UK Autumn Budget 2017 - impact on Scotland

The UK Government's Autumn Budget 2017 was published on 22 November. This briefing summarises some of the implications of that Budget for the Scottish public finances. The Scottish Government will present its draft budget to Parliament on 14 December.

Introduction

On 22 November, the Chancellor of the Exchequer, the Rt Hon Phillip Hammond MP, presented his Budget to the UK Parliament1. This contained spending plans for all UK Departments and devolved administrations through to 2019-20 for Resource spending and 2020-21 for Capital spending; as well as a range of tax plans in advance of the new tax year in April 2018.

The Scottish Budget

The Autumn Budget contained the latest block grant allocations to Scotland, and these are presented in Table 1.

| £m | 2017-18 | 2018-19 | 2019-20 |

|---|---|---|---|

| Cash terms | |||

| Fiscal Revenue DEL (RDEL) | 26,635 | 26,824 | 26,866 |

| £m change | 188 | 43 | |

| % change | 0.7% | 0.2% | |

| Capital DEL (CDEL) | 3,166 | 3,414 | 3,726 |

| £m change | 247 | 313 | |

| % change | 7.8% | 9.2% | |

| Financial Transactions | 445 | 488 | 519 |

| £m change | 43 | 31 | |

| % change | 9.7% | 6.3% | |

| Total | 30,247 | 30,725 | 31,111 |

| £m change | 479 | 386 | |

| % change | 1.6% | 1.3% | |

| Real terms | |||

| Fiscal Revenue DEL | 26,225 | 26,026 | 25,706 |

| £m change | -199.0 | -319.8 | |

| % change | -0.8% | -1.2% | |

| Capital DEL | 3,117 | 3,312 | 3,565 |

| £m change | 195 | 253 | |

| % change | 6.2% | 7.6% | |

| Financial Transactions | 438 | 474 | 497 |

| £m change | 35 | 23 | |

| % change | 8.1% | 4.8% | |

| Total | 29,781 | 29,812 | 29,768 |

| £m change | 31 | -44 | |

| % change | 0.1% | -0.1% |

These plans represent an increase in Scottish spending relative to the UK Government plans set out in the previous UK fiscal event of March this year. DEL Resource figures have increased by £347m over the period to 2020 compared with the plans set out in March. DEL Capital plans have increased by £509m over the period to 2021 compared with March plans. £1,115m in Barnett consequentials derive from Financial Transactions, which must ultimately be repaid to HM Treasury.

Overall, the DEL Resource budget will increase in cash terms in 2018-19 by 0.7% which represents a real terms fall of 0.8%. The picture for DEL Capital spending is much more positive with a cash terms increase of 7.8% next year, equivalent to a 6.2% increase adjusted for inflation.

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

|---|---|---|---|---|

| RDEL | 8.4 | 183.3 | 154.9 | n/a |

| CDEL | 58.6 | 68.6 | 169.3 | 212.1 |

| CDEL-FTs | 156.3 | 271.3 | 332.0 | 355.3 |

| Total Barnett Consequentials | 1,970.1 | |||

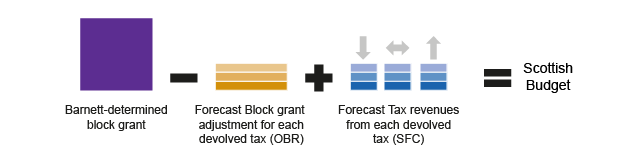

Under the terms of the Fiscal Framework1 agreed between the UK and Scottish Government to implement the Scotland Act 2016 powers, the size of the Scottish Budget is now not only comprised from the block grant. It is now determined by three elements (see Figure 1):

The block grant allocation from the UK Budget - changes in this block are determined by increases or decreases in English spending on functions that are ‘comparable’ to those devolved to the Scottish Parliament.

A block grant adjustment (BGA), which is essentially a forecast of the revenue the UK Government has foregone by devolving taxes to the Scottish Parliament.

A Scottish Fiscal Commission (SFC) produced forecast for the revenue raised from taxes devolved or transferred to the Scottish Government.

The BGA is presented in a footnote to Table 1.7 of the UK budget document.2 The details of the calculation of the BGA are not published. The BGAs are as follows:

£12.5bn in 2017-18.

£13.1bn in 2018-19 (but this includes Air Passenger Duty, the devolution of which has been postponed so the BGA will need to be recalculated).

£13.4bn in 2019-20 (but this also includes Air Passenger Duty, the devolution of which has been postponed so the BGA will need to be recalculated).

When the Scottish Government presents its Budget in three weeks time, the Scottish Fiscal Commission will publish its forecast of Scottish tax revenues alongside it. These estimates will be the sum that will be available to the Scottish Government to draw down from Treasury throughout 2018-19. These forecasts will be reconciled to outturn data once it is available, and the Scottish budget adjusted up or down in subsequent years to account for this.

The taxes devolved to Scotland must generate revenue equal to the BGA for the Scottish budget to be no worse off than it would have been without fiscal devolution. If tax forecasts and subsequently receipts are lower than the BGA, the Scottish budget is worse off; if higher than the BGA, the Scottish budget is better off than it would have been without tax devolution.

We will not know this final element of the equation, comprising the size of the Scottish spending envelope, until we see the Fiscal Commission's forecasts published alongside the Budget on 14 December.

OBR forecasts

On the same day as the Autumn Budget, the OBR published its Economic and Fiscal Outlook1. This contains a forecast for all UK tax receipts collected. Alongside that, and consistent with the main UK forecasts, the OBR published forecasts for the fully or partially devolved Scottish taxes2.

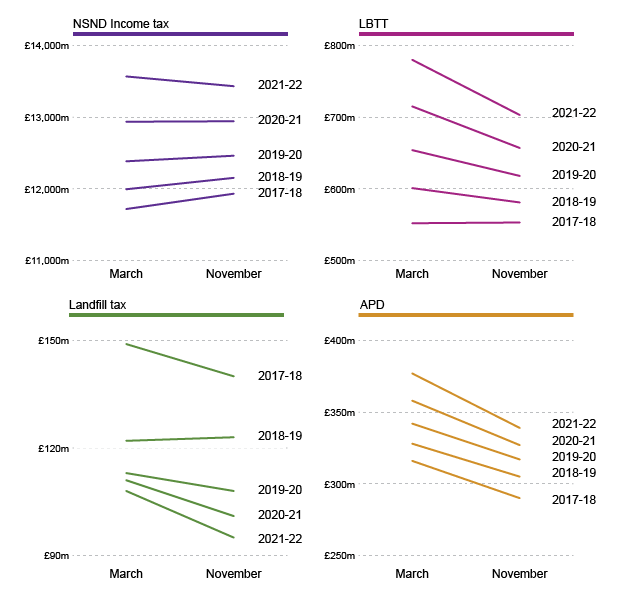

The OBR's Scottish tax forecasts (excluding aggregates levy) are presented in the following chart and table. This table also includes the difference in the latest forecast compared with the March forecast. As can be seen, the income tax forecasts for NSND income tax are slightly higher in most years of the forecast period relative to March. Other tax forecasts are marginally down.

Note the changes between March and November take into account Government policy factors (such as changes to tax rates) as well as non-policy factors (such as demographic changes).

| £m | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 |

|---|---|---|---|---|---|

| NSND Income tax | 11,932 | 12,153 | 12,462 | 12,943 | 13,432 |

| difference with March forecast | 214 | 159 | 78 | 7 | -163 |

| LBTT | 553 | 581 | 618 | 657 | 703 |

| difference with March forecast | 1 | -20 | -36 | -58 | -77 |

| Landfill tax | 140 | 123 | 108 | 101 | 95 |

| difference with March forecast | -9 | 1 | -5 | -10 | -13 |

| APD | 290 | 305 | 317 | 327 | 339 |

| difference with March forecast | -26 | -23 | -25 | -31 | -38 |

| Total Scottish tax forecasts | 12,915 | 13,162 | 13,505 | 14,028 | 14,569 |

Policy and tax announcements

The Chancellor announced that the Scottish Police and Fire services will no longer be liable for VAT. The single national Police and Fire services have been liable for VAT since they were established as a replacement for regional forces in April 2013. This change will free up around £35m which has been the annual VAT bill for Police and Fire services, but there will be no reimbursement for VAT already paid.

A policy to introduce "Transferable tax history" for transfers of oil and gas fields in the North Sea was announced. This is designed to encourage new entrants to invest in north sea oil and gas exploration by buying late life assets. Draft legislation will be published by the UK Government in spring 2018 and the government plans to legislate to make transferable tax histories available from 1 November 2018.

The Chancellor announced that Stamp Duty would be abolished for first time homebuyers in England, Wales and Northern Ireland on homes up to the value of £300,000. Stamp Duty is a devolved tax (Land and Buildings Transaction Tax) and the Scottish Government will set out its proposed rates for 2018-19 in its Budget.

Scottish Budget 2018-19

The Scottish Government is due to publish its proposed budget for financial year 2018-19 on 14 December.

Publication of this document will commence parliamentary scrutiny of the Budget which will culminate with a Budget Bill being voted on by Parliament in February.

Last year's initial Draft Budget for 2017-181 was amended during the Budget Bill's passage through Parliament when an additional £220m funding was allocated. This was funded by:

£135m in underspends from 2016-17 carried into 2017-18.

£60m from the non-domestic rates pool.

£29m from revenue raised by lowering the higher rate income tax threshold relative to the initial draft budget proposal.

£6m from lower than expected borrowing costs.

It is possible that some combination of additional resource may be necessary to achieve the support of a majority of MSPs for the 2018-19 Budget Bill's passage.

On tax, the Scottish Government has signalled that it is minded to increase revenues2 to support public services, but the extent of revenue raising is still not known.

On underspends, the Scottish Government usually has between £100m-£200m of underspends in any given year. Alongside new tax powers, the Scottish Government now has the option to place any underspends or tax surpluses in a Scotland Reserve. The Cabinet Secretary will face a choice of whether to allocate these in the 2018-19 budget (as he did previously prior to the creation of the Reserve) or place them in reserve to smooth any subsequent shortfalls in tax receipts relative to forecast.

| £m | Resource DEL | Capital DEL | Financial Transactions |

|---|---|---|---|

| 2007-08 | -40 | -2 | - |

| 2008-09 | -121 | -3 | - |

| 2009-10 | -116 | -3 | - |

| 2010-11 | -10 | -2 | - |

| 2011-12 | -149 | -30 | - |

| 2012-13 | -150 | -29 | - |

| 2013-14 | -144 | -1 | -31 |

| 2014-15 | -151 | -41 | -12 |

| 2015-16 | -75 | -40 | -40 |

| 2016-17 | -98 | -40 | -53 |

The position of the NDRI pool is less clear, as we only have the Audit Scotland report on the NDRI accounts for financial year 2015-163 (figures for 2016-17 are due to be published later this year). Figures for 2015-16 show that there was a £215m deficit for that year and a cumulative negative balance in the pool of £289m which would be carried forward into 2016-17.