Inshore Fisheries

This briefing explores key issues facing Scotland's inshore fisheries. It provides an overview of the inshore fishing fleet and its contribution to Scotland's economy. It also examines inshore fisheries governance, competing interests in inshore waters and implications of Brexit for the inshore fleet.

Executive Summary

Scotland’s inshore waters extend from the coast out to 12 nautical miles (nm), with a concentration of fishing taking place within 6 nm.

Scotland's inshore fishing fleet plays an important role in providing a source of food to the UK as well as employment and income for rural, coastal communities. The fleet faces a range of challenges related to fisheries governance and competing interests in inshore waters.

The inshore fleet mainly comprises vessels under 10m in length and makes up two-thirds Scotland's fishing fleet in terms of vessel numbers.

The inshore fleet is diverse and includes trawlers, creelers, netters, dredgers and divers, mainly targeting shellfish species such as brown and velvet crab, lobster, scallops and Nephrops (langoustines).

Most of the inshore fleet uses low-impact fishing methods using static gear such as creels and pots to target crab and lobster. Mobile gear methods such as dredging and trawling are also used to target scallops and Nephrops.

In 2017, UK vessels under 10m in length landed 12,983 tonnes of fish and shellfish into Scottish ports worth £45 million. This accounted for approximately 10% of total landings by value and 5% by landed weight.

The wider fisheries framework is currently governed by the European Union under the Common Fisheries Policy (CFP). However, Scottish Ministers have significant scope to regulate fishing in inshore waters.

Although the majority of the inshore fleet target non-quota shellfish species, some quota for sea fish is available to vessels under 10m in length.

Quota is allocated to the fleet by Marine Scotland from its apportion of the UK's share of the Total Allowable Catch determined annually by the EU Council of Ministers.

The current system of domestic quota allocation has been criticised for being unfairly balanced in favour of large vessels operating in offshore waters (12-200 nm), and has been linked to poor economic performance of smaller inshore vessels. However, there are practical and historical reasons for the current structure of quota distribution.

The inshore fleet faces many competing interests in inshore waters. These include:

Gear conflict between vessels operating mobile gear (e.g. trawling the sea bed) and static gear (e.g. lobster and crab pots).

The closing of fishing grounds or gear restrictions related to the development of marine renewable energy projects, Marine Protected Areas and aquaculture sites.

Managing these competing interests is made difficult by a lack of data on the fishing activities of under 10m vessels. This is because small vessels are not required to use vessel tracking technology to monitor activity.

The benefits of potential increased fishing opportunities associated with the UK becoming an independent coastal state after Brexit may not be gained by the inshore fleet which primarily targets non-quota species. Concerns over tariff and non-tariff barriers have been raised by representatives of the inshore fleet which is heavily dependent on exporting fresh shellfish to EU markets.

Data description

This briefing uses a combination of publicly available data published by the UK and Scottish fisheries administrations (Marine Maritime Organisation and Marine Scotland) and economic data provided to SPICe by Seafish. Seafish is a Non-Departmental Public Body (NDPB) set up by the Fisheries Act 1981 to improve efficiency and raise standards across the seafood industry. Seafish is funded by a levy on the first sale of seafood products in the UK, including imported seafood in accordance with the 1981 Fisheries Act.

Seafish produce annual statistics on the economics of the UK fishing fleet. These statistics combine data collected by UK fisheries administrations and annual surveys of fishing business owners conducted by Seafish. Full details of methodology are available in the Economics of the UK Fishing Fleet 2017 report.

Scotland's inshore fleet

There are over 1,400 vessels fishing in Scotland's inshore waters, making up two-thirds of the Scottish fleet. Inshore vessels are typically smaller boats under 10m in length and have a one or two-person crew. These vessels fish within inshore waters that extend from the coast out to 12 nautical miles (nm), with the majority of fishing activity taking place within 6 nm.

The inshore fleet is diverse and includes trawlers, creelers, netters, dredgers and divers. The main target are shellfish species - primarily brown and velvet crab, lobster, scallops and Nephrops (langoustines).1

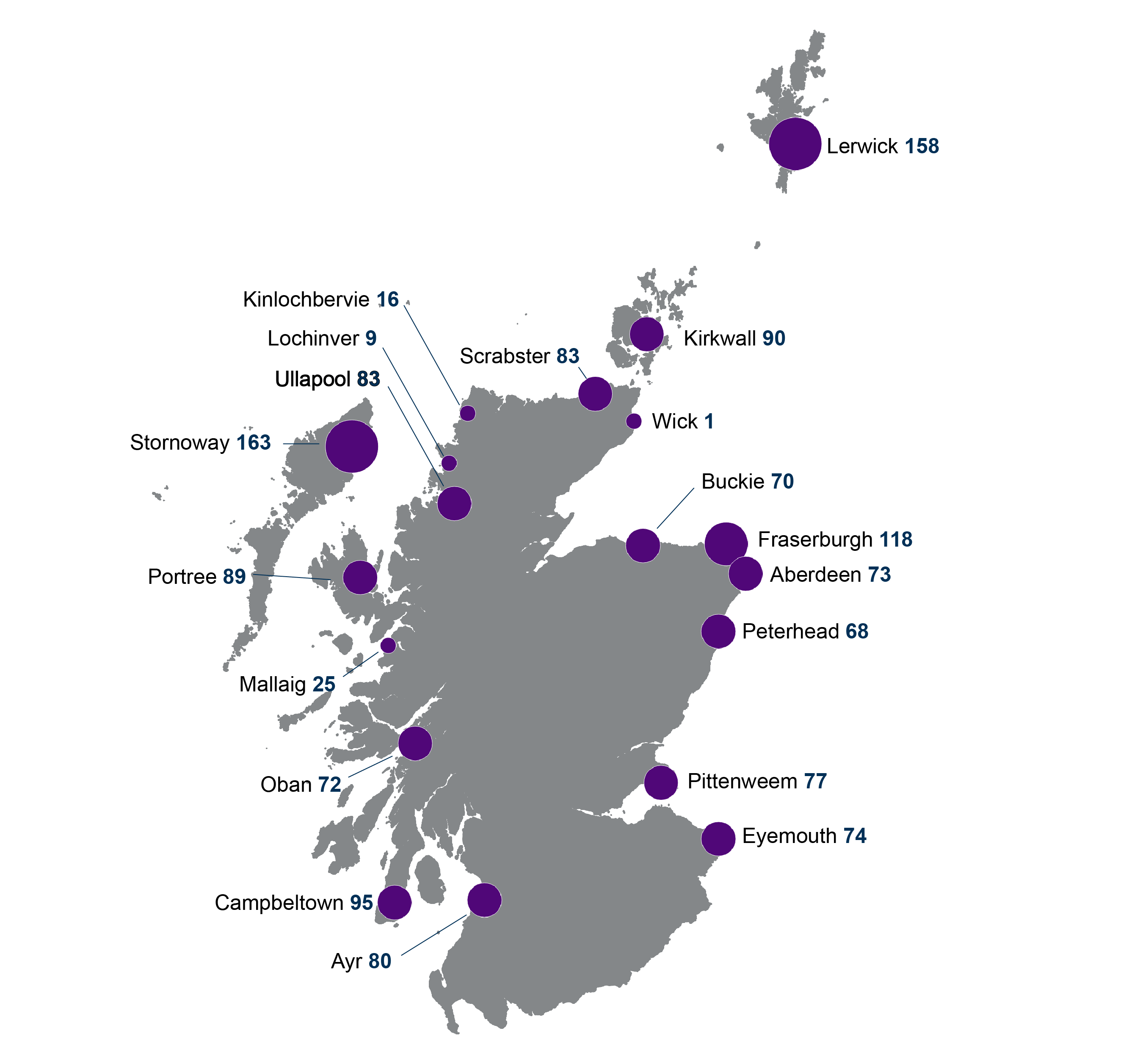

The map below shows the administrative port of Scotland's inshore fishing vessels as of August 2018. Just under half (44%) of these vessels are located on the west coast and Western Isles with the remainder on the north coast, and in the Orkney Islands and Shetland Isles (23%), and east coast (33%). The top five administrative ports in terms of the number vessels under 10m as of August 2018 were:

1. Stornoway (163)

2. Lerwick (158)

3. Fraserburgh (118)

4. Campbeltown (95)

5. Portree (89)

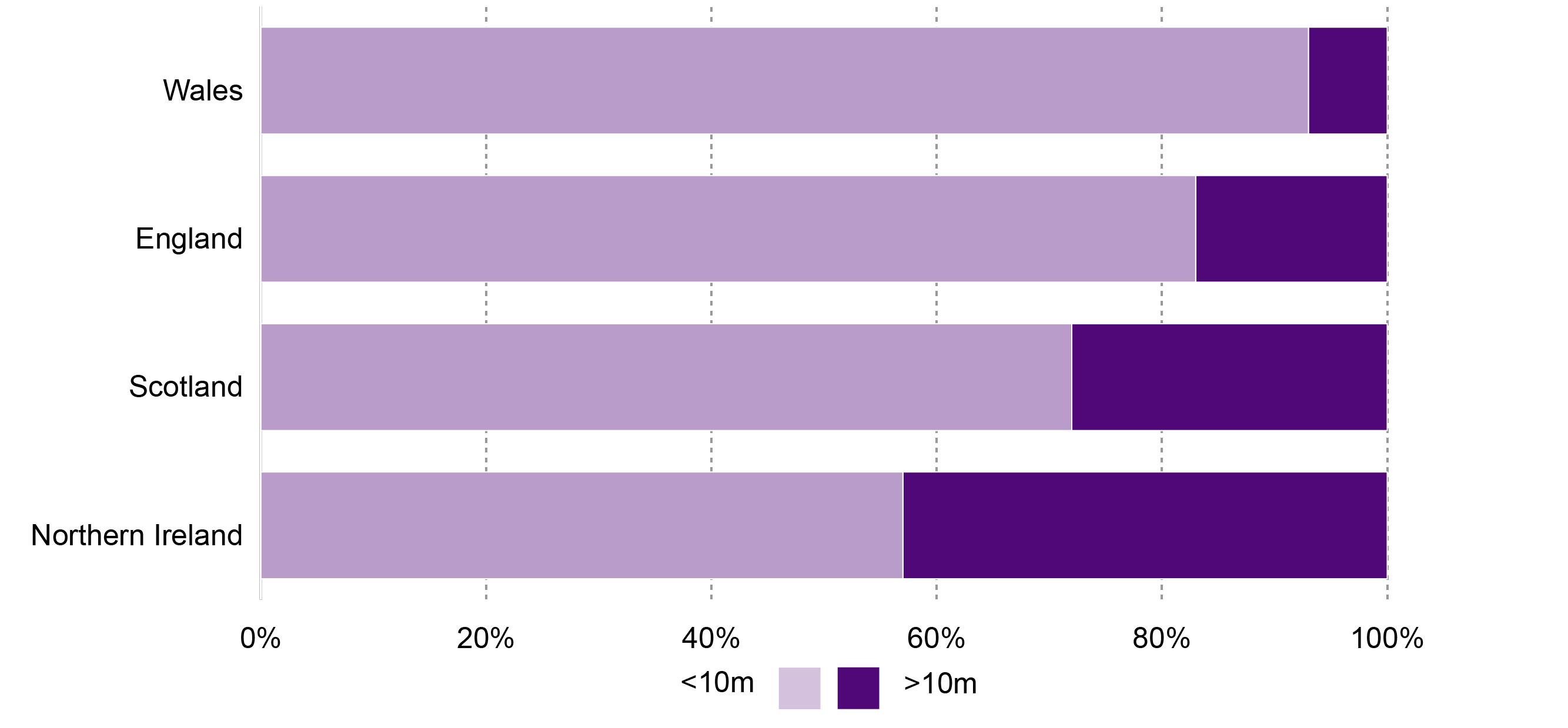

The 1,493 vessels under 10m in length make up 72% of the Scottish fleet in terms of numbers, but 25% in terms of vessel capacity (for catch).i The chart below shows the proportion of the under 10m fleet by number of vessels for each UK nation in 2017. In terms of vessel numbers, the Welsh fleet had the highest proportion (93%) of vessels under 10m in length (417) and the English fleet had the highest number at 2,512 vessels, representing 83% of its fleet.

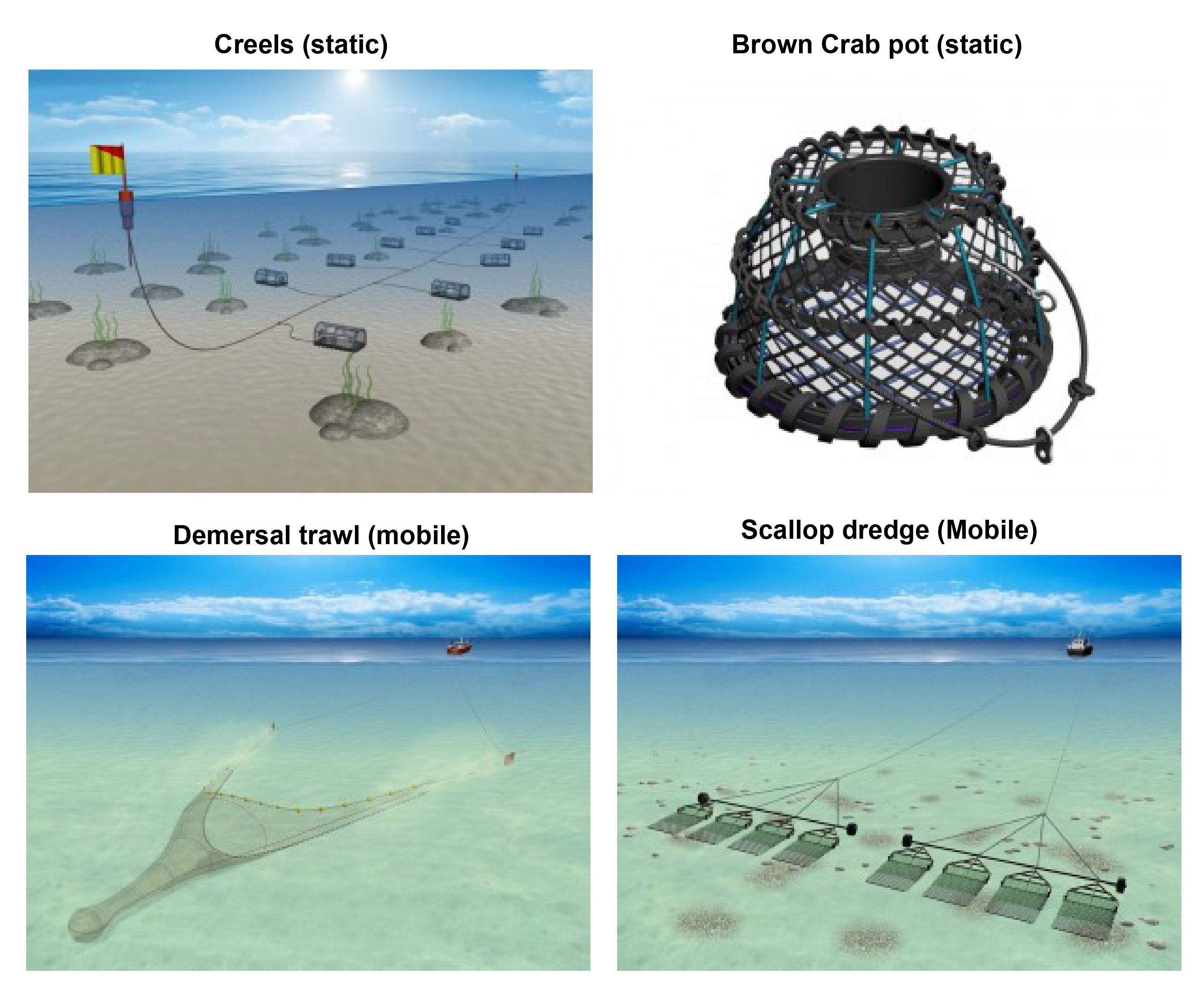

Inshore fishing is conducted by two methods:

Static gear: fishing for crabs, lobster and Nephrops by placing baited pots or creels on the seabed.

Mobile gear: fishing involving the towing of gear behind a vessel, such as nets for Nephrops or dredges for scallops.2

Most of the inshore fleet consists of vessels under 10m in length, predominantly using static gear. However, larger, more powerful vessels (e.g. 15-24 m in length) capable of operating in both inshore and offshore waters operate mobile gear. However, some areas in inshore waters located within Marine Protected Areas are closed to mobile fishing methods such as trawling and dredging to protect organisms on the seabed. 3

Economic value of inshore fisheries

Landings by the inshore fleet

Inshore vessels make a significant contribution to landings into Scottish ports. In 2017, UK vessels under 10m in length accounted for approximately 10% of total landings into Scottish ports by value (£45 million) and 5% by landed weight (12,983 tonnes).

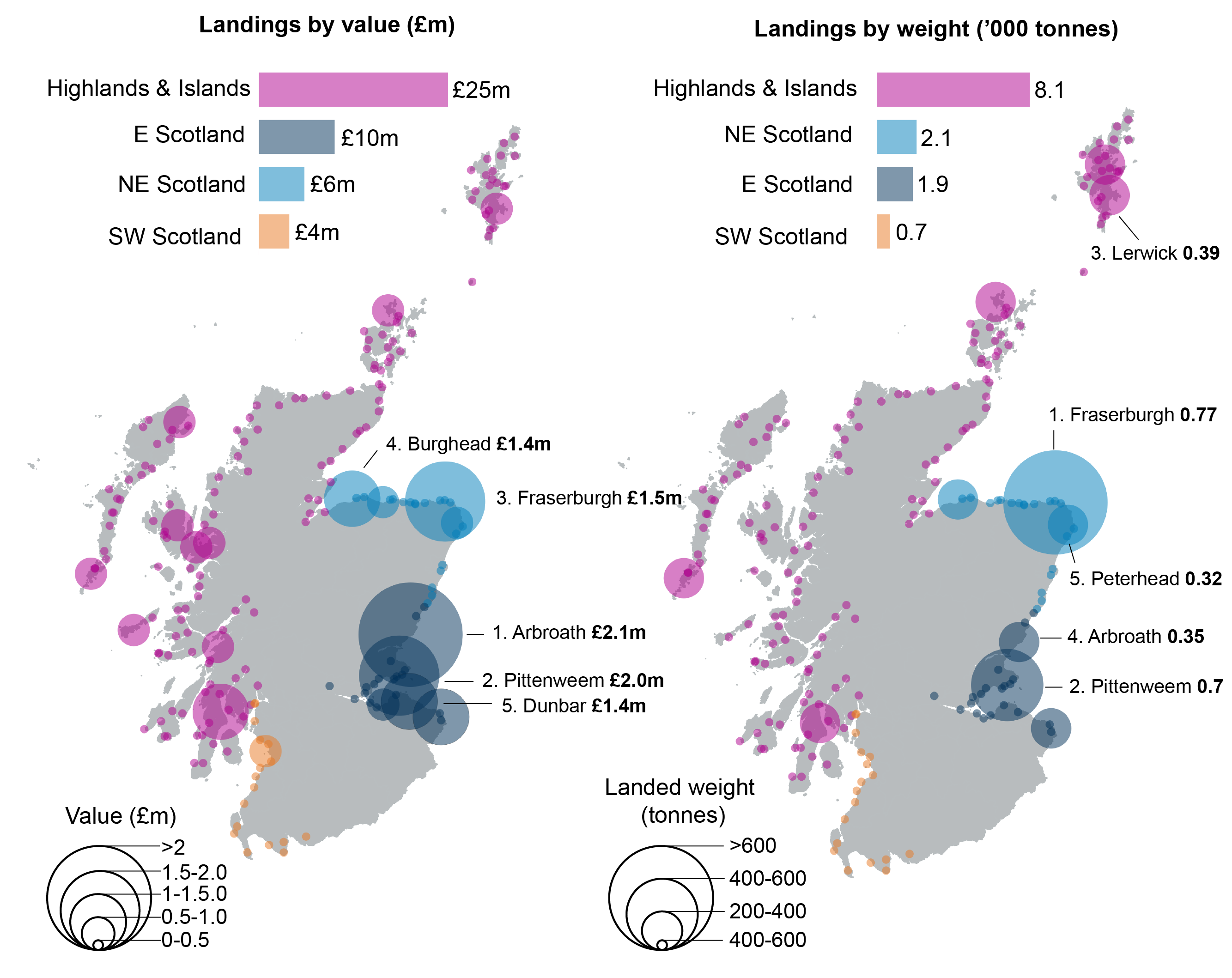

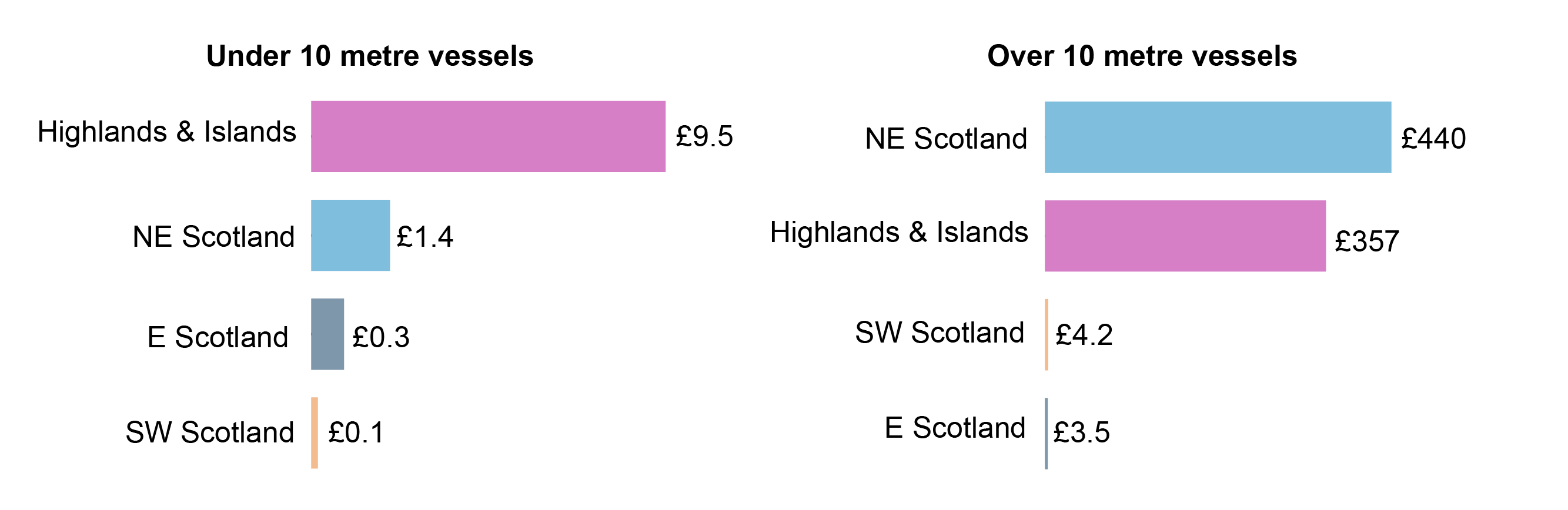

The maps below show the total landings by vessels under 10m in length for each region and port in Scotland in terms of value and landed weight in 2017. Highlands and Islands region recorded the highest total landings by weight and value (8,192 tonnes and £25m respectively).

Given the greater extent of coastline and number of ports in the Highlands and Islands area, it is not surprising that this region accounts for the highest total value and weight of landings. The charts below show the same data taking the population of each region into account.

The charts show that the value of landings per capita by vessels under 10m is significantly higher in the Highlands and Islands compared to other regions. For vessels over 10m in length, landings are higher in the northeast of Scotland.

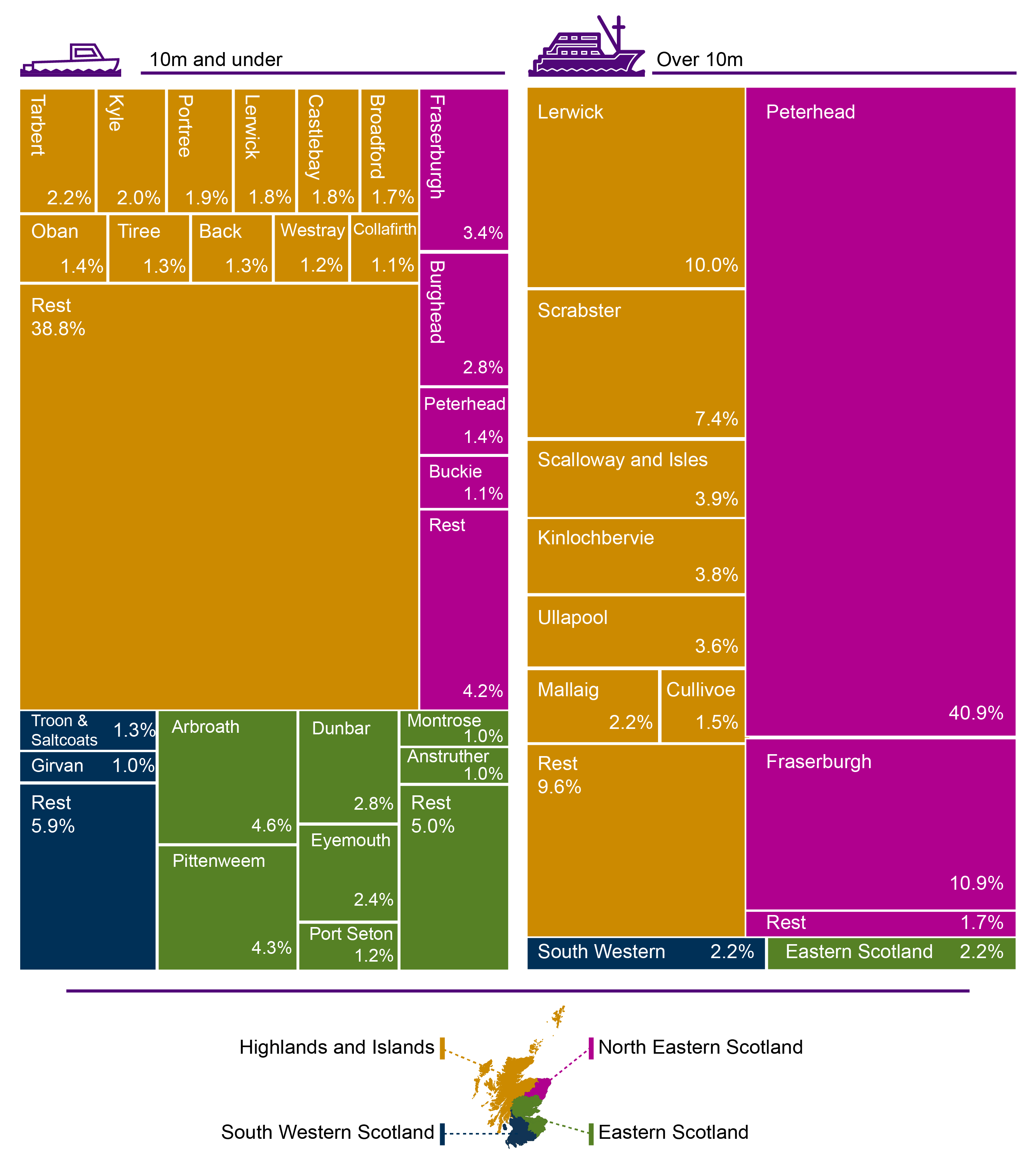

The chart below compares the proportion of total landings by UK vessels in 2017 by vessel length group and port of landing. It shows that the majority of catches by vessels over 10m in length are landed into a handful of ports. Peterhead and Fraserburgh in Aberdeenshire account for just over half (51.8%) of all catches by value worth £210million.

In contrast, landings by vessels under 10m in length are more evenly distributed across a larger number of ports. The highest ranking port by value is Arbroath in Angus, which accounted for 4.6% of landings by value by under 10m vessels worth £2 million.

Employment

Inshore fishing is an important source of employment in Scotland's coastal communities. In 2016, an estimated 1,858 fishers (911 Full-time equivalents (FTEs)) were employed on Scottish registered vessels under 10m in length. This represented 33% of the UK's employees in this vessel length group and 45% in terms of FTEs.i

A recent report by the Scottish Government shows that 'agriculture, forestry and fishing' is the largest source of private sector jobs in remote rural areas, accounting for 15% of employment. This compares to 11% in 'Accessible Rural' areas and 0.5% in the rest of Scotland.1

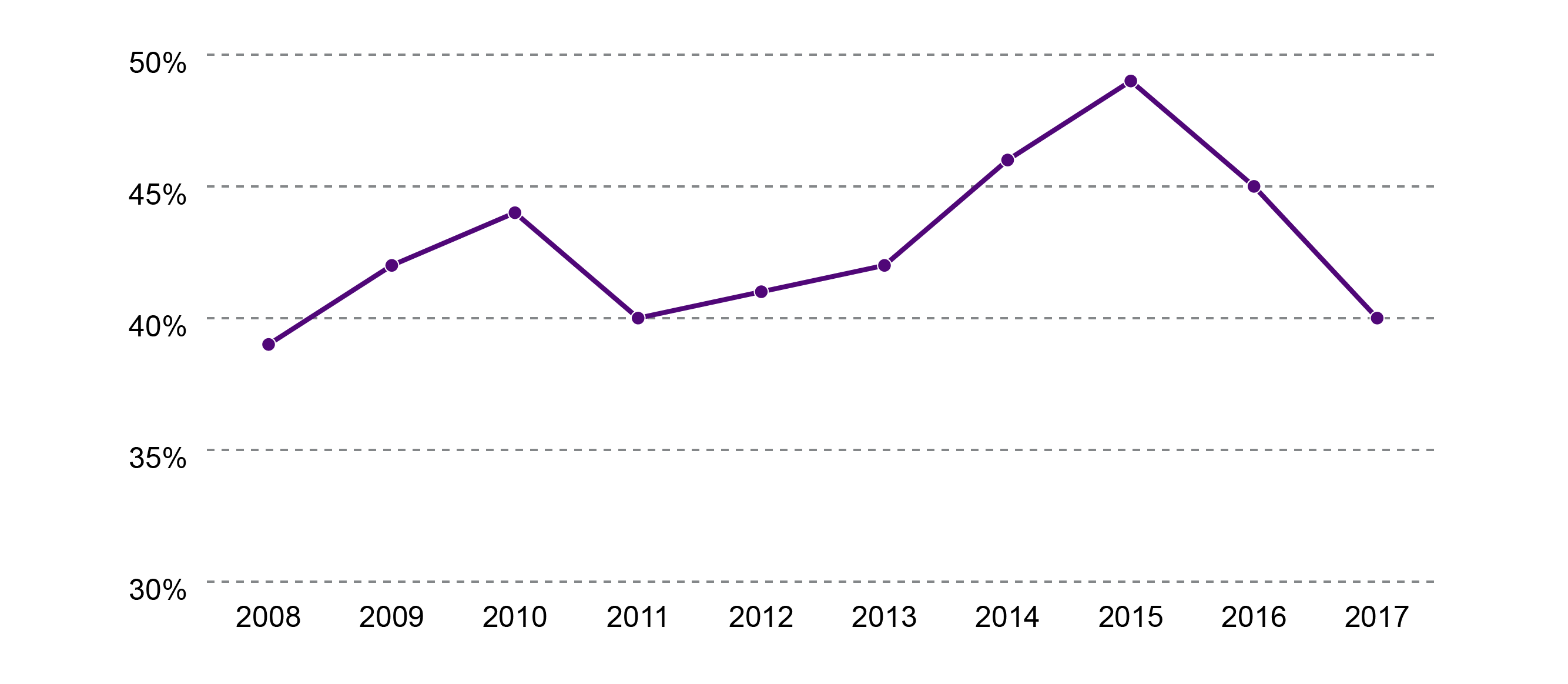

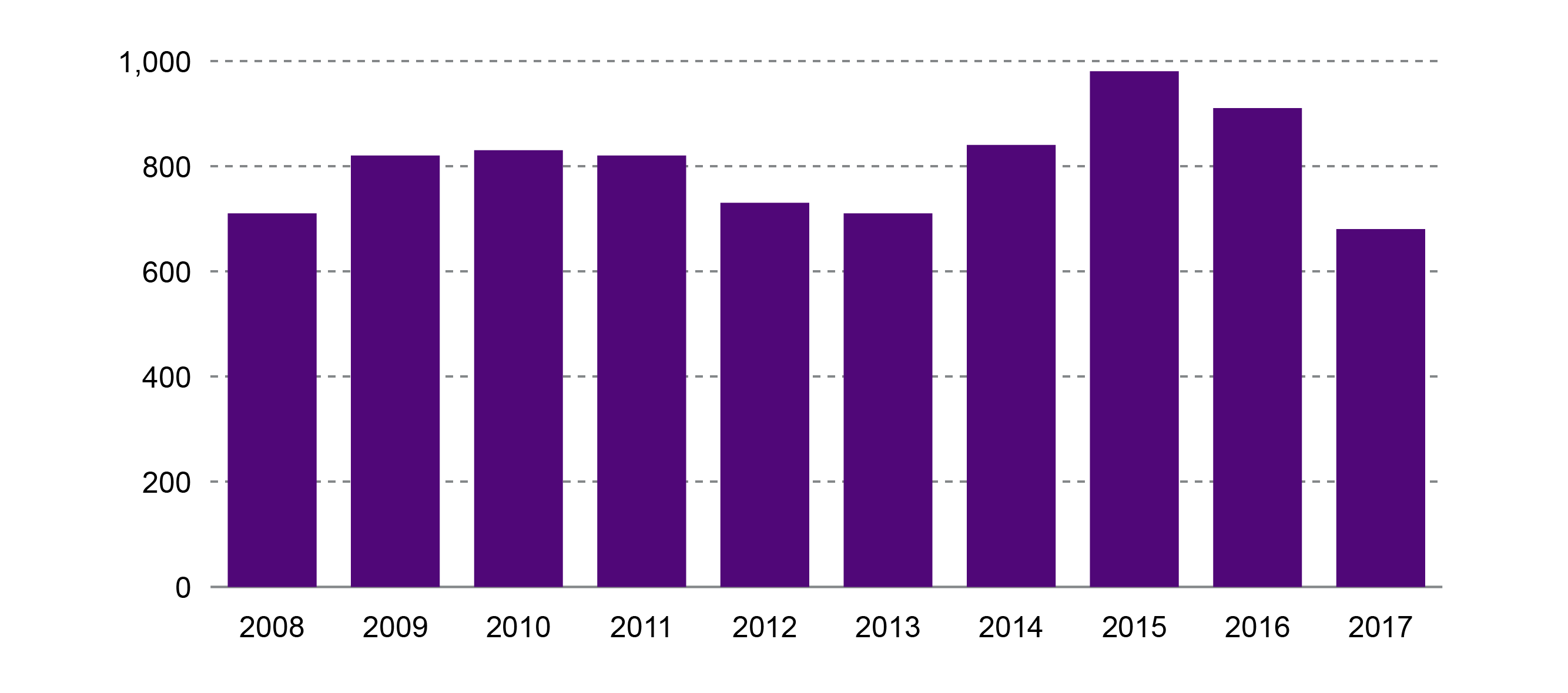

The charts below show estimates of employment in the UK's fishing fleets conducted by Seafish. The statistics show that a significant proportion of the UK's fishers on vessels under 10m in length are employed on vessels registered in Scotland. The proportion has fluctuated since 2008 but has remained above 39%.

Exports

In 2017, the UK exported £197 million worth of fresh shellfish species commonly targeted by the inshore fleet (Lobsters, Nephrops, Crabs, Scallops). Of these exports, 86% (£170 million) was exported to other countries within the EUi. HM Revenue and Customs do not provide regional statistics at species level. However, in 2017, Scottish ports accounted for 46% of all shellfish landings by the UK fleet. This figure is slightly higher at 49% for vessels under 10m in length.ii

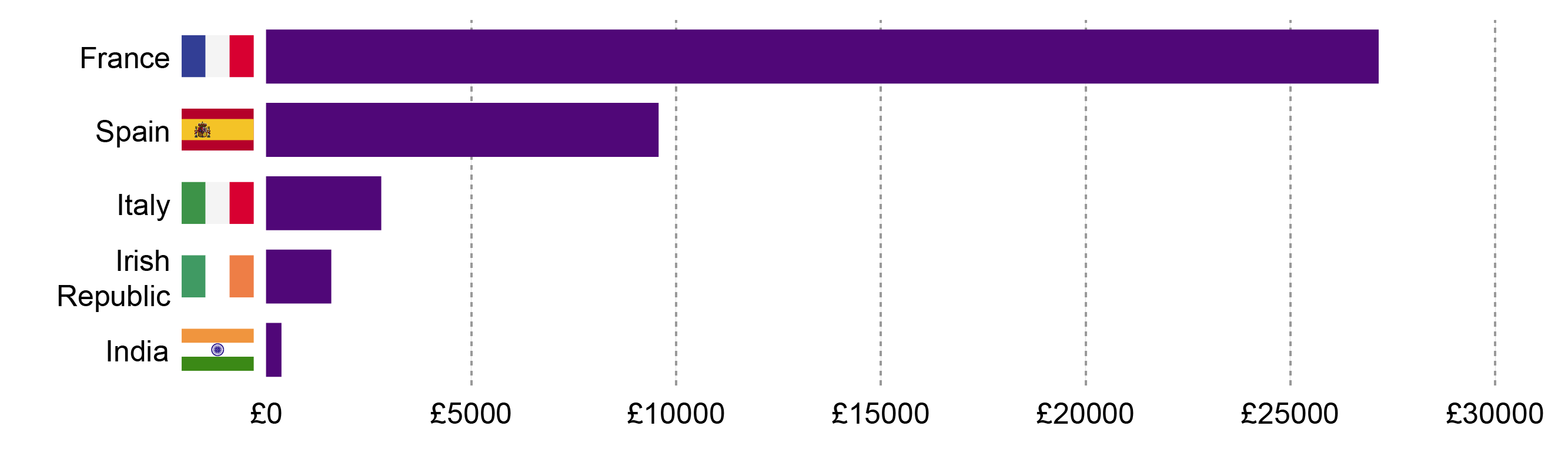

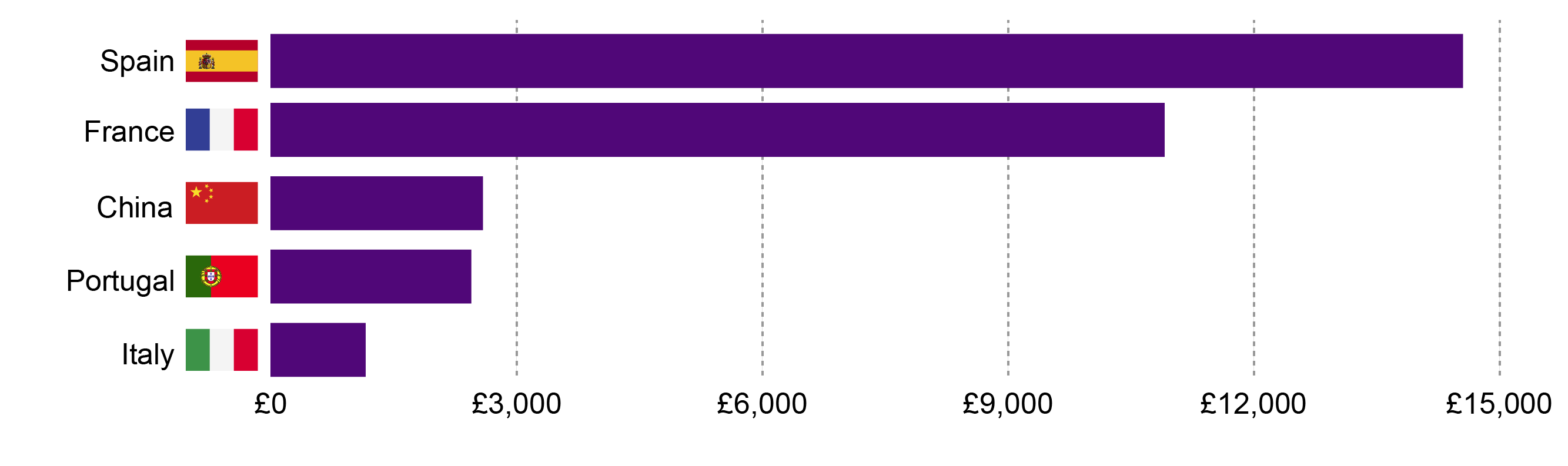

The charts below show data provided by Seafish of the top five destination countries of key species targeted by inshore vessels by value (values are for all vessel length groups).

Governance and management

The framework for Scotland's sea fisheries is governed by the European Union under the Common Fisheries Policy (CFP). The UK has exclusive rights to fish within 6 nm of its coastline. Fishing by non-UK vessels between 6 and 12 nm is restricted to countries with historic rights relating to specific fisheries. Scottish Ministers are responsible for the regulation of sea fishing within the Scottish zone of British Fishery Limits. Within 12 nm the Scottish Government has the ability to take non-discriminatory conservation measures, provided that the EU has not already legislated in this area.

In general, the only areas where the European Commission adopts measures which have effect within 12 nm are in relation to the Total Allowable Catch and gear regulations. This means that there is particular scope for Scotland to introduce its own management measures in the inshore zone. 1

Legislation

Inshore fisheries in Scotland are primarily regulated by the Inshore Fishing (Scotland) Act 1984. This Act enables Scottish Ministers to regulate fishing in inshore waters by prohibiting one or a combination of the following:

all fishing for sea fish;

fishing for a specified description of sea fish;

fishing by a specified method;

fishing from a specified description of fishing boat;

fishing from or by means of any vehicle, or any vehicle of a specific description;

fishing by means of a specified description of equipment.

Ministers may also specify the period during which prohibitions apply, and any exceptions to any prohibition.

Management of inshore fisheries in Scotland also falls under the following legislation:

The Sea Fish (Conservation) Act 1967 allows regulation of the size of fish landed, gear type that can be used, and restrictions on species that can be landed.

The Sea Fish (Shellfish) Act 1967 allows local management of fisheries through the granting of Several orders for setting up or improving private shellfisheries, and/or Regulating Orders which give the right to manage exploitation of a natural shellfishery.

The Scottish Government Inshore Fisheries Strategy

In 2012, the Scottish Government published its Inshore Fisheries Strategy which focused on three key elements:

improving science and data required for more effective management

improving engagement with fishermen

supporting the Inshore Fisheries Group network.

This was updated by the Scottish Inshore Fisheries Strategy 2015 which provided greater focus on integration with the marine planning system, with emphasis on the following:

improving the evidence base on which fisheries management decisions are made

streamlining fisheries governance, and promoting stakeholder participation

embedding inshore fisheries management into wider marine planning.

One area of focus in the strategy is on maximising European Funding through the European Maritime Fisheries Fund (EMFF) to support the implementation of the strategy. The strategy specifically aims to direct this funding towards areas of vessel monitoring, technical innovation and diversification to alternative fishing methods.

Commitments in the Scottish Government's Programme for Government

The Scottish Government's 2016-17 Programme for Government included a commitment to develop a new Inshore Fisheries Bill. There was no mention of the Bill in the 2017-18 Programme for Government.

The 2018-19 Programme for Government states that it will:

take steps to modernise the management of inshore fisheries through the introduction of appropriate vessel tracking and monitoring.

We want to help coastal communities keep fishing harbours operational because of their importance to the maritime and rural economies, and the greater wellbeing of those communities. Therefore, in the year ahead, we will provide up to £2 million to meet emergency work at fishing harbours which ensures the continued operation of the facility and the safety of the fishermen and wider community. We will also work with Fisheries Local Action Groups to deliver projects which support harbour diversification and delivers an increase in harbour income.1

Regional Inshore Fisheries Groups (RIFGs)

Regional Inshore Fisheries Groups (RIFGs) were established in 2016 by the Scottish Government with the aim of improving the management of inshore fisheries in the 0-6nm zone of Scottish waters. They also aim to give commercial inshore fishermen a stronger voice in wider marine management developments.

RIFGs are non-statutory bodies. Six Inshore Fisheries Groups (IFGs) were originally established in 2013-16 but were succeeded by five RIFGs as of April 2016:1

Each RIFG has an independent Chair, appointed by Marine Scotland to engage fishermen and to facilitate their input at meetings either at regional or local level. The RIFG Management Committee is expected to bring forward a Fisheries Management Plan for the region which can be broken down to define important local issues or those issues directly influencing a Scottish Marine Regional Marine Planning Partnership (MPP) in determining spatial management arrangements. 2

Further details on the structure, functions and decision making process of RIFGs can be accessed here.

Inshore Fisheries Management & Conservation group (IFMAC)

The Inshore Fisheries Management and Conservation group (IFMAC) complements the work of RIFGs focussing on national inshore fisheries issues outside the remit of RIFGs in the 6-12 nm zone.

IFMAC makes recommendations to Marine Scotland on matters related to:

The development of national inshore fishing policies and legislation relating to the management and conservation of the sea in the 0-12 nm zone, and effects on the marine environment so as to ensure a viable Scottish fishing industry and the maintenance of sustainable fishing communities.

The allocation and management of inshore fishing opportunities available to vessels managed by the Scottish Government, seeking, where possible, to align management measures with economic objectives identified by the Scottish Seafood Partnership (SSP). The aim of the SSP is to add value to all seafood products from net to plate and to promote the sustainable profitability of the seafood sector.

The development of national measures designed to better conserve and sustainably exploit stocks of sea fish and shellfish, and to enable fishermen and other persons with an interest to contribute to such development.

IFMAC is chaired by Marine Scotland and is open to the following organisations:

Regional Inshore Fisheries Groups

Fishing associations that represent a minimum of 10 inshore fishing vessels

National fishing federations

Non-governmental organisations with a national interest in inshore fisheries

Any other organisation, subject to the agreement of the above members.1

Quota allocation

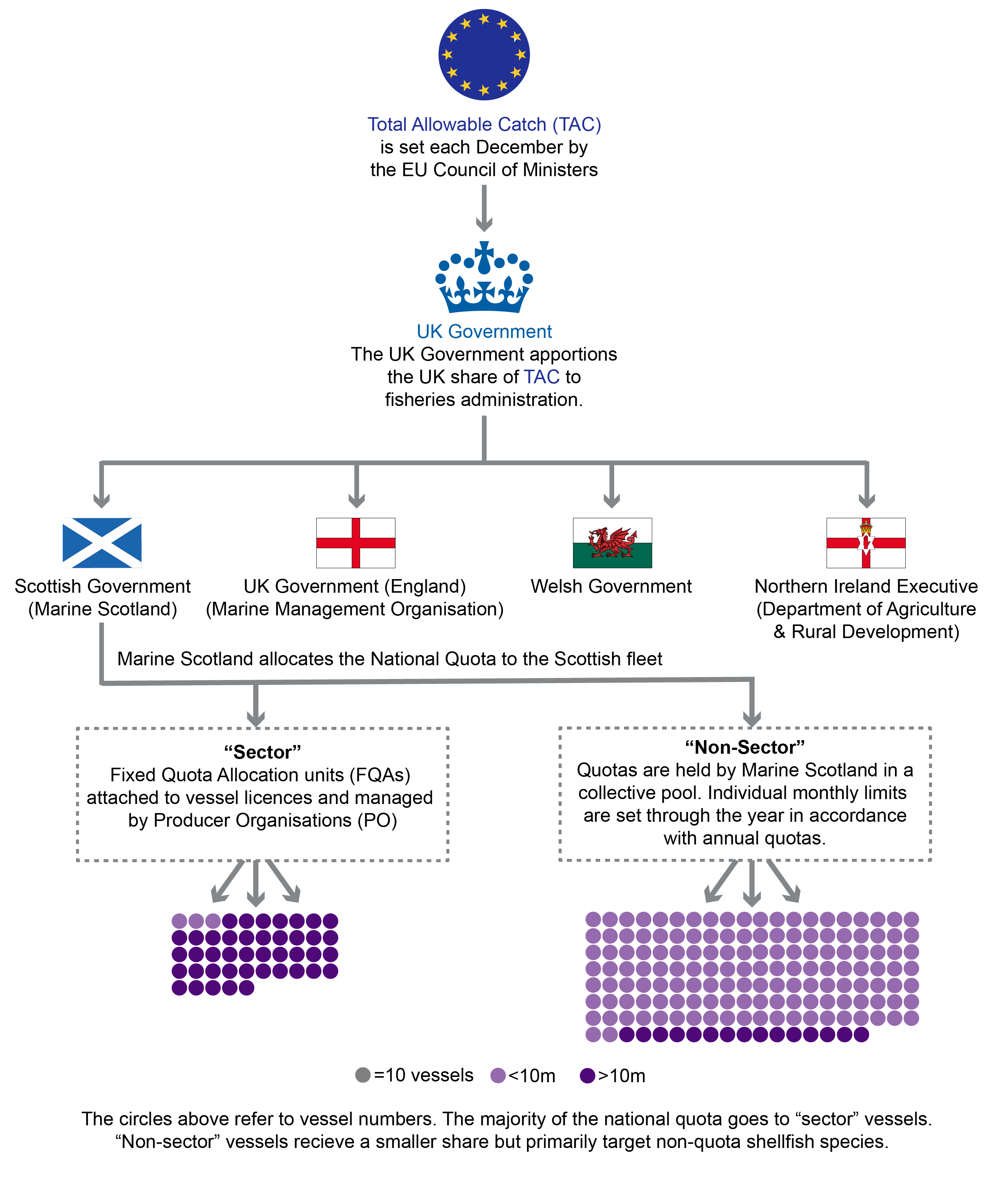

In December each year the EU Council of Ministers sets a "Total Allowable Catch" (TAC) for various fish stocks for the following year based on scientific advice. The UK (as a Member State) is allocated a proportion of TACs. An overview of this process is provided in a SPICe blog. The UK Government is responsible in turn for allocating a proportion of the UK's TACs to the devolved administrations. The amount of fish (in tonnes) that can be caught for each stock is known as "quota".

Quota is allocated to each of the UK's fisheries administrations according to the 2012 Concordat on Fisheries Management in the UK. The Fisheries Concordat is an agreement between the UK Administrations that sets out a number of arrangements for UK fisheries management, including which UK fishing vessels each Administration will license and how UK quotas are allocated to the four UK countries.

There are different processes for allocating domestic quota to the "sector" comprised mainly of large vessels over 10m in length and "non-sector" vessels - mostly small vessels less than 10m in length that make up the inshore fleet. This process is summarised in the diagram below.

Sector Quota: For "sector" vessels, quota is allocated on the basis of Fixed Quota allocation units (FQAs). FQAs were introduced in Scotland and across the UK in 1999, and allocated to vessel licenses based on catches recorded between 1994-1996. This reference period has not been updated since FQAs were introduced.

While most vessels in the sector are over 10m, there are a small number of under 10m vessels that are members of a Producer Organisation (PO) and therefore fall within this method of quota allocation. 1

Non-Sector Quota: For "non-sector" vessels, allocations are split between devolved administrations on the basis of recorded landings by 10m and under fishing vessels of each nationality in the period 2008-2012. 2Most vessels in the "non-sector" quota allocation are under 10m. However, there are a small number of vessels that are over 10m and not a member of a PO. These vessels are not permitted to hold FQA units. Marine Scotland manages the quota "pool" for non-sector vessels in collaboration with relevant industry interests. These quotas are normally provided on the basis of monthly catch limits.34

Fixed Quota Allocation Units (FQAs) Vs Quota - What's the difference?

In short, FQAs determine the proportion of the UK quota that "sector" vessels have the right to catch, whereas quota is the actual amount (tonnage) that can be caught for a particular stock in a calendar year.

The value of an FQA cannot itself be fixed. This is because value is determined by quota, which varies year-to-year depending on the Total Allowable Catch (TAC) agreed during negotiations among EU Member States and between the EU and Independent Coastal States. TACs are set based on scientific advice on the health of stocks.

What is a Producer Organisation?

Producer Organisations (POs) are membership organisations that are made up of fishermen. Each PO has a Board, Chief Executive and supporting officials. There are currently 10 Scottish POs recognised by Marine Scotland. Their role, in EU legislation, is to market the products of their members and to implement measures that promote the concentration of supply and stabilise prices.

The objective is to avoid catching fish for which there is little or no demand, by encouraging better planning of fishing activity. To conserve fish stocks and remain competitive, producers must anticipate market needs in terms of quantity, quality and regularity of supply.

POs are allocated the vast majority of UK quotas by Fisheries Administrations and are responsible for managing these quotas on behalf of their members. Vessels in membership of a PO cannot access quota from the non-sector pool and non-sector vessels cannot access quota held by POs.56

Key issues for inshore fisheries

Quota distribution

There has been criticism in recent years for what some argue as an inequitable distribution of quota among under 10m and over 10m vessels. The claim is that the current system favours large pelagici vessels operating in offshore waters at the expense of smaller, lower-impact inshore vessels.1

Is the current quota distribution fair?

A recent investigation by Unearthed - Greenpeace's investigative journalism unit, found that more than two-thirds of the UK's fishing quota is controlled by just 25 businesses. In Scotland, close to half (45%) of all Scottish fishing quotas were found to be wholly or partly owned by five families. 1

There are concerns that the FQA system enhances quota consolidation (concentration of quota to a small number of vessels). There are two main reasons for this. Firstly, the historical reference period used for distributing FQAs (1994-1996) was a time when under 10m vessels were not required to record landings. This led to landings by smaller vessels being underestimated.2

Unequal distribution may be further enhanced by the internal transfer of FQA units. The current system of FQAs was introduced in 1999. When it was originally introduced, it was agreed that FQAs should be linked to active vessel licenses in order to prevent the development of a market in FQAs. However, this was overcome by buyers and sellers signing a legal agreement committing both parties and their respective POs to transferring quota units bought and sold.

Trading of FQAs is now commonplace within the industry and has led to the current system of FQAs being referred to as a "de facto Individual Transferable Quota (ITQ)i" system.24Since there are no limits on how much quota can be held by individuals and who can hold them, it is possible for quota to become highly concentrated to a small proportion of the national fleet. 2

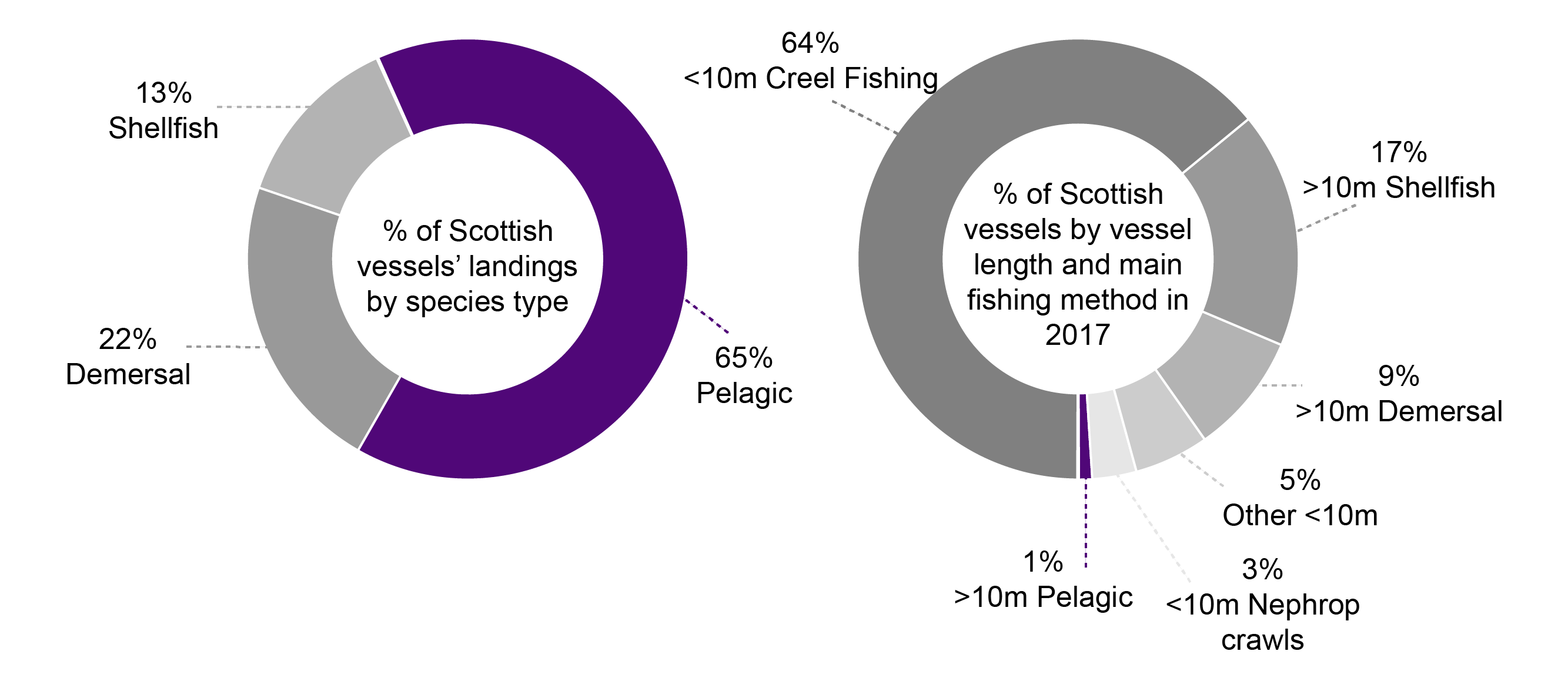

However, there are structural reasons for this consolidation of quota rights that are important to recognise. The majority of the UK (and Scotland's) quota share from TACs are for pelagic stocks, but there are only a small number of large-scale pelagic vessels with the capacity to catch them.

The charts below show that in 2017, pelagic species represented 65% by tonnage of landings by the Scottish fleet. However, in 2017, pelagic vessels over 10m in length represented only 1% of the fleet (20 vessels).

Marine Scotland has informed SPICe that FQA units were created on the basis of 1 unit for every 100kgs of stock landed during the fixed reference period (1994-1996). As the charts above demonstrate, the tonnage that can be caught by the pelagic fleet are much larger than other sectors of the fleet and therefore there are far more FQA units attached to pelagic stocks. Because there are far fewer pelagic vessels, it follows that a consolidation of quota rights exists.6

However, it is unclear to what extent opportunities for inshore vessels to access offshore pelagic and demersal species are restricted by operational limitations. Limitations may include:

Fuel capacity to operate offshore

Vessel harvesting capacity

Ability to operate safely in offshore waters

Having necessary gear

This highlights a potential catch 22 for inshore fishers. Without access to additional quota for pelagic and demersal stocks, it may not be possible for fishers to finance new vessels or gear. But without vessels capable of utilising additional quota, there is no justification for allocating it to the inshore fleet.

Fleet profitability

A 2017 report by the New Economics Foundation suggests that this quota divide is a contributing factor to a sharp divide in UK fleet economic performance with the large-scale fleet recording profit margins of 19% and the small-scale fleet operating at a profit margin of 0%.1

However, the Scottish Fisherman's Federation and Scottish Fishermen's Organisation have argued against reallocation of quota stating that "The competitiveness of the different fleet segments in Scotland is relatively well-balanced." This is based on an independent report it commissioned analysing different sectors of the nephrops industry. The report carried out by Anderson Solutions Ltd found similarity in the Gross Value Added per full-time equivalent post across all fleet segments and in the competitiveness of the larger creel vessels and the trawl fleet segments. 2

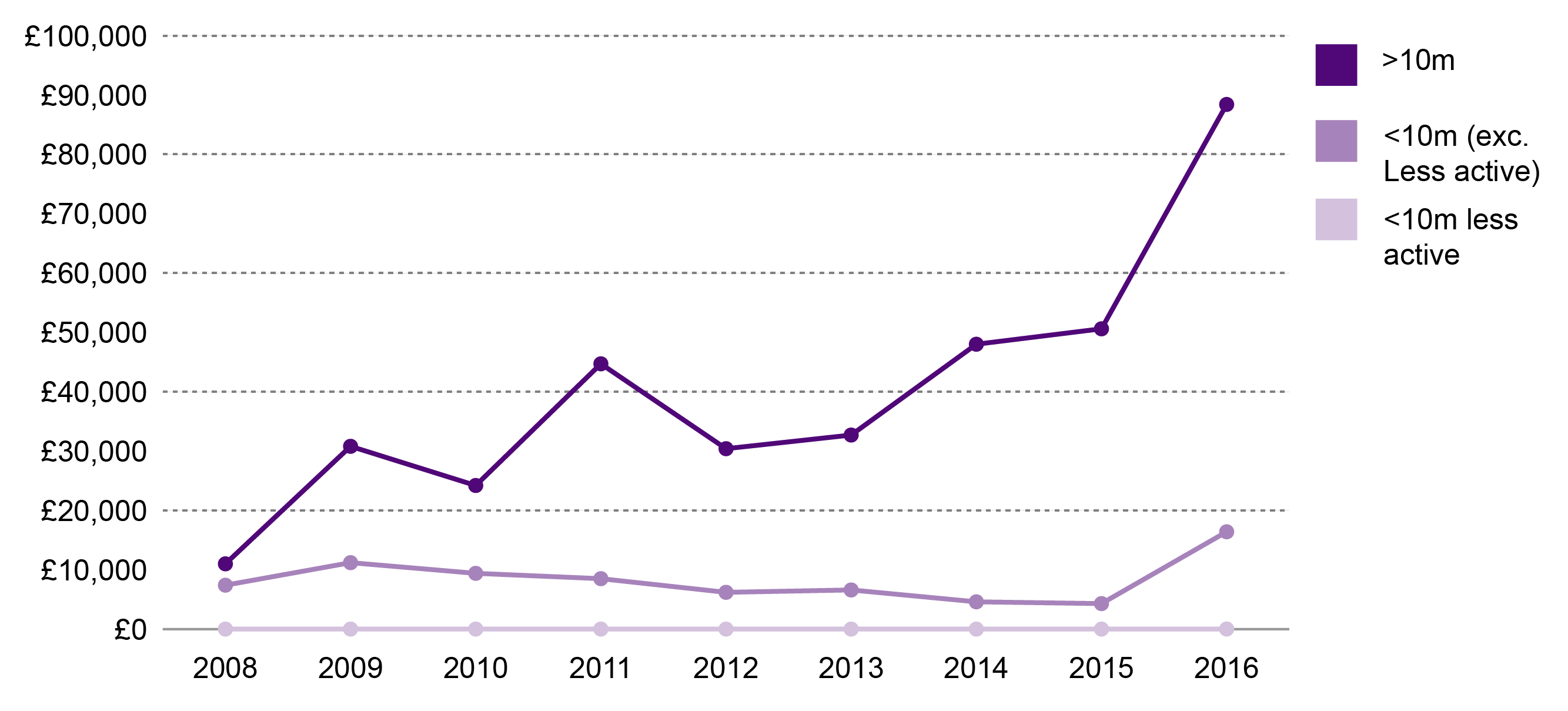

The charts below show net profits for different segments of the Scottish fishing fleet. The data shows a clear difference in net profits between different fleet segments. In 2016, net profits for vessels over 10m in length was estimated at £88,400 compared to £16,400 for vessels under 10m excluding less active vessels (vessels with revenues less than £10,000 per year). Less active vessels under 10m in length recorded a profit of £100.

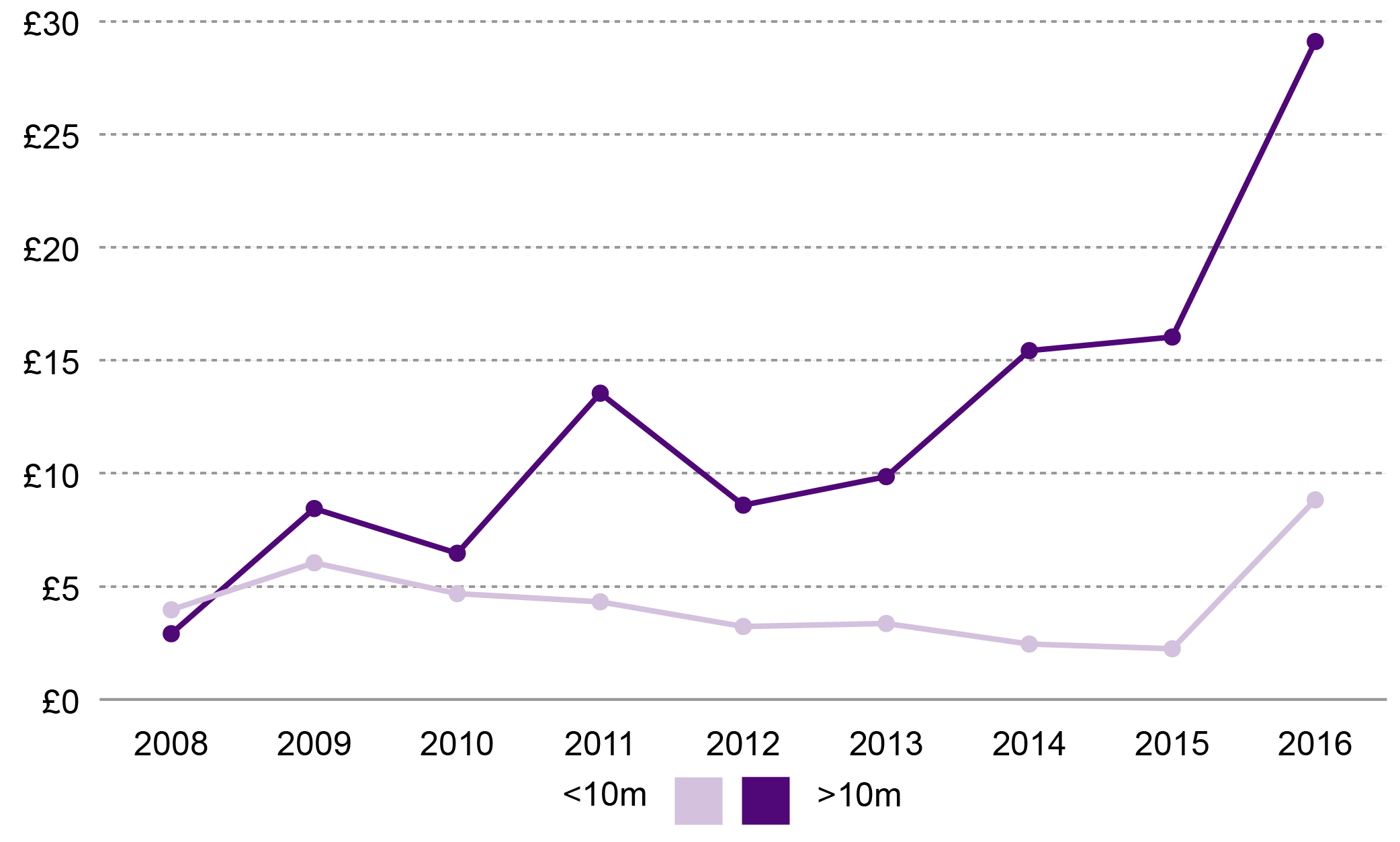

In the chart below, net profits were divided by the number of employees for each year. The data show there has been an increasing divergence in net profits per employee. From 2008 to 2016, net profit per employee increased tenfold from £2.9 to £29 for over 10m vessels. For vessels under 10m there was an overall declining trend between 2009 and 2015. However, from 2008 to 2016, there was an overall increase from £4 to just under £9.

Redistribution of quota

There have been actions by both the UK and Scottish Governments to redistribute quota to its inshore fleets. In 2013, the Department for Food, Environment and Agriculture (Defra) announced plans to reallocate underused quota to the under 10m fleet in England. This led to a legal challenge by the UK Association of Fish Producer Organisations (UKAFPO) which represents larger vessels. It argued that the reallocation was unlawful under both EU and domestic law. The High Court ruled in favour of Defra's decision to reallocate unused quota and the judge ruled that there was no discrimination by Defra.1

Marine Scotland is responsible for allocating Scotland's share of the UK quota to the Scottish fleet and currently has the power to reallocate FQAs within the Scottish fleet. On 26 June 2014, Marine Scotland launched a consultation on the allocation of Scottish quotas. The consultation sought views on whether to change the current system of quota allocation. It provided three options:

Keep the status quo;

Make changes to the current system to achieve more of the Government's policy objectives; or

Move to a new system.

The Scottish Government has stated it intends to publish a detailed policy response to the consultation once a new UK Fisheries Concordat is in place. According to an article in Fishing News, correspondence between the Scottish and UK Government reveals that the Concordat was due to have been published in December 2017. 2

Between 2014-2017, the Scottish Government ran a trial mackerel inshore fishery. This involved an increased allocation to the Scottish non-sector quota pool for both the North Sea and western mackerel fisheries (1,000 tonnes in the North Sea and 321 tonnes in western waters).

The Scottish Government state that the intention of the trial was to

provide more opportunities for inshore fishermen to expand and diversify, to encourage new entrants, to examine the potential for more low impact fisheries and to widen the benefits from quota to local communities around the coast.

A review of the trial found that uptake in additional quota (the proportion of quota caught) increased significantly in the Moray Firth, Orkney and Shetland. However, uptake in the west of Scotland was low (around 5-6%). The review also found that in general, the increased uptake benefited communities through increased numbers of vessels, or through economic benefits. Despite low uptake of additional quota in the west of Scotland, the value of landings in 2016 was over double the value for 2013.

After the review and a consultation which ran from the 1 November 2017 to 13 December 2018, the Scottish Government decided to continue the increased allocation (1,000 tonnes) of North Sea mackerel and reduced the western mackerel allocation to 100 tonnes to the 10m and under fleet. The decision to reduce the western mackerel allocation was due to the low uptake in the extra allocation in this fishery.3

Spatial data from under 10m vessels

Understanding where fishing activity takes place in Scotland's inshore waters is crucial for planning marine activities and development. For example, it is particularly important in relation to the following:

marine renewable development

marine nature conservation management and designations,

aquaculture development

fisheries management and compliance

Spatial data is readily available for larger vessels over 12 m in length that are required by EU law to operate Vessel Monitoring Systems (VMS). Vessels under 12 m in length that mainly operate in inshore waters are not required to carry VMS systems. This is because VMS systems are expensive and many smaller vessels are not equipped to carry and operate them.

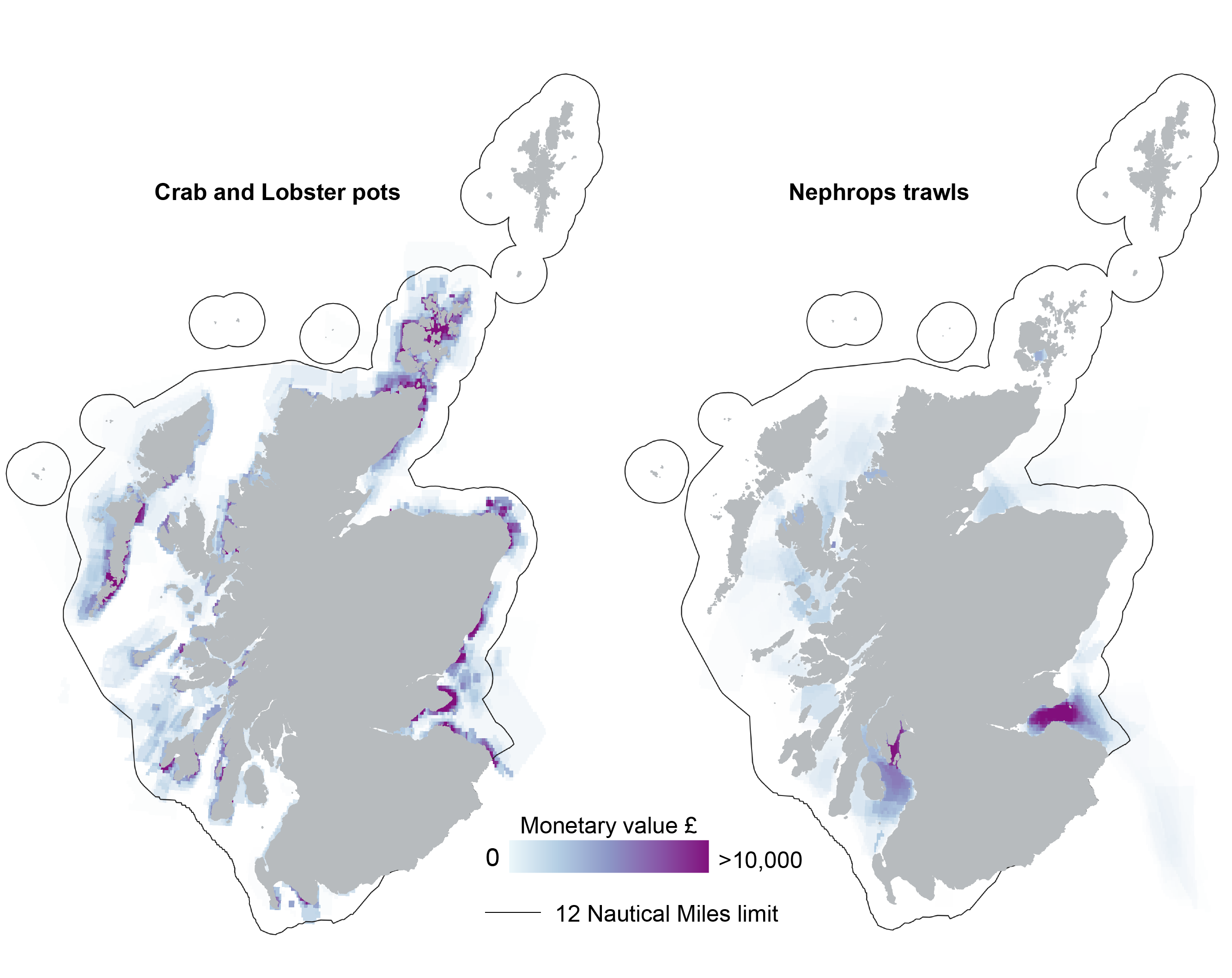

There have been recent efforts to address this data gap. From 2011-12, Marine Scotland carried out a study of inshore fisheries activity "ScotMap", with the aim of providing detailed, spatially resolved information on commercial inshore fishing activity around Scotland. The study interviewed 1,510 vessel owners and operators.

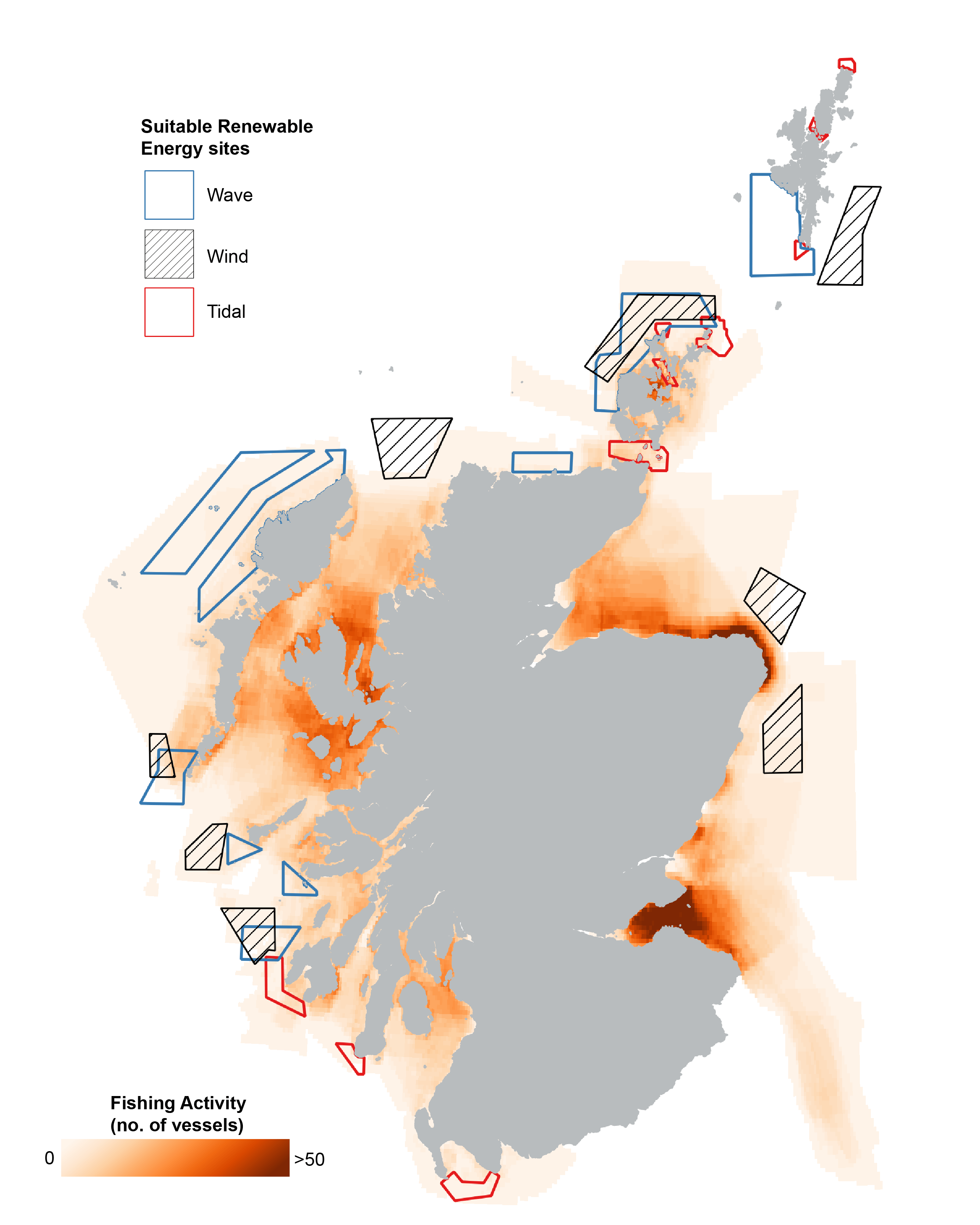

The results allowed detailed maps to be produced, showing inshore fishing activity by different gear and species combinations. An example of this data is shown below. Further maps and analysis can be viewed in the ScotMap publication. Because the data relies on interviews, it does not cover the full extent of activity. For example, there is no data coverage in Shetland.

In July 2016, a new requirement to record the latitude and longitude of fishing activity was introduced on Fish 1 Forms. Owners or masters of vessels under 10m in length are required to complete Fish 1 Forms recording their landings as part of vessel licence conditions. However, there are problems with the quality and accuracy of this spatial data because locations are self-reported and entered manually.

Scottish Inshore Fisheries Integrated Data System (SIFIDS)

The Scottish Inshore Fisheries Integrated Data System (SIFIDS) is a £1.53 million project funded by the European Maritime and Fisheries Fund (EMFF). The project funds research into the development of an integrated system for the collection, collation, analysis and interrogation of data from the Scottish inshore fishing fleet.

A key aim of the project is to develop a low-cost system that can be deployed on inshore vessels. A FISH1 phone app developed by the SIFIDS project, has recently been trialled on inshore vessels. The app can be downloaded and installed on Android mobile phones and uses existing mobile phone GPS technology, allowing users to track the location of vessels. The app also records information on species, gear, landings and allows fishers to record sightings of marine mammals and other species. The SIFIDS project is funded from December 2016 until May 2019.

Competing interests in inshore waters

Gear conflict

The use of both static and mobile fishing techniques in the same waters can sometimes lead to instances of "gear conflict" whereby static fishing gear such as pots and traps can become entangled in mobile trawler nets. This can occur between and within different sectors of the Scottish fleet (i.e. between or within vessels over and under 10m).1

Gear conflict can result from accidental snagging of fixed gear or as a result of deliberate vandalism by fishermen competing for access to the same fishing grounds. Accusations of deliberate vandalism may often go unresolved due to a lack of witnesses or difficulty in proving intent. The problem may have significant financial implications for small-scale fishers. A survey of 300 fishermen conducted by Marine Scotland Science in 2015 reported a total financial cost of £1.2 million as a result of gear conflict.2

After a series of complaints from fishermen to the Scottish Government, Richard Lochead MSP, the then Cabinet Secretary for Rural Affairs, Food and the Environment established a Gear Conflict Task Force in November 2013. The Task Force was asked to:

consider the range of issues contributing to gear conflict, both accidental and deliberate;

examine how processes and procedures might be improved both to prevent gear conflict and to deal more effectively where instances of conflict arise; and

make recommendations on possible solutions for the Scottish Government and its Industry Partners to consider.3

The Gear Conflict Task Force published a report which recommended a public consultation on measures to improve the reporting and resolution of gear conflict. A consultation on measures to tackle gear conflict in Scottish inshore waters was launched on 14 November 2014 and ran for 12 weeks, closing on 6 February 2015.

The outcome of the consultation was a report Promoting Best Practice for Inshore Fisheries: a consultation on measures to tackle gear conflict in Scottish inshore waters which was published in December 2015. It recommended a suite of measures aimed at enhancing both reporting and recording in order to prevent incidents occurring, and to improve deterrence against deliberate acts of gear vandalism and theft.

A further consultation on the marking of static gear was held from November 2016 to February 2017. After the consultation, Marine Scotland issued guidelines for marking static gear in inshore waters and will introduce new regulations in spring 2019 which will ban the use of equipment not manufactured for the purpose of marking fishing gear.4

Marine conservation

The Marine and Coastal Access Act 2009 and the Marine (Scotland) Act 2010 provided powers to designate Marine Protected Areas in order to protect marine habitats and species in line with Article 21 of the EU Marine Strategy Framework Directive. The Scottish MPA Network now consists of 231 sites covering approximately 22% of Scotland's sea area. The map below shows the extent of Scotland's MPA network in 2018.

In addition to the designation of MPAs, the Marine (Scotland) Act 2010 provided powers for Scottish Ministers to introduce marine conservation orders to restrict certain activities within designated MPAs. These powers were used to introduce management measures restricting certain fishing gears in either the whole or specific zones of MPAs. Typically this involves restricting the use of mobile fishing gear such as bottom trawling or scallop dredging that can have a detrimental impact on the seabed.

Public Authorities have been required to take account of the MPAs in their decision making since August 2014, together with subsequent fisheries measures introduced in February and March 2016.1 These measures are summarised in Annex 1 of the Scottish Government's Scottish Marine Protected Areas Socioeconomic Monitoring 2016 Report.

Proposals for management measures restricting fishing activity in some areas were met by opposition within some sectors of the Scottish fishing fleet, particularly those operating mobile gear such as scallop dredgers and trawlers.

In March 2017, the Scottish Government published its first assessment of evidence on the socio-economic impacts of Scotland's MPA network. The assessment analysed fishing activity data and interviews from key informant's to establish what impact the designation of MPAs and associated management measures were having on coastal communities. The assessment presented the following key findings:

There is a high-level of compliance with MPAs with very few suspected cases of deliberate incursion into MPAs or breaches of management measures;

Fishing activity data analysis found no notable changes in the number of fishing voyages and effort days following the introduction of management measures;

Mobile dredge activity had decreased in the majority of areas containing MPA management measures.;

Interviews suggested that three fishing vessels may have left the industry because of MPA management measures. Further inquiry found supporting evidence for only one of these vessels. The vessel was a pot and trap vessel targeting Nephrops in grounds situated in the East Mingulay SAC.2

Although these findings suggest that there has been no significant socio-economic impacts attributed to the introduction of MPA management measures, the report acknowledges that it could be too early to assess their full impact as different sectors adjust to measures.

The report recommended a further review of the socio-economic impacts of MPA management measures to be undertaken in 2018. The Scottish MPA network - Parliamentary Report published in December 2018 states that a further analysis of the socio-economic impacts will be undertaken in 2019.

Aquaculture

The Scottish aquaculture industry has developed in west coast sea lochs and inshore waters since the late 1970s. Scotland is the largest producer of farmed Atlantic Salmon in the EU and one of the top three producers globally, producing 162,817 tonnes (£765 million) in 2016.1

However, expansion of the industry has led to impacts on the wider marine environment. Some of these impacts have implications for marine ecosystems and species targeted by the inshore fishing fleet.

On 25 January 2018, the Scottish Parliament's Environment, Climate Change and Land Reform (ECCLR) Committee launched and inquiry into the environmental impacts of salmon farming. This complemented a wider inquiry on Salmon Farming in Scotland carried out by the Rural Economy and Connectivity Committee. The ECCLR Committee commissioned a report undertaken by SAMS Research Service Ltd. Of the environmental impacts identified in the report, the following have implications for inshore fisheries.

Diseases: Diseases of farmed fish might spread to other animals;

Organic waste: Salmon farm organic waste accumulating on the seabed can significantly degrade communities of benthic (seabed dwelling) animals beneath or near farms;

Eutrophication: Significant enrichment of lochs and regional seas by salmon farm nutrients could lead to enhanced growth of phytoplankton, and undesirable disturbance to the balance of organisms and to water quality;

Medicines and chemicals: Synthetic chemicals (including antibiotics) used to treat lice infestation or salmon diseases, to prevent fouling of farm structure, or as dietary supplements, might be harming other organisms and, perhaps, ecosystems;

Wrasse/lumpsucker fishery: The harvesting of wrasse and lumpsucker for use as lice cleaners, could harm the wild populations of these fish.

With regards to the last point, the salmon farming sector has acknowledged the need to protect wild wrasse populations and is working with the sea fishing industry by introducing voluntary control measures for the live capture of wild wrasse.2

Written evidence submitted to the Rural Economy and Connectivity Committee by stakeholders from the fishing industry explained how aquaculture sites had displaced some vessels from important fishing grounds.

The Scottish White Fish Producers Association Ltd and Mallaig & North-West Fishermen's Association stated:

The locations the salmon farms use, protected in inlets, are often rich fishing grounds or safety areas for fishermen in bad weather. When farms are put in these areas, fishermen are forced to work outside these protected areas, losing important fishing grounds and creating dangerous situations.

The North Minch Shellfish Association echoed these views:

regarding the loss of highly productive fishing grounds to fish farms and that threat is growing as the industry seeks to expand its production by huge amounts... Apart from taking over productive fishing grounds they also take over sheltered waters potentially forcing smaller boats to fish in less safe waters.

Planning permission for aquaculture sites are issued by local authorities. Once a planning application has been submitted, applications are available for public comment and subject to consultation with statutory consultees. This process also includes an environmental impact assessment.3

Marine renewable energy

As demand for renewable energy increases, competition for space for marine resources is also increasing. The Scottish Government has set a target for generating 100% of Scottish demand for electricity from renewable energy sources by 2020.1 Scotland also has an estimated 25% of Europe's offshore wind resources, 25% of Europe's tidal resource and 10% of its wave potential.2

A 2011 Scottish Government report3 identified the following potential impacts of offshore wind development to commercial fisheries:

Disturbance of mobile species and disruption or damage to habitats, nursery and spawning grounds, direct damage to sessile species (organisms attached to a substrate e.g. mussels), leading to displacement of or reduction in fish and shellfish resources;

Reduction in or loss of access to traditional fishing grounds;

Displacement of activity to existing (less profitable) fishing grounds;

Consequent increase in fishing pressure and competition on alternative available grounds;

Obstruction of navigation routes to and from fishing grounds leading to increased travel times;

Snagging of fishing gear on cables and seabed infrastructure;

Safety issues for fishing vessels in transiting wind farm arrays or in diverting around them; and

Potential reduced Catch Per Unit Efforti and consequential loss of profit.

In 2002, the Fishing Liaison with Offshore Wind and Wet Renewables Group (FLOWW) was set up to foster good relations between the fishing and offshore renewable energy sectors and encourage co-existence of the industries. Its website states that FLOWW’s objectives are to "discuss effectively on issues arising from the interaction of the fishing industry and offshore renewables activity, share and develop best practice, and liaise with other sectors with interests in the marine environment."

Engagement between the Offshore Wind Energy and fisheries sectors was further enhanced after Marine Scotland set up the first ‘Bringing the Offshore Wind & Fisheries sector Together’ meeting in Dundee on 31 May 2018. The aim of this meeting was to aid regular dialogue between the fishing and offshore wind industries and raise awareness of ongoing work and issues. These meetings will continue on a biannual basis.

The figure below shows areas identified as being suitable for marine renewable energy development and fishing activity in inshore waters from ScotMap interview data. The data for ScotMap was collected during face-to-face interviews with individual fishing vessel owners and operators and relates to fishing activity for the period 2007 to 2011.

Research has also suggested that offshore wind farms could have positive impacts for marine ecosystems that could benefit fisheries. For example, a study published in 2013 found that the hard surfaces of wind turbine foundations create artificial reefs providing food for marine organisms and boosting fish populations.5

Implications of Brexit for inshore fisheries

When the UK leaves the European Union, it will become an independent coastal state, meaning that it will have full control over fisheries governance and access to waters in its Exclusive Economic Zone. After Brexit, management of shared fish stocks will be negotiated by the UK with the EU and other independent Coastal States such as Norway, Iceland and the Faroe Islands.

The Scottish Fisherman's Federation (SFF) have referred to Brexit as a "sea of opportunities" with the potential to deliver a greater share of fishing opportunities for the Scottish fleet. However, the potential benefits of a greater share of fishing opportunities are less likely to be beneficial to the inshore fleet because smaller vessels mostly target non-quota species not covered by the Common Fisheries Policy.

This issue is highlighted in a report published by the New Economics Foundation in November 2017. The report found that the economic performance of the inshore fleet does not benefit from increased quota and access due to the current distribution of quota among the inshore and offshore fleets:

As the gains from quota increases accrue to those who hold the quota rights, these gains further entrench the ‘haves and have nots’ of UK fisheries. Small-scale vessels also see little benefit from exclusive access out to 200 nautical miles, as they fish exclusively in inshore waters.1

A greater concern for the inshore fleet is the impact of Brexit on future trade and customs arrangements with the EU. This can be boiled down to two key issues - the impact of trade tariffs on profits (tariff barriers) and getting seafood to EU markets quickly (non-tariff barriers) . These concerns were expressed by a representative of the Scottish Creel Fisherman's Association in an article by Politico:

Hard borders would be a disaster for us. Most of our prawns are sent right away to Europe in lorries filled with salt water tanks so they stay alive. That's why we get more money for our product and even a short delay means fishermen don't get paid...Any tariffs would hurt our margins and profitability. It would also dismantle 20 years of perfecting the current system - overnight.2

As an EU Member State, UK exports of seafood to the EU are tariff-free. After Brexit, tariffs on seafood will depend upon the future trade agreement between the UK and the EU. In the event of a 'no deal' Brexit, trade in fisheries products would revert to World Trade Organisation (WTO) tariffs.

In written evidence submitted to the House of Lords Select Committee on Europe in 2016, Defra stated that the EU's Most Favoured Nation (MFN) tariffs on fisheries products range from 0% to 25%, with higher tariffs generally applied to highly processed products. The evidence listed the EU's MFN tariffs for the UK's five product lines with the largest exports to the EU. Three of these product lines are species targeted by inshore vessels:

8% tariff: Live, fresh or chilled scallops, exports worth £62m in 2014;

12% tariff: Frozen unsmoked Norway Lobsters (Nephrops), exports worth £56m in 2014;

12% tariff: Not frozen and unsmoked Norway Lobsters (Nephrops), exports worth £45m in 2014.

On 12 October 2018, the UK Government published a technical notice - Commercial fishing if there's no Brexit deal. The notice outlines potential non-tariff barriers in the event of a no-deal Brexit. This includes extra administration requirements for exporting fisheries products to the EU such as:

A catch certificate for each consignment of fish or fisheries products exported;

A Multiple Vessel Schedule for consignments sourced from more than one UK vessel (as currently required by third countries exporting to the EU).

The future tariff regime for fisheries products will emerge from negotiations on the future trading relationship between the UK and EU. The UK Government Fisheries White Paper states that agreements on access to markets for fisheries products will be separate to the question of fishing opportunities and access for EU vessels to the UK's waters. However, this contrasts with the European Commission's negotiating guidelines which state:

Trade in goods, with the aim of covering all sectors, which should be subject to zero tariffs and no quantitative restrictions with appropriate accompanying rules of origin. In this context, existing reciprocal access to fishing waters and resources should be maintained.

More detailed analysis of the implications of Brexit negotiations for fishing opportunities and trade in fisheries products is provided in SPICe briefing Will fishing be discarded in the Brexit negotiations?

Details on provisions for fisheries under the EU Withdrawal agreeement can be found in a SPICe briefing - The UK's Departure From The European Union - An Overview Of The Withdrawal Agreement.

Implications of a no deal Brexit for fisheries are summarised in a SPICe Spotlight Blog. A further SPICe Spotlight Blog also summarises key aspects of the UK Government's technical notice on commercial fishing if there's no Brexit deal.