Local Government Finance: Budget 2022-23 and provisional allocations to local authorities

This briefing focuses on both the overall local government settlement for 2022-23, and the provisional allocations to local authorities. The positions of Scottish Government and COSLA are explained in some detail. The briefing also discusses the potential for multi-year allocations as well as the possible implications of the removal of the council tax freeze.

Executive Summary

This Briefing covers a lot of ground. However, the main points Members should be aware of are:

Each year there is debate between the Scottish Government and COSLA over how much local government receives from the Scottish Government in its budget, and whether this constitutes an increase or a decrease between years.

For the first time there appears to be some agreement over what constitutes "core" revenue funding.

Both the Scottish Government and COSLA agree that "core" revenue budget remains the same in cash-terms between 2021-22 and 2022-23.

However, when the likely impact of inflation is factored-in, the "core" revenue budget reduces by £284 million, or -2.6%, in real terms between 2021-22 and 2022-23.

COSLA reports that all 32 local council leaders are unhappy with this decision.

The Scottish Government argues that revenue allocations to local authorities should be seen in their entirety, and this includes an additional £1,367 million in 2022-23 which will be transferred in-year to local government from other portfolios.

Once this additional revenue is factored in, the local government revenue settlement increases by £557 million, or 4.9% in real terms, between 2021-22 and 2022-23.

The Scottish Government argues that local authorities have "complete autonomy" over how they spend this additional funding; COSLA disagrees and states that the vast majority is effectively ring-fenced.

Once capital grants are added to total revenue allocations, the total local government settlement, as it appears in the provisional Finance Circular, increases to £12,538 million, a real-terms increase of £603 million or +5.1% between 2021-22 and 2022-23.

A complex funding formula is used to calculate how much revenue funding each individual local authority receives.

Provisional local authority budget allocations from the Scottish Government were published on 20th December.

These show real terms increases in provisional revenue allocations for all of Scotland’s local authorities in 2022-23, except for Comhairle nan Eilean Siar, Shetland Islands Council and Orkney Islands Council, who all see small real-terms reductions.

The island local authorities will still receive by far the largest allocations per-head than any other local authorities.

On Council Tax, the Scottish Government states that local authorities will have full flexibility to set Council tax rates, thus “enhancing their fiscal autonomy”.

The appetite of Councillors to raise significant revenues from council tax, however, may be tested by the local authority elections in May.

Understanding the Scottish Budget

Local government is the second largest area of Scottish Government spend (after health). This shouldn't be a surprise given the range, and importance, of the services provided by Scotland's local authorities, including schools, nurseries, social services, housing services, adult social care, refuse collection and recycling, roads maintenance, leisure and sports facilities, parks, planning, licensing, and so on.

Each year the Scottish Government and local authorities engage in a thorough and lengthy conversation on the appropriate levels of funding for local government. Negotiations on the annual local government finance settlement are conducted between the Scottish Government and the Convention of Scottish Local Authorities (COSLA), on behalf of all 32 local authorities, ahead of the announcement of the Scottish Budget.

The budget and allocation process this year is likely to follow this process:

UK Spending Review published in Nov 2021.

SG Cabinet discusses and agrees portfolio distributions for next financial year.

Scottish Government Budget published on 9 December 2021 which includes total local government settlement figures.

Distribution formula applied (more information below).

Local Government Finance Circular 21/9 published; includes provisional allocations to individual councils (published on 20 Dec).

Budget Stage 1 debate in Scottish Parliament (likely late January 2022)

Budget Stage 2 by the Parliament’s Finance and Constitution Committee (likely early February).

Budget Stage 3 debate in Parliament (preceded by rate resolution).

Budget Bill, possibly amended, approved by Scottish Parliament.

LG Finance Order presented to the Parliament, and LG Finance Circular published with final allocations.

The distribution formula

Total revenue funding is distributed between Scotland's 32 local authorities using a "needs-based" distribution formula. This has been developed over many years through consultation between central and local government and is , according to the Scottish Public Finance Manual, "kept under constant review".

The formula is part of the process used by the Scottish Government to apportion a share of revenue budget to each of Scotland’s 32 local authorities. To do this, each service area is considered separately and each service area has a different funding formula using relevant population, deprivation, geographic data, etc. More information on the funding formula is included in a useful Scottish Government guide.

Once initial allocations are calculated, the Government adjusts figures using a mechanism called the Main Funding Floor. This ensures that no local authority experiences particularly large variances in support from one year to the next. A further funding floor is applied to ensure that no local authority receives less than 85 per cent of the average Scottish per capita revenue (in 2022-23 this only impacts the City of Edinburgh).

Central to this process is the Settlement Distribution Group (SDG), a joint group attended by Scottish Government, COSLA and local authority officials. The SDG considers any new local government funding and distribution, whilst providing a forum for officials to discuss future issues. Decisions taken at the SDG are then passed to COSLA leaders and Scottish Ministers for approval (see the Scottish Public Finance Manual for more information).

Changes to the overall local government settlement

To answer the question "how has the local government budget changed over the year?" very much depends on what is included in the calculation. Local authorities, as represented by COSLA, prefer to focus on "core funding". The Scottish Government, on the other hand, tends to focus on the total settlement. This includes an element of funding for national policies which local authorities deliver using money transferred in-year from other Scottish Government directorates. The extent to which this transferred funding is "ring-fenced" - i.e. to be used for that specific purpose only - is hotly disputed. Also, the actual cost to local authorities of delivering these national priorities is a source of some disagreement.

Changes to “core” revenue funding

The Scottish Government and COSLA use the term “core” revenue funding for the combined total of General Revenue Grant, Non-Domestic Rates income and Specific Resource Grants funding. As set out in Table 5.13 of the Scottish Government’s Budget document1, core revenue funding will be £10,491 million in 2022-23.

| Elements of "core" revenue | |

|---|---|

| General Revenue Grant | £6,973.2m |

| Non-Domestic Rates | £2,766.0m |

| Specific Resource Grants | £752.1m |

| Total “core” revenue | £10,491.3m |

During her recent evidence session with the Finance and Public Administration Committee2, the Cabinet Secretary for Finance and the Economy confirmed that the Government has “protected the core budget in cash terms” between 2021-22 and 2022-23. Nevertheless, this translates into a real-terms reduction when the likely impact of inflation is factored in.

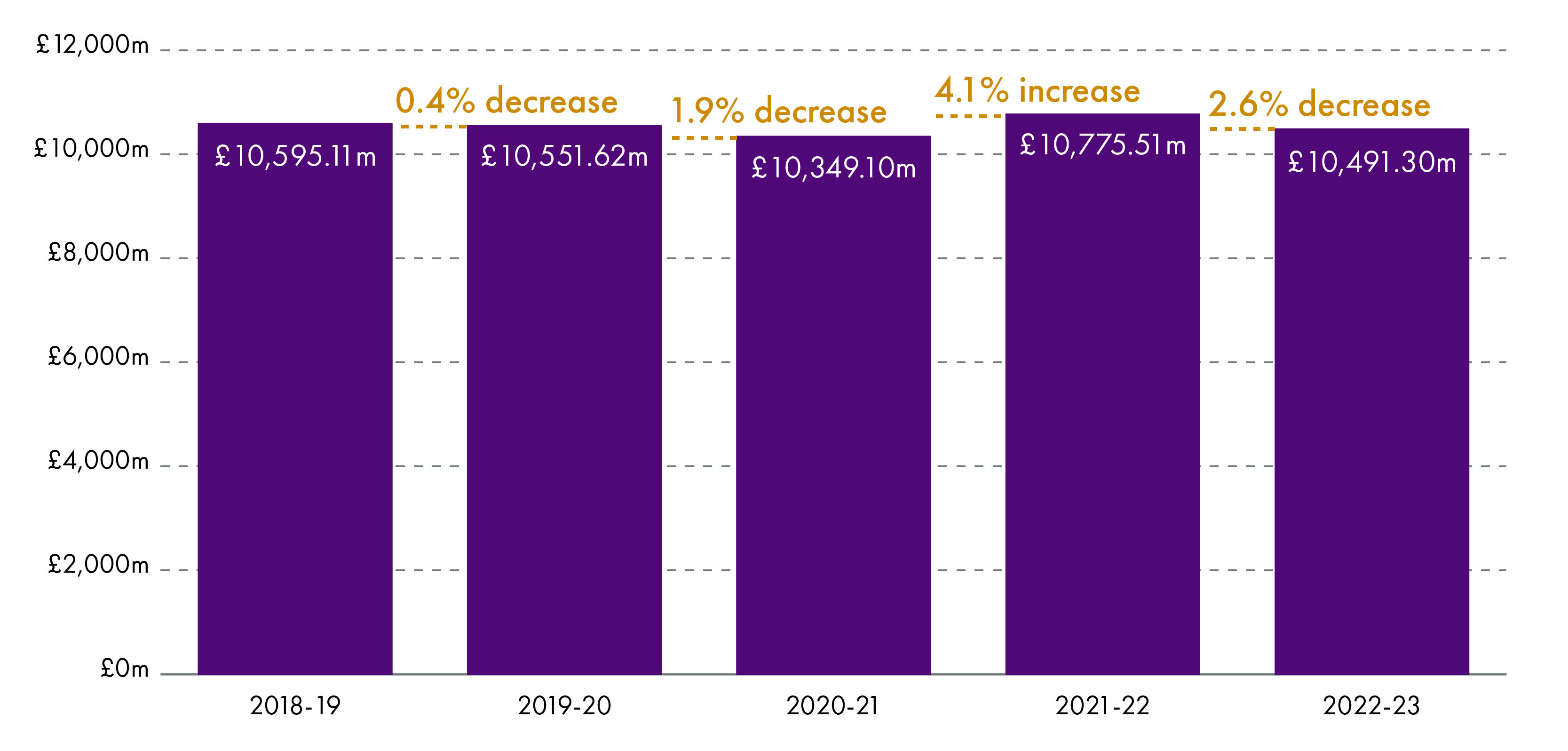

Core revenue funding between 2021-22 and 2022-23 reduces by £284 million, or 2.6% in real terms over the year. The following chart shows the annual real-terms changes to core revenue funding for each of the past five years:

Changes to total revenue in Finance Circular

Local Government Finance Circular 2021/91 shows that once funding from other portfolios (£1,368 million) is added to core funding, local government’s total revenue settlement increases to £11,859 million. The comparable figure for 2021-22 is £11,003 million.

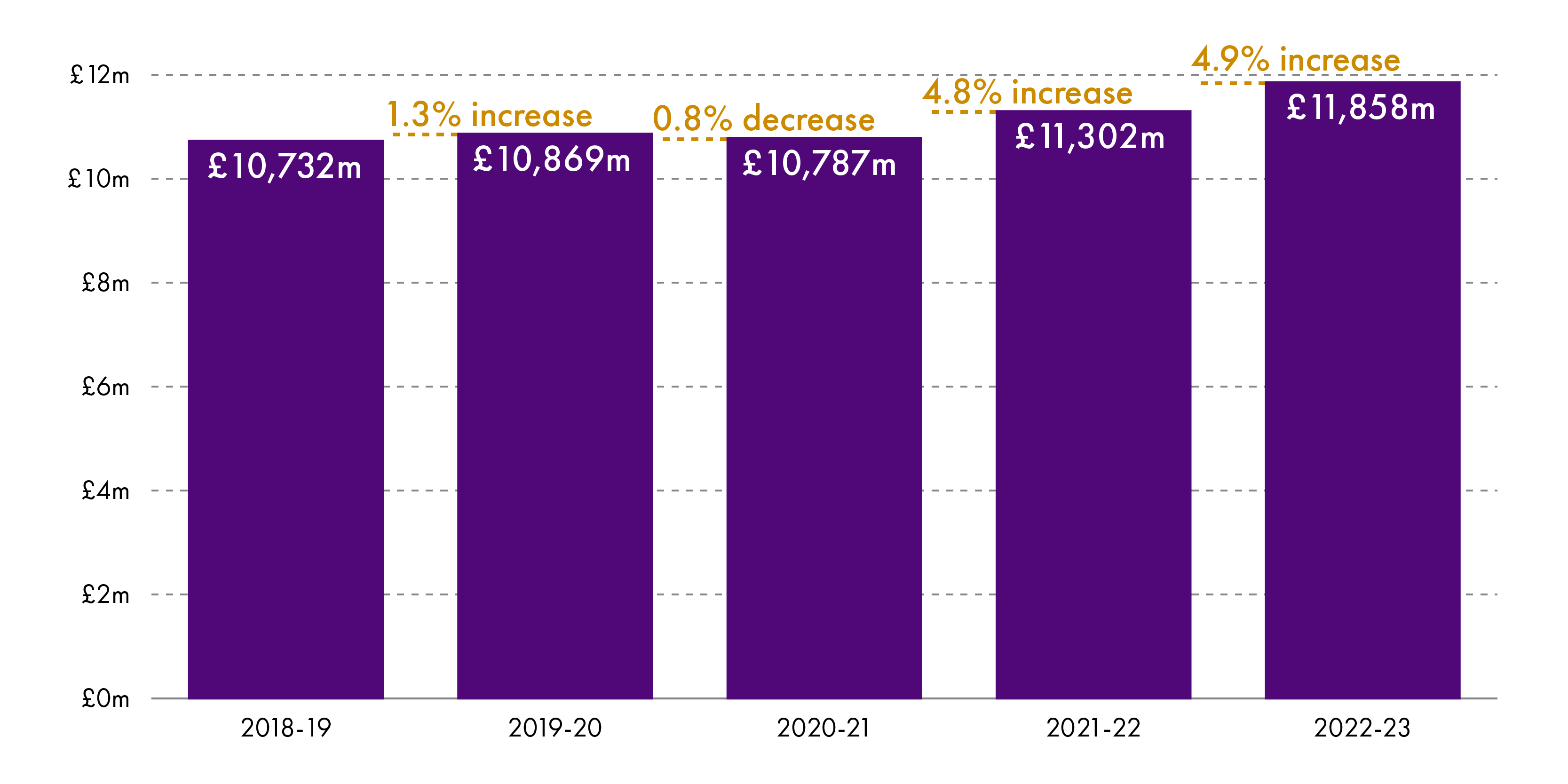

The total revenue figure as set out in the recent Finance Circular represents a cash increase of £856 million (+7.8%) between 2021-22 and 2022-23. In “real terms” this is an increase of £557 million (+4.9%).

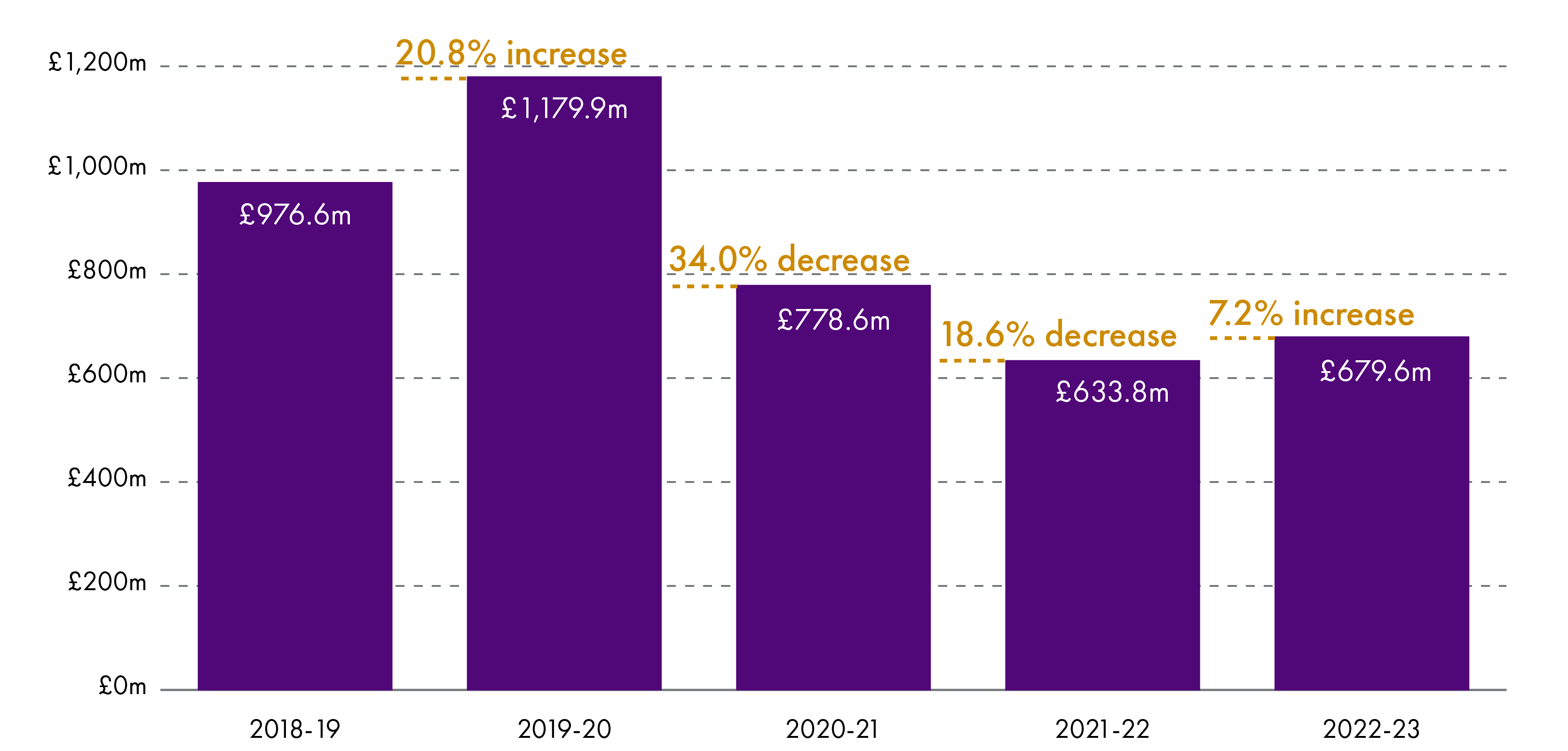

Chart 2 shows the annual real-terms changes to total revenue funding (as set out in the provisional Finance Circulars) for each of the past five years:

Changes to total funding in Finance Circular

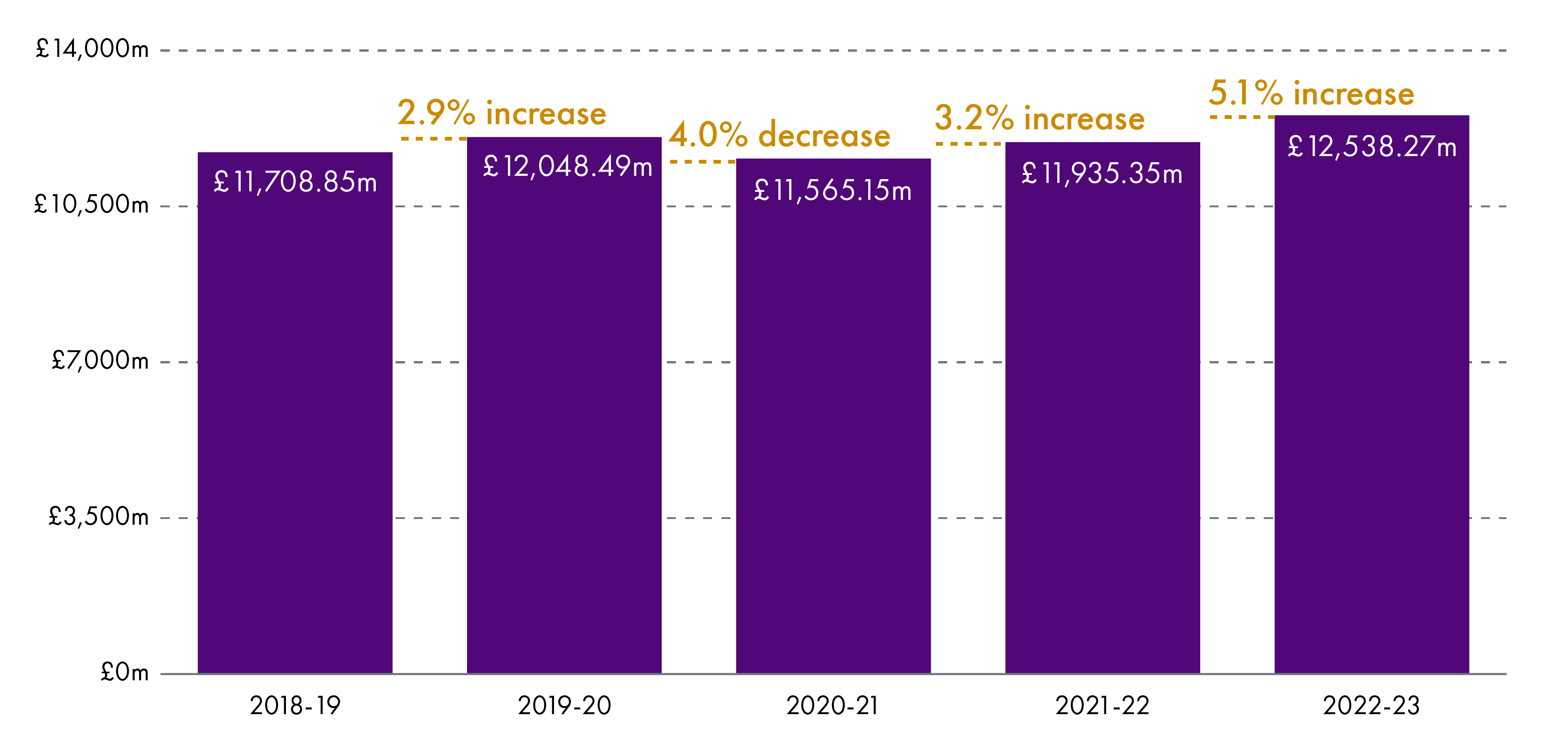

Once capital grants, totalling £679 million, are added to the revenue figures discussed above, total funding allocation to local government in 2022-23 is £12,538 million. This is the figure used in the Deputy First Minister’s recent letter1 to the Local Government, Housing and Planning Committee which describes a “fair and affordable Local Government Settlement of over £12.5 billion”.

Between 2021-22 and 2022-23 the total Finance Circular settlement increases by £918 million in cash terms (+7.9%). This is a £603 million real terms increase (+5.1%). Chart 3 shows the annual real-terms changes to total settlement (as set out in the provisional Finance Circulars) for each of the past five years:

Are in-year transfers "ring-fenced"?

With almost all of the increase to the 2022-23 settlement coming from in-year transfers from other directorates, the question of ring-fencing is more pertinent - and more disputed - than ever. The ambiguity surrounding ring-fencing was summed-up by the Deputy First Minister when he told the Local Government, Housing and Planning Committee in November1

I would not suggest that ring fencing is a precise science; rather, it is a question of judgement.

In its letter to the Local Government, Housing and Planning Committee2, the Scottish Government states that only the Specific Resource Grant element of the revenue settlement is ring-fenced. This amounts to £752 million in 2022-23, or 7% of the total revenue settlement as set-out in the Finance Circular. Referring to the current year's budget, the Deputy First Minister states that

"local Authorities have complete autonomy to allocate over 92 per cent - £10.7 billion - of the funding we provide in 2021-22, plus all locally raised income".

As explained above, £1,368 million is being transferred in-year from other portfolios to the local government revenue settlement. The Scottish Government's position is that this funding is added to the General Revenue Grant (GRG)- indeed, this is how it appears in the Finance Circular - and local authorities then have autonomy to allocate their GRG based on local needs and priorities.

Writing on this matter in 2019, Audit Scotland stated3 that in addition to specific revenue grants, "funding for other national policy initiatives is set out in the annual settlement but not formally ring-fenced. These are mainly initiatives linked to education and social care."

The Cabinet Secretary for Finance and the Economy told the Parliament's Finance and Public Administration Committee4:

I fought very hard in this budget to ensure that a fair share of the health and social care consequentials go to local government, because it deserves a fair share of those consequentials—they are not just health consequentials; they are health and social care consequentials.

In the 2022-23 Budget document5, the largest in-year transfers are:

| Revenue Funding from Other Portfolios | |

| Health and Social Care | £257.2m |

| Living Wage (for care workers) | £233.5m |

| Additional Teachers and Support Staff | £145.5m |

| Care at Home | £124.0m |

| Health and Social Care and Mental Health | £120.0m |

| Discretionary Housing Payments | £80.2m |

| Child Bridging Payments | £68.2m |

| Carer's Act | £60.5m |

Correspondence from the Scottish Government6 to the Finance and Public Administration Committee confirmed a further £64 million resource funding from the Education portfolio to support the expansion of Free School Meals.

Although the Scottish Government states that local authorities have autonomy over how this money is spent, COSLA appears to disagree. Writing to the former Local Government and Communities Committee in March 20197, COSLA stated its view that revenue funding transferred from other portfolios is"ring-fenced for achieving a prescribed policy intention":

‘Revenue from other portfolios’ describes a situation where a Scottish Government Directorate (the portfolio) holds the budget responsibility for funding of a particular policy. Where it is agreed that Local Government will implement or deliver that policy, the funding is transferred from the relevant Scottish Government Directorate to Local Government...All ring-fenced funds come to Local Government with conditions and reporting requirements which are often time consuming and bureaucratic - particularly in relation to funding from other portfolios.

Ring fencing as a proportion of total resource allocation

Regardless of whether funding within other portfolios is, or is not, included in the calculation, there has been a steady increase in the proportion of total revenue funding which is ring-fenced. Indeed, the justification for some degree of ring-fencing was set-out by the Deputy First Minister in his evidence1 to the Local Government, Housing and Planning Committee in November:

Part of the reason why we have to introduce ring fencing is that we see too great a variation in performance among local authorities in Scotland. Some local authorities might be good at delivering outcomes in certain areas while others are poor at doing so. The Parliament—understandably, I think—pressures the Government to ensure that performance is at a higher level.

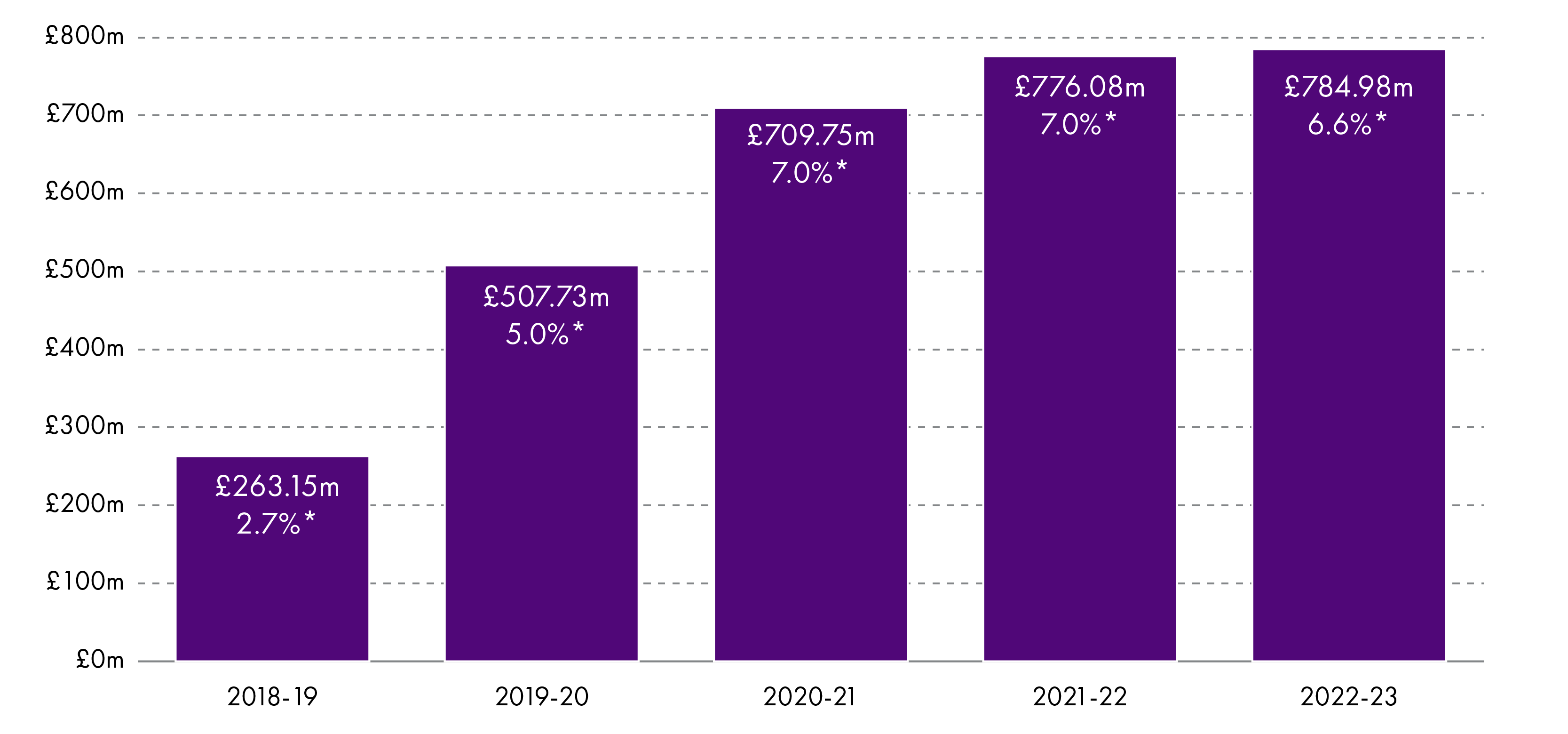

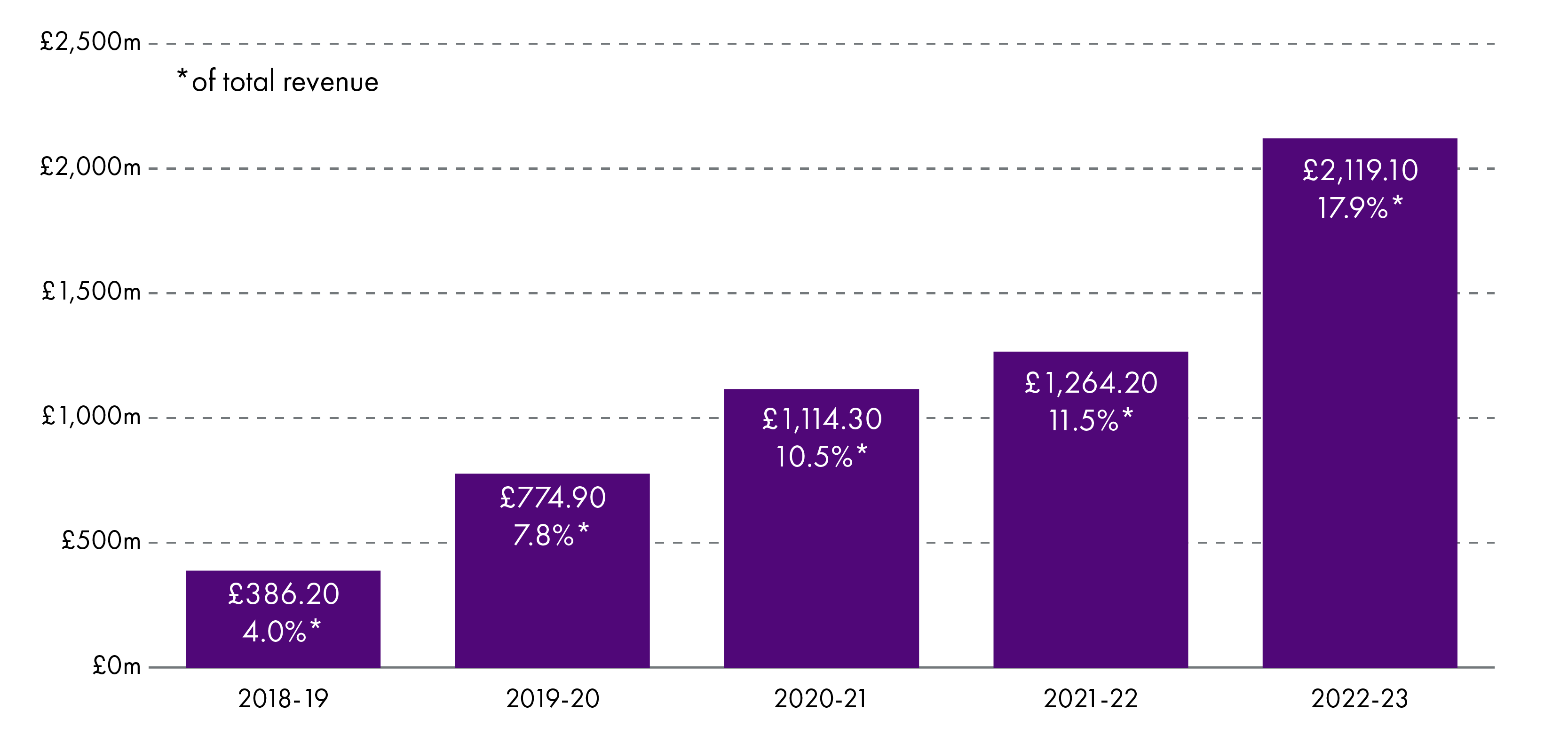

Accepting that Specific Resource Grants are the only "ring-fenced" revenue element of the Finance Circular, as the Scottish Government does, then the following chart shows that ring-fenced funds as a proportion of total revenue grew from 2.7% in 2018-19 to 6.6% in 2022-23.

If the broader definition of ring-fencing is used - i.e. Specific Resource Grants plus transferred revenue from within other portfolios - then ring-fencing as a proportion of total revenue grew from 4.0% in 2018-19 to 17.9% in 2022-23.

COSLA has consistently argued that "ring-fenced", "directed" or "protected" spending goes further than even this chart would suggest. In its letter to the former Local Government and Communities Committee in March 2019 2, COSLA argues that "there is now protection of 60% of the Local Government Budget" as they combine what they refer to as "explicit ring-fencing", "hidden ring-fencing through statutory obligations and policy", "hidden ring-fencing as a result of demand" plus loan charges.

COSLA's response and Scottish Government reaction

In early November, COSLA launched its 2022-23 budget lobbying campaign1 which called for "adequate funding from the Scottish Government and a reversal of historical cuts". At the heart of COSLA's message was the argument that core revenue funding, used for councils' day-to-day services, is not keeping pace with increasing demands and other pressures.

In its Live Well Locally document2, COSLA states the 2022-23 finance circular revenue total would need to increase to £12,075 million for local authorities simply "to survive". This is based on an inflationary increase of the 2021-22 settlement, plus £650 million for additional national policy commitments and £75 million to compensate councils for the increase in National Insurance Contributions as an employer. As noted above, however, the actual figure set out in Finance Circular 9/2021 is £11,859 million, so some £216 million short of what COSLA believe local government needs to survive in 2022-23.

In response, the Deputy First Minister highlighted in a letter to the Parliament's Local Government, Housing and Planning Committee3that "since the start of the pandemic, in aggregate the amount of money held in local authority reserves has increased by around £300 million". The Accounts Commission's Local government in Scotland Financial overview 2019/204, published in January 2021, also noted that councils' total usable revenue reserves in the year leading up to the pandemic stood at £2,000 million. (It is worth noting that COSLA, CIPFA and SOLACE wrote a joint letter to the previous Local Government and Communities Committee in March 2021 setting out their position on the issue of reserves).

Soon after the Budget was published, COSLA issued a news release condemning the budget5 as "a bad deal for communities". Although acknowledging increases to both the overall revenue and capital settlements, they argue that much of these additions relate to Scottish Government national commitments which, they believe, will be considerably more expensive for local authorities to deliver than the Budget document assumes. COSLA calculates6 that these policy commitments and the resulting pressures will cost local government an extra £891 million; therefore, £100 million more than the cash increase of £791 million set-out in the Budget document.

In a further news release7, published on 22 December, COSLA announced that council leaders had unanimously agreed to "take their case for a better financial settlement for next year directly to the First Minister". In this release, COSLA state that the funding cut to the core revenue budget is actually £371 million in real-terms. This figures is comprised of the £100 million shortfall identified in the "budget reality" document plus COSLA's calculation of the real-terms cut to the core revenue budget.

When asked about COSLA's calculations by the Finance and Public Administration Committee, Cabinet Secretary for Finance and the economy stated8:

In relation to the core budget, which is protected in cash terms, I do not recognise the £100 million figure that local government is using. COSLA recently wrote to me about that £100 million, and I am trying to get underneath it. My understanding is that COSLA is saying that it is for Scottish Government priorities, but I do not recognise the figure. As far as I am concerned, if you compare last year’s core budget to this year’s core budget, you will see protection in cash terms.

Multi-year allocations, but just not yet...

The single-year nature of budget allocations is problematic for local authorities as it makes long-term planning and multi-year spending decisions much more difficult to achieve. The Local Government, Housing and Planning Committee also noted1 the impact of single-year allocations on local government partners, for example third sector organisations.

Over the past few years the Scottish Government has felt2 they can only provide single-year settlements to local government because of the one-year nature of their settlement from the UK Government:

…as long as the UK Government continues to provide the Scottish Government with an annual resource budget settlement it will not be possible for the Scottish Government to set more than a single year budget and therefore a single year local government finance settlement.

This frustration was once again on display when the Cabinet Secretary for Finance and Economy told the Local Government, Housing and Planning Committee in August of this year3:

We desperately want to provide that long-term security and we desperately want that long-term security ourselves so that we can make long-term plans, which we have been unable to do because of year-to-year budgets. My sincere hope is that we will get the spending review this autumn, which will allow us to embark on our spending review and provide multiyear certainty to local government.

With the UK government publishing a 3-year spending review in October, including Scottish Treasury spending limits through to 2024-25, this barrier appeared to have been removed. However, when the Scottish Government's budget was published in December, the document only included single-year allocations for local government.

In a letter to the Local Government, Housing and Planning Committee4 sent just before the publication of the Budget, the Cabinet Secretary for Finance and the Economy explained that multi-year allocations would not be included in the Budget because the Government and COSLA are currently developing a fiscal framework "to support future funding settlements for local government" (news of this framework being in development was first announced in November 2019)5.

It seems likely that the Scottish Government will include indicative local government allocations in its multi-year Spending Review6 due to be published in May 2022.

Capital

Capital budget refers to spend on physical items which benefit service users over a number of years. For budget and accounting purposes, it is important to distinguish between capital and revenue. Like revenue allocations, capital grants from the Scottish Government take the form of general and specific (ring-fenced) grants. However, unlike revenue allocations (the terms "revenue" and "resource" are used interchangeably), the level of capital funding can vary widely year-to-year depending on planned infrastructure investment (see Exhibit 12 in the Accounts Commission's 2019-20 local government overview1).

The total capital allocation for local government in 2022-23 is £680 million, with £15 million of this going directly to Strathclyde Partnership for Transport. Focussing on the last five provisional Finance Circulars, Chart 6 shows that total capital allocation in 2022-23 is £297 million (-30%) lower in real terms than it was in 2018-19.

Council Tax

In its Budget document1, the Scottish Government states that local authorities will have "full flexibility" to set Council Tax rates for 2022-23, thus “enhancing their fiscal autonomy”. This comes after a Council Tax freeze in 2021-22 was agreed between the Scottish Government and local authorities, with the former providing £90 million to councils to compensate for the freeze (approximately equivalent to a what could be raised with a 3% increase across the country). There will be no national freeze or cap on Council Tax rates in 2022-23.

In a podcast by the University of Strathclyde's Fraser of Allander Institute (FAI), research fellow Emma Congreve believes this decision puts councils in "a hard place", particularly with local elections coming up in May. Furthermore, as reported by Scotland on Sunday on the 19th December, the FAI economist states:

“I think it will be a very difficult decision for councils to make, but I think the likelihood is that some will have no choice but to increase rates if they are to be able to provide the public services that they’ve been charged to provide.”

Allocations to individual local authorities

Finance Circular 9/20211 includes provisional revenue and capital allocations for all 32 local authorities. Allocations in the circular are subject to consultation, therefore local authorities should not set their final budgets on the basis of these figures. The Scottish Government expects local authorities to inform COSLA, and for COSLA in turn to inform the Scottish Government by no later than 21 January 2022, "if they think there are any discrepancies or changes required to these provisional allocations".

Consultation on the figures presented in the circular will take place between the Scottish Government and COSLA in advance of the Local Government Finance (Scotland) Order 2022 being presented to the Scottish Parliament in late February. Final allocations will likely be published in a circular in mid-March.

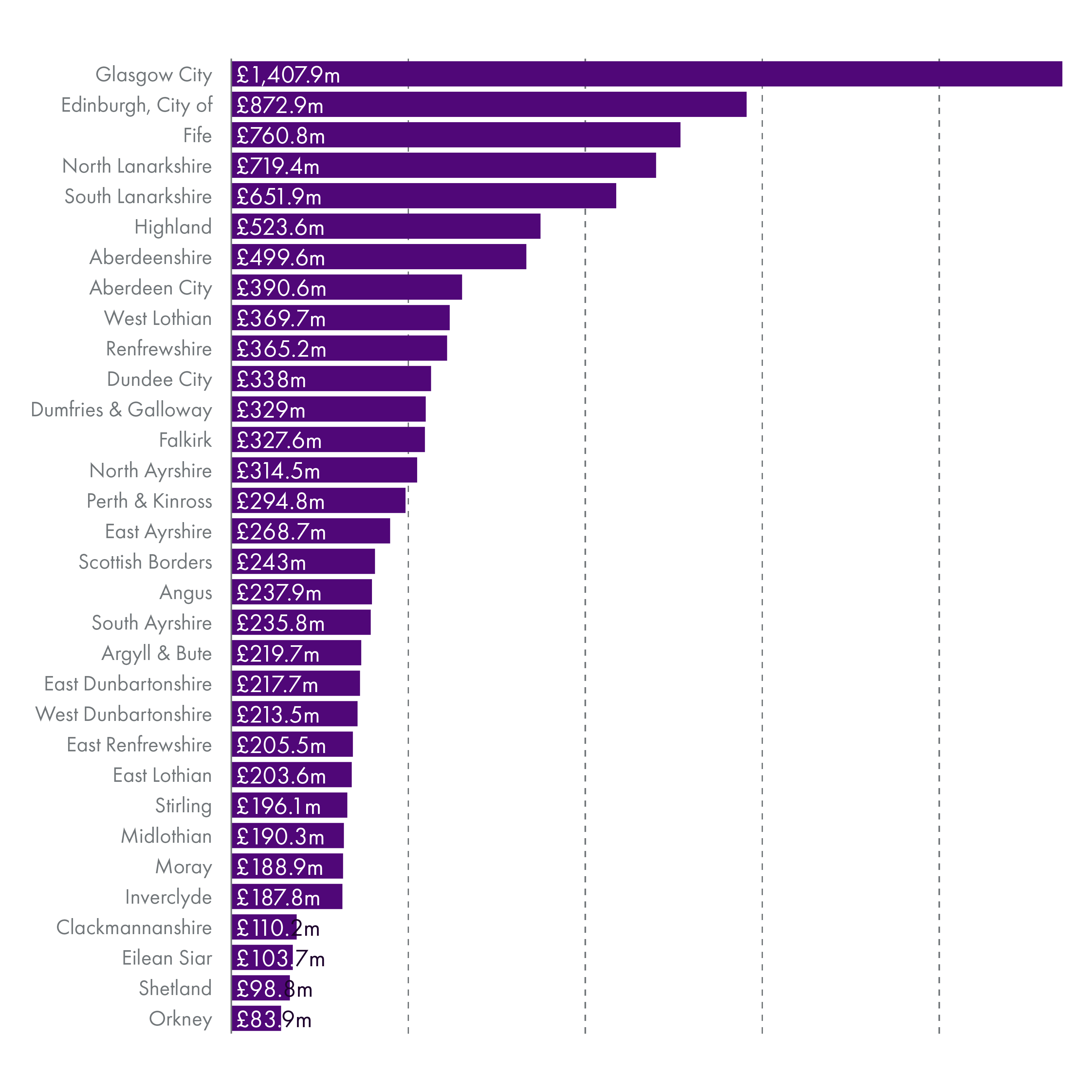

Chart 7 shows the provisional revenue allocations for each local authority, as set out in Finance Circular 9/21.

Year-to-year comparisons in this section of the briefing are made using the new Finance Circular (9/2021)1 and last year's equivalent Finance Circular, published in January 2021 (1/2021)3. Figures for cash and real changes, per head allocations and percentage of the Scottish average are based on Total Revenue funding settlements, as set out in Column 13 of Annex B of the Local Government Finance Circulars.

Changes in revenue allocations - cash and real

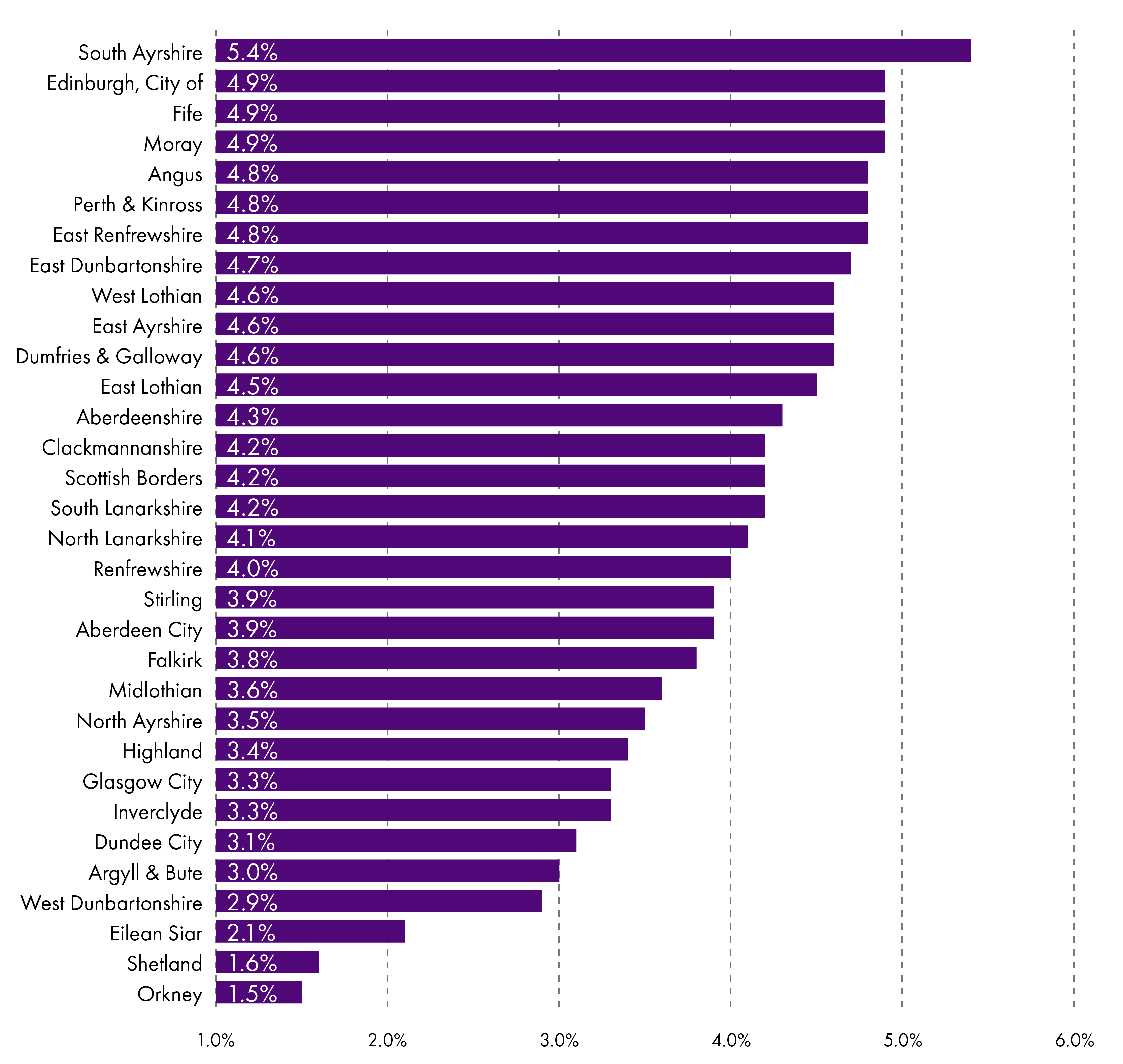

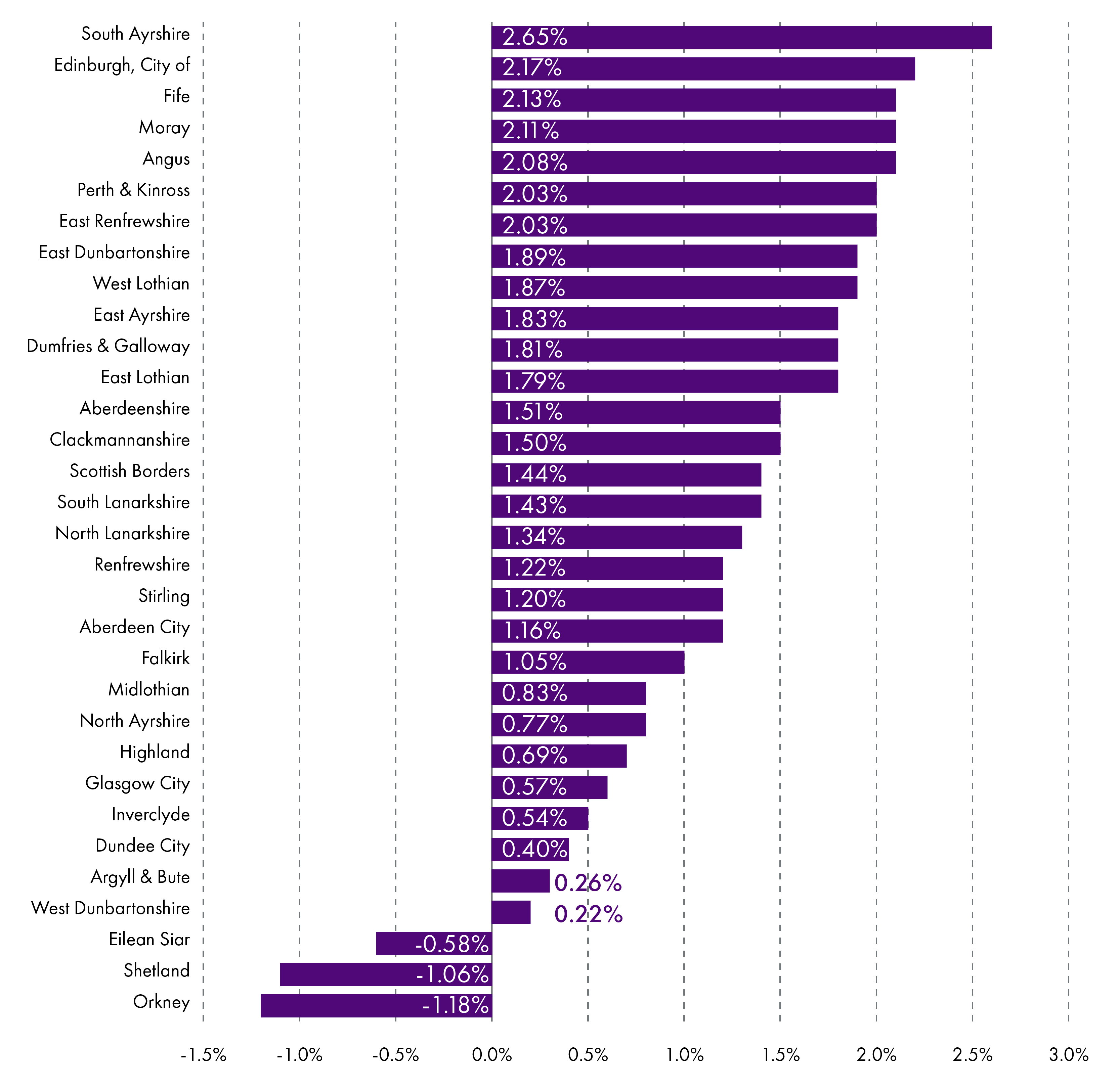

Chart 8, below, shows that all 32 local authorities receive a cash increase in their total revenue support when compared to 2021-22. The largest percentage increases are seen in South Ayrshire, Edinburgh City, Fife, Moray and Angus.

Chart 9 (below) puts 2021-22 allocations into 2022-23 prices and shows that every local authority receives a real terms increase over the year except the island local authorities of Orkney, Shetland and Eilean Siar.

Revenue allocations per head

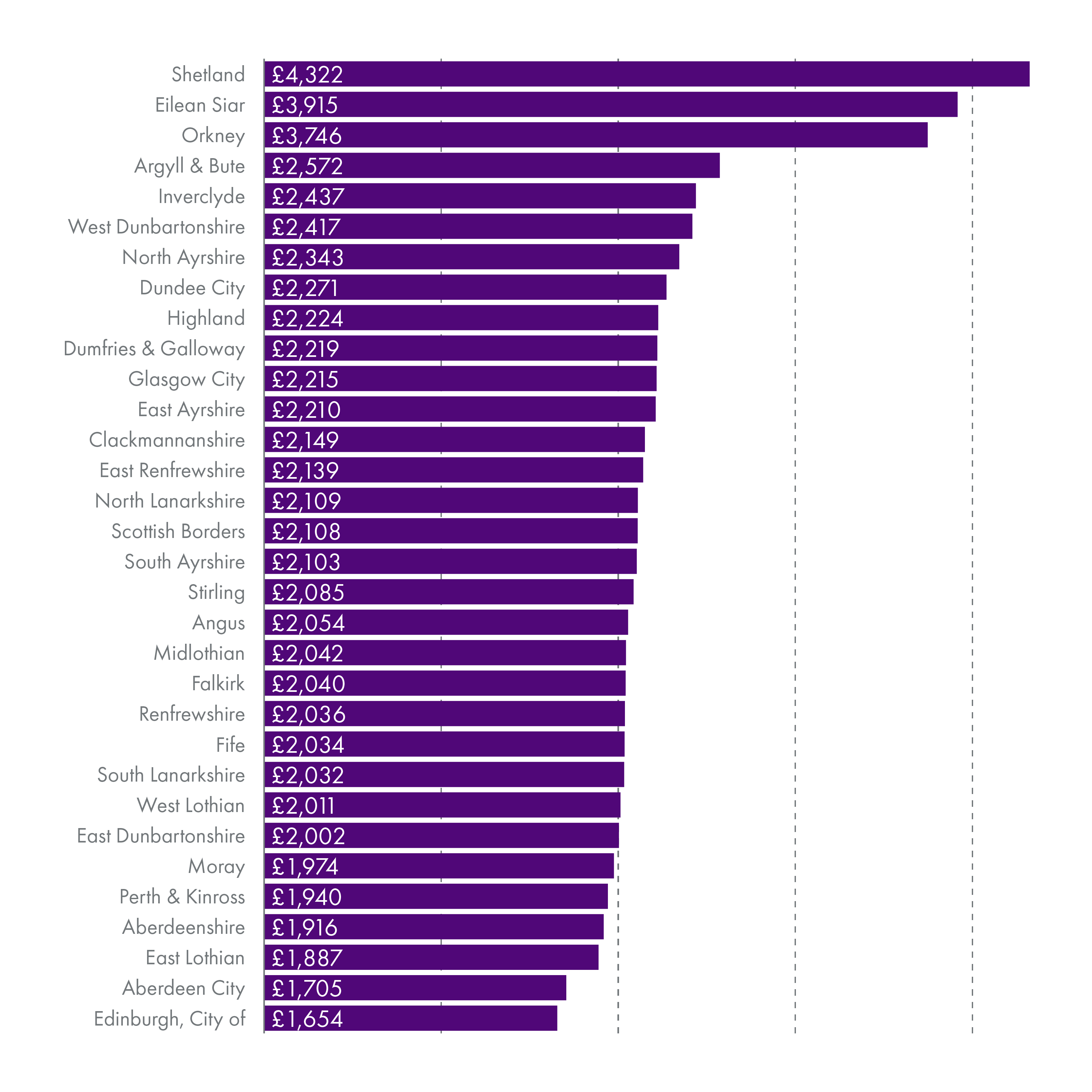

Chart 10 (below) shows the provisional revenue allocations on a per head basis.

As in previous years, the three island authorities receive the greatest amount of Total Revenue funding per head, which reflects the particular circumstances of delivering public services in island communities.

Again, the City of Edinburgh and Aberdeen City have the lowest allocations per head. As detailed in the SPICe briefing Local Government Finance: The funding formula and local taxation income, these councils receive a high proportion of income from Council Tax.

The Scottish Government has made the commitment that no local authority will receive less than 85% of the Scottish average per head in terms of Revenue support. This includes funding from Council Tax income. As in 2020-21 and 2021-22, the only local authority affected by this adjustment in 2022-23 is City of Edinburgh.

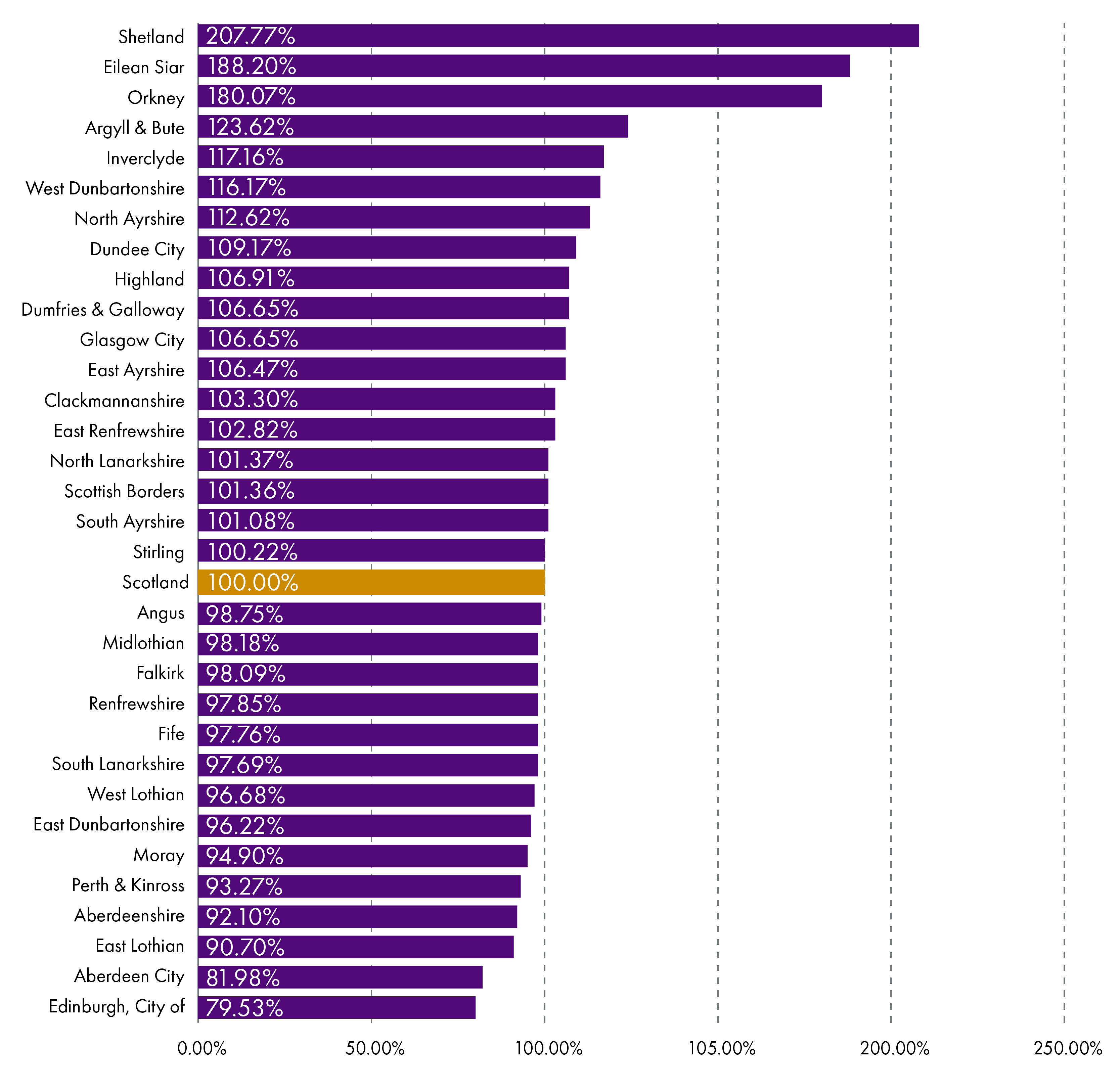

Revenue per head as a % of Scottish average

Chart 11 (below) shows the data presented in Chart 10 as a percentage of the Scottish average - which is £2,080 per head. This shows that, as in previous years, and as would be expected, the island authorities receive by far the highest amount of funding per head. The City of Edinburgh, followed by Aberdeen City and East Lothian, receive the lowest percentage of the Scottish average funding per head.

Provisional capital allocations

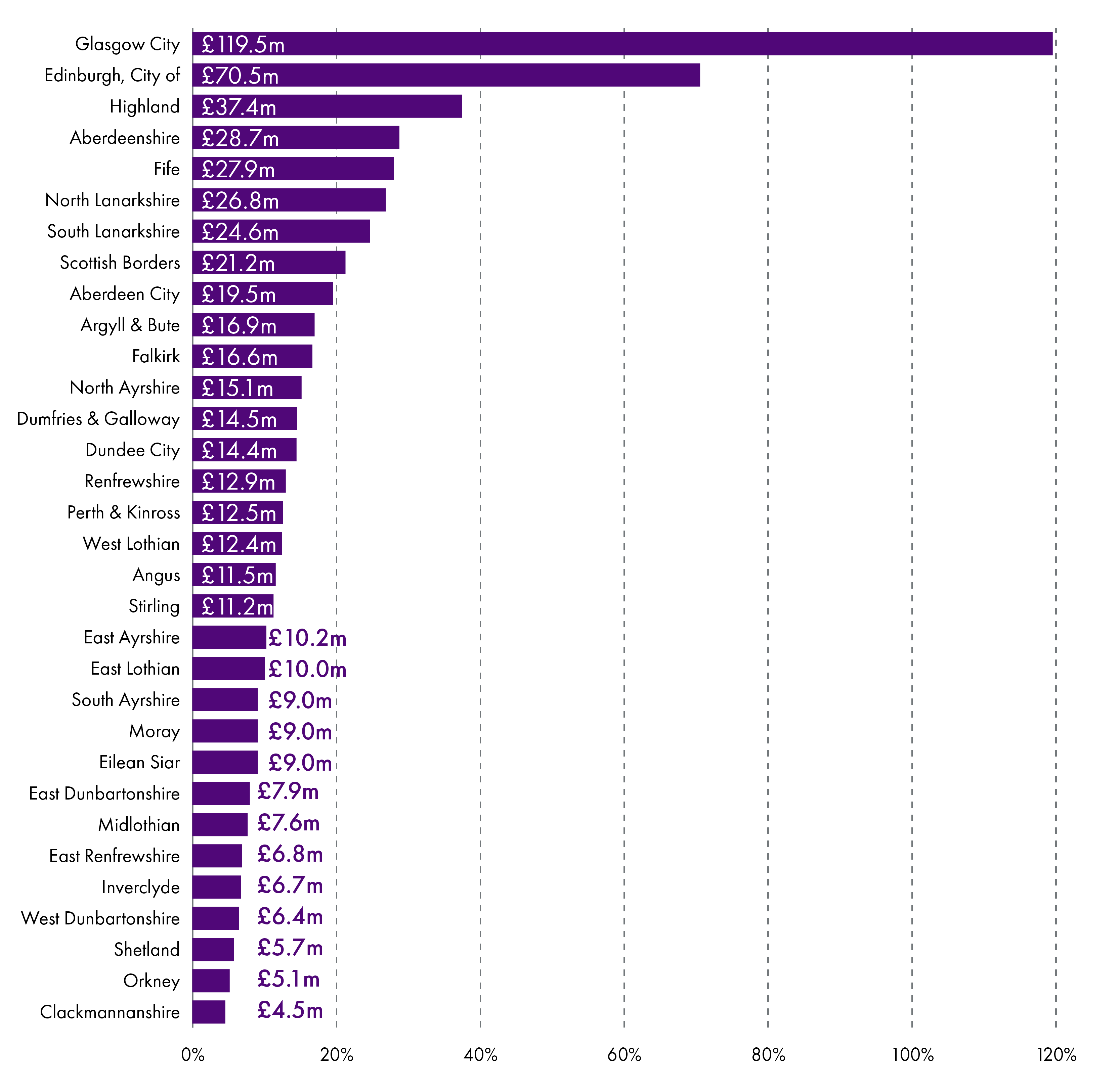

Chart 12 (below) shows total capital allocation by local authority in 2022-23, with Edinburgh and Glasgow receiving by far the the largest settlements.

Finance Circular 9/2021, Annex I, also shows undistributed capital funding of £53 million. This is considerably more than the undistributed sum of £10 million in the comparable circular for 2021-22