Scottish Budget 2019-20

This briefing summarises the Scottish Government's spending and tax plans for 2019-20. More detailed presentation of the budget figures can be found in our Budget spreadsheets. Infographics created by Andrew Aiton, Kayleigh Finnigan and Laura Gilman.

Executive Summary

Scottish Budget 2019-20 was overshadowed by continuing uncertainty about Brexit outcomes and included a warning from the Cabinet Secretary that he may need to revisit his Budget in the event of a disorderly Brexit next year.

It will also be remembered as the Budget where the Scottish Government opted to freeze the Higher Rate tax threshold at the 2018-19 level of £43,430 rather than increasing it closer to the UK level for 2019-20 of £50,000.

The Scottish Government's income tax policies generate additional resource for the Scottish Budget but mean that Scottish taxpayers earning over £27,000 will pay more tax than in the rest of the UK. Those earning under £27,000 will pay around £20 per year less than in the rest of the UK.

For the Scottish budget to be better off than it would otherwise have been without fiscal devolution, the SFC forecasts need to exceed the size of the block grant adjustment now made to the budget to account for taxes being devolved to the Scottish Parliament. The SFC forecast that total devolved tax receipts will exceed the block grant adjustment by £271 million in 2019-20. Forecast tax receipts will ultimately be reconciled with outturn when final tax receipts are known.

The Scottish Government state that the decision not to replicate the UK Government’s tax policy means that the Scottish budget is £500m better off than it would otherwise be. However, the operation of the fiscal framework means that, based on current forecasts, the Scottish Government will only generate £182m more in income tax revenues than will be removed from the Scottish budget via the block grant adjustment. So the net benefit to the Scottish budget (pre-reconciliation) is £182m.

In his statement to Parliament, and in the foreword to the budget document, the Cabinet Secretary stated that, if the Barnett consequentials for health were excluded from the budget, then the resource block grant fell by £340m in real terms. However, the spending plans in the Budget document include all of the Barnett consequentials.

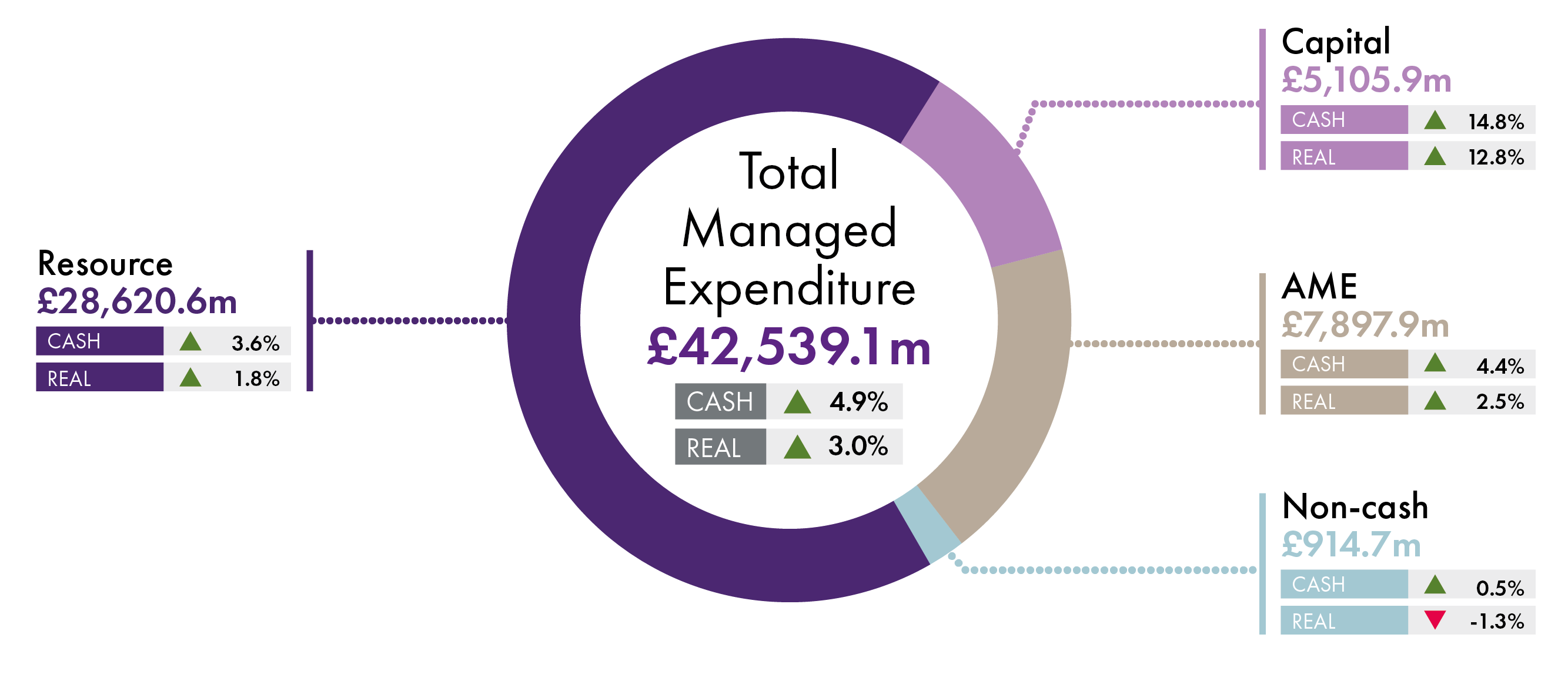

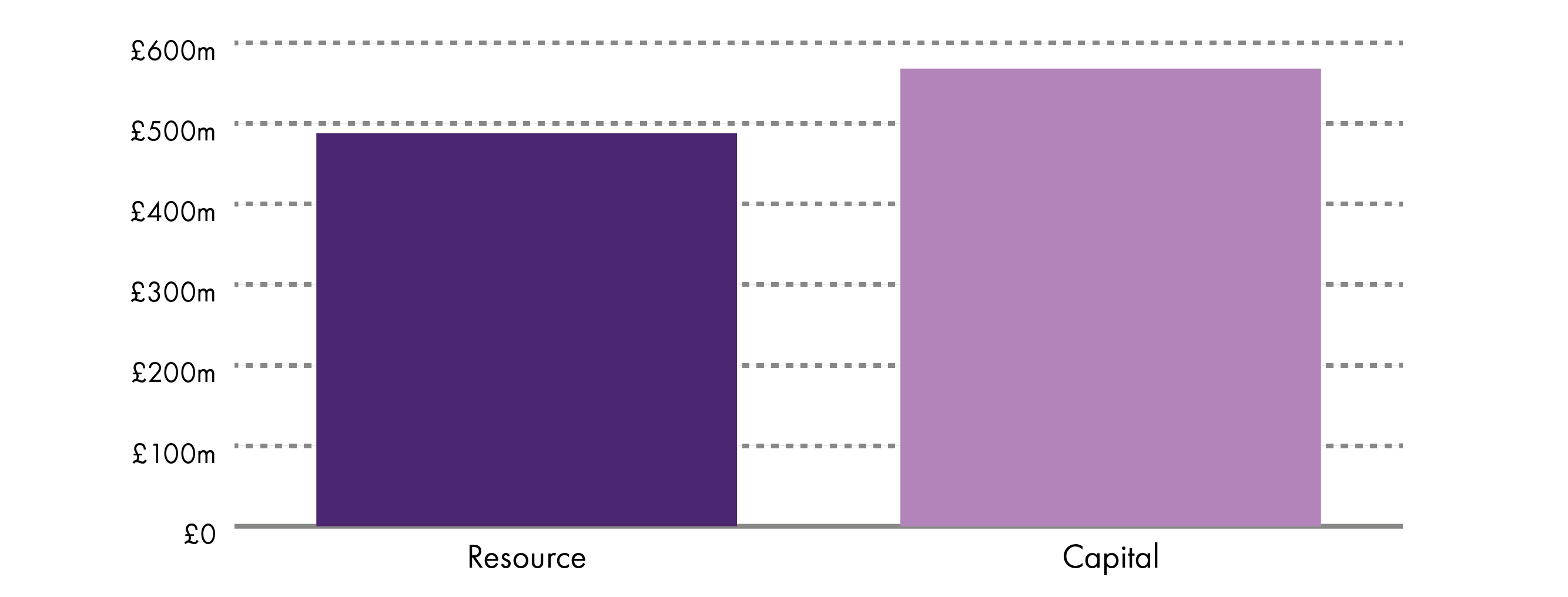

In terms of the amounts that the Scottish budget 2019-20 will allocate, Total Managed Expenditure in 2019-20 will be £42,539 million, up 3% in real terms on the previous year. Of this, the discretionary element of the Budget is the Resource and Capital allocations, which total £33,727 million (+3.3% in real terms). Resource expenditure will increase after inflation by 1.8%, and Capital (including Financial Transactions and Borrowing) by 12.8%.

Health and Sport remains the largest spending portfolio by some margin, comprising 41.4% of the total discretionary spending power, and nearly half of day-to-day (Resource) spending.

As in previous years, a number of different presentations of the local government settlement are possible. The Cabinet Secretary referred to “an overall real-terms increase in the total local government settlement of more than £210 million.” This figure (a 2% increase in real terms) is derived from the total allocation to local government in the Local Government Finance Circular. As well as the core revenue grant, this also includes specific revenue grants and capital grants, along with revenue funding in other portfolios.

The core local government revenue settlement – General Resource Grant and Non-Domestic Rates Income combined – falls in real terms by £319 million (-3.4%).

Within that, Non-Domestic Rates Income is forecast to increase in 2019-20 (by around 6% in real terms). This increase is helped by £100m in forecast income brought forward from future years.

These are draft proposals and commence a period of parliamentary scrutiny and political negotiation as the Scottish Government seeks majority support from MSPs.

Context for Budget 2019-20

Scottish Budget 2019-201 was published on 12 December 2018 and presents the Scottish Government's draft spending and tax plans for 2019-20. It incorporates Scottish Government responses to parliamentary committees' pre-budget reports, produced earlier this year for the first time as part of the new Budget process. There now follows an additional period of parliamentary scrutiny and political negotiation as the Government seeks parliamentary support for its tax resolutions and budget bill in advance of the new financial year.

The Budget incorporates devolved tax forecasts undertaken by the Scottish Fiscal Commission (SFC). As well as producing point estimates for each of the devolved taxes (including non-domestic rates income (NDRI)) for the next 5 years, the SFC is also tasked with producing forecasts for Scottish economic growth and spending forecasts for the newly devolved social security areas.

The economic outlook for Scotland continues to be overshadowed by ongoing uncertainty around Brexit. In his statement to the Chamber, Dereck Mackay MSP, Cabinet Secretary for Finance, Economy and Fair Work stated that "if the UK does end up in a no deal Brexit, I may be required to revisit the priorities in this Budget."

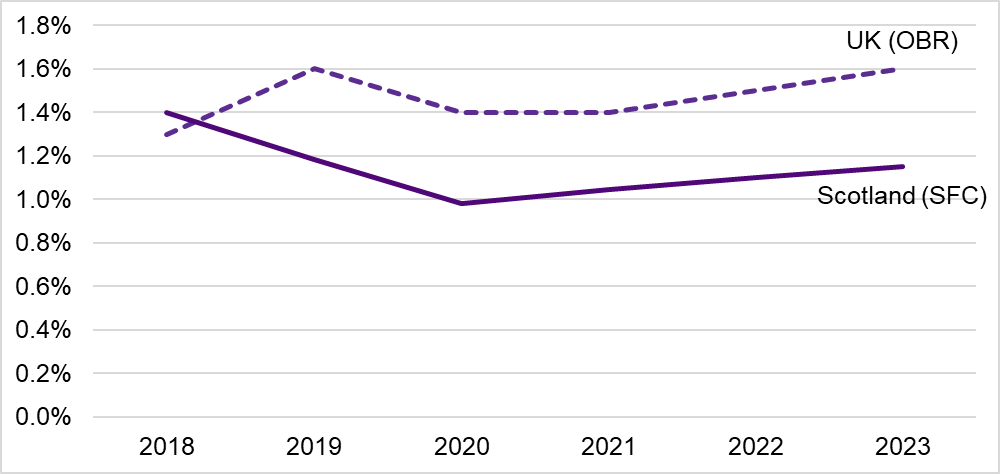

Presenting their outlook for the Scottish economy, the Scottish Fiscal Commission (SFC) forecast over a five-year horizon broadly assumes a relatively smooth and orderly Brexit process. The SFC expect slightly higher growth throughout the forecast period than they did in May. However, overall they expect economic growth to be subdued in the longer term, averaging just over 1% over the next five years.

The SFC has forecast economic growth of 1.4% this year and 1.2% in 2019, and has more cautious Scottish forecasts for growth than other economic forecasters in 2020 and 2021 (table 1).

| 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|

| Fraser of Allander2 | 1.3% | 1.4% | 1.5% | 1.4% |

| Ernst and Young3 | 1.6% | 1.0% | 1.4% | 1.5% |

| Scottish Fiscal Commission | 1.4% | 1.2% | 1.0% | 1.0% |

The SFC also includes forecasts for 2022 (1.1%) and 2023 (1.2%).

Like the SFC for Scotland, the Office for Budget Responsibility (OBR) is mandated to produce economic forecasts for the UK. The latest OBR forecasts for the UK are presented in table 2. Scotland is forecast to grow more quickly than the UK in 2018, but the OBR's UK growth forecasts are higher than the SFC's Scottish forecasts in subsequent years.

| 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|

| 1.3% | 1.6% | 1.4% | 1.4% |

The overall spending envelope

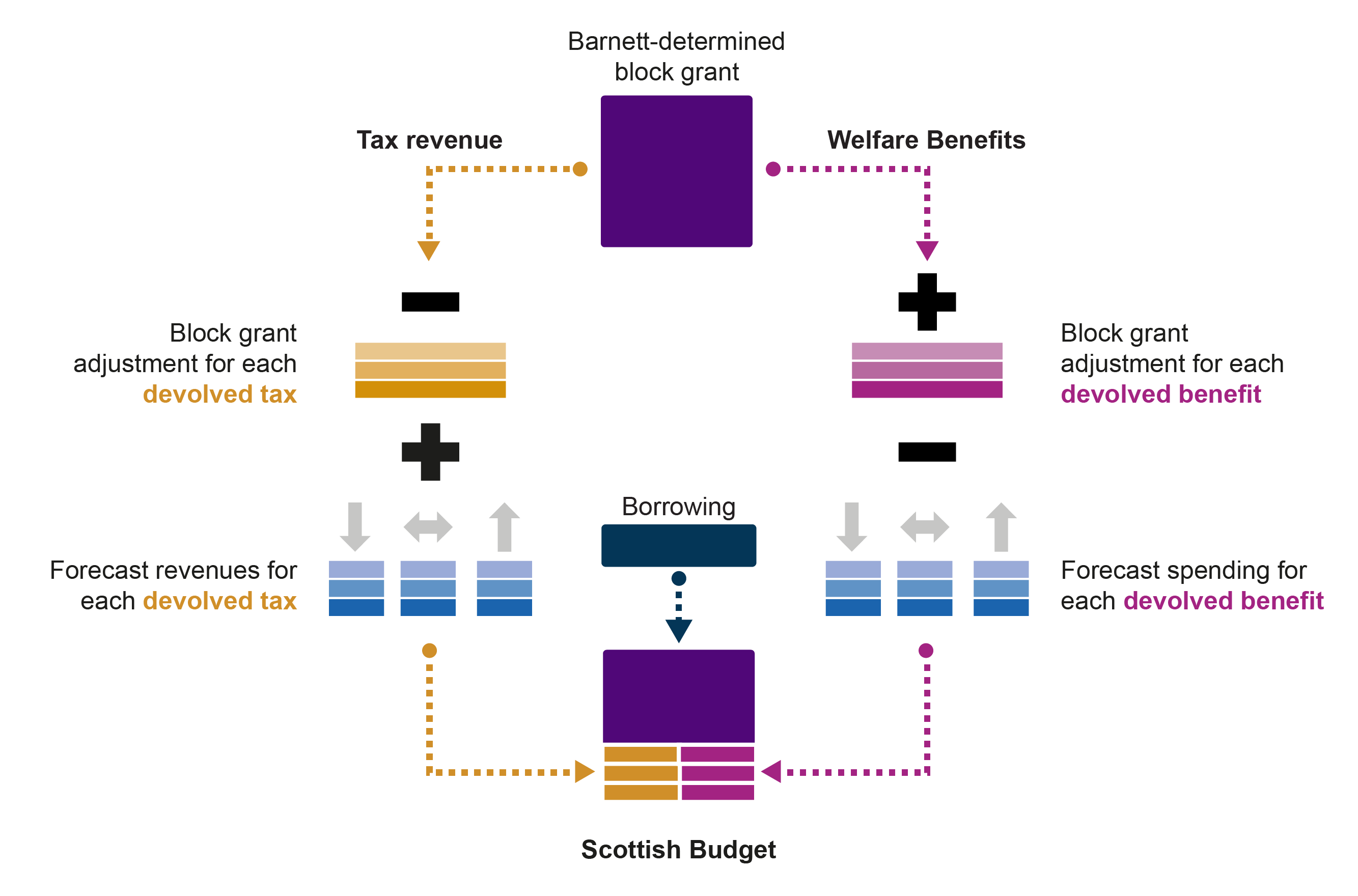

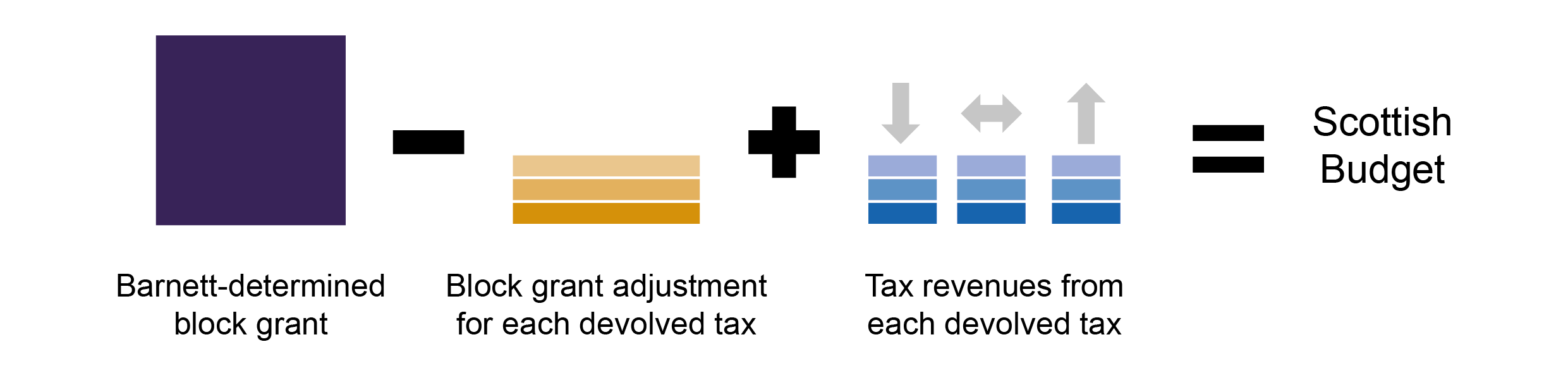

Under the terms of the Fiscal Framework1 agreed between the UK and Scottish Government to implement the Scotland Act 2016 powers, the size of the Scottish Budget is now determined by the following elements (see figure 1).

The block grant allocation from the UK Budget - changes in this block are determined by increases or decreases in English spending on functions that are ‘comparable' to those devolved to the Scottish Parliament.

A block grant adjustment (BGA), which is essentially a forecast of the revenue the UK Government has foregone/gained by devolving taxes/welfare benefits to the Scottish Parliament.

A SFC produced forecast for the revenue raised from each devolved or shared tax or spending on each devolved welfare benefit.

These three elements plus the capital borrowing powers devolved by Scotland Act 2016, comprise the spending power of the Scottish budget.

Table 1.02 of the Draft Budget document presents the Scottish budget through to financial year 2019-20 in cash terms. This shows the total budget will grow in cash terms by 4.2% in 2019-20 (2.3% in real terms). Within this, Scottish Government Fiscal Resource spending, for day-to-day expenditure, will fall slightly in real terms in 2019-20 and Capital spending will increase by 9%. The Capital numbers include £450 million in borrowing, the maximum the Scottish Government is able to draw on in any single year.

As is discussed in Box 1 below, for a number of reasons the figures in table 1.02 of the Draft Budget differ to the totals actually allocated amongst portfolios in the document -- annex A of the Draft Budget provides a reconciliation. The next section of the briefing looks at the total allocations for Resource, Capital and annually managed expenditure (AME) and how these are distributed amongst portfolios.

As mentioned, the Scottish Government intend to use their full annual capital borrowing limit of £450 million in 2019-20. This will need to be repaid in subsequent years, and the Budget states on p43 that the borrowing will be drawn from the National Loans Fund with an assumption of repayment over 25 years, an interest rate of 2.5 per cent, repaid from 2020-21.

Many of the numbers in this briefing are adjusted for inflation (presented in 'real terms'/ 2018-19 prices) and the deflator used is the Treasury deflator2.

Box 1: The reconciliation of available funding with spending plans

The numbers presented in table 1.02 differ to the total amounts allocated by the Scottish Government in the Budget 2019-20 document. Annex A provides a reconciliation of the available funding (table A.01) to the proposed spending plans. There are a number of reasons for the differences which are summarised below:

The 2018-19 baseline numbers in the spending plans reflect the plans as at Budget Bill 2018-19 for that year to show a like-for-like comparison against 2019-20 plans.

As such, the budget figures in table 1.02 include additional Barnett consequentials for 2017-18 and 2018-19 from UK fiscal events since the relevant Budget Bill, whereas the spending plans do not.

2017-18 spending plans are underpinned by anticipated underspends carried from the previous year. From 2018-19, it is through the operation of the Scotland Reserve.

Machinery of Government changes, which relate to the transfer of responsibility from the UK to Scottish Government are not reflected in table 1.02, but are included in the portfolio spending plans.

There are some anticipated budget transfers for Scotland Act 2016 implementation and administration, that are not reflected in table 1.02 but are included in the spending plans in anticipation of being formally confirmed at a future UK fiscal event. The amount for 2019-20 also includes anticipated funding for EU exit preparations.

Non-cash allocations are often more than required, and therefore not allocated to portfolios in spending plans and subsequently returned to HM Treasury.

£29 million was raised from freezing the Higher Rate Income Tax threshold in 2017-18 at stage 2 of the Bill. £62 million was raised for 2018-19 from changes made to the tax and pay policy during the parliamentary passage of the Bill.

In 2018-19, £50 million in accumulated revenues for the Queen's and Lord Treasurer's Remembrancer (QLTR) is shown in the spending plans but not table 1.02. £5 million is the estimate for 2019-20.

| SG Spending Limits – Cash Terms | 2017–18 (£m) | 2018–19 (£m) | 2019–20 (£m) |

|---|---|---|---|

| Scottish Government Funding | 32090 | 32821 | 34256 |

| Barnett Consequentials | -633 | -142 | |

| Budget Exchange/Reserve | 203 | 234 | 313 |

| Machinery of Government Changes | 31 | -1 | 28 |

| Anticipated budget transfers | 156 | 159 | 269 |

| Unallocated Non-cash budget | -229 | -196 | -230 |

| Changes to Income Tax | 29 | 62 | |

| Queen's and Lord Treasurer's Remembrancer | 50 | 5 | |

| Total Reconciling Items | -443 | 166 | 385 |

| Scottish Government Spending Plans | 31647 | 32987 | 34641 |

Budget allocations

Total allocations

Total Managed Expenditure (TME) comprises Fiscal Resource, non-cash Resource, Capital and Annually Managed Expenditure (AME). TME in 2019-20 is £42,539.1m. Figure 2 shows how this is allocated. Fiscal Resource (which covers day-to-day expenditure) and Capital (covering infrastructure expenditure) are the elements of the budget over which the Scottish Government has discretion. AME is expenditure which is difficult to predict precisely, but where there is a commitment to spend or pay a charge, for example, pensions. Pensions in AME are fully funded by HM Treasury, so do not impact on the Scottish Government's spending power. Non-domestic rates are also classed as an AME item in the budget and form part of Local Government spending.

Figure 3 shows the real terms changes in Resource and Capital between 2018-19 and 2019-20. The Capital numbers include Financial Transactions and the proposed borrowing in 2019-20.

Portfolio allocations

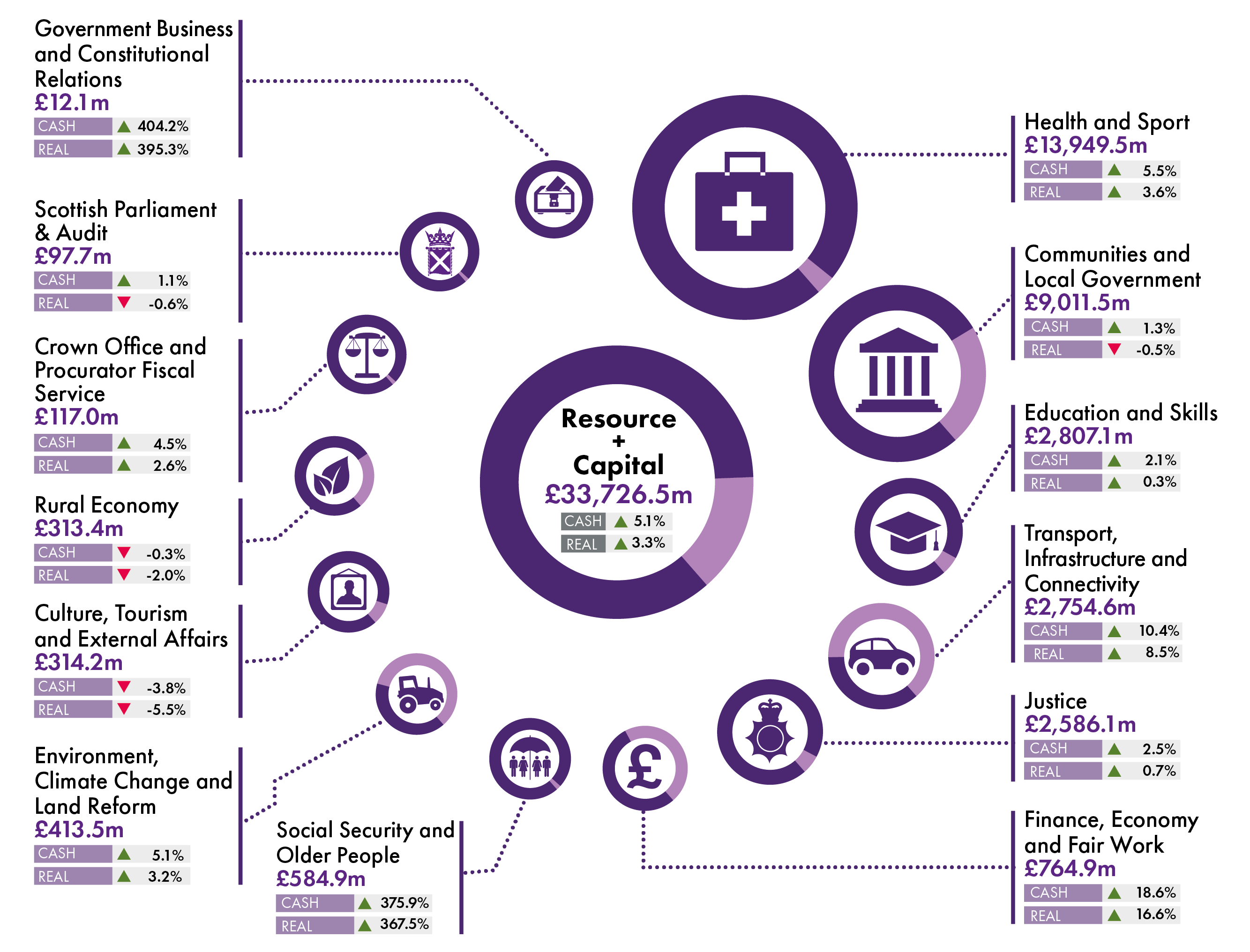

Resource and Capital allocations to portfolios for 2019-20, and how they have changed on the previous year, are presented in figure 4.

Figure 4 shows the Resource and Capital spending by portfolio and their cash and real terms changes in 2019-20. Key points to note are as follows:

Health and Sport is the largest portfolio, comprising 41.4% of the discretionary spending power (Resource and Capital) of the Scottish budget in 2019-20.

The next largest portfolio is Communities and Local Government which comprises 26.7% of the Resource and Capital spend combined. Local Government, and the settlement to local authorities, is the subject of another SPICe briefing, due for publication in the week of 17 December 2018.

The Administration portfolio of the Budget no longer exists. Instead the administrative costs of each portfolio are built into the respective portfolio budgets (further information is provided in Annex G of the document).

Portfolios decreasing in real terms are Culture, Tourism and External Affairs (-5.5%); Rural Economy (-2.0%); Scottish Parliament and Audit (-0.6%); Communities and Local Government (-0.5%).

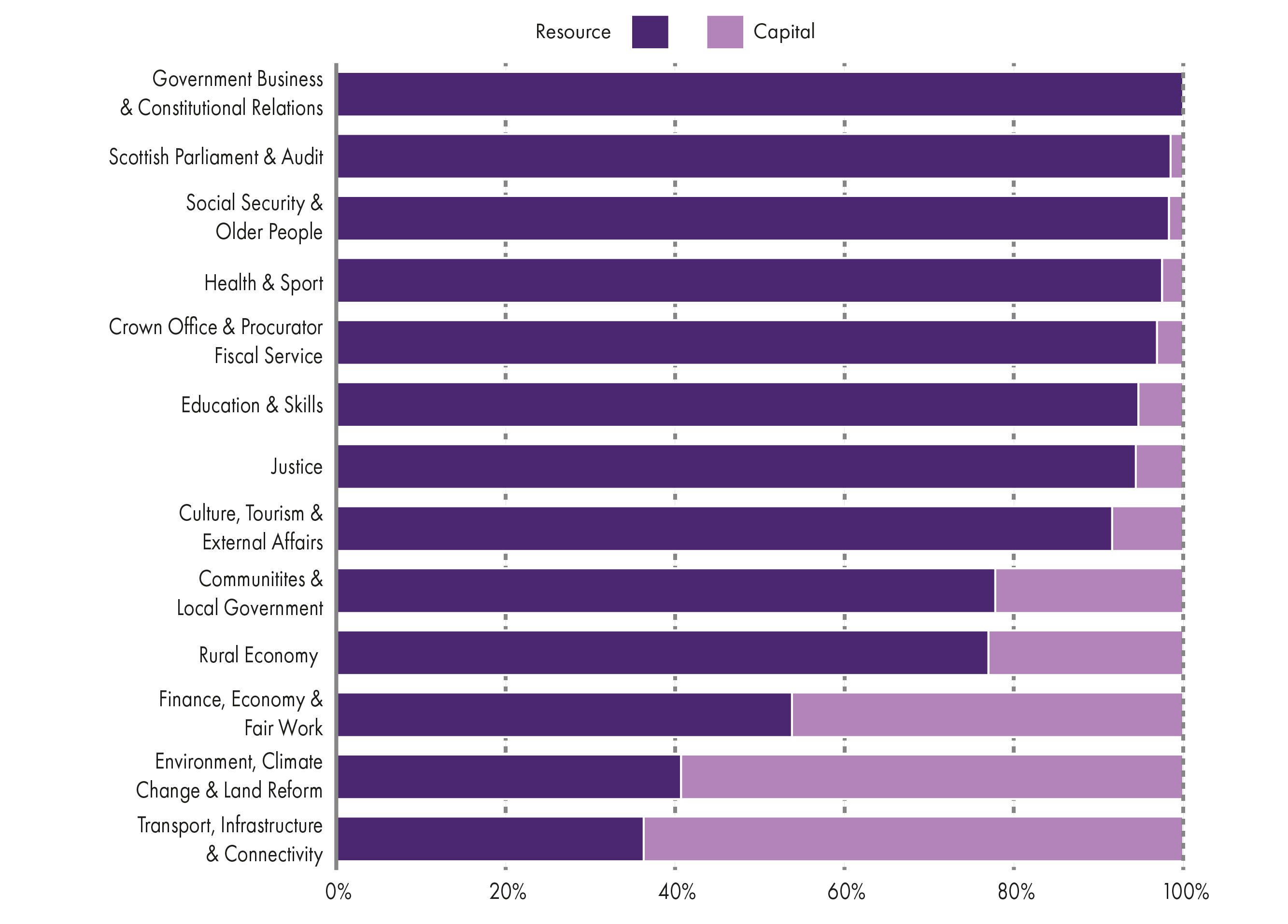

Resource and Capital expenditure

Figure 5 below shows the split between Resource and Capital by portfolio. This shows that most portfolios are heavily weighted towards funding day-to-day spending commitments.

Not surprisingly, the Transport, Infrastructure and Connectivity portfolio has the highest proportion of its budget comprising Capital expenditure (over 60%). Environment, Climate Change and Land Reform is the only other portfolio where over half of its budget is allocated to Capital investment.

Taxation policies and revenues

Income tax

Income tax proposals

The Scottish Government set out its proposals for income tax from April 2019 as part of the Scottish Budget 2019-20. The proposed rates and bands are shown below.

| Bands | Band name | Rate (%) |

|---|---|---|

| Over £12,500* - £14,549 | Starter | 19 |

| Over £14,549 - £24,944 | Basic | 20 |

| Over £24,944 - £43,430 | Intermediate | 21 |

| Over £43,430 - £150,000** | Higher | 41 |

| Above £150,000** | Top | 46 |

* Assumes individuals are in receipt of the standard UK personal allowance (£12,500 in 2019-20)

** Those earning more than £100,000 will see their personal allowance reduced by £1 for every £2 earned over £100,000

These proposals incorporate:

An increase to the personal allowance to £12,500 (which is determined by the UK Government).

A 5% increase in the threshold for the basic rate and a 4% increase in the threshold for the intermediate rate.

No change in the higher rate threshold or top rate threshold, which remain at £43,430 and £150,000 respectively.

The proposed increases to the basic rate and intermediate rate thresholds are above inflation, but have the effect of ensuring that the amount of income at which starter rate tax and basic rate tax is paid increases in line with inflation. For example, in 2018-19, the first £2,000 of taxable income was taxed at 19%. Under these proposals, the first £2,049 will be taxed at 19%, which represents an inflationary increase of 2.5%.

The proposals mean that the gap between the higher rate thresholds in Scotland and the rest of the UK (rUK) will widen. The higher rate threshold in rUK will increase to £50,000 from April 2019, which is £6,570 higher than the proposed threshold for Scotland. In addition, Scottish taxpayers earning above the higher rate threshold will be paying 41% tax compared to 40% in rUK, and will pay 46% on earnings above £150,000, compared to 45% in rUK.

| Bands | Band name | Rate (%) |

|---|---|---|

| Over £12,500* - £50,000 | Basic | 20 |

| Over £50,000 - £150,000** | Higher | 40 |

| Above £150,000** | Additional | 45 |

* Assumes individuals are in receipt of the standard UK personal allowance (£12,500 in 2019-20)

** Those earning more than £100,000 will see their personal allowance reduced by £1 for every £2 earned over £100,000

Income tax revenues

The Scottish Fiscal Commission (SFC) forecast that, under these proposals, non-savings non-dividend (NSND) income tax revenues will total £11,684 million in 2019-20. Forecasts for subsequent years are shown in Table 5.

| 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|---|---|

| NSND income tax | 11,684 | 12,285 | 12,746 | 13,242 | 13,805 |

The SFC estimate that the Scottish Government's decision to freeze the higher rate threshold at £43,430, rather than increasing it in line with inflation will generate additional revenues of £68 million. This includes a downward adjustment of £6 million to reflect anticipated behavioural changes in response to the change in income tax policy.

Impact on individuals

Income tax at various levels of earning under the Scottish Government proposals is shown in Table 6. All those earning up to £124,375 will pay less tax in 2019-20 than they did in 2018-19, although much of this gain is due to the increase in the personal allowance, which was a decision of the UK Government. The Scottish Government estimates that those benefiting from the changes represent 99% of all taxpayers. For the majority, only around £10 of the benefit results from the Scottish Government’s decisions; the rest (£120-£130) is the result of the UK Government’s change to the personal allowance.

When compared with what individuals would be paying in the rUK, the comparisons are less favourable. Under the Scottish Government proposals, those earning less than £27,000 will pay slightly less (around £20 per year) than they would in rUK. However, those earning more than £27,000 will pay more tax in Scotland than they would in rUK. This accounts for 45% of taxpayers, according to the Scottish Government, and the differential is in excess of £1,500 a year for those earning more than £50,000.

| Scottish Government proposals£ per year | Difference compared with 2018-19£ per year | Difference compared with rUK£ per year | |

|---|---|---|---|

| 15,000 | 480 | -130 | -20 |

| 20,000 | 1,479 | -130 | -20 |

| 25,000 | 2,480 | -140 | -20 |

| 30,000 | 3,530 | -140 | 30 |

| 35,000 | 4,580 | -140 | 80 |

| 40,000 | 5,630 | -140 | 130 |

| 45,000 | 6,994 | -140 | 494 |

| 50,000 | 9,044 | -140 | 1,544 |

| 60,000 | 13,144 | -140 | 1,644 |

| 70,000 | 17,244 | -140 | 1,744 |

| 80,000 | 21,344 | -140 | 1,844 |

| 90,000 | 25,444 | -140 | 1,944 |

| 100,000 | 29,544 | -140 | 2,044 |

National insurance contributions

Decisions on national insurance contributions (NICs) are made by the UK Government, but will interact with the Scottish Government's decisions on NSND income tax to determine overall tax rates. NICs are linked to UK tax thresholds and the NIC rate drops from 12% to 2% at the UK higher rate threshold, which will be £50,000 from April 2019. This means that Scottish taxpayers who earn between the proposed Scottish higher rate threshold (£43,430) and the rUK higher rate threshold (£50,000) will pay 41% income tax and 12% NICs on their earnings between these two amounts – a combined tax rate of 53%.

Behavioural impacts

Any changes to tax policies can result in individuals changing their behaviour so as to minimise the tax that they pay. If they are able to, taxpayers might try to change how they receive their income (for example, by taking it in the form of dividends or setting themselves up as a company). Or, they might move to a different location where tax rates are lower (again, if this is a realistic possibility for them). As Scottish tax policy diverges further from rUK tax policy, the risk that individuals might relocate from Scotland increases. Giving evidence to the House of Commons Treasury Select Committee after the October 2018 UK budget, Andy King of the Office for Budget Responsibility (OBR)1 said:

…when we were looking, and when the SFC [Scottish Fiscal Commission] was looking, at the effect of raising the top rate of income tax, HMRC was looking at this behaviour and whether people would change their addresses. It is a particularly significant risk for the Scottish Government because if someone changes their address, the Scottish Government loses all of that income tax.

In their December 2018 Economic and Fiscal Forecasts2, the SFC also refer to the behavioural effects that might result from the tax differences. Commenting on the 53% marginal tax rate that results from the combination of income tax and NICs for those earning between £43,430 and £50,000, the SFC say:

We expect that this higher marginal tax rate will start to affect taxpayer behaviour, for example decisions on how many hours to work. We estimate that in 2019-20 around 120,000 taxpayers in Scotland will be subject to this higher marginal rate. Using our standard approach to modelling taxpayer behaviour, we have estimated that this effect will lead to a reduction in income tax in Scotland of £7 million in 2019-20.

And, commenting on the divergence between Scottish and rUK tax policy, the SFC say: “We expect this to start to have an effect on tax residency decisions.”

In his budget statement3, the Cabinet Secretary for Finance, Economy and Fair Work said he was asking the Council of Economic Advisers to expand their analysis of the impact of potential behavioural effects and the possible impact on future revenues.

Devolved taxes

Land and Buildings Transaction tax and and Scottish Landfill tax have been devolved to the Scottish Parliament since April 2015. Scottish Budget 2019-20 proposes to maintain residential rates and bands of LBTT at their current (2018-19) levels but make some changes to non-residential rates and bands (see table 7).

The Scottish Government propose to reduce non-residential LBTT at the lower rate from 3% to 1%, and increase the upper rate from 4.5% to 5%, with the starting threshold of the upper rate being reduced from £350,000 to £250,000. The SFC state that this policy:

raises £13 million in 2019-20, increasing to £15 million in 2023-24. We estimate a limited forestalling effect of £2.3 million revenue brought forward into January. Some lower value transactions will delay until after the tax change, and some higher value transactions will be brought forward.1

| Residential transactions | Non-residential transactions | Non-residential leases | |||

|---|---|---|---|---|---|

| Purchase price | LBTT rate | Purchase price | LBTT rate | Net present value of rent payable | LBTT rate |

| Up to £145000 | 0% | Up to £150000 | 0% | Up to £150000 | 0% |

| £145001 to £250000 | 2% | £150001 to £250000 | 1% | Over £150000 | 1% |

| £250001 to £325000 | 5% | Over £250000 | 5% | ||

| £325001 to £750000 | 10% | ||||

| Over £750000 | 12% | ||||

The Scottish Government also proposes increasing the Additional Dwelling Supplement (ADS) in 2019-20 from 3 per cent to 4 per cent. The SFC estimate that this policy will raise an additional £27m per annum.

Table 8 sets out the Scottish Government's proposed rates and bands for Scottish Landfill tax, which will apply from April 2019 and compares them with the previous year.

| 2018-19 | 2019-20 | % increase | |

|---|---|---|---|

| Standard rate | £88.95 | £91.35 | 2.7% |

| Lower rate | £2.80 | £2.90 | 3.6% |

The budget document states that Scottish rates are set with issues around "waste tourism" in mind - namely the potential for waste moving across the Scotland/England border should one country have a lower tax charge than the other.

Block grant adjustment

Since the devolution of tax and social security powers introduced by Scotland Act 2016, there has been a need to adjust the Scottish Government's block grant from the UK Government to reflect the fact that Scotland generates tax revenues and incurs expenditure on social security benefits.

Changes to the Scottish Government's block grant will still be determined by the Barnett formula, which reflects changes to UK spending areas that are devolved to the Scottish Parliament. The block grant is then adjusted to reflect the retention of some tax revenues in Scotland, and the transfer of new social security powers (see Figure 1).

In relation to taxes, the initial block grant adjustment (BGA) was equal to the UK Governments tax receipts generated in Scotland in the year immediately prior to devolution. In subsequent years, the BGA for taxes has been calculated according to indexation mechanisms agreed as part of the Fiscal Framework1.

The planned BGAs in relation to taxes and the forecast receipts for 2019-20 are shown in Table 9.

| Block grant adjustment | SFC forecast revenues | Difference | |

|---|---|---|---|

| Income tax (NSND) | 11,501 | 11,684 | 182 |

| LBTT | 567 | 643 | 76 |

| SLfT | 91 | 104 | 13 |

| Total | 12,159 | 12,430 | 271 |

The differences between the BGA and the SFC's forecasts will reflect

different tax policies set by the Scottish and UK Governments

different economic conditions

different forecast methodologies used by the SFC and the OBR.

The table shows, for example, that the Scottish Government's income tax policy is expected to generate £182 million more than will be deducted from the Scottish Government block grant in relation to income tax.

The Scottish Government state that the decision not to replicate the UK Government’s tax policy means that the Scottish budget is £500m better off than it would otherwise be. However, the operation of the fiscal framework means that, on the basis of current forecasts, the Scottish Government will only generate £182m more in income tax revenues than will be removed from the Scottish budget via the block grant adjustment. So the net benefit to the Scottish budget is £182m.

Over the years since 2016-17, the Scottish Government has adopted different income tax policies and the economies of Scotland and rUK will have performed differently. This means that, even if Scotland adopted the UK tax policy, it might not generate enough in tax revenues to offset the block grant adjustment.

The Fiscal Framework that determines how the block grant adjustment is calculated protects Scotland from reductions in revenue that result from slower population growth, but does not insulate Scotland from any reductions in revenue that result from wider economic changes, such as a fall in the number of taxpayers, slower wage growth, or a change in the mix of taxpayers (such as lower numbers of higher rate taxpayers). If these types of changes hit Scotland harder than rUK, then it will make it harder for the Scottish Government to generate the tax revenues that it needs to offset the block grant adjustment.

There will also be a £290 million addition to the Scottish budget to reflect the devolution of carer's allowance to Scotland. The SFC estimate that the Scottish Government will spend £283 million on delivering the carer's allowance in 2019-20, but will also fund a carer's allowance supplement that will cost an estimated £37 million.

Reconciliation of forecasts to actual data

The forecasts for both Scottish tax revenues and the BGA are produced based on the latest available information at the time of the Budget. Once outturn data is available for the Scottish tax revenues, a reconciliation will be carried out as per the timetable set out in the Fiscal Framework. For Scottish income tax, outturn data is likely to be available 15 months after the end of the financial year and for LBTT and SLfT this is likely to be available six months after the end of the financial year.

Alternative indexation methodologies

Under the terms of the Fiscal Framework agreement, the block grant adjustment will be indexed using a method known as the Comparable Model (CM) and the results will then be adjusted to “achieve the outcome delivered by Indexed Per Capita (IPC)”. Each year, block grant adjustments will be produced based on both these mechanisms. Last year's Draft Budget document set out the block grant adjustments that would be implied by the two methodologies and showed that use of the IPC methodology resulted in a smaller block grant adjustment than would be the case under the CM methodology. However, the comparison is not provided in this year's budget document.

The Scottish Fiscal Commission forecasts

The Scottish Fiscal Commission's (SFC) main forecast publication Scotland's Economic and Fiscal Forecasts December 20181 was published alongside the Scottish Budget for 2019-20. The SFC’s forecasts are an important component in determining the total budget available to the Scottish Government to spend in each financial year. The Scottish Budget is also affected by the corresponding Block Grant Adjustments (BGAs). For taxes these adjustments are reductions in the block grant, whilst for the larger social security benefits these are additions to the block grant.

In this chapter, we summarise some of the key points from the SFC’s detailed economic and fiscal forecasts.

Economic outlook

GDP forecasts

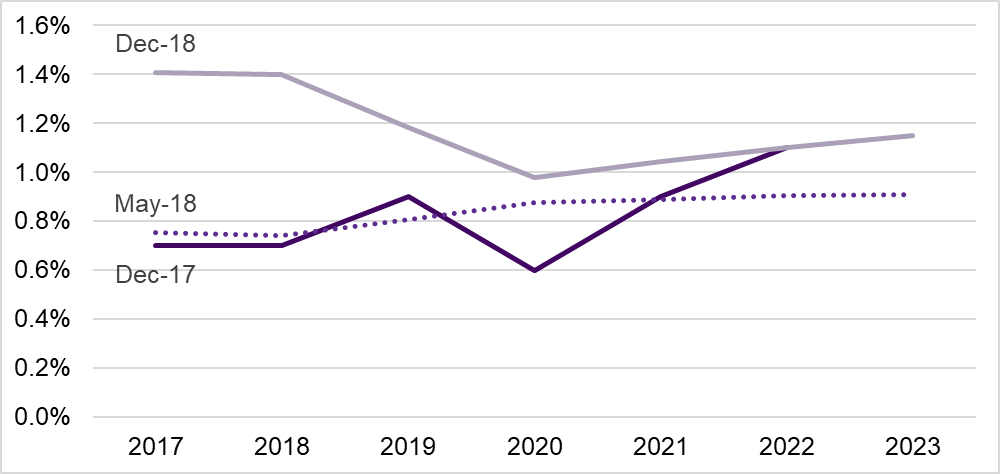

Figure 7 shows that the SFC expect slightly higher growth throughout the forecast period than they did in May 2018 and December 2017. Nonetheless they expect economic growth to be subdued in the longer term, averaging just over 1 per cent over the next five years to 2023. They highlight that the potential effect of Brexit on Scotland remains highly uncertain. The SFC has assumed a relatively smooth and orderly Brexit process in their forecast. However, they do consider a no-deal Brexit to be a downside risk to their forecast.

The slight upward revisions to GDP were driven by three factors.

First, GDP growth over the last two years been stronger than the SFC expected, following new data releases and revisions to past GDP data since May 2018. This more positive performance has been driven, in part, by growth in the production industry and exports.

Second, government expenditure in Scotland is expected to grow significantly faster than the SFC previously forecast. This has been driven primarily by increases in UK Government expenditure announced in the UK Budget in October 2018.

Third, available earnings data for 2018 are a little stronger than was expected back in May. Thus, SFC has revised up their forecast of average earnings growth by around 0.2 percentage points in 2018 and beyond.

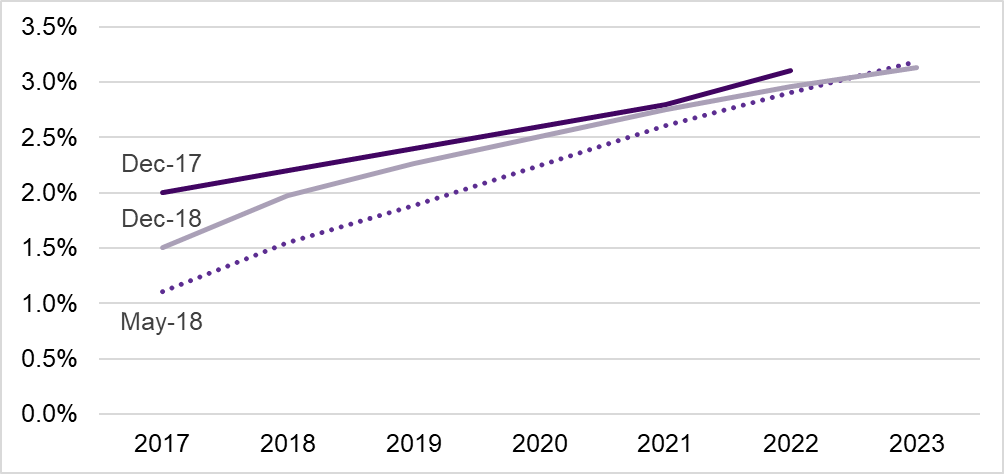

Figure 8 shows the changing nature of forecast nominal earnings by the SFC with the most recent prediction more positive in the short-term but down slightly in the long-term.

The stronger than expected GDP performance over the last two years was primarily because of revisions to construction industry activity. Growth in construction industry activity in 2015 was revised down from 18.3% to 6.2%, while for 2017 it was revised up from 3.8% to 4.3%. While the construction industry only accounts for around six per cent of GDP, these large revisions had a significant impact on economic growth. SFC note that the scale of the revisions published in August were exceptional. The SFC acknowledge that economic data will always be subject to revision and state that "measures of construction industry activity and its impact on economic growth over the last few years are by no means settled".1

Wider economic factors

The SFC assume that productivity growth gradually increases from the low rates observed in recent years but remains well below its pre-crisis trend over the forecast period (see Table 10). They state that lower levels of trade, migration and investment, and a lower level of economic openness more generally, strengthens their judgement that productivity in Scotland will continue to grow at a lower rate over the next five years than historic trends.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| May 2018 | 0.0 | 0.2 | 0.5 | 0.8 | 0.9 | 1.0 | 1.1 |

| December 2018 | 0.2 | 0.3 | 0.7 | 0.9 | 1.0 | 1.1 | 1.2 |

The SFC believe that spare capacity in the economy is limited, particularly with their assessment of a tight labour market, where the unemployment rate is currently very low, and this assessment is further supported by modelled trends in GDP and by available surveys of the economy.

Other factors highlighted by the SFC that will impact on economic performance:

They expect high inflation to dampen consumer spending and retail sales over the near term.

The volume of Scotland’s manufactured exports to the rest of the world grew by 8.5% during 2017 and has continued to increase in the first two quarters of 2018. From the second half of 2018, growth in the production industry may start to diminish, given falling oil prices.

Their outlook for the oil and gas sector is weak because of significant uncertainty over oil price movements and its implications for capital investment projects.

UK comparison

Compared to the OBR’s forecasts for the UK, the SFC has forecast slower GDP growth for Scotland (see Figure 9) with a gap of 0.4 percentage points post 2018. This is in part because of slower population growth, and in particular slower growth of the 16-64 population in Scotland.

Policy impacts

Here we summarise some of the headline results from modelled Scottish Government policy changes announced in the Budget that impact fiscal forecasts.

Income tax

The SFC has revised down their income tax forecast since May 2018. A number of different factors have contributed to the revisions. New outturn data for 2016-17 and changes in UK income tax policy have reduced their forecast, while changes in Scottish income tax policy and a more positive outlook for the economy since May have increased the income tax forecast. In combination, it is forecast that income tax liabilities will be £661 million lower in 2019-20 than in their May 2018 forecast.

A number of fiscal policies were announced by the Scottish Government in this Budget. The SFC believe that the policy with the largest fiscal effect is the income tax policy to maintain the higher rate threshold at £43,430, expected to raise around £68 million in 2019-20. The SFC is of the opinion that the lower household income and spending as a result of this policy will be largely offset by higher government income and spending.

With the higher rate threshold in Scotland set at £43,430 in 2019-20, SFC state that there is a growing gap between the higher rate threshold in Scotland and the rest of the UK. SFC provide the following example:

A taxpayer earning £50,000 is expected to pay around £1,540 more in income tax in Scotland in 2019-20 than in the UK, and this expected difference has increased by more than £695 since the May 2018 forecast. We expect this to start to have an effect on tax residency decisions.

SFC has estimated that changes in taxpayer residence behaviour will lead to a reduction of income tax in Scotland of £6 million in 2019-20.

Non-Domestic Rates (NDR)

The SFC forecast of NDR for 2019-20 is £2,785 million, £74 million lower than forecast in May 2018. The downward revision reflects data and modelling updates as well as Scottish Government policy changes. The largest change results from the Scottish Government’s announcement that the tax rate, or poundage, will be set at 49.0p, reducing receipts by £35 million in 2019-20 relative to the SFC’s baseline assumption of an increase in line with RPI.

The SFC highlight that given their forecast of the contributable amount and the Scottish Government’s proposed distributable amount, they now project a £100 million negative balance in the NDR Rating Account at the end of 2019-20. Should the projected negative balance in 2019-20 materialise this will have to be addressed by the Government at future Budgets. Non-Domestic Rates are discussed further in the Local Government section of this briefing.

Land & Buildings Transaction Tax (LBTT)

SFC’s forecast of revenues from residential LBTT in 2019-20 has been revised down from £342 million in May to £296 million. This is in part because of the weaker outlook for transactions and in part because of a revision to the forecast which now apportions slightly more transactions to the lower tax bands. Since then average house prices have continued to grow, but at a lower rate.

The SFC estimate £122 million in Additional Dwelling Supplement (ADS) revenue in 2019-20. The Scottish Government will increase the tax rate on transactions liable for the ADS from 3 per cent to 4 per cent. SFC estimate this will increase ADS receipts by an average of £27 million per year from 2019-20 onwards.

Non-residential LBTT receipts are forecast to be £226 million in 2019-20, increasing over the five-year forecast horizon to £255 million in 2023-24.

Scottish Landfill Tax (SLfT)

SLfT revenue is forecast to fall from £104 million in 2019-20 to £14 million in 2023-24. There are two main drivers reducing landfilled waste and, therefore, SLfT receipts. These relate to projected increases in incineration capacity and the introduction of the Scottish Government’s legislative ban on the landfilling of biodegradable municipal waste in 2021.

Social security

Due to increased devolved powers around social security in Scotland, forecasts for social security expenditure have increased significantly. The SFC’s social security forecasts are for £458 million expenditure in 2019-20. They estimate that the new and expanded social security plans will cost £90 million more than the funding received for these benefits. SFC’s forecasts of social security expenditure are of the total amount paid to, or in respect of, claimants, and do not include any administrative costs.

Impact of SFC forecasts

The primary drivers of the Scottish Government’s budget are the Block Grant, SFC tax forecasts, and the corresponding Block Grant Adjustments (BGAs). The forecasts of BGAs are based on OBR forecasts of UK Government receipts; they do not relate to the OBR’s forecasts of Scottish taxes.

The SFC’s fiscal forecasts directly inform the Scottish Government’s Budget. In total the SFC are forecasting £15.2 billion of the Scottish Budget will be raised by tax in 2019-20.

Table 11, extracted from the SFC forecast, shows how the Block Grant, and the net effect of the SFC tax forecasts and the BGA, have changed since the SFC’s May 2018 forecasts. Detailed analysis within the SFC forecast shows that receipts are greater than the BGAs over the whole of this period. The differences reflect both policy decisions by the Scottish and UK Governments as well as differences in the underlying growth of tax revenues.

| £ million | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 |

|---|---|---|---|---|---|

| Base resource spending limit (block grant) | 27,633 | 28,822 | 29,688 | 30,596 | 31,631 |

| Change since May 18 | 570 | 1,468 | 1,840 | 2,255 | 0 |

| Net BGA | 271 | 281 | 284 | 310 | 329 |

| Change since May 18 | 89 | 7 | -127 | -203 | 0 |

These differences in government policy decisions, directly impact government consumption. Compared to SFC’s May 2018 forecast of real growth in government consumption of 0.8%, they now predict that real government consumption will grow by 1.4% in 2019-20. Real government consumption growth has been revised up by between 0.5 and 1.1 percentage points in each year of the forecast.

The SFC state that:

government expenditure accounts for around quarter of the economy, and so these large revisions to the outlook for government expenditure will create significant additional demand in the economy.1

At the UK Autumn Budget in October 2018, UK tax revenues for 2018-19 had been revised up, while projections of baseline expenditure had been revised down. This provided the UK government with an unexpected fiscal windfall of around £12 billion in 2019-20. In response, the UK Government increased expenditure above its previous plans in real terms for the next five years, with the majority of this additional expenditure allocated to the NHS.

This higher expenditure affects Scotland in two ways. The Scottish Government will receive extra funding via the Block Grant as a consequential of higher UK Government spending, and the expenditure by other UK Government departments in Scotland may also increase directly.

There is much emphasis on the fact that the Scottish Budget in future years will be affected by reconciliations relating to previous years’ forecasts of Scottish receipts and the BGAs. The largest reconciliations in the next couple of years are expected to relate to income tax. The first reconciliation for income tax will occur after the outturn data for 2017-18 become available in summer 2019 and will affect the Scottish Budget 2020-21.

The SFC believe that since outturn data will now be published on a regular basis that they will be able to calibrate their forecasts to these.

The SFC highlight that large revisions to economic data, and newly available data on outturn income tax liabilities in Scotland, has had a significant effect on the accuracy of their forecasts. They emphasise that they continue to seek improvements to the economic, tax and social security data available for Scotland, as highlighted in their Statement of Data Needs.

Capital and infrastructure

The 2019-20 capital budget from HM Treasury is £3,956 million, a 10.4% increase in real terms compared with 2018-19. The Scottish Government plans to further boost investment in infrastructure in 2019-20 through a combination of mechanisms:

Carrying forward from 2018-19 capital consequentials made available as a result of the 2018 UK budget.

Using maximum borrowing powers (£450 million).

Using Financial Transactions funding from the UK Government (£635.5 million).

Financing some projects using revenue financing methods, which avoids the need to pay for projects upfront (projects with a capital value of £60 million funded in this way).

Making use of innovative finance mechanisms, such as the Growth Accelerator and Tax Incremental Financing (£30 million).

These additional financing sources will mean total infrastructure investment in 2019-20 of £5,195.8 million. Further detail on these funding sources is given below.

Carry forward of 2018-19 consequentials

The Autumn 2018 UK budget allocated £91 million in capital consequentials to the Scottish Government for 2018-19. The budget document states that the Scottish Government is "deploying 2018-19 capital consequentials from the UK Budget by carrying them forward into 2019-20". The budget numbers would suggest that £64 million of the 2018-19 capital consequentials have been carried forward into 2019-20.

Borrowing powers

The Scottish Government is able to borrow up to £450m in 2019-20 for capital investment. The Budget states that: “In order to maximise our commitment to investing in infrastructure, we will make use of the full £450 million available in 2019-20.”

The Budget also notes that: “Final decisions on borrowing arrangements will be taken over the course of the year reflecting an ongoing assessment of programme requirements.”

Borrowing powers were used in full in 2017-18 and are planned to be used in full in 2018-19. Prior to this, in 2015-16 and 2016-17, ‘notional’ borrowing powers were used to provide budget cover for revenue-financed projects that had to be transferred to the public sector (see section on Revenue financed investment). This ‘notional’ borrowing counts towards the cumulative borrowing limit of £3 billion.

According to the Scottish Government’s Fiscal Framework Outturn Report1, the Scottish Government will have accumulated £1,459 million of capital debt by the end of 2018-19, representing 49% of the £3 billion limit. SPICe analysis suggests that the Scottish Government could continue to borrow the maximum of £450 million per year until 2022-23 before it would breach the £3 billion limit, assuming that the repayment terms for future borrowing are similar to those for existing borrowing.

Financial transactions

The 2019-20 Budget includes £519m for financial transactions (FTs). This relates to Barnett consequentials resulting from a range of UK Government equity/loan finance schemes (primarily the UK housing scheme, Help to Buy). Over the period 2012-13 to 2019-20, financial transactions allocations will total £2.5 billion. The Scottish Government has to use these funds to support equity/loan schemes beyond the public sector, but has some discretion in the exact parameters of those schemes and the areas in which they will be offered. This means that the Scottish Government is not obliged to restrict these schemes to housing-related measures and is able to provide a different mix of equity/loan finance.

In 2019-20, a total of £261.5 million in financial transactions has been allocated to housing-related schemes, including Help to Buy (Scotland). The Scottish Government is also providing equity/loan finance support in areas other than housing. FTs will also be used:

to provide loan funding to small and medium-sized enterprises

to fund energy efficiency programmes

to support investment in the higher education sector (£55.5 million)

to provide upfront capitalisation for the Scottish National Investment Bank which is planned to become operational in 2020 (£120 million)

to continue the Building Scotland Fund (£50 million).

Individual tables in the budget document show the following profile for financial transactions.

| £ million | |

|---|---|

| Health and Sport | 10.0 |

| Communities and Local Government | 261.5 |

| Finance, Economy and Fair Work | 265.5 |

| Education & Skills | 55.5 |

| Transport, Infrastructure and Connectivity | 36.5 |

| Rural Economy | 5.0 |

| Culture, Tourism and External Affairs | 1.5 |

| Total | 635.5 |

The total planned FT spending exceeds the total allocated for 2019-20, as FT monies from earlier years are being re-profiled.

The Scottish Government will be required to make repayments to HM Treasury in respect of these financial transactions. The repayments will be spread over 30 years, reflecting the fact that the majority of FT allocations relate to long term lending to support house purchases and the construction sector. The repayment schedule is based on the anticipated profile of Scottish Government receipts, with the first repayment to HM Treasury of £51 million scheduled for 2019-20.

Revenue financed investment

In recent years, the Scottish Government has used revenue financing to increase the level of infrastructure investment that can be achieved through the capital budget alone. Revenue financing means that the Scottish Government does not pay the upfront construction costs, but is committed to making annual repayments to the contractor, typically over the course of 25-30 years.

As a result of new European accounting guidance (European System of Accounts 2010 – ESA10), the budgeting treatment of revenue financed projects has changed. Projects funded via the Non-Profit Distributing (NPD) model are now deemed to be public sector projects and require upfront budget cover to be provided from the capital budget over the construction period of the asset. This compares with the budget treatment for private sector projects, where the costs are treated as revenue costs and are spread over the period (usually 25-30 years) over which the asset is used and maintained. No new NPD projects are currently being considered.

The Scottish Government has been able to adjust the design of smaller revenue-funded hub projects so that they can continue to be treated as private sector assets and financed through the revenue budget as before. In 2019-20, the capital value of revenue-financed hub projects is £60 million.

Innovative financing

The Growth Accelerator (GA) and Tax Incremental Financing (TIF) are local authority led financing schemes, whereby projects are financed through borrowing in the expectation that future uplifts in local taxation income will fund the repayments. The Scottish Government provides some support to such schemes, as well as to City Region and Regional Growth Deals, totalling £30 million in 2019-20.

Revenue financing and the 5% cap

Annual repayments resulting from revenue financed projects and borrowing come from the Scottish Government’s resource budget. The Scottish Government has committed to spending no more than 5% of its total budget on repayments resulting from revenue financing (which includes NPD/hub, previous PPP contracts, regulatory asset base (RAB) rail investment) and any repayments resulting from borrowing.

In the 2019-20 budget, the definition of the baseline has been changed from the total budget to resource budget (excluding social security). As the latter figure will be lower, this has the effect of reducing the level of repayments that can be met before breaching the cap. However, it is also worth noting that there has been a change in the budget treatment of RAB-financed rail projects. The changes mean that future rail investment will be grant financed and that there will be no ongoing repayment commitments in relation to RAB projects. This has the effect of giving the Scottish Government more headroom within its 5% cap.

Based on current plans and taking these changes into account, the Scottish Government estimates that it will spend 3.2% of its resource budget on these repayments in 2019-20.

National Infrastructure Mission

The Scottish Government’s Economic Action Plan 2018-201 announced plans to increase Scotland’s annual infrastructure investment so that it is £1.5 billion higher by the end of the next Parliament than in 2019-20. The 2019-20 Budget defines this baseline at £5,195.8 million and so sets out the ambition to increase annual infrastructure investment to £6,750.8 million by 2025-26. The Budget document states that future budgets will provide details of progress against the target. No details are provided on how the investment will be financed, other than saying that it will be a mix of capital grant, FTs, borrowing and innovative finance instruments. The Budget document also makes reference to asking the Scottish Futures Trust to examine the use of profit sharing revenue finance schemes, such as the Welsh Government’s Mutual Investment Model. This is a modified version of the Scottish Government’s NPD model, adjusted so that projects can continue to be classified as private sector assets.

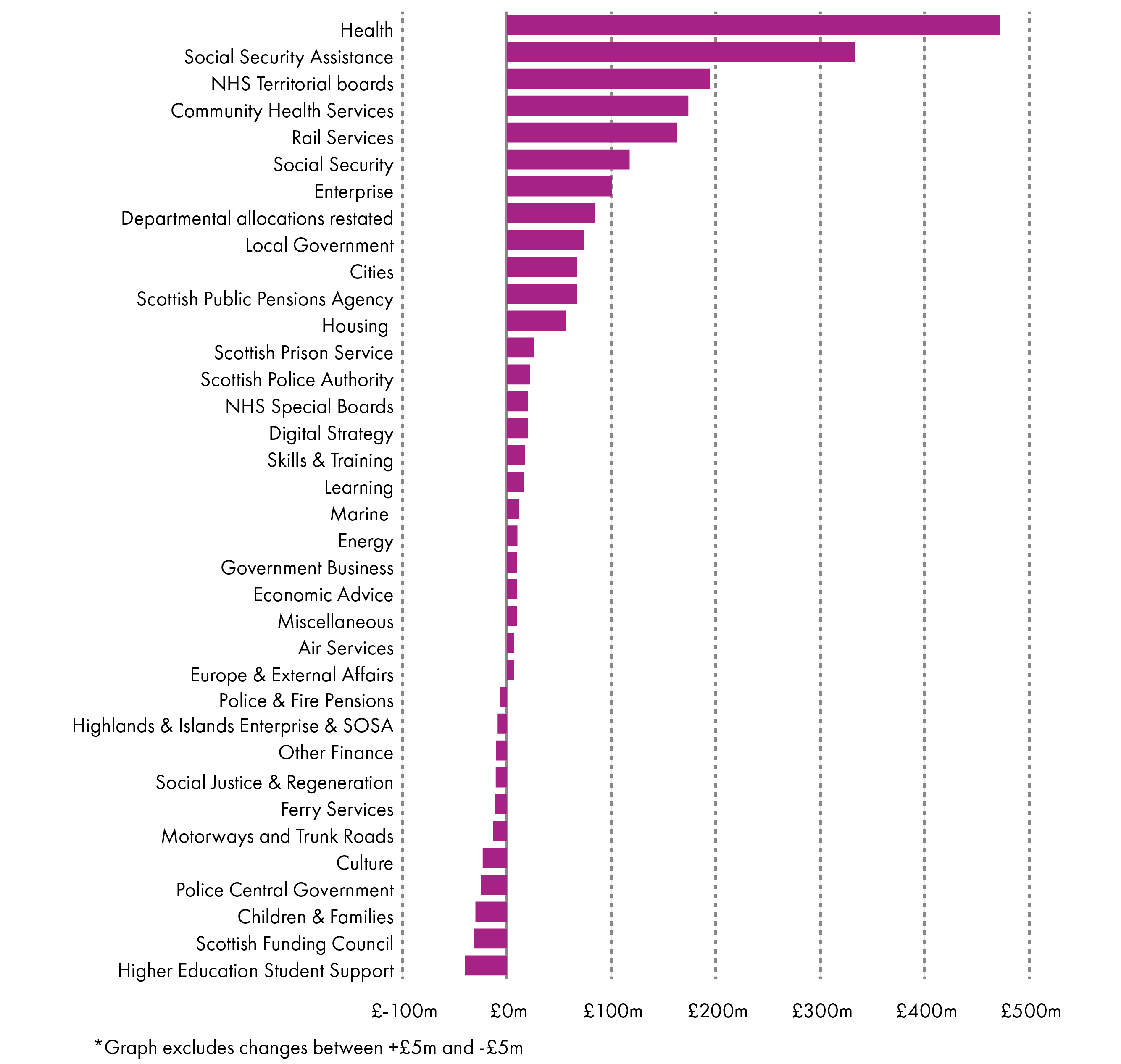

The largest real terms increases and decreases

Figure 10 presents the largest real terms level 2 budget line increases and decreases in 2019-20 compared with the previous year.

Health receives the highest absolute increase of over £470 million (+3.5%) and Higher Education Student Support receives the largest reduction of over £40 million (-4.2%).

Local Government

This section of the briefing sets out a high level summary and analysis of the local government budget for 2019-20. The Local Government Finance Circular, which sets out funding in further detail and individual allocations to local authorities, is due to be published on Monday 17 December. A dedicated SPICe briefing setting out the settlement for local authorities in more detail will follow this. Figures relating to this section can be found in the Annex, with headline figures marked in bold.

Historical context

The years 2016-171 and 2017-182 were characterised by reductions in the core grant to local authorities, together with changes to the way in which the total amount of resources available to local authorities was presented. This was followed by an uplift in Revenue funding for local government in 2018-193, and further presentational changes.

2019-20 local government funding

The total allocation to local government in the 2019-20 Budget is £10,779.9 million. This is mostly made up of General Revenue Grant (GRG) and Non-Domestic Rates Income (NDRI), with smaller amounts for General Capital Grant and Specific (or ring-fenced) Revenue and Capital grants. This represents a 2.5% increase in cash terms, or a 0.7% increase in real terms.

Once Revenue funding within other portfolios (but still from the Scottish Government to local authorities) is included, the total is £11,071.2 million, a cash increase of 3.8% (£405.1 million), or 2% (£210.5 million) in real terms. This £210 million real terms figure was used by the Cabinet Secretary as the headline Local Government figure in his Budget speech.

Finally, if "Local government funding outwith the Core Settlement" is included, the total rises to £11,519.9 million, a cash increase of 4.4%, or 2.6% in real terms.

The story behind the figures

Revenue funding

Whilst the Scottish Government presents an increase to the local government settlement, there are varying ways to interpret the figures. Full figures relating to this section can be found at the Annex.

The Scottish Government guarantees combined GRG and distributable NDRI figure, approved by Parliament, to each local authority. If NDRI is lower than forecast, this is compensated for by an increase in GRG, and vice versa (see SB-18/60 - Local Government Finance: The Funding Formula and local taxation income1). Therefore, to calculate Local Government's revenue settlement the combined GRG + NDRI figure is used.

The General Revenue Grant, combined with Non-Domestic Rates represents the core settlement available to local authorities to deliver services. When looking specifically at the non-ringfenced funding available for councils to deliver services, GRG+NDR, this falls by 1.7% (-£157.2 million) in cash terms, or 3.4% (-£319.1 million) in real terms between 2018-19 and 2019-20.

Non-Domestic Rates, in 2019-20, sees a dramatic increase, of 8.2% (£217 million) in cash terms, or 6.3% (£166.8 million) in real terms. It should be noted that £100 million of this increase comes from a decision to include forecast funds from future years to the 2019-20 Budget .

The Statutory Background to the Non Domestic Rating Account is set out in the annual account2. The legislation makes it clear that all non-domestic rates collected must be redistributed but it does not give any timescale for doing so. The account states that, if there is a surplus, it is carried forward by debiting the account for the year and crediting the next year's account, so increasing the amount available for redistribution the following year. A deficit is carried forward by crediting the account for the year and debiting the next year's account (Schedule 12, Paragraph 8). This account demonstrates that, looking at the non-domestic rates account over a number of years, all non-domestic rates paid to Scottish Ministers are redistributed to authorities.

The increase in Specific Revenue Grants and Non-Domestic Rates masks a fall in the General Revenue Grant, which is down 5.6% (-£374.2 million) in cash terms, or 7.2% (-£486 million) in real terms. However, again, it should be noted that the Government guarantees the combined GRG and distributable NDRI figure, approved by Parliament, to each local authority.

Capital funding

Changes to Capital funding also contribute to the total figures for local government, quoted by the Scottish Government. In 2019-20, Total Capital funding, increases by 23.7% in cash terms (£207.6 million), or 21.5% in real terms (£188.2 million). This increase represents a boost to both general support for Capital, and Specific Capital Grants. It should be noted, however, that, as set out in previous Budget documents, £150 million of funding which was "reprofiled" out of the local government settlement in 2016-17 has been added back into 2019-20. If this sum were removed, "Support for Capital" would fall significantly in both cash (-7.5%) and real (-9.1%) terms.

As in previous years, it is expected that local authorities will need to agree to certain commitments to access the full funding package, which can place potential constraints on the use of Revenue funding. The Budget document does not highlight any changes to these commitments; these will be set out in detail in the Local Government Finance Circular and explored in the full Local Authority allocations briefing.

COSLA's position

The Convention of Scottish Local Authorities (COSLA) sets out, in its "Budget Reality" figures, its own interpretation of the settlement. This has been calculated by combining GRG, NDRI and Revenue funding in other portfolios, then adding in £34.5 million that was paid in 2017-18 but used as part of the 2018-19 Budget back to 2018-19. From this figure, COSLA then deduct around £400 million of new commitments from the funding package, to produce their figure for the "cut to the core budget".

How might the Budget change?

As mentioned above, publication of the Budget commences a parliamentary scrutiny process and political negotiation, as the Scottish Government seeks a parliamentary majority for 2019-20 tax and spending. So how might the budget change prior to final parliamentary votes on tax and spending proposals?

Given the parliamentary arithmetic, where no single political party commands a majority, it is likely that the SNP will have to strike a deal with another political group.

So far in this session of Parliament, the Green Party has voted for an amended Budget containing changes to the higher rate income tax threshold and increased local government spending. By already having proposed to freeze the higher and additional rate, the Scottish Government's room for manoeuvre on income tax may be more limited than it has been in the past.

This time Green MSPs are demanding reforms to local taxation. The budget document states the following:

The Scottish Government is committed to making local taxation more progressive whilst improving the financial accountability of local government and we endorse the primary conclusion from the Commission on Local Tax Reform's 2016 report that ‘the present council tax system must end'.

The coming weeks will reveal if SNP-Green votes will combine to pass the tax rate resolution and budget bill, or whether new budget alliances might need to be formed.

Other issues

Public sector pay

The Scottish Government published its Public Sector Pay Policy for 2019-201 alongside the Budget. The Scottish Government 2019-20 pay policy replicates the policy that was in place for 2018-19.

The main features of the 2018-19 pay policy are:

a minimum 3 per cent increase for public sector workers who earn £36,500 or less

a limit of 2 per cent on the increase in baseline paybill for those earning above £36,500 and below £80,000

a limit of £1,600 on the pay increase for those earning £80,000 or more

a continuation of the requirement for employers to pay staff the real Living Wage (currently £9.00 per hour)

flexibility for employers to use up to 1 per cent of paybill savings on baseline salaries for limited non-consolidated payments to certain employees or to address equality issues.

The pay policy retains the features of previous pay policies in relation to:

discretion for employers in relation to pay progression

the suspension of non-consolidated performance related pay (bonuses)

the commitment to no compulsory redundancies

the expectation that there will be a 10% reduction in remuneration packages for new Chief Executive appointments.

The pay policy does not apply directly to all public sector staff. It only directly affects the pay of Scottish Government staff, and the staff of 44 public bodies, which together account for around 9% of the Scottish public sector (around 37,000 staff). Large parts of the public sector, such as local government and the NHS are not directly covered by the Scottish Government’s pay policy and pay is determined separately for these groups, although often in line with the Scottish Government's pay policy and - in some cases - with some Ministerial control.

The pay policy notes that: “This policy also acts as a benchmark for all major public sector workforce groups across Scotland including NHS Scotland, fire-fighters and police officers, teachers and further education workers. For local government employees, pay and other employment matters are delegated to local authorities.”

Equality and Fairer Scotland Budget Statement

This is the tenth year the Scottish Government has published an equality statement1 to accompany its budget. The statement provides analysis of how protected characteristics (as set-out in the Equality Act 2010) are affected by the 2019-20 Budget. In preparing the statement, the Government has been assisted by the Equality Budget Advisory Group, a non-statutory advisory group which has helped shape the Scottish Government's approach to budgeting since the early days of devolution.

The first part of this year's statement provides a strategic overview; including looking at the Budget as a whole and explaining equality budgeting. Much of the rest of the statement is comprised of summary chapters for each of the 12 Ministerial portfolios.

This year's statement has additional chapters on both the Fairer Scotland Duty, which came into force in April 2018, and child poverty targets. The Fairer Scotland Duty requires the Scottish Government, and other public bodies, to consider how they can reduce inequalities of outcome caused by socio-economic disadvantage. The Fairer Scotland chapter lists and discusses various policies which will be funded during 2019-20; however, it is very much focussed on inputs. It would be useful in next year's statement to get an understanding of the outcomes, or at least the outputs, achieved by this spend.

In previous statements there have been specific chapters on inclusive growth. However, this year's focus is on the impact of the Budget on child poverty targets (which became law last year). The Government identifies three main drivers of child poverty reduction: increasing income from work and earnings; reducing household costs; and maximising income from social security. A number of policies and spending commitments, from a wide range of portfolios, are included under each driver. For example, within the work and earnings section, the statement mentions the Child Poverty Fund, skills programmes, the enterprise agencies and Living Wage promotion. Again, it would be useful to get an update next year on how these spending commitments have contributed to progress towards the targets, perhaps through closer linkage to the National Performance Framework.

Carbon Assessment

The Climate Change (Scotland) Act 2009 requires the Scottish Government to publish an assessment of the impact its budget has on Scottish emissions of greenhouse gases. This document is required by law to describe "the direct and indirect impact on greenhouse gas emissions of the activities to be funded by virtue of the proposals". In other words, the carbon emissions associated with the Scottish Government's purchase of goods and services. Of course, we don't know at this stage exactly what carbon emissions will be next year – the figures included are estimates based on Government modelling.

The carbon assessment1 accompanying the Budget estimates total emissions of 7.3 million tonnes CO2-equivalent (MtCO2e) resulting from the 2019-20 Budget. This is an increase of 0.3 MtCO2e from 2018/19.

The three portfolios seeing the highest emission levels are Communities and Local Government (30% of total), Health and Sport (26%) and Transport, Infrastructure and Connectivity (14%). Of course, the first two are by far the largest spending portfolios in the budget, accounting for over 60% of total spend between them, so it is little surprise that their emissions are highest.

The Rural Economy portfolio has the highest ratio of emissions to spend of all portfolios, and we know that the farming activity that this spend supports leads to significant levels of methane and nitrous oxide emissions. The Transport, Infrastructure and Connectivity portfolio has the next highest ratio – this area accounts for 7% of all spend but is responsible for 14% of carbon emissions.

The assessment tells us that a third of the Scottish Government's carbon footprint comes from the use of energy, water and waste (33%), followed by the purchase of manufactured goods (23%), and then transport/communication (15%).

It is worth remembering that the document is an assessment of a single year, and doesn't account for multi-year "lock-in effects" of certain investment choices made in/for that year, especially in infrastructure. For example, if the Government chooses to budget for more road-building, it is widely argued that this "locks" Scotland into increased greenhouse gas emissions through road use over the longer term. Therefore, there may be multi-year impacts over and above the carbon emissions of simply constructing the road which aren't included in the carbon assessment.

Annex - Local Government funding

| Local Government | 2018-19 | 2019-20 (cash) | Cash change | Cash change % | 2019-20 (real) | Real change | Real change % |

|---|---|---|---|---|---|---|---|

| Local Government Spending Plans (Table 6.10 in the Budget document) | |||||||

| General Revenue Grant | 6,733.5 | 6,359.3 | -374.2 | -5.6% | 6,247.5 | -486.0 | -7.2% |

| Non-Domestic Rates | 2,636.0 | 2,853.0 | 217.0 | 8.2% | 2,802.8 | 166.8 | 6.3% |

| Support for Capital | 598.4 | 703.8 | 105.4 | 17.6% | 691.4 | 93.0 | 15.5% |

| Specific Resource Grants | 273.7 | 483.6 | 209.9 | 76.7% | 475.1 | 201.4 | 73.6% |

| Specific Capital Grants | 278.0 | 380.2 | 102.2 | 36.8% | 373.5 | 95.5 | 34.4% |

| Local Government Advice and Policy | - | 3.0 | - | - | - | - | - |

| Total Level 2 | 10,519.6 | 10,782.9 | 263.3 | 2.5% | 10,593.3 | 73.7 | 0.7% |

| GRG+NDRI | 9,369.5 | 9,212.3 | -157.2 | -1.7% | 9,050.4 | -319.1 | -3.4% |

| GRG, NDRI and SRG | 9,643.2 | 9,695.9 | 52.7 | 0.5% | 9,525.5 | -117.7 | -1.2% |

| Total Capital | 876.4 | 1,084.0 | 207.6 | 23.7% | 1,064.9 | 188.5 | 21.5% |

| Revenue funding in other portfolios (Table 6.14 in the Budget document) | |||||||

| Local Government Budget Settlement | 10519.6 | 10779.9 | 260.3 | 2.5% | 10,590.4 | 70.8 | 0.7% |

| Total revenue within other portfolios | 146.5 | 291.3 | 144.8 | 98.8% | 286.2 | 139.7 | 95.3% |

| Finance Circular | 10,666.1 | 11,071.2 | 405.1 | 3.8% | 10,876.6 | 210.5 | 2.0% |

| Funding outwith core settlement (Table 6.15 in the Budget document) | |||||||

| Revenue | 153.8 | 161.4 | 7.6 | 4.9% | 158.6 | 4.8 | 3.1% |

| Capital | 210.0 | 287.3 | 77.3 | 36.8% | 282.2 | 72.2 | 34.4% |

| Total funding outwith core | 363.8 | 448.7 | 84.9 | 23.3% | 440.8 | 77.0 | 21.2% |

| Overall SG funding for LG | 11,029.9 | 11,519.9 | 490.0 | 4.4% | 11,317.4 | 287.5 | 2.6% |