Finance and Public Administration Committee

Annual Report of the Finance and Public Administration Committee 2024-25

Introduction

This report provides a summary of the key activities undertaken by the Finance and Public Administration Committee during the parliamentary year from 13 May 2024 to 12 May 2025.

This is the Committee’s fourth annual report since its establishment in June 2021. In addition to examining Scotland’s public finances, the Committee’s remit includes scrutiny of public administration in Scotland, public service reform and the National Performance Framework.

Full details of our work, including copies of Committee papers and reports can be found on the Committee’s webpage.

Membership Changes

One Committee membership change occurred during the Parliamentary year: Jamie Halcro Johnston left the Committee on 10 October 2024 and was replaced by Craig Hoy.

Committee meetings

During the reporting period, the Committee met 35 times. Seven meetings were held wholly in private. The Committee agreed at the beginning of the session to consider future work plans and draft reports in private.

Scrutiny of Legislation and the Scottish Budget

Pre-Budget Scrutiny 2025-26 - Managing Scotland's Public Finances: A Strategic Approach

The Committee focussed its pre-budget 2025-26 scrutiny on three main areas—

the Scottish Government’s approach to taxation,

how the Scottish Government is using its capital expenditure to achieve innovation, productivity, and growth, and

progress with the Scottish Government’s public service reform programme.

Although the Scottish Government normally publishes a Medium-Term Financial Strategy (MTFS) in May each year, the MTFS was not published in 2024 which the Scottish Government said was due to a change in First Minister and a UK general election.

The FPA Committee expressed disappointment at the Scottish Government’s decision not to publish an MTFS during 2024 as it undermined the Committee’s ability to consider how the priorities for the next Budget sit within this longer-term context.

In addition to gathering written and oral evidence, the Committee held two fact-finding visits this year; to the School of Life Sciences at the University of Dundee to discuss opportunities to achieve innovation, productivity, and growth, and to Estonia to learn from that country’s experience of public service reform, and in particular its digital transformation programme.

The Committee heard strong evidence that the Scottish Government should adopt a more strategic and longer term approach to budgeting which should include multi-year plans.

Learning from the experience in Estonia, the Committee asked the Scottish Government to explore whether a zero-based budgeting approach would be suitable for certain portfolios. Zero-based budgeting involves the design of a budget from zero, rather than as an adjustment to the previous year’s budget.

To increase the sustainability of public finances the Committee has asked the Scottish Government to set out its ambitions for increasing the tax base. Given that capital investment is essential for growing the economy, the Committee is disappointed by the repeated delays by the Scottish Government to publish an updated Infrastructure Investment Plan.

The Committee received examples of good practices from across the public sector and local government regarding digitalisation and the use of Artificial Intelligence. Given the positive effects of consistent investment in digitalisation that the Committee learned about during the visit to Estonia, the Committee asked the Scottish Government to consider whether Scotland should create a permanent spending commitment on IT, which can endure beyond political cycles.

Estonia visit case study

The Committee visited Tallinn, Estonia between 23-26 September 2024. The purpose of the visit was to learn from Estonia’s experience of public service reform, including its digital transformation. The Organisation for Economic Co-operation and Development has described Estonia as a “frontrunner in digital governance and innovation”.

At present 99 per cent of Estonia’s public services are online and it is estimated easy data exchanges between governmental agencies save over 2000 years of working time annually. The Committee also heard about Estonia’s efforts to rationalise public sector agencies, in a context where Estonia’s public sector is already significantly slimmer compared to Scotland.

The Committee was impressed with Estonia’s progress in digitalisation and public service reform. The information gathered shaped the Committee’s overall approach to pre-budget scrutiny.

Scrutiny of the Scottish Budget 2025 - 26

The Committee’s scrutiny of the Scottish Budget 2025-26 was informed by written and oral evidence and built on the themes covered in our Pre-Budget Report. We consider that a commitment to more certainty around the timing of UK fiscal events by the UK government should enable the Scottish Government to adopt a more strategic approach to public finances. We have repeatedly recommended that there be much more progress in this regard.

The focus of the Committee’s scrutiny was driven by Scotland’s economic and fiscal context. The Scottish Fiscal Commission noted in its August 2024 fiscal update that the Scottish Government “will face persistent challenges in balancing its budget” and that Scottish Government decisions “have played a role in […] budget pressures”.

Scotland’s slower economic growth compared to the rest of the UK has a more direct impact on Scottish public finances since income tax was devolved. Scottish taxpayers contribute £1,676m more in income tax because of the higher tax burden in Scotland. However, the Scottish Budget is only benefitting by £838m due to what the Scottish Fiscal Commission (SFC) describes as an “economic performance gap” in their December 2024 forecasts. The Committee recommended that the Scottish Government undertakes more detailed research on behavioural responses to tax policy so that future decision-making is driven by a more complete evidence base.

Although there are many excellent examples of public bodies delivering reform, the Committee has urged the Scottish Government to demonstrate stronger leadership and bring an overall vision to Public Service Reform. We therefore look forward to examining the Scottish Government’s first Public Service Reform Strategy which is expected to be published in June 2025.

In response to the Committee’s Budget 2025-26 recommendations, the Scottish Government has agreed to:

consider the potential to pilot ‘zero-based budgeting’ and how it might be used in a Scottish Government context.

undertake an exercise across portfolios to identify ‘live’ strategies with a view for their number to be reduced and for the strategies to be streamlined.

improve transparency in the Scottish Budget so that interested parties can gain a clearer understanding of the funding position for portfolios, including details of how the funding has changed from one year to the next.

have a renewed focus on preventative spending, to ensure better outcomes and cost-effectiveness.

Aggregates Tax and Devolved Taxes Administration (Scotland) Bill

Following publication of its Stage 1 report in the previous reporting year, the Committee continued scrutiny of the Aggregates Tax and Devolved Taxes Administration (Scotland) Bill at stage 2. The Bill was enacted on 12 November 2024 and the tax is due to come into effect from April 2026.

Scrutiny of Financial Memorandums

Each Bill introduced in the Parliament must be accompanied by a Financial Memorandum (FM) setting out the estimated financial implications of the legislation. The Committee is responsible for scrutinising each FM and reporting our findings to the lead committee.

This session the Committee has expressed repeated concerns about the quality of FMs provided by the Scottish Government and therefore asked the Scottish Government to make a series of improvements to their consistency and presentation. On 6 March 2025, the Minister for Parliamentary Business wrote to the Committee advising that this action, including changes to the Scottish Public Finance Manual and enhanced training, is being taken across the Scottish Government to improve the quality of future FMs.

During this reporting period, the Committee issued calls for views on 13 FMs. This enabled the Committee to build an evidence base on the cost estimates relating to Bills that could then be passed on to the lead Committee to pursue in evidence with the Scottish Government and, in the case of Members’ Bills, the Member in charge. In addition, the Committee took oral evidence on four FMs to inform letters to the relevant lead Committees:

Right to Addiction Recovery (Scotland) Bill

The Committee explored amongst other issues the potential for cost increases due to unknown unmet need for addiction recovery. The Member in charge of the Bill provided additional information to the Committee after the evidence session including updated costs together with research which suggests that “Every £1 currently spent on harm reduction and treatment gives a combined health and justice return on investment of £4”.

Assisted Dying for Terminally Ill Adults (Scotland) Bill

The Committee took evidence from the Member in charge and reported its views to the lead Committee, highlighting a range of issues including the potential for incorrect assumptions in the costs provided together with some concerns on the comparability of costs from other jurisdictions. The Bill passed Stage 1 in May 2025.

Disability Commissioner (Scotland) Bill

The Committee heard evidence from the Member in charge. In its letter to the lead Committee, it expressed concerns regarding the creation of an additional Commissioner, which has the potential to lead to overlap and duplication of work which in turn leads to increased costs. The Committee’s view is that funding for new Commissioners would be better spent on the delivery of services.

Schools (Residential Outdoor Education) (Scotland) Bill

Following evidence from the Member in charge, the Committee wrote to the lead Committee noting a general lack of data which impacts the accuracy of the costs provided in the FM. We also noted that the FM does not provide sufficient details on indirect costs such as those arising from a potential need to renegotiate some teachers’ contracts.

Scottish Statutory Instruments

The Committee considered and reported on the following Scottish Statutory Instruments (all laid under the affirmative procedure) during the reporting period—

The Scotland Act 1998 (Specification of Devolved Tax) (Building Safety) Order 2024 [draft]

The Budget (Scotland) Act 2024 Amendment Regulations 2024 [draft]

The Land and Buildings Transaction Tax (Additional Amount: Transactions relating to second homes etc.) (Scotland) Amendment Order 2024

The Scottish Landfill Tax (Standard Rate and Lower Rate) Order 2025 [draft]

The Public Services Reform (Scotland) Act 2010 (Part 2 Further Extension) Order 2025 [draft]

The Budget (Scotland) Act 2024 Amendment Regulations 2025 [draft]

The Land and Buildings Transaction Tax (Group Relief and Sub-sale Development Relief Modifications) (Scotland) Order 2025 [draft]

Inquiries

National Performance Framework: Inquiry into proposed National Outcomes

The FPA Committee was lead Committee for the Scottish Parliament’s scrutiny of the proposed National Outcomes, which included co-ordinating other committees’ consideration of those outcomes within their remits. The National Outcomes set out the aims of the National Performance Framework (NPF). The Scottish Government describes the NPF as “Scotland’s wellbeing framework and sets the vision for the kind of Scotland we all want to live in”.

The Committee heard evidence from a range of stakeholders which confirmed that the NPF provides an important strategic direction for Scotland. We found that, for the NPF to be used as a strategic tool it needs to be implemented effectively. Although the Committee is supportive of the fact that the Scottish Government proposes a renewed focus on implementation, it recommends that the implementation plan links more clearly spending decisions with the NPF.

The Committee made a range of recommendations to the Scottish Government in the inquiry report to which the Deputy First Minister has responded. In particular, following the Committee’s recommendations, the Scottish Government has agreed to:

Consider how governmental policies (national and local), strategies and legislation deliver on the NPF.

Consider the interlinkages and co-dependencies between the National Outcomes more fully, especially when deciding trade-offs when using National Outcomes to decide on policy and spending decisions.

Work with stakeholders to agree with them acceptable proxy measures which address current data gaps.

The Deputy First Minister advised that the evidence gathered during the review had led the Scottish Government to announce a fundamental review of the National Performance Framework. This is expected to report before the end of the Parliamentary session.

Scotland's Commissioner Landscape: A Strategic Approach

The Committee ran an inquiry into Scotland’s Commissioner Landscape to understand better if the status quo is appropriate and to establish if any changes need to be made. The Commissioners in scope have a range of functions such as investigatory and advocacy roles.

The Committee concluded, based on the comprehensive evidence it received, that there should be a moratorium on creating new Commissioners or expanding the remit of existing bodies until a ‘root and branch’ review of the structure is carried out by a dedicated committee of the Parliament. It recommended that this review should put in place a clear strategic framework to underpin and provide more coherence and structure to the landscape, create more effective accountability and scrutiny mechanisms, strengthen and formalise the criteria for creating new SPCB supported bodies, and identify and address any barriers to sharing services.

The Parliament agreed to the Committee’s recommendations following a debate in October 2024 and the SPCB Supported Bodies Landscape Review Committee was created in December. It is due to report its findings by end of June 2025, as requested by Parliament.

Annual scrutiny sessions

The Committee held two evidence sessions with two bodies that sit within the Committee’s remit and are directly accountable to Parliament – Revenue Scotland and the SFC – on how they are fulfilling their functions. The Committee scrutinised the information in their annual reports and accounts and other corporate information. In addition, the session with the SFC covered the findings and recommendations of the OECD arising from its second review of the SFC.

Given the Committee’s remit on public administration, the Committee hears regularly from the Permanent Secretary to the Scottish Government. This year, the Committee scrutinised information in the Scottish Government’s consolidated accounts for the year ended 31 March 2024 and discussed a range of other live issues such as the Scottish Government’s action on fiscal sustainability and his achievements while in post.

Interparliamentary Finance Committee Forum

The Interparliamentary Finance Committee Forum met for the fourth time on 19 March 2025 at the Northern Ireland Assembly. Committee Members attended the meeting together with Members from the Senedd’s Finance Committee and the Northern Ireland Assembly Finance Committee. The Forum was given only a 15 minute online session with the Chief Secretary to the Treasury, and also met with the Northern Ireland Finance Minister and Chair of the Northern Ireland Fiscal Council. The Forum agreed to produce a legacy report for consideration by successor devolved committees.

The Forum issued a joint letter to the Chief Secretary to the Treasury which stated a desire to reset relationships with the UK Government to work more closely together.

Equalities and Engagement

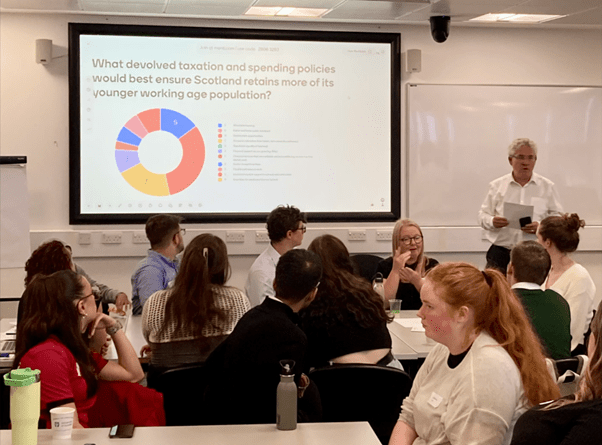

The Committee held an engagement event in Dundee on 28 August 2024 to discuss young people’s priorities for the budget 2025-26, particularly the incentives that have the most significant impact on their decision to live and work in Scotland. The top three priorities identified were (i) employment opportunities, (ii) access to education and (iii) affordable housing.

After finishing full-time education, the young people’s decision to remain in Scotland is mainly based on the existence of appropriate employment opportunities, followed by affordable housing and free tuition. The level of tax or indeed the salary was not seen by some young people as important as having access to high quality employment.

Issues relating to equal opportunities continue to be a key feature of Committee’s work, including our annual budget scrutiny. For example, our Guidance for Committees on the Budget Process includes a section that aims to embed equalities in subject committees’ budget scrutiny, and our witnesses are selected to represent a broad range of society.

We also concluded during pre-budget 2025-26 scrutiny, that the Scottish Government publishing impact assessments several months after it references them in other substantive policy documents is not good practice, nor is it helpful for Parliamentary scrutiny. Our view is that Committees must have the opportunity to fully examine the Scottish Government’s assessment of the potential impacts of its spending decisions on different areas of society. We therefore requested that all impact assessments are published at the same time as the corresponding announcements and publications.

The Committee further requested that the Scottish Government set out clearly how it is targeting spending in its 2025-26 Budget towards achieving each of the First Minister’s four priorities, which include eradicating child poverty. We also asked the Scottish Government to report back to the Committee on how it will apply more widely the learning from the Marmot Place Approach given its reported success in taking action to improve health and reduce health inequalities. This was with a view to addressing some of the causes of economic inactivity in the working age population.

Ongoing work

The Committee looks forward to publishing a report in June 2025 outlining the findings in relation to our current inquiry into the Scottish Budget process in practice. The purpose of this inquiry is to determine whether the Scottish budget process has been effective during the current parliamentary session (2021–26) and to recommend any improvements that can be made ahead of Session 7.

The Committee has also launched an inquiry into the cost-effectiveness of Scottish public inquiries. Given that public inquiries often involve significant sums of money, the Committee aims to assess if the current system delivers good value for money and whether any changes could be made to make the public inquiry framework more efficient. The Committee started taking oral evidence on the inquiry in May 2025 and will continue this work over the following months, with the intention of publishing a report by the end of the year.