Medicines in Scotland

Medicines form a vital part of modern healthcare and account for an increasing proportion of healthcare spend. Like most modern countries, Scotland tries to balance the best access to effective medicines, with ensuring affordability and supporting research and innovation. This briefing explains each of the key parts of the medicines supply chain and some of the challenges faced by the sector.

Executive Summary

Medicines expenditure in Scotland has risen steadily over the last decade and it now accounts for 13.1% of the total health budget. Most prescribing takes place in the community but recent trends show that prescribing costs in this sector have reduced.

However, drugs expenditure in the community and hospitals has been growing at a higher rate than overall expenditure. If this trend continues then savings will need to be found from other parts of the health budget. This would be most pronounced in primary care where prescribing accounts for a greater proportion of total spend.

The Pharmaceutical industry is a global industry worth more than US$1.2 trillion. It is also a significant industry within the UK, accounting for 7% of manufacturing output and contributing £13.8bn to the UK economy. The largest proportion (20%) of UK pharmaceutical imports come from the Netherlands and the largest proportion (23%) of UK pharmaceutical exports go to the US.

All medicines must undergo lengthy research before they can be licensed for use. This can take between 12-13 years. Medicines under patent are called branded and command a higher price. After the patent runs out, competitors can produce the drug and the price usually falls. The majority of new drugs are developed in the US.

The price of medicines in the UK is controlled by statutory and non-statutory regulation schemes. These depend on whether the medicine is branded or generic. The current scheme covering most branded medicines caps growth in expenditure at 2% and anything above this is paid back to the NHS.

Scotland cannot negotiate the price regulation schemes but it can control what it is willing to pay for medicines. This is influenced by the Scottish Drugs Tariff, central procurement, health technology appraisals by the Scottish Medicines Consortium and the Patient Access Scheme.

Medicines in the UK are regulated by the Medicines and Healthcare products Regulatory Authority (MHRA). This is the body responsible for assessing the safety and efficacy of medicines, issuing marketing authorisations and monitoring safety.

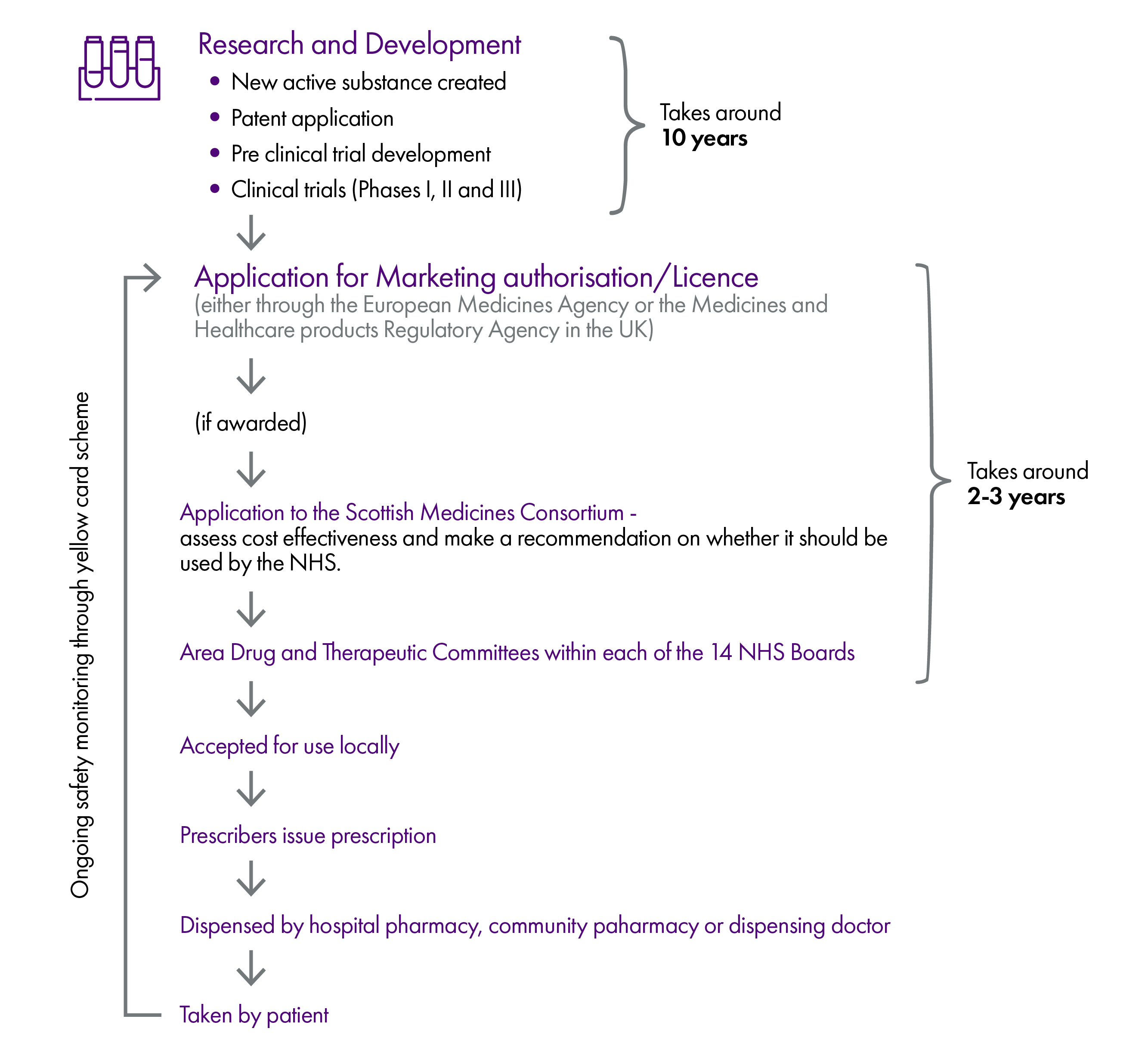

Once a new medicine is given a marketing authorisation, this usually kick starts the decision making process on whether it can be used in the NHS or not. In Scotland, this consists of an application to the Scottish Medicines Consortium (SMC) and, if recommended for use, consideration by the local Area Drug and Therapeutic Committees (ADTCs) of the NHS boards. ADTCs decide whether to include a medicine in their prescribing guidance (known as a formulary).

Medicines can still be prescribed to patients without a marketing authorisation, approval by the SMC or inclusion in the local formualry. There are special procedures established for doing this, for example, Peer and Clinician Engagement (PACE) and the Peer Approved Clinical System.

Clinicians ultimately make the decision on what to prescribe, but these decisions are influenced by the availability of a marketing authorisation, clinical guidance and the advice of the SMC and ADTCs.

There is a difference in how medicines are procured depending on whether they are dispensed in the community or in an NHS facility such as a hospital. Most hospital medicines are procured centrally by the NHS, while medicines dispensed in the community are normally obtained by community pharmacists from independent wholesalers.

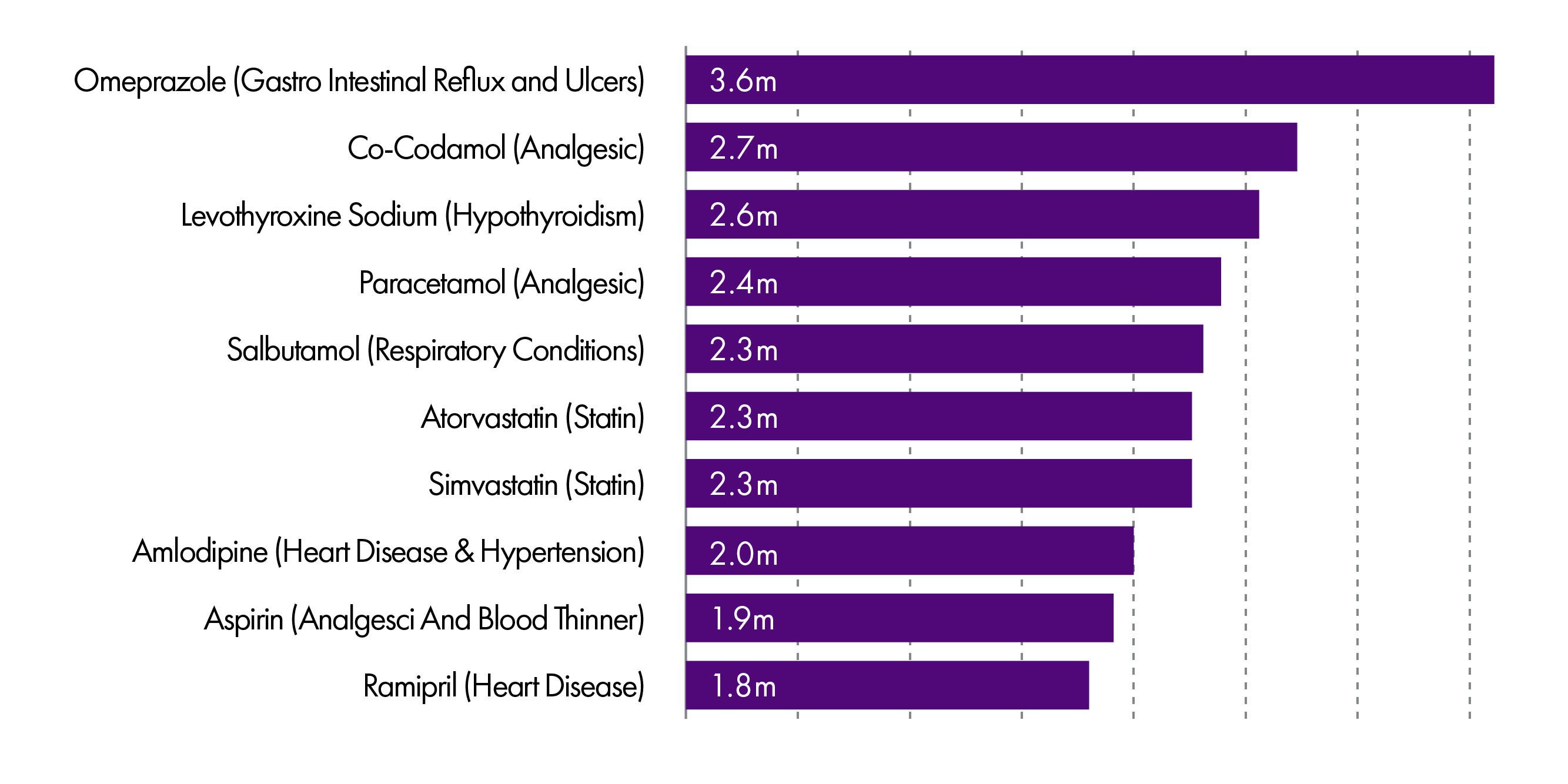

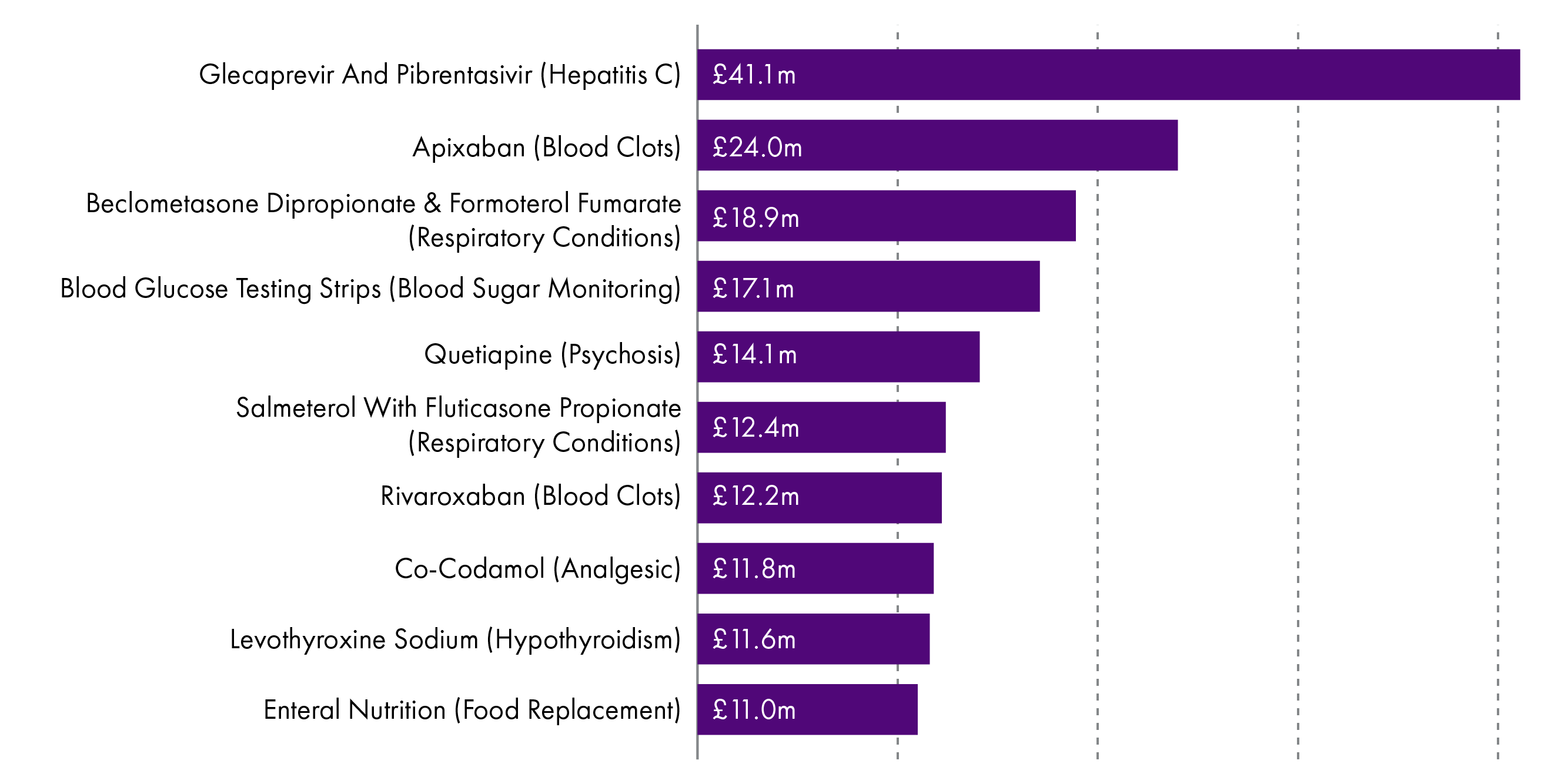

The number of items dispensed in the community has increased by 15.8% over the last decade (from 89.3m items to 103.4m items). The most commonly dispensed drugs are Omeprazole and Co-Codamol. In contrast, the drugs with the largest expenditure tend to be more specialist and are less likely to be generic. Treatments for Hepatitis C account for the largest expenditure in Scotland (£41.1m).

Medicines prescribed on the NHS can only be dispensed by a pharmacy which has been entered onto the NHS board's pharmaceutical list. There are currently 1257 community pharmacy contracts in place in Scotland. In some areas, pharmaceutical services are provided by dispensing doctors. There are currently 92 dispensing practices in Scotland.

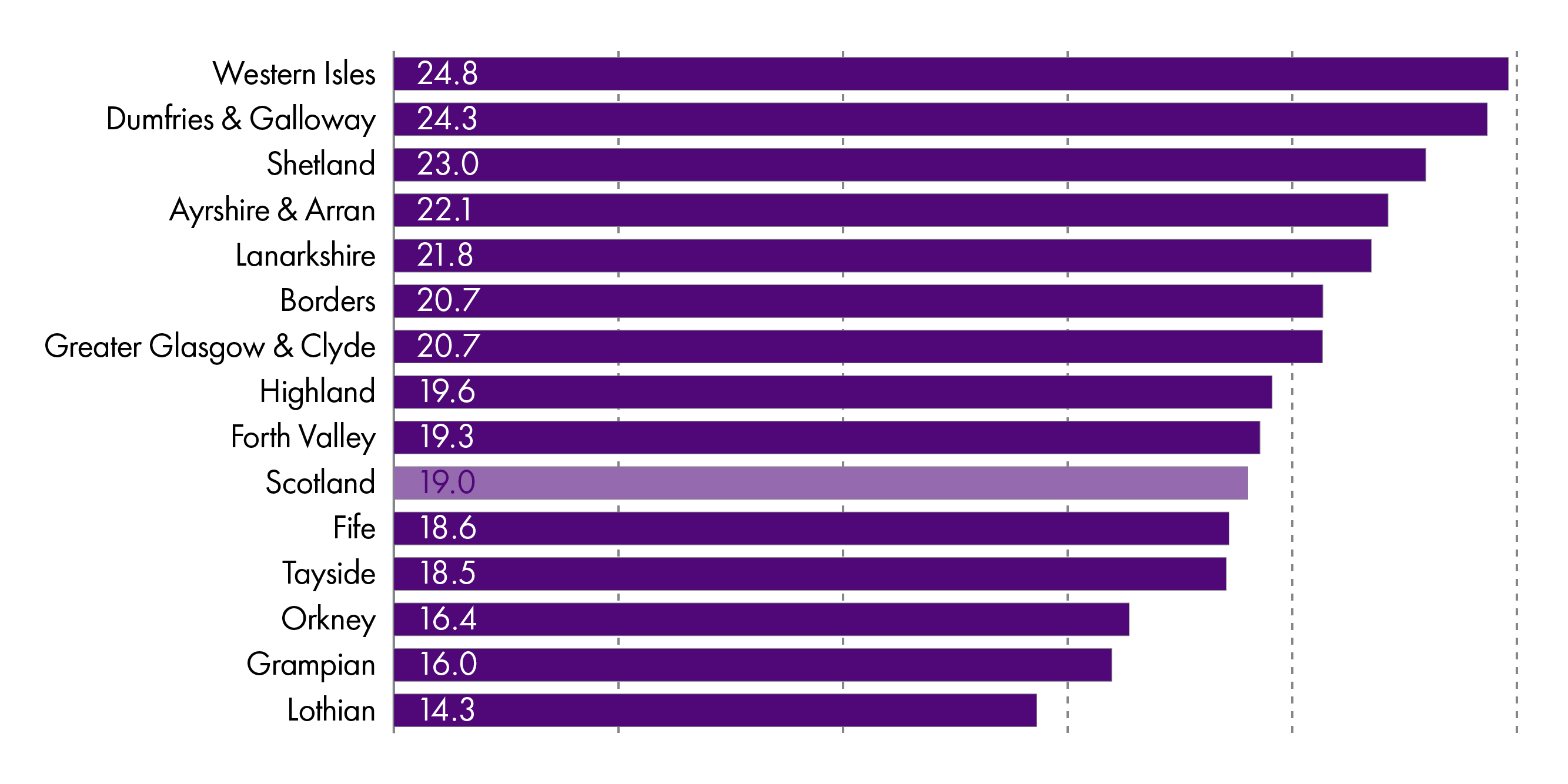

The average number of prescriptions issued per head of population is 19, although this varies between areas (e.g. 24.8 in the Western Isles compared to 14.3 in Lothian). It has been estimated that there is between £12-18m worth of avoidable medicinal waste in Scotland. Reasons attributed to this have included repeat prescribing, over-ordering by patients and waste in care homes.

Key issues facing the sector include the effect of Brexit on the supply and price of medicines.

Introduction

When a medicine is used by a patient in Scotland, it is at the final stage of a journey that may have taken over a decade. Medicines exist in a complex and highly regulated global market and must clear a number of hurdles before being used for their intended purpose.

These hurdles are summarised in the infographic below. However, please note that this is a simplified version which assumes a smooth journey but in reality there may be some diversions along the way.

This briefing explains in more detail how the system works.

Medicines expenditure in Scotland

Medicines play a vital part in modern healthcare but increasing costs, innovations and expectations mean that many healthcare systems have had to grapple with how to maximise access within constrained budgets.

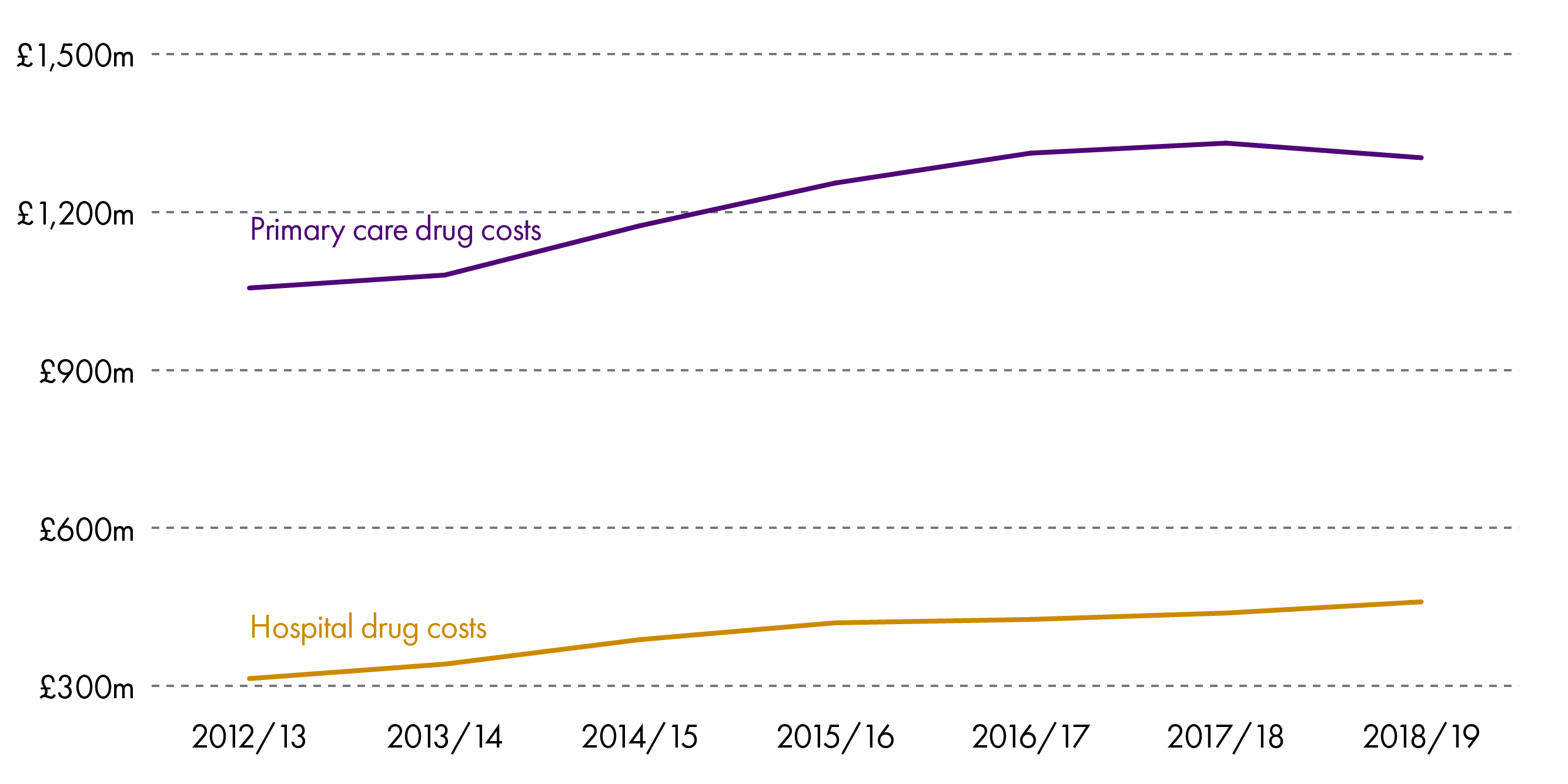

This is also true of Scotland where the cost of medicines has been increasing steadily over recent years, both in hospitals and the community.

As can be seen above, the largest proportion of drugs expenditure is in the community.

While the graph shows a steady increase, it is worth noting that in 2018/19, the total cost of providing medicines and pharmacy services in the community decreased by 0.5%. This is the first fall after a sustained rise of 20% over the last 10 years.1 Similarly, the total expenditure has fallen by 0.2% in real terms.

This success was noted by Audit Scotland in its recent overview report of the NHS, which attributed the fall to:2

increasing the use of generic medicines in secondary care

reducing the amount of drugs dispensed in primary care by more regularly reviewing the medicines that are being prescribed

switching from high-cost drugs to cheaper alternatives that are chemically similar to the original drugs and close enough to achieve the same results. These are referred to as biosimilars.

Nevertheless, expenditure on drugs takes up an increasing proportion of the budget and in 2018/19 amounted to £1.76bn.3 This is 16.1% of total NHS expenditure (hospitals and primary care - £10.97bn) or 13.1% of the total health budget (£13.4bn).

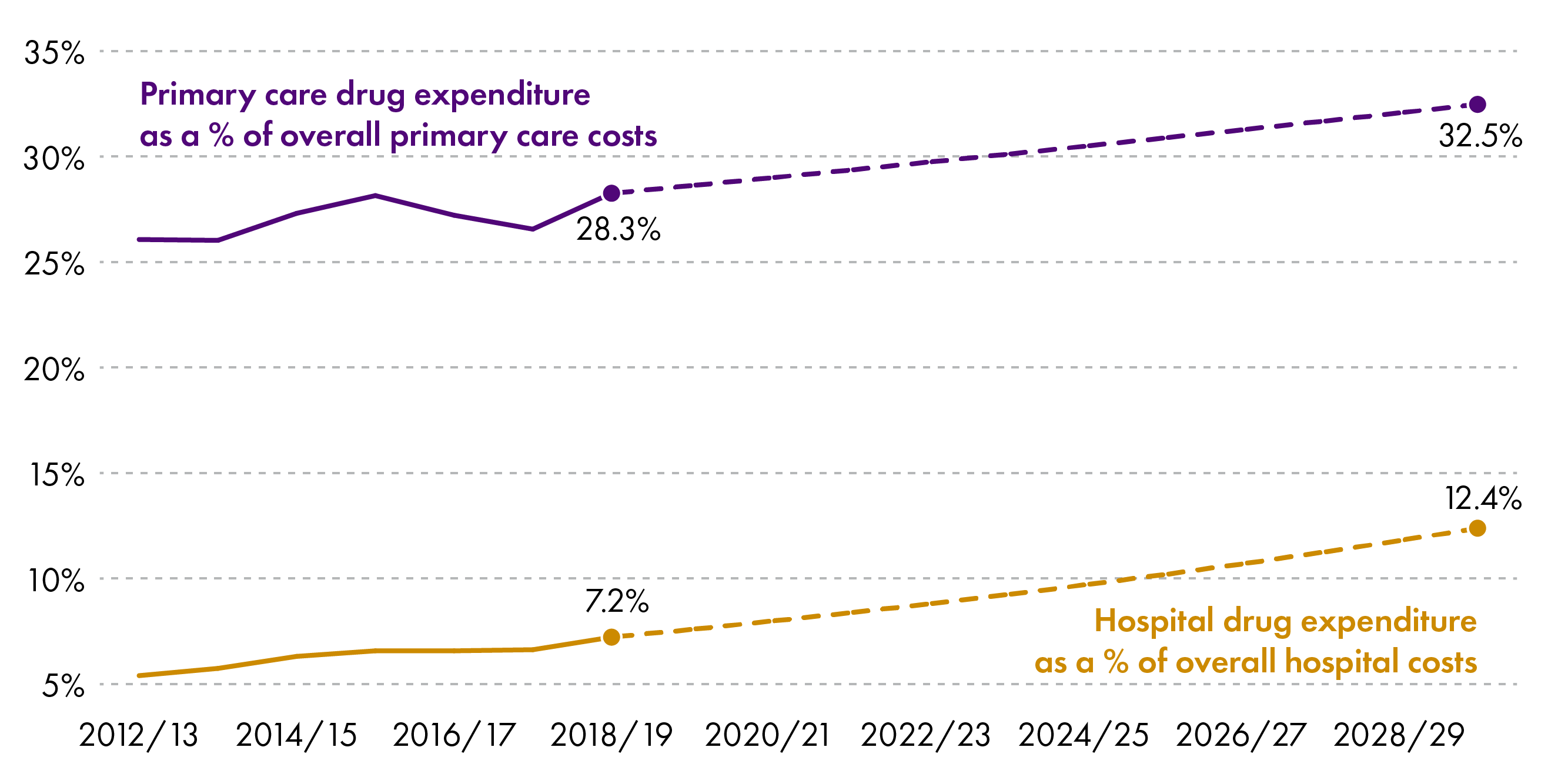

In 2017, the Healthcare Financial Management Association published Medicines Costs in Scotland.4 This report analysed historical growth in medicine expenditure and projected future spend by extrapolating from these trends.

The most recent data was used to update the analysis and give an overview of growth in expenditure over the previous 6 years . This was then used to project the trend for the coming decade.

The table shows the average growth in hospital and primary care costs.5

| Compound average growth rate | |

|---|---|

| Hospital drug costs | 6.6% |

| All hospital costs | 1.5% |

| Primary care drug costs | 3.6% |

| All primary care costs | 2.3% |

This shows that the rate of growth in drugs expenditure outstrips the growth in overall expenditure in both hospitals and primary care. In its 2017 report, the HFMA concluded:

If growth continues at this rate then, given that it significantly outstrips the growth in healthcare funding in Scotland, an increasing proportion of healthcare expenditure will need to be on medicines, and savings will have to be found elsewhere.

The following graph shows projected drugs expenditure as a proportion of overall expenditure in hospitals and the community if growth continues at the same average rate.

The biggest effect would be seen in the primary care sector where it could potentially account for 32.5% of expenditure.

Growth would be less pronounced in secondary care (12.4% of spend in 2029/30) but the spend would still take up an increasing proportion of the budget, meaning savings would have to come from elsewhere.

Pharmaceutical Industry

Definition of a medicine

In the UK, a medicinal product is definedi as:

any substance or combination of substances presented as having properties of preventing or treating disease in human beings

any substance or combination of substances that may be used by or administered to human beings with a view to restoring, correcting or modifying a physiological function by exerting a pharmacological, immunological or metabolic action, or making a medical diagnosis

This does not cover medical devices, food supplements, cosmetics, blood or blood products

Trade and Industry

Pharmaceutical companies are responsible for the development, production and marketing of medicines. It is a global industry worth $1.2 trillion per annum.1

In 2018, the industry contributed £13.8bn to the UK economy. This amounted to 0.7% of total economic output and 7% of manufacturing output.2

The UK is both an importer and exporter of pharmaceutical products. In 2018, exports were worth £23.5bn and 46% of these went to the EU.2

The UK imports almost an equal value of pharmaceutical products (£23.4bn) with 76% coming from the EU.2

The biggest proportion of UK imports came from the Netherlands (20%) and the largest proportion of exports go to the US (23%).2

| Exports | Imports | ||||

|---|---|---|---|---|---|

| £ Billions | % of total | £ Billions | % of total | ||

| United States | 5.4 | 23% | Netherlands | 4.7 | 20% |

| Germany | 3 | 13% | Germany | 3.4 | 14% |

| Netherlands | 1.6 | 7% | Switzerland | 3.1 | 13% |

| Irish Republic | 1.2 | 5% | Belgium | 2.3 | 10% |

| France | 1.1 | 5% | Irish Republic | 2.1 | 9% |

| China | 1 | 4% | United States | 2.1 | 9% |

| Italy | 1 | 4% | France | 1.4 | 6% |

| Spain | 0.9 | 4% | Italy | 1.1 | 5% |

| Japan | 0.8 | 3% | Denmark | 0.5 | 2% |

| Belgium | 0.7 | 3% | Spain | 0.5 | 2% |

| EU | 10.9 | 46% | EU | 17.7 | 76% |

| Non-EU | 12.7 | 54% | Non-EU | 5.7 | 24% |

| World | 23.5 | 100% | World | 23.4 | 100% |

Research and Development

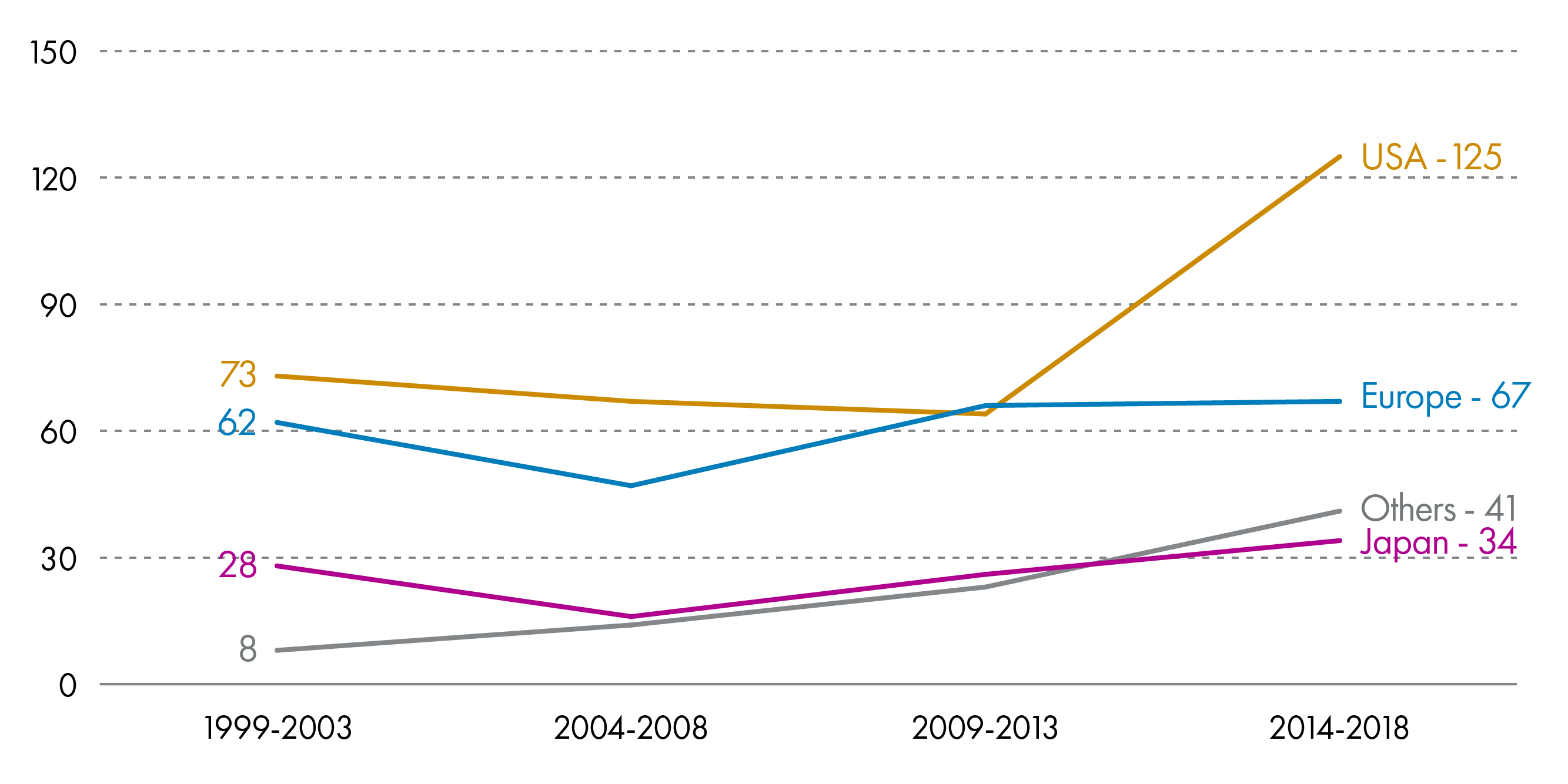

The US is the world leader in research and development but, within Europe, the UK has one of the highest spends on pharmaceutical research and development, coming only behind Germany and Switzerland.7

All new medicines must undergo lengthy research before they can be placed on the market. The time between the synthesis of a new active substance and its launch on the market is an average of 12-13 years. However, only 1 or 2 of every 10,000 new chemical or biological substances will make it to market, at an estimated cost of 1,926 million Euros (2014 prices).7

Most patents last for 25 years which means that the original developer of a medicine retains the right to be the only seller of that product. At this time, medicines are 'branded' and can command a higher price.

The 25 years in which a drug is considered 'branded' includes the 12-13 years in which the drug was being developed so, in reality, pharmaceutical companies have 12-13 years of branded pricing before it becomes 'generic'. At this time, competitors are allowed to manufacture and market the same substance and the price usually falls.

The branded period allows pharmaceutical companies to recoup the research and development costs of their drugs and is therefore intended to act as an incentive for research and development.

Between 2014-2018, 267 new chemical or biological substances were brought to market. 47% of these were developed in the US.7

There is rapid growth in the pharmaceutical industry in emerging economies such as Brazil, China and India. This has led to a gradual shift in the industry from Europe to these fast-growing markets. During 2014-2018 the Brazilian, Chinese and Indian markets grew by 11.4%, 7.3% and 11.2% respectively, compared to an average growth of 5.0% in the top 5 EU markets and 7.8% in the US.7

Sales

The US and Canada account for almost half of global pharmaceutical sales (48.9%). This compares to 23.2% for Europe, 17.1% for Africa, Asia & Australia, 7.4% in Japan and 3.3% in South America.7

In Europe, the price paid for medicines is usually regulated by Governments through the control of profit margins and VAT.

The retail price paid for a medicine in Europe is, on average, distributed along the following lines:7

Manufacturer - 66.6%

Wholesaler - 5.3%

Pharmacist - 17.8%

State (VAT and taxes) - 10.3%

In the UK, VAT is not applied to prescription drugs but 'over the counter' medicines have 20% VAT applied.7

Regulation of Medicines in the UK

Before any medicine can be used in the UK, it usually has to receive a marketing authorisation from either the Medicines and Healthcare Products Regulatory Agency (MHRA), or the European Medicines Agency (EMA).

The MHRA is the UK's licensing and regulatory authority and its functions are reserved to Westminster. It therefore operates on behalf of the 4 UK countries.

A marketing authorisation is often referred to as a 'licence' and can only be issued following the completion of clinical trials that show:

the medicine treats the condition it was developed for,

the medicine meets safety and quality standards, and

the medicine does not cause unacceptable side effects.

At the moment there are a number of routes for a medicine to obtain a marketing authorisation in the UK but at a very basic level this boils down to either applying via the EMA, or applying to the MHRA (see box below).

Box 1: Routes for obtaining a marketing authorisation in the UK1

Centralised procedure - pharmaceutical companies apply to the EMA for a marketing authorisation which will then apply across the EU and EEA countries. Certain medicines must use this procedure (e.g. orphan medicinesi).

Mutual recognition procedure - through this procedure, a medicine assessed and licensed in one EU member state is recognised throughout the EU and EEA by the EMA.

Decentralised procedure - an application is made to a number of Member States at the same time and one is designated the 'Reference Member State'. This member state will undertake the assessment on behalf of the others and any licence issued will apply to all.

National procedure - this refers to an application to a single national authority and any authorisation would apply only in that member state.

Marketing authorisations normally apply for 5 years in the first instance and can then be renewed following a re-evaluation.

Obtaining a marketing authorisation which is valid in an EU member state, does not guarantee the medicine will become available in that country. This is because companies can choose which countries to market their products in.

Post Authorisation Monitoring (Pharmacovigilance)

Once a medicine has a marketing authorisation, the EMA and the national regulatory authorities monitor its safety. Ongoing monitoring is important as the safety and efficacy of a drug is usually only assessed on the basis of clinical trial data.

In the UK this monitoring happens via the 'yellow card scheme'. This scheme allows side effects to be reported to the MHRA and these are considered alongside clinical trial data, data from other international regulators and emerging medical literature. The yellow card scheme provides feedback on real life experience of a drug. If a new side effect is identified, the drug is assessed by safety experts and the MHRA can take action action.

Pricing

The price paid for medicines in the UK is controlled by a number of statutory and non-statutory regulatory schemes. These differ depending on whether the medicine is branded or a generic.

There are also other mechanisms which can be used to influence the price paid. These are detailed in the following sections.

Branded Drug Price Regulation

The pricing of branded medicines in the UK is controlled under two different schemes.

Voluntary Scheme on Branded Medicines

Since 1957, the UK government has operated a voluntary pricing scheme with the pharmaceutical industry which was known as the Pharmaceutical Price Regulation Scheme (PPRS).

Initially, the PPRS involved a cut in the list price of branded medicines. However, in the last 5 years of operation, the scheme indirectly controlled prices by agreeing that if NHS expenditure exceeded an agreed percentage then members of the scheme would pay back the excess.

The scheme was a voluntary arrangement negotiated between the Association of the British Pharmaceutical Industry (ABPI) and the Department of Health and Social Care (DHSC) in England (on behalf of all UK nations). About 80% of branded medicines were covered by the PPRS.

In 2019, PPRS was replaced by the Voluntary Scheme on Branded Medicines Pricing and Access (VPAS). This continues the model of the recent PPRS in that the growth in spend is capped at 2% and any expenditure over this is paid back to the NHS.1

The overarching objectives of the VPAS are to balance access, affordability and innovation, while ensuring predictability for the industry and the NHS.

To encourage innovation, manufacturers of new active substances have the freedom to set their list price and are exempt from payments to the scheme for the first 3 years after launch. There are also exemptions for smaller pharmaceutical companies.

Payments received by the DHSC are allocated to the devolved administrations. In Scotland, the Scottish Government has historically ring-fenced this money for spending on new medicines via the New Medicines Fund. According to ABPI Scotland, their members have paid £258 million back to Scottish health boards over the last 5 years from PPRS.

Another new feature of the VPAS is that a price deal agreed in one UK nation must be offered to all of the others.

Statutory Scheme - Branded Medicines

Manufacturers or suppliers of branded medicines who choose not to join the voluntary scheme are subject to a statutory scheme established under the Branded Health Service Medicines (Costs) Regulations 2018.

Under this scheme, companies pay a rebate which is a percentage of total UK revenues. In 2019 this was set at 9.9% and is due to rise to 15.8% in 2020. The DHSC can change the percentages each year after consultation.

Generic Drug Price Regulation

Generic medicines are outside of their patent period so can be manufactured and supplied by a number of companies. Consequently, the general approach to pricing is to allow manufacturers price freedom and rely on competition to deliver value for money.

However, greater price regulation was recently introducedi following concerns around the prices of some generics, especially 'single source generics' i.e. generic products sold by one manufacturer. In addition, growth in the price of generics had been significantly higher than branded drugs (14.4% vs 5.5%).1

Unlike the schemes for branded drugs, there is no fixed growth or rebates for generics. However, UK Ministers now have the power to step in to control price rises in generics where competition is insufficient. Ministers also have the power to demand information on sales and purchases from all parts of the supply chain.

Scottish Powers over Pricing

Scotland cannot negotiate the price regulation schemes. However, the Scottish NHS has control over what it will pay for medicines and there are a number of mechanisms in place which influence this.

Scottish Drug Tariff

The Scottish Drug Tariff sets out the price paid to a dispensing contractor (community pharmacy, dispensing doctor or appliance contractor) for individual drugs and appliances dispensed to a patient through an NHS prescription.

The contractor is reimbursed for the cost of the item and the prescription effectively becomes an invoice which is sent to the Practitioner Services Division for payment.

The main part of the tariff (part 7) is published monthly and amendments are negotiated between Community Pharmacy Scotland and the Scottish Government.

Prices are determined in accordance with a protocol established by Scottish Ministers in consultation with Community Pharmacy Scotland. The protocol allows the pharmacy network to achieve an agreed level of margin.

NHS Procurement

NHS National Procurement was created to help NHS boards deliver better value in the goods they procure, including medicines. It now procures over two thirds of NHS Scotland spend, with the remainder being sourced locally by Health Boards. It does not procure medicines for primary care (see Procurement).

According to NHS National Procurement, in 2018/19, there were 120 Scotland-wide Framework Agreements associated with medicines. This represented a spend coverage of £447m and delivered savings to Health Boards of around £58m.1

Scottish Medicines Consortium

The Scottish Medicines Consortium (SMC) assesses the cost-effectiveness of new medicines and makes a recommendation on their use in the NHS.

The SMC does not directly negotiate the price of a medicine submitted by a pharmaceutical company. However, indirectly, the SMC has an influence on price as its recommendations are based on an assessment of value i.e. it measures the benefits of a medicine against the cost (see New Medicines below).

As a result, the price submitted by a company can have a significant bearing on whether or not the medicine meets the threshold to be accepted for use. Recent changes to the SMC's processes also means that a company has an opportunity to pause the appraisal process and revise its price. Companies can also resubmit an application.

Patient Access Schemes

When a medicine is assessed by the SMC and not recommended for use, there is scope for a pharmaceutical company to review its pricing structure and seek approval again from the SMC. This process is known as the ‘Patient Access Scheme’ and may result in drugs being approved for use but at a lower price than was originally offered. The PAS is operated separately from the normal SMC appraisal process.

Prescribing

There are different categories of medicine in the UKi. These are:

Prescription only medicines (POMs) - available from a pharmacist and dispensing doctor practice if prescribed by an appropriate practitioner

Pharmacy medicines (P) - available only from a pharmacy but without a prescription

General sales list (GSLs) - may be bought from any shop without a prescription or pharmacist supervision.

Despite the different categorisations, almost allii may be prescribed to patients if there is a clinical need. There is no fee applied to NHS prescriptions in Scotland.

Who can prescribe?

It is not only doctors that have prescribing powers. An increasing number of health professionals are able to prescribe, including nurses, pharmacists, physiotherapists, podiatrists and paramedics.

However, the prescribing rights of different practitioners may differ. Prescribing rights include things like the ability to prescribe controlled drugs and unlicensed medicines.

Prescribing Trends

The number of itemsi issued in the community has steadily increased over the past decade, from 89.3 million items in 2009/10 to 103.4 million items in 2018/19 (+15.8%). However, the numbers have plateaued since 2016.

The top ten most commonly dispensed drugs in the community are set out in the graph below, showing that Omeprazole and Co-Codamol take the top two spots.

However, in terms of cost, the drugs on which the NHS spends the most presents quite a different picture.

All of the 10 most commonly prescribed drugs are generic, which may in part explain why only two appear in the top 10 with the highest expenditure.

The top 10 drugs with the highest expenditure are also influenced by prescribing volume and changes in prescribing practice. For example, the amount of Glecaprevir and Pibrentasivir -used in the treatment of chronic Hepatitis C - has increased by over six times in the last year alone.1 This can happen when new treatments enter the market and their uptake increases and may replace older medicines. It also reflects an increasing trend for people to be treated with high cost, specialist drugs in the community.

The top ten items by expenditure accounted for £200.5 million in 2017/18. This is 17.2% of the total Gross Ingredient Cost for that year. 1

The majority of items dispensed are generic (84.3%). However, these represent just 33% of expenditure, with the smaller volume of branded medicines therefore accounting for a disproportionate amount of prescribing costs.1

Unfortunately, comparable data for prescribing in hospitals is not available, despite growth in drugs expenditure being higher in hospitals than in the community.

Influences on Prescribing Decisions

Decisions on prescribing are ultimately for a clinician to make in consultation with a patient. However, clinicians operate within a system which applies constraints to their prescribing practice. These constraints are intended to ensure safety, efficacy and value. The main constraints are detailed below.

Licensing

Pharmaceutical companies apply for a marketing authorisation (licence) for their product in order to endorse its safety, quality and efficacy. A marketing authorisation defines the clinical conditions, routes of administration, dosages and precautions for which the licensing authority has approved a medicine. It does not indicate cost effectiveness or value for the NHS.

Most prescribing is within the indicated use in the marketing authorisation but clinicians are also able to prescribe unlicensed products or products which are not authorised for a particular use. This is often referred to as off-label or unlicensed prescribing.

Off-label and unlicensed prescribing carries a greater risk for patients and consequently for a clinician's professional liability. It is therefore less likely to take place, although it is more common in certain specialties. This is often due to the lack of clinical trials in patient groups for which it is difficult to obtain ethical approval to research.

Licensing authorities, such as the UK's Medicines and Healthcare products Regulatory Agency (MHRA), cannot force manufacturers to apply for a licence and on occasions there may be drugs licensed in other parts of the world but not in the UK simply because no licence has been applied for. On these occasions there may be a reluctance for doctors to prescribe particular drugs even where there is considerable pressure from patients and their families (e.g. cannabis oil, T3/T4 for hypothyroidism). However, there is no way to force a clinician to prescribe a particular medication.

Clinical Guidance

Professional guidance to clinicians on prescribing states that they must 'provide effective treatments based on the best available evidence'. 1

Doctors are expected to work within the limits of their competence and keep their knowledge and skills up to date. One of the ways in which they do this, is by using clinical guidance.

There are a number of sources of clinical guidance, including professional bodies such as the Royal Colleges, the Scottish Intercollegiate Guidelines Network (SIGN) and the National Institute for health and Care Excellence (NICE).

The Scottish Medicines Consortium and Area Drug and Therapeutic Committees

The Scottish Medicines Consortium (SMC) is the appraisal body for new medicines. When a new medicine is licensed, the manufacturer can then make an application to the SMC for an appraisal of whether it should be prescribed on the NHS in Scotland (for more detail of this process please see the next section on 'New Medicines').

The SMC considers the cost-effectiveness of the medicine and issues a recommendation. However, this recommendation is to the 14 area NHS boards and is not binding. Whether a board accepts the decision to fund the drug is a matter predominantly for its Area Drug and Therapeutic Committee (ADTC).

One of the key differences between the two bodies is that the SMC considers value for money, while the latter also has to consider affordability. For example, the SMC may find that a medicine is excellent value for money, but if it is relatively expensive or would be appropriate for a large cohort of patients then it may not be affordable to an NHS board.

As a consequence the ADTCs make decision on which drugs should be prescribed their area. These drugs form the local 'formulary'. The formulary may set out first, second and third line treatment preferences for different conditions. Clinicians can prescribe outwith the formulary but there is an expectation that they will comply unless there is good reason not to.

NHS Boards also employ pharmacist advisers to work in GP practices and help them review their prescribing practice.

New Medicines

As detailed above, those who prescribe medicines in the NHS are constrained by decisions taken at a national and board level. Prescribers do not control the budget for medicines, with the cost ultimately borne by the NHS boards. As a result, before a newly licensed medicine can become routinely used by the NHS, its value is appraised by the Scottish Medicines Consortium (SMC).

Prior to the creation of the SMC in 2002, each of the Area Drug and Therapeutic Committees would advise their NHS board on which new medicines should be accepted for use. The SMC was intended to provide a single point of advice and to reduce duplication of work and differences in availability (sometimes referred to as 'postcode lotteries').1

Applications to the SMC

It is sometimes believed that the SMC considers all newly licensed medicines. However, this is not the case and in fact it will only appraise a medicine if the manufacturer has made a submission.

If a drug has been accepted for use by the NHS in Englandi then this decision is not applicable to Scotland (and vice versa).

Measuring value

Due to the finite resources of the NHS, the role of the SMC is to measure whether a particular medicine is good value for money. In doing this, the SMC uses Quality Adjusted Life Years (QALYs) as its measure of value.

A QALY is an attempt to quantify the quality of someone’s health. For example, one year at perfect health corresponds to one QALY, three years at only half of perfect health corresponds to 1.5 QALYs etc. The ratio of the incremental cost to incremental QALY is called the ‘incremental cost-effectiveness ratio’ (ICER).

Generally speaking, a medicine will be recommended for use if it has a cost of less than £20,000-30,000 per QALY. However, it is now recognised that this threshold is not always appropriate for end-of-life medicines or medicines for very rare conditionsii. As a result, there are now two distinct processes within the SMC; the 'standard' process and the 'rare and end-of-life conditions' process.

The key difference between the two processes is that the SMC will give less weight to the ICER for end-of-life medicines or rare conditions than for standard medicines. Instead it will also take into account the wider benefits of a drug not captured by a QALY (e.g. ability of a patient to work). These benefits are usually captured through what is called Patient and Clinician Engagement (PACE).

After the Scottish Medicines Consortium

If a medicine is recommended for use by the SMC, this does not automatically bind NHS Boards to fund it. The Scottish Government has previously said that it expects NHS Boards to implement SMC recommendations but it is ultimately a decision for individual NHS Boards and their Area Drug and Therapeutic Committees (ADTCs).

If a medicine is not recommended for use by the SMC then patients may still seek to access it through the either tier 1 or 2 of the Peer Approved Clinical System (PACS).

PACS tier 2 replaced the Individual Patient Treatment Request (IPTR) system and it is used to seek access to all types of medicines not approved by SMC. Ultra-orphan medicine are dealt with under Tier 1 of PACS.

A National Review Panel has now replaced the local appeals process of NHS boards and clinicians can ask for a review of a PACS decision. The panel independently reviews the original information and decides whether the decision is reasonable and whether due process was followed.

Generally speaking, PACS 1 and 2 involve patients and their clinicians presenting a case as to why their circumstances merit use of a particular drug.

Procurement

There is a difference in how medicines are procured depending on whether they are dispensed in the community or in an NHS facility such as a hospital.

Community Procurement

The vast majority of medicines are dispensed to patients in the community using a prescription issued by a General Practitioner (GP) or another prescriber such as a dentists or nurse. These prescriptions are usually taken to a community pharmacy and dispensed by a pharmacist.

Like GPs, community pharmacists are not employees of the NHS but instead they operate as independent businesses contracted by the NHS.

There are currently 1257 pharmacies providing pharmaceutical care services in Scotland. Applications to open a community pharmacy are made to NHS Boards through the ‘Control of Entry’ arrangements. i Successful applicants are placed on the NHS Boards ‘pharmaceutical list’ and can then dispense NHS prescriptions.

Each community pharmacist procures medicines to fulfil prescriptions on behalf of their patients. This is generally done by procuring the required medicine from wholesalers who effectively act as a middleman between the pharmaceutical companies and pharmacists. Some manufacturers may offer a direct to pharmacy arrangement for the procurement of medicines (i.e. bypassing the wholesaler).

Community Pharmacy operates a 'just in time model' and holds the stock so therefore carry the risk of any unused stock. This is because they are only reimbursed for the medicines they dispense.

Reimbursement by the NHS is based on the negotiated prices in the Scottish Drug Tariff but community pharmacies are free to 'shop around' and purchase their stock at lower prices from wholesalers.

The price the NHS pays to a community pharmacist for a medicine is made up of the cost of the medicine (as set out in the Scottish Drug Tariff) and a dispensing fee. The pharmacy funding model allows contractors to retain an element of margin from the purchase of drugs. The margin achieved in part funds the pharmaceutical care services provided by contractors (approx. 45%) and encourages pharmacy contractors to drive efficiencies into the system.

Hospital Procurement

Medicines dispensed in hospitals are procured centrally, either by NHS National Procurement (a part of the special health board National Services Scotland) or by individual area NHS boards.

Unlike community pharmacists, pharmacists that work in hospitals are employees of the NHS and are salaried.

NHS National Procurement works closely with Health Boards to procure medicines to be supplied to Scottish hospitals. In 2018/19, there were 120 Scotland-wide Framework Agreements associated with medicines; representing a spend coverage of £447m and delivering estimated savings of ~ £58m to Health Boards.

Dispensing

The dispensing of a medicine refers to the process of preparing and giving the medicine to a patient in line with a prescription.

Good dispensing practice ensures that:

...an effective form of the correct medicine is delivered to the right patient, in the correct dosage and quantity, with clear instructions, and in a package that maintains the potency of the medicine.1

This is predominantly a role for registered pharmacists, a profession regulated by the General Pharmaceutical Council (GPhC). All pharmacies in the UK must also be registered with the GPhC.

In Scotland, patients may have their medicines dispensed in hospital by a hospital pharmacist employed by the NHS, or in the community by a community pharmacist or dispensing doctor practice.

In order to dispense NHS prescriptions, a pharmacy must be entered onto the NHS board's pharmaceutical list. This involves an application to the board and consideration by its Pharmacy Practices Committee. Pharmacies are included on the list when it is considered necessary or desirable in order to secure adequate provision of pharmaceutical services.i

In some areas where a community pharmacist does not operate (e.g. remote and rural areas), medicines may be dispensed by a dispensing doctor. There were 92 dispensing practices in Scotland in 2017/18. A reduction from 95 in the previous year.2

Consumption

The average cost of prescriptions per person in Scotland is £246.96 per year and the average number of prescriptions issued per person is 19.1

This average varies between NHS boards and there are many reasons underlying this variation. These include the prevalence of disease, demographics and the duration of repeat prescriptions.

The number of prescriptions per capita had been had been increasing in the last decade but this has decreased slightly in the last few years.

A number of policy decisions over the last decade have aimed to improve access to medicines in Scotland. For example, prescription charges were abolished in 2011 and this was expected to benefit those who were previously prevented obtaining their prescription due to cost.

There are also a number of other initiatives agreed as part of the pharmacy contract which aim to improve access:

Minor Ailments Scheme - allows eligible people to register with a community pharmacist for the consultation and, if appropriate, the treatment of common conditions. The pharmacist advises, treats or refers the person according to their clinical needs.

Public Health Service - aims to support self care through activities delivered by community pharmacy such as the supply of emergency contraception and smoking cessation, including the supply of nicotine replacement therapy.

Chronic Medication Service - encourages joint working between GPs and community pharmacists in order to improve long-term care and enable ongoing dispensing for suitable patients with long-term conditions (e.g. diabetes). Patients register then GPs and community pharmacists work together to determine appropriate patient care and establish a serial prescription for a 24, 48 or 56 week period.

Waste

Pharmaceutical waste can be divided into 5 types:1

Non-compliance - patient does not take medicines as prescribed. For example, taking at irregular intervals or in incorrect doses

Intentional non-adherence - patient stops taking medication due to adverse side effects or personal beliefs

Unintentional non-adherence - patient stops taking medicine, or fails to take at correct intervals due to forgetfulness

Non-preventable waste - patient dies and unused medicines are wasted, or a change in treatment means current dispensed medicines are no longer required.

Preventable waste - patient stock piles medicines. All items from repeat prescription are dispensed even if patient no longer takes the medicine.

A study in 2010 estimated that medicines wastage in England was in the region of £300m per year, about 4% of expenditure on prescribing. This included an estimated £90m of unused medicines in people's homes (30% of wastage), £110m returned to community pharmacies (36.6% of wastage) unused and £50m worth of unused medicines disposed of by care homes (16.6% of wastage).2

The study estimated that about 50% of waste was unavoidable but between £100 to £150m could be avoided without undue cost.

In 2013, Audit Scotland used these figures to estimate avoidable waste in Scotland would be in the region of £12-18m.3

During the audit, NHS Boards were surveyed and they identified what they thought were the five main causes of waste.

Repeat prescribing

Over-ordering by patients

Medicines in care homes

Abolition of prescription charges

Patients prescribed multiple drugs (polypharmacy)

Key Issues

The following sections detail some of the key issues and challenges in the field of medicines currently.

Brexit

The UK Government’s EU Exit Analysis identified pharmaceuticals as the sector for which UK/EU market access is the most important.

Key concerns include; potential challenges around ensuring supply in the face of border delays, potential impact on price and the UK pharmaceutical industry, as well as implications for the licensing system and clinical research.

Supply

There has been much speculation about the potential impact of Brexit on the continued supply of medicines. These concerns stem from the unknown impact of border controls on goods and the potential loss of ‘parallel trade’ which allows the UK to procure medicines from other EU countries. If a deal is reached then supplies should hopefully not be affected, but the UK Government has been leading on contingency plans for medicinal supplies in the absence of a deal.

This planning includes ensuring that the UK has a 6 week stockpile of medicines. Predominantly this has involved the UK government asking pharmaceutical supply companies to ensure that they have an additional 6 weeks supply of medicines over and above their normal operational buffer. The NHS itself has not been asked to stockpile any supplies. See Medicines Supply Contingency Planning Programme guidance for more detail.

For medicines with a short shelf life, the UK government has asked suppliers to ensure they have plans in place to air freight those products in order to avoid any border delays that may arise. However, the Department for Health and Social Care (DHSC) also wrote to suppliers detailing that it has secured additional ferry capacity and medicines and medicinal products will have priority use of that additional capacity. The DHSC has also established a ‘dedicated shipping channel’ as a contingency arrangement in the event of severe disruption.

The UK Government has also established an express freight service to transport small medical supplies into the UK on a 24 hour basis. This is being led by DHSC and will be a response to any urgent need or where a supplier's own plans experience disruption.

Price

The UK imports £23.4bn worth of pharmaceuticals a year, with more than three quarters (76%) coming from the EU. It is also a significant exporter, exporting in the region of £23.5bn per annum.1

In the absence of new trade agreements, the UK would revert to World Trade Organisation (WTO) tariffs. The WTO’s Pharmaceutical Tariff Elimination Agreement means that for signatory states (e.g. Japan, the US, Canada, Australia and EU member states) pharmaceutical products are subject to 0% tariffs. However, for other states such as Brazil, China and Russia there are tariffs of between 1% and 15%.2

In addition, there has recently been much speculation that a post-Brexit trade deal will result in changes to the price paid by the UK for US medicines. This is because it has been reported that US trade negotiators have said they want non-discriminatory access to the UK market. The price of the top 20 drugs in the US is 4.8 times more than in the UK.3

It is not entirely clear what this would mean in practice but one suggested example includes extending patents (US patents last longer than UK patents) which would mean that medicines would be held at a higher price for longer before generic competition would kick in.3

New medicines

The system for approval of medicines within the EU is two-fold. Pharmaceutical companies can apply to the European Medicines Agency (EMA) or to the UK’s regulator (the Medicines and Healthcare products Regulatory Agency - MHRA) to acquire a licence for its products to be used in the UK.

A licence granted through the EMA applies to all the countries in the EU so often pharmaceutical companies will utilise this route to avoid duplication and gain faster entry to the European market.

This centralised procedure prevents duplication of spending and work and makes the UK and other EU countries a priority for the introduction of new drugs. The Medicines and Healthcare products Regulatory Agency (MHRA) has its own procedures for licensing medicines, which are not covered through the centralised procedure of the EMA.

The current twin track system is still in place until we leave the EU, but as the EMA was headquartered in the MHRA in London, it is now in the process of moving to Amsterdam. The immediate effect of this has been on the relocation of staff but there is some concern that future arrangements which result in a separation from the EMA could result in a delay to accessing new drugs and could require increased investment in our own regulatory system.

The impact will ultimately depend on what arrangements are arrived at post Brexit.

Medicine Shortages

Medicine shortages appear to have become increasingly common in recent years. The reasons for this are multifactorial but an article by the BBC reported that pharmacists were finding it increasingly difficult to obtain some of the most commonly prescribed drugs.1

Medicine shortages are not new and can be down to a number of different reasons. Such reasons include manufacturing problems, a shortage of active ingredients, increasing global demand and fewer producers.

The impact of shortages includes patients not receiving the medication they require and having to go back to the prescriber for an alternative. It also results in community pharmacists spending an increasing amount of time trying to source the appropriate medications.

Governments have the power to apply an adjusted tariff price in order to appropriately compensate pharmacists who have had to order more expensive versions of a medicine facing a shortage. An analysis by the BBC found that the number of medicines on the English price concessions list had grown six-fold in 3 years.1

This obviously has an impact on budgets and the article reports that it can result in the trebling of monthly costs for the drugs which had been given price concessions.