Devolved benefits for carers

There are three devolved benefits for carers: Carer's Allowance, Carer's Allowance Supplement and Young Carer Grant. This briefing gives an overview of these three benefits and the plan to introduce a Scottish replacement for Carer’s Allowance.

Summary

The three devolved social security benefits for carers are:

Carer's Allowance - for people with little or no earnings who are caring full-time. It is administered on the Scottish Government's behalf by the Department of Work and Pensions (DWP), under an agency agreement. This year it is £67.60 per week.

Carer's Allowance Supplement - an automatic additional payment made in June and December to people in Scotland getting Carer's Allowance on the qualifying dates. In 2021, the June payment was £231.40. The Carer's Allowance Supplement(Scotland) Bill proposes that the December payment will be £462.80. It is administered by Social Security Scotland.

Young Carer Grant - an annual payment of £308.15 made to carers aged 16, 17 and 18 who provide, on average, 16 hours of unpaid care a week. It is administered by Social Security Scotland.

For all three benefits the person being cared for must be getting certain disability benefits.

The Scottish Government is in the process of developing Scottish Carer's Assistance which will replace Carer's Allowance and the supplement. There is no date for when this will start, but when it does it will be very similar to Carer's Allowance. A recent Scottish Government discussion paper sets out proposals.1 Further consultation is expected later in 2021.

£316 million was spent on carer benefits in Scotland in 2019-20. This is forecast to increase to around £428 million by 2025-26. Almost all of this is spending on Carer’s Allowance. The caseload, currently around 84,000,2 is forecast to increase to around 102,000 by 2025-26.3 Social Security Scotland's approach to preventing and recovering overpayments will be particularly important for Scottish Carer's Assistance. This will be informed by a legal requirement to have regard to the financial circumstances in each case.

Only a minority of unpaid carers are entitled to carer benefits. Carers UK estimated that there are up to 729,000 unpaid carers in Scotland and that this figure may have increased by up to 400,000 at the height of the COVID-19 outbreak4 Carer benefits are therefore only one part of the Scottish Government’s wider policy on unpaid carers:

The Scottish Government's vision for unpaid carers, as set out in the draft Carers Strategic Policy Statement, is that all unpaid carers are supported on a consistent basis to allow them to continue caring, if that is their wish, in good health and wellbeing, allowing for a life of their own outside of caring. Scottish Carer's Assistance, our replacement for Carer's Allowance, will be a vital element in delivering this vision.

Scottish Government. (2021). Scottish Carer's Assistance Discussion Paper. Retrieved from https://www.gov.scot/publications/scottish-carers-assistance-discussion-paper/pages/3/ [accessed 8 2021]

Carer's Allowance

Carer’s Allowance was devolved in September 2018 but is being run by the DWP under an agency agreement until the Social Security Scotland replacement is introduced. The agency agreement includes a commitment to keep to UK Government policy while DWP is administering the benefit.

Carer’s Allowance is currently £67.60 per week and is adjusted each year by inflation.

Eligibility

Carer's Allowance is available to people with no or very low earnings who provide unpaid, full-ime care (35 hours a week). The person they care for must be getting one of the following disability benefits:

Personal Independent Payment – daily living

Disability Living Allowance – middle or highest care rate

Constant Attendance Allowanceat or above the normal maximum rate with an Industrial Injuries Disablement Benefit

Constant Attendance Allowance at the basic (full day) rate with a War Disablement Pension

The first three of these are being replaced by Social Security Scotland benefits, starting with Child Disability Payment (CDP). CDP is a qualifying benefit for Carer’s Allowance.1

Carer's Allowance can not be claimed if the carer earns more than £128 per week (net, after expenses) nor if they are in full-time education.

Interaction with other benefits

Carer’s Allowance can affect other social security benefits.

For example, the ‘over-lapping benefit’ rule means that two earnings replacement benefits cannot be paid in full at the same time. For example its not possible to get Carer’s Allowance at the same time as a full State Pension.i People who apply for Carer's Allowance and are affected by this rule are said to have underlying entitlement. Having underlying entitlement can increase the amount received through other benefits, so it can still be worth applying for Carer's Allowance.

A disabled person cannot get a Severe Disability Premium included in their benefits if someone is getting Carer’s Allowance for looking after them. Universal Credit doesn't include a Severe Disability Premium, so, as more people apply for Universal Credit instead of Employment and Support Allowance, more carers will be able to receive Carer's Allowance.

Carer’s Allowance counts as unearned income for some benefits, including Universal Credit. If a carer gets Universal Credit and Carer’s Allowance at the same time, the full amount of Carer’s Allowance is deducted from their Universal Credit. Instead, carers get an additional carer element added to their Universal Credit. A number of other benefits also have extra amounts included if the person applying is entitled to Carer’s Allowance, even if they are not receiving it due to the ‘over-lapping’ benefit rule.

Unlike many benefits, Carer’s Allowance is taxable which will affect those who have incomes above the personal earnings tax threshold. Carer's Allowance also entitles people to additional National Insurance credits.

Carer's Allowance Supplement

Carer’s Allowance Supplement (CAS) was the first Social Security Scotland payment to be introduced, starting in September 2018. It was created to fulfil the Scottish Government’s commitment, made in October 2015, to increase the level of Carer's Allowance to that of Jobseeker's Allowance (JSA).1

CAS is intended as a temporary benefit until Scottish Carer’s Assistance starts and contributes to two main policy objectives:

to improve outcomes for carers by providing some additional financial support. Specifically, to impact positively on carers’ finances and carers’ quality of life (including physical health, mental health and wellbeing, and feelings of control and empowerment)

to recognise the contribution that carers make to society.2

Eligibility

Carer’s Allowance Supplement is paid as a lump sum twice a year to everyone in Scotland who gets Carer’s Allowance on the qualifying dates. There are two qualifying dates. This year they are 12 April (for payment from June) and 11 October (for payment from December). Payments are made automatically based on DWP data, so there is no need to make an application.

Amount paid

Carer’s Allowance Supplement must be uprated by inflation each year. In 2021-22, the payment for June was £231.40. The Carer’s Allowance Supplement (Scotland) Bill proposes a payment of £462.80 in December. A separate SPICe briefing looks at the Bill in more detail.

Assuming the Bill is passed, someone entitled to both the June and December payments would receive £694.20 this year, the equivalent of an extra £13.35 per week on top of their Carer's Allowance.

Like Carer's Allowance, CAS is taxable. Unlike Carer's Allowance, it is not counted as income for other benefits.

Evaluation

An evaluation of CAS found that, in general, the payment had a small impact on health and wellbeing. It was described as ‘a wee lift’. However in exceptional cases it was “transformational”

where it had enabled carers in great financial difficulty to pay off debts or where it had been used towards a trip away when carers felt they were close to breaking point.

Scottish Government. (2020). Carer's Allowance Supplement Evaluation. Retrieved from https://www.gov.scot/publications/evaluation-carers-allowance-supplement/ [accessed 8 July 2021]

In considering wider, long-term impacts, the evaluation noted that:

the impact that around £450 per annum could reasonably be expected to make to these long-term outcomes should also be borne in mind.

Scottish Government. (2020). Carer's Allowance Supplement Evaluation. Retrieved from https://www.gov.scot/publications/evaluation-carers-allowance-supplement/ [accessed 8 July 2021]

Social Security Scotland's Client Survey found that 86% of CAS recipients thought the organisation treated them with dignity and respect.3

Social Security feedback statistics recorded 100 complaints about CAS from its launch in September 2018 to the end of March 2021. Over that time, Social Security Scotland had made payments to 113,750 clients.4

Young Carer Grant

The Young Carer Grant is an annual grant for 16, 17 and 18 year old carers who do not get Carer’s Allowance. It was introduced in October 2019 and at that time was £300. It must be uprated by inflation each year and in 2021-22, it is worth £308.15.

To get the grant:

the young carer must be caring for 16 hours a week on average for the last three months

the person cared for must be getting certain disability benefits.

They must not be getting Carer’s Allowance at the time they receive the Young Carer Grant.

Care for up to three people can be combined to get the total hours required.

If two of more young carers share their caring responsibilities only one of them can get the grant.

The Client Survey1 found that 94% of Young Carer Grant recipients thought Social Security Scotland treated them with dignity. No complaints have been received about the Young Carer Grant.2

Carer Benefits and Brexit

Under social security co-ordination rules, all three carer benefits can be paid to people in the EU if they are protected under the Withdrawal Agreement and have a close connection with Scotland.

In general terms, this means people who were in a ‘cross-border situation’ at the end of the transition period in December 2020. For example, a UK national who has been living in France since December 2020 can stillclaim Carer’s Allowance and Carer’s Allowance Supplement or they could claim the Young Carer Grant (assuming they met the other eligibility criteria).

In these cases, Carer’s Allowance Supplement is not paid automatically but has to be applied for.

However, as a result of Brexit, a UK national moving to an EU country after December 2020 would not be able to get these benefits paid to them abroad on a permanent basis.

Another implication of these co-ordination rules is that people are exempt from ‘past presence’ requirements. In general, in order to get Carer’s Allowance (and therefore also Carer’s Allowance Supplement), a person must have been present in the UK for two out of the last three years. This rule does not apply if the person claiming is covered by social security co-ordination rules and protected under the Withdrawal Agreement.

For more information, see the SPICe briefing series on Brexit and devolved social security.1

Carer Benefits and COVID-19

Changes were made to carer benefits to reflect the impact of COVID-19. These were:

A temporary relaxation of the Carer’s Allowance rules to allow for breaks in caring if a break was due to COVID-19. This is due to expire on 31 August 2021.1 Normally, someone can take a break from caring for up to four weeks in every 26 weeks and still be paid Carer's Allowance. However, these temporary rules mean that breaks in care taken as a result of infection with, or self-isolation due to, COVID-19 do not count towards a carer’s total permitted breaks.

A double payment of Carer’s Allowance Supplement was made in June 20202 and another is proposed for December 2021.3

Deadlines for applying for the Young Carer Grant have been relaxed, where the reason the deadline is missed relates to COVID-19. This also applies to deadlines for requesting redeterminations and appeals.4

Proposals for Scottish Carer's Assistance

Scottish Carer’s Assistance will replace Carer’s Allowance and the Carer’s Allowance Supplement.

When will it start?

When the first detailed timetable for Scottish social security was set out in February 2019, the Scottish Government intended to start Scottish Carer’s Assistance at the end of 2021. There were also proposals for a supplement for those with more than one disabled child to be introduced in early 2021.1

In June 2019, plans for the Scottish Child Payment led to Scottish Carer’s Assistance being delayed to early 2022.2 In April 2020, COVID-19 meant the timetable was delayed again,3 with no revised date for introduction yet announced. However, the expectation is still that the benefit will be introduced and case transfer complete by the end of this parliamentary session.

These delays have meant that the temporary measure of CAS and the DWP’s administration of devolved Carer’s Allowance will continue for longer than first intended.

Consultation and policy development

The Scottish Government has already undertaken public consultation and stakeholder engagement about what Scottish Carer’s Assistance should look like. This includes:

Carer Benefits Advisory Group established (2015)

public consultation on Social Security in Scotlandasked for views on the overall approach to Scottish carer benefits (2016)

Disability and Carer Benefits Expert Advisory Group established (2016)

A recent discussion paper summarises the work to date and explains the approach for further development.1

The Scottish Government plans further consultation later in 2021 on its preferred proposals for Scottish Carer’s Assistance.1

There will be no change to DWP eligibility criteria until all those getting Carer’s Allowance are transferred to the new Scottish benefit. Even after transfer is complete, the discussion paper warns that there may be limitations to the changes that are possible. For example:

carers need to be able to get the same additional amounts added to other UK social security benefits regardless of whether they are entitled to Carer’s Allowance or Scottish Carer’s Assistance

any additional money provided should not be deducted elsewhere in the system.

Section 55 of the Smith Commission agreement states that:

Any new benefits or discretionary payments introduced by the Scottish Parliament must provide additional income for a recipient and not result in an automatic offsetting reduction in their entitlement to other benefits or post-tax earnings if in employment.

Smith Commission. (2014). Report of the Smith Commission for further devolution of powers to the Scottish Parliament. Retrieved from http://webarchive.nationalarchives.gov.uk/20151202171017/http://www.smith-commission.scot/ [accessed 29 August 2017]

This principle has been applied to all the benefits introduced to date.

Calls for policy changes

There have been criticisms of some Carer’s Allowance rules, and some organisations would like to see the new Scottish Carer’s Assistance address these. Responses to the social security consultation in 2016 1included:

Carer’s Allowance should be paid at a higher level than Job Seeker’s Allowance

Scottish Carer’s Assistance should not result in people's other benefits being paid at a lower rate

the rules on ‘overlapping benefits’, the earnings threshold, rules on studying and on requiring 35 hours of care need to change

support for a young carer's allowance and for improving benefit take-up

Five years later many of these concerns remain. For example, Carers Scotland ‘Manifesto 2021’ stated:

The new Scottish Carer’s Assistance should be available to carers who care for 20 hours or more each week; […] The new benefit should consider how to address the overlapping benefit rule […] opportunities should be sought to make changes to the current benefit including changing the earnings threshold and removing the cliff edge.

Carers Scotland. (2021). Manifesto 2021. Retrieved from https://www.carersuk.org/scotland/policy/manifesto-2021 [accessed 8 July 2021]

What will be different?

As mentioned, when it is introduced, Scottish Carer’s Assistance will have much the same rules as Carer’s Allowance. The discussion paper described what would be different. This included:

improving take-up, helped by Social Security Scotland’s local delivery services and improving application processes and systems

connecting carers to wider services to help carers get the support they need.

There is a long-standing commitment to providing extra support to people caring for more than one disabled child and the SNP manifesto proposes extending this to:

pay anyone looking after more than one disabled person an extra £10 per week.

Scottish National Party. (2021). SNP 2021 Manifesto: Scotland's Future Scotland's Choice. Retrieved from https://www.snp.org/manifesto/ [accessed 21 May 2021]

While this was originally going to be introduced as a separate payment, it may now be part of Scottish Carer’s Assistance. 2

The SNP manifesto also included a proposal to continue paying Carer’s Assistance for 12 weeks instead of eight weeks after a cared-for person dies.

Expenditure and Caseload

Spending on carer benefits is forecast to increase over the next few years, even without significant policy changes in the new Scottish Carer's Assistance. Funding provided through the block grant adjustment is also forecast to increase. One issue that affects budgeting is that there is an historic problem with overpayments in Carer's Allowance. This is largely due to the way the benefit is designed. This will make Social Security Scotland's approach to debt recovery particularly important when it comes to Scottish Carer's Assistance.

Caseload and underlying entitlement

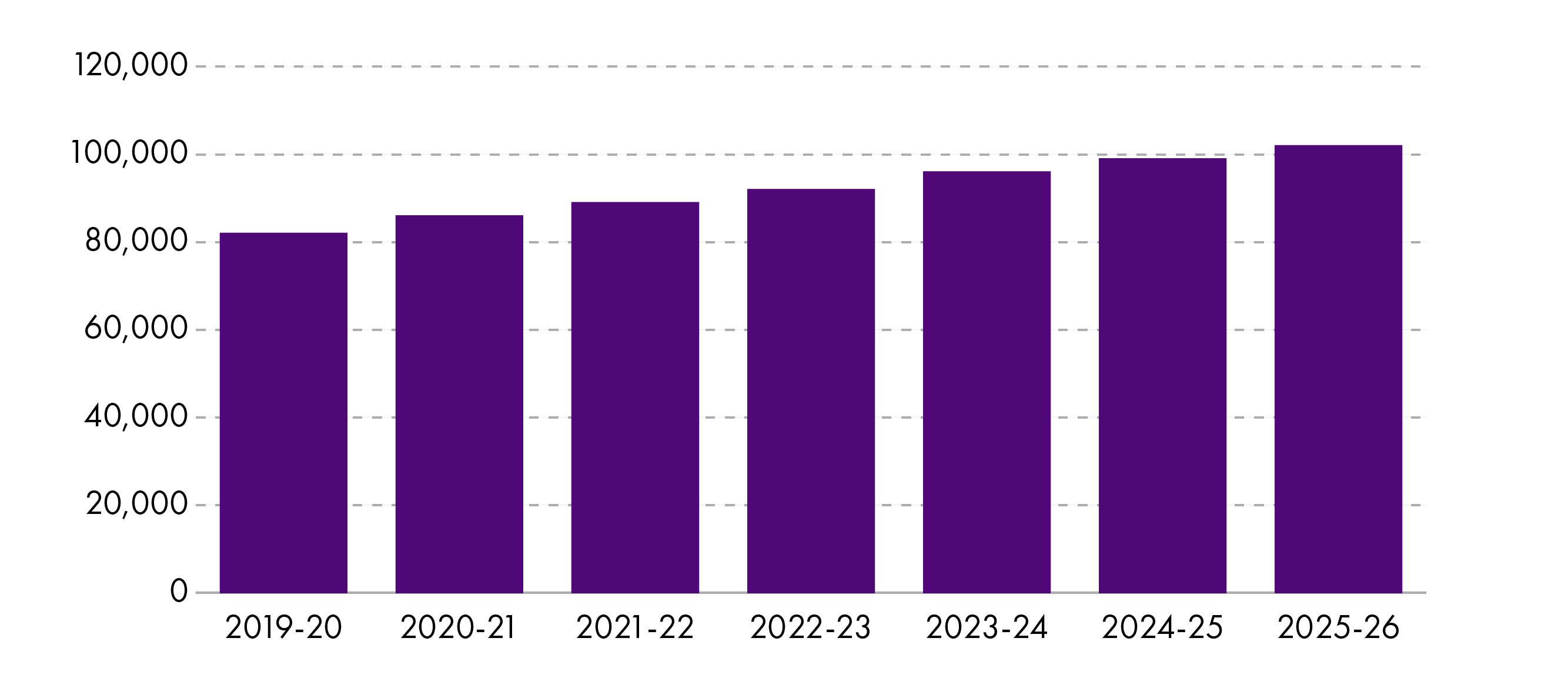

The number of people receiving Carer’s Allowance is steadily increasing. The chart below shows how caseload is forecast to increase from 82,000 people in 2019-20 to 102,000 in 2025-26.

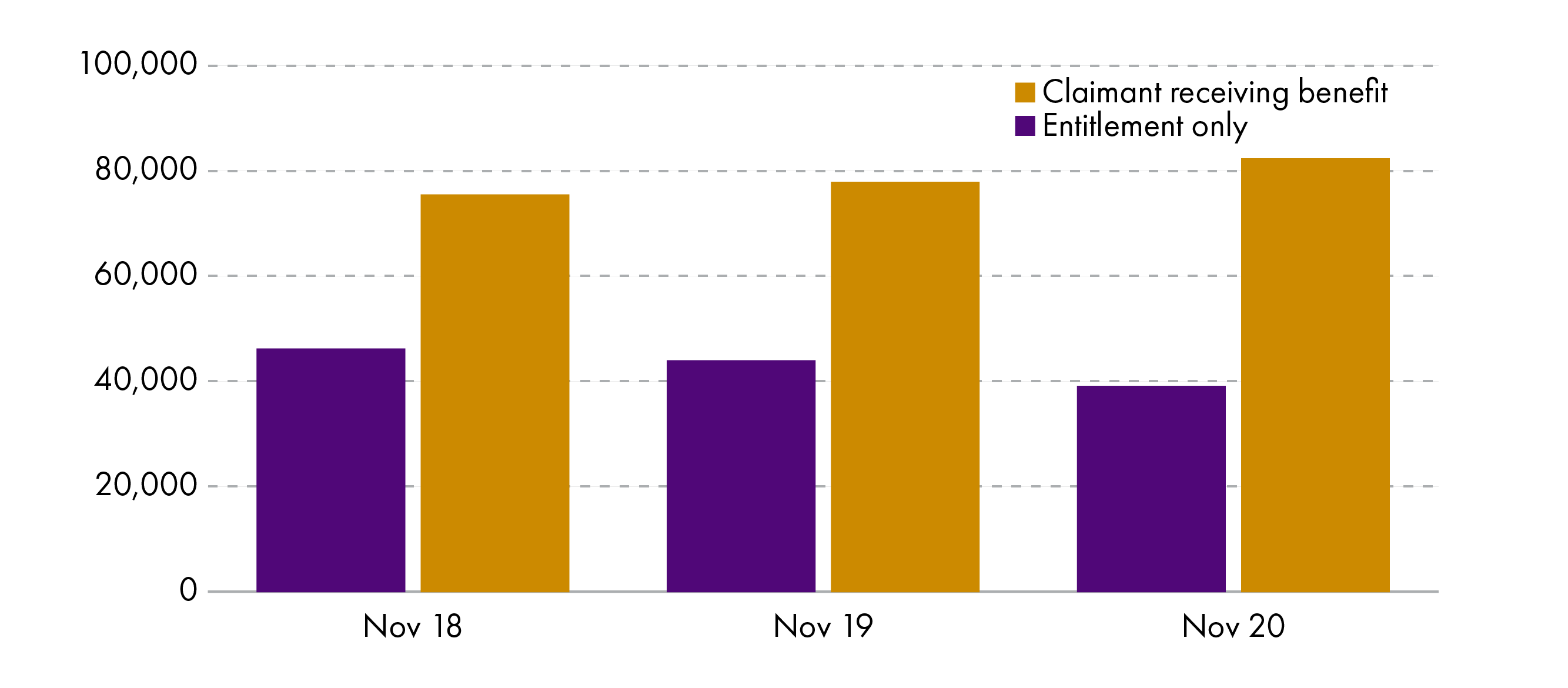

In addition, in November 2020, there were roughly 39,000 people in Scotland who had underlying entitlement to Carer’s Allowance but did not receive it. (See discussion above). The number of claims with underlying entitlement has been falling over recent years. There could be many reasons for this, but one may be the increasing State Pension age. This means that fewer people are eligible for both Carer's Allowance and the State Pension.

Almost all (84%) of those with underlying entitlement are over State Pension age. However, the number of working age people with underlying entitlement has also been dropping, from around 9,700 in November 2018 to around 6,400 in November 2020.2

As CAS is paid to people who already get Carer’s Allowance, the caseload on the CAS qualifying dates is the same as that for Carer’s Allowance on those dates.

In contrast to Carer’s Allowance and CAS, a much smaller number of people have so far received the annual Young Carer Grant. Latest statistics show that, from its launch in October 2019 to the end of April 2021, a total of 2,945 people were given at least one Young Carer Grant.3

Expenditure on carer benefits

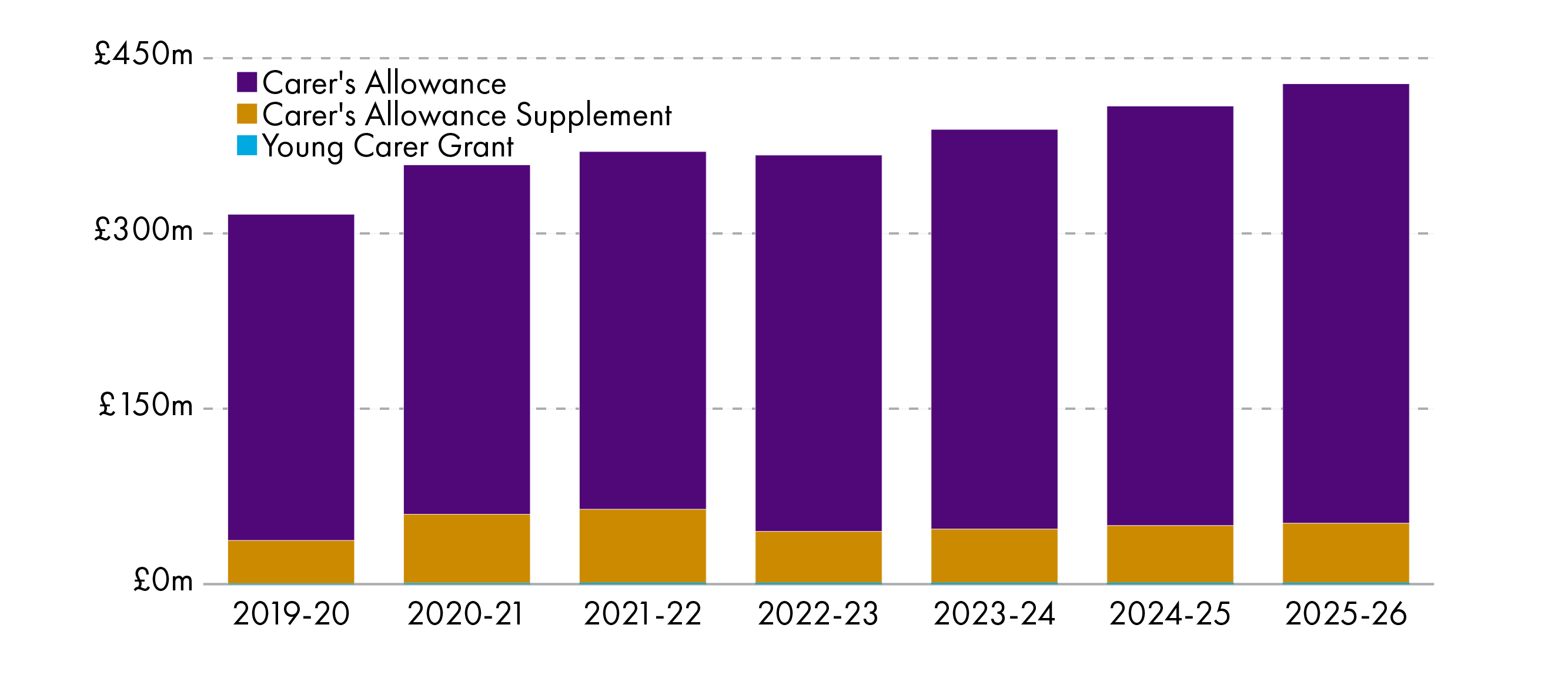

The chart below shows £316 million was spent on carer benefits in Scotland in 2019-20. Almost all of this is Carer’s Allowance, spending on which is forecast to increase from £306 million this year to £376 million in 2025-26. This does not take account of any changes that might be introduced after Carer’s Allowance has been converted into Scottish Carer’s Assistance.

At under £1 million, spending on the Young Carer Grant does not show up on the chart and is not forecast by the Scottish Fiscal Commission. In 2019-20 ,£0.4 million was paid out in Young Carer Grants.1 Administrative statistics suggest that this increased to £0.7 million in 2020-21.2 At the time the regulations creating the grant were made, the Scottish Government estimated annual spending of around £0.7 million.3

Funding carer benefits

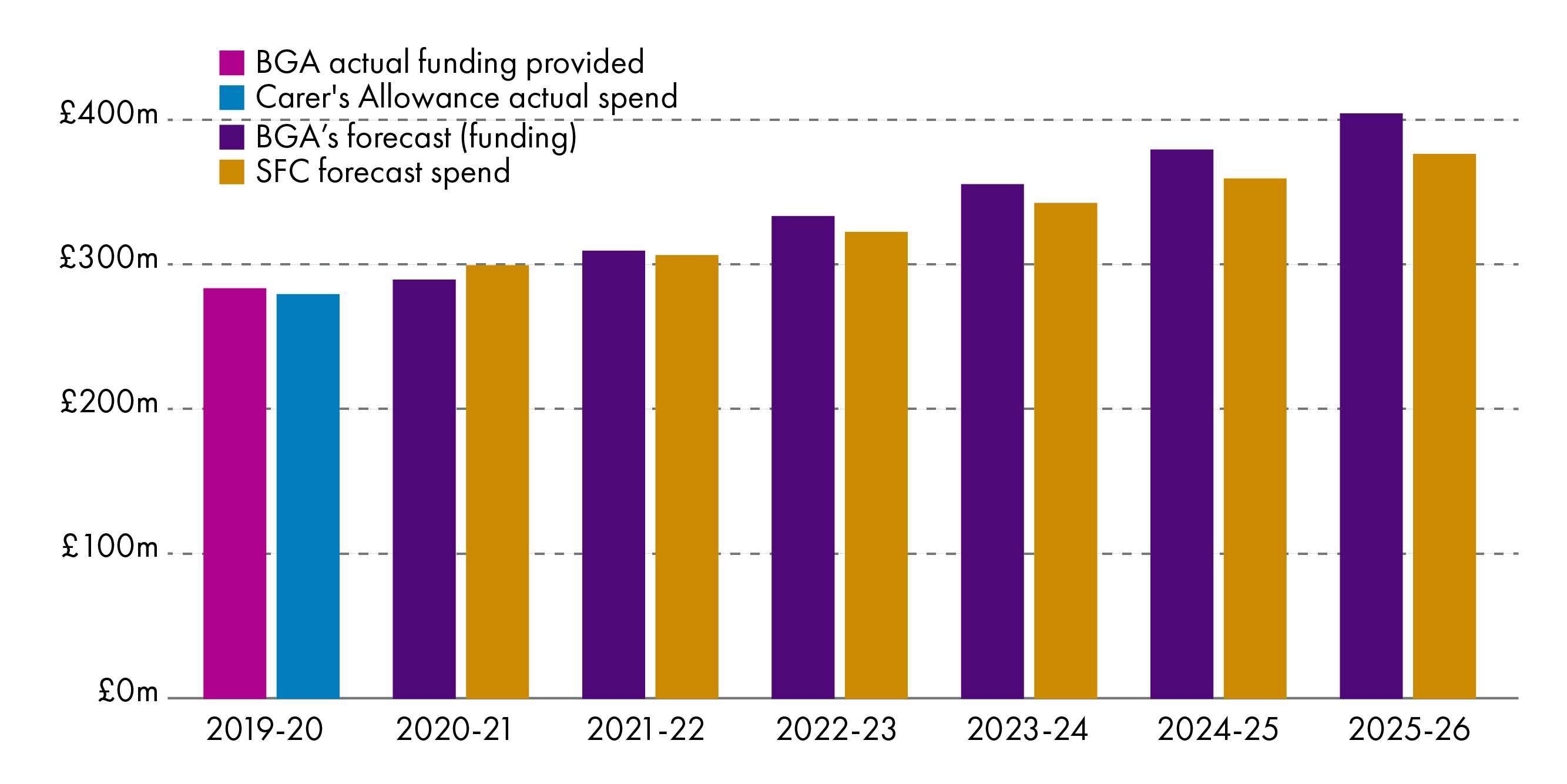

The Scottish Government receives a Block Grant Adjustment (BGA) from the UK Government. The amount is based on an estimate of what would have been spent in Scotland had Carer’s Allowance not been devolved.

The method for calculating the BGA is explained in a technical note.1

Figure 5 compares the BGA received from the UK Government with forecast spending in Scotland. This is based on SFC forecasts in January 2021 derived from the Office of Budget Responsibility forecasts in November 2020. Both these forecasts will be updated.

This shows that, for 2019-20, the Scottish Government received £4 million more in BGA than it spent on Carer’s Allowance. The final BGA was £283 million and outturn spending was £279 million. However the Scottish Government also spent £37 million on Carer’s Allowance Supplement and £0.3 million on the Young Carer Grant for which there is no UK Government funding. This makes a total of £316 million spent on carer benefits in Scotland (figure 3 above).

SFC forecasts suggest that, apart from 2020-21, the Scottish Government will receive more in BGA funding than it spends on Carer’s Allowance. However, it is important to note that this can change as forecasts are updated and the forecasts do not take into account any changes that might be introduced when Carer’s Allowance becomes Scottish Carer’s Assistance. Nor does it take into account spending on carer benefits that are unique to Scotland: the Carer’s Allowance Supplement and the Young Carer Grant.

Overpayments

The National Audit Office has issued a qualified opinion on the DWP accounts for the last 31 years. Because of the estimated level of error and fraud in Carer’s Allowance, and because of the way the legislation is drafted, Audit Scotland has issued a qualified opinioni for Social Security Scotland’s accounts in both 2018-19 and 2019-20.1

The DWP estimate that 5.2% of Carer’s Allowance spending is overpaid due to error and fraud.2 In 2019, Carer’s Allowance overpayment was investigated by the National Audit Office3 and by the Westminster Select Committee on Work and Pensions.

A basic problem is that the rules make it very easy for someone to accidentally accrue overpayments. In their inquiry the Westminster Committee noted that:

If a carer fails to realise that their earnings have risen above the £123 a week “cliff edge”, even by a very small amount, and report this to the Department, they can face disproportionately punitive effects compared to other benefits. This is because they will owe the Department the full £66.15 per week they are receiving.

Work and Pensions Select Committee. (2019). Overpayments of Carer's Allowance. Retrieved from https://publications.parliament.uk/pa/cm201719/cmselect/cmworpen/1772/177202.htm [accessed 9 July 2021], NB the earnings threshold is now £128 and Carer's Allowance is £67.60

Part of the issue in 2019 was that an increased ability to identify overpayment led to the DWP increasing its recovery of historic debt.

However, the eligibility rules themselves appear to make it very easy to create overpayments. The Work and Pensions Select Committee report commented that: "The design of CA sets carers up for a fall."4 Keeping these same rules in Scottish Carer’s Assistance suggests that the same issues of overpayment could occur. The issue then becomes whether and how such overpayments are recovered.

At the time of writing, Social Security Scotland's approach to debt recovery - including liability to repay, small overpayments and consideration of hardship - is still being developed.6

Section 64 of the Social Security (Scotland) Act 2018 provides that there is no liability to repay if the error is neither the individual's fault nor the kind of error they'd reasonably be required to notice. Under Section 65, Scottish Ministers (i.e Social Security Scotland) "must have regard to the financial circumstances of the individual who owes the money."

The Scottish Public Finance Manual requires that:

Public sector organisations should always pursue recovery of overpayments, irrespective of how they came to be made. However it is recognised that there will be both practical and legal limits depending on individual circumstances. Each case should therefore be dealt with on its merits.

Scottish Government. (2019). Scottish Public Sector Finance Manual. Retrieved from https://www.gov.scot/publications/scottish-public-finance-manual/overpayments/overpayments/ [accessed 9 July 2021]

The manual also notes that: "Public Sector organisations may waive recovery of overpayments if it would cause hardship."

Annexe: Legislation

Carer’s Allowance is legislated for under section 70 of the Social Security Contributions and Benefits Act 1992. The main regulations are: The Social Security (Invalid Care Allowance) Regulations 1976 (SI 1976/409).

Carer’s Allowance Supplement is created by section 81 of the Social Security (Scotland) Act 2018.

The Young Carer Grant is created by regulations under the Social Security (Scotland) Act 2018. The main regulations are: Carer’s Assistance (Young Carer Grant) (Scotland) Regulations 2019 (SSI 2019/324). The Scottish Commission on Social Security (SCoSS) reported on the Young Carer Grant on 17 May 2019 and the regulations were considered by the Scottish Parliament’s Social Security Committee on 19 September 2019.

SCoSS are not required to report on Carer's Allowance Supplement or Carer's Allowance.

Changes have been made to increase the amount of benefit paid, to allow Carer's Allowance Supplement and Young Carer Grant to be claimed from abroad in some cases and there have also been changes in response to COVID-19. Changes include:

annual uprating of all three carer benefits for inflation and increasing the ‘earnings threshold’ in Carer’s Allowance to £128 per week. (SSI 2020/32)

allowing Carer’s Allowance Supplement and the Young Carer Grant to be claimed by people living in EU member states, but only if they are protected under the Withdrawal Agreement and have a close link to Scotland (SSI 2020/475)

making a double CAS payment in June 2020 in response to COVID-19 (section 81(4A) of the Social Security (Scotland) Act 2018 inserted by Coronavirus (Scotland) (No. 2) Act 2020 ). This provision expires on 30 September 2021 under the Coronavirus (Extension and Expiry) (Scotland) Bill

relaxing deadlines for applications if the reason they are missed is related to COVID-19 (sections 52A and 52B of the Social Security (Scotland) Act 2018)

ensuring someone is not disqualified from Carer’s Allowance where they take breaks from care if those breaks are related to COVID-19. This has been extended twice and is currently due to expire in August 2021 (SSI 2021/140)

Carer’s Allowance Supplement (Scotland) Bill proposes a double CAS payment in December 2021.