Standards, Procedures and Public Appointments Committee

Standing Order Rule changes on the financial scrutiny of bills

Introduction

The Standards, Procedures and Public Appointments Committee is responsible for recommending that changes are made to Standing Orders.

The Standing Order Rules relating to the scrutiny of the financial implications of Bills have been in place for a number of years and have not been revised despite the increasing importance of revenue from devolved taxation following the changes made to the Scottish Parliament's legislative competence by the Scotland Act 2016.

During the Stage 3 debate on the Air Departure Tax (Scotland) Bill in 2017, Patrick Harvie MSP raised a point of order regarding whether Standing Orders were suitably worded to reflect the Parliament's increased tax-raising powers. While the Financial Memorandum must set out an assessment of the costs that are likely to arise from a Bill, it is not currently required to assess any change in revenue resulting from taxation measures in a Bill. The rules relating to the need for a financial resolution do not make any specific reference to revenue from taxation.

The Presiding Officer agreed to look into this matter further. It was considered by the Budget Process Review Group (established by the Finance and Constitution Committee and conducted in consultation with the Scottish Government and external experts to review the Parliament's budget process in the light of changes to tax powers). No specific recommendation was proposed in the Review Group's final report.

The proposed changes would require that a Financial Memorandum sets out any change in revenue resulting from taxation measures in a Bill and change the rule on when a financial resolution is required. The need for the proposed changes was identified in part by previous review processes, and in part by the experience of Members in the course of scrutiny of Bills earlier this session. The proposed changes have been prepared by the Legislation Team in collaboration with the Parliamentary Counsel Office.

Proposed Revisions to the rules on the financial scrutiny of bills

The proposed revisions relate to two key rules:

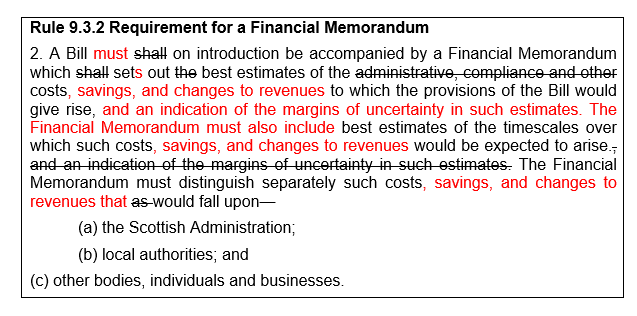

Rule 9.3.2 – which sets out the requirement on the member-in-charge to provide a Financial Memorandum when introducing a Bill, and describes the information that the Memorandum must provide.

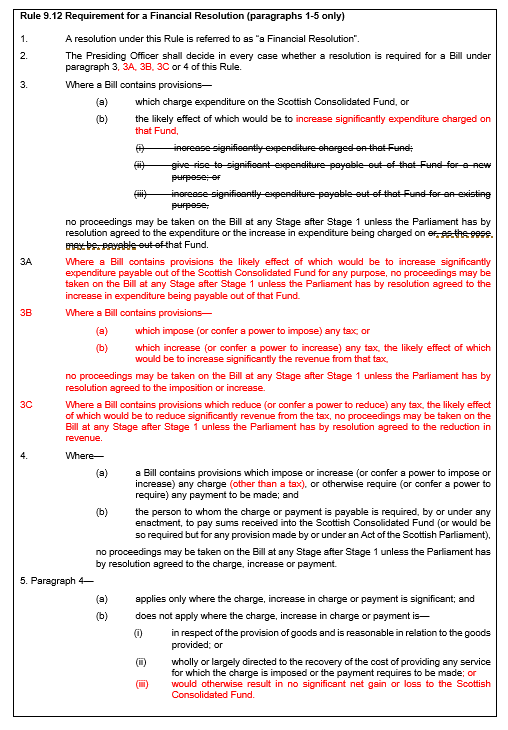

Rule 9.12 – which sets out the requirement on the Presiding Officer to decide in every case whether a Bill requires a financial resolution, and sets out the criteria to be applied in determining whether a resolution will be required.

There are also consequential changes proposed relating to corresponding rules on Private Bills and Hybrid Bills.

Rule 9.3.2 – Proposed changes to ensure that a Financial Memorandum reflects changes in taxation revenue

Rule 9.3.2 requires a Financial Memorandum to be prepared for each Public Bill and sets out the information the Memorandum must contain. The purpose of the Rule is to ensure that, when it is scrutinising a Bill, the Parliament has before it not only information about the policy being proposed, but information about the likely financial implications of the Bill. At Stage 1, the lead committee is required by Rule 9.6.3 to consider and report on the Financial Memorandum and, in doing so, to take into account any views submitted to it by the Finance and Constitution Committee. The availability of appropriate financial information is, therefore, seen as integral to the Parliament's scrutiny of Bills.

Currently, Rule 9.3.2 requires the Memorandum to include information on any costs that would fall upon the Scottish Administration, local authorities or other bodies, individuals and businesses. It does not specifically require any information to be provided on potential taxation revenue, or changes to such revenue, arising from a Bill.

The rule currently requires that the Financial Memorandum sets out best estimates of "the administrative, compliance and other costs to which the provisions of the Bill would give rise".

The proposed revision requires that the Memorandum sets out best estimates of "the costs, savings and changes to revenues to which the provisions of the Bill would give rise". Other changes to the wording of the rule are simply to make this change sit in context in as readable a manner as possible and do not involve any other changes of substance.

Making this change would help ensure that, on the introduction of a Bill, the Parliament would be provided with appropriate information about the financial implications of a Bill to ensure effective scrutiny. It would also reflect and respond to recent changes where an increasing number of tax powers have been devolved.

Associated with Rule 9.3.2 is Rule 9.7.8B, which sets out the requirement on the member-in-charge to produce a revised or supplementary Financial Memorandum after Stage 2 if the costs set out in the original Memorandum have been substantially altered as a result of amendments agreed to at Stage 2. The wording of that Rule refers to "any of the costs set out" in the Financial Memorandum.

In order to match the proposed change to Rule 9.3.2, it is suggested that the wording of Rule 9.7.8B is also changed so that it reads "any of the costs, savings and changes to revenues set out".

Consultation

The SPPA Committee consulted Committee Conveners and Business Managers on the proposed changes to Rule 9.3.2. The responses received are attached at Annexe B.

The responses received from Committee Conveners were overwhelmingly supportive of the approach. The Finance and Constitution Committee highlighted the fact that currently—

the rules on the financial implications of bills do not take into account the changes to the Parliament's legislative competence in the Scotland Act 2012 and Scotland Act 2016 in relation to revenue from devolved taxation. Information on potential taxation revenue – or changes to such revenue – arising from a Bill are not currently included in FMs.i

Given the recommendation of the Budget Process Reform Group that Standing Order rules should be reviewed in relation to FMs and Financial Resolutions to reflect the new taxation powers, the Finance and Constitution Committee welcomed the work undertaken to revise the rules. It further stated—

The Committee agrees with you that, in light of the new taxation powers, the rules should be changed making it a requirement for information on potential taxation revenue arising from a Bill to be included in FMs. This would help ensure that, on the introduction of a Bill, the Parliament would be provided with appropriate information on both the expenditure and revenue financial implications of a Bill to ensure effective scrutiny.i

The Economy, Energy and Tourism Committee Convener stated—

I agree that it would be sensible for FMs (and any subsequent revised or supplementary FMs) to include details of any change in revenue resulting from taxation measures in a Bill. This information would allow the lead committee to form a fuller picture of the financial impact of the measures set out in the Bill.iii

The Convener of the Education and Skills Committee indicated that the "proposed change will ensure that our successor committee can take into account the impact on taxation revenue of any proposed legislation within its remit, therefore strengthening its ability to properly scrutinise any financial implications." She further stated—

In my view, the changes proposed to Standing Orders would be a positive step which would assist committees in considering more fully the wider financial impact of proposed legislation, whether the legislation is initiated by the Scottish Government or individual MSPs. I would therefore support the proposed revisions.iv

The Convener of the Rural Economy and Connectivity Committee stated—

In my view, the proposals seem proportionate and reasonable, and would assist in committee scrutiny. I therefore agree with you that the proposed changes to Rule 9.3.2 will strengthen the requirements for the provision of information in the Financial Memorandum and therefore support improved scrutiny of the savings and changes to revenues, as well as to costs that will result from the Bill.v

The Minister for Parliamentary Business and Veterans indicated that he was "broadly supportive of these revisions as they propose to ensure the necessary information is provided to the Parliament in its scrutiny of the financial implications of Public Bills reflecting the changes to the legislative competence of the Parliament in the Scotland Act 2016."vi

The SPPA Committee is therefore satisfied that there is widespread support for these rule changes.

Text of proposed rule change

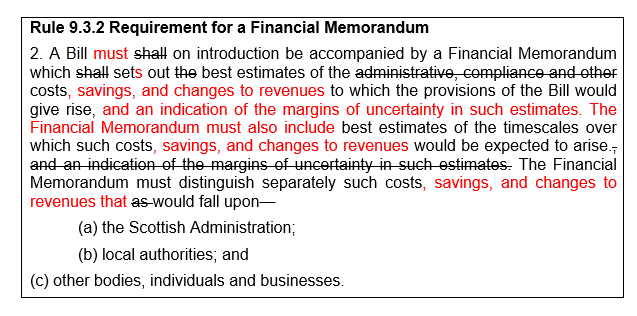

The proposed changes to Rule 9.3.2 are set out in the box below:

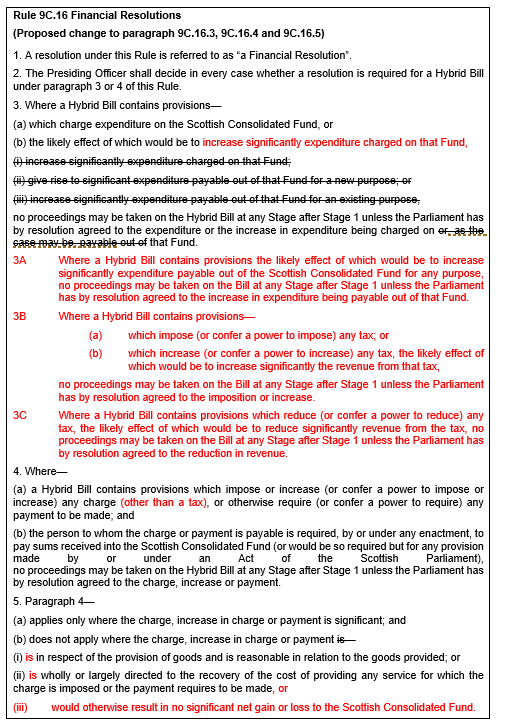

Rule 9.12 – Proposed revisions to ensure that changes to taxation revenues are factored into the decision about the need for a financial resolution

Background

Rule 9.12.2 requires the Presiding Officer to decide in every case whether a Public Bill requires a financial resolution. Rules 9.12.3 and 9.12.4 then go on to set out in further detail the circumstances in which a Bill will require a financial resolution. (Rule 9.12.4 is further explained by Rule 9.12.5.)

Where a Bill contains particular provisions affecting payments into or out of the Scottish Consolidated Fund (the "SCF"), no proceedings can be taken on the Bill after Stage 1 unless the Parliament has, by resolution, agreed to the relevant provisions.

The financial resolution procedure is a means of giving extra control to the Scottish Government over Bills with certain financial implications. Only a member of the Scottish Government or a junior Scottish Minister can lodge a motion for a financial resolution (Rule 9.12.7), and so the Government has a veto on whether any Bill that requires such a resolution makes progress. Unless a motion is lodged and the Parliament agrees to it, a Bill that requires a financial resolution falls.

Rule 9.12 is intended to give effect to the principles of the Financial Issues Advisory Group (FIAG) which reported to the Consultative Steering Group (CSG) before the establishment of the Parliament. FIAG advocated a clear separation between "policy Bills" that would create powers or functions, and "Budget Bills" that would allocate resources. Policy Bills confer the functions which give rise to the demand for funding. Budget Bills provide authorisation for the spending of money. It is the policy provision that requires the consent of the Parliament by means of a financial resolution. A resolution recognises that the demand for funding in a policy Bill is something that will require to be met from the SCF.

In recommending this system, FIAG was attempting to give effect to the established principle that the executive arm of government has a unique responsibility in relation to the management of public funds. If it is to fulfil this function, the Scottish Government must maintain control both over the raising of revenue and over public spending – hence the need for a mechanism to secure Scottish Government consent for payments either into or out of central funds.

In a number of places, the current rule refers to "significant" expenditure or expenditure increasing "significantly". What is meant by "significant" in the context of the financial resolution rules is for the Presiding Officer to determine in discharge of the Presiding Officer’s duty under Rule 9.12.2. At the start of each session, the Presiding Officer is asked to consider how this will be approached so that decision making is consistent. The current practice is that, where a Bill is likely to give rise to cumulative costs on the SCF of at least £400,000 in any one financial year, this will be considered "significant" and a financial resolution will be required.

Significance being considered on a cumulative basis means that if, for example, a Bill gives rise to an increase of £200,000 a year in expenditure charged on the SCF and expenditure to be met out of the SCF of £200,000 a year, it will be a Bill that would trigger the need for a resolution as the cumulative effect would be an increase in expenditure of £400,000 a year.

Proposed changes

The proposed revised form of words for Rule 9.12.1 - 9.12.5 are set out at the end of this section. The proposed revisions seek to address four issues:

a simplification of the layout in relation to provisions which charge expenditure on the SCF,

ending the distinction in the way the rules are structured between expenditure out of the SCF for new and existing purposes,

revising the rules so as to reflect the fact that financial implications are now more likely to arise from changes to taxation revenues,

to reflect a change in the way that certain ‘designated receipts’ are dealt with. Each of these is explained below.

Provisions which charge expenditure on the Scottish Consolidated Fund

The current Rule separates out in Rule 9.12.3(a) and (b)(i) provisions which charge expenditure on the SCF (i.e. which create a new charge) and provisions which increase significantly expenditure charged on the SCF. Having part of this in paragraph (b) creates potential confusion with the other elements of paragraph (b), which are about a separate category of expenditure. The proposed revised wording simply suggests combining these into the same new paragraph 3 for ease of reading. There are no changes to the wording or meaning of the Rule suggested.

The effect is that provisions that makes any new charge on the SCF will continue to mean that a Bill will require a financial resolution. A provision that increases significantly a category of expenditure already charged on the SCF would also mean that a Bill would require a financial resolution.

Expenditure for new and existing purposes

The current wording and layout of Rule 9.12.3(b)(ii) and (iii) creates a distinction between expenditure out of the SCF for a new purposes and expenditure for an existing purpose. However, the same minimum threshold of £400,000 is applied to both limbs and has been applied for some time. Nothing is, therefore, lost in practice by dropping the distinction – resulting in the suggested new wording and layout in paragraph 3A.

The SCF is generally speaking a finite sum. A Bill which increases expenditure for one purpose will probably also lead to reductions elsewhere in budgets for other things. The previous reference to "new" and "existing" purposes has, therefore, been changed to "any purpose".

Implications of changes to taxation revenues

Rule 9.12.4 currently provides that a financial resolution is required where a Bill makes provision that imposes or increases (or confers a power to impose or increase) any charge, or otherwise requires (or confers a power to require) any payment to be made into the SCF. Rule 9.12.5(a) provides that this only applies if the total to be paid in through that charge or payment is significant. Rule 9.12.5(b) provides that Rule 9.12.4 does not apply if the charge or payment is a reasonable one for a good or service provided or is directed wholly or partly at recovering the costs of providing a service.

The rule does not make it explicitly clear whether a tax is intended to be classed as a payment into the SCF. The need to be clear about how taxes are to be treated has become more acute as more revenue-raising measures have been devolved and Bills relating to taxation measures have become more common.

A tax is a liability on a person to make a payment. It is distinct from a fee for a service, which a person who wants to use the service must pay (such as a fee for a planning application, or for a licence for a shotgun) or other types of payment.

In the interpretation of Rule 9.12.4 to date, taxes (such as Land and Buildings Transaction Tax and Air Departure Tax) have been regarded as generating income for the SCF. The Bills for both of those taxes made devolved provision for the first time for such taxes. They were replacing equivalent UK taxes and so it might have been argued that there was no change as far as taxpayers were concerned. However, the UK equivalent UK taxes were disapplied in Scotland. The Scottish Government had a choice as to whether to propose replacement devolved taxes. That choice had significant consequences for the funds available to the SCF. It was, therefore, considered appropriate that the revenue from the tax be regarded as a payment into the SCF for the purposes of Rule 9.12.4.

The Rule does not, however, make it clear how a Bill that was likely to result in revenue from a tax being reduced should be treated. The effect of such a Bill might be expected to be that there would be less money available from the SCF for other political priorities. Determining that such a Bill would require a financial resolution serves two purposes. It ensures parliamentary approval for the effect of the changes to taxation measures and it provides Executive control over the implications for the public finances in line with the FIAG principles (as no such measures could be imposed without the Executive agreeing to lodge a motion for a financial resolution).

The proposed revised wording for Rule 9.12 includes two new paragraphs, 3B and 3C, which seek to make clear how Bills that include taxation measures should be considered. The effect of these new paragraphs is three-fold.

Firstly, a Bill which includes provision for a new tax will require a financial resolution. It is not thought necessary to include any reference to the taxation leading to "significant" income for the SCF in the proposed paragraph 3B(a). It is considered that, on principle, any new tax should cause a Bill to require a resolution (in the same way that any new charge on the SCF causes a Bill to require a resolution under paragraph 9.12.3(a), both at present and in the proposed new wording). In any event, it is considered likely that any new tax would raise revenue that would be "significant" in terms of being at least £400,000 in any one financial year.

Secondly, under the proposed paragraph 3B(b), a Bill which includes provision to increase an existing tax will require a resolution only if the likely effect is that the increase in revenue from the tax will be "significant". This mirrors the provisions on charges on, and expenditure out of, the SCF.

Thirdly, under the proposed paragraph 3C, a Bill which includes provision to reduce an existing tax will require a resolution if the likely effect is that the reduction in revenue from the tax will be "significant".

The proposed paragraph 3B in effect makes explicit the interpretation that has been applied to taxation Bills to date. The proposed paragraph 3C adds additional flexibility to consider measures that result in reduced tax revenues (by, for example, abolishing a tax or by creating or extending a tax relief). The changes proposed at paragraphs 9-16 above in regard to Financial Memorandums will work in conjunction with this, with the express requirement for the Memorandum to deal with changes in revenues.

Neither paragraph 3B or 3C specifically mentions the SCF, and neither defines what is a "tax". There is an underlying assumption that any revenue from a new tax or a tax increase is payable into the SCF. It is considered best to retain flexibility in interpretation of what is a tax. However, it would be possible to make it explicit that a charge can only be classed as a "tax" (and so governed by paragraphs 3B and 3C rather than 4) if the revenue from it was payable into the SCF.

It is possible that the lack of definition of "tax" may allow room for disputes about whether some levies do not give rise to the need for a resolution because they are charges that are covered by the exemption in Rule 9.12.5(b)(i) as a reasonable charge for the provision of goods. If flexibility in the Rule is thought desirable, the published Guidance on Public Bills could be used to make clear that the term "tax" is intended to include devolved taxes (by reference to the Scotland Act 1998 definition) and local taxes (again by reference to schedule 5 of the Scotland Act 1998). This may be preferable to including definitions in Rule 9.12.

Finally, as noted earlier in this report, whether costs or income are "significant" is considered on a cumulative basis. It is the cumulative effect of different provisions on the funds available in the SCF that is important. If a Bill is predicted to result in reduced tax revenues (for example, by creating a new relief) of £300,000 a year, no resolution under the proposed Rule 9.12.3C would be needed. If the costs to Revenue Scotland of administering the new tax relief were also to be £300,000 a year, those costs alone would not cause the Bill to require a financial resolution under the proposed Rule 9.12.3A. However, both figures represent "reductions" to the money available from the SCF. The cumulative effect would be a £600,000 reduction, which would trigger a need for a financial resolution.

Similarly, a provision removing an existing relief that resulted in tax revenues being predicted to rise by £300,000 a year would be set off against the reduction in revenue caused by the new relief. The net effect of the Bill might then not be significant and no resolution would be needed. Looking at the position in the round in this way allows the decision on the need for a financial resolution to focus on the Parliament having visibility on the overall implications of a Bill for the SCF.

Designated receipts

A financial resolution is required if a Bill satisfies the two tests set out in Rule 9.12.4(a) and (b). The first test is that it would impose or increase a charge, or otherwise require a payment to be made, including by provision that is to be made by subordinate legislation.

The second test is that the charge or payment must be made – with one exception – to persons with a statutory duty to pay the amounts involved into the SCF. In practice, this means the Scottish Ministers and other office-holders in the Scottish Administration, together with directly-funded bodies. It excludes most non-departmental public bodies (NDPBs), whose income is not payable into the Fund.

An exemption is set out in Rule 9.12.5 for charges or payments which are levied to recover the cost of goods or a service provided. Charges for goods that are reasonable and charges for services that are limited to approximately cost recovery level do not require financial resolution cover. The underlying intention is that a financial resolution should only be required in cases where charges or payments can be levied in such a way as to contribute significantly to the funds in the SCF.

Bills often include provisions that create offences which might lead to fines being paid on conviction. They also often establish fixed penalty regimes. The ‘income’ from such fines and penalties may give rise to the need for a financial resolution under Rule 9.12.4 if that income is payable into the SCF.

However, fines and fixed penalties have been classed as ‘designated receipts’ under section 64 of the Scotland Act 1998 (and the Scotland Act 1998 (Designation of Receipts) Order 2009). This meant that, after being paid into the SCF, they had to be remitted to the UK Treasury and so did not increase the net resources available to the Scottish Administration. In that situation, even if the income from fines etc as a result of a Bill may have been very substantial, the interpretation applied has been that this sort of provision did not cause a Bill to require a financial resolution under Rule 9.12.4.

This interpretation is based on the understanding that the purpose of the rule is that the Parliament should be aware, through the requirement to agree to a financial resolution, that passing a Bill will result in more (or less) funds being available for other political priorities. Where income going into the Fund results in no net additional resources (through an equivalent sum being remitted to the Treasury as a "designated receipt"), there is no purpose in requiring the Parliament to accept this by agreeing a financial resolution in relation to that income.

The 2009 Order was amended, with effect from 31 March 2018, by a UK statutory instrument as a result of the Smith Commission recommendations. The effect of the amendment is that receipts from fines and fixed penalties are no longer designated receipts and so do not have to be surrendered to the UK Treasury. They are, therefore, potentially additional resources for the SCF and, if they are likely to amount to £400,000 or above in any one financial year, would mean that a Bill containing such provisions would require a financial resolution under Rule 9.12.4.

However, the Fiscal Framework arrangements (agreed between the UK and Scottish Governments following the transfer of legislative competence over additional matters - primarily aspects of tax and social security - in the Scotland Act 2016) lead to a similar outcome in practice. A technical note to the Fiscal Framework published in 2019 states that revenue into the SCF from fines, forfeitures, and fixed penalties "results in a corresponding downwards adjustment of Scotland’s Block Grant". In other words, income from fines etc. still results in no net additional resources to the SCF, as the Scottish block grant is adjusted to compensate.

It is suggested, therefore, that the interpretation of the effect of income from fines, etc. should be maintained. However, the wording of Rule 9.12.4 does not directly address how the Presiding Officer should treat this situation. It states that any payment into the Fund may give rise to the need for a resolution under that rule. The wording of Rule 9.12.4 does not directly address how the Presiding Officer should treat this situation. It states that any payment into the Fund may give rise to the need for a resolution under that rule. Arguably, therefore, the wording of the Rule does not support the interpretation currently being followed. The interpretation is based on an understanding of the purpose of the Rule rather than a strict reading of its wording.

Where various other changes to Rule 9.12 are being proposed, it is suggested that the opportunity should also be taken to clarify the position on this issue. The proposed revised wording at Annex B therefore includes a new exception - in Rule 9.12.5(b)(iii) – to provide that income payable into the SCF will not lead to a Bill requiring a financial resolution if it "would otherwise result in no significant net gain or loss to the Scottish Consolidated Fund".

This approach to the wording of Rule 9.12.5.(b)(iii) focusses on the consequence of a measure for the SCF rather than on the nature of the measure itself. If the situation with the block grant adjustment were to change in the future, this rule may have to be reconsidered in relation to fines etc.. However, this is thought preferable to trying to agree wording that tries to specify the nature of measures. While a fine is generally understood as not being intended as a means of raising income, but as a method of enforcement of the law. However, the intention may not always be entirely clear and raising of income might be an intended consequence of some approaches to enforcement. Trying to craft a rule that focusses on whether or not a provision in a Bill is, or is not, intended to be revenue-raising, which seems likely to be too subjective a judgement to make on the provision.

The word "significant" has been included because it is difficult to say with certainty that a type of income that is assumed to have no overall net effect on the SCF will have no effect on the SCF. Fine income is paid in as it is received but the block grant adjustment takes place at various points in the normal spending review cycle and that can happen over a number of years (previous adjustments being further adjusted as more up to date information is obtained, original adjustments having been based on estimates and forecasts). The inclusion of "significant" is intended to focus the proposed rule on the overall effect.

Consultation responses

The Finance and Constitution Committee commented specifically on the proposed rule change relating to the requirements for a Financial Resolution, stating—

In addition, given the rules relating to the need for a financial resolution do not make any specific reference to revenue from taxation and does not make it explicitly clear whether a tax is intended to be classed as a payment into the Scottish Consolidate Fund, we agree that the rule change proposals will ensure that changes to taxation revenues are factored into the decision as to whether there is a need for a financial resolution.

As noted at paragraph 21, the Minister indicated that he was broadly supportive of the proposed revisions.

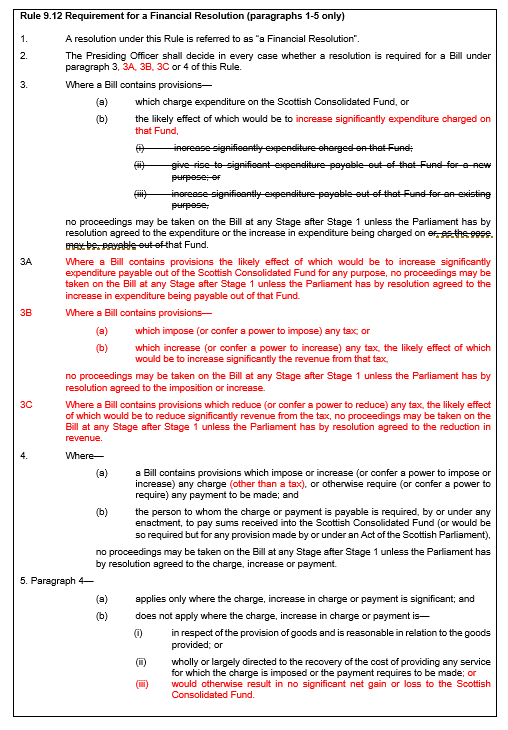

The proposed revision to Rule 9.12 is set out in the box below:

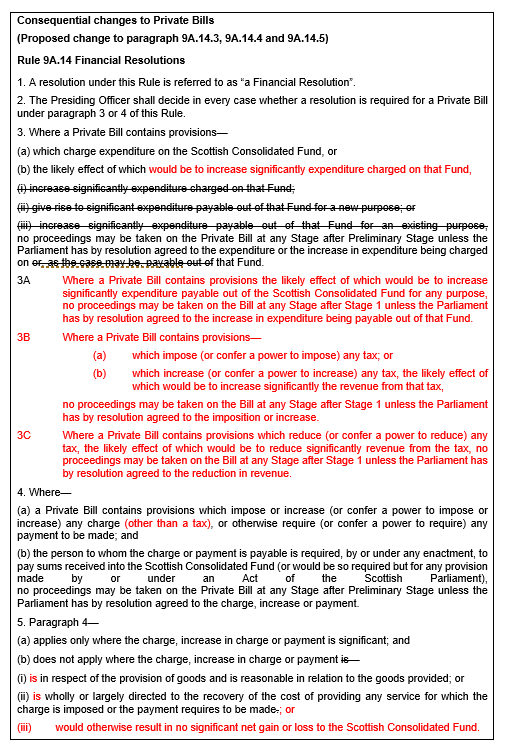

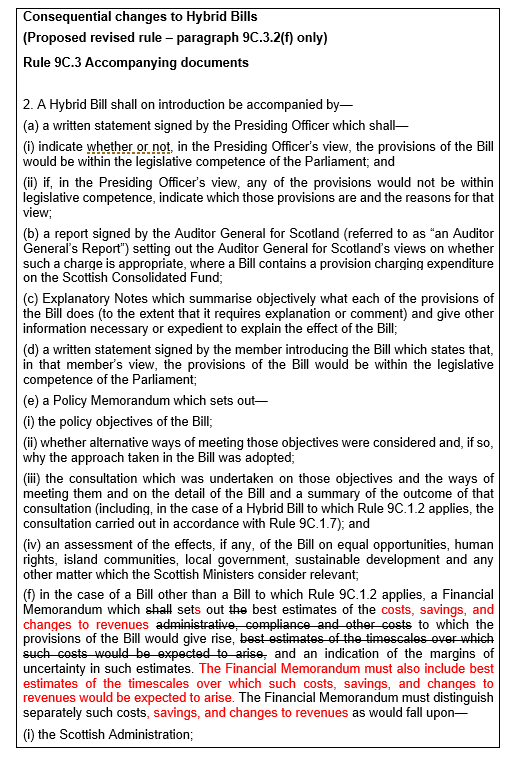

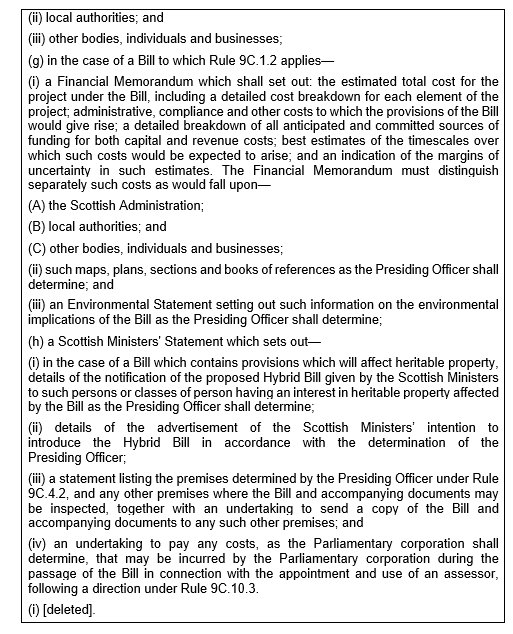

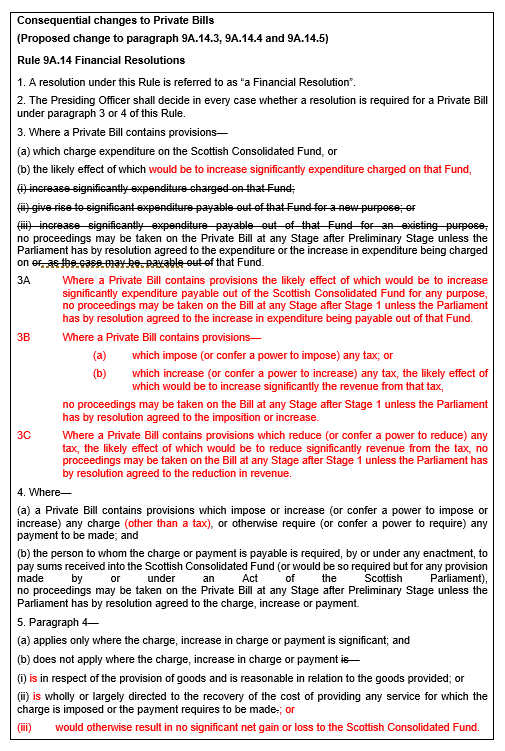

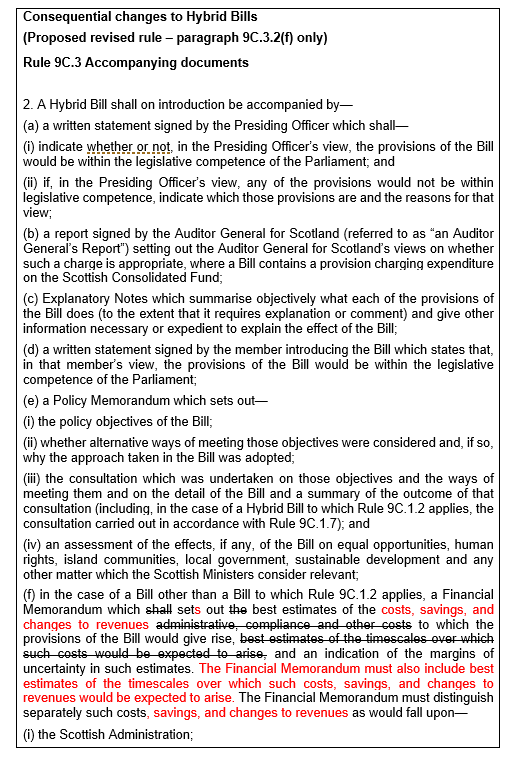

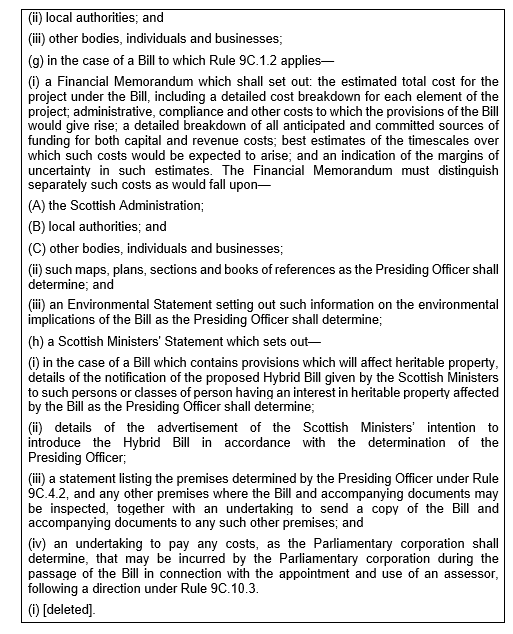

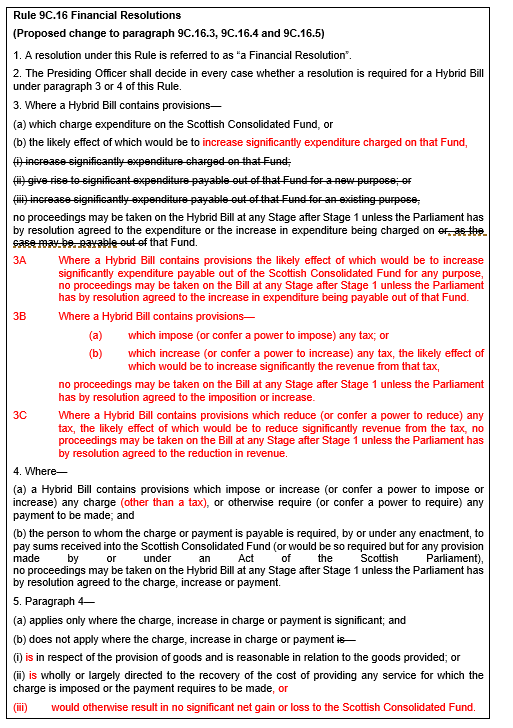

Private and Hybrid Bills

It is also proposed to make the following consequential changes to the provisions relating to Hybrid Bills and Private Bills in order to ensure consistency.

Recommendation

The Standards, Procedures and Public Appointments Committee recommends to the Parliament the changes to Standing Orders set out at Annexe A of this report

Annexe A: Standing Order rule changes

The proposed changes set out in each box below show new inserted text in red, and deleted text in strikethrough.

Annexe B: Responses to Consultation On Proposed Rule Changes

Culture, Tourism, Europe and External Affairs Committee

The Committee had no comment to make on the letter and was therefore content with the proposed revisions.

Minutes of Culture, Tourism, Europe and External Affairs Committee 4 February 2021 (60KB pdf)

Delegated Powers and Law Reform Committee

I refer to your correspondence of 22 January 2021.

Thank you for providing the Delegated Powers and Law Reform Committee with the opportunity to comment on the proposed revisions to Standing Order rules on the scrutiny of financial implications of bills.

As the Committee has no role in scrutinising financial memorandums, it has no experience to draw on to enable it to provide any helpful comment on the proposals. Can I nevertheless wish your Committee well in its work.

Economy, Energy and Fair Work Committee

I refer to your letter of 22 January seeking my views on proposed revisions to Standing Order rules on the scrutiny of financial implications of bills.

I note that the SPPA Committee has considered proposals to:

revise Standing Orders to require that a Financial Memorandum (FM) sets out any change in revenue resulting from taxation measures in a Bill and

change the rule on when a financial resolution is required.

I agree that it would be sensible for FMs (and any subsequent revised or supplementary FMs) to include details of any change in revenue resulting from taxation measures in a Bill. This information would allow the lead committee to form a fuller picture of the financial impact of the measures set out in the Bill.

I would also support proposals to change Rule 9.12 to ensure that changes to taxation revenues are factored into the decision about the need for a financial resolution.

Education and Skills Committee

Thank you for your letter dated 22 January 2021 regarding the proposed revisions to Standing Order rules on the scrutiny of the financial implications of bills. As you will know, the Education and Skills Committee has considered a smaller number of Bills in my time as Convener compared to other committees. However, the Bills which have been considered have required close scrutiny of the anticipated financial impact of their proposals.

The Education and Skills Committee takes seriously its duty to consider the financial impact of Bills it scrutinises, and the proposed change will ensure that our successor committee can take into account the impact on taxation revenue of any proposed legislation within its remit, therefore strengthening its ability to properly scrutinise any financial implications.

In my view, the changes proposed to Standing Orders would be a positive step which would assist committees in considering more fully the wider financial impact of proposed legislation, whether the legislation is initiated by the Scottish Government or individual MSPs. I would therefore support the proposed revisions.

Environment, Climate Change and Land Reform Committee

Thank you for inviting the Environment, Climate Change and Land Reform Committee to comment on the proposed changes to Rule 9.3.2 and associated rules and to note the proposals to change Rule 9.12 to ensure that changes to taxation revenues are factored into the decision about the need for a financial resolution.

The Committee agreed that the proposed changes would enhance scrutiny of Financial Memoranda and provide Committees with a more realistic assessment of the financial implications of a Bill.

The Committee did not have any concerns to raise in connection with the changes proposed by the Legislation Team and the SPPA Committee.

Equalities and Human Rights Committee

Thank you for your letter of 22 January, on proposals to revise Standing Orders to require that a Financial Memorandum sets out any change in revenue resulting from taxation measures in a Bill and change the rule on when a financial resolution is required.

The proposed revision to Rule 9.3.2, on the requirement for a Financial Memorandum appears sensible, in that it should assist committees from the outset to better scrutinise the financial implications of a bill alongside the scrutiny of the policy, providing as full a picture as possible of the impact of the bill.

The proposed revision to Rule 9.12, as well as the consequential changes to corresponding rules as they apply to Private Bills and Hybrid Bills are also noted.

Finance and Constitution Committee

Thank you for your letter of 22 January 2021 seeking the Committee's views on proposed revisions to Standing Order rules on the scrutiny of financial implications of bills.

As you are aware, the Budget Process Review Group (BPRG) published its final report in June 2017 on the new process for budget scrutiny. As part of its review, it highlighted the fact that Financial Memoranda (FMs) are expressed in terms of costs and the rules on Financial Resolutions refer to increases in expenditure or increases in any charge or any payment to be made to the Scottish Consolidated Fund.

Currently the rules on the financial implications of bills do not take into account the changes to the Parliament's legislative competence in the Scotland Act 2012 and Scotland Act 2016 in relation to revenue from devolved taxation. Information on potential taxation revenue – or changes to such revenue – arising from a Bill are not currently included in FMs.

As a result, the BPRG recommended that further consideration should be given to reviewing Standing Order rules in relation to FMs and Financial Resolutions to reflect the new taxation powers.

We therefore welcome your Committee's consideration of this matter and are grateful for the work done by the Parliament's Legislation Team and the Parliamentary Counsel Office on preparing the proposed rule changes.

The Committee agrees with you that, in light of the new taxation powers, the rules should be changed making it a requirement for information on potential taxation revenue arising from a Bill to be included in FMs. This would help ensure that, on the introduction of a Bill, the Parliament would be provided with appropriate information on both the expenditure and revenue financial implications of a Bill to ensure effective scrutiny.

In addition, given the rules relating to the need for a financial resolution do not make any specific reference to revenue from taxation and does not make it explicitly clear whether a tax is intended to be classed as a payment into the Scottish Consolidate Fund, we agree that the rule change proposals will ensure that changes to taxation revenues are factored into the decision as to whether there is a need for a financial resolution.

Health and Sport Committee

Thank you for your letter of 22 January in relation to proposed Standing Order changes to Rule 9.3.2 intended to strengthen the requirements for the provision of information in the Financial Memorandum.

I welcome these proposed changes which I consider will support committee scrutiny of the savings and changes to revenues, as well as to costs that will result from Bills being brought forward.

Justice Committee

Given that these types of tax-raising requirements do not arise very often in justice-related legislation, the Committee indicated that it had no specific comments to make.

Minister for Parliamentary Business and Veterans

Thank you for your letter of 22 January 2021 seeking my views on the above. I would like to acknowledge the work undertaken on this and set out that the Scottish Government supports the principle of periodically reviewing the Scottish Parliament's procedures to ensure they remain fit for purpose.

With that in mind I am broadly supportive of these revisions as they propose to ensure the necessary information is provided to the Parliament in its scrutiny of the financial implications of Public Bills reflecting the change to the legislative competence of the Parliament in the Scotland Act 2016.

I understand the proposed revisions are still being refined and as such have asked my officials to follow-up with the Parliament's Legislation Team to seek clarity on a few points of detail.

Subject to those discussions, I can confirm that I am content for my interests to agree in principle to the approach to the proposed revisions to Rule 9.3.2 and Rule 9.12.2, which would be implemented at the start of the new parliamentary session.

Public Audit and Post-legislative Scrutiny Committee

Thank you for your letter of 22 January seeking the views of the Public Audit and Post-legislative Scrutiny Committee's on proposed revisions to Standing Order rules on the scrutiny of financial implications of Bills.

The proposed revisions appear to be reasonable and I note that provision of this additional financial information at a Bill's introduction may be of interest to committees subsequently undertaking post-legislative scrutiny.

Rural Economy and Connectivity Committee

I am writing in response to your letter of 22 January 2021 asking for my views on proposed revisions to Standing Order rules on the scrutiny of financial implications of bills.

In my view, the proposals seem proportionate and reasonable, and would assist in committee scrutiny. I therefore agree with you that the proposed changes to Rule 9.3.2 will strengthen the requirements for the provision of information in the Financial Memorandum and therefore support improved scrutiny of the savings and changes to revenues, as well as to costs that will result from the Bill.

Social Security Committee

Thank you for your letter dated 22 January regarding revisions to Standing Order rules on the scrutiny of financial implications of bills.

Having reviewed the information provided I am content with the proposed changes.

Annexe C: Extract from minutes

1st Meeting, 2021 (Session 5) Thursday 14 January 2021

Standing Order Rule Changes (in private): The Committee considered the rules scrutiny of financial implications of Bills.

5th Meeting 2021 (Session 5), Thursday 25 February 2021

Standing Order Rule Changes (in private): The Committee agreed a draft report and draft Standing Order Rule Changes in relation to financial scrutiny.