Finance and Public Administration Committee

Pre-Budget Scrutiny 2024-25: The Sustainability of Scotland's Finances

Introduction

The Finance and Public Administration Committee’s Pre-Budget 2024-25 scrutiny takes place at a time of significant financial strain. Indeed, the Scottish Government has itself projected a potential £1 billion resource spending gap in 2024-25, rising to £1.9 billion by 2027-28. Difficult decisions lie ahead in relation to its approach to taxation, prioritisation of spending and the reform of public services.

The longer-term funding position is no less challenging. The Scottish Fiscal Commission (SFC) warns that Scottish Government spending over the next 50 years is projected to exceed the estimated funding available by an average of 1.7% each year, or £1.5 billion in today’s prices, under current Scottish and UK Government fiscal policies. Scotland’s population is projected to continue to grow older, with potential implications for the future demand of public services, as well as Government spending and tax revenues.

Household budgets also continue to be squeezed. The population continues to face stubbornly high inflation and a cost-of-living crisis, with real disposable income per person expected to fall by 4% by the end of 2023-24. This, the SFC notes, would be Scotland’s highest fall in living standards on record.

Against this background, the Committee has focused our Pre-Budget scrutiny this year on the Sustainability of Scotland's Public Finances. Our report also includes the findings and recommendations arising from our recent inquiry into the Scottish Government’s public service reform programme, given the Scottish Government identified this as a clear area of focus to help it ‘balance the books’. We also revisit some ongoing areas of interest such as enhancing fiscal transparency, improving links between spending decisions and National Outcomes, and financing the delivery of net zero targets.

To set the context to, and inform our Pre-Budget Scrutiny for 2024-25, we first heard from the SFC and the Deputy First Minister and Cabinet Secretary for Finance in early June 2023, in relation to Scotland’s Economic and Fiscal Forecasts – May 2023, and the Scottish Government’s sixth Medium-Term Financial Strategy (MTFS). Our call for views ran between June and August 2023, receiving 27 submissions. We then held three evidence sessions with a range of witnesses, before hearing from the Deputy First Minister on 3 October. In August, for the first time, we also held an engagement event with members of the public and representatives from public bodies, local government and the business community, to hear first-hand about their priorities for the Scottish Budget 2024-25 and beyond. The views we heard informed our questioning of witnesses, including the Deputy First Minister, and our recommendations in this report.

The Committee thanks all those who took the time during both inquiries, to contribute their views, which have helped shape our findings. We are also grateful to our adviser, Professor Mairi Spowage, for her invaluable expertise throughout this inquiry.

Fiscal sustainability: context

At the time of our Pre-Budget 2023-24 Report1 in November 2022, we said we were not convinced that the Scottish Government was carrying out enough strategic long-term financial planning to ensure fiscal sustainability. We also sought more evidence on how the Scottish Government is seeking to strike the right balance between responding to the immediate financial pressures and addressing long-term fiscal challenges. In his response,2 the then Deputy First Minister advised that the Scottish Government’s approach to its 2023-24 Budget was addressing both short and long-term needs, and that it would set out its approach to medium and long-term financial planning in its next MTFS, in May 2023.

The SFC’s first Fiscal Sustainability Report3 published in March 2023 projects that Scotland’s population will fall by approximately 400,000 over the next 50 years, driven by a low birth rate. The proportion of the population aged 65 and over is expected to increase from 22% in 2026-27 to 31% by 2072-73, while the size of the working age (16-64) and under-16 population will fall. These changes to the population structure will, the SFC argues, “translate into different levels of demand for public services, with pressure on health services and reduced demand for services used by younger people, such as education”.

It concluded that “if public services in Scotland are to continue to be delivered as they are today, Scottish Government spending over the next 50 years will exceed the estimated funding available by an average of 1.7% a year”, the equivalent of £1.5 billion in today’s prices. The SFC suggested that, to address this gap, the Scottish Government would have to consistently reduce spending or raise devolved taxes through the next 50 years”.

In response4 to the SFC’s report, the Scottish Government said that its work on public service reform is “a key element in ensuring fiscal sustainability and that public services are appropriate to support the needs of Scotland’s changing population”. It also points to the launch of a new Talent Attraction and Migration Service in 2023, and a new Addressing Depopulation Action Plan “with a focus on resilience for local communities” and said it will continue to press the UK Government to put in place immigration reforms to meet Scotland’s needs.

On 25 May 2023, Scotland’s Fiscal Outlook: The Scottish Government’s Sixth MTFS5 was published alongside the SFC’s Scotland’s Economic and Fiscal Forecasts May 20236, which set out the SFC’s five-year forecasts of the Scottish economy, tax receipts and social security expenditure. The position is slightly improved since its December 2022 Forecasts, with economic growth at 0.3% in 2023-24, rising to 1.3% in 2025-26.

The SFC also forecasts that:

Total resource funding will grow by 8% from 2023-24 to £52.6 billion in 2028-29 in real terms.

By 2028-29, the Scottish Government’s capital budget will be 16% smaller in real terms than in 2023-24.

Social security spend is forecast to increase from £5.3 billion in 2023-24 to £7.8 billion in 2028-29 (in cash terms). By 2027-28, the Scottish Government is to spend £1.3 billion more in cash terms on social security than the funding received from the UK Government through Block Grant Adjustments (BGAs).

Devolved taxes are forecast to raise £20.1 billion of revenue in cash terms in 2023-24, £384 million more than forecast in the SFC’s December 2022 Forecasts, with income tax revenues revised upward in line with higher employment growth and higher nominal earnings growth, driven by inflation.

The SFC’s May 2023 Forecasts estimated an indicative negative reconciliation for Scottish income tax in 2021-22 of -£712 million, to be applied to the Scottish Budget 2024-25. The Fiscal Framework Outturn Report7 published by the Scottish Government on 29 September 2023 confirmed a much lower income tax reconciliation of -£389.9 millioni. With other devolved taxation applied, the total provisional reconciliation figure is -£331.8 million and this amount will therefore, once finalised, be deducted from the Scottish Budget 2024-25. Chair of the SFC, Professor Graeme Roy, advised the Committee that, while the figure is lower than the indicative estimate, “the Scottish Government will still need to carefully consider how to handle it”.

In her foreword to the May 2023 MTFS, the Deputy First Minister said that her “number one priority is to ensure the Scottish finances remain on a sustainable trajectory so that we can deliver first class public services for our communities, improve equality by reducing poverty and seize the opportunities of an economy that is fair, green and growing”. The MTFS stated that “tough and decisive action must … be taken to ensure the sustainability of public finances and that future budgets can be balanced” and set out three pillars underpinning the Scottish Government’s strategic approach to managing public finances—

focusing spending decisions on achieving the Scottish Government’s three critical missionsii,

supporting sustainable, inclusive economic growth and the generation of tax revenues, and

maintaining and developing the Scottish Government’s strategic approach to tax.

Alongside the 2024-25 Budget, the Scottish Government is to refresh multi-year spending envelopes for resource and capital and extend the Capital Spending Review and Infrastructure Investment Plan period by one year, taking these plans up to 2026-27. It said it will also explore how it can seize opportunities in areas where Scotland has a competitive advantage, such as the green economy. The MTFS noted that the Scottish Government has created an external tax advisory group “to consider how best to engage with the public and other stakeholders on the future direction of tax policy, including whether a national conversation on tax is required”. The outcomes of its work will feed into the Scottish Budget 2024-25 and development of a longer-term tax strategy to be published alongside the 2024 MTFS.

In its blog on the MTFS – Decisions Pushed Back,9 SPICe commented that the MTFS “contains lots of details as to the scale of the challenges facing the public finances in the coming years, and general approach to setting budget priorities, but specific details of how the Scottish Government intends to take on these challenges were missing”. SPICe also highlighted that there is no additional detail on some high-profile policy areas such as the proposed national care service or how it plans to meet its net zero targets.

The Verity House Agreement (VHA)10 between the Scottish Government and COSLA, published on 30 June 2023, stated that—

The default position will be no ring-fencing or direction of funding, unless there is a clear joint understanding for a rationale for such arrangements … [and] additionally, current funding lines and in-year transfers will be reviewed ahead of the draft 2024-25 Budget Bill, with a view to merging into General Revenue Grant Funding.

The VHA goes on to say that more details will be included in a fiscal framework to be agreed between the Scottish Government and local government by the end of September 2023. This is to include a presumption in favour of local flexibility where national approaches are being progressed, “so far as is possible and effective” as well as streamlined and refined strategic and service level plans and associated reporting. A monitoring and accountability framework will be agreed, “drawing on proportionate reporting and data collection, to provide evidence and visibility over progress towards agreed outcomes”, with independent evaluation of progress invited from Audit Scotland and the Accounts Commission.

The Programme for Government (PfG) 2023-2411 announced on 5 September 2023 is “unapologetically anti-poverty, pro-growth which is both fair and green, and focused on delivering high quality public services”. The Deputy First Minister noted in the PfG that “we continue to face one of the most challenging financial situations since devolution, putting significant pressures on our public finances”, adding that “delivering sound public finances, producing a balanced budget and leading cross-government delivery, including to reform Scotland’s public services, are my top priorities”.

The Scottish Budget 2024-25 is to be published on 19 December 2023, later than usual, largely due to a delay in the UK Government’s Autumn Statement and accompanying Office for Budget Responsibility (OBR) Forecasts, planned for 22 November. In her response,12 the Deputy First Minister acknowledged the Committee’s proposal that we publish our Scottish Budget 2024-25 report at the end of January 2024.

The Committee notes that an earlier publication date is impractical. Nevertheless, enough time must be allocated to enable the Finance and Public Administration Committee to undertake effective parliamentary scrutiny.

Economic and fiscal context

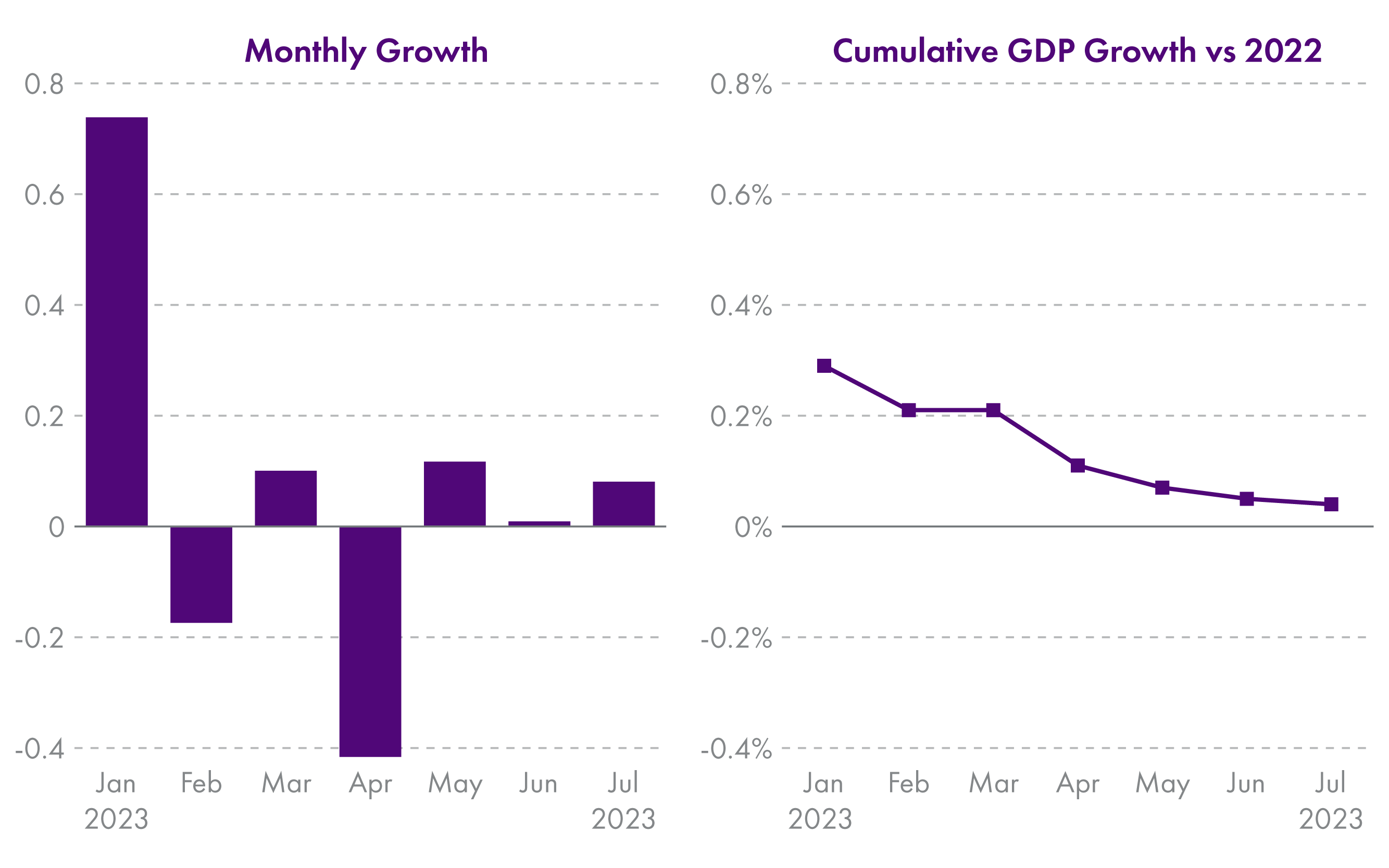

The latest data in the economy reflects a fairly mixed picture. While the UK was not, as expected by many forecasters, in the middle of a recession at the end of 2022, monthly or quarterly GDP growth over 2023 has been both positive and negative, resulting in a position where growth to date (up to July) in 2023 is only 0.04% compared to 2022 levels (see Charts 1a and 1b). The Committee’s Budget Adviser notes that decent growth will be required in the rest of the year to achieve even the “anaemic” growth that is currently forecasted for the Scottish economy by the SFC of 0.2% in 2023.

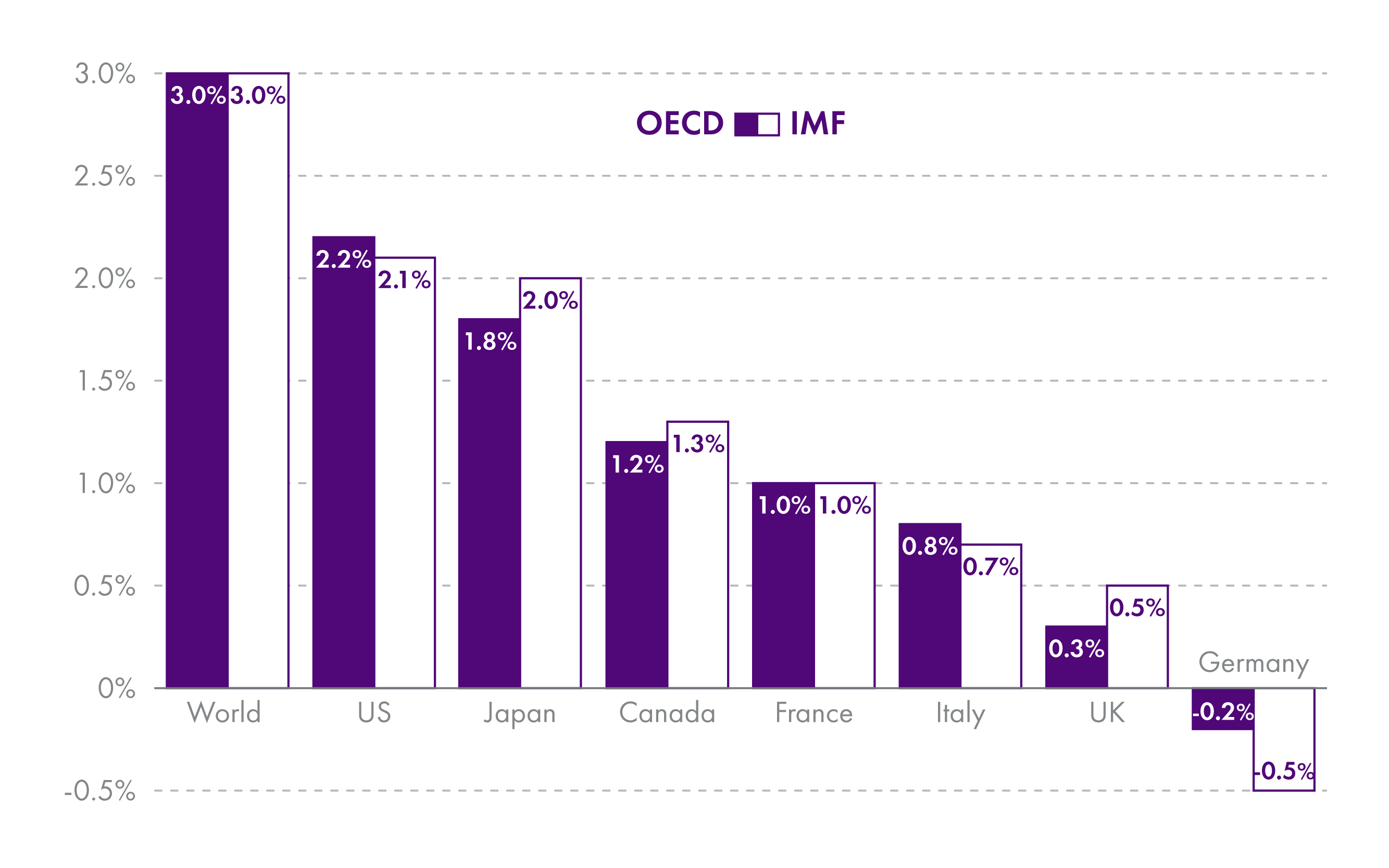

The Office for National Statistics (ONS) has recently revised growth in the UK over 2020 and 2021. Rather than showing that the UK is at the ‘back of the pack’ in terms of recovery since the pandemic as had previously been the case, it showed that the UK had recovered better than Germany and France. So, the UK is now a mid-table performer in the G7 when we consider 2020 and 2021.

However, this does not mean that the outlook for the UK economy has improved markedly. The Organisation for Economic Co-operation and Development (OECD) and the International Monetary Fund (IMF) are forecasting that GDP growth in the UK for 2023 will be 0.3% and 0.5% respectively, ahead only of Germany in the G7. This compares to the expectations for the US of 2.2% and 2.1% (see Chart 2).

The backdrop to this is the stubbornly high inflation rate in the UK. The latest data for inflation shows that the Consumer Prices Index remained at 6.7% in September, unchanged from the rate in August. Under the headline figure, higher fuel prices are being offset by a slowing in energy and food price inflation.

The Bank of England Monetary Policy Committee chose not to continue raising interest rates at its most recent meeting in September 2023 (at the time of writing), voting 5-4 to keep rates at 5.25%. The continued stubbornness of inflation, and the fact that wages rose faster than inflation in the most recent ONS data means that many analysts think that the Bank of England may choose to raise rates further at their next meeting on 3 November.i

Business and consumer sentiment are both showing considerable effects from wider economic uncertainty. Our Budget Adviser notes, in particular, that businesses are signalling that many planned investments are being delayed or cancelled due to uncertainty and higher borrowing costs.

There was speculation in some quarters that the improvement in GDP growth in recent years could increase the scope for the loosening of fiscal policy at the UK Government’s Autumn Statement.

However, the improvements in real GDP growth in 2020 and 2021 do not impact on nominal (cash) GDP, as the ONS revisions were focussed on reflecting changing prices. This, our Budget Adviser notes, is what matters for the Chancellor’s fiscal rule of reducing Debt-to-GDP ratio by the end of the 5-year forecast period (2027-28). Therefore, the ONS revisions do not create any fiscal headroom.

Rather, it is likely that the outlook for UK Government borrowing costs has become considerably worse since March 2023, which our Budget Adviser suggests may well mean the fiscal headroom available to the UK Government is more limited than previously forecasted. This tight fiscal outlook is therefore still likely to feed through into the spending envelope for the Scottish Government budget on 19 December.

The Committee remains concerned regarding the prospects for long-term economic growth in both the UK and Scotland.

National Outcomes

In early 2024, the Scottish Government is due to lay in Parliament proposals for revised National Outcomes as part of its statutory review of the National Outcomes in the National Performance Framework (NPF). Its PfG 2024-25 stated that it is “also committed to continually improving the way the NPF is used, across government and more widely”.1

The Committee has repeatedly recommended that there needs to be a clearer link between spending decisions in the Scottish Budget and their impact on the delivery of National Outcomes, including in our 2022 inquiry report on the NPF: Ambitions into Action.2 In response,3 the Scottish Government told us that “the Committee’s interest in this area is understood and [it] has been considering this question further [, however,] it is challenging to identify in a meaningful way the individual annual impact of multiple budget lines on the delivery of longer-term, complex national outcomes”. Instead, it is “developing an approach centred around multi-year programmes, the associated outcomes and the annual spend profiles attached”.

The Institute for Public Policy Research (IPPR)4 Scotland told the Committee this year that—

We quite often talk about the NPF being our north star. I always torture the metaphor and say, “If I get lost, I can follow the north star, but I still might fall off the edge of a cliff because although I am following it, I do not know where I am going. We are still not very good at determining what things we are changing in of those large-scale National Outcomes. We are not there yet.

We also received evidence that “a number of Scotland’s National Outcomes are showing performance declining” and witnesses advised that financial pressures “will only make this situation worse”.5 Some organisations, such as Public Health Scotland,6 welcomed the Scottish Government’s upcoming statutory review, and others, including the Federation of Small Businesses (FSB), proactively suggesting the adoption of new National Outcomes and National Indicators relating to entrepreneurship and procurement.7

The Committee looks forward to leading the Scottish Parliament’s scrutiny of the proposals for revised National Outcomes. We also welcome the commitment in the Scottish Government’s Programme for Government 2023-24 “to continually improve the way the NPF is used, across government and more widely”.

With this in mind, the Committee asks the Scottish Government to provide an update on progress towards “developing an approach centred around multi-year programmes, the associated outcomes and the annual spend profiles attached”, including an overall timetable for completion of this work.

Financial transparency and accountability

Enhancing the transparency of budgetary and fiscal information has been another area of ongoing interest to the Committee.

In our letter1 to the Deputy First Minister of 21 September 2023, we welcomed the Scottish Government’s efforts to enhance transparency, including its publication of additional explanatory information with annual budget revisions and analysis of budgetary information by Classification of the Functions of Government (COFOG) to enable comparison of data based on OECD standards. We also noted progress made in developing a fiscal transparency portal as part of the Scottish Government’s Open Government Action Plan 2021-2025. Building on this work, our letter proposed specific areas for further development, to which the Deputy First Minister responded2 on 17 October, accepting some of our suggestions and indicating she would give further consideration to others.

Our recent scrutiny of Financial Memorandums (FMs) has highlighted, in some cases, the need for more robust detail on cost estimates and savings. This is of particular concern in the case of ‘framework’ bills, where costings remain subject to design of secondary regulations. During our Pre-Budget 2024-25 inquiry, the Fraser of Allander Institute (FAI) suggested that improvements to the information provided in FMs by the Scottish Government would lead to more transparency and enhanced parliamentary scrutiny.3

During our recent engagement event in Largs,4 greater transparency regarding decision-making was a priority for participants, with some considering that this could help to overcome a perceived lack of accountability, for example, with delayed and over-budget projects. Other issues raised during evidence included the need for more information on how the UK and Scottish taxation systems interacti, greater transparency over the potential consequences (on other policy areas) of decisions to spend more money, than the BGAs, on areas such as social securityii, and making it easier for individuals and organisations to engage with the budget processiii.

In the PfG 2023-24, the First Minister highlighted that “in my first 100 days I introduced a new approach to how we will deliver as a government, agreeing a mandate letteriv between myself and each member of my Cabinet which sets out the outcomes they will achieve in the months ahead”. The First Minister’s mandate letter to the Deputy First Minister5 of 5 September 2023 includes his expectations regarding the outcomes she will deliver in this financial year, and priorities for this parliamentary session, which broadly mirror the activity included in the MTFS and PfG. The First Minister invites six-monthly discussions with all Cabinet Secretaries on progress against the outcomes.

The Government of Canada takes a similar approach. In his mandate letters,6 however, the Prime Minister also states that “to ensure we are accountable for our work, I will be asking you to publicly report to me, and all Canadians, on your progress toward these commitments on a regular basis”.

The Committee welcomes the Deputy First Minister’s commitment to put in place some of our proposals to enhance transparency in budgetary information and to give further consideration to others. We look forward to continued engagement with her on these matters. We also restate our position that the Scottish Government should adopt a similar approach to that of the UK Government and Scottish Fiscal Commission in comparing new plans for spending with estimates or outturns from the previous year.

The Committee seeks further detail on the expected timetable for producing whole of government accounts, which was committed to back in 2018, and which we consider will help to bring greater transparency to annual public spending in its entirety.

The Committee welcomes the introduction of mandate letters setting out the outcomes that Cabinet Secretaries are expected to achieve in the months and years ahead. We believe that this approach could help ensure greater accountability of government decisions and actions, but only if there is transparency around the level of progress being made. The Committee therefore asks the First Minister to ensure that Cabinet Secretaries report regularly to Parliament on progress and we seek clarity on how he will hold Cabinet Secretaries to account if outcomes are not achieved. We further seek details of how the mandate outcomes relate to the National Outcomes in the National Performance Framework.

Fiscal Framework Review

The MTFS, at the time of its publication in May 2023, confirmed that the independent report on Block Grant Adjustments (BGAs) had been submitted to the UK and Scottish Governments ahead of the Fiscal Framework Review. The timing and arrangements for publication were at that time still being considered.

The Committee submitted a response1 in September 2022 to the call for views2 developed by the report authorsi to inform their independent report, which was originally intended to be provided to both governments by the end of 2021 but was not commissioned until June 2022. We had also intended to submit a response to the planned consultation on the review once its remit and terms of reference had been agreed between the two Governments.

The Deputy First Minister wrote to the Committee on 4 August 20233 confirming that she had “now reached agreement with the Chief Secretary to the Treasury on a package of changes to the Scottish Government’s Fiscal Framework”. The Framework and independent report were published at the same time alongside her letter, which explained she judged it appropriate to concede to a narrower scope for the review than originally planned “in the interest of securing long sought practical borrowing and reserve flexibilities, and to protect those arrangements that we already have in place that work in our favour”. The updated Fiscal Framework4 retains on a permanent basis the index per capita mechanism for calculating BGAs and increases borrowing and reserve limits. The Scottish and UK Governments have also agreed to continue their consideration of when and how to implement VAT assignment.

One of the authors of the independent report, Professor David Bell, told the Committee on 19 September 2023 “it came as a surprise to me … that the Framework had been agreed on the day on which our report was published”, adding “we expected much longer discussion”. He however suggested that retaining the index per capita method “is probably as good an outcome as Scotland could have hoped for”, while also noting the “not massively” increased borrowing powers. Professor David Heald agreed that keeping the index per capita method was “crucial, adding he would have liked to have seen more capital and resource borrowing powers. Both witnesses recognised that there would have been ‘trade-offs’ during the negotiations

The Committee is holding a dedicated evidence session with the Deputy First Minister on the updated Fiscal Framework in November, to be informed by evidence from experts, including on VAT assignment. On 3 October, she was however asked to explain the timeline for agreeing the Framework, given the expectation that there would be an opportunity to consider the independent report and submit responses to the review.5

The Deputy First Minister explained that “we agreed to publish [the independent report] on the same day as the outcome of the review because we thought that that would help people to make sense of [why we came] to the conclusions that we had come to”. She said that approach had “constrained things”, but she was unsure there would in any case have been “any great public or media debate” on the report due to its technical nature. She went on to say that a more expansive review, which was favoured by the Scottish Government, “was not on the table, so the process became about increasing our borrowing and reserve capacity and securing the index per capital methodology”. While the Scottish Government had had to give ground on their requests for more borrowing capacity and a longer repayment term, “given the headwinds that we face in the immediate financial term …, the agreements we got were important ones [and] will help, particularly with next year’s budget”.

The Committee is surprised that the Fiscal Framework Review was concluded without the opportunity for the Committee and others to consider the independent report and submit responses to inform the Review. The Committee welcomes the modest but permanent gains in fiscal flexibility achieved through the Review. Nevertheless, the lack of transparency in the process was disappointing, particularly given our calls for a more open approach than that taken with the original Fiscal Framework agreement in 2016.

The Committee looks forward to exploring in greater detail the updated Fiscal Framework with the Deputy First Minister in November, informed by evidence from experts.

Raising revenue and stimulating economic growth

A strategic approach to taxation

The Scottish Government published its Framework for Tax in December 2021,1 which set out the six principlesiand policy objectives that underpin the Scottish Approach to Taxation. As referred to earlier in this report, it has more recently created an external tax advisory group as part of its MTFS, to discuss the tax system as a whole and identify opportunities for broader public engagement. The PfG 2023-24 stated that an updated tax strategy would be published alongside the May 2024 MTFS, “setting out how the Scottish Government intends to continue to deliver a progressive tax system”.

The need for a longer-term, more strategic approach to taxation in Scotland was raised in evidence, with witnesses highlighting the current tax system’s complexity, challenges in its interaction with the UK tax system, and possible exposure to risk due to behavioural change.

The IPPR Scotland highlighted “we quite often just tweak” or freeze income tax rates, “which brings people in by fiscal drag” and suggested “we must start to rethink what the tax system that we need looks like and, more importantly, where those quirks and interactions come through with the reserved system”.2 Professor David Heald agreed that “we do not have a strategic approach to tax” and suggested that, although “constrained by what the UK Government does, […], we have not been agile in trying to make the system work”, pointing to peaks in the marginal rate threshold regarding national insurance and withdrawal of the personal allowance.2 Professor David Bell questioned whether so much emphasis on income tax was appropriate and suggested, for example, that taxing carbon could be considered in light of the Scottish Government’s net zero approach. He restated that the tax system as a whole needs looked at.2

Some witnesses, such as the STUC5 and IPPR Scotland2 favour the introduction of wealth taxes. However, the FAI suggested that such taxes “look very difficult not just in the context of devolution, but in terms of any realistic timeline for implementation”. It explained that “time is required to be spent on designing the tax, consulting on its implementation and preparing the implementation and collection mechanisms”, adding therefore “it is unlikely that a new tax would help the Scottish Government’s financial position in 2024-25”.7 Professor Bell further highlighted the potential for avoidance in relation to wealth tax and argued that in places, other than Switzerland, “it is largely regarded as not being a very significant potential source of revenue”.2

The May 2023 MTFS9 stated that “the Scottish Government’s strategic approach to taxation also applies to local taxes”. It goes on to explain that the Scottish Government has convened a Joint Working Group on Sources of Local Government Funding and Council Tax Reform “to build consensus on an alternative to the present Council Tax”, as part of joint working to develop a fiscal framework for local government. The Scottish Government and COSLA jointly launched a consultation10 in July 2023 seeking views on proposals which would see increased council tax charges for households in bands E, F, G and H come into effect from April 2024-25. This consultation closed on 20 September 2023.

The FAI11 has highlighted that the current valuations that form the tax base for council tax “are so old (1991) that it bears little relation to them, and despite numerous attempts, reform has not yet taken place, and is likely to be difficult because of the large number of potential losers”. As in previous years, the need to reform council tax was highlighted by a number of witnesses during Pre-Budget scrutiny. Professor Heald2 told the Committee “it is ludicrous, given the fact that the issue is fully devolved, that we are still using 1991 house prices as the basis for council tax”, adding that while he is strongly in favour of a residential property tax, “one discredits the principle that it is a useful mechanism for funding local government by using 1991 values”.

The First Minister’s announcement13 on 17 October 2023 of a council tax freeze until April 2025 came as a surprise to local government. COSLA stated in response14 that “this has longer term implications for all councils across the country, at a time when we know there are acute financial pressures, and where we are jointly looking at all local revenue raising options”. It plans to consider the implications with their members “when we get more detail” and “this will also need to be examined against the principles of the recently signed VHA”. The Scottish Government later announced that the Scottish Government will fully fund the freeze “to ensure councils can maintain their services”. The FAI, in a recent blog of 18 October 2023,15 noted that “the freeze in council tax – assuming that councils would have followed the increases from the previous year – will cost £148m”. Asked on 24 October16 to confirm how much the council tax freeze would cost and where that money would come from, the Deputy First Minister told the Parliament that negotiation with COSLA would take place “to ensure that the council tax freeze is fully funded [and] the figure will be part of the 2024-25 Budget process”.

Immediately prior to the VHA being agreed, the Committee heard evidence from COSLA, SOLACE and a number of local authorities. SOLACE told the Committee at the time that “there has been a bit of a reset in relationships [between the Scottish Government and local authorities], which we worked proactively towards and welcome”.17 The Deputy First Minister advised the Committee on 3 October18 that work is continuing to develop a fiscal framework with local government, but that this was unlikely to be concluded in time for the Scottish Budget 2024-25 “because by its definition it is quite difficult and complex”. She went on to say that, under the VHA, “we are also keen to look at whether there are additional revenue-raising opportunities for local government”, adding “there is a lag time with some of that because it takes time to develop those”.

Local authorities have consistently made the case to the Committee of the need for fair and sustainable funding on a multi-year basis. Comhairle nan Eilean Siar stated that “the share of the Scottish Budget that local government attracts has diminished significantly in recent years” and argued “we need a gradual restoration of funding levels, not in excess of what was there before but to mitigate some of the reductions”19. COSLA further told the Committee that “we need to have a very honest discussion with our Scottish Government colleagues about what is and what is not affordable from the envelope of funding that is available”, adding “if there is no more funding available, we need to start talking about what we stop delivering”20. Professor Heald highlighted in relation to multi-year funding, "we have a problem at the UK level, which then transmits down to Scottish Government level, which then transmits down to local government, which then transmits down to voluntary organisations, ..., with one-year funding", adding "if you want to improve efficiency in the way in which public spending works, going back to a multiyear system would make a vast improvement".2

In line with a recommendation from the New Deal for Business Groupiii, the Scottish Government’s tax advisory group is considering “the role of non-domestic rates and other taxes in achieving the right balance between sustainable levels of taxation and creating a competitive environment to do business while also supporting communities”.22 The FSB supports this approach, while the Scottish Retail Consortium (SRC) said “we don’t see an uplift [in non-domestic rates] as sensible given the failing real terms value of retail sales and the ongoing raft of cost pressures” faced by retailers.23

The Deputy First Minister indicated that “the tax decisions that we have to make are seen through [a] pretty short-term lens” and so “there is a need for us to take a step back, look across the range of taxes in Scotland—not just income tax—and ask what that medium to longer-term view looks like”.18 The tax advisory group’s work is to feed into both the Scottish Budget 2024-25 and the tax strategy over the longer-term.

Dr Andrew Scott, Director of Tax and Revenues at the Scottish Government, said he expected that “any strategy that the Government produces will talk about the burden of taxation, its distribution, the interaction between taxes, the performance of various taxes, the effects of population on the tax base, the effects of an ageing population on the tax base, prospects for economic growth, international evidence, the ability to tax wealth in a more general sense … and, finally, taxes that can bring about some kind of behavioural change”. He added that “possibly the most significant issue is the prospect of environmental taxes and our carbon footprint”.18

The Committee welcomes the establishment of the Scottish Government’s advisory group on taxation as a step towards the creation of a clear strategy for taxation in Scotland. Given the complexity of the current tax system, as well as the scale of the financial challenges ahead, it is imperative that this work progresses at pace.

In the meantime, every effort should be made to resolve current anomalies with the UK and Scottish tax systems relating to national insurance and personal allowance. We ask that the UK and Scottish Governments seek to mitigate any future anomalies through engagement on future tax policy where appropriate.

We recognise that any new forms of taxation will not be in place in time to generate new revenue in the financial year 2024-25. We recommend that the Scottish Government’s new strategy for taxation in Scotland sets out a framework for decision-making around the introduction of new taxes.

The Committee requests further details of the announcement made at the SNP’s recent party conference that council tax will be frozen up until April 2025. In particular, we seek information on how this spending announcement will be funded. Like many others, we believe that a more fundamental reform of council tax is now overdue.

The Committee notes the delay in publishing the fiscal framework between the Scottish Government and local government and that it will now not be ready before the Scottish Budget 2024-25 is published in December. We ask how the Budget will reflect the principles set out in the VHA.

We also seek clarification from the Scottish Government on how the VHA principle of “no ring-fencing or direction of funding” unless jointly agreed will impact on transparency and Parliamentary scrutiny of those national priorities being delivered by local government.

Specific income tax proposals and associated risks

Some witnesses argued that income tax should be raised to fund spending and several included specific proposals in evidence. It is welcome that bodies are considering not only their spending priorities but how these might be funded.

The Scottish Trades Union Congress (STUC),1 for example, proposed a 44p levy rate on earnings between £75,000 and £125,140, which they estimated would raise £200 million a year. The joint IPPR Scotland submission2 suggested a 45p rate on earnings between £58,285 and £125,140, which they estimated would raise £257 million a year. Neither proposal takes into account potential behavioural change. However, the FAI,3 employing a similar method to that used by the SFC in its policy costings, suggested that “about a third of the tax yield is likely to be lost through behaviour”, 30% in the IPPR’s proposal and 36% in the proposal from the STUC. The FAI goes on to explain that—

Our best estimate is that the STUC proposal would raise £56m in 2024-25 after accounting for behaviour and would be paid by around 141,000 people (5% of those with any Scottish Income Tax liability). In the case of the IPPR Scotland proposal, revenues raised would be larger – both because the band starts at a lower level and because the new rate would be higher. We estimate that it would raise around £161m in 2024-25 and be paid by 234,000 people – roughly 10% of those with Scottish Income Tax liabilities.

Professor Heald4 also noted that increasing the higher marginal rates would have “longer-term consequences”. Noting that 5% of Scottish taxpayers pay roughly 40% of total revenues from income tax in Scotland, he argued that the behavioural response of a relatively small group of high-earning taxpayers can have a significant impact on Scottish tax revenues. Some witnesses, such as Children in Scotland,4 were however less convinced that income tax rates would have a significant impact on people’s choices, adding that, for some, other criteria such as job satisfaction and childcare would take precedence.

As explained by SPICe in its Blog on Behavioural Responses to Changes in Income Tax,6 behavioural change is not limited to changing residence, it can include people reducing their working hours to avoid moving into a higher tax band or choosing to receive additional income through other methods of payments, such as dividends which are subject to a different, UK, tax rate. The FAI4 notes that the higher the income, the greater the level of response and that “you could end up in a position where, if you hike the rate a lot for people who can shift the way that they get paid, more income will go to the UK Government, not to the Scottish Government”. The FAI further noted that choosing to reduce working hours can have an effect on productivity levels.

The Scottish Government’s Ready Reckoners on Scottish Tax – Changes for 2023-248 highlighted that it is working with HMRC on the “development of new, and robust, data sources and evidence to help better understand potential behavioural responses, including taxpayer movements across the UK over time”.

The Committee heard that increased income tax levels could also have an impact on economic growth and the potential for investment. Professor Bell4 explained that “if Scotland does end up with higher tax rates than other parts of the UK, that will be seized upon by those other parts of the UK whenever potential inward investment opportunities arise in an attempt to ensure that they do not come to Scotland but go instead to their regions, wherever they happen to be”. He added “the impression that is given, not just the tax rates themselves, matters quite a lot, too”.

Professor Bell further told the Committee that, rather than tax changes, it was “economic growth … [that] will drive revenue and the income side of Scotland’s balance sheet more positively”.4

The Deputy First Minister11 explained that “the revenues generated by taking decisions that are different from those of the UK Government have been important in really difficult financial times”, adding that the changes to tax bands in last year’s budget raised £520 million, which was “critical” in helping to meet additional pay demands. She went on to say that “there is quite a lot of uncertainty when it comes to estimating taxpayers’ behavioural responses, [however] considering taxpayer behaviour is a vital part of our tax policy decisions” and is built into the SFC’s forecasts. She added that “we have limited levers, and we have to deploy them very carefully” and “it is not about looking at income tax in isolation; a range of other taxes need to be looked at in the round, including local and business taxes”.

The Committee asks the Scottish Government to confirm how it is considering potential behavioural impacts as part of its decisions on taxation policy in 2024-25 and as part of its new strategy for tax in Scotland to be published in May 2024. We also request an update on its work with HMRC on developing “new, and robust, data sources and evidence to help better understand potential behavioural responses, including taxpayer movements across the UK over time”.

Developing the workforce and stimulating economic growth

The Scottish Government’s National Strategy for Economic Transformation (NSET)1 published in March 2022 set out “the priorities for Scotland’s economy as well as the actions needed to maximise the opportunities of the next decade to achieve our vision of a wellbeing economy”. In its response to the Committee’s previous recommendations that more action is needed to increase productivity, wage growth and labour market participation, the Scottish Government pointed to the NSET as key to making progress on these issues. At the Committee’s recent engagement event,2 participants suggested that, while the NSET is a helpful document, it now needs greater involvement and ‘buy-in’ from public bodies, including to deliver on environmental as well as economic impact.

The Committee heard evidence from the FSB3 that business creation is one of the key drivers of economic growth, with high business birth rates driving up innovation, productivity and competitiveness. However, it went on to tell the Committee that “Scotland currently has its lowest business birth rate in 11 years, and more than 2,300 fewer businesses are operating in Scotland now compared with the number at the start of the pandemic”. Its ‘big small business survey’ carried out earlier this year found that more than half of small businesses do not feel that Scotland is currently an attractive place to start a business, with economic uncertainty and the cost-of-living crisis cited as the main reasons behind this. It confirmed that "we are in negative territory across the entirety of the UK due to the economic uncertainty, so it is not solely a Scottish issue". The survey also highlighted, however, that businesses have a strong appetite for growth, with more than three-fifths of Small and Medium Enterprises in Scotland hoping to grow in the next two years.

The FSB put forward a number of proposals in its written submission,4 including creating a new National Outcome on entrepreneurship, a “one door approach to the provision of support”, introduction of a small business impact assessment, and retaining the small business bonus scheme relief, at least at the current threshold. It welcomed the £15 million funding for entrepreneurship announced in the Scottish Government’s PfG 2023-24, although it was unclear exactly what the programme would involve and whether this sum is realistic.

The Scottish Hospitality Group (SHG)3 highlighted a particular lack of confidence in the hospitality sector and among consumers “who are seeing their pay packets not going as far as they once did”. The SHG described the hospitality sector as at “an absolute precipice”, with a significant number of business closures and others struggling with the continuing impact of the pandemic, current energy costs and “extraordinary” recruitment challenges. The picture is more positive in the financial sector in Scotland, with Scottish Financial Enterprise (SFE)3 noting that this sector in Scotland “has regularly outperformed every part of the UK other than London and the south-east on investment in our industry”. It suggested that “Scotland is quite an attractive place to start or invest in a business in financial and professional services”.

The Committee heard from Universities Scotland7 that Scotland attracts people from across the world through its research and innovation projects, creating clusters of innovation and economic growth. It argued however that parity of esteem between education pathways is now required, a view echoed by participants at our recent engagement event as well as by Colleges Scotland8 and James Withers in his Independent Review of the Skills Delivery Landscape.9 SFE suggested that the education sector must align with the skills needs of the economy for the next five to 10 years. It also questioned whether the skills system is currently set up to deliver against the needs of the financial sector, including in areas such as data, artificial intelligence and automation, which are expected to be in “huge demand” within the sector.

Universities Scotland7 told the Committee that “graduates create growth, bring skills to the economy and create tax growth by generating a virtuous cycle of high skills and more productive employment”. Professor Heald7 explained that economic growth is in part driven by “having an economy that makes the people whom we have educated at great expense to stay in Scotland”, arguing that “we want to be a high-wage economy, because that has benefits in the form of the private consumption of the individuals and of the tax revenues that they pay into the Scottish Budget”.

The need to retain skills in Scotland was echoed by Professor Bell,7 who noted that an essential part of enhancing the growth of the economy is having opportunities for young people in their early 20s, when they are most mobile, for example, by supporting start-ups. Divergence in income tax and land and buildings transaction tax was highlighted by SFE3 as a potential disincentive for young professionals from the rest of the UK to come and live and work in Scotland. It went on to call for a greater focus on increasing the ‘tax base’ rather than the ‘tax take’, explaining that “we have opportunities in Scotland, through our growth industries, to have well paid and highly skilled jobs that will pay more tax and which will then be able to fund public services”, adding that other sectors “should benefit, on the back of that”.

The Deputy First Minister14 responded that “we need to make sure that Scotland is seen as a good place in which to invest” and highlighted “there is a lot of interest from private investors”, but they “need certainty and continuity on the proposition”, including on renewable energy and net zero approaches. She went on to highlight commentary in the MTFS on the need to seize opportunities in areas in which Scotland has a competitive advantage; supporting entrepreneurs, start-ups and scale-ups; and helping businesses to raise productivity. She suggested that the Scottish Government’s enhanced childcare offer is also an important way to “boost” labour market participation. The need to support older workers to work for longer where possible was also noted by the Deputy First Minister, echoing points made by participants at our engagement event and by Age Scotland,7 who considered there may be additional benefits in this approach in reducing spending on health and social security.

The Committee has consistently recommended that more action is needed to increase productivity, wage growth and labour market participation in Scotland and notes the Scottish Government’s response pointing to its National Strategy for Economic Transformation (NSET) as key to addressing these issues.

We ask what progress has been made in delivering actions in the NSET that will help increase productivity, wage growth and labour market participation. We also request details of how the Scottish Government is ensuring ‘buy-in’ from the public sector to help deliver the ambitions in the NSET.

The Committee seeks information from the Scottish Government on the steps it is taking to ensure that Scotland can retain the graduates it educates. We also request further details of the criteria for, and outcomes expected from, the £15 million entrepreneurship fund announced in the recent Programme for Government, and ask what plans are in place to help broaden Scotland’s tax base.

Spending priorities

Prioritisation

As noted earlier in this report, the First Minister has set three missions for the Scottish Government to deliver - equality, opportunity and community - which are also restated as priorities in its PfG 2023-24.

The Committee heard evidence that prioritisation of public spending is needed in order to meet the significant financial challenges ahead. Professor Bell,1 for example suggested that “there are too many demands on the public purse at the moment for them all to be simultaneously satisfied [and so] there has to be prioritisation”, and suggested a ‘one out, one in’ approach to new initiatives and programmes could be considered. He went on to highlight “the danger of entering into commitments that have medium or long-term implications and then feeling that it is not possible to stop them” for fear of negative publicity. It was also suggested at our recent engagement event2 that the Scottish Government should be prepared to stop funding a policy approach or project if it is no longer relevant or is not delivering impact.

Later in this report we hear about the ‘radical prioritisation’ that has been undertaken by some public bodies in the face of the financial challenges and the need to make efficiency savings.

The sustainability of rising spend on health was discussed with witnesses, in light of the SFC’s projections that health spending is expected to increase from 35% of devolved spending in 2027-28 to 50% in 2072-73. Professor Heald1 warned that “if something like 50% of the Scottish Budget goes on health, that will have devastating consequences for the rest of the Budget”. He went on to suggest that reducing spending in other areas such as local government, housing and employment can also have an impact on healthcare and so “it is very important to see the connections between the different kinds of spend”. However, Professor Bell1 questioned the premise in the SFC’s Fiscal Sustainability Report5 that “health spending on a person increases as they get older or increases with their proximity to death”.

The SFC’s report noted that “since the devolution of social security, the Scottish Government has made policy and operational changes (such as the introduction of the Scottish Child Payment) which result in social security expenditure exceeding the BGAs by more than £1 billion by 2027-28”. This additional expenditure, the SFC explained, persists throughout its 50-year projections. Some witnesses, such as the Poverty Alliance,1 welcomed the Scottish Government’s approach, highlighting for example that “the Scottish Child Payment is expected to lift 90,000 people out of poverty, and our members do not think that we have reached the end point of what we can do through the social security system to address poverty”. However, noting the SFC’s projections, Professor Heald1 told the Committee that this means “the Scottish Government, which has a largely fixed budget, has to divert money from core public services such as health, education and local government”. He said he worried that the same people accessing social security benefits were those who relied most on public services and would therefore be most affected by any deterioration in services caused by budget reductions.

Questions also arose in evidence as to whether certain programmes were being funded appropriately to the scale of their aims and objectives. A recent report by the Poverty and Inequality Commission highlighted that investment in the Scottish Government’s programme ‘Best Start, Bright Futures: Tackling Child Poverty Delivery Plan 2022-2026’ has not matched the ambitions of the programme.8 The IPPR Scotland1 told the Committee that “we are still not very good at outcomes-based budgeting [and] quite often, our position is still, “this is how much money we have, so we will put it into this”, rather than “how much money will this require to tackle it””.

Children in Scotland1 made a similar point, suggesting that “we tend to fund activity that can be measured, rather than think about the long-term outcomes that we are looking for”. In their joint written submission, COSLA, SOLACE and CIPFA Directors of Finance11 echoed this view, suggesting that behaviour and public spending is influenced by a continued focus on short-term input measures and outputs rather than outcomes, “in ways that are not necessarily best value”. This, they noted, is “exacerbated by the number of different policy announcements from within the same or different government portfolios which lack a cohesive and joined up approach to improving outcomes”. Audit Scotland12 argued “the Scottish Government’s decisions on prioritising or deprioritising spending should be based on a clear understanding of the impact these changes will have on the outcomes that it wishes to achieve”.

The Deputy First Minister13 explained that the Scottish Government is looking at whether existing programmes, “some of which have been around for quite some time”, meet the test of the three missions of equality, opportunity and community. She went on to say that “we have to make sure that the key priorities receive the funding”. She also defended the Scottish Government’s approach to social security benefits, arguing that “making it a more dignified and progressive system that is based on dignity and respect means that it costs more … therefore, we need to make decisions elsewhere”.

Questions have also arisen regarding the affordability of some flagship Scottish Government programmes. For example, we were recently told by the Minister for Social Care, Mental Wellbeing and Sport that the Deputy First Minister “has not set a ceiling” for spend on the national care service.14 The Deputy First Minister later explained “I am not sure that taking everything on the basis of what the country can afford, in its bluntest sense, is the best starting point”, arguing that it should instead be “what priority is being given in a difficult financial environment … [and] I can say that social care is a key priority”.13 Asked in a similar vein whether there is a cost level at which decisions will be taken not to proceed with building the MV Glen Sannox and MV Glen Rosa ferries, the Deputy First Minister explained that “due diligence is being done on the value-for-money assessment that was completed this year” and relevant committees will be updated on the outcomes.

We heard a mix of views on whether universal policies should be revisited in favour of means testing or a more targeted approach. Some participants at our engagement event argued that consideration should be given to the sustainability of universal provision and suggested that, rather than “costly means testing”, a more ‘light-touch’ approach or regime could be developed. However, the Poverty Alliance1 raised concerns regarding the availability of the data that would be needed to ensure the effective targeting of resources and policies, as well as the potential impact on uptake due to poverty-related stigma. The IPPR Scotland1 suggested that “it does not have to be an either/or” but rather “it is about how you phase, target and ensure you are using resources in the best possible way”.

The Deputy First Minister explained that the Scottish Government is “looking in great detail at what the options are in relation to targeting” and suggested that “value for money, purpose and impact all need to be looked at, but our focus is definitely on better targeting”. She suggested that means testing “is more complex, because a whole system would need to be set up for that” and highlighted that this can often be uneconomical.13

Once again, this year, we heard the case being made by public bodies, local government and the voluntary sector for multi-year budgets, which they argued would provide stability and enhance efficiency, transparency and trust. Children in Scotland1 told the Committee that short-term funding “leads to an industry of creating grant proposals and getting money but not actually doing the work”, resulting in inefficiency both for civil servants and those organisations receiving the funds. Age Scotland echoed the point that longer-term funding can deliver better value for money, and active travel spend was cited by Living Streets Scotland as a positive example of a longer-term commitment over the course of a parliamentary session1. The FAI1 suggested “it is possible, even under the current arrangements and with the instability that there has been in the past few years, to take a multi-year approach”, adding “we could look at things such as the baseline level that we could expect if nothing were to change, and as there is more defined funding closer to the time, we could revise that”. As highlighted earlier in this report, the Deputy First Minister has committed, for the first time, to providing multi-year spending envelopes to 2026-27 alongside the Scottish Budget 2024-25.

In January this year, the Committee reported that we were not convinced that the Scottish Government was carrying out enough strategic long-term financial planning to ensure fiscal sustainability and that it appeared to be “firefighting on a number of fronts”. We have little evidence to suggest a shift away from a short-term approach to financial planning.

The Committee therefore strongly recommends that the Scottish Government produces a full response to the SFC’s Fiscal Sustainability Report setting out the actions it will take to start addressing the longer-term challenges ahead. We also suggest that the Scottish Government holds a debate in Parliament on the long-term sustainability of Scotland's finances.

We note the statement in the Scottish Government’s May 2023 MTFS that “tough and decisive action must be taken to ensure the sustainability of public finances and that future budgets can be balanced”. However, we are concerned that affordability does not appear to be a key factor in Scottish Government decision-making. We ask that detail of spending announcements is in future provided to Parliament.

We recommend that the Scottish Government explicitly sets out in the Scottish Budget 2024-25 if there are any areas of spending it has assessed as not meeting its three missions test and where funding will, as a result, be reduced or ceased entirely.

Capital budget

In its May 2023 Forecasts,1 the SFC projected that the capital budget, used to fund long-term investment such as infrastructure, hospitals and research and development, will be 16% smaller in real terms in 2028-29 than in 2023-24. Block Grant funding from the UK Government is the largest component of capital funding. The Scottish Government has said it will use its borrowing powers to contribute to capital funding at a level of £250 million each year and assumes further funding of £200 million from sources other than the Block Grant. The updated Fiscal Framework, explored earlier in this report, increased capital borrowing limits in line with inflation from 2023-24. It is unclear whether the Scottish Government will upscale its borrowing plans next year. As noted earlier in this report, the Scottish Government committed in its May 2023 MTFS to refreshing multi-year spending envelopes for capital (and resource) alongside the 2024-25 Budget and to extend the Capital Spending Review and Infrastructure Investment Plan by one year, taking these to 2026-27.

The challenge of delivering much-needed investment in infrastructure within a limited capital budget was highlighted by a significant number of witnesses. The FAI2 highlighted that “low investment is a UK-wide issue … and the picture is broadly similar in Scotland”, with investment (onshore) averaging 0.5 percentage points below the UK average in the decade before the pandemic, and 5.1 percentage points below the OECD average. The FAI goes on to state that, “given the tight capital budget settlement the Scottish Government is faced with, it is more important than ever that robust project management tools are put into place to ensure adequate delivery and maximum value for money”.

Professor Bell3 suggested that “if capital is used widely, it can … [also] be a catalyst for the private sector to invest”, while Professor Heald3 noted that “if we want successful private sector delivery of capital investment in infrastructure, private firms need to have a reasonably steady flow of work”. It was noted by Universities Scotland3 that investment will also “create confidence that those industries will invest in the throughput of talent in apprenticeships” and that there are sustainable careers in construction and engineering. FSB6 further indicated that there is support amongst small businesses for investment in infrastructure. Universities Scotland3 was among those witnesses who highlighted that capital investment in infrastructure further contributes to productivity, with FAI3 also suggesting that “cuts to capital today can have a significant impact on growth and productivity in the long term”. In terms of attracting investment for infrastructure projects, SFE6 noted that “the pension industry and others would quite gladly look at longer-term investments over 20 or 30 years, whether through bonds or some other vehicle to support infrastructure investment”, while warning that there would “need to be a return for that money at some point”.

The need for capital investment to help meet the Scottish Government’s net zero targets was highlighted by a number of witnesses. Professor Bell,3 for example, argued that government spending is required in order to de-risk investment by the private sector in areas that will reduce our carbon usage, while the FAI3 highlighted conclusions from the OBR’s 2021 Fiscal Risks Report that earlier action on climate change is expected to be cheaper overall. The joint COSLA, SOLACE and CIPFA Directors of Finance submission12 argued that new investment will be required “but with scarce resources, funding must be aligned against the most critical programmes in the high-carbon sectors of transport and heat” and difficult decisions taken on deprioritising other areas. Citizens Advice Scotland13 strongly argued for energy efficiency spending to be protected in capital budgets.

The First Minister announced on 17 October 202314 up to £500 million investment “to help create thousands of green jobs and deliver the full economic potential of offshore renewables projects” over the next five years. This is intended to “leverage private investments in ports, manufacturing and assembly work to support major supply chain opportunities to Scotland”. As part of the Scottish Budget 2024-25, the Scottish Government is taking a revised approach to undertaking a climate impact taxonomy of budget lines which involves expansion from solely capital to both capital and resource. He also announced that “the Scottish Government will take steps to issue its first ever bond to finance key infrastructure in Scotland”.15

In evidence to the Committee, the Deputy First Minister stated that “it is extremely concerning that the UK Government did not inflation-proof its capital budget, which has resulted in a 7% real-terms fall in our Barnett capital funding over the medium-term between 2023-24 and 2027-28”.16 This, she argued, had significantly impacted on the Scottish Government’s ability to deliver its capital infrastructure commitments and compounded with high construction inflation, “there is a double whammy of less capital and that capital not going as far as it once did”. As a result, the Scottish Government is to prioritise those capital projects that “will have the biggest impact”, including on economic growth, net zero ambitions and sustainable public services, and the delivery of some other projects will take longer over the next few years.

The Committee is disappointed that the capital funding available to the Scottish Government continues to reduce and that, by 2028-29, it is expected to be 16% smaller in real terms than in the current financial year. This is particularly concerning during times of financial strain when governments should be investing in infrastructure to stimulate economic growth.

The Committee asks whether the Scottish Government’s approach to using its borrowing and reserve powers will be updated in light of the recent changes to the Fiscal Framework.

We request that the multi-year envelopes for capital and resource spending to be published alongside the Scottish Budget 2024-25 contain a sufficient level of detail to enable meaningful parliamentary scrutiny and to allow public bodies to plan ahead. We look forward to examining this information along with the updated Infrastructure Investment Plan when published this December.

The Scottish Government's Public Service Reform Programme

Overview

In his foreword to the report of the Commission on the Future Delivery of Public Services1 published in June 2011, Dr Campbell Christie stated that—

Reforming the delivery of [public] services is not only a matter of fiscal necessity. We also have to implement reforms that improve the quality of public services to better meet the needs of the people and the communities they seek to support.

If we are to have effective and sustainable public services capable of meeting the challenges ahead, the reform process must begin now.

He went on to say that a process involving all stakeholders must be initiated, however “ultimate responsibility for reform rests … with the Scottish Government [and] I urge them to act quickly and decisively – as a society we no longer have time for delay”.

The Christie Commission’s report is built around four pillars—

a decisive shift towards prevention,

greater integration of public services at a local level driven by better partnership, collaboration and effective local delivery,

greater investment in the people who deliver services through enhanced workforce development and effective leadership, and

a sharp focus on improving performance, through greater transparency, innovation and use of digital technology.

In November 2021, the Committee heard evidence to suggest that, while the Christie principles remain relevant, limited or “sporadic” progress with reform has been made.2 At that time, the then Deputy First Minister, John Swinney MSP, reiterated that “the Government’s commitment to Christie’s vision and public services reform remains strong”3.

Eleven years on from the Christie Commission’s report, the Scottish Government’s ‘Investing in Scotland’s Future’ Resource Spending Review (RSR), published in May 2022, identified five areas of focus for public service reform over the lifetime of this Parliament (until 2026):

digitalisation

maximising revenue through public sector innovation

reform of the public sector estates

reform of the public body landscape, and

improving public procurement.

The RSR noted that “the more efficient and effective we can become in the delivery of public services, the more able we will be to achieve key priorities and direct support towards those who need it most”. It also set out the Scottish Government’s plans to develop—

a pathway to return the overall size of the public sector workforce broadly to pre-Covid-19 pandemic levels, while supporting expansion in key areas of service delivery, helping to hold total pay bill costs – as opposed to pay levels – at 2022-23 levels.4

However, the Scottish Budget 2023-24 published in December 2022 outlined a change in approach in relation to workforce levels. The then Deputy First Minister explained that “following further analysis and engagement, our proposal on how we achieve sustainable public bodies developed [and] it is [now] for individual public bodies to determine locally the target operating model for their workforces and to ensure workforce plans and projections are affordable in 2023-24 and in the medium term”.5

The RSR committed the Scottish Government to setting out proposals for the future of the public body landscape and “initial conclusions on the potential for the further sharing of services by public bodies” alongside the 2023-24 Scottish Budget. These proposals did not materialise.

The Committee therefore sought further details of the Scottish Government’s programme as part of its Budget 2023-24 Report6 and, in response,7 the Scottish Government confirmed that public bodies’ reform plans were expected later in 2023 for inclusion in the Scottish Budget 2024-25. We further sought details of the milestones for delivering each of the five reform priorities, along with the costs, efficiencies and savings the Scottish Government anticipates as a result. The Scottish Government responded by saying that “details of savings, costs and milestones will emerge from the plans that public bodies produce and which flow from more formal reviews”.

With the aim of achieving greater understanding and transparency around the Scottish Government’s public service reform programme, the Committee launched an inquiry on 6 March 2023. Our hope was that the evidence gathered would help the Committee to continue to track progress against delivery of the programme’s objectives in the years ahead. We received 32 written submissions8 to our call for views and SPICe has published a summary of the written evidence received.9 The Committee held evidence sessions as part of this inquiry during the period May to September 2023.

The Scottish Government’s reform programme has continued to change throughout the period of our inquiry.

In late March 2023, the then Deputy First Minister, John Swinney MSP, announced that the reform programme would be “accompanied by a clear financial strategy, taking account of significant changes, available resources and expected cost pressures including demographic changes, technological advances and inflation, as well as considering necessary mitigations”.10 This financial strategy has not yet been published.

Changes to the Scottish Government’s approach also appear in the Scottish Government’s ‘Equality, Opportunity and Community Prospectus'11 published in April 2023. This commits the Deputy First Minister by 2026 to have progressed a 10-year programme of public bodies and public services reform, strengthened the resilience of public services and communities, and “targeted both short-term efficiencies and wider, deeper, and longer-term reform”. It is unclear exactly when the 10-year programme started and ends. Its MTFS12 published a month later, in May 2023, sets out four new workstreams relating to public service reform:

Public bodies and public service reform with “the aim … [to] achieve fiscally sustainable person-centred public services, which over time both improve outcomes and reduce inequalities of outcome across communities in Scotland”.

Efficiency levers, which includes digital, shared services, public sector estates (though a Single Scottish Estate programme), procurement, and grant management, each being progressed by individual public bodies and the Scottish Government.

Revenue raising with guidance and a robust decision-making process developed through discussions between the Scottish Government and public bodies to support them in “considering, developing and implementing new revenue-raising ideas”. This work is intended to support future budget allocations.

Pay sustainability, which restates that “it is for individual public bodies … to determine the target operating model for their workforces and to ensure workforce plans and projects are affordable in 2023-24 and over the medium-term.

While these workstreams incorporate some of the original areas of focus for reform set out in the RSR, they include new elements and appear to reprioritise others.

The MTFS also stated that “specific larger scale reform programmes underway are an integral part of a wider 10-year Public Service Reform programme” and provided examples such as the education reform programme, The Promise, the National Strategy for Economic Transformation, and a national care service.

The MTFS further noted “it is critical that progress is effectively quantified and tracked”, including through regular updates to the Committee. We asked the Scottish Government about the frequency and scope of reporting on its public service reform programme. The Deputy First Minister in her letter of 25 May 2023 confirmed that the first update will be provided to the Committee “no later than alongside the 2024-25 Budget and before the end of this calendar year [and], thereafter reports would align with the MTFS and the Budget”.13

The Scottish Government’s PfG 2023-24,14 published in September 2023, included specific reforms to be undertaken “in the coming year”, including progressing a four-day working week public sector pilot, maximising opportunities through progressive procurement policy and practice, delivering a framework for digital service transformation, and working with island authorities to develop alternative governance arrangements.

While the Committee accepts that government policies will, of course, evolve and develop over time, we are concerned that the focus of the Scottish Government’s public service reform programme has, since May 2022, changed multiple times, as have the timescales for publishing further detail on what the programme will entail. Given the financial challenges facing the Scottish Budget, this represents a missed opportunity to be further along the path to delivering more effective and sustainable public services.

It is disappointing that commitments to set out further details of the Scottish Government’s reform programme have at times not been met. Eighteen months into the programme and a lack of clarity remains in relation to the overall purpose, objectives, timetable, upfront costs required and anticipated savings and efficiencies to be delivered. Much more work is needed if the Scottish Government is to achieve the type of reform envisaged by the Christie Commission in 2011 that delivers “effective and sustainable public services capable of meeting the challenges ahead”.15

Our recommendations in this section of the report aim to bring much-needed impetus, focus and direction to the Scottish Government’s reform programme to ensure successful outcomes can be achieved at a much quicker pace.

The role of government in reform

The Committee explored with witnesses what the role of government should be in relation to public service reform. Audit Scotland was one of many organisations who told the Committee that the Scottish Government should have a vision and clear sense of purpose for its reform agenda, and said it hopes to see “a more worked-up plan”, including what success might look like “in the relatively short term”. 1 A similar position was taken by Dundee City Council, who argued that “radical reform requires strong leadership and direction”.2 The STUC agreed that strength in vision and capacity is needed to deliver reform3 and Professor James Connelly of Glasgow Caledonian University said that “at a central level, direction and capacity in the system remain important”.4 Reform Scotland is also in favour of “centrally set objectives and outcomes for what we want to deliver, but with local discretion in the delivery of how these are met”.4

Some witnesses considered that the Scottish Government should ‘mandate’ public bodies to make greater progress with reform. Drawing on their own experience of being created by legislation through a merger of eight regional ‘legacy’ police forces and two specialist bodiesi, Police Scotland argued that “to achieve significant cost savings in public sector reform and improve services, there has to be a mandate to get people to want to do it”.6 South of Scotland Enterprise (SoSE) also considered that mandating public bodies to collaborate could be needed,6 however, Reform Scotland was less convinced that a ‘top-down’ approach to collaboration was required to drive reform.4