Economy and Fair Work Committee

Scotland's City and Regional Growth Deals

Membership changes

The following committee membership changes occurred during the course of the inquiry—

On 19 June 2024, Willie Coffey replaced Evelyn Tweed, Lorna Slater replaced Maggie Chapman, and Michelle Thomson replaced Colin Beattie.

On 10 October 2024, Jamie Halcro Johnston replaced Brian Whittle.

On 06 November 2024, Daniel Johnson replaced Claire Baker.

Introduction

Growth deals emerged out of City Deals in England, which were introduced in 2011. In these deals, the UK Government gave additional funding and powers to cities to allow them to play a more prominent role in promoting the growth of regional economies. The first deal in Scotland, for the Glasgow City Region, was signed in 2014.

City Region Deals and Regional Growth Deals ('growth deals') are bespoke multi-year funding deals agreed between the Scottish Government, the UK Government, local authorities and local partners. They are designed to bring about long-term improvements to regional economies.

The Committee undertook an inquiry to understand whether growth deals are achieving their aims. The remit of the inquiry was to consider:

the implementation and effectiveness of deals;

how they have contributed to addressing local issues and

how they have supported development and inclusive growth.

The Committee issued a call for written views, received 40 responses and took evidence from the following witnesses:

27 November 2024

Cornilius Chikwama, Audit Director and Catherine Young, Senior Manager, Audit Scotland;

Neil McInroy, Chair, Economic Development Association Scotland; and

Paul Mitchell, Operations Director, Scottish Building Federation.

4 December 2024

Stuart Bews, Programme Manager, Aberdeen City Region Deal;

Paul Lawrence, Chief Executive, Edinburgh and South East Scotland City Region Deal;

Councillor Susan Aitken, Leader of Glasgow City Council and Chair of the Glasgow City Region Cabinet, Councillor Owen O'Donnell, Leader of East Renfrewshire Council and Depute Chair of the Glasgow City Region Cabinet, and Kevin Rush, Director of Regional Economic Growth, Glasgow City Region Deal; and

Matt Bailey, Programme Manager, Inverness and Highland City Region Deal.

11 December 2024

Malcolm Bennie, Director of Place Services, Falkirk Growth Deal;

David McDowall, Head of Economic Growth, Ayrshire Growth Deal;

Anne Murray, Chief Officer, Economic & Community Regeneration, Islands Growth Deal; and

Rick O'Farrell, Director, Borderlands Inclusive Growth Deal.

15 January 2025

Panel 1

Rt Hon. Ian Murray, Secretary of State for Scotland; and

Alasdair MacDonald, Deputy Director for Policy, UK Government;

Panel 2

Anthony Daye, Interim Director of Place and Enterprise, South of Scotland Enterprise;

Zoe Laird, Head of Growth Deals and Digital, Highlands and Islands Enterprise; and

Derek Shaw, Director of Scaling Innovation and Matt Lockley, Head of Partnerships, Scottish Enterprise.

22 January 2025

Carolyn Currie, Chief Executive, Women's Enterprise Scotland;

Vikki Manson, Deputy Head of Policy Scotland, Federation of Small Businesses; and

Duncan Thorp, Policy and Public Affairs Manager, Social Enterprise Scotland.

5 February 2025

Kate Forbes, Deputy First Minister and Cabinet Secretary for Economy and Gaelic;

Kate Bryson, Head of East & West of Scotland Growth Deals;

Kimberley Daly, Head of Highlands, Islands, Edinburgh and South of Scotland Growth Deals; and

Anne-Marie Martin, Deputy Director for Regional Economic Development, Scottish Government.

The Committee also visited the National Robotarium at Heriot-Watt University, a growth deal project and extends its thanks to everyone who gave evidence and contributed to the inquiry.

Background

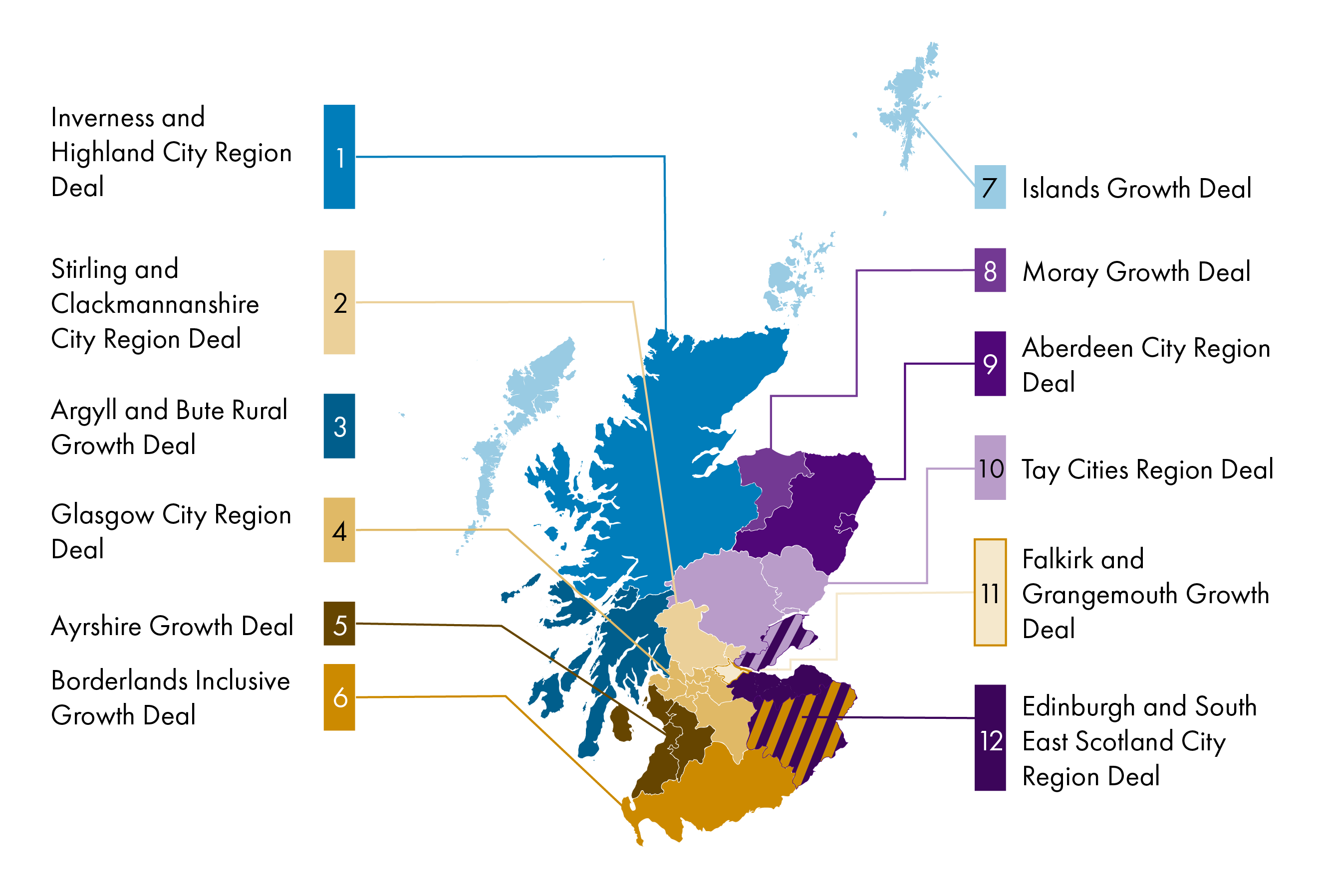

There are now twelve growth deals in Scotland, at different stages of their life cycle.

Map of Deal boundaries and local authorities involved in each Deal  The Scottish Parliament

The Scottish Parliament

Table of Deal boundaries and local authorities involved in each Deal Key Deal Councils 1 Inverness and Highland City Region Deal Highland 2 Stirling and Clackmannanshire City Region Deal Stirling, Clackmannanshire 3 Argyll and Bute Rural Growth Deal Argyll and Bute 4 Glasgow City Region Deal Glasgow City, East Dumbartonshire, East Renfrewshire, Inverclyde, North Lanarkshire, Renfrewshire, South Lanarkshire, West Dumbartonshire 5 Ayrshire Growth Deal East Ayrshire, North Ayrshire, South Ayrshire 6 Borderlands Inclusive Growth Deal Dumfries and Galloway, Scottish Borders, Carlisle City, Cumbria, Northumberland 7 Islands Growth Deal Na h-Eileanan Siar, Orkney Islands, Shetland Islands 8 Moray Growth Deal Moray 9 Aberdeen City Region Deal Aberdeen City, Aberdeenshire 10 Tay Cities Region Deal Angus, Dundee City, Fife, Perth and Kinross 11 Falkirk and Grangemouth Growth Deal Falkirk 12 Edinburgh and South East Scotland City Region Deal City of Edinburgh, Fife, East Lothian, Midlothian, Scottish Borders, West Lothian Note: Borderlands Inclusive Growth Deal includes five councils (two in Scotland and three in England).

In total, £6.3 billion of funding has been committed to the deals over 11 years: £1.6 billion by the Scottish Government (SG), £1.5 billion by the UK Government (UKG) and £3.1 billion by local authorities, private investors and other partners (figures rounded).

Deal SG UKG Council and regional partners Total funding Length of Deal Glasgow City Region Deal £520m £523.7m £380.6m £1,434m 20 years Aberdeen City Region Deal £125m £125m £763.1m £1,013m 9 years Inverness and Highland City Region Deal £135m £53.1m £127m £315m 10 years Edinburgh and South East Scotland City Region Deal £300m £300m £850.2m £1,450m 15 years Tay Cities Region Deal £150m £150m £400m £700m 10 years Ayrshire Growth Deal £103m £103m £45.5m £252m 10 years Stirling and Clackmannanshire City Region Deal £45.1m £45.1m £123.8m £214m 10 years Borderlands Inclusive Growth Deal £85m £65m £41.2m £191m 10 years Moray Growth Deal £32.5m £32.5m £35.8m £101m 10 years Islands Growth Deal £50m £50m £293m £393m 10 years Argyll and Bute Rural Growth Deal £25m £25m £20m £70m 10 - 15 years expected Falkirk and Grangemouth Growth Deal £40m £40m £68.7m £148.7m 10 years

The Scottish budget for 2025-26 included £215 million for ‘Cities Investment and Strategy’, which largely funds the Scottish Government contribution to the City Region Growth deals. This is an increase of 8.7% compared to the 2024-25 budget at the time of the Autumn Budget Revision. The Scottish Government noted that this includes £8 million for the Corran Ferry now contained within this budget line as part of the Inverness and Highland City Region Deal funding allocation.

There have been significant inflationary pressures since the deals were signed. The UK Government spending review, which is due to be set out in a statement in June 2025, will set the spending frameworks for the next stages of local growth in the coming years. That sits alongside the £1.4 billion already committed. This will inform future plans for investment in local growth.

City Region and Regional Growth Deals

The Scotland Office explained that many of the same themes are shared across the strategic objectives of each of the growth deals, including:

• generating inclusive and sustainable economic growth;

• improving transport and digital connectivity;

• promoting innovation to foster greater productivity and

• attracting and unlocking additional private sector investment.1

In its 2023 report, Audit Scotland said growth deals had enabled economic development projects that otherwise may not have gone ahead. Growth deals had been a catalyst for increased collaboration between local authorities and their partners.2 They had also brought stakeholders together to leverage in private finance.3

The Cabinet Secretary highlighted the benefits of collaborative working that growth deals create:

The advantage that I immediately see is that partnership establishes greater financial power behind projects. Each partner has committed a budget that is significant for that partner, and if you pull those commitments together, you end up with a budget for each project that can do something really significant and substantial.4

Whilst there was a recognition that some growth deal projects may have proceeded without a deal, there was general agreement that deals provided pace, accelerating and catalysing projects. The ability of growth deals to catalyse action were highlighted by Councillor Susan Aitken (Glasgow City Region Deal):

The kinds of projects that the city deal has addressed were, in many cases, from long-standing geographical deficits. They were hangovers from Glasgow city region's post-industrial past, and in many cases were issues that had needed to be addressed for 30 or 40 years. People knew that it would be a good thing if those projects were done, but they had never reached the top of the priority list for capital spend.5

The long-term approach and partnership working are considered to be the core strengths of growth deals. Growth deals have brought both governments and local authorities together within an agreed common governance arrangement to deliver specific projects. This has allowed for long term planning and given partners more confidence which has helped to draw in other sources of finance. Witnesses also spoke of the scale of investment and pipeline of projects which came about from the creation of growth deals.

In this report, the Committee will examine how growth deals have operated and identify lessons learned to inform what follows the deals after their completion.

The Committee welcomes the creation of growth deals in Scotland and notes that they provide long-term funding certainty which has catalysed projects across Scotland. The Committee welcomes the collaborative working across local authority boundaries that growth deals have enabled through their governance structures, which has been beneficial for regional economies.

Some deals are nearing completion and the Committee believes that, given their success, there should be a second phase of growth deals in Scotland. However, it is important that lessons are learned from the current deals before proceeding to the next phase. This report sets out recommendations for the next round of deals.

Governance and accountability

Each growth deal has a unique governance and oversight structure. The involvement of many partners in planning, financing and implementation has created a complex landscape of organisations and funding streams working together to achieve the deals' goals. Audit Scotland highlighted the importance of everyone involved being clear about their roles and responsibilities.1

Each growth deal is a tripartite agreement between local authorities, the UK Government and the Scottish Government. Deal programmes are governed by boards which are accountable for the delivery of the programmes.2

The funding is discharged to local authorities by the Scottish Government. Where there is more than one local authority in a deal, one becomes the accountable (lead) authority which then distributes funding to the projects and partners as required. The lead authority is accountable to both the Scottish and UK governments. Each deal, with the exception of the Borderlands Inclusive Growth Deal, has one accountable authority. Other deal partners (such as universities and the enterprise agencies) can lead individual projects and programmes within the deals.

Funding for growth deals is reviewed through rigorous governance frameworks, with section 95 officers in local authorities ensuring compliance with deal agreements. Financial reports from the accountable bodies are reviewed by Scottish Government officials to track expenditure, milestones and progress; statements of compliance are produced annually.2

Growth deals are overseen by the joint Scottish Government and UK Government Scottish City Region and Growth Deal Delivery Board (the joint board). Audit Scotland's 2023 report highlighted the role of the joint board and stated that it has improved accountability.4

Catherine Young from Audit Scotland explained that when a growth deal is formulated, it goes through a rigorous process, from a strategic outline, to an outline business case and then to a full business case.5 All business cases follow the Green Book process.

The Treasury Green Book is a guide issued by HMT on how to appraise policies, programmes and projects. It provides guidance on the design and use of monitoring and evaluation before, during and after implementation. The Green Book aims to ensure that public resources are used effectively and efficiently to deliver the best public value.6

The Scotland Office said that while processes to agree deals can be time consuming, this is partly as a result of a need to carry out sufficiently robust due diligence of growth deal programmes.7 However, the Committee heard that the process for agreeing business cases can be lengthy and is holding up projects.

The Committee heard from witnesses that the process has become "quite rigid" and can be resource intensive.8 Scottish Borders Council and others noted that a focus on Green Book compliance, rather than viewing the Green Book as guidance, is adding to pressures on capacity. This has led to delays in gaining approval for business cases and in developing projects, ultimately drawing capacity away from implementation.9

Comhairle nan Eilean Siar, Orkney Islands Council, Shetland Islands Council and others suggested that there is more rigour and uniformity at government level now, which can be helpful, but there needs to be a degree of proportionality.

David McDowall (Ayrshire Growth Deal) said that the level of intensity in agreeing business cases can vary with different Scottish Government or UK Government personnel.8 South of Scotland Enterprise (SOSE) also highlighted consistency issues:

This complexity can be justified for the larger projects, yet we have seen at times inconsistency between the Scottish Government and the UK Government in their scrutiny and risk appetites during the review process.11

Kimberley Daly of the Scottish Government explained that the length of the process depends on the strength of the business case that comes forward.2 The Cabinet Secretary said that, as deals have evolved from the early ones, they have learned lessons and made changes as a result.2 However, she added:

When you are primarily dealing with three different collaborating organisations, there is an added element to governance and to getting agreement.2

The Committee heard that more recent deals have the additional challenge of navigating through higher levels of bureaucracy, whereas mature deals had more flexibility in the way their business cases were developed. Malcolm Bennie (Falkirk and Grangemouth Growth Deal) stated:

We found a high level of administration and bureaucracy. Every learning point that has come from every single deal that has ever happened has been built on, so when we came in at the end, we had to navigate our way through all that regulation.8

Highlands and Islands Enterprise (HIE) said that projects take an 'exceptionally long time' to move from concept to delivery, with some projects taking years. This has led to an increasingly challenging context in terms of inflationary price rises, limited and reducing public sector finance, and changes in demand through the period of project development, as a result of COVID, Brexit and cost inflation.16 Colleges Scotland said that such delays require project adaptation, adversely impacting the project and the local community it is intended to benefit.17

In its 2023 report, Audit Scotland stated that growth deals had made good progress with clarifying lines of accountability, escalation processes and risk management arrangements. It found that deals are regularly reviewing their governance arrangements to ensure structures are still fit for purpose.1 Catherine Young of Audit Scotland said that "one size does not fit all" when it comes to the decisions on how to structure the governance of the deals.5

However, witnesses raised the issue of blurred lines of accountability, where the accountable authority is not ultimately accountable for decisions around prioritisation and must seek approval from the Scottish and UK governments.

Stuart Bews (Aberdeen City Region Deal) explained that their proposals and business cases are taken to the joint committee, which comprises three Aberdeen City councillors, three Aberdeenshire councillors, and three Opportunity North East board members. Once a decision has been made, further sign-off by the Scottish Government is required:

The question is this: to what extent should our joint committee be able to take that decision and for that to be the final decision? The question on the structure is whether, through the deals, we manage the funding through the accountable body, which, in our case, is Aberdeenshire Council, or whether there is someone else who is perhaps more accountable and carries out a further check.4

Paul Lawrence (Edinburgh and South East Scotland City Region Deal) stated that they would have preferred a programme-based approach, rather than focussing on individual projects:

we found that we were tied down too much to individual projects too early—that came from both governments, I should say—because a degree of certainty was wanted. I would much prefer to have negotiated a deal based around programme priorities with outcomes attached to them, than to have been tied down too soon to individual projects.4

The Glasgow City Region Deal's governance model is different from that of the other growth deals. Glasgow created the City Region Cabinet, which consists of eight democratically elected local politicians who lead the local authorities in the Glasgow City Region Deal. The Cabinet makes investment decisions, but still liaises with both the UK and Scottish governments. Kevin Rush (Glasgow City Region Deal) explained:

We go through a gateway review period every five years to satisfy both governments that we are doing the right thing and that we are generating economic benefit. However, there is no right of veto for the governments. Once we pass the gateway review, that essentially unlocks the investment for the next five years.4

The Scottish Government told the Committee that that the level of governance and Green Book compliance for all investment in the Scottish programme is consistent across the deals.2

However, some witnesses indicated that the bespoke governance arrangements had led to a lack of consistency across Scotland, which can be challenging for partners. Paul Mitchell from Scottish Building Federation (SBF) said:

If you push the decision making and the autonomy out to the different regions, you will get different approaches and different decision-making structures... A standardised approach would be helpful in being able to communicate to our members the benefits of the city deal and regional deal programmes.5

Derek Shaw of Scottish Enterprise set out the complexity of some growth deal arrangements:

Across the eight deals, 30 groups exist to support the deals. That is complex, and there could be an opportunity to look at how some of that is streamlined, while retaining the positive flexibility to adapt governance and processes at regional level.25

The Cabinet Secretary stated that the Scottish Government is currently working with the UK Government to consider whether they could further streamline deal governance.2 This would be with a view to speeding up progress for projects and considering whether every project has to go through the same steps.2

The UK Secretary of State for Scotland (the Secretary of State) noted that some deals have faced challenges around the capacity of local authorities to deliver some of the bigger infrastructure growth deal projects.25 However, witnesses noted that the structures established as part of growth deals were particularly useful to smaller local authorities, as they provided a resource that might not otherwise be available (for example, the Programme Management Office (PMO), which is responsible for monitoring and reporting on deals).

Councillor Owen O’Donnell (Glasgow City Region Deal) said that the deal has given them the framework, the negotiating power and the ability to think about economic development, which they would not otherwise have had:

We have an excellent programme management office, so although a lot of capabilities have been hollowed out of local government over the years, we have a centre of expertise that we can tap into.4

The Committee acknowledges the benefits of partnership working between multiple levels of government and partners fostered by growth deals. However, the range of partners has created complex governance structures and untidy lines of accountability, where local decisions require final approval from the Scottish and UK governments. The Committee notes that the process for agreeing projects is more bureaucratic today than in the early days of growth deals in Scotland. Ensuring compliance with Green Book requirements has proved to be onerous and caused long delays in some cases.

Governance of growth deals has evolved over time. The Committee notes Audit Scotland's finding that governance of growth deals has improved. The Committee welcomes the approach of continuous improvement and believes that this should continue as growth deals evolve. The Committee welcomes the role of the new joint board in providing support. However, it is acting as a further layer of decision making which, in some cases, is slowing down progress.

Growth deals should align with national and local strategic priorities and have the flexibility to adjust to evolving economic context and national policies and priorities, for example in relation to climate targets.

The Committee notes the impact on capacity that the demands of the business case process has placed on some local authorities and other partners. Whilst recognising the need for rigour and due diligence, the Committee believes that the process should be reviewed with a view to making it more proportionate, less costly and more responsive to local needs.

The Committee welcomes the Cabinet Secretary's commitment to work with the UK Government to streamline processes to allow for faster progress on growth deal projects. The Committee asks the Scottish Government to report back once this work is completed or by the end of 2025 if it is still ongoing.

Flexibility

Since the first growth deal was introduced in 2014, deals have had to contend with various challenging economic factors such as the Covid-19 pandemic and periods of high levels of inflation. This has meant some projects have not been able to progress as originally planned, or have been paused to allow changes to be made to adapt to new economic circumstances.

Cornilius Chikwama of Audit Scotland said that economic development requires a sustained long-term effort, with a 10 to 20-year time horizon ensuring a consistent focus on outcomes. However, growth deals must be flexible to adapt to changing contexts whilst maintaining this long-term perspective.1

The Scotland Office stated that both governments have been flexible in working with local authorities to make changes to projects and programmes, to reflect the changing context for investments.2

For changes to be made to a project, deals must go through a change management process. To make this process rigorous, changes have to be agreed by the joint board and can therefore take time to be approved.1

Matt Bailey (Inverness and Highland City Region Deal) noted that their experience of the change management process had not been particularly onerous, but mentioned the number of layers of governance required to move forward. He stated that "paramount in a mature deal is the ability to act quickly" in order to respond to changes over the 8-10 years since the deal was signed.4

The Committee heard that bureaucracy can come at the cost of flexibility. Some deals expressed frustration with the numerous layers of governance and accountability, feeling that this hindered their progress when making changes to projects, funding and timescales within the deals.

More recent deals also raised the issue of a lack of flexibility around change management processes, with Falkirk Council noting that local authorities’ own capital budgets and other funding streams such as Levelling Up or Green Freeports are not as bureaucratic or as inflexible.5

David McDowall (Ayrshire Growth Deal) said that the change management process is not quick, and that they have had to "jump through a lot of hoops". He stated that other deals have a more streamlined approach, and that there is an opportunity to look at best practice with a view to making the process more efficient. He said:

we have a level of trust through our section 95 officers for all our other finances, including the shared prosperity fund, the no one left behind funding and a wide range of other types of external funding that comes in through both governments. It would be helpful if we were given the same level of trust in respect of the growth deal projects.5

Given its unique governance structure, the local democratic decision-making structures flow to and from the Glasgow City Region Cabinet. This means that the Glasgow Cabinet regularly takes decisions on re-profiling city deal spends and approves business cases.4

Councillor Aitken told the Committee that the Glasgow Cabinet regularly sees significant change to some of the projects. She highlighted North Lanarkshire's major project, which now looks very different to the one originally signed off in 2014, showing that the Cabinet has been responsive and flexible to the changing economic circumstances faced by the deal over the past ten years.4

Kate Bryson of the Scottish Government said that although there is a slightly different model in Glasgow, it still follows the same Green Book process as other deals.9

The Committee is supportive of the long-term nature of growth deals and the benefits that brings, including certainty for investing partners. Growth deals should align with national and local strategic priorities and have the flexibility to adjust to evolving economic contexts and national policies. This could involve projects being de-prioritised or re-scoped quickly.

The Committee notes that being able to cancel or amend projects quickly where needed would relieve pressure on limited resources. The Committee recommends that the change process is a focus of the review of governance processes being carried out by the Scottish and UK governments.

The Committee asks the Scottish and UK governments, as part of the review of governance arrangements, to investigate the reasons for increased bureaucracy experienced by the newer growth deals and to report back on what changes will be made to ensure lessons are learned for the next phase of growth deals.

Risks

UK Government funds are distributed through an annual process where His Majesty's Treasury (HMT) transfers the drawdown for deals to the Scottish Government to distribute to the lead authorities in each deal.1

The Secretary of State explained that deal funding sits in the HMT Reserve and is transferred directly to the Scottish Government as a ring-fenced Barnett top-up annually in line with pre-agreed funding profiles for each of the respective deals in delivery.2

Anne-Marie Martin of the Scottish Government explained that the Scotland Office was not a spending department when the growth deal arrangements were agreed. Therefore, the money flows directly from HMT to the Scottish Government.3

The Secretary of State said that while the UK and Scottish governments are funding the deals jointly, from a legal perspective the Scottish Government is ultimately accountable given that the funding is passed to the Scottish Government and distributed as part of the annual budget.1

The Committee explored whether there is a risk to the Scottish Government if funding by the UK Government were to be withdrawn or paused. In response, the Scottish Government highlighted that the joint board is co-chaired by the UK Government and the Scottish Government, with HMT also a member. The Cabinet Secretary said:

Technically, there probably is a question around the accountable body issue, but the fact that there is joint governance by both parties, with HMT on that board, means that there is no dubiety or uncertainty on the extent to which the legal commitments will be honoured, as they are signed by both parties.3

Aberdeen City Council highlighted that capital projects are normally delivered over multiple financial years but there is no guarantee of being able to carry forward any underspend from one financial year to the next. If the Scottish Government was not able to allow a carry-forward of funds to the following year, there is a risk that projects may require to halt. They said that genuine multi-year commitments would help to de-risk this process.6

The Cabinet Secretary explained that the most significant risk is around the budget. As the money flows through the Scottish Government, it has to manage the projects across years. If projects sit between years and are impacted by inflation or are delayed, the Scottish Government has to manage those financially. The Scottish Government still has to balance its budget, irrespective of what is happening with local projects on the ground, particularly the bigger infrastructure projects.3

The Committee notes that the Scottish Government is the formal Government Accounting Officer for the growth deals programme, accountable for the distribution of Scottish Government and UK Government funding. The Scotland Office is not currently a spending department. Liability therefore rests with the Scottish Government, should the UK Government withdraw funding. As such, the Committee finds that there continue to be budgetary risks to programmes. The Committee recommends that the Scottish and UK governments review the arrangements for the Government Accounting Officer role and report back to the Committee on the changes recommended.

Transparency and scrutiny

In its 2023 report, Audit Scotland highlighted the need for transparency, and that information should be available to the public so that people can see why particular decisions on specific growth deal projects were made. Audit Scotland said that whilst deals have made good progress in raising public awareness, this is not consistent across all deals and in some cases decisions and information on project selection are hard to find in council committee papers.1

The Federation of Small Businesses (FSB) highlighted concerns that projects were selected behind closed doors, and that there is a strong feeling that the small business community does not have a significant voice within the decision-making process for the growth deals.2 Scottish Chambers of Commerce agreed, stating that the Scottish Government should consider how to make more information publicly available setting out the reasons behind key decisions on funding and project selection, to support effective scrutiny.3

Neil McInroy from Economic Development Association Scotland (EDAS) said that governance needs to be democratic and subject to scrutiny, and that there is a need to strengthen democratic oversight:

The whole process is not democratised or transparent and open enough. The box should be opened up a lot more and there should be more democratic and community oversight of the activities.4

The Committee heard examples of good practice in transparency, such as the Aberdeen City Region Deal Joint Committee holding public facing meetings to ensure the decision-making process was open. However, Aberdeen City Council argued that if the joint board were to decide not to endorse the deal's decisions, this could raise concerns over the transparency of the decision making at government level.5

The FSB said that whilst they are beginning to see changes in the scrutiny, impact and measurement of the metrics in growth deals through more consistent reporting, this is not understood by communities and businesses. Therefore, there needs to be a more rigorous effort to make information on the delivery of projects publicly available. This would allow stakeholders to understand how deals are progressing and being monitored.2

Some deals explained the basis for making decisions about projects. Stewart Bews (Aberdeen City Region Deal) spoke of the importance of aligning projects to the regional economic strategy which has been developed in partnership with regional economic partners and gone through both councils as part of that wider public scrutiny piece. His view is that the deal implements the regional economic strategy, meaning that public consultation is not needed in every case.7

Some witnesses stated that a number of projects were 'taken off shelves' and may not meet the original goals of growth deals. Others stated that growth deal projects might not meet the most pressing needs in communities. Some deals argued, however, that whilst certain projects may not, on the face of it, appear to represent the priorities of communities, the intended economic outcomes of projects would address significant issues in communities.7

Councillor Aitken (Glasgow City Region Deal) said the difference that the city deal made was the focus on driving economic benefit and growth. The gross value added uplift was the main criterion and measure:

That concentrated minds around project selection in a way that was not about the urgent things that were right in front of us that had to be done right then; rather, it was about projects that could drive transformation.7

As part of the inquiry, the Committee visited the National Robotarium which is supported through the £1.4 billion Edinburgh and South East Scotland City Region Deal. Paul Lawrence (Edinburgh and South East Scotland City Region Deal) agreed that ensuring that governance is rooted in local democracy is important; however, he added that inclusion is a key focus:

Do I think that the National Robotarium at Heriot-Watt was the people’s priority? No, I do not. Do I think that our job is to make sure that the jobs of tomorrow are accessible to the most deprived in the city? Yes—100 per cent.7

Colleges Scotland said that the level of awareness of growth deals varies substantially across the college sector. This is partly due to a lack of visibility of growth deal projects. Some colleges feel quite far removed from the decision-making process on projects in their regions. Others perceive the deals to be focused on capital funding, which means that funds are not available for skills development which would provide more direct opportunities for colleges and other community stakeholders to be involved.11

Looking ahead, Paul Lawrence (Edinburgh and South East Scotland City Region Deal) said that he would like decisions to be more programme-based:

we, too, are looking forward to the next phase of regional economic policy, whatever that looks like—we need to have something that is programme-based. Again, I go back to the point about skills. The Withers review—as the committee will know—sets out very clearly a challenge around the devolution of skills at the city regional level. It would be better to set programme and outcome priorities and then give us the flexibility on individual projects.7

In response to concerns raised about project selection, the Secretary of State said:

I can see why there could be some concerns that deal funding is being used to supplement stuff that should be paid for through the normal channels at local authority level. I can see that. However, these projects are critical to economic growth and to the areas that require them, so I do not have any concerns that deal funding has been replacing day-to-day, normal council funding, if you like.13

When asked about using growth deal funds for the Corran Ferry, Matt Bailey (Inverness and Highland City Region Deal) said:

That is in response to a specific need in quite a fragile and rural community. It depends on the ferry; it is an absolute lifeline, for so many reasons. That is an example of how, in taking forward the deal, a community was listened to and their needs responded to.7

The Secretary of State said the deals have been 'grass roots up', supporting economic growth, creating jobs and providing sustainable development across the country.13

The Cabinet Secretary highlighted the project selection process:

The projects that are supported through the deals have been selected, designed and delivered by local authorities and other regional partners that know their areas best. That ensures local decision making, which is in the best interests of communities.16

When the Cabinet Secretary was asked about the scrutiny of the deals, she said that there is an opportunity for scrutiny, particularly of the Scottish Government. The additional governance was built in to deal with the fact that the arrangement covers three jurisdictions:

Parliamentary scrutiny is always to be welcomed, but the deals’ programmes are governed by boards because they are tripartite arrangements, and the boards are accountable for delivery of the programmes. On those boards are representatives from the three partners and others.7

The Committee is concerned at the lack of transparency around decision making about growth deal projects. The Committee believes that stakeholders and the wider community should understand why decisions on certain projects are made. While decisions are driven by many factors, including regional economic strategies, it is crucial that information is publicly provided explaining these decisions.

The Committee recommends that the Scottish and UK governments include this requirement in their review of governance arrangements. The Committee also recommends that transparency in decision making should be a condition of the awarding of growth deal funding, or any funding that comes after the current deals have concluded.

The Committee notes views from witnesses that growth deal funding has been used to fund projects 'off the shelf' or to plug funding gaps. The Committee asks the Scottish and UK governments to set out in detail how they ensure that growth deal projects fit with the strategic objectives of growth deals and wider regional and national economic strategies.

There is a need to develop skills in Scotland's economy and to address skills gaps. The Committee notes that skills development forms part of many growth deals. The Committee recommends that future growth deals take a programme-based approach which includes a specific focus on skills development.

The Committee notes that there is no role for nationally elected members from inception of the design of a growth deal and no clear mechanism for parliamentary scrutiny of deal spending and outcomes. The Committee recommends that its successor committee consider the design and operation of deals and how scrutiny of deals and their outcomes could be achieved (for example by requesting regular updates or examining growth deals as part of annual budget scrutiny). The Committee will include this in its legacy report.

In order to support this work, the Committee recommends that the Scottish Government clearly sets out its expenditure on growth deals in the annual budget to allow for proper scrutiny. The Committee also asks the Scottish Government to publish a longer-term forecast of its anticipated spend profile on growth deals. Further, it would be helpful to show disaggregated Scottish Government and UK Government contributions to growth deals in the level 4 budget spreadsheet, setting out the contribution to each deal.

Growth deals and regional economic development

Growth deals exist within a wider economic development structure. Regional collaboration was highlighted as a key benefit of growth deals. Witnesses suggested they had also helped to develop collaboration on other initiatives, including the shared prosperity fund.

The Scottish Government stated that the success of a regional approach to economic development was evident from the early growth deals and formed the basis for the establishment of a network of eight Regional Economic Partnerships across Scotland. They said:

Given that Deals in themselves are regional collaborations and offer the region the opportunity to build on substantial investment, this regional structure has been seen by partners as the most logical to build on in order to retain the evident benefits around coordinated investment and a collaborative forum for Government to engage with.1

Regional Economic Partnerships are collaborations between local government, the private sector, education and skills providers, enterprise and skills agencies and the third sector to deliver economic prosperity across Scotland's regions.

The enterprise agencies were positive about the development of regional economic partnerships; they did not consider that this meant there was considerable duplication with the deal structures but rather they would be complementary.

Witnesses spoke of the catalytic effect of growth deals and in partners working together more effectively at regional level. Zoe Laird of HIE agreed that growth deal partnerships work, but argued that they could potentially become stronger by working through Regional Economic Partnerships.2

Neil McInroy of EDAS made a case for the role of Regional Economic Partnerships in determining how funds are allocated:

If we think about economic development in Scotland, there is clearly a case to be made for streamlining things through local economic or regional economic partnerships as a way of giving local areas the volition to steer projects and make their own decisions on what their priorities are, rather than having a bespoke project come from above.3

In its 2023 report, Audit Scotland said that for Regional Economic Partnerships to work effectively, they need to have a strategy that sets out the vision for their region and the outcomes they expect to achieve.4

Aberdeen City Council explained that the investment of the Aberdeen City Region Deal supports keys sectors within their Regional Economic Strategy.5 They explained that the Regional Economic Strategy allows for longer-term planning and creates some certainty over economic priorities for the region, rather than a piecemeal approach. They suggested that the strategy could be used to plan for what follows the deal, which concludes in 2027.5

When asked whether both growth deals and Regional Economic Partnerships are needed, the Cabinet Secretary said:

The regional economic partnerships can deliver the investment zones and so on, so we are not comparing like with like. It should be the regional economic partnerships that establish the strategy in a local area and then bring in the partners that are required to deliver that strategy. They should be the forum in each area that brings in partners.7

The Committee notes that growth deals sit alongside other regional economic structures, such as Regional Economic Partnerships, which have been revitalised since the inception of growth deals.

The Committee welcomes the creation of Regional Economic Partnerships and believes that they can be an effective mechanism for continuing collaborative regional working, for which growth deals have demonstrated to be beneficial. The Committee asks the Scottish Government to set out its vision for the future role of Regional Economic Partnerships, in the context of planning for what will come after the current growth deals have concluded.

The Committee notes that Audit Scotland stated that Regional Economic Partnerships need to have a regional strategy in order to work effectively. The Committee recommends that regional strategies form the basis of plans for a second round of growth deals to ensure a bottom-up approach to project choice.

Partnership working

As set out above, one of the main benefits of growth deals is that they provide a governance structure for collaboration with a range of partners, including public sector, business, community, education and third sector interests.

In its 2023 report, Audit Scotland set out examples of ways growth deals are ensuring a wide range of partners and stakeholders are involved throughout the process including stakeholder mapping exercises prior to the approval of business cases, public consultation and stakeholders taking the lead in delivering projects, or leading individual project boards.1

Private sector and other partners

In its 2020 report, Audit Scotland recommended that the Scottish Government should coordinate the sharing of good practice and advise deal partners on how to work with businesses in their area.1

Business leaders launched Opportunity North East (ONE) in 2015 to address the long-term economic challenges in the North East and began to engage with Aberdeen City Council and Aberdeenshire Council. ONE played a key role in developing the regional economic strategy and the Aberdeen City Region Deal.1

Audit Scotland highlighted the Aberdeen model as a case study and set out the benefits that ONE's involvement has brought to the deal, including the presence of a strong and influential business leader, who can tap into a wide network of contacts as well as ONE committing development funding, matched by Scottish Enterprise, to leverage resources for the development of the business cases.1

Stewart Bews (Aberdeen City Region Deal) explained that the deal built on the work of the then Aberdeen City and Shire Economic Future, or ACSEF, which has now merged into a Regional Economic Partnership:

As we had engaged with the private sector from the outset and knew where that investment might come in, we have been able to structure a regional economic strategy with priorities that the private sector is looking to invest in, to support delivery.4

David McDowall (Ayrshire Growth Deal) said that growth deal projects are catalysts to get external funding and to work with the private sector and with academia. The HALO project in Kilmarnock was led by the private sector and has now been completed.5 Malcolm Bennie (Falkirk and Grangemouth Growth Deal) said that Forth Ports is leading their transport, renewables and career exploration hub.5

The Edinburgh and South East Scotland City Region Deal is being delivered in partnership with the region’s higher and further education institutions which played a key role in developing the deal; it also involves charities and voluntary organisations.

The enterprise agencies are partners in a number of deals. Scottish Enterprise explained that it has been involved in the eight deals in various ways, including investing in projects where there is strong alignment with its remit around growth, supporting businesses and attracting inward investment. They have invested in excess of £48 million in projects that they think will drive regional and national economic growth in the areas where there is strong competitive advantage7. Similarly, HIE outlined an anticipated financial contribution to growth deals of £34 million.8

SOSE said that meaningful engagement of the private sector has been challenging. They have been exploring ways in which private sector involvement could be enhanced, for example, by inviting private sector members onto project boards in future deals.9

The Cabinet Secretary cited examples of how businesses are engaged with deals across the country. She said:

Alongside the growth deals are the regional economic partners... their role was reinvigorated partly as a result of how inspired I was by what was happening in the north-east. Therefore, it is fair to say that different parts of Scotland are at different stages in engaging well with the private sector.10

Reflecting on the Aberdeen example, the Cabinet Secretary highlighted that ONE were a key signatory to the deal and were on its joint committee:

there is... a unique element to Aberdeen, in that it feels like there is private sector ownership. That is replicated in some of the other deals, but it is particularly noticeable in Aberdeen. That deal comes to an end in 2027, at which point we will be able to look back and reflect on all that has been achieved.10

The Committee notes the varying levels of private sector involvement in growth deals. The Committee welcomes the positive example of the Aberdeen City Region Growth Deal which grew out of an existing structure with private sector involvement at its core, and has secured commitments of £660 million in private investment. The Committee believes it is vital that lessons are learned and shared from the success of this model and recommends that the Scottish Government considers this as it plans for future deals.

The Committee asks the Scottish and UK governments to consider strengthening private sector involvement in future deals as part of governance arrangements. This will be necessary given the state of public finances and the impact of high inflation, which is covered later in the report.

Local business and community partners

The Committee considered how growth deal projects are creating opportunities for local supply chains and communities and ensuring that economic benefits remain within cities and regions.

The enterprise agencies highlighted the use of procurement policies to encourage local supply chain development and community benefits. Such policies have community wealth building built in and outcomes around keeping money in the local economy. Procurement processes can also be used to ensure that local businesses know about the opportunities and are supported to bid for work.1

Carolyn Currie of Women's Enterprise Scotland (WES) said that their members have very low awareness of the deals, and any contact or involvement has been minimal.2 Similarly, the FSB indicated that many small businesses are often unaware of the opportunities which growth deals afford:

Many of our members have reported that they are either unaware of the deals or have not had the opportunity to meaningfully engage in their development. Many small businesses told us that during the decision-making process for how funding is allocated, they do not feel that their voices are heard or that sufficient engagement is undertaken by those organisations providing funding.3

Paul Mitchell of the SBF highlighted the lack of a standardised approach as a challenge:

when we surveyed our members, the majority came back and said that they either had not heard of or were not aware of city deals, or had not had the opportunity to engage with them because the picture is so complicated across the country.4

The FSB highlighted an example of good practice in the Edinburgh and South East Scotland City Region Deal. The FSB chairs the Regional Enterprise Council, which is represented on the decision-making board for the deal, and aims to give a voice to business and the third sector. This body was, however, created after the projects in the deal had been selected. Another example of good practice is in the Moray Growth Deal, where the FSB Development Manager for North East Scotland has been involved in discussions from the outset.

The FSB argued that, going forward, it is important to ensure small businesses have the opportunity to bid for projects related to the deals, and highlighted discussions around embedding local spend criteria to ensure local spend remains high.3

Social Enterprise Scotland highlighted that there is an inconsistent experience across Scotland in terms of social enterprise involvement with growth deals. Some local organisations outwith city boundaries feel that engagement is concentrated on local organisations within the city. They said that the main engagement focus for the growth deals has been on big public sector organisations and big businesses.2

Businesses noted that some support for engaging with growth deals was available from Business Gateway and local authorities, including workshops and training to help navigate procurement processes. However, smaller organisations in particular still face barriers. Aberdeen Ethnic Minority Women’s Group CIC said:

while there is some support in place to help local businesses engage with city region deals, challenges remain—particularly around accessibility and alignment with smaller organisations’ capabilities. Expanding targeted support, improving access to information, and ensuring that the procurement process is inclusive of smaller, community-focused businesses would be essential for maximising the local economic impact of these deals.7

Business representatives said that there is limited data on business involvement with growth deals. Vikki Manson from the FSB advocated for a robust reporting environment, where the economic impact of the deals on the cities and regions could be outlined and published regularly so that the impact can be monitored.2 The importance of including the evaluation of localised/regional impact of the deals in the annual reports was also highlighted by Scottish Chambers of Commerce.9

Paul Mitchell of the SBF said that there are no national statistics on business involvement in growth deals; he noted that roughly a third of the Glasgow Growth Deal infrastructure expenditure has been spent on local businesses, which is lower than they would have expected. He suggested that raised a question about embedding local spend criteria in the projects.4

When asked about the benefits of deals to the local economy through supply chains and job creation, the Committee was told not every deal could provide a breakdown of the contracts awarded to local businesses. Kimberley Daly of the Scottish Government said:

We have that information. If it is not as visible as it could be, we will certainly work with partners to ensure that it is included in future annual reports.11

Carolyn Currie from WES reiterated the need for clear, informative data, particularly data on women-led businesses:

we should cast a gender lens across all the investment to define what we mean by inclusive economic growth right at the start... We should have gender-disaggregated data available as part of our measure of that; indeed we should have a suite of measures that reflect whether we are achieving the specific inclusive growth targets.2

Carolyn Currie also spoke of the low level of involvement of women-led businesses in growth deals. In response, the Cabinet Secretary said that involving women-led businesses requires specific attention in order to ensure that women are not left out of business engagement work: 'That needs to be part of a much bigger commitment to engage with female led businesses'.11

In its 2020 report, Audit Scotland found that communities had had very limited direct involvement in the development of deals. They recommended that the Scottish Government should clarify its expectations around community involvement in the development of deals.14 Their 2023 report found good progress in raising public awareness, but also a lack of consistency across the deals.

Evidence around growth deal engagement with local communities and the third sector was mixed. Witnesses highlighted specific projects or funds which were led by community groups but noted that these groups face challenges in terms of their capacity to engage with bureaucratic processes which limits their involvement.

Clyde Naval Heritage did not feel a part of the process, and where they have sought to engage were told that decisions have already been taken. They suggested that community organisations are overlooked in favour of commercial operators.15

The Committee heard good examples of community engagement in the Islands Deal, and the use of a community wealth building lens in Ayrshire Deal. Neil McInroy of EDAS said:

There was a lot more sophisticated conversation with the community on the island deals, which seems to me to be effective in creating clarity and breaking out of the dissonance that occurs with some of the deals and the opacity. The conversation goes, “We might be getting a deal. Let us have a conversation about what it will all be about. What are our priorities? Let us devise the deal according to what we, the people, want through the democratic bodies here.”4

The Aberdeen Ethnic Minority Women’s Group CIC said that the main challenges include a lack of clear information, limited resources to compete with larger organisations, and sometimes a mismatch between the available opportunities and the specific needs of community-focused work. They called for enhanced support for outreach and guidance for early-stage and community-focused organisations.7

The Committee notes the evidence suggesting that many local businesses and other stakeholders are not aware of growth deals and the opportunities they offer. The Committee recommends that the Scottish and UK governments make clear the expectations on local authorities to engage with local businesses and stakeholders to ensure a broad base of business input. The Committee calls for local authorities to enhance the support made available to stakeholders to ensure they are well-equipped to engage in and benefit from growth deals. Growth deals must also ensure that information about their activities is readily available to local businesses and other stakeholders.

The Committee welcomes the commitment from the Scottish Government to work with growth deals to ensure that data on local business involvement is included in future annual reports. This will help to build a picture of the benefits of growth deals to local economies.

Measuring outcomes

Witnesses highlighted the need for clarity on how outcomes are measured and assessed. Whilst progress has been made in developing monitoring processes, it is still challenging to see a full picture of the overall impact of growth deals. The Committee also received evidence questioning whether the deals have set or are measuring the correct objectives.

In its 2020 report, Audit Scotland highlighted the need for the Scottish Government to develop arrangements for measuring the overall impact of the deals programme and in particular how it has taken account of outcomes set out in the National Performance Framework. Audit Scotland reported in 2023 that there has been some good progress; all deals now have a benefits realisation plan and there is evidence that they have made progress on collecting and analysing data on different groups in their communities.

Growth deals now set out how they will measure and report on progress in benefits realisation plans, as part of governance and accountability arrangements. This includes reporting against inclusive growth and carbon measures. As part of this process, growth deals produce annual reports setting out progress in relation to their objectives.1

The UK and Scottish governments have agreed a joint framework for assessing each deal, which covers annual conversations, the annual performance report, programme dashboards and quarterly performance meetings.

Each deal is tailored to its own local and regional circumstances and benefit realisation plans are not standardised. This makes it challenging to see a national picture of deals’ contributions to outcomes in the National Performance Framework.1 Catherine Young of Audit Scotland said that the Scottish Government plans to use the metrics that the deals currently collect to present that overall picture in due course, when deals have progressed:

it is difficult to get the overall picture and make the links with the national performance outcomes overall, because the deals are so different in what they are trying to do, and the outputs are quite different. Nevertheless, there is information there at a granular or local level.3

The Scotland Office explained that the expected economic impact of each project is assessed by the Project Management Office of the Scottish and UK governments to ensure that the expected economic impact of each project is aligned with Treasury Green Book guidance; the targets set out in the business cases are then regularly reported against.4

The Secretary of State indicated that each individual deal will set out its own measurements but overall, economic development and more jobs are the biggest outcomes of the growth deals: 'Those are not just short-term jobs, because the deals are all long term.'5 The UK Government noted that the gateway review process in Glasgow had found some evidence of benefit realisation, but that it was still too early to see the full impact.5

The Scottish Chambers of Commerce called for consistency in measuring outcomes, including clarifying for partners at the outset how they should plan for and then measure and report on their impact, including the impact on business through jobs created and investment made:

To ensure consistency, the implementation of clear and robust monitoring and evaluation mechanisms to ensure uniform assessment of project success would help to ensure alignment with intended objectives. Such frameworks should align with broader national policy aims.7

Neil McInroy of EDAS questioned the objectives being set for growth deals, suggesting that they should reflect a move away from the 'old economic growth model' towards the more innovative, sustainable and greener approach:

the deals are conceptualised by questions of growth and productivity, and they are focused on capital investment and skills. However, real innovation in the economy comes from total factor productivity, which involves innovation, technology, ownership models, culture, place, investment in public services and making people feel good about themselves. Academics say that that makes up 60 per cent of productivity.3

Carolyn Currie of WES said that there has been a focus on particular industry sectors that are not those in which women are well represented, which means that there is less opportunity for WES members:9

a majority of deals lack robust mechanisms to ensure that benefits reach women, which risks the focus being on only headline economic growth rather than broader inclusion. There is also variability in how inclusive growth is monitored. Only 17 per cent of deals actually defined inclusive growth, zero per cent had an inclusive growth budget, and only 8 per cent set a target in any shape or form for inclusive growth. There is scope for a lot of improvement.9

Social Enterprise Scotland concurred, stating that growth deals should not only focus on traditional economic measures such as GDP:

These narrow measures do not adequately measure every day quality of life and the tangible economic and social impacts on local communities. We should ensure that all significant investments are measured against other, more useful real-world tools, including the National Performance Framework.11

Neil McInroy of EDAS said that trajectory planning is being done for individual projects, but that the goal should be to create a bigger transformative change:

It is just too projecty, and it is not about how all of this lands and creates these bigger ripple effects in the economy.3

When asked whether Audit Scotland has examined the outcomes of the previous model in place in Aberdeen as compared to the growth deal, Cornilius Chikwama said:

Outcomes are driven by a wide range of factors, including different economic contexts over time. Are we likely to identify differences that we can attribute purely to those differences in governance arrangements? I am not sure. I am not convinced, but there is the potential to look qualitatively at whether the governance arrangements that we have now are better than the ones that we had before.3

Aberdeen City Region Deal explained that their deal was well underway when they were informed of the need to produce a benefits realisation plan. This was challenging as there was no resource to develop the plan and they had to build in the benefits realisation reporting after the project business cases had been approved.14 The Net Zero Technology Centre, which is part of the growth deal, explained that there was a challenge with the lack of baseline data, as benefits realisation reporting commenced in 2023, which was over six years into operation.15

The Cabinet Secretary said that growth deals are long-term strategic programmes, which means that getting a quicker evaluation is less important than the longer-term benefits that are being delivered.16

The Committee welcomes the improvement to performance reporting on growth deals found by Audit Scotland. However, comparing outcomes of growth deals remains challenging. Whilst the creation of benefits realisation plans is a welcome development, these plans are not standardised so it is not possible to create an overall picture.

Benefits realisation plans are a relatively new development and older deals have had to fit them into their projects retrospectively. This has been resource intensive and challenging. The Committee notes that benefit realisation plans are now created as standard for newer growth deals.

The Committee notes the challenges in measuring the longer-term outcomes of deals given the long timescales involved. However, the Committee asks the Scottish and UK governments to set out how more strategic, long-term benefits will be measured.

The Committee agrees with WES that there should be a suite of measures that reflect whether growth deals are achieving specific inclusive growth targets, and recommends that benefits realisation plans should include gathering and presenting gender disaggregated data.

Funding growth deals

Witnesses were positive about the multi-year funding commitments that growth deals bring, as this has created confidence for others to invest. The Scottish Chambers of Commerce said that long-term funding provides certainty for businesses:

Providing long-term at scale funding from all levels of government, is critical to support confidence and certainty of match-funding from other stakeholders involved, as well as allow for better planning of major projects under the deal.1

Derek Shaw of Scottish Enterprise highlighted the need for certainty of public funding to bring in private investment:

Public sector funding is critical for the projects and programmes to be successful, and having confidence in the availability of that public sector funding into the future and for the duration of the deals is critical to leveraging private sector investment. From the projects and deals that Scottish Enterprise has been involved in and supported, we are encouraged by the support from the private sector but, ultimately, on-going public sector support is critical to leveraging private sector funding.

The Cabinet Secretary noted that the Scottish Government wants to be in the position of giving multi-year certainty to partners, but that is dependent on the UK Government's spending review due in June 2025.2

Malcolm Bennie (Falkirk and Grangemouth Growth Deal) highlighted that one of the most challenging aspects about the growth deal is that the money received is flat. He also indicated that timing was an issue. He noted that the deal receives roughly £8 million a year. However, if several projects with a combined cost exceeding this amount are ready to start at the same time, some projects may not be able to proceed. This results in partner organisations having to 'front-load' the spending and wait for the next tranche of funding to recoup their money.3

Inflationary pressures and the construction sector

Each of the twelve deals has faced economic challenges such as the Covid-19 pandemic, labour shortages, constrained public finances and high levels of inflation. Between 2014 and 2024, the cumulative rate of inflation measured by the GDP deflator was 32.8%.1 The Committee heard of the particular pressures through construction price inflation, which has run even higher over this period than the general measure of inflation expressed by the GDP deflator. According to the ONS, between 2014 and 2024 construction prices increased by 46%.2 This has had an impact on the pipeline of projects going forward as a significant proportion of the funding comes from fixed government contributions. HIE said:

Ultimately it is challenging to future proof a set of project proposals, to be delivered over a ten year period, against economic shocks, and changes in market conditions.

Moray Council highlighted the challenging gap between the outline business case and the full business case, exacerbated by a difficult delivery environment, including cuts to partner organisations' budgets due to constrained public finances. Other local authorities, including Comhairle nan Eilean Siar, Orkney Islands Council, and Shetland Islands Council agreed.

The high inflationary environment was not envisaged when the deals were put together. Where this has impacted on projects, Audit Scotland indicated that deals have been told to seek alternative funding where possible, to look at the scope of projects and, as a last resort, descoping or changing the original project. Catherine Young of Audit Scotland said:

Deal bodies have indicated to us that there is a real risk that projects will not start or the intended benefits that were originally set out will not be achieved.3

The enterprise agencies highlighted the importance of value engineering and seeking additional or greater contributions from other funding partners. Scottish Enterprise highlighted that they gave one project an initial commitment of £1 million, which rose to £8 million in response to cost pressures.4 Both Scottish Enterprise and HIE indicated that value engineering can be expensive due to the need to revisit the design process before procurement.4

Paul Mitchell of the SBF welcomed the investment that growth deals bring but noted that since the £6.2 billion is spread over 10 to 15 years, it will not be transformational. The construction industry in Scotland turned over £13.7 billion in output in 2023 alone, and this is expected to increase. He noted that the construction sector values the pipeline and certainty of work.3

Paul Mitchell said that in 2022, the inflation figure for material costs in the construction industry was in excess of 20 per cent, and there has been significant wage inflation, too. However, funding for apprenticeships has remained static, which is squeezing what providers and colleges are able to do; some colleges have started to drop some construction courses.3

Zoe Laird of HIE acknowledged that the construction sector has limitations, which usually relate to the number of available staff, including skilled staff:

In areas where HIE has the resource to support things such apprentices or graduates, we put that wraparound support around a project that we are involved in.4

The Cabinet Secretary said that inflation has 'undoubtedly had a massive impact on the projects, particularly the infrastructure projects, and it has impacted on budgets'.9 Kimberley Daley of the Scottish Government said that there are examples of good innovative working in local authorities to manage the new cost-inflation environment.9

The Committee welcomes the multi-year funding provided by growth deals and the pipeline of work that this creates, as well as providing confidence to private sector investors. The Committee recommends that the UK and Scottish governments commit to continuing to provide multi-year funding to promote regional economic growth.

Many growth deals have faced a challenging economic environment, including significant inflation. This means that deals have had to adapt by finding other sources of funding, repurposing or deprioritising projects and governance processes need to be agile, as set out earlier in this report.

The Committee notes that growth deals have to schedule expenditure to meet the annual funding allocations, which can lead to projects being delayed. The Committee invites the Scottish and UK governments to consider what measures could be put in place to address this, including releasing higher sums earlier which would also help to address inflationary pressures.

Cluttered policy and funding landscape

Growth deals exist within the wider context of local and national policies, including the National Strategy for Economic Transformation and the National Performance Framework. They also sit within a wider economic development context, alongside organisations such as the enterprise agencies and the Scottish National Investment Bank (SNIB), which have their own objectives and priorities. There are also other sources of funding aimed at regional economic improvement, such as the shared prosperity fund.

The Committee considered the extent to which the objectives of the growth deals are strategically coherent with national policy and the priorities of economic development organisations and how these objectives fit into their longer-term strategies. The Committee also looked at how growth deals work alongside other regional economic development funding.

The Scotland Office said that there is broad alignment between the economic development priorities set by the Scottish and UK governments and individual city region and growth deal programmes. This includes alignment with the Scottish Government's National Strategy for Economic Transformation. They said that there is also a strong alignment between many deal projects and the eight growth-driving priority sectors set out in the UK Government's Modern Industrial Strategy Green Paper: Invest 2035.1

Paul Lawrence (Edinburgh and South East Scotland City Region Deal) said that growth deals can tie together local priorities of both the Scottish and UK governments:

The ability to take different parts of the economic landscape—if I can call it that—and design them together to address innovation, inclusion, infrastructure and culture, with different competencies being held in different places, but being absolutely... allied together at city region level, is how you get economic growth. The city region deal enabled that co-design. There was no other game in town with which to do it.2

David Waite, Stuart McIntyre and Graeme Roy highlighted that deals add to a cluttered landscape for economic development in Scotland:

The economic development landscape was already characterised by a number of actors with overlapping remits before city-region deals emerged. We remain sceptical that this is the best environment to deliver economic development policy in Scotland. While City-Region deals provide an emphasis and resource to local authorities, it is unclear to what extent these are effectively coordinated with other initiatives, such as day-to-day spending upon economic development in Scotland by other agencies and the Scottish Government, and more recent UK-wide initiatives such as investment zones, innovation accelerators and green freeports. Urban and regional policy in Scotland has become something of patchwork of various funding pots and tools, that ultimately elides a strategic sense of what is needed and what will be most impactful.3

The Glasgow City Region Deal said that it had worked closely with the Scottish Government in relation to NSET and that their regional strategy and the Scottish Government's national strategy are closely aligned.2 Similarly, Edinburgh and South East Scotland City Region Deal said that their regional prosperity framework encompasses growth deal projects and other initiatives, such as UK shared prosperity funding, which has enabled them to pick up on new and emerging national priorities.2 The FSB agreed that there is a clear link between the deals and other aspects of economic policy, including NSET.6

Aberdeen City Council highlighted one area where there has been a change in direction where the Oil and Gas Technology Centre became the Net Zero Technology Centre (which is a growth deal project). That change continued to represent the aims and objectives of the Regional Economic Strategy, while linking more closely to policy objectives nationally around an energy transition and a just transition.7

However, the Scottish Chambers of Commerce called for a review of how deals are co-ordinated with other initiatives and strategies. Otherwise, they warned that 'a myriad of policy measures' will impact the overall strategic direction and reduce the impact of deals. They said that clarity from the UK Government on the future of the levelling up agenda or other new regional economic development platforms would support this.8

Individual responses suggested that there is a lack of alignment, particularly in some deals where there is a focus on road building which is inconsistent with government targets to reduce car kilometres and its wider climate goals, and suggested that the declaration of a climate emergency had not had a significant impact on deals.

Transform Scotland raised similar concerns, stating that 70% of transport spending across deals is concentrated in high carbon road projects which are at odds with Scotland’s net zero strategy.

HIE said that the deal projects are well aligned with economic development policy but there is less ability to deliver against the complementary skills and entrepreneurship policies, given the largely capital nature of the growth deal funding. They also argued that, as new priorities emerge, such as automation, robotics, digitisation and technology and the impacts of climate change, the growth deal projects will be limited in their ability to deliver against these new economic drivers.9

Matt Lockley of Scottish Enterprise said that as growth deals have developed over time, some of their alignment with its own objectives has diverged. Scottish Enterprise now has a clearer set of missions, which means that they no longer actively support or sit alongside some of the deal projects that they were previously involved in.10

Cornilius Chikwama of Audit Scotland said that since the creation of the growth deals, there have been further changes to the regional and local economic development landscape, partly as a result of various interventions by the UK Government, for example, green freeports, investment zones and the shared prosperity funds: