The Scottish Crown Estate Bill

This briefing sets out the background to the Scottish Crown Estate Bill, now before parliament. It briefly describes the Scottish Crown Estate assets, the process of devolution, the results of a government consultation, as well as the proposals in the bill. These include taking account of wider objectives, such as environmental and social well-being, when deciding how to manage the assets. The bill also enables a number of different types of organisation to become asset managers.

Executive Summary

The Scottish Crown Estate comprises a diverse and extensive range of assets including:

37,000 hectares of rural land.

Salmon fishing rights on many Scottish rivers.

Around half the foreshore around Scotland.

Leasing of virtually all seabed out to 12 nautical miles.

The rights to offshore renewable energy and gas and carbon storage out to 200 nautical miles.

Retail and office units on George Street Edinburgh.1

In 2014 the Smith Commission2 recommended devolution of The Crown Estate’s management responsibilities and revenues in Scotland. The Scotland Act 2016 (section 36)3 made provision for a Treasury transfer scheme to transfer the functions of the existing Crown Estate Commissioners to Crown Estate Scotland (Interim Management). Provision was also made to amend Schedule 5 of the Scotland Act 1998 in which the the Crown Estate was defined as the property, rights and interests under the management of the Crown Estate Commissioners.

The transfer of management functions were put into effect on 1 April 2017 through:

the Crown Estate Transfer Scheme 2017 (to transfer management) and

the Crown Estate (Interim Management) Order 2017 (to establish a new interim body to operate until the long term arrangements as set out in the bill, come into effect)

The duties, as set out in the Crown Estate Act 1961 (to secure a commercial return but with regard to the principles of good management) continue to apply to the new Scottish interim body following devolution. The Scottish Crown Estate Bill (the Bill) however dis-applies the 1961 Act, and Section 7 of the Bill states that managers of the assets must maintain and seek to enhance the value of the assets and also the income they generate. Having said that they may do so in a way that is likely to contribute to a range of wider objectives including:

economic development,

regeneration,

social wellbeing,

environmental wellbeing,

sustainable development.

In practice, as set out in Section 11, this means that a manager will have a duty to obtain “market value” if they are selling or leasing an asset, but also the power to make a transaction for below the market value if it contributes to one of the objectives above.

The Smith Commission had recommended that “responsibility for the management of those assets will be further devolved to local authority areas such as Orkney, Shetland, Na h-Eilean Siar or other areas who seek such responsibilities.”

However Sections 3,4,5 and 6, of the Bill include a number of options as to who could be a manager:

Scottish Ministers

Crown Estate Scotland

Public authorities

Local authorities

Community organisation

Other provisions within Part 3 of the bill set out the powers of managers, for example that they can act as though they were the owner (Section 8), but also set out some restrictions placed on managers. For example Scottish Ministers need to give consent for the transfer of ownership of some assets (Section 10); Scottish Ministers may give directions about rent and other charges (Section 13); andthe bill includes provisions that leases shall be granted for no more than 150 years (Section 14).

Sections 20 to 25 in the bill set out requirements for planning and reporting. Given the diversity of the assets in the Scottish Crown Estate and the potential complexity of management and reporting arrangements, these include national and local arrangements.

Sections 26 to 34 put in place a number of measures aiming to deliver appropriate and consistent financial reporting and accountability. This includes for example the treatment of income and capital, the requirements for transferring sums of money between asset managers, and the ability of Scottish Ministers to make grants and loans.

What is the Scottish Crown Estate?

The Scottish Crown Estate comprises a diverse and extensive range of assets including the following:

37,000 hectares of rural land .

Salmon fishing rights on many Scottish rivers.

Around half the foreshore around Scotland.

Leasing of virtually all seabed out to 12 nautical miles.

The rights to offshore renewable energy and gas and carbon storage out to 200 nautical miles.

Retail and office units on George Street Edinburgh.

A closer look at the assets

The Crown Estate Transfer Scheme 2017 devolved the management of the assets to Scotland. The Scheme listed the assets in detail (as below):

| Assets as listed in Schedule 1 of the Crown Estate Transfer Scheme 2017 |

|---|

| Interpretation1. In this Schedule, “gas” has the same meaning as in section 1(6) of the Energy Act 2008(1). 2. In this Schedule, with the exception of paragraph 18, any reference to property, rights and land is a reference to property, rights and land owned by Her Majesty. Rural estate3. The Whitehill estate. 4. The Glenlivet estate. 5. The Applegirth estate. 6. The Fochabers estate. 7. 1 and 2 Kings Park Cottages, Stirling. 8. 10 the Homesteads, Stirling. Commercial estate9. The land known as 39 to 41 George Street, Edinburgh. 10. The lock-up garage at 3 and 5 West Thistle Street Lane, Edinburgh. 11. The land at Rhu Marina. Seabed etc.12. The land forming the seabed of Scottish coastal waters. 13. The rights in the Scottish zone— (a) of unloading gas to installations or pipelines, (b) of storing gas for any purpose and recovering stored gas, (c) of exploitation for the production of energy from water or winds, (d) of exploration in connection with any of those rights, and (e) for other purposes connected with the exploitation mentioned in sub-paragraph (c) including, in particular, the transmission, distribution and supply of electricity generated in the course of such exploitation. 14. The right in the Scottish zone of exploiting the seabed and its subsoil other than for hydrocarbons. 15. The land which lies between the high and low water marks of ordinary spring tides. 16. Rockall. Other property, rights and interests17. All rights— (a)of fishing for salmon in rivers and Scottish coastal waters, (b)to naturally occurring gold and silver, (c)to reserved mineral rights. 18. Any other property, rights and interests— (a) which are held by the Commissioners on behalf of the Crown; and (b) to which paragraphs (a) or (b) of section 90B(2) of the 1998 Act apply. |

Not included in the above list is the Fort Kinnaird Retail Park in Edinburgh1, which the Crown Estate Commissioners holds in partnership with a property trust. It should also be noted that it is the management of the assets that has been devolved, not the ownership. The assets are held ‘in right of The Crown’ and the Monarch remains the legal owner.

Crown Estate Scotland estimates that these assets are worth approximately £276m. The rural portfolio (including the four farming estates) is estimated to be the most valuable portfolio valued at £106m.

Rural assets

The rural assets include farming, forestry, minerals, and wild salmon fishing rights1

Assets include 37,000 hectares (around 91,000 acres) of land in rural Scotland; the vast majority let for a variety of uses including farming, residential, commercial, sporting and mineral operations. This includes the Glenlivet and Fochabers estates in Moray, the Applegirth Estate in Dumfries & Galloway and the Whitehill Estate in Midlothian.

Crown Estate Scotland (Interim Management), which trades as Crown Estate Scotland, manages 5,000 hectares (around 12,000 acres) of commercial forestry, mostly in Glenlivet2Forestry assets on these estates are managed directly by Crown Estate Scotland rather than being let.

Crown Estate Scotland grants leases to commercial mineral operators to exploit minerals found on its four rural estates. In addition, they manage the rights to naturally occurring gold and silver (known as Mines Royal) across most of Scotland. In a few specific areas these rights have been granted away.

The rights to fish for salmon and fish of the salmon kind are part of ancient rights held by The Crown in Scotland. Crown Estate Scotland manages around 140 river salmon fishing tenancies, on around 60 rivers across Scotland.

Coastal assets (harbours and ports)

Crown Estate Scotland manages around half of the foreshore and most of the seabed out to the 12 nautical mile limit1. This includes working closely "with local authorities, businesses, coastal communities and other partners" to:

"Give occupation rights to Crown foreshore and seabed for projects providing marine infrastructure, e.g. ports and harbours, marinas, bridges, cables, pipes, moorings and dredging.

Help coastal communities manage their local marine resource, for examples, through local authority regulating leases and mooring associations.

Support marine leisure tourism by providing expertise and funding for strategic research at a local and national level."

Marine assets

As well as managing leasing of the seabed out to 12 nautical miles, Crown Estate Scotland also manages the rights to offshore renewable energy and carbon and gas storage out to 200 nautical miles from the shore. Within the 12 nautical mile limit, Crown Estate Scotland awards and manages leases for telecommunication and electricity cables, oil and gas pipelines, offshore renewable energy projects, fish farms and ports & harbours.

Crown Estate Scotland states that its role in offshore renewable energy is that of "landlord, catalyst and supportive partner". Marine Scotland is responsible for environmental considerations, regulatory compliance and assessing consent applications. MeyGen tidal power development in the Pentland Firth is the first commercial scale tidal stream array in the world. This £10 million investment is now part of the Crown Estate Scotland portfolio.

Crown Estate Scotland awards and manages offshore wind leases, but also works with developers through pre-planning and consenting to construction. Robin Rigg in the Solway Firth, with 180MW of installed capacity, is currently the only commercial scale offshore wind farm in Scottish waters but there are several other sites in construction or in planning. Crown Estate Scotland has now started to consider if and how to issue new leasing rights for commercial-scale fixed and / or floating offshore wind projects (100 MW+) 1.

Crown Estate Scotland also provides licences to give developers rights to lay, maintain and operate cables and pipelines on the seabed up to 12 nautical miles from the shore. This includes oil and gas pipelines, electricity and telecommunication cables.

Aquaculture assets

Crown Estate Scotland currently leases around 750 sites to fish farm operators to grow finfish and shellfish 1. Aquaculture operators require a seabed (or foreshore) lease from Crown Estate Scotland of two types:

When businesses want to explore areas for potential development they may apply to the Crown Estate for a Lease Option Agreement (LOA). This secures the area of seabed, while planning permission and other licences are sought.

Once all relevant consent and licences have been granted for the site, the Crown Estate will then grant a seabed lease.

Rents for fish farms are reviewed every five years by an independent expert. Rent levels are set based on the net gutted weight for finfish. The current charge for salmon is £27.50 per tonne, whilst Outer Isles farms (Outer Hebrides, Orkney and Shetland) receive a 10% reduction to reflect their higher costs. For shellfish such as mussels, grown on ropes, the charge is 20 pence per metre with a minimum charge of £135 per annum).

However, Crown Estate Scotland is not a regulator and has no statutory function in relation to fish farming. As set out in the Scottish Government's independent review of Scottish Aquaculture consenting2, fish farming operates in a complex regulatory environment. Other bodies involved include:

local authorities - in relation to planning permission, and environmental impact assessments

Marine Scotland - for example to secure a Marine Licence (through the Licensing Operation team), and an authorisation to operate an aquaculture production business through the Fish Health Inspectorate

Scottish Environment Protection Agency - to secure a controlled activity regulation licence.

Urban property

Crown Estate Scotland premises at 39-41 George Street, Edinburgh, is managed by Savills and currently occupied by retailer Anthropologie on the ground floor with office spaces on the upper floors.

At the point of devolution the Crown Estate held an interest in Fort Kinnaird Shopping Park, in Edinburgh through a 50:50 joint venture with Hercules Unit Trust (in an English Limited Partnership). Under Section 90B(3) of the Scotland Act 1998 this was not one of the assets whose management was devolved. It was reportedly valued at £480m in 2007, and generated £5.7m of profit for the Crown Estate in 2013-141.

The road to the Bill

According to the Crown Estate Commissioners' website1 (the body managing assets across the rest of the UK), the Crown Estate as a whole dates back to 1066. Since 1760, the net income of the Crown Estate has been transferred to the Exchequer under successive Civil List Acts, passed at the beginning of each reign. The Crown Estate Act 19612 subsequently provided the legislative basis for the management by Crown Estate Commissioners of various crown property, rights and interests across the UK. This places a statutory duty on Commissioners to “maintain and enhance its value and the return obtained from it, but with due regard to the requirements of good management” (s.1 (3)).

In 2014 the Smith Commission made recommendations for devolution of The Crown Estate’s management responsibilities and revenues in Scotland:

32. Responsibility for the management of the Crown Estate’s economic assets in Scotland, and the revenue generated from these assets, will be transferred to the Scottish Parliament. This will include the Crown Estate’s seabed, urban assets, rural estates, mineral and fishing rights, and the Scottish foreshore for which it is responsible.

33. Following this transfer, responsibility for the management of those assets will be further devolved to local authority areas such as Orkney, Shetland, Na h-Eilean Siar or other areas who seek such responsibilities. It is recommended that the definition of economic assets in coastal waters recognises the foreshore and economic activity such as aquaculture.

34. The Scottish and UK Governments will draw up and agree a Memorandum of Understanding to ensure that such devolution is not detrimental to UK-wide critical national infrastructure in relation to matters such as defence & security, oil & gas and energy, thereby safeguarding the defence and security importance of the Crown Estate’s foreshore and seabed assets to the UK as a whole.

35. Responsibility for financing the Sovereign Grant will need to reflect this revised settlement for the Crown Estate.

The Scotland Act 2016 (section 36) made provision for a Treasury transfer scheme to transfer the powers of the existing Commissioners to Crown Estate Scotland (Interim Management). Provision was also made to amend Schedule 5 of the Scotland Act 1998 which defined the Crown Estate as the property, rights and interests under the management of the Crown Estate Commissioners. The explanatory notes3 to the bill stated that:

Depending on any future legislation passed by the Scottish Parliament, the Scottish Ministers may be able to take a different approach to managing the Scottish assets (for example, to adopt a less commercial approach to some aspects of management, including widening the role of social enterprise).

The Scotland Act 2016 also amends section 1(2) of the Civil List Act 1952 (c.37) so that the revenue from the Scottish assets will be paid into the Scottish Consolidated Fund, rather than the UK Consolidated Fund. It also sets out that the Scottish assets should be held as an ‘estate in land’ in perpetuity.

The transfer of management functions were put into effect on 1 April 2017 through:

the Crown Estate Transfer Scheme 2017 4 (to transfer management) and

the Crown Estate (Interim Management) Order 20175 (to establish a new interim body to operate until the long term arrangements as set out in the bill, come into effect).

The duties, as set out in the 1961 Act (to secure a commercial return but with regard to the principles of good management) continue to apply to the new Scottish interim body following devolution. For the time being Crown Estate Scotland interprets this remit as being “to ensure that the assets are developed and enjoyed sustainably to deliver benefits to communities and to Scotland.”

As set out below the new bill before the Scottish Parliament, the Scottish Crown Estate bill6, disapplies the 1961 Act and sets out a new role for the new body and other future managers of the assets.

Management options

The Scottish Government launched a consultation1 (January - March 2017) on the longer term arrangements for the Crown Estate in Scotland. The consultation stated that for the longer term

The Scottish Ministers intend to introduce legislation which puts in place a new legislative framework for management of Crown Estate assets in Scotland that ensures accountability to the Scottish Parliament and alignment with Scottish policy objectives.

The consultation document set out three principles that Scottish Ministers would apply when considering the best approach for the future management of assets

1. People should be able to influence decisions that affect them and their families, and trust the decisions made on their behalf by those they elect.

2. Arrangements should be appropriate and tailored towards the needs and aspirations of people and places, to support the delivery of shared national outcomes.

3. Arrangements should be effective, efficient and represent value for money for Scotland as a whole.

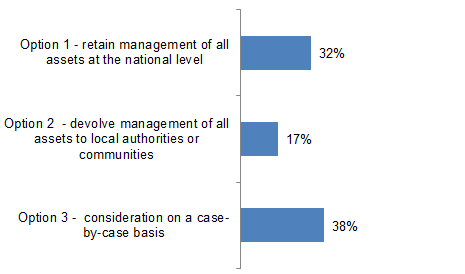

Three options were set out for future management arrangements:

Option 1: Retain management of all assets at the national level.

Option 2: Devolve management of all assets to local authorities or communities.

Option 3: Consider on a case-by-case basis the appropriate governance arrangements for each asset of the Crown Estate in Scotland.

In relation to the three options the consultation document set out where different assets might sit:

| Option | Asset |

|---|---|

| Functions that could potentially be further devolved to councils or communities |

|

| Functions that may be better managed at the national level |

|

| Functions that need more consideration |

|

Views of consultees

The Scottish Government received over 200 consultation responses. In a letter to the Convener of the Environment, Climate Change and Land Reform Committee1 (July 2017) the Cabinet Secretary Roseanna Cunningham MSP summarised the consultation responses:

The preliminary findings from the consultation responses suggest that there was support for a number of proposals in the consultation paper. There was support amongst respondents for a phased approach to introduce reforms to the management of Scottish assets, for the ability for decisions on future management of the assets to take account of wider socio-economic and environmental objectives as well as commercial considerations, and for a national framework to govern opportunities for devolution of management to the local level. Scottish Ministers will consider the consultation responses and take those into account as the proposals for future legislation are developed.

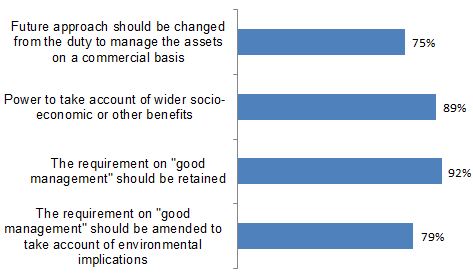

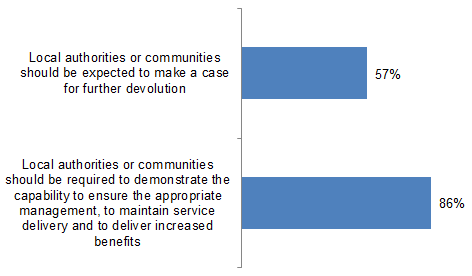

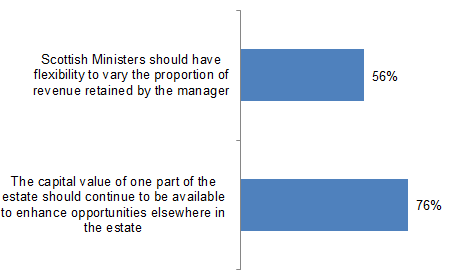

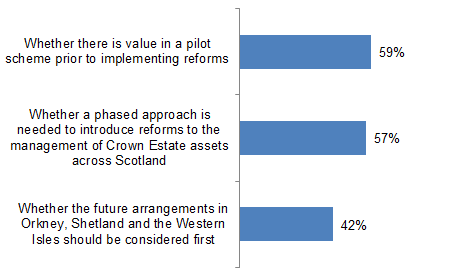

The Scottish Government subsequently analysed the responses to the consultation2. Some of the key findings are included in the charts below:

Piloting new management arrangements

Crown Estate Scotland's three-year corporate plan1 sets out its commitment to test different methods of managing assets, empowering communities and giving local people more say in decisions that impact the land, coastline and sea near where they live. Crown Estate Scotland states:

We have appointed Argyll-based Sarah Brown of C2W consulting to support us by providing advice, defining criteria for selecting pilots and ensuring the scheme is informed by consultation and engagement.

Work has already started on establishing a set of criteria and also to ensure there is a clear process in place to gauge the success of projects that go ahead. In 2018 we will be consulting with coastal and rural community representatives and other individuals and organisations to ensure that the final scheme – the criteria and process – are robust and transparent.

More recently, in evidence to the Environment, Climate Change and Land Reform committee on 20 February 20182, Scottish Government officials indicated:

Crown Estate Scotland (Interim Management) was requested by the Scottish ministers to continue dialogue with the islands councils about the proposal for pilots of local management in the island areas. Those discussions have continued between Crown Estate Scotland (Interim Management) and the local authorities.

Another strand of thinking that Crown Estate Scotland (Interim Management) has been developing involves the possibility of pilots in other areas. The board of Crown Estate Scotland (Interim Management) has been considering how best to take forward the issue of pilots. It is finalising its thinking and is in dialogue with COSLA and the islands councils about making an announcement on the best way forward in the near future.

A closer look at the Bill

On the publication of the bill the Cabinet Secretary for Land Reform, Roseanna Cunningham set out the basis for the approach to the legislation1:

The Estate consists of a diverse portfolio, including thousands of hectares of rural land, half of Scotland’s foreshore, urban property and seabed leasing rights for activities such as renewable energy. That is why this Bill recognises that a ‘one size fits all’ approach is not practical, laying the foundation for changes in the management of individual assets.

I believe strongly in maximising the benefits of the Crown Estate for our communities and the country as a whole, while ensuring assets are well maintained and managed, with high standards of openness and accountability.

That’s why I have put these principles at the very heart of this important Bill.

Overall the bill re-names the existing Scottish public body Crown Estate Scotland (Interim Management) as Crown Estate Scotland, and sets out the framework for its governance and decision making. However the public body must operate within some UK legislative constraints, as set out below.

The extent of devolution

The Bill's Policy Memorandum 1sets out the legislative basis for devolution as follows:

9. The Crown Estate Transfer Scheme 2017 (S.I. 2017/524) effected the devolution of the management functions for these assets, the revenue arising from those assets and competence to legislate about those functions subject to some reservations. Parliament’s legislative competence is restricted by the 1998 Act in that:

the Scottish Crown Estate assets must continue to be managed on behalf of the Crown;

the assets must be maintained as an estate in land, or estates in land managed separately i.e. the existing assets must be maintained and any capital proceeds from asset sales must be reinvested in the existing estate or in other land, and assets acquired in the course of management will be owned by the Crown;

the payment of hereditary revenues from the Crown Estate’s wholly owned assets in Scotland is to be paid into the Scottish Consolidated Fund (in accordance with the Civil List Act 1952).

Specifically the Civil List Act 19522 now includes the following provision

In relation to Scotland, the hereditary revenues of the Crown from bona vacantia, ultimus haeres and treasure trove and from the property, rights and interests the management of which is transferred by the scheme under section 90B of the Scotland Act 1998 shall be paid into the Scottish Consolidated Fund.

This throws up some challenges for the Scottish Government as to how to deliver on the commitment, for example from the First Minister in 20153 that

coastal and island councils will benefit from 100 per cent of the net revenue generated in their area from activities within 12 miles of the shore

In terms of the impact on the revenues generated by the Island councils the Final Business and Regulatory Impact Assessment4 published alongside the bill states:

“We are currently considering how best to design the arrangements for distribution of the net revenue from marine assets out 12 nautical miles”

This was echoed in evidence from the Bill team to the Environment, Climate Change and Land Reform committee5:

We are in discussion with the Convention of Scottish Local Authorities about the mechanics of implementing that commitment. The starting point is that, as we speak, and although the devolution of the management has been secured, we do not yet have a set of audited accounts for Scotland, let alone for the assets at a more local level. That set of accounts will be available only at the end of this financial year. Once it is produced and finalised by Crown Estate Scotland and audited by the Auditor General, that will provide the reference point for what the net revenue is. In our discussions with COSLA, we have been looking at a way in which there can be an allocation to individual local authorities based on that amount, probably on an interim basis, given that that will be the first set of accounts.

Another constraint for the Scottish Crown Estate relates to the protection of UK wide interests as outlined in the Transfer Scheme. This includes provision to ensure that decisions taken are not detrimental to UK-wide critical national infrastructure in relation to matters such as defence & security, oil & gas and energy.

A new set of duties

As indicated above the Crown Estate Act 1961 gave the UK commissioners “a duty to maintain and enhance the value of the estate and the return obtained from it, but with due regard to the requirements of good management”. The new bill dis-applies the 1961 Act and provides a potentially wider remit for the management of the assets.

Section 7 of the Bill states that managers of the assets must maintain and seek to enhance the value of the assets and also the income they generate. Having said that they may do so in a way that is likely to contribute to a range of wider objectives including:

economic development

regeneration

social wellbeing

environmental wellbeing

sustainable development.

In practice, as set out in Section 11, this means that a manager will have a duty to obtain “market value” if they are selling or leasing an asset, but also the power to make a transaction for below the market value if it contributes to one of the objectives above.

So, what could these new duties mean in practice? In one of the background documents to the bill, the Scottish Crown Estate Bill: Screening report1 (required by the Environmental Assessment (Scotland) Act 2005) states for example that.

The Bill will not change the way in which decisions are made, rather it will provide an opportunity to make explicit on the face of the legislation that ‘good management’ can include consideration of wider socioeconomic , environmental or sustainability benefits.

The Business and Regulatory Impact Assessment states

Scottish Ministers consider there to be merit in continuing to manage assets on a largely commercial basis, but to introduce reforms to provide scope to take into account wider environmental or socio-economic benefits when charging for a lease or sale of land. For example, this would enable the manager to charge a lower amount to support economic development projects where the manager is satisfied that this could lead to broader socio-economic or environmental benefits for Scotland

Similarly the Scottish Government Bill team discussed the ways in which the new duties would make a difference2

the duty in section 7 is a reform of the duty in the Crown Estate Act 1961, which requires the manager to “maintain and enhance” the value of the estate

“and the return obtained from it, but with due regard to the requirements of good management.”

However, “good management” has never been defined. It has sometimes been interpreted as requiring good stewardship; at other times, it has been interpreted as having the ability to take account of other factors. There are examples of the Crown Estate Commissioners in the past, and Crown Estate Scotland currently, using that second interpretation at small scale, but the existing managers have always been wary about the legal vires of that. Therefore, in thinking about what the long-term framework for management of the Crown estate in Scotland should be, the Scottish ministers have wished to make it more explicit that wider factors—the economic, social and environmental benefits that can arise from decision making—can properly be taken into account. We expect that, through that more explicit ability, managers will be more encouraged and will be careful to take account of opportunities before final decisions are reached

The new managers of the Scottish Crown Estate

The bill also sets out the governance framework, importantly setting out how decisions will be made on who will be the new managers of the assets.

The Smith Commission had recommended that “responsibility for the management of those assets will be further devolved to local authority areas such as Orkney, Shetland, Na h-Eilean Siar or other areas who seek such responsibilities.”

However Sections 3,4,5 and 6, of the Bill include a number of options as to who could be a manager:

Scottish Ministers.

Crown Estate Scotland.

Public authorities.

Local authorities.

Community organisations.

Finally the bill gives the Scottish Ministers two routes through which powers can be devolved:

It can be by a transfer through regulations, which identifies who the manager will be, and exactly what powers are being transferred.

Scottish Ministers can also direct an existing manager to delegate the management to another person.

| Transfer (Section 3) | Delegation (Sections 4 and 5) |

|---|---|

Seen as permanent arrangementScottish Ministers make regulationsCan transfer to:

| Seen as temporary arrangementScottish Minsters direct manager of an asset to delegate function to:

|

The reasoning behind the two approaches was explained by the Scottish Government as follows1

Ministers’ basic approach is to have more than one tool in the toolbox—it is horses for courses. When the transfer process would result in a permanent change, the delegation process is required to have a timescale that could be quite long term, although there is the ability to complete the process on a shorter-term basis.

More fundamentally, the result of a transfer would be the end of Crown Estate Scotland’s involvement in the direct management of the asset whereas, with a delegation, there would still be a relationship between Crown Estate Scotland and the new manager. We view the second result, in which there is the ability to have that relationship, as potentially more attractive to some local managers. It could involve Crown Estate Scotland providing such things as staff support, other infrastructure or guidance. The main on-the-ground difference between the two processes for further devolution is that delegation would enable Crown Estate Scotland to be one step removed from direct involvement.

Section 6 of the bill creates a definition of "community organisation", taking a different approach to that in other legislation (such as community bodies in relation to Community Right to Buy under the Land Reform (Scotland) Act 2003). The Scottish Government explained the reasoning as follows:

What is being contemplated here is different from what is in other legislation, but the bill is modelled on existing legislation in terms of the characteristics and criteria. The value of not exactly mirroring what is in other legislation is that this situation is different and ministers think that it is very important to make it possible for community organisations to take on the management of assets. A third sector community organisation would need to consider carefully whether its constitution and so on will tolerate its becoming the manager of an asset on behalf of the Crown. Other legislation mentions specifically Scottish charitable incorporated organisations or community benefit societies, and the judgement was made that such mentions could imply that it would be automatically possible for any such organisation to take on management. In fact, very careful case-by-case consideration will be required

Other provisions within Part 3 of the bill set out the powers of managers, for example that they can act as though they were the owner (Section 8), but also sets out some restrictions placed on managers. For example Scottish Ministers need to give consent for the transfer of ownership of some assets (Section 10); Scottish Ministers may give directions about rent and other charges (Section 13); and the bill includes provisions that leases shall be granted for no more than 150 years (Section 14).

Reporting, transparency and accountability

Sections 20 to 25 in the bill set out requirements for planning and reporting. Given the diversity of the assets in the Scottish Crown Estate and the potential complexity of management and reporting arrangements, these include national and local arrangements. The provisions include:

a requirement for a strategic management plan, to be laid before the Scottish Parliament, and which must be reviewed every five years

three year management plans, to be prepared by asset managers, to be submitted to Scottish Ministers

An annual report from each asset manager, each to be laid before the Scottish Parliament (either individually or as a consolidated single document).

Finance

Sections 26 to 34 put in place a number of measures aiming to deliver appropriate and consistent financial reporting and accountability. This includes for example the treatment of income and capital, the requirements for transferring sums of money between asset managers, and the ability of Scottish Ministers to make grants and loans.

As indicated above the Scotland Act 2016 (and the subsequent UK Government Transfer Scheme) creates some financial constraints. Revenue from the Scottish assets must be paid into the Scottish Consolidated Fund (the Scottish Government’s main budget) and Scottish Ministers can then decide how the revenue returned to the Scottish Consolidated Fund is used. If a manager sells an asset it must re-invest all the capital proceeds in the Scottish Crown Estate. While there are separate accounting arrangements for revenue and capital, the manager is currently able to retain 9% of the revenue profits for investment in the estate. The Bill includes provisions to enable similar arrangements to operate in future, whereby a manager can retain a proportion of the revenue as the Scottish Ministers direct, for investment in the estate.

The Scottish Government explained1 the context for the 9% figure

That is a carryover and a continuation of the long-standing arrangements that the Crown Estate Commissioners agreed with the Treasury. Through discussion with Crown Estate Scotland (Interim Management), that was thought to be the appropriate requirement moving forward. The bill will enable that 9 per cent to be varied, primarily depending on need for reinvestment, such as capital investment, in the estate

The Financial Memorandum (FM) to the Bill 2summarised the potential costs of the bill as follows:

| Asset | Likely costs to the Scottish Administration | Likely costs to business | Likely costs to Scotland from sale of capital assets below market value |

|---|---|---|---|

| Foreshore rights, land in local authority ports and non-operational ports and jetties | £0 to medium (up to £16.5m) | £0 to low | £0 to low |

| Leasing for wave and tidal energy | £0 to low | £0 to low | £0 |

| Offshore renewable leasing (12-200nm zone), rights over cables and pipelines, other seabed rights (12-200nm zone), rights to naturally occurring gold and silver, and reserved mining rights. | 0 (no current plans for devolution) | 0 (no current plans for devolution) | £0 |

| Rural Estates | £0 | £0 | £0 |

| Urban property | £0 | £0 | £0 |

| Aquaculture | £0 | £0 | £0 |

| Salmon fishing rights | £0 | £0 | £0 |

The FM considered that it was not possible to be definitive about costs on local authorities, but that a Business and Regulatory Impact Assessment would be carried out before any transfer of management responsibility through a Scottish Statutory Instrument. The FM also pointed out the uncertainties of incurring one-off or recurring costs in setting up new arrangements. The FM did identify that the Crown Estate Commissioners had estimated that the total costs for the transfer to Crown Estate Scotland (Interim Management) were £2.4m including a substantial proportion of this total for the costs of setting up new IT systems.

Two other financial issues (though not covered directly in the bill) relate to the Block Grant adjustment and the Sovereign Grant

Block grant adjustment - The Fiscal Framework agreement between the UK and Scottish government indicated that

The Governments have agreed that a baseline deduction to the Scottish Government's block grant will be equal to the net revenues generated by the Crown Estate assets in Scotland in the year immediately prior to the transfer

It was also agreed that this adjustment would be fixed and not be subject to indexation. The net revenue was estimated to be £6.1m in 2016-17 (around 0.02% of Scotland’s block grant).

The Sovereign Grant - The earnings from the Scottish Crown Estate are not related to the Sovereign Grant. The UK Government determines the amount of UK Government funding for the Monarch. This calculation uses as a reference point the revenue profit of The Crown Estate (which operates in Wales, England and Northern Ireland, and includes properties in London's west end) but does not take into account revenue profit from the Scottish Crown Estate. This sum is then paid by the Treasury out of funds raised by general taxation3.