Scotland's Economic Performance

Executive Summary

It has now been a decade since the beginning of the financial crash and the subsequent 'Great Recession'. It has also been a decade since the introduction of the Scottish Government's National Performance Framework (NPF) which measures performance and progress towards the Scottish Government's economic priorities. We thought that this ten year milestone marked a timely opportunity to look at the performance of the economy as well as future challenges for Scotland’s businesses and households.

This inquiry sought to examine the performance of Scotland's economy and to engage a wide range of people in considering which economic policies will best serve Scotland in the forthcoming decade.

The Committee's conclusions and recommendations are as follows:

National Performance Framework

The Committee has concerns about the ability to measure policy impact under the new performance framework.

Entrepreneurship

The Committee believes that entrepreneurial thinking and the commercialisation of ideas should be encouraged by colleges and universities. Whilst acknowledging that some educational institutions are already doing this, consideration should be given to how best to increase the integration of practical entrepreneurial, commercial and problem solving skills into courses.

Scale-up

The Committee notes evidence on the need to ensure that Scotland "remains a good place in which to do business" and asks the Scottish Government to ensure that the Scottish business environment enables businesses to achieve their potential.

The Committee notes that the scale-up of companies has been a long-standing challenge in Scotland. There is a lack of business confidence to do so and the Committee recommends that the Scottish Government sets out how it will tackle this 'fear of heights'.

The scale-up of businesses from small to medium sized enterprises could have significant economic impact. Evidence to the Committee suggests that "missing middle businesses" cannot access support to grow. The Committee believes that there is a missed opportunity if we do not give support to businesses that have growth potential and the desire to grow, but that are not currently eligible for Scottish Enterprise account-management support. The Committee asks the Scottish Government to quantify the scale of businesses which fall into the "missing middle" category and to set out to the Committee how it will ensure that these businesses receive the support they need to thrive.

The Committee is aware that in Scotland businesses are often being acquired rather than scaled-up. If the money is reinvested in the Scottish economy, that can be beneficial. However, it can also result in the loss of entrepreneurial role models and experienced people to manage larger scale businesses based in Scotland.

In order to gain a fuller picture, the Committee asks the Scottish Government how many account-managed companies have subsequently been sold and how much is reinvested in Scotland.

The Committee believes that targeted employee ownership policies and incentives may help to keep business ownership in Scotland. Other policies would provide the "anchoring" effect needed to embed businesses in Scotland including ensuring that there is adequate investment, not just from Government, but from other sources. As Jim McColl told us, we need more large businesses based in Scotland to support those coming through the pipeline.

Withdrawal from the EU

The Committee previously did an inquiry on the economic impact of leaving the EU and made a number of recommendations, including asking the Scottish Government to detail how it will engage with Scottish businesses on the issues arising from negotiations on leaving the EU.The Committee asks for an update on what work the Scottish Government has done to engage Scottish businesses in this way and what representations it has made to the UK Government on their behalf, including steps to prepare businesses to trade with countries outside the EU, such as USA, China, Japan and India.

Technology and Automation

The Committee recommends that the Scottish Government reviews its labour market strategy to ensure that its policies reflect developments in automation and technology in the workplace. The Committee also asks that the enterprise and skills agencies set out a range of actions to reflect developments in automation and technology in the workplace.

Procurement and Payment

The Committee encourages the Scottish Government to take social impact into account in procurement decisions. The Committee believes that the Scottish Government could show greater flexibility in its approach to finding delivery models which would allow for such factors to be considered, along with the need to support Scotland's SMEs.

The Committee asks the Scottish Government to encourage greater uptake of the Business Pledge, including the commitment to prompt payment.

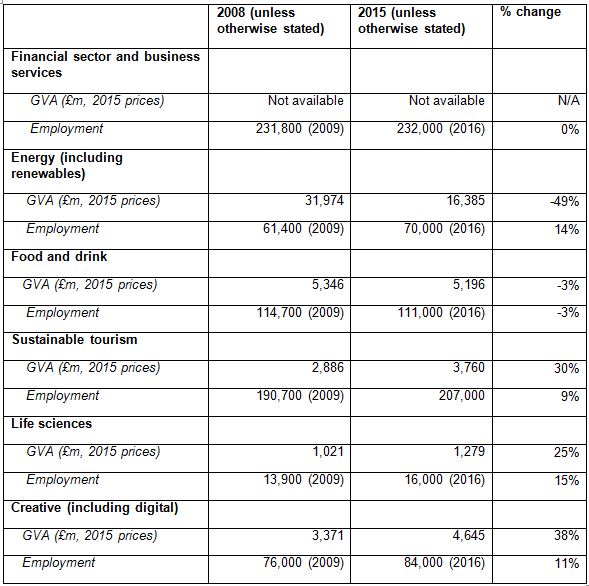

Growth Sectors

The Committee believes that there is a need to evaluate the growth sectors. There are unanswered questions about the benefits of supporting growth sectors and the possible detrimental impact exclusion of other businesses may have. Whilst the Committee agrees that the Scottish Government should provide support in areas where Scotland has natural advantage, a lack of flexibility could be limiting opportunities for growth. Evaluation is needed so that we have a better understanding of the growth sectors and can channel resources accordingly.

The Committee recommends that in addition to evaluating the growth sectors, the Scottish Government commissions research to analyse the potential economic gain that could be made from investing more resource into improving productivity in the low productivity sectors.

The Committee highlights its previous recommendation in its Gender Pay Gap report that: It is vital that we raise the status of care in Scotland. As a first step in recognising its importance, the Committee recommends that care becomes a Scottish Government priority sector with a monetary value put on the sector. The Committee reiterates that recommendation in relation to this inquiry and asks the Scottish Government to put a monetary value on the sector and grant it the same status as the six growth sectors mentioned in the Economic Strategy.

Economic Strategy

Whilst the Cabinet Secretary made no indication that there were any plans to update the Scottish Government's Economic Strategy, we note that there have been different iterations in the past and believe that any future economic strategy should be accompanied by a strong action and implementation policy, backed up with a monitoring and evaluation plan.

Inclusive Growth

The Committee notes that the Scottish Government is developing an inclusive growth framework and we call on the Scottish Government to promote a consistent, commonly held and settled definition. The enterprise and skills agencies should be working from the same understanding of inclusive growth and this should be reflected in their operational plans.

Regional Growth

The Committee notes the different approaches to boosting the economic prospects of regions and recommends that the Scottish Government evaluate and consolidate these policies. The Committee believes that it is vital that the gap between low-performing and high-performing regions in Scotland is reduced.

The Committee is considering regional policy in the context of its current inquiry into European Structural Funds. The Committee is keen to ensure that the long-term investment given to regions through that funding is maintained.

The Committee believes that there is an opportunity for the South of Scotland enterprise agency to build transparent measurement and evaluation into its activities from the outset. This will allow it to establish what works in the region and adapt its approach accordingly. The Committee would like to have sight of such evaluations and information on how policies have been changed based on the results.

Women

Witnesses highlighted that if the same number of women started businesses as men, there would be a £7.6 billion prize for the Scottish economy. The Committee highlights its previous recommendation in its Gender Pay Gap report that: "The Committee asks the Scottish Government and its agencies to review the funding streams available to new and existing female entrepreneurs. Of particular concern to the Committee is the suggestion that male entrepreneurs are more successful in accessing capital than females. It is important to establish whether this has been the experience of female-owned account managed companies and Business Gateway clients, and recommends the Scottish Government and its agencies undertake research in this area."

Social Enterprises

The Committee recommends the Scottish Government supports the creation of a kite-mark that helps identify the wider value that a social enterprise brings beyond traditional growth, success and earnings.

The Committee recommends that there is a role for the new Scottish National Investment Bank (SNIB), working with Social Investment Scotland, to consider how social enterprises can be better supported in accessing finance.

Employee ownership and co-operatives

The Committee believes that employee-owned companies and co-operatives have huge potential to improve productivity, facilitate future growth, reduce inequality and retain jobs in Scotland.

The Committee asks the Scottish Government to publish transparent targets to grow the number of employee-owned and co-operative businesses being supported. The Committee asks that progress towards these targets is measured and published. The Committee believes that support with succession planning is vital in promoting this model of ownership.

Innovation

The Committee notes the Scottish Government’s new “innovation active” indicator which adopts the wider definition of business innovation as used in the UK Innovation Survey. We therefore request the Scottish Government provides the Committee with details of how it is supporting Scottish businesses to become more innovation active.

The Committee recommends that the Scottish Government develops the funding model for universities in order to incentivise innovation and impact. The Committee also recommends increased investment in the innovation fund.

Consideration should be given to how less innovative firms could engage more with Universities to spread good practice and improve productivity. There should be structures in place to allow businesses to easily access the resources for promoting innovation that Universities can provide.

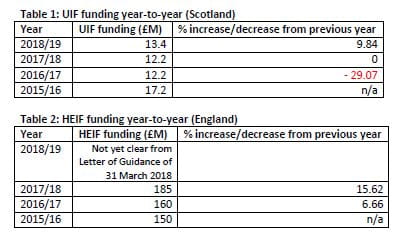

Whilst we recognise that it is for the Scottish Government to decide how to use Barnett consequentials, the Committee asks the Scottish Government to clarify what additional funding is available to Scottish universities as a result of the UK Government's Higher Education Innovation Fund in England. The Committee also asks the UK Government what funding is available to Scottish businesses and research institutions through the UK-wide Industrial Strategy Challenge Fund announced in April 2017.

The retention of intellectual property in Scotland is linked to ensuring that businesses are based in Scotland. Whilst we recognise the positive role of incubator facilities in assisting with protecting intellectual property, it has been suggested that there is not sufficient infrastructure to ensure that it is retained in Scotland. The Committee asks the Scottish Government to clarify its policy on intellectual property

Internationalisation

The Committee recommends that SDI should report both the number of businesses being supported to export and those companies which are supported to export for the first time.

The Committee agrees with SDI that the problem is not the Scottish Government's international ambition or trade strategy, but the level of investment dedicated to this policy commitment. The Committee seeks clarity on what proportion of the budget is allocated towards realising the Scottish Government's export ambition.

The Committee highlights its previous work on economic data, where it was recommended that the Scottish Government and the Office of National Statistics prioritise improving the coverage and quality of trade (export and import) statistics and asks the Scottish Government to provide an update on what progress has been made in this area.

Investment

The Committee welcomes the proposed alignment of funding sources such as the Growth Scheme and SME Holding Fund within the Scottish National Investment Bank in order to make it easier for businesses to navigate.

The Committee recognises the evidence that the Scottish Investment Bank funding model has been beneficial to businesses and the Committee seeks reassurances from the Scottish Government that this will not be lost or diluted when the two banks merge.

The Committee notes the low take up in the Growth Scheme and recommends that the Scottish Government conduct research into the reasons for this to allow any lessons to be learned before it is subsumed into the SNIB.

The Committee agrees that the SNIB has potential to improve economic performance. The risk however is that it has a growing list of priorities and demands and success will be diluted if it seeks to address them all. We welcome the Scottish Parliament motion that calls on the Scottish Government for clarity of focus and delivery with respect to the role and objectives of the bank.The Committee also welcomes the SNIB implementation plan and the Scottish Government’s acceptance of its recommendations.

The remit and ambition of the SNIB will be set out by the Scottish Government. The Committee recommends that budget for assessment and evaluation is built in to the SNIB from the outset, and that all investment decisions should be subject to equality impact assessments, and any other appropriate assessments.

The Committee requests clarity from the Scottish Government over what operational currency will be used by the SNIB over the 10-15 year investment period mentioned in the implementation plan.

Enterprise and Skills

The Committee has launched an inquiry into local business support to give further consideration to the role of Business Gateway within the wider ecosystem of public sector support agencies.

The Committee notes that there has been a move away from the "key sector" approach in the 2018-19 Scottish Enterprise business plan. Instead the focus is on “opportunities". If this is indicative of a more flexible look at the merits of individual businesses and a move away from a rigid prioritisation of sectors, then it is welcome.

The Committee notes the evidence that creative/digital companies can miss out on agency support and asks Scottish Enterprise to report back to it on what steps it takes to keep apace with digital and technological developments to ensure that it is able to offer advice to such companies coming through the pipeline.

The Committee welcomes the Strategic Board's focus on de-cluttering and streamlining of the enterprise and skills support landscape.

The Committee recommends more transparency on the performance targets set by the enterprise agencies, how these targets are measured and whether they have been achieved. These targets must also include support for women in business and enterprise agencies must incorporate these into their measurement frameworks. The Committee asks the Enterprise Agencies to respond to this recommendation.

We agree with the Strategic Board that an assessment needs to e made of what works and resources need to be directed accordingly.

We look forward to hearing future updates from the Strategic Board on its progress.

Council of Economic Advisers

The Committee encourages the Scottish Government to work with the Council of Economic Advisers to consider how economic policies could be consistently evaluated. The Committee asks the Scottish Government to clarify the role of the Council of Economic Advisers in future work on Scotland's economic performance.

Businesses

The Committee is not aware of the existence of any evaluation of the impact of the Business Pledge. Our evidence suggests that it is not necessarily reflective of the number of employers encouraging fair work practices in workplaces; we ask the Scottish Government to set out the action it will take to encourage businesses to sign up to the pledge, including those businesses that provide goods and services to the public sector; and to establish whether the pledge has encouraged businesses to evaluate their policies and to publish its findings.

The Committee believes that learning from one another could help grow business ambition in Scotland. Skyscanner is a great success story and geography is not a barrier to it keeping abreast of the activities of other companies in its field. The Committee encourages businesses in Scotland to seek out such learning, from those who are succeeding in what they do.

UK Industrial Strategy

We look forward to further dialogue with the Secretary of State for Business, Energy and Industrial Strategy and ask him to provide an annual update.

The Committee encourages continued meaningful engagement between the UK and Scottish Governments on the Industrial Strategy and sector deals.

Apprenticeships and Skills

The Committee agrees that skills are key to the success of the economy and intends to look at skills in more depth in a future inquiry.

The Committee recommends that the Scottish Government considers what more could be done to support job transitions, in-work training and reskilling.

The Committee also recommends that the Scottish Government takes further action on matching the skills needs of businesses, including language skills, with its education policies.

The Committee agrees that there is a continual need to support young people seeking apprenticeship opportunities, but urges the Scottish Government to balance this with consideration of apprenticeship opportunities for older people. The Committee believes that particular focus should be given to sectors that are seeing changing skill needs and increased digitisation.

We also ask the Scottish Government to provide an update on the uptake of modern apprenticeships in relation to disability, Black and Minority Ethnic (BME) people, gender and care leavers.

The Committee asks the Scottish Government to provide an update on how funds raised through the apprenticeship levy will be spent in Scotland.

Strategy

The Committee recommends that the Scottish Government produces an action and implementation plan for its economic strategy, backed up with a monitoring and evaluation plan.

Conclusions

Whilst it is recognised that there are considerable challenges in the Scottish economy, we expect the UK and Scottish Governments to work together to realise the significant opportunities that exist, and of which, we can and should make more.

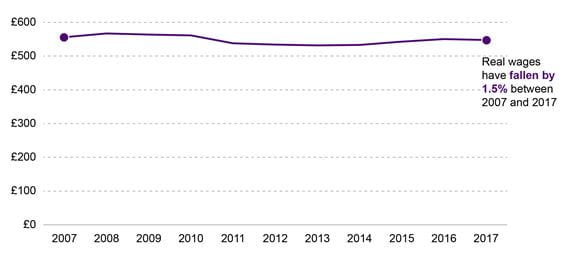

Economic growth in Scotland for the period 2007-2017 is significantly below Scottish Government targets, the performance of the UK economy as a whole, historical trend growth rates for Scotland and small EU countries. Levels of GDP growth are marginal; productivity is low and wages are stagnant. Whilst employment growth has been positive, some of that increase has been in insecure, low paid work.i

It is clear that the future will be equally challenging given the independent Scottish Fiscal Commission's revised forecast of lower tax revenues, of as much as £1.7 billion, and already low GDP growth has been revised downwards to less than 1%.

If we are to reverse this trend then the Scottish Government must use all of the levers at its disposal to bring a sharper focus on growing the economy, and ensuring that growth is inclusive.

The Committee recommends that:

The Economic Strategy is reviewed and updated as a matter of urgency, not least to take account of the potential economic consequences of Brexit;

Whilst the creation of the Strategic Board is welcome the enterprise and skills agencies need to be much more clearly focused on delivering on the strategy;

There is a consistent, commonly held and settled definition of inclusive growth and this should be reflected in the enterprise and skills agencies' operational plans;

There is a robust and appropriately resourced action plan that identifies lead responsibility for key areas of the strategy; and

A comprehensive, monitoring and evaluation framework is in place to measure outcomes and establish what works.

Introduction

there is no single driver of Scotland’s economy, or any other economy; we need to pull dozens of different levers at different times and in different ways. Projects and programmes need to be delivered by a range of actors in central and local government, the private sector, the public sector, colleges and universities.

Economy, Jobs and Fair Work Committee 21 November 2017, Richard Marsh, contrib. 15, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11220&c=2042120

The economic success of a country is not the consequence of any one factor, but the result of a range of internal and external influences, shaping the environment in which businesses operate and Governments form policy. It has now been a decade since the beginning of the financial crash and the subsequent 'Great Recession'. It has also been a decade since the introduction of the Scottish Government's National Performance Framework (NPF) which measures performance and progress towards the Scottish Government's economic priorities. We thought that this ten year milestone marked a timely opportunity to look at the performance of the economy as well as future challenges for Scotland’s businesses and households.

The remit of the inquiry was:

To examine Scotland's economic performance since 2007 and understand the reasons for recent trends and divergences in performance between Scotland and the UK as a whole, other regions/nations in the UK, and other countries in the EU. The inquiry will also identify challenges and opportunities facing the Scottish Economy over the next ten years and understand what action is required to make Scotland's economy more inclusive, innovative and international.

we have never lived in a period of such fast change as the one that we live in now and that it will never be this slow again.

Economy, Jobs and Fair Work Committee 27 March 2018, Chris van der Kuyl, contrib. 34, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11456&c=2080751

Our inquiry is intended as a snapshot in time, a broad scan of past performance and future opportunities rather than an in-depth investigation into any one contributory factor. When we launched our inquiry, we were keen to obtain as full a picture as possible of drivers for economic growth as well as inequality and labour market issues. We also wanted to consider how economic performance impacts on household income and businesses' optimism about the future.

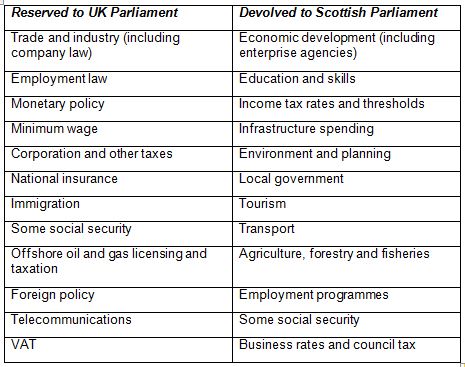

Table 1 (below) lists a number of devolved and reserved areas of legislative competence, which can influence growth, productivity and levels of inequality. Some have been devolved to the Scottish Parliament since 1999, for example economic development and skills/education. Others, such as employment law, immigration and monetary policy are reserved to Westminster.

Despite the restriction of legislative competences, the Scottish Government has broader executive policies relating to the economy, such as promoting trade, inward investment, the living wage and increasing productivity.

The executive summary presents a full list of the Committee's recommendations.

Evidence taking

We held focus groups, a consultation workshop, made visits and took evidence from a range of individuals, businesses and organisations. We aimed to hear a wide range of experiences and views, including households, professionals, entrepreneurs, economists and members of the Scottish Youth Parliament. Links to that evidence and notes of visits are set out in annexes A, B and C of this report. We would like to thank all of those who engaged with the Committee in relation to this inquiry.

The Committee would also like to thank Graeme Roy, Director of the Fraser of Allander Institute (FAI) for offering his experience, knowledge and expertise as the Committee's adviser during this piece of work.

Membership Changes

The membership of the Committee changed during the course of the Committee's inquiry. The Committee would like to record its thanks to:

Richard Leonard (to 23 November 2017);

Daniel Johnson (to 9 January 2018), and

Tom Arthur (to 19 April 2018).

Previous Performance

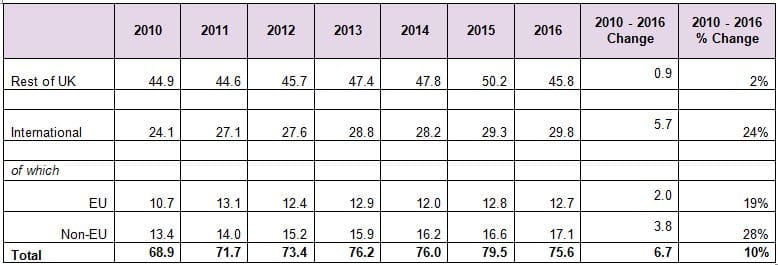

The inquiry has looked at Scotland’s economic performance over the past decade. The reason for choosing 2007 as our base year is that during that year the Scottish Government launched its National Performance Framework, setting a number of economy-related targets.

Many of the Government’s eleven Purpose Targets explicitly focus on the period between 2007 and 2017. With that in mind the Committee feels now is a good time to examine how Scotland’s economy has performed through the prism of these indicators.

The Purpose Targets of particular interest to our inquiry are:

To raise the GDP growth rate to the UK level.i

To match the GDP growth rate of the small independent EU countries by 2017.

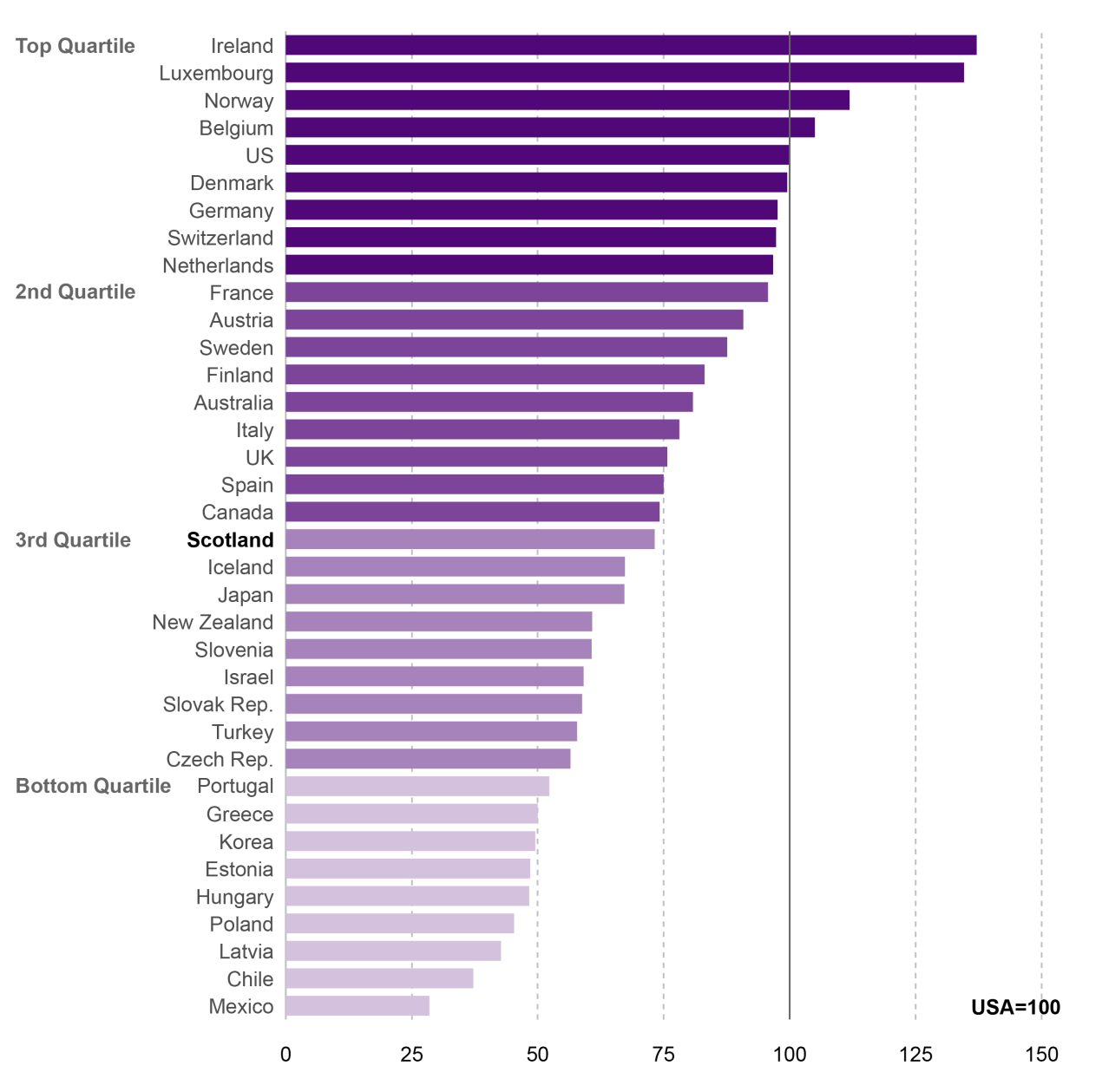

To rank in the top quartile for productivity against our key trading partners in the Organisation for Economic Co-Operation and Development (OECD) by 2017.

To maintain our position on labour market participation as the top performing country in the UK.

To close the gap (in terms of employment rates) with the top five OECD economies by 2017.

To narrow the gap in (labour market) participation between Scotland's best and worst performing regions by 2017.

To increase overall income and reduce income inequality by 2017.

| Purpose Target | Currently meeting target? | Progress |

|---|---|---|

| To raise the GDP growth rate to the UK level | No | UK growth higher in each of the last 14 quarters |

| To match the GDP growth rate of the small independent EU countries by 2017 | No | Growth in small EU countries has been higher than Scottish growth for each of the last 12 quarters |

| To rank in the top quartile for productivity against our key trading partners in the OECD by 2017 | No | In 2016, Scotland sat in the third quartile |

| To maintain our position on labour market participation as the top performing country in the UK | No | Currently Scotland is second to England in terms of employment rate |

| To close the gap (in terms of employment rates) with the top five OECD economies by 2017 | No | The gap widened between 2007 and 2016. |

| To narrow the gap in (labour market) participation between Scotland's best and worst performing regions by 2017 | No | The gap widened between 2007 and 2017. |

| To increase overall income and reduce income inequality by 2017 | Yes and no | Household income has increased; however so has inequality (up to 2015/16) |

The following section will assess, in more detail, Scotland’s performance against these targets.

GDP Growth Rate

At the heart of the 2007 NPF is the Scottish Government’s central Purpose of “increasing sustainable economic growth”. By “growth” the Scottish Government means an increase in the value of all goods and services produced in Scotland, as measured by Gross Domestic Product (GDP).

There are two Purpose Targets relating to GDP growth. The first looks at Scotland’s performance compared to overall UK performance. And the second looks at Scotland’s GDP growth rate in relation to that of a number of small European countries.

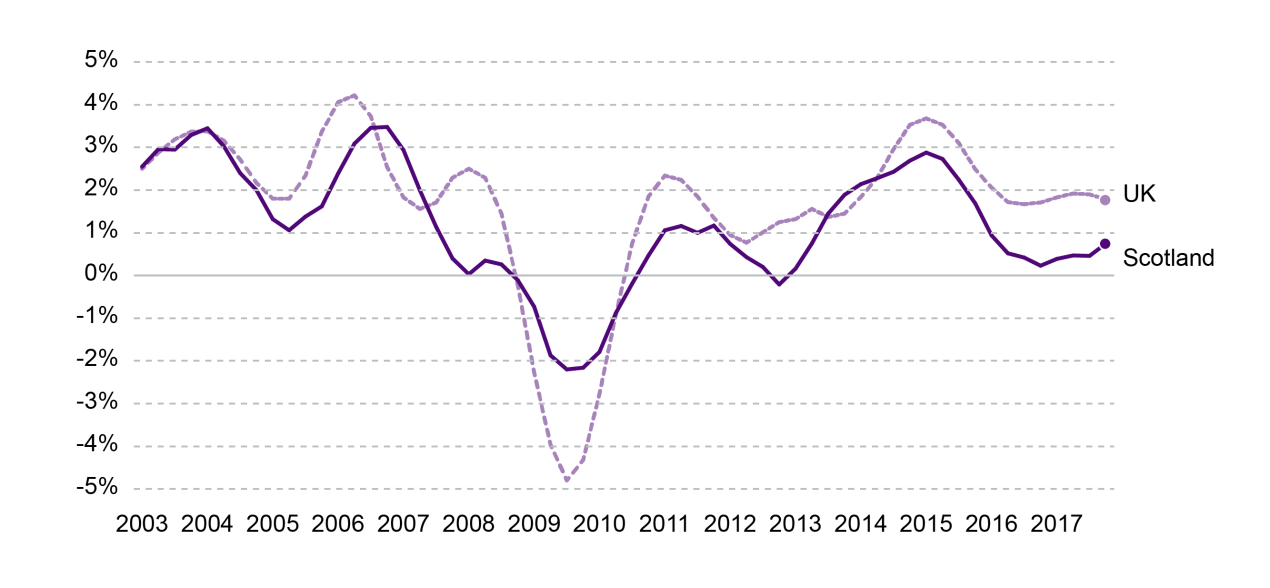

As shown in Figure 1, for most of the last ten years UK GDP has grown at a faster rate than Scottish GDP. This has been particularly striking over the past four years, with UK growth being higher than Scottish growth every quarter since quarter 2 2014.

| Scotland | UK | |

|---|---|---|

| 2007 | 0.4 | 2.4 |

| 2008 | -0.1 | -0.5 |

| 2009 | -2.2 | -4.2 |

| 2010 | 0.5 | 1.7 |

| 2011 | 1.2 | 1.4 |

| 2012 | -0.2 | 1.5 |

| 2013 | 1.9 | 2.0 |

| 2014 | 2.7 | 3.1 |

| 2015 | 1.7 | 2.4 |

| 2016 | 0.2 | 1.9 |

| 2017 | 0.8 | 1.8 |

A number of witnesses spoke about Scotland’s low growth rate over the past decade. It is true that for some sectors – food and drink, tourism, life sciences, the video games industry – growth has been encouraging; however, other areas of the economy such as the oil and gas industry, construction and retail have not fared so well.

Of course, Scotland is one part of the United Kingdom economy, a fact acknowledged by Michael Jacobs, director of the IPPR Commission on Economic Justice:

Scotland is doing better than most of the English regions, Wales and Northern Ireland, but the gap between London and the south-east and the rest of the economy is very great.

Economy, Jobs and Fair Work Committee 16 January 2018 , Michael Jacobs (Institute for Public Policy Research), contrib. 67, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11308&c=2055922

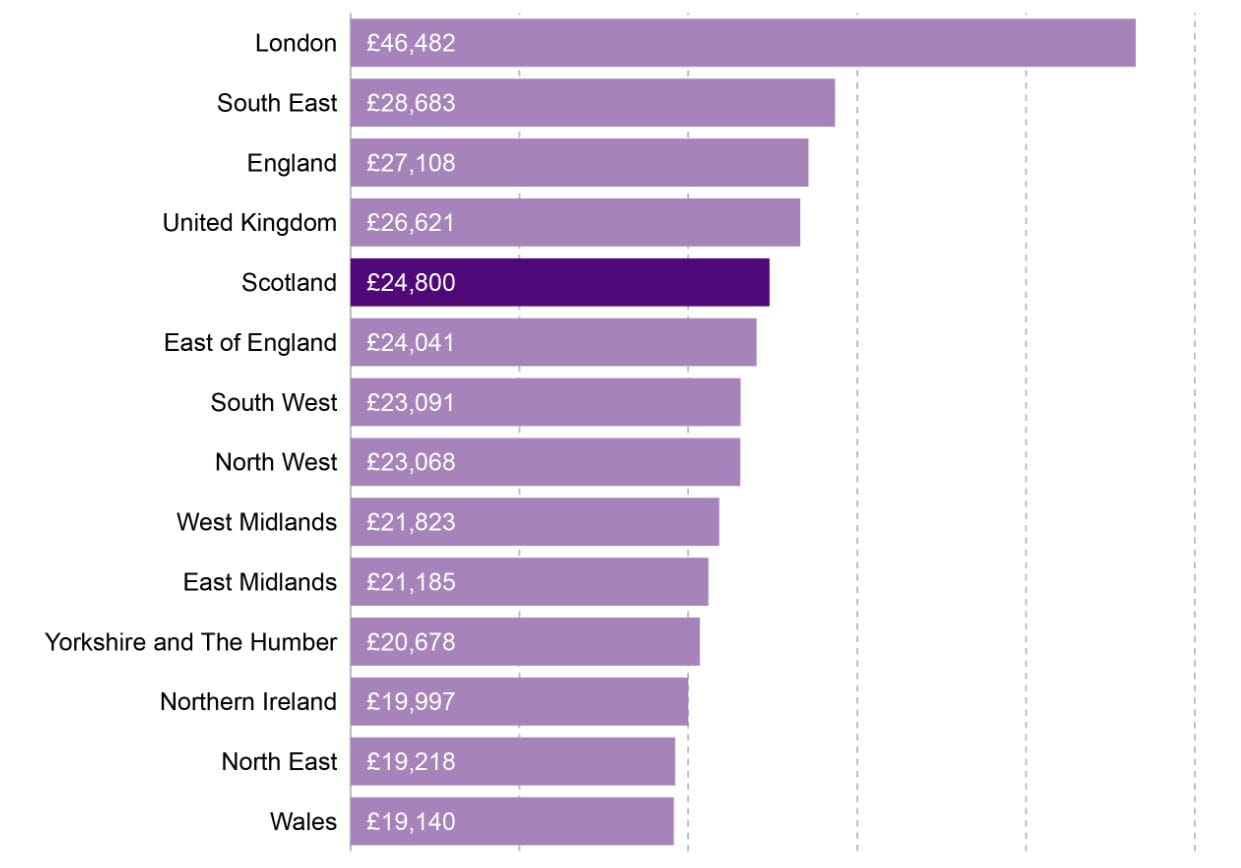

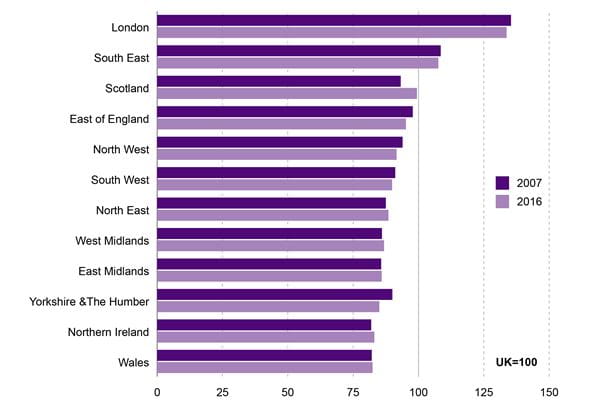

Although recent years have witnessed a slowing of Scotland’s growth rate, output per head still compares favourably to other regions of the UK. Using Gross Value Added (GVA) per head as a measure, Scotland ranked third out of the twelve regions of the UK in 2016.i

Commissioner David Wilson of the Scottish Fiscal Commission confirmed that “Scotland is on or around the same level of GDP per capita as the UK as a whole."2 Nevertheless, Michael Jacobs reminds us that the UK as a whole over the past few years “has been—and is—performing pretty disastrously."1 He attributes much of this to the UK Government’s austerity policies which, he argues, has led to “a massive withdrawal of demand over the past eight years.”4

Within a Scotland-specific context, Professor Sara Carter believes that over the past 10 years, “everything that we see has been shaped by the financial crisis of 2008-09.”5

Small EU Countries

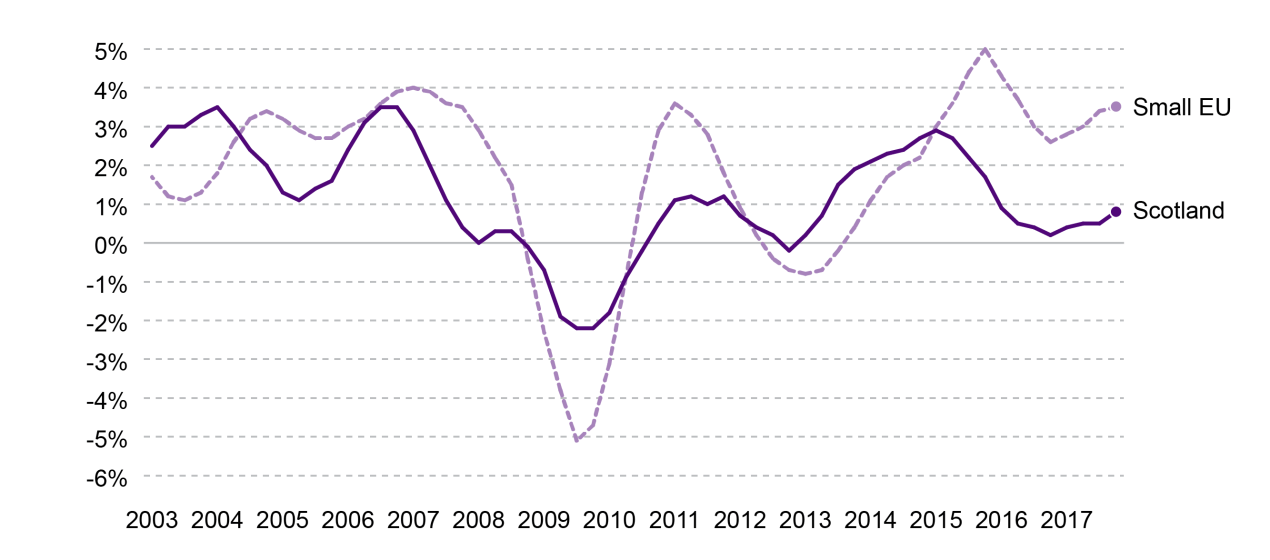

The one other Purpose Target focusing on GDP growth looks at Scotland’s performance compared to a range of small independent EU countries, as selected by the Scottish Government (namely Austria, Denmark, Finland, Ireland, Luxembourg, Portugal and Sweden).

Again, average GDP growth across this group of nations has generally outpaced Scotland for most of the past decade. And, similar to the gap between Scottish and UK growth, there has been a growing divergence in performance since 2014/15.

Much of this recent gap may be due to the remarkable post-recession Irish economy which saw growth of 44% between 2014 and 2017. However, as highlighted by the Fraser of Allander Institute in a recent blog post, "Ireland benefits from a number of multi-nationals operating out of Dublin. The activity of these firms significantly boosts Irish GDP. But in reality, quite often only a fraction of this makes its way into the incomes of the Irish people. Instead, the profits are transferred back to head-offices and investors in the US and elsewhere".

| Year | Scotland | Small EU |

|---|---|---|

| 2003 | 3.3% | 1.3% |

| 2004 | 2.0% | 3.4% |

| 2005 | 1.6% | 2.7% |

| 2006 | 3.5% | 3.9% |

| 2007 | 0.4% | 3.5% |

| 2008 | -0.1% | -0.4% |

| 2009 | -2.2% | -4.7% |

| 2010 | 0.5% | 2.9% |

| 2011 | 1.2% | 1.8% |

| 2012 | -0.2% | -0.7% |

| 2013 | 1.9% | 0.4% |

| 2014 | 2.7% | 2.2% |

| 2015 | 1.7% | 5.0% |

| 2016 | 0.2% | 2.6% |

| 2017 | 0.8% | 3.5% |

Productivity

Productivity can be measured by dividing GDP by the total number of hours worked over a year. This is the preferred measure of the Scottish Government and the one used in its productivity Purpose Target.

When this Target was set in 2007, the Government aspired to raise Scotland’s productivity to levels seen in the top performing countries of the OECD. Although figures are currently only available to 2016, it is unlikely that the target of ranking in the top quartile by 2017 will be met.

In terms of our ranking alongside the 35 OECD countries, Scotland’s relative performance has changed little over the past decade. Indeed, Scotland was ranked 19th out of 36 in 2007 – exactly the same position we currently hold. The Scottish Government’s Enterprise and Skills Review interim strategic plan estimates that Scotland needs an increase in GDP per hour worked of £9.60 (+27%) to reach the OECD top quartile.

Scotland’s relatively low productivity compared to other OECD countries has been discussed throughout the course of the inquiry, with a number of theories put forward as to why Scotland is not much more productive than it currently is.

A number of witnesses, for example Professor John McLaren, Graeme Jones and Professor Sara Carter, highlighted the impact of the financial and oil price crises on two of our most productive sectors and therefore the economy as a whole. Others commented on the need for more medium-sized and large companies in Scotland (currently fewer than 2% of all private sector enterprises employ more than 49 people).i As larger companies tend to be more productiveii and are also more likely to export,i witnesses such as Professor Carter and Professor McEwan felt further work needs to be done to support the scaling up of companies with growth ambitions.

To become more productive in international standards witnesses said Scotland needs to focus efforts across all sectors and all regions, not just those seen as having high growth potential. Professor Julia Derby, Michael Jacobs, Sara Carter and Professor Catia Montagna all stressed the importance of productivity improvements being made in “non-frontier" companies, or the “everyday economy”1where the vast majority of people work. Michael Jacobs referred specifically to firms working in retail, wholesale, hospitality, food and drink and light manufacturing: “the problem for those companies is not that they need to be at the frontier of technological innovation—that is not what they do—but that they need to adopt innovation”.

If Scotland suffers from relatively low productivity levels, then this is also a problem for the UK as a whole, as acknowledged by Michael Jacobs and the UK Government’s Industrial Strategy. The Committee heard that compared to other countries/regions of the UK, Scotland is actually performing well. Even without North Sea oil and gas extraction, Scotland is still the third most productive of the 12 regions of the UK, with productivity sitting just below the UK average. Indeed, only London and the South East of England are more productive than Scotland.

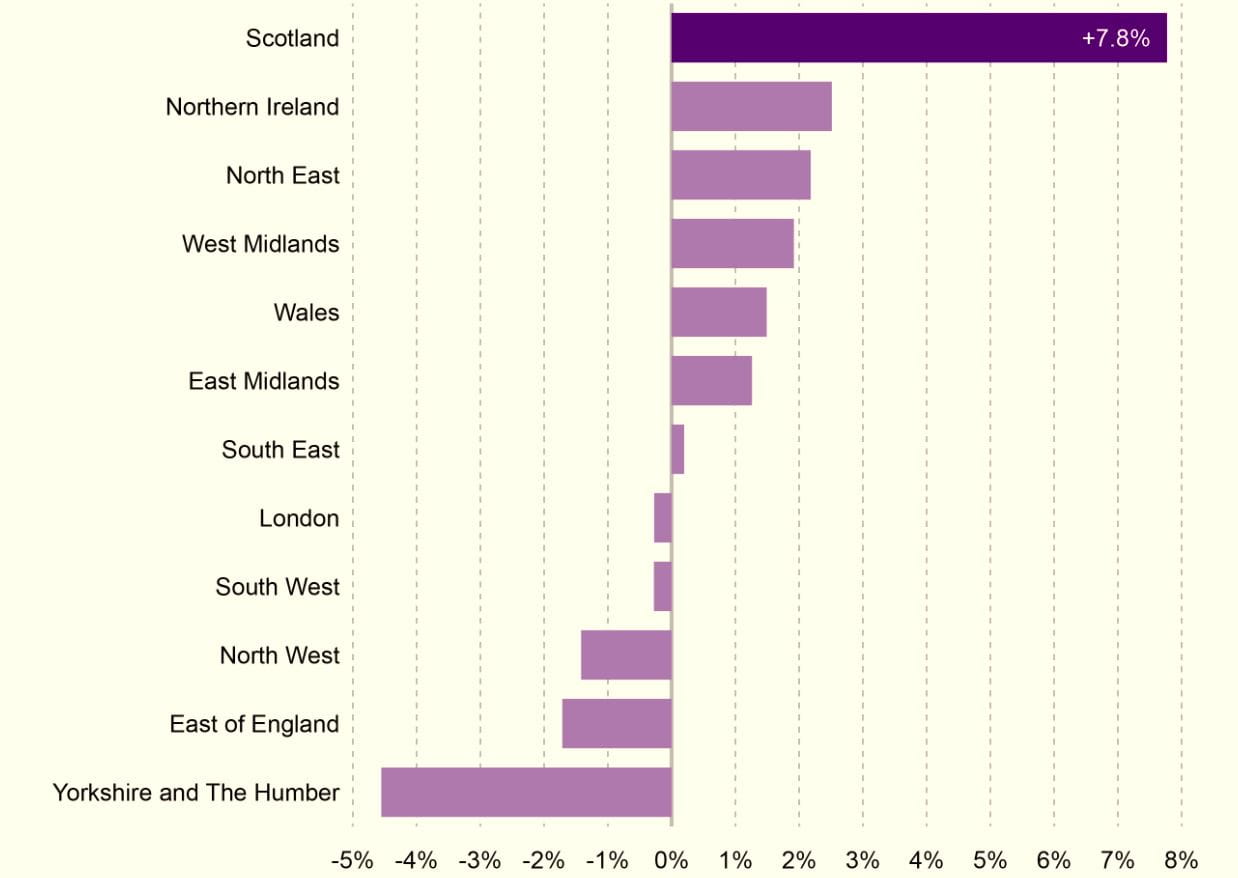

Furthermore, Scotland’s productivity grew by 7.8% between 2007 and 2016 (in real terms), a growth rate higher than that seen in any other country or region of the UK:

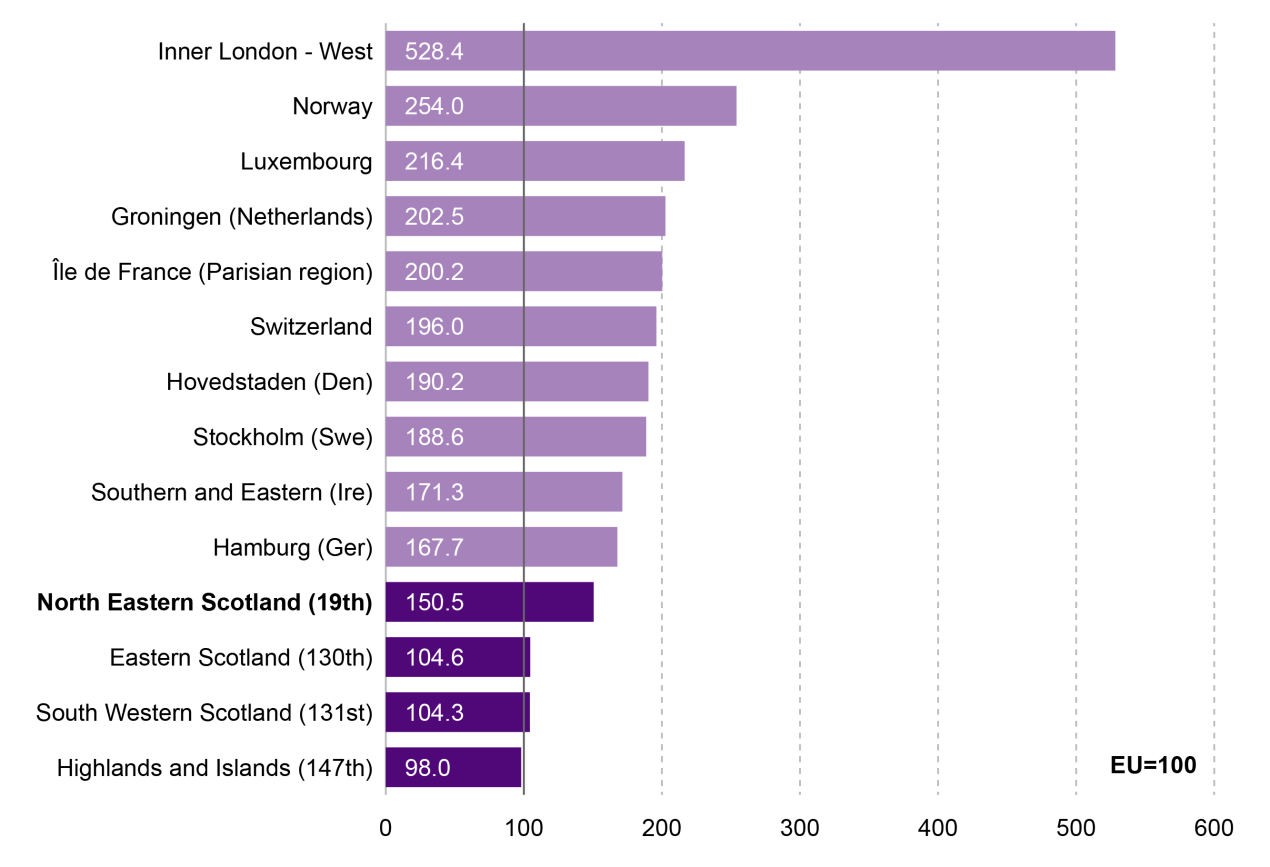

Research conducted by SPICe, shows that three of Scotland’s four NUTS 2 regions – North East, Eastern Scotland and South Western Scotland – all display above average EU productivity levels. Indeed, the Aberdeen and Aberdeenshire area ranked 19th of all the 266 EU regions in 2015:

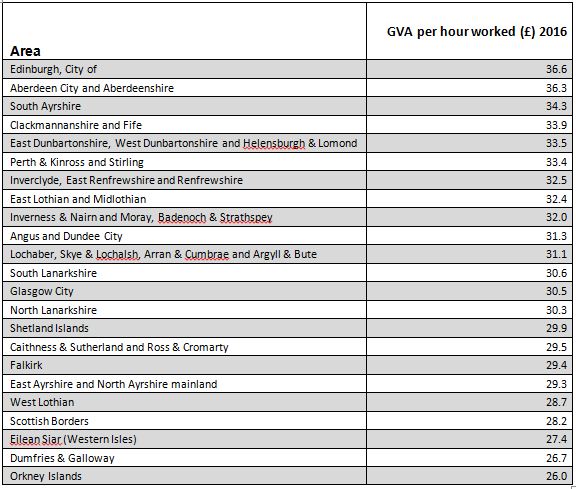

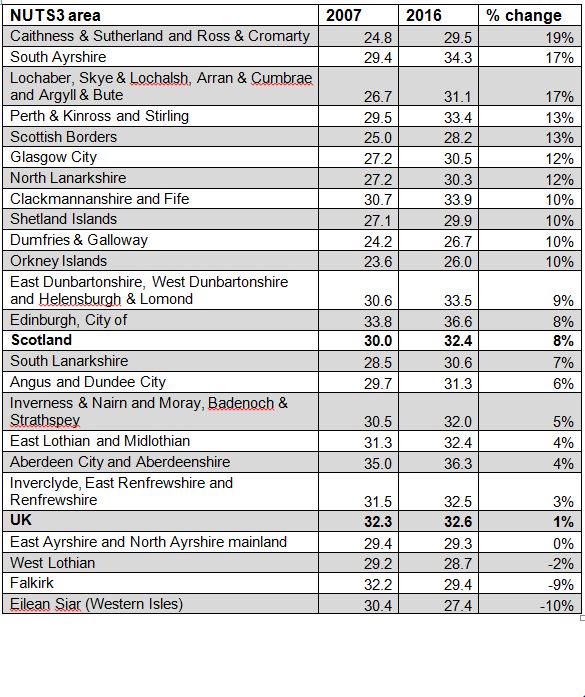

As illustrated above, there is significant variation in the productivity levels across the various regions of Scotland. This is also striking when we look at the more localised NUTS 3 areas, of which there are 23 in Scotland.

The figures below also show that productivity in the top NUTS 3 performing area, Edinburgh City, was 13% above the average (£32.4) in 2016, whilst the level in Orkney, the least productive area, was 20% below.

When comparing the percentage change in productivity over the period 2007-2016, the above table shows that of the 23 Scottish NUTS 3 areas 19 grew faster than the UK average growth rate. The area seeing the fastest growth in Scotland was Caithness & Sutherland and Ross & Cromarty which saw productivity grow by 19% over the period (adjusted for inflation).

The number of areas with higher productivity levels than the UK average has trebled over the last 10 years. In 2007, only two areas - Aberdeen/Aberdeenshire and Edinburgh - saw GVA per hour levels above the UK average. In 2016, there were six areas: Aberdeen/Aberdeenshire, Edinburgh, South Ayrshire, Clackmannanshire and Fife, the Dunbartonshires and Perth/Kinross/Stirling.

Participation

There are three Purpose Targets in the National Performance Framework relating to labour market participation. For example, the Scottish Government focuses on employment rates in its target “to maintain our position on labour market participation as the top performing country in the UK”.

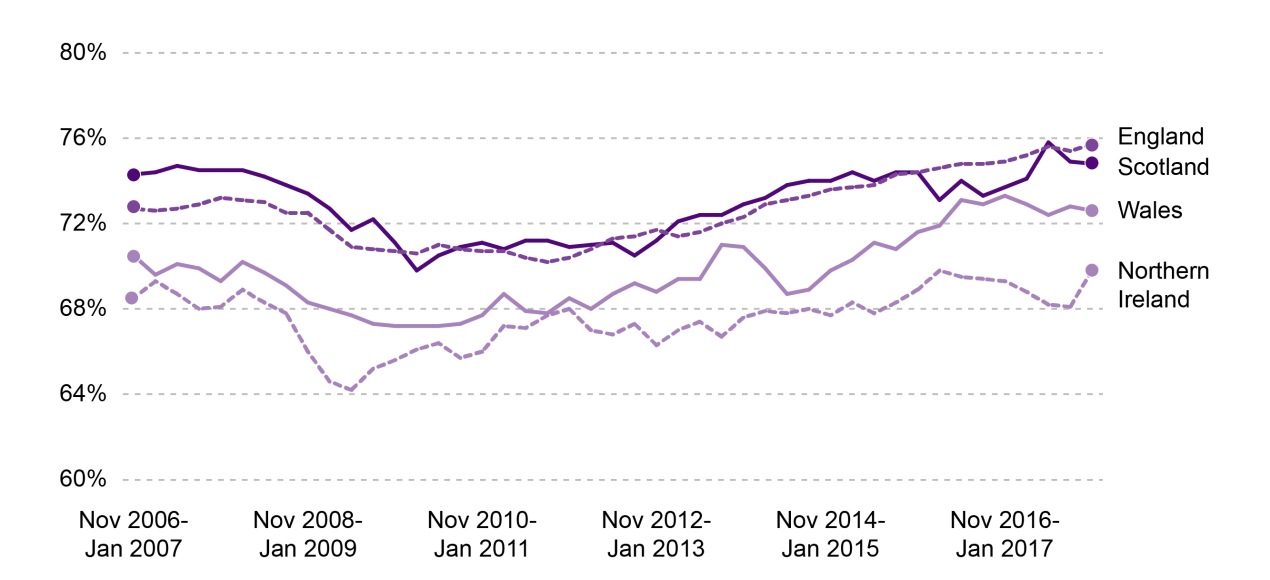

Most witnesses praised Scotland’s resilient labour market over the past decade. As is evident in Figure 8, for most of the period between 2007 and 2017 Scotland has been the top performing country of the UK in terms of its employment rate. However, since Quarter 1 2016 Scotland’s employment rate has been slightly below the English rate. The most recent figures taken from the Labour Force Survey, for period February to April 2018, show that Scotland's employment rate is currently 0.8 percentage points below the rate for England.

| 16-64 employment rate (%) | |

|---|---|

| England | 76.0 |

| Scotland | 75.2 |

| Wales | 73.3 |

| Northern Ireland | 69.7 |

Scotland also has the second lowest rate of economic inactivity of all the countries of the UK, with 21.4% of 16-64 year olds being out of work and not looking/available for work.

| Economic inactivity rate (% of 16-64 year olds) | |

|---|---|

| Northern Ireland | 27.9 |

| Wales | 23.2 |

| Scotland | 21.4 |

| England | 20.6 |

John McLaren highlighted increased levels of self-employment and part-time employment in Scotland, and across the UK as a whole, over recent years.1 Indeed, the most recent Annual Population Survey figures for 2017 show that 50,000 more people work part-time in Scotland than in 2007, whilst the number of people working full-time reduced slightly (by 2,500). Likewise, the number of self-employed people increased by 40,000 over the period, an increase of 15%. Professor Catia Montagne believes that “the majority of the jobs that have been created in the past few years are either self-employed jobs—and we are talking not about Rockefeller self-employed but about zero employee firms and people not making much of their enterprise—or temporary jobs”.2

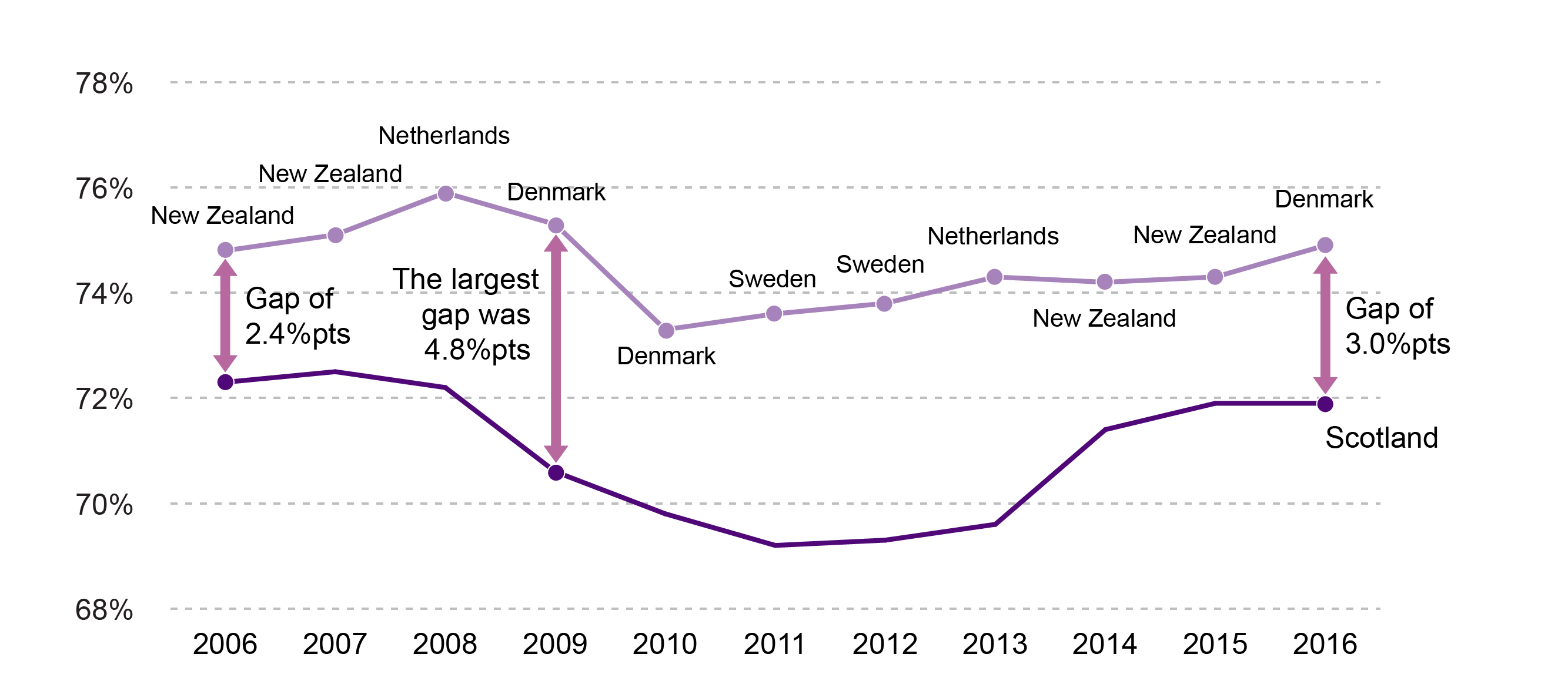

The Scottish Government also set a Purpose Target to close the gap (in terms of employment rates) with the top five OECD economies by 2017. As can be seen in Figure 9 (below), the gap between Scotland and the fifth best performing country in the OECD has not closed. The difference between Scotland and Denmark’s employment rate was 3.0 percentage points in 2016, whilst the gap between Scotland and New Zealand (the fifth best performer in 2006) was 2.4 percentage points. The Scottish Government’s Enterprise and Skills Review interim strategic plan estimates that Scotland needs 85,000 more people to participate in the labour market to reach the OECD top quartile.

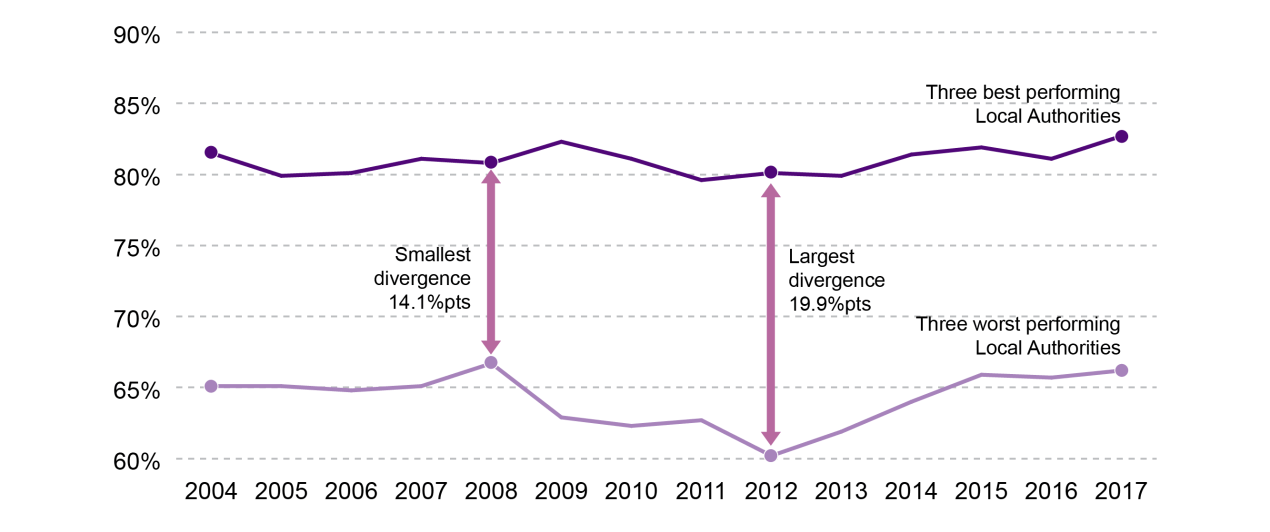

The final Purpose Target relating to employment looks at regional performance within Scotland. This is the Scottish Government’s Cohesion target which aspires to narrow the gap in labour market participation between Scotland's best and worst performing regions. The reason given for including this indicator is that the “benefits of economic growth should be enjoyed across the whole of Scotland… differences in income, participation and growth across Scotland act as a drag on our collective economic performance and potential”.

Figure 10 (below) shows that the gap between the best performing local authority areas in Scotland and the worst, in terms of employment rate, actually widened between 2007 and 2017. In 2007, the employment rate for the combined Orkney, Shetland and Aberdeenshire local authority areas was 81.1%, whilst the combined rate for Glasgow, Inverclyde and Clackmannanshire was 65.1%. This represents a gap of 16.1 percentage points. In 2017, the gap between the same top three areas and the new bottom three (Glasgow, Dundee and North Ayrshire) was 16.5 percentage points.

Regional disparities in employment rate exist within many European countries. For example, in Norway there is an 11 point difference between the best performing county and the area with the lowest employment rate. In Germany, 15 percentage points separate the best and worst performing districts.

It is also worth noting that the employment rate for Scotland overall did actually rise over the period - by 0.4 percentage points - with 51,000 more people in work now than ten years ago. However, it is also clear that not all areas of Scotland have benefited equally.

Solidarity - income inequality and household income

The Scottish Government’s Solidarity Purpose Target focuses on two indicators: increasing overall household income and reducing income inequality by 2017. These are important to the Government for the following reasons:

“…international evidence suggests that increased income inequality can be detrimental to a country's economic performance. It is important for society, because more equal societies tend to be more cohesive. It is important for individuals, who want to be treated fairly and be able to fulfil their potential.”

Professor Catia Montagna concurs, referring to data showing “a strong correlation between the degree of inequality in a country and the ability of the country to recover from recession, so countries that have done better in that sense are countries that have a much lower inequality.”1

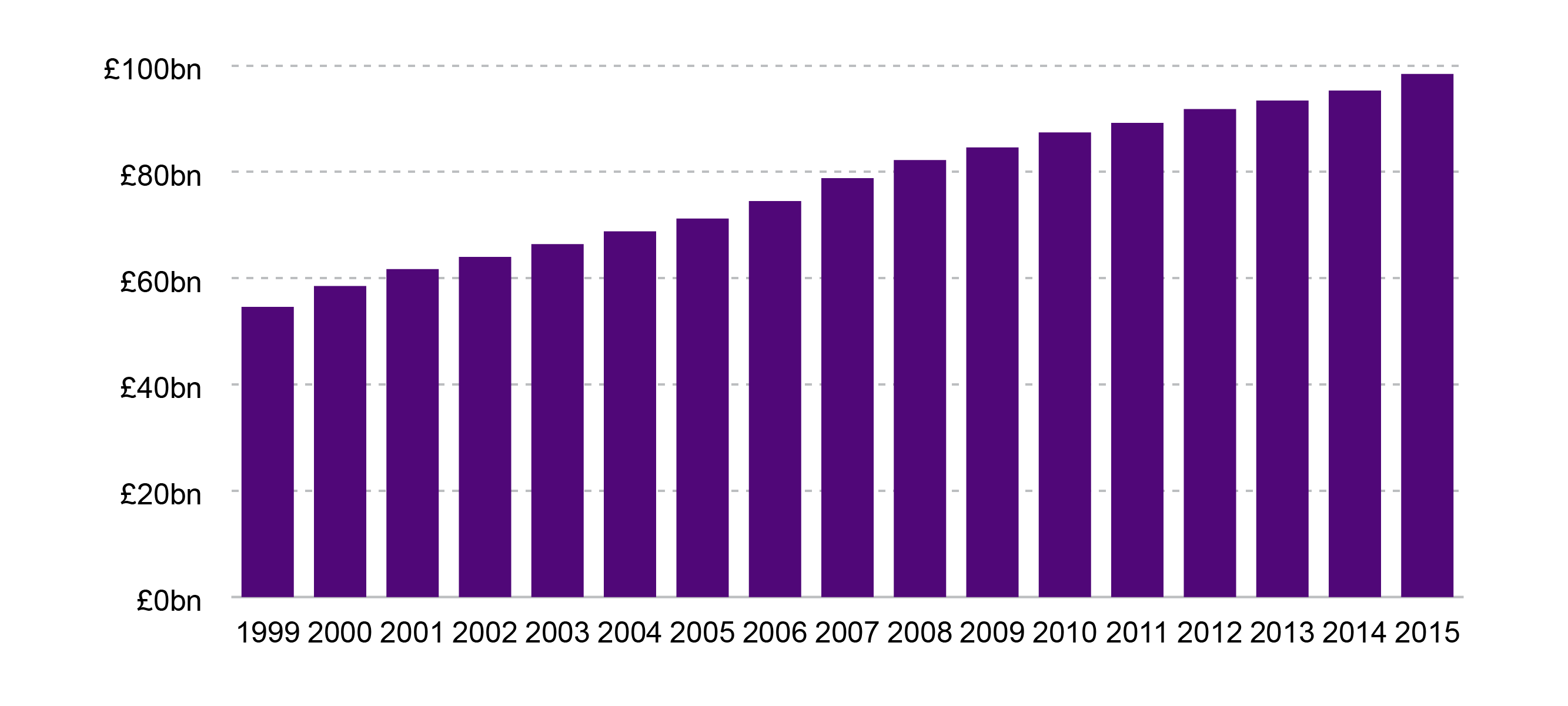

The following chart shows the proportion of total income that goes to the top 10% of earners in Scotland compared to the proportion going to the bottom 40%. This is set out as a ratio, known as the Palma Ratio. It demonstrates inequality of income (not wealth); so when the ratio rises, the level of income inequality is increasing; when it falls, income inequality is said to be decreasing.

After falling dramatically between 2009/10 and 2010/11, the proportion of income going to Scotland’s highest earners rose and is now larger than it has been since the data series began in 1999. Data for the end point of the target period, year 2017/18, won’t be available until summer 2020. So, it is too early to say whether or not this Purpose Target has been met.

The Scottish Government’s 2015 Economic Strategy attempted to place Scotland’s inequality levels within an international context: “of the 34 OECD countries, the UK ranked 29th in terms of income inequality – in other words, the 6th worst…Whist income inequality in Scotland is closer to the OECD average than the UK, Scotland is still more unequal than many other countries and would rank 20th”. The Scottish Government’s Enterprise and Skills Review interim strategic plan estimates that Scotland needs to reduce income inequality by 13 percentage points to reach the OECD top quartile.

Michael Jacobs believes that lower levels of income inequality seen in other European countries can be partly explained by the very different types of labour market across the continent:

Within Europe, Germany has a very different kind of labour market...and Sweden’s is rather similar to it. The structure of the labour market in those two countries and in some other Scandinavian countries has two features, both of which we have moved away from in the UK. The first is that they have quite a lot of labour market regulation, which is largely about requiring employers to have minimum standards for wages and particularly on things such as how overtime is paid and benefits. That is combined with relatively high levels of trade union density. That is not the case throughout the German economy but it is in parts of it, and the levels are certainly higher in Sweden, and that gives workers a kind of bargaining power in the labour market.

Economy, Jobs and Fair Work Committee 16 January 2018 , Michael Jacobs, contrib. 97, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11308&c=2055952

The second element of the Scottish Government’s Solidarity target relates to total household income, which includes earnings from work or property ownership, plus welfare benefits. Figure 12 shows that total household income has increased steadily since 1999 and is now 25% higher (in real terms) than in 2007. However, it is clear from the inequality discussion above that these increases have not been distributed equally across society.

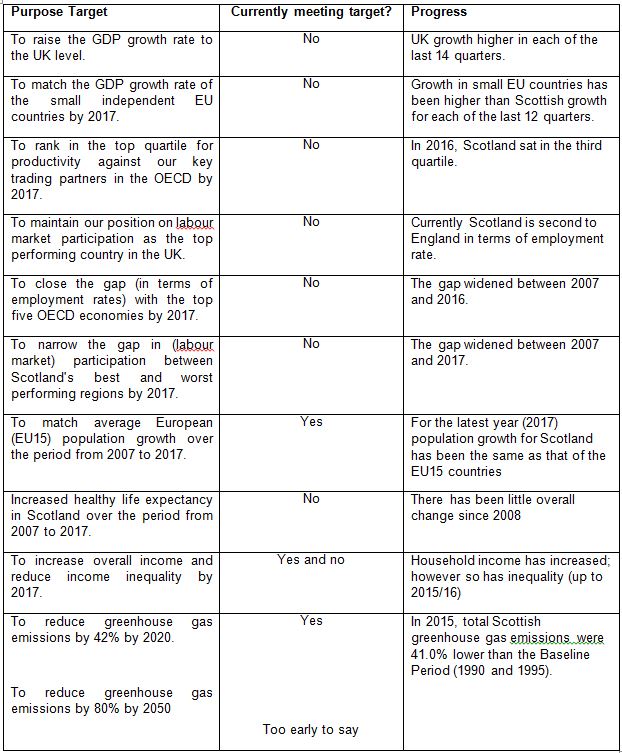

Export Targets

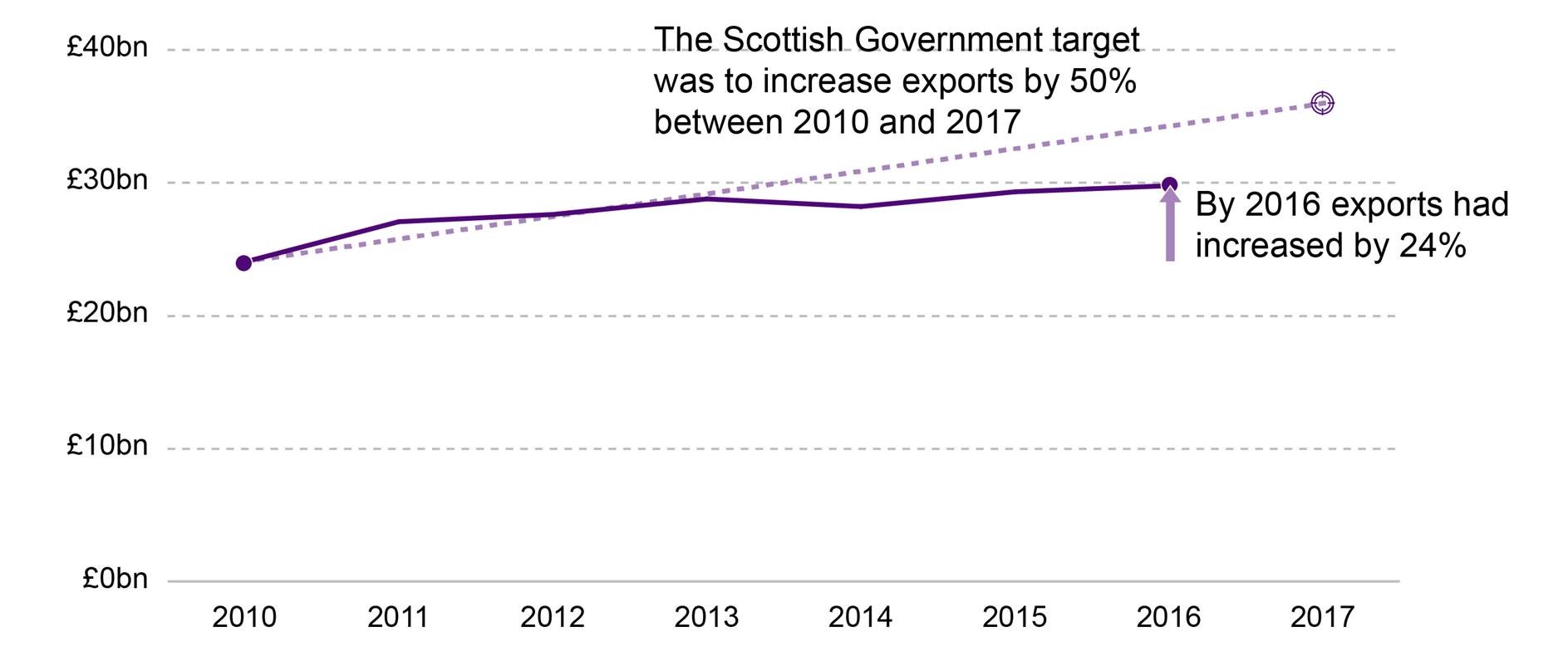

Although not a Purpose Target, the Scottish Government did set an exports target within its 2011 Economic Strategy. This is for Scottish businesses to have delivered a 50% increase in the value of international exports by 2017 (with the base year being 2010). Internationalisation is also one of the “four Is” of the most recent economic strategy, with the Government stating:

“Increasing exports is also key to rebalancing Scotland’s economy. As well as having positive implications in terms of the resilience and sustainability of economic growth, there is evidence that companies that are exposed to international investment and competition become more productive.”

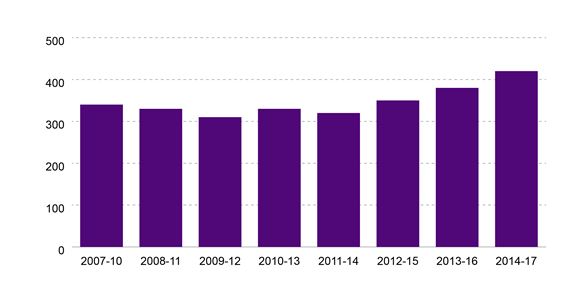

The following chart therefore shows the value of international exports (i.e. not including trade with the rest of the UK) for each year between 2010 and 2016. In line with the original target, these values have not been adjusted for inflation.

Between 2010 and 2016 (the most recent data available), the value of Scotland’s international exports grew by 24%. As highlighted by the Fraser of Allander Institute in a recent blog post, “this implies that we need growth of over 20% (or £6.3 billion) next year if Scotland is to meet the 2011 target”. In other words, this target is unlikely to be met.

Giving evidence to the Committee in February, Nora Senior Chair of the Strategic Board for Enterprise and Skills, also informed us that “we need 5,000 more companies to move into exports in order for Scotland to move into the OECD upper quartile.”1 It was acknowledged throughout the inquiry that Scotland depends on a small number of larger companies to drive our export activity. Professor Sara Carter concluded that “we must get those currently small firms to a state in which they can contribute more to productivity and exporting in the overall economy”.2

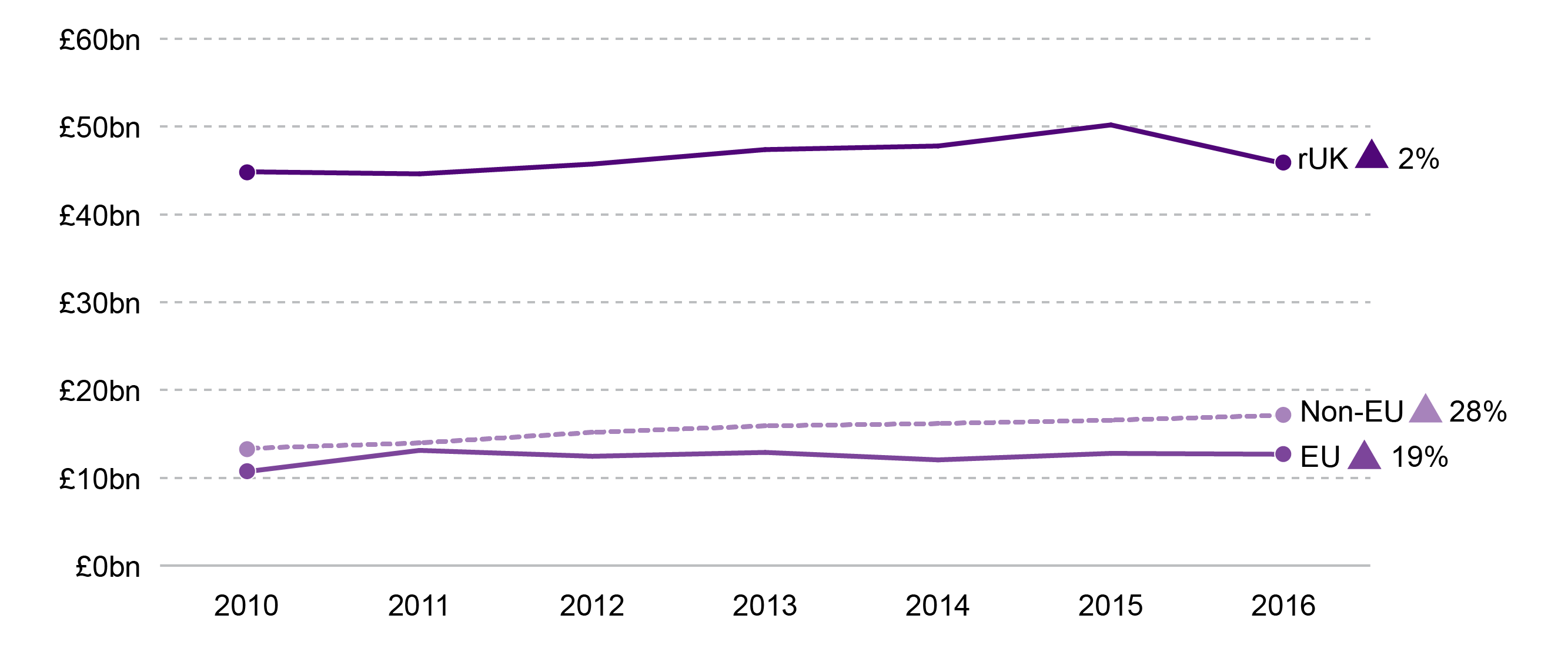

The Scottish Government publishes a breakdown of international exports statistics by main market, for example EU and non-EU markets. In 2016, exports to EU destinations totalled £12.7bn and exports to non-EU destinations were £17.1 bn. The following chart shows that between 2010 and 2016 exports to EU countries increased by 19%, whilst non-EU exports grew by 28%.

The Committee was keen to understand changes in the value of exports to the rest of the UK (rUK). The above chart shows that between 2010 and 2016 these grew by 2% (not inflation adjusted). Nevertheless, the value of rest of UK exports (£45.8bn) is still considerably higher than total international exports (£29.8bn).

All exports data used originates from the Scottish Government's annual Exports Statistics Scotland publication.

Purpose Targets

Scotland is a wealthy and prosperous country. There are areas where we have performed well, but as highlighted by the benchmarking of the Purpose Targets, there have also been challenges. In summary, as stated by the Cabinet Secretary for Economy, Jobs and Fair Work:

There has been a mix of targets. Some have been achieved and some have not. All have been affected by global circumstances through the recession, austerity and the 2014 downturn in the price of oil and gas.

Economy, Jobs and Fair Work Committee 22 May 2018 [Draft], The Deputy Convener, contrib. 6, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11549&c=2094633

The Cabinet Secretary also stated that local authorities and the UK Government have a role in whether or not targets are met. He said that targets should be made in areas where it is within the Scottish Government's powers to realise those targets.2

The Committee acknowledges that external factors can impact on whether or not targets are met.The Cabinet Secretary said:

It is perfectly legitimate for Governments to set targets for economic growth—indeed it is desirable to do so—but a greater appreciation of the factors that will contribute to that and the extent to which the Government can be responsible for achieving it is also important.

Economy, Jobs and Fair Work Committee 22 May 2018 [Draft], Keith Brown, contrib. 65, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11549&c=2094692

However, measurement and evaluation were key themes in our evidence-taking. In response to the Scottish Government's consultation on National Outcomes, the Committee expressed concerns over the lack of detail in the new approach to measurement of economic impact if purpose targets are to be removed:

How will the impact of policy be measured if we are moving away from the previous specific time-based purpose targets? What will the benchmark be? Can the Scottish Government clarify how policy is to be tracked and monitored under the new framework?i

As stated in its response to the Scottish Government's consultation on National Outcomes, the Committee has concerns about the ability to measure policy impact under the new performance framework.

We have noted the influence of overarching challenges and opportunities, which will impact future performance of the economy throughout this report and also note the unquestionable impact that factors such as the financial crisis had on past performance.

Challenges and Opportunities

this is a time of exciting opportunity for all parts of the United Kingdom. Around the world, industries are being transformed by new technologies. The ways in which we work, live and consume products and services are changing, and it so happens that the UK—and, in many particular respects, Scotland—is uniquely well placed to benefit from that.

Economy, Jobs and Fair Work Committee 19 April 2018, Rt Hon Greg Clark MP (Secretary of State for Business, Energy and Industrial Strategy), contrib. 3, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11477&c=2084006

The people of Scotland - policymakers, businesses and citizens alike - are united in their desire to see Scotland's economy thrive. We therefore wanted to focus our inquiry on identifying the challenges and opportunities that face the Scottish economy. We mirrored our evidence-taking on the areas that the Scottish Government sees as having the greatest influence; namely the four "I"s of innovation, internationalisation, investment and inclusive growth, outlined as key objectives in the 2015 Economic Strategy.2 We looked at the role of the enterprise and skills agencies in stimulating success in these areas and the overarching channelling of support towards the Scottish Government's identified growth sectors. We also considered how success is measured and evaluated.

The Scottish Fiscal Commission (SFC) gave evidence to the Committee on its economic forecasts, concluding that "subdued " economic growth should be expected over the next five years. The SFC highlighted that "since the financial crash, overall growth has been weak by international and historical standards. That has also been the case at United Kingdom level and internationally."3 SFC Commissioner, David Wilson, commented that industries such as oil and gas and construction "are unlikely to provide the boost to economic activity that they did in the early part of the decade."3 He emphasised the importance of underlying productivity and population projections, as well as the UK's changing relationship with the EU, which was also factored in the SFC forecasts. Finally, the SFC reflected on the historically low levels of unemployment.

In its recent report, setting out its five-year forecasts for the Scottish economy, the SFC stated that, "the latest outlook for the Scottish economy remains subdued, with growth remaining under 1.0 per cent for the period of the forecast".

Witnesses highlighted a number of areas where they felt there was great potential for future economic growth, and others that pose challenges. Population size, regional variance, skills shortage and infrastructure were all cited as limiting factors. Our business sphere is predominantly made up of small enterprises and there is a lack of big businesses to act as role models, investors and pacesetters leading the way into international markets. Technology too acts as both a challenge and opportunity and our economic performance should be considered within the context of societal and technological change. As Richard Marsh, Director of 4-Consulting said, there are many levers that jointly contribute to performance and there are no quick fixes or easy answers.5

The concept of economic growth and how it is measured is also contentious. For some the focus should be on growing GDP, yet most think that capturing additional measurements would help us gain a fuller picture of performance. Several witnesses told us that productivity is key to economic growth and many thought that well-being and the distribution of wealth should also be indicators.

We have followed the growth journey of Scotland's businesses, looking at start-up entrepreneurs, the SME composition of the labour market, scale-up and acquisition.

Entrepreneurship and start-ups

Firstly, we turn our attention to the business journey from start-up to scale-up. Chris van der Kuyl, Chairman of 4J Studios told us that barriers which existed in the past when looking to startup a business were no longer an issue. He said investment used to be a challenge for entrepreneurs, but there are now fantastic entrepreneurial support networks for start-ups and business angels who will provide capital. He felt the main problem is signposting people so that they can find the information and support required.1

Awards such as Scottish EDGE and Converge Challenge were viewed favourably by entrepreneurs who felt that the flexible support and finance offered by these programmes has helped encourage growth in early-stage companies.

Despite the growth in start-up companies, witnesses thought more could be done to encourage an entrepreneurial mindset. The Committee was told that we need more people who want to be entrepreneurs and this needs to be encouraged through the education system and by parents. Dr Suzanne Mawson of the University of Stirling noted that there is a gap in people's perception of the skills and abilities needed to start a business with many entrepreneurs struggling to translate a good idea into a fully fledged business.2

We heard several examples of how entrepreneurial skills are being introduced to people studying in a variety of disciplines at universities. For example, from autumn every student studying at Robert Gordon University will do a module on entrepreneurship, regardless of the subject. The Committee believes that this should be seen as good practice, but could be extended to include general business and leadership skills. All educational institutions should look at how best to integrate practical entrepreneurial, commercial and problem solving skills into courses. Witnesses representing the life sciences sector also acknowledged that integrating commercial acumen into science courses would be beneficial.

Self-employment

We ran a series of 8 focus groups to hear about experiences and perceptions of the Scottish economy from people in different areas across Scotland. Very few focus group participants had considered starting a business and becoming self-employed as it was generally felt this lacked stability as a career choice. The young people who took part in the Committee's Scottish Youth Parliament workshops and survey also had a negative perception of self-employment, with the majority citing insecurity as the main barrier. Growing up in a post-recession environment has perhaps bred caution among Scotland's young people who value job security and a fair wage above the potential for the more high-risk creativity offered by self-employment.

However, despite this perception self-employment has increased by 66% since 2000. In Scotland more people work for themselves than the number employed by the NHS. The Federation of Small Businesses (FSB) said that the narrative around self-employment is often negative, but 84% of self-employed people think their life is better than it would be if they were an employee. Jim McColl, Founder, Chairman & CEO, Clyde Blowers Capital, disagreed and said high self-employment reflected a lack of high-quality jobs and employment opportunities.3

Jackie Brierton, Vice-Chair of Women's Enterprise Scotland and CEO of GrowBiz, highlighted that the rural self-employment rate is more than double the urban rate. She also said that increases in the numbers of self-employed people and unregistered businesses over the last ten years, make this a key area of potential scale-up over the next ten years. These businesses need help to grow to the next stage.4

The Committee believes that entrepreneurial thinking and the commercialisation of ideas should be encouraged by colleges and universities. Whilst acknowledging that some educational institutions are already doing this, consideration should be given to how best to increase the integration of practical entrepreneurial, commercial and problem solving skills into courses.

Scale-up and the fear of heights

We have a growth issue. In Scotland, we seem to sell our businesses quite early in comparison with many other economies. We seem to have a fear of heights in that respect.

Economy, Jobs and Fair Work Committee 06 February 2018, Professor McEwan, contrib. 213, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11363&c=2064520

The Committee spoke to many entrepreneurs who felt that Scotland was an attractive place to start a new business. Several people said that, if there were one area where Scotland could do better, it would be in scaling-up businesses once they had been successfully established. This was described as a "missing middle" and something that should be of greater concern to government.2

The number of businesses in Scotland has increased dramatically post-devolution, with over 100,000 more businesses now than in 2000. SMEs account for 99% of all businesses in Scotland, with microbusinesses alone accounting for half a million jobs. We have about 20,000 medium-sized businesses and around 198,000 small and microbusinesses in Scotland. Crucially, this structure impacts upon local economies with 4 in 5 private sector jobs in rural areas provided in small and medium sized businesses. Gary Gillespie, Chief Economist at the Scottish Government, told the Committee that Scotland may need to grow more medium sized businesses.3

Nora Senior, Chair of the Strategic Board for Enterprise and Skills, highlighted that some of these microbusinesses are not paying VAT or participating in the pay-as-you-earn system. She said that if these microbusinesses could become small or medium businesses that would have a significant knock-on effect.4

We were told that scale-up takes time and long-term investment. There is not a quick win and cash-flow is essential.

Ambition

I note that one of the big issues, to be blunt, is lack of ambition. If people can make a comfortable living doing what they are doing without taking the risk of expanding their business, an awful lot of people in Scotland will be happy just to do that.

Economy, Jobs and Fair Work Committee 06 March 2018 [Draft], Sandy Finlayson, contrib. 11, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11410&c=2071747

Professor McEwan, Chief Executive of Elevator, told us that too few people in Scotland have experience of growing global companies. He said

the slight immaturity of our entrepreneurs means that they get out while they can—while the going is good—which is often too early.

Economy, Jobs and Fair Work Committee 06 February 2018, Professor McEwan, contrib. 213, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11363&c=2064520

It is not just a question of facilitating growth, companies must have the desire to grow. A report from the British Business Bank said 70 per cent of companies do not want to take on any funding to grow their business, they would rather focus on stability.7

Council of Economic Advisers member, Professor Carter, felt it is incumbent to support small companies to become more ambitious. She argued that whilst tax incentives may be helpful for some firms, targeted initiatives designed to support businesses to develop leadership and management skills and encourage ambition have been found to be particularly effective. This can often be achieved through mentoring and peer learning.8

Support

Once they have passed start-up, there is nothing for them unless they fulfil the criteria for high-growth support. A vast array of missing middle businesses in Scotland cannot access support.

Economy, Jobs and Fair Work Committee 30 January 2018, Jackie Brierton, contrib. 20, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11342&c=2061259

During evidence it became clear that there is a perceived gap in business support for SMEs. As Professor Carter said:

2,000 of the roughly 360,000 enterprises that we have in Scotland are account managed by Scottish Enterprise...Traditionally, an issue with Scottish Enterprise is the thresholds that companies have to reach in order to get on to the account managed programme.

Economy, Jobs and Fair Work Committee 13 March 2018, Professor Carter, contrib. 46, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11425&c=2074976Business Gateway is designed to support start-ups and Scottish Enterprise focuses on high-growth larger companies. This suggests that there may be a gap in the support structure where the majority Scottish businesses lie. The Cabinet Secretary told the Committee that the Scottish Government does not wish to see businesses excluded from receiving support.11

There has been considerable growth in self-employment and the number of unregistered businesses in Scotland. The challenge lies in how these people are moved onto the next stage of the business lifecycle and how this is reconciled with the many businesses that do not want to grow.

In relation to investment and taxation, Gareth Wynn of Oil and Gas UK told us:

"It is important that we maintain the long-term incentives, the political support and the national investment in initiatives such as the Oil & Gas Technology Centre. Our sector deal builds on that support by proposing the creation of centres of excellence. Beyond that, it is important to ensure that, in general, Scotland remains a good place in which to do business. We need the right personal taxation regime, and we need to make Scotland a nice place to live."

12

The Committee notes evidence on the need to ensure that Scotland "remains a good place in which to do business" and asks the Scottish Government to ensure that the Scottish business environment enables businesses to achieve their potential.

Evidence to the Committee suggests that "missing middle businesses" cannot access support to grow. The Committee believes that there is a missed opportunity if we do not give support to businesses that have growth potential and the desire to grow, but that are not currently eligible for Scottish Enterprise account-management support. The Committee asks the Scottish Government to quantify the scale of businesses which fall into the "missing middle" category and to set out to the Committee how it will ensure that these businesses receive the support they need to thrive.

Acquisition

For many businesses, scale-up means finding a suitable succession model or buyer. Instead of growing to become medium or large companies, some entrepreneurs who have started businesses choose to sell them. This acquisition of indigenous firms, often by foreign companies, can be seen as both an opportunity and a challenge for Scottish economic growth.

Witnesses told the Committee that this can be positive in creating a healthy entrepreneurial cycle where business owners sell and move on with new endeavours. Of greater concern, was how we ensure that CEOs, managing directors, employees, skills, talent and supply chains are retained in Scotland.

Jim McColl's concern was not the sale of firms, but the lack of strong Scottish businesses who could invest in smaller Scottish companies. Only 1% of Scottish businesses are considered 'large'. Therefore, there are not many indigenous businesses with the means to buy smaller companies.1

In terms of account-management, Scottish Enterprise look for year on year growth targets to be met in order for a business to receive support. It was suggested by Dr Mawson that by its nature, this attracts the kind of companies that are looking to grow for sale and can mean that investment is then lost abroad. Dr Mawson felt there is a lack of data to track and measure how much capital from a sale is reinvested and therefore not lost from Scotland, but recycled:

Support might be part of the issue...We are giving an awful lot of funding—tons and tons of support, financial and otherwise—to very promising, early-stage businesses only to then help line the pockets of big multinationals and give away our intellectual property and other benefits that should be kept here and should be benefiting Scotland and the Scottish economy.

Economy, Jobs and Fair Work Committee 30 January 2018, Dr Mawson, contrib. 30, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11342&c=2061269

To extend the reach of the call for evidence, the Committee agreed to undertake a digital pilot, seeking the views of university-level economy students on the issues raised by the inquiry via the online platform Dialogue. One submission suggested that funding support should be tied to ‘anchoring’ strategies which ensure expanding enterprises remain in Scotland. They considered this essential to tackling Scotland’s low-rate of domestic headquartered companies, and associated low-rate of business research & development investment, which hinders productivity.

With regard to scale-up, Skyscanner CEO Gareth Williams suggested that we should look to companies who sold at the £5m mark to see the factors that contributed to their decisions. If we research why this trigger exists from first-hand case studies, this could offer a valuable insight for future policy decisions.

The Cabinet Secretary for Economy, Jobs and Fair Work commented on historic issues with companies being headquartered outside of Scotland. He said that high-value jobs were also often located within headquarters and this led to an outflow of income. In his opinion, "Scotland could do far better" in this regard.3

The Committee is aware that in Scotland businesses are often being acquired rather than scaled-up. If the money is reinvested in the Scottish economy, that can be beneficial. However, it can also result in the loss of entrepreneurial role models and experienced people to manage larger scale businesses based in Scotland.

In order to gain a fuller picture, the Committee asks the Scottish Government how many account-managed companies have subsequently been sold and how much is reinvested in Scotland.

The Committee notes that the scale-up of companies has been a long-standing challenge in Scotland. There is a lack of business confidence to do so and the Committee recommends that the Scottish Government sets out how it will tackle this 'fear of heights'.

The Committee believes that targeted employee ownership policies (discussed below) and incentives may help to keep business ownership in Scotland. Other policies would provide the "anchoring" effect needed to embed businesses in Scotland including ensuring that there is adequate investment, not just from Government, but from other sources. As Jim McColl told us, we need more large businesses based in Scotland to support those coming through the pipeline.

Withdrawal from the EU

“Once we know what it is, we’ll roll our sleeves up and get on with it.” The problem is, however, that we do not know what it is.

Economy, Jobs and Fair Work Committee 17 April 2018, Paul Sheerin, contrib. 10, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11470&c=2083183

The potential impact of the decision to leave the European Union was inevitably raised by witnesses during our evidence sessions. The overarching consensus from businesses was that uncertainty was a big challenge. It was thought that this could link to current levels of ambition and the desire for businesses to grow. Claire Slipper of the National Farmers' Union Scotland (NFUS) said, "there is currently a bit of a batten-down-the-hatches approach in light of the political situation in which we find ourselves." This could also relate to businesses' supposed "fear of heights".2

Some witnesses were concerned by the potential impact that labour migration may have on their workforce, whether that be seasonal workers in the food and drink sector or Erasmus students volunteering with social enterprises. Representatives from the care and construction sectors told the Committee that Brexit risked making recruitment more difficult. This was of particular concern for the care sector where there is already recruitment challenges.

The Cabinet Secretary for Economy, Jobs and Fair Work said that the population of Scotland had an impact on economic performance. He highlighted that the working age population has not grown at the same rate as it has in other places. In his opinion, this made the potential reduction in migrants particularly damaging for Scotland. Mr Brown also said that greater population growth in England was driving productivity south of the border.3

When questioned by the Committee, Secretary of State for Business, Energy and Industrial Strategy Greg Clark said:

One of the features that comes out strongly in the industrial strategy is recognition of the needs of different industries and the different needs of different places. In its work, the Migration Advisory Committee has a remit to advise independently and objectively, and I am sure that it will publish its assessment as to what is needed. It is right that it should do that, and I dare say that this committee will then want to look at its recommendations and see how they are translated into policy.

Economy, Jobs and Fair Work Committee 19 April 2018, Greg Clark, contrib. 58, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11477&c=2084061

Members of the Council of Economic Advisers indicated that, in their opinion, Brexit and leaving the Single Market in particular, would have a significant negative impact on the Scottish economy. The Cabinet Secretary said that if any positive was to be drawn from withdrawal from the EU, it was the increased public debate and awareness developing around international trade.

However for others, leaving the European Union was seen as an opportunity for economic growth. In terms of procurement, Karen Pickering of Page/Park Architects wondered if the alleviation of European procurement process would create opportunities for building projects to be advertised more locally, reducing competition.5

Some witnesses highlighted the need to support businesses in trading outwith the EU. Paul Sheerin stressed the need to "educate a generation of people to think about operating worldwide rather than stopping at the border of Scotland, the UK or Europe".6 The Scotch Whisky Association spoke of the need for support:

Support is [also] important on the trade-policy side, and will become increasingly so as we go through Brexit and come out the other side. We currently use the European Commission to help us to tackle trade barriers and issues that arise in-market...those can be tariff barriers or regulatory barriers. We do not need trade agreements to solve those problems, although such agreements can be helpful. Issues can be resolved outside trade agreements, sometimes sector by sector.7

Claire Mack, Chief Executive of Scottish Renewables told the Committee that the challenges and opportunities varied by sector,

the renewables industry, and energy as a whole, presents a bit of a Brexit bridge for Scotland. We have to collaborate because that is now the way in which our energy system operates, so we have the opportunity, as a result of Brexit, to maintain our current links and to use our energy system as a way of building bridges outside Scotland.

Economy, Jobs and Fair Work Committee 20 March 2018 , Claire Mack, contrib. 17, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11438&c=2077491

The protection of geographical indicators was noted as particularly important to Scotland's food and drink sector as it contributes significantly to the export value of products. Greg Clark assured the Committee that the provenance of products is considered vital and is an area of priority for the UK Government.9

The Committee did an inquiry on the economic impact of leaving the EU and made a number of recommendations, including asking the Scottish Government to detail how it will engage with Scottish businesses on the issues arising from negotiations on leaving the EU. The Committee asks for an update on what work the Scottish Government has done to engage Scottish businesses in this way and what representations it has made to the UK Government on their behalf, including steps to prepare businesses to trade with countries outside the EU, such as USA, China, Japan and India.

Technology

87 per cent of businesses in Scotland have a website, use email and think that they are digitally and technology enabled. However, between 7 and 9 per cent of businesses adopt programmes for customer relationship and supply chain management or resource planning and embed digital in their approach. Among our competitor countries...the minimum figure in that respect is 43 per cent. It is clear that there is already a huge chasm with regard to our business approach.

Economy, Jobs and Fair Work Committee 27 February 2018, Nora Senior, contrib. 11, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11393&c=2068748

If SMEs are to grow, more attention also needs to be given to supporting the uptake of technology. We were told that the SME environment is not adjusting quickly enough to technological change, but that improvements could be made with a combination of support and investment.

Technology has the potential to increase productivity and improve performance. Cloud-based computing has marked a revolution where people with innovative ideas no longer need huge amounts of capital to realise those ideas and grow a business. Chris van der Kuyl said there has been a "democratisation of distribution".2 Opportunities for small companies have expanded and the big corporations, which benefited from physical retail no longer have the advantage:

We always bemoan the fact that the high street is shrinking and becoming less important as a terrible thing for us all. The flipside of that is that, for small creative businesses, the distribution model being online has completely opened up the market.

Economy, Jobs and Fair Work Committee 27 March 2018, Chris van der Kuyl, contrib. 16, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11456&c=2080733

Broadband was considered to be an absolute necessity for improved economic performance in general, but to regional progress in particular. Chris van der Kuyl of 4J Studios and Graeme Jones of Scottish Financial Enterprise (SFE) argued that Scotland has very poor digital infrastructure, and that this lack of good bandwidth meant that many people would not consider moving to remote or rural areas. During evidence the Cabinet Secretary said:

Through the R100 programme, we are trying to ensure that every single business and individual in Scotland is connected to superfast broadband by 2021—that means a speed of 30 megabits per second, which is three times the speed that the UK Government wants to achieve in England and Wales. Superfast broadband is happening, and the coverage is high up in the 90 per cents now

Economy, Jobs and Fair Work Committee 22 May 2018 [Draft], Keith Brown, contrib. 69, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11549&c=2094696

Witnesses highlighted the considerable potential for growth by utilising technology and being supported to do so. We were told by Malcolm Roughead, Chief Executive of VisitScotland, that only 50% of accommodation providers in the tourism industry are online. This must be inhibiting growth and limiting their market potential.5

Automation

Machines are also very expensive, so an economic decision needs to be made. Who will invest in automation? It does not just happen; companies need to invest in machines and so on for which, at the moment, there is relatively little application.

Economy, Jobs and Fair Work Committee 16 January 2018 , Michael Jacobs, contrib. 122, http://www.scottish.parliament.uk/parliamentarybusiness/report.aspx?r=11308&c=2055977

Automation is another overarching factor which is likely to have a significant impact on our economy in the years ahead. Support and investment could mean the difference between automation having a significantly positive, rather than negative, impact. For some witnesses there was a perception that we should avoid scaremongering. With automation it is likely that many current jobs will change or disappear, but new opportunities will emerge. Managing transitions would be key, with a particular emphasis on job creation and reskilling.

A number of witnesses believed that automation offered a chance for people in more manual jobs to become high-skilled and focus on innovation. Others were concerned that people in low-skilled jobs were at higher-risk and noted a need for government to be proactive in recognising the threat and helping retrain affected staff as quickly as possible.