Social Security: subject profile

This briefing is an introduction to devolved social security, setting out which benefits are devolved, the legal and administrative structures and plans for completing the programme of social security devolution begun with the Smith Commission in 2015.

Summary

The Scottish Government is part way through devolution of substantial aspects of social security. Although some minor social security powers had been devolved before 2016, the Scotland Act 2016 provided for a large expansion of devolved social security. These new powers relate mainly to disability and carer benefits, but also include some low income benefits such as the Funeral Support Payment. Almost all of the new powers were devolved by April 2020. However many ‘devolved’ benefits are still run by the Department of Work and Pensions (DWP) under Agency Agreements. Between now and 2025 ‘Scottish versions’ of all but one of these benefits (Severe Disablement Allowance) will be developed for delivery by Social Security Scotland (an executive agency set up in 2018). By April 2021, it directly administered seven separate social security benefits. (The Scottish Government count the three Best Start Grants as three separate benefits and also include the Job Start Payment which would make the total ten). Child Disability Payment is due to start as a pilot in July, bringing the total to eight by the end of this year (or eleven by the Scottish Government's count). The Scottish Milk and Healthy Snack Scheme (a form of welfare foods) is also due to start this year, but it will be run by local authorities.

The timetable for developing the new benefits has changed several times, most recently due to COVID-19. In 2022, Adult Disability Payment is due to launch and eligibility for the Scottish Child Payment is due to be extended from children under 6 to children under 16, but beyond that, revised start dates for the remaining benefits have still to be announced. The cost of developing and running the benefits has increased, mainly due to the addition of the Scottish Child Payment.

Throughout this process the Scottish Government has emphasised the need for 'safe and secure transfer' from DWP and establishing a system that treats people receiving benefits with 'dignity and respect'.

The main legal framework is the Social Security (Scotland) Act 2018. New benefits are created through regulations made under this Act. The Scottish Commission on Social Security provides independent scrutiny of the regulations. That said, a large number of devolved benefits are outwith this framework, in particular those still managed by the DWP which are still governed by the Westminster derived legislation that created them.

The budget process for devolved social security is a bit different to most other devolved areas in that the budget is mainly demand-led. Budgets are initially set based on forecasts from the Scottish Fiscal Commission and then reconciled over time to actual expenditure. The funding from the UK government is also based on forecasts (from the Office of Budget Responsibility) and reconciled over time to comparable UK Government expenditure. In order to track forecasts through to actual spending it is necessary to look across several years rather than simply consider one budget year in isolation.

Which benefits are devolved?

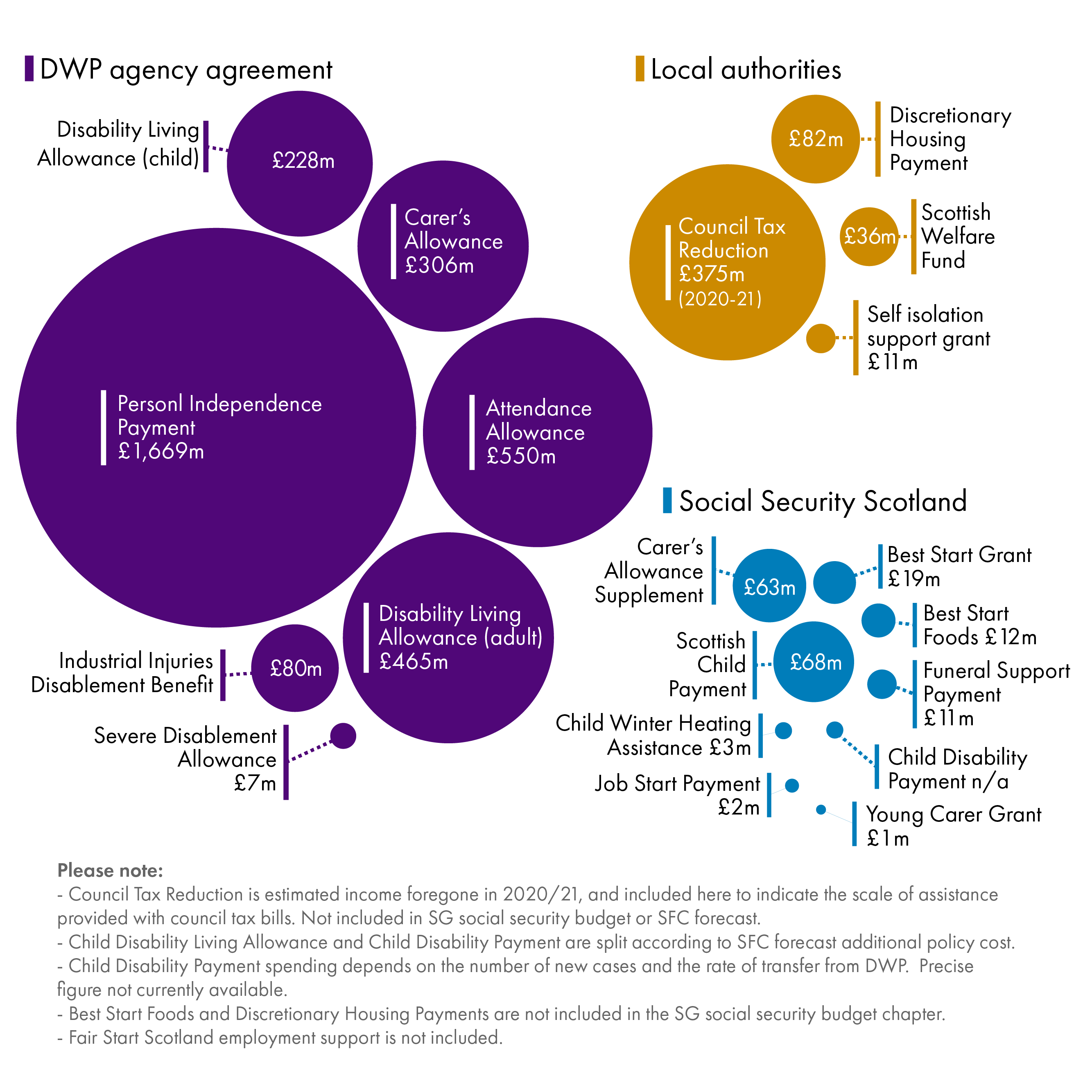

Currently, there are 18 devolved social security benefits (figure 1). Seven of these are administered by the DWP under six ‘Agency Agreements’. These seven account for around 90% of the total spend on devolved benefits (figure 2).

If Best Start Grant is treated as a single benefit, then Social Security Scotland currently (June 2021) administers another seven along with the Job Start Payment, a form of employment support. (If Best Start Grant is counted as three benefits and Job Start Payment is included as a benefit the total is ten; the Child Disability Payment, due to start in July, will make it 11 benefits).

Local authorities administer various discretionary schemes which are also defined as social security under the Scotland Act 1998. These arrangements pre-date the expansion of devolved social security in the Scotland Act 2016. The main funds are:

Scottish Welfare Fund

Discretionary Housing Payments.

They also administer the Self-isolation Support Grant. This is a new payment, introduced in response to COVID-19 and administered through the Scottish Welfare Fund.

Finally, the Department of Health and Communities administers a UK Nursery Milk Scheme. A new Scottish version, known as the Scottish Milk and Healthy Snack Scheme is due to replace the UK scheme starting this August and will be run by local authorities.

Figure 1 lists the current payments made under the Scotland Act definition of social security in order of expenditure. It notes whether they are administered by DWP, Social Security Scotland or local authorities (LA) and shows the latest data on budget and caseload.1 (See Figure 4 below for proposed future payments which will replace some of these).

| Benefit | Delivered by | Budget in 2021-22 | Forecast caseload 2021-22 000s | Brief description |

|---|---|---|---|---|

| Personal Independence Payment | DWP | £1,669m | 305 | Disability benefit applied for by working age people. Not means tested. |

| Attendance Allowance | DWP | £550m | 133 | Disability benefit for applied for by people of pension age. Not means tested. |

| Disability Living Allowance (adult) (DLA) | DWP | £465m | 92 | Disability benefit applied for by working age people. Not means tested. |

| Carer's Allowance | DWP | £306m | 89 | For carers with little or no earnings, caring for people getting certain disability benefits. |

| Disability Living Allowance (child) | DWP | £231m | 51 | Disability benefit for children. Not means tested. |

| Discretionary Housing Payments | LA | £82m | Not forecast. (See notes) | Help with housing costs for people who get Universal Credit or Housing Benefit payments for their rent. Budget limited, except where mitigating the 'bedroom tax' |

| Industrial Injuries Disablement Benefits | DWP | £80m | 19 | For people disabled or ill due to accidents or diseases at work. |

| Scottish Child Payment | Social Security Scotland | £68m | 130 | £10 per week for each child under 6 in families getting low income benefits. |

| Carer's Allowance Supplement | Social Security Scotland | £42m (not including proposed additional payment this year) | 90 | Additional payment to those getting Carer's Allowance |

| Scottish Welfare Fund | LA | £36m | Not forecast (see notes) | Grants paid in a crisis or to support people in a settled way of life. Budget limited. |

| Best Start Grant | Social Security Scotland | £19m | 63 | Grants for families on low income benefits. Paid around birth, nursery age and age of starting school. |

| Best Start Foods | Social Security Scotland | £12m | 43 | Payment card for healthy food for pregnant women and families with young children on low income benefits. |

| Self-isolation Support Grant | LA | £11m | 21 (estimated payments) | £500 for people on low incomes required to self-isolate. |

| Funeral Support Payment | Social Security Scotland | £11m | 6 | Help with funeral costs for those on low income benefits. |

| Severe Disablement Allowance | DWP | £7m | 1 | For people unable to work due to sickness or disability. Closed to new claims since 2001. |

| Nursery Milk Scheme | UK Dept. Health & Social Care | £4m | 30 | Free milk for children under 5 who attend registered daycare. |

| Child Winter Heating Assistance | Social Security Scotland | £3m | 15 | Annual payment for children getting highest care rate DLA |

| Young Carer Grant | Social Security Scotland | £1m | 3 | Annual payment for young carers who don't get Carer's Allowance, but are caring for someone who gets certain disability benefits. |

| Social work payments | LA | unknown | unknown | Includes payments to kinship carers and care leavers. |

Some payments which are not defined as social security under the Scotland Act still have a close relationship with social security. These include:

Council Tax Reduction (CTR) which replaced Council Tax Benefit in 2013. It is administered by local authorities under Scottish regulations. Legally it is not a social security benefit, but a reduction in a liability to pay tax. However, its rules and structure are almost exactly the same as Council Tax Benefit before it was abolished and are very similar to Housing Benefit. In March 2021, there were nearly 1/2 million recipients of Council Tax Reduction. 8 The number of recipients increased sharply as the economic impact of COVID-19 was felt, reaching a peak of 501,680 CTR recipients in August 2020.9

Job Start Payment is a new payment which, legally, is made under the devolution of employment support rather than social security. However, it is a cash payment provided by Social Security Scotland and is therefore included in this briefing. From its launch in August 2020 to 31 March 2021, £277,450 was issued with 1,020 applications approved.10

Finally, there is Universal CreditScottish choices. This is not a benefit but is a Scottish power to alter the way Universal Credit is paid. It is administered by the DWP. The flexibilities currently available are:

to choose to have benefits made to cover rent paid directly to the landlord

to choose more frequent payments.

There is also a power to allow the Universal Credit payment to be made to more than one bank account (i.e split payments), but discussions between the Scottish Government and DWP about how to implement this have not reached the stage of legislative proposals. Will Quince MP (Minister for Welfare Delivery) told the Scottish Affairs Committee in March that: "we are yet to find a way in which it could be operationalised at scale." 11

Which benefits are still to be devolved?

There are two benefits which, under the Scotland Act 2016, are still due to be devolved: Cold Weather Payments and the Winter Fuel Payment.

Both are currently paid under the Social Fund. Initially, regulations provided for the Social Fund to close in Scotland in April 2020, triggering the devolution of these benefits.1 In 2019, regulations amended this date to April 2022.2

The Scottish Government is now seeking a further postponement of up to two years. A letter to the Social Justice and Social Security Committee3 (1 July 2021) states that the DWP are:

no longer in a position to support the process of ‘household matching’ of data on reserved benefits via the Seasonal Payments System when the winter benefits are devolved.

The Scottish Government is asking that the Social Fund continue in Scotland for a further two years, noting that:

While our aim remains to deliver the benefits as soon as feasibly possible and I remain confident in our ability to do so, it would seem prudent to give ourselves the contingency of taking legal provision to keep the fund open to Scottish residents, as the development work proceeds.

| Benefit | Description | Spend | Caseload |

|---|---|---|---|

| Winter Fuel Payment | Annual grant for older people. Not means tested. | SFC forecast £169m in 2021-22 | c. 1 million |

| Cold Weather Payment (CWP) | Paid to people on low income benefits if local temperature drops below zero for 7 consecutive days. | Depends on the weather. Ranged from £1.7m to £20m over last five years. | c. 350,000 low income households on qualifying benefits. Actual caseload depends on the weather. |

Although these two benefits are not particularly large in terms of spending, a large number of people are eligible to receive them. That said, because payment depends on the local temperature, it would be an unusually cold winter for everyone who was on a qualifying benefit to actually receive the current CWP. This may change however, as the SNP have a manifesto commitment to replace the CWP with a Scottish benefit that pays a flat rate £50 annual payment to low income households.7

What Scottish benefits are being planned?

The Scottish Government plans to introduce another eight benefits before 2025. Seven of these are replacements for current DWP devolved benefits. The other replaces the current UK Nursery Milk Scheme.

Two schemes are due to start in 2021: the Child Disability Payment, replacing child Disability Benefit in Scotland and the new Scottish Milk and Healthy Snack Scheme which will replace the UK Nursery Milk Scheme in Scotland.

Child Disability Payment

In 2021, Child Disability Payment will start to replace child Disability Living Allowance (child DLA). The regulations were passed by the Scottish Parliament in March 2021. A pilot will start in Dundee, Perth and Kinross and the Western Isles on 26 July 2021, followed by national roll-out for new claims from 21 November 2021.1 The majority of current child DLA cases are expected to be transferred from DWP to Social Security Scotland by the end of 2022.2 This is the first major disability benefit to be paid by Social Security Scotland. The rules are largely the same as the benefit it is replacing (child DLA), although some administrative processes are expected to be different. The rules will remain similar to child DLA until all recipients in Scotland have had their cases transferred to Social Security Scotland. This is to avoid a situation where people in the same circumstances get different payments depending on whether or not they are getting the DWP or Social Security Scotland version of the benefit.

Scottish Milk and Healthy Snacks Scheme

In August 2021, the Scottish replacement for the UK Nursery Milk Scheme is due to start.1 The current scheme, run by the UK Department for Health and Communities under an Agency Agreement, will be replaced with a scheme administered by Scottish local authorities. It will fund a daily portion of plain fresh cow's milk (or specified alternative) and a healthy snack (fruit or vegetables). Its available to pre-school children spending two hours or more at regulated day care providers and childminders. Providers need to register with the scheme. Around 190,000 children are estimated to be eligible, but it is not known what take-up will be. Spending is estimated at £10 million.2

Adult Disability Payment

In 2022, the largest of all the devolved benefits (in terms of spend) is due to be converted into a Social Security Scotland payment. Adult Disability Payment will start to replace Personal Independence Payment, with a pilot in spring 2022 and national roll-out for new claims from summer 2022. A consultation1 on draft regulations ran from December 2020 to March 2021. On 25 June, the Scottish Government published its response2 and sent draft regulations to the Scottish Commission on Social Security.3

Regulations creating Adult Disability Payment are therefore expected early in the new Parliament in order that the pilot can start in spring 2022. As with Child Disability Payment, until all cases have transferred from DWP, the rules are expected to be largely the same as the DWP benefit it is replacing. As with Child Disability Payment, this is to avoid people in the same circumstances receiving different payments. However, an independent review in 2023 will consider what are changes are needed once case transfer is complete.

Scottish Child Payment extension

Scottish Child Payment was introduced in 2021, but in 2022 a major extension in eligibility is planned, from children under 6 to children under 16. There are also plans to increase the payment from £10 to £20 per child per week ‘over the course of this parliament.’1 This benefit is closely linked to the Scottish Government’s strategy for tackling child poverty and, in 2019, modelling suggested it could reduce child poverty by three percentage points.2

Timetable changes

The timetable for social security has changed several times over the last few years. At the time of writing, there is no detailed timetable beyond the launch of Adult Disability Payment and extension of the Scottish Child Payment next year. The Scottish Government has a strong focus on 'safe and secure transfer' which means that people must be able to get their regular payments as the systems change from DWP to Social Security Scotland.

Previous timetable changes

Regulations made under the Scotland Act 2016 provided for devolution of social security by April 2020. However, when the first detailed timetable was announced in February 2019,1 the plan was to complete the full programme by 2024 with any 'gaps' filled by using Agency Agreements. In June 2019, the timetable was revised in order to fit in Scottish Child Payment. This would have seen all the Social Security Scotland benefits launched for new claims by 2022 and completion of the full programme by 2025.2 The following year this was disrupted due to COVID-19. A revised timetable for Child and Adult Disability Payments was announced in November 20203 but, at time of writing, there has been no announcement on the other benefits. As at November 2020, the Scottish Government still expected to complete the programme, including all case transfers from the DWP, by 2025.4

Current timetable

Figure 4 below sets out the timetable as at June 2021 for the introduction of Scottish versions of current UK-wide benefits. As mentioned, there are no plans to replace Severe Disablement Allowance which, although devolved, will remain with DWP.1 The Scottish Government has published a collection of policy position papers in 2019 and 20202 setting out their plans for devolved benefits.

| Benefit | Description | Start date |

|---|---|---|

| Child Disability Payment | Replacing child DLA | Pilot from 26 July 2021. National roll-out for new claims November 2021. Transfer of most child DLA cases by end 2022. |

| Scottish Milk and Healthy Snack Scheme | Replacing UK Nursery Milk Scheme | August 2021 |

| Adult Disability Payment | Replacing PIP | Pilot in Spring 2022. National roll-out for new claims Summer 2022. |

| Winter Heating Assistance | Replacing Winter Fuel Payment | TBC, but before 2025 |

| Cold Spell Heating Assistance | Replacing Cold Weather Payment | TBC, but before 2025 |

| Pension Age Disability Assistance | Replacing Attendance Allowance | TBC, but before 2025 |

| Scottish Carer's Assistance | Replacing Carer's Allowance | TBC, but before 2025 |

| Employment Injury Assistance | Replacing Industrial Injuries Disablement benefits | TBC, but before 2025 |

New proposals

SNP manifesto commitments1 on social security include:

increase the Best Start Foods payment from £4.25 to £4.50 per week and extend eligibility to all those getting Universal Credit. Regulations have already been laid to increase the payment amount.2 However, they only increase the income threshold slightly rather than removing it as proposed in the manifesto. Regulations to remove the income thresholds in line with the manifesto commitment will be brought later in the parliamentary session.

double the December 2021 Carer's Allowance Supplement payment. A bill has already been introduced to provide for this.

provide £520 p.a. to children in receipt of free school meals until the roll out of the SCP is complete. This will include a £100 payment 'near the start of the summer holidays'3

increase the Scottish Child Payment to £20 ‘over the course of the parliament’

introduce a flat rate annual ‘winter heating payment’ of £50 for low income households in place of the Cold Weather Payment

explore the possibility of a Minimum Income Guarantee

introduce a care leaver grant of £200 per year for care leavers from the age of 16 to 26

provide £12 million for advice services in 2022

review the Scottish Welfare Fund

additional payments for carers of more than one disabled person

pay Carer’s Assistance for 12 weeks instead of 8 following the death of a cared for person.

Developing Scottish benefits

Benefits are developed within the Scottish Government Social Security Directorate before being handed over to Social Security Scotland for delivery.

Cost of developing benefits

The estimates of implementation costs for the Programme have more than doubled since the 2017 Financial Memorandum to the Social Security (Scotland) Bill. Reasons given in a Programme Business Case1 for this increase are:

new policy such as the Scottish Child Payment, Young Carer Grant and Job Start Payment

complexities of delivering ‘safely and securely’

costs that could not be forecast accurately at the time, such as the likely cost of DWP recharges.

The Financial Memorandum was clear that the figures given at that time were only initial estimates which could change materially, and that firm estimates of cost would only become clear as the key decisions are taken.

In February 2020, implementation costs were estimated at £651 million over seven years (2018-19 to 2024-5). Figure 5 below compares this to the initial estimate of £308 million over four years.

| Financial Memorandum in 2017 (£m) | Business Case in 2020 (£m) | |

|---|---|---|

| Time period | Four years to 2020-21 | Seven years to 2024-25 |

| Staff | £104 | £350 |

| Estates | £14 | £11 |

| Technology | £190 | £212 |

| Other | n/a | £78 |

| Total | £308 | £651 |

A more detailed breakdown is available at tables 5.6 and 5.7 of the Programme Business Case.1 It also describes the management and governance arrangements, including a discussion of how risk is treated.

Commenting on the figures estimated in the Programme Business Case, the then Cabinet Secretary for Social Security and Older People, Shirley-Anne Somerville MSP, noted in January 2021 that the expected overall costs remained at the level estimated in February 2020:

We do not expect the overall cost of the programme or, indeed, of Social Security Scotland to increase, but you will see a difference in the phasing

Scottish Parliament. (2021, January 21). Social Security Committee Official Report. Retrieved from http://archive2021.parliament.scot/parliamentarybusiness/report.aspx?r=13146&mode=pdf [accessed 27 May 2021]

Approach to developing benefits

One of the statutory principles of Scottish social security is that: 'the Scottish social security system is to be designed with the people of Scotland on the basis of evidence.'i

The Scottish Government set up Experience Panels to ensure that people with 'lived experience' contribute to the development of Scottish benefits. Over 2,400 have been involved. An overview of their work is available in their publications and annual reports.

The Scottish Government also involve other stakeholders and experts. (A list of government groups is available at:https://www.gov.scot/groups/).In particular, the 'Disability and Carer Benefits Expert Advisory Group' has provided detailed advice to the Scottish Government. Among other groups set up are ones to advise on terminal illness rules and on the Best Start Grant.

Social Security Scotland

The new benefits are being delivered by Social Security Scotland, an executive agency created in 2018. It's head office is in Dundee with a second base in Glasgow. It is also developing local services which are due to start this year. The Programme Business Case estimated that:

Once fully operational, Social Security Scotland will administer the devolved benefits, supporting 1.8 million people and providing over approximately £4.0 billion in payments every year. Once all of the benefits have been introduced, it is estimated that it will employ 1,900 people with headquarters in Dundee, an office in Glasgow and 400 people located in communities across Scotland delivering face-to-face support to those who need it.

Scottish Government. (2020). Social Security Programme revised business case - update February 2020. Retrieved from https://www.gov.scot/binaries/content/documents/govscot/publications/research-and-analysis/2020/02/social-security-programme-business-case-executive-summary/documents/social-security-programme-pmo-business-cases-sspbc-version-4/social-security-programme-pmo-business-cases-sspbc-version-4/govscot%3Adocument/social-security-programme-pmo-business-cases-sspbc-version-4.pdf [accessed 27 May 2021]

Its Corporate Plan notes that:

The pace, scale and scope of our growth and change over the next three years will be huge. This covers everything, from the number of buildings we work in to the number of people we employ, the job roles that we will need and the nature of the support that we provide.

Social Security Scotland. (2021). Corporate Plan 2020 - 23. Available at: https://www.socialsecurity.gov.scot/asset-storage/production/downloads/Corporate-Plan-2020-2023-ISBN-978-1-80004-391-6.pdf. (n.p.): (n.p.).

By March 2021, the agency had 1,136 directly employed staff (1,102 FTE) and 349 ‘contingent’ workers. (This includes consultants, contractor staff, interim managers, inward secondment, UK fast stream and short-term youth employment initiatives).3

Operating costs

In its early years, Social Security Scotland has a relatively high administrative budget compared to what it will be once in 'steady state'. This is because it is preparing systems for benefits that haven’t started yet.

Social Security Scotland’s operating budget for 2021-22 is £271 million.1 Of this £84 million is for benefits managed by DWP under Agency Agreements. There is also £22 million for capital. This leaves £165 million for preparations to administer new benefits and the administration of those benefits run on a day to day basis by Social Security Scotland. The majority of this (£125m) is staff costs.2

Not including Child Disability Payment (CDP), forecast spend on these directly administered benefits in 2021-22 is £155 million. Spending on CDP depends on how quickly cases are transferred from child Disability Living Allowance. As combined spending on both benefits is expected to be £231 million this year this suggests that spending on benefits directly administered by Social Security Scotland will be between £155 million and £368 million this year. Devolved benefits administered by the DWP are also paid for by Social Security Scotland, as part of the Scottish budget.

In February 2021, the then Cabinet Secretary explained to the then Social Security Committee:

On why the agency will cost more next year, I go back to the point that it will do more and it will take on functions that were previously within the Scottish Government, such as the chief digital officer’s division. That is the reason for the increases. They are to do with staff costs, the ability to build the agency, and everything that goes with the staff, including training, equipment, facilities and workspaces.

Scottish Parliament. (2021, February 18). Social Security Committee Official Report. Retrieved from http://archive2021.parliament.scot/parliamentarybusiness/report.aspx?r=13146&mode=pdf [accessed 27 May 2021]

As new benefits become established, operating costs are expected to settle into to a ‘steady state’. The Financial Memorandum in 2017 estimated this 'steady state' to be between £144 million and £156 million per annum. Uprated for inflation this is £175-£190 million. The Programme Business Case in 2020 updated this to between £193 and £208 million per annum. This increase in running costs was mainly due to the introduction of Scottish Child Payment.

These operating costs should be considered in the context of the agency eventually administering around £4 billion of benefit payments. The expectation is that:

under steady state, our cost of administration would be around 5 per cent of the benefits administered.

Scottish Parliament. (2021, January 21). Social Security Committee Official Report. Retrieved from http://archive2021.parliament.scot/parliamentarybusiness/report.aspx?r=13146&mode=pdf [accessed 27 May 2021]

Dignity and respect

Aside from the cost, an equally important part of delivery is how clients are treated by the organisation. From the beginning the focus has been on ‘dignity, fairness and respect’. The Social Security Charter sets out expectations and a Charter Measurement Framework (2019) provides the analytical framework which will capture how Social Security Scotland is delivering against the Charter. The first report was published in December 2020.1

Maximising take-up

There are various statutory duties intended to assist people access their entitlements.

The Scottish Government has a statutory duty to have a benefit take-up strategy.i The first was published in October 2019 and a second is due in October 2021. When someone applies for a Scottish benefit, there is also a duty on Scottish Ministers (i.e Social Security Scotland) to inform the applicant of any other Scottish social security that they may be eligible for.ii Social Security Scotland's ‘pre-claims support service’ will provide face to face support locally. This is expected to start in summer to autumn 2021. Their corporate plan noted:

We are rolling out claims advice and support across Scotland, putting staff in every local authority area and basing them in places that people from the area already visit.

Social Security Scotland. (2021). Corporate Plan 2020 - 23. Available at: https://www.socialsecurity.gov.scot/asset-storage/production/downloads/Corporate-Plan-2020-2023-ISBN-978-1-80004-391-6.pdf. (n.p.): (n.p.).

The Social Security (Scotland) Act 2018 also requires an independent advocacy service to be available for disabled people who need support to apply for Scottish benefits.iii An interim service was launched in July 2020. The contract for the full service is out to tender until 28 June 2021.2 An important part of ensuring someone gets the benefits they are entitled to is the ability to challenge decisions. For most Social Security Scotland benefits, if someone is unhappy with a benefit decision they can ask Social Security Scotland for a ‘redetermination’ and, if that does not resolve the issue, appeal to the Social Security Chamber of the First-tier Tribunal for Scotland. However, Best Start Foods can be reviewed but not appealed; Carer's Allowance Supplement can only be appealed if it's claimed from abroad.

Information on applying for Scottish benefits is available at https://www.mygov.scot/browse/benefits

DWP and devolved benefits

Close working between DWP and the Scottish Government is essential to ensuring ‘safe and secure transfer’ of devolved benefits.

The connections between reserved and devolved benefits means that, even after the current programme is complete, Social Security Scotland and the DWP will continue to rely on each others’ data and administrative systems to ensure the smooth running of social security.

At ministerial level, the Joint Ministerial Working Group provides a forum for discussion.

As mentioned, the Scottish Government has Agency Agreements with DWP to deliver devolved benefits on its behalf while the Social Security Scotland benefits that will replace them are being developed. In 2021-22, these are expected to cost £84 million. Costs will reduce as more benefits are transferred to Social Security Scotland.1

The Scottish Government are also reliant on DWP for:

administering Universal Credit Scottish Choices

providing data on entitlement to reserved low income benefits. Most current Social Security Scotland benefits are for people who already get low income benefits from DWP or HMRC.

The Scottish Parliament needs to mirror Westminster legislative changes to ensure the same rules apply in Scotland and the rest of Great Britain while Agency Agreements are in place.

It is also important that Scottish benefits are taken into account in the rules for reserved benefits. The fifth annual report on the Scotland Acts notes that:

Close working continues to support the feasibility and design of the proposed Scottish replacement benefits, ensuring they work with the DWP systems and benefits they will interact with.

Secretary of State for Scotland. (2021). Fifth annual report on the implementation of the Scotland Act 2016. Retrieved from https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/972963/Fifth_Annual_Report_on_the_implementation_of_the_Scotland_Act_2016_and_Ninth_Annual_Report_on_the_implementation_and_operation_of_part_3__financial_provisions__of_the_Scotland_Act_2012.pdf [accessed 27 May 2021]

The legislative framework

Scottish social security has been set up so that most new benefits are created through regulations rather than Acts of the Scottish Parliament. This affects how they are scrutinised in the Parliament. This section explains the legislative framework and sets out which benefits are within it and which are not.

Scotland Act 1998

Devolved social security is defined by the ‘exceptions to the reservation’ of social security in Head F of Schedule 5 to the Scotland Act 1998.1 This sets out 10 exceptions to the general rule that social security is reserved. The Scottish Parliament can pass legislation within this overall framework of what is not reserved.

Social Security (Scotland) Act 2018

The Social Security (Scotland) Act 2018 (the 2018 Act) sets out the framework for most Scottish social security. It sets up types of ‘social security assistance’ corresponding to the areas of social security devolved by the Scotland Act 2016. Individual benefits are created through regulations under each type. The table below sets out the nine types of assistance and the six benefits created to date under this scheme.

| 2018 Act types of 'assistance' | Benefits created to date |

|---|---|

| Carer's assistance | Young Carer Grant |

| Cold spell heating assistance | None |

| Winter heating assistance | Child Winter Heating Assistance |

| Disability assistance | Child Disability Payment |

| Early years assistance | Best Start Grant |

| Employment injury assistance | None |

| Funeral expense assistance | Funeral Support Payment |

| Housing assistance | None |

| Short term assistance | Short Term Assistance |

Some benefits are created under the 2018 Act but not under this general ‘assistance’ framework. These are:

Carer’s Allowance Supplement, made under section 81 of the 2018 Act.

Scottish Child Payment, regulations made under section 79 of the 2018 Act, the ‘top-up powers’.

Benefits created by regulations under the 2018 Act are scrutinised by the Scottish Commission on Social Security (SCoSS) as part of a ‘super-affirmative’ procedure set out in s.97, 2018 Act. This requires that:

draft regulations are made available publicly before regulations are laid in the Parliament

SCoSS reports on draft regulations

the Scottish Government publishes its response to SCoSS when regulations are laid in the Parliament.

Once laid, the regulations are treated under the normal affirmative procedure which means a motion whether to approve the regulations is taken 40 days after the regulations are laid.

Other devolved benefits have been created under entirely different legislation and are not scrutinised by SCoSS.

Devolved benefits created under other legislation

Scottish benefits created under legislation other than the Social Security (Scotland) Act 2018 are listed below:

Best Start Foods – regulations made under section 13 Social Security Act 1988

Scottish Milk and Healthy Snack Scheme – regulations made under section 13 Social Security Act 1988 as amended

Self-isolation Support Grant – made partly as a form of Crisis Grant under the Scottish Welfare Fund and, for those with no recourse to public funds, payments are made under the Public Health (Scotland) Act 2008

Universal Credit Scottish Choices – regulations made under section 30 Scotland Act 2016

Scottish Welfare Fund – regulationsmade under the Welfare Funds (Scotland) Act 2015

Discretionary Housing Payments – despite provision in Part 5 of the 2018 Act for DHPs, they continue to be made under the Discretionary Financial Assistance regulations 2001

Devolved benefits administered by DWP continue to have their legislative basis in the UK legislation that created them. For example, PIP in Scotland is now devolved, but the relevant legislation is still regulations made under the Welfare Reform Act 2012 and it is still run by the DWP. Regulations making changes to these Agency Agreement benefits come to the Scottish Parliament as Scottish Statutory Instruments. For example, a recent change to PIP and industrial injuries disability benefits allowed for assessments to be done by phone or video.

Part of the Agency Agreement is that the Scottish Government will not diverge from UK government policy where benefits are delivered by DWP for the duration of the Agency Agreement.

The budget process for benefit spending

Social security is mainly demand-led, which calls for a different approach to budgeting compared to some other policy areas.

The Scottish Government’s social security budget is based on forecasts made by the Scottish Fiscal Commission (SFC). The budget is then adjusted throughout the year to reflect actual expenditure. As a demand-led budget, it is not subject to spending limits in the normal way. The accuracy of forecasts is therefore crucial but forecasts are always uncertain.

The SFC normally publish forecasts twice a year, in May and December. In 2021, because of the election their next forecast will be published on 26 August.1

The SFC also publish policy costings for new benefits. The next new costing will be for the Adult Disability Payment.

Funding Scottish social security

The Scottish Government receives money from the UK Government in recognition of social security devolution. The arrangements are set out in the Fiscal Framework. The method used is described in detail in the fiscal framework technical note.

Very briefly, the Scottish block grant is increased to reflect what would probably have been spent on the relevant benefits if they’d remained with DWP. This ‘Block Grant Adjustment’ is used for six of the devolved benefits.i It is initially set based on forecasts by the Office for Budget Responsibility (OBR). It is then reconciled, first as forecasts are updated and then a second time once outturn data is available.

Tracking funding and spending

The two processes (funding based on OBR forecasts and Scottish social security budgets based on SFC forecasts) introduce complexity to scrutinising the social security budget. The fact that both are based on forecasts which are later reconciled to outturn data make it worth looking at the social security budget across several years. For example, Carer’s Allowance in 2019-20 was forecast in December 2018 but was not finally reconciled to outturn until the 2021-22 Scottish Government budget.

The table below shows that, when the draft budget for 2019-20 was published in December 2018, the SFC forecast that £283 million would be spent on Carer’s Allowance in Scotland. The OBR's forecasts when applied to the fiscal framework calculation meant that the Scottish Government received a £290 million initial Block Grant Adjustment (BGA) to fund it.

Forecasts were updated in 2019 and, by December 2020, it was clear that, in fact, £279 million had been spent on Carer’s Allowance in Scotland and the Scottish Government received a final BGA of £283 million from the UK Government to fund it.

Overall, even though the final BGA was £7 million less than the initial BGA, actual spending was also lower than forecast (by £4 million). The outturn BGA compared with the outturn on Social Security Scotland spending shows that the Scottish Government received £4 million more in funding than it paid out in Carer's Allowance.

| BGA (funding) | Social Security portfolio budget (spending) | Difference (BGA - forecast spend) | |

|---|---|---|---|

| Initial forecast - autumn/winter 2018 | £290mOBR Forecast October 2018 | £283mSFC Forecast December 2018 | +£7m |

| Updated forecast - spring 2019 | £287mOBR update March 2019 | £286mSFC update May 2019 | +£1m |

| Outturn - winter 2020-21 | £283mMedium term financial strategy | £279mSocial Security Scotland annual report | +£4m |

| Difference initial to outturn | -£7m | -£4m |

This process is repeated for each year and for each benefit that has a Block Grant Adjustment.

This makes tracking budget against spend and comparing that to the funding received from the UK government quite a complex and long term task. In addition to the SFC and OBR forecasts, other useful documents for tracking these movements over time are the Scottish Government's Medium term financial strategy and the Fiscal framework data annex (last updated January 2021).

The above process relates only to the amount paid out in benefits. The budget for administration is set in the normal way.