Finance and Public Administration Committee

Report on Pre-Budget Scrutiny 2025-26 - Managing Scotland's Public Finances: A Strategic Approach

Introduction

The Finance and Public Administration Committee’s pre-budget 2025-26 report sets out recommendations aimed at putting Scotland’s public finances on a more sustainable footing, through a strategic financial planning approach. Our report could not be more opportune. In recent weeks, the Scottish Fiscal Commission confirmed that the Scottish Government “will face persistent challenges in balancing its budget”1, while the Scottish Government announced nearly £500 million of savings and plans to use up to £460 million of ScotWind revenue “in the face of enormous and growing pressure on the public finances”2. The position is no less challenging in the medium- to longer-term. Our work on the sustainability of Scotland’s finances and on the Scottish Government’s public service reform programme therefore provide an important longer-term perspective to our pre-budget work.

It is against this background that the Committee concentrated our pre-budget 2025-26 scrutiny on Managing Scotland’s Public Finances: A Strategic Approach3, focusing on the following three areas—

the Scottish Government’s approach to taxation,

how the Scottish Government is using its capital expenditure to achieve innovation, productivity, and growth, and

progress with the Scottish Government’s public service reform programme.

The Committee’s call for views ran from 10 June until 12 August 2024. SPICe has produced a summary4 of the 44 submissions5 received. Oral evidence sessions with a range of witnesses were held on 10 September 6, 17 September7 and 1 October8, and concluded with evidence-taking from the Cabinet Secretary for Finance and Local Government, Shona Robison MSP, on 8 October 20249. The findings set out in this report are therefore based on evidence we received in advance of the UK Government’s Budget announcements on 30 October, although we have referred to some of their potential impacts on the Scottish Budget where it has been possible to do so.

The report also draws on the views of a group of young people as well as business and public sector organisations on what devolved taxation and spending policies would best ensure Scotland retains more of its younger working age population. In addition, we held fact-finding visits to the School of Life Sciences at the University of Dundee to discuss opportunities to achieve innovation, productivity, and growth, and to Estonia to learn from that country’s experience of public service reform, and in particular its digital transformation programme. Our Committee inquiry web pages3 include summary notes of the engagement event and visit to Dundee, along with a detailed report of our fact-finding visit to Estonia, which provides more context to those recommendations in this report arising from our visit. Learning from successful approaches is crucial as we navigate our way through difficult financial times, and we therefore urge the Scottish Government to take a similar outward-looking approach.

The Committee thanks our budget adviser, Professor Mairi Spowage, Director of the Fraser of Allander Institute, and the Financial Scrutiny Unit in SPICe, for their support with this work. We also thank those who took the time to provide evidence, which has helped shape our findings and recommendations.

Context for pre-budget 2025-26 scrutiny

The Scottish Government normally publishes a Medium-Term Financial Strategy (MTFS) in May each year, alongside Economic and Fiscal Forecasts produced by the Scottish Fiscal Commission (SFC). This year, the MTFS was delayed, due to a change in First Minister and thereafter a UK general election being called. The Cabinet Secretary has since confirmed that the next MTFS and SFC Forecasts will be published after the outcomes of the UK Government Spending Review are known.1 The UK Autumn Budget 2024, published on 30 October 2024, confirmed that this Spending Review will conclude in late Spring 2025.2

To help inform pre-budget 2025-26 scrutiny, the SFC instead published a fiscal update – August 20243 setting out economic and fiscal developments since its last Forecasts in December 2023, and the implications of Scottish and UK Government announcements on the funding available for the 2024-25 and 2025-26 Scottish Budgets. We explored key points from the fiscal update during an evidence session with the SFC on 3 September 2024, including—

Scottish Government decisions “have played a role in … budget pressures”. The SFC states that “as well as previous public sector pay deals in Scotland being higher than in the rest of the UK, other policy commitments made by the Scottish Government such as the council tax freeze in 2024-25 and the ongoing effect of its social security reforms have contributed to the growing pressure on the Scottish Budget”.

Consumer Price Index (CPI) inflation fell back to the 2% target in 2024 Q2, “around a year earlier than we expected in December 2023”. According to the Office for National Statistics (ONS), CPI inflation has since reduced further to 1.7% (in September 2024).4

Scotland’s earnings growth in the first part of 2024-25 has slowed and is now similar to the UK average, following a period “where tighter labour market conditions in Scotland” had increased Scottish earnings relative to the UK.

Real disposable income per person increased in 2023-24, following a record fall in 2022-23. However, “the outlook in the near term remains challenging as the downward pressure from higher prices and the recent period of higher interest rates may continue for some time”.

Annual productivity growth in Scotland averaged 0.6% from 2011 to 2023 compared to 1.7% from 1999 to 2010. In December 2023, the SFC forecast annual productivity growth of 1.1% by 2028-29, broadly in line with the OBR’s forecast for the UK, with the underlying assumption that productivity growth in Scotland and the UK “will remain subdued and will not return to the pre-global financial crisis average”.

An ‘economic performance gap’ whereby funding in the Scottish Budget in 2022-23 was around £624 million lower than it would have been had Scottish economic performance matched the rest of the UK. The SFC highlighted “in addition, the latest data suggests Scottish earnings growth is slowing relative to the UK, meaning the period of catch-up in Scottish income tax revenues may be coming to an end in 2024-25”.

Following an audit of public spending, the Chancellor of the Exchequer on 29 July 2024 announced a series of savings aimed at alleviating a forecast overspend of £21 billion above the resource departmental expenditure limit totals set by HM Treasury in the UK Spring Budget 2024.5 The UK Autumn Budget 2024 “confirms that the [UK] Government is progressing the savings commitments announced as part of [this] audit of public spending in July” and further sets a 2% productivity, efficiencies and savings target for government departments. It also formally launched the Office for Value for Money “to realise benefits from every pound of public spending”.2

The Cabinet Secretary wrote to the Committee on 27 August 2024 stating that “… additional measures are now necessary following the UK Treasury’s recent audit of public spending and lack of clarity over whether their decision to deliver Pay Review Body recommendations will be fully funded”.1 She confirmed that the Scottish Government has “introduced a set of spending controls with the intention of further reducing spend in 2024-25” and that “we had no choice but to replicate the UK Government’s decision to restrict eligibility for the Winter Fuel Payment to older people”. In making this announcement on 14 August 2024, the Cabinet Secretary for Social Justice, Shirley-Anne Sommerville explained that "this is a necessary decision when faced with such a deep cut to our funding and in the most challenging financial circumstances since devolution”.8

The Cabinet Secretary wrote again9 to the Committee following her pre-budget fiscal statement in Parliament on 3 September,10 setting out further reductions and reprioritisation of spending which, alongside implementation of emergency spending controls, would help “to balance the 2024-25 Budget”. These measures, she explained, are necessary to fund public sector pay, demand-led activities, and a significant health and social care backlog. The letter also confirms that “… up to £500 million savings measures have been taken” across portfolio areas, including reintroduction of peak train fares, not progressing with its scheme to provide concessionary fares for asylum seekers, and restrictions on recruitment, overtime, travel, and marketing across the Scottish Government. Plans to utilise up to £460 million of ScotWind revenue funding are also included in the letter. The Scottish Parliament’s Information Centre (SPICe), in its blog, Filling in fiscal cracks ... again, notes that “this is the third year in a row that the Scottish Government has made in-year changes to the Budget passed by Parliament just a few months previously”.11

The Cabinet Secretary’s letter further indicated that, “as required by law, I can assure the Committee that the impact of these measures has been appropriately assessed, including in formal impact assessments where required”.9 However, these impact assessments were not published on the Scottish Government’s website until 3 October 2024 and their publication was not communicated to this Committee. This left Parliamentary committees with little or no time to scrutinise them as part of the pre-budget process. The Committee notes that a similar issue occurred with the Business and Regulatory Impact Assessment for the Housing (Scotland) Bill, which the Scottish Government referenced in correspondence months before it was then published, after both this Committee and the lead Committee had concluded their evidence-taking on the financial memorandum and Bill at Stage 1.

During a parliamentary debate on fiscal sustainability which took place on 29 October 2024, the Cabinet Secretary announced the creation of a five-year Fiscal Sustainable Delivery Plan, to be published alongside the next MTFS. She noted that the Delivery Plan “… will provide clarity and transparency on progress on delivery against the objectives that are set out in the MTFS”.13

In its 2017 report the Budget Process Review Group (BPRG) recommended the introduction of an annual MTFS to the budget process, the purpose of which would be “to provide a means of focussing on the longer-term sustainability of Scotland’s public finances”.14 Given this recommendation and the Committee’s continued request that the Scottish Government take a longer-term approach to financial planning, we are disappointed at the Scottish Government’s decision not to publish an MTFS during 2024. The absence of an MTFS this year has undermined our ability to consider how the priorities for the next Budget sit within this longer-term context. The Committee therefore seeks assurances that this situation will not be repeated in future years.

While welcome, the Scottish Government’s fiscal statement focuses primarily on immediate pressures with little medium or longer-term outlook. Nevertheless, it will provide helpful context for our scrutiny of how the Scottish Government is addressing the immediate pressures in the 2024-25 Budget when we examine the Autumn Budget Revision in November.

As requested in our letter of 3 September 2024, the Committee expects the Scottish Government to provide medium-term projections (tables of figures usually included in the MTFS) alongside the 2025-26 Budget where possible, as well as the latest projected 2024-25 spend, to aid scrutiny and transparency.15

In the absence of an MTFS and full Economic and Fiscal Forecasts, the SFC’s fiscal update was valuable in providing the necessary economic and fiscal context for the Committee to undertake effective pre-budget 2025-26 scrutiny. We ask the SFC to consider publishing a similar document in August/September each year to provide an up-to-date Government funding position and commentary on significant in-year spending changes.

The Committee considers that the Scottish Government publishing impact assessments several months after it references them in other substantive policy documents is not good practice, nor is it helpful for Parliamentary scrutiny. Committees must have the opportunity to fully examine the Scottish Government’s assessment of the potential impacts of its spending decisions on different areas of society. We therefore request that all impact assessments are published at the same time as the corresponding announcements and publications.

Economic and fiscal context

As our Budget Adviser explained, economic performance during 2024 has been more sustained than during 2023, particularly in the first half of the year. This relatively positive story of growth has led many forecasters to revise up the prospects for UK economic growth in 2024. She also highlighted, however, there are some indications that since the UK general election business and consumer confidence has faltered, with some evidence that this is being impacted by the messages of gloom that have been emanating from the UK Government. This was arguably compounded by a lengthy wait for the UK Budget.

On 30 October 2024, the new Chancellor of the Exchequer’s first Budget to Parliament set out a significant change in fiscal stance. The tax changes presented in the Budget amount to a £40 billion tax rise next year, averaging around £35 billion a year over the full period of the forecast (to 2029-30). Spending in the UK Budget is up considerably too, averaging roughly a £70 billion a year increase over the forecast period. These revenues include compensation for employer national insurance contributions in the public sector. Together this means that borrowing is up significantly too over the period, averaging around £32 billion per annum over the forecast period.

The Chancellor also changed the definition of debt in her fiscal rules, to allow space for this extra borrowing. The Office for Budget Responsibility (OBR) explains that the UK Government intends “to target Public Sector Net Financial Liabilities (PSNFL) as the main balance sheet aggregate in its fiscal rules”.1 PSNFL is a wider measure of debt which includes financial assets and liabilities (such as the Student Loan Book and funded public sector pension schemes), meaning interest rates may take longer to fall. This extra headroom has been used extensively in this Budget, leaving the Chancellor with very little headroom to borrow more if required in the years to come.

The biggest single tax rise was the change to employer national insurance contributions, which raises around £26 billion next year. The OBR “assume that firms pass on most but not all of their higher tax costs to employees”. Our adviser also noted the debate around whether changing employer contributions would increase taxes on working people and if these costs will ultimately be borne mostly by workers. This could be in the form of lower wages than otherwise would have been the case, perhaps fewer hours, and ultimately from a macro point of view fewer people employed.

The OBR in its analysis estimated that around three-quarters of the impact will be passed on to employees, disproportionately affecting the lower paid. Around a quarter of the impact will be borne by employers in the form of lower profits, and ultimately lower business investment. Both of these, according to the OBR, will put downward pressure on economic growth. We seek clarification regarding the impact on the third sector and independent care sector.

On the other side of the equation, increased public spending and investment is boosting growth in 2025 and 2026, but that growth tails off in the later part of the forecast as spending growth slows. Overall, economic growth is 1.5% in the later part of the forecast. This is lower than previously forecast.

The package of tax-raising measures also saw increases in Capital Gains and Inheritance Tax. Inheritance Tax is now to be charged (albeit at 20% rather than 40%) on agricultural land of a value over £1 million. This is likely to bring significant numbers of farms into the tax, and some consider that it may mean some family farms cannot be passed down in families. As our adviser noted there had been some concern in HM Treasury that the previous Inheritance Tax rules relating to agricultural land had been exploited by wealthy people buying agricultural land to reduce their tax liability.

For the Scottish Budget, the UK Budget has provided a significant uplift in funding, given large spending announcements by the Chancellor in areas that are devolved. Extra funding arising from this Budget is £1.5bn this year (2024-25), rising to £3.4bn for 2025-26, including £600m of capital.

HM Treasury will also provide compensation for the higher staff costs associated with the changes to national insurance contributions for public sector employers. It is understood that this will be additional to the £3.4bn announced by the Chancellor in the UK Budget. The exact amount of compensation that the Scottish Government will receive is unclear and the Committee therefore seeks clarification from the Scottish Government on this as soon as possible.

A positive move for parliamentary scrutiny and devolved governments is the UK Government’s commitment to holding an Autumn Budget in every year. This, coupled with regular multiyear spending reviews, is welcome to provide more certainty and stability.

A Strategic Approach?

Scottish Government priorities

On 22 May 2024, the First Minister, John Swinney MSP, outlined “the four priorities that will guide my Government’s decisions on policy and budget …”, as follows—

eradicating child poverty, which he described as “the single most important objective of my Government and my Cabinet”,

growing the economy,

tackling the climate emergency, and

delivering better public services.1

The Committee sought to establish the extent to which these are the right priorities for Scotland. The evidence we gathered suggests there is broad support for all four priorities, however, there were contrasting views on how the priority of ‘growing the economy’ should be framed. The Federation of Small Businesses (FSB), Scottish Retail Consortium (SRC), Royal Society of Edinburgh (RSE) and Universities Scotland were among those witnesses who agreed with the priority of ‘growing the economy’.2 Indeed, the FSB told the Committee that this priority would underpin the achievement of every other priority, including the most important objective of the Government - eradicating child poverty.3

Other witnesses however disagreed with this position, including Oxfam Scotland, who argued that “a catch-all pursuit of economic growth is not a legitimate goal and even risks undermining the First Minister’s wider priorities”.4 A similar point was made by the Health and Social Care Alliance (the ALLIANCE), who recommended that “the Scottish Government explicitly re-commit to the wellbeing economy, and to economic growth that does not negatively impact on the climate, wellbeing, or human rights”.5There was also disappointment amongst some witnesses that the Scottish Government’s Wellbeing and Sustainable Development Bill has not yet materialised.6 The Deputy First Minister later confirmed that the Scottish Government would no longer be bringing forward that Bill but would instead work closely with Sarah Boyack MSP on her planned Members’ Bill, which is expected to have similar policy intentions.7

Commenting on the four Government priorities, some witnesses suggested they are “nebulous and could be interpreted differently"8, and “provide limited guidance for actual budget decisions”9. According to the RSE, the Scottish Government should move away from “vague commitments”, and provide clarity on how it will “address the key priorities and demonstrate what policy options are available10. We also heard from the Fraser of Allander Institute (FAI) that “ultimately, the most important thing to come from the 2025-26 Scottish Budget will be to what extent the measures that are implemented will reflect these priorities”, given that last year’s budgetary decisions “did not necessarily chime with [the Government’s then] priorities”.11 As set out in our report on the Scottish Budget for 2024-25, the Committee was also not convinced that the Government’s spending prioritisation exercise had been carried out in “a strategic, coherent and co-ordinated way”, and suggested that, in fact, some spending decisions appeared to conflict with the Government’s priorities.12

This year, we also received suggestions for how the Scottish Government could best support delivery of its priorities, including from Audit Scotland, who said the annual budget would benefit from an approach similar to the mandate lettersi issued to Cabinet Secretaries in September 2023, “showing how the Scottish Government’s priorities are met by overall portfolio spending”.13 Professor Heald argued that the priorities would more likely be achieved if the Scottish Government was to collaborate effectively with the UK Government and local authorities.9 On this point, the Cabinet Secretary confirmed that “the First Minister and I have taken a constructive approach to engaging with the new UK Government, and I am pleased to have seen a marked improvement since the [general] election”.7 COSLA has also welcomed the positive engagement with the Scottish Government in relation to progressing the fiscal framework for local government and budgetary discussions.16

The Cabinet Secretary told the Committee that the National Performance Framework (NPF) is an important part of the budget process, in enabling Government “to look at our performance on key delivery areas [and make] any adjustments that we need to make”. She went on to say that while the NPF “will have an impact on the prioritisation of spend, “so will the priorities … set out in the Programme for Government” (PfG).7 The NPF has five aims, not all of which mirror the Scottish Government’s four priorities, as well as a series of national outcomes currently being updated through a statutory review.18 We heard from witnesses that the NPF is a “powerful tool”, but accountability is weak and there is little evidence that it drives Government decisions, including on spending.6 Asked why there is no mention of the NPF or national outcomes in the PfG, the Cabinet Secretary said: “I think it was assumed that there was an alignment”.7

The Committee heard that Estonia uses a similar approach to the NPF, however, the country’s progress towards national strategic goals are demonstrated through the 'Tree of Truth'’, an interactive dashboard developed by Statistics Estonia using national statistics. 21This approach is seen to improve transparency through “an intuitive interface in one central location [and] gives everyone the opportunity to monitor the country’s progress through objective metrics”. After independence, “the ballooning number of strategy documents in the ministries had gotten ‘a little out of hand’”, according to Karl-Erik Tender, former Deputy Head of the Ministry’s State Budget Department22. As part of a rationalisation exercise, the number now sits at 17 and these strategies are linked to budgets with clear metrics, including public satisfaction.

The Committee asks that the Scottish Government learns from concerns raised last year that spending decisions were not properly aligned with Government priorities. To this end, we request that, in its response to this report, the Scottish Government sets out clearly how it is targeting spending in its 2025-26 Budget towards achieving each of the First Minister’s four priorities. The response should also be transparent about where it has not been possible to align spending to priorities, and why.

As part of a strategic approach to financial planning, this transparency is essential in informing future spending decisions by building up a picture of where spending is making a difference and where funds may need to be targeted to deliver against key priorities.

The Committee notes the UK Government’s plans to increase day-to-day department spending by an average of 2% per year in real terms between 2023-24 and 2029-30 “to support public services”. The UK Autumn Budget also states that the Scottish Government will receive an additional £3.4 billion in Barnett consequentials for 2025-26. We would therefore welcome details of the basis on which the Scottish Government will decide where to direct the additional funding received.

The Committee has concerns regarding the apparent lack of alignment between the First Minister’s priorities and the National Performance Framework. We further note that national outcomes are often not referred to at all in strategy documents such as the Programme for Government. The Committee looks forward to publishing our detailed recommendations in relation to the proposed national outcomes and their implementation in a separate report in November 2024.

The Committee previously recommended that the Scottish Government should rationalise the number of strategy documents it holds to ensure clarity of goals and better evaluation of impact. We therefore welcome the First Minister’s intention to provide “more concrete actions and fewer strategy documents”23. We seek an update on progress with this exercise, including any reduction in numbers achieved, as at December 2024 compared with the year before, particularly in the light of the Scottish Government’s recent proposal to create an additional strategy document (Fiscal Sustainable Development Plan).

We also ask the Scottish Government to consider adopting a similar approach to that in Estonia where (a) the Government’s small number of strategy documents are linked to budgets with clear metrics, including public satisfaction, and (b) a ‘Tree of Truth’ style accessible dashboard of objective metrics showing how the Government is performing against its key goals, using national statistics.

It is the Committee’s view that the mandate letters issued to Cabinet Secretaries by the previous First Minister provided an opportunity for better accountability of decision-making and delivery of outcomes. We therefore seek confirmation that the mandate letters will be updated to reflect the four new priorities and that the actions of Cabinet Secretaries in terms of delivering these priorities will be measured and publicly reported.

Budgeting approaches

In our report on the Scottish Budget 2024-25, published in January 2024, the Committee noted that “the Scottish Government remains focused on plugging short-term funding gaps at the expense of medium- and longer-term financial planning”. We said we were not convinced by the reasons provided for delays to publishing key documents, such as multi-year spending plans, the public sector pay policy 2024-25, and a reset of the Investment Infrastructure Plan (IiP) pipeline.1The delays in producing such documents, including the MTFS, which provide helpful context to enhance scrutiny and transparency, have continued into this year.

In its fiscal update, the SFC repeated its calls for the Scottish Government to undertake short-, medium-, and long-term financial planning.2 The Committee, again this year, heard strong evidence that the Scottish Government should adopt a longer-term approach to budgeting, including multi-year plans. The Institute of Chartered Accountants Scotland (ICAS), for example, argued that longer-term planning “offers greater flexibility for managing challenges, meeting/balancing future needs, managing capital expenditure requirements, and understanding how well priorities are being delivered”.3 Audit Scotland recommended that “the spending and taxation decisions in the annual budget have a clear read across to the Scottish Government’s medium-term plans”4, while Professor David Bell argued “don’t waste a crisis”, or in other words, the current fiscal constraints provide an opportunity for the Scottish Government to be more strategic with its financial planning.5

We also learned that the Estonian Government has started using zero-based budgeting within three Ministries, which involves justifying and approving budget lines each year rather than basing it on past spending. The Committee was told that this approach helps to ensure efficiency and can better align spending with strategic objectives.6

Asked whether the Scottish Government would consider using a zero-based budgeting approach, the Cabinet Secretary said she is “open minded about any ideas that we can take from international examples in relation to how we construct our budget”, however, “in the here and now, my focus is on 2025-26”. She added that multi-year budgets may provide opportunities “to look at how we do things differently”.7

There is little evidence that the Scottish Government is carrying out sufficient medium- and longer-term financial planning. Year-to-year budgeting has also become more challenging, with emergency in-year savings announced in each of the last three years. We note the Cabinet Secretary’s focus on the “here and now” and her view that multi-year plans arising from the UK Government’s Spending Review in late Spring 2025, may provide an opportunity to “do things differently”.

The Committee welcomes the UK Government’s commitment to “one major fiscal event a year and more regular Spending Reviews", the latter of which the Scottish Government has said provides the certainty it needs to put Scotland’s public finances on a more sustainable footing.

Nevertheless, the Scottish Government cannot stand still, waiting for the next fiscal event to happen before it undertakes longer-term financial planning. We agree with Professor David Bell’s comments that the Scottish Government “should not waste a crisis” as “the current situation is an opportunity to put in place a more coherent and strategic view”. Our recommendations in this report requesting medium-term projections to be provided alongside the Scottish Budget therefore aim to support the Scottish Government to start to plan for the future.

The Committee asks that the Scottish Government’s first Fiscal Sustainable Delivery Plan, which is to accompany the 2025 MTFS, confirms what actions have been taken, and are planned, in response to the SFC’s March 2023 Fiscal Sustainability Report and associated parliamentary debate held in October 2024. This longer-term outlook is crucial if the challenges highlighted by the SFC are to be addressed.

We welcome confirmation that a more collaborative and constructive relationship is being developed between the UK and Scottish Governments, which we hope continues in relation to the timing and nature of future UK Budget and Spending Review announcements. We request confirmation that the Scottish Government will carry out a full Scottish Spending Review (SSR) in 2025 and look forward to examining the outcomes in detail. We ask the Scottish Government to set out the process for engaging the Parliament and its committees, as well as the Scottish Fiscal Commission, in this SSR process.

We also ask the Scottish Government to explore whether a zero-based budgeting approach might be suitable in a Scottish context, learning from the experience of Estonia. One option, for example, would be to pilot the approach in one or two portfolio areas for the Scottish Budget 2026-27 and thereafter evaluate the approach for efficiency and delivery of outcomes.

Sustainability of key spending decisions

Public sector pay

The SFC’s fiscal update noted that the total public sector pay bill for 2023-24 was around £25 billion, over half of Scottish Government resource spending, and that the public sector in Scotland accounts for 22.6% of total Scottish employment compared to 17.6% for the UK overall. The SFC went on to say that “since December 2023 there have been no significant confirmed changes in the Scottish Government’s funding, but the pressure on spending has increased with public sector pay offers in Scotland now coming in higher than the pay policy published in May 2024”. It also notes “significant uncertainty” regarding the level of funding the Scottish Government will receive from the UK Government in relation to public sector pay.1

The Public Sector Pay Policy 2024 sets out the Scottish Government’s assumption of public sector pay growth of 3%.2 The delay in providing this information presented challenges for the SFC in producing its December 2023 Forecasts and did not meet the requirements of the protocol between the SFC and Scottish Government for the provision of specific data within certain deadlines. The SFC explained to the Committee at the time that it had extended its deadline for receipt of this information, but it was still not forthcoming from the Scottish Government. Instead, the SFC assumed average devolved public sector pay growth of 4.5% which, alongside other assumptions it had made, implied a fall in Scotland’s public sector employment from 2023-24 onwards.3 The SFC, in its fiscal update, stated that—

If a Budget is set based on pay assumptions which are lower than those that materialise, this creates challenges with in-year management of the Budget, requiring the Government to reduce its planned spending on services. The recent emergency spending controls the Scottish Government has put in place for 2024-25 are the result of those challenges.1

The Committee heard from the FAI that “not publishing a public sector pay policy at the time … implies a lack of transparency”. It also questioned “whether at the very least, less of the funding total should have been allocated and therefore some more left in reserve to deal with this kind of situation”. This, it argued, “is especially true for a devolved government which has fewer levers to borrow its way out of spending issues – it makes it more, not less important that contingency be built into budgets”.5 Audit Scotland also told the Committee that budget and medium-term plans should be informed by, amongst other things, “expected changes in spending due to pay growth by sector based on pay policies and pay deals”.6

The Cabinet Secretary confirmed that the Government’s 3% assumption was used when putting together the Scottish Budget 2024-25 and that this was based on “what we could afford, … the budget, and the intelligence that we had about available funding”. She explained that if a higher figure had been assumed “that would have become the floor and I would have had to announce a swathe of savings to create that floor”. The UK Government’s decision to accept the Pay Review Bodies recommendations of pay increases of between 4.75% and 6%, had led to greater demand for higher than anticipated settlements in Scotland.7

She went on to say that the devolved governments in the UK have discussed with the Chief Secretary to the Treasury the need to co-ordinate public sector pay across the UK in a way “that does not generate huge pressure for the devolved nations”. She added that she is “mindful of where we go next with pay policy” and whether its purpose is to manage or drive expectations, adding “the UK Government does not set a pay policy, and I do not think that it has any intention of doing so”. She advised that she would, however, “provide enough information for the SFC” to carry out its forecasts.7

Asked whether the Scottish Government would, as suggested by the FAI, set out its assumptions and intentions and present scenario plans for how it will fund higher than expected pay deals, the Cabinet Secretary noted “how complex pay is and how important it is for us to be very careful about how we land pay policy”. However, she went on to say that she would “look carefully at comments from the FAI …”.7

The Committee understands that the Scottish Government’s public sector pay growth assumption of 3% was factored into the Scottish Budget 2024-25 in December 2023 based on affordability. It is therefore disappointing that the Scottish Government’s Pay Policy 2024-25, which contained the same assumption, did not materialise until May 2024. We also note that the Cabinet Secretary now appears to be considering whether an annual Pay Policy is needed at all.

With over half the resource budget now being spent on public sector pay, the Committee strongly urges the Scottish Government to produce a Pay Policy each year, setting out realistic pay growth assumptions. This should wherever possible be published alongside the Scottish Budget to allow scrutiny of how these assumptions might impact on other areas of the Budget, and to inform the SFC’s December Forecasts.

The Scottish Government should also consider the suggestion from the FAI that the annual Pay Policy should include scenario plans for how the Scottish Government would fund higher than expected pay deals. This more strategic and transparent approach to public sector pay could also support the Scottish Government in mitigating last-minute emergency spending controls.

Social security spending

Social security spending is another significant and rising component of the Scottish Budget. The SFC forecasts that devolved social security payments will account for around £7 billion of spending by 2027-28, rising to £13 billion in 2072-73 in real terms.1 In its fiscal update, the SFC states that “our assessment is that the gap between spending on devolved social security and the associated Block Grant Adjustment (BGA) funding is the result of policy choices made by the Scottish Government”.2 In December 2023, the SFC forecast total spending on devolved social security in 2024-25 to be around £1.1 billion higher than the funding the Scottish Government receives through the social security BGA, with that gap growing to around £1.5 billion in 2028-29.3

Audit Scotland explained, in its written submission, that this is the only area of Scottish Government expenditure that has seen significant growth and is already expected to exceed the relevant BGA. It went on to suggest however that “prioritising eradicating child poverty may have longer-term societal and economic benefits for Scotland, which could lead to reduced pressures on public finances in the longer-term”.4 Some witnesses also told the Committee that investment in social security contributes to economic growth as it leads directly to consumer spending.5

However, others, including the RSE, expressed concern regarding “the rising cost of social security spending and the sustainability of this with the pressure on public finances”.6 Professor Heald also told the Committee that “being ‘progressive’ on social security and other cash benefits at the expense of public services expenditure will have an ‘anti-progressive’ effect because lower income groups have less access to substitute private services if satisfactory public services are not available”.7 We also heard from some local authorities that their hardship funds could no longer meet demand and that it was therefore unclear the extent to which social security payments are helping families avoid reaching crisis point.8

Asked whether the Scottish Government has undertaken any studies of the opportunity cost of spending money on benefits rather than supporting public services, the Cabinet Secretary explained that “in my view, it is not either/or” and that the Government’s plans to meet its statutory child poverty interim targets has “three prongs, support to people directly; services that wrap around, such as childcare; and employability, because work is one of the main ways out of poverty”. Responding to a question on whether the Scottish Government would continue to spend £133.7 million on mitigating UK Government decisions, the Cabinet Secretary said that the Scottish Government “will continue to look at this very much on a case-by-case basis”.9

In our Report on the Scottish Budget 2024-25, the Committee asked the Scottish Government how it will continue to assess the long-term affordability and sustainability of its social security policies and their impact on other areas of spend.10 In its response of 16 February 2024, the Scottish Government said it “will continue to take a responsible and capable approach to Scotland’s finances as new budget pressures emerge”, including “monitoring all areas of expenditure during the year, prioritising spend, and maximising efficiencies”.11

We do not consider this to be an adequate response and therefore repeat our request that the Scottish Government now carries out this full assessment. Outcomes should be included in the 2025 MTFS and used to inform future budget planning.

ScotWind revenues

As part of her fiscal statement on 3 September 2024, the Cabinet Secretary announced that “at present, I am also reluctantly planning on the basis of utilising up to £460 million of additional ScotWind revenue funding”. She went on to say that “as the financial year progresses, and through our emergency spend controls and continued robust forecasting I am seeking to protect as far as possible that ScotWind revenue – just as I was able to do in 2023-24”.1

ScotWind funds were originally intended to support the transition to greener energy. Some witnesses therefore expressed concern that the Scottish Government is using one-off ScotWind funds to plug day-to-day funding gaps in-year and that this approach limits their potential spend on renewables, as originally intended.2 The Cabinet Secretary explained that, while £424 million has been set aside as part of the autumn budget revision, “we are driving down non-essential spending out of an explicit desire to minimise the use of ScotWind money”. She also highlighted that more funds can be expected, including £54 million from the innovation and targeted oil and gas round in 2024-25.3

The Committee recognises the challenges faced by the Scottish Government in meeting immediate financial pressures. However, we do not consider it to be good practice to use non-recurring revenue to fund recurring expenditure. We therefore hope that, with effective strategic financial planning in the future, as recommended in our report, the Scottish Government can avoid this practice in the future.

Bonds

The Scottish Government’s Investor Panel recommended in November 2023 that “… Scotland’s profile could be significantly raised in the international capital markets by using existing devolved powers to issue debt”. This, the Panel argued, “will provide a motivation for regular engagement by investors and an opportunity to market Scotland’s investment story [and] it would also allow the development of relationships with providers of debt, a track record and credit rating”. 1The Scottish Government’s Response to the Panel’s Report stated that—

A process of due diligence on this proposal, involving consultation with banks, credit agencies, financial experts and the Treasury has begun. If fiscal, economic and value for money conditions are satisfied, the aim is to make the bonds available to the market by the end of the current parliamentary session.2

The Cabinet Secretary explained during evidence that “we are continuing to look at bonds”, including carrying out a due diligence process. Asked whether the Scottish Government would proceed with issuing bonds even if they were found to be of less value than regular borrowing, the Cabinet Secretary gave assurances that, “as part of our due diligence, the value for money test is absolutely critical, although we are still at quite an early stage”. She indicated that she would keep the Committee updated on progress.3

The Committee welcomes the Cabinet Secretary’s commitment to provide updates on progress regarding the Scottish Government’s consideration of the Investor Panel’s recommendation on issuing bonds. We ask the Scottish Government to share with the Committee details of the issues it is considering, including risks and benefits, to inform its final decision, for transparency and to aid scrutiny.

While we understand the Investor Panel’s view that bonds could encourage investor confidence, we would caution against pursuing this form of borrowing unless value for money can, through due diligence, be assured.

Approach to taxation

Tax Strategy

Scotland’s Framework for Tax 2021 sets out the principles and strategic objectives that underpin the Scottish Approach to Taxation, as well as the Scottish Government’s approach to decision making, engagement and how it “manages and sequences tax policy and delivery around the fiscal cycle”.1 The Scottish Government intends to publish a ‘final’ Tax Strategy alongside the Scottish Budget 2025-26, rather than in ‘draft’ form as originally planned.

Scottish Government officials explained during evidence that the Strategy would “look in more detail at a number of areas of the tax process, improve evidence and evaluation gathering, improve communications and engagement, and look in the round at the current tax system and the potential for future powers”.2

While arguing that the principles in the Framework for Tax had not always been followed in relation to some tax policies, such as business rates, the Scottish Retail Consortium (SRC) suggested that these principles should be retained in the Tax Strategy and that it should also include an additional principle of ‘competitiveness’. This, the SRC argued, would stimulate greater levels of private sector investment and consumer demand.3 The Cabinet Secretary later advised that including ‘competitiveness’ as a principle is being considered “and it has been raised and discussed with members of the [Tax Advisory] Group”.2

Witnesses also told us that the Tax Strategy should move beyond the ‘theory’ set out in the Framework for Tax 2021 and provide a clear direction on tax policy. For example, Oxfam Scotland argued that the Strategy “should commit to a tax system in Scotland that proactively, strategically, and consistently enables significantly more public spending on people, public services, and green infrastructure …, robustly redistributes income and wealth [using] a mix of fairer taxes, [… and] shapes behaviours in socially and environmentally positive ways”.5

We also heard from Professor Heald that the Tax Strategy should focus on the main revenue-raisers – Scottish income tax, non-domestic rates, and council tax. He went on to say that tax decisions made by the Scottish Parliament “should at the very least not magnify the faults of the UK tax system, instead offsetting them when the UK Government is not willing to address them”.6

However, the FAI warned that “ultimately a Tax Strategy is only part of the answer, and while it can guide one’s actions, it is those actions that shape what actually gets enacted and the direction of travel of the country’s tax system”.7 The Cabinet Secretary appeared to confirm this approach in evidence, noting that the Tax Advisory Group “is looking at where Tax Strategy needs to land to ensure that we maximise awareness, get high levels of compliance and have a system that is fair, understandable and easy to navigate”, adding “we want a system that takes cognisance of how it drives behaviours”.2

Asked whether the Tax Strategy would include current evidence on existing tax structures that work well in delivering better economic outcomes and where challenges have arisen, the Cabinet Secretary said she would “take that away” to reassure herself that this is doable.2

The Committee recommends that the Scottish Government’s upcoming Tax Strategy provides a framework within which tax policies are designed to contribute to the longer-term sustainability of Scotland’s public finances.

We note that the Scottish Government has undertaken some engagement in relation to its Tax Strategy, including through the Tax Advisory Group and discussions with other stakeholders. The Committee is, however, disappointed that the Strategy will not, as originally intended, be published in draft form which would have been a more open and transparent process. It would also have provided the opportunity to attract a wider range of views on specific proposals, and enabled effective scrutiny of those proposals, ultimately leading to a better output.

The Committee therefore asks the Scottish Government to consider how best to reflect the views of our witnesses as set out above, and in written and oral evidence we received, in the final Tax Strategy. This includes issues such as improving data and evaluation of behavioural change, adding a ‘competitiveness’ principle, and how tax policies are performing in relation to economic outcomes.

We look forward to hearing more about the Scottish Government’s plans for the Tax Strategy in a briefing by officials in November. We also intend to examine the final Strategy as part of our scrutiny of the Scottish Budget 2025-26.

Income tax policy

In 2024-25, the Scottish Government’s income tax policy included setting six bands of income tax as shown in the table below.i This included a new ‘Advanced rate’, an additional 1p on the Top rate of tax, and uprating the Starter and Basic rates in line with inflation. The SFC, in its December 2023 Forecasts, said it expected income tax to raise £18,844 million in 2024-25 in Scotland.1[

| Taxable income | Band | Tax rate |

|---|---|---|

| Over £12,571 to £14,876 | Starter rate | 19% |

| Over £14,877 to £26,561 | Scottish basic rate | 20% |

| Over £26,562 to £43,662 | Intermediate rate | 21% |

| Over £43,663 to £75,000 | Higher rate | 42% |

| Over £75,001 to £125,140 | Advanced rate | 45% |

| Above £125,140 | Top rate | 48% |

The then Deputy First Minister, Shona Robison MSP, stated at the time that “Scotland has the most progressive income tax system in the UK” adding that “the new Advanced band builds on that progressive approach, protecting those who earn less and asking those who earn more to contribute more”. She went on to say that “the money raised through income tax allows people in Scotland to benefit from a wide range of services and social security payments not provided elsewhere in the UK, including free prescriptions and free higher education".3 This is often referred to by the Scottish Government as a ‘social contract’ with the people of Scotland.

As we learned during our recent fact-finding visit, Estonia has been recognised by the OECD as the top country in the world for tax competitiveness. Its ‘transparent and simple tax system’ includes a flat 20%ii tax on individual income, no corporate income tax on reinvested and retained profits, a property tax which applies only to the value of land, and a territorial tax system which exempts 100% of international profits earned by domestic corporations from domestic taxation.4 Tax returns are completed online, with forms mostly pre-filled and can take as little as two minutes to complete. The UK Government confirmed as part of the UK Autumn Budget that it “will announce a package of measures to simplify tax administration and improve the customer experience in Spring 2025, with a focus on reducing burdens on small businesses”.5

During evidence, the Committee heard that the Scottish Government should consider what the tax system should look like in 10 years’ time and how devolved taxes fit into a UK-wide system.6 Some witnesses suggested that the UK Government should be asked to take the lead in looking “at the whole system”, including anomalies with marginal tax rates.7 Professor Heald went on to suggest that people paying marginal tax rates of 50% on incomes between £43,664 and £50,271, and 69% on incomes between £100,001 and £125,140, is “ludicrous”7 and undesirable on grounds of both efficiency and equity.9

The Cabinet Secretary told the Committee that “we are cognisant of the issue of marginal tax rates, … because our system is a hybrid one of reserved and devolved taxes, it is a bit clunky, which, without a doubt, causes complexity”. She went on to say that the Scottish Government continues to monitor this issue and that there is also external scrutiny through the SFC’s work and HMRC (on monitoring behavioural issues).10

The Women’s Economic Empowerment Project said it supports progressive taxation but suggested that there is a need to better communicate how taxes are used and the benefit that individuals and society receive from the taxation they pay.11 ICAS agreed that “progressive rates of tax are a good and worthy idea in principle …, however, at a certain point people will compare their tax cost to others in other jurisdictions” and suggested that “people need to see that the tax they are paying is fully accounted for and can be seen to benefit society”.12

The Committee has a long-standing interest in promoting greater understanding of, and gathering better data on, potential behavioural impacts arising from tax policies. This year, Aberdeen and Grampian Chamber of Commerce told us that the additional ‘Advanced’ band and elevated rates for higher earners “make it harder for employers to attract senior talent, exacerbating existing skills shortages”.13 This view was shared by the Scottish Chambers of Commerce, who highlighted its recent research that found taxation had overtaken inflation as the leading external concern for Scottish firms, “confirming that the overall burden is having a significant impact on job and investment decisions across the economy”.14

The FAI’s research published on 17 September 2024 “reveal mixed perceptions among businesses regarding the Scottish Government’s income tax policy”. It highlighted that “28% of businesses reported no impact from the income tax policy, while a similar portion (29%) felt ‘a little’ impact”. “34% of firms indicated that the policy has affected them ‘a fair amount to a lot, with 17% reporting ‘a fair amount’; and 17% choosing ‘a lot’ of impact”.iiiiv There was also some recognition that “higher taxes play a role in funding public services in Scotland, such as healthcare and education”.15

The view of some witnesses was that the potential for behavioural change can sometimes be overblown. This included the ALLIANCE, who highlighted views of the Institute for Public Policy Research (IPPR) “that behavioural changes can sometimes be somewhat exaggerated and that, once such measures are brought in, they are not necessarily felt on the ground to the extent that the modelling suggests that they might be”.6 ICAS also suggested that “it is very difficult to get a figure for the behavioural impact”, adding “sometimes it is almost conjecture, because a lot of the activities that might be involved might not be visible”.6

Some witnesses, such as the ALLIANCE suggested that “we should start with what kind of society we think is acceptable in the light of our human rights obligations and then build taxation and spending around that”.6 Indeed, tax policy did not feature significantly in the Committee’s discussion with young people or business and public sector organisations about what devolved tax and spending policies would make Scotland an attractive place to live and work.19

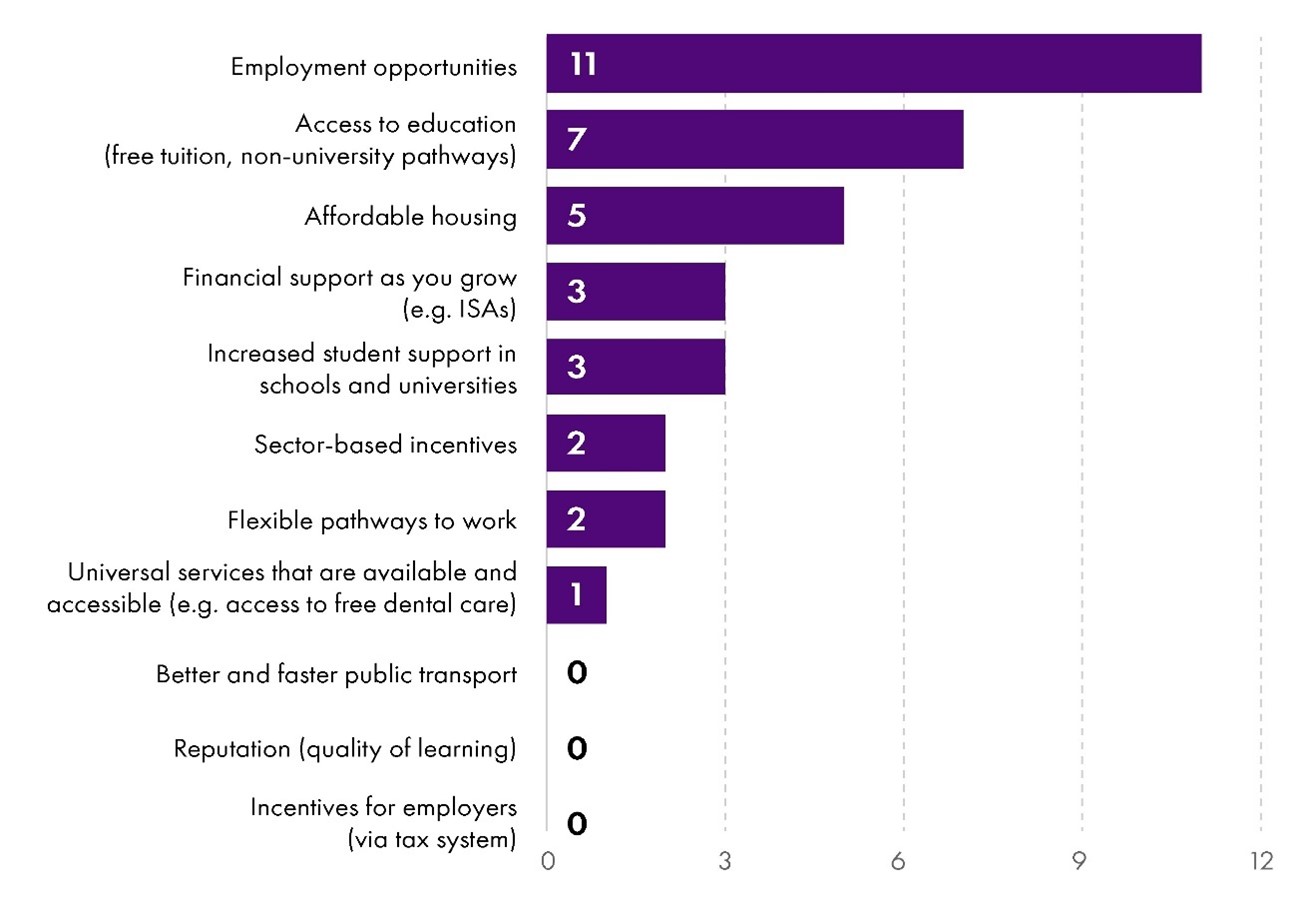

They told us that their three main priorities, in order of importance, are (1) employment opportunities, (2) access to education (free tuition fees as well as non-university career pathways), and (3) affordable housing (see figure 1 below).

The Cabinet Secretary told the Committee that “if you are asking me whether there is evidence of population flight that I should be worried about or of disincentives that are putting people off coming here, I would say that, on balance, people are still coming to live and work in Scotland, and their choice to do so will be for a variety of reasons”. She went on to say, “however, I am not complacent about that, which is why continuing to improve the evidence and evaluation is important”, adding “with HMRC and others, we will continue to ensure that we monitor all that and, importantly respond”. She further confirmed that the Scottish Government had also engaged with the business community on possible behavioural impacts as part of their work on the upcoming Tax Strategy.10

The Committee asks the Scottish Government to consider how it might learn from Estonia’s ‘simple and competitive tax system’, including working with HMRC and Revenue Scotland to make it easier to complete and submit tax returns, which has the potential to improve compliance.

As a matter of urgency, the Committee asks the Scottish Government to work closely with the UK Government to address current anomalies relating to marginal tax rates in Scotland.

The forthcoming Tax Strategy should specify that, when developing future tax policy, the Scottish Government should assess how individual rates and bands in Scotland would interact with the UK-wide tax system, to avoid such significant issues arising in the future.

We note the differing views of witnesses in relation to the potential behavioural impacts arising from tax policy. The Committee believes that this strengthens the argument for more detailed research on the behavioural effects of differential income tax systems in Scotland and the rest of the UK. We therefore ask the Scottish Government to continue to work with HMRC to evaluate tax policy for behavioural impacts as it evolves, and that this data is reviewed by the Tax Advisory Group on an ongoing basis.

Other national taxes

Land and Buildings Transaction Tax (LBTT) and the Scottish Landfill Tax (SLfT) are fully devolved to the Scottish Parliament. The Scottish Government states that LBTT “applies a progressive rates and bands structure”.1 There are currently five bands and rates paid on increasing portions of the residential property price, ranging from 0% on houses of up to £145,000 to 12% for houses above £750,000. Non-residential rates are also paid on an increasing portion of the property price, ranging from 0% for properties up to £150,000 to 5% for properties above £250,000. The SLfT lower rate is set at £3.30 per tonne in 2024-25, and the standard rate at £103.70 per tonne, mirroring the equivalent tax rates in England and Wales. The SFC’s overall forecast for residential and non-residential LBTT revenue for 2024-25 is £730 million, and for SLfT is £58 million in the same period.2

The Scottish Aggregates Tax was recently passed by the Scottish Parliament and will come into effect in April 2026.

The Air Departure Tax was also devolved under the Scotland Act 2016 but is yet to be introduced. The Cabinet Secretary told the Committee that “we will set out the high-level principles of the Air Departure Tax, including—importantly how it will support emissions reductions”, adding “we will do that as soon as possible, and we will review the rates and bands, including the rates on private jet flights, to ensure that they are aligned with our net zero ambitions”. She said work continues with the UK Government “to resolve the subsidy control issue” regarding the tax exemption for flights departing Highlands and Islands airports.3

The Committee notes that, as part of the UK Autumn Budget 2024, air passenger duty rates will be increased in 2026-27 by £2 for economy flights to short haul destinations. Higher rates for private jets will increase by 50% and the UK Government is also consulting on extending the higher rate to include more private jets.4

The Committee requests that the Scottish Government keeps the Committee updated on its progress with introducing an Air Departure Tax, including its discussions with the UK Government.

Sustainability of local government finances

Financial pressures and flexibilities

Significant concerns were raised during evidence in relation to the sustainability of local government finances. The joint submission from COSLA, CIPFA and Directors of Finance (COSLA joint submission) confirmed that local authorities are unable to deliver the same level of services within current funding levels, suggesting that councils will face an estimated cumulative budget gap of £780 million by 2026/27.1 Local authorities are, it argued, taking action to manage the funding gap, which is leading to difficult decisions, including reducing some services. Scottish Borders Council indicated that “systematic underfunding of local government” has resulted in “declining service performance and user satisfaction, with councils unable to invest in preventative non-statutory services due to prioritising statutory services”.2 The COSLA joint submission, therefore, argued that Scottish and local governments should, given the financial constraints, work together to identify commitments that are no longer feasible.1

The COSLA joint submission estimates that only 30% of local government funding is entirely subject to local flexibility, with 70% being directed spend. It argued that “these protections and directions mean that cuts are then disproportionally focused on the limited areas where councils have discretion, often those services that are most critical to early intervention and prevention”.1 Greater flexibility, it suggested, will empower local government to make spending decisions on outcomes, and both reflect the needs of local communities and progress shared priorities”. The councils we heard from said that the policy on maintaining teacher numbers is considered to be particularly restrictive, especially in the context of school roll figures and projections.5

COSLA and local authorities welcomed the creation of new local levies, fees, and charges, although they recognised that the revenues gathered from these measures would only plug existing funding gaps rather than provide additional resources. Pressed on what new proposals it would wish to “put on the table” to raise more revenue, COSLA said that, while it would want to explore council tax reform and other sources of local revenue raising, it did not have a specific set of new proposals to put forward.5 Scottish Borders Council further told the Committee that it does not think it needs any more powers, beyond council tax reform and other issues already being discussed. It went on to say that “at the moment, we have a huge array of legislative power to act on behalf of our communities, but the key issues for us are about flexibility, reducing direction and ring fencing and allowing local priorities to be funded”.5

While the fiscal framework between the Scottish Government and local government is still to be agreed, COSLA was positive about the “open dialogue” and significant progress made.5 The Cabinet Secretary also indicated that, although the fiscal framework is not formally in place, one key aspect is early engagement on the budget, “and that has happened”. Responding to specific concerns regarding the lack of local flexibility in relation to teacher numbers, the Cabinet Secretary said “… what is important is closing the poverty-related attainment gap, and teachers are an important part of that”, adding that the teachers need to be in the right place, given school rolls are falling in some areas and rising in others.9

The former First Minister announced a council tax freeze for 2024-25 in October 2023 “to help those struggling during the cost-of-living crisis”.10 The announcement was made without prior consultation with local authorities and was followed by disputes around whether the policy was fully funded. The FAI has argued that the council tax freeze was not fully funded.11 The SFC noted in its fiscal update that the council tax freeze, amongst other policies, have contributed to the growing pressure on the Scottish Budget.12 We heard from South Lanarkshire Council that “the imposition of a council tax freeze was incongruous with the fact that council tax is (and should be) the tool available to local government to generate local taxes, that help meet the needs of local people”.13 Both Fife Council and Scottish Borders Council suggested that the council tax freeze “contradicts” and “cast doubt on the effectiveness of the [Verity House] Agreement”. Both further argued that greater discretionary tax-raising powers would allow them to reinvest in local services, enhance local democratic accountability and address local priorities, with the Visitor Levy (Scotland) Act 2024 seen as a step forward in allowing local authorities to raise their own revenues.14

Local authorities also collect and administer non-domestic ratesi; however, these rates are set by the Scottish Government. In 2024-25, the Basic Property Rate was frozen at 49.8p and Intermediate and Higher Property Rates increased by inflation. The Scottish Government also introduced a 100% relief capped at £110,000 per ratepayer for hospitality businesses on islands and specified remote areas.

As with last year, small and retail businesses called for small business reliefs in line with the enhanced rates relief in place in England and Wales.ii Aberdeen and Grampian Chamber of Commerce noted that “as things stand, the tax burden on businesses is extremely high; this penalises success, reduces profitability and damages our global competitiveness”. 15We also heard from the Scottish Hospitality Group that the “hospitality industry currently pays business rates based on the turnover of their business, while retailers pay business rates based on the square footage of their premises [, which] in practice often results in businesses of a similar size and in an immediate proximity paying vastly different rates”. The tax system, it therefore argued, should ensure “businesses and sectors operating in the same space are treated equally”.16

The Cabinet Secretary told the Committee that the Scottish Government is progressing “the principles of more flexibility and more financial powers”.9

It is encouraging that both the Cabinet Secretary and COSLA have spoken of their constructive budgetary discussions and that progress is being made towards agreeing the fiscal framework between the Scottish Government and local government. We recommend that the fiscal framework clearly sets out an overall approach to securing the long-term sustainability of local government finances, including local levies and flexibility.

The Committee further seeks an update on when a final version of the fiscal framework is now expected to be agreed, given that this was originally expected to conclude in September 2023.

In the meantime, we ask the Scottish Government to work with local government in identifying where existing commitments and ring-fencing may no longer be needed. This could allow funds to be targeted towards important preventative and early intervention work, which has the potential to deliver better outcomes and save money in the longer-term.

Council Tax reform

Significant concerns were raised regarding lack of progress with council tax reform, a recurrent issue during Committee scrutiny. We heard from Professor David Heald that, “… unless the Parliament can find some way to build cross-party consensus for reforming council tax, the system will become more and more irrational, inequitable and inefficient”. He added “I fully understand that reform is incredibly difficult politically, but it reflects badly on the Parliament that that has not happened”.1 These views were shared by Professor David Bell.1

The Cabinet Secretary told the Committee that the Scottish Government is progressing “the principles of more flexibility and more financial powers”, adding that “fundamental council tax reform is harder and will take longer to do, so it is important to get on with some of the fiscal empowerment with more levers”. She went on to say that “in part, the issue depends on whether we can build a degree of cross-party consensus about the ambition on council tax reform [and] if we could get to that stage by the end of the current parliamentary session, that would stand the next Parliament in better stead to make further progress on reform”.3

On the revaluation of properties, The Cabinet Secretary highlighted evidence that people on lower incomes pay a higher proportion of their income in council tax than those on higher incomes, and that “we want to try to construct a way of doing it that has public buy-in, is gradual—not a cliff edge or a big bang —and is reasonable and fair”.3

The Committee understands the frustration of witnesses at the lack of progress in relation to council tax reform and revaluation of residential properties. We also recognise that making changes to local taxes would inevitably result in ‘winners’ and ‘losers’ amongst homeowners and those in rented accommodation.

Nonetheless, given this work is long overdue, we ask the Scottish Government to set out, following the Cabinet Secretary's suggestion that cross-party consensus will be required, how it will create the space for discussions and consensus-building in this parliamentary session . The Scottish Government should also build into the process any learning from the experience in Wales and other countries regarding reform and revaluation.

Growing the economy

Growing the tax base

Growing the tax base, rather than continuing to increase taxes, was seen by witnesses as crucial to growing the economy. Professor Heald, for example, suggested that “now we have reached the point at which getting more tax revenue by introducing higher tax rates will be very difficult—politically and economically”.1 We also heard from the Women’s Economic Empowerment Project that, in growing the tax base, policies should focus on improving access for disabled working-age adults, noting that half of this group of society (53%) in the UK are in employment, compared with 82% of non-disabled working-age adults.2

Universities Scotland noted that investment in university research and innovation is a “proven avenue of generating opportunities for growth and in scaling-up established initiatives that lever the resources to grow Scotland’s economy”.3 Staff at the University of Dundee’s School of Life Sciences suggested during the Committee’s visit in August 2024, that “we generate £10 of Gross Value Added for every £1 from the Scottish Government”.4

A decline in the number of international students has diminished funding available to cross-subsidise university research, with visa requirements cited as the main reason for this fall in numbers. In evidence to the Committee, Universities Scotland therefore argued that the Scottish Government should “pivot back” towards funding research to support growing the economy.3

Asked about the Scottish Government’s policy priorities for expanding the tax base, the Cabinet Secretary responded that she wants to “make sure that, through our continued success on inward investment, we are able to grow in key sectors, such as green energy …, and the other end of the spectrum is about getting more people into work”. She went on to say that she has been meeting with the Deputy First Minister to ensure that “our economic and tax strategies are all pointing in the same direction”.6 The economic strategy to which the Cabinet Secretary refers is the 10-year National Strategy for Economic Transformation (NSET) launched in 2022.

The Cabinet Secretary also explained that research, development, and innovation is one of the five core themes in the data-driven innovation initiative deal, which receives funding of £60 million and £290 million from the Scottish and UK Governments respectively and noted that innovation hubs and programmes are examples of “investing strategically”. She indicated that the Scottish Government would reflect on what else it can do on research and development, including how the UK Infrastructure Bank and Scottish National Investment Bank can work together on critical investments, and how funding between the Scottish and UK Governments can be aligned for strategic investments. This, she recognised, would help to grow the tax base, and bring in funds to spend on public services.6

The Committee welcomes the Cabinet Secretary’s commitment to consider what more the Scottish Government can do to support research and development, recognising the important role that universities play in attracting investment, supporting Scotland’s world-leading sectors, and building a highly skilled workforce. We look forward to receiving the Cabinet Secretary’s proposals in this area as part of the Scottish Government’s response to our report.

We further welcome confirmation that the Cabinet Secretary and Deputy First Minister are working together to ensure that the Tax Strategy is ‘joined up’ with the National Strategy for Economic Transformation (NSET). We however note the concerns of Audit Scotland that NSET “currently lacks collective political leadership and clear targets” and seek an update on progress with addressing these concerns.

Labour market participation and productivity

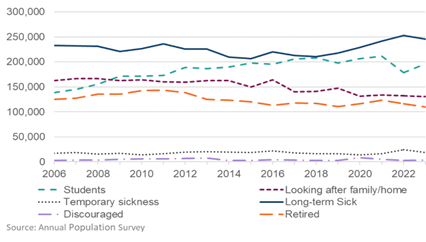

Latest Office for National Statistics (ONS) labour force datai indicates that Scotland’s economic inactivity rate of those aged between 16 and 64 was 23.2% between June and August 2024.1 Research published by the Scottish Government in September 2024 cites long-term sickness as the leading cause of inactivity in Scotland, as shown in figure 2.2 It further highlights that this trend is replicated across the UK and puts it at odds with the majority of other OECD countries.

The Committee heard evidence that good health enables people to work, while good jobs are important to people’s health. We were also told that learning can be taken from the Marmot Place approach, which “recognises that health and health inequalities are mostly shaped by the social determinants of health: the conditions in which people are born, grow, live, work and age, and takes action to improve health and reduce health inequalities”. Access to childcare and improving the fabric of buildings can contribute to improving health and the ability of people to work.3

Witnesses also argued that support should be targeted towards those people who want to move into the workforce, including disabled people, and that the system of universal credit currently disincentivises some women from entering the workforce. Some witnesses further highlighted that economically inactive people are often still contributing to society, for example, as unpaid carers, where care would be a cost to the public purse otherwise.3

During our fact-finding visit, we heard that companies who come to Estonia “tend to stay”, along with the highly skilled workforce, and that the substantial number of micro-businesses in the country is partly attributed to the ease of setting up a business.5

Productivity levels in Scotland in 2023 (measured at output per hour) are estimated to have fallen by 1.1% compared to 2022. Since the financial crisis in 2008, productivity in Scotland has increased by an average of 1% a year, compared to an average annual growth of 0.4% for the UK, and 0.8% per year for the EU.6 The RSE recommended that “any road map to economic growth addresses the key issues that are causing stagnation in productivity” and that “carefully planned public sector investments will be crucial to help to achieve the increase in productivity growth that is critical for the future of our economy and the public finances”.7

The Committee asks the Scottish Government to set out its ambitions for increasing labour market participation and productivity levels in the workforce in Scotland, with a view to growing the tax base. It should also outline the detailed steps it will take to meet these ambitions, including any pilot projects to support specific groups of society.

We further ask the Scottish Government to report back to the Committee on how it will apply more widely the learning from the Marmot Place Approach given its reported success in taking action to improve health and reduce health inequalities. This is with a view to addressing some of the causes of economic inactivity in the working age population.

Capital expenditure

In its December 2023 Forecasts, the SFC states that it expects capital funding to fall by 20% in real terms between 2023-24 and 2028-29.1 During evidence we heard that, at times of financial pressure, Governments across the UK tend to cut capital spend, rather than reduce ‘day-to-day’ spending. However, witnesses also told us that capital spend is essential to grow the economy, increase productivity and attract private investment, and that better medium- and longer-term planning is needed to maximise capital investment. For example, ICAS asked “how stewardship and value for money can be achieved on capital expenditure if decisions are taken on a short-term basis”, adding “this is not a sustainable position and risks creating more costs”.2

The Scottish Property Federation expressed particular concern regarding reductions to capital investment, while also noting that uncertainty around the Scottish Government’s Housing (Scotland) Bill has led to decreased investment in housing developments, which “kick-start the economy”. Concerns were also expressed regarding “sudden large cuts to [… the] housing budget”, which some witnesses saw as being a key area of productivity.3 Local authorities further argued that more capital funding is needed to help address the housing emergencies arising in up to 10 local authority areas.4

The Cabinet Secretary reiterated that housing investment is “a key priority” of the Scottish Government for capital spending and noted that the Chancellor is currently considering the issue of financial transactions, which are traditionally used to fund house building.5

The Committee has repeatedly called for publication of the Scottish Government’s reset of the Infrastructure Investment Plan pipeline as early as possible, following its delay from the original publication date of December 2023. In our Report on the Scottish Budget 2024-25, we asked that it be published by Easter 2024.6 The Cabinet Secretary however argued that setting out the pipeline “without knowing what the capital envelope will be does not strike me as being very sensible”, as it could constrain decisions or drive confidence downwards if there is uncertainty surrounding projects. She went on to say that she would prefer to wait until after the UK Spending Review is announced in Spring 2025, “which is not far off”, and confirmed that not all capital projects were at a halt; some are ongoing.5