Social Security Committee

Social Security and In-Work Poverty

Membership changes

The following membership changes took place during the inquiry:

On 6 September:

Bob Doris MSP replaced Clare Adamson MSP

Shona Robison MSP replaced Ben Macpherson MSP

Alasdair Allan MSP replaced Ruth Maguire MSP

On 13 December:

Keith Brown MSP replaced George Adam MSP

Summary of conclusions

Low pay and the labour market

Measures to tackle poverty, in and out of work, cut across multiple reserved and devolved policy areas. We welcome the Scottish Government's commitment to tackling poverty and its emphasis on tackling low pay for those in work in addition to providing employment support for those moving in to work.

Tackling poverty requires a sustained strategic approach. Social security, the focus of this Committee, is a split responsibility between the Scottish and UK Government Ministers. An effective social security system has a key role to play in any sustained strategic approach to tackling poverty.

It is essential that both Governments work together meaningfully and constructively, whilst acknowledging respective policy differences.

Social security - a split responsibility

In advance of the update to the Parliament in June 2019 on the new income supplement, the Committee would welcome more information on progress towards developing what will become a new devolved benefit. The Committee is particularly interested in the discussions taking place around delivery, potential eligibility and take-up and would be grateful for a progress report from the Scottish Government before Easter recess.

Although some much-needed changes were made recently to Universal Credit, significant damage was caused by the cuts made in the 2015 UK Budget. These cuts should now be reversed by the UK Government.

The Committee is disappointed that the UK Government did not take the opportunity of its recent Budget to end the benefits freeze. The benefits freeze has a disproportionate impact on the poorest and those in most need.i

Design and implementation

Whilst the Committee welcomes the increase to Universal Credit work allowances, we are disappointed that the UK Government has chosen not to completely reverse the cut to work allowances made in 2015. We intend to write to the UK Government calling for these cuts to be fully reversed.

The Committee, alongside other commentators, is supportive of a more simplified and streamlined benefits system, however, key aspects of the way in which Universal Credit is being implemented mean that it is not working for many claimants.ii

The Committee observes, when talking about social security support, that language referring to “winners and losers” can cause offence. Our social security systems must be designed to ensure everyone in need receives all the support they are entitled to.

The Committee believes it is unacceptable to make any claimant wait a minimum of five weeks before receiving the financial support they are entitled to under Universal Credit. We urge the UK Government to urgently reform this design feature to ensure payments are made within two weeks of an application being made, as was the case under legacy benefits such as Job Seekers Allowance.ii

The monthly assessment period

The Committee has significant concerns about Universal Credit assessment dates not aligning with paydays. We recognise that the UK Government has said it is now urgently looking at this. We agree this must be urgently addressed and request an update from UK Government ministers following their consideration.

For surplus earnings rules, retaining the higher earnings threshold before income is carried over would ease the impact of fluctuating incomes and provide greater certainty for those in receipt of Universal Credit. We recommend that the threshold be maintained at £2,500.

Whilst we agree with the principle of encouraging people to budget and take responsibility for their finances, the unpredictability of Universal Credit payments makes this more difficult. DWP is already able to identify vulnerable claimants. It needs to provide more support, by telephone and in person, to those who need it with making and managing a claim.

Jobcentre Plus work coaches

Work coaches can have a positive impact when working with those seeking to move in to employment or people looking to progress in their careers. Work coaches can also have a high degree of discretion around claimant commitments and whether they have been met. The effectiveness of a work coach is very likely to be undermined if the workload is excessive.

We are concerned about the current workload of Jobcentre Plus staff. Caseload is forecast to increase significantly in response to managed migration. It is crucial that the DWP ensures it has adequate numbers of well-trained and experienced work coaches for existing claimants. (paragraph 65)

We are of the view that the managed migration process should not commence until DWP can demonstrate both that sufficient staff resources are available to ensure satisfactory service levels for all existing and new claimants and that robust workforce plans are in place to ensure readiness for people moving on to Universal Credit by managed migration.iv (paragraph 66)

Digital first approach

This Committee, along with many others, will be watching carefully to see whether the new Universal Support initiative results in meaningful improvements. Support must be available to all Universal Credit claimants who need it, in all localities.

The Committee is concerned that a digital first approach may be digital by default, particularly for those who simply have no adequate access to the internet or have additional barriers to using IT in such a way. Our view is that a genuinely mixed approach must be taken to supporting clients, similar to the intention of Social Security Scotland, which aims to provide adequate telephone and face-to-face access for claimants, particularly the most vulnerable, who are not able to navigate a vital service delivered by default.ii

Managed migration

We are aware that people in work and in receipt of working tax credits, quite understandably, may not consider themselves to be benefit claimants. As such, on moving to Universal Credit, they will face not just a significant culture change but a radical change of regime.

Managed migration represents a considerable challenge for HMRC and DWP and a significant change for claimants. It is unclear what the DWP's process is for designing and working through how best to migrate claimants. Given that managed migration is due to start this year, the Committee is surprised and disappointed that there is not more clarity around this. As a result, there is considerable uncertainty and little or no evidence of workforce planning to support the change.ii

We feel that the DWP is missing the point. Our concern is about the circumstances in which transitional protection (extra money) can be lost under managed migration and the potential for that to drive behaviours. For example, a victim of domestic abuse may be faced with having to choose between leaving an abusive partner or losing money under transitional protection due to a change in circumstance. The UK Government's transitional protection regulations provide no exceptions, for example in cases of domestic abuse, which the Committee finds disappointing.iiii

The Committee agrees that managed migration should not proceed until there is more clarity around what it will mean for those being expected to move over. (paragraph 93)

More work needs to be done to identify information currently held by HMRC that could be used to pre-populate DWP systems to ensure people moving on to Universal Credit can do so seamlessly. (paragraph 94)

We also consider that much more needs to be done to publicise what migration will mean for claimants and to ensure DWP can manage the migration effectively. The Committee would like detail from DWP about the proposed 10,000 initial test cases, including how they will be chosen and monitored. (paragraph 95)

It is the view of the Committee that priority should be given to addressing the existing concerns with Universal Credit before seeking to move up to three million people currently on legacy benefits on to Universal Credit.ix (paragraph 96)

Universal Credit and self-employed claimants

We urge the UK Government to urgently reconsider how Universal Credit impacts on claimants who are self-employed. Universal Credit needs to better support those who are self-employed, at the same time ensuring that unsustainable enterprises are not subsidised indefinitely.

It is our view that, when applying the Minimum Income Floor, the Universal Credit calculation should take in to account average monthly earnings over a longer period, rather than only income received in the previous month.

In-work conditionality

The PCS trade union told us that job centre closures had resulted in the loss of experience and community links and a reduction in the service that job centres are able to provide. Job centres have an important role in creating and maintaining links with local employers. It is counter-productive to close job centres in communities most likely to have higher and increasing numbers of Universal Credit claimants.ii (paragraph 129)

The PCS trade union, which represents many DWP front-line staff delivering Universal Credit, has expressed serious concerns to DWP managers, including about in-work conditionality, and do not feel they are being listened to. Trades Unions representing staff delivering Universal Credit are a valuable source of information about how well Universal Credit is working. The Committee suggests the DWP pay much closer attention to the concerns they raise. (paragraph 130)

The Committee believes that the dramatic reduction in the number of job centres, at a time when Universal Credit is being rolled-out across Scotland, was a serious error of judgement by the DWP. This has impacted on service and compounded the disconnect between many service users and the DWP. We believe there is a case to be made to review local access to DWP and other forms of employment support across Scotland to allow for more localised and community-focussed support, in place of an increasingly remote and digital by default support system. (paragraph 131)

Providing constructive support to increasing numbers of people on Universal Credit will require significant investment in the number of JobcentrePlus staff and their training. (paragraph 132)

Given the DWP has no evidence to support the development of in-work conditionality and, more fundamentally, that the Committee is opposed in principle to attaching punitive conditions to those already in work, the Committee does not support any extension of in-work conditionality. (paragraph 133)

Furthermore, as tax credits, administered by HMRC, are not subject to conditionality or sanction, there is a strong case to be made for not only halting further migration of people in receipt of tax credits to Universal Credit but also to considering the removal of tax credit support from Universal Credit altogether and continuing to use HMRC unless the threat of conditionality and sanctions are removed.xi (paragraph 134)

Increasing demand faced by foodbanks

On the strength of the evidence provided by food banks, the Committee believes that Universal Credit is a significant cause of the rise in demand for food bank services.xii

The Committee notes the invaluable work of foodbanks and acknowledges there can be a variety of reasons why people visit foodbanks. We are on record as agreeing that a long-term sustainable approach to tackling food insecurity, across a range of policies, is required. The Committee shares the view of a number of those who gave evidence representing food banks that we should never come to see them as a substitute for the social security system, or take them for granted in this way.

We welcome the Scottish Government's increase to the budget for its Fair Food Fund. We have already called for an increase in funding for the Scottish Welfare Fund to address growing pressure and need. We also restate here our view that more needs to be done to increase awareness of and enable access to the Scottish Welfare Fund. We extend that to awareness of the Fair Food Fund.

UN Special Rapporteur on Extreme Poverty

The Committee was alarmed by Professor Alston's findings and has written to him with a view to holding an evidence session with him when his final report is available.

Conclusions

Although this Committee's focus is on social security, we know that the increasing prevalence of in-work poverty is driven not only by problems with Universal Credit. Low or insecure incomes, together with rising housing, travel and utility costs are also key factors. Many different policy levers, both reserved and devolved, have roles to play in addressing poverty more widely.

It is the view of the Committee that the UK Government's freeze on benefits must be lifted. It is not realistic to expect any Scottish Government to top-up or mitigate every UK Government welfare policy to ensure the income of Scottish claimants does not drop in real terms.

The Committee acknowledges that Universal Credit is likely to stay but fundamental urgent changes are required to its design. These include reducing the waiting time for initial payment from five weeks to, at most, two weeks from the date of application being made, providing more support to those who need it with making and managing claims and aligning dates with paydays.

It is the view of the Committee that the cut to work allowances, made in 2015, should be completely reversed.

Universal Credit, a reserved benefit, is the UK Government's social security payment for people of working age either not in work, or in work with a low income. Scottish Ministers have very limited powers in relation to it. We call on the Scottish Government to look again at the criteria for passported benefits with the aim of addressing problems that can arise from any link to Universal Credit.

We also ask the Scottish Government to set out in detail what action it is taking to support income maximisation and take-up of entitlements.

The Committee welcomes the Scottish Government's intention to introduce a new benefit in the form of an income supplement. The Committee seeks assurances about how this benefit will affect those in work.

Introduction

As the UK Government continues its roll-out of Universal Credit (UC), the Committee undertook a short inquiry to consider the potential impact of UC on in-work poverty in Scotland. This was the remit-

To explore the potential impact of Universal Credit on in-work poverty. This will include consideration of recent research on trends in low wages and in-work poverty and indications of increasing financial need in working households including, for example, increased use of food banks.

The Committee expects that some of the issues raised during this inquiry will be taken forward in future workstreams. For now, we wanted to publish this report highlighting our key concerns and recommendations.

UC is the UK Government's social security payment for people of working age either not in work, or in work but with a low income. It replaces six (legacy) benefits for working age people; income support, income-based jobseekers allowance, income-related employment and support allowance, housing benefit, child tax credit and working tax credit. A monthly household UC payment, including any rent, is made in arrears direct to a bank account. As of October 2018, there were 127,197 UC claimants in Scotland, of which 43,371 were in employment.

UC is being rolled out for anyone making a brand new claim or those on existing benefits where a change of circumstances means they need to make a new claim. People on legacy benefits, whose circumstances have not changed, will be expected to move on to UC as part of "managed migration". Managed migration is due to start in July 2019 and will bring increasing numbers of people in work onto UC.

As UC is a reserved benefit, we note the ongoing scrutiny of UC by the UK Parliament's Work and Pensions Committee (Work and Pensions Committee) and the Social Security Advisory Committee (SSAC).

Responsibility for some social security benefits including discretionary housing payment, disability benefits and carer's allowance have been devolved to Scottish Ministers.

Although the policy and rules surrounding UC are reserved, it is difficult to disentangle them from devolved social security powers. Indeed, Scottish Ministers do have some very limited powers around UC. For example, in Scotland, UC claimants have the choice of whether to receive UC twice monthly and whether to have any UC housing element paid directly to a landlord. These are known as “Scottish Choices”. The most recent available statistics show that, as of August 2018, 66,700 people were offered Scottish Choices of which around 32,000 have chosen to use these flexibilities. Of these 32,000, 26,910 chose twice monthly payments and 11,430 chose direct to landlord payments.1

The Committee is grateful to all those who provided evidence during our inquiry. We would like to thank the staff of Jobcentre Plus and Social Security Scotland for taking the time to meet with us in Dundee. We would also like to thank the people we met during our visits to Dundee Foodbank, Taught by Muhammad and the Shore Youth Café who all gave us an insight in to their own personal experiences of UC and other issues associated with in-work poverty.

The Committee was disappointed that neither the then Secretary of State for Work and Pensions nor the Minister of State for Employment accepted our invitation to give evidence during this inquiry. The Minister has now accepted an invitation to attend next month.

Low pay and the labour market

According to the latest Joseph Rowntree Foundation (JRF) research, the number of people in work and living in poverty is the highest on record.1The employment rate is also at a record high but this has not brought about lower poverty.

The number of workers in poverty has increased at a faster rate than the total number of people in employment, meaning people in work are increasingly likely to find themselves in poverty. Where a couple are both in employment, in-work poverty rates are lowest. In couples where the second earner is working part-time in-work poverty rates are low. Couples with only one earner and couples with only part-time workers are at a higher risk of poverty.

The written submissions highlighted labour market trends, including-

A fall in the number of workless families, the low growth in men's earnings and increasing numbers of women working (IFS);

In Scotland 18% of workers are paid less than the (voluntary) living wage (JRF/Oxfam);

In Scotland there are c.63,000 workers on zero-hours contracts (Oxfam) but “some welcome evidence of reducing prevalence of zero hours contracts” (JRF);

Full time work at national minimum wage falls short of the JRF ‘minimum income standard’ (Oxfam); and

6% of workers are on temporary contracts (Oxfam).

Much of the evidence we received acknowledged that in-work poverty cannot be addressed by social security alone (e.g. Scottish Government, NHS Tayside, Shetland Council, Inclusion Scotland, Church of Scotland, Inverclyde Financial Inclusion Partnership, JRF and Oxfam). The IPPR noted that in-work poverty cannot be divorced from the economy and that lack of career progression is at the heart of in-work poverty.

We received evidence telling us that some people are disproportionately impacted by in-work poverty. Submissions from Oxfam, Scottish Women's Convention, STUC among others, emphasised that poverty and low wages are strongly gendered. Similarly, Inclusion Scotland drew attention to the additional costs and barriers faced by disabled people and CRER noted the higher incidence of in-work poverty amongst black and minority ethnic individuals. For anyone with several of these characteristics, disadvantage is multiplied.

Broader issues raised included the lack of flexible affordable childcare (CAS, Shelter, Close the Gap, STUC, Oxfam), the increasing cost of living, particularly housing (Shelter, CRISIS), poor wage growth (Scottish Government) and the growth of insecure employment (Oxfam). CRISIS and CIH both gave worked examples comparing income from wages and UC to the ‘poverty line’ and the JRF's ‘Minimum Income Standard’.

In her evidence, the Cabinet Secretary for Social Security and Older People explained what action the Scottish Government is taking, across portfolios, to address poverty. This included a drive to create a living wage nation and, through Fair Start Scotland, providing support to get people back in to work.

Measures to tackle poverty, in and out of work, cut across multiple reserved and devolved policy areas. We welcome the Scottish Government's commitment to tackling poverty and its emphasis on tackling low pay for those in work in addition to providing employment support for those moving in to work.

Tackling poverty requires a sustained strategic approach. Social security, the focus of this Committee, is a split responsibility between the Scottish and UK Government Ministers. An effective social security system has a key role to play in any sustained strategic approach to tackling poverty.

It is essential that both Governments work together meaningfully and constructively, whilst acknowledging respective policy differences.

Social Security - a split responsibility

The Scotland Act 2016 devolved responsibility for delivery of 11 benefits to Scottish Ministers; Personal Independence Payments, Carer's Allowance, Attendance Allowance, Disability Living Allowance, Winter Fuel Payments, Cold Weather Payments, Severe Disablement Allowance, Industrial Injuries Disability Benefit, Funeral Expenses Payments, Sure Start Maternity Grant and Discretionary Housing Payments (DHPs). The Social Security (Scotland) Act 2018 (the Act) provided the framework for delivery.

At the time legislative power was devolved, these benefits represented around 15% of overall social security spend (28% if the state pension is not included in the total of reserved benefits)i. The administrative handover is being phased. Social Security Scotland, a new executive agency of the Scottish Government, is expected to deliver the devolved benefits by 2021, with the exception of DHPs which were fully devolved in 2017 and are delivered by local authorities.

The Act also gave the Scottish Ministers powers to create new benefits and to top-up reserved benefits. Carer's Allowance Supplement, an extra payment introduced in 2018 for people in Scotland who get Carer's Allowance, is the first example of a benefit being paid by the new agency.

The Act requires Scottish Ministers to report annually on the value of each devolved form of assistance and specified devolved benefits must be uprated annually in line with inflation.

The Scottish Government has said it will introduce a new benefit; a supplement for low income families. Scottish Ministers are currently considering options and aim to have the new income supplement in place by 2022. The Cabinet Secretary said an update will be provided to the Parliament in June 2019.

Alongside the responsibilities devolved to the Scottish Ministers, UK ministers retain responsibility for most of social security spend across the UK. According to Scottish Government research, welfare spending in Scotland will be £3.7 billion lower in 2020/21 than it would have been had the welfare reform measures not been implemented. Most of this reduction is due to the UK Government's benefit freeze.

In its 2018 Budget, the UK Government announced a number of changes including an increase of £1,000 to work allowances in UC and an additional two-week payment of income support and the income-related elements of JSA and ESA at the start of a UC claim effective from July 2020.

In advance of the update to the Parliament in June 2019 on the new income supplement, the Committee would welcome more information on progress towards developing what will become a new devolved benefit. The Committee is particularly interested in the discussions taking place around delivery, potential eligibility and take-up and would be grateful for a progress report from the Scottish Government before Easter recess.

Although some much-needed changes were made recently to Universal Credit, significant damage was caused by the cuts made in the 2015 UK Budget. These cuts should now be reversed by the UK Government.

The Committee is disappointed that the UK Government did not take the opportunity of its recent Budget to end the benefits freeze. The benefits freeze has a disproportionate impact on the poorest and those in most need.ii

Universal Credit and working households

Universal Credit - lived experience and illustrative examples

Throughout this inquiry, we heard concerns about how UC is working in practice. The following accounts were given to us informally by people we met during a visit to Dundee. What we heard was deeply concerning-

Case 1. A woman living with her partner and young child. Since moving to UC, she owes more than £7,000 on her credit card. After being made redundant, her partner found work through Universal Jobmatch. Since then, he has worked 12-hour shifts for more than 16 days in a row with an hour walk each way. She told us they are not able to live on what they have coming in and were accumulating debt to survive. She had found it difficult to get help, support or clear advice at the job centre. She was very upset and said her mental health had deteriorated. She is very worried about the pressure on her partner and the debt.

Case 2. A single parent sanctioned for volunteering in a community project instead of spending that time looking for paid work. She had been carrying out her job searches in the evening. Due to the sanction, her family received no benefits for four weeks and had to resort to food parcels.

Case 3. Children caught stealing food from a community garden. Their mother had no money for food, as her UC claim had been delayed by a week. Food from the community garden was then given to the family. The mother was ashamed and grateful and said she would make soup for the family.

Case 4. A claimant encouraged to move to UC and advised (wrongly) he would be better off. He applied for an advance and managed the repayment and the change to how his rent was paid. He was told to approach his boss about getting more hours. No further hours were available. He was told to spend four hours a day looking for work but all the sites list the same few jobs. On one occasion he had been unable to update his journal as the site was down. He was asked by his work coach why he hadn't updated his journal the previous day. When he explained that the site had been down, he was told “well, it was fine here” which made him feel he wasn't believed.

Case 5. A JSA claimant was due to appear as a witness in court. After failing to attend court for a second time she was arrested and imprisoned for eight hours. In that time, DWP recorded a change of circumstance and she was moved to UC.

Case 6. A man on a fixed-term contract knew his contract would come to an end in December and he was worrying about this. He was not able to update his journal until the job ended and he was not able to notify increases in rent until they came in to effect. He spoke about the need to prove he was always looking for work and the impact this had on his family life, even on holiday. He also highlighted difficulties getting online where the broadband signal was not good.

Case 7. A woman with children separated from her partner moving from a joint claim for tax credits to a single UC claim. She informed us that she was told her new single claim did not entitle her to an advance and then went without any payment for seven weeks. Some job centre staff had been helpful but she had to re-submit documentation and didn't always receive responses to online journal entries. She never knew how much UC to expect, making it difficult to budget. She had had to borrow from friends and family and had relied on foodbanks. Her job paid weekly and her hours were steady. She could not understand the reason for her fluctuating UC payments. If she has questions, the job centre refers her to online resources. More recently she had started a further education course at college. It wasn't clear to her how this should be notified to DWP online.

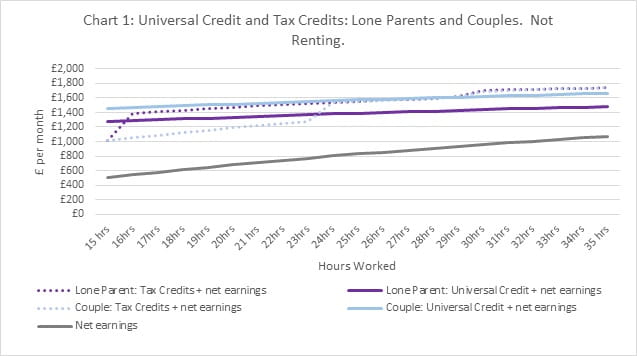

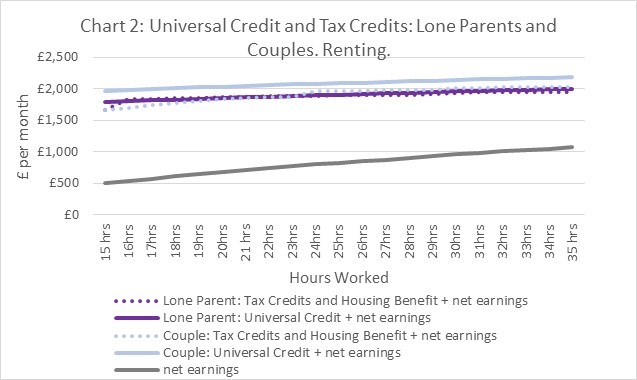

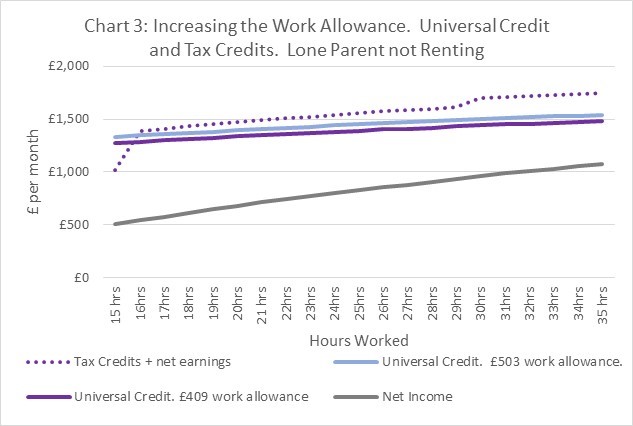

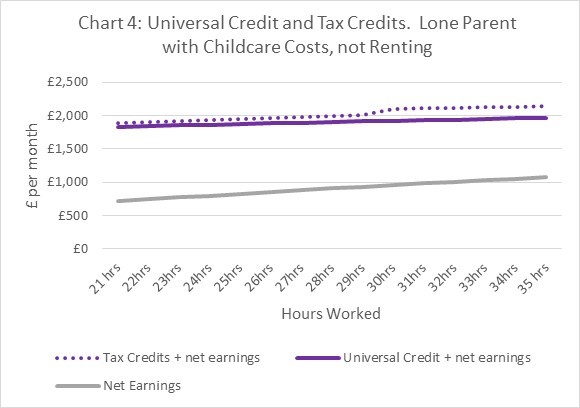

Annex A also provides some worked examples of the effect of moving on to UC.

Design and implementation

The original policy aims of UC were to-

encourage people on benefits to start paid work or increase their hours by making sure work pays,

make it easier for people to manage the move into work;

simplify the system making it easier for people to understand and easier and cheaper for the government to administer;

reduce the number of people in work and living in poverty; and

reduce fraud and error.1

Many of the submissions we received said changes to the original design of UC, and how UC is being implemented, mean work is much less likely to pay for those on UC. In particular, cuts to work allowances and the high “marginal effective tax rates” (how much of each additional £1 earned by someone on UC, ends up in their pocket, after tax and benefit tapers are applied) weakened incentives to work.

In 2016, the IFS found that, compared to Tax Credits, UC increased the incentive to have one partner in work (rather than neither) but reduced the incentives for two partners to be in work. It said-

despite cuts to work allowances, UC will still strengthen work incentives overall. Importantly, UC will have the welcome effect of strengthening work incentives for groups who face the weakest incentives now.2

However, in 2017, the Resolution Foundation reported that UC did little to improve financial incentives overall, with work incentives being particularly weak for lone parents and second earners.3

Also in 2017, a CPAG-commissioned IPPR report concluded-

Overall it is clear that the effect of changes to Universal Credit has been to reduce family incomes, unless they are working a high number of hours or earning relatively high wages and claiming support for childcare costs. This may be regarded as a work incentive, but for families with young children it may simply not be possible or desirable to increase hours to the extent needed to recoup the losses.4

Following the increase to work allowances in the 2018 UK Budget, the Office for Budget Responsibility’s (OBR) Economic and Fiscal Outlook (October 2018) commented-

the Government has reversed half the savings associated with the Summer Budget 2015 cuts to UC work allowances by raising them by £1,000. This increases the amount that eligible claimants can earn before their UC award is tapered.5

The Resolution Foundation's report Back in Credit concluded-

The Budget 2018 work allowance increase means that the number of working families that gain from the switch to UC increases by 200,000 – from 2.2 million families previously to 2.4 million families now. Among working families with children, the number (1.5 million) expected to be better off under UC now matches the number (1.5 million) expected to be worse off.6

Whilst the Committee welcomes the increase to Universal Credit work allowances, we are disappointed that the UK Government has chosen not to completely reverse the cut to work allowances made in 2015. We intend to write to the UK Government calling for these cuts to be fully reversed.

Other UC design and implementation issues raised included-

the inbuilt five-week period before people receive their first UC payment is causing hardship;

for self-employed people, the minimum income floor means a UC award can be based on income they don't have;

the surplus earnings rules mean someone with a high income in one month can have their UC award reduced over subsequent months, whether or not that income is still available to them;

passported benefit rules are recreating “cliff edges” that UC was intended to remove; and

difficulties in reporting childcare costs.

The two most common concerns raised in submissions were problems with the monthly assessment period and in-work conditionality. These are addressed in more detail below.

Despite problems, positive aspects of UC were recognised. For example, Russell Gunson (Institute for Public Policy Research Scotland) acknowledged-

Bringing six means-tested benefits together in one on a single taper is a good and positive idea, but the funding levels that were originally promised have dropped significantly...Whether universal credit will work or not has to relate to three factors: the structure, the funding and how it is implemented.

Social Security Committee 13 September 2018, Russell Gunson (Institute for Public Policy Research Scotland), contrib. 14, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110806Robert Joyce (Institute for Fiscal Studies) said-

A significant group of working households will keep more benefits under universal credit than they would have kept under the old system...on the other hand, plenty of working households will lose out.

Social Security Committee 13 September 2018, Robert Joyce (Institute for Fiscal Studies), contrib. 15, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2148796And David Finch (Resolution Foundation) pointed out-

Because universal credit is a single benefit, more families will get everything to which they are entitled. That will probably benefit the lowest-income households most.

Social Security Committee 13 September 2018, David Finch (Resolution Foundation), contrib. 16, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110808

The Committee, alongside other commentators, is supportive of a more simplified and streamlined benefits system, however, key aspects of the way in which Universal Credit is being implemented mean that it is not working for many claimants.i

The Committee observes, when talking about social security support, that language referring to “winners and losers” can cause offence. Our social security systems must be designed to ensure everyone in need receives all the support they are entitled to.

The Committee believes it is unacceptable to make any claimant wait a minimum of five weeks before receiving the financial support they are entitled to under Universal Credit. We urge the UK Government to urgently reform this design feature to ensure payments are made within two weeks of an application being made, as was the case under legacy benefits such as Job Seekers Allowance.i

The monthly assessment period

UC is paid monthly in arrears based on earnings during the “monthly assessment period”. Circumstances are assessed on the last day of the assessment period.

Information on earnings is provided to DWP from HMRC and self-employed people must make monthly declarations of earnings. Earnings within the monthly assessment period are taken in to account in that month's UC award. UC tops up earnings received during the assessment period. In this way, it was intended to “smooth out” fluctuations in income. However, this can lead to fluctuating UC awards due to-

fluctuating incomes from month to month; and

pay cycles differing from the UC cycle (e.g. people being paid four weekly or on ‘last Friday of the month’ etc.). Where the UC assessment period and a job pay cycle are ‘out of sync’, the UC award can end up taking two pay cheques in to account one month, and none the following.

Much of our evidence pointed out the budgeting difficulties created by fluctuating UC awards.

The DWP has consistently said it is an individual's responsibility to budget for fluctuating incomes and that it provides the necessary funding for support. However, we note the comments of Russell Gunson (IPPR Scotland), who said-

it is not good enough to suggest that people on the lowest fluctuating incomes—potentially they are people in insecure work, whether self-employed or otherwise—just need to budget better. We know that people having fluctuating incomes has been a temporary trend in the economy over at least the past 10 years and, with automation and other changes coming our way, they could become a bigger part of the economy.

Social Security Committee 13 September 2018, Russell Gunson, contrib. 53, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110845

CPAG highlighted other problems caused by fluctuating UC awards, including the benefit cap being applied in a month where someone's earnings are below the threshold to trigger the cap and households losing entitlements to passported benefits. Problems with applying a rigid monthly assessment period were summarised in a recent report from CPAG.

The strict monthly assessment period is a key design feature of UC. The UK Government has repeatedly said there are no plans to change it, despite the problems created by fluctuating UC awards.

There is an exception to the strict monthly assessment period created by the surplus earnings rules. The surplus earnings rules mean if someone's UC claim ends because their earnings have increased, any further claim for UC within six months, if earnings are high enough, may result in income from previous months being taken in to account and used in the UC assessment. As soon as a UC award tapers to £0, no UC is payable that month. Any income “left over” above a certain threshold (temporarily £2,500 until April 2020) is included in any UC claim made over the next six months. In each subsequent month, a lower amount of “surplus earnings” is included until it reduces to £0.

The surplus earnings rules are intended to prevent people manipulating their earnings pattern to gain more UC. However, the SSAC has commented that largely due to the complexity of the rules, it “has serious doubts about the potential for this detailed policy to operate effectively”.2

The current temporary surplus earnings threshold of £2,500 was due to reduce to £300 in April 2019 but this was delayed for a year in the 2018 UK Budget. At £300, the surplus earnings rules will affect many more people and to a greater degree.

The Committee has significant concerns about Universal Credit assessment dates not aligning with paydays. We recognise that the UK Government has said it is now urgently looking at this. We agree this must be urgently addressed and request an update from UK Government ministers following their consideration.

For surplus earnings rules, retaining the higher earnings threshold before income is carried over would ease the impact of fluctuating incomes and provide greater certainty for those in receipt of Universal Credit. We recommend that the threshold be maintained at £2,500.

Whilst we agree with the principle of encouraging people to budget and take responsibility for their finances, the unpredictability of Universal Credit payments makes this more difficult. DWP is already able to identify vulnerable claimants. It needs to provide more support, by telephone and in person, to those who need it with making and managing a claim.

Jobcentre Plus work coaches

According to the National Audit Office, the caseload for a work coach is 85 claimants and for a case manager it is 154. At full implementation, the NAO expects work coaches to have a caseload of 343 and case managers 919. Work coaches are responsible for maintaining regular contact with claimants to support claimant commitments. Case managers are responsible for reviewing journal entries and ensuring correct UC payments are being made.1

In its written submission, the PCS said there was already pressure on staff-

In the most recent large-scale survey of staff, from February 2018, involving 554 individual responses from staff working on UC, 80% of respondents felt their workplace did not have sufficient staff to manage the workload. Almost three-quarters of respondents suggested they hadn't been suitably trained to discharge their duties.2

Pete Searle (DWP) said that increasing caseloads would not necessarily involve a proportionate increase in workload. He explained-

The cases on universal credit now are fundamentally unemployed people whom we see every two weeks, so that requires a lot of activity. Many of the new cases will be on less intensive regimes, which will mean that the work coaches can increase their case load.

Social Security Committee 08 November 2018, Pete Searle, contrib. 41, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125856

The OBR observed-

DWP expects a lot of the modestly paid work coaches it is recruiting in terms of tailoring interventions to the needs of individuals and families in the context of local labour markets; setting conditions and monitoring compliance with them.4

Dave Semple (PCS Union) suggested that in other countries, the job of a work coach is degree-level and well paid. He called for more investment-

If the DWP is going to persist with the approach, we absolutely want much better training—accredited training. We do not mean by that the cut-price apprenticeships that the DWP occasionally tries to roll out; we mean serious training that will help people to support their claimants.

Social Security Committee 01 November 2018, Dave Semple, contrib. 59, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11755&c=2124001

Denise Horsfall (DWP) described the DWP accreditation process-

During the past two years, about a third of our work coaches have gone through accreditation or apprenticeships. That is between 14 and 18 months of work on a City & Guilds qualification, which makes sure that we deepen the expertise of the work coaches. With support from tutors, they can really understand and investigate how to further build their capability as operational professionals.

Social Security Committee 08 November 2018, Denise Horsfall, contrib. 85, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125900

Work coaches can have a positive impact when working with those seeking to move in to employment or people looking to progress in their careers. Work coaches can also have a high degree of discretion around claimant commitments and whether they have been met. The effectiveness of a work coach is very likely to be undermined if the workload is excessive.

We are concerned about the current workload of Jobcentre Plus staff. Caseload is forecast to increase significantly in response to managed migration. It is crucial that the DWP ensures it has adequate numbers of well-trained and experienced work coaches for existing claimants.

We are of the view that the managed migration process should not commence until DWP can demonstrate both that sufficient staff resources are available to ensure satisfactory service levels for all existing and new claimants and that robust workforce plans are in place to ensure readiness for people moving on to Universal Credit by managed migration.i

Digital first approach

Universal Credit takes a digital first approach. There is an expectation that applications for UC are made online and queries and ongoing interaction with work coaches and case managers will be primarily through an online journal.

We heard from PCS about pressure on DWP staff caused by the digital first approach. Dave Semple told us-

The constant problem that we face is that we receive too many phone calls to the service centres—people rely on having telephone contact with the service centres because the digital service is not fit for purpose... Those people call the service centres, but the centres are not staffed for that, because the system has been designed to be a digital first system.

Social Security Committee 01 November 2018, Dave Semple, contrib. 33, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11755&c=2123975

We asked DWP about people being unable to make and manage their UC claims online. Denise Horsfall said she had not seen any delay in the claims process-

We are 90 per cent through new-claim roll-out and I have not seen delays or problems to date.

Social Security Committee 08 November 2018, Denise Horsfall, contrib. 32, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125847

The DWP’s view just does not square with the views we heard. We were told that people are facing delays with initial payments, difficulties navigating the digital system and often not receiving the support they need in job centres or by telephone.

We asked Denise Horsfall how UC caters for people in Scotland without digital access or skills and how they can access support. She replied-

It depends on where customers are in the country. If they are in the central belt, there is lots of provision to support them.

Social Security Committee 08 November 2018, Denise Horsfall, contrib. 26, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125841

We asked specifically about people living in rural communities and those living more remotely in island communities. She then explained-

...we would first contact the customer to see when they would be available. If they cannot get across to the mainland, we either send a visiting officer the other way or we try to ensure that we take the claim over the phone and progress it when the individual can come in. They need to sign their claimant commitment and have that conversation.

We then try to do things through journals and by phone, although it may be appropriate to bring somebody in...

Social Security Committee 08 November 2018, Denise Horsfall, contrib. 28, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125843

In October 2018, the DWP announced that from April 2019 Citizens Advice would be funded to provide Universal Support. Universal Support is a scheme to help claimants with claims. Its focus is on budgeting skills and digital support. Until April, Universal Support will continue to be provided by local authorities.

This Committee, along with many others, will be watching carefully to see whether the new Universal Support initiative results in meaningful improvements. Support must be available to all Universal Credit claimants who need it, in all localities.

The Committee is concerned that a digital first approach may be digital by default, particularly for those who simply have no adequate access to the internet or have additional barriers to using IT in such a way. Our view is that a genuinely mixed approach must be taken to supporting clients, similar to the intention of Social Security Scotland, which aims to provide adequate telephone and face-to-face access for claimants, particularly the most vulnerable, who are not able to navigate a vital service delivered by default.i

Managed migration

People move onto UC under natural migration or managed migration. Now that every area has moved on to full service, anyone on a legacy benefit who has a change of circumstances that requires a new claim (such as moving to a new address in a different local authority area or a couple separating) must now make a new claim for UC. A move on to UC in this way is natural migration. There is no transitional protection for natural migration.

From July 2019 to December 2023, people still on legacy benefits will be moved over to UC. This is managed migration. A person in receipt of a legacy benefit will stop receiving it and will have to make a new application for UC. People moving on to UC through managed migration will be given some transitional protection, until they have a change of circumstances which requires a new claim for UC to be made.

The Committee notes that claimants moving on to UC because of a change of circumstance (natural migration) do not receive the transitional protection, but those who will move on to UC, under managed migration, will receive transitional protection. It is unclear to the Committee what the reasons are for this difference in treatment between claimants.

The transitional protection for those moving through managed migration is an extra amount to top up their UC award to ensure they are not worse off on moving on to UC. The amount of transitional protection will depend on income under the legacy benefit.

Pete Searle (DWP) explained how managed migration will be approached-

In the latter part of next year and into 2020, we will be testing in a very light-touch way the migration process in something like 10,000 cases...

Social Security Committee 08 November 2018, Pete Searle, contrib. 62, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125877

In November 2018, regulations setting out the detail for managed migration were laid at Westminster, together with the SSAC's report.

The SSAC consultation to inform its report on the draft regulations received a record number of responses. A significant majority were from individuals or their carers, expressing a high degree of anxiety about the proposals.

The SSAC reported major logistical concerns about the claims process. This included the move to monthly payments and the level of risk being passed to claimants by the DWP by its requirement that all existing claimants must make a new claim for UC. The SSAC was “of the strong view that the responsibility for ensuring that claimants are migrated safely to Universal Credit rests with the Government.” We agree with that view.

Dave Semple (PCS) said “not a great deal” of preparation had been carried out by the DWP in preparation for managed migration. He outlined his concerns about moving people over from tax credits administered by HMRC-

We are talking about fundamental changes that will vastly increase the amount of work per claimant under the new universal credit system. For example, whereas HMRC would have looked at earnings annually, we now have to look at them monthly. The volume of work has gone up dramatically, and that is before we get to the question of conditionality, bringing people into jobcentres or regularly phoning them from service centres.

Social Security Committee 01 November 2018, Dave Semple, contrib. 29, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11755&c=2123971

We are aware that people in work and in receipt of working tax credits, quite understandably, may not consider themselves to be benefit claimants. As such, on moving to Universal Credit, they will face not just a significant culture change but a radical change of regime.

In evidence to the Work and Pension Committee on 18 October, Neil Couling (DWP Director General for UC) acknowledged this-

We also have the problem of recognition with tax credit claimants. A number of them do not recognise that they are on a form of benefit; so far as they are concerned, they are customers of HMRC—strictly speaking they are—so they don‘t recognise the DWP. There is a process to design and work through with HMRC about the best way to bring tax credit claimants over to universal credit.3

We asked the DWP to explain why people previously in receipt of benefits through the tax system have to make a new claim for UC. Pete Searle explained-

The rationale is partly a legal one. Legally, we could not just deem that someone had made a claim for universal credit. We cannot pay someone universal credit without them having formally made a claim. That is the process that we have to initiate through the managed migration.

Social Security Committee 08 November 2018, Pete Searle, contrib. 133, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125948

Managed migration represents a considerable challenge for HMRC and DWP and a significant change for claimants. It is unclear what the DWP's process is for designing and working through how best to migrate claimants. Given that managed migration is due to start this year, the Committee is surprised and disappointed that there is not more clarity around this. As a result, there is considerable uncertainty and little or no evidence of workforce planning to support the change.i

As managed migration will attract some transitional protection, we are concerned that this could drive undesirable behaviours. In households where there is domestic abuse, the fear of losing money and having to make a new application for UC, with the delay that entails, could induce a person experiencing abuse to stay instead of leave.

When we raised this with the DWP, Pete Searle (DWP) said-

On the point about natural migrations and managed migrations, if someone split from their partner, there would in effect be a new claim at that point and the person’s claim circumstances would have changed quite dramatically, so I am not sure what we would transitionally protect if they moved across to universal credit.

Social Security Committee 08 November 2018, Pete Searle, contrib. 48, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125863

We feel that the DWP is missing the point. Our concern is about the circumstances in which transitional protection (extra money) can be lost under managed migration and the potential for that to drive behaviours. For example, a victim of domestic abuse may be faced with having to choose between leaving an abusive partner or losing money under transitional protection due to a change in circumstance. The UK Government's transitional protection regulations provide no exceptions, for example in cases of domestic abuse, which the Committee finds disappointing.ii

In her evidence, the Cabinet Secretary was clear-

Until we know how managed migration will affect individuals, in particular the most vulnerable individuals in society, we should not implement managed migration. Unless we are reassured that people will not fall through a gap, and that a woman will not stay in an abusive relationship because she is frightened about how much money she will receive, we simply should not go down this path

Social Security Committee 22 November 2018 [Draft], Shirley-Anne Somerville, contrib. 29, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11801&c=2131359

The Committee agrees that managed migration should not proceed until there is more clarity around what it will mean for those being expected to move over.

More work needs to be done to identify information currently held by HMRC that could be used to pre-populate DWP systems to ensure people moving on to Universal Credit can do so seamlessly.

We also consider that much more needs to be done to publicise what migration will mean for claimants and to ensure DWP can manage the migration effectively. The Committee would like detail from DWP about the proposed 10,000 initial test cases, including how they will be chosen and monitored.

It is the view of the Committee that priority should be given to addressing the existing concerns with Universal Credit before seeking to move up to three million people currently on legacy benefits on to Universal Credit.iv

Universal Credit and self-employed claimants

Thirteen per cent of the working population are self-employed compared to 12% before the financial crisis. According to the IFS-

There are more sole traders reporting very low profits. 14% of sole traders (around 550,000 people) report very low profits of between £0 and £2,000 per year in 2015–16, up from 12% in 2003–04. Over half of this group have another job (53%), 28% are in their first year of self-employment and only 7% undertake investment. This is not proof of, but is consistent with, increased numbers of people working in the “gig economy” or running a “kitchen table business”, with relatively few hours of work and little capital invested.1

For the self-employed, UC brings significant changes: a requirement to attend a job centre to determine whether the employment is gainful (the gainful self-employment test), a Minimum Income Floor (MIF) (after 12 months there is an assumed level of earnings, even if actual earnings are lower), a requirement to report earnings monthly (instead of annually as is the case with tax and Tax Credits) and the surplus earnings rule.

After passing the gainful self-employment tests, and after a business has been operating for more than a year, the MIF will apply. The MIF is broadly based on 35 hours at minimum wage and assumes that every month a self-employed claimant's earnings are above the minimum threshold.

The OBR estimates that around 15% of self-employed people will be on UC. Of these, around two thirds (65%) will receive less UC because the award is based on the MIF rather than their actual earnings.2

The surplus earnings rules apply to all UC claimants, including those who are self-employed. The rules mean some earnings or losses are carried forward and taken in to account in future income assessments. As a result, UC monthly payments can be reduced for up to six months following a higher earnings month. As noted already, the surplus earnings threshold is currently £2,500 but is due to reduce to £300 from April 2020.

Many self-employed people have fluctuating earnings; this can be because their business is based on seasonal work or the nature of their work may mean it is highly unpredictable.

A recent Citizens Advice survey showed that nearly half of people who were self-employed or in insecure work said that their earnings changed either a fair amount or a great deal from month to month.3

Difficulties for self-employed people claiming UC were raised in many of the written submissions (e.g. LITRG, CPAG, Scottish Government, JRF, CAS, Aberdeenshire Council, Inverclyde Financial Inclusion Partnership).

CPAG told us-

CPAG's Early Warning System has received a number of cases of self-employed workers facing destitution because their actual income falls well below the minimum income floor.4

The Low Income Tax Reform Group (LITRG) said-

If major changes are not made there is a risk that those who are already self-employed will be forced to give up their businesses in order to access state support. We also think that the structure of UC may deter people from starting self-employment.5

And, Robert Joyce (IFS) said-

It is not just an issue of how the system treats self-employed people versus how it treats non-self-employed people; it is also an issue of how it treats self-employed people with volatile incomes versus how it treats those whose income is not volatile. Two people may have the same earnings over the year, but one could get a lot more universal credit than the other. That is a pretty big discrepancy.

Social Security Committee 13 September 2018, Robert Joyce, contrib. 46, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110838

In May, the Work and Pensions Committee looked at UC for the self-employed. It concluded that “UC was not designed with the self-employed in mind”7. It recommended that the 12-month start up period before the MIF comes in to effect be extended to three years, on a case by case basis. A tapered MIF could then be introduced. The UK Government disagreed with this, saying it would diminish the incentive for anyone who is self-employed to grow their earnings.

In its response to the Work and Pensions Committee, the UK Government said that monthly reporting of earnings ensures UC can be adjusted more quickly, particularly where earnings fall and that volatile earnings and expenses are entirely normal for many self-employed people. It concluded-

The Government's view is therefore that fluctuating earnings are something self-employed UC claimants need to plan for, just as other self-employed earners do. And that monthly reporting is not overly onerous, or unreasonable in return for State support.8

We urge the UK Government to urgently reconsider how Universal Credit impacts on claimants who are self-employed. Universal Credit needs to better support those who are self-employed, at the same time ensuring that unsustainable enterprises are not subsidised indefinitely.

It is our view that, when applying the Minimum Income Floor, the Universal Credit calculation should take in to account average monthly earnings over a longer period, rather than only income received in the previous month.

In-work conditionality

Unlike Working Tax Credits, in UC there is no requirement to work 16 hours before being entitled to claim. However, although it is not being actively applied at the moment unless someone is on very low wages, the policy intention is that someone in receipt of UC could be subject to conditionality (and potentially sanctions) despite working more than 16 hours.

Requiring a claimant already in work to take active steps to increase their earnings as an ongoing condition of receiving UC, is “unprecedented internationally” according to the Organisation for Economic Co-operation and Development (OECD) and SSAC.1

There is currently no expectation that someone in low paid work, and receiving Working Tax Credits, should seek to earn more and there is no penalty for not doing so. UC changes that.

The complexity and unprecedented nature of in-work conditionality has been reported on by the SSAC (2017) and the Work and Pensions Committee (2016)1.

All UC claimants are placed in one of four “work conditionality groups”. A UC claimant who is in work will be placed in the “All Work Requirements” group unless their earnings are above the “conditionality threshold” or they are exempted. Claimants in the “All Work Requirements” group are expected to look for more or better paid work. There are three relevant earnings levels-

Under the Administrative Earnings Threshold (AET) (£338 per month for single people, £541 for couples) a claimant can be required to look for more work or sanctions can be applied.

Over the Conditionality Earnings Threshold (CET,) there is no conditionality. Expected hours are set by the JCP work coach but are normally 35 hours a week at the national minimum wage. It can be less if you have caring responsibilities or health issues.

Between the AET and CET, “light touch” conditionality is currently being applied.

According to DWP guidance on the light touch approach-

The support provided will depend on what would best address the individual request and the claimant's specific needs. Any activities agreed with the claimant are voluntary and failure to complete the activities will not lead to a sanction.3

The DWP is currently undertaking research on whether to extend in-work conditionality to those earning between AET and CET. In October 2018, the DWP told the Work and Pensions Committee that it did not envisage in-work conditionality being part of managed migration.

In September 2018, the DWP published a report following a randomised control trial of different levels of intervention, including the application of sanctions on participants’ earnings. The trial found the role of the work coach to be crucial but found no evidence of a statistically significant impact on earnings, 15 months after starting the trial.4

Pete Searle (DWP) acknowledged that there is no meaningful evidence of the efficacy of in-work conditionality. He told us-

We do not have evidence at the moment about what could work and about the best way of interacting with people in work, who have got jobs to go to and do not need to be popping down to the job centre every five minutes.

We got £8 million from the Treasury in the 2017 budget to do that research over four years.

Social Security Committee 08 November 2018, Pete Searle (Department for Work and Pensions), contrib. 5, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11767&c=2125820

In-work conditionality was the second most often raised concern in our written submissions. Issues raised, included-

The prospect of improving earnings is often not within the control of the claimant (e.g. Oxfam, Scottish Government);

The particular difficulties in trying to increase working hours and/or pay for those caring for children, disabled people and carers (e.g. CAS, Scottish Women's Convention, Glasgow Centre for Population Health (GCPH); and

In-work conditionality may lead to people either giving up work or giving up claiming UC (e.g. Falkirk Council, Scottish Government, Menu for Change, GCPH, CPAG).

Submissions from Oxfam and PCS said that ‘in-work progression’ could be positive, if developed in a supportive way. Oxfam wrote-

Progression is fundamental in ensuring that work acts as a route out of poverty, but Oxfam has concerns around how in-work progression policy has been conceptualised.

Russell Gunson, IPPR Scotland told us-

Conditionality for universal credit includes in-work requirements, so the onus is on the claimant to increase their earnings or hours. There are also other elements that we could describe as conditionality such as work requirements for those who are out of work and the minimum income floor, which one could argue is conditionality for those who are self-employed.

Social Security Committee 13 September 2018, Russell Gunson, contrib. 21, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110813He went on to add that one of the problems with conditionality is the onus is placed on the claimant-

The idea that it is the sole responsibility of the claimant to increase their hours or earnings to satisfy the universal credit system bears no relation to reality. It is the employer, the economy more generally and the client that have the ability and responsibility to do that.

Social Security Committee 13 September 2018, Russell Gunson, contrib. 21, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110813

The PCS is supportive of a light touch, voluntary approach. We asked Dave Semple about developing the current light touch approach into one that would involve work coaches providing support to people in work to increase their hours, or earn more, with the possible threat of sanctions for not doing so. He stated-

The current number of work coaches simply would not be able to do that work in any meaningful way.

Social Security Committee 01 November 2018, Dave Semple, contrib. 15, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11755&c=2123957

Evidence is only now being gathered on what interventions could be effective for those currently in work. The evidence will not be available for at least two more years. For now, there is no clarity around what work coaches and UC claimants who are in work might be required to do and what in-work conditionality could look like.

If it is decided to introduce in-work conditionality for people currently being placed in the light touch group, this will represent a fundamental change for claimants and for JCP staff.

The Committee notes the comments of Russell Gunson who told us-

As long as the minimum wage is being enforced, we will not see 60-hour weeks being worked as a consequence of in-work conditionality. However, if the judgments that are made at the discretion of the DWP or Jobcentre Plus are incorrect, we may see lone parents or second earners in a household who are working less than full time either being pushed to work more hours than is suitable to their circumstances or receiving a reduction in their entitlement to universal credit.

Social Security Committee 13 September 2018, Russell Gunson, contrib. 27, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110819

The Cabinet Secretary called on the DWP to be clearer about its plans, saying-

When it comes to sanctions, for example, we will never agree that that is an effective or useful policy, but we need to know what the DWP’s intentions are, so that the Scottish Government, local authorities and Scottish Government agencies can, in full awareness of that, adapt accordingly.

Social Security Committee 22 November 2018 [Draft], Shirley-Anne Somerville, contrib. 7, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11801&c=2131337

The PCS trade union told us that job centre closures had resulted in the loss of experience and community links and a reduction in the service that job centres are able to provide. Job centres have an important role in creating and maintaining links with local employers. It is counter-productive to close job centres in communities most likely to have higher and increasing numbers of Universal Credit claimants.i

The PCS trade union, which represents many DWP front-line staff delivering Universal Credit, has expressed serious concerns to DWP managers, including about in-work conditionality, and do not feel they are being listened to. Trades Unions representing staff delivering Universal Credit are a valuable source of information about how well Universal Credit is working. The Committee suggests the DWP pay much closer attention to the concerns they raise.

The Committee believes that the dramatic reduction in the number of job centres, at a time when Universal Credit is being rolled-out across Scotland, was a serious error of judgement by the DWP. This has impacted on service and compounded the disconnect between many service users and the DWP. We believe there is a case to be made to review local access to DWP and other forms of employment support across Scotland to allow for more localised and community-focussed support, in place of an increasingly remote and digital by default support system.

Providing constructive support to increasing numbers of people on Universal Credit will require significant investment in the number of JobcentrePlus staff and their training.

Given the DWP has no evidence to support the development of in-work conditionality and, more fundamentally, that the Committee is opposed in principle to attaching punitive conditions to those already in work, the Committee does not support any extension of in-work conditionality.

Furthermore, as tax credits, administered by HMRC, are not subject to conditionality or sanction, there is a strong case to be made for not only halting further migration of people in receipt of tax credits to Universal Credit but also to considering the removal of tax credit support from Universal Credit altogether and continuing to use HMRC unless the threat of conditionality and sanctions are removed.ii

Increasing demand faced by foodbanks

According to the Trussell Trust, when UC goes live in an area there is a clear increase in demand for support from its foodbanks. On average, 12 months after rollout, Trussell Trust foodbanks see a 52% increase in demand. The wait for the first UC payment is one of the key reasons for the increase.

In its report “Left Behind” the Trussell Trust found that 9% of 284 participants were in work or had recently left work. It recommended

An urgent inquiry into poor administration within Universal Credit and its effects, particularly in relation to insecure work.1

In the last year, the Trussell Trust has distributed more than 170,000 parcels in Scotland, a 17% increase on the previous year and a higher increase than the rest of the UK.2

Many of our written submissions commented on the rising numbers of people using foodbanks, for example-

Church of Scotland said:

The demographic of people who are forced to visit a foodbank due to poverty includes people who work and claim UC, because of late payments, sanctions, and unpredictable payments.3

Shelter provided the following case study:

Joe (not his real name) is working fulltime on minimum wage and is living in temporary accommodation. The charge for his temporary accommodation is nearly half of his monthly take home pay and he is having to use foodbanks and free food places as a result. He has seriously considered whether to give up work so that housing benefit covers his temporary accommodation and he may be financially better off overall but has decided to continue to work in the hope that he will soon move out of temporary accommodation.4

Aberdeenshire Council said:

There is an increase in the use of foodbanks within Aberdeenshire and Scotland by working families, who report that they will do without or are increasingly reliant on family and friends for support if they cannot access the foodbank. The feedback is more working people are in that situation as the cost of living is higher than wages.5

The Committee notes that-

New foodbanks typically experience strong growth in their first year.6

Polly Jones (Oxfam/ menu for change) told the Committee about the impact insecure work has on UC claimants-

Most of our work is in Dundee, East Ayrshire and Fife, where there are big local employers who are well known for using temporary contracts all the time. That has left many people’s families without money for weeks on end, because their claims have been stopped. The amount that they have earned in one assessment period might have peaked, so their claim is closed and they have to reapply.

Social Security Committee 13 September 2018, Polly Jones, contrib. 89, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11665&c=2110881

During our round table session, we heard some troubling evidence from those running foodbanks about their experience with UC. These are just two examples-

Aziz Zeria, Crookston Community Group

A young child who had been eating tomato sauce at school came to us for food. We received a note to say, “Thank you for giving my mum food so that we could have something to eat.”

Social Security Committee 25 October 2018, Aziz Zeria, contrib. 52, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11736&c=2121180Mandy Nutt, Tain Foodbank

We have to take people to the jobcentre to do their application or to do the identification check after they have done an online application, because it is 20 miles away and it costs £10 to get there on the bus. I could run a bus service. I pick people up on the A9 going back and forth to the jobcentre—they are told to thumb a lift. These are young women who are being told to thumb a lift down to the jobcentre.

Social Security Committee 25 October 2018, Mandy Nutt, contrib. 62, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11736&c=2121190

We heard frustration that people ending up at foodbanks were not being directed beforehand to help available elsewhere. Laura Ferguson (Trussell Trust) said-

Normally, people access the Scottish welfare fund through a telephone or online application. Fife Council managed to fund advisers to come to the food bank, and food bank referrals dropped by 30 per cent. That happened because people went through the application process and received money.

Social Security Committee 25 October 2018, Laura Ferguson, contrib. 57, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11736&c=2121185

The Scottish Government's Fair Food Fund (formerly Fair Food Transformation Fund) was set up to support community projects enable people to feed themselves and their families and reduce reliance on emergency food provision. The Cabinet Secretary told us-

we are increasing our fair food fund to £3.5 million in 2019-20 to support dignified responses to food poverty and security.

Social Security Committee 22 November 2018, The Cabinet Secretary for Social Security and Older People (Shirley-Anne Somerville), contrib. 3, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11801&c=2131333

On the strength of the evidence provided by food banks, the Committee believes that Universal Credit is a significant cause of the rise in demand for food bank services.i

The Committee notes the invaluable work of foodbanks and acknowledges there can be a variety of reasons why people visit foodbanks. We are on record as agreeing that a long-term sustainable approach to tackling food insecurity, across a range of policies, is required. The Committee shares the view of a number of those who gave evidence representing food banks that we should never come to see them as a substitute for the social security system, or take them for granted in this way.

We welcome the Scottish Government's increase to the budget for its Fair Food Fund. We have already called for an increase in funding for the Scottish Welfare Fund to address growing pressure and need. We also restate here our view that more needs to be done to increase awareness of and enable access to the Scottish Welfare Fund. We extend that to awareness of the Fair Food Fund.

UN Special Rapporteur on Extreme Poverty

Finally, the conclusion of our evidence-taking coincided with the publication of the UN Special Rapporteur on extreme poverty and human rights’ preliminary findings following his visit to the UK. Describing Universal Credit, Professor Alston was extremely critical. Unsurprisingly, his findings about the impact of Universal Credit echoed many of the concerns highlighted to the Committee.

The following direct quotes from Professor Alston’s findings were cited during our evidence session with the Cabinet Secretary on 22 November 2018 -

“Although in its initial conception it represented a potentially major improvement in the system, it is fast falling into Universal Discredit.”

Social Security Committee 22 November 2018, The Cabinet Secretary for Social Security and Older People (Shirley-Anne Somerville), contrib. 3, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11801&c=2131333“it is outrageous that devolved administrations need to spend resources to shield people from government policies.”

Social Security Committee 22 November 2018, The Cabinet Secretary for Social Security and Older People (Shirley-Anne Somerville), contrib. 3, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11801&c=2131333“British compassion for those who are suffering has been replaced by a punitive, mean-spirited, and often callous approach”