Finance and Public Administration Committee

Annual report of the Finance and Public Administration Committee 2022-23

Introduction

This report provides a summary of the key activities undertaken by the Finance and Public Administration Committee during the parliamentary year from 13 May 2022 to 12 May 2023.

This is the Committee’s second annual report since its establishment in June 2021. In addition to examining Scotland’s public finances, the Committee’s remit includes scrutiny of public administration in Scotland, public service reform and the National Performance Framework.

Full details of our work, including copies of Committee papers and reports can be found on the Committee’s webpages.

Membership changes

The following changes to Committee membership occurred during the course of this parliamentary year—

on 25 April 2023, Michael Marra replaced Daniel Johnson. Michael Marra was subsequently elected as Deputy Convener of the Committee on 2 May 2023.

Meetings

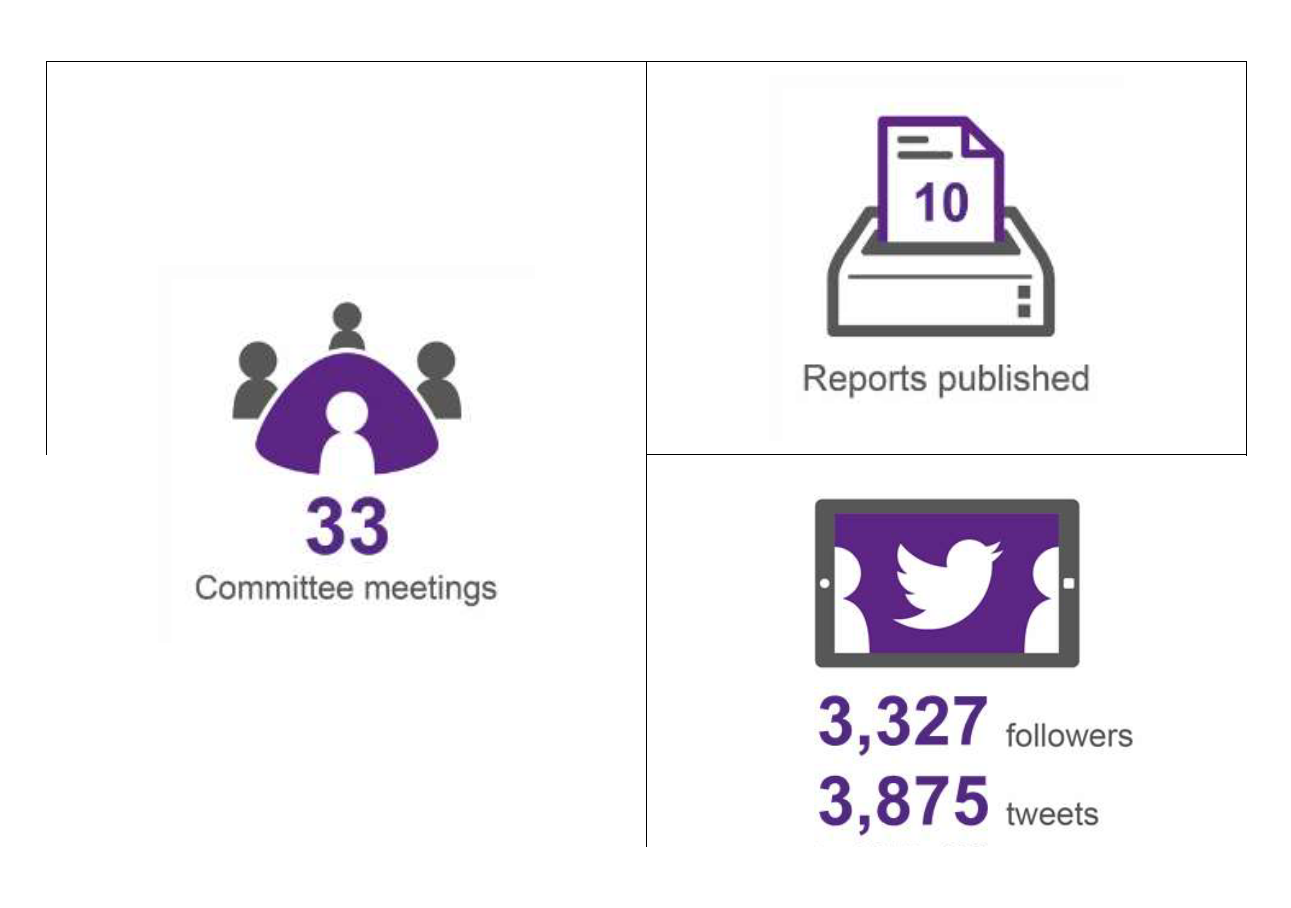

During the reporting period, the Committee met 33 times. The Committee predominantly met in person in the Parliament but, on occasion, met in a hybrid format, with some participants attending online using video conference technology. Of the Committee’s 33 meetings, 6 meetings were held entirely in public, 6 meetings were held entirely in private and 21 meetings included private items. Committee business tends to be taken in private when draft reports and work programmes are being considered.

Legislation and budget scrutiny

Pre-budget scrutiny

The Committee’s pre-budget scrutiny and scrutiny of the Scottish Budget 2023-24 were informed by advice from Professor Mairi Spowage, Director of the Fraser of Allander Institute, who was appointed as Committee Adviser on 31 August 2021.

The Committee’s pre-budget scrutiny focused on Scotland's public finances in 2023-24: the impact of the cost of living crisis and public service reform. To set the context to, and inform, our pre-budget scrutiny, the Committee heard from the Scottish Fiscal Commission (SFC) and from the Cabinet Secretary for Finance and the Economy in early June 2022, following the publication, on 31 May 2022, of—

the SFC’s Scotland's Economic and Fiscal Forecasts – May 2022,

the Scottish Government's first Resource Spending Review (RSR) since 2011,

the Scottish Government's fifth Medium-Term Financial Strategy (MTFS) and

the outcome of a targeted review of the Scottish Government’s 2021-22 to 2025- 26 Capital Spending Plans.

The SFC Forecasts stated that "the Russian invasion of Ukraine, steeply rising energy prices and further global supply chain disruptions in China have led to a challenging economic outlook" and that Scotland and the UK faced the biggest annual fall in living standards since equivalent Scottish and UK records began. The Cabinet Secretary highlighted in her foreword to the MTFS that "rising inflation, and the consecutive increases in the Bank of England interest rate, are also increasing budgetary pressures on the Scottish Government and public bodies, and will put pressure on our public services in real terms".

After taking evidence, the Committee noted in its report that the strain on Scotland's public finances is both substantial and immediate, and preventative measures are key to unlocking future benefits of a healthier and more prosperous society, while also saving significant sums in the longer term. The Committee asked the Scottish Government to set out how it will make progress with its preventative agenda over the remainder of the parliamentary session, given current fiscal pressures, and to confirm how it will work with the public sector to minimise the impact of reform and efficiency savings on the quality of public services and the delivery of national outcomes. The Committee noted that there is a need to foster an open and honest debate with the public about how services and priorities are funded, including the role of taxation in funding wider policy benefits to society, and sought assurances from the Scottish Government that it will work in partnership with local authorities in ‘co-designing’ a joint approach to local delivery of new national priorities and any potential impacts on local frontline services.

The Scottish Government responded to the Committee's report on 20 December 2022, with the Cabinet Secretary stating that—

“the Scottish Government Budget for 2023-24 takes place in the most turbulent economic and financial context that most people can remember. That context is creating enormous pressures on the public finances. Public sector reform is now a necessity.”

Budget scrutiny

The Scottish Budget 2023-24 was published on 15 December 2022, alongside the SFC’s forecasts for the economy, tax revenues and social security spending - Scotland’s Economic and Fiscal Outlook, December 2022. The SFC’s view as of December 2022 was that Scotland had already entered a recession and it expected Scottish households to see the biggest real terms fall in their disposable income since Scottish records began in 1998. The SFC advised that resource funding in the Scottish Budget 2023-24 was set to increase by £1.7 billion in nominal terms, but by just £279 million in real terms compared to the latest funding position for 2022-23. It also stated that the capital budget was flat in nominal terms between the latest position for 2022-23 and 2023-24, reflecting a cut in real terms of £185 million.

The Committee noted, in its report Budget Scrutiny 2023-24, that Scotland’s public finances were under considerable strain, with high inflation, a cost-of-living crisis and demands for improved public sector pay deals. Evidence received, including from the former Deputy First Minister, also pointed to volatility from global factors and the consequences of the UK Government’s September 2022 Fiscal Statement as unprecedented challenges that the Scottish Government was facing. The former Deputy First Minister suggested that the pressures on the 2023-24 budget “cannot be overstated”, with inflation continuing to erode the spending power of government, households and businesses.

A key theme in the Committee’s report was that, while the Scottish Government’s focus on addressing the cost-of-living impacts is understandable given the scale and immediacy of the challenge, there is evidence that longer term planning is not being given the priority it needs to ensure fiscal sustainability. The Committee called for greater progress and clarity in a number of areas, including on the Scottish Government’s public service reform programme and its public pay policy.

The Committee expressed concern that the RSR no longer provides the level of certainty or a clear planning scenario that was intended when it was published in May 2022 and asked the Scottish Government to update the RSR as soon as possible and provide more clarity and certainty about the resource spending position to ensure confidence around the sustainability of Scotland’s finances.

The Committee’s report acknowledged the significant challenges faced by the Scottish Government, however, on the basis of the evidence received, the Committee was not convinced that the Scottish Government is carrying out enough strategic long-term financial planning to ensure future fiscal sustainability, including in relation to how it meets its public service reform and social security commitments—

“It is clear from our scrutiny of the Scottish Budget 2023-24 that the Scottish Government is firefighting on a number of fronts.”

The Scottish Government responded to the Committee's report on 3 February 2023, with the then Deputy First Minister stating that—

“The Scottish Government’s ability to manage short-term and medium-term risks to funding is defined by our current powers within the Fiscal Framework”

and that “[its] approach to public service reform across the public body landscape goes beyond simply achieving efficiencies […] It is designed to ensure that resources are deployed in the most effective and sustainable ways to improve outcomes.”

The Committee considered the Budget Bill at Stage 2 on 7 February 2023 and the Bill was passed by the Parliament at Stage 3 on 21 February 2023.

Scrutiny of Financial Memorandums

The Committee scrutinises Financial Memorandums (FM) that set out the estimated financial implications of legislation. Each Bill that is introduced in the Parliament must be accompanied by an FM. Throughout the course of this year, the Committee issued calls for views on nine FMs in total and referred the responses received to lead committees for further consideration.

The Committee undertook in depth scrutiny of the Financial Memorandum for the National Care Service (Scotland) Bill, highlighting significant concerns in relation to the costings within the FM, which the Committee considered did not provide best estimates of the costs to which the Bill gives rise. The Committee requested that the Scottish Government provide a revised Financial Memorandum at least two weeks prior to the completion of Stage 1, which at the time was scheduled for March 2023. The Stage 1 deadline for the Bill has since been extended and the Committee continues to press for more details of the financial implications to be provided.

The Committee also requested an updated FM ahead of the Stage 1 debate for the Children (Care and Justice) (Scotland) Bill, in light of similar concerns about a lack of financial information contained in the FM. In our letter to the lead Committee, we expressed concerns, given ongoing issues regarding the FM for the National Care Service (Scotland) Bill, should there be an emerging pattern of not placing the best possible full and sufficient costings and information before Parliament for scrutiny ahead of Stage 1 votes.

Secondary legislation

In total, the Committee considered four Scottish Statutory Instruments during its reporting period: two made affirmatives—

The Scottish Landfill Tax (Prescribed Landfill Site Activities) Amendment Order 2022 (SSI 2022/233) – an annual uprating of landfill tax, and

The Land and Buildings Transaction Tax (additional amount: transactions relating to second homes etc.) (Scotland) Amendment Order 2022 (SSI 2022/375)

and two draft affirmatives—

The Budget (Scotland) Act 2022 Amendment Regulations 2023 [draft] – Autumn Budget Revision, and

The Budget (Scotland) Act 2022 Amendment (No. 2) Regulations 2023 [draft] – Spring Budget Revision.

Away from the usual cycle of SSIs considered by the Committee, we also considered the Land and Buildings Transaction Tax (additional amount: transactions relating to second homes etc.) (Scotland) Amendment Order 2022, which was laid before Parliament on 15 December 2022 and came into force on 16 December 2022. The Order amended schedule 2A of the Land and Buildings Transaction Tax (Scotland) Act 2013, providing for an increase in the rate of the Land and Buildings Transaction Tax (LBTT) Additional Dwelling Supplement (ADS) from 4% to 6%, as announced in the Scottish Budget 2023-24. Following publication of the Committee’s report, the Scottish Government published a consultation on proposed legislative changes to the arrangements for the Additional Dwelling Supplement.

Inquiries

National Performance Framework: Ambitions into Action

The Scottish Government introduced a new outcomes-based National Performance Framework (NPF) in 2007 which sets out its ambitions for society and the values that guide its approach. The NPF was refreshed in 2011 and in 2016 with the next review due in 2023.

One of the purposes of the cross-cutting NPF (which ‘underpins’ the Budget) is “to increase the wellbeing of the people of Scotland”.

The Committee conducted an inquiry into the NPF and how National Outcomes shape Scottish Government policy aims and spending decisions and, in turn, how this drives delivery at national and local level.

The Committee’s report concluded that NPF remains an important vision of the type of place Scotland should aspire to be but there needs to be more sustained progress towards achieving that vision. We made a wide range of recommendations, including that the NPF should become a much more explicit delivery framework, starting with “the Scottish Government setting out clearly how it will use it in setting national policy as well as collaborating with COSLA and wider Scottish society on how they can do the same.”

Responding to the Committee’s report, the Scottish Government welcomed the Committee’s report and confirmed that a number of the Committee’s recommendations will be taken forward as part of its review of the National Outcomes. That review has since been launched as required under the Community Empowerment (Scotland) Act 2015.

Inquiry into Public Administration - Effective Scottish Government decision-making

On 6 December 2022, the Committee launched its inquiry into effective Scottish Government decision-making, which seeks to explore the following issues—

Transparency of the current approach

Good practice in decision-making

Roles and structure

Process and scrutiny

Information and analysis

Recording and reviewing decision-making.

The purpose of the inquiry is to better understand the current policy decision-making process used by the Scottish Government and to identify the skills and key principles necessary to support an effective government decision-making process.

The Committee appointed Professor Paul Cairney as an Adviser to provide support to its inquiry, which included producing a research paper on decision-making within the UK and internationally, including by Government.

Alongside formal written and oral evidence, the Committee has also undertaken engagement with former Ministers, former special advisers, former civil servants and current civil servants.

The Committee will report its findings later in 2023.

Inquiry into the Scottish Government’s Public Service Reform programme

In its Resource Spending Review published in May 2022, the Scottish Government stated that—

“challenges, uncertainties and constraints in the economic and fiscal context make it essential to drive reform across public services, policies and programmes, in order that resources are targeted effectively to deliver the best outcomes for Scotland”.

Detailed plans on the Scottish Government’s reform programme were expected to be published with the Scottish Budget 2023-24 but did not materialise. This prompted the Committee to launch its own inquiry to bring greater understanding and transparency around the Scottish Government’s aims for reform and to track progress on delivery.

The Committee issued a call for views and is due to hear from a range of witnesses in May/June 2023. This evidence will then be put to the Deputy First Minister and Cabinet Secretary for Finance as part of pre-budget scrutiny in autumn 2023 and inform our pre-budget 2024-25 report. The Committee intends to return to the issue year-on-year to track progress and, towards the end of the parliamentary session, examine the outcomes from the reform programme.

Scottish Fiscal Commission’s Fiscal Sustainability Report

The SFC published its first Fiscal Sustainability Report on 22 March 2023, following recommendations by the OECD and this Committee’s predecessor, which were supported by this session’s Committee. The report projects the Scottish Government’s spending and funding up to 2072-73, with a particular focus on demographics, trends, and the cost of delivery of public services.

The SFC concludes that, “if public services in Scotland are to continue to be delivered as they are today, Scottish Government spending over the next 50 years will exceed the estimated funding available by an average of 1.7% a year”. The report notes that the sustainability challenges facing Scotland are common across the UK and high-income economies, however, under the fiscal framework, managing the challenge of fiscal sustainability in Scotland is a shared endeavour between the Scottish and UK governments. The SFC explains that, based on the Office for Budget Responsibility’s “suggested paths for reducing the projected UK Government deficit, we have modelled a scenario where the fiscal tightening is applied evenly across all areas of UK Government spending and taxation”. In this scenario, Scotland’s average budget gap over the next 50 years would be significantly higher, at 10.1%.

The Committee anticipates that this important report will inform much of its future work and certainly pre-budget and budget scrutiny. We took evidence from the SFC on its report on 28 March 2023 and have recently written to the Minister for Parliamentary Business seeking a government-led debate on the report.

Fiscal Framework Review

The Fiscal Framework sets out the arrangements required to go alongside the devolution of new tax and welfare powers to the Scottish Parliament in 2016. However, both the UK and the Scottish Governments agreed there should be a review of the block grant adjustment (BGA) mechanisms informed by an independent report, which has now been delayed from December 2021. The Committee stated in its Budget Report 2022-23 that it believes that continued slippage in starting this work, and resulting delays to delivering its outcomes, is detrimental to the effective management of the Scottish Budget.

The Committee issued its response to the consultation to inform the Fiscal Framework Independent Report in September 2022, arguing that there should be—

More detailed information made available on the reasons for changes in the BGAs year to year;

An agreed procedure as to how any changes to BGA methods are communicated to this Committee and the Scottish Parliament;

A clear communication plan alongside the Fiscal Framework, agreed following the review, setting out in plain English to the extent possible what the Framework is, what the changes are and why they have been made.

In their response to our pre-budget scrutiny report, the Scottish Government stated that work is underway between officials to develop a Terms of Reference for the Fiscal Framework Review, “which will be agreed by Ministers in the coming months”. At the time of this report, final agreement on the terms of the independent report, and the wider review by the UK and Scottish Governments, has yet to be confirmed.

Replacing EU structural funds in Scotland

The Committee has a longstanding interest in the replacement of EU Funding in Scotland, building on the work of its predecessor Committee in Session 5. As such, it has undertaken scrutiny of the Levelling Up Fund, UK Shared Prosperity Fund and Community Renewal Fund as they were launched.

During the reporting period, the Committee continued its scrutiny in this area, seeking written evidence from local authorities, the Scottish Local Authorities’ Economic Development Group, the Scottish Council for Voluntary Organisations / TSI Scotland Network, Glasgow City Region and the What Works Centre for Local Economic Growth.

Responding to our invitation, the Secretary of State for Levelling Up, Housing and Communities has agreed to give evidence to the Committee at a suitable date in 2023.

Scottish Government’s Continuous Improvement Programme and updated complaints policy

The Committee is responsible for examining the Scottish Government's response to the report of the Committee on the Scottish Government’s Handling of Harassment Complaints (SGHHC Committee) published in March 2021 and two other related reviews by Laura Dunlop QC and James Hamilton. The report sought improvements within government in relation to its cultures and behaviours, openness and transparency, governance and oversight, records keeping and information management.

The Committee took evidence from the then Deputy First Minister on 22 November 2022 regarding progress in delivering the Scottish Government's Continuous Improvement Programme (CIP), which is part of its response to the three reviews.

Following the evidence session, the former Deputy First Minister wrote to the Committee in December, stating that “the period of reflection on the updates to the procedure has concluded and there are no further changes following engagement with the Committee, staff, expert groups and trade unions”, with the final version of the updated procedure coming into effect in December 2022.

Equalities and human rights

Equalities and human rights have featured throughout the Committee’s work. For example, during our pre-budget scrutiny, the Committee heard compelling evidence that the cost-of-living crisis is having a disproportionate impact on women, and we therefore asked the Scottish Government to consider how it can best support women through these challenging times.

We further asked, in our Budget Scrutiny 2023-24 report, for details of how the Scottish Government is taking forward "integrating intersectional gender analysis to its policy making as part of its wider work on equality and human rights budgeting", and to what timescale. We again sought evidence to support how this approach will lead to robust and transparent processes to evaluate all policies and outcomes for gender impact.

Post-legislative scrutiny

The Committee undertook post-legislative scrutiny of the FM that accompanied the Children and Young People (Scotland) Bill (now the 2014 Act), specifically in relation to the early learning and childcare provisions. This particular Bill was selected on the basis of significant concerns raised by the Session 4 Finance Committee over the financial estimates. At the time, this led to a supplementary FM being published and recommendations that expenditure regarding the policy roll-out be monitored.

The present Committee looked at the accuracy of the original cost figures in the FM and the subsequent cost of implementation, focusing specifically on the costs of the expansion of early learning and childcare, with the aim of helping to inform and improve the Scottish Government’s development of future FMs.

The Committee wrote to the then Deputy First Minister in October 2022, calling for increased clarity and transparency in FMs, which “should clearly set out the nature of any uncertainties and risks, and that costings in such situations should reflect a range, rather than a specific cost.” The Committee recommended that major policies should not be implemented via secondary legislation or business cases which cannot be subject to the same in-depth and formal financial scrutiny as Financial Memorandums to bills and called for outcomes and monitoring information to be considered at an early stage in the development of policy.

Interparliamentary Finance Committee Forum

The second meeting of the Interparliamentary Finance Committee Forum was held in the Senedd on Friday 24 March, with Members from the Senedd’s Finance Committee and the Scottish Parliament’s Finance and Public Administration Committee in attendance.

Members heard from the Welsh Minister for Finance and Local Government, on the intergovernmental mechanisms in place to discuss and resolve fiscal matters affecting the devolved administrations, and from the House of Commons Library on budget scrutiny by the UK Parliament.

The next meeting of the Forum is due to take place during the autumn term, with the exact location and dates to be agreed in due course.

Conference on Frameworks and Forecasts: The Scottish approach to taxation

The Committee held a joint conference with Scotland’s Futures Forum, the Royal Society of Edinburgh and the Celtic Academies Alliance on taxation in Scotland on 21 November 2022.

The conference looked at how the taxation system in Scotland can support Government ambitions both now, and in the future, and covered what makes a good taxation system, as well as the short and the long-term policy options available to Scotland. The session brought together MSPs and a range of participants from the Parliament and Government, academia, and the public and private sectors, to explore the long-term opportunities and challenges related to taxation in Scotland.

Following the conference, the then Deputy First Minister wrote to the Committee on 19 January 2023, acknowledging “the importance of increasing public understanding of taxation and improving engagement and public discourse”, and setting out the Scottish Government’s plans to introduce a future devolved aggregates levy and to review Air Departure Tax rates and bands prior to introduction.