range of forms" which frameworks could take.

More detail on the background to frameworks is available in a SPICe briefing and also in a series of blogs available on SPICe spotlight.

The Late Payment Common Framework covers policy previously covered by EU legislation - Late Payment Directive (2011/7/EU)2 - designed to protect businesses against late payment in commercial transactions.

The framework sets out how the four governments propose to work together on late payment (commercial transactions) policy. The framework was developed collaboratively by the:

UK government

Scottish Government

Welsh Government

Northern Ireland Executive

The framework is a non-legislative agreement formalising ways of working between the four governments on late payment (commercial transactions) policy. Its purpose is to facilitate multilateral policy development through establishing governance arrangements and setting out commitments for ways of working. The framework sets out the roles and responsibilities of parties to the framework, the mechanisms for monitoring, review, amendment, and dispute resolution.

There is currently a level playing field across the UK in respect of late payment legislation.

There does not appear to be any substantive issues within the provisional late payment common framework. However, there are some minor areas where further consideration and clarification would be merited around enforcement and transparency.

What are common frameworks?

A common framework is an agreed approach to a particular policy, including the implementation and governance of it. The aim of common frameworks is to manage divergence in order to achieve some degree of consistency in policy and practice across UK nations in areas formerly governed by EU law.

In its October 2017 communique on common frameworks, the Joint Ministerial Committee (EU Negotiations) (JMC (EN)) stated that:

A framework will set out a common UK, or GB, approach and how it will be operated and governed. This may consist of common goals, minimum or maximum standards, harmonisation, limits on action, or mutual recognition, depending on the policy area and the objectives being pursued. Frameworks may be implemented by legislation, by executive action, by memorandums of understanding, or by other means depending on the context in which the framework is intended to operate.

Joint Ministerial Council (EU Negotiations), 16 October 2017, Common Frameworks: Definition and Principles

The Scottish Government indicated in 2019 that common frameworks would set out:

the area of EU law under consideration, the current arrangements and any elements from the policy that will not be considered. It will also record any relevant legal or technical definitions.

a breakdown of the policy area into its component parts, explain where the common rules will and will not be required, and the rationale for that approach. It will also set out any areas of disagreement.

how the framework will operate in practice: how decisions will be made; the planned roles and responsibilities for each administration, or third party; how implementation will be monitored, and if appropriate enforced; arrangements for reviewing and amending the framework; and dispute resolution arrangements.

However, the Food and Feed Safety and Hygiene Law framework outline considered by the session five Health and Sport Committee noted that:

the framework itself is high level and commits all signatories to early, robust engagement on policy changes within scope.

Framework Outline Agreement and Concordat, 30 November 2020

The framework outline went on to note that the framework:

is intended to facilitate multilateral policy development and set out proposed high level commitments for the four UK Administrations. It should be viewed as a tool that helps policy development, rather than a rigid template to be followed.

As such, it is likely that there will be significant variation between frameworks in terms of whether they set policy or set out how decisions on policy within the scope of the framework will be taken.

There are, however, similarities between frameworks in terms of their overall structure, with the agreements setting out the roles and responsibilities for parties to the framework, how the framework can be reviewed and amended, and how disputes are to be resolved.

Why are common frameworks needed?

During its membership of the European Union, the UK was required to comply with EU law. This means that, in many policy areas, a consistent approach was often adopted across all four nations of the UK, even where those policy areas were devolved.

On 31 December 2020, the transition period ended, and the United Kingdom left the EU single market and customs union. At this point, the requirement to comply with EU law also came to an end. As a result, the UK and devolved governments agreed that common frameworks would be needed to avoid significant policy divergence between the nations of the UK, where that would be undesirable.

The Joint Ministerial Committee (JMC) was a set of committees that comprises ministers from the UK and devolved governments. The JMC (EU Negotiations) sub-committee was created specifically as a forum to involve the devolved administrations in discussion about the UK’s approach to EU Exit. Ministers responsible for Brexit preparations in the UK and devolved governments attended these meetings.

In October 2017, the JMC (EN) agreed an underlying set of principles to guide work in creating common frameworks. These principles are set out below.

Common frameworks will be established where they are necessary in order to:

enable the functioning of the UK internal market, while acknowledging policy divergence;

ensure compliance with international obligations;

ensure the UK can negotiate, enter into and implement new trade agreements and international treaties;

enable the management of common resources;

administer and provide access to justice in cases with a cross-border element; and

safeguard the security of the UK.

Frameworks will respect the devolution settlements and the democratic accountability of the devolved legislatures, and will therefore:

be based on established conventions and practices, including that the competence of the devolved institutions will not normally be adjusted without their consent;

maintain, as a minimum, equivalent flexibility for tailoring policies to the specific needs of each territory, as is afforded by current EU rules; and

lead to a significant increase in decision-making powers for the devolved administrations.

What is the process for developing frameworks ?

Frameworks are inter-governmental agreements between the UK Government and the devolved administrations.

They are approved by Ministers on behalf of each government prior to being sent to all UK legislatures for scrutiny.

The UK Government Cabinet Office is coordinating the work on developing common frameworks.

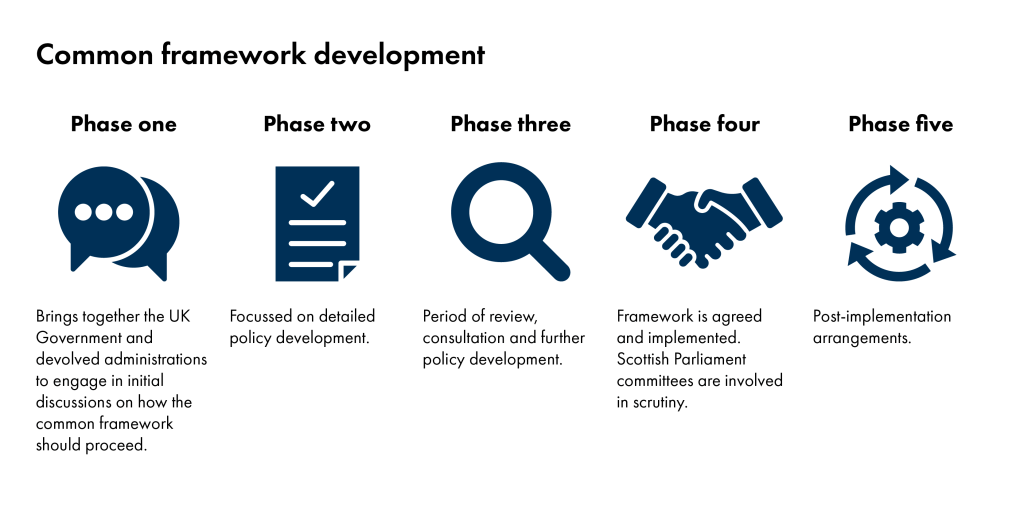

Common frameworks go through four phases of development before implementation at phase five. The stages are set out below. The parliament receives frameworks for scrutiny at phase four.

How will the Scottish Parliament consider frameworks?

Frameworks which have reached phase four are available to be considered by the Scottish Parliament. Subject committees can consider frameworks which sit within their policy areas.

Each legislature in the UK can consider common frameworks. Issues raised by legislatures during this scrutiny are fed back to their respective government. Governments then consider any changes which should be made to frameworks in light of scrutiny by legislatures before implementing the framework. Changes in light of scrutiny are not, however, a requirement.

The Constitution, Europe, External Affairs and Culture Committee has an oversight role in relation to frameworks and will lead on cross-cutting issues around transparency, governance and ongoing scrutiny.

The Scottish Government has previously acknowledged the ongoing role of the Scottish Parliament in relation to frameworks:

Consideration will also need to be given to what role the Parliament might have in the ongoing monitoring and scrutiny of frameworks post-implementation.

Scottish Government response to the session five Finance and Constitution Committee report on common frameworks, June 2019

The Scrutiny Challenge

The way in which common frameworks have been developed and will operate raises some significant scrutiny challenges for the Scottish Parliament.

Common frameworks are intergovernmental agreements and the scope for parliamentary influence in their development is significantly limited with scrutiny taking place at phase four.

The ongoing operation of frameworks will take place at an official level between government departments. It is therefore unclear how much information the Parliament may be able to access to scrutinise the effect of frameworks on policy-making.

The Scottish Government and the UK Government have differing objectives in relation to frameworks. The UK Government is seeking “high levels of regulatory coherence”.1 The Scottish Government believes that they are about “allowing legitimate policy choices”.1

The interconnected nature of common frameworks and the UK Internal Market Act 2020 (see section on the UK Internal Market Act).

The impact of common frameworks on the Scottish Government’s stated policy position of keeping pace with EU law.

The fact that most frameworks have been operating on an interim basis since 1 January 2021 in spite of being unavailable for scrutiny by legislatures3.

The legacy expert panel report to the session five Finance and Constitution Committee noted these scrutiny challenges. The Committee had previously recommended that the Scottish Government should have to report on the operation of each common framework, noting interactions with cross-cutting issues such as keeping pace with EU law, on an annual basis.

Scrutiny at other legislatures

The late payment framework (the focus of this briefing) was considered by the Houses of Lords Common Frameworks Scrutiny Committee on 18 January 2022. The views of the committee are discussed in the Framework Analysis section.

The UK Internal Market Act 2020

The UK Internal Market Act 2020 was introduced in the UK Parliament by the UK Government in preparation for the UK’s exit from the EU. The Act establishes two market access principles to protect the flow of goods and services in the UK’s internal market.

The principle of mutual recognition, which means that goods and services which can be sold lawfully in one nation of the UK can be sold in any other nation of the UK.

The principle of non-discrimination, which means authorities across the UK cannot discriminate against goods and service providers from another part of the UK.

The Act means that the market access principles apply even where divergence may have been agreed in a framework.

The introduction of the UK Internal Market Act had a significant impact on the common frameworks programme because of the tension between the market access principles contained in the Act and the political agreement reached that “common frameworks would be developed in respect of a range of factors, including "ensuring the functioning of the UK internal market, while acknowledging policy divergence"."i

UK Government Ministers have the power to disapply the market access principles set out in the Act where the UK Government has agreed with one or more of the devolved governments that divergence is acceptable through the common frameworks process.

Although UK Ministers can disapply the market access principles in such circumstances, they are not legally obliged to do so.

On 2 December 2021, Angus Robertson MSP, Cabinet Secretary for Constitution, External Affairs and Culture wrote to the Convener of the Constitution, Europe, External Affairs and Culture Committee to give an update on the common frameworks programme.

The letter indicated that at a recent Ministerial quadrilateral, agreement had been reached between the UK Government and the Scottish Government and other devolved administrationsii on an approach to "securing exemptions to the Act for policy divergence agreed through common frameworks".

The meeting agreed an approach to securing exemptions to the Act for policy divergence agreed through common frameworks, and endorsed the text of a statement that UK Ministers will shortly make to the House of Commons. This will give effect to firm commitments made to the UK Parliament during the passage of the Bill that “…divergence may occur where there is agreement under a common framework, and that such divergence could be excluded from the market access principles. Regulations to give effect to such an agreement can be made under Clauses 10 and 17. In those cases, the Secretary of State would be able to bring to the House a statutory instrument to exclude from the market access principles a specific agreed area of divergence.

This would follow consensus being reached between the UK Government and all the relevant parties that this is appropriate in respect of any specific defined topic within a common framework.

Letter from the Cabinet Secretary for Constitution, External Affairs and Culture, 2 December 2021

Process for considering UK Internal Market Act exclusions in common framework areas

The UK Government and devolved administrations have agreed a process for considering exclusions to the market access principles of the UK Internal Market Act 2020. The process was published on 10 December 2021.

The process requires that if a party to the framework wishes to seek an exclusion to the market access principles, it must set out the scope and rationale for this. The proposed exclusion is then considered by the appropriate framework forum, taking into account evidence including about the likely direct and indirect economic impact of the proposed exemption. If the exemption is agreed, it is for UK Ministers to introduce a draft instrument to the UK Parliament to give effect to the exclusion. The UK Parliament will then consider the draft instrument.

The process is set out in full below.

Proposal and consideration of exclusions

1. Sections 10 and 18 and Schedules 1 and 2 of the UK Internal Market Act contain provisions excluding the application of the United Kingdom market access principles in certain cases.

2. Whenever any party is proposing an amendment to those Schedules in areas covered by a Common Framework:

a. the exclusion seeking party should set out the scope and rationale for the proposed exclusion; and

b. consideration of the proposal, associated evidence and potential impact should be taken forward consistent with the established processes as set out in the relevant Common Framework, including an assessment of direct and indirect economic impacts.

3. It is recognised that all parties will have their own processes for considering policy proposals. Administrations should consult and seek agreement internally on their position before seeking to formally agree the position within the relevant Common Frameworks forum.

Agreement of an exclusion request

4. Where policy divergence has been agreed through a Common Framework this should be confirmed in the relevant Common Framework forum. This includes any agreement to create or amend an exclusion to the UKIM Act 2020’s market access principles.

5. Evidence of the final position of each party regarding any exclusion and whether an agreement has been reached should be recorded in all cases. This could take the form of an exchange of letters between appropriate UK Government and Devolved Administration ministers and include confirmation of the mandated consent period for Devolved Administration ministers regarding changes to exclusions within the Act.

6. Parties remain able to engage the dispute resolution mechanism within the appropriate Common Framework if desired.

Finalising an exclusion

7. Under section 10 or section 18 of the UK Internal Market Act 2020 amendments to the schedules containing exclusions from the application of the market access principles require the approval of both Houses of the UK Parliament through the affirmative resolution procedure. Where agreement to such an exclusion is reached within a Common Framework, the Secretary of State for the UK Government department named in the Framework is responsible for ensuring that a draft statutory instrument is put before the UK Parliament.

Uk Government . (2021, December 10). Guidance: Process for considering UK Internal Market Act exclusions in Common Framework areas. Retrieved from https://www.gov.uk/government/publications/process-for-considering-ukim-act-exclusions-in-common-framework-areas/process-for-considering-uk-internal-market-act-exclusions-in-common-framework-areas#agreement-of-an-exclusion-request [accessed 13 December 2021]

Common Framework on Late Payment (commercial transactions)

The Common Framework on Late Payment (commercial transactions) ("the framework") has reached phase four and has, as such, been received by the Scottish Parliament for scrutiny. Scrutiny will be undertaken by the Economy and Fair Work committee.

The framework has also been received by other UK legislatures.

This briefing is intended to facilitate scrutiny of the framework by the Scottish Parliament.

Policy area

The Late Payment Common Framework covers policy previously covered by EU legislation - Late Payment Directive (2011/7/EU)1 - designed to protect businesses against late payment in commercial transactions.

The original EU Directive was designed to protect businesses, in particular SMEs (small and medium-sized enterprises), against late payment and to improve their competitiveness. For SMEs, any disruption to cash flow can mean the difference between solvency and bankruptcy. The purpose of the original EU directive was to put in place strict measures which, when implemented would contribute to employment, growth and an improvement in the liquidity of businesses.

The framework has been developed collaboratively by the:

UK government

Scottish Government

Welsh Government

Northern Ireland Executive.

Scope

The United Kingdom first implemented late payment legislation in 1998 (Late Payment of Commercial Debts (Interest) Act 19981). This saw a statutory right to interest for late payment for small businesses from large firms and the public sector, and from small firms since 2002 (Late Payment of Commercial Debts Regulations 20022,The Late Payment of Commercial Debts (Scotland) Regulations 20023).

Amended late payment legislation came into force on 16 March 2013 under the Late Payment of Commercial Debts Regulations 20134 (The Late Payment of Commercial Debts (Scotland) Regulations 20135) implementing recast European Directive 2011/7/EU 6on combatting late payment in commercial transactions. This replaced the original Late Payment Directive 2000/35/EC7. Amendment Regulations were made in 2015 (SI no 1336 and SSI no 226) and minor amendments were made in 2018, under The Late Payment of Commercial Debts (Amendment) Regulations 20188(The Late Payment of Commercial Debts (Scotland) Amendment Regulations 20189) to ensure that the EU Directive was correctly implemented.

The main provisions of the Late Payment Directive (2011/7/EU) were as follows:

Public authorities have to pay for the goods and services that they procure within 30 days.

Enterprises have to pay their invoices within 60 days, unless they expressly agree otherwise and provided it is not grossly unfair.

Automatic entitlement to interest for late payment and €40 minimum as compensation for recovery costs - the UK position is a fixed charge of £40, £70 or £100 depending on the size of the debt (under £1,000, under £10,000, and higher), plus additional reasonable costs incurred.

Statutory interest of at least eight percentage points above the European Central Bank’s reference rate - the UK position is the Bank of England reference rate plus at least eight percentage points.

EU countries may continue maintaining or bringing into force laws and regulations which are more favourable to the creditor than the provisions of the Directive.

Legislative competence relating to Late Payments is devolved in Scotland (under the Scotland Act 1998), Wales (under the Government of Wales Act 2006), and Northern Ireland (Northern Ireland Act 1998). The UK Government laid regulations on behalf of Northern Ireland (NI) and Wales, and Scotland made their own legislation.

As a result of the EU directive, the existing legislation was applied uniformly across the four nations. This has limited the ability of governments to independently set policy in this space, as they were required to remain compliant with the standards set in the overarching EU directive.

The Reporting on Payment Practices and Performance Regulations (2017)10 and Small Business Commissioner (Scope and Scheme) Regulations (2017)11 are out of scope for this Framework, as they are not devolved.

The area of policy covered by this common framework does not fall directly within the provisions of the Trade and Cooperation Agreement, although both the common framework and that agreement will impact significantly on devolved and reserved responsibilities. Agreed outcomes of the ongoing intergovernmental relations review will be reflected in this framework.

There is no conflict in the framework proposals with the relevant provisions of the Belfast/Good Friday agreement, and there is no linkage in this framework to the operation of the Ireland/Northern Ireland Protocol. As the Protocol evolves, this will be kept under review.

Definitions

The framework does not list any definitions and notes this section as 'not applicable'.

Summary of proposed approach

A business operating across different parts of the UK would be directly affected by divergent regulations.

For example, each of the four nations could choose to implement different regulatory timescales for repayment or introduce different statutory interest rates on late payments. As a result, there would need to be clear-cut criteria to ascertain which regulations apply to businesses operating across different parts of the UK, and to avoid some businesses being presented with a competitive advantage or disadvantage.

To manage divergence, the four nations have agreed to develop a common UK-wide approach to maintain a level playing field for business which will maintain the functioning of the UK internal market.

This is a non-legislative framework, underpinned by an exchange of ministerial letters. It is intended this approach will maintain existing mutual understanding and joint ways of working between stakeholders. It will provide a forum to consult on developments within, or between, and to manage any divergence. All four governments have jointly agreed that legislation is not required to deliver this, with an exchange of letters being deemed appropriate to formalise existing ways of working.

It was considered whether a concordat was required as part of the development of this common framework. However, it was agreed by all parties that a separate concordat is not required in this instance, as it would duplicate information that is already in the framework outline agreement.

Whilst the four legislatures have had the powers to diverge within their existing competence, a common UK approach has been maintained to date with recognition of the importance of maintaining a level playing field across the existing body of late payment legislation, providing consistency and a uniform approach to the benefit of businesses across the UK.

Stakeholder engagement

According to the 'cover page' of Scottish Government correspondence on the framework to the Economy and Fair Work Committee, business representative organisations and stakeholders were given the opportunity to comment on the framework summary. For Scottish interests this included FSB, CBI, IoD, the Scottish Chambers, Business Gateway and SCDI. The correspondence did not make clear how many of these stakeholders took the opportunity to comment.

Detailed overview of proposed framework: legislation

This section provides information on the legislation associated with the framework.

There is currently effectively a level playing field across the UK in respect of late payment of commercial debts legislation, which provides for payment periods between businesses of 60 days (or more by agreement), and 30 days for public bodies to businesses. No new legislation is considered necessary to maintain this approach.

The framework covers the Late Payment Directive (2011/7/EU)1, designed to protect European businesses against late payment in commercial transactions. It is implemented through The Late Payment of Commercial Debts (Interest) Act 19982, as amended, on behalf of Northern Ireland, Wales and England and in Scotland by The Late Payment of Commercial Debts (Scotland) Regulations 20153 and The Late Payment of Commercial Debts (Scotland) Amendment Regulations 20184.

Detailed overview of proposed framework: non-legislative arrangements

The framework policy paper1 states that existing joint working relationships have been satisfactory for all parties. Previous conversations between officials have highlighted a preference for maintaining the current degree of coordination now that the UK is outside the EU.

The outline agreement (the published provisional common framework), covered by an exchange of ministerial letters, will constitute the framework.

Working principles

Six key principles have been proposed that will set out required ways of working, consistent with what is in place now, to support work on late payment, and ensure a joined-up approach is maintained.

All parties agree that it is beneficial for all UK businesses that there is a common framework for late payment policy.

Parties will consider the impact of decisions on other parties and the UK internal market and provide time for meaningful engagement on the issue in quarterly meetings of the Late Payment Working Group, containing policy leads from each of the parties. This working group will meet regularly when required, for example for information sharing, decision-making or dispute resolution purposes. Meetings of the working group may also be convened outside the regular schedule if a substantial issue arises.

Any proposed legislative changes should be shared with the other parties at an official level at the earliest possible point, typically through email exchange initially. The party or parties proposing to diverge from existing arrangements will notify and consult the other parties in respect of their intended action. Should any of the other governments object to the proposed action, the parties will endeavour to identify a mutually acceptable common approach which would achieve an equivalent, or preferably identical outcome. If no mutually acceptable resolution is found, the objecting party or parties may initiate the formal dispute resolution procedure set out in point 5. The framework will not prejudice the right of parties to opt to ‘agree to disagree’ or ‘agree to diverge’ in certain circumstances.

Future collaborative meetings will be conducted at official level and without prejudice to ministerial views. Official level meetings will be scheduled quarterly to foster regular engagement and ensure parties do not lose touch with key officials. Additional meetings will be scheduled on an ad hoc basis if any significant issues arise.

Whilst it is not anticipated that any dispute will arise, any action under dispute should be paused pending resolution through the dispute resolution mechanism. This process will be guided by an agreement to resolve disputes at the lowest possible level of governance. If one party wishes to diverge, the party must first see if a common approach can be agreed that accommodates that individual parties’ desired outcomes and does not disproportionately impact on the UK internal market.

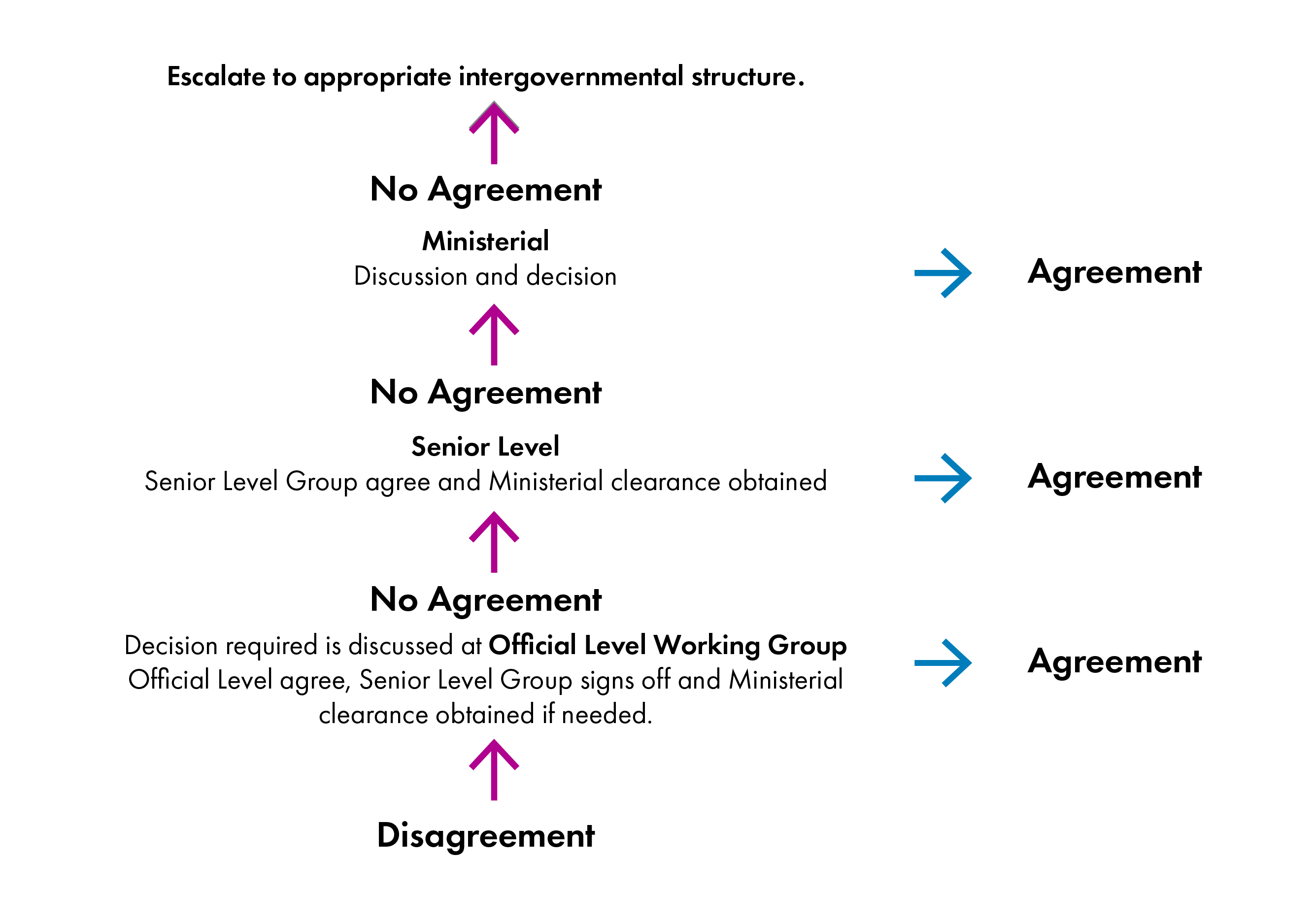

Escalations, if necessary, should be done first at official level via the Late Payment Working Group. If a satisfactory resolution cannot be found, the matter should then be escalated to the Late Payment Programme Board, made up of senior officials. If a resolution cannot be reached, it will be escalated to Ministers to provide input or hold a multilateral discussion. Existing routes of multilateral engagement between the parties should be used for this process. If a resolution cannot be reached at this level, the matter may be referred to appropriate intergovernmental structures – although both parties will strive to resolve issues at official or ministerial level between Departments.

The principles cover common agreement on the need for a framework, how the mechanisms for information sharing, decision-making, proposed legislative changes, and dispute resolution will interact and work.

Late payments in practice

Decision-making

The principles were agreed through exchange of letters drafted in cooperation between the four parties. The common framework will only be put in place once there is unanimous agreement between all parties.

Decisions will be made in accordance with:

the principles outlined previously

the Common Framework principles agreed at JMC(EN).

The agreed quarterly meetings of the Late Payment Working Group will involve all four governments to ensure joint working and information sharing is conducted. All parties will have equal decision-making standing.

Decisions will pass through the Late Payment Working Group to the Late Payment Programme Board, made up of senior officials from all four governments, and then ministers. However, not every decision will need to be escalated to the Late Payment Programme Board, nor to ministerial level. In the unlikely event that a decision cannot be made at ministerial level, the matter will be referred to the dispute resolution mechanism.

Roles and responsibilities: parties to the framework

This section sets out the roles and responsibilities of each party to the framework.

Officials

Policy officials will hold regular discussions on the policy covered by the Late Payment Framework, and put advice to ministers with the rationale for the approach taken within the policy area (e.g. a UK/GB-wide approach), or why divergent policies may be necessary.

Officials across the four governments will convene to discuss policy issues as appropriate and will discuss any ramifications that policy will have across different parts of the UK. If officials do not agree when making decisions, issues discussed at the Late Payment Working Group can be escalated to senior officials in the Late Payment Programme Board, in line with the framework’s dispute avoidance and resolution mechanism.

Senior officials

Senior officials across the four legislatures (e.g. Deputy Directors and Directors) will provide strategic direction on the policy areas governed by the Late Payment Framework and take key operational decisions.

They may review an issue as per the framework’s dispute avoidance and resolution mechanism if officials are not able to agree an approach, or if ministers have disagreed with advice from officials in the first instance, in another attempt to reach agreement.

Senior officials will convene to discuss issues as appropriate, on an ad hoc basis, through the Late Payment Programme Board.

Ministers

Ministers may receive advice from their officials either concurrently across parties as issues arise, or in the course of business as usual for individual parties. Ministers may accept advice, or they may reject it.

If work is remitted to senior officials and an issue remains unresolved, the issue may be escalated to ministers. Where ministers are considering issues as part of the framework’s dispute avoidance and resolution mechanism this could be via several media, including inter-ministerial meetings or by correspondence.

Late Payment Working Group

The purpose of the Late Payment Working Group is to bring together the four parties to:

Facilitate multilateral policy development.

Seek to maintain a level playing field across the existing body of late payment legislation, providing consistency and a uniform approach to the benefit of businesses across the UK.

Manage potential divergence in a way that respects the devolution settlements.

While policy on late payment is a devolved matter, there are some wider policy initiatives and regulations that operate on a UK-wide basis. The Late Payment Working Group will be a collegiate group which facilitates collaboration across the Parties within this policy area. It will provide a forum for policy officials to engage on policy development, provide updates on progress, and raise concerns and awareness of cross-cutting issues.

Core membership will include:

Department for Business Energy and Industrial Strategy (BEIS)

Scottish Government (SG)

Welsh Government (WG)

Department for the Economy (NI).

The following rules of procedure have been proposed for the Working Group.

BEIS will chair and provide secretariat support for the group. However, this will be kept under constant review by the members.

Regular meetings will be scheduled to take place, with ad-hoc meetings when required.

The meeting date, time and location will be agreed with all Parties.

The Group will review its Terms of Reference against its objectives on a 12-month basis or more regularly if required to ensure it continues to add value.

Late Payment Programme Board

The purpose of the Late Payment Programme Board is to bring together the four parties to:

Facilitate multilateral policy development by resolving disputes relating to the Late Payment Working Group.

Make decisions, by consensus of the Parties, on recommendations made by the Late Payment Working Group.

Provide strategic planning decisions as identified by the Late Payment Working Group.

Provide a mechanism of dispute resolution as needed and as referred by the Late Payment Working Group.

Decide, by consensus of the Parties, to refer disputes of the Late Payment Working Group to Ministers.

Manage potential divergence in a way that respects the devolution settlements.

While policy on late payment is a devolved matter, there are a number of wider policy initiatives and regulations that operate on a UK-wide basis. The Late Payment Programme Board will be a collegiate group which has oversight over the Late Payment Working Group within this policy area. It will, where identified by the Late Payment Working Group, act as a key mechanism of the dispute resolution procedure within the Common Framework Agreement.

The Late Payment Programme Board maintains an oversight of relevant decisions of the Late Payment Working Group, and the scope of the Late Payment Programme Board is inclusive of relevant matters as identified by the Late Payment Working Group. Specifically, the Late Payment Programme Board will meet where dispute resolution is needed.

The primary objectives of the Late Payment Programme Board are to resolve disputes arising from to the Late Payment Working Group. The Late Payment Programme Board may decide, by consensus of the Parties, to refer matters to Ministers in each Party.

Core membership of the Programme Board will include:

Department for Business Energy and Industrial Strategy (BEIS)

Scottish Government (SG)

Welsh Government (WG)

Department for the Economy (NI)

The following rules of procedure have been proposed for the Programme Board.

The position of chair will rotate among members at each meeting.

BEIS will provide secretariat support for the group. However, this will be kept under constant review by the members.

The Group will meet where dispute resolution is needed or for financial and/or strategic planning decisions.

The meeting date, time and location will be agreed with all Parties.

The Group will review its Terms of Reference against its objectives on a 12-month basis or more regularly if required to ensure it continues to add value.

Parliamentary and stakeholder communication and engagement

There is no regular planned Parliamentary or stakeholder engagement for this policy area. It is intended that communication will take place on an ad hoc basis.

Roles and responsibilities: existing or new bodies

There are no existing or new bodies that have a formal role with respect to the operation of this framework.

Monitoring and enforcement

Monitoring

The Late Payment Working Group will oversee the functioning of the framework, and any request to amend any element of the framework will be considered at this group. The group will agree what information it will need to see to provide assurance that the framework is operating effectively, and on what frequency the information should be collected and reviewed.

Enforcement

Enforcement needs further consideration, and the mechanisms available for providing assurance that the framework will be adhered to will depend on the way in which the framework is implemented. The dispute resolution mechanisms provide the first means for ensuring that the framework is adhered to, with issues to be referred to overarching intergovernmental dispute resolution mechanisms where appropriate.

Review and amendment

The framework will be reviewed annually through the Late Payment Working Group. The review will look at compliance with the framework, as well as evaluating whether it is still suitable to ensure all four governments can achieve their aims on late payment policy. Ad-hoc reviews can also be scheduled on the request of any party, if a substantial issue arises.

Third parties can be used by any party to the framework to provide advice at any stage in the review or amendment process. If agreement is not reached in either the review or amendment stage, parties to the framework can raise it as a dispute through the framework’s dispute avoidance and resolution process.

Review Stage

The Late Payment Working Group will review the framework one year after final sign off, and every three years thereafter, to ensure it is working effectively, or if any amendments should be made. If changes to the framework are required, senior officials and ministers will need to agree to triggering the amendment stage.

An exceptional review can be triggered by a significant issue:

To constitute a significant issue, an issue must be time-sensitive, and fundamentally impact on the operation and/or the scope of the framework.

An example would be an issue that means the framework no longer adheres to the Common Frameworks principles agreed at JMC(EN) in October 2017.

Amendment stage

The amendment stage can only be triggered through unanimous agreement by ministers. The existing framework will remain in place until a final amendment has been agreed.

All amendments to the framework must be agreed by ministers from all parties, and a new non-legislative agreement signed.

Common framework dispute resolution

It is anticipated that recourse to resolution at Ministerial level will be as a last resort and only sought where dispute resolution at official level has failed. Disputes which reach Ministerial level will be resolved through intergovernmental dispute resolution mechanisms. Relevant intergovernmental disputes may concern the "interpretation of, or actions taken in relation to, matters governed by […] common framework agreements".

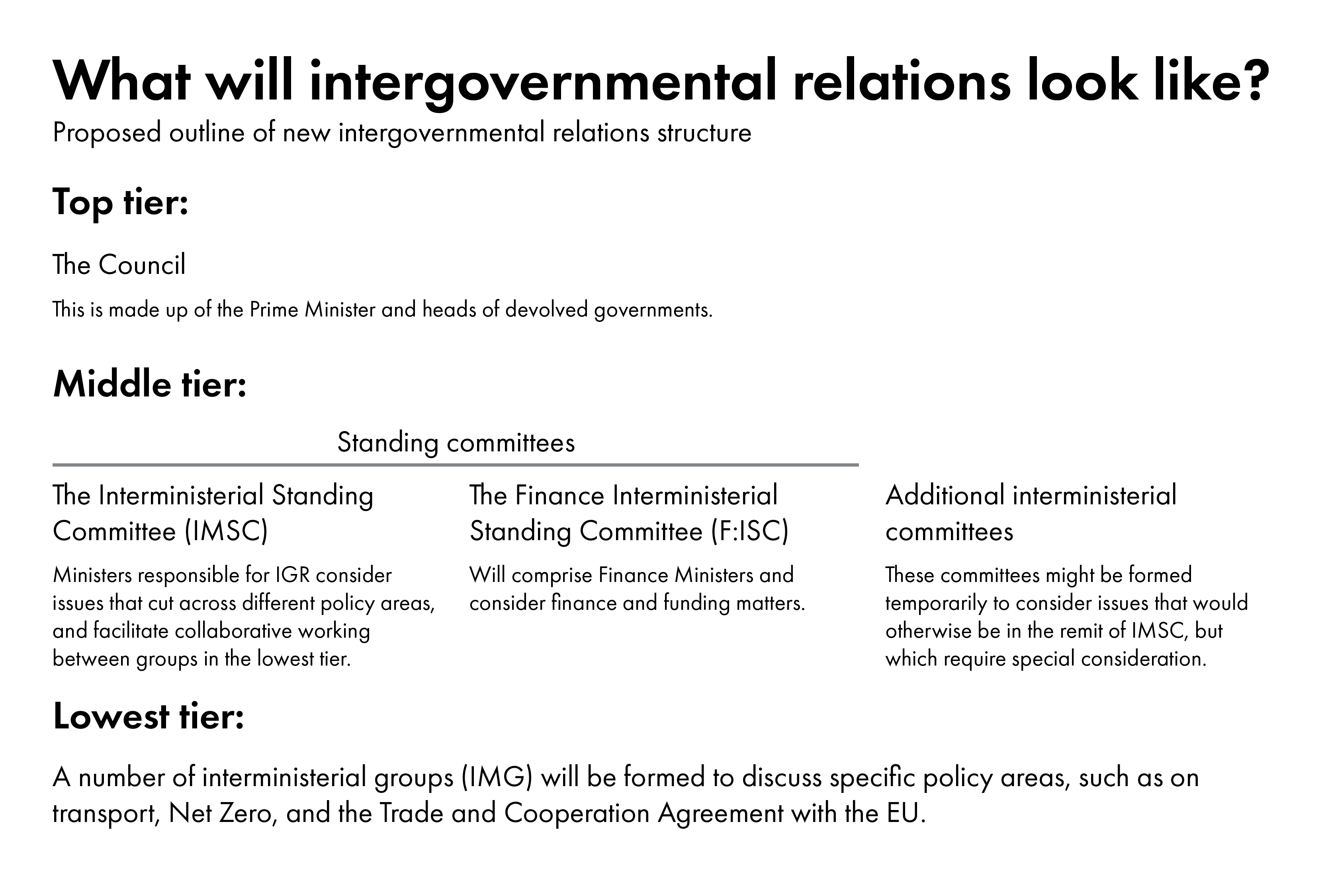

Intergovernmental dispute resolution mechanisms were considered as part of the joint review on intergovernmental relations. The conclusions of the joint review were published on 13 January 2022 and set out a new approach to intergovernmental relations, which the UK Government and devolved governments have agreed to work to. The joint review created a new three-tiered system for intergovernmental discussions, doing away with the old Joint Ministerial Committee structure.

The lowest and middle tiers have specific responsibilities for common frameworks. At the lowest tier, interministerial groups (IMGs) are responsible for particular policy areas, including common frameworks falling within them. At the middle-tier, the Interministerial Standing Committee (IMSC) is intended to provide oversight of the common frameworks programme.

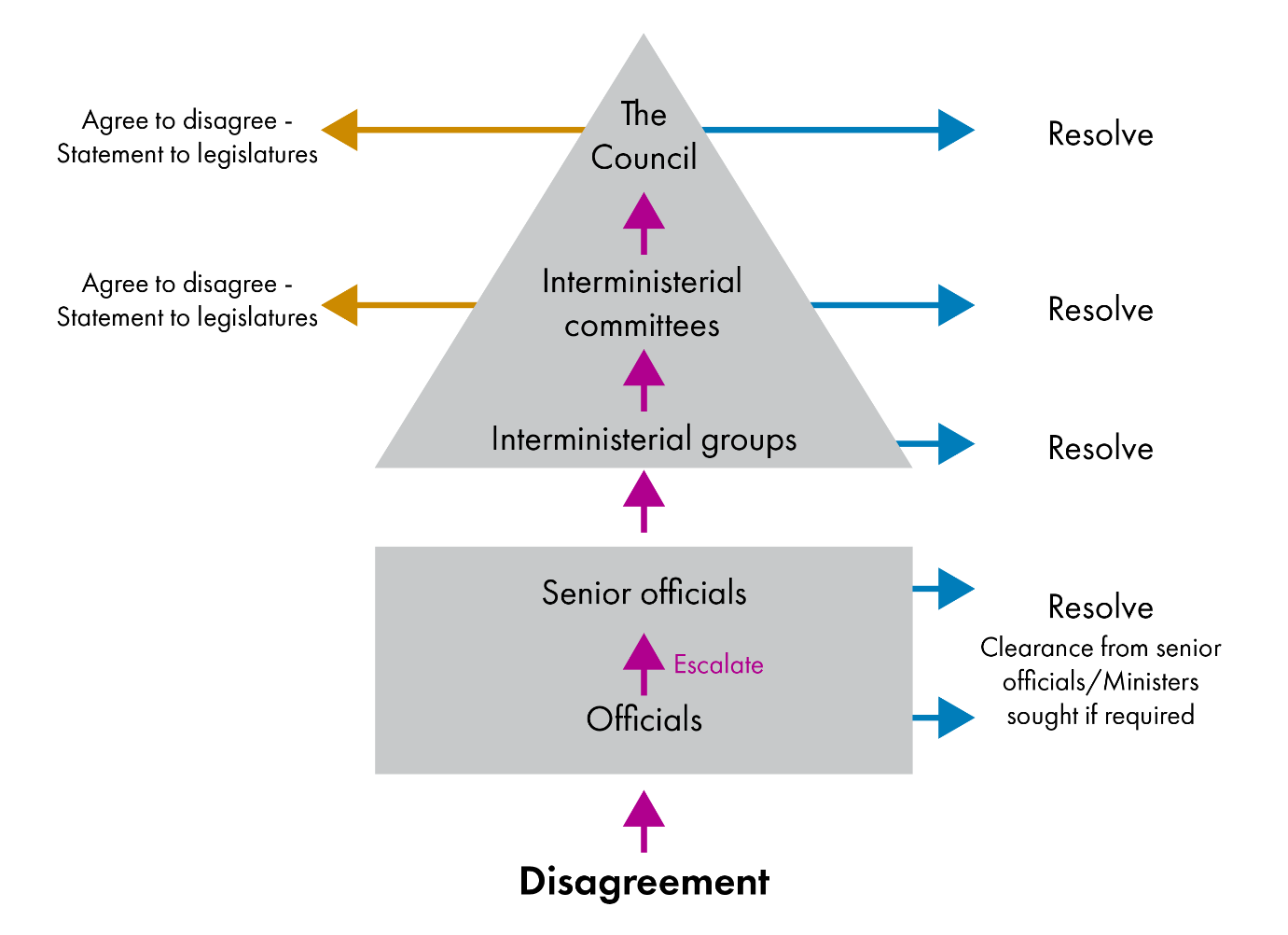

The new intergovernmental dispute resolution process follows on from the process at the official level. If a dispute cannot be resolved at the official level as set out in individual frameworks, it is escalated to the Ministerial level. The diagram below illustrates the general dispute resolution process for frameworks, including discussions between officials (square) and Ministers (triangle). i In the late payments framework, there appears to be an additional layer of ministerial input before a dispute is referred to intergovernmental structures. This input is discussed in the section on Ministerial dispute resolution in the late payments framework.

At the lowest level, interministerial groups comprising portfolio Ministers attempt to resolve the disagreement. If their attempts are unsuccessful, the issue can be escalated to an interministerial committee. If the interministerial committee is unsuccessful in resolving the issue, it can either agree to disagree, in which case each government makes a statement to their legislature to or escalate the dispute further. If a dispute is escalated to the highest level, third-party advice or mediation should normally be sought and made available to the Council. If the Council fails to find agreement, it is again required to make a statement to their legislatures.

The new process includes more extensive reporting requirements about disputes. The IGR secretariat is required to report on the outcome of disputes at the final escalation stage, including on any third-party advice received. Each government is also required to lay this report before its legislature.

The Office for the Internal Market (OIM) can provide expert, independent advice to the UK Government and devolved governments. Its advice and reports may, however, be used by governments as evidence during a dispute on a common framework.

Rachel Merelie of the OIM explained the position whilst giving evidence to the House of Lords Common Frameworks Scrutiny Committee in November 2021:

The OIM is not involved in dispute resolution. We are here to provide advice to government, using our economic and technical expertise…It is of course possible…that our reports are considered in some shape or form as evidence in support of that process, and we remain open to being used in that way.

Dispute resolution late payment framework

This section considers the dispute resolution process set out within the late payment framework.

Disputes could potentially arise at official level (i.e. where officials cannot agree to either recommending a common approach, or recommending that divergence is appropriate, and outlining the impact that this may have on the internal market); or at ministerial level (where Ministers cannot agree on the response to the recommendation put forward to them by officials, or where a dispute cannot be resolved at official level and is escalated to Ministers, who can also not reach a decision).

Dispute resolution processes should only be used if resolution through normal working processes has not been possible. It is intended that the late payment governance will provide mechanisms for good communication and cooperation, which should reduce the likelihood of disputes arising. In some areas, commonality of approach will not be needed to meet the JMC principles and therefore an “agreement to diverge” would be acceptable.

Ministerial dispute resolution

In rare instances where Ministers do not reach unanimous agreement on a joint recommendation, or where officials cannot agree an approach (and the dispute is escalated to Ministers for a decision), then a ministerial dispute resolution mechanism will be required at the portfolio level (i.e. there should be a process for Ministers to seek to resolve dispute and reach agreement). Where disputes do arise, they should be handled with adherence to the same principles as the officials’ dispute resolution process. In the first instance, the matter should return to officials (with a steer on areas of further work), who should review the available technical material and present further advice to Ministers as appropriate. If this is not sufficient to resolve the dispute, a panel of senior officials from the four nations could meet to discuss possible approaches and a way forward.

Once all of the other options outlined above have been exhausted, and if a disagreement has still not been resolved, the disagreement will be referred to the appropriate intergovernmental structures.

Decisions will be made in accordance with the key principles, as well as the Common Framework principles agreed at JMC(EN) in October 2017. It is intended the Late Payment governance will provide mechanisms for good communication and cooperation, which should reduce the likelihood of disputes arising. In the unlikely event that a disagreement does arise, a resolution will be sought by following principles:

It does not always follow that, where disagreements emerge, they will need to be escalated or a ‘solution’ established. The Framework will not prejudice the right of parties to opt to ‘agree to disagree’ in certain circumstances.

In the unlikely event that a common approach cannot be agreed, and divergence is not considered acceptable by one or more of the parties, the dispute resolution mechanism should be engaged. This should only happen if:

genuine agreement cannot be made;

one or more party considers the core principles or terms of reference agreed for the Framework to have been breached; or

One party considers that a Common Framework principle has not been respected, or undue weight has been placed on one principle (or part of a principle) at the expense of another.

This process will be guided by the principle to resolve at the lowest possible level of governance. If a satisfactory resolution cannot be agreed at working level, the matter will be escalated to senior officials, before being escalated to Ministers. Issues will be referred to the overarching dispute avoidance and resolution mechanism outlined in the MoU on Devolution.

Actions under dispute should be paused pending resolution through the dispute resolution mechanism.

Implementation

The final framework will be fully in place once scrutiny has been completed across all four legislatures and Ministerial letters exchanged.

Framework Analysis

Current policy position

There is currently a level playing field across the UK in respect of Late Payment legislation.

Key issues

There do not appear to be any substantive issues within the provisional late payment common framework. However, there are some minor areas where further consideration and clarification would be merited.

The provisional late payment common framework explicitly states that further consideration is needed around enforcement and the mechanisms available for assuring that the framework will be adhered to. While the framework has clear dispute resolution mechanisms, it is not clear whether these are sufficient to maintain adherence.

There is no commitment in the provisional late payment common framework to publish updates on the functioning of the framework (e.g. meeting notes from the Working Group or Programme Board, review outcomes, annual updates on implementation) or to regularly update the relevant four legislatures. Further consideration and commitments around transparency should be encouraged.

While not directly linked to the drafting of the framework, it is worth noting the wider late payment policy area is not devolved (Reporting on Payment Practices and Performance Regulations (2017)1 and Small Business Commissioner (Scope and Scheme) Regulations (2017)2) and out of scope for this framework. A challenge for Scottish policy makers might be the synergies between what the framework covers – UK-wide co-operation to ensure the laws around penalties for late payments to businesses are co-ordinated – and the actual policy of improving the late payment culture and its impact on businesses.

Scrutiny at other legislatures

The Houses of Lords having considered the provisional late payment framework alongside the radioactive substances provisional framework and stated1:

We welcome these two frameworks which we believe provide a good foundation for cooperation in these areas. However, we have concerns about ongoing parliamentary and stakeholder engagement. We would also welcome additional clarity in the frameworks on the UK Internal Market, and the dispute mechanism and level of commitment to core principles in the Radioactive Substances Framework.

We are disappointed to note the absence in these frameworks of any commitments on ongoing engagement with Parliament. We note the absence of any commitments in the texts of these frameworks to publish reviews of the frameworks or to update legislatures on the outcomes of reviews. The Government has separately committed to improving transparency in Intergovernmental Relations. Transparency in this area should include regular statements to legislatures on the functioning of these frameworks.

At the time of drafting the other legislatures had not published considerations on the provisional late payment framework.