Social Security Budget 2021-22

This briefing looks at the budget and forecast spending on devolved social security for 2021-22. It also looks at spending in 2020-21 and the impact of COVID-19.

Executive Summary

With a budget of around £3.6 billion for benefit payments,1 social security is the third largest area of the Scottish budget after health (£17 billion) and local government (£11 billion).2 However the Department for Work and Pensions (DWP) administers £3.3 billion of this. The proportion of spending administered by Social Security Scotland should increase considerably in the next few years as the 'Scottish versions' of devolved DWP benefits are introduced.

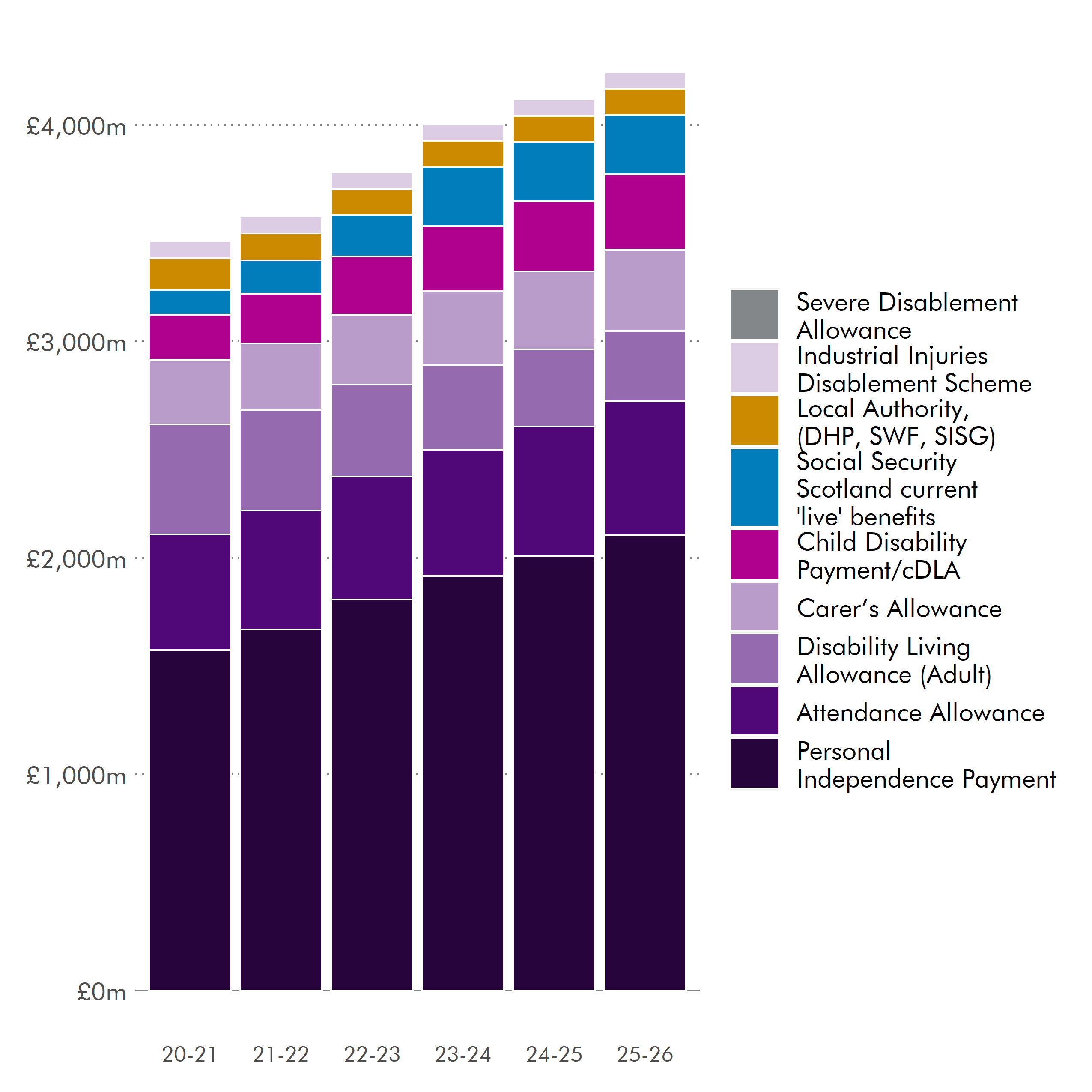

Devolved social security is forecast to grow by grow by £662 million from £3.6 billion in 2021-22 to £4.3 billion in 2025-26. However, this does not include forecasts for Social Security Scotland benefits starting after autumn 2021. Adult Disability Payment (ADP) will replace Personal Independence Payment (PIP) in summer 2022 after a pilot in spring 2022. The replacements for other DWP devolved benefits will follow before 2025. Because these will be replacing existing benefits they do not represent entirely new spending. However, policy differences might mean they are more expensive than the DWP benefits they are replacing. For large benefits such as PIP (current spending £1.7 billion), even small policy differences could make a big impact on the budget. This means that forecasts could change considerably over the next couple of years.

The impact of COVID-19 on devolved social security has been relatively modest. While some additions were made, for example the £20 million increase to the Scottish Welfare Fund, these have been partly offset by savings created by the decision to delay the introduction of some benefits.

There is one new benefit starting in 2021-22 - the Child Disability Payment (CDP), replacing child Disability Living Allowance. This will only have a very modest impact on the budget this year, as it replaces an existing benefit rather than being new spend and starts part way through the year.

The only area of substantial additional spend on benefits due to Scottish Government policy decisions is the Scottish Child Payment (SCP). This started in February 2021, so 2021-22 is its first full year at a forecast spend of £68 million.

SCP is Social Security Scotland's largest scale benefit so far (forecast to benefit around 130,000 children in 2021-22) and CDP its most complex. The agency is also preparing for the start of ADP in 2022. Perhaps reflecting this, there is a big increase in the agency's administration budget this year from £186 million to £271 million.

This year, due to 'exceptional circumstances' caused by COVID-19, the Scottish Government has uprated most Social Security Scotland benefits above the level of inflation. As inflation is 0.5% this policy has a minimal impact on the budget at a cost of £0.25 million.

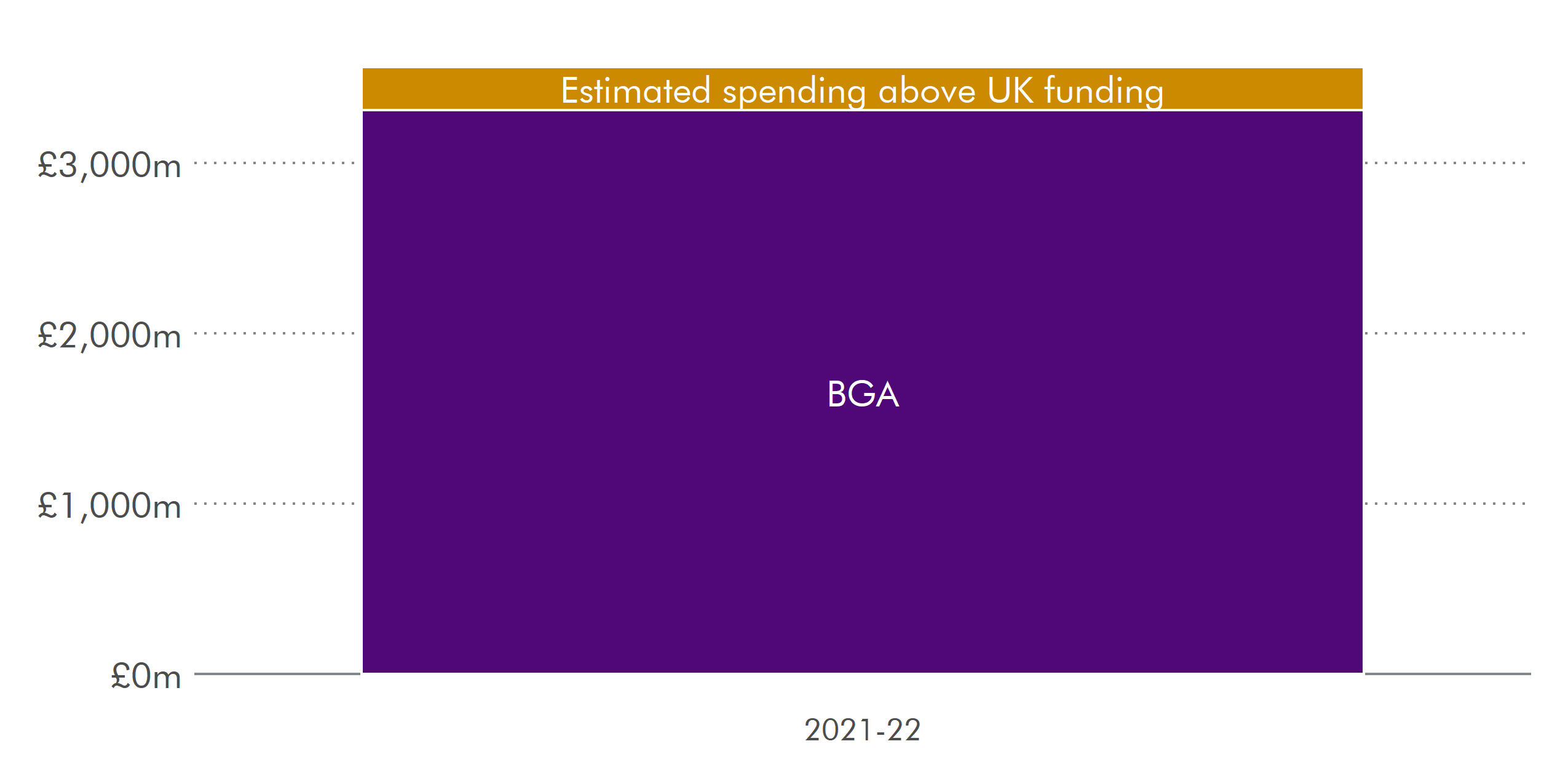

Over 90% of devolved social security is funded by the UK Government through the Block Grant Adjustment (BGA). SPICe calculations suggest that the Scottish Government contribution in addition to this is in the region of £250 million. However this may change if policy for the Scottish versions of large DWP benefits proves to be more expensive.

Spending by Social Security Scotland, DWP and local authorities

Around £3.6 billion is forecast to be spent on devolved social security payments in 2021-22.1

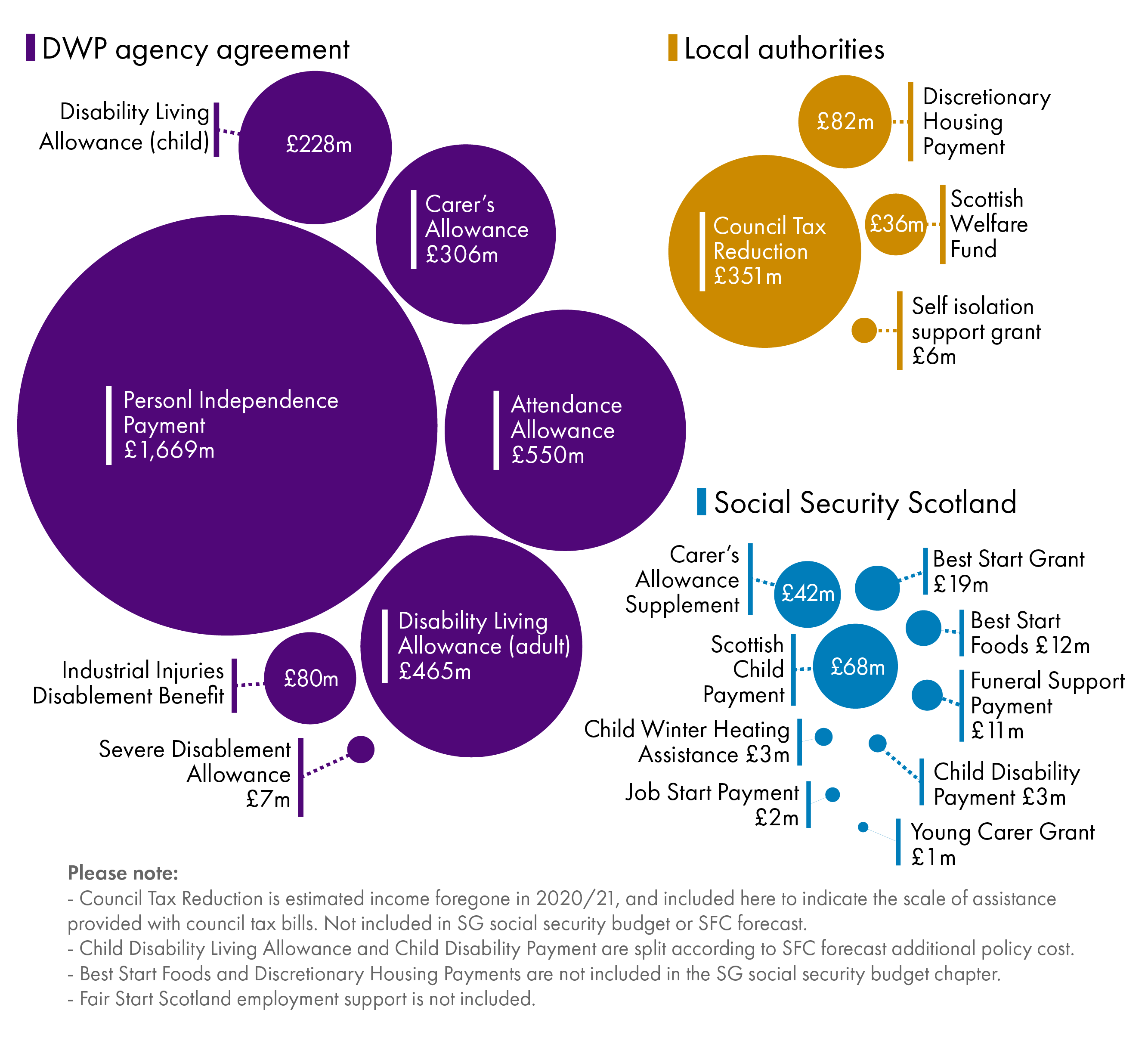

It is the third largest area of the budget after health (£17 billion) and local government (£11 billion).2 The DWP will administer £3.3 billion of this. Not including the new Child Disability Payment (CDP), £158 million will be administered by Social Security Scotland.i If child Disability Living Allowance (child DLA) cases are transferred quickly to the new CDP, this picture could change during the course of the year. The remainder is administered by local authorities.

Figure 1 shows spending by agency in 2021-22. It also includes estimated income foregone in Council Tax Reduction (CTR), which despite technically not being social security, does provide substantial assistance through a social security-like scheme. Actual income foregone in 2021-22 will be higher, as the Scottish Government allocated an additional £25 million for the increase in claims due to COVID-19.

The proportion of spending by Social Security Scotland should increase considerably from 2022-23 onwards as people are transferred from child DLA to CDP and the new Adult Disability Payment (ADP) starts to replace PIP.

Growth in spending

Devolved social security spending is forecast to grow by £662 million from £3.6 billion in 2021-22 to £4.3 billion in 2025-26. (Not including Council Tax Reduction). These forecasts do not take account of whether the Scottish versions of DWP benefits will be more expensive. The Scottish Government is focusing on 'safe and secure' transfer and not proposing large scale changes. However, given the scale of PIP, small differences of policy could still have a big impact.

The Scottish Fiscal Commission (SFC) has yet to do a costing as Scottish Government policy is not finalised. The policy for PIP's replacement (Adult Disability Payment) is currently out for consultation. It is due to start as a pilot in spring 2022 before full roll-out in summer 2022.

Impact of COVID-19

The impact of COVID-19 on forecast spend is relatively modest. In total, the SFC forecasts that policy and other impacts due to COVID-19 will result in spending increasing by £87 million in 2020-21 and by £64 million in 2021-22.1 The SFC states:

The net effect of COVID-19 on our forecasts is not as significant as we may expect. Overall we expect COVID-19 to increase social security spending, largely because we assume eligibility and take up increases, but there are changes that reduce spending and reduce the overall effect.

Scottish Fiscal Commission. (2021). Scotland's Economic and Fiscal Forecasts January 2021. Retrieved from https://www.fiscalcommission.scot/forecast/scotlands-economic-and-fiscal-forecasts-january-2021/ [accessed 9 February 2021]

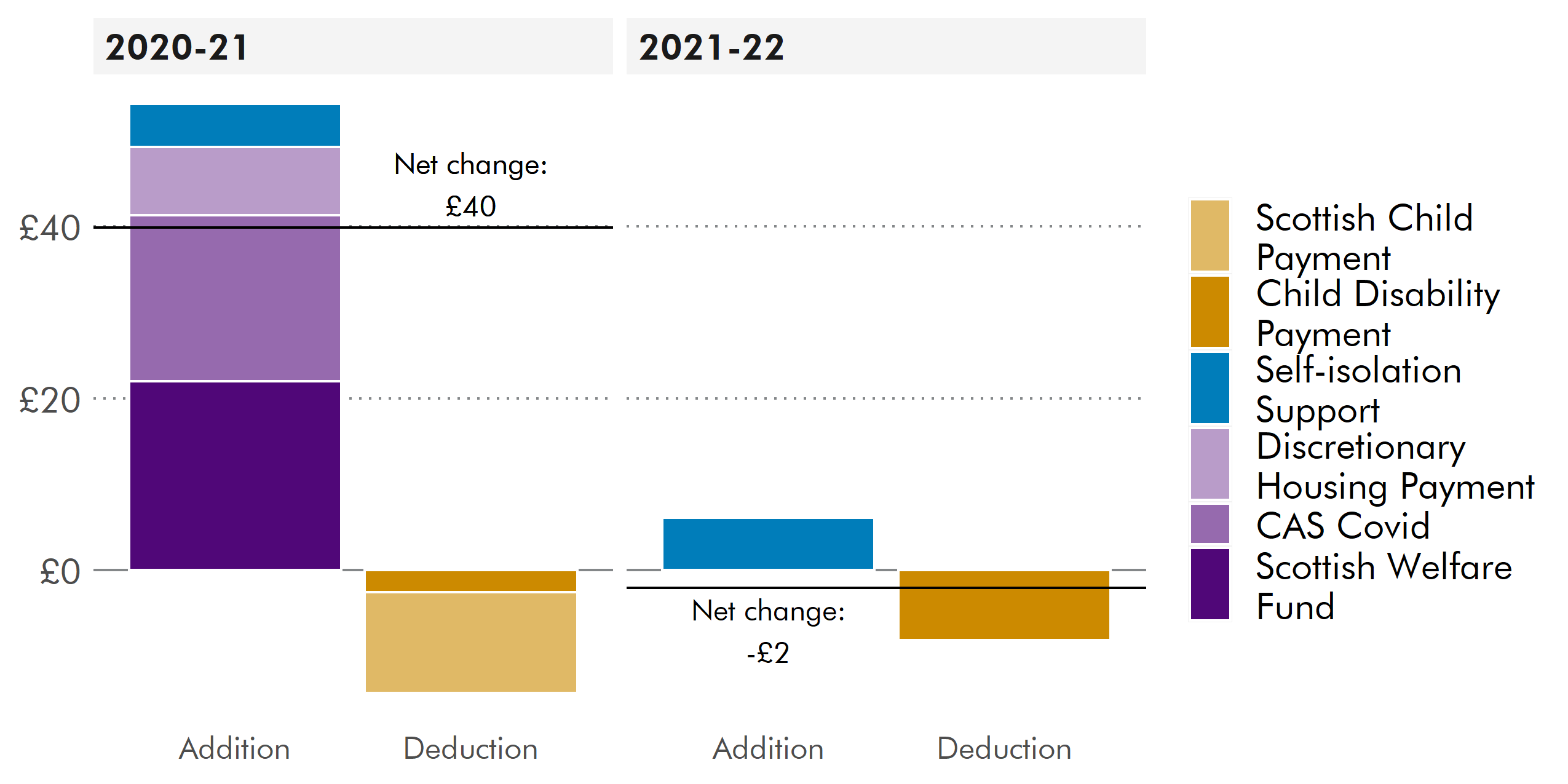

Scottish Government policy

In 2020-21, the Scottish Government announced £54.3 million additional spending, but this was offset by savings of £14.4 million caused by the delay to starting new benefits. In general, the Scottish Government’s ‘Covid response’ has been through measures other than social security. In evidence to the Social Security Committee, the Cabinet Secretary, Shirley-Anne Somerville, observed that:

particularly in the face of the pandemic, social security is quite a blunt instrument in terms of what’s required

Social Security Committee, 18 February 2021

Figure 3 shows how the increase to the Scottish Welfare Fund (£22 million), Discretionary Housing Payments (£8 million), the additional Carer’s Allowance Supplement (£19 million) and the introduction of the new Self-Isolation Support Grant (£5 million) were partly offset by savings from delaying the start of the Child Disability Payment (-£2.6 million) and Scottish Child Payment (-£11.8 million).

In 2021-22, the only additional policy specifically related to COVID-19 is £6 million for the Self-Isolation Support Grant. This may increase once the expanded eligibility announced on 2 February is factored in.1 Delaying the start of the CDP continues to have an impact, reducing spending by £8.2 million compared to previous forecasts. The Scottish Welfare Fund budget returns to its ‘normal’ (pre-COVID-19) level of £35.5 million for 2021-22.

Impact of COVID-19 beyond the Scottish policy response

The impact of COVID-19 on devolved benefit spending goes beyond Scottish Government policy and includes:

UK Government policy

health and demographic impacts

lower inflation

impact of social restrictions

impact of unemployment and lower wages on ‘passported’ Scottish benefits.

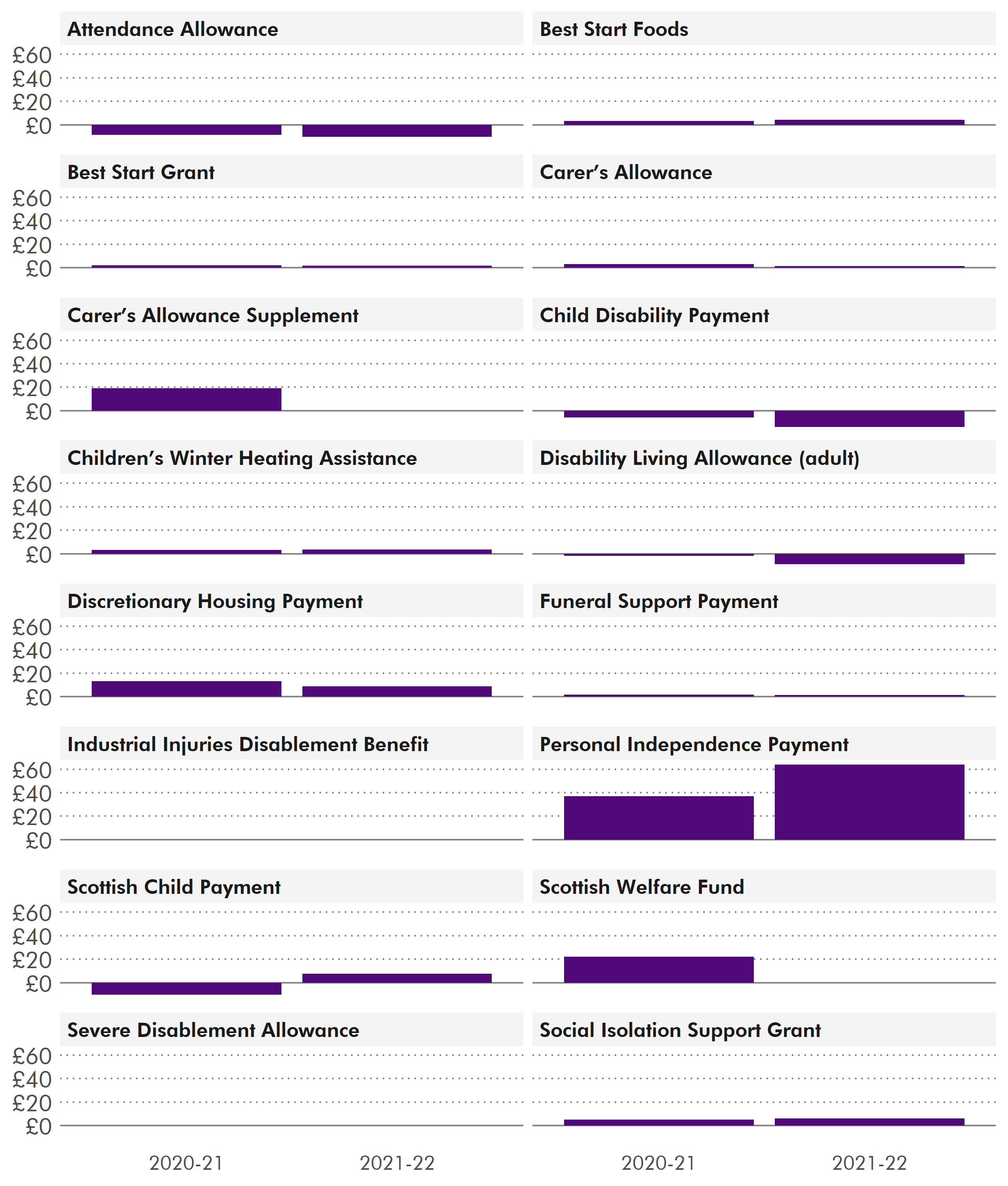

Figure 4 shows how the impact of COVID-19 is forecast to change spending on devolved benefits. The biggest impact is on PIP, as it is the biggest benefit. This is forecast to increase by £37 million in 2020-21 and £64 million in 2021-22 due to COVID-19. Factors include:

DWP operational changes, including suspending face to face assessments, reviews and reassessments

delayed claims following the reduction in new claims for PIP in Spring 2020.

assumed longer term mental and physical health effects of COVID-19

The net impact on current benefits directly administered by Social Security Scotland is to add £19 million in 2020-21 (16% of total spending of £118 million) and £17 million in 2021-22 (11% of total spending of £158 million). This does not include CDP as it is not yet live, but includes Young Carer Grant(£1 million) and Job Start Payment (£2 million) which are not included in SFC forecasts.

New benefits in 2021-22

New benefits in 2021-22 will not increase spending by very much.

The only new benefit due to start in 2021-22 is the Child Disability Payment (CDP which replaces child Disability Living Allowance (child DLA)). It is due to start in November following a pilot in July. The SFC forecasts that Scottish Government policy differences will add £3 million to the cost compared to continuing with child DLA. The actual amount of money administered by Social Security Scotland will depend on the number of new cases and how quickly people are transferred from DWP. The cost of child DLA and CDP combined is forecast to be £231 million in 2021-22.1

A pilot of Adult Disability Payment (replacing PIP) is due to start in spring 2022. This may start before the 2021-22 financial year. However the SFC expects that it will cost less than £5 million in 2021-22.1

The Scottish Child Payment (SCP) provides an additional £10 per week for every child in families who get qualifying benefits such as Universal Credit. Technically it is not a ‘new benefit’ in 2021-22, but as payments only started in February 2021, it does represent the largest new area of spending for Social Security Scotland in 2021-22. The SFC forecasts that £68 million will be spent on the SCP in 2021-22.1

Uprating

This year the Scottish Government has uprated some benefits above inflation. However, this does not have much impact on forecast spend because inflation is lower than had been expected. The change in uprating policy is forecast to add £0.25 million 1 to spending in 2021-22.

In February 2020, spend was forecast based on 2% over the forecast period of 2020-2024. In the event, largely due to COVID-19, inflation dropped to 0.5% in September 2020 (the reference month used for uprating).

The Scottish Government is legally required to uprate the Funeral Support Payment, Carer's Allowance Supplement and the Young Carer Grant (sections 78 and 81, Social Security (Scotland) Act 2018).

The Scottish Government’s uprating policy2 this year is:

Uprate by 1%: Best Start Grant, Child Winter Heating Assistance, Funeral Support Payment, Young Carer Grant, Job Start Payment.

Uprate by 0.5%; Carer’s Allowance Supplement. Uprating is restricted by section 81 of the Social Security (Scotland) Act 2018.

Not uprated: Best Start Foods, Scottish Child Payment.

Benefits administered by the DWP are uprated by DWP policy which is Consumer Price Inflation (CPI) for carer and disability benefits (0.5%) and ‘triple lock’ for pensioner benefits (2.5%).3

Council Tax Reduction is being uprated by 0.5% for the working age elements and 2.5% for the pension age elements.4

Benefits not uprated

The two benefits not being uprated are Best Start Foods and the Scottish Child Payment (SCP).

There is a legislative duty to uprate the SCP but it is not yet in force (section 7, Social Security Administration and Tribunal Membership (Scotland) Act 2020). A letter to the Social Security Committee in September 2020 stated:

As first payments of the SCP will start from the end of February 2021, the duty to uprate would be effective from April 2022.

Letter from Cabinet Secretary for Social Security and Older People, Shirley-Anne Somerville to Bob Doris, Convener, Social Security Committee . (2020, September 8). Retrieved from https://www.parliament.scot/S5_Social_Security/Cab_Sec_SSOP_to_Social_Security_Committee_-_Scottish_Child_Payment_Regulations_-_8_September_2020_.pdf [accessed 9 February 2021]

In their report on uprating, the Scottish Commission on Social Security (SCoSS) commented that:

We accept there may be practical difficulties to uprating SCP so soon after payments start to be made, or budgetary constraints that preclude uprating it this time. However, it would be helpful to understand the reasons and we are aware this issue is of interest to stakeholders.

Scottish Commission on Social Security. (2021). Uprating Report 2021. Retrieved from https://www.gov.scot/publications/scottish-commission-on-social-security-uprating-report-2021/ [accessed 9 February 2021]

In reply, the Cabinet Secretary for Social Security and Older People, Shirley-Anne Somerville MSP, reiterated that:

As the first payments of the Scottish Child Payment would start from the end of February 2021, it makes sense that the duty to uprate annually would be made effective from April 2022 and would be brought into force by commencement regulations, likely to be in late 2021.

Scottish Government. (2021). Letter from Cabinet Secretary to Dr. Sally Witcher dated 10 February 2021 "Annual Uprating of Social Security Assistance". (n.p.): (n.p.).

Best Start Foods has not been uprated since it started in summer 2019. On its launch it was provided at a higher rate (£4.25) than its UK equivalent (Healthy Start Vouchers paid at £3.10). The UK Government has now announced it will increase Healthy Start Vouchers to £4.25 starting from April 2021,4matching the Scottish Best Start Foods payment. However, Healthy Start is still available to children under 4 while, in Scotland, Best Start Foods is available to children under 3. Some supermarkets in the rest of the UK had already been topping up the payment.5

SCoSS noted that:

The amount of Best Start Foods means that a 0.5% increase would be rounded down to the current amount. A 1% increase would be rounded up to 5 pence .

Scottish Commission on Social Security. (2021). Uprating Report 2021. Retrieved from https://www.gov.scot/publications/scottish-commission-on-social-security-uprating-report-2021/ [accessed 9 February 2021]

SCoSS welcomed the decision to uprate some benefits above inflation. However, it noted that:

In response to the impact of COVID, decisions go beyond statutory requirements and do not reflect the Scottish Government’s previously stated strategic approach to uprating.

Scottish Commission on Social Security. (2021). Uprating Report 2021. Retrieved from https://www.gov.scot/publications/scottish-commission-on-social-security-uprating-report-2021/ [accessed 9 February 2021]

In reply, the Scottish Government explained that this year's policy of uprating above inflation was an exceptional measure due to the impact of COVID-19. In general, discussion of the generosity of benefits is a separate issue from keeping up with inflation.

The decision to double the 0.5% CPI rate for the low-income assistance was taken within the context of the impact of COVID-19 on low income families and as such should not be taken to represent a fundamental change of approach but rather a response to the current exceptional circumstances.

Scottish Government. (2021). Letter from Cabinet Secretary to Dr. Sally Witcher dated 10 February 2021 "Annual Uprating of Social Security Assistance". (n.p.): (n.p.).

Benefit rates 2021-22

The table below shows the rates for current Social Security Scotland benefits in 2020-21 and 2021-22. It also shows the previous September's CPI as this is the inflation figure used for uprating.

| 2020-21 | 2021-22 | |

|---|---|---|

| Previous September CPI | 1.70% | 0.50% |

| One-off Grants | ||

| Best Start Grant-pregnancy and baby, 1st child | £600.00 | £606.00 |

| Best Start Grant - pregnancy and baby, subsequent children | £300.00 | £303.00 |

| Best Start Grant -early learning | £300.00 | £303.00 |

| Best Start Grant - school age | £250.00 | £252.50 |

| Job Start Payment (standard rate) | £250.00 | £252.50 |

| Job Start Payment (higher rate) | £400.00 | £404.00 |

| Funeral Support Payment (standard rate) | £1,000.00 | £1,010.00 |

| Funeral Support Payment (funeral plan rate) | £122.05 | £123.25 |

| Funeral Support Payment (removal of medical devices) | £20.35 | £20.55 |

| Annual Payments | ||

| Child Winter Heating Assistance | £200.00 | £202.00 |

| Young Carer Grant | £305.10 | £308.15 |

| Twice Yearly Payments | ||

| Carer's Allowance Supplement | £305.10 | £308.15 |

| Weekly Payments | ||

| Best Start Foods (higher rate) | £8.50 | £8.50 |

| Best Start Foods (standard rate) | £4.25 | £4.25 |

| Scottish Child Payment | £10.00 | £10.00 |

Funding social security

Around 90% of devolved social security spending is funded through ‘block grant adjustments’ (BGA). (For details on how this works see Scottish Government's Fiscal Framework Technical Note.1)

The way the BGA has operated this year illustrates how risks that are the same across the UK are not necessarily risks to the Scottish budget. The Scottish Fiscal Commission (SFC) states:

There are significant risks to our forecasts for these benefits, largely as a result of COVID-19 [...], but our expectation is that these would be offset by similar changes in spending in England and Wales.

Scottish Fiscal Commission. (2021). Scotland's Economic and Fiscal Forecasts January 2021. Retrieved from https://www.fiscalcommission.scot/forecast/scotlands-economic-and-fiscal-forecasts-january-2021/ [accessed 9 February 2021]

Not all benefits are included in the BGA process. It excludes:

benefits that are unique to Scotland, such as the Scottish Child Payment

additional Scottish Government policy (eg. policy differences between the CDP and child DLA)

benefits funded through Machinery of Government transfers and Barnett (eg. Discretionary Housing Payments).

See the Glossary for a list of which benefits are funded through the BGA.

Scottish Government additional funding

Table 2 estimates that the Scottish Government is spending around £254 million on social security above the level of funding it gets from the UK Government. Most of this is spending on 'Scotland only' benefits. For those benefits that have a UK equivalent but are not included in the BGA, the calculation deducts the level of UK funding prior to devolution. For those benefits that are included in the BGA, the SFC forecast of additional Scottish Government policy cost is included.

This is an approximation but does give the likely scale of spending above UK funding.

| Benefit | £m | Notes |

|---|---|---|

| Scottish Child Payment | £68 | Scotland only benefit |

| Discretionary Housing Payments | £64 | £83 million current budget minus £18.5 million transferred from UK on devolution in 2017/18 |

| Carer's Allowance Supplement | £42 | Scotland only benefit |

| Scottish Welfare Fund | £36 | No DWP equivalent, although there are some local schemes. |

| Best Start Grant | £17 | £19 million current budget minus £2 million paid out in Healthy Start Maternity Grant prior to devolution |

| Best Start Foods | £12 | Welfare Foods in Scotland funded by the Scottish Government prior to its full devolution. |

| Funeral Support Payment | £7 | Current budget of £11 million minus £4 million spend on Funeral Expense Payment prior to devolution |

| Child Disability Payment | £3 | Scottish Fiscal Commission estimate of cost of additional Scottish Government policy in 2021-22 |

| Child Winter Heating Assistance | £3 | Scotland only benefit |

| Job Start Payment | £2 | Scotland only benefit |

| Young Carer Grant | £1 | Scotland only benefit |

| Total | £254 |

Figure 5 illustrates the difference in scale between UK Government funding and the additional sums added to the social security budget due to Scottish Government policy. This may change in the next few years if policy differences between PIP and Adult Disability Payment create substantial differences in spending.

Forecast errors, reconciliation and risk to the budget

The budget is set based on SFC forecasts of spending in Scotland. The Block Grant Adjustment (BGA) is set based on Office for Budget Responsibility (OBR) Forecasts of spending in England and Wales. The BGA is reconciled twice – once during the year based on updated OBR forecasts and then again, after the end of the financial year, once outturn figures are available. The Scottish Budget is updated three times – through summer, autumn and spring revisions. The following sections describe the latest position - the final reconciliation of the 2019-20 BGA against actual spending, the interim reconciliation for 2020-21 against updated forecasts and the initial BGA for 2021-22 based on initial forecasts.

Initial BGA for 2021-22

A mismatch between the two initial forecasts (SFC and OBR) could potentially cause a risk to the Scottish Budget because one determines funding and the other determines the social security budget. This year, despite some differences for individual benefits, the totals for the two forecasts are aligned.1 This means that, at the moment, it looks as though UK funding will match Scottish spending on those benefits which are subject to the BGA. However, this position may change as forecasts are updated and outturn figures become available.

Interim reconciliation of 2020-21 BGA

The initial BGA for 2020-21 that was applied to the Scottish 2020-21 Budget in February 2020 has been updated to reflect updated OBR forecasts. This update is applied in-year to the 2020-21 budget and results in the BGA being reduced by £17 million (i.e the initial BGA calculation is now thought to have been £17 million too high). This will be adjusted again once outturn figures are available in September 2021 and applied to the 2022-23 budget. This interim reconciliation is not part of the 2021-22 budget.

Final reconciliation of 2019-20 BGA

In the 2021-22 budget, the final reconciliation for 2019-20 is applied based on outturn data for England and Wales. This final funding figure can be compared to actual spending in Scotland that year. The final BGA for 2019-20 (£283 million) is £4 million higher than actual spending in Scotland of £279 million in 2019-20.1 This means that, the Scottish Government received £4 million more in BGA for Carer’s Allowance than it actually spent. In 2019-20 the BGA process only applied to Carer’s Allowance.

Forecast errors for 'Scotland only' benefits

In addition to the risk of differences between spending and funding for benefits included in the BGA process, there is also the risk that forecasts for ‘Scotland only’ benefits may differ from actual spending.

These ‘Scotland only’ benefits do not make up a large proportion of devolved social security spend but spending on new benefits is more difficult to forecast.

Forecast errors for say, the Scottish Child Payment, will not have a large impact on total spending of over £3 billion. However, they may be significant in the context of the additional spending provided by the Scottish Government, where the SCP makes up over a quarter (27%) of additional spend. Similarly, the Scottish Government’s policy to mitigate the bedroom tax (which drives most DHP spending) is far more significant for the budget when considered in the context of additional, rather than total, spend on social security.

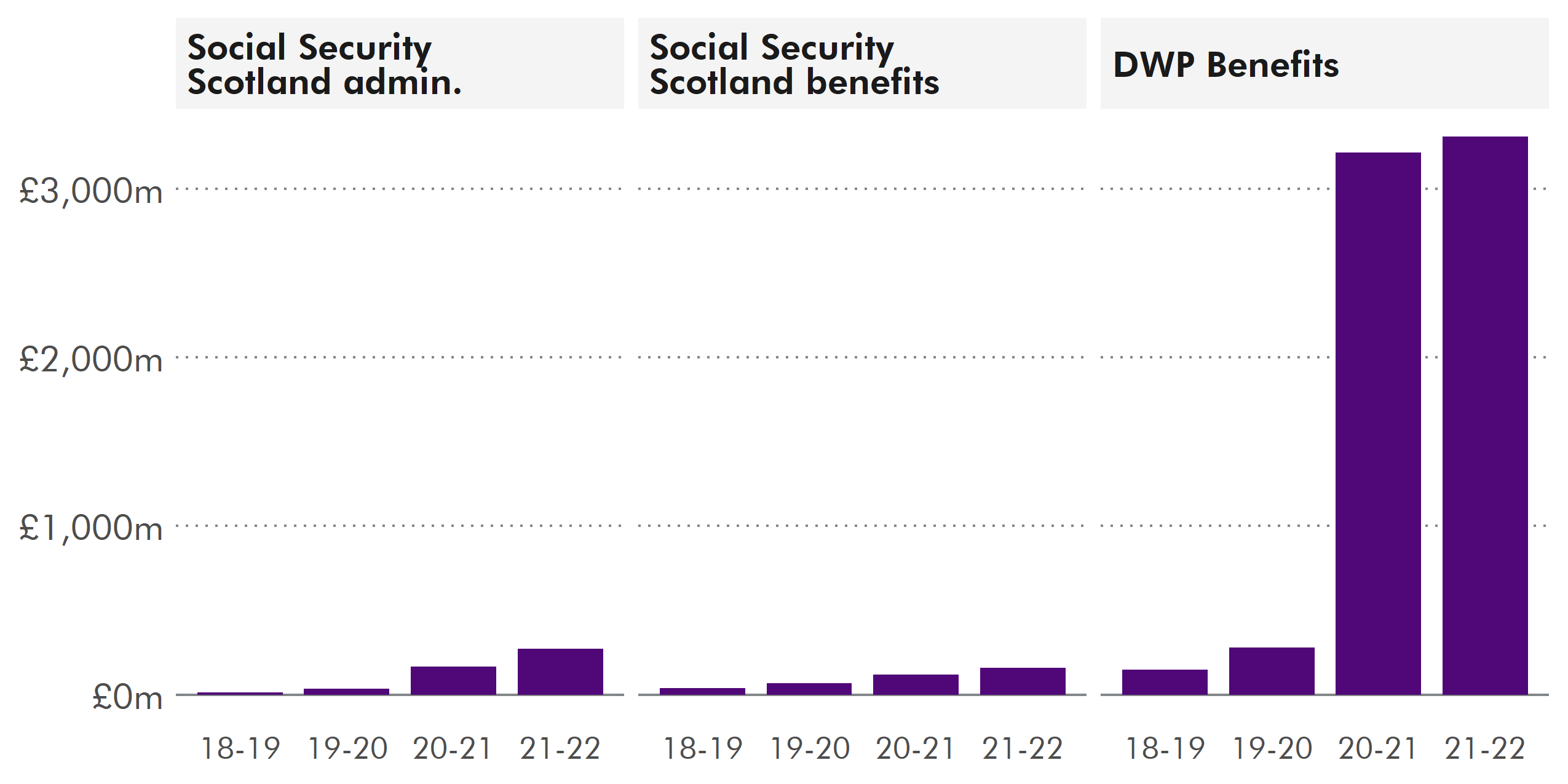

Administration costs

Social Security Scotland’s administration costs are high compared to the amount of benefit payments they administer. However it is difficult to separate current operating costs from preparations for new benefits.

There is a large increase this year in Social Security Scotland’s administration budget. It grows by £63 million from £186 million at the 2020-21 draft budget to £271 million for 2021-22 (46%).

In reality, it is an even bigger increase because, during 2020-21, at the summer budget revision, £18 million of Social Security Scotland’s administration budget was re-allocated to COVID-19 spending. This reduced its actual administration budget for 2020-21 to £168 million. The increase therefore reverses the £18 million ‘cut’ made during summer 2020, and tops this up by a further £45 million. This increase includes a new £22 million capital budget.

The ‘level 4’ budget figures describe this 46% increase as due to:

The ongoing building of the organisation to manage the further devolution of benefit administration, including the transfer of some functions from the Scottish Government into the Agency.

Scottish Government. (2021). Detailed 'level 4' Budget Data. Retrieved from https://beta.parliament.scot/chamber-and-committees/research-prepared-for-parliament/financial-scrutiny [accessed 12 February 2021]

The Scottish Government's 'Social Security Programme' budget is focused on developing new benefits and is separate from that of Social Security Scotland. However, it is not clear from the budget to what extent development work for future benefits is also undertaken at the agency itself. As mentioned in the quote above, some functions have been transferred. The budget for the 'Programme' increases from £175 million to £195 million. This is in addition to Social Security Scotland's administration budget of £271 million.

Figure 6 compares administration costs with benefit spending. It shows that, in 2020-21 and 2021-22, administration costs are expected to exceed the amount paid out in benefits by Social Security Scotland. There are several reasons why this may be the case.

In 2021-22, the only totally new activity for Social Security Scotland is delivering the Child Disability Payment (CDP) pilot, followed by nationwide roll-out for new cases to an estimated 2,000 children over the year.2 The CDP is a much more complex benefit to administer than current Social Security Scotland benefits because it requires assessment of evidence rather than just fact checking. The growth in administrative work also depends on how quickly existing cases are transferred from DWP.

The Scottish Child Payment was launched in late 2020-21, opening for applications in November with payments starting from the end of February 2021. In 2021-22, this will reach an estimated 107,000 households containing 130,000 children.2 This is a significant increase in activity compared with the start of 2020-21 and will therefore contribute to increased administration costs.

The pilot of Adult Disability Payment is due to start in spring 2022, so this may start before the end of the 2021-22 financial year, again adding to administrative requirements.

The 'level 4' budget figures also refer to functions transferring from the Programme to the Agency. These new functions may also contribute to the large increase in the administration budget.

A certain proportion of administration spending is payment for Agency Agreements with DWP although the amount is not specified in the draft budget. Therefore Figure 6 also shows spend on devolved benefits by the DWP. The 'Business Case' for Social Security Scotland, published in February 2020,4 indicated that Agency Agreements would around £70 million.

Glossary

| Benefit | Description | Devolution |

|---|---|---|

| Attendance Allowance | Pension age disability benefit | Social Security Scotland version by 2025. Funded through BGA |

| Adult Disability Payment | Working age disability benefit | Due to replace PIP from summer 2022. |

| Best Start Foods | Money to spend on certain foods for low income families with young children and pregnant women. | Started summer 2019. Funded through Health Department Welfare Foods. |

| Best Start Grant | Grants paid to families on qualifying benefits, around age 0, 2 1/2 and 5 | Started December 2018 to April 2019. DWP pay a grant for first baby only. |

| Carer's Allowance | Benefit for people caring for someone on certain rates of disability benefits. | Social Security Scotland version by 2025. Funded through BGA |

| Carer's Allowance Supplement | Supplement for people getting Carer's Allowance | Started September 2018. No DWP equivalent. |

| Child Disability Payment | Disability benefit for those under 18 | National roll-out autumn 2021, replacing child DLA. |

| Child Winter Heating Allowance | Annual payment to families with children on higher rate of disability benefits | Started November 2020. No DWP equivalent. |

| Child Disability Living Allowance | Disability benefit for those under 16 | To be replaced by CDP from autumn 2021. Funded by BGA. |

| Disability Living Allowance (adult) | Disability benefit being replaced by PIP. | To be replaced by ADP from summer 2022. Funded through BGA |

| Discretionary Housing Payment | Help with housing costs for those on qualifying benefits | Devolved 2017-18. Run by local authorities. |

| Funeral Support Payment | Help with funeral costs for people on qualifying benefits. | Started September 2019, replacing Funeral Expense Payment. |

| Industrial Injuries Disablement Benefits | Benefits related to industrial accidents and occupational diseases. | Social Security Scotland version by 2025. Funded through BGA |

| Personal Independence Payment | Working age disability benefit. | To be replaced by ADP from summer 2022. Funded through BGA |

| Scottish Child Payment | Top up for each child under 6 in families on qualifying benefits | Started February 2021. To be extended to under 16s in 2022. No DWP equivalent. |

| Self-Isolation Support Grant | Grant for people on a low income who are told to self-isolate due to COVID-19 | Started October 2020. Administered via Scottish Welfare Fund. |

| Severe Disablement Allowance | No longer available to new applicants | Funded through BGA. Not being transferred to Social Security Scotland |

| Scottish Welfare Fund | Discretionary crisis grants and community care grants | Started 2013. Run by local authorities. No DWP equivalent, but some local schemes. |

| Other relevant payments | ||

| Council Tax Reduction | Means tested scheme which reduces people's council tax bills | Replaced council tax benefit in 2013. Run by local authorities. |

| Cold Weather Payment | Payment during spells of cold weather for people on qualifying benefits. | Yet to be fully devolved. |

| Winter Fuel Payment | Annual payment for pensioners. | Yet to be fully devolved. |