Buying a home - Scottish Government support

This briefing paper provides an overview of Scottish Government schemes intended to assist people to buy their own home. The paper provides some context to home ownership in Scotland, gives details of current schemes, including statistics, and provides comments on these schemes.

Executive Summary

The context of home ownership in Scotland

Home ownership is the most common tenure in Scotland, although home ownership rates have fallen slightly in recent years. In the mid-2000s, around 66% of households owned their own homes compared to around 62% in 2017.

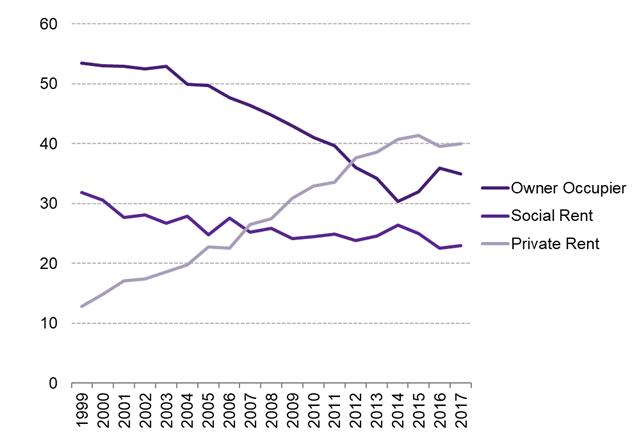

The fall in home ownership rates is particularly marked for younger households. Around half (53%) of young adult householders (aged 16-34) were owner occupiers in 1999, compared to just over a third (35%) in 2017.

Barriers to home ownership

Although many non-homeowners would like to buy their own property, they can face difficulties in doing so. Barriers to accessing the owner occupier market include: mortgage lenders' requirements for substantial deposits; incomes not keeping up with house price inflation and job insecurity.

The average deposit for first time buyers is around £19k. Research has estimated that over a fifth of buyers get help from the 'bank of mum and dad' to buy a house. This situation has been described as one which is neither desirable nor sustainable, and one that increases inequality.

Impact of housing market changes on tenure

The change in tenure patterns may be partly linked to substantial rises in house prices from the early 2000s, which impacted on affordability. Following the global financial crisis, the availability of high loan to value mortgage products reduced and many first time buyers found it difficult to meet the deposit requirements.

House prices are now back to just above their pre-crisis peak levels, with the average price of a house across Scotland around £176k. However, affordability, in terms of mortgage cost to income ratios, has improved. The number of first time buyers has also increased in recent years. In 2017, there were around 35,400 loans to first time buyers in Scotland, the highest level in a decade.

Levels of private sector house building and house sales also declined dramatically following the global financial crisis. Although housebuilding activity and sales have increased in recent years, they are still well below pre-financial crisis levels.

Government support for buying a home

Government support for people buying a home has been a long standing feature of housing policy in Scotland. Support for home ownership has taken many forms, determined by different policy objectives.

Current Scottish Government support for buying a home

The main way that the Scottish Government currently supports people to buy a home is through shared equity schemes. Under these schemes, the government provides purchasers with an equity stake, which reduces the deposit they need to find. Purchasers pay the government back its equity contribution at some point in the future.

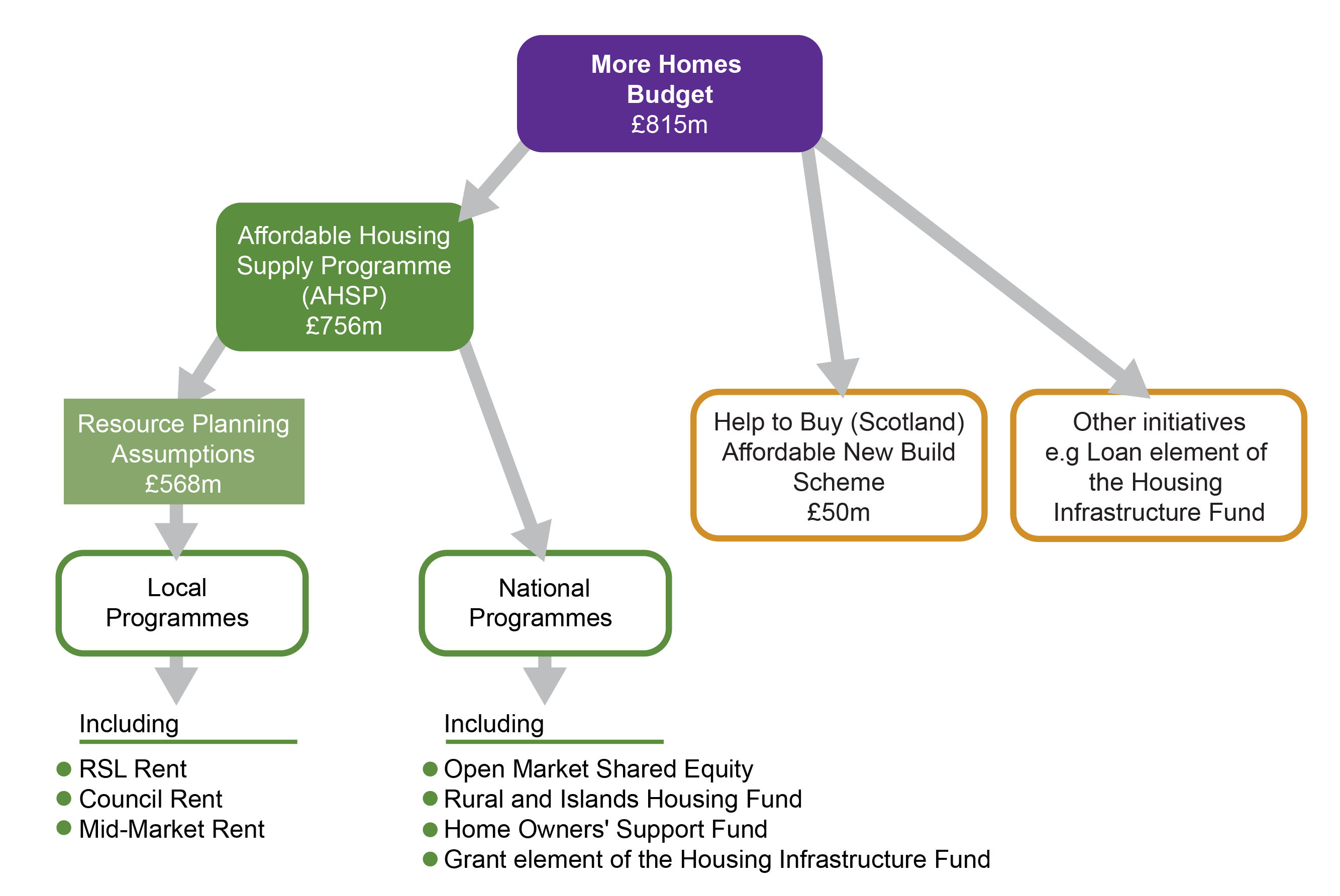

In 2018/19, at least £120m of support will be available through the Low Cost Initiative for First-Time Buyers (LIFT) and through the Help to Buy scheme. This represents around 15% of the Scottish Government's More Homes budget for 2018/19.

LIFT schemes

Two shared equity schemes are part of LIFT, which is part of the Scottish Government's Affordable Housing Supply Programme. These schemes are targeted at first-time buyers and priority groups, which include those living in social rented housing and disabled people. The main schemes are:

Open Market Shared Equity Scheme (OMSE). This provides a shared equity contribution to help buyers purchase a house, up to certain price thresholds, on the open market. Up to £70m is available in 2018/19.

New Supply Shared Equity Scheme (NSSE). This is similar to the OMSE scheme, however, properties are new builds constructed by Registered Social Landlords rather than properties which are sold on the open market.

Sales under these schemes count towards the Scottish Government's target to deliver at least 50,000 affordable homes in this parliamentary session (1 April 2016- 31 Mar 2021). Over the first two years of this parliamentary session, 4,001 affordable home ownership units were completed, accounting for around 25% of all affordable housing completions. Both schemes are funded through Financial Transactions Capital funding provided by the UK Treasury.

Help to Buy

The Help to Buy scheme, first launched in September 2013, provides a shared equity contribution for households to purchase a new build property from a participating developer. In 2016, the Help to Buy (Scotland) Affordable New Build Scheme & Small Developers Scheme replaced the previous version of Help to Buy. The new scheme focused on more affordable properties. The maximum value of property that can be purchased has been reduced in a series of stages from £400k to £200k.

Over 12,800 sales, using around £436m of Scottish Government equity funding, have taken place under both versions of Help to Buy (from 30 Sept 2013 to 31 Mar 2018). Over the next three years (2018/19 to 2020/21) a further £150m worth of funding will be available.

The Help to Buy scheme makes an important contribution to total new build sales in Scotland. In 2017/18, it is estimated that sales through Help to Buy in Scotland accounted for at least 30% of new build sales under £250k, down from just over half of new build sales in 2014/15.

Comment on home ownership schemes

Some of the questions raised about government schemes to support for home ownership include, for example,

whether government investment in such schemes inflates the price of new build properties,

whether such schemes provide additional homes, or just enable people to buy a property earlier than they would otherwise have done.

Much of the debate on home ownership schemes in the media appears to relate to the situation in England where the UK Government has placed more emphasis than the Scottish Government on supporting home ownership. The Help to Buy schemes in England and Wales also differ from the Scottish scheme, a key difference being that there is a lower maximum purchase price in Scotland.

Homes for Scotland (a body representing housebuilders) is supportive of the Scottish Help to Buy scheme, highlighting the scheme's role in stimulating the house construction industry and the economic benefits that this brings. On the other hand, some have questioned whether the Scottish Government has dedicated sufficient resources to increasing home ownership.

There has been relatively little comment made about the LIFT schemes. There is also relatively little recent Scottish research evidence about the impact of either the LIFT schemes or the Help to Buy scheme.

Home ownership in Scotland - background

At the start of the 1980s, less than 40% of households in Scotland owned their own homes.1 Home ownership rates in Scotland increased steadily from then, partly driven by the right to buy, to reach a high of 66% by the mid-2000s. Since then, home ownership rates have declined slightly, with around 62% of households living in owner occupied housing in 2017.2

While home ownership rates have fallen slightly in recent years, private renting has increased. In 1999, around 5% of households lived in private rented housing compared to 15% in 2017. 2

Younger households are now more likely to live in private rented housing than in owner occupied housing. The proportion of young adult householders (age 16-34) who are owner occupiers was 53% in 1999 but then fell to 30% in 2014, rising to reach 35% by 2017. 2

Despite the slight fall in owner occupation, many people would still like to own their own home. 27 For example, the 2017 Scottish Household Survey reported that 74% of households in private rented accommodation, and 44% of households in social rented accommodation, would most like to live in an owner-occupier property.2

There still appears to be a strong preference for home ownership. However, some reports suggest that the importance of home ownership is beginning to change, particularly for younger households. For example, Yorkshire Building Society recently published results of a survey of young adults who have never owned a property. One of the conclusions from the research was that:

... young adults in the UK who have never owned a property continue to place importance on achieving this milestone. They continue to prefer owner occupancy among all other tenures, though the popularity of living with family and friends has risen significantly since 2016. As well as being a good financial investment, owning a property is associated with feeling settled and “grown up”. However, the proportion of respondents saying that owning a property is essential to feeling like they had succeeded in life had decreased since 2016, suggesting that the importance placed on home ownership might be beginning to change

Palframan, M., De, P., & Fernandes, A. (2018, May). First -time Buyers 2018. Retrieved from https://www.ybs.co.uk/assets/files/first-time-buyers-report.pdf [accessed 18 July 2017]

Supply of new private housebuilding and house sales

The global financial crisis had a dramatic impact on both the supply of new private sector housebuilding and the volume of house sales in Scotland.

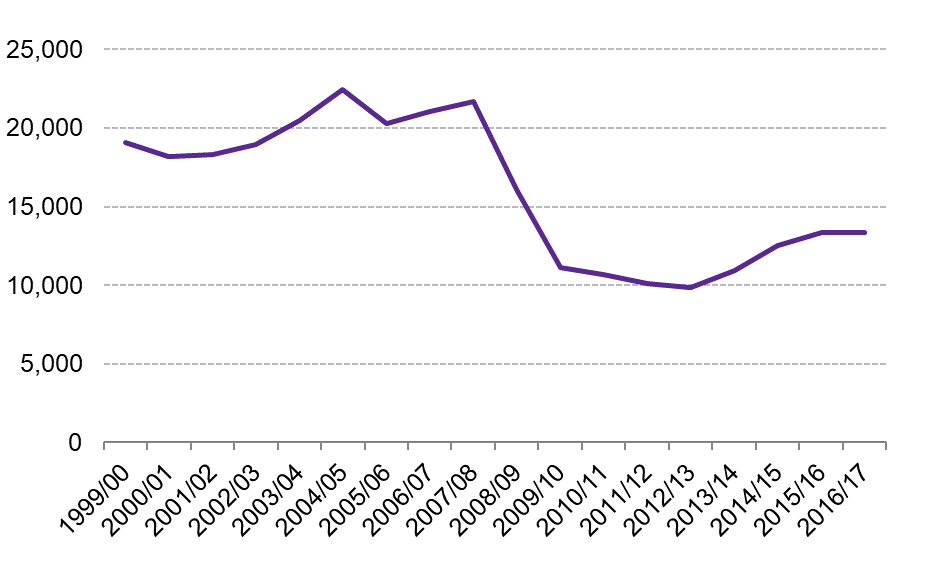

Since 1999/00, the highest number of private sector new build completions, at around 22,400, was achieved in 2004/05. However, by 2012/13, this figure had more than halved to just under 9,900. Private sector housebuilding activity has increased in the last couple of years, with new build completions now averaging around 13,300 per year, although this is still around 40% lower than in 2004/05.10

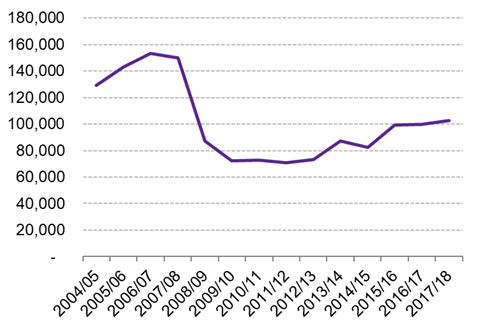

Residential sales also dropped dramatically after the financial crisis. From a high of around 150,000 2006/07, sales dropped to around 70,500 in 2011/12. Sales have increased since then. In 2017/18, there were nearly 104,000 residential sales, the highest level in ten years, although this is still around 31% lower than in 2006/7.12

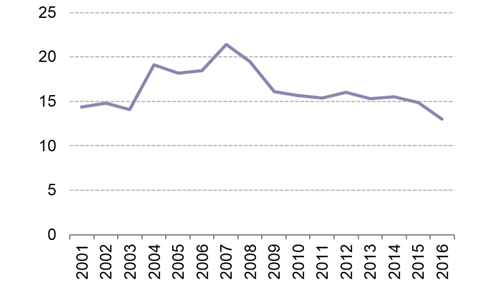

A trend, also reported by Registers of Scotland, is the rise in the proportion of sales that are paid for with cash rather than with a mortgage. In 2017/18, cash sales accounted for 32% cent of the residential sales in Scotland. This compares to 15.5% in 2007/08.12

Impact of the global financial crisis on home ownership

One of the reasons for changing tenure patterns is likely to be connected to the global financial crisis.

Prior to the financial crisis, rapidly rising house prices resulted in home ownership becoming unaffordable for some households.

Following the financial crisis, with the fall in interest rates and a fall in house prices, home ownership for first time buyers, based on mortgage cost-to-income ratios, became more affordable.

However, some people found it more difficult to obtain a mortgage. First time buyers have tended to buy at high loan to value ratios, but these type of mortgages became restricted as lenders tightened their lending criteria. For example, the BBC reported in January 2009 that there were just 21 mortgage products available with a deposit of 5% or less, compared to the previous year when there were more than 1,200 such products on offer. Many potential home owners found the high deposit requirements problematic.2

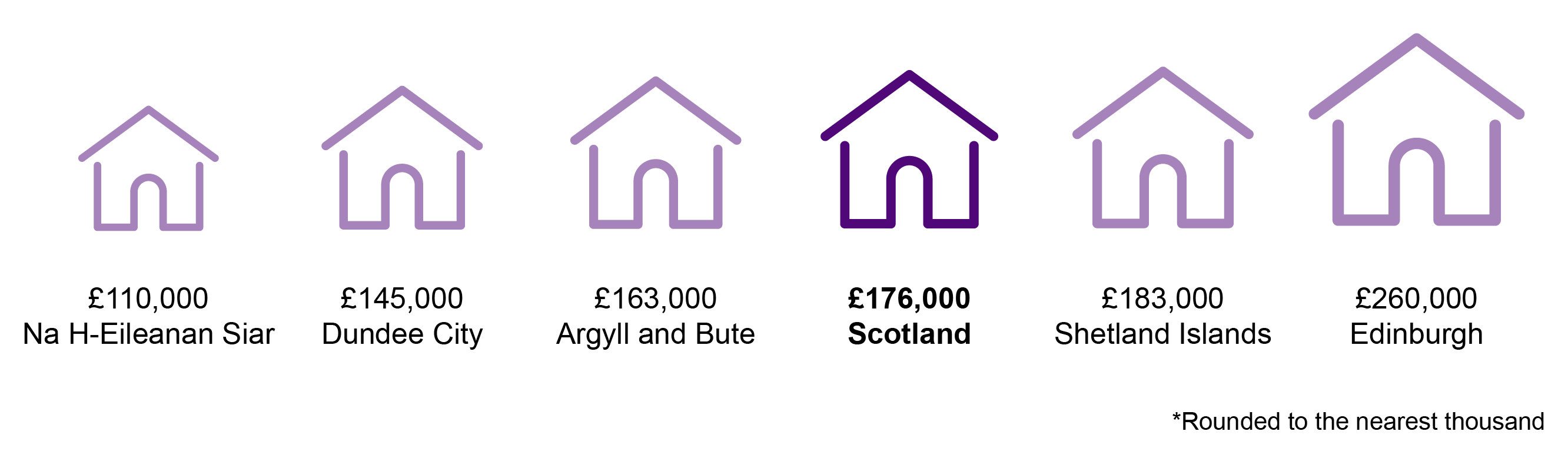

House prices are now slightly above their pre-crisis peak.3In May 2018, the average house price in Scotland was around £176k, ranging from a low of £110k in Na H-Eileanan Siar to a high of £260k in Edinburgh.

Although house prices are above their pre-crisis levels, sustained low interest rates, a widening of available mortgage products and schemes such as Help to Buy have helped to increase the number of first time buyers in Scotland in recent years.

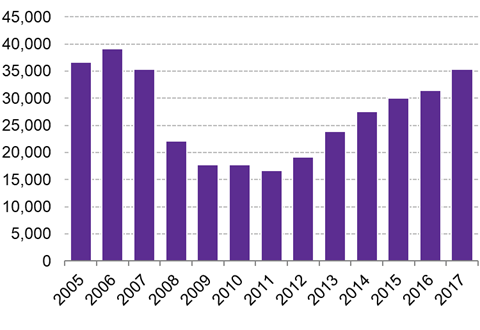

In 2017, there were around 35,400 loans for first time buyers in Scotland, almost double the number in 2011, although still below the 2006 peak levels of 39,100.

More recent data for Q1 and Q2 2018, shows that there has been a drop in first time buyer loans. In Q1 2018, there were 9% fewer loans for first-time buyers compared to a year earlier, while in Q2 there were 3% fewer loans.7 8 Whether this trend will continue remains to be seen.

The importance of first time buyers in the housing market

It has been argued that first time buyers (FTBs) are crucial to maintaining a healthy housing market. For example, a report prepared for UK Finance, comparing UK and Irish housing markets from a first time buyer perspective, argues that:

FTBs are an important part of the housing market, and vital for the wider health of the market in the UK and Ireland. They provide liquidity, allow people to trade up, and create housing chains. FTBs may come from the parental home, social housing or private rented accommodation. This often determines if they are forming a new household. Those leaving the parental home are forming new independent households but those coming from social housing or private rented accommodation are not unless they lived in shared accommodation.

Existing homeowners in most cases need to sell their property to be able to move, so the rate at which FTBs enter the market has implications for the smooth running of the housing market as a whole. ....A lack of FTBs coming into the market can cause issues in the short run which accumulate and show through longer term. These have implications for the overall health of the market and can impact transactions and labour mobility.

UK and Irish housing markets: a first-time buyer perspective. (2017, September). Retrieved from https://www.ukfinance.org.uk/wp-content/uploads/2017/09/UK-and-Irish-housing-markets-Final.pdf [accessed 23 July 2018]

Barriers to home ownership

A range of reasons exist that make it difficult for some people to buy a home. For example, a recent survey of potential first time buyers, commissioned by Yorkshire Building Society, revealed that not being able to afford a deposit was the most commonly reported barrier to buying a home. Other barriers cited included the rising cost of living, properties in the area being too expensive and job insecurity.1

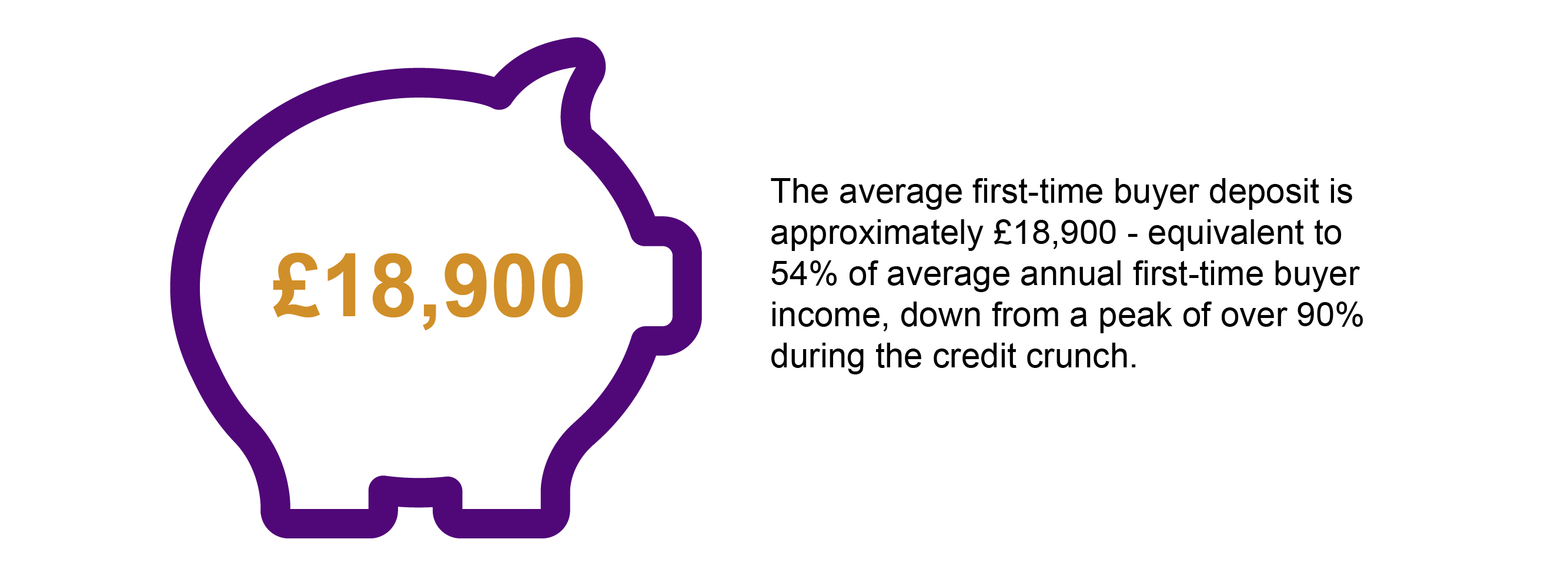

According to UK Finance, the average first time buyer deposit is just under £19k. 2

Many buyers now expect to rely on the 'bank of mum and dad' to help purchase their first home. 1 5 Legal and General, for example, estimate that, in 2018, just over a quarter of buyers across the UK will receive some help from family or friends to buy their own home - making financial assistance from family and friends equivalent to a £5.7bn mortgage lender.6 Similarly, Bank of Scotland research suggests that more than one in five (22%) Scots anticipate financial support from family members to help them buy their own home.1

Some commentators have raised concerns about this increased reliance on the 'bank of mum and dad.' Legal and General's report argues that this situation is neither sustainable nor desirable. Their research suggests that households are "feeling the pinch" and that parents are providing lower levels of financial assistance compared to the previous year. Another finding suggested that around 10% of parents who provided such assistance said that their contribution had left them feeling less secure about their own financial future. 6

The UK's Social Mobility Commission has argued that the reliance on the 'bank of mum and dad' is exacerbating inequality and impeding social mobility. As a 2017 report stated:

...aspiring FTBs for whom family help is unavailable will most likely remain disadvantaged, even more so if their parents fall into the least educationally qualified category. Going forward, the gap will almost certainly be maintained between those in the UK who can acquire that most significant of financial assets, the family home, and those who cannot.

Udagawa, C., & Sanderson, D.P. (2017, March). The impacts of family support on access to homeownership for young people in the UK. Retrieved from https://www.cchpr.landecon.cam.ac.uk/Projects/Start-Year/2016/Research-impact-family-support-access-homeownership-young-people-UK/family_support/DownloadTemplate [accessed 16 July 2018]

Government initiatives to support home ownership - background

Government support to help people buy a home has been a long standing feature of housing policy.

The introduction of Right to Buy in 1981 was a major factor in increasing home ownership rates in Scotland throughout the 1980s.

Prior to devolution, other government schemes to promote home ownership focused on the regeneration of areas and the creation of mixed tenure communities in areas that were dominated by social housing. For example, 'shared ownership', where a buyer shares ownership of a property with a housing association, and pays an occupancy charge on the share owned by the housing association, was first introduced in Scotland in 1983. Gro-grants for owner occupation were introduced in 1990. These were grants to private developers to build properties to stimulate the private housing market, create mixed communities, or to address local shortages in supply.1

Scottish Executive 1999-2007

Following devolution, shared ownership and gro-grants continued to be available (as did rural home ownership grants).

In 2005, the then Scottish Executive published its policy paper Homes for Scotland's People: a Scottish Housing Policy Statement. This built on its 2004 review of affordable housing. It noted that many first-time buyers were having to increase their deposits and that more people who would traditionally have been first time buyers now found themselves priced out of particular local markets. 2

To, “respond to the aspirations of many to own their own homes," the policy paper set out plans for an expanded programme for low-cost home ownership. Its purpose was to enable first-time buyers, and others on modest incomes, to enter the property market through buying a majority stake (i.e. a share of the equity) in a home which would otherwise be unaffordable for them.

In September 2005, the Scottish Executive launched its shared equity 'Homestake' schemes; one addressing new supply properties and the other supporting purchases in the open market in certain areas. This was essentially the New Supply Shared equity scheme and the Open Market Shared equity scheme which are still in existence today.

Reform of the Right to Buy was also a feature of Scottish Executive housing policy. The Housing (Scotland) Act 2001 introduced the modernised Right to Buy. This extended the right to buy to housing association tenants (albeit suspended until 2021). It also introduced changes to limit the number of sales, including a longer waiting period for tenants to buy their property, and less generous discounts.

Scottish Government 2007- current

In October 2007, the new SNP administration rebranded support for home owners under the Low-Cost Initiative for First-time buyers (LIFT) banner and extended the Open Market Shared Equity scheme across the country. Other initiatives supported by the Scottish Government included Rural Home Ownership grants and a New Supply Shared Equity Scheme for developers. 1 Gro-grants for occupation were renamed Partnership for Regeneration.

The introduction of Help to Buy in 2013 sought to help the housebuilding sector in the economic downturn.

Further measures were taken to restrict the Right to Buy, and it was eventually abolished in August 2016.

UK Government

Scottish potential homebuyers can also make use of the UK Government schemes to support people into home ownership. The Help to Buy ISA and the Lifetime ISA both involve a UK Government contribution to any savings in these accounts when a house is purchased.

A Help to Buy mortgage guarantee scheme, which protected the lender against any losses, was also available until the end of 2016. This was used by 9,800 first-time buyers in Scotland from October 2013 to September 2016.4

Current Scottish Government initiatives

Currently, the Scottish Government supports three shared equity schemes:

Two schemes through the Scottish Government's Low-Cost Initiative for First-time Buyers. The Open Market Shared Equity Scheme and the New Supply Shared Equity scheme.

the Help to Buy (Scotland) Affordable New Build and Smaller Developers Scheme.

What is shared equity?

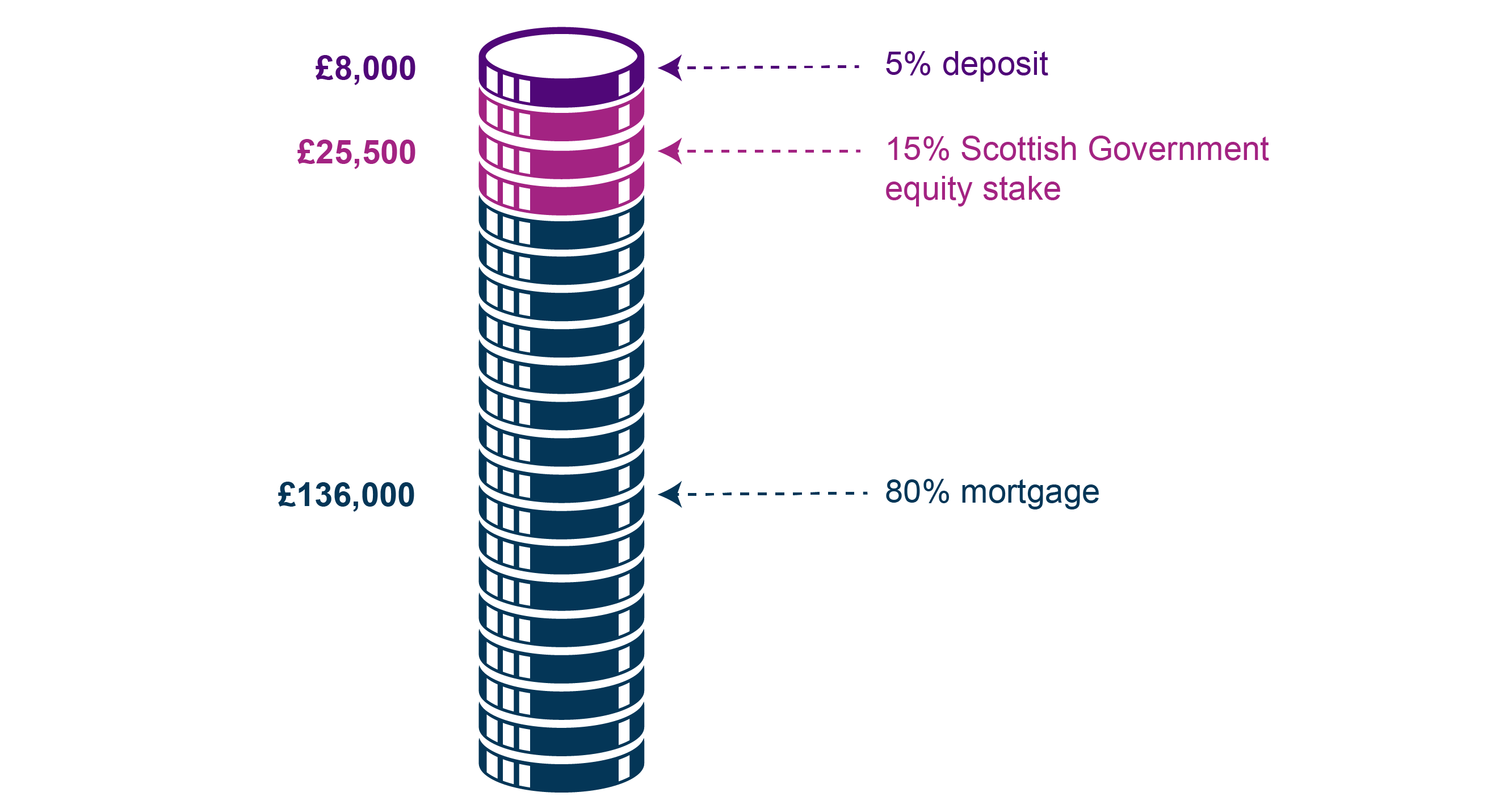

With a shared equity scheme the buyer purchases the majority share of the property and the Scottish Government provides an equity stake to the buyer for the remaining share.

When a shared equity property is sold the Scottish Government will get back its share of the proceeds of the sale. For example, if the buyer pays for 80% of the purchase price, the Scottish Government will provide the remaining 20%. When the property is sold, the government would get back 20% of the sale price. In most cases, buyers can also increase their equity share before the property is sold.

Purchasers buying through a shared equity scheme will have “full title” to their property. This means that they own the property and will have the same responsibilities as every other home owner, including for repairs and maintenance.

Further detail is provided in the Summary table of Scottish Government shared equity schemes.

Other Scottish Government initiatives

Shared ownership (where someone owns part of a home and pays rent to a housing association that owns the other part of the home) is an option under the LIFT programme and local authorities can decide to include this in their strategic housing investment plans. However, the Scottish Government does not promote shared ownership, since an evaluation of LIFT schemes in 2011 indicated that other tenures were better value for owners. i

Partnership Support for Regeneration grants (former gro- grants) are also still available. A grant is only considered where projects meet the local strategic investment objectives of the area and are consistent with the Local Housing Strategy of the local authority where development is proposed.

Following a pilot self-build loan fund launched in the Highlands area in 2016, the Scottish Government will also provide a new £4m self-build loan fund from autumn 2018. This will offer financial support to people who want to build their own homes.1

Changes have also been made to the first- time buyer relief from Land and Building Transaction Tax (LBTT) scheme. From June 2018, the zero tax LBTT threshold for first-time buyers was raised from £145k to £175k. First-time buyers buying a property above £175k will only pay LBTT on the amount above £175k. The Scottish Fiscal Commission estimated that this will result in 80% of first-time buyers in Scotland paying no LBTT at all, whilst all other first-time buyers will see their tax reduced by £600. Overall, it is estimated that this policy will help 12,000 first-time buyers each year.2

Summary table of Scottish Government shared equity schemes

Table 1 summarises the current Scottish Government schemes to help people access home ownership.

With each of these schemes, applicants need to undergo a financial assessment to see if they are eligible to participate. Applicants need to be able to show that they cannot afford to buy a home that meets their needs without government assistance and that they can afford the mortgage repayments.

| Scheme | Buyer Contribution | Scottish Government Equity stake | What property can be bought? | Who has priority ? |

|---|---|---|---|---|

| Open Market Shared Equity Scheme | 60-90% of the cost, with a modest deposit (normally 5%).Over 60s are not required to take out a mortgage. | Between 40% and 10% of the value of the property. | Existing properties advertised for sale on the open market.The maximum price of a property that can be purchased is set for different sized properties across regions of Scotland. These are referred to as threshold prices. | First time buyers who are:

|

| New Supply Shared Equity Scheme | Generally, the buyer pays between 60% and 80% of cost, although the minimum equity stake can be reduced to 51% in exceptional circumstances. | Generally, between 40% and 20% of property value. | New-build property from a council or housing association.Under this scheme grants are provided to local authorities or Registered Social Landlords to enable them to develop or purchase properties which are sold at a proportion of market value.Details of currently available properties are available on-line. | Same as above. Also available to people who have previously owned a home and have experienced a significant change in circumstances – for example, a marital breakdown. |

| Help to Buy (Scotland) Affordable New Build Scheme | At least 85% of the price. Lenders are likely to require a deposit of around 5%.Mortgage must be a repayment mortgage, of at least 25% of the purchase price | Up to 15% of the price. | New-build property from a participating developer including smaller scale developers.Maximum price of the property that can be purchased is £200k. | No priority criteria. Applicants must not be able to afford to purchase a home without support from the scheme. |

Low-Cost Initiative for First Time Buyers

The following sections provides more information on the LIFT scheme including

LIFT planning and management

The LIFT schemes are all funded through the Scottish Government’s Affordable Housing Supply Programme (AHSP).

Units completed through the AHSP count towards the Scottish Government's target to deliver at least 50,000 affordable housing units over the five year period April 2016 to March 2021. At least 35,000 homes will be for social rent. No targets are set for home ownership as the schemes are demand led.

Funding for the Help to Buy scheme sits outwith the Affordable Housing Supply budget. Homes sold under the Help to Buy scheme do not count towards this 50,000 target.

Within the AHSP, the New Supply Shared Equity Scheme (NSSE) and Open Market Shared Equity (OMSE) scheme operate differently.

New Supply Shared Equity: Arrangements for developing NSSE properties are part of the 'local programmes' developed by councils. Plans for any NSSE properties will be set out in the local authority Strategic Housing Investment Plan.

There is no specific budget for NSSE. In 2016/17, £9m was spent on NSSE.1

Partnership for regeneration projects and shared ownership properties are also developed through the local programmes.

Open Market Shared Equity scheme: OMSE is part of the ASHP 'national programmes' that are managed centrally (although LINK homes is the managing agent for the scheme).

Expenditure on OMSE in 2016/17 was £66m and £72.5m in 2017/18.i1 Up to £70m is available in 2018/19.

Together with the Help to Buy equity funding, at least £120m worth of equity funding will be available in 2018/19, around 15% of the total More Homes Budget.

Numbers of affordable home ownership completions

Just over 4,000 affordable home ownership completions were funded through the AHSP during the first two years of this parliamentary session (2016/17 and 2017/18), accounting for one quarter of all the affordable housing supply completions over this period.

As Table 2 shows, the OMSE scheme accounts for the vast majority (83%) of the affordable home ownership completions.

| 2016-17 | 2017-18 | Total Apr 2016-March 2018 | |

|---|---|---|---|

| RSL NSSE | 183 | 165 | 348 |

| Other Affordable home ownership | 30 | 204 | 234 |

| OMSE | 1,653 | 1,766 | 3,419 |

| Total | 1,866 | 2,135 | 4,001 |

| % of all AHSP completions | 25% | 25% | 25% |

Geographical pattern of affordable home ownership investment

Although affordable home ownership completions account for around 25% of completions funded through the AHSP over the last few years, this proportion varies widely by council area.

Over the four year period 2013/14 to 2016/17, the council areas with the highest proportion of AHSP completions for affordable home ownership were: Perth (50%), Midlothian (47%), West Lothian (43%), Edinburgh (35%), East Lothian and Highland (both 43%). By contrast, affordable home ownership completions accounted for just 1% of all affordable completions in East Ayrshire and only 3% in Argyll and Bute and South Ayrshire council areas. 12

The majority of affordable home ownership completions take place through the OMSE scheme. Statistics show that OMSE schemes are geographically concentrated in a few areas.

In 2016/17, just over half (55%) of the total Open Market Shared Equity sales were concentrated in four local authority areas, Edinburgh (21%), West Lothian (15%) and Highland (10%) and Perth and Kinross (9%).

In 2016/17 there were no OMSE sales in Inverclyde or on the Shetland Islands.2

One of a number of possible reasons for the geographical variation in sales could be the threshold price levels set for different areas.

For example, in response to the Local Government and Communities Committee's call for evidence to support their 2016/17 pre-budget scrutiny , Argyll and Bute Council noted concern about the threshold levels set for their area. Their response indicated that, in the most pressured housing market areas of Oban and Lorn, Helensburgh, Mid Argyll and the islands, the thresholds (e.g. £60k for a two apartment home) are too low to make this a realistic alternative for first time buyers. 4

A review of threshold prices and areas is currently underway and is due to conclude in autumn 2018.

Who buys homes under the LIFT schemes?

The LIFT schemes are aimed at first time buyers and priority access groups e.g. those living in social rented housing, disabled people and people leaving the armed forces.

While the Scottish Government collects voluntary monitoring information on who buys under the LIFT schemes, this information is not routinely published. We do not know, therefore, the extent to which priority groups are helped through these schemes.

However, some information on the characteristics of purchasers was provided in response to a written parliamentary question. In 2016/17, around 98% of properties purchased through the OMSE and NSSE schemes were by first-time buyers and less than 1% were by those over 60 years old. The figures should be treated as estimates, given that the response rate to the monitoring forms was only around 78%.1

An evaluation of the LIFT schemes (2011) found that, for both shared equity schemes, the majority of purchasers were previously either living with parents or relatives, or were renting privately. Further details about the LIFT evaluation are given in the section Comment on the impact on home ownership schemes 2

Help to Buy (Scotland) Affordable New Build Scheme & Small Developers Scheme - Background

The Help to Buy Scotland scheme was launched in September 2013, using financial transaction funding allocated to the Scottish Government by HM Treasury. Financial transaction funding can only be used to make loans or equity investments into the private sector, and must be repaid to HM Treasury.

Announcing the development of the scheme in May 2013, the then Deputy First Minister, Nicola Sturgeon, said:

People in Scotland who should rightly be able to afford a mortgage are still facing real challenges buying a home.

We are well aware of the challenges that people face and want to continue to do all we can to help. The £120 million funding announced today will not only help people to buy their first home, they will also help ‘second-steppers’ to be able to sell their home and to move to another property.

But this is not only about helping people to buy houses. Our actions are also stimulating the economy. By supporting house buying and construction, we are creating new work for the sector and supporting jobs.

Scottish Government. (2017, May 13). Fresh help for house buyers. News release 17 May 2013. Retrieved from http://www.gov.scot/News/Releases/2013/05/Shared-equity-17052013 [accessed 26 June 2018]

When Help to Buy was first introduced in Scotland, the maximum price of a property that could be purchased under that scheme was set at £400,000. However, from 22 October 2014, the maximum price was reduced to £250,000. That version of the Help to Buy scheme closed on 31st March 2016.

Help to Buy Scotland (Affordable) New Build and Smaller Developers Schemes

From April 2016, the Help to Buy Scotland (Affordable) New Build and Smaller Developers Schemes, with a greater focus on affordable new build properties, came into operation.

Under this new scheme, the maximum purchase price was further reduced from £250,000 to:

£230,000 for purchases which complete on or before 31st March 2017

£200,000 for purchases on or before 31st March 2018

Initially, the Scottish Government planned to reduce the maximum purchase price to £175k for properties purchased on or before 31 March 2019. However, on 31 March 2017, the Government announced its decision to maintain the £200k limit to keep the scheme open to as many people in as many areas as possible.2

In addition, the maximum Scottish Government equity share was reduced from up to 20% to up to 15% of the property value.

Help to Buy Sales - statistics

As shown by Table 3 :

From Sept 2013 to March 2018 there were 12,800 Help to Buy sales

In 2017/18, the average purchase price was around £170k with an average Scottish Government stake of around £25,000

Around £436m in equity loans has already been spent on both versions of the Help to Buy schemes to date (from 30 Sept to 31 Mar 18)

In the remainder of this parliamentary session, up to £150m of Help to Buy loans will be available

Overall, the Scottish Government expects that this funding, in combination with the original Help to Buy scheme, could help around 18,000 households to buy new-build homes.

| Year | Sales | Average SG stake (£) | Average purchase price (£) | Expenditure (ex) / budget (b) |

|---|---|---|---|---|

| (Sept 2013/16) | 8,160 | 38,000 | 190,000 | £314m (ex) |

| 2016/17 | 2,370 | 27,000 | 179,400 | £64 (ex) |

| 2017/18 | 2,290 | 25,400 | 170,300 | £58m (ex) |

| 2018/19 | n/a | n/a | n/a | £50m (b) |

| 2019/2021 | n/a | n/a | - | £100m (b) |

| Total | 12,820 | n/a | n/a | £586m |

How much Help to Buy equity funding has been repaid to the Scottish Government?

As explained earlier, at some point in the future after the initial house purchase (for example when the property is sold) the purchasers are required to return the Scottish Government's equity stake .

There is no set deadline for buyers to repay their equity loan to the Scottish Government. The scheme runs on indefinitely and purchasers can decide to buy back all or some of the Scottish Government's equity stake in their home whenever they want. This is known as 'tranching up.' An owner can increase their equity stake, regardless of whether the open market value of their property has increased or decreased. The price the owner pays for tranching up is based on a valuation of the property at that time. On the sale of the property, the value of the equity to be repaid is based on the selling price of the property at the time of the repayment.1

In response to a Parliamentary Question, answered in April 2018, the Minister for Local Government and Housing. Kevin Stewart MSP, said that around £20.3m has been received in sales receipts over the period 2015/16 to 2017/18 (provisional).2

As expenditure on Help to Buy over this time period has been around £435m, this suggests that around 5% of the Scottish Government’s total loan value has been returned. The value of the receipts returned to the Government could be worth more or less than the original loan value depending on movements in the property market. However, from the information available, it is not possible to determine whether receipts are more or less than predicted.

Geographical pattern of Help to Buy sales

There are geographical variations in sales under the Help to Buy scheme, which primarily depend on where the participating builders are building, and how the schemes are marketed in different areas. It is a demand-led scheme and there is no specific targeting of funding to particular areas of the country and no direct link to local authority housing strategies.

Data from 2016/17 and 2017/18 shows that half of the sales under Help to Buy took place in West Scotland, while 4% of sales took place in the Highlands and Islands (see Table 4).

| Area | Number of sales 2016/17 to 2017/18 | % of total sales |

|---|---|---|

| Central Scotland | 500 | 11% |

| Highlands and Islands | 200 | 4% |

| North-East Scotland | 350 | 8% |

| South East Scotland | 1,250 | 27% |

| West Scotland | 2,350 | 50% |

| Scotland | 4,660 | 100% |

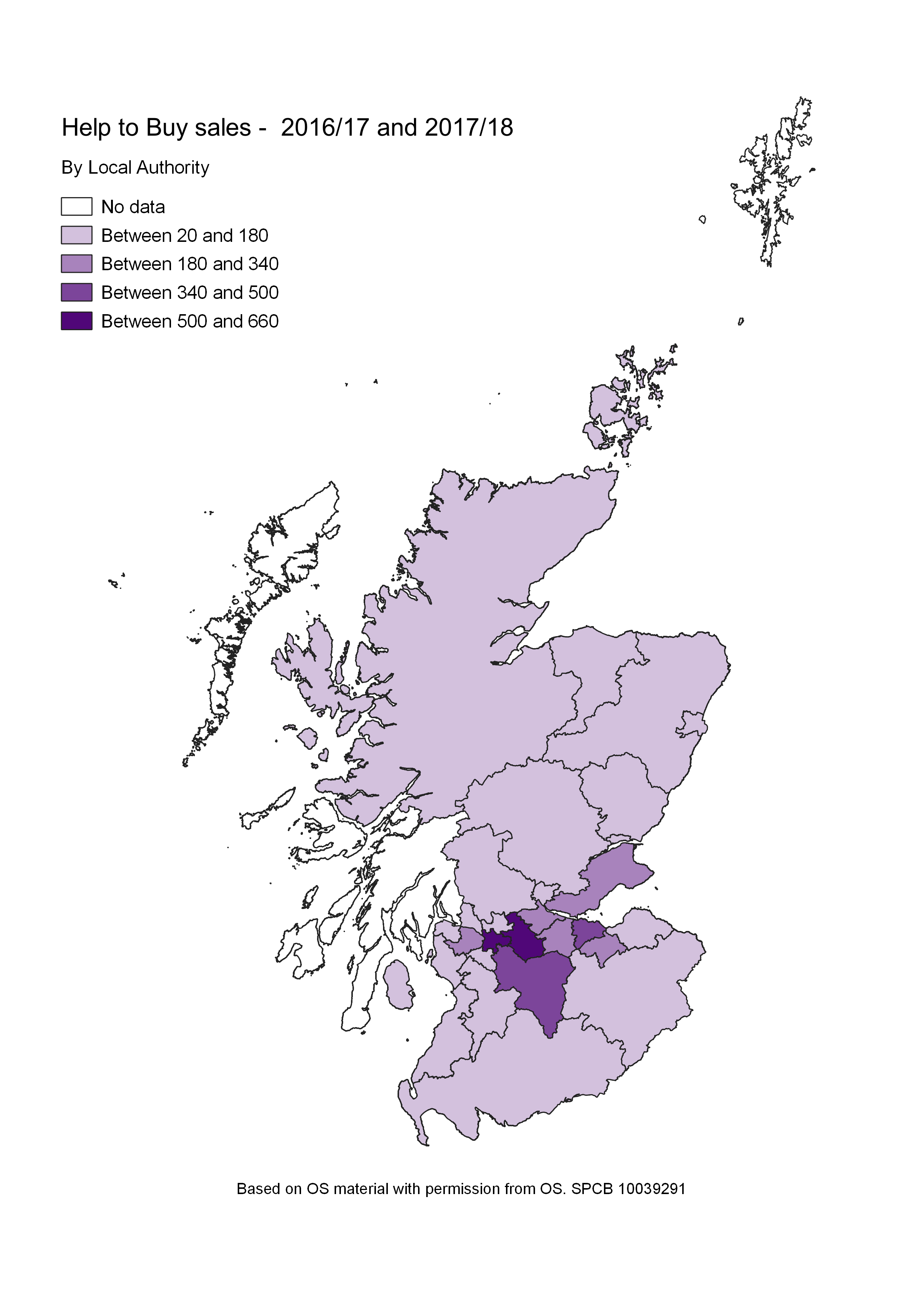

Help to Buy sales by local authority area

Map 1 shows that, at individual local authority level, over the financial years 2016/17 and 2017/18:

Most sales have taken place in North Lanarkshire Council area (600) and Glasgow City council area (660).

No data is provided for Argyll and Bute, Eilean Siar (Western Isles) or Sheltand Isles as small numbers of sales have been suppressed to prevent disclosure

Impact of Help to Buy on the housing market

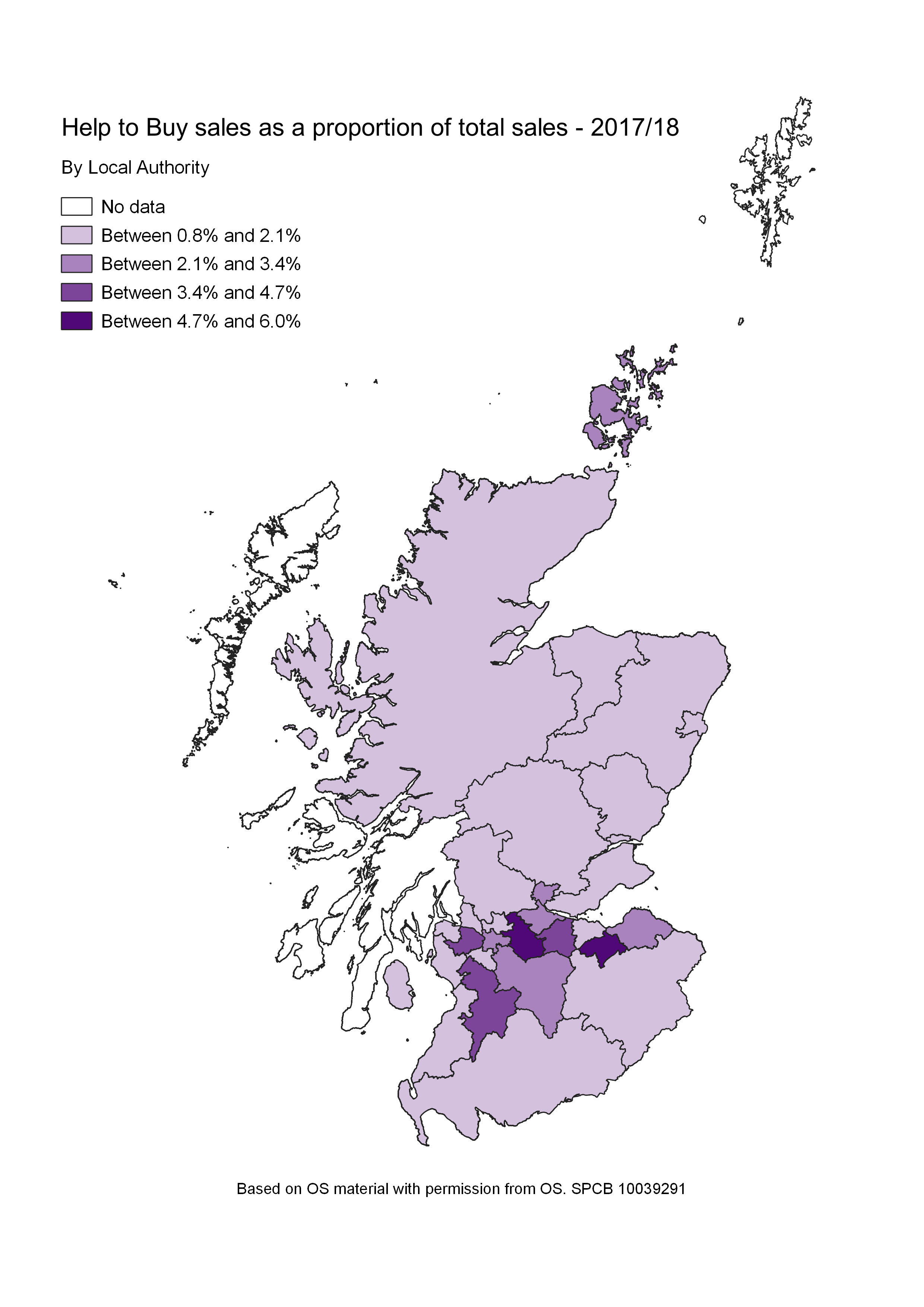

One way to look at the impact of Help to Buy on the housing market is to consider the number of Help to Buy sales as a proportion of total house sales.

Using sales data from Registers of Scotland, it can be estimated that house sales with the assistance of Help to Buy account for a relatively small, and declining, proportion of total house sales in Scotland. These amounted to just under 4% of sales in 2014/15 compared to just over 2% in 2017/18. 1

Again, there are geographical variations in Help to Buy sales. In 2017/18, Help to Buy sales, as a proportion of all sales, were more significant in Glasgow and Midlothian local authority area, accounting for around 6% of all sales (see Map 2).

Help to Buy sales as a proportion of new build sales

Although Help to Buy sales account for a relatively small proportion of total house sales in Scotland, the scheme is only available on new build properties below a certain price.

Registers of Scotland publish data on new build sales by price bands. Using this data, it can be seen that Help to Buy sales are a much more significant part of the new build sector of the market.

Table 5 shows that, in the last two years, Help to Buy sales have accounted for just under a third (31%) of all new build sales under £250k. Help to Buy sales were more significant in 2014/15, where they accounted for just over half of sales.

| Total new build sales under £250k | Total Help to Buy Sales | Help to Buy sales as a % of new build sales under £250k | |

|---|---|---|---|

| 2014/15 | 6,932 | 3,690 | 53% |

| 2015/16 | 7,527 | 3,560 | 47% |

| 2016/17 | 7,537 | 2,370 | 31% |

| 2017/18 | 7,279 | 2,290 | 31% |

Which builders do Help to Buy purchasers buy from?

Information about Help to Buy was released by the Scottish Government in response to a Freedom of Information request in November 2017. This FOI response provides data on the number of homes, and the total value of the homes purchased by people taking part in the Help to Buy scheme, broken down by participating builder.1

That information shows that just over half (51%) of the sales from April 2016 to November 2017 were for homes built by three housebuilders; Persimmon Homes, Taylor Wimpey and BDW Trading, part of Barratt Homes.

Across Great Britain, Help to Buy schemes make an important contribution to the sales of these large housebuilders. For example, Persimmon Home's 2017 Annual Report states that around 48% of its sales were through Help to Buy.2 Similarly, Taylor Wimpey's Annual Report and Accounts 2017 notes that Help to Buy was used in around 43% of its total sales in that year.3In both cases, the reports do not provide Scottish specific information.

Smaller developers scheme

A proportion of Help to Buy funding is set aside for use by customers of the smaller developers scheme. Otherwise, the schemes operate under the same rules. In the current year, 2018/19, just over a third of the budget is aimed at smaller developers.

In 2016/17, £11.4mi was spent on the smaller developers scheme, less than the overall budget of £21.6m. It is worth noting that up to £80m was available for Help to Buy in 2016/17, but only £64m was spent.

| Year | Budget | Smaller developers' budget share |

|---|---|---|

| 2016/2017 | £80m | £21.6m |

| 2017/2018 | £65m | £18.8m |

| 2018/2019 | £50m | £18m |

| 2019/2020 | £50m | £18m |

| 2020/2021 | £50m | £18m |

Who buys homes under the Help to Buy scheme?

The Scottish Government collects information for management purposes about people who buy Help to Buy properties.

This information is based on a ‘log form’ returned by participating households. Completion of log forms is voluntary. For the year 2016/17, 1,805 log forms were completed, which represents 76% of the 2,370 Help to Buy sales in this year. Given this response rate and the fact that some completed log forms contained missing or inaccurate information, these statistics should be treated as estimates only. However, the Scottish Government claims that they should still provide a reasonable indication of the characteristics of households purchasing homes under Help to Buy. 1

Based on these log form returns, key findings for 2016/17 include:

Almost three-quarters (73%) of Help to Buy (Scotland) households were not existing home owners, whilst just over a quarter (27%) were.

More than a third (37%) of purchasers had previously been living with parents or relatives, 28% in a privately rented property, 25% in a property they were paying a mortgage on, 6% in social rented housing, 1% with friends (but not renting), and 2% in other accommodation.

More than half (55%) of buyers were aged 30 years or under, with over three quarters (76%) of buyers aged 35 or under. The average age was 31 years.

More than half (56%) of purchasing households had a gross household income between £30k and £50k per year. Just under a quarter (24%) of purchasing households had a gross household income of over £50k.

There were some clear differences in the profiles of purchasing households between first time buyers and existing home owners, with first time buyers more likely to be younger purchasers, more likely to have lower household incomes, and less likely to purchase detached properties.

Comment on home ownership schemes

As noted earlier in this briefing, much of the comment in the national media on the schemes to help households access home ownership relates to UK Government's policies. A House of Commons Library briefing Extending home ownership: Government initiatives1 provides a useful overview of UK Government policy on home ownership support. It suggests that debate on the impact of these schemes has focused on various questions including:

Do the schemes boost supply or contribute to house price inflation?

Do the equity loan schemes provide additionality and value for money?

Are the schemes well targeted?

While these questions are also applicable to Scotland, there appears to be less recent Scottish research available to answer these questions.

There has been relatively little comment made about the Scottish Government's LIFT schemes. Some comment was made in response to the Local Government and Communities Committee's call for evidence to support their 2017/18 pre-budget scrutiny. Respondents had mixed views. For example, some local authorities expressed support for schemes that promote home ownership, particularly the OMSE scheme. One council said that housing association shared equity schemes had been very successful in delivering low cost home ownership as part of mixed tenure developments. However, the council pointed out that the grant benchmarks for shared equity were not increased in 2016, and that the expected subsidy level of around £40k makes it difficult to deliver shared equity. 2

Other evidence, was less supportive of the level of resources dedicated to home ownership. For example, Shelter Scotland's response stated:

We have consistently questioned whether schemes to underwrite increased home ownership per se provide value for money in light of the scale of backlog housing needs. There is a risk that the various schemes simply allow households to vary the timing or scale of housing purchase, and in a way which provides little long-lasting benefit beyond the initial purchase. While, we recognise and support the aspiration of households to own, the scale of funding (at least £160m in 2016-17) is significant and the challenge for government is to ensure that home ownership is both easier to access and to sustain but without the level of direct financial commitment currently allocated.

Shelter Scotland. (2017). Scrutiny of Draft Budget 2017-18 Submission from Shelter Scotland. Retrieved from http://www.parliament.scot/S5_Local_Gov/Inquiries/20161024_Budget_ShelterScotland.pdf [accessed 18 July 2018]

Evaluation of LIFT Schemes

The Scottish Government commissioned an evaluation of four LIFT schemes in 2010-11. The research covered the period 2005/06 to 2009/10, so is somewhat dated.4 Key points included:

There was some evidence of additionality, around 21% of LIFT purchasers were living in social rented accommodation or likely to be offered it.

NSSE (and Gro-grants and shared ownership) had resulted in new build properties and in creating more owner-occupied homes.

LIFT had largely been successful at targeting the households identified as priorities .

The OMSE and NSSE appeared to contribute significantly to quality of life for purchasers, resulting in wider social benefits.

Despite the cost effectiveness of the OMSE scheme, it does not add directly to housing supply. However, it may stimulate a chain of sales and purchases which could include newly built housing. The evaluation recommended undertaking further work to assess the economic impact of OMSE.

Another, smaller scale piece of research considered LIFT schemes which operated in two deprived areas of the west of Scotland. This research highlighted that, in addition to any positive benefits and opportunities that might be experienced, there were also a number of challenges for purchasers. These included the financial costs of home ownership as well the additional expenditure on insurance, repairs and maintenance. This can be a financial stretch for low-income groups, especially those who had previously lived in the rental sector. 5

Help to Buy

In relation to the Scottish Help to Buy scheme, there has been relatively little substantive research about its impact in Scotland.

Homes for Scotland, the body representing Scotland's house builders is, perhaps unsurprisingly, supportive of the scheme and has emphasised its economic benefits. For example, it has suggested that, since Help to Buy was first introduced in September 2013, it has supported an estimated nine thousand jobs and contributed over half a billion pounds in Gross Value Added to the Scottish economy.6

In response to the Scottish Government announcement in April 2018 on the extension of the Help to Buy scheme to 2021, Nicola Barclay, Chief Executive of Homes for Scotland said:

By allocating further targeted funding until 2021, it is not only extending the opportunity of home ownership to more Scots who are currently saving to buy their own home but will also provide the much-needed confidence and certainty that housebuilding companies need to continue to invest and grow their businesses in Scotland. This positive message is fundamental to helping us work together to increase the supply of new housing.

It is essential to remember that, as well as being directly responsible for additional new homes being built, Help to Buy is also relieving pressure on the public sector with earlier figures showing that around five per cent of purchasers have moved from social rented housing and a further five per cent were on a social housing waiting list.

With Help to Buy providing an equity stake that is repayable to the Scottish Government, and with receipts received to date higher than projected, the scheme is already demonstrating its value as an effective housing policy driver for the delivery of new homes, enabling Scots to purchase a new-build home without the need for a large deposit, and with very little impact on the public purse.

Homes for Scotland. (2018, April 4). Help to Buy scheme set to benefit even more Scots. Retrieved from https://www.homesforscotland.com/Latest-news/ID/689/Help-to-Buy-scheme-set-to-benefit-even-more-Scots [accessed 18 July 2018]

GB comment on impact of home ownership schemes

As noted earlier in this briefing, the UK Government has, in recent years, put much more emphasis on supporting home ownership, through a range of schemes than the Scottish Government which has, by comparison, prioritised supporting affordable rented housing. While the UK Government's support for home ownership continues, the 2017 White Paper Fixing Our Broken Housing Market indicated a shift in focus to delivering a wider range of affordable housing, including for affordable rent.1

Help to Buy in England and Wales

The Scottish Help to Buy scheme operates slightly differently to the equivalent English and Welsh schemes. This should be borne in mind when comparing Help to Buy in these countries. There is no Help to Buy scheme operating in Northern Ireland, although other forms of support to buy a property are available.

The main differences between Scottish and English and Welsh Help to Buy schemes are:

The maximum purchase price is £600k in England and £300k in Wales, compared to £200k in Scotland.

The government equity loan will cover up to 20% of the purchase price in England, up to 40% in London and up to 20% in Wales, compared to 15% in Scotland. This means that the maximum government equity loan available is £120k (England), £240k (London), £60k (Wales) and £40k (Scotland).

In Scotland, buyers are not eligible to participate if they can afford over 100% of the purchase price through a combination of a mortgage and a deposit. This is not an explicit condition in the Welsh and English schemes.

Shared equity loans are interest free in Scotland. In England and Wales an interest charge is payable after five years.

The House of Commons library briefing Extending home ownership: Government initiatives 1provides a review of comments made on the Help to Buy initiative. It states that commentators have generally supported interventions to support home ownership in challenging market conditions, but have emphasised the need for an overall increase in housing supply to prevent subsidised home ownership from simply adding to house price inflation.

An evaluation of the UK Government’s Help to Buy shared equity scheme, published in 2016, noted that there had been concerns around targeting of the scheme. There were questions about whether, in practice, the scheme allowed people to buy bigger or better homes rather than just enabling them to buy a first home. Overall, the evaluation was positive, concluding:

Overall, the scheme has met its objectives in terms of increased housing supply. It has done this via a stimulus to demand which has fed through into an expansion of supply and with little evidence of a serious and destabilising impact on house prices – Help to Buy Equity Loan has typically supported 2% to 3% of total residential property transactions in England on a monthly basis. The scheme helped restore market confidence as shown by consumers, developers and lenders and as expressed in re-invigorated regional and local housing markets.

Finlay, S., Ipos Mori, ., Williams, P., & Whithead, C. (2016, February). Evaluation of the Help to Buy Equity Loan Scheme. Retrieved from https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/499701/Evaluation_of_Help_to_Buy_Equity_Loan_FINAL.pdf [accessed 02 July 2018]

A further UK Government evaluation, covering the period 2015-17, is due to be published later in 2018.4

In 2016, the Welsh Government commissioned an interim evaluation of the Welsh Help to Buy scheme. It considered how the scheme has influenced buyer and developer behaviour. Key points from the research included:

Help to Buy showed evidence of additionality, as 89% of survey respondents were first-time buyers, and 89% said that the scheme had influenced them in purchasing a property.

There was evidence of displacement on buyer activity, with some buyers suggesting that the scheme had altered their behaviour, for example, by them purchasing a bigger house or bringing forward their time-frame for buying.

There was also evidence, although limited, that it has become more difficult to sell smaller properties that could be marketed as ‘starter homes’ as the Help to Buy scheme encourages first time buyers to purchase larger and more expensive homes than they would otherwise have done.

The report made a number of recommendations including: that there is a need for further research and monitoring; a need for an enhanced provision on the Welsh speaking service; and a need for greater promotion of the scheme.5

While the Welsh Government views the scheme as a success, it has also provoked some questions. For example, during an Assembly debate on low cost home ownership, the Plaid Cymru housing spokesperson, Bethan Sayed , asked whether there were more effective ways to assist first-time buyers. She noted that the average price of a home under the scheme was £180k and that a quarter of participants were not first-time buyers.6

Unlike in Scotland, the Welsh Help to Buy sales count towards the Government's affordable homes target (delivering 20,000 affordable homes towards the end of the fifth assembly). Bethan Sayed has also questioned the inclusion of Help to Buy sales within the affordable housing programme, given that a third of the properties that have been bought are over £200k.7