Devolved social security powers: progress and plans

This briefing provides an update on the devolution of certain aspects of social security, primarily following the Scotland Act 2016. By 2024 Social Security Scotland is expected to be delivering a range of social security provision including carer's and disability benefits. A separate briefing will provide further detail on individual benefits. This paper focuses on the timeline, delivery agencies and funding.

Executive Summary

The Scotland Act 2016 devolved various areas of social security to Scotland – mainly related to carers and disability benefits. All these newly devolved benefits are expected to be in place, and existing cases transferredi from the DWP, by 2024. Under the Scotland Act 1998 there had already been some very limited social security devolution of payments made by local authorities, but the new benefits will be delivered mostly by a new executive agency: Social Security Scotland.

Devolved social security is delivered by several organisations: local authorities, Social Security Scotland and, mostly as a transitional measure, the DWP or Department of Health and Social Care acting on behalf of the Scottish Government. At the moment, most devolved spend is through local authorities and the DWP, but this will change as Social Security Scotland starts to deliver disability benefits.

The Scottish Government's priority is ‘safe and secure transfer’ and it does not plan to make major changes to benefits at the point they transfer. A series of policy position papers were published in February 2019 and proposals for disability assistance were published for consultation in March.

So far, the benefits being paid by Social Security Scotland are the carer's allowance supplement and two of the three best start grant payments (baby and early years payments). The DWP is currently delivering carer’s allowance under an agency agreement and the Department of Health is delivering welfare foods on a similar basis.

Social Security Scotland will begin to deliver the following benefits this year: funeral support payment, young carer grant, best start foods and the school age payment of the best start grant. From next year the Scottish Government will begin to legislate for the remaining benefits, starting with disability assistance for children and young people in summer 2020.

Full legal and financial responsibility for all benefits being devolved is expected to have been transferred to the Scottish Government by April 2020. The Scottish Government budget for 2020/21 will therefore include money for all the benefits being devolved, whether delivered by the Social Security Scotland or DWP.

Implementation by Social Security Scotland will not be complete until 2024. This means that the Scottish Government will need to use agency agreements with the DWP to deliver devolved benefits in the interim.

Introduction

The Scotland Act 1998 (as amended in 2016) devolved significant social security powers to Scotland. These are listed below, together with the relevant reserved social security benefits in brackets:

disability benefits (disability living allowance, personal independence payment, attendance allowance, severe disablement benefit and industrial injuries disablement benefits)

benefits for carers (carer's allowance)

payments related to cold weather (the social fund winter fuel payment and cold weather payment)

funeral expenses (the social fund funeral expense payment)

welfare foods and certain payments for maternity expenses (healthy start vouchers and vitamins, nursery milk and the social fund sure start maternity grant)

The Scotland Act 2016 also allows Scottish Ministers to alter the housing costs element of universal credit and change how these payments are made. It devolves power to top up reserved benefits (except those relating to housing costs) and to create new benefits (except pensions). Earlier SPICe briefings provide background on the devolution of social security under the 2016 Act. See: SB 16-45: New Social Security Powers.

The Scottish Parliament has had the power to create primary legislation in most of these areas since 2017.i This enabled the Social Security (Scotland) Act 2018 (2018 Act) which creates the regulatory framework for Scottish social security.

Ministers will have full legal and financial responsibility for all their new social security powers by April 2020.ii However, the actual delivery of these benefits will transfer from the DWP to Social Security Scotland between 2018 and 2024.

This will complete the most significant devolution of social security powers since 1998. However, it is worth noting that some social security powers were available to the Scottish Government prior to the Scotland Act 2016.

The initial devolution settlement under the Scotland Act 1998 had included some aspects of social work payments under the exception to the general reservation of social security. These included payments for social welfare services, kinship carers, foster carers and care leavers.

Between 1998 and 2013 there was little change - with the exception of the Scottish Executive gaining some executive powers over welfare foods in 2006. Then in 2013, mirroring the devolution of powers to local authorities in England, the Scottish Government gained responsibility for what had been; community care grants, crisis loans and council tax benefit. These were created under devolved legislation as the Scottish welfare fund (SWF) and the council tax reduction scheme (CTR). This stage of devolution before the Smith Commission concluded in 2014 when Ministers gained powers related to funding another local authority administered scheme - discretionary housing payments. DHPs were fully devolved in 2017.iii

This paper looks at the timeline for social security devolution, its funding and its delivery by local authorities, DWP and Social Security Scotland. A separate briefing, to be published shortly, will look in more detail at the administration of individual Scottish social security benefits.

For an overview of how the newly devolved powers fit into the wider context of reserved social security see: Social Security for Scotland.

Social security timeline: 'safe and secure transfer'

The Scottish Government is taking a gradual approach to delivering its new responsibilities for social security, with a focus on 'safe and secure transfer.'i This means:

starting with the most straightforward payments and gradually building up to the most complicated,

using agency agreements where the DWP can continue to deliver benefits on the Scottish Government's behalf, and

not making extensive policy changes when the benefits are first introduced in Scotland.

We propose to keep the components and financial values of the transferring benefits largely unchanged at the point of transfer.

Scottish Government. (2019). Social security case transfer: policy position paper. Retrieved from https://www.gov.scot/publications/social-security-case-transfer-policy-position-paper/ [accessed 9 April 2019]

The current plan is to complete implementation of the new social security powers by 2024. This is a change to an earlier plan to complete implementation by the end of the current parliamentary session in 2021.3 Announcing the new timetable in February this year, Shirley-Anne Somerville, Cabinet Secretary for Social Security and Older People, emphasised that:

the timescales that I have set out remain very challenging, […] we will therefore keep our plans under careful review

Scottish Government. (2019, February 28). Devolution of benefits: Ministerial statement. Retrieved from http://www.parliament.scot/parliamentarybusiness/report.aspx?r=10910 [accessed 10 April 2019]

Reflecting this challenging context, Audit Scotland reported in May 2019 that:

there is a significant risk that the programme doesn’t have the time and capacity to learn from experience to date and make the changes necessary to successfully deliver on wave two timescales.

Audit Scotland. (2019, May). Social security: Implementing the devolved powers. Retrieved from http://www.audit-scotland.gov.uk/uploads/docs/report/2019/nr_190502_social_security.pdf [accessed 2 May 2019]

A Scottish Government 'lessons learned' document described the timescale as 'ambitious but realistic.' Referring to the UK Government's experience of implementing universal credit it stated that the Scottish social security programme would 'prioritise taking the time to get the new services right.'6

The following tables summarise developments up to 2019 and plans up to 2024. A detailed timeline and links to relevant legislation are provided in the Annexe to this paper.

Devolved social security: 2013 to 2019

Table 1 below shows out how various UK social security benefits have been replaced by local authority payments since 2013 and, more recently, by Social Security Scotland benefits.

| UK benefit | Scottish equivalent | |

|---|---|---|

| Before 2018 | ||

| Council tax benefit | April 2013 | Council tax reduction |

| Social fund: crisis grants and community care grants | April 2017 | Scottish welfare fund |

| Discretionary housing payments | April 2017i | Discretionary housing payments |

| n/a | October 2017 | Universal credit Scottish choicesii |

| 2018 | ||

| n/a | September 2018 | Carer's allowance supplement |

| Sure start maternity grant | December 2018 | Best start grant: pregnancy and baby |

| 2019 | ||

| n/a | 29 April 2019 | Best start grant: early years |

| n/a | 3 June 2019 | Best start grant: school age |

| Social fund: funeral expenses payment | summer 2019 | Funeral support payment |

| Welfare foods (healthy start vouchers and vitamins) | summer 2019 | Best start foods |

| n/a | autumn 2019 | Young carer grant |

Devolved social security: 2020 to 2024

Table 2 below lists current UK benefits and indicates when Social Security Scotland is expected to deliver the Scottish equivalents. This process is should be complete by 2024.

| UK Benefit | Scottish Equivalent | |

|---|---|---|

| 2020 | ||

| Child disability living allowance | summer 2020 | Disability assistance for children and young people (DACYP) |

| n/a | summer 2020i | Short term assistance |

| Welfare foods (nursery milk) | August 2020ii | Scottish nursery milk scheme |

| Attendance allowance | winter 2020 | Disability assistance for older people |

| n/a | winter 2020 | Winter heating assistance where a child has highest rate care component of the new DACYP |

| 2021 | ||

| Personal independence payment | early 2021 | Disability assistance for working age people |

| n/a | early 2021 | Carer's allowance supplement for those with more than one disabled child |

| Social fund winter fuel payment | winter 2021 | Winter heating assistance for older people (initially for those on another Scottish social security benefit)1 |

| Social fund cold weather payment | winter 2021 | Cold spell heating assistance |

| 2022 | ||

| n/a | 2022 | Income supplement |

| Carer's allowance | spring 2022 | Start transfer of existing cases to carer's assistance |

| Industrial injuries disablement benefits | autumn 20222 | Employment injury assistance |

| 2023 | Majority of existing caseload due to have been transferred | |

| Severe disablement allowance to remain administered by DWP | 2024 | Transfer of existing caseload expected to be complete (except for SDA). Those of pension age on DLA to transfer to the agency but remain on DLA3 |

Legislative process from devolution to delivery

As the timescales outlined above illustrate, there are several stages between legislating for new devolved powers in the Scotland Act 2016 and making payments of a new Scottish social security benefit.

The process of devolving these powers can be thought of as having up to three stages: legislative competence, executive competence and delivery.

With the exception of welfare foods, the Scottish Parliament's powers to legislate for these social security benefits commenced in September 2016 and May 2017.1 This transfer of legislative competence allowed the Parliament to pass the Social Security (Scotland) Act 2018 (the 2018 Act) which provides the over-arching framework for Scottish social security. Individual benefits will be created by regulations made under this Act.i

For most benefits, the second stage is 'executive competence'. This refers to the power to make regulations and taking legal responsibility for delivery. It is also when financial responsibility transfers. Executive competence has been transferred for carer’s assistance and welfare foods. These are currently being delivered by the UK Government on the Scottish Government's behalf. Executive competence for disability benefits is due to transfer in April 2020.2 However, as Scottish disability assistance will not be available at that time, there will be an agency agreement with the DWP to deliver disability benefits on behalf of the Scottish Government.

The other group of benefits being transferred are those paid out of the social fund.ii Technically, these do not require a transfer of executive competence. However, responsibility for making these payments still needs to be transferred. This has already happened for the best start grant and will happen shortly for funeral expenses payment to co-incide with the start of the Scottish funeral support payment.iii

For the two other social fund payments (cold weather payment and winter fuel payment) there will be a gap between the transfer of responsibility for making payments to Scottish Ministers in April 202032 and new Scottish benefits starting in November 2021. This will require either further legislation and/or an agency agreement.

The third stage, for most benefits, is when a benefit is delivered by Social Security Scotland based on Scottish regulations made under the 2018 Act. For most benefits this will happen through the introduction of Scottish legislation between now and 2024. However there are exceptions. Severe disablement allowance will remain administered by the DWP in the long term. At least initially, Scottish welfare foods provision will be covered by Scottish regulations made under Westminster legislation rather than under the 2018 Act. In addition, people over pension age who currently receive disability living allowance (DLA) will transfer to Social Security Scotland but remain on DLA rather than move to Scottish disability assistance.5

Organisational structure of devolved social security

The Scottish Government's current focus is on establishing the infrastructure for Scottish social security. This is being developed through the following agencies and groups:

the social security programme based in the Scottish Government social security directorate which develops policy on the benefits to be delivered in future. There is also significant involvement of the Chief Digital Office and communities analysis division. This work includes the development of IT systems, consultation with those with 'lived experience' of social security through 'experience panels', and working with a number of reference and advisory groups (listed in annexe),

the Scottish Commission on Social Security - an independent statutory body which will scrutinise the regulations which create the benefits,

the Scottish Fiscal Commission - a statutory body with a legal duty to forecast spend on current Scottish tax and benefits, and

the Joint Ministerial Group on Welfare which provides a forum for UK and Scottish Ministers to discuss interaction between devolved and reserved social security and ensure a smooth transition from reserved to devolved responsibility.

Devolved social security is delivered by:

Social Security Scotland, an executive agency of the Scottish Government,

the Department for Work and Pensions where they have an agency agreement with the Scottish Government, and

local authorities: which deliver discretionary housing payments, the Scottish welfare fund and various social work payments

Social security programme

As mentioned above, the Scottish Government's social security programme is developing the policy and systems for the benefits which will be delivered by Social Security Scotland. The programme is separate from Social Security Scotland and has a separate budget.

A recent progress report by Audit Scotland found that important groundwork had been undertaken in developing benefits. However, the complexity of social security and the need for specialist skills meant that there were significant challenges in delivering the programme. Not least among these was the availability of staff with the right skills in IT and finance. Audit Scotland reported that:

the Scottish Government does not yet have a clear understanding of the key things needed to deliver all remaining benefits in the way it intends

Audit Scotland. (2019, May). Social security: Implementing the devolved powers. Retrieved from http://www.audit-scotland.gov.uk/uploads/docs/report/2019/nr_190502_social_security.pdf [accessed 2 May 2019]

The social security directorate's programme team has assessed it needs 345 ‘core staff’ but has been 'routinely operating' with around 30 per cent of these posts unfilled. Audit Scotland commented that:

Given the real likelihood that the pace and pressure within the programme will increase, there is a high risk of a decline in staff morale and staff leaving, resulting in the loss of existing skills and experience

Audit Scotland. (2019, May). Social security: Implementing the devolved powers. Retrieved from http://www.audit-scotland.gov.uk/uploads/docs/report/2019/nr_190502_social_security.pdf [accessed 2 May 2019]

Audit Scotland commented that a reliance on temporary and contractor staff, 'has implications for the programme in terms of costs and continuity.' It has impacted on the capacity of the programme to plan and deliver. This in turn has further increased costs, created greater reliance on existing DWP systems and placed pressure on staff.

The report acknowledged that the programme team 'is aware of the challenges and is doing the right things' but that overall, the Scottish Government has found delivery 'harder than expected.'

Action taken by the Scottish Government to address the issues raised includes:3

exploring salary flexibility for IT posts, along with a longer term programme designed to develop the Government's own specialist base,

commissioning an independent review of finances, which is due to report at the end of May 2019

putting in place a dedicated programme resourcing team and a new workforce planning group

The Cabinet Secretary said:

I value Audit Scotland’s views and am pleased we are already taking action that responds to their recommendations. While we recognise there is much more to do - our track record shows we can meet the challenge ahead.

Scottish Government. (2019, May 2). Meeting the social security challenge. Retrieved from https://www.gov.scot/news/meeting-the-social-security-challenge/ [accessed 2 May 2019]

Funding devolved social security

In April 2020, the UK Government will transfer funding for all the devolved social security benefits to the Scottish Government – including where these benefits will be delivered by the DWP under an agency agreement.i This is likely to be in the region of £3.5bn per year. This section of the briefing sets out how the amount of money transferred is calculated. The calculation method is set out in the fiscal framework, agreed by the UK and Scottish Governments in 2016.1

Baseline

In the first year, the amount transferred for each benefit is based on the UK Government spend in Scotland on that benefit in the year prior to its devolution.i For most benefits this is the spend in 2019/20.iiThis figure is then adjusted to reflect changes in expenditure and population between 2019/20 and 2020/21 to get the block grant adjustment for 2020/21. This adjusted figure is added to the block grant.

Ongoing funding for disability and carer benefits and winter payments

After the first year, adjustments to the block grant will be based on the previous year's figures adjusted for:

percentage change in expenditure on that benefit in England and Wales, as forecast by the Office of Budget Responsibility (OBR), and

the difference in population growth between Scotland and England and Wales (currently Scottish population growth is 99.8% of the rate of growth in England and Wales).1

The block grant adjustment is intended to reflect what would have been spent in Scotland if UK policy remained in place. Scottish policy choices do not affect the amount transferred, nor do changes in the rate of take-up of Scottish benefits.i

For example: Year 1 transfer

a benefit is devolved in 2020/21

£500m was spent in Scotland on that benefit in 2019/20

the OBR forecast that between 2019/20 and 2020/21 spend in England and Wales will increase by 1.4%

Scottish population growth is 99.8% of the rate of growth in England and Wales

so, in 2020/21 £506m is transferred (i.e £500m * 1.014 * 0.998)

Example continued: Year 2 transfer

the OBR forecasts that UK government spending on that benefit in England and Wales will increase by 1% in 2021

Scottish population growth continues to be 99.8% of the rate of growth in England and Wales

so, for 2021/22 the Scottish Government will get £510m (i.e the previous year's £506m multiplied by 1.01 (expenditure adjustment) multiplied by 0.998 (population adjustment)).

This example is illustrated in the tables below and extended to a third year. This first shows the factors included in the calculation and then shows how these are used to calculate the block grant adjustment.

| 2019/20 | 2020/21 | 2021/22 | 2022/23 | |

|---|---|---|---|---|

| change in spend in England and Wales | up 1.4% | up 1% | up 1.2% | |

| spend on benefit in Scotland | £500m | n/a | n/a | n/a |

| Scottish population growth relative to England and Wales | 99.8% | 99.8% | 99.8% |

| 2020/21 | 2021/22 | 2022/23 | |

|---|---|---|---|

| previous year figure | £500m | £506m | £510m |

| multiplied by England & Wales expenditure change | 1.014 | 1.01 | 1.012 |

| multiplied by relative population change | 0.998 | 0.998 | 0.998 |

| = transfer to Scottish Government | £506m | £510m | £515m |

The fiscal framework will be reviewed in 2021 and an independent report will be presented to Ministers at the end of that year.2 This will be only the second year of operating block grant adjustments for the majority of devolved benefits.

Ongoing funding for other benefits

Funding for some benefits being devolved is transferred by machinery of government transfers. This applies to: discretionary housing payments, best start grants and funeral support payment.1 This is then uprated as part of the Barnett formula, as with other areas of devolved expenditure. This means that the Scottish Government receives the Scottish population share of any change in UK Government spend related to devolved functions.

Setting the Scottish Government budget for social security

To this point, this briefing has discussed the amount of money transferred from the UK to the Scottish Government. However, there is a separate process for the allocation of money to social security in the Scottish Government’s budget. This is based on the Scottish Fiscal Commission’s (SFC) forecast of Scottish benefits. It reflects the SFC's assessment of the effect of Scottish Government policy decisions. For example, if the Scottish Government was to run a campaign to encourage people to take-up their entitlement to benefits, this might impact on the SFC’s forecasts for the Scottish budget, but would have no impact on how much money is transferred from the UK government.

The budget for 2019/20 is discussed below (see tables 3 and 5).

No detriment due to policy 'spill-overs'

The fiscal framework also addresses what happens when Scottish policy diverges from UK social security policy. If Scottish social security benefits were to have different rules compared to the equivalent UK benefits, this could have an impact on the UK government's spending. Similarly, UK policy could impact on Scottish social security spending.

These effects are known as 'policy spill-overs.' They occur when the policy decisions of one Government impact on the spending of the other.

For example, a family is entitled to a higher payment of universal credit if their child qualifies for certain disability benefits. If Scottish benefit rules resulted in more people getting disability assistance for children and young people this could lead to more people being entitled to the 'disabled child' addition in universal credit.

The fiscal framework agreement requires that the cost of these 'spill-over' effects be re-imbursed:

where either government makes a policy decision that affects the [...] expenditure of the other, the decision-making government will either reimburse the other if there is an additional cost, or receive a transfer from the other if there is a saving

Scottish Government and HM Treasury. (2016, February). The agreement between the Scottish government and the United Kingdom government on the Scottish Government's fiscal framework. Retrieved from https://www.gov.uk/government/publications/the-agreement-between-the-scottish-government-and-the-united-kingdom-government-on-the-scottish-governments-fiscal-framework [accessed 10 April 2019]

Policy spill-overs can result from either 'direct effects' (the way the rules interact) or 'behavioural effects' (where a policy changes people's behaviour). The disabled child addition mentioned above is an example of a direct effect as it is a result of the way the rules of the two systems interact. Any increase in reserved benefit spend which arises as a result of Scottish Government social security policy would need to be funded by the Scottish Government. However, the fiscal framework states that any reimbursement must be agreed between the two governments.

Any decision or transfer relating to a spillover effect must be jointly agreed by both Governments. Without a joint agreement, no transfer or decision will be made.

Scottish Government and HM Treasury. (2016, February). The agreement between the Scottish government and the United Kingdom government on the Scottish Government's fiscal framework. Retrieved from https://www.gov.uk/government/publications/the-agreement-between-the-scottish-government-and-the-united-kingdom-government-on-the-scottish-governments-fiscal-framework [accessed 10 April 2019]

Another principle underpinning the way two systems ought to work together is that individual benefit recipients should not 'lose out.' The fiscal framework states that Scottish benefits:

must provide additional income for a recipient and not result in an automatic offsetting reduction by the UK Government in their entitlement elsewhere in the UK benefits system.

Scottish Government and HM Treasury. (2016, February). The agreement between the Scottish government and the United Kingdom government on the Scottish Government's fiscal framework. Retrieved from https://www.gov.uk/government/publications/the-agreement-between-the-scottish-government-and-the-united-kingdom-government-on-the-scottish-governments-fiscal-framework [accessed 10 April 2019]

This has already been applied in the way that the reserved benefits system treats devolved benefits. For example, the carer’s allowance supplement (CAS) does not count as income for universal credit. This means that the CAS is always received as an extra payment and not deducted from universal credit. It also means that the UK Government cannot make savings to its universal credit spend as a result of the additional spend on CAS made by the Scottish Government.

Social Security Expenditure in 2019/20

This year the largest element of devolved social security spend is carer’s allowance which is being delivered by the DWP. The next largest element is local authority spend on various discretionary funds. This spending pattern will change as Social Security Scotland takes on the delivery of carer and disability benefits between 2020 and 2024. The table belowi sets out forecast spend for 2019/20 on Scottish social security by the agency making the payment.

| Benefit | Local authorities | Social Security Scotland | DWP on behalf of Scottish Government |

|---|---|---|---|

| discretionary housing payments - 'bedroom tax' | 52.3 | ||

| discretionary housing payments - other | 10.9 | ||

| Scottish welfare fund | 33.0 | ||

| carer's allowance | 283.0 | ||

| carer's allowance supplement | 37.0 | ||

| young carer grant | 0.5 | ||

| best start grant | 12.4 | ||

| funeral support payment | 6.2 | ||

| best start foods | 2.5 | ||

| total | 96.19 | 58.6 | 283.0 |

The figures shown in table 3 relate to the money that would be paid out to individuals. Separate from this are budgets for administration and developing new benefits. In 2019/20 the budget for Social Security Scotland is £42m and the budget for the social security programme is £78m. Audit Scotland noted that the programme team had estimated that the programme needed £118m in 2019/20 but was allocated £77.8m in the Scottish budget. Audit Scotland noted that:

managing expenditure within this budget is challenging given the level of activity anticipated.

Audit Scotland. (2019, May). Social security: Implementing the devolved powers. Retrieved from http://www.audit-scotland.gov.uk/uploads/docs/report/2019/nr_190502_social_security.pdf [accessed 2 May 2019]

Audit Scotland also commented on the need for the Scottish Government to have more detailed and up to date estimates of the likely overall implementation costs. An estimate of £308m for spending on implementation up to 2022/23 was provided in the financial memorandum to the Social Security (Scotland) Bill in 2017 and work has started on updating this figure through revision of the programme business case.4

The following sections examine the three 'delivery routes' in turn; local authorities, the DWP and Social Security Scotland, and explain the current arrangements and what is known about future plans.

Local authority payments

Until now, the majority of devolved social security, and schemes which replace previous social security benefits, have been provided by local authorities. The most significant in scale of this type of support is council tax reduction (CTR).

Local authority support includes:

Council tax reduction

the Scottish welfare fund

Discretionary housing payments

certain kinds of social work payments (including some forms of kinship care payment, provision of social welfare services and payments to care leavers)

CTR is based on detailed rules and ineracts in complex ways with the reserved benefits system. CTR must be provided to those who meet the entitlement criteria at an amount calculated in accordance with those rules.i It is a means tested, demand led scheme which assists nearly 500,000 people with their council tax bill. It replaced council tax benefit in 2013. However, although the rules and operation of CTR are, to a great extent, identical to the council tax benefit it replaced, it is provided as a form of tax relief rather than as a social security benefit. In practical terms, it is unlikely that anyone receiving CTR would have noticed much of a difference from council tax benefit. In policy terms though, this different legal basis means that CTR is generally not included in discussion of social security, despite it providing a significant level of assistance with council tax bills. The Scottish Government is planning to revise the scheme to ensure that people on universal credit receive the same level of relief as is the case for claimants of legacy benefits.1

The other schemes are mostly discretionary and based on far more broadly drawn rules.

The Scottish Welfare Fund (SWF) is intended to relieve short term crisis and enable claimants to maintain a settled home. It replaced social fund payments in 2013 and provides crisis grants and community care grants. The budget has remained the same in cash terms for a number of years. The Social Security Committee has asked the Scottish Government to increase the budget for the SWF on a number of occasions,2 citing increased pressure due to welfare reform. But the Scottish Government consider that the budget is adequate, partly because it is underspent each year.

Discretionary housing payments (DHPs) provide help with the costs of renting. In 2014, the Scottish Government gained powers to increase DHP funding. (Earlier legislation had capped the funding that could be provided). This enabled them to provide additional funding to local authorities to mitigate the bedroom tax.ii At this point, DHPs were only partially devolved and were funded by both the DWP and the Scottish Government. From April 2017, DHPs were fully devolved, and remaining funding was transferred from the DWP to the Scottish Government. The Scottish Government is in the process of developing guidance for Scotland,3 but in the meantime, local authorities continue to use DWP guidance for this devolved scheme.

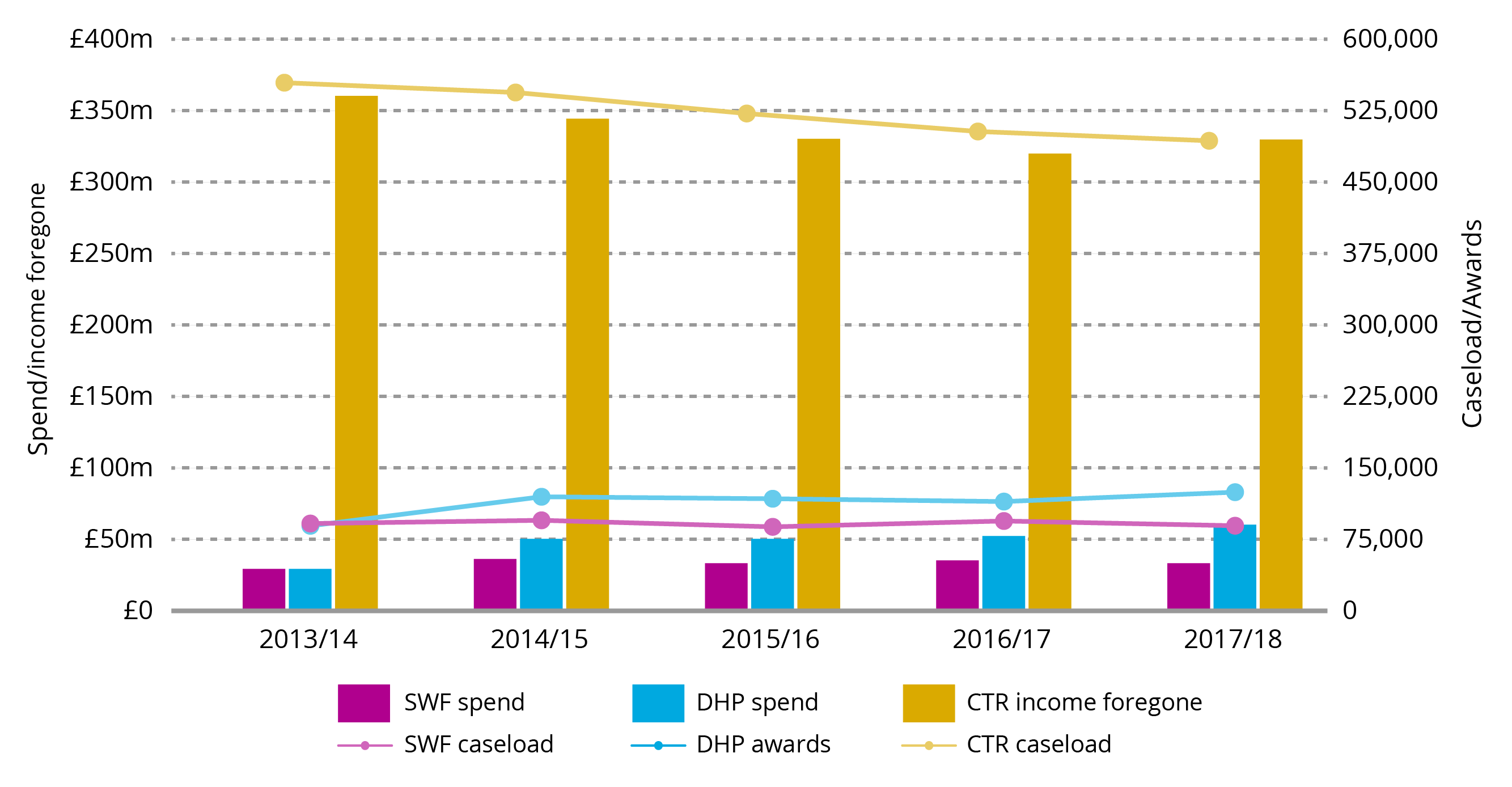

The chart below shows how provision of CTR greatly exceeds support provided through DHPs and SWF. CTR also outweighs current support provided through Social Security Scotland. There are no figures available for social work payments.

UK Government delivery of Scottish social security

Delivering social security under the new Scottish social security system requires joint work between the Scottish and UK Governments, including:

ensuring smooth interaction between reserved and devolved social security for people receiving payments,

agency agreements where the UK Government delivers devolved benefits on the Scottish Government’s behalf, and

reliance on data and administrative systems run by the DWP.

A memorandum of understanding1 between the two governments sets out: 'a framework for co-operation between the parties.' The Joint Ministerial Working Group on Welfare provides a forum for discussion at ministerial level and there is joint working at an organisational level. Both Governments have emphasised the importance of joint working,2 and Audit Scotland reported that:

The programme has maintained productive working relationships with the DWP across operational areas

Audit Scotland. (2019, May). Social security: Implementing the devolved powers. Retrieved from http://www.audit-scotland.gov.uk/uploads/docs/report/2019/nr_190502_social_security.pdf [accessed 2 May 2019]

However, delivery of the programme has not been without its difficulties. For example, in March, Amber Rudd MP, Secretary of State for Work and Pensions, wrote to MSPs saying:

the slow development of their [Scottish Government's] approach to the benefits being devolved and underestimating the task at hand [meant it was not ready to accept] significant caseloads

The Herald. (2019). Rudd: SNP Ministers to blame for new benefits powers delay. Herald.

Later in March, Shirley-Anne Somerville, Cabinet Secretary for Social Security and Older People, expressed her disappointment in these comments, and noted that she had since:

received a letter from her committing to work constructively with the Scottish Government to effect the safe and secure transfer of powers and I am hopeful that the meeting of the Joint Ministerial Working Group on Welfare, which is now scheduled for 1 April, will be an opportunity for us to reaffirm these commitments and progress our joint programme of work.

Somerville, S.A. (2019, March 28). Letter from Shirley-Anne Somerville MSP, Cabinet Secretary for Social Security and Older People to Bob Dorris MSP, Convener, Social Security Committee. Retrieved from https://www.parliament.scot/S5_Social_Security/General%20Documents/20190328_CabSecSSOP_to_Convener_quarterly_update.pdf [accessed 30 April 2019]

Audit Scotland commented that:

The programme and agency will be reliant on the DWP for a number of years.

Audit Scotland. (2019, May). Social security: Implementing the devolved powers. Retrieved from http://www.audit-scotland.gov.uk/uploads/docs/report/2019/nr_190502_social_security.pdf [accessed 2 May 2019]

The UK Government currently delivers four schemes under agency agreements on the Scottish Government's behalf. These are: carer’s allowance, healthy start vouchers, nursery milk and universal credit-Scottish choices. Further agency agreements will be required for other benefits.

The existing agency agreement for carer’s allowance runs until September 2020. As the Scottish Government intends to start taking new applications for Scottish carer’s assistance at the end of 2021 and transferring existing claims from spring 2022,7 it will need to be extended. An extension would need to be agreed and notified by September 2019.

Another agency agreement (not published) covers healthy start vouchers until best start foods begins in summer 2019 and nursery milk in August 2020.8

There is also legislation9 which would allow disability benefits to be provided under an agency agreement from April 2020. Similar arrangements may be needed for cold weather payments and winter fuel payments.

Most agency agreements relate to the transitional period in the creation of Scottish social security up to 2024. The two exceptions are universal credit Scottish choices and severe disablement allowance. Scottish choices is based on Scottish Ministers' powers to change certain aspects of universal credit. It will therefore always require the DWP to deliver these on the Scottish Government's behalf, because universal credit is not devolved.

A long term arrangement will also be put in place for the delivery of severe disablement allowance which, although a devolved benefit, will remain administered by the DWP. This is mainly because it has been closed to new claims since 2001.

The Scottish Government is also using DWP administrative and IT systems for some of the benefits that Social Security Scotland is delivering. The Scottish Government has agreed a contract with DWP to use its payment and customer information systems for three to five years with the potential for extension. The Scottish Government is currently assessing the feasibility of developing digital systems at a Scotland wide level in the longer term.3

Social Security Scotland

Previous sections have discussed existing agencies that deliver devolved social security (local authorities and the DWP). However, by 2024 the bulk of Scottish social security payments will be delivered by a new agency, Social Security Scotland which was created in September 2018 as an executive agency of the Scottish Government. Reflecting the principle of 'safe and secure transfer', Social Security Scotland is building up its caseload and expenditure slowly. It is currently (May 2019) delivering the best start grant (BSG) and the carer's allowance supplement (CAS).

The agency is starting with 'one-off' payments - i.e payments that are paid once or twice a year at most. By January 2019, the agency had made CAS payments to around around 79,000 people. By 28 February 2019 it had also paid best start grants to 9,770 people.1 In 2019/20 the introduction of new benefits means that its 'caseload' is expected to increase to around 160,000 (see table 4 below).

Table 4 below illustrates how the scale of operations will grow over the next few years.

From summer 2020, Social Security Scotland will start to take claims for 'on-going' benefits - i.e benefits made as regular payments. The agency will start by taking new claims (i.e claims from people who aren't already claiming the equivalent DWP benefit). The disability assistance consultation estimated that there would be:2

7,600 new applications for child DLA in 2020/21 (being replaced that year by disability assistance for children and young people)

28,000 new applications for attendance allowance in 2021/22 (being replaced in winter 2020 by disability assistance for older people)

over 50,000 new applications for PIP in 2021/22 (being replaced that year by disability assistance for working age people)

Disability and carers assistance will provide the most substantial financial support of the benefits being devolved and will be the most complex benefits to deliver. However, the largest caseload will be winter heating assistance. The reserved equivalent, winter fuel payment, is a single, annual payment made automatically to those qualifying during a particular week. Winter fuel payment is currently made to around 1 million people in Scotland, but this number will decline as state pension age rises.

The table belowi gives a broad indication of the scale of operations this year and in 2023/24. These figures are based on the caseload for current reserved benefits.

| Benefits | 2018/19 | Estimate 2019/20 | Estimate 2023/24 |

|---|---|---|---|

| BSG pregnancy and baby | 13,000 | 13,000 | 15,000 |

| BSG early years | 0 | 15,000 | 17,000 |

| BSG school age | 0 | 13,000 | 17,000 |

| carer's supplement/allowance | 79,000 | 87,000 | 98,000 |

| funeral support payment | 0 | 4,400 | 4,400 |

| young carer grant | 0 | 1,700 | 1,700 |

| best start foods | 0 | 23,000 | 23,000 |

| DLA child | 0 | 0 | 38,000 |

| DLA working age | 0 | 0 | 75,000 |

| PIP | 0 | 0 | 220,000 |

| DLA pension age | 0 | 0 | 82,000 |

| attendance allowance | 0 | 0 | 126,000 |

| industrial injuries disablement benefits | 0 | 0 | 29,000 |

| winter fuel payment | 0 | 0 | 1,021,590 |

| cold weather payment | 0 | 0 | unknown |

| indicative total | c.90,000 | c.160,000 | c.1.75m |

The Charter

The Scottish Government has always emphasised that Scottish social security will be based on certain principles. These are set out in the Social Security (Scotland) Act 2018. One of the main expressions of these principles is the Charter on Scottish Social Security,1 which was developed in consultation with people who have 'lived experience' of the current system and seeks to embed ‘dignity and respect’ in Scottish social security. Social Security Scotland must have regard to the Charter which explains what customers can expect from their dealings with the Agency. For example, it includes a commitment to 'be patient, kind and to consider how you might feel' and 'to be honest, provide clear reasons for decisions and explain what to do if you disagree.' It includes a commitment to: 'listen, learn and improve by owning up to mistakes and valuing feedback, complaints and appeal decisions' and to 'make your contact with the agency as stress free as possible.' The Charter also sets out some of the statutory provisions from the 2018 Act, such as the right to appeal, and minimisation of the use of face to face assessments.

Staffing and operational costs

Social Security Scotland's staff and costs will increase over the next few years, reflecting the phased approach to implementation of the new benefits.

Social Security Scotland has its headquarters in Dundee and a second administrative base in Glasgow. It is also planning a ‘local presence’ in communities across Scotland. As of 1 February 2019, it employed 323 staff (164 in Dundee, 140 in Glasgow and 19 local delivery leads) and is expected to employ up to 1,900 people once it is delivering the full range of benefits (750 in Dundee, 750 in Glasgow and 400 in local delivery across the country).1

Its budget in 2019/20 is £42m (see table 5 belowi), although, once it is delivering its full range of benefits, it will have estimated running costs of around £153 to £165m (at 2019/20 prices - see table 6 below).

| 2018/19 | 2019/20 | |

|---|---|---|

| staff costs | £7.2m | £20.1m |

| information and communication technology | £3.4m | £5.6m |

| facilities and property | £0.7m | £4.2m |

| other | £6.4m | £6.1m (DWP payment excl. VAT)£2.9m (shared service re-charge)£2.6m (operational office costs) |

| total | £17.7m | £41.5m |

| steady state annual cost | |

|---|---|

| core operating costs and digital | £88 to £89m |

| pre-claim support services | £22m |

| assessment services | £26 to £36m |

| estates services | £16 to £18m |

| total | £153 to £165m |

Local delivery and advice

Social Security Scotland will have a strong local presence across Scotland, 'located wherever possible, in places that people already visit.'1 This will enable the provision of: 'face to face advice, supported by administrative functions in Dundee and Glasgow.'2 The Agency will:

enable staff to travel to and operate from locations across their local area,

offer support in outreach locations, prisons and home visits,

provide one to one support, and

help people understand their entitlements and complete application forms.3

The development of pre-claims advice flows from statutory duties in the 2018 Act. These include:

a duty to ensure applicants are given information about independent advice, information and advocacy (s.6)

a requirement for Scottish Ministers to publish a strategy to promote take up (s.9)

a duty to inform applicants where they might be entitled to other Scottish social security benefits (s.53)

As well as processing applications and making payments, the Agency will make redeterminations where someone disagrees with a benefit decision, investigate possible offences and recover overpayments of benefit due to fraud or error. This is discussed in the following sections.

Investigation of offences

The 2018 Act creates offences of; obtaining benefits by deceit (fraud) and failing to notify (or causing a person to fail to notify) a change of circumstances. Social Security Scotland will have powers to investigate these offences. Proposed powers, yet to be made in regulations,i include:

the power to compel any individual or organisation to provide information where requested by an authorised officer and where its reasonably requested in connection with an investigation,

the power to enter and search premises other than dwelling houses (although permission from the occupier would be required to enter premises), and

the power to impose fines for non-compliance.

Social Security Scotland's counter fraud strategy states that:

We understand that care must be taken to ensure disproportionate controls are not adopted

Social Security Scotland. (2018). Counter fraud strategy 2018 - 2022. Retrieved from https://dgxmvz0tqkndr.cloudfront.net/production/images/general/Social-Security-Scotland-Counter-Fraud-Strategy.pdf [accessed 11 April 2019]

Investigations can include covert surveillance. The carer's allowance agency agreement noted that:

the Scottish Government laid an amendment order to the Regulation of Investigatory Powers (Scotland) Act (RIP(S)A), adding its new agency Social Security Scotland to the list of bodies that may authorise covert surveillance when it is deemed necessary

DWP and Scottish Government. (2018, August). Carer's allowance in Scotland: agency agreement. Retrieved from https://www.gov.uk/government/publications/carers-allowance-in-scotland-agency-agreement-and-service-level-agreement/carers-allowance-in-scotland-agency-agreement [accessed 17 April 2019]

Redeterminations and appeals

There is a new appeal route in relation to Scottish social security. However, while the DWP is delivering benefits on behalf of the Scottish Government, UK rules on appeals will apply. Local authority payments also have different rules. These different routes are set out in the table below.

| Benefit/delivery agency | Reconsideration/review | Appeal heard byi |

|---|---|---|

| Most benefits delivered by the Agencyii | redetermination by Social Security Scotland | Social Security Chamber of the First-tier Tribunal for Scotland |

| DWP agency arrangements | mandatory reconsideration by DWP | Social entitlement chamber of the UK First-tier Tribunal |

| council tax reduction | local authority review | Council Tax Reduction Review Panel |

| discretionary housing payments | local authority review | no appeal |

| Scottish welfare fund | local authority review | 2nd tier review by SPSO |

Early experience in the first few months of paying the best start grant was that around two thirds (65%) of the 14,935 applications processed by 28 February 2019 were successful and around a third (33%) were denied. There were 240 requests for redetermination of a decision to deny a payment. Around a third of the 145 redeterminations completed by 28 February 2019 had the decision reversed.1 David Wallace, Chief Executive, Social Security Scotland, told the Social Security Committee that decisions to reverse the initial decision were often due to people having gained eligibility in the time between the original decision and the redetermination:

It is not that the original decision was incorrect when it was made; rather, people have now come into payment of universal credit.

Social Security Committee 28 February 2019, David Wallace, contrib. 88, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11972&c=2156117

Following a redetermination, a claimant can appeal to the First-tier Tribunal. There is no data available yet on whether there have been any such appeals related to best start grants. There is no redetermination or appeal process for CAS, which is the other Scottish social security benefit currently in payment.

The Scottish Government expects that there will not be as many appeals in the Scottish system as there are for reserved social security benefits.iii The reserved equivalents of the benefits being devolved generated around half of all social security appeals in 2017/18. (c.125,000 appeals across the whole of Great Britain related to benefits that are being devolved).4 Even with a very large reduction in appeals these figures suggest there would still be a significant number of appeals in the Scottish system.

Overpayments and deductions

Overpayments of benefits could result from official error, claimant error or fraud. The 2018 Act allows overpayments to be recoveredi where:

it is the claimant's fault

it is not the claimant's fault, but they would reasonably be expected to notice that they had been overpaid

While this is the statutory position, the consultation paper on disability assistance suggests a narrower approach as a matter of policy:

where an overpayment is made as a result of Agency error it will not be pursued unless under exceptional circumstances such as a large and obvious overpayment

Scottish Government. (2019, February). Disability assistance in Scotland: consultation. Retrieved from https://www.gov.scot/publications/social-security-consultation-disability-assistance-scotland/ [accessed 11 April 2019]

Social Security Scotland will have five years to recover an overpayment and could so do through deductions of benefit.ii The Agency must have regard to the claimant’s financial circumstancesiii but: 'detailed policy for how deductions may be made is still under development.' The disability assistance consultation asks for views on 'whether or not there should be a maximum level of deduction.'iv1

Brexit and Scottish social security

Many of the benefits being devolved are currently covered by EU Co-ordination Rules making Brexit relevant to Scottish social security. In very general terms the EU co-ordination rulesi are concerned with how people moving between different EEA states claim non-means tested social security benefits. Under these rules some social security benefits can be claimed by UK nationals living in another EEA country (under the principle of ‘exportability’) and by EEA nationals living in the UK. For example, the rules enable people who move from the UK to another EEA country to claim the winter fuel payment. The rules also apply to carer's allowance and some disability benefits (see table 8 below). The rules set out the following six principles, which are:

Single state: you can only claim a benefit from one state at any one time

Equal treatment of people. A state cannot discriminate on the bases of nationality

Equal treatment of benefits income, facts and events. Where these have a legal consequence in one state, they must be recognised in the same way in other member states

Aggregation: periods of certain categories of residence or insurance contributions made in one state can count towards qualification for benefits in other states

Exportability: some benefits can be claimed or continue to be claimed if someone moves to another member state

Administration co-operation. Member states will co-operate in the administration of the co-ordination rules

The UK Government policy intention is that broadly the same rights will apply immediately after Brexit as apply now in relation to the co-ordination of social security. Regulations have been passed to allow the UK’s obligations to remain essentially the same in event of ‘no deal.’ii

As part of this process, the Scottish Government has agreed to UK regulations which replicate the current EU law.

This is not a situation where the Scottish Government would make different choices for such elements of provision as are devolved

Somerville, S. (2018, December 21). Letter from Shirley-Anne Somerville MSP, Cabinet Secretary for Social Security and Older People to Bob Doris, Convenor Social Security Committee. Retrieved from https://www.parliament.scot/S5_Social_Security/Meeting%20Papers/SSCPublicPapers_20190117.pdf [accessed 11 April 2019]

The Withdrawal Agreement, were it to come into effect, would allow the current rules to continue to apply until December 2020 (the transition period).

Policy after the transition period is still being considered by the UK Government. A current Westminster bill, the Immigration and Social Security Co-ordination (EU Withdrawal) Bill,2 would enable changes to the co-ordination rules to be made through regulations. This would include changes to the co-ordination of devolved social security. Such changes could be made by UK Ministers or by Scottish Ministers. As currently drafted, there is no requirement that UK Ministers consult Scottish Ministers before legislating on devolved social security legislation (in so far as it relates to EU co-ordination).

The Scottish Government has declined to lodge a legislative consent motion for the bill, but this would not prevent the UK from legislating.

The Westminster Parliament criticised the wide regulation making powers in the bill.iii The House of Lords Delegated Powers and Regulatory Reform Committee recommended that the relevant provision on social security co-ordination be removed. The Committee observed:

Part 2 of the Bill gives current and future Ministers almost absolute power to rewrite the Co-ordination Regulations at any time of their choosing. Parliament will have no opportunity to amend this Ministerial legislation; the two Houses would be asked only to approve or reject it under the affirmative procedure.

House of Lords Delegated Powers and Regulatory Reform Committee. (2019, January). 46th Report: Immigration and Social Security Co-ordination (EU Withdrawal) Bill. HL Paper 275. Retrieved from https://publications.parliament.uk/pa/ld201719/ldselect/lddelreg/275/27502.htm

The Scottish Parliament’s Social Security Committee considered the bill on 21 March 2019. Shirley-Anne Somerville, Cabinet Secretary for Social Security and Older People, indicated that the Scottish Government had no objection to the regulation making powers provided, and that in relation to devolved social security:

Although having such a power might be a useful tool, we have no plans to exercise it. The UK Government’s approach to co-ordination has been broadly positive—to the extent that it has committed to honouring the rules even in a no-deal scenario. The political declaration on the future relationship also makes reference to the desirability of on-going co-ordination in the future.

Therefore, in normal circumstances, the Scottish Government might have been minded to propose a consent motion.

Social Security Committee 21 March 2019 [Draft], The Cabinet Secretary for Social Security and Older People (Shirley-Anne Somerville), contrib. 156, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=12017&c=2163567

The table below gives the numbers of people and amount of spend by DWP on exportable benefits that are to be devolved. It is not known how many of these have a 'close connection' to Scotland and so potentially within scope of policy decisions on devolved benefits.

| Caseload | Spend | |

|---|---|---|

| disability living allowance care and personal independence payment daily living | 4,600 (EEA) | £15m |

| industrial diseases disablement benefits | 6,000 (worldwide) | £16m |

| attendance allowance | 3,100 (EEA) | £11m |

| winter fuel payment | 40,000 (EEA) | £8m |

| carer's allowance | 1,100 (EEA) | £1m |

| severe disablement allowance | 50 (overseas or unknown) |

Source: Home Office6 except SDA from NOMIS as at August 2018.

The Scottish Government has not stated what eligibility will be for Scottish benefits for people living abroad. However, in relation to EEA nationals living in Scotland it has said that:

The Scottish Government is committed to its legal responsibility to ensure that all devolved benefits offer fair and equal access to EEA nationals

Scottish Parliament. (2019, March 14). Written PQ S5W-21939. Retrieved from https://www.parliament.scot/parliamentarybusiness/28877.aspx?SearchType=Advance&ReferenceNumbers=S5W-21939&ResultsPerPage=10 [accessed 11 April 2019]

As well as EU Co-ordination Rules there are reciprocal agreements between individual countries. The UK and Irish governments have signed a Convention on Social Security to provide for reciprocal treatment of social security rights between the two states. Legislation implementing this includes a power8 for the UK Government to modify specific social security Acts in order to give effect to the Convention. Scottish regulations9 provide for the Convention to be given effect in relation to devolved social security.

Another area where Brexit could impact on Scottish social security is if the residency rules for UK social security benefits change. Some Scottish social security benefits are only paid to people who receive certain UK social security benefits. Any changes to the residency requirements for these UK benefits would therefore affect entitlement to Scottish social security benefits.

Annexe 1: Social security devolution. 1998 to April 2019

| Date | Legislation | Other |

|---|---|---|

| 1998 | Scotland Act devolves various social security payments made by local authorities such as social work payments related to welfare services, certain kinship care payments, payments to care leavers and certain payments by enterprise agencies related to industrial injuries. | |

| 2006 | executive competence for some aspects of welfare foods devolvedi | |

| 2013 | council tax reduction scheme establishediiinterim Scottish welfare fund establishediii | Scottish welfare fund reference group established |

| 2014 | power to set limit on discretionary housing payments devolved,2 iv enabling the Scottish Government to mitigate the 'bedroom tax' | |

| 2015 | February: Joint Ministerial Working Group establishedNovember: Carer Benefit Advisory Group established. | |

| 2016 | Scotland Act 2016 provides for devolution of further social security benefits, the power to top up reserved benefits, create new benefits and make certain changes to universal credit.vApril: statutory Scottish welfare fund establishedviSeptember: powers commenced to top up reserved benefits, make discretionary paymentsvii and implement universal credit flexibilities4 | February: Fiscal framework5 agreed between UK and Scottish Government, setting out how funding for newly devolved powers including social security will be transferred.March: Funeral poverty and funeral expense assistance reference group established.March: Ill-health and disability benefits stakeholder reference group established.May: Industrial injuries disablement benefits advisory group establishedJuly: Scottish Government consultation: "A new future for social security"viii7October: Best start reference group established. |

| 2017 | April: powers commenced for full devolution of discretionary housing payments4April: Scottish Fiscal Commission required to forecast Scottish social security spend.ixMay: legislative competence commenced for: disability, carer's, cold weather, heating, funeral and maternity expenses.9 However, full legal responsibility due to commence from April 2020 at the latest (see below).10 October: universal credit Scottish choices established, allowing someone to choose twice monthly payments and/or have the housing element paid direct to the landlordvi | April: Disability and Carer's Benefits Expert Advisory Group establishedJune: Experience panels establishedOctober: Young carer grant working group establishedOctober: Agreement between Scottish Government and DWP on universal credit choices13November: Communications and engagement group establishedDecember: Agency operations reference group established. |

| 2018 | May: Regulations allow DWP to deliver carer's, disability and industrial injuries assistance under agency agreements.14June: Social Security (Scotland) Act 2018 setting the framework for devolved benefits, receives Royal Assent.June/July: carer's allowance supplement will not count as income for various UK social security benefits15 nor for council tax reduction.16September: carer's allowance supplement first payments made.17October: Further commencement of 2018 Act including provision relating to making payments, the charter, appeals and offences.18November: best start grant and funeral support payment will not count as income for council tax reduction19Appeals and tribunals regulations create a social security chamber of the First-tier Tribunal,20 temporarily sharing a president with another chamber,21 set out detailed rules of procedure,2223 how many members sit on a panel,24 the type of expertise they should have25 and payment of expenses.December: best start grant pregnancy and baby payments start2627 and sure start maternity grants ends in Scotland.28early years assistance not counted as income for various social security benefits.28December: Immigration and Social Security Co-ordination (EU Withdrawal) Bill 2017-19 provides for UK and/or Scottish Ministers to make regulations to change provisions for EU Co-ordination of social security, including devolved social security. | March to June: Best start grant consultation.30April to June: Welfare foods consultation.31August: Carer's Allowance agency agreement32August to October: Consultation on fraud offences and investigations.33September: Scottish Fiscal Commission publish approach to social security forecasting34 and costing for best start grant.35September to December: Young carer grant consultation36October: Social Security Scotland corporate plan37 and IT strategy.38October: 75,000 carer's allowance supplement payments made.39December: Scottish Fiscal Commission Forecast published40 and Scottish draft Budget 2019/20 provides £126m for social security administration and £435m for provision of benefits.40 |

| 2019 | January: provisions on Scottish Commission on Social Security in force,42 but requirement to report on regulations does not apply to early years or funeral expenses.January: Scottish Parliament consents43 to UK ministers legislating on devolved social security in relation to 'no-deal' Brexit. February: amendments made to best start grant regulations.44February: welfare foods legislative devolution commences45 and regulations allow an agency agreement for UK Ministers to deliver these benefits until Scottish Government provision is ready to start.46April: carer's allowance is uprated by CPI (2.4%)47 and the weekly earnings threshold is increased from £120 to £12348April: best start grant: early years payments start.49 | January: Sally Witcher announced as chair of Scottish Social Security Commission. Board members are: Judith Paterson, Mark Simpson and Sharon McIntyre. The first benefit they will consider will be the young carer grant.50January: Social security charter published and approved by Parliament51February: Ministerial statement on timing of 'wave 2' benefits,52 and publication of policy position papers.March to May: Consultation on disability assistance and short term assistance 53April: carer's allowance supplement is uprated by inflation (2.4%)54April: funding for 2019/20 transferred from UK to Scottish Government for social security based on forecasts |

Annexe 2: Future developments: May 2019 to 2024

| Legislation | Other | |

|---|---|---|

| 2019 | Summer: funeral support payment due to starti2June: best start grant school payment due to start3Summer: best start foods due to startAutumn: young carer grant due to start | June: progress report expected on child poverty delivery plan to include progress on plans for an income supplement"as soon as practicable after the end of the financial year" annual reports on social security and appealsiiSeptember: details of measurement framework for the Charter and research on clients' experiences of Social Security Scotland expected.October: strategy on promoting take-up of Scottish social security required to be publishedDecember: Scottish draft bduget 2020/21 will include UK Government transfer for all devolved benefits |

| 2020 | April: Full legal and financial responsibility for carer's, disability and cold weather and winter heating payments. Executive competence for disability and carer's benefits due to transfer4 5along with funding. Cold weather and winter fuel payments (or their equivalent) due to be funded by Scottish Ministers. iii April: right to advocacy expected to be in force7Summer: disability assistance for children and young people (DACYP) (new claims)Summer: short term assistanceAugust: Scottish nursery milk scheme due to start8Winter: disability assistance for older people (new claims)Winter: winter heating assistance where child on higher rate care DACYP Earliest date for abolishing bedroom tax at source910 | April: annual uprating of certain benefitsMay: Fiscal Commission forecastsAfter financial year end: annual reports on social security system and appealsSeptember: current agency agreement on carer's allowance due to end.11Autumn: Funding transfer from UK for 2019/20 finalised based on outturn data, and transfer for 2020/21 updatedDecember draft budget and Fiscal Commission forecast |

| 2021 | Previous policy commitment to deliver all benefits "by the end of the Parliament" i.e May 2021 BUT see below for new timetable.Early: working age disability assistance (new claims)End: Scottish carer's assistance (new claims)Winter: winter heating assistanceWinter: cold spell heating assistance | April: annual uprating of certain benefitsMay: Fiscal Commission forecastsAfter After financial year end: annual reports on social security system and appealsAutumn: Funding transfer from UK for 2021/22 finalised based on outturn data, and transfer for 2022/23 updated.December: draft Budget and Fiscal Commission Forecast. |

| 2022 | Income supplement12start to transfer existing carer's allowance cases to carer's assistanceAutumn: employment injury assistance13 | April: annual uprating of certain benefitsMay: Fiscal Commission ForecastsAfter financial year end: annual reports on Social Security System and appealsAutumn: Funding transfer from UK for 2021/22 finalised based on outturn data, and transfer for 2022/23 updated.December: draft Budget and Fiscal Commission Forecast |

| 2023 | Majority of existing cases will have been transferred | April: annual uprating of certain benefitsMay: Fiscal Commission ForecastsAfter financial year end: annual reports on Social Security System and appealsAutumn: Funding transfer from UK for 2022/23 finalised based on outturn data, and transfer for 2023/24 updated.December: draft Budget and Fiscal Commission Forecast |

| 2024 | Transfer of existing cases due to be completed | January: Charter due to be reviewedivApril: annual uprating of certain benefitsMay: Fiscal Commission ForecastsAfter financial year end: annual reports on Social Security System and appeals |

Annexe 3: Annual cycle of reporting to the Parliament

There are certain reports and regulations on Scottish social security that will come to the Parliament each year. These are set out below.

| Timing | Report/regulations |

|---|---|

| Before the end of the financial year | annual uprating for carer's, disability, employment injury and funeral support payment (s.78 2018 Act).uprating carer's allowance (until it is replaced by carer's assistance) |

| annual uprating of carer's allowance supplement. (s.81 2018 Act). This does not require regulations, but Ministers must published a statement. | |

| May | Scottish Fiscal Commission forecast of benefit expenditure |

| After end of financial year | annual report on social security (s.20 2018 Act)annual report on appeals (s.87 2018 Act) |

| December | Scottish Fiscal Commission forecast of benefit expenditure |

| As outturn data becomes available | Scottish Fiscal Commission annual evaluation of forecasts |