COVID-19: impact on businesses, workers and the economy and pre-budget scrutiny

Section one- Background and impact on businesses

COVID-19 has triggered the most severe economic recession in almost a century. Its impact is being felt by businesses and people across the whole country. The Committee has been carrying out an ongoing inquiry on the impact of the crisis on businesses, workers and the economy.

Over the summer, the Committee sought written evidence on four key strands of the inquiry:

Impact on businesses and workers

Role of the enterprise agencies and SNIB

Plans for economic recovery (including scrutiny of the Advisory Group on Economic Recovery (AGER) report)

Impact on young people.

The Committee would like to thank all those who provided written and oral evidence and attended the focus groups. This evidence was valuable in informing the Committee’s ongoing scrutiny of the response to the impact of the pandemic.

This is an extremely difficult time for many businesses and workers. They play a central role to life in Scotland, providing vital services and the revenue to fund public services. The Committee would like to thank Scotland’s businesses and workers for their resilience and hard work throughout the pandemic and to acknowledge the trying times that many are facing.

This is an interim report as the Committee’s inquiry is ongoing. This report covers the Committee’s work from March to early October 2020; the report is a snapshot in time and does not cover the period after early October. As this crisis continues to evolve, we have not sought to make firm recommendations in every policy area. Over the next two months, the Committee plans to take evidence from witnesses across Scotland to find out the impact in different places. The crisis is affecting regions in different ways; this is explored later in this report.

Initial economic impact estimates

From the onset of the pandemic, it was apparent that traditional economic statistics, such as GDP, are not the most useful to gauge impact in the current extraordinary times. They are published with a lag and they are built upon ‘sectors’ as defined by national accounts rather than type of business activity (which is most relevant for social distancing).

The Scottish Government statisticians in response to this challenge developed new monthly economic statistics to track the immediate impact on the economy and to assist decision makers in relation to the response:

They have published a Monthly Business Turnover Index from March 2020 onwards. This is an early indicator of business activity, broken down to Manufacturing and detailed Services sectors, based on the survey data used for GDP

They have also published estimates of Monthly GDP, which are a flash estimate of changes in output across the whole economy. Results are available shortly after the release of the equivalent UK monthly GDP statistics, at around 45-50 days after the reference period.

The latest estimates from the State of the Economy report (29 September 2020) forecast that in the short term the central scenario is for economic output in Scotland to fall 9.8% in 2020, broadly in line with the Bank of England’s projection for the UK, while unemployment in Scotland may peak at around 8.2% in the fourth quarter. Recovery in the medium-term is still expected to be gradual with economic activity returning to pre-crisis levels by the end of 2023.

Data published at the end of September show that while economic output remains 10.7% lower than pre-pandemic levels, the Scottish economy grew for the third consecutive month in July, at 6.8%, and has now recovered more than half the fall in output we saw in March and April.

Headline labour market measures of employment and unemployment have held up primarily as a result of the substantial Government support through the furlough scheme. In June, around 32% of Scotland’s workforce was furloughed, which gradually fell to around 15% at the end of August, equivalent to around 217,000 jobs, with 67.2% of businesses with a presence in Scotland reporting having staff on furlough leave.

Looking forward, the State of the Economy report stresses global economic uncertainty remains high, and risks to the outlook are very much skewed to the downside. Trading conditions, particularly for those sectors that have been disproportionally impacted, remain extremely challenging with many operating at reduced levels of capacity and facing ongoing cashflow challenges. This is reflected in wider labour market indicators with businesses reporting reductions in staffing levels and downward pressure on wages to adapt to lower levels of demand. The variation in how sectors are faring is striking and recovery is likely to be slow for many parts of the economy.

There is great uncertainty around future economic estimates with significant negative risks from further waves of coronavirus cases (domestic and global) and further local and international restrictions, as well as a possible failure to agree a trade deal with the EU.

COVID-19 - business support

During the crisis, both governments have offered various packages of business support to address the impact on businesses and economic activity. Comprehensive measures were needed to protect businesses and individuals during the crisis.

The Committee has heard evidence about support for businesses; as this is a fast-moving crisis, many of the issues raised early in the inquiry have already been addressed or superseded. Given this, the Committee is not seeking to make recommendations in relation to the type of business support on offer, but the report does cover business support processes and the role of economic development agencies in providing support.

At the time of writing this report (October 2020), the following business support had been made available. The Scottish Government’s initial response introduced a package of measures worth £2.3 billion to support businesses. This has included:

100% rates relief for properties in the retail, hospitality, leisure and airport sectors

1.6% rates relief for all non-domestic properties across Scotland

a local authority-delivered Business Support Fund with grants. These funds are now closed and the most recent data show local authorities reported that over 106,000 applications have been received for the Small Business Grant Scheme and the Retail, Hospitality and Leisure Business Grant Scheme across Scotland. Of these applications, over 90,000 grants valuing over £1,014m have been awarded.

Pivotal Enterprise Resilience Fund £120 million

Newly self-employed Hardship Fund (incl. £3m re-purposed from 15 June to support Bed and Breakfasts) £34 million

Creative, Tourism, Hospitality Enterprises and Hardship Fund £30 million

a package worth £60 million agreed with the water industry to help businesses facing difficulties with water charges during the outbreak

an initial package of more than £5 million for the fishing industry to help more than 650 vulnerable seafood fishing vessels

a £10 million scheme will provide financial support for seafood processors

a £3 million scheme for around 100 businesses which make a full time living from shellfish growing and trout farming

a £3.5 million package to help large sea fishing vessels.

two tourism funding packages, worth £15 million - £1 million grant available for self-catering businesses and £14 million Hotel Recovery Programme.

Furthermore, in June the Scottish Government announced a £230 million economic stimulus package. Initiatives cover construction, low carbon projects, digitisation and business support. It is funded by the reallocation of underspends from schemes interrupted by COVID-19. New projects featured in the package include:

£51 million for business support, including boosting high growth companies

£78 million for construction, including £40 million for regeneration projects and £20 million for roads maintenance

£66 million to kick-start green recovery, including £7 million to equip buses for physical distancing and the return to work

£35.5 million for digitisation, including justice and education services.

According to Audit Scotland business support announcements from the Scottish Government have totalled £3,272 million (as of 31st July), as detailed in the table below.i

Business support measures Costing (£m) Business support grants (total cost) 1,202 Business rates relief (total cost) 875 Pivotal Enterprise Resilience Fund 120 Newly Self-Employed Hardship Fund 34 Creative, Tourism & Hospitality Enterprises Hardship Fund 30 Bridging bursaries fund 1 Scottish Water Support for Business Water and Sewerage Bills 60 SME Housebuilders Emergency Loan Fund 100 The Private Rent Sector Landlord Covid-19 Loan Scheme 5 Support for reopening zoos 3 Total support for seafood and fishing industry (3 funds) 23 Return to work package 230 Community and Renewable Energy Scheme and Low Carbon Infrastructure Programme 6 Energy Transition Fund 62 Support and economic stimulus for Scottish newspaper industry through additional marketing spend 3 Investing in Scotland’s entrepreneurs and innovators 38 Agriculture loan scheme 340 Charity sector 110 Tourism and cultural sector (in addition to business support grants) 31 Total SG business support announcements 3,272

In addition to the schemes introduced by the Scottish Government, Scottish businesses can also access a number of UK-wide schemes that have been introduced (and funded/guaranteed) by the UK Government. As these are UK-wide schemes, the Scottish Government does not receive Barnett consequentials in relation to them as Scottish businesses can benefit through applying directly for the relevant support. Up to October 2020, UK Government schemes and support measures that could be accessed by Scottish businesses included:

A Self-Employment Income Support Scheme that will pay self-employed individuals up to 80% of their profits for three months, up to a £2,500 per month cap. The scheme will not apply to those who operate under a company structure and take dividends

A Coronavirus Business Interruption Loan Scheme that will see banks offer loans of up to £5 million to support small and medium size enterprises (SMEs). The Government will cover the costs of interest on these loans for the first six months. The scheme was extended to larger businesses from 20 April

The Bounce Back Loan Scheme helps small and medium-sized businesses to borrow between £2,000 and £50,000. UK Government guarantees 100% of the loan and there won’t be any fees or interest to pay for the first 12 months. Loan terms will be up to 6 years. No repayments will be due during the first 12 months

A Coronavirus Job Retention Scheme that will see HMRC pay 80% of “furloughed” workers’ wages, up to a £2,500 per month, currently for up to 4 months starting from 1 March 2020, but it may be extended if necessary and employers can use this scheme anytime during this period

The Job Support Scheme expanded to support businesses across the UK required to close their premises due to COVID-19 restrictions; the UK Government will pay two thirds of employees’ salaries and cash grants for businesses required to close in local lockdowns have been increased to up to £3,000 per month

Statutory Sick Pay (SSP) costs for businesses with fewer than 250 employees will be met by the UK Government in full for up to 14 days per employee

A COVID-19 Corporate Financing Facility (CCFF) for large businesses

Tax deferments are available on both self-assessment tax returns and VAT returns

Up-scaling of HMRC Time To Pay service, allowing businesses and the self-employed to defer tax payments over an agreed period of time.

Submissions to the inquiry were received from across Scotland, from Ullapool to Glasgow’s pub scene. No sector of Scotland’s economy has been left untouched; the Committee has heard from agriculture, health, creative industries, energy, food and drink manufacturing, and construction to name just a few.

Some common issues from across the submissions received over the summer included:

further clarification from the Scottish Government on the guidance on which businesses can continue to operate in compliance with social distancing

many are frustrated by the complexity or lack of flexibility in eligibility criteria across support interventions

a need for different COVID-19 policy responses between urban and rural areas (e.g. around social distancing and business operation guidance, specific rural funding schemes)

concern that loans, deferrals (such as VAT) and payment holidays were not adequately supporting businesses as they created short- and medium-term debt that businesses were unwilling to take on with such future uncertainty

increased costs associated with social distancing requirements (flexi-plastic at tills, additional signage, additional cleaning, PPE, extra security for marshalling)

concerns around the mixed messaging from both the UK and Scottish Governments

likely supply-chain impacts, especially if a different pace of reopening across geographies or sectors

the need to look at non-domestic rates, planning and procurement as part of support for businesses during the crisis

concerns that reduced productivity across the supply chain, due to the pandemic, will lead to gaps in orders for some businesses (such as manufacturing businesses)

concerns about the ‘double whammy’ of COVID-19 and Brexit.

The Committee commissioned an international comparison of support for business during the crisis from the Institute for Government. As in the UK, the bulk of policies in the countries examined were aimed at helping all businesses survive the initial shock caused by the spread of the virus and, in most cases, extensive economic lockdown. A second set of policies has focused on helping the economy recover and restructure once the threat of COVID-19 wanes.ii

Many of the schemes covered have been open to all businesses but all the countries in the study also provided some sector-specific support, mainly to those firms that have been hardest hit, usually the travel, tourism or hospitality industries, but also to start-ups, exporting firms and strategically important businesses. All governments have targeted the most generous support at smaller firms. This latter targeting has been justified in most cases by the fact that the majority of employees in those countries work for small and medium-sized enterprises (SMEs) and that those firms had fewer resources to deal with a crisis.ii

The Committee welcomes the business support made available to date. Given the fast-changing nature of this policy area, we are not making any specific recommendations in this report on the packages offered to businesses. The Committee has corresponded with both the Scottish and UK Governments on issues with business support. That correspondence can be found here. In this report, the Committee will explore evidence from businesses on support measures going forward. The Committee has also looked at the delivery of support.

Impact on businesses

FSB Scotland’s Scottish small business confidence index for Q3 2020, published in October, found that:

almost a quarter of Scottish business owners (24%) believe that conditions for their business will get much worse over the next three months, a fifth (19%) believe they will get slightly worse;

over half (53%) of the Scottish businesses surveyed reported a drop in revenue growth; a similar share (49%) expect revenues to fall next quarter;

on a UK-wide basis, one in four (25%) small firms said that they have reduced headcounts over the past quarter; 29% expect to make redundancies over the coming three months.i

Business organisations welcomed the support given by both governments as the crisis has evolved; this has provided a lifeline in many cases. However, they also called for sustained government support for businesses which continue to grapple with the impact of the crisis and for support to continue through the winter and into next year.ii There have been calls for support to be tailored to different sectors and regions. These issues are explored below.

A number of witnesses stressed that the UK Government’s Job Retention Scheme is masking unemployment which will come further down the line. In August, Liz Cameron of the Scottish Chambers of Commerce (SCC) said:

It is clear that 35 to 40 per cent of businesses will struggle to bring back all their employees [at that point] and are already planning redundancy consultations and packages. The unfortunate position is that a lot of redundancies will be coming our way in the next few months.iii

In September, the Cabinet Secretary for Economy, Fair Work and Culture (‘the Cabinet Secretary’) spoke of the need to extend the furlough scheme and argued that this measure would maintain productive capacity, yield tax returns and prevent the costs of unemployment.iv There have been developments with the provision of job retention support since that evidence was given, but the concern remains about redundancies coming down the line. The Committee covers this in the section of the report on the labour market.

Giving evidence back in May, Tracy Black of CBI Scotland spoke of the need to work together at this time of crisis:

Protecting lives and livelihoods and initiating full resumption of economic life in Scotland requires true partnership between both Governments— national and devolved—alongside business, employee representatives and other stakeholders. That is how we will successfully manage this complex, multifaceted and unique situation.v

The AGER report also highlighted the need for the Scottish Government and the business community to take urgent action to develop a ‘new collaborative partnership on the strategy for Scotland’s economic recovery.’ In its response, the Scottish Government committed to a partnership approach with business, trade unions, the third and voluntary sectors, local authorities and enterprise and skills agencies, that is based on shared ambitions.vi

The Committee agrees that working together is key to supporting businesses and workers through the crisis. The Committee believes that it is vital that both governments work with businesses, trade unions and individuals to identify and address any delays or gaps in financial support. It is important that information on funds available, and any gaps, is made available for scrutiny (as discussed below in the section on data).

Supply chains

The COVID-19 pandemic has disrupted production for many businesses, leading to supply chain challenges for companies in Scotland. Some businesses told the Committee that getting supplies has been a challenge and this has affected their ability to take advantage of increased demand (for example, in certain parts of the construction sector).i

Speaking to the Committee in June, the Cabinet Secretary explained that the Pivotal Enterprise Resilience Fund (PERF) is for companies that are vital to Scotland’s economy, which were viable before COVID-19, but have become vulnerable due to the crisis. She said that companies in supply chains are part of that as they are key to restarting the economy:

We will not be able to restart if we do not keep productive capacity in supply chains. If companies that have sustained demand and activity cannot function fully, we will not have an integrated economic response.ii

Demand for PERF was high and the fund was oversubscribed; there were 5069 applications for PERF and 1763 PERF grants were offered, totalling £121,792,000.

In September, the Cabinet Secretary highlighted the work being done by the National Manufacturing Institute Scotland to increase manufacturing self-sufficiency for Scottish supply chains.iii

Data

It is important that data on business support is produced to highlight gaps and scrutinise its reach. Throughout the inquiry, the Committee has emphasised the importance of transparency regarding how funds are being awarded. The Committee asked the Scottish Government to publish detailed data, including the type of business receiving support, to allow the Committee and others to analyse the impact of the funding.

Over recent months more data on the uptake and distribution of various business support programmes has become available:

Summary statistics for the Newly Self-Employed Hardship Fund, Pivotal Enterprise Resilience Fund (PERF) and Creative, Tourism and Hospitality Enterprises Hardship Fund (CTHEHF), and Bed and Breakfasts Hardship Fund (B&BHF) (published August 2020)

Grant statistics for the Small Business Grant Scheme and the Retail, Hospitality and Leisure Business Grant Scheme across Scotland (initially published in April 2020 and last updated in September 2020)

Coronavirus Job Retention Scheme Official Statistics (published monthly) (only some breakdowns available at a Scotland level)

Self-Employment Income Support Scheme Official Statistics (published monthly) (only some breakdowns available at a Scotland level)

Eat Out to Help Out Scheme - regional data (September 2020)

Coronavirus Business / Large Business Interruption Loan Schemes (CBILS/CLBILS), Bounce Back Loan Scheme (BBLS) and Future Fund (UK level only from HM Treasury), regional distribution of loans under CBILS and BBLS (British Business Bank), and CBILS & BBLS offered by Constituency (British Business Bank).

In correspondence in May and June, the Scottish Government explained that information on the business support schemes by local authority is being published but that the available data does not provide information broken down by sector.i Although data on local authority grants schemes has not been made available by sector, data on PERF and other schemes is now available.

It is also important to establish the reach of business support across different types of business. Women’s Enterprise Scotland (WES) said that the economic and health impacts of COVID-19 will be gendered. They highlighted the need to gather gender disaggregated data and to recognise gender differences in the effects of the COVID-19 virus both physically (e.g. pregnancy) and economically. They highlighted that there has been no targeted support for women-owned businesses, who remain at increased risk. They stated that there is a mounting possibility that the impact of COVID-19 will undo decades of progress on equality if the lack of targeted action continues.ii

In evidence to the Committee in May, Susan Love of FSB Scotland said that migrant entrepreneurs are less engaged with support systems, so they might be struggling to access what they are entitled to.iii At the same meeting, the Scottish Council for Development and Industry (SCDI) recognised that most support announced to date has been targeted at SMEs; they are concerned that some organisations in larger sectors will also need greater support given the scale of financial disruption.iv

To represent the position of those processing business support applications, Scottish Local Authorities Economic Development Group (SLAED) highlighted that as a result of the crisis, certain data collecting processes have been simplified and ‘red tape’ has been removed to enable quicker responses. They believe that this should be built upon to permanently remove barriers around systems and evidence gathering to make it easier for local authorities to support people and businesses. They noted that standardisation of the collection of data has been useful in responding to the crisis and means that all local authorities and the Scottish Government are able to analyse this to spot trends and make decisions.ii

The Committee understands the initial reasons for the lack of disaggregated data, given the speed at which business support has been provided during the pandemic and notes that data has since been published by both Governments. However, gaps still remain. The Committee asks the Scottish Government and its agencies to set out what steps they are taking to ensure that there is equality of awareness and access to business support during the pandemic, especially for businesses led by women, people with disabilities and ethnic minority businesses.

The Committee also asks the UK Government to provide more consistent data on the uptake in Scotland of business support packages and loan schemes.

Sectors

The underlying structure of Scotland’s economy could look very different when we emerge from the current crisis. The impact on sectors has very much been driven by the extent that restrictions have required business sectors to close, the ability for jobs to be continued from home and the extent to which demand has enabled businesses to continue trading (including at reduced capacity).

This variation was particularly evident in GDP output data (published in September) in which accommodation and food services output fell 76.7%, transport and storage fell 24.9%, while sectors with more flexibility to work from home and continue working, such as financial and insurance activities, fell 3.4% and public administration and defence growth was flat (0.0%). In the production sector, manufacturing output fell 15.5% over the Q2 2020, while mining and quarrying industries fell 28.9%, with output across industries most impacted by the capacity at which business operations have been able to operate and the extent to which supply chains have remained open.

Some sectors and regions of the economy are particularly exposed to the major drops in economic activity. This was reflected in evidence received by the Committee; a summary is available in this Scottish Parliament Information Centre (SPICe) blog.

Scottish Government analysis developed a sectoral risk rating based on exposure to international supply, international and domestic demand and labour market disruptions which shows that the cumulative economic impact appears greatest for manufacturing, construction, retail and wholesale, accommodation and food services, and entertainment and recreation.i

There is a regional dimension to the impact on different sectors, as illustrated by Highlands and Islands Enterprise (HIE) in evidence given in September:

our top priorities are retaining and creating jobs, and we will be organising all our resources to support the key sectors in the region’s economy, which depend on those jobs. Those sectors, which include tourism and food and drink, have been among the hardest hit. We also continue to focus on the key geographical areas where there has been a severe impact, including the islands and remote mainland areas. However, we are looking at new opportunities, such as growing a space sector, life sciences, renewable energy and the marine economy.ii

South of Scotland Enterprise Agency (SOSE) explained, in correspondence in August, that the South of Scotland has been particularly exposed to the effects of COVID-19, reflecting the rurality of their region and the composition of their economy. Their business base is heavily dominated by SMEs and high levels of self-employment, which it is widely acknowledged will be more exposed. 52.5% of jobs within the South of Scotland are in sectors which are highly impacted (including tourism, accommodation & food services, non-food retail, creative industries, manufacturing and construction).iii

Giving evidence in May, Matt Lancashire of SCDI highlighted that the oil and gas sector in the north-east is struggling because of the global oil price and current lack of demand for oil:

We need to think about how we can regenerate the north-east and the oil and gas sector, and support it through the crisis in a way that keeps the people with the skills, talent and knowledge employed in the north-east, so that we can look towards a green recovery and the low-carbon transition. It is possible for us to become a global leader in that industry, and the chance exists for us to do so in the transition period up to 2045. However, we will not do that unless we support the sector and retain the knowledge that exists in it right now.iv

In evidence in May, business organisations supported a tailored approach to business support, recognising the needs of different sectors.[1] In June, the Cabinet Secretary said that the Scottish Government has asked the UK Government for more support in particular areas because there are aspects of the Scottish economy that will require longer-term support:

One is the tourism sector. We know that, even if tourism businesses can come back and have a summer season, their margins will be challenging. We must keep that capacity because tourism is a very important part of our economy.v

In August, the STUC argued strongly that employees in certain sectors which have seen a complete drop in demand for their services (such as hospitality, tourism and aviation) will be particularly in need of ongoing furlough support.[1] Giving evidence in May, Tracy Black of CBI Scotland also highlighted the differential impact:

Some of our members reckon that they will be operating at around 60 or, at best, 80 per cent capacity. For many companies, that is not a viable proposition—particularly in industries that have very tight margins, like the automotive and aerospace industries. It is a real concern and comes back to the need for tailored support for sectors that will take time to recover.vi

Although sector-specific support is important, business organisations pointed out that many businesses do not fit neatly into one sector.vii In evidence to the Committee in May, Tracy Black of CBI Scotland said:

We need a comprehensive look at recovery for all areas of Scotland and across sectors, rather than just putting sectors in silos.vii

At the same meeting, Susan Love of FSB Scotland illustrated that the impact on one sector, such as tourism, has an impact through the wider chain of businesses supporting that sector. Support is needed for that wider chain of businesses.ix

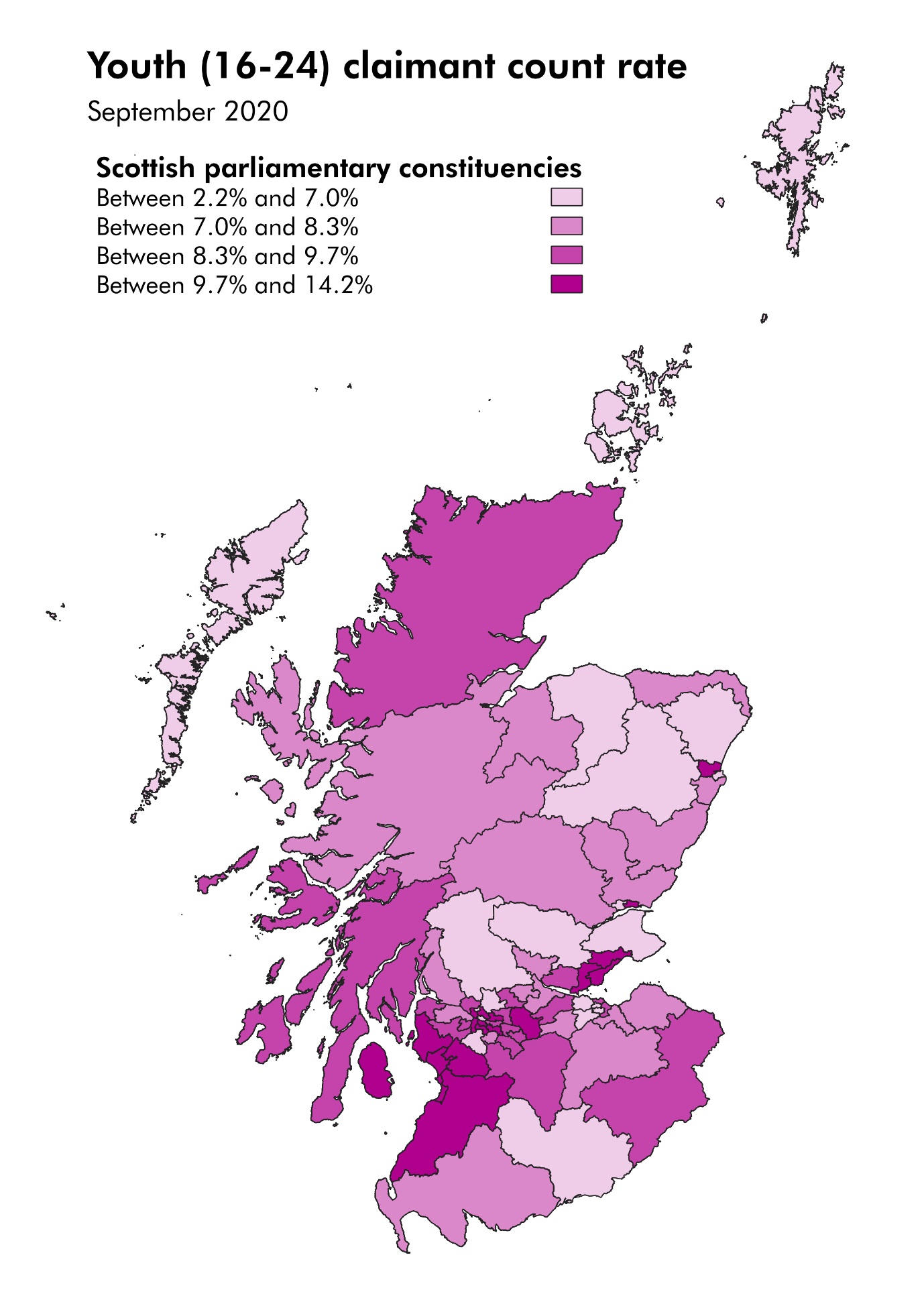

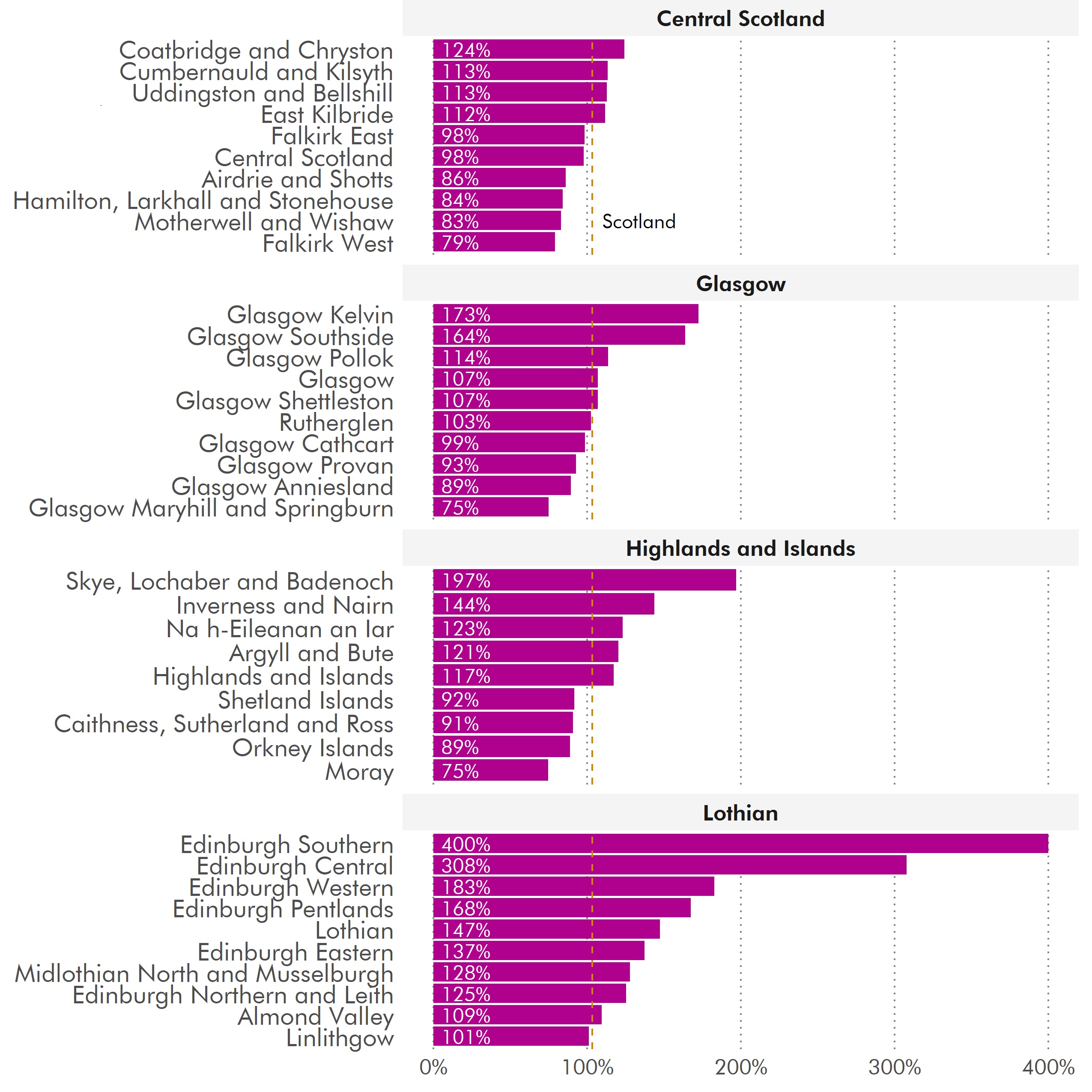

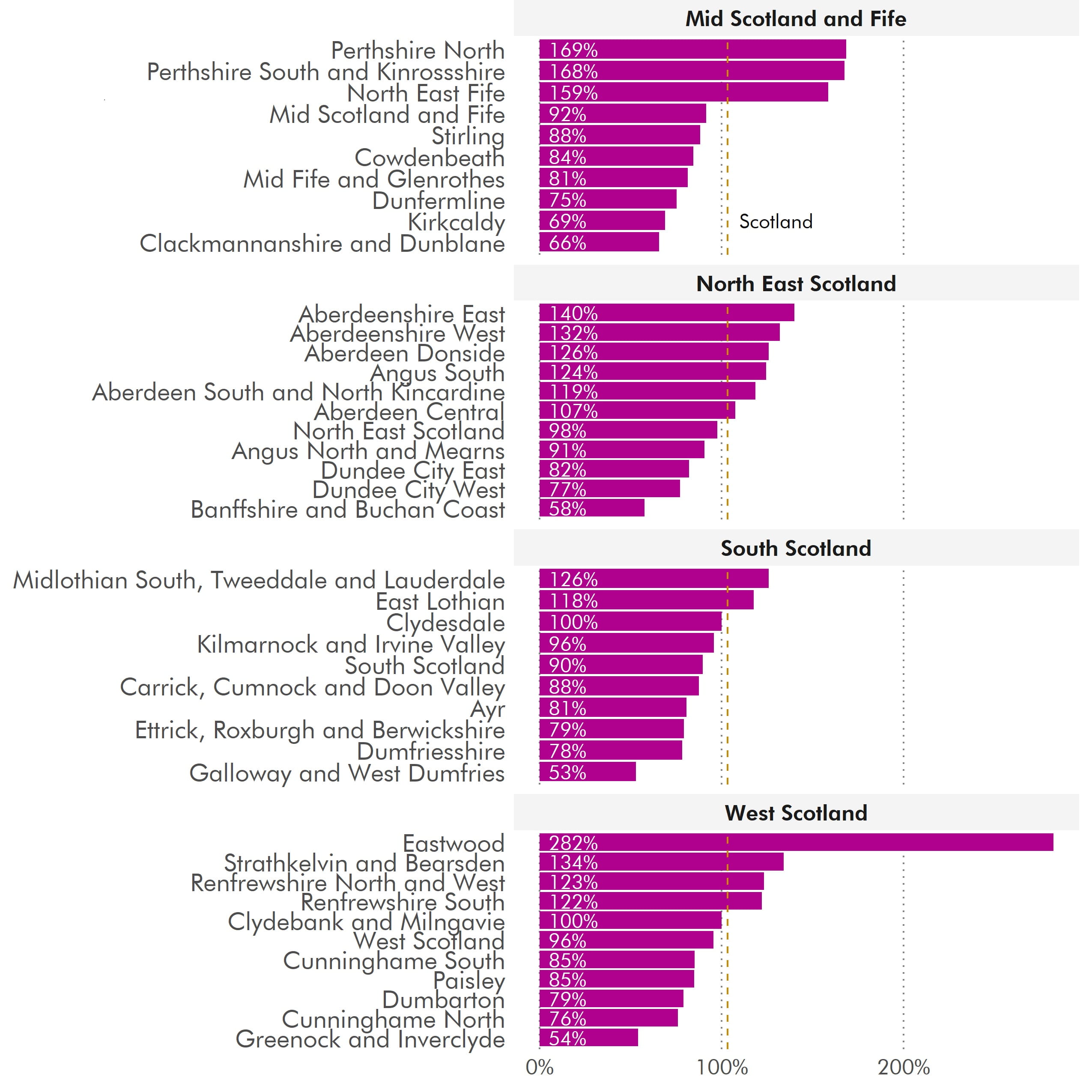

Regions

As outlined above, the impact of the crisis is not evenly spread across Scotland. Certain areas of Scotland, where particular sectors dominate, are more vulnerable to long-term impacts.

The AGER report said that the Scottish Government’s commitment to inclusive growth has a strong regional dimension, recognising the significant differences in economic opportunities, activities, levels of output and income per person that exist in different parts of Scotland. These derive in part from Scotland’s particular economic geography, with large remote and rural areas, coupled with recent trends towards city-based economic growth.i

The Scottish Government has developed an index to assess relative resilience of local authorities across Scotland which considers the business base, existing deprivation and income levels, digital connectivity and productivity, factors which are likely to make areas more resilient to shocks.i

Aberdeen and Aberdeenshire are likely to suffer from the oil price crash, as well as the impacts of COVID-19 on the capacity of the business base. Also, there is the stalling of strategic projects such as Aberdeen Harbour. Argyll and Bute and the Highlands and Islands in particular have a high dependence on the tourism sector. Other areas of high dependence include South Ayrshire, Stirling, Perth and Kinross, and West Dunbartonshire. In terms of the rural economy, Susan Love of FSB Scotland said (at a Committee meeting in May):

…the rural economy is more reliant on certain industries, there is a much higher proportion of self-employed people and there is more unemployment. Private sector employment in rural areas is far more likely to be in small businesses and there are issues around the available workforce and connectivity…businesses in the rural areas are more fearful about whether they will reopen than those in urban areas.iii

At a Committee meeting in September, HIE said that overall gross domestic product in the region is estimated to have decreased during the year by between £1.5 billion and £2.6 billion, which is severe in a region of just under 500,000 people.iv

Barry McCulloch of FSB Scotland expressed concern, whilst giving evidence in August, about the impact of the crisis on businesses and areas that were already struggling before COVID-19 hit:

The Higgins report made clear the difference before the crisis between economic output figures in the Edinburgh economy and Ayrshire economies, for example—it showed that there was a £30,000 per head difference in output. Obviously, the crisis will just exacerbate that difference. The question is how we target action to ensure that the places that will be worst affected by the pandemic have a sustainable route out of it. I do not think that we have cracked that problem yet. The Scottish Government’s implementation plan talks about aligning resources to a regional level for Scottish Enterprise. To be honest, I am not sure what that means.v

Giving evidence in August, Liz Cameron of the SCC agreed that there is a case to be made for looking closely at local support mechanisms and customising support into specific areas:

There is funding within city deals, and there is also funding in some of the other UK and Scottish Government town deals and urban deals. If we can begin to co-ordinate that funding a bit better than we are doing now, it might help to support businesses in the areas concerned.vi

Mairi Spowage of the Fraser of Allander Institute (FAI) highlighted at a Committee meeting in May that small businesses without cash reserves are more likely to disappear, and are especially dominant in rural areas:

so there could be an impact not only on the local economies but on the communities, which are already dealing with challenges such as the ageing population and people moving to more urban areas.vii

Later in this report, the Committee will explore the ‘place based’ approach being pursued by Scotland’s enterprise agencies. Given the regional and sectoral divergence across Scotland, the Committee agrees that business support should be from the ground up and tailored to the local economy. The Committee recognises that the immediate response to the crisis could not fully embrace this approach, given the urgency of the situation. However, the Committee recommends that this approach is taken to the provision of business support going forward.

Debt

The AGER report said that sectors hardest hit by the pandemic are often the same as those with the highest level of indebtedness. Despite the support measures in place, businesses, households, organisations of all kinds and government will all emerge from the crisis with debt, and how this debt is dealt with will have a substantial bearing on the speed of economic recovery.i

The UK Government has put measures in place to protect businesses from insolvency, which will be extended to give businesses some breathing space during the pandemic; the Scottish Government is seeking to agree a National Debt Plan to provide support to businesses, households and the banking system as the economy recovers by managing debt over a longer time period.ii

One of the key objectives of policies early in the crisis was to prevent viable businesses going under because of liquidity problems. Data on the prevalence of bankruptcies suggests all the countries examined by the Institute for Government’s comparative report have done enough to avert widespread business failure so far. However, there are some signs that policy in some countries may be hampering the normal process of ‘creative destruction’ in the economy; bankruptcy rates have, for example, dropped well below 2019 levels in Canada, Germany and Norway.iii

In recent commentary published in August, FAI was struck by how many businesses had increased their debt burden during the crisis. Almost half of businesses had undertaken additional borrowing since March, with a clear correlation between resilience and rising debt levels. Whilst 1 in 4 firms which described their cashflow as ‘very secure’ had increased their debt levels, this figure rose to 3 out of 4 for firms whose cashflow was ‘very insecure’.

In a focus group in September, businesses told the Committee that there is a reluctance to take on debt; some took loans through COVID-19 schemes as an ‘emergency parachute’ but hoped not to use them.v Liz Cameron of the SCC said, in evidence given in May, that the majority of its member businesses were not accessing the loans, because confidence in their ability to pay back loans is extremely low. They are concerned about taking on excessive debt and not being able to make repayments.vi

Barry McCulloch of FSB highlighted, during a Committee meeting in August, the impact of debt on economic recovery:

The figures from the bounce back loan scheme and the coronavirus business interruption loan scheme show that those schemes have had a huge impact. However, we are unsure what impact servicing that debt will have in the longer term, and whether it will take the place of investing in the business, dampen the recovery when we get to that point, or come at the cost of doing other things that the business would otherwise like to do, such as investing in or training staff, or upgrading premises.vii

Giving evidence in May, Matt Lancashire of SCDI asked for risk-taking to be recognised in business support schemes:

The debt will be absolutely humongous and significant—SCDI members and I believe that business support should start to reward risk in order to create new opportunities, products, services and manufacturing ideas that create jobs. If we create jobs, the tax take goes up, which can start to pay back some of the debt that we will have accumulated throughout the process. That is critical.viii

The Committee recognises that debt levels are rising as a result of the crisis; this will impact on economic recovery. The Committee asks the Scottish and UK Governments to set out how their future response to the crisis will address higher levels of indebtedness by businesses.

Section 2 - Enterprise and local economic development agencies

Enterprise agency activity

The role of enterprise and local economic development agencies is critical to the immediate response to the pandemic and working towards medium and long-term economic recovery.

All three enterprise agencies have adapted their day-to-day activities and plans to focus on mitigating the effects of COVID-19. This was in line with the Scottish Government’s interim letter of guidance issued to all enterprise and skills bodies in April which indicated that all resources not required to meet contractual commitments should be prioritised to meet the emerging economic and social challenges arising from the pandemic. The enterprise agencies have been part of the COVID-19 Response Steering Group, which is a collaborative multi-agency. It is seeking to ensure alignment in delivery of support.

In March, the Scottish Government allocated £300,000 additional funding to Scottish Enterprise (SE) to support the delivery of the Find Business Support website and a helpline to support businesses through the COVID-19 crisis. The enterprise agencies are also supporting two initiatives hosted by SE: Contact (the monitoring of existing social media accounts and aims to respond to queries made via these channels in 24 hours) and Peer to Peer (a new platform that will allow businesses to link up with one another in a bid to build an online community that will help resolve problems such as supply chain issues).i

SE, in conjunction with the Scottish Government and the other enterprise agencies, delivered the Pivotal Enterprise Resilience Fund (PERF) and the Creative, Tourism & Hospitality Enterprises Hardship Fund; the £150m funding for these funds came directly from Scottish Government. SE explained that the creation of the PERF and Hardship fund required a new approach, cross-agency in nature and at a greater volume than any enterprise agency scheme has ever faced. The funds had to be developed, implemented and disbursed in a matter of weeks.ii

The Early Stage Growth Challenge Fund is managed by the Scottish Investment Bank, Scottish Enterprise’s investment arm. This fund is designed to support early-stage, high growth, innovative Scottish companies who have been negatively affected by COVID-19. In addition, the Hotel Recovery Programme will support an estimated 50 to 60 businesses with grant funding and business support from the relevant enterprise agency and partners.

In correspondence in August, SE said that a current workstream is ‘Future Economy’ described as ‘identifying and prioritising future opportunities to drive the economic recovery phase, with a focus on how to build economic resilience and respond to emerging global growth opportunities where Scotland has genuine international advantage’.ii

SE has played a central role to the efforts in supporting businesses through the crisis. The Committee was recently informed that the SE Chief Executive, Steve Dunlop, is stepping down from his role. Given the challenges that Scotland’s economy is currently facing, the timing of this change at the top is unfortunate.

HIE said that while many of their existing products and services are still relevant during the crisis, they have had to adapt and evolve both the delivery and content. HIE’s key financial interventions in respect of the COVID-19 response phase came via the Supporting Communities Fund, PERF and the Hardship Fund. The resources and expenditure for the former were routed directly via HIE whereas for the latter they were routed through SE.iv

Overall SOSE has supported over 270 businesses and organisations in the South of Scotland with over £12 million of support, ‘many of which may have ceased trading had it not been for this support’. SOSE is also taking a role in delivering ongoing Scottish Government COVID support such as the Hotel Recovery Programme. In particular, SOSE has been focused on the emerging challenge of redundancies in the South of Scotland. SOSE is working with SE and other PACE partners to support businesses in distress in an effort to sustain businesses and associated jobs.v

Enterprise agency response to COVID-19 - evidence

The Committee received feedback from businesses on the activities of the enterprise agencies during the crisis; this is set out below.

Process

WES said that the enterprise agencies responded quickly to the pandemic, providing information on the support being made available. Having the Find Business Support platform available as a one-stop point for information was useful. The provision of telephone-based support was less helpful in practice, with repeated reports from businesses of lines being constantly engaged and the ultimate advice provided being exactly the same as the advice and insight on the Find Business Support website, leading to increased frustration with businesses expecting to gain greater insights from staff on the phone.i

The Scottish Council for Voluntary Organisations (SCVO) and Social Enterprise Scotland submitted a joint view that potential sector customers of SOSE, SE and HIE have found it challenging to do business as each agency has different processes. They asked ‘how will these agencies work together to reduce the friction, effort, risk and cost within their processes, so that sector organisations have a consistent experience?’ They suggested that dedicated teams joining the dots and supporting voluntary and social enterprise organisations could be a remedy.i

Highland Food & Drink Club CIC referred to receiving lots of information from the economic development system, though too much at times - all saying the same thing from multiple sources. This was ‘all well-meaning - but at the same time became overwhelming and resulted in potential missing out of important updates’.i

Giving evidence in May, Tracy Black of CBI Scotland said that that businesses have stressed the need for speed and simplicity. The grants, such as PERF, were seen as hugely welcome and critically important, but the process of applying for a grant can be bureaucratic. CBI Scotland spoke of the need for continual improvement of the process.iv

Highland Food & Drink Club CIC also believes that enterprise agencies have become too bureaucratic and not clear if achieving their delivery goals. They ‘need to adopt a new culture - go back to what they used to be - one with aspiration and delivery - not reports and too many staff’. It was felt that the agencies had too much of a top-down approach and were removed from the actual situation on the ground, ‘they MUST get closer to reality and stop the TOP down approach - it feels like they are in a world of their own and self-interested.’i

In August, Liz Cameron of SCC welcomed the delivery of support schemes but identified a need for restructuring:

moving forward, we should be looking closely at what all the economic agencies are going to do on wider business support. Agencies such as Skills Development Scotland, Highlands and Islands Enterprise, Scottish Enterprise and the Scottish Funding Council need to work more collaboratively. I would like them to not just collaborate but stop and look closely at how they might restructure and identify what the key business support mechanisms need to be for the next three to six months. There have been gaps, and the agencies have enough intelligence to be aware of that. We would like to see that support revisited.’vi

Consulting businesses

As set out earlier in the report, there is agreement that governments and their agencies must work together in response to the crisis and consultation with businesses is a central part of that approach.

Fife Council stated that there is scope for a more consistent and coordinated approach to consulting businesses, with a sense that too many agencies have been separately surveying businesses on a similar range of issues. Furthermore, they believe that there is insufficient data made available at a local level from national agencies.i

WES wrote that the risk of an inequitable response and outcomes could have been addressed by engaging entrepreneurial support organisations in framing a response. For example, while WES was engaged and asked to promote awareness of the support mechanisms available, they were not asked to contribute to the development of the support, nor to input on the appropriateness of the mechanisms put in place.i

Highland Food & Drink Club CIC highlighted that the consultation process for the food and drink sector was poor, in contrast to the tourism sector.i

Alignment

Over the years of scrutinising Scotland’s enterprise and local economic development agencies, the Committee has highlighted the need for strategic alignment. In these dire economic times, this is more vital than ever.

The AGER report said that this is an opportunity to accelerate reform and crack the longstanding, difficult problems of collaboration at pace. In that context, they believe that Scottish Enterprise should align resources more closely at regional level, while playing a leading role at international and national level in support of economic recovery. The report also said that Regional Economic Partnerships should be ‘strengthened and bolstered’.i

Glasgow City Council said that one of the drivers of the Enterprise and Skills review was to improve alignment of the public sector offer in terms of employability and business support and to reduce clutter but the Council’s experience is that much more remains to be done on this issue. The temptation should be resisted to launch a plethora of recovery interventions. Instead the principles of collaboration, co-design and sensitivity to regional/local conditions should be embedded into any new interventions.ii

SE said that as the public health crisis emerged, Scotland’s three enterprise agencies quickly came together with their partners to agree a response; in evidence, they highlighted this alignment as ‘critical’ in developing and deploying COVID-19 specific funds.iii The new signposting service is now available and covers 45 different partner offers, underpinned by a phone service.iv SE spoke of ‘a tremendous drawing together of all the partners and different bodies.’v

Highland Food & Drink Club CIC said that there appeared to be more collaboration between organisations than previously.ii The Cabinet Secretary agreed that the agencies have been collaborative:

The amount of co-working, co-operation and partnership between the agencies at this time is a blueprint for how we should expect them to work in the future. In the past, one criticism has been that our agencies are not working as laterally as they could.vii

In June, the Cabinet Secretary highlighted the benefits of collaboration in ensuring that there is geographical spread of support:

On the grants system and response, we were looking to ensure that there was geographical spread. That is why there is that partnership between agencies, to ensure that the Highlands and Islands and the south of Scotland receive the support that they need and that it is not all centred on where the bulk of the population of businesses are located.viii

The Committee welcomes the alignment that has been demonstrated as a result of the crisis. However, there is still work to be done on longer-term strategic alignment. This is covered later in the report.

A place-based approach

The Committee has heard about a variance in the impact of the pandemic across the regions of Scotland (as explored earlier in this report). In correspondence in August, HIE referred to research and analysis which indicated that GDP in the region is expected to contract significantly in 2020 and is estimated to decrease by £1.5-£2.6bn. HIE noted that medium term recovery forecasts for Scotland are for gradual recovery by Q4 2022; however, for the region, recovery to pre-COVID levels is unlikely until 2023 at the earliest.i

SOSE noted that the South of Scotland has been particularly exposed to the effects of COVID-19, reflecting the rurality of the region and the composition of its economy. SOSE stated that it is driven and informed by its ‘place-based’ approach and will seek to provide tailored support to meet the needs of businesses in distress. The key drivers are to sustain employment and support pivotal businesses.ii

Last year SE announced a shift to a broader role in helping to create quality jobs, with security and wellbeing a priority, and to tackle inequalities in communities and regions.

SLAED believes that the Scottish Government should explore how national agency spend can be used to support local economies, particularly fragile regions, through more local spend and the creation of local supply chains. Furthermore, prioritisation of budget at a local and regional level is required to reflect regional differences and needs. This should be a transparent process in consultation with local government to maximise resources and ensure there are no gaps or duplication in provision.iii

Fife Council highlighted that a recent Local Government Information Unit report noted that ‘economic development has often been geared towards attracting inward investment and foreign direct investment rather than promoting the circulation of wealth within the local economy.’ They agree with the AGER that the economic development landscape in Scotland should pivot to a more regionally focused model in order to address the specific new challenges of economic recovery. The crisis has accelerated the need for responses that are tailored to regional and sectoral needs, ‘Scotland is not a big economy, but it is an economy of many parts; and geographical and sectorial differences need to be recognised, respected and championed’.iii

In its response to the AGER report, the Scottish Government said that over the next 12 months, SE will shift to a more regionally, place focused model for economic development drawing on its national capacity and expertise. For example, SE will work intensively with partners in three regional economies (Glasgow and Clyde, Ayrshire and the North East) to ‘learn by doing and demonstrate the value of deeper and more regionally focused collaboration.’v

The Scottish Government wants Regional Economic Partnerships (REP) to play a strong role in leading regional economic recovery and renewal and will ask each REP to deliver an action plan for doing so. Specifically, the Scottish Government committed to:

work with SE to support their shift to a more bespoke, regionally-focused approach across the SE area by the end of 2022 through Regional Economic Partnerships,

work closely with local government, Enterprise Agencies and other key economic actors, including the private sector, to take a focused ‘taskforce’ approach to driving place-based recovery and renewal.vi

Evidence on the need for a more regional local approach would suggest that recent shifts in Scotland’s economic policy landscape towards a place-based approach have yet to have an impact. The enterprise agencies have committed to a more regional approach. Given the evidence set out earlier in the report on the differing local economies across Scotland, the Committee agrees that this approach must be pursued with urgency. The Committee notes SE’s pilot activity around a ‘place based’ model and asks it to set out its longer-term plans for this approach. Given that Scotland’s economy is in crisis, place-based interventions are needed across the whole country, including an enhanced role for local authorities in supporting businesses. This is covered later in the report.

Regional selective assistance (RSA)

During last year’s budget scrutiny, the Committee had concerns about the regional spread and uptake of enterprise agency interventions across Scotland’s regions. In its response to the Committee in February, the Scottish Government told the Committee that the enterprise agencies will work with and through Regional Economic Partnerships to ensure that their products, services and support can be flexed to meet the distinct needs and opportunities of each region.

In its report, the Committee said that regional data should be produced routinely to allow for scrutiny of the regional spread of RSA and recommended that it is produced as part of future SE annual reports. Following the Committee’s report, the Scottish Government agreed that it is important to be able to scrutinise the outcome of jobs related grant expenditure by the enterprise agencies. The Scottish Government stated that from 2019/20, SE would provide data on jobs supported through RSA across Scotland in its annual report. The 2019/20 SE report stated the following:

Jobs delivered from completed Regional Selective Assistance (RSA) projects during 2019/20 totalled 3,499.5 - 2,230.5 were new jobs and 1,269 were safeguarded. Also, during the year, Scottish Enterprise offered £24.7m of new grants to support companies with future capital expenditure and job retention/creation projects.ii

The RSA annual report does set regional data for 2019/20.[1] However, the report does not show RSA regional spend for previous years and is lacking in context. It also does not set out the local authority areas in which there has been no spend in 2019/20 (such as Highland Council). The most recent RSA update available on the SE website is from Jan-Mar 2020; it would be helpful to see more recent quarterly data to assess the performance of RSA during the pandemic.iii

The Committee welcomes the provision of jobs and regional data on RSA projects. To aid transparency, the Committee recommends that all local authorities are included in the data, including those which received no grants. Regional data for previous years' spend should also be provided.

In its pre-budget scrutiny report in 2019, the Committee noted the striking regional disparities in the award of RSA over the last five years. We acknowledged that RSA is part of a wider package of support for businesses across the regions and is demand led. However, the Committee recommended that work should be carried out as a matter of urgency to maximise demand stimulation across the regions. The Committee asks the Scottish Government and its agencies to consider how to ensure a more even spread of RSA to make sure that funds are awarded to businesses most in need of support across Scotland.

Local economic development response

The Committee’s call for views captured the following perspectives on the COVID-19 response from the local economic development system. A strong theme was a sentiment that the local economic development system is undervalued and that there is capacity for local authorities to play a more significant role within Scotland’s economic development service.

Fife Council agreed with the findings of the AGER that the key role played by local authorities is undervalued and constrained by a lack of resources.i Argyll and Bute Council believes that local authority input and added value to a nimble economic development system across Scotland is key and needs to be better recognised at a national level. The Council believes that the quick and effective response to the dissemination of NDR business support grants and hardship funds across Argyll and Bute has shown that working collaboratively across council departments and with CPP partners, it can respond to such a crisis effectively and within very tight timescales.i

Glasgow City Council called for national powers - and accompanying resource - to be devolved to a regional level to allow Glasgow City Innovation District, GRID and National Manufacturing Institute Scotland to turn their respective visions into viable plans.i

The overall conclusion of the Committee’s Business Support Inquiry in February 2019 was:

There is a range of business support, advice and products available to businesses and during this inquiry we heard that this is a strength of the Scottish system. There is much to be commended, but opportunities have also been missed to align local and national economic priorities and improve ease of access to services by businesses. Business Gateway has evolved organically and does not perform the function that was initially intended. A decade on from its inception, the Committee has found that revisiting this role and purpose of Business Gateway is necessary to improve alignment.

The Committee is concerned about the lack of transparency, accountability and alignment in relation to Business Gateway services. In this report we have recommended a number of ways in which this can be addressed, including the publication of budget and performance information.

The approach in Ireland provides a mix of tailored local delivery and national strategic direction. We ask the Scottish Government to review the Irish model and consider whether this model, or elements of it, are applicable in the Scottish context to overcome the current accountability and alignment challenges. The Committee believes that such a review is necessary to improve the offer to businesses across Scotland.

In its report, the Committee noted the variance in spend on Business Gateway services in different areas across the country and that the spend has not increased in the last decade.

In response, the Scottish Government committed to work with the Environment and Economy Spokesperson for COSLA to co-produce solutions that will allow Business Gateway to most effectively be a core part of the Scottish Government’s single-system approach to business support. And also to work with local authorities in a number of specific areas including the transparency of performance information.v

In a letter to the Committee in July 2020, the Cabinet Secretary reiterated that the Scottish Government was committed to ensuring that Business Gateway is part of a joined-up enterprise support system where businesses can get the right information, advice and support at the right time. The letter stated:

The Scottish Government’s response to the Committee’s inquiry report stated that we would work with local authorities, which have lead responsibility for Business Gateway, while respecting local accountability and balancing local needs with national objectives. The focus of that work over the past year has been developing a common business support delivery environment with a view to improving the business customer experience through more effectively targeted and joined up support.vi

The Committee welcomes the alignment between the enterprise agencies and local economic development partners to deliver business support during the pandemic. The Committee asks the Scottish Government to set out how it will ensure that there continues to be such strategic alignment in future.

Role of local authorities in delivering COVID-19 business support

Local authorities have played a pivotal role in distributing funds to businesses across Scotland. By 8 September, councils had received and processed more than 100,000 grant applications for the small business grant, more than 90,000 applications had been approved, and funding of more than £1 billion had been awarded.i

Given the scale of the challenge and the need for a quick response, a number of issues arose in relation to delivery of the funding. There have been concerns from some about variances in how local authorities have been interpreting eligibility criteria, resulting in potential inconsistencies.

In August, Barry McCulloch of FSB Scotland highlighted concerns regarding capacity and systems used within local authorities for processing the grants. He said:

Local authorities have different processes and they approach the scheme in different ways. Some have done very well and have got the money out quickly. They interpreted the guidance flexibly and they got the money to where it was needed. Other local authorities have stuck far more closely to the guidance that was issued. That creates an unacceptable situation in which lots of local businesses are still waiting to receive support funding.ii

In correspondence in April, the Scottish Government said that local authorities were instructed to administer grant funding schemes in accordance with guidance outlining the parameters of the business grant schemes and the eligibility criteria. They acknowledged that, due to the breadth of businesses falling within the scope of this fund, the guidelines could not comprehensively instruct local authorities for every individual case. As such, they said that they allowed local authorities a degree of discretion. The Scottish Government said:

The local discretion afforded by the guidance will naturally create some variation in approach across local authorities. However, our direct contacts with all local authorities, facilitated by both COSLA and the Institute of Revenues Rating and Valuation, are intended to provide a degree of consistency on how this discretion can be applied. The Cabinet Secretary for Finance has written to all Chief Executives asking them to provide grant funding in keeping with the spirit of the guidance which is to support as many businesses as possible.iii

Susan Love of FSB Scotland, whilst giving evidence in May, highlighted the need for better digital-facing public services, including the rates system, for businesses, and said that there are important lessons to learn about the delivery mechanisms and how these services are set up to enable support. Susan Love explained that Scottish assessors hold a register of properties on the valuation roll, but local authorities work from a different database of ratepayers whom they bill, and there has been confusion about who holds which business information on which database. There has also been the difficulty of getting different computer systems to process all the pieces of information.iv

Looking ahead, Mairi Spowage of FAI said in May that it is important to consider what investment is needed in local economic development to ensure that local government can properly support businesses to recover in their local areas.v

The Committee notes the scale of the challenge met by local authorities in delivering funding to businesses across the country. The Committee would like to thank all those involved in delivering such a swift response. The Committee recommends that local authority delivery of COVID-19 business support is reviewed so that lessons can be learned for future funding programmes, including a review of digital systems and looking at how they can be aligned across the economic development agencies.

BUDGET

Enterprise agency budgets

At the time of scrutiny, the total Scottish Government budget allocation for economic development partners in 2020/21 is £868.3 million. This includes:

SNIB £276 million

Scottish Enterprise £493 million[1]

Highlands and Islands Enterprise £74.3 million

South of Scotland Enterprise £25 millioni

This total is greater than originally estimated due to in-year allocations received from the Scottish Government to deliver COVID-19 support; the allocations may change further depending on any future COVID-19 support announcements. Individual enterprise agency budget allocation figures are analysed in more detail in the following section.

Scottish Enterprise budget

The revised SE Operating Plan budget for 2020/21 is now expected to total to £529.2m. This overall budget is comprised of Scottish Government funding of £492.9m and anticipated business income of £36.3m. The overall budget is comprised as follows:

Capital DEL £118.5m

Financial Transactions £98.5m

Resource DEL £312.2m

The updated budget includes in-year allocations received from the Scottish Government to deliver the PERF, the Creative, Tourism & Hospitality Enterprises Hardship Fund, the Early Stage Growth Challenge Fund and the Hotel Recovery Programme.

Originally, SE had been allocated Scottish Government funding totalling £212 million for 2020/21, which was a decrease of 17% on the previous year (some resources and functions have been moved to SNIB and SOSE).

SE’s 2019/20 Annual Report was recently published. Key points include:

SE’s net under-spend against its allocated budget for the year to 31 March 2020 was £7.3m. SE drew down Grant in Aid of £268.8m, including £69.2m of Financial Transactions funding net of repayments, against the 2019/20 Grant in Aid provision of £271.0m

The provision of rental concessions for tenants within investment property portfolios, and the re-scheduling of loan repayments due to COVID-19 will potentially result in a significant shortfall against the Financial Transactions income budget as part of the 2020/21 budget settlement. This has been highlighted to the Scottish Government and will be kept under review as part of the normal budget monitoring process

SE entered the 2019/20 financial year with a high level of contractual legal commitment in place (set out further below)

During 2019/20 SE received a further non-cash allocation of £35m to cover expected credit losses, the estimated future cash shortfall from financial instrument held at amortised cost, and financial assets that have been written off. They state that due to the high-risk nature of many of their investments, there are occasions when SE is required to write off balances which are no longer recoverable. In the year to 31 March 2020, there were 76 Claims abandoned or waived totalling £20.1m. This was up significantly on 2018/19 when abandoned/waived claims totalled £12.3m and £8.4m in 2017/18.

Commitment of funds

SE entered the last financial year (2019/20) with a high level of contractual legal commitment in place; during the course of that financial year, most of these projects progressed as planned. This meant that, unlike historic experience, no significant budget flexibility arising from project slippage emerged during the course of the financial year. Consequently, SE did not have the financial capacity to absorb any new project proposals that resulted in additional expenditure during 2019/20. Action was taken during the final quarter to ensure that no new commitments were approved in order to achieve the primary financial objective of delivering a balanced budget with a marginal bias towards underspend.i

SE also entered the current financial year (2020/21) with a high level of legal commitment already in place, particularly across its resource and capital budgets. These commitments largely pre-dated the onset of the COVID-19 pandemic and are orientated to supporting companies in potential growth sectors. In correspondence in August, SE said:

The projects that Scottish Enterprise will support via these commitments will be essential as economic activity hopefully begins to re-emerge across different business sectors later in the financial year.ii

For this financial year (2020/21), SE said that in February, before the impact of COVID-19 was fully apparent, they set a budget of about £342 million, with an expectation that they would be able to generate nearly £50 million in business income from property and investment assets to support that planned expenditure during the year. Throughout the financial year, they have seen some erosion of that business income due to significant changes to the investment market. They have also had to reschedule loan repayments with companies, as part of the response to the pandemic. SE explained that the business income forecast remains volatile; although it has recovered slightly, it is still 20 per cent lower than they anticipated at the beginning of the year.iii

Despite entering this financial year (2020/21) with a highly committed budget, SE had anticipated that, as a result of COVID-19, there would be attrition and slippage, releasing budget resources that they could then pivot to use for other things. Scottish Enterprise said:

That was all in line with the interim guidance from Scottish Government. It was clear that it wanted us to halt, in effect, all but the most critical business-as-usual activities, and to contribute to support for businesses and communities in Scotland, but it also recognised that we would need to deliver our contractual commitments.iv

However, SE has, to date, seen very little of that anticipated attrition or slippage emerging, and their legal commitments have converted into expenditure.iv

Giving evidence in June, the Cabinet Secretary emphasised the importance of continuing to support commitments in place for growth areas:

There is a shift and a pivot in how the enterprise companies are servicing and supporting businesses. We are assessing what funding can be released for different areas. It would not be wise to renege on commitments that we have made to companies in the growth sectors, because they will be the companies that will have jobs in the future. We need to ensure that we have growth companies in order to face large-scale unemployment, particularly for young people.vi

Excluding funds deployed for PERF and the hardship fund, SE’s expenditure over the five-month period to the end of August was £105 million, the highest level of expenditure that they have incurred in the past five years. Douglas Colquhoun of SE said:

the budget is finely balanced on a knife edge. To illustrate the way that it could move, I note that any additional volatility and erosion in our income forecast could move us into overspend fairly quickly. We are currently running with slight deficits on our capital and resource budgets. Equally, if the attrition or slippage that I referred to earlier start to emerge significantly, particularly in the latter stages of the year, we could quickly move into underspend. At the moment, as I said, we are sitting with deficits that we think are manageable. However, I have worked in Scottish Enterprise for 32 years, and this is the most challenging set of circumstances that I have faced in my career.vii

SE explained that commitments made in past years have an impact on the budget this year, because there are drawdowns for projects that have been approved. That implies that, in past years, when projects were approved, funds were not hypothecated or set aside against a particular project, and that future drawdowns were simply budgeted forward, thereby automatically reducing SE’s ability to do future projects.

Douglas Colquhoun of SE confirmed that they report on the current year’s commitments and monitor the build-up of commitments going into future years, so that they are ‘very clear’ at any point in time what kind of discretionary funding they have available. He highlighted the annuality of the budget settlement process and referred to the possibility of receiving allocations, particularly in capital, to give them more certainty over the next two to three years, which would be ‘extremely useful’.viii

SE is in discussion with the Scottish Government about budgetary requirements for the 2021/22 financial year. These discussions are likely to continue for some time yet, particularly as they evaluate the ongoing economic impact of COVID-19. In correspondence in August, SE stated that ‘this is a dynamic and challenging position and it is therefore too early to provide the Committee with any meaningful information at this stage’.ii

In September, the Cabinet Secretary indicated that there would be an additional £8.3 million of capital funding during the period of this year’s budget to help address challenges and pressures in 2020-21.x

The Committee notes that prior to the pandemic, SE’s budget was decreased by 17% on the previous year (some resources and functions have been moved to SNIB and SOSE).

Whilst the Committee agrees that support for growth companies is important, the lack of flexibility in SE’s budget is a cause for concern. The Committee recommends that more flexibility and contingency is built into Scottish Enterprise’s budget to allow them to respond to unforeseen circumstances. The Committee asks the Scottish Government and Scottish Enterprise to set out how this can be achieved.

The process of awarding funds on a multi-annual basis has led to a lack of funds for new projects. It is important that there is transparency in this multi-annual allocation of SE resources and that these commitments are published for scrutiny. The Committee notes that discussions on SE’s forthcoming budget are underway and asks to be informed of the outcome.

The Committee notes Scottish Enterprise’s evidence that the annuality of their budget can be challenging, particularly in relation to capital commitments. The Committee invites the Scottish Government to consider this and any other measures which can assist SE with forward planning and budgeting.

Highlands and Islands Enterprise budget

HIE’s budget for 2020/21 totals £78.8m. This overall budget is comprised of Scottish Government funding of £74.3m and anticipated business income of £4.5m. The key categories of budget are as follows:

Capital £41.2m (includes £2m of capital receipts and £8.6m for Wave Energy Scotland, funded by the Scottish Government)

Financial Transactions £2.0m

Resource £35.6m (includes £2.4m of revenue receipts and £4m grant from the Scottish Government in respect the COVID19 Supporting Communities Fund and £0.2 for Wave Energy Scotland).

Correspondence from HIE in August noted that they entered the financial year with over-commitments on both Capital and Resource budgets and the pandemic may exacerbate this situation due to potential reductions in operating income. To free up budget to enable a response to the pandemic they will need to remove or defer commitments that they had already made to businesses and social enterprises. This process takes time, as the consequences of any changes to plans need to be ascertained at individual project level, including ongoing engagement with businesses and communities to determine whether revision to their support will ensure projects take place is a key part of the process.i

HIE set a £1 million deficit budget, in expectation that there would be some attrition, which allowed them to mount a response to the pandemic. This was done as a ‘considered risk’, and they have seen some attrition.ii

South of Scotland Enterprise Agency budget

SOSE assumed legal duties on 1 April 2020. The majority of their budget, other than carried forward SE/SOSEP and early investments, has been directed towards aiding and assisting organisations in the South of Scotland through the pandemic. SOSE’s overall budget comprised of Scottish Government allocated funding of £24.8m (cash) and is split as below:

Resource DEL £11.4m

Capital DEL £8.4m

Financial Transactions £5.0m

In evidence in September, SOSE highlighted that their budget will see further adjustments as a result of the Autumn Budget Revision process, as well as small adjustments for income and expenditure matched (net zero change) due to inheriting land and property assets in a legislative transfer on 1 June 2020. SOSE said:

Like Scottish Enterprise, we are currently forecasting through budget revisions. We started at £24.8 million, and we are now forecast to spend £26.6 million, as a result of autumn and spring budget revisions. However, again like Scottish Enterprise, we will see some volatility as we move towards the year end, therefore we need to monitor the situation closely over the rest of the year.i

Targets - Scottish Enterprise

SE’s 2019/20 Annual Report states that they successfully delivered all five published targets for 2019/20 with all of those exceeding the target ranges, as per the table below.i

Primary Outcome Measures 2019/20 Result 2019/20 8,000 - 10,500 planned new/safeguarded jobs paying at least the real living wage ▲ 11,188 £300m - £350m planned R&D investment by businesses and sectors ▲ £485m £150m - £200m planned capital expenditure by businesses and sectors ▲ £355m £ 160m - £255m growth funding raised by businesses ▲ £437m £ 1.25bn -£ 1.5bn planned international export sales ▲ £2.22bn Key: ▲ Exceeded; ◄► Achieved ; ▼ Not Achieved

SE further states that beyond the primary outcomes set out above, there is a fuller performance framework which management teams use internally, to track and monitor not only what they deliver but how they deliver. They use this framework to monitor how inclusive their actions are by tracking a number of indicators aimed at giving more insight into how far activities reach in terms of people and place.ii

In relation to this year’s targets, SE said in evidence in September: