Local Government Finance: Budget 2021-22 and provisional allocations to local authorities

This briefing focuses on both the overall local government budget for 2021-22, and the provisional allocations to local authorities. Another briefing has been published by SPICe, covering the overall Budget 2021-22.

Executive Summary

This briefing sets out a summary and analysis of the local government budget for 2021-22, and the provisional allocations to local authorities.

The Cabinet Secretary for Finance, in her statement on 28 January 20211, set out the Scottish Government’s position on the local government budget, explaining that additional funding combined:

takes the increase for core revenue services to £335.6 million and when added to the non-recurring COVID funding of £259 million, provides a total increase for local government of £594.6 million in 2021-22.

Scottish Government. (2021, January 28). Budget Statement: 2021-22. Retrieved from https://www.gov.scot/publications/budget-statement-2021-22/ [accessed 2 February 2021]

As ever with the local government budget, there are a wide range of interpretations that can be produced, depending on what is included in the calculation.

First, using the numbers in the Budget document:

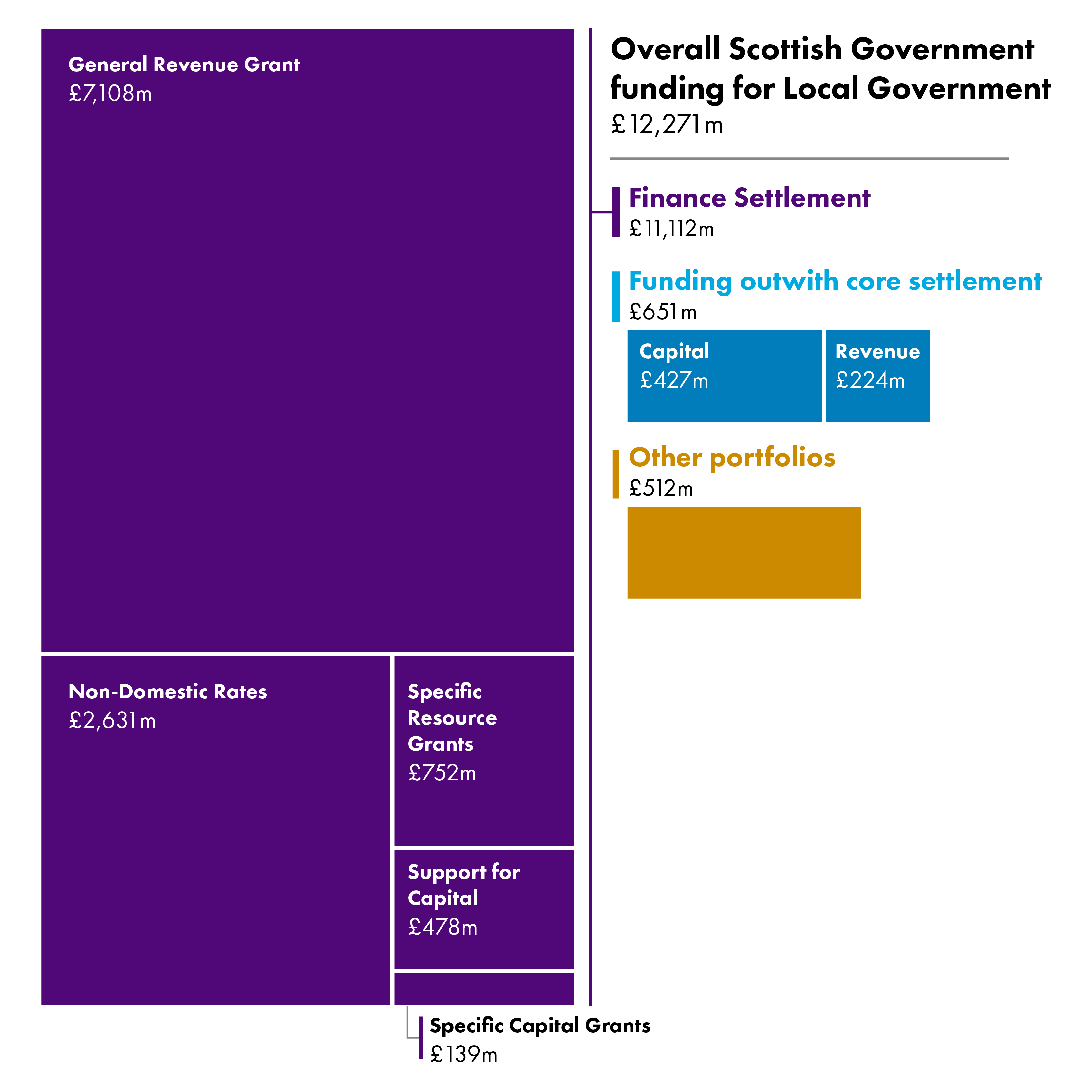

The total allocation to local government in the 2021-22 Budget is £11,108.2 million. This is mostly made up of General Revenue Grant (GRG) and Non-Domestic Rates Income (NDRI), with smaller amounts for General Capital Grant and Specific (or ring-fenced) Resource and Capital grants.

Once Revenue funding within other portfolios (but still within the totals in the Finance Circular) is included, the total is £11,620.4 million.

Once a number of funding streams attached to particular portfolio policy initiatives, but outside the totals in the Circular are included, the total rises to £12,270.8 million.

Within these global headline figures, the breakdown between different interpretations for revenue and capital, and the year to year change, has been subject of much parliamentary debate in recent years. The following sections set out these figures.

Revenue funding

The Scottish Government guarantees the combined GRG and distributable NDRI figure, approved by Parliament, to each local authority. If NDRI is lower than forecast, this is compensated for by an increase in GRG and vice versa.

Breaking down the figures in the Scottish Budget document we get the following figures:

This combined GRG+NDRI figure only (i.e. the amount of money to deliver services over which local authorities have control) increases by 1.9% in cash terms, or £185.8 million.

Once specific, ring fenced resource grants are included, then the combined figure for the resource budget increases by 2.5% in cash terms, or by £252.2 million.

With the additional £259 million announced for the allocation of Covid consequentials added to this, the additional funding increases to £511.20 million.

To get the £594.6 million figure quoted in the Cabinet Secretary’s statement, the Total revenue within other Portfolios is added to this combined sum. The Scottish Government has described this as an increase of £335.6m, or 3.1%, when looking at the overall budget to budget settlement.

Capital

Alongside the revenue budget, used to pay for public services, local government also receives a capital budget, again made up of general (i.e. discretionary) and specific (i.e. ring-fenced) grants. Overall, the total capital budget sees a decrease in cash terms this year, of -20.7% or by £161 million. This is mostly driven by a decrease in non-recurrent specific capital grants, with support for capital remaining relatively static with an increase of 2.2%, following a significant decrease between 2019-20 and 2020-21 .

Comparison to Scottish Government budget

Looking at the historic allocations to local government, compared to the Scottish Government's allocation from the UK Government, from 2013-14 to 2021-22, local government total revenue reduced by 2.4% in real terms (or -£276 million). The Scottish Government's fiscal resource budget limit from HM Treasury, plus NDRI, increased in real terms over the same period, by 3.1% (or £1,013.9 million).

Between 2013-14 and 2021-22, the local government revenue budget as a share of the Scottish Government equivalent reduced by 1.9 percentage point, from 34.7% to 32.8%.

COSLA's response to the local government settlement

In its response, COSLA drew attention to ongoing pressures faced by local authorities and highlighted that additional funding was"predominantly for Government priorities.":

We welcome elements of today’s announcement but overall this budget falls short of what we would consider a fair settlement for Local Government.

COSLA. (2021, January 28). Budget Response 2021-22. Retrieved from https://www.cosla.gov.uk/news/2021/cosla-budget-response-january-2021 [accessed 2 February 2021]

In COSLA's Budget Reality 2021-22 document4, released alongside its statement on the Budget, COSLA argues that, in comparison to the asks in its pre-Budget document, Respect our communities: protect our funding5, the settlement "represents a shortfall" of:

£362 million in core revenue funding.

£20 million in core capital funding, and

£511 million in non-recurring COVID-19 funding.

Council Tax

During her Budget announcement the Cabinet Secretary confirmed that, subject to approval from local authorities, Council Tax would again be in effect frozen. £90 million would be made available to councils to compensate for this, which would be equivalent to around a 3% increase.

Non-Domestic Rates

The Scottish Government introduced a 100% rates relief for retail, hospitality and leisure businesses for 2020-21, which was due to be in place until 31 March 20216. As part of the Budget statement, the Cabinet Secretary announced (noting that the UK Government had not yet announced an extension) that this would be extended for a further three months, potentially further should the UK Government take similar action (resulting in Barnett consequentials).

In addition to this relief extension, the Cabinet Secretary announced that the poundage rate for Non-Domestic Rates would be reduced by 0.8p to 49p, making it the lowest poundage rate in the UK.

Understanding the local government budget

Funding for local authorities in Scotland is drawn from a number of sources, but by far the greatest portion of funding comes from the settlement from the Scottish Government.

In 2020-21, the Scottish Government Budget1 was announced prior to the UK Government Budget, which was explored at the time in a SPICe Blog on the revised timetable2. Due to the ongoing COVID-19 pandemic, the timetable for 2021-22 is similar, with the Scottish Budget being announced on 28 January 2021 and the UK Government Budget being announced on 3 March 2021.

This creates additional challenges where the local government funding settlement is concerned. The Scottish Government needs to provide certainty about funding to Scottish public bodies for the next financial year. In the case of local government, under the Local Government Finance Act 19923, there is a requirement on local authorities to set their council tax for the next year before 11 March.

Concerns around the protection of large pockets of revenue funding has been an increasing source of debate in recent years, and is likely to again be a discussion point for the 2021-22 Budget.

Presenting the figures

As covered in previous SPICe briefings on the Scottish Government Budget and local government finance settlement, the presentation of figures in the Budget and associated documents has changed over time.

Presentation of the headline figures for local government can be complicated by:

Which number is used for presenting the Scottish Government's direct grants to local authorities. For instance, taking any of the approaches below could result in a very different presentation:

the "Total Local Government" line (which includes capital, and specific, ring-fenced grants)

the sum of "General Resource Grant + Non-Domestic Rates Income"

or the "Total Revenue" line from the Finance Circular.

Whether figures are presented in cash or real terms, and the approach taken to real terms calculations.

Whether figures for "Total Estimated Expenditure" are used, which also include income raised from Council Tax.

Whether "Revenue funding within other Portfolios" is included, such as funding for Health and Social Care.

And finally, which financial year is used as the base year in calculations.

Taken together, different combinations of these issues can lead to huge variations in the headline £ million and percentage change figures that are presented.

The local government funding formula

The Scottish Government estimates how much local government needs to fund the services it provides. It then applies a needs-based formula to allocate the total available funding. Once these initial allocations are calculated, the Scottish Government adjusts these initial figures using the Main Funding Floor, to ensure that no council is disproportionately disadvantaged in its year-on-year funding allocations. This provides those local authorities with reducing need an opportunity to reduce their spending to match their reducing funding. From this total, Council Tax income, Distributable Non-Domestic Rates income, and specific revenue grants are deducted to obtain the General Resource Grant (GRG), which together with the Distributable Non-Domestic Rates income makes up the guaranteed non-ring-fenced funding the Scottish Government provides to local government. A further funding floor is applied to ensure that no local authority receives less than 85% of the Scottish average of per head Revenue funding, and finally, a figure for Distributable revenue funding is reached.

The Scottish Government agrees with COSLA the Total Revenue funding that will be made available for the duration of the Spending Review. However, in recent years, the Draft Budget has been presented as a single-year budget. This is the same for the 2021-22 Budget, which is to be expected given that 2021 is a Scottish Parliament election year and the uncertainty around how long COVID-19 mitigation measures will need to be in place.

The funding formula for local government is set out in full in the 'Green Book' for Grant Aided Expenditure1, and the local government funding formula, as well as how the Scottish Government takes into account income from Council Tax and Non-Domestic Rates, is discussed in detail in the SPICe briefing Local Government Finance: The funding formula and local taxation income2.

Specific 2021-22 challenges - COVID-19 and inflation

In 2021-22 there are two challenges at the outset of the budget which will make year-on-year comparisons complicated.

When looking at overall totals for entirety of Local Government revenue funding, which the Scottish Government typically does during its Budget announcement, there will be complications arising from the inclusion of COVID-19 funding. In 2021-22, and to some extent in 2020-21, the total funding for local authorities as described in Budget statements will be skewed from previous years because of large amounts of additional funding being routed through local authorities to tackle the COVID-19 pandemic (for instance, £259 million in 2021-22). In future, care will need to be taken to look only at figures which exclude COVID-19 funding.

The second challenge lies with making real terms comparisons of figures.

The GDP deflator is a measure of general price inflation in the domestic economy, and what we use to calculate real terms prices. HM Treasury produce the GDP deflator using data from the Office of National Statistics (ONS).

The ONS produce two different measures of GDP; current prices and constant prices. The ratio of these two different measures is the movement in prices over time. By combining measures of hundreds of different deflators, the GDP deflator can give a broad measure of inflation across the economy. This is used to calculate the real terms change in public spending. COVID-19 has had a significant impact on measurements of Government consumption, which has in turn meant that the forecasts for the GDP deflator in 2020-21 and 2021-22 look a little odd.

In short, the issue is that with any comparisons that include the real terms change in either 2020-21 or 2021-22, but not both, the real terms calculation is being skewed by either the large positive 2020-21 deflator or the negative 2021-22 deflator.

In our analysis we have decided in most instances to use the cash terms figures when calculating changes in spending, as introducing an alternative real terms calculation is likely to cause confusion. The one exception to this is in our section comparing local government and Scottish Government historic changes between 2013-14 and 2021-22, as this can be done without using 2020-21 deflators. Members should be cautious when making any real terms comparisons, particularly if only looking at the change in this years' spending plans, to avoid possible confusion about the true scale of any increase. For more detail on this see our main briefing on the Scottish Budget 2021-221.

Budget 2020-21 - Local government funding

Local government total allocations

The total allocation to local government in the 2021-22 Budget is £11,108.2 million. This is mostly made up of General Revenue Grant (GRG) and Non-Domestic Rates Income (NDRI), with smaller amounts for General Capital Grant and Specific (or ring-fenced) Resource and Capital grants.

Once Revenue funding within other portfolios (but still within the totals in the Finance Circular) is included, the total is £11,620.4 million. Further, once a number of funding streams attached to particular portfolio policy initiatives, but outside the totals in the Circular are included, the total rises to £12,270.8 million. Figure 1 below illustrates these different funding streams.

Of course, aside from government grant, Non-Domestic Rates Income, and income from Council Tax, local authorities also receive a range of other income, mainly from sales, and fees and charges for services. However, while this is an important part of the bigger picture of local authority finance, this other income does not play a part in the annual budget process. In addition, amounts are generally not known until outturn data is available, often around a year after the end of the fiscal year in question. For 2021-22 (as will have been the case in 2020-21), it is expected that, due to lockdowns and other measures aimed at slowing the spread of COVID-19, income from sales, fees and charges will be much lower than in other years - COSLA suggested that this could be as much as £90 million in its pre-Budget document, Respect our communities: protect our funding1.

Central and local government, and different political parties, will have different preferences for what to include when discussing funding for local government. In this briefing, as before, SPICe has set out how different figures are arrived at, to allow for the greatest transparency in parliamentary scrutiny. For further detail, Annex table 2 shows a breakdown of calculations connected to the figures in the Cabinet Secretary's Budget statement to make it clear where these figures are sourced.

Our approach

In the total allocations section, we set out the different totals for local government. However, in the remainder of this section of the briefing, which focuses on the year on year change figures, we concentrate on the numbers within the central local government budget - that is, the breakdown of the £11,108.2 million figure in the table "Total LG Funding in 2021-22" of the Budget1, and the headline numbers in the Local Government Finance Circular2.

The Scottish Government guarantees the combined GRG and distributable NDRI figure, approved by Parliament, to each local authority. If NDRI is lower than forecast, this is compensated for by an increase in GRG and vice versa. Therefore, to calculate Local Government's Revenue settlement, the combined GRG + NDRI figure is used (rather than just GRG). Further detail on NDRI within the Budget 2020-21 can be found in the main SPICe briefing on the Budget 2021-223.

This briefing, reflecting recent changes to the Budget process and in line with the Scottish Government's presentation, compares Budget 2021-22 figures to those 2020-21 figures presented in the Budget document1. Individual allocations to local authorities are compared to the local government finance circular published in February 20205.

In this briefing we sometimes refer to the "core" revenue settlement. We use this as shorthand to refer to the discretionary element of the local government revenue settlement - i.e. the amount of money to deliver services over which local authorities have control. There is no agreed definition of what constitutes the "core" - COSLA in "Fair Funding for Essential Services 2019-20"6 goes into detail on its view of the core budget, and makes a clear distinction between "core" and "initiative" funding, a point reiterated in latter years. However, the Scottish Government's view is that core revenue funding should include specific, ring-fenced grants, in addition to GRG and NDRI as this also provides funding to support delivery of core services such as education.

Change in the local government budget from 2020-21

Headline figures

Revenue, or resource, funding, is used by local authorities to deliver services. While local authorities appear to have discretion over much of this side of the budget, some areas of the budget are “ring-fenced” for a specific purpose. As well as these specific, ring-fenced areas, there is also a debate about how much of the “discretionary” budget is actually fully under the control of local government, and how much is allocated to Scottish Government priorities.

The Cabinet Secretary for Finance, in her Budget Statement, said of the revenue settlement:

Local Government had been at the forefront of our response to Covid. And I remain extremely grateful to Local Government colleagues, many of whom have worked night and day to manage grant funding, welfare support and maintain statutory services throughout lockdown.

We will make available to local government a total funding package amounting to £11.6 billion for 2021-22, including a £245.6 million increase in core revenue funding and an additional £259 million of non-recurring Covid funding. That is a total additional revenue funding of more than half a billion pounds.

...

That takes the increase for core revenue services to £335.6 million and when added to the non-recurring COVID funding of £259 million, provides a total increase for local government of £594.6 million in 2021-22. I have also confirmed a further increase of £110 million over previously announced plans for the lost income scheme for local government.

Scottish Government. (2021, January 28). Budget Statement: 2021-22. Retrieved from https://www.gov.scot/publications/budget-statement-2021-22/ [accessed 2 February 2021]

The Scottish Government guarantees the combined GRG and distributable NDRI figure, approved by Parliament, to each local authority. If NDRI is lower than forecast, this is compensated for by an increase in GRG and vice versa.

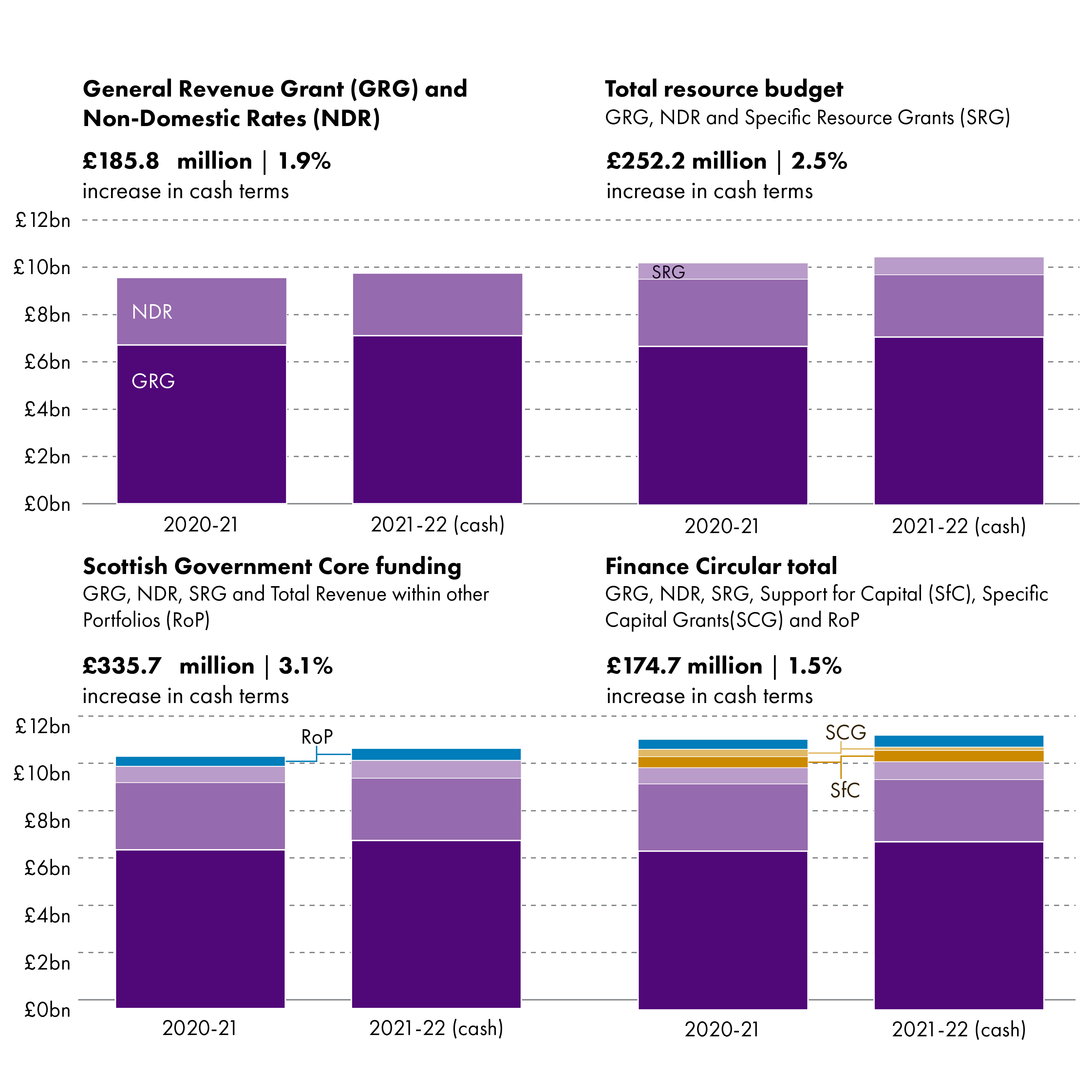

This combined GRG+NDRI figure only (i.e. the amount of money to deliver services over which local authorities have control) increases by 1.9% in cash terms, or £185.8 million.

Once specific, ring fenced resource grants are included, then the combined figure for the resource budget increases by 2.5% in cash terms, or by £252.2 million.

With the additional £259 million announced for the allocation of COVID-19 consequentials added to this, the additional funding increases to £511.20 million.

To get the £594.6 million figure quoted in the Cabinet Secretary’s statement1, the Total revenue within other Portfolios is added to this combined sum. The Scottish Government has described this as an increase of £335.6m, or 3.1%, when looking at the overall budget to budget settlement.

Figure 2 shows how the different elements of the local government budget have changed from 2020-21 to 2021-22, in line with the headline figures above, the Scottish Government's statement, and in the finance circular figure set out in the Budget document.

Alongside the revenue budget, used to pay for public services, local government also receives a capital budget, again made up of general (i.e. discretionary) and specific (i.e. ring-fenced) grants. Overall, the total capital budget sees a decrease in cash terms this year, of -20.7% or by £161 million. This is mostly driven by a decrease in non-recurrent specific capital grants, with support for capital remaining relatively static with an increase of 2.2%, following a significant decrease between 2019-20 and 2020-21 .

COSLA's response

In its pre-Budget document, Respect our communities: protect our funding1, COSLA argued that:

In 2020-21 there was £482m less general, undirected grant funding when compared to 2013/14. What appears as a cash increase is for new policies - Early Learning and Childcare, free personal care, health and social care integration - and commitments like teachers’ pay and pensions, pupil/teacher ratio. This approach erodes the very core of communities and the essential services they rely on.

COSLA asked the following of the 2021-22 Budget:

COSLA. (2021, January). Respect our communities Protect our Funding. Retrieved from https://www.cosla.gov.uk/__data/assets/pdf_file/0006/23010/Respect-our-communities-protect-our-funding-Jan-21.pdf [accessed 2 February 2021]

Any additional COVID-related funding for 2020-21 from UK Government must be passed on to Local Government – there remains a gap of at least £360m that must be addressed.

Any cash increase for 2021-22 from UK Government must be passed on.

Additional social care costs (for delegated services) should continue to be met from Health consequentials during 2021-22 (c£300m additional for 20-21).

All known Scottish Government policy commitments must be fully funded.

No cap on council tax - this must be a truly local tax.

The settlement should respect the efforts across “one workforce” and allow councils to make a pay award that aligns with all other parts of the public sector.

An end to small pots of ring-fenced, highly directed funding out with the Settlement.

Local Government’s wider role must be respected and funded - this includes adequate capital for affordable housing.

In its response to the Budget3, COSLA drew attention to ongoing pressures faced by local authorities and highlighted the protection of much of the additional funding announced:

The Cabinet Secretary, in her speech, recognised Councils’ role as deliverers of vital services and yes on the face of it there is more money but that is predominantly for Government priorities.

The addition of £259 million flexible funding for 2021/22 will help councils address Covid related costs next year, including providing the support that the most vulnerable in our communities will require but we need solid assurances that if this figure falls short, as is expected, that further funding will be forthcoming.

To deal with pressures this year, the announcement of an additional £110 million to help compensate Councils for loss of income, which when added to the money we have already had, makes £200 million, is to be welcomed. However, for many councils this won’t be enough - income loss will leave a very large hole in their finances for years to come. We welcome that the Cabinet Secretary for Finance has listened to Leaders requests for further funding to cover loss of income but there is still work to do where there is a shortfall.

We welcome elements of today’s announcement but overall this budget falls short of what we would consider a fair settlement for Local Government.

COSLA. (2021, January 28). Budget Response 2021-22. Retrieved from https://www.cosla.gov.uk/news/2021/cosla-budget-response-january-2021 [accessed 2 February 2021]

In COSLA's Budget Reality 2021-22 document5, released alongside its statement on the Budget, COSLA argues that, in comparison to the asks in its pre-Budget document, Respect our communities: protect our funding1, the settlement "represents a shortfall" of:

£362 million in core revenue funding.

£20 million in core capital funding, and

£511 million in non-recurring COVID-19 funding.

The Scottish Government has, at the time of publication, not responded to COSLA's figures, however it is likely that there will be some discussion of this when the Local Government and Communities Committee takes evidence from both organisations (separately) during February 2021.

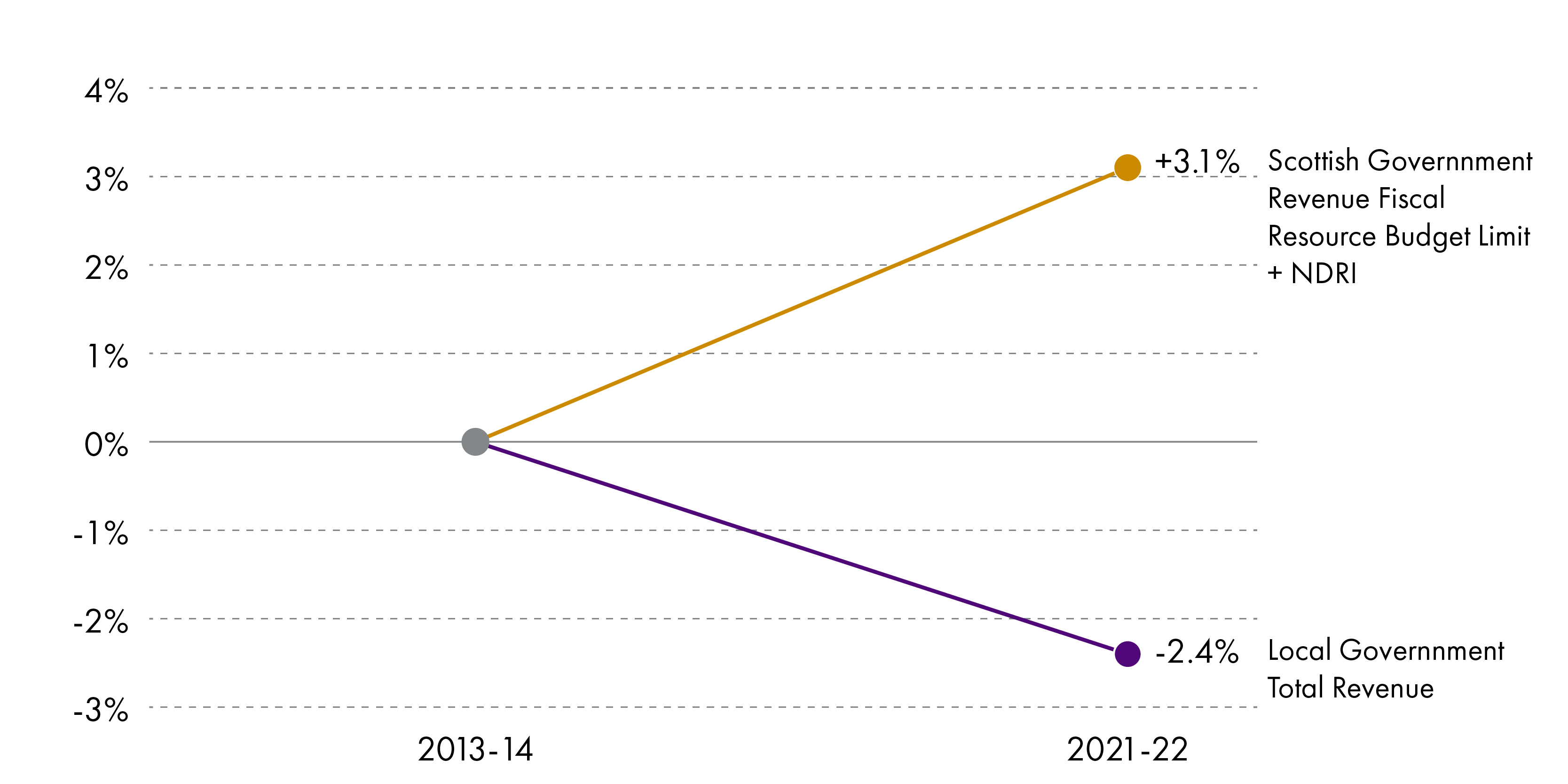

Local Government and Scottish Government historic changes

The briefing, Local government finance: facts and figures 2013-14 to 2020-211 looked at real terms change over time, comparing the local government settlement to the Scottish Government budget. Figure 3 below updates this by showing the change in the local government revenue budget compared to the best comparable figures for the Scottish Government's revenue budget.

We use 2013-14 as the base year for these calculations as that was the year that responsibility for police and fire services (and the associated funding) was transferred to the new central organisations. Doing completely accurate comparisons prior to 2013-14 is impossible, as estimates and assumptions have to be made to account for the police and fire issue. However, going from 2013-14 onwards removes this uncertainty.

In the majority of this briefing we are sharing figures in cash only because of complications around real terms calculations including the year 2020. This comparison is the one exception, as we are able to make a comparison which does not include the affected years, but it should be noted that there is a slight difference in approach from past briefings. Usually, SPICe would present real terms relating to the current financial year at the time of publication, but in order to avoid using 2020 deflators we have in this instance used the real terms figures for the Budget year (2021-22).

Local Government figures are based on "Total Revenue" figures from Annex A of the relevant Local Government Finance Circulars, published alongside the Budget document each year, and include ring-fenced grants and NDRI. Scottish Government figures are based on the Scottish Government's Fiscal Resource Budget Limit from HM Treasury, plus NDRI. NDRI is included in the Government side for comparability purposes, as it is also included on the local government side.

In recent years explorations of these figures have shown that, against a fixed baseline of 2013-14, and in real terms, the local government revenue budget has either fallen at a steeper rate than the Scottish Government equivalent, or has fallen while the Scottish Government revenue budget has increased, and that the local government revenue budget as a share of the Scottish Government equivalent budget has fallen.

Figure 3 shows that this trend has continued. Looking at the historic allocations to local government, compared to the Scottish Government's allocation from the UK Government, from 2013-14 to 2021-22, local government total revenue reduced by 2.4% in real terms (or -£276 million). The Scottish Government's fiscal resource budget limit from HM Treasury, plus NDRI, increased in real terms over the same period, by 3.1% (or £1,013.9 million). By comparison, when looking at the 2020-21 Budget, this increase was a -3.8% change in real terms for local government, and a 2.6% real increase for the Scottish Government.

Between 2013-14 and 2021-22, the local government revenue budget as a share of the Scottish Government equivalent reduced by 1.9 percentage point, from 34.7% to 32.8%.

Non-Domestic Rates and Council Tax

Non-Domestic Rates

The SPICe Briefing on the overall budget contains detailed analysis of the Government's policy proposals on Non-Domestic Rates and the Scottish Fiscal Commission's forecasts.

Over the last two Budgets, the Scottish Government has made innovative and complex use of the Non-Domestic Rating Account. In the budget for 2019-20, the Government stated that it had brought forward £100 million of anticipated future NDRI into the 2019-20 budget. However in the 2020-21 Budget, the Government stated that it had not needed to use this additional money in 2019-20 as originally planned. As a result, it intended to use the measure in 2020-21 instead, intending to bring the pool back into balance in 2022-23.

The Scottish Government did not make any announcements to this effect as part of its 2021-22 Budget statement, which may be a result of COVID-19 and its impact on Non-Domestic Rates income. It is likely that there will be accompanying delays in bringing the NDR pool back in to balance, but according to the Scottish Government the impact of COVID-19 on the Non-Domestic Rating Account will not be clear until late 20211.

Non-Domestic Rates (NDR) reliefs have been a key feature of COVID-19 business support. Early in the pandemic, the Scottish Government announced 100% rates relief for the industries most significantly affected, along with a series of business grants tied to the Non-Domestic Rates system. For more detail on NDR reliefs and grants during the pandemic, and how they have compared to UK Government measures, see the SPICe Blog on COVID-19: Non-Domestic Rates related business support FAQs2.

This 100% rates relief for retail, hospitality and leisure businesses was due to be in place until 31 March 20213. As part of the Budget statement, the Cabinet Secretary announced (noting that the UK Government had not yet announced an extension) that this would be extended for a further three months, potentially further should the UK Government take similar action (resulting in Barnett consequentials).

In addition to this relief extension, the Cabinet Secretary announced that the poundage rate for Non-Domestic Rates would be reduced by 0.8p to 49p, making it the lowest poundage rate in the UK.

Council Tax

Alongside a number of reforms to Council Tax introduced in 2017-18, a previous freeze on Council Tax, which had been in place since 2007-08, was lifted. In the years since, the Scottish Government has capped increases, initially by 3%, and more recently by 3% plus inflation, with local authorities using their power to increase Council Tax to varying extents. The most recent overview of Council Tax changes since reform can be found in the SPICe briefing Local Government Finance: facts and figures 2013-14 to 2020-211.

During her Budget announcement2, the Cabinet Secretary confirmed that, subject to approval from local authorities, Council Tax would again be in effect frozen. £90 million would be made available to councils to compensate for this, which would be equivalent to around a 3% increase. Based on the finance circular3 funding will be made available to those councils that choose to freeze the Council Tax rate at 2020-21 levels, with £90 million being the total funding package should all councils choose to do so. There is no suggestion that this freeze is mandatory, unlike the Council Tax freeze which was in place between 2007-8 and 2016-17, however as the Scottish Government has agreed to fund the freeze at the same level as potential maximum increases, it seems unlikely that Councils would choose not to participate.

Allocations to local authorities

Local Government Finance Circular 1/20211 was published on 1 February 2021, a few days after the Budget, and contains provisional allocations to local authorities.

Allocations in the circular are provisional and subject to consultation, therefore local authorities should not set their final budgets on the basis of these figures. Previous Finance Circulars set out a deadline for local authorities to agree to the offer and associated terms. However, this year (as in 2020) the circular is phrased slightly differently, and only asks local authorities to inform COSLA of any "discrepancies or changes required" by 12 February 2021, and does not appear to offer the opportunity for local authorities not to agree to the offer.

Consultation on the figures presented in the circular will take place between the Scottish Government and COSLA in advance of the Local Government Finance (Scotland) Order 2021 being presented to the Scottish Parliament. Final allocations will be published in a circular in mid- March.

Provisional revenue allocations

Year to year comparisons in this section of the Briefing are made between the new Finance Circular (1/2021)1 and the Finance Circular published in February 2020 (1/2020)2.

Note that in past briefings we have presented this data in real terms. Because of complications arising from atypical changes to inflation (see section on Specific 2021-22 challenges), all figures in this briefings are presented in cash terms. SPICe hopes to carry out further analysis on real terms equivalents following the publication of the Local Government Finance Order 2021 in March.

Figures for cash change, per head allocations and percentage of the Scottish average are based on Total Revenue funding settlements, as set out in Column 12 of Annex B of the Local Government Finance Circulars.

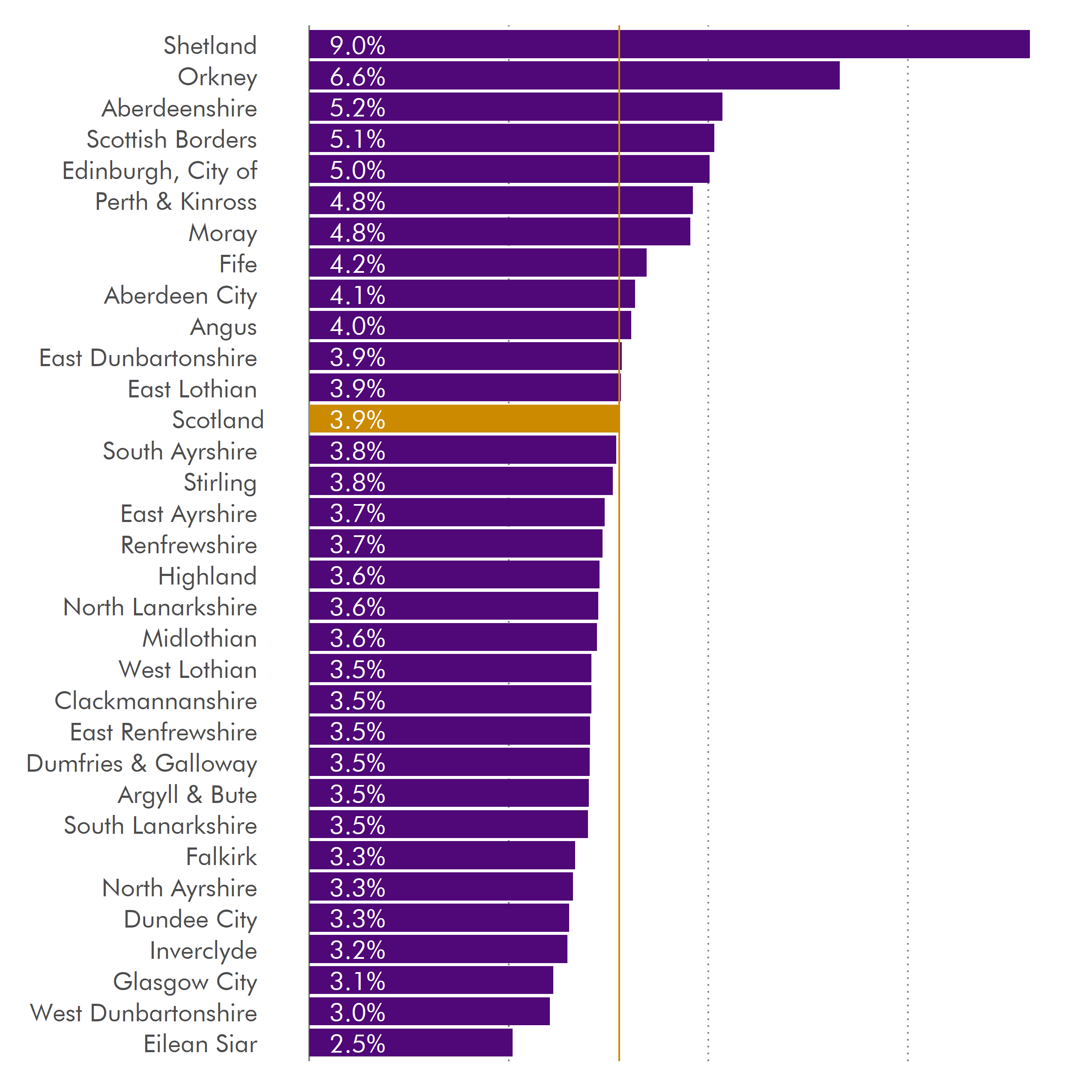

Cash change, 2020-2021 to 2021-22

Figure 5 shows that all local authorities receive an increase in their total revenue support from 2020-21.

Revenue allocations per head

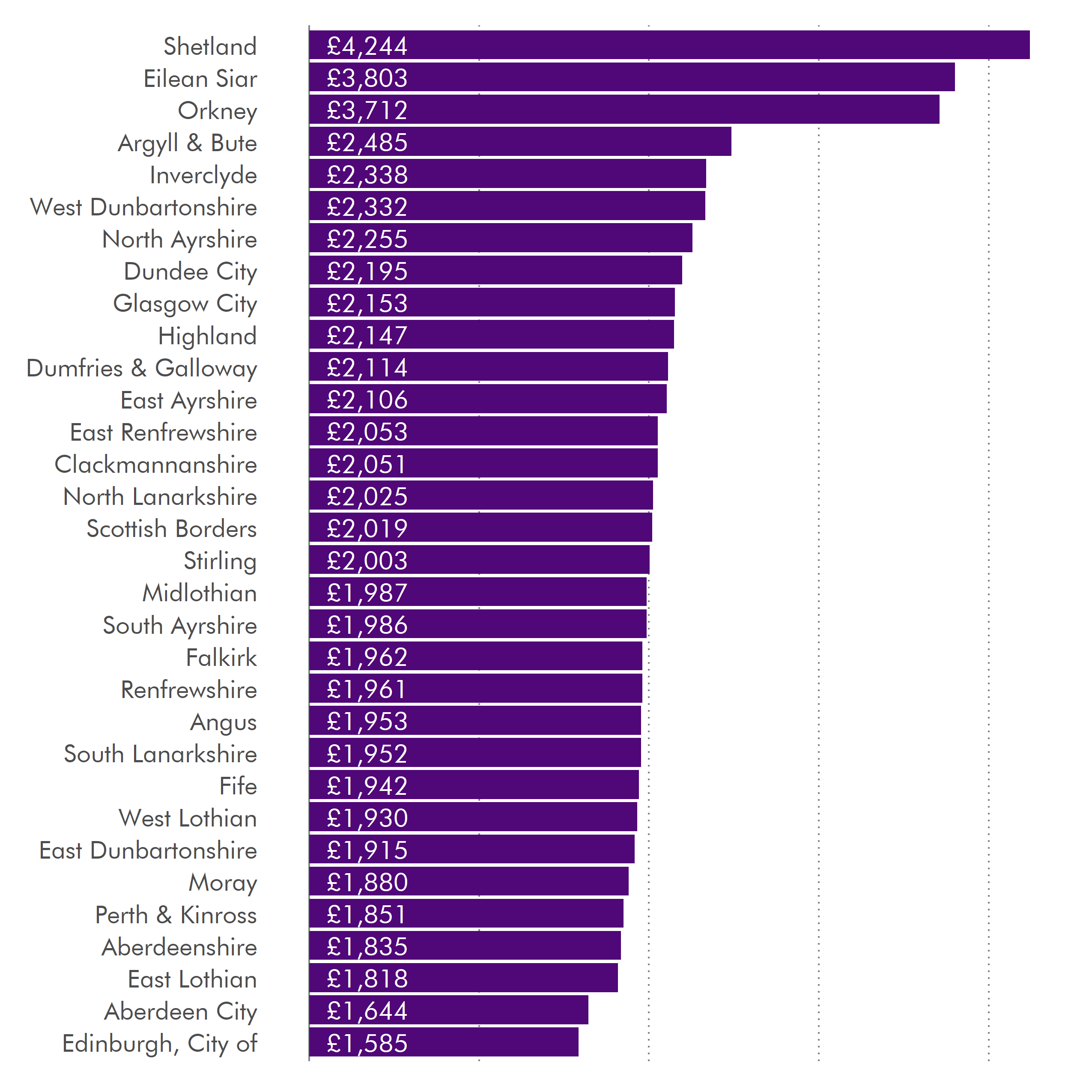

Figure 6 below shows the provisional revenue allocations on a per head basis.

As in previous years, the three island authorities receive the greatest amount of Total Revenue funding per head, which reflects the particular circumstances of delivering public services in island communities1.

Again, the City of Edinburgh and Aberdeen City have the lowest allocations per head. As detailed in the SPICe briefing Local Government Finance: The funding formula and local taxation income2, these councils receive a high proportion of income from Council Tax.

The Scottish Government has made the commitment that no local authority will receive less than 85% of the Scottish average per head in terms of Revenue support. This includes funding from Council Tax income. As in 2020-21, the only local authority affected by this adjustment in 2020-21 is City of Edinburgh.

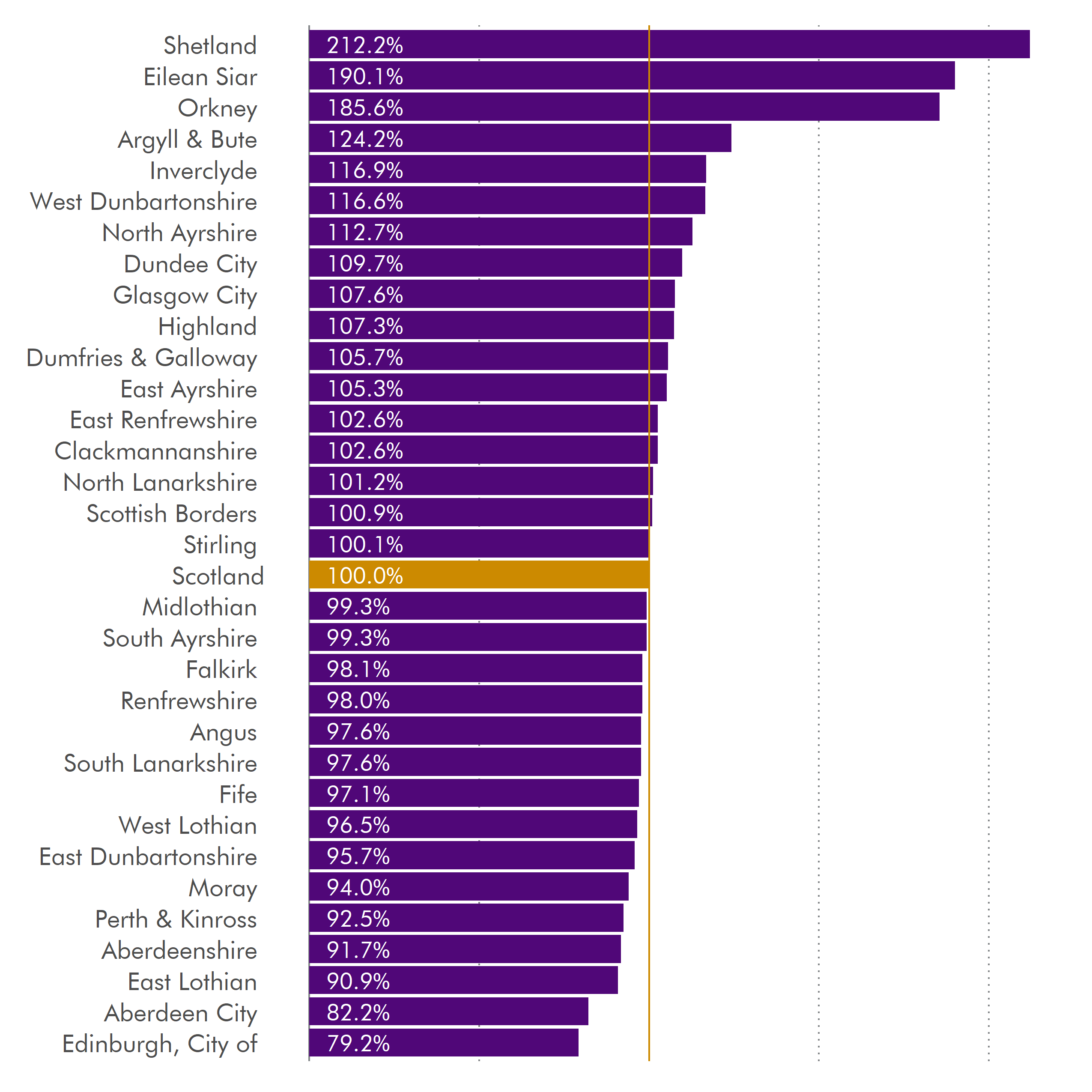

Percentage of Scottish average

Figure 7 shows the data presented in Figure 6 in percentage terms. This shows that, as in previous years and as would be expected, the island authorities receive the highest amount of funding per head, whilst the City of Edinburgh, followed by Aberdeen City and East Lothian, receive the lowest percentage of the Scottish average funding per head.

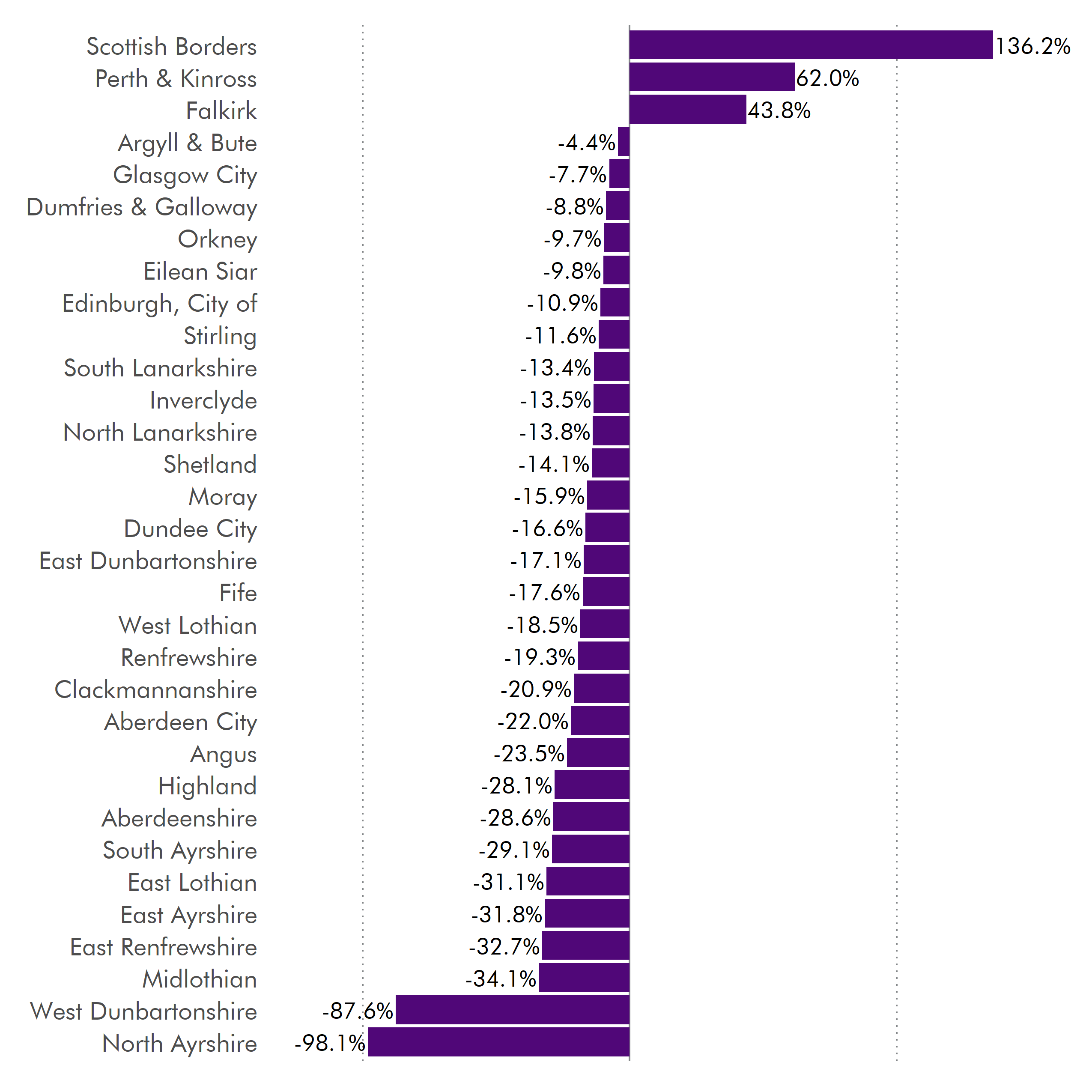

Provisional Capital allocations

As noted in the 'Headline figures' section, Total Capital funding is reducing substantially in 2021-22, and this is reflected in individual local authority allocations.

A full breakdown of the figures, and the actual allocations for 2021-22, are in Table 5 of the Annex. These are presented for information only and figures should be treated with caution. As Capital grants can vary widely year to year depending on planned infrastructure investment, looking at Capital funding over time does not show an accurate trend in local government investment, so these figures are purely illustrative.

Annex

Table 1 - Local Government funding

| Local Government | 2020-21 | 2021-22 (cash) | Cash change | Cash change % |

|---|---|---|---|---|

| Local Government Spending Plans (Table 5.11) | ||||

| General Revenue Grant | 6,713.4 | 7,108.2 | 394.8 | 5.9% |

| Non-Domestic Rates | 2,840.0 | 2,631.0 | -209.0 | -7.4% |

| Support for Capital | 467.9 | 478.0 | 10.1 | 2.2% |

| Specific Resource Grants | 685.6 | 752.0 | 66.4 | 9.7% |

| Specific Capital Grants | 310.1 | 139.0 | -171.1 | -55.2% |

| Local Government Advice and Policy | 3.8 | 3.80 | 0.0 | 0.0% |

| Total Level 2 | 11,020.8 | 11,112.0 | 91.2 | 0.8% |

| GRG+NDRI | 9,553.4 | 9,739.2 | 185.8 | 1.9% |

| GRG, NDRI and SRG | 10,239.0 | 10,491.2 | 252.2 | 2.5% |

| Total Capital | 778.0 | 617.0 | -161.0 | -20.7% |

| Revenue funding in other portfolios (Table 6.14 in 2020-21, 'Total LG Funding in 2021-22) | ||||

| Local Government Budget Settlement | 11,017.0 | 11,108.2 | 91.2 | 0.8% |

| Total revenue within other Portfolios | 428.7 | 512.2 | 83.5 | 19.5% |

| Finance Circular | 11,445.7 | 11,620.43 | 174.7 | 1.5% |

| Funding outwith core settlement (Table 6.15 in 2020-21, Table 15.15 in 2021-22) | ||||

| Revenue | 197.9 | 223.5 | 6.6 | 3.3% |

| Capital | 382.4 | 426.9 | 44.5 | 11.6% |

| Total funding outwith core | 580.3 | 631.4 | 51.1 | 8.8% |

| Overall SG funding for LG | 12,026.0 | 12,270.80 | 225.8 | 1.9% |

Note that Table 5.15 of the Budget Document was updated on 3 February 2021, which means that figures for funding outwith core settlement and Overall Scottish Government Funding for Local Government will differ in this briefing from any previous Budget 2021-22 publications.

Table 2 - Breakdown of Budget 2021-22 statement figures

| Cab Sec figures from statement | Components of sum | SPICe Calculations | Budget document source | Scottish Government confirmed figure (where different from SPICe)* |

|---|---|---|---|---|

| £11.6 billion total funding package | Finance Circular total | 11620.43 | Budget document "Total LG Funding - Finance Circular" | |

| £245.6 million increase in core revenue funding | GRG, SRG + NDRI - Rev funding outwith core settlement | 245.60 | Budget Table 5.11, and 5.15 | |

| £259 million non-recurring Covid funding | Single sum | 259.00 | Level 4 spreadsheet, C & LG, line 99 | |

| £90 million for CT freeze | Part of GRG | 90.00 | Level 4 spreadsheet, C & LG, line 85 | |

| Increase in core revenue - £335.6 million | GRG, SRG + NDRI + Rev funding outwith core settlement | 335.70 | Budget Table 5.11, and 5.15 | 335.579 |

| Total increase £594.6 million | Total increase in core rev (inc other portfolios + CT freeze) + non-recurring covid funding | 594.70 | Budget Table 5.11, and 5.15, Level 4 spreadsheet, C & LG, line 99 | 594.579 |

* Provided by the Scottish Government in correspondence with SPICe on 31 January 2021; these discrepancies with SPICe figures are due to rounding.

Note that Table 5.15 of the Budget Document was updated on 3 February 2021, which means that figures for funding outwith core settlement and Overall Scottish Government Funding for Local Government will differ in this briefing from any previous Budget 2021-22 publications, and from the Budget statement. For the sake of consistency, this table reconciles the Budget statement with the Budget document as published.

Table 3 - Local government and Scottish Government revenue comparison, 2013-14 to 2021-22

| £m, cash | LG Total Revenue | SG Fiscal Resource Budget Limit | SG Revenue Fiscal Resource Budget Limit + NDRI | LG as a % of SG |

|---|---|---|---|---|

| 2013-14 | 9,728.5 | 25,631.0 | 28,066.0 | 34.7% |

| 2014-15 | 9,848.3 | 25,777.0 | 28,426.5 | 34.6% |

| 2015-16 | 9,994.1 | 25,991.0 | 28,779.5 | 34.7% |

| 2016-17 | 9,693.4 | 26,088.0 | 28,856.5 | 33.6% |

| 2017-18 | 9,639.5 | 27,027.0 | 29,692.8 | 32.5% |

| 2018-19 | 9,779.9 | 27,200.0 | 29,836.0 | 32.8% |

| 2019-20 | 10,078.4 | 28,770.0 | 31,623.0 | 31.9% |

| 2020-21 | 10,572.8 | 29,711.0 | 32,551.0 | 32.5% |

| 2021-22 | 11,003.4 | 30,923.0 | 33,554.0 | 32.8% |

| £m change 2013-14 to 2021-22 | 1,274.9 | 5,292.0 | 5,488.0 | |

| % Change 2013-14 to 2021-22 | 13.1% | 20.6% | 19.6% | -1.9% |

| £m, real terms (2021-22) | LG Total Revenue | SG Fiscal Resource Budget Limit | SG Revenue Fiscal Resource Budget Limit + NDRI | LG as a % of SG |

|---|---|---|---|---|

| 2013-14 | 11,279.3 | 29,716.9 | 32,540.1 | 34.7% |

| 2021-22 | 11,003.4 | 30,923.0 | 33,554.0 | 32.8% |

| £m change 2013-14 to 2021-22 | -276.0 | 1,206.1 | 1,013.9 | |

| % Change 2013-14 to 2021-22 | -2.4% | 4.1% | 3.1% | -1.9% |

Table 4 - Provisional Revenue allocations

| Local Authority - Finance circular, Annex B, Col 12 | 2020-21 (from 1/2020) | 2021-22 (from 1/2021) | Cash change | Cash change % |

|---|---|---|---|---|

| Aberdeen City | 361.2 | 376.0 | 14.7 | 4.1% |

| Aberdeenshire | 455.6 | 479.2 | 23.6 | 5.2% |

| Angus | 218.1 | 226.9 | 8.8 | 4.0% |

| Argyll & Bute | 206.1 | 213.3 | 7.2 | 3.5% |

| Clackmannanshire | 102.1 | 105.7 | 3.6 | 3.5% |

| Dumfries & Galloway | 303.9 | 314.6 | 10.7 | 3.5% |

| Dundee City | 317.4 | 327.7 | 10.3 | 3.3% |

| East Ayrshire | 247.7 | 256.9 | 9.2 | 3.7% |

| East Dunbartonshire | 200.2 | 208.0 | 7.8 | 3.9% |

| East Lothian | 187.4 | 194.7 | 7.3 | 3.9% |

| East Renfrewshire | 189.4 | 196.1 | 6.7 | 3.5% |

| Edinburgh, City of | 792.1 | 831.9 | 39.7 | 5.0% |

| Eilean Siar | 99.1 | 101.6 | 2.5 | 2.5% |

| Falkirk | 305.5 | 315.7 | 10.2 | 3.3% |

| Fife | 695.9 | 725.3 | 29.4 | 4.2% |

| Glasgow City | 1,322.5 | 1,362.9 | 40.4 | 3.1% |

| Highland | 488.5 | 506.3 | 17.8 | 3.6% |

| Inverclyde | 176.2 | 181.9 | 5.7 | 3.2% |

| Midlothian | 177.3 | 183.7 | 6.4 | 3.6% |

| Moray | 172.0 | 180.2 | 8.2 | 4.8% |

| North Ayrshire | 294.2 | 303.9 | 9.7 | 3.3% |

| North Lanarkshire | 667.0 | 691.2 | 24.1 | 3.6% |

| Orkney | 77.5 | 82.7 | 5.1 | 6.6% |

| Perth & Kinross | 268.4 | 281.3 | 12.9 | 4.8% |

| Renfrewshire | 338.8 | 351.2 | 12.4 | 3.7% |

| Scottish Borders | 222.0 | 233.2 | 11.3 | 5.1% |

| Shetland | 89.2 | 97.3 | 8.1 | 9.0% |

| South Ayrshire | 215.4 | 223.7 | 8.3 | 3.8% |

| South Lanarkshire | 604.7 | 625.8 | 21.1 | 3.5% |

| Stirling | 181.8 | 188.7 | 6.9 | 3.8% |

| West Dunbartonshire | 201.3 | 207.4 | 6.1 | 3.0% |

| West Lothian | 341.3 | 353.3 | 12.1 | 3.5% |

| Scotland | 10,520.0 | 10,928.3 | 408.3 | 3.9% |

Table 5 - Provisional Revenue allocations, per head

| 2021-22 Total Revenue, £m, cash | 2019 mid year population | Per head | % of scottish average | |

|---|---|---|---|---|

| Aberdeen City | 376.0 | 228,670 | 1,644 | 82.2% |

| Aberdeenshire | 479.2 | 261,210 | 1,835 | 91.7% |

| Angus | 226.9 | 116,200 | 1,953 | 97.6% |

| Argyll & Bute | 213.3 | 85,870 | 2,485 | 124.2% |

| Clackmannanshire | 105.7 | 51,540 | 2,051 | 102.6% |

| Dumfries & Galloway | 314.6 | 148,860 | 2,114 | 105.7% |

| Dundee City | 327.7 | 149,320 | 2,195 | 109.7% |

| East Ayrshire | 256.9 | 122,010 | 2,106 | 105.3% |

| East Dunbartonshire | 208.0 | 108,640 | 1,915 | 95.7% |

| East Lothian | 194.7 | 107,090 | 1,818 | 90.9% |

| East Renfrewshire | 196.1 | 95,530 | 2,053 | 102.6% |

| Edinburgh, City of | 831.9 | 524,930 | 1,585 | 79.2% |

| Eilean Siar | 101.6 | 26,720 | 3,803 | 190.1% |

| Falkirk | 315.7 | 160,890 | 1,962 | 98.1% |

| Fife | 725.3 | 373,550 | 1,942 | 97.1% |

| Glasgow City | 1,362.9 | 633,120 | 2,153 | 107.6% |

| Highland | 506.3 | 235,830 | 2,147 | 107.3% |

| Inverclyde | 181.9 | 77,800 | 2,338 | 116.9% |

| Midlothian | 183.7 | 92,460 | 1,987 | 99.3% |

| Moray | 180.2 | 95,820 | 1,880 | 94.0% |

| North Ayrshire | 303.9 | 134,740 | 2,255 | 112.7% |

| North Lanarkshire | 691.2 | 341,370 | 2,025 | 101.2% |

| Orkney | 82.7 | 22,270 | 3,712 | 185.6% |

| Perth & Kinross | 281.3 | 151,950 | 1,851 | 92.5% |

| Renfrewshire | 351.2 | 179,100 | 1,961 | 98.0% |

| Scottish Borders | 233.2 | 115,510 | 2,019 | 100.9% |

| Shetland | 97.3 | 22,920 | 4,244 | 212.2% |

| South Ayrshire | 223.7 | 112,610 | 1,986 | 99.3% |

| South Lanarkshire | 625.8 | 320,530 | 1,952 | 97.6% |

| Stirling | 188.7 | 94,210 | 2,003 | 100.1% |

| West Dunbartonshire | 207.4 | 88,930 | 2,332 | 116.6% |

| West Lothian | 353.3 | 183,100 | 1,930 | 96.5% |

| Scotland | 10,928.3 | 5,463,300 | 2,000 | 100.0% |

Table 6 - Provisional Capital allocations

| £m, cash | 2020-21 total capital | Total general capital grant payable 2021-22 | Specific capital grants - settlement 2021-22 | Total Capital funding | Cash change | Cash change % |

|---|---|---|---|---|---|---|

| Aberdeen City | 25.0 | 18.5 | 1.0 | 19.5 | -5.5 | -22.0% |

| Aberdeenshire | 33.8 | 23.0 | 1.1 | 24.1 | -9.7 | -28.6% |

| Angus | 14.3 | 10.4 | 0.5 | 11.0 | -3.4 | -23.5% |

| Argyll & Bute | 10.7 | 9.9 | 0.4 | 10.3 | -0.5 | -4.4% |

| Clackmannanshire | 5.7 | 4.3 | 0.2 | 4.5 | -1.2 | -20.9% |

| Dumfries & Galloway | 17.1 | 15.0 | 0.7 | 15.6 | -1.5 | -8.8% |

| Dundee City | 17.4 | 13.9 | 0.7 | 14.5 | -2.9 | -16.6% |

| East Ayrshire | 14.9 | 9.7 | 0.5 | 10.2 | -4.7 | -31.8% |

| East Dunbartonshire | 9.6 | 7.5 | 0.5 | 7.9 | -1.6 | -17.1% |

| East Lothian | 12.9 | 8.4 | 0.5 | 8.9 | -4.0 | -31.1% |

| East Renfrewshire | 9.0 | 5.6 | 0.4 | 6.1 | -2.9 | -32.7% |

| Edinburgh, City of | 77.0 | 38.4 | 30.2 | 68.6 | -8.4 | -10.9% |

| Eilean Siar | 7.2 | 6.4 | 0.1 | 6.5 | -0.7 | -9.8% |

| Falkirk | 17.3 | 24.1 | 0.7 | 24.8 | 7.6 | 43.8% |

| Fife | 34.1 | 25.0 | 3.1 | 28.1 | -6.0 | -17.6% |

| Glasgow City | 129.8 | 50.6 | 69.2 | 119.8 | -9.9 | -7.7% |

| Highland | 33.8 | 23.2 | 1.0 | 24.3 | -9.5 | -28.1% |

| Inverclyde | 7.8 | 6.4 | 0.3 | 6.7 | -1.1 | -13.5% |

| Midlothian | 11.5 | 7.2 | 0.4 | 7.6 | -3.9 | -34.1% |

| Moray | 10.3 | 8.2 | 0.4 | 8.6 | -1.6 | -15.9% |

| North Ayrshire | 32.0 | -1.3 | 1.9 | 0.6 | -31.4 | -98.1% |

| North Lanarkshire | 31.1 | 23.4 | 3.4 | 26.8 | -4.3 | -13.8% |

| Orkney | 5.7 | 5.0 | 0.1 | 5.1 | -0.6 | -9.7% |

| Perth & Kinross | 16.0 | 25.3 | 0.7 | 26.0 | 9.9 | 62.0% |

| Renfrewshire | 15.9 | 12.1 | 0.8 | 12.9 | -3.1 | -19.3% |

| Scottish Borders | 13.6 | 31.6 | 0.5 | 32.2 | 18.5 | 136.2% |

| Shetland | 6.1 | 5.2 | 0.1 | 5.3 | -0.9 | -14.1% |

| South Ayrshire | 12.8 | 8.6 | 0.5 | 9.1 | -3.7 | -29.1% |

| South Lanarkshire | 27.1 | 21.4 | 2.1 | 23.5 | -3.6 | -13.4% |

| Stirling | 9.8 | 8.2 | 0.4 | 8.6 | -1.1 | -11.6% |

| West Dunbartonshire | 13.1 | 1.2 | 0.4 | 1.6 | -11.5 | -87.6% |

| West Lothian | 15.1 | 11.5 | 0.8 | 12.3 | -2.8 | -18.5% |

| Undistributed | 50.0 | 10.0 | 0.0 | 10.0 | -40.0 | |

| Total | 747.8 | 477.9 | 123.8 | 601.7 | -146.1 | -19.5% |

| SPT | 15.3 | 15.3 | 15.3 | 0.0 | 0.0% | |

| Total | 763.1 | 477.9 | 139.1 | 617.0 | -146.1 | -19.1% |

Abbreviations

COSLA - Convention of Scottish Local Authorities

GRG - General Revenue Grant

LG - Local Government

NDRI - Non-Domestic Rates Income

SG - Scottish Government

SRG - Specific Resource Grants

Related Briefings

SB 17/82 - Local Government Finance: Fees and Charges 2011-12 to 2015-16

SB 18/60 - Local Government Finance: The Funding Formula and local taxation income

SB 18/82 - Pro-poor or pro-rich? The social impact of local government budgets, 2016 to 2019

SB 20/12 - Scottish Budget 2020-21

SB 20/16 - Local Government Finance: Budget 2020-21 and provisional allocations to local authorities

SB 20/43 - Local Government Finance: facts and figures 2013-14 to 2020-21

SB 21/05 - Scottish Budget 2021-22