Mackerel

This briefing highlights the importance of mackerel to Scotland's fishing industry and economy. It provides an overview of the value of mackerel landed in Scotland's ports and how much is exported to, and imported from, countries within and outside the European Union. The briefing also takes a closer look at the "Mackerel War" to help outline policies governing access to fisheries, fishing quotas and how scientific advice is used to assess the sustainability of fish stocks.

Executive Summary

Mackerel is one of the most important and abundant species landed by the Scottish fishing fleet. It is a key source of income and employment in Scotland's rural communities.

The total value of mackerel landed by Scottish vessels in 2016 was £169 million. This accounted for 43% of the total value of all sea fish species landed.

In 2016, 84% (£82m) of mackerel landed in UK ports were caught by Scottish vessels. Of the total value landed in the UK's ports, 94% (£92 m) was landed in Scottish Ports. £86.4 million of mackerel was also landed abroad by Scottish vessels.

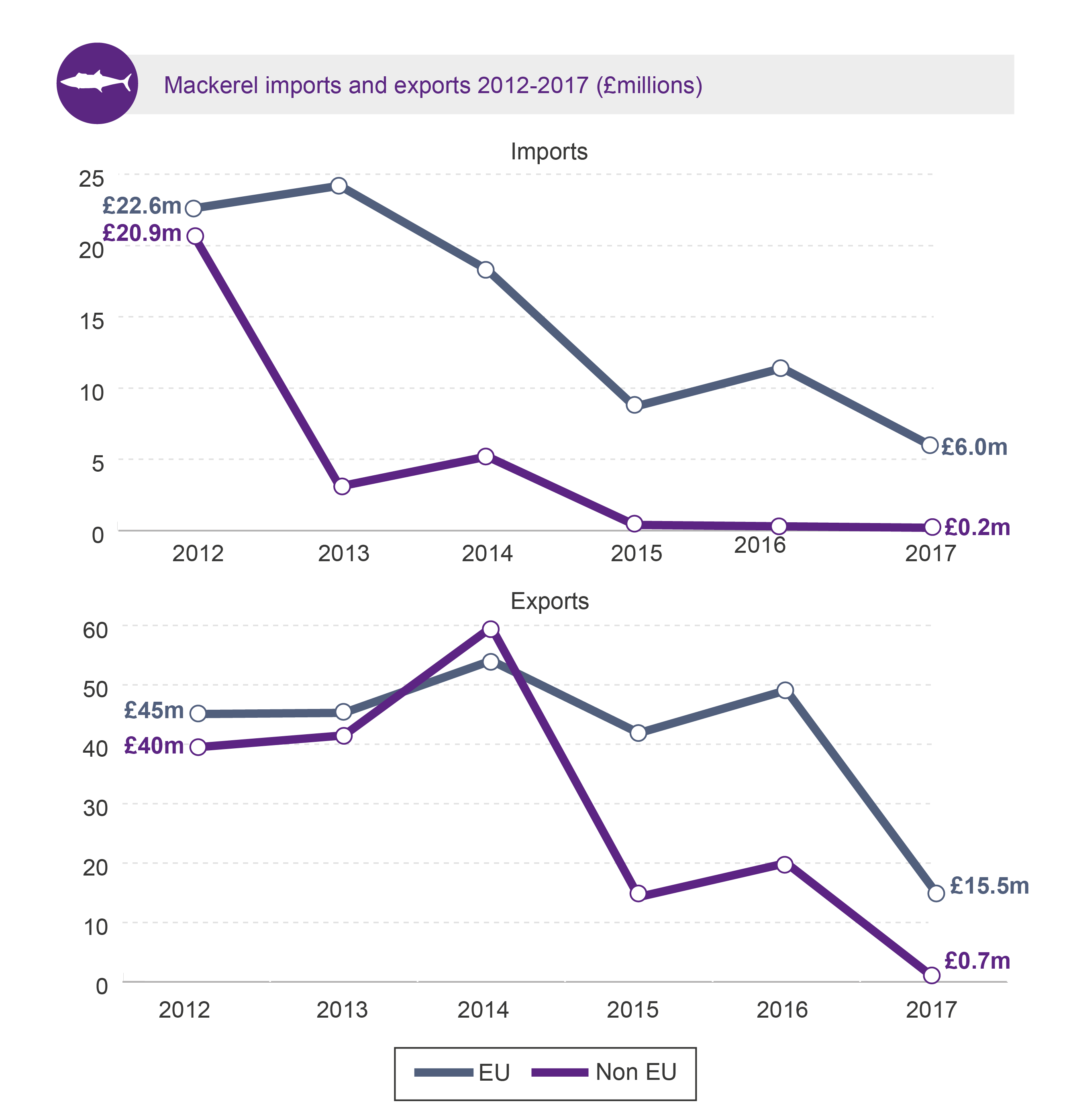

The UK is a net exporter of mackerel. According to HMRC overseas trade statistics, the majority of mackerel exports go to the European Union. Exports to the EU increased between 2012 and 2016 but fell sharply in 2017. Over the same period, exports to non-EU countries declined.

Taking into account the potential distortion of the ‘Rotterdam effect’ on export statistics, analysis conducted for Marine Scotland shows that the top ten destinations for mackerel exports in 2015 were: Norway, Netherlands, Denmark, Nigeria, Irish Republic, Poland, France, Romania, Germany, and Latvia. These countries accounted for 93% of the UK's pelagic landings in 2015 (including landings abroad).

Decisions on how much mackerel can be caught, and where, is currently determined through multilateral negotiations between contracting parties of the Northeast Atlantic Fisheries Commission (NEAFC).

Total Allowable Catch (TAC) is allocated between the EU and other independent coastal states based on scientific advice from the International Council for the Exploration of the Sea (ICES). ICES monitors the health of fish stocks and provides advice on how much can be caught while ensuring sustainability of stocks.

The EU’s share of the TAC is distributed among Member States under the Common Fisheries Policy (CFP).

When the UK leaves the European Union it will become an independent coastal state and the CFP will no longer apply. The UK will be required to negotiate the joint management of fish stocks with the EU and neighbouring non-EU coastal states through regional fisheries management organisations such as the NEAFC.

Between 2010 and 2014, disputes arose between the EU and Norway and Iceland and the Faroe Islands over access to mackerel stocks and the share of quotas. This led to mackerel catches rising above recommended limits leading to the species losing its Marine Stewardship Council certification of sustainability.

Within its Exclusive Economic Zone (EEZ), independent coastal states are entitled to control the exploitation of fish and shellfish. Under the CFP the United Kingdom ceded control of fisheries within the UK EEZ to the European Union.

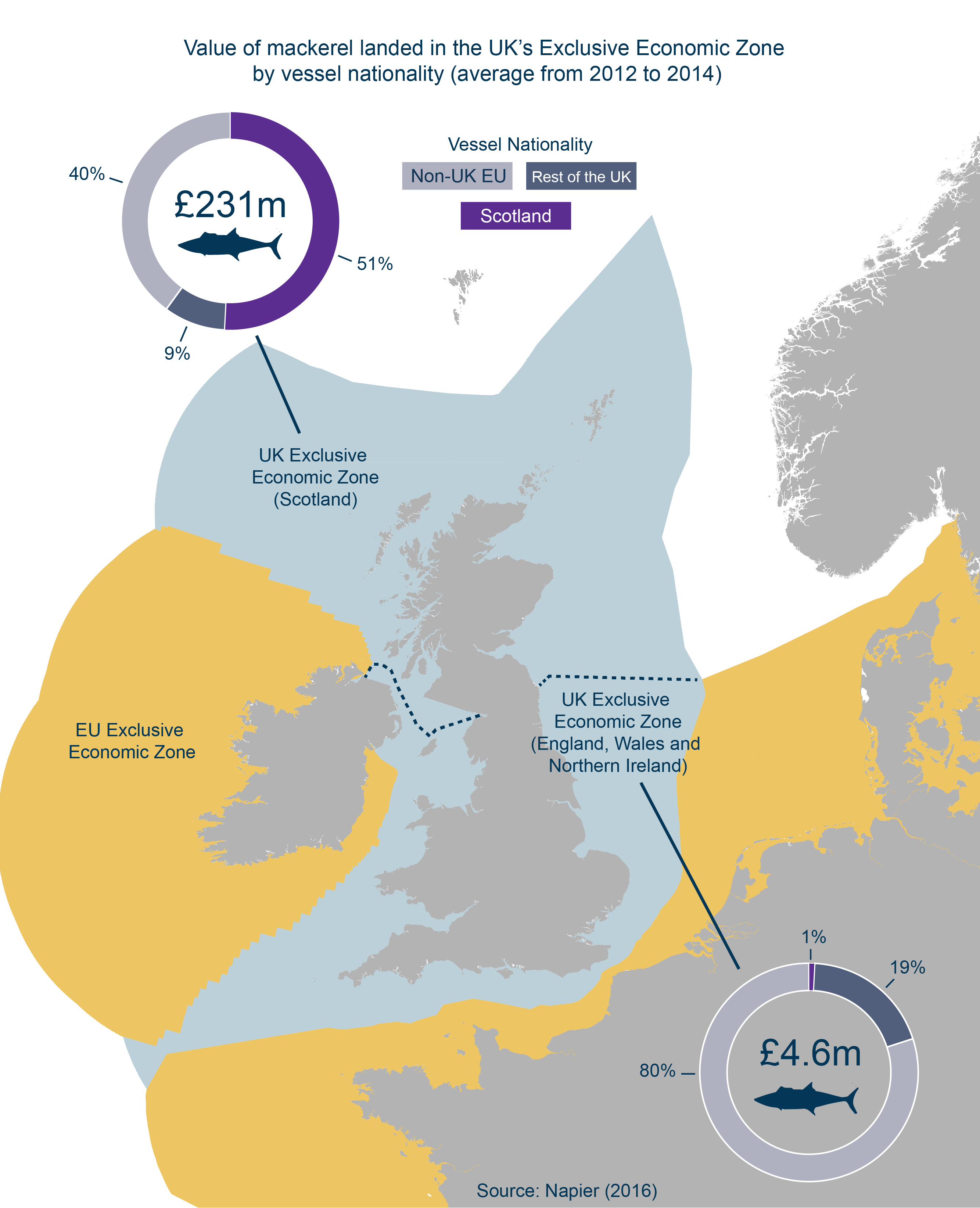

An Analysis of annual average landings in the UK's EEZ from 2012 to 2014 shows that 98% of mackerel landings were from the Scottish part of the UK's EEZ. Non-UK EU boats landed more than 110,000 tonnes of mackerel, worth almost £100 million, each year.

The economic value of Mackerel to Scotland

Mackerel is the most valuable stock to the Scottish fleet. In 2016, the total real terms valuei of mackerel landed by Scottish vessels was £169 million. This accounted for 43% of the total value (£391 million) of all sea fish species landed in 2016.

The real terms value of mackerel increased by 27% in 2016 compared to 2015. While the quantity of mackerel landed decreased by 6% the average price increased by 35%, from £664 per tonne in 2015 to £895 per tonne in 2016. 1

Landings by Scottish vessels in UK ports

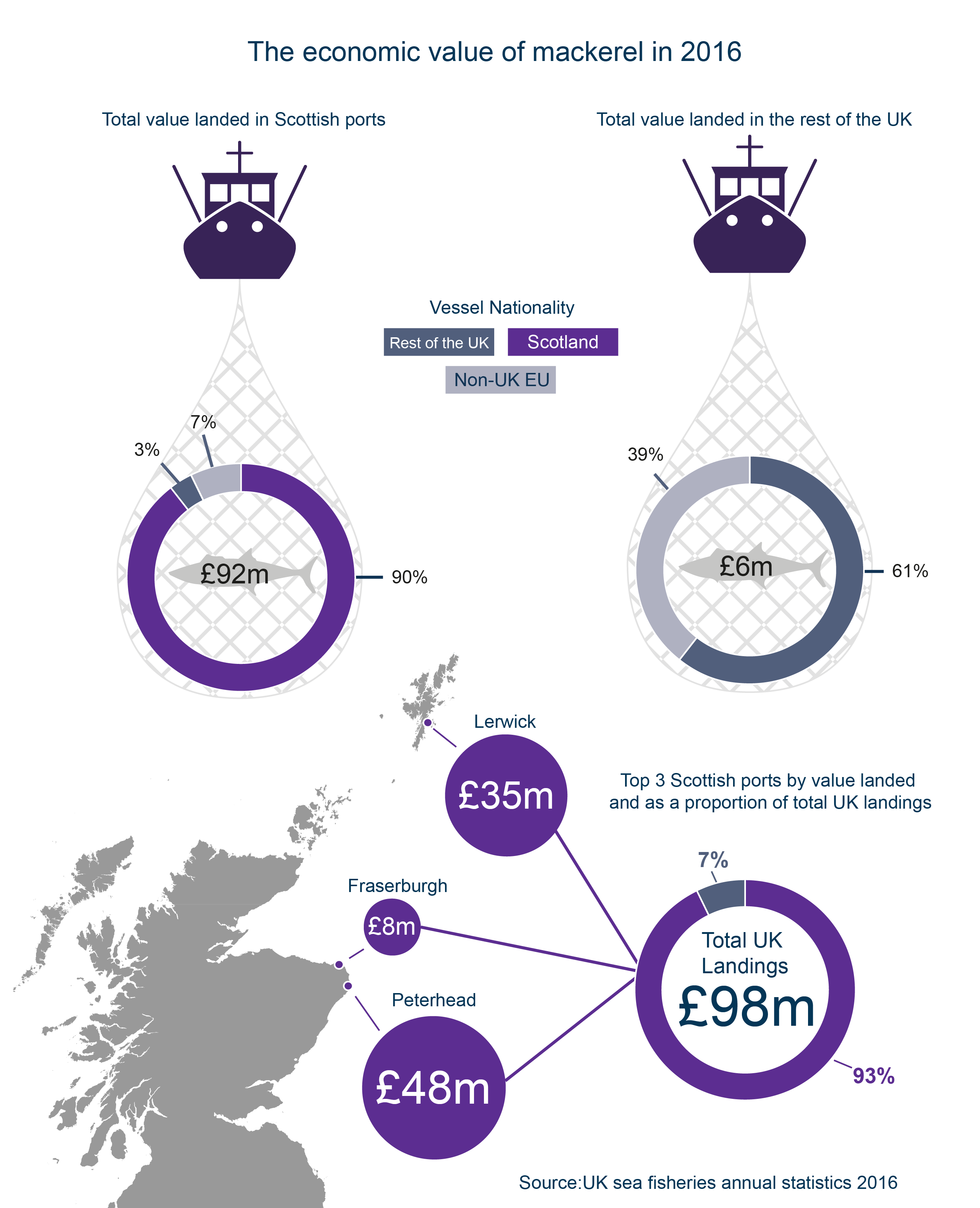

The Scottish fleet accounts for a large proportion of the UK's mackerel landings. In 2016, Scottish vessels landed £82 million of mackerel into the UK's ports. This accounted for 84% of the total mackerel landings into UK ports and 90% of mackerel landed into Scottish ports.

In the rest of the UK, a total of £6 million of mackerel was landed in 2016. The majority of this (£3.5 million) was landed by vessels from the rest of the UK and by Non-UK EU vessels (£2.3 million). Scottish vessels accounted for less than 1% (£2,400) of landings in the rest of the UK.

Of the total value landed in the UK's ports in 2016, 94% (£92 m) was landed in Scottish Ports. The ports of Peterhead and Fraserburgh in Aberdeenshire and Lerwick in the Shetland Islands accounted for 93% of the total landings in the UK. In 2016, these ports accounted for one third (1,610) of all fisherman employed in Scotland.1

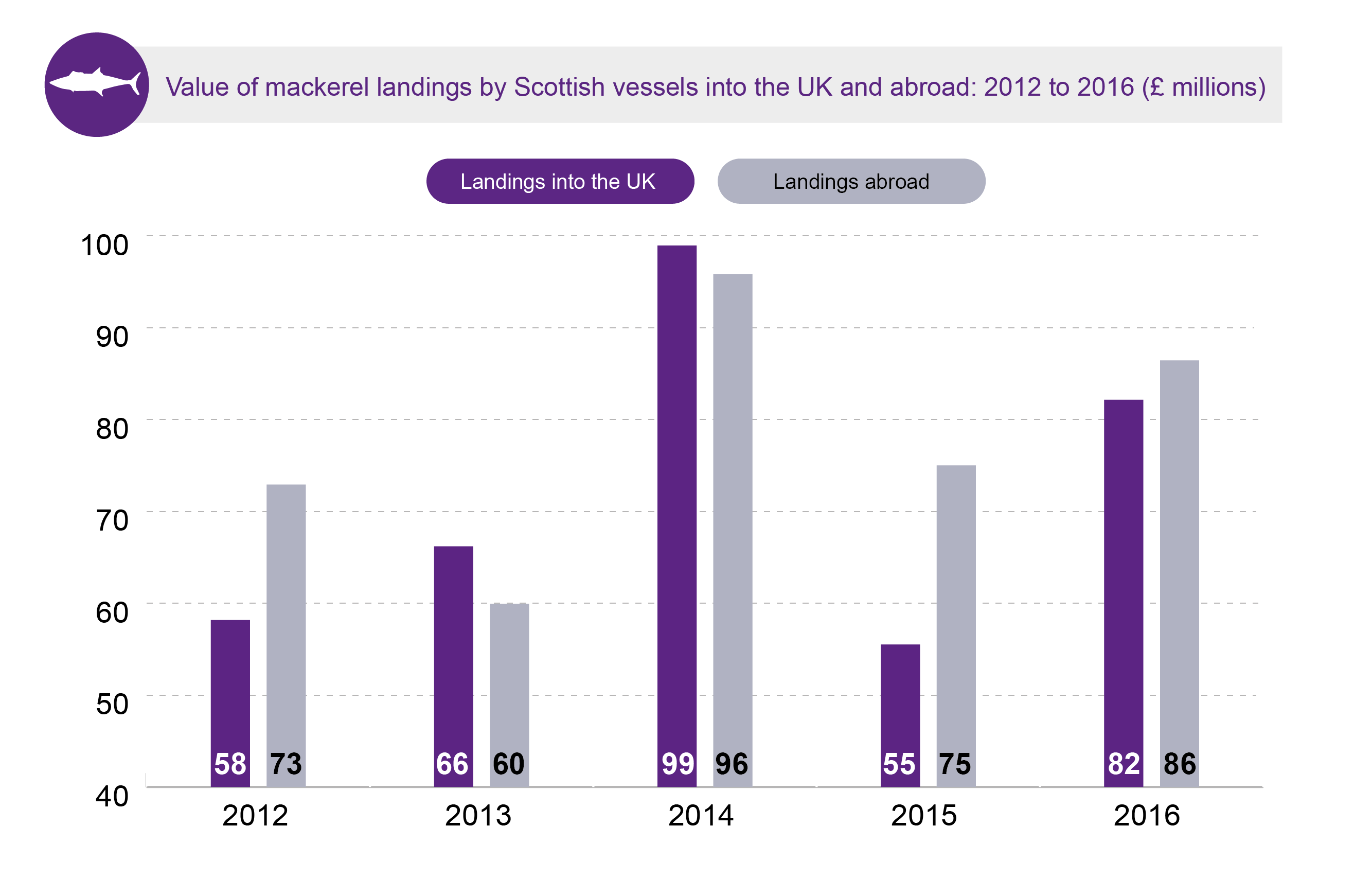

Landings by Scottish vessels abroad

In 2016, Scottish vessels landed over 92,000 tonnes of mackerel abroad worth £86.4 million. This exceeded the value of landings by Scottish vessels into the UK (£82.2 million). The figure below shows that the value of landings abroad compared to landings into the UK has fluctuated between 2012 and 2016. In 2013 and 2014, the value of landings by Scottish vessels into the UK exceeded the value of landings abroad. A significant proportion of UK mackerel exports are from landings abroad. More details on exports are provided in the next section.

Import and exports

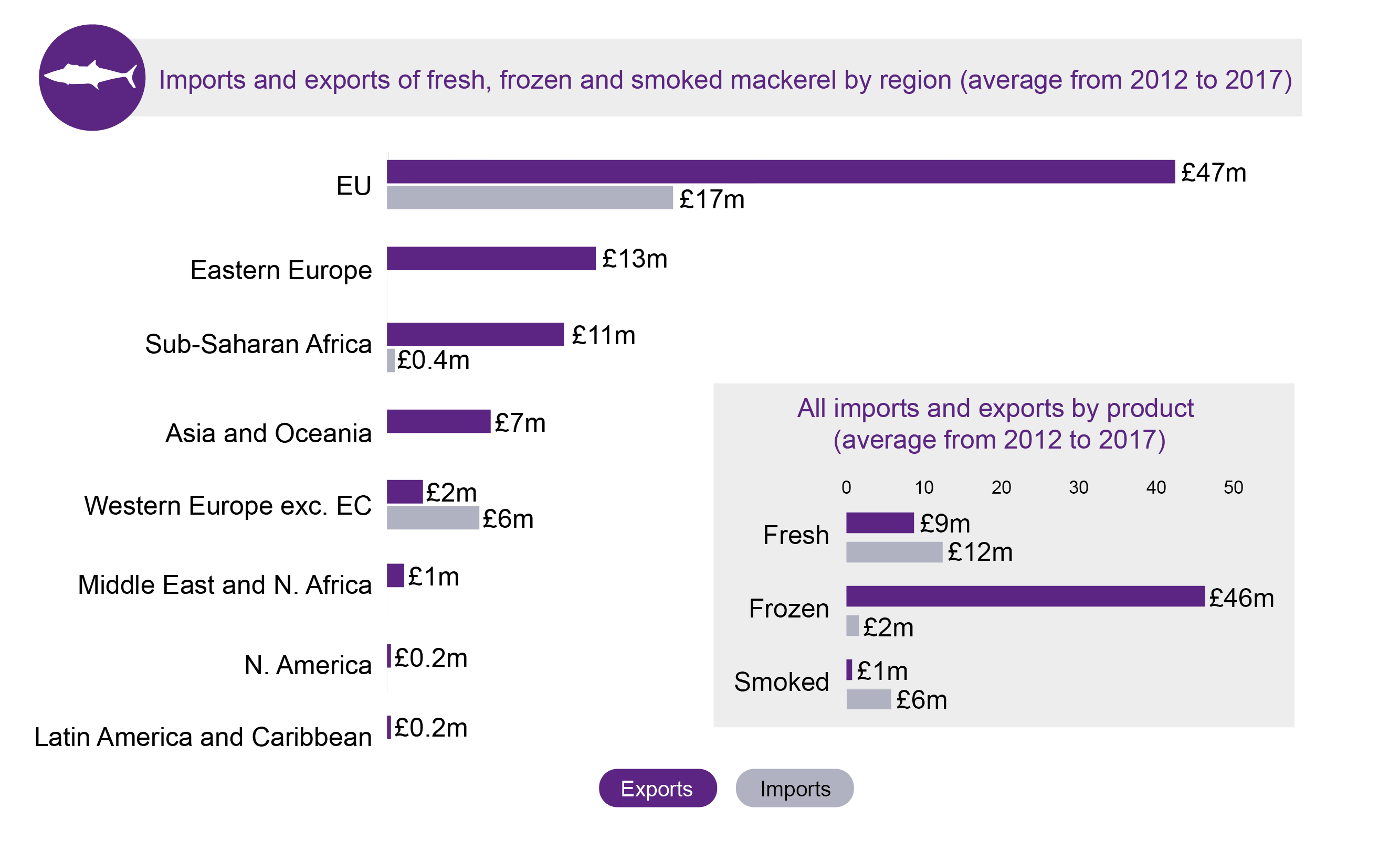

The majority of mackerel landed in the UK is exported overseas. According to figures from HMRC overseas trade statistics, the largest export market is the European Union.

The majority of mackerel exported is frozen. The following statistics are taken from HMRC overseas trade statistics:1

From 2012 to 2017, on average just under £42 million of mackerel was exported to the EU annually. The EU accounted for 59% (£251 million) of total exports of mackerel over the same period.

The Netherlands accounted for the largest share of exports within the EU with an average of £13.3 million exported each year from 2012 to 2017. These figures may be overestimated due to the "Rotterdam effect" (explained later in this briefing). This may also lead to an overestimate of exports to the EU.

Prior to 2015, Eastern Europe was the largest export market outside of the EU with an average of £21.9 million each year from 2012 to 2014, primarily to Russia and Ukraine.

Since 2015, sub-Saharan Africa has become the largest export market outside of the EU. An average of £5.6 million was exported to this region from 2015 to December 2017, primarily to Nigeria.

The loss of the Russian export market in 2015 was caused by a ban on imports of EU agricultural products. The Russian Federation introduced import restrictions as a response to trade sanctions imposed by the EU following Russia's annexation of the Crimean Peninsula.

From 2012 to 2017, the UK was a net exporter of mackerel. On average, 65% more was exported each year by weight than was imported.2The figures below show the average value of mackerel imports and exports taken from HMRC overseas trade statistics.i HMRC do not provide separate statistics for Scotland. However, over 90% of mackerel available for export in the UK is landed in Scottish ports.

Imports of mackerel from EU and non-EU countries steadily declined between 2012 and 2017. Exports to EU and non-EU countries were comparable between 2012 to 2014 but have diverged since. From 2012 to 2016, exports to EU countries increased overall from £45 million to £49 million but fell sharply in 2017 to £15.5 million. Between 2012 and 2017, exports to non-EU countries declined overall from £40 million to £0.7 million. The decline in export since 2014 may partly be due to the decline in the Total Allowable Catch.

HMRC overseas trade statistics do not take into account the ‘Rotterdam effect’. This may lead to overestimates of exports to the EU.

What is the ‘Rotterdam effect’?

Dutch trade flows are over-estimated because of the so-called ‘Rotterdam effect’ (or quasi-transit trade): that is goods bound for other EU countries arrive in Dutch ports and, according to EU rules, are recorded as extra-EU imports by the Netherlands (the country where goods are released for free circulation). This in turn increases the intra-EU flows from the Netherlands to those Member States to which the goods are re-exported.

It has been argued that the pattern of trade between the UK and other countries has been distorted by the Rotterdam effect. An analysis by the Office of National Statistics (ONS) estimated that 50 per cent of all goods exported to the Netherlands were re-exported to non-EU countries. It also estimated that the Rotterdam effect would account for around four percentage points of the UK’s exports of goods.56

Based on export data analysis conducted for Marine Scotland to account for exports through UK vessels landing directly abroad and the ‘Rotterdam effect’ the top ten destination for mackerel exports in 2015 were:

Norway

Netherlands

Denmark

Nigeria

Irish Republic

Poland

France

Romania

Germany

Latvia.

These top ten destinations accounted for 93% of 2015 pelagic exports (including landings abroad).

Almost 60% of total UK mackerel exports were comprised of landings abroad, with the remainder being processed or handled in the UK before being exported (primarily as frozen). The final export destination of landings abroad are not known, for instance, landings into Norway by UK vessels may in turn be exported to the EU market once processed (pers. comm. Marine Scotland).

About Mackerel

The mackerel (Scomber scombrus) is a pelagic fish. Pelagic fish live in large shoals occupying open waters at mid-water to surface depths. The diet of mackerel can vary with the area and the season. They feed on small crustacea, juvenile fish such as sandeel, herring and Norway pout. Some pelagic fish species such as mackerel are migratory. Mackerel migrate from the spawning areas west of Ireland that they occupy from March through to July, to the North Sea for the winter. 12

At one year old, only a small proportion of females are mature and able to spawn, while more than half can spawn at two years old. By the time they reach three years old, most mackerel are mature. Female mackerel shed their eggs in about 20 separate batches over the course of a spawning season. An average-sized fish produces around 250,000 eggs. Juvenile mackerel grow quickly and can reach 22 cm after one year and 30 cm after two years.

Mackerel Stocks

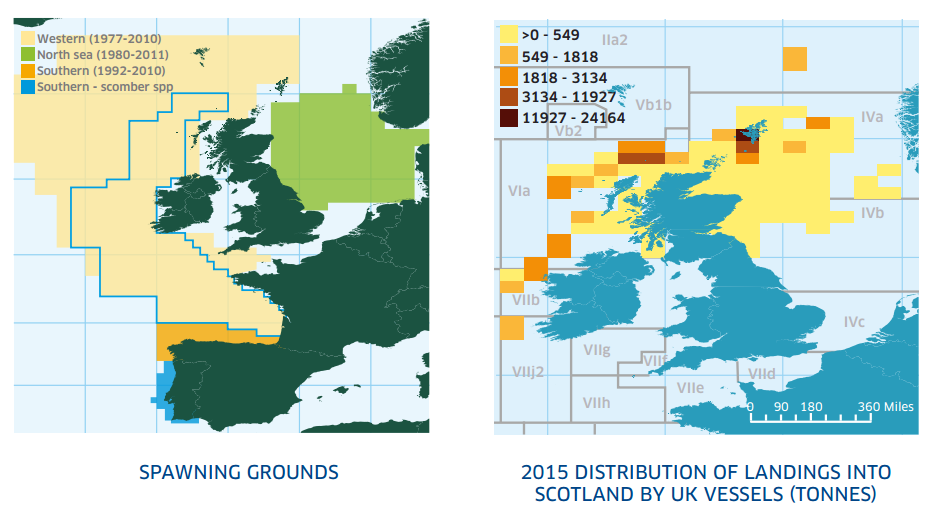

The mackerel caught in the North Sea belong to two different stocks - the North Sea and the western Atlantic. This separation is based on differences in the timing of and the areas used for spawning. The North Sea and Western stocks mix together during the autumn and winter in the northern North Sea. In January the North Sea stock migrates south to spawn in the central part of the North Sea from May until July and the western stock migrates down the west of the British Isles to spawn.

The western mackerel stock is found over a vast area near to the continental slope, where shallow waters of continental shelf transition into deeper ocean waters. These fish spawn between March and July, mainly to the south and west of the British Isles. When spawning is finished, most of them move to the feeding grounds in the Norwegian Sea and the northern North Sea where they mix with the North Sea stock.

The western stock mackerel travel long distances between the feeding grounds and the spawning areas. Over the past 20 years, the pattern of their southerly migration has changed dramatically in both timing and route. In the 1970s and 1980s this movement occurred in late summer and autumn with the fish passing through the relatively shallow waters of the Minch. Over recent years the migration pattern has gradually changed to occur later in the year and further offshore. Some studies have suggested the northwards shift in North Atlantic mackerel stocks is related to increased seawater temperature.12

The pattern of the return northerly journey, after spawning, has remained relatively constant. The boundaries of the spawning areas have also slowly changed, with an increase in spawning activity in the north of the area and to the west of the shelf edge.3

The figure below shows the location of spawning grounds of different mackerel stocks on the left panel and the distribution of mackerel landings in tonnes into Scotland in 2015 on the right panel.

Policy Context

A short summary of key legislation governing UK and Scottish fisheries is provided below. More detailed information on policy and the implications of leaving the EU for Scottish fisheries can be found in SPICe Briefing SB 17/21.

Marine Scotland is responsible for controlling the activities of all fishing vessels operating within the Scottish zone, as defined by the Fishery Limits Act 1976 and the Scotland Act 1998.

The Common Fisheries Policy

Scotland's fisheries are currently governed by the EU through the Common Fisheries Policy (CFP). The CFP is a set of rules for managing European fishing fleets and for conserving fish stocks. Designed to manage a common resource, it gives all European fishing fleets equal access to EU waters and fishing grounds out to 200 nautical miles and allows fishermen to compete fairly.

The CFP aims to ensure that fishing and aquaculture are environmentally, economically and socially sustainable and that they provide a source of healthy food for EU citizens. The current policy stipulates that between 2015 and 2020 catch limits should be set that are sustainable and maintain fish stocks in the long term.

The CFP was first introduced in the 1970s and went through successive updates, the most recent of which took effect on 1 January 2014 (see SPICe Briefing SB 14/49).1

How much can be caught?

The North East Atlantic mackerel fishery is managed by agreements between the EU and other coastal states that are contracting parties of the Northeast Atlantic Fisheries Commission (NEAFC). The current contracting parties of the NEAFC are:

The European Union

Denmark (in respect of the Faroe Islands and Greenland)

Iceland

Norway

Russian Federation

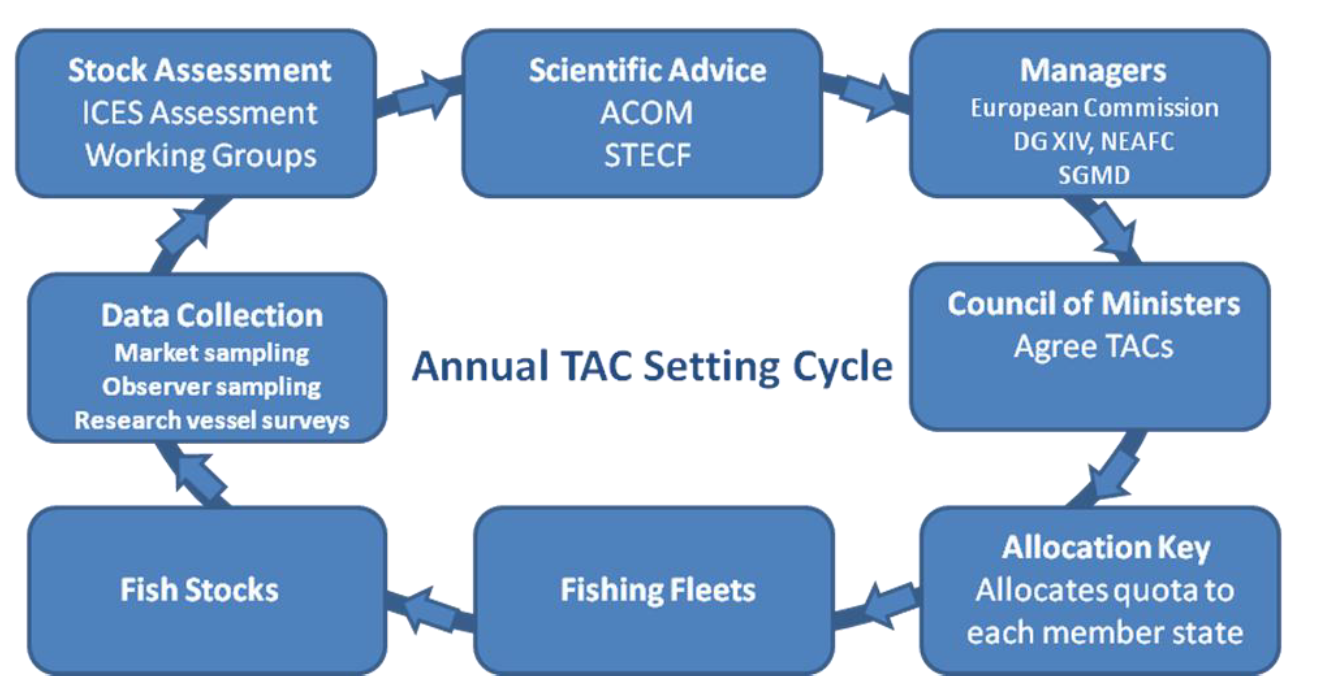

The quantity of fish that can be caught each year is set by the Total Allowable Catch (TAC) negotiated between contracting parties of the NEAFC. This number is based on scientific advice on the current size of stocks and estimated future stock levels for individual species published each year by the International Council for the Exploration of the Seas (ICES).

Once the TAC has been agreed between the EU and other coastal states, the EU’s share of the TAC is distributed among member states in the form of national quotas in accordance with the objectives of the Common Fisheries Policy (CFP). For each stock a different allocation percentage per EU country is applied to establish a share of the quotas. This fixed percentage is known as the relative stability key. EU countries can exchange quotas with other EU countries.1

What is 'relative stability'.

Relative stability is an allocation key used to share out fishing opportunities between Member States. It was established in 1983 on the basis of historic catches, the loss of opportunities for some Member States as a result of the general extension of 200 nautical mile limits in 1976; and the need to protect particular regions where local populations were especially reliant on the fishing industry. The relative stability share has remained constant over time.2

TACs are set on an annual cycle shown in the figure below. The ICES approach for assessing fish stocks is explained later in this briefing.

When the UK leaves the EU, it will become an independent coastal state and will no longer be governed by policies under the CFP. The UK will be required to jointly manage fish stocks through agreements between the EU and other neighbouring coastal states through bilateral and multilateral agreements.

Norway, the EU and the Faroe Islands agreed a TAC of 817,797 tonnes for North East Atlantic mackerel in 2018. This is a 20% reduction from the quota for 2017 of 1,020,996 tonnes. ICES advice recommended a 35% reduction in the North East Atlantic mackerel quota.34

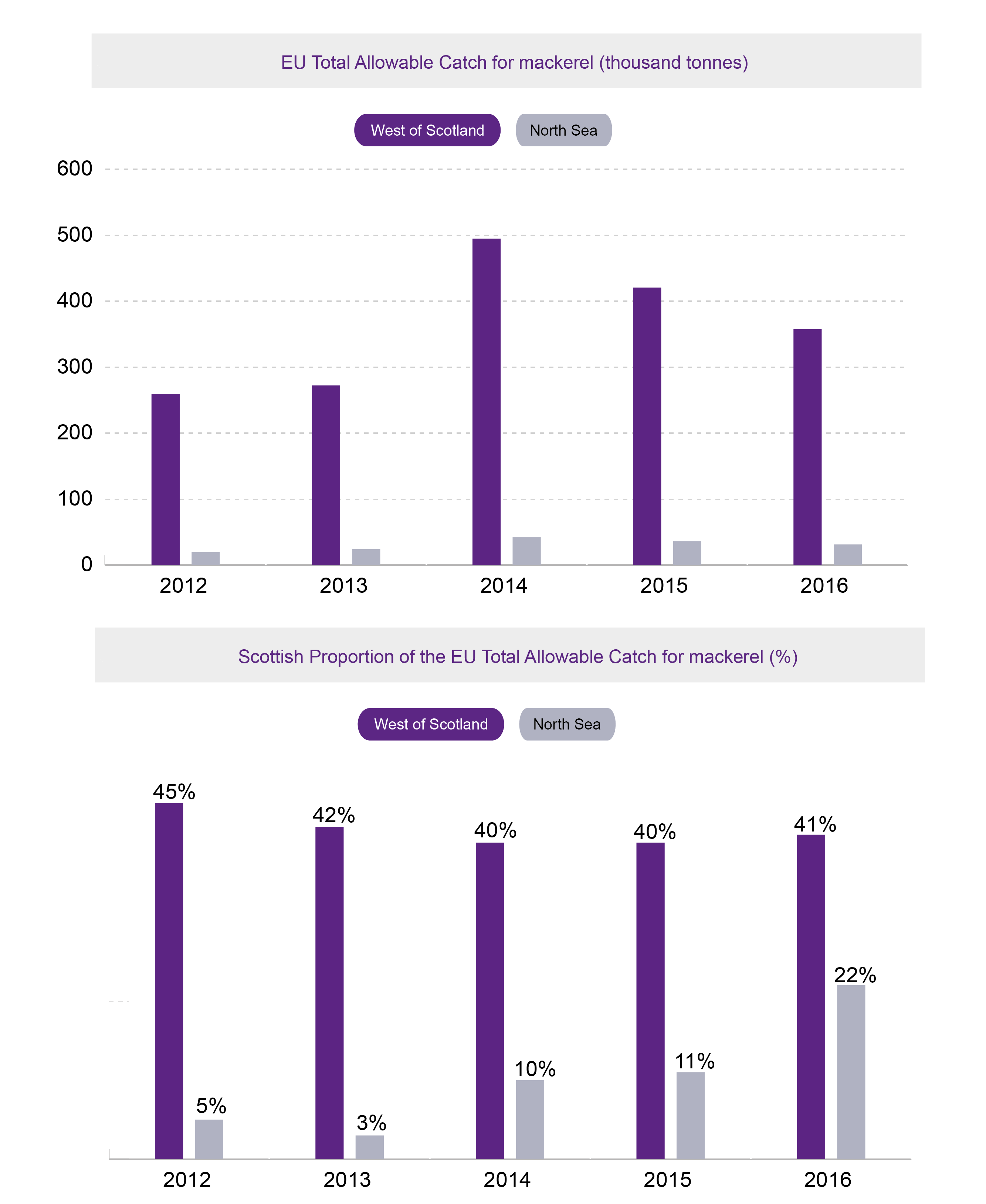

The figures below show the TAC for mackerel for the Western Scotland and North Sea regions and Scotland's share of the TAC between 2012 to 2016. Between 2013 and 2014 there was an increase in the TAC for North East Atlantic Mackerel following the 'Mackerel War' (see the following section).

The TAC increased by 82% from 272,317 to 494,941 tonnes for the West of Scotland and by 75% from 24,221 to 42,304 tonnes for the North Sea. Since 2014, the TAC has decreased by 28% (137,354 tonnes) and 26% (11,063 tonnes) respectively. Scotland's share of the TAC in the West of Scotland remained relatively stable between 2012 and 2016. However, in the North Sea region Scotland's share of the TAC has increased from 5% in 2012 to 22% in 2016.

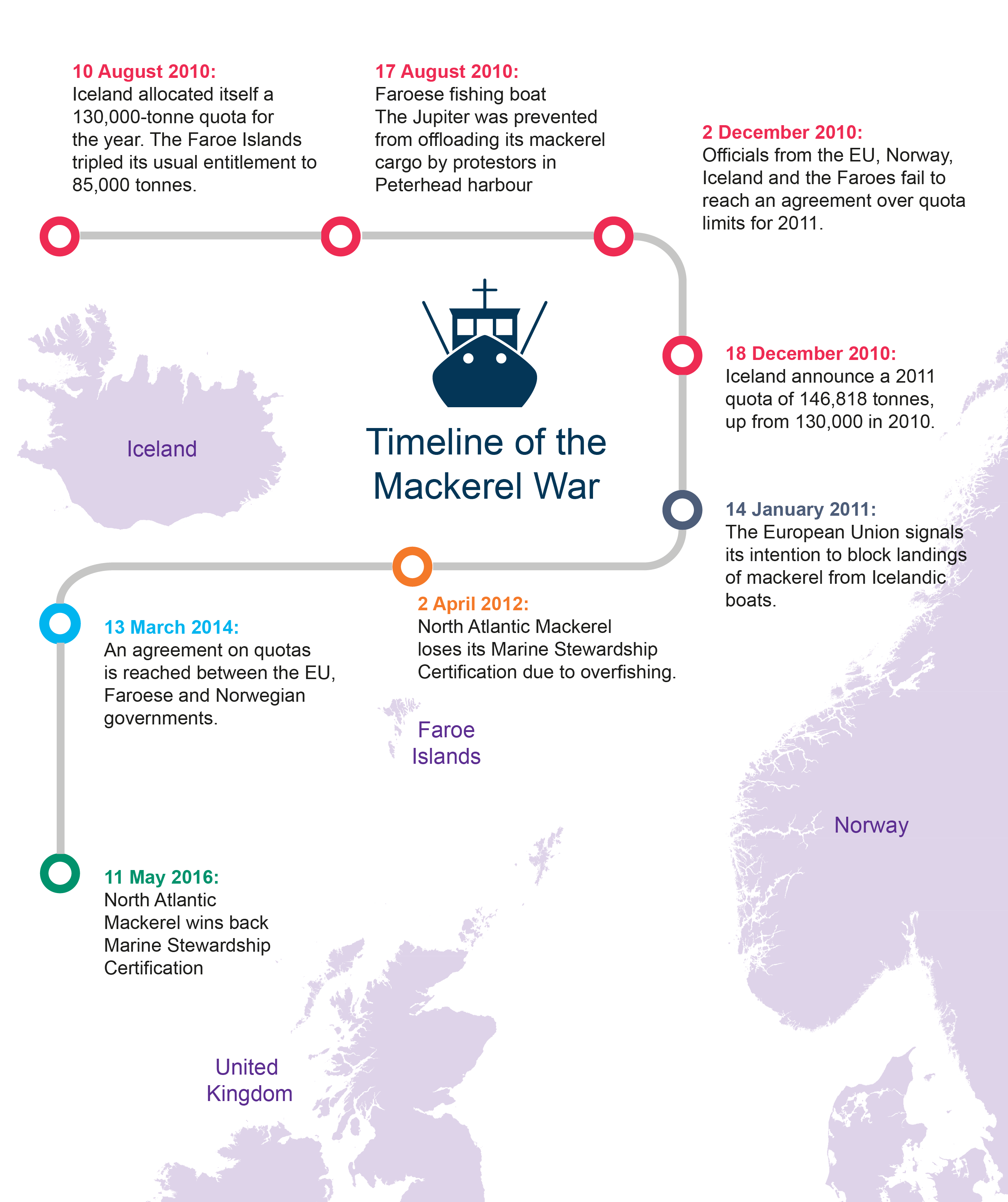

Case Study: "The Mackerel War"

The Mackerel War refers to a period from 2010 to 2014 when disputes arose over mackerel quota levels set between the EU, Norway, Iceland and the Faroe Islands. Prior to 2006, Iceland had landed very little mackerel. In 2010, Iceland allocated itself a 130,000-tonne quota, up from 36,000 tonnes in 2007. The Faroe Islands also tripled its entitlement to 85,000 tonnes. The increased quotas raised concerns over the sustainability of the mackerel stock.1

In response to a parliamentary question about Iceland's quota increase on 2 August 2010, the Cabinet Secretary for Rural Affairs and Environment, Richard Lochead, stated:

The actions of Iceland and Faeroes in setting unilateral total allowable catches (TACs) for mackerel in the North East Atlantic are irresponsible and risk the future sustainability of the stock, which in turn could have serious impacts for the Scottish Pelagic Fleet.

Iceland and the Faroe Islands justified their quota increase arguing that the mackerel stock had migrated north in recent years into Iceland's Exclusive Economic Zone. It was also claimed that more traditional target species such as cod and herring were in decline, justifying the need to target mackerel.21

In 2012 the Marine Stewardship Council (MSC) announced that North Sea and North Atlantic mackerel would no longer be allowed to carry Marine Stewardship Council accreditation as they no longer viewed these fisheries as sustainable. After a series of failed talks, the dispute was eventually resolved in 2014 when it was agreed that Norway and EU nations would take 71.8% of the TAC with Iceland and Russia taking 15.6% and the Faroe Islands 12.6%.4

Following the dispute a bilateral agreement was negotiated between the EU and the Faroe Islands. This included a quota exchange agreement and an access arrangement allowing vessels from the Faroe Islands to catch some of their quota in EU waters rather than in Faroese waters. In return, EU vessels were able to catch some of their quota in Faroese waters.

The Scottish pelagic sector expressed dissatisfaction with the agreement, maintaining that the bilateral deal heavily favoured the Faroese. Ian McFadden of the Scottish Pelagic Processors Association stated:

“We are extremely concerned about the current access arrangements because the quality of mackerel is better in our waters. Furthermore, Faroese boats are financially penalised by their own government if they land this mackerel into Scotland.

“This means that Faroese processors are benefiting from fish caught in Scottish seas, to the detriment of our own processing industry based in Shetland and the North East of Scotland.”5

An independent analysis of the utilisation of the 2016 EU-Faroe bilateral agreement conducted by Seafish found that Faroese vessels landed 32,974 tonnes (83% of the quota) from EU waters worth an estimated £27.8 million. Over the same period, UK vessels did not land any mackerel from Faroese waters. 6

In 2016, the Marine Stewardship Council reinstated sustainable certification of the fishery after a two-year assessment.7

The figure below summarises key events and nations involved in the Mackerel War.

Sustainability

Disputes surrounding the mackerel war led to a significant increase in the amount of mackerel caught by countries outside the fleets certified by the Marine Stewardship Council (MSC) and the breakdown of international agreements aimed at managing the stock. This resulted in two years of catches above the limits recommended by scientific advice and all seven MSC mackerel certificates being suspended in 2012.

Following suspension of MSC status, an international coalition of mackerel fisherman came together through the Mackerel Industry Northern Sustainability Alliance (MINSA) to prove the sustainability of the North Atlantic mackerel stock. MSC status was restored in May 2016 after a two-year scientific assessment of the mackerel stock.1

ICES fish stock assessments

The International Council for the Exploration of the Sea (ICES) is a global organisation of scientists and marine institutes responsible for providing scientific advice for the sustainable use of oceans. ICES provide advice on fish stocks to the European Commission for setting the annual Total Allowable Catch for individual species within European fisheries.

A key measure of the health of fish stocks is the spawning stock biomass (SSB) which is the measure of the mature fish population. Specific biomass reference points are defined in order to guide fisheries managers and other stakeholders in their decisions on how much can be caught within sustainable limits. These include:

Biomass limit (Blim): below this limit, fish recruitment (the number of juvenile fish reaching a size or age to be caught) is impaired. When the SBB falls below this limit the stock is considered unsustainable.

Precautionary approach (Bpa): the precautionary limit is set to have a low risk of the stock falling below the biomass limit and takes into account uncertainties in stock assessments.

Maximum sustainable yield trigger (MSY Btrigger): the largest average catch or yield that can continuously be taken from a stock under existing environmental conditions. This is normally equal to, or higher than Bpa. When biomass goes below the MSY Btrigger, ICES advises a reduction in fishing levels.2

The figure below shows the spawning stock biomass and reference points for mackerel from 1980 to 2016. The SSB declined below the maximum sustainable yield trigger in the early 90s but has recovered over the last decade.

![ICES Stock Assessment Database. Copenhagen, Denmark. ICES. [accessed 10/01/2018]. http://standardgraphs.ices.dk](/~/media/digitalpublications/spice/431/7396/Mackerelstocksustainability0101.png)

Who catches mackerel and where?

An Exclusive Economic Zone (EEZ) is a sea area defined by the United Nations Convention on the Law of the Sea (UNCLOS) that extends up to 200 nautical miles (371 km) from a country's coast. The outer limit of the EEZ, and the area of the EEZ, are sometimes referred to as the ‘200-mile limit’ or the ‘fisheries limit’. Within its EEZ, independent coastal states are entitled to control the exploitation of fish and shellfish. Under the CFP the United Kingdom ceded control of fisheries within the UK EEZ to the European Union.1

Control and exploitation of fish stocks within EEZs is subject to provisions in UNCLOS related to straddling fish stocks and migratory species. Where stocks migrate through, or occur in, more than one EEZ, there is an obligation for states to co-operate in their shared management.

The Scottish part of the UK EEZ can be seen as the part of the UK EEZ north of the agreed boundary between English and Scottish waters. It accounts for 61% of the total United Kingdom EEZ.1

An Analysis of annual average landings in the UK's EEZ from 2012 to 2014 conducted by the NAFC Marine Centre, University of the Highlands and Islands, shows that 98% of mackerel landings were from the Scottish part of the UK's EEZ. Mackerel was the only pelagic species where more than half of the landings from the Scottish part of the UK EEZ (60%) were caught by UK fishing boats (51% by Scottish vessels). Non-UK EU boats landed more than 110,000 tonnes of mackerel, worth almost £100 million, each year.1

The data available for this study do not allow an estimate to be made of the quantities of fish and shellfish caught in the UK EEZ by non-EU fishing boats, such as those from Faroe and Norway.1