The Scottish Government's Medium-Term Financial Strategy, May 2019

On 30 May 2019, the Scottish Government published Scotland's Fiscal Outlook: The Scottish Government's Medium-Term Financial Strategy. On the same day, the Scottish Fiscal Commission published its latest set of economic and fiscal forecasts. This briefing provides a summary and analysis of key elements of these reports.

Executive Summary

The Scottish Government published its Medium-Term Financial Strategy on 30 May 2019. The document is underpinned by the latest Scottish Fiscal Commission (SFC) Economic and Fiscal Forecasts which were published on the same day.

The SFC has revised down its short-term GDP forecast from December due to ongoing Brexit uncertainty, meaning that Scottish growth forecasts are below the latest official overall GDP forecast for the UK, produced by the Office for Budget Responsibility (OBR).

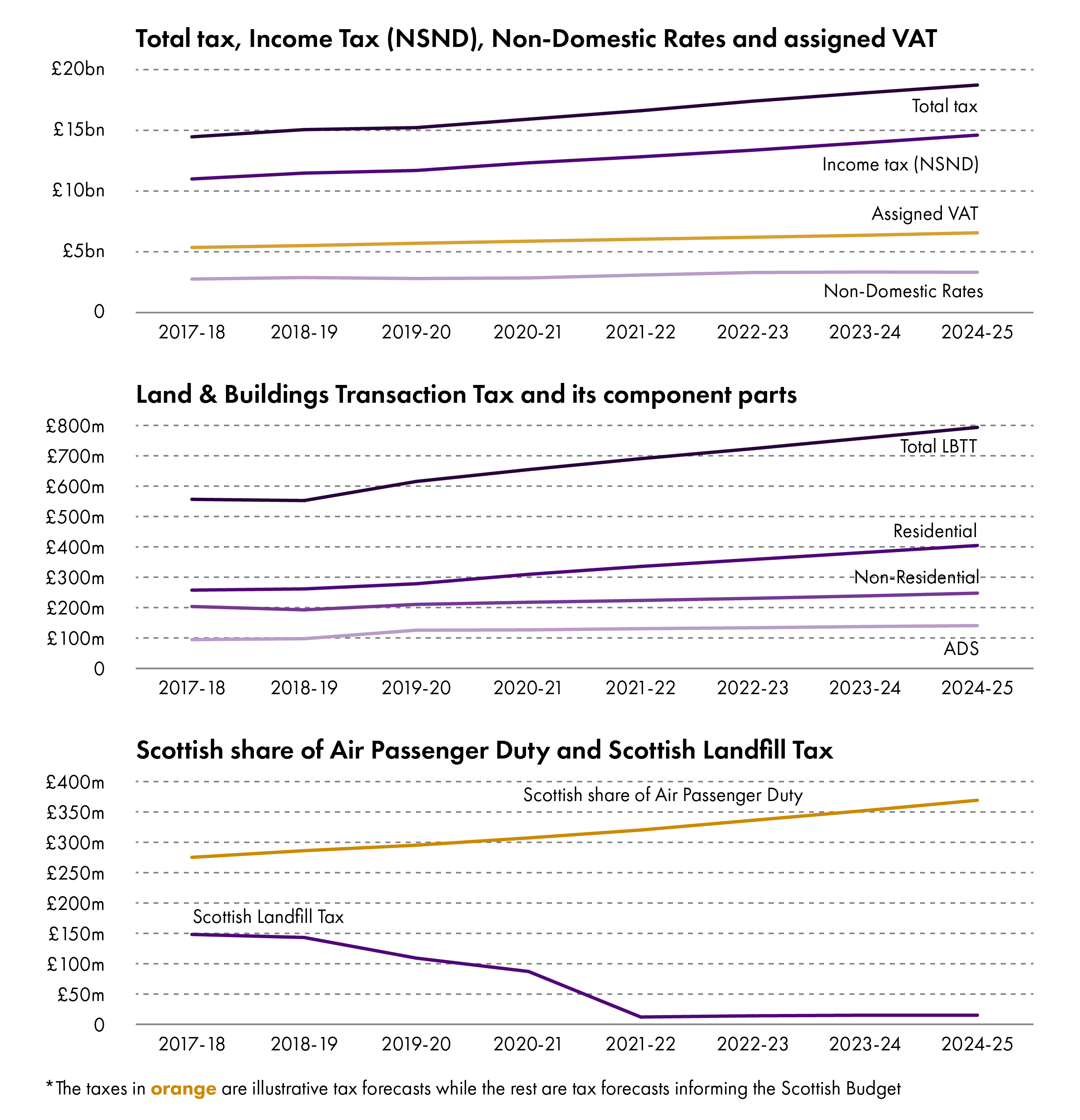

All the devolved taxes are projected by the SFC to increase over the forecast period with the exception of landfill tax, which is expected to fall - in line with the Scottish Government policy priority of reducing waste going to landfill.

The big story from these forecasts for the Scottish budget relates to the anticipated reconciliations that may need to be made at future budgets.

The latest income tax forecasts suggest that the Scottish Government may need to plug a significant revenue shortfall in each of the next three years because forecasts have changed since the budgets were set. However, it is important to note that these are just forecast reconciliations at this stage. The actual reconciliations could be better or worse for the overall budget position.

Over the three years these reconciliations total over £1 billion. This means on latest forecasts the Scottish budget has allocated over £1 billion that it may not actually have had. When the budgets are first set, tax revenues can only be estimated, so it is only over time once taxes are received that the actual spending available to the budget can be known for certain - and this can be higher or lower than originally estimated by both the SFC and OBR. At that point, a reconciliation must be made to future budgets.

A larger part of the latest forecast reconciliations is due to upward revisions to the block grant adjustment (BGA) derived from OBR forecasts, rather than downward revsions to the SFC's Scottish forecasts.

The Scottish budget takes on the budgetary risk for devolved social security spending in full from 2020-21, despite the fact that most claimants will still be receiving their benefits from the Department for Work and Pensions (DWP) at that point. This means that the Budget to be introduced later this year will include spending for all benefits being devolved. This will result in social security spending rising by £3 billion in the 2020-21 budget.

Whilst the overall budgetary outlook is presented in the MTFS, there is no detail on Scottish Government spending priorities or plans. Instead, a set of principles which will be used by the Government in undertaking a Spending Review is provided.

Most surprising is the lack of detail as to how the Scottish Government might meet the challenge presented by a possible £1 billion reconciliation over the next three financial years.

The document does not provide subject Committees much material with which to undertake pre-budget scrutiny of the Scottish Government’s spending plans, contrary to one of the original intentions of the document when it was recommended by the Budget Process Review Group.

Context: the Medium Term Financial Strategy

On 30 May 2019, the Scottish Government published Scotland's Fiscal Outlook: The Scottish Government's Medium-Term Financial Strategy.1

This is the second fiscal outlook produced by the Scottish Government, following a recommendation of the Budget Process Review Group (BPRG) that the Scottish Government takes a more medium to longer-term approach to financial planning.2

The document is informed by the latest Scottish Fiscal Commission (SFC) Economic and Fiscal Forecasts3 for tax revenues, social security spending and economic growth which are produced twice per year. These forecasts, along with other assumptions, underpin the Government’s projections for their available resources over the period covered by the MTFS.

This briefing summarises the latest fiscal forecasts, and what they tell us about the outlook for the Scottish budget.

The briefing concludes with some analysis of the MTFS document itself. The purpose of the MTFS, as recommended by the BPRG, was to 'provide a means of focussing on the longer-term sustainability of Scotland's public finances'. This was to include 'forecast revenue and demand-led (ie social security) spending estimates; the effect of different economic scenarios on the budget, 'broad financial plans for the next five years'; and 'clear policies and principles for using, managing and controlling the new financial powers'. Does the MTFS deliver on these objectives?

Scotland's Economic and Fiscal Forecasts

Economic growth

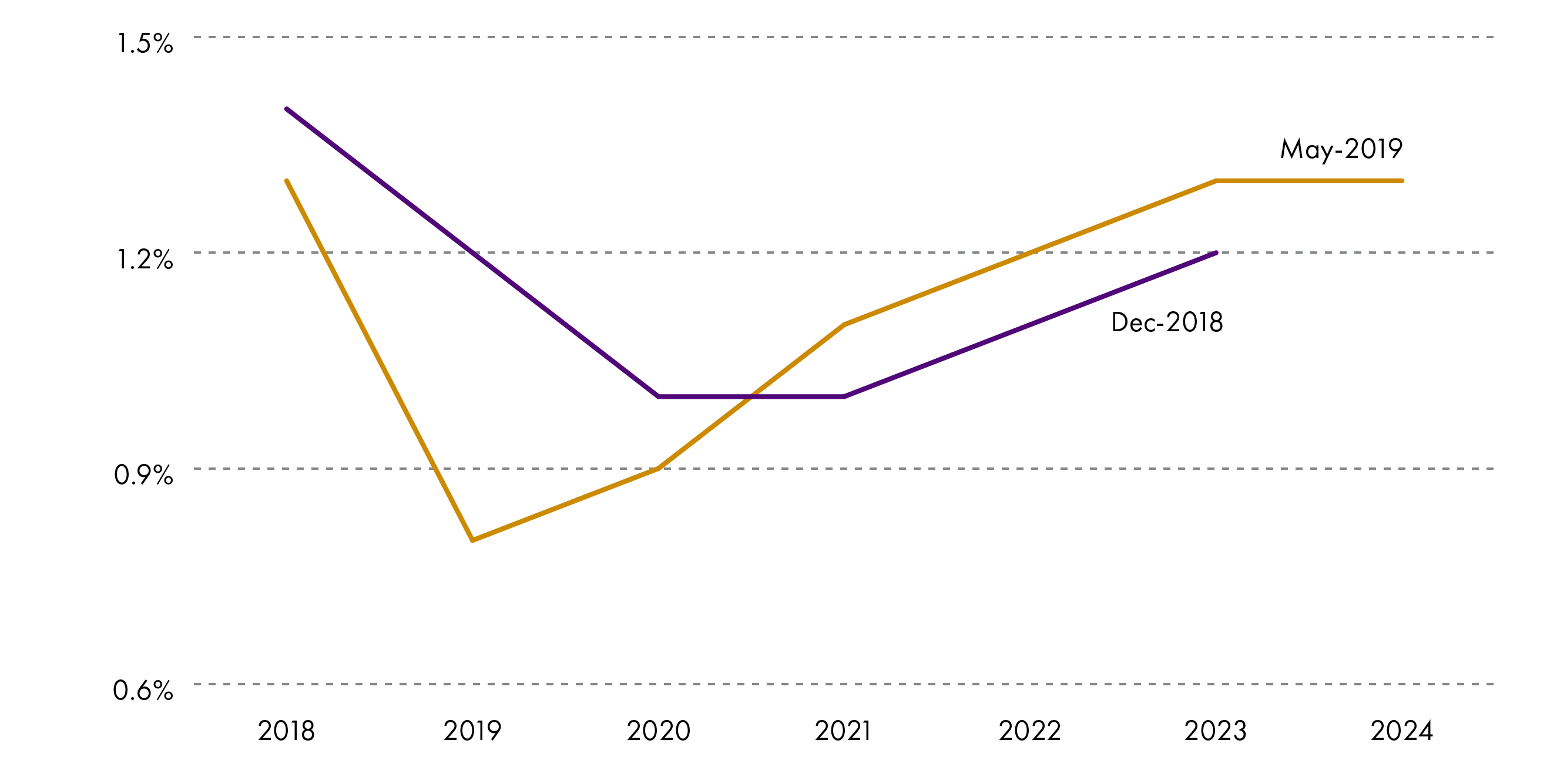

The SFC has revised down its short-term GDP growth forecast from December citing “ongoing uncertainty created by the Brexit negotiation process”. They are projecting that growth will fall from the 2018 outturn figure of 1.3% to 0.8% in 2019 before rising slightly to 0.9% in 2020.

This is below the overall GDP growth forecast for the UK produced by the Office for Budget Responsibility (OBR) at the Spring Statement in March, of 1.4% in 2018 and 1.2% in 2019 and 1.4% in 2020.

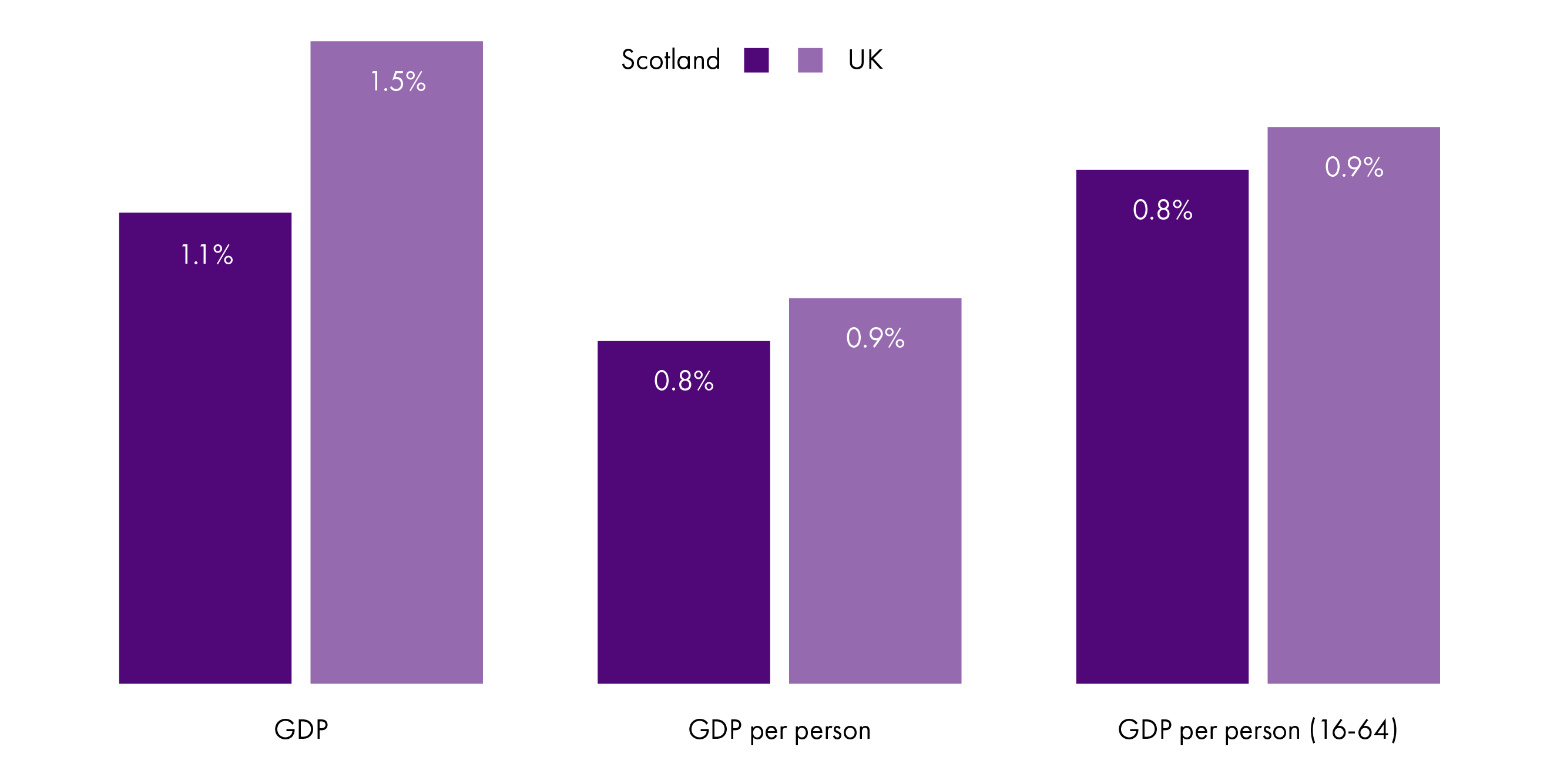

However, as the figure below shows, Scottish GDP per person over the forecast period is much more closely aligned with the UK as a whole. It is slower population growth in Scotland that is driving the overall slower GDP growth. On a per person GDP basis, the SFC economic forecasts show that Scotland is expected to converge with the UK, but “remain lower overall because of slower productivity growth in Scotland.”

Tax revenue forecasts

The SFC is responsible for producing five year forecasts for devolved, shared and assigned tax revenues. The latest forecasts are presented in the following figure.

Income Tax reconciliations

Forecasts are inevitably subject to change as new information comes to light. There was always a likelihood that the Scottish Government would end up having somewhat more, or somewhat less resource available to it than was thought when the budget was set, as when the budgets are set, they need to depend on estimates of future tax revenues.

The forecasts that matter for the setting of the budget are the ones made by the SFC (for revenues) and the OBR (for the block grant adjustment, see below) at the time of the Budget. These are then locked in and that is what is available for public spending.

The Budgets are then subsequently reconciled with outturn income tax receipts some 16 months after the end of the financial year.

Importance of the Block Grant Adjustment

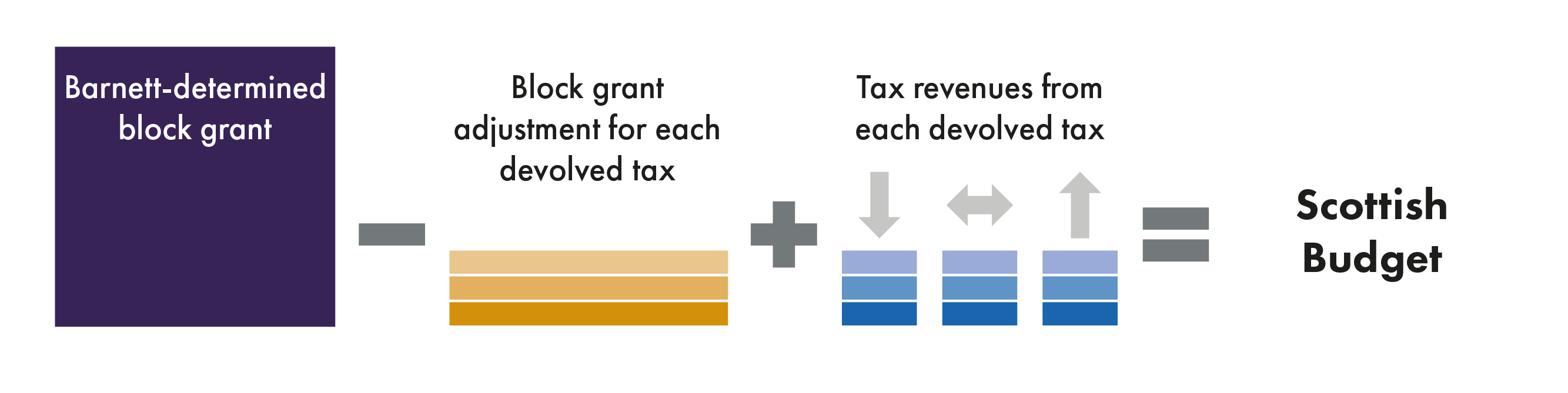

Under the Fiscal Framework, equally important to the Scottish budget as the SFC revenue forecasts, is the block grant adjustment (BGA) made to the Scottish budget to reflect the revenues foregone by the UK government from the devolution of each tax.

The BGA is linked to the growth rate of revenues in the “equivalent” taxes in the rest of the UK.

However, at recent fiscal events the OBR has been raising its income tax forecasts for the rest of the UK compared to earlier forecasts. This has the effect of the increasing the size of the BGA, and increasing the potential size of reconciliations that may have to made to future Scottish budgets.

Net potential impact of latest Revenue and BGA forecasts

The latest income tax forecasts suggest that the Scottish Government may need to plug a significant revenue shortfall in each of the next three years because forecasts have changed since the budgets were set. However, it is important to note that these are just forecast reconciliations at this stage. The actual reconciliations could be better or worse for the overall budget position.

Income tax forecast

How has the SFC income tax forecast changed since its last forecast in December? Forecasts will always be subject to change, with some factors increasing the forecast, and others reducing it.

There is an upward revision from an improved outlook for earnings growth following better-than-anticipated outturn figures on earnings published since December.

Improved earnings growth is largely offset by a downward reduction to the forecast as a result of an improvement in the way that the effects of pensions auto-enrolment is accounted for (auto-enrolment reduces revenues because pension contributions are not taxed).

The forecast is also revised down (very slightly) to account for new taxpayer survey data.

The effect of the improved outlook for earnings outweighs the downward adjustment associated with the other two factors. The SFC’s income tax forecast has been revised up (very slightly) since December, for each year of the forecast period. However, it is the net tax position that matters for the Scottish budget.

Net tax position

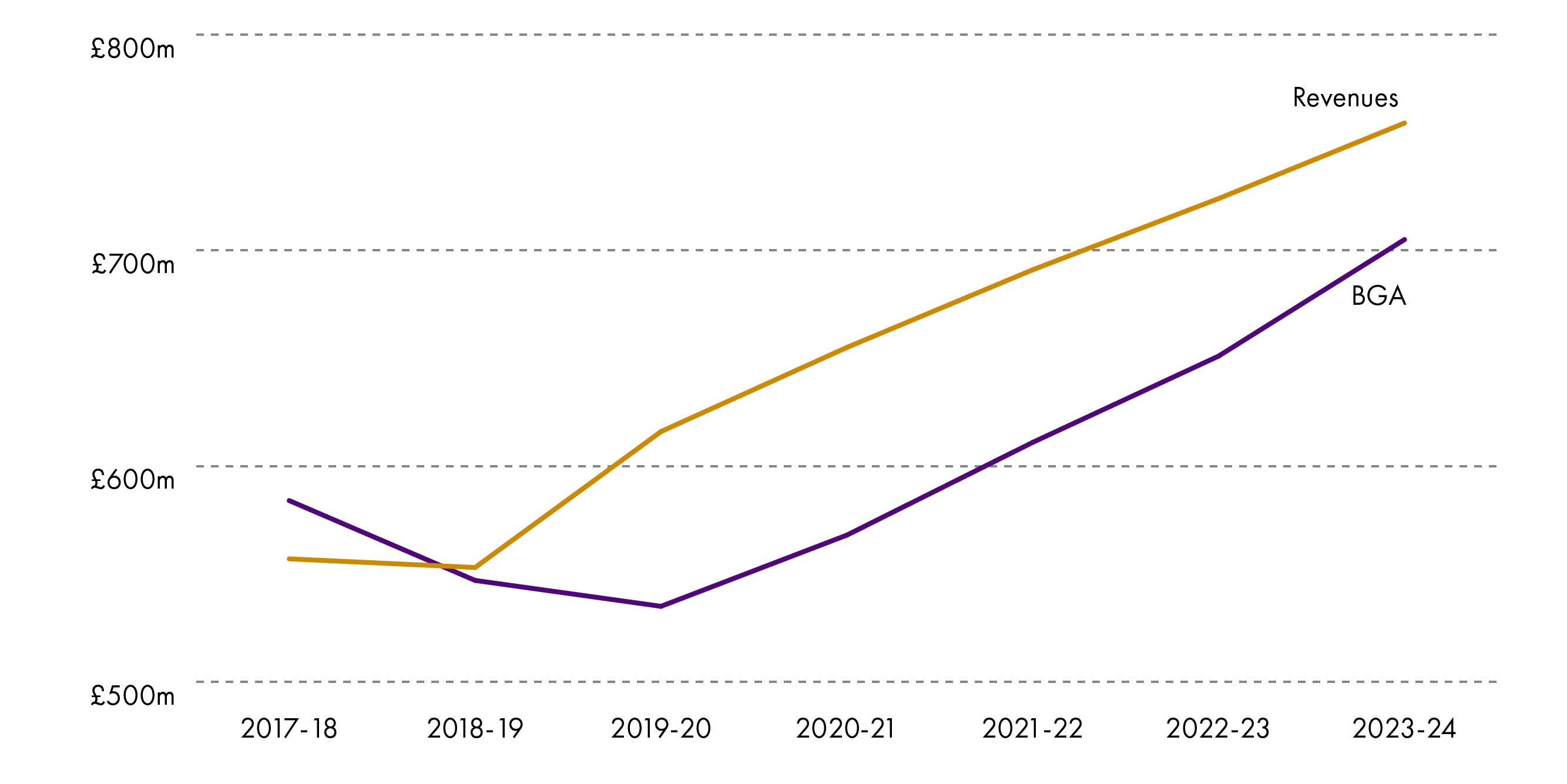

This section reproduces analysis from a paper produced for the Finance and Constitution Committee by its adviser on the Fiscal Framework, David Eiser.1

As illustrated in figure 4, what matters for the Scottish budget is not only the outlook for Scottish revenues, but the outlook for the ‘net tax’ position – the difference between Scottish revenues and the Block Grant Adjustment (BGA). The BGA is the estimate of the revenues foregone by the UK Government as a result of transferring a tax to Scotland. It is calculated by assuming that, if it had not been devolved, revenues from the tax in Scotland would have grown at the same per capita rate as they have done in the rest of the UK.

We now know that the most up-to-date forecasts show that the ‘net tax’ position has deteriorated since December. Although the Scottish revenue forecast has improved by £20 million in 2019-20, the forecast of the BGA has increased by £208m. Thus the ‘net tax’ position for 2019-20 has worsened by £188m since December.

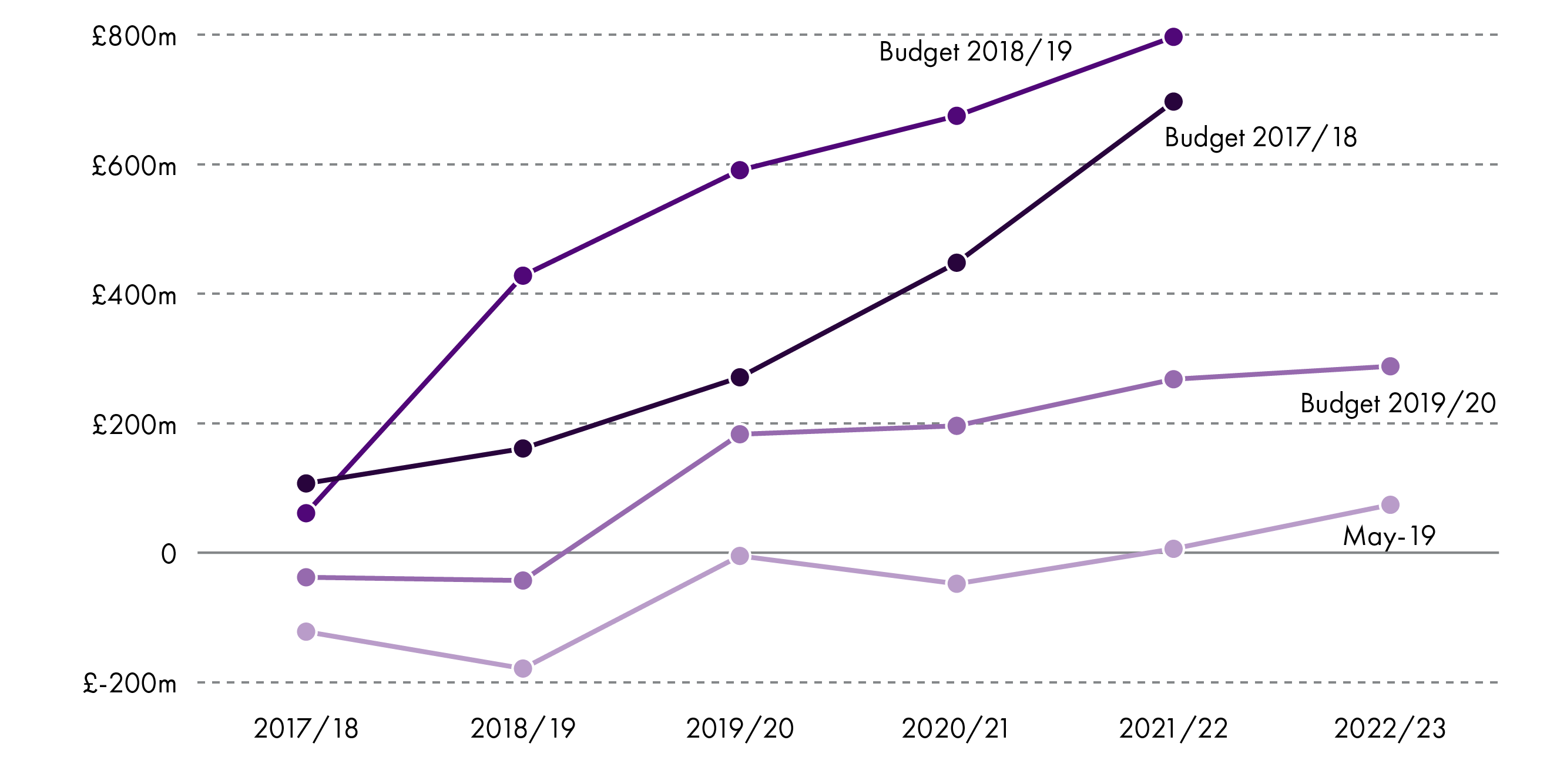

The chart below shows how the net tax position has changed across successive fiscal events. It is summarised by David Eiser2 as follows:

"When the 2017-18 budget was set, revenues were forecast to outperform the BGA by £100m, largely as a result of the Scottish Government’s decision to freeze the higher rate threshold. In years beyond 2017-18, the net tax position was forecast to continue to improve, as a result of a slightly stronger earnings outlook in Scotland than rUK.

When the 2018-19 budget was set, the net tax position improved substantially, largely because of the Scottish Government’s tax policy announcements.

By the time of the 2019-20 budget however the net tax position had deteriorated substantially. This was due to a combination of a downward revision to the SFC forecast with an upward revision to the OBR forecast for rUK.

In the latest analysis things have deteriorated again. In 2019-20, Scottish revenues are forecast to be equal to the BGA. But this is despite the fact that Scottish taxpayers are paying £500m more in tax revenues than they would be if the UK Government policy applied. Slower growth in the Scottish tax base relative to rUK tax base since 2016-17 has cost the budget £500m in 2019-20, wiping out any dividend of higher revenues from increased tax rates."

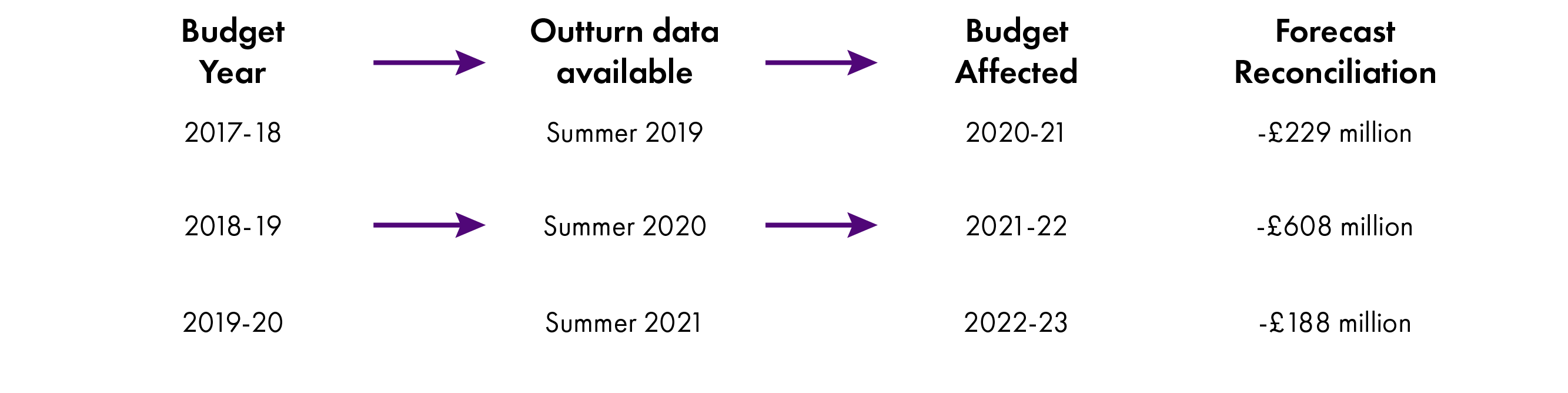

Latest reconciliation forecasts

Over the next three years latest reconciliation forecasts total over £1 billion. This means on latest forecasts the Scottish budget has allocated over £1 billion that it may not actually have had.

Options available to the Scottish Government for addressing the reconciliations if and when they arrive include reducing some areas of spend, increasing taxation, borrowing or accessing the Scotland Reserve.

The forecast reconciliation is highest in 2021-22 when the Cabinet Secretary is potentially faced with a shortfall of over £600 million. This is an amount that exceeds the resource borrowing limit of £300 million for forecast error set by the Fiscal Framework; and is also significantly higher than the Scotland Reserve access limit of £250 million Resource and £100 million Capital set out in the Fiscal Framework.

If reconciliations exceed the flexibilities provided by the Fiscal Framework for dealing with them, that may be an issue for consideration when the Fiscal Framework is reviewed in 2020 and 2021.

Why has the net income tax position deteriorated?

This section reproduces analysis from a paper produced for the Finance and Constitution Committee by its adviser on the Fiscal Framework, David Eiser.

Eiser asks "why has the net tax position deteriorated since budget forecasts were made? Is it due more to error on the part of the Scottish forecasts, or more due to error on the part of the rUK forecasts?

At first glance it is not easy to answer this question. This is because the forecasts for both Scottish revenues and the BGA declined substantially following the publication of 2016-17 outturn data in summer 2018. We need to strip this effect out, and instead look at how forecasts of annual growth, of both Scottish revenues and the BGA, have changed. This is done in the Table below. This shows that:

When the 2017-18 budget was set (row 1, table 1), the Scottish Government forecast that Scottish revenues would grow 2.9% in 2017-18; latest data (row 4, table 1) suggest growth of 2.7%, so the original Scottish Government forecast appears to have been only marginally too optimistic. In contrast, the 2017-18 Budget forecast the BGA to grow 2%; latest data indicate it will grow by 3.8%. A larger part of the 2017-18 reconciliation is thus due to upward revisions to the OBR forecast as opposed to downward revisions to the Scottish forecast.

When the 2018-19 budget was set, the SFC forecast growth in Scottish revenues of 3.3% and 5.1% in 2017-18 and 2018-19 respectively (cumulative growth of 8.6%). The latest data suggests somewhat weaker growth in both years (cumulative 7.2%). The OBR initially forecast growth in the BGA of 2.8% and 2% in 2017-18 and 2019-20 (cumulative growth of 4.8%). Under its latest forecasts, the implied growth is 3.8% and 4.8% (cumulative growth of 8.8%). A majority of the 2018-19 reconciliation is thus again due to upward revisions to the BGA, rather than downward revisions to the Scottish forecasts.

The emerging picture for 2019-20 is again, of larger proportionate revisions to the BGA (and implicitly to the OBR’s forecasts for rUK) than to the Scottish forecasts."

Table 1: Forecast growth on previous year, successive budget events

| 2017-18 | 2018-19 | 2019-20 | ||

|---|---|---|---|---|

| Scottish revenues | Budget 2017-18 | 2.9% | 3.9% | 5.1% |

| Budget 2018-19 | 3.3% | 5.1% | 3.9% | |

| Budget 2019-20 | 2.7% | 4.0% | 2.0% | |

| May-19 | 2.7% | 4.4% | 1.9% | |

| BGA | Budget 2017-18 | 2.0% | 3.5% | 4.2% |

| Budget 2018-19 | 2.8% | 2.0% | 2.6% | |

| Budget 2019-20 | 3.1% | 4.1% | 0.1% | |

| May-19 | 3.8% | 4.8% | 0.4% |

Source: Eiser, 2019

Devolved taxes

Land and Buildings Transaction tax

The forecast for residential and non-residential LBTT has been revised down slightly since December due to slower than anticipated price growth in the residential market and weaker outturn data in the non-residential market.

LBTT revenues are now forecast to be slightly higher than the BGA in 2018-19, and then around £80 million per annum higher in 2019-20 to 2021-22.

The Finance and Constitution Committee asked the SFC about the explanation for this strong net tax position in its Budget 2019-20 report1. The SFC’s response 2stated that it was due to the more progressive tax rates in Scotland, the lower price distribution of Scottish properties which increase the effects of ‘fiscal drag’, and the higher rate of Additional Dwelling Supplement.

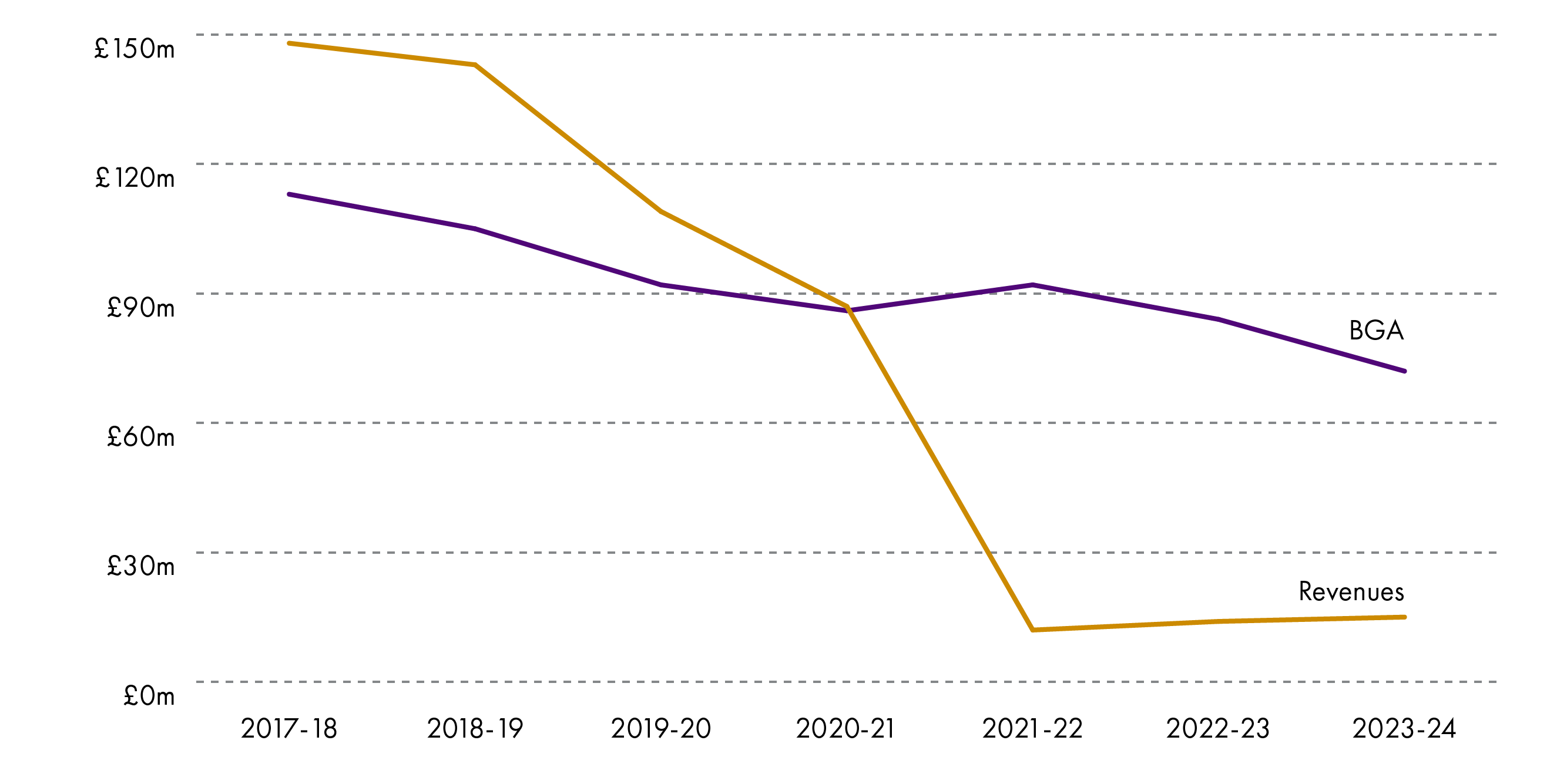

Landfill Tax

The forecast for Landfill Tax has been revised up very slightly since December. There is forecast to be a large reduction in revenues in 2020-21. This results (mainly) from the planned ban on Biodegradeable Municipal Waste due to come into force in 2021, (combined to a lesser extent with new waste incineration capacity coming on stream).

As a result of the forecast drop in revenues in 2020-21 – due to the ban on Biodegradable Municipal Waste – revenues are forecast to be substantially lower than the BGA in that year (offsetting the forecast positive position for LBTT).

Non-Domestic Rates

There have been very small changes to the NDR forecast since December, due largely to updated data on appeal losses. Policy changes are forecast to raise £9m in 2020-21 (the SFC state that withdrawing independent schools from charitable relief is forecast to raise £7m, whilst withdrawing NDR exemptions for certain types of buildings, such as cafes in local authority parks is forecast to raise £2m).

The balance of the NDR pool is currently projected at minus £100m in 2019-20 (this is the difference between the distributable amount in 2019-20 and the projected contributions for 2019-20 plus adjustments from previous years). This is discussed further in the SPICe briefing on Budget 2019-20.

Social security - a potential fiscal risk?

This section draws on a paper produced for the Finance and Constitution Committee by its adviser on the Fiscal Framework, David Eiser.

Spending on the new social security powers is significant, and forecast error in relation to social security spending could have implications for other areas of the budget.

Social security spending informing the 2019-20 Budget is forecast at £467 million (Table 3.3 of the SFC report). Most of this (£323 million) is accounted for by the Carer’s Allowance and Carer’s Allowance Supplement. Several of the social security benefits currently forecast by the SFC are small in monetary terms (e.g. Best Start Grant, Best Start Foods, Funeral Support Payment cost £31 million in total, and spending on employability services is around £16 million), although there is significant uncertainty about forecast spending on some of these the benefits given the ‘new’ nature of the benefits and the lack of data). Forecast expenditure on Discretionary Housing Payments (£64 million), and the Scottish Welfare Fund (£33 million) is somewhat higher.

But more significantly, fiscal responsibility for the remaining benefits to be devolved will transfer to the Scottish Parliament by April 2020 at the latest. This means that the Scottish budget takes the risk from spending on social security benefits in full from 2020-21.

Specifically, the SFC will forecast expenditure on devolved social security benefits from 2020-21. The Scottish Government will reimburse DWP for continuing to deliver benefits to Scottish claimants, until claimants are transferred to the Scottish Social Security Agency. Forecast Scottish spending on benefits such as PIP and their replacements will depend on the way that the replacement benefits are designed, and the pace at which claimants are transferred onto the replacement benefits.

The Scottish Budget for 2020-21 will include spending for all benefits being devolved, and there will be a positive BGA increase to the Budget to reflect spending on the the devolved benefits at the point of devolution. In practice this will result in social security spending rising by a further £3 billion in the 2020-21 Budget (Table 3.4 of the SFC forecasts). Note however that the SFC has not yet been able to cost in detail the Government’s intended policy changes to some of these benefits, as there is not yet sufficient detail on the nature of intended policy change. The SFC thus notes that its illustrative forecasts for the remaining benefits are ‘likely to underestimate expenditure’.

In short, there are substantial budgetary risks associated with the new social security powers, and these budgetary risks are transferred to the Scottish budget in 2020-21, despite the fact that most claimants will still be receiving their benefits from the DWP at that point.

VAT

The SFC has revised down its Scottish assigned VAT forecasts due to the emergence of new data since December 2018. The forecasts incorporate small revisions to historic VAT assignment outturn estimates, which were published by HMRC on the same day as the MTFS1 (and shared with the SFC in advance). In addition, the OBR’s March 2019 UK VAT receipts were revised down, and the SFC has assumed that Scottish VAT assignment follows a similar pattern. The downward revision to the economy forecast also impact on the expenditure liable for VAT.

The SFC report seems to chime with recent analysis from the Scottish Government that there are risks to the Scottish Budget from random fluctuations in data, and there never being actual VAT outturn revenues available. The Cabinet Secretary for Finance, Economy and Fair Work has recently written to the Chief Secretary to the Treasury to express his view that consideration is given to delaying the implementation of VAT assignment. The SFC report states:

The VAT reconciliation will be based on VAT assignment estimates. Differences between our VAT assignment forecasts and VAT assignment estimates could be because the Scottish economy performed differently to what we expected, or it could be because of unobserved random variation generated by the Living Costs and Food Survey sample, or any other changes in the VAT assignment model. This would expose the Scottish Budget to an additional sampling error risk which does not apply for any other taxes or benefits where the actual amount raised or spent is eventually known.

It is difficult to fully understand the sampling error issue when there is limited published information on VAT assignment estimates. We think further data, analysis and discussion is needed to fully understand the risks to the Scottish Budget of VAT assignment and to consider mechanisms for handling sampling error risks.

The budget outlook

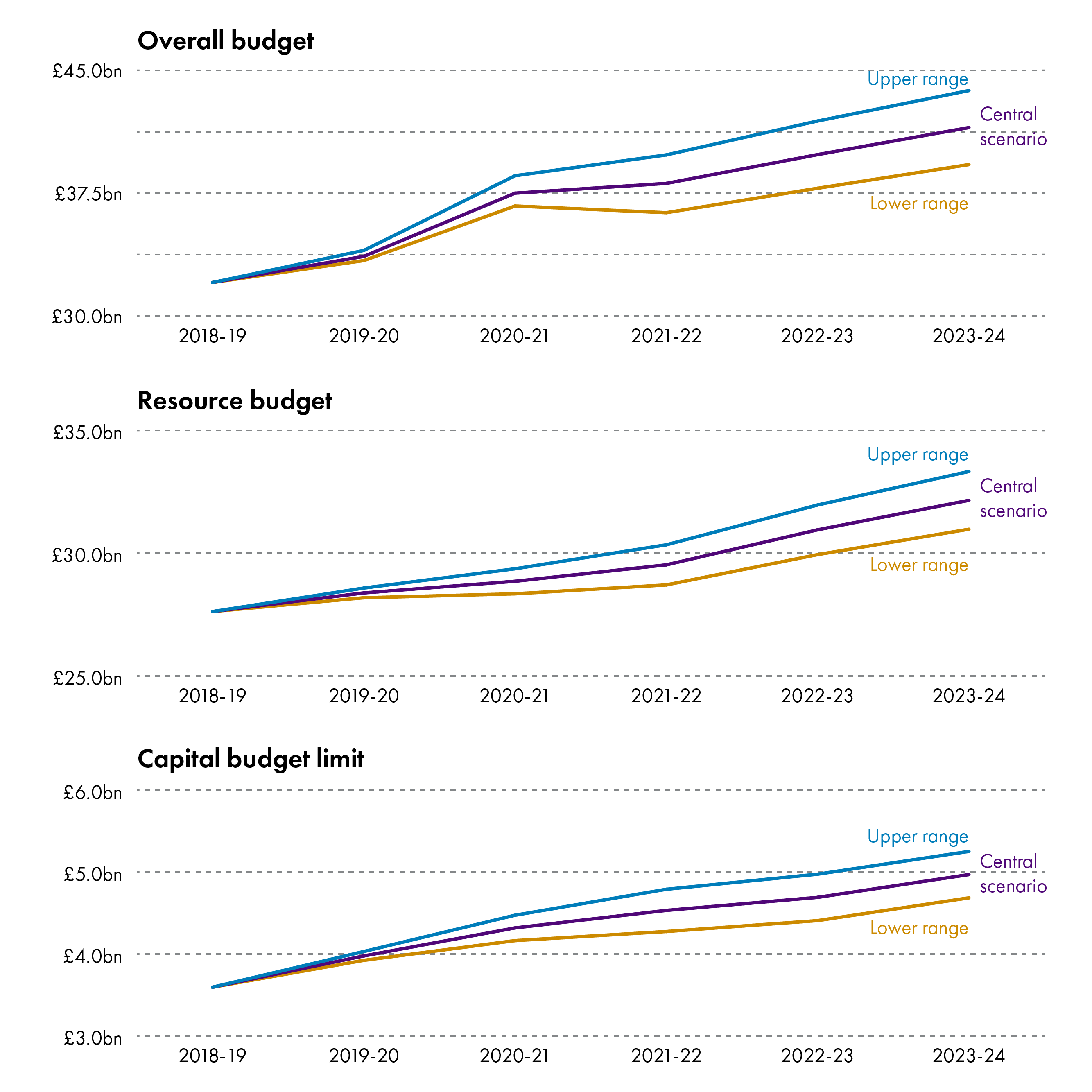

The MTFS sets out the outlook for the various aspects of the budget – the resource budget (including and excluding resources for new social security powers), capital budget and borrowing, and financial transactions. The ‘central scenario’ is based on assumptions for the evolution of the block grant and the budget position including the latest forecasts.

The resource budget (excluding new social security funding) is projected in the MTFS to increase by 1.1% per annum in real terms over the period from 2019-20 to 2023-24 under the central scenario.

Under the ‘upper’ and ‘lower’ scenarios, the resource budget is projected to grow in real terms by around 1.8% per annum and 0.3% per annum respectively over the period 2019-24.

Spending plans

Last year's MTFS (which was the first) contained high level information about already announced core spending priorities on Health, Police, Early Learning and Childcare, Attainment and Higher Education. Inclusion of explicit spending priority areas allowed for some analysis of implications for other or 'non-protected' parts of the budget1.

This year's MTFS provides no detail on Scottish Government spending priorities or plans. Rather, it sets out a set of principles which will be used by the Government in undertaking a Spending Review. Whether this Spending Review occurs later this year is still uncertain.

There is obviously a great deal of uncertainty around when the UK Government might publish a UK Spending Review, and whether that will happen this year or not. The Chancellor has previously said that a UK Spending Review would be published in Autumn if an EU exit deal was agreed. But with the Brexit extension delayed until the end of October and a Conservative party leadership contest underway, that timeframe is far from certain.

The MTFS leaves some wriggle room on whether a Scottish Spending Review will follow later this year. It states:

Irrespective of the UK Government's decision about its Spending Review, the Scottish Government plans to hold a multi-year review of spending

but also says:

On resource [spending], we currently plan to publish indicative budgets in December 2019 alongside the Scottish Budget 2020-21, but that may not be possible if we do not have sufficient clarity from the UK Government on its spending plans at that stage.

The Fraser of Allander Institute published a blog on the MTFS on 5 June2. This was quite critical of the MTFS document and stated

to be fully effective, whatever administration is in office, future MTFSs will need much more detail on future plans as well as appropriate assessments of risks & opportunities.

The purpose of the MTFS was to inform scrutiny of the Scottish Budget. Not only was it to set out the longer term trajectory of the aggregate numbers, but it was also to inform debates over the challenges and opportunities that policymakers will face – across electoral cycles – when making tax and spending choices.

Of course, this is all the more important in the context of the new and complex way in which the Scottish Budget is now determined.

Given the 'new and complex way in which the Scottish Budget is now determined', it was perhaps most surprising that having identified that the latest forecasts point to a £1 billion reconciliation over the next three years, there was no detail in the document on how the Scottish Government might chose to tackle that clear budgetary challenge.

It is unclear how the subject committees of the Parliament will be able to use the MTFS in their pre-budget scrutiny work in the coming months. The lack of even indicative spending plans is contrary to one of the original intentions of the MTFS document when it was recommended by the Budget Process Review Group.

Borrowing

The MTFS sets out the Scottish Government's approach to borrowing.

On resource borrowing, the document states that 'no resource borrowing has been undertaken to date and none is planned in 2019-20.'

On the capital borrowing side, the MTFS sets out the Government’s plans to borrow the maximum limit of £450m in 2019-20 and £350m in 2020-21.

Annex B of the MTFS shows the implication of various different capital borrowing scenarios for

the amount of borrowing headroom it will have in each year to 2025-26 (i.e. the extent to which it remains below its total borrowing limit of £3bn)

annual repayments associated with capital borrowing and other forms of capital financing.

These scenarios show that borrowing the maximum annual allocation each and every year is not sustainable, and that borrowing for shorter periods rather than longer periods means that annual repayments are higher, but greater ‘headroom’ is maintained.

The Scotland Reserve

Table C17 of the MTFS presents the latest position of the Scotland Reserve.

The forecast closing balance at the end of 2019-20 is £300 million. In reality the balance will end up being higher, as underspends from 2019-20 have not yet been factored in.

The £300 million forecast balance in 2019-20 consists of a balance on the resource side of £145.7 million and on the capital side of £154.5 million. The capital balance cannot be used to address forecast error.

Table 2: Summary of the Scotland Reserve

| £ million | Opening balance | Payments in | Payments out | Closing balance |

|---|---|---|---|---|

| 2018-19 | 538 | 211.7 | -250 | 499.7 |

| 2019-20 | 499.7 | 208 | -407.5 | 300.2 |

| Of which resource | 145.7 | |||

| Of which capital | 154.5 | |||