Risk management in agriculture

This briefing examines risk management policies for agriculture. Currently, events which negatively impact agricultural productivity, such as adverse weather, price fluctuations and disease events, are often addressed in the UK through ad hoc payments from governments. However, in the United States, Canada, Australia and New Zealand, instruments addressing risk management are built into agricultural policy. With agricultural policy about to change in the UK, consideration of policy instruments used by these countries to manage risk may be useful.

Executive Summary

Agriculture is particularly prone to business risks. This year, the Scottish Government unveiled a fund of £250,000 to farmers and crofters to compensate for lost stock due to adverse weather from the ‘Beast from the East’. Scottish farmers have received other ad hoc payments to help them deal with unexpected events. For example, for fluctuations in dairy prices in 2016 and during the foot and mouth disease crisis in 2001.

Under the current EU Common Agricultural Policy, farmers receive direct payments, which are guaranteed annual payments to farmers. They act as a form of risk management, by shielding farmers from strong fluctuations in markets. However, some countries build risk management explicitly into their agriculture policy. As agricultural policy changes in the UK in the coming years, examination of risk management policies in these countries may be useful.

Indeed, George Eustice, Minister of State at the Department for Environment, Food and Rural Affairs has said “We are looking at a range of policy options around risk management and resilience. We are looking at the approach taken in countries like the U.S. and Canada, and even Australia, where they have approaches that help farmers manage risks, whether they be weather risks or large downturns in margins, for instance.”

This briefing examines the risk management policies in the United States, Canada, Australia and New Zealand.

In the U.S., farmers adopt either commodity programmes which support incomes when prices or revenue fall below reference levels, or government-subsidised crop insurance schemes which can cover both yield and revenue losses.

The Canadian Government has developed various business risk management programmes to address different layers of public response to risk in agriculture; AgriInsurance, AgriStability, AgriRecovery, AgriInvest, AgriRisk Initiatives.

The Australian Government provides a series of disaster assistance measures and taxation measures to support farmers in the management of business risks.

The New Zealand Government offers a layered approach to risk management, through the adverse events recovery plan. Government assistance measures can be administered in small, medium and large-scale adverse events.

The pros and cons of different approaches are discussed. For example, direct payments provide a guaranteed source of income to EU farmers, although these payments do not provide a means to tackle market volatility. Furthermore, it has recently been argued that although government-subsidised insurance has a large uptake in the U.S., it could make farmers less resilient to climate change, and could lead to more risk taking by farmers. Market-oriented strategies such as forward contracts and futures markets can reduce the cost of subsidies, but they can be difficult to administer for some agricultural sectors.

Background

Seventy three percent of Scotland’s land mass is under agricultural production, covering 5.7 million hectares1. Figure 1 provides statistics on the economic importance of agriculture to the Scottish economy. The total income from farming in Scotland in 2017 was £917 million2. For such an economically important sector, appropriate agricultural policies must be in place, for the provision of public goods, and to ensure food security3.

Due to the variability in the economic and biophysical environment in which it operates, agricultural activity is particularly prone to a range of business risks. Markets have been affected by economic disturbances, disease outbreaks and adverse weather events4. For example, in 2007/2008, a food commodity price spike occurred, creating a global crisis and leading to political and economic instability5.

Having an efficient system to address these business risks in agriculture can preserve the standard of living of those who depend on farming, strengthen the viability of farm businesses, and provide an environment which supports investment in the farming sector4.

What is risk in agriculture?

Gomes (1999)1 proposes a simple definition of risk - “A loss due to a damaging event”. This can be easily measured, for example by quantifying the loss of agricultural income or productivity, as a result of anything which can compromise the productivity of the farm.

Examples of risk in agriculture

A report by the Scottish Government identified the most common sources of risks to Scottish agriculture, based on categories pre-determined by the Organisation for Economic Co-operation and Development (OECD) in 20082.

Market/price risk involves uncertainty about future changes in prices of inputs and outputs due to shocks, trade policy and new markets. Unpredictable socio-economic factors can lead to sudden changes in supply and demand, impacting market price (See 'Aid package from European Commission for dairy crisis').

Production/yield risk includes weather related factors, crop and livestock diseases, and technological changes which can impact crop and livestock performances (See 'Ad hoc payments from Scottish Government in 2018').

Institutional or regulatory risk refers to unpredictable changes in the provision of services from institutions which support farming.

Financial risk includes uncertainty about financial flows within a business due to variability in interest rates, access to credit and value of financial assets can lead to financial risk.

Personnel risk refers to risks to the farm business caused by illness or death and the personal situation of the farm family.

Policy context of risk management

Risks in agriculture are managed in some countries by integrating risk management tools into agricultural policies. Such policies are getting the attention of agricultural policy makers across the European Commission, the UK Government and the Scottish Government.

European Commission

In a Future of food and farming press release from the EU commission1, which discusses the future of the Common Agricultural Policy (CAP), a key priority area is "Creating an EU-level platform on risk management on how best to help farmers cope with the uncertainty of climate, market volatility and other risks".

UK Government

Written evidence from the Department for Environment, Food and Rural Affairs (Defra)1 to the European Union Lords Select Committee2 states:

Farmers wishing to mitigate price risk have at their disposal a number of market-based solutions, including forward contracts, futures markets, swaps and options, and similar over-the-counter products. According to Defra, farmers have used such tools for a long time in the United States, where agricultural commodity prices fluctuate widely.

George Eustice MP, Minister of State for Defra, made a statement in the House of Commons meeting on Brexit: Agriculture and Fisheries3:

We are looking at a range of policy options around risk management and resilience. We are looking at the approach taken in countries like the U.S. and Canada, and even Australia, where they have approaches that help farmers manage risks, whether they be weather risks or large downturns in margins, for instance.

He further indicated interest in risk management approaches in other countries4:

I want us to explore the potential for government-backed insurance schemes like they have in Canada and futures markets like they have in the U.S. to help mitigate risk.

Health and Harmony paper, Defra

The ‘Health and Harmony1’ paper from Defra, highlighting the future for food, farming and the environment, includes a section on risk management and resilience. Market volatility is discussed, mentioning the need for farmers' access to tools to management market volatility year-to-year:

We are consulting on the barriers to wider development of insurance, futures contracts and other risk management tools, and how government can encourage their adoption. We are also considering how to improve the government response to major crises.

We need to understand the relationship farmers have with risk better, and the barriers to the uptake of insurance and other tools. We will conduct behavioural research and engage the farming and insurance sectors in order to inform further work in this area. Post-Brexit agriculture should focus on market-led risk management tools, such as insurance or futures and options contracts, rather than looking for government subsidies, as they can distort markets and undermine the need to properly reduce risks.

As well as short-term market volatility, support for farmers experiencing significant crises are also mentioned in the white paper:

... farmers may also in highly exceptional circumstances need support in the event of a significant crisis such as a disease outbreak or catastrophic weather. We propose domestic provision for safety net mechanisms currently provided by the EU Common Market Organisation regulations, which will allow the government to intervene in such crises. We will consider how best to define and respond to these crises in future.

Removal of direct payments1 to farmers is also proposed:

We therefore propose to further reduce and phase out Direct Payments in England completely by the end of the ‘agricultural transition’ period, which will last a number of years beyond the implementation period. Direct Payments can distort land prices, rents and other aspects of the market, creating a reliance on these payments, which can limit farmers’ ability to improve the profitability of their businesses.

The Agriculture and Horticulture Development Board (AHDB)3 state that insurance premiums, covering losses caused by adverse climatic events, animal or plant diseases, pest infestation, or an environmental incident, would need to be subsidised to be commercially viable in the UK, as is the case in the U.S.:

With traditional insurance the policy covers high impact, low likelihood events. In insuring volatility though, the events are high impact, high likelihood, which would make premiums commercially unviable. This would likely require the CAP to subsidise premiums and/or underwrite the risk.

Taken together, the white paper indicates that the UK Government could be looking to adopt a more risk management oriented agricultural policy.

Scottish Government

One outcome from the National Discussion on the Future of Scottish Agriculture 2015-2016 (set out in future of farming paper1) was:

Strong sustainable growth in profits from agriculture, driven by increased market-orientation, competitiveness and resource efficiency.

Levels of risk and the need for support

Agricultural risks can be broadly categorised into three layers 1, which either require actions by individual farmers themselves, or the government.

1) Normal variations in production, where fluctuations in prices and weather do not require policy support and can be managed by the farmer.

2) Marketable variations can be handled through market tools such as insurance, future markets or through cooperative arrangements among farmers.

3) Catastrophic variations could affect farmers over a wider area, and are therefore of government concern. This could include adverse weather for prolonged periods of time, or the outbreak of disease.

Some crossover between the layers can also occur (see "Aid package from European Commission for dairy crisis").

Managing normal variations does not require specific government response, so will not be discussed in detail.

Managing market variations

Agriculture is particularly prone to changes in the market. Demand for food is relatively stable, because food is a basic human requirement. However, supply is unable to adapt quickly because food takes time to be produced. As a result, even small changes in agricultural supply or demand can cause large variations in prices1, causing permanent market instability.

Market-based tools work specifically to reduce these price risks to farmers. These are derivative-based schemes, such as forward contracts, futures and options. Farmers can use contracts to hedge their risks to protect themselves against unforeseen decreases in prices.

Farmers can use futures and options2 contracts to hedge their risks to protect themselves against unforeseen decreases in prices. An options market gives the buyer the right, but not the obligation, to buy or sell a commodity at a fixed price in the future. With a futures contract, this trade is an obligation once it has been agreed, meaning the buyer must purchase the asset, and the seller must deliver it at a specific date. With a futures contract, both parties face high risks, as prices could move against them, but companies are okay with this as the commodity needs to be bought or sold anyway. Contrastingly, with an options contract, the seller has high risk, and the buyer has limited risk, as they are not obliged to purchase.

Farmers can also take out insurance to protect their crops, animals and plants (known as 'commodities'), and are compensated by an insurance company if they experience serious production losses. While the provision of these risk-pooling tools is made through the market3, many countries have heavy government involvement in agricultural insurance markets through subsidies in insurance premiums or the direct provision of insurance.

In the event of catastrophic risk which can lead to major and typically irreversible losses4, individual farms can do very little. At this point, it can become the role of the governments to provide a set of actions to address these losses.

Managing catastrophic variations

Adverse weather, animal and plant health and changes in markets can directly impact the profitability and viability of agricultural businesses1. Such events can lead to the European Commission, the UK Government or the Scottish Government making ad hoc payments available to farmers to compensate them for costs incurred.

Aid package from the European Commission for dairy crisis

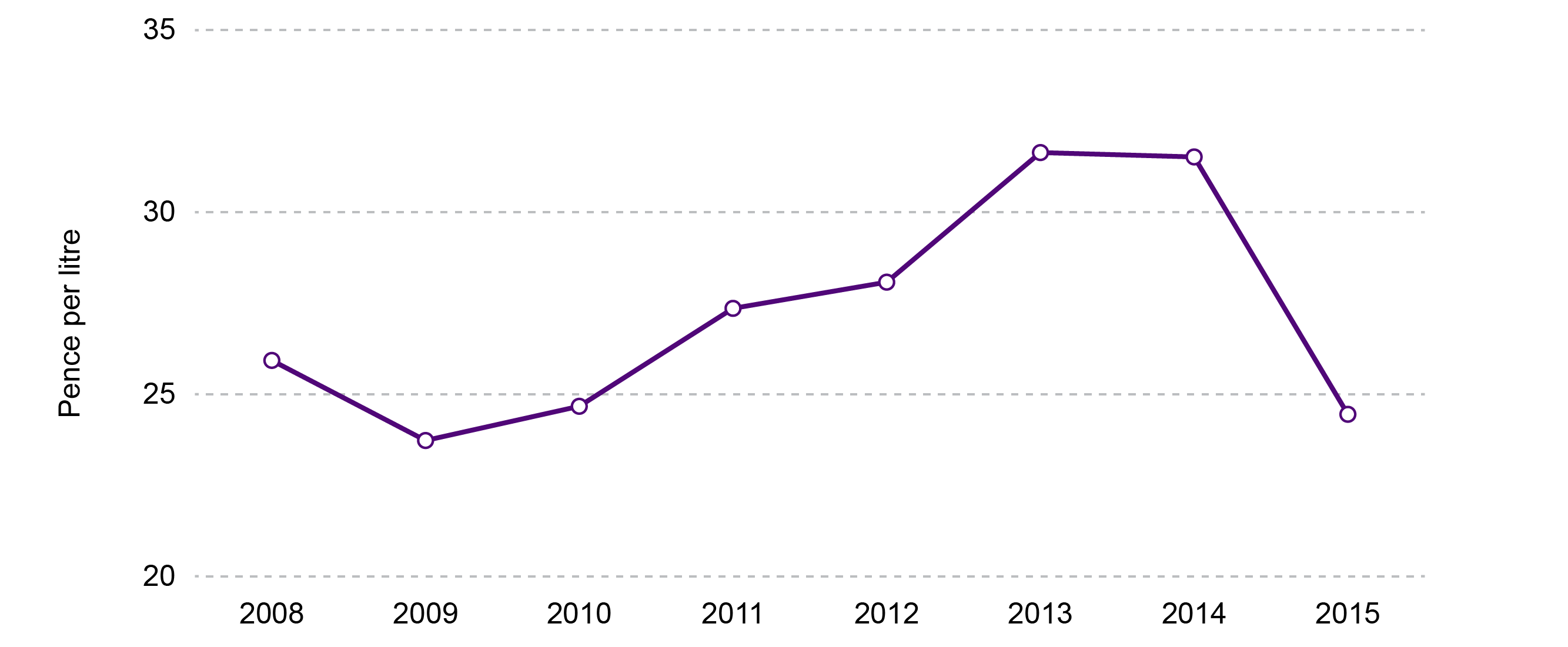

A combination of the abolition of EU quotas in 2015, the Russian embargo on agricultural products, and falling demand for milk in China led to a collapse in EU milk prices from 2014 to 20151 (Figure 2).

The European Commission recognised the crisis in the dairy sector and provided £350 million to be shared across member states to deal with this event. £2.4 million of this was allocated to Scottish farmers2. Other ways in which the EU provided assistance were through intervention buying and private storage aid, where the EU would buy commodities to take milk supplies from suppliers and smooth the market.

This example demonstrates that marketable variations and catastrophic variations can come under the same category.

Source- Defra provided data for report, which was presented in the telegraph3.

Ad hoc payments from UK Government in 2001

The outbreak of foot and mouth disease (FMD) in the UK in 2001 caused a crisis in British agriculture and tourism. The disease was first discovered in an Essex abattoir on 19 February 2001, and by 2 March, the disease had reached Scotland1.

In Scotland, 735,517 animals were slaughtered across 187 premises 2. The overall impact of the outbreak in 2001 reduced Scottish Gross Domestic Product by between £13.6 million and £29.8 million34.

A report by the Royal Society of Edinburgh2 stated that the full cost of compensation to farmers in Scotland was £154 million for the culls and additional £17 million for Livestock Welfare Disposal Scheme and the Light Lamb Scheme, compared to £1,120 million and £210 million for the UK . These funds were paid by Defra.

The report2 estimated that the costs to Scottish agriculture from FMD was around £231 million, and VisitScotland estimate the loss of gross revenue to tourism to be £200-250 million. Whilst compensation given to farmers covered slaughtering of livestock, the losses due to reduced tourism were not considered. A stakeholder from the Scottish Crofting Federation commented that crofters in the highlands and islands whose livestock were not affected by the disease, but who were affected by tourism reduction, suffered particularly in the outbreak.

Ad hoc payments from Scottish Government in 2018

‘The beast from the east’ brought extreme and adverse weather conditions during winter 2018, preceded by difficult summer conditions, and subsequent reductions in the production of animal feed (silage). As a result, lambing season in Scotland was severely disrupted, leading to losses of sheep including pregnant ewes. The National Fallen Stock Company estimate the storm resulted in more than 250,000 lamb losses in the UK in March April and May1; a record number

The Scottish Government unveiled a £250,000 package2 to reimburse farmers and crofters who have been affected by the adverse weather. This will be used to help offset the cost of retrieving and disposing of dead cattle and sheep, through the national fallen stock support scheme.

On longer term solutions for risk management, Fergus Ewing MSP , Cabinet Secretary for Rural Economy and Connectivity, commented3:

We need to identify longer term solutions to address these so I plan to convene a meeting of commercial feed companies and cooperatives to explore what more can be done to reduce shortages, increase resilience and create collaborative solutions.

Farmers who lost out on crops yields were also not compensated for loss of yields. Many crops, such as spring barley and spring wheat, are weeks behind sowing schedule. Brassicas and Lettuce which were due to go into fields have had to be thrown away 4.

The effectiveness of ad hoc payments

The European Commission 'Risk management: empowering our farmers with effective tools to manage risks post-2020' document indicates a shift away from ad hoc payments is needed1, stating:

One of the lessons learnt is that we cannot only rely on reactive measures. The agricultural sector has to become more resilient and take responsibility in addressing risks.

In the 2017 reflection paper on the future of EU finances2, the European Commission made a statement regarding the use of ad hoc payments in risk management:

Developments over recent years showed that the EU budget has had to provide recurrently ad hoc emergency support to react to specific developments such as the fall in dairy prices or the Russian ban on imports of certain agricultural products. There is hence a need to explore the right balance of instruments in the future common agricultural policy between policy measures and financial envelopes, grants and financial instruments, risk-management tools and other market arrangements to cope with risk and unexpected adverse events in the agricultural sector.

Whilst ad hoc payments are often necessary to counter the impact of unexpected events, there seems to be agreement that ad hoc payments should be the exception rather than the rule3, and efforts should be made to increase preparedness and resilience, strengthening pro-active strategies through other policy instruments. Moreover, any risk that could be insured should not be compensated with ad hoc payments3.

Risk management policies in the EU, the United States, Canada, Australia and New Zealand

The EU, the U.S., Canada, Australia and New Zealand all use risk management in their agricultural policy. The table below summarises each area's approach (Table 1). The Percentage Producer Support Estimate 1(%PSE) is an indicator of the amount of money which goes to farmers from consumers and taxpayers, arising from policy measures that support agriculture. A higher PSE means greater agricultural support from a country.

| Country/Jurisdiction | Guaranteed annual direct payment | Additional forms of support | Producer support estimate (%) |

|---|---|---|---|

| EU | Yes | Market tools/Direct Payments/Pillar 2 | 18.9 |

| U.S. | No | Crop insurance policies/commodity programmes | 9.4 |

| Canada | No | Business risk management programmes | 9.4 |

| Australia | No | Taxation measures and disaster relief | 1.3 |

| New Zealand | No | Natural disaster relief | 0.7 |

European Union (Common Agricultural Policy)

The CAP is composed of two pillars. Following a CAP reform in 2005, there are two main streams of CAP payments: one for direct income support (pillar 1) and the second for rural development (pillar 2). These have been discussed in previous briefings (SPICe briefing 17/12), and will be discussed here in the context risk management.

Pillar 1 (Direct payments)

Direct payments are guaranteed annual support payments to maintain farmers' income, and are paid to farmers for working farmland. These payments are a form of risk management, acting as a safety net by supplementing the main business income of farmers and crofters1. Whilst payments shield European farmers from fluctuations in markets, they don’t provide a means to tackle market volatility, nor do they respond to market variation 2. Direct payments can de-incentivise farmers' attitudes about risks, leading to more risky behaviour.

An EU-wide crisis reserve is also linked to direct payments. From 2018, the EU will reduce spending on direct payments exceeding €2000 by around 1.39%3, which will go into a crisis reserve, to cover any potential crises in agricultural markets.Unused money from the crisis reserve can then be reimbursed to EU farmers for direct payments over €2000, and reached a total of €433 million in 20174.

Pillar 2 (Scottish Rural Development Programme)

The 2014 CAP reform identified six key priority areas for pillar 2 to address, including risk management tools. A CAP-supported risk management toolkit was then developed, which provides the following 123:

Financial contributions to insurance premiums - for crop, animal and plant insurance against losses to farmers caused by adverse weather, disease or an environmental incident. In order to be insured, farmers need to pay a fee (called a 'premium') to the insurance company. The rural development programme of the CAP promotes the use of these forms of insurance by financing up to 65% of the premium costs 4.

Financial contributions to mutual funds - cash reserves built up by member states contributions over time, which can then be withdrawn by member states in the event of severe production losses caused by adverse weather, disease or an environmental incident. Financial aid is also promoted by the rural development programme to 65% of the costs, while losses should be higher than 30% of the average annual production in the last three or five years4.

Income Stabilisation Tool (IST) - enables compensation for farmers who experience severe income losses, exceeding 30% of the average annual income of the farmer in previous years6. This is similar to a mutual fund, although an IST will compensate farmers for income losses, rather than production losses. The rural development programme can be used to create an IST to compensate farmers.

The three instruments described above have been criticised as being weak options for member states1, rather than full-fledged programmes for farmers to deal with income and price volatility. As a result, there has been a low uptake by member states for this risk management toolkit.

Other reasons for low uptake of this according to the European Commission8 include the availability of other safety net instruments (i.e. direct payments) and other state aid schemes (i.e. ad hoc payments)8. Scotland has chosen not to make use of this risk management toolkit10, partially due to the small budget available after risk management moved from Pillar 1 to Pillar 2.

Defra commented11 that:

in Europe, in contrast [compared to the U.S.], many farmers were unaccustomed to such hedging instruments, because the CAP had historically supported prices and provided substantial subsidies."

Independently from CAP-supported schemes, many Member States have deployed their own risk management support mechanisms.

The CAP has been criticised for not integrating risk management into its core agricultural framework, with critics stating that risk management is considered ‘as an afterthought’12. Although CAP support for agricultural risk management has increased after the reform, the share of CAP funds being spent on crisis and prevention measures continues to be very low; less than 2% of the Pillar II funds and 0.4% of the total 2014-2020 CAP budget13.

United States Department of Agriculture

The 2014 farm act in the U.S. includes risk management tools as an integral component of national agricultural policy1. The U.S. farm act brought direct payment schemes to an end, so farmers no longer receive fixed payments per acre.

The main focusses of the farm act are now on market income and promoting the use of commodity and insurance programmes to address risk management 2. This means the government guarantees compensation for farmers for losses of crops or livestock, if yields or revenue fall below a specific level.

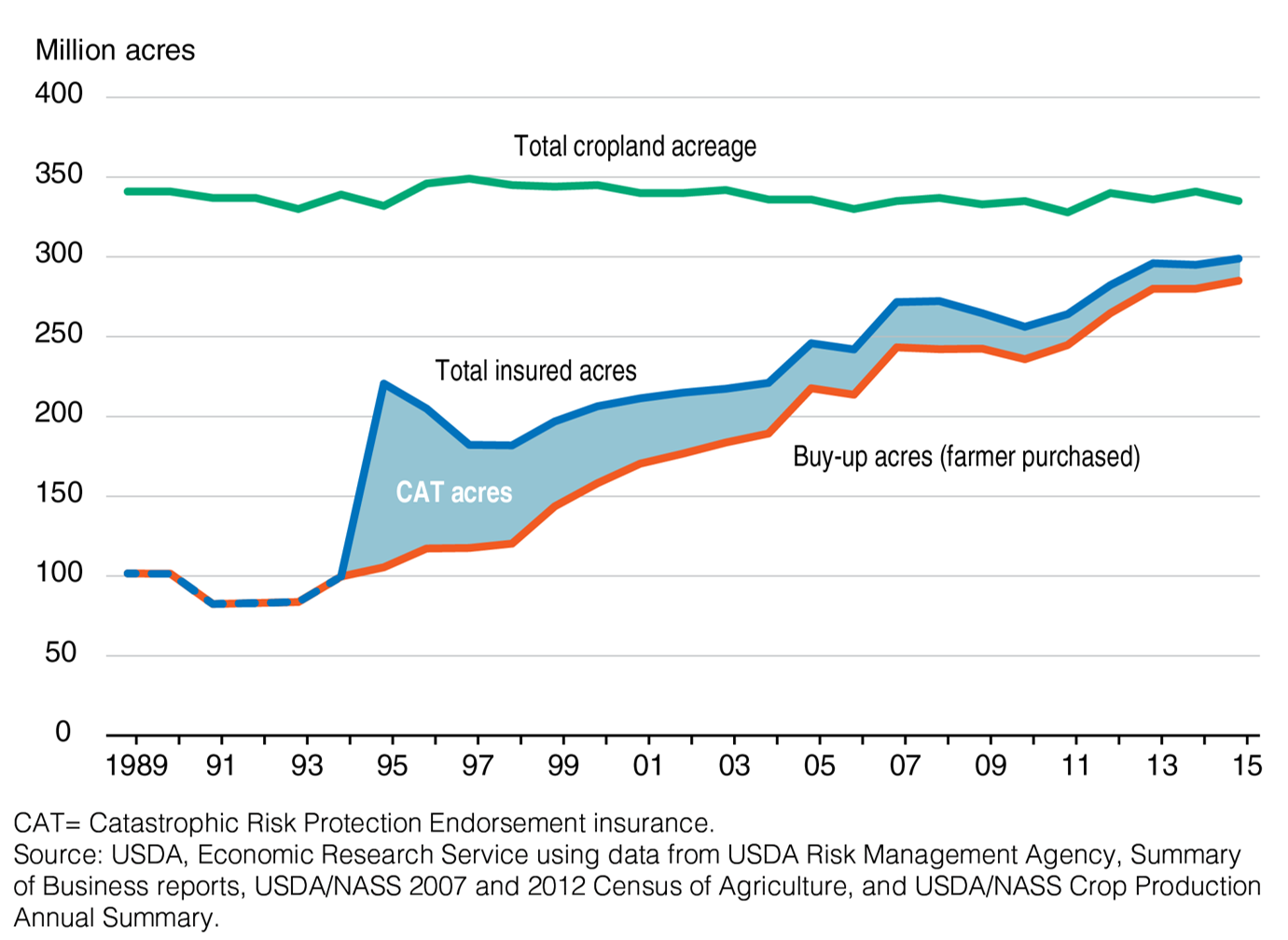

In total, the U.S. agricultural policy consists of around 60% insurance tools and no direct payments, whereas the CAP involves less than 1% insurance instruments and 60% income support through direct payments 3. The U.S. has the largest government subsidised agricultural insurance programme in the world4. As a result, the share of U.S. cropland insured has increased from less than 30% in the early 1990s to nearly 90% in 20155 (Figure 3).

The U.S. Agricultural Policy includes commodity programmes and crop insurance programmes.

Commodity programmes

These schemes support farmers' incomes when the revenue or prices of certain farm produced commodities, including crops and seeds, fall below certain reference levels. Instead of receiving direct payments, the primary producer picks one of two commodity programmes: Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC)1. The decision is one-time and irrevocable, remaining effective until 2018, when the farm act expires.

Agriculture Risk Coverage (ARC)

ARC gives payments to farmers when their total revenue (i.e. income) from certain commodities (such as crops or seeds) falls below 86% of a benchmark revenue. This benchmark is calculated as the average revenue either:

1) Across the whole county from previous years (ARC-County)

or

2) Across an individual farm from previous years (ARC-Individual).

ARC-Individual is designed to address a situation where individual farm yields may not correlate with the yields across the county, providing extra safety where ARC-County programmes would provide little assistance2.

Price Loss Coverage (PLC)

PLC provides payments on a commodity-by-commodity basis when annual national market prices for a covered commodity fall below a reference price, which has been set for each commodity in the 2014 U.S. farm bill. The programme is designed to address sharp declines in commodity prices. Unlike ARC, yields and historical prices do not factor into the payment calculation.

Crop Insurance programmes

Crop insurance schemes can cover both yield and revenue losses.

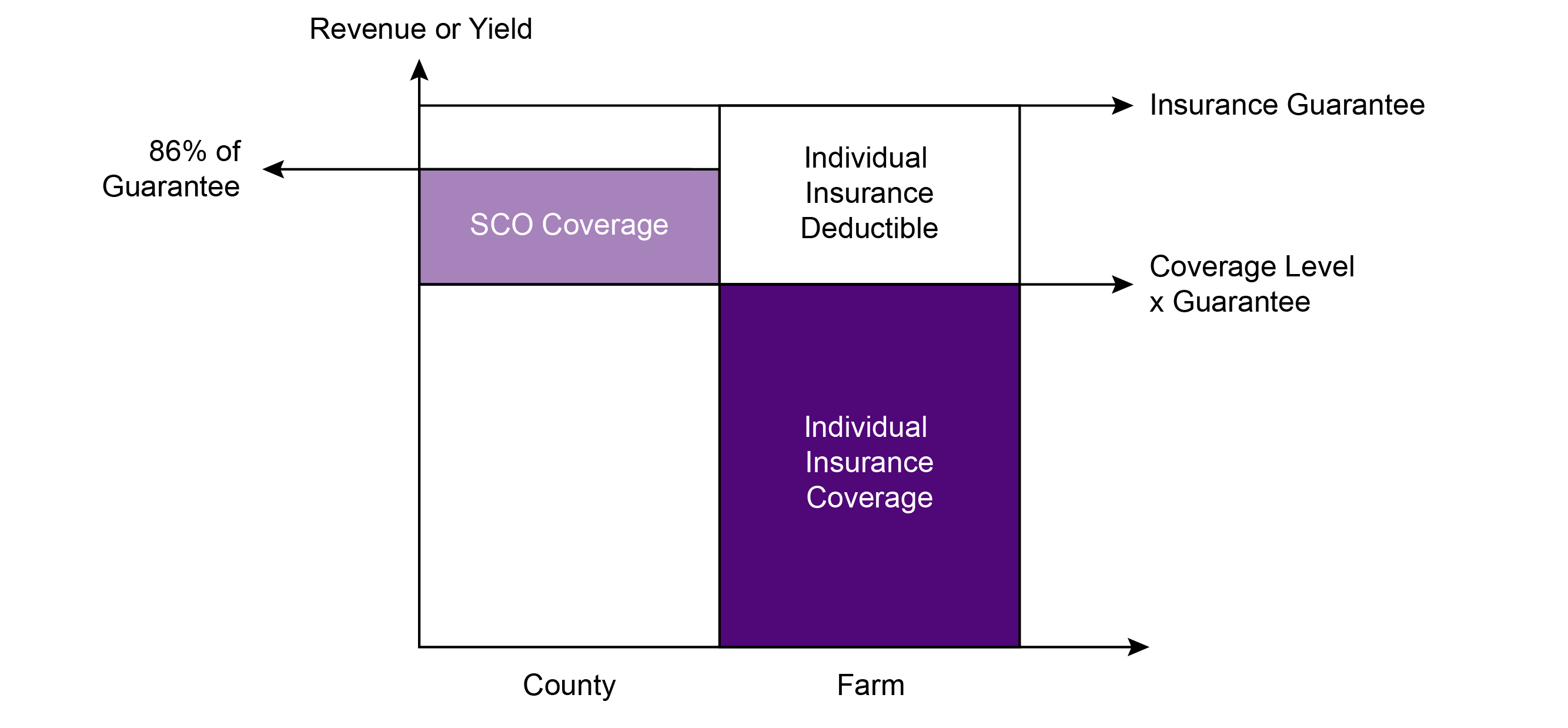

SCO is an add-on crop insurance providing supplemental coverage in producers’ underlying crop insurance policies, increasing protection to 86% of producers’ actual production history (Figure 4). For example, if a farmer has 75% guarantee coverage from an underlying insurance policy on their individual farm, the SCO can then cover the range from 75 to 86% (Figure 4). SCO can be used to supplement crops covered under the PLC commodity programme, but not ARC2.

Non-insured Assistance Programmes (NAP) are also available which provide financial assistance to producers of non-insurable crops.

Whole farm revenue protection

The whole farm revenue protection scheme acts as a safety blanket against risks, enabling farmers to insure historic revenue across all commodities on a farm under insurance policies4. This scheme rewards farms which produce a diverse range of commodities. Farmers can insure 50-85% of their gross revenue, and includes livestock and crops. This scheme benefits farmers who produce a commodity which is not common in a particular county, where there may not be an insurance policy in place. Moreover, if a farmer raises small amounts of several crops, insuring each individual crop may be time consuming.

Dairy Margin Protection Programme

The programme acts as a system of subsidised price insurance for dairy farmers which provides income to farmers in the event that national dairy margins fall below a level which is chosen by the producer5. The national margins are calculated by the USDA, by taking the national average milk price minus the average feed cost.

Canadian Agricultural Partnership

Lana Popham, the Minister for Agriculture in British Columbia, highlights how the security of Canadian farmers’ businesses are dependent on risk management policies1:

Canadian farmers are depending on the Partnership to deliver programs that help them grow their businesses through research, marketing and operational support, and protect their livelihoods through risk management programs.

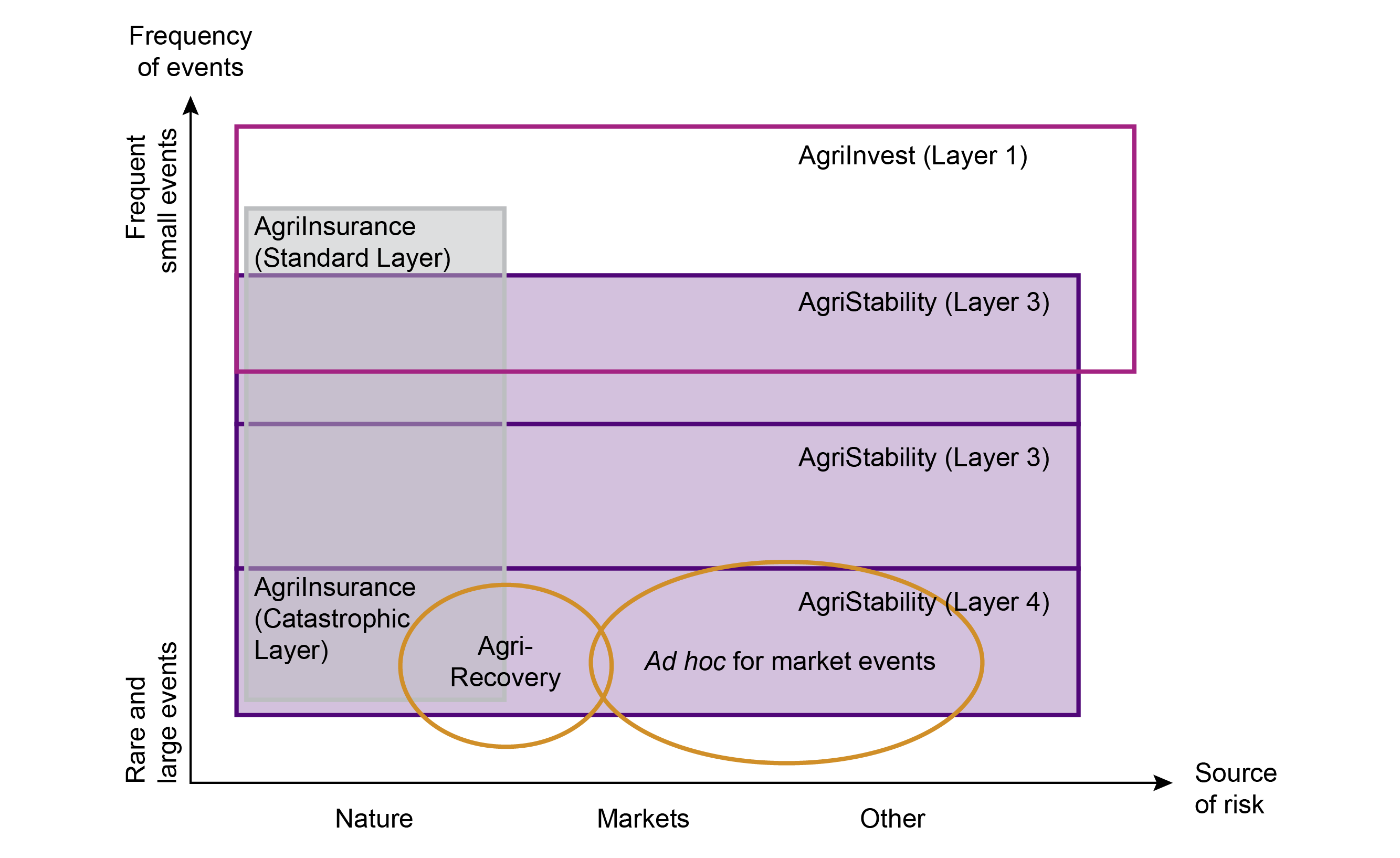

The Canadian Agricultural Partnership gives producers access to a suite of business risk management programmes to help manage significant risks which could threaten farm viability. Risk management is a key priority area in the next policy framework of Canada, which aims to improve the anticipation, mitigation and response to risks2. This has led to the development of different programmes to define different layers of public response to risk in agriculture. The programmes are not defined in terms of specific types of risk, meaning there can be overlap in terms of coverage and response (Figure 5).

AgriInsurance3 stabilises a producer's income by minimising the economic effects of production losses caused by natural hazards, covering cereal crops, horticultural crops and includes livestock insurance plans.

AgriStability4 helps Canadian producers cope with large margin declines, and guarantees producers at least 70% of their reference margin, which is calculated as an average over previous years.

AgriRecovery5 is a framework rather than a specific scheme, which helps producers with extraordinarily large costs of activities necessary for recovery following natural disaster events. The approach relies on the government declaring a disaster, and is triggered where there is need for assistance beyond existing programmes.

AgriInvest6 is a savings scheme providing cash flow to help producers manage small income declines, where the government matches deposits made by farmers. The programme helps to cover income declines and supports investments that help mitigate risks.

AgriRisk Initiatives7 supports the development of new risk management tools through federal, provincial and territorial governments.

Ad hoc payments are also administered for disaster level market events.

The implementation of each programme depends on the frequency of the event, and the source of risk. The AgriInvest programme has no triggering mechanism, and AgriRecovery and ad hoc payments are decided by provincial and federal governments subject to non-defined specific criteria.

Australia

Australia has gradually adopted a more market-oriented approach to risk management, with a more straightforward approach to agricultural policy, using existing infrastructure of the tax system to manage variable income1.

The Australian Government2 supports farmers to manage their business risks and to prepare for, manage and recover from adverse events and financial hardship. Prior to the late 1980s, Australia had modest risk management policies in place3.

Now, half of Australia's agricultural budget1 is spent on policy instruments which can prevent income losses for farmers, consisting of disaster assistance and tax concessions. Tax concessions enable farmers to defer their tax in years of hardship.

Examples of disaster assistance measures

Farm Household Allowances1. An income support payment paid fortnightly, and provided for up to three years for farmers experiencing financial hardship, which may have occurred as a result of a disaster. Payments are paid to meet basic household needs whilst farmers make decisions about the future of their farm businesses. The programme is uncapped and demand-driven2.

Managing weeds and pest animals3. Funding from the Australian Government to help manage the effects of pests and weeds in drought affected areas.

Farm Finance Concessional Loans Scheme4. Offers three concessional loan programmes to help farmers in times of difficulty, or to help farmers grow their business, which have subsidised interest rates. These include Dairy Recovery concessional loans and business improvement concessional loans. These can be a maximum 10 year loans of up to $1 million.

Rural Financial Counselling Service5. Provides free financial counselling to farmers, fishers, forest growers and harvesters and small related businesses who are suffering financial hardship. This initiative is funded by Australian, State and Northern Territory governments, and delivers intensive individualised support to each client.

Examples of tax concessions

Income tax averaging. Enables farmers to average out high and low income years and the tax payable over five years, putting farm businesses on a level playing field with other taxpayers who are more likely to have a steady income.

Farm management deposits1. A deferred tax savings scheme measure, enabling the primary producer to deal with fluctuations in income variability and market volatility. Farmers can reserve money during years of high income into a tax-free savings account, which can then be withdrawn during low income years. The deposits were designed to increase the self-reliance of Australian primary producers by managing financial risk.

Schemes similar to Farm Management Deposits have received policy interest in Ireland2. The Irish Creamery Milk Suppliers Association (ICMSA) believes there is an urgent case for the introduction of a farm management deposits scheme as a dairy income stability measure.

The president, Pat McCormack, said the operation of a scheme is a matter of urgency and must form part of next October's Budget 2019.

We can and will move our farming and agri-food sector forward – but that can only be done fairly and sustainably on the basis of policies and instruments that deal with the kind of ruinous price and income volatility that has proved so destructive in recent years.

We desperately need some financial tool that will help farmers to manage the inherent volatility within the sector, especially during years of low milk prices.

The solution has now been identified and it is squarely within the power of Ministers Donohue and Creed to recognise the answer and bring it forward in Budget 2019.

New Zealand

New Zealand's agricultural sector has become market and export-oriented, and domestic prices of agricultural products are aligned with world markets1.

In 19842, direct payments were abandoned for the agricultural sector. This was designed to improve productivity in agricultural sector and to encourage growth in the rest of the economy. Currently, in New Zealand, government support for agricultural production is the second lowest of all OECD economies2. Currently, payments by the government are only provided for animal disease control and relief in the event of large scale climate and natural disasters1.

New Zealand's risk related policies focus on two clusters5: risk assessment/communication and dealing with catastrophic risks.

Risk assessment/communication

The Government's priorities for risk management involve raising the awareness of farmers to risks, highlighting the importance of their own risk management. The government has no role to play with respect to farmers' price/market risks5. Insurance companies receive no Government subsidies, as well as their marketable risk management techniques, such as co-operatives, financial futures and options markets .

Catastrophic risks

Biosecurity New Zealand is an important area of New Zealand's agricultural policy, which is primarily responsible for protection against invasive species, and accounts for around 80% of the Ministry Agriculture and Forestry (MAF) total budget5. A national Bovine Tuberculosis pest management strategy is partially funded by the central government, including annual testing for farmers livestock, and any infected livestock can be slaughtered at a reduced rate.

Adverse events and recovery measures, such as the adverse events recovery plan, are put in place for periods of adverse weather, climatic events or natural disasters.

On farm adverse events recovery plan1

New Zealand offers a layered approach1 to catastrophic risk management, which require differentiated policy responses. Government assistance measures can be administered in small, medium and large-scale adverse events (Table 2).

Individuals and Rural communities are primarily responsible for co-ordinating response and recovery following adverse events. Once an event becomes too large for individuals and rural communities to manage, the central government can then take measures to help recover from the event, who determine whether the adverse event was small, medium or large scale.

An OECD report3 commented on the experience of New Zealand with the on farm events recovery plan:

The experience of New Zealand shows the importance of a balance between pre-determined rules and post-event decisions for provision of relief assistance. It has allowed the government to explicitly delimit its responsibility in advance of any catastrophic event, as well as to tailor assistance according to the severity of the event when it occurs. This eases political pressures and simplifies the decision-making process to provide assistance in the event of catastrophes.

Small-scale risk

This includes periods of disruptive weather which impact just a small number of farms. The first measure taken by communities is to organise a local response with their local government and their local rural support trust, and further central government assistance includes:

Tax relief assistance measures.

Working for families’ assistance, which is extra money received by working families if farmers' income changes after a disaster.

Labour assistance.

Financial assistance to farmers whose incomes become severely affected.

Financial negotiation and counselling services.

Medium-scale risk

These include adverse events which can impact on farms and farming families on a district/multi-district scale. Local responses are still expected from communities and regional organisations, but the government can also provide assistance as outlined previously and additional assistance:

Rural assistance payments to cover essential living expenses.

New start grants for families to permanently leave farming after an adverse event.

Technology Transfer Assistance grants for education workshops, meeting and media information to provide technical and financial advice on options for dealing with adverse events.

Funding to sponsor local community events aimed at boosting morale.

Facilitators can be appointed to coordinate initial stages of some recovery operations.

Enhanced labour assistance schemes to cover wages of extra workers and supervisors to help with recovery operations.

Travel and accommodation costs for volunteers.

Large-scale risk

Large scale events are defined as climatic or natural disasters which impact the regional and national economy. For such events, Central government lead the response and recovery phase alongside local government and may provide additional assistance to that previously outlined.

Special recovery measures can be implemented, including recovery measures which would reimburse costs for restoration of uninsurable on-farm infrastructure, re-establishment of uninsurable pasture, crops and forestry, and initial clean-up of silt and debris.

Assistance is capped at $250,000 per farm business.

| Scale of adverse event | ||||

|---|---|---|---|---|

| Small-scale | Medium-scale | Large-scale | ||

| Themes | Criteria | Assessment/Classification of the event | ||

| Risk management options | Availability of options | Readily available | Moderately available | No practical options available |

| Magnitude of event | LikelihoodScale of physical impact | FrequentLocal level | InfrequentDistrict/multi district level | RareRegional/national level |

| Capacity of community to cope | Degree of economic impactDegree of social impact | Local levelLocal level | District/multi-district levelDistrict/multi-district level | Regional/national levelRegional/national level |

| Possible government assistance | Localised event recovery measures | Localised event recovery measures+ Medium-scale event recovery measures | Localised event recovery measures+ Medium-scale event recovery measures+ Special recovery measures | |

Pros and cons of risk management strategies

Based on the policies described, the pros and cons for each risk management tool can be broadly categorised under three headings:

1) Direct payments, which act as a form of risk management under pillar 1 of the CAP

2) Government-subsidised insurance policies, which are heavily utilised in the U.S. and Canada1

3) Market-oriented agricultural risk management policy, such as the use of market based tools, which are used in Australia1

Importantly, these three strategies should not be considered in isolation. For example, insurance policies can often be triggered in response to market fluctuations.

1) Direct payments

Advantages of direct payments

Direct payments currently act as a safety blanket against risk, protecting producers from income volatility

Receiving direct payments of from the EU means Scotland can compete with other countries receiving direct payments, creating a level playing field1

Environmental payments from Pillar 2 alone are not guaranteed to cover farmers income (AHDB, personal communication)

Disadvantages of direct payments

Direct payments undermine the need to address risk, and may even encourage them to increase the amount of risk that they take on2

Not targeted on any particular market failure, and provide little value for money3 for the taxpayer

Subsidies can be trade distorting (AHDB, SRUC; Personal communications)

Payments don’t provide a means to tackle market volatility, nor do they respond to market variation2

2) Government-subsidised insurance

Advantages of government-subsidised insurance policies

Occasional pay-outs are generally cheaper than annual pay-outs1

Insurance schemes in the U.S. are counter-cyclical, so money for farmers goes up as prices go down (NFU, personal communication)

Very large uptake in the U.S.; 90% of acres are insured2

Disadvantages of government-subsidised insurance policies

In Canada, subsidised insurance has not deterred ad hoc disaster assistance3

Due to the variability of pay-outs to farmers each year, there are challenges for those managing public budgets (NFU, personal communication)

Counter-cyclical insurance schemes rely heavily on farm data from individual farmers which can take time to process, and cause delays in the administration of insurances (AHDB, personal communication)

Does little to mitigate risks from climate change or disease breakouts, and could lead to more risk taking by farmers, as it rewards failure1

Could increase levels of monoculture5 when only one type of crop is insured

Systemic risks could present a particular issue for government subsidised insurance, due to the probability that the insurer will face a large number of claims at the same time6

U.S. evidence suggests crop insurance could make farms less resilient to climate change7, and cause overuse of some resources, including water

3) Market-oriented strategies

Advantages of market-oriented agricultural risk management policy

Can lead to lower food prices1 (SRUC, personal communication)

Can generate a more efficient agricultural sector2, responding to consumer needs and adapting to the emerging needs of society

Reduces the cost of subsidies3 to the tax payer

Markets solve the problem of uncertainty about future prices through contracting and futures markets4

Disadvantages of market-oriented agricultural risk management policy

Futures markets would be difficult to administer for livestock and dairy5 as they are perishable and expensive to transport

Farmers will need training on how to understand markets and use the information. Insurers and the financial sector will also need to be trained (NFU, personal communication)

Local prices may not correlate with world market prices6, so local producers or commodity users can't always rely on international futures markets

A clearer idea of trade policies post-Brexit is required before decisions are made on market-oriented approaches, such as futures contracts (AHDB, personal communication)

Agricultural policy is changing within the EU, the UK and Scotland. If the agricultural sector is to become more resilient, elements from these countries approaches to risk management might be worthy of consideration.