Council Tax Reduction

This briefing gives an overview of the Council Tax Reduction (CTR) scheme. It describes how people in the same situation can get different amounts of CTR and how new rules seek to address this. It also looks briefly at council tax support in England and Wales.

Summary

Council Tax Reduction (CTR) replaced Council Tax Benefit in 2013. It is a means-tested scheme under which around half a million households pay less council tax.

There is a problem with how the rules take account of Universal Credit. Government analysis1 shows that the average CTR award is lower for people who also get Universal Credit compared to those who get the benefits that Universal Credit replaces (legacy benefits).

That analysis suggests that, by the time everyone has moved over to Universal Credit, around a fifth of households could lose out.

To address this, new rules are being introduced for working age households.2 These are intended to make sure that – as far as possible – households in the same situation get the same amount of CTR regardless of whether they are on legacy benefits or Universal Credit.

Scottish Government analysis1 suggests that, when introduced in April 2022, the new rules will result in 5% of households getting less CTR than under the current rules. 14% of households are expected to get more CTR under the new scheme but most (85%) are expected to see no difference.i

The new scheme is estimated to cost an additional £15 million in the year of introduction.

In England and Wales, Council Tax Benefit was replaced by local schemes which generally provide less support than Council Tax Benefit, particularly for working age people.

Introduction

When Council Tax Benefit was abolished in 2013, local authorities in England and the Welsh and Scottish Governments had to develop replacement schemes.

Developments in England and Wales are discussed at the end of this briefing. (Northern Ireland has rates rather than council tax, so is not covered here).

In Scotland, the intention was to make sure that the new scheme gave people the same level of support as they received before. However, as the benefit system has changed, and especially with the introduction of Universal Credit, this has proved more difficult than might at first have been anticipated.

New regulations have been laid which aim to improve the way Council Tax Reduction (CTR) is calculated for people who get Universal Credit. This is to make sure that, as far as possible, people in the same situation get the same level of CTR regardless of which benefits they are getting.

This briefing gives an overview of the scale of CTR and the types of households that benefit. It summarises analysis done by the Scottish Government on the impact of the new rules before looking very briefly at council tax support in England and Wales. The Annexe sets out an example calculation to illustrate how the calculation works now and how it is changing.

What is Council Tax Reduction?

CTR is a means tested scheme which reduces the amount of council tax a household has to pay. Council tax varies by local authority and council tax band. Council tax reduction differs according to individual circumstances. Some of the key factors affecting the amount of reduction are:

which social security benefits a household gets

the amount of income and capital a household has

personal characteristics such as being a carer or being disabled

family structure - whether someone is single or in a couple, working age or pension age, number of children

being a student or sharing a house with other adults who aren't part of the family

There are different forms of CTR

'main' CTR for

working age people

pension age people

Scottish special rebate for those in bands E to H who are on a low income

second adult rebate - this is a reduction because an unrelated adult lives in the household and that other adult is on a low income.

In addition to CTR, there is a range of discounts and exemptions which can mean people pay less or no council tax. Edinburgh Council lists 16 exemptions and discounts. The most commonly used is the single person 25% discount.

For more information on the different forms of CTR and other discounts and exemption that are available see Citizens Advice Scotland.

This briefing focuses on the rules for main CTR for working age people as these are the rules that are changing.

The scale of the CTR scheme

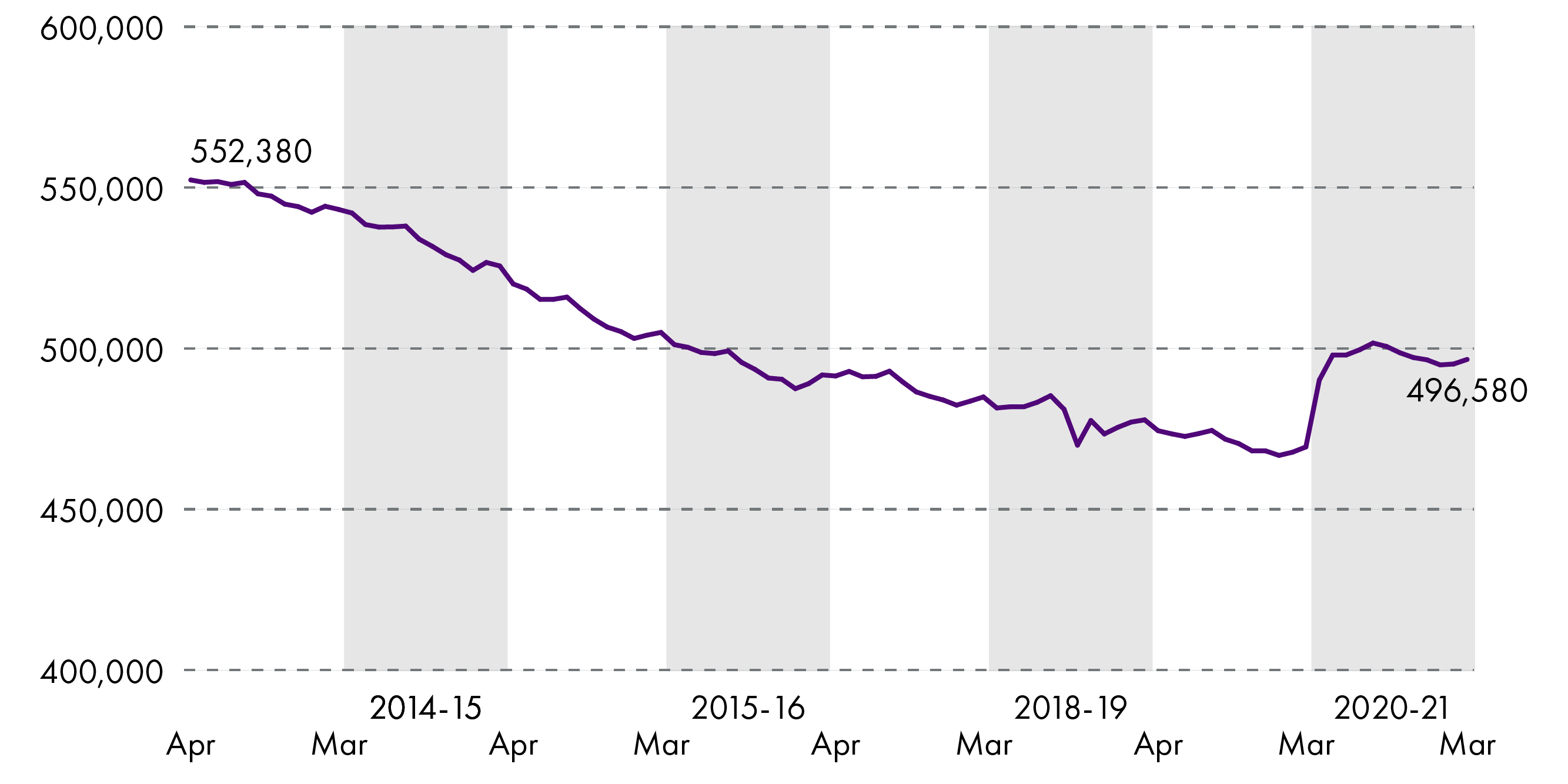

Council Tax Reduction is a large-scale scheme. At its recent peak, in August 2020, around half a million households got CTR.

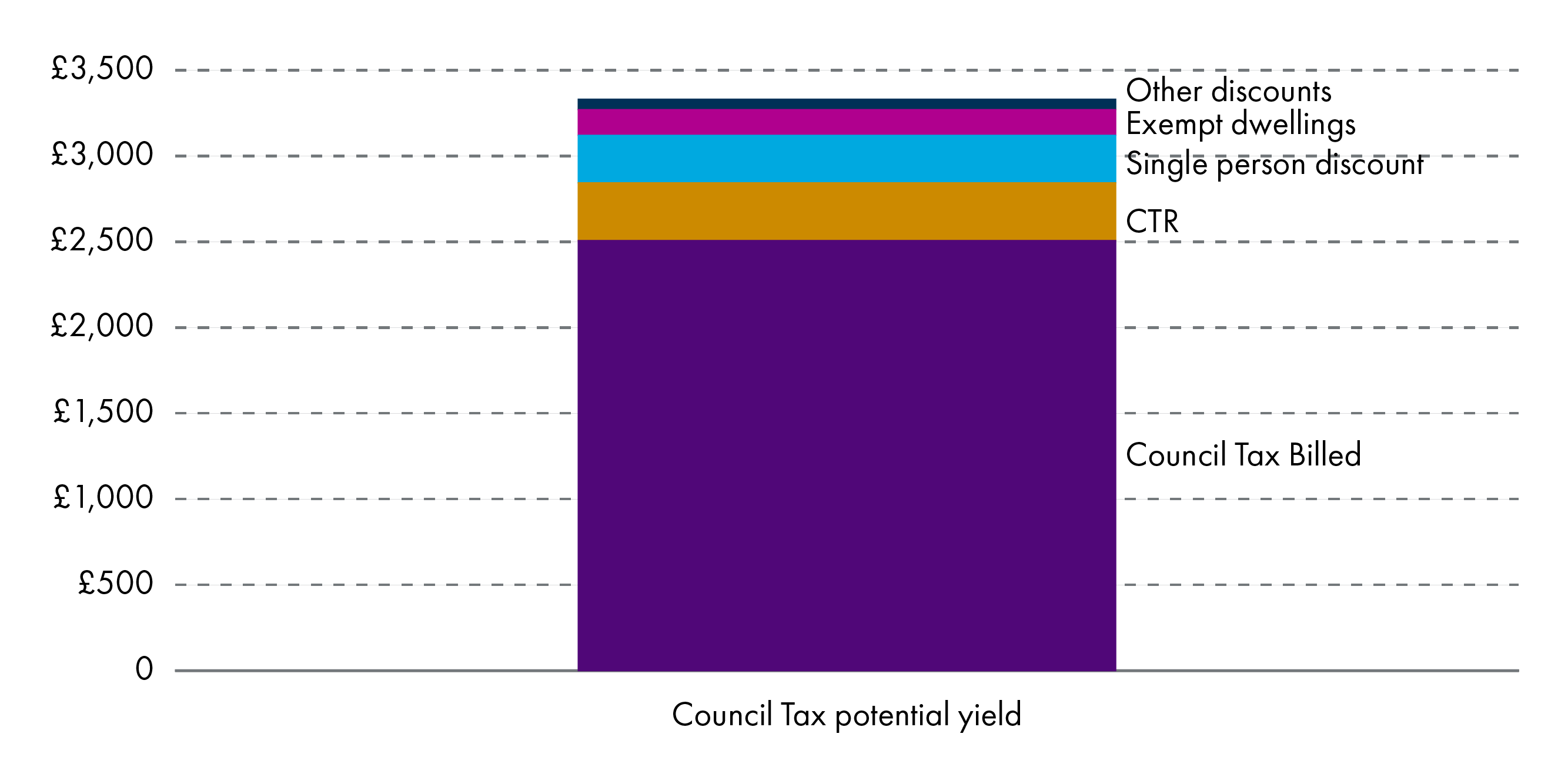

CTR and other discounts reduce the total council tax 'take' by 25%

The chart below shows how CTR, along with the other exemptions and discounts, reduce the amount of council tax that is paid in Scotland by around a quarter. In 2019-20, potential council tax yield was £3.3 billion. CTR, discounts and exemptions reduced this by £824 million. The largest element of this was CTR, which reduced the total amount of council tax by £336 million.

The number of people getting CTR increased in 2020

Until recently, the total number of people getting CTR each year had been falling (Chart 2). Most of this decline was amongst pension age households. Until recently, the trend in working age households was fairly static at around 300,000 households.1

Numbers increased substantially during 2020, largely as an impact of COVID-19. This increase was almost entirely amongst working age households. From March 2020, the working age CTR caseload increased by around 35,000. It has since fallen back, and the number of pension age households getting CTR continues to fall.1 Scottish Government statistics note that:

Between March 2020 and March 2021, the number of CTR recipients increased for all age groups apart from those aged 65 or over which decreased by 1 per cent. Those aged 35-44 increased the most (13 per cent) between March 2020 and March 2021.

Scottish Government. (2021). Council Tax Reduction in Scotland, 2020-21. Retrieved from https://www.gov.scot/publications/council-tax-reduction-scotland-2020-21/pages/4/ [accessed 14 September 2021]

Even at its recent peak, in August 2020, the total number of CTR recipients was still lower than it had been when the scheme was introduced in 2013 as a replacement for Council Tax Benefit.

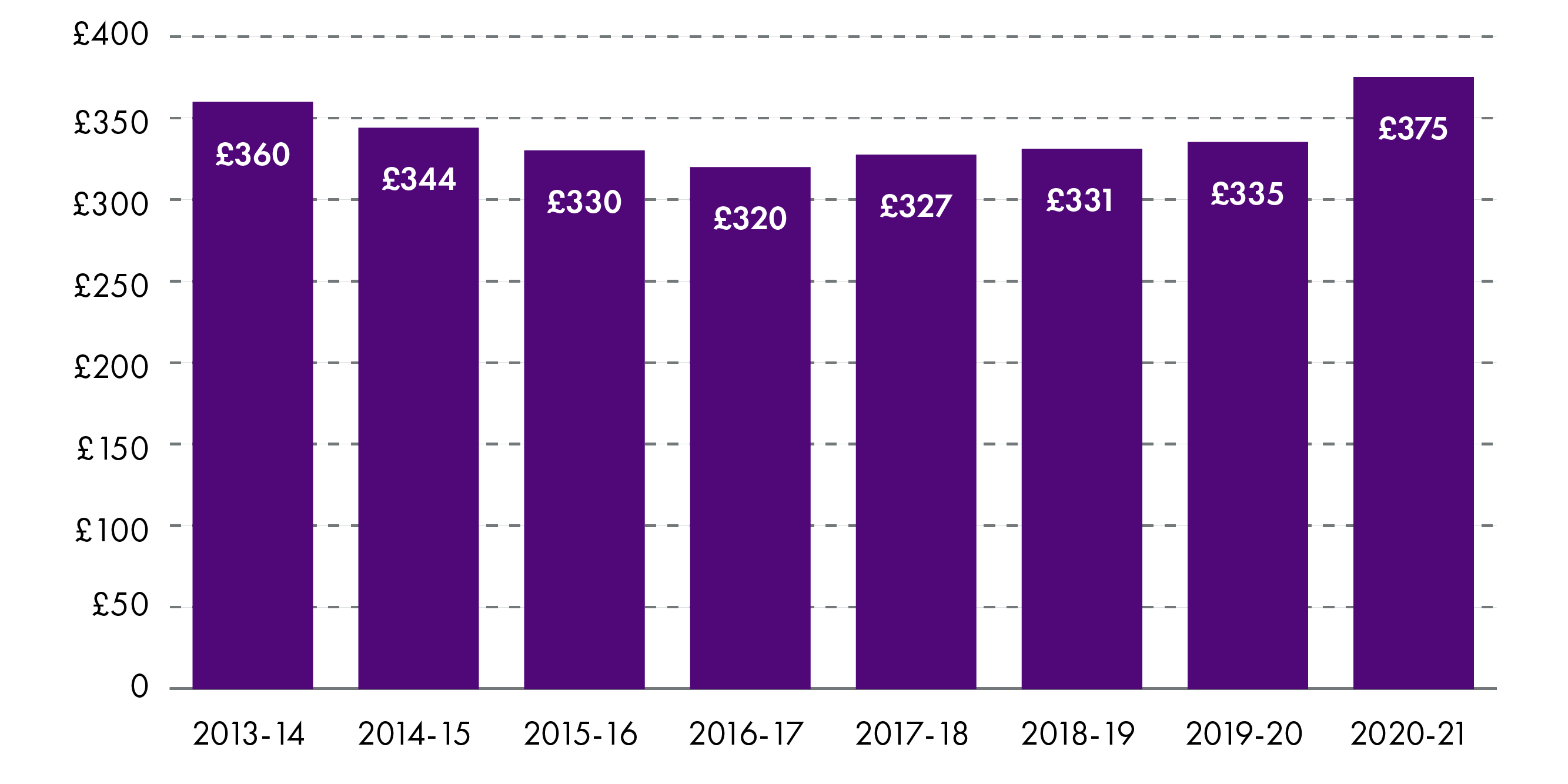

CTR amounted to £375 million in 2020-21

The CTR scheme means that local authorities get less income from council tax. In 2019-20, this ‘income foregone’ was £335 million.1 Provisional figures suggest this increased to £375 million in 2020-21.2

The Scottish Government provides funding to local authorities to help meet the loss in tax receipts associated with the CTR scheme.

Since 2017-18, the Scottish Government has provided £351 million per year. In 2020/21, an additional £25 million was provided in recognition of the impact of COVID-19.3

The Scottish Government estimates that the proposed new rules will result in an additional £15 million ‘income foregone’ in the year that they are introduced.

Chart 3 below shows the total income foregone due to CTR since the scheme was introduced.

Two-thirds of people getting CTR are under 65

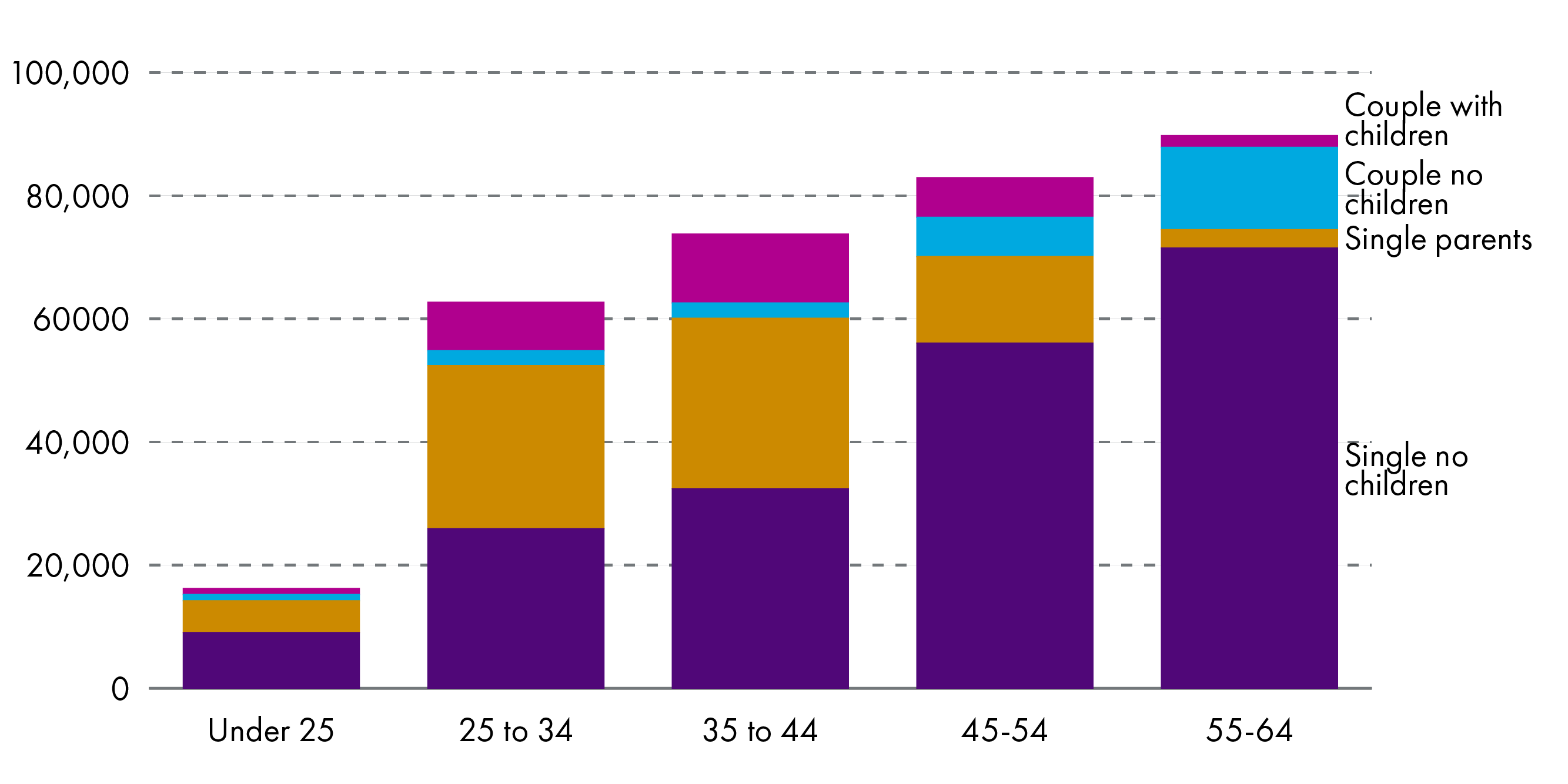

By the end of 2020-21, around half a million (496,580 as at March 2021) households paid less council tax because of the CTR scheme. That’s around a fifth of the households that are liable for council tax.

Around two-thirds (67%) were of working age (331,920). 1 Most people getting CTR have no earned income.

Chart 4 below shows that older people are more likely to get CTR than younger people. Most recipients are single and have no dependent children. However, particularly in the ‘under 45’ age bracket, there are significant numbers of lone parents getting CTR.

CTR is a passport to other support

CTR can act as a ‘passport’ to other payments. This means that getting CTR of even a very small amount can be worthwhile. Examples include:

Some local authorities provide the school clothing grant to people getting CTR. This is £210 for secondary school children and £150 for primary school children. For example, Glasgow City Council.

Some local authorities provided additional 'COVID support' to people getting CTR. For example, Perth and Kinross 'financial insecurity fund' provided £80 for each child under 6.

Social security benefits and CTR

One of the complications for CTR is how to take account of people’s social security benefits.

Four ‘low-income’ benefits are a ‘passport’ to ‘full CTR’. That is, they automatically mean that a household pays no council tax. These are:

Income-based Job Seekers Allowance (JS)

Income-related Employment and Support Allowance (ESA)

Income Support (IS)

Pension Credit

In March 2021, just under 134,000 households on 'working age' benefits (JSA, IS and ESA) and 93,650 households getting Pension Credit paid no council tax because they were passported to full CTR.1

All three of the working age ‘passporting benefits’ are being replaced by Universal Credit. Universal Credit is not a passport to full CTR. However, if no-one in a household has any income then they pay no council tax, even if they are claiming Universal Credit (subject to any non-dependent deductions).i

The Universal Credit problem

Council Tax Reduction rules were amended to take account of Universal Credit, but as Universal Credit has rolled out it has become apparent that in many circumstances people get less CTR if they are on Universal Credit compared to legacy benefits. However, there isn't an easy way to adapt CTR to take account of Universal Credit. As more people move from legacy benefits to Universal Credit, the need for changes to the CTR scheme becomes more urgent.

Between 2016 and December 2020, the number of people claiming both CTR and Universal Credit rose from almost none to 151,730. That's 46% of the working age CTR caseload.1

The average CTR award is lower for households on Universal Credit

The amount of CTR a household gets varies a lot depending on individual circumstances. However Scottish Government analysis has found that the average CTR award is lower for households getting Universal Credit compared to households getting legacy benefits:

Working-age CTR cases in receipt of UC on average receive lower CTR awards than equivalent cases in receipt of legacy benefits.

Scottish Government. (2021). Analysis of the impact of revisions to the council tax reduction scheme for working-age caseload in receipt of universal credit. (n.p.): Available in SPICe bib no.62606.

The analysis found that if everyone moved from legacy benefits to Universal Credit then, under the current rules:

72% would see no change in their CTR award

7% would gain more CTR

5% would get CTR for the first time

20% would get less (of which 5% would no longer qualify for CTR).

The above sums to more than 100% because new cases become eligible for the first time.

The analysis further found that:

Households that were modelled to lose CTR are estimated to lose around £300 to £350 per year, and households that were modelled to gain CTR are estimated to gain around £200 to £350 per year.

Scottish Government. (2021). Analysis of the impact of revisions to the council tax reduction scheme for working-age caseload in receipt of universal credit. (n.p.): Available in SPICe bib no.62606.

As mentioned, most households getting CTR have no earned income. They will get ‘full CTR’ whether they are on legacy benefits or Universal Credit.

However, once people start to work a few hours and get some earned income, the current rules mean that people on Universal Credit often get less CTR compared to those on legacy benefits. On average the type of households who get less are:

those that are working, but working working fewer than 16 hours

families with children where someone in the household is working.

There isn't an easy way to change CTR to take account of Universal Credit

The current CTR scheme treats Tax Credits differently to other legacy benefits. This creates a problem. Should CTR treat Universal Credit like Tax Credits or like the other legacy benefits or a mixture of the two approaches?

For example, under the current rules,

if someone is on JSA, IS or ESA then they are 'passported' to full CTR.

if someone is on Tax Credits, then their net earnings (after tax, National Insurance and allowable deductions) are included in the calculation, less a certain amount that is 'disregarded' known as an 'earnings disregard'.

Issues like this make it difficult to create rules which ensure that everyone would get the same amount of CTR regardless of whether they got Universal Credit or legacy benefits.

The current approach for a household on Universal Credit is to use the income figure that is included in their Universal Credit award. That means that all their net earnings (after tax, National Insurance and allowable deductions) are included in the CTR calculation. There is no 'earnings disregard'.

Impact of the new rules

The new rules are intended to ensure ‘as far as possible’ that people get the same amount of CTR whether they are on legacy benefits or Universal Credit.1

On average, Scottish Government analysis2 suggests that the new rules will be more generous and will result in an additional £15 million of CTR in the year the changes are introduced.

The effects for individuals will vary depending on their personal circumstances. The annexe sets out an example calculation explaining in more detail how the current and new rules work. In very general terms, the calculation for people getting Universal Credit is changing so that the new rules:

change what is included under income (this includes ignoring some earned income and some parts of the Universal Credit award)

change the amounts included to reflect personal circumstances (e.g. family structure, disability, carer) to bring it more in line with what is included for legacy benefits, i.e. ‘the applicable amount’.

There is no change to the basic calculation. Under both schemes, a household is expected to contribute 20% of the difference between their assessable income and their ‘applicable amount’ towards their council tax bill. (This is explained further in the Annexe).

If everyone’s CTR was worked out using the new rules then Scottish Government modelling suggests that:

14% would gain (including 4% that are new cases becoming eligible under the new rules)

5% would lose

85% would stay the same.

Most would stay the same because most people who get CTR at the moment have no earned income.

Those who lose out include families more likely to have a combination of the following factors:

have no children

rent rather than own their own homes

earn more than the minimum wage

live in houses in higher council tax bands.

Stakeholder Views

The Social Justice and Social Security Committee wrote to stakeholders asking for their views on the new rules.i Key points made were that:

the new rules are an improvement for Universal Credit claimants, but the complexity of the regulations makes it difficult to assess in detail who the 'winners and losers' are

consultation has been limited to discussions with a few key stakeholders.

Citizens Advice Scotland (CAS) has commented that the new rules "are certainly a good step forward for Universal Credit Claimants"1 and One Parent Families Scotland has said "we feel the proposed changes will result in a fairer system overall."2

Child Poverty Action Group provided detailed comments.3 Key themes included that:

without a robust assessment of the impacts of such changes, it is difficult for Parliament to assess who are the winners and losers

the policy could be more ambitious and do more to reduce child poverty by providing more generous support

there is no Scottish Government guidance published on these regulations, resulting in different local approaches and difficulty in understanding how decisions have been reached.

While the Child Poverty Action Group (CPAG) has been engaged with officials on the technicalities of the regulations, they note that there has been no wider public consultation. The organisation comments that:

Given the size of the investment in low-income families involved, it is striking how little consultation there has been in relation to CTR compared to the approach taken to types of assistance under the Social Security (Scotland) Act, for example.

Child Poverty Action Group. (2021). Letter to Social Justice and Social Security Committee (unpublished). (n.p.): (n.p.).

CPAG also picked up on various technical issues and provided suggestions to the Committee of how the regulations could be improved.

The Social Justice and Social Security Committee invited the Scottish Government to respond to the points made. Tom Arthur, MSP Minister for Public Finance, Planning and Community Wealth explained that a formal public consultation and impact analyses were not carried out because "these regulations do successfully replicate outcomes for the overwhelming majority of cases." Nonetheless:

officials have been in regular contact with welfare rights groups, local authorities and other stakeholders.

Arthur, T. (n.d.) Letter to Neil Gray MSP, Convener Social Justice and Social Security Committee dated 23 September 2021. (unpublished). (n.p.): (n.p.).

On suggestions that the scheme should do more to tackle poverty he noted that the Scottish Government is open to considering changes in future that would make the scheme more generous:

We are open to considering such changes in the future, but the policy rationale behind these regulations is to replicate existing outcomes in a changing benefits landscape, rather than make new policy choices which would require considerable engagement, consultation, and development.

His reply included a detailed response to the technical issues raised by stakeholders noting that where CPAG have raised problems or potential errors; "we will seek to amend the regulations before they come into force".

On the lack of Scottish Government guidance for local authorities he stated:

The Scottish Government has never provided guidance for local authorities on the administration of CTR. Council Tax, including this associated CTR scheme, are an important part of ensuring financial and administrative accountability for each local authority. Each local authority is accountable for how they choose to exercise their discretion. It would therefore not be appropriate for the Scottish Government to advise local authorities on how to administer the CTR scheme

The letter also refers to the Water Charges Reduction Scheme which provides up to 35% discount on water charges for low income households.

The Committee received a later response from the Institute of Revenues Rating and Valuation (IRRV) who had surveyed their Scottish members. In addition to points about consultation and complexity IRRV members stated that there are still IT issues to be ironed out:

There are concerns about delivery on time, and uncertainty that costs of IT development, testing and implementation will be met by the Scottish Government.

Institute of Revenues, Rating and Valuation. (2021). Submission to Social Justice and Social Security Committee - unpublished. (n.p.): (n.p.).

The current rules mean that, for Universal Credit clients, local authorities can automate most of the calculation using data shared by the DWP. There are strong concerns amongst IRRV members about how far such automation will be possible under the new rules. A Scottish Government event is planned for October to explain the new scheme to IRRV members.

England and Wales

In England and Wales, research has found that, for many working age people, council tax support is a lot less generous than the council tax benefit it replaced.

The rules for pensioners are largely still determined by central government. However local authorities were given a large degree of choice about how to design support for working age people.

Analysis by the Institute for Fiscal Studies1 found that the most commonly protected groups, aside from pensioners, were veterans (protected by 70% of councils in 2018/19) and disabled people (88% of councils in 2018/19).

Their research, conducted in 2018-19, found that almost all local councils had cut the level of support. Most councils require all households (except ‘vulnerable groups’) to pay at least a certain proportion of their gross council tax bill. The IFS comment that:

This is the first time since the poll tax that many of the lowest-income households have been required to pay local tax.

Adam, S., Joyce, R., & Pope, T. (2019). The impacts of localised council tax support scheme. Retrieved from https://ifs.org.uk/uploads/publications/comms/R153.pdf [accessed 14 September 2021]

The research found that, in 2018-19:

The 3.6 million working-age households in England who would have been entitled to some support under the old CTB system are now entitled to 24% (£196 a year) less on average – 1.0% of their income – than if the generosity of the system had been maintained at its pre-2013 level.

Adam, S., Joyce, R., & Pope, T. (2019). The impacts of localised council tax support scheme. Retrieved from https://ifs.org.uk/uploads/publications/comms/R153.pdf [accessed 14 September 2021]

There were changes introduced due to COVID-19. £500 million was provided for additional support. In accompanying guidance the Ministry of Housing, Communities and Local Government (MHCLG) said it had a “strong expectation” that billing authorities would provide all recipients of working age local Council Tax support with a further reduction in their annual council tax bill of £150 .

For further detail on schemes in England and Wales see: House of Commons Library (2020) Council Tax Reduction Schemes.4

Annexe: How does the CTR calculation work?

This section of the briefing describes the basic CTR calculation, illustrating some of the problems with the current rules and how the new rules seek to fix these.

If someone is not on a passporting benefit, the amount of CTR will vary according to a range of factors, the main ones being:

the size of their council tax bill

their earned and unearned income (e.g. wages and benefits)

their personal circumstances (e.g. whether they are a carer or are disabled or have childcare costs)

their family structure (couple or single, number of children).

The basic way CTR is calculated is not changing. It calculates how much of someone’s assessable income should be means tested. The amount to be means tested is called ‘excess income’. The basic steps are:

How much of someone’s earned and unearned income is included in the calculation? This is the assessable income.

Find ‘applicable amount’. This is a set amount depending on family structure and personal circumstances.

Compare assessable income with applicable amount. If ‘assessable income’ is more than ‘applicable amount’ this is considered ‘excess income’.

A household is expected to pay 20% of their ‘excess income’ towards their council tax bill.

Council Tax Reduction is the council tax bill minus the amount that someone is expected to pay. (see step 4).

This can also be described as:

Excess Income = Assessable Income – Applicable Amount

Contribution = 20% of Excess Income

Level of Council Tax Reduction = Council Tax Bill - Contribution

This basic method is not changing. What is changing is the amounts included for income and the amounts included under the applicable amount.

Example for working lone parent with two children

The following is an example of how CTR is calculated for someone on a low income under the current and proposed rules.

Scenario: Fiona is a lone parent, aged over 25 with two children, a boy and a girl, aged 12 and 14. She works 18 hours a week at the minimum wage and pays £250 per week for a 3 bedroom flat. Her council tax bill (after discounts) is £17.16 per week.

The fact that this scenario is so specific illustrates how much CTR varies according to personal circumstances. Much of the complication in the rules is because they take into account so many different circumstances.

This example shows how Fiona’s council tax bill changes depending on whether she gets Universal Credit or Tax Credits and whether her Council Tax Reduction is worked out under the current or proposed new rules. In this particular scenario the differences are quite large:

if she gets Tax Credits – she’ll pay £11.23 council tax per week

if she gets Universal Credit then:

under the current rules she pays £13.53 council tax

under the new rules she pays £1.82 council tax.

These differences occur because ‘excess income’ is different in each case.

Background information: Before working out her council tax reduction, we need to know Fiona’s earnings and benefit income.

In 2021-22 she has:

£160.38 net earnings per week and pays no income tax or National Insurance.

Either: £406.43 per week Universal Credit (which includes money for housing costs and the £20 temporary uplift)

Or: £184.08 per week Tax Credits. (She would also get housing benefit, but that isn’t relevant to this calculation. This does not include the temporary uplift to Working Tax Credit as this was paid as a £500 one-off payment rather than being included in the benefit calculation).1

Everything is converted into weekly amounts to make it easier to compare.

Calculating 'excess income' under the current rules

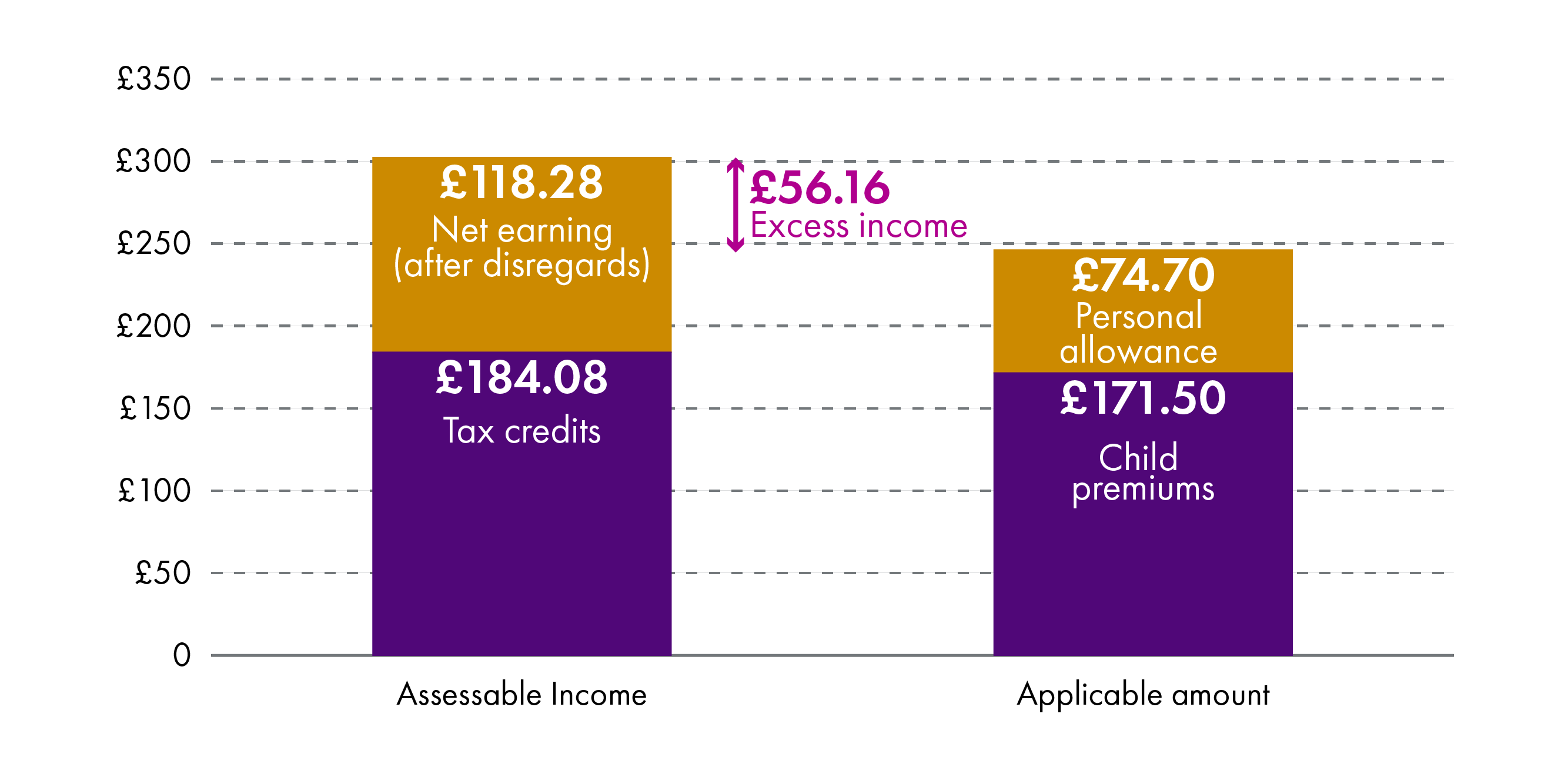

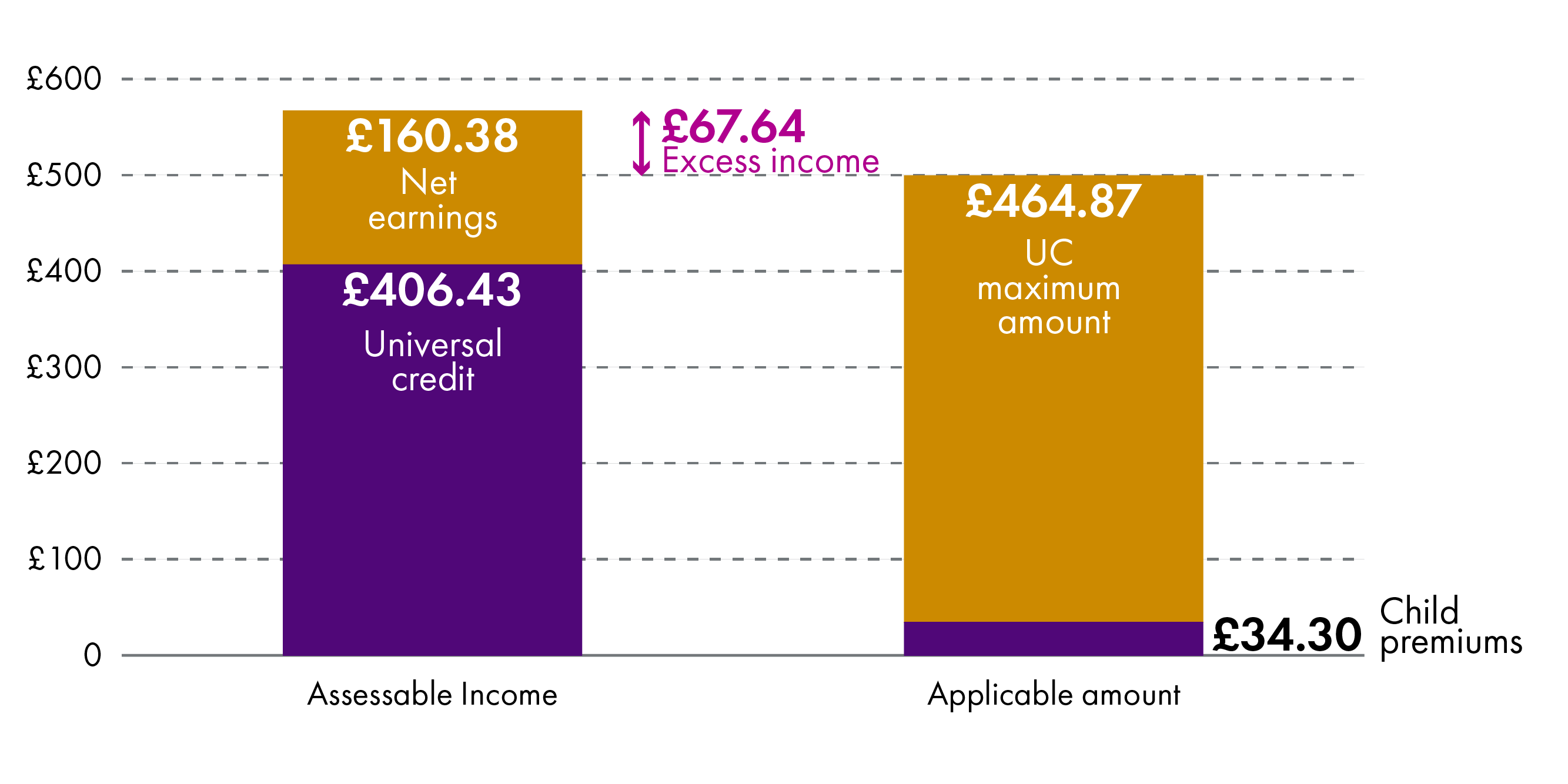

Chart A1 and A2 show how, under the current rules, Fiona’s ‘excess income’ works out at £56.16 if she gets Tax Credits (Chart A1) compared to £67.64 if she gets Universal Credit (Chart A2).

This is because different amounts are included in both income and applicable amount.

Income

On Tax Credits (Chart A1), Fiona’s income includes her tax credits and her earnings less £42.10. £25 of her earnings are ignored because she is a lone parent and a further £17.10 is ignored because she is gets Tax Credits.

On Universal Credit (chart A2), her income includes her Universal Credit award and the full amount of her net earnings.

Her Universal Credit award is more than her Tax Credits mainly because her Universal Credit includes her housing costs. The fact that Universal Credit can include housing costs and Tax Credits do not is one reason why Tax Credits and Universal Credit cannot be treated in exactly the same way in Council Tax Reduction.

Applicable Amount

On Tax Credits (Chart A1), Fiona’s ‘applicable amount’ is a ‘personal allowance’ added to an allowance for each child. These amounts are set out in the CTR regulations.

On Universal Credit (Chart A2), her applicable amount is the standard allowance, child element and amount for housing costs that are included in the Universal Credit calculation (called the ‘maximum amount’). An additional amount is added for children.

This example illustrates two key differences in the way the Universal Credit is treated compared to Tax Credits:

there is no ‘earnings disregard’ in CTR when someone is getting Universal Credit

the Universal Credit ‘maximum amount’ is used to calculate CTR instead of the allowances and premiums in the CTR regulations.

Calculating excess income under the new rules: how treatment of Universal Credit is changing

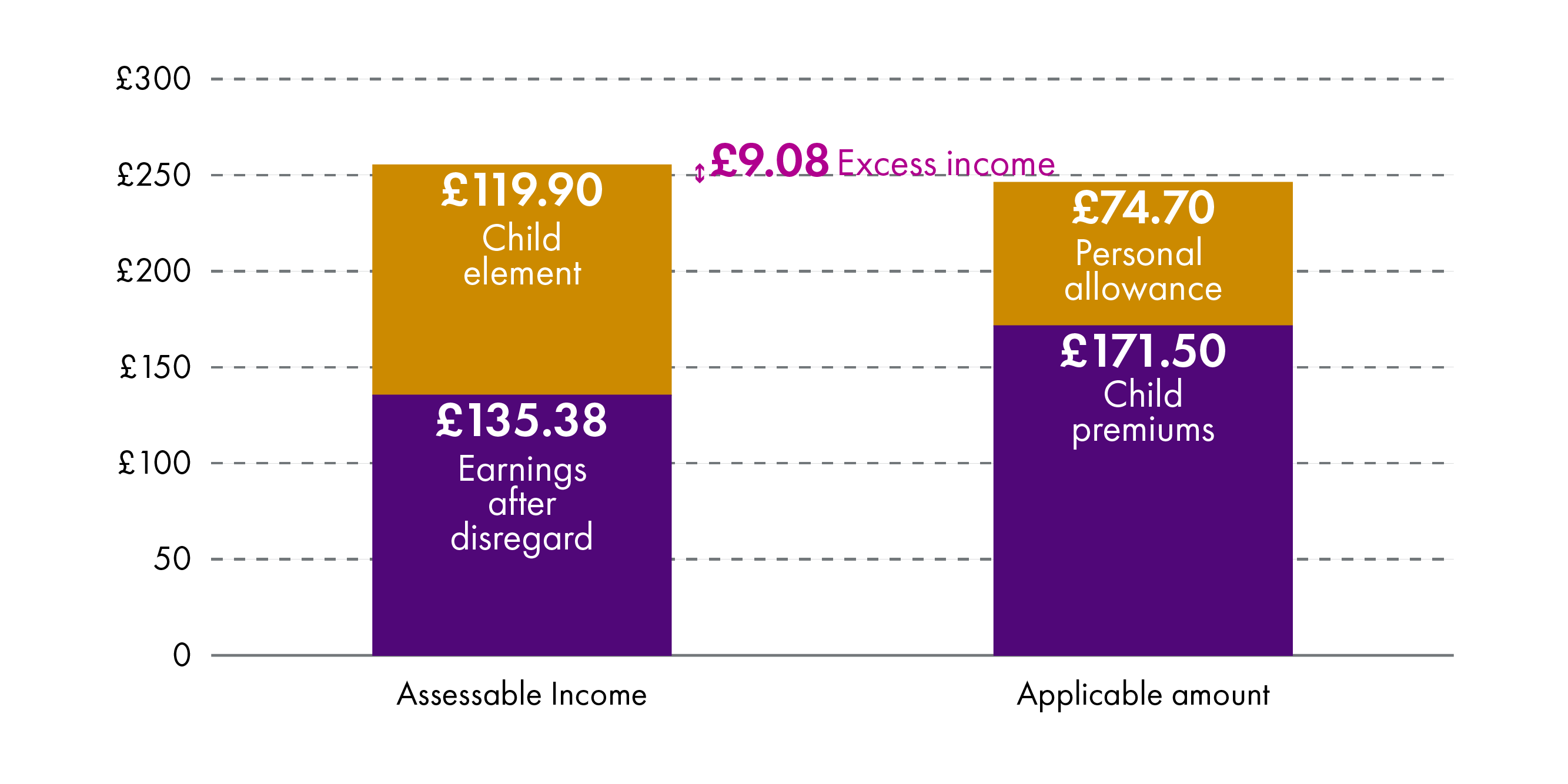

Chart A3 shows how the calculation for Fiona would be different if it was done under the proposed new rules. Instead of £67.64, her ‘excess income’ would come out at just £9.08. This is because, under the new rules:

Not all her earned income is included. £25 is ‘disregarded' because she is a lone parent.

Instead of including her whole Universal Credit award as income, the calculation includes the lower of the entire Universal Credit award or the amount of the specified elements. In this example, the child element is included.

Instead of using the Universal Credit ‘maximum amount’, the applicable amount is made up of personal allowances and premiums set out in the CTR regulations. In this case £171.50 for two children and £74.70 for a lone parent. Although not applicable here, there is no 'two-child limit' in CTR.

In all three versions (Tax Credit and the current and new rules for Universal Credit) the difference between ‘assessable income’ and ‘applicable amount’ is then means tested. This part of the calculation is not changing.

The means test

A person is expected to contribute 20% of their ‘excess income’ towards their council tax bill. Where this 20% comes to more than their council tax bill, then they have to pay the whole bill.

The table below shows how, if Fiona was getting Tax Credits she’d have to pay £11.23 a week council tax, but, under the current rules, if she was getting Universal Credit she’d have to pay £13.53 per week. However, under the new rules, if she was getting Universal Credit, she’d only pay £1.82 council tax per week.

| Tax Credits | Universal Credit | ||

|---|---|---|---|

| Current rules | New rules | ||

| Excess income | £56.16 | £67.64 | £9.08 |

| Council tax bill (after single person discount) | £17.16 | £17.16 | £17.16 |

| Contribution (20% of excess income) | £11.23 | £13.53 | £1.82 |

| CTR (bill - contribution) | £5.93 | £3.63 | £15.34 |

| Council tax to pay | £11.23 | £13.53 | £1.82 |